Evaluating the Liquidity Response of South African Exchange-Traded Funds to Country Risk Effects

Abstract

:1. Introduction

2. Literature Review

2.1. Conceptualization of Liquidity

2.2. Review of Empirical Studies

3. Data

3.1. Data Sample

3.2. Liquidity Measures

3.3. Disaggregated Country Risk Measures

4. Model Specification

5. Results and Analysis

5.1. Descriptive Statistics

5.2. Cross-Dependence and Unit Root Testing

5.3. Analysis of Long-Run Relationships

5.4. Analysis of Short-Run Relationships

6. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

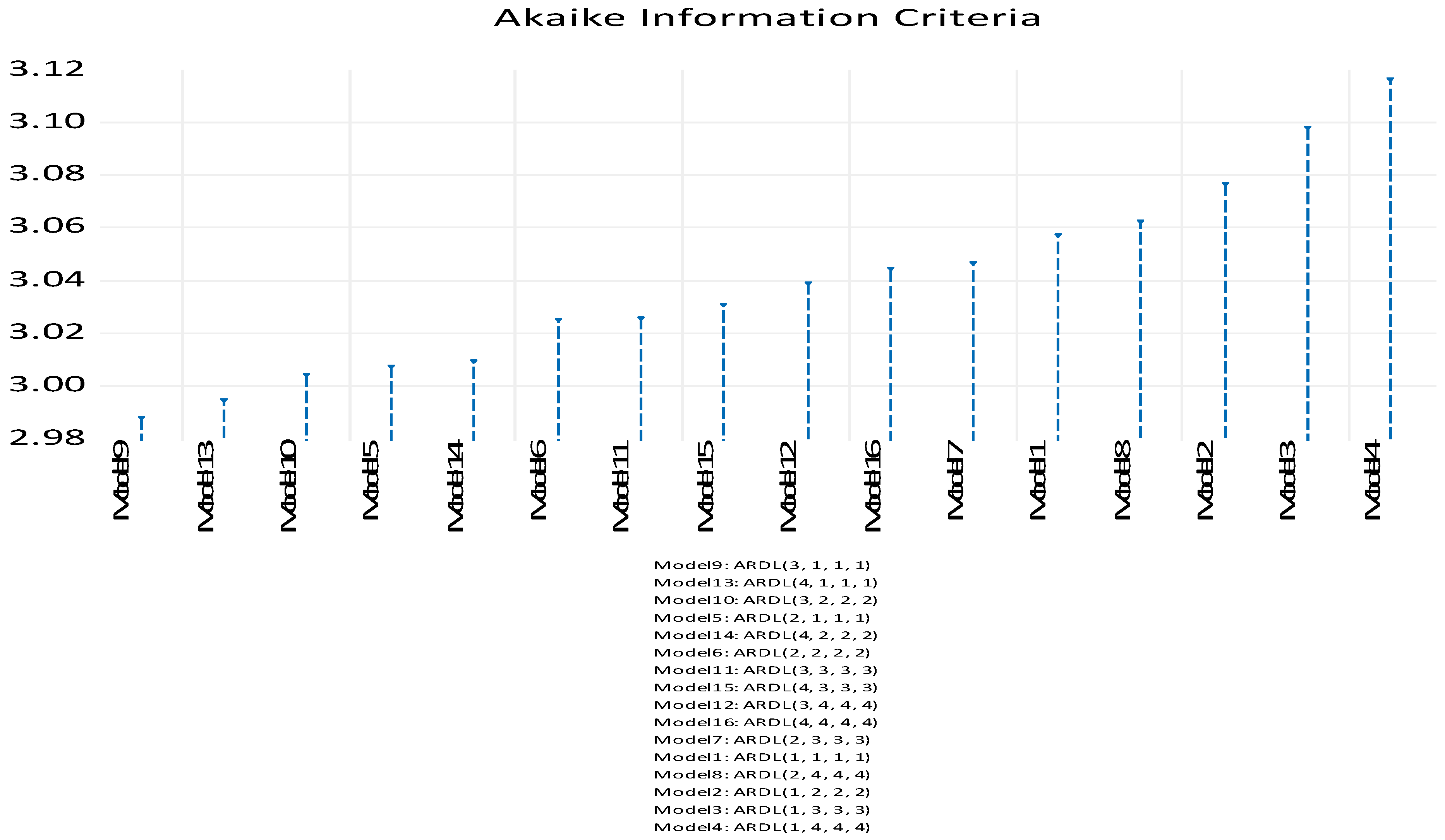

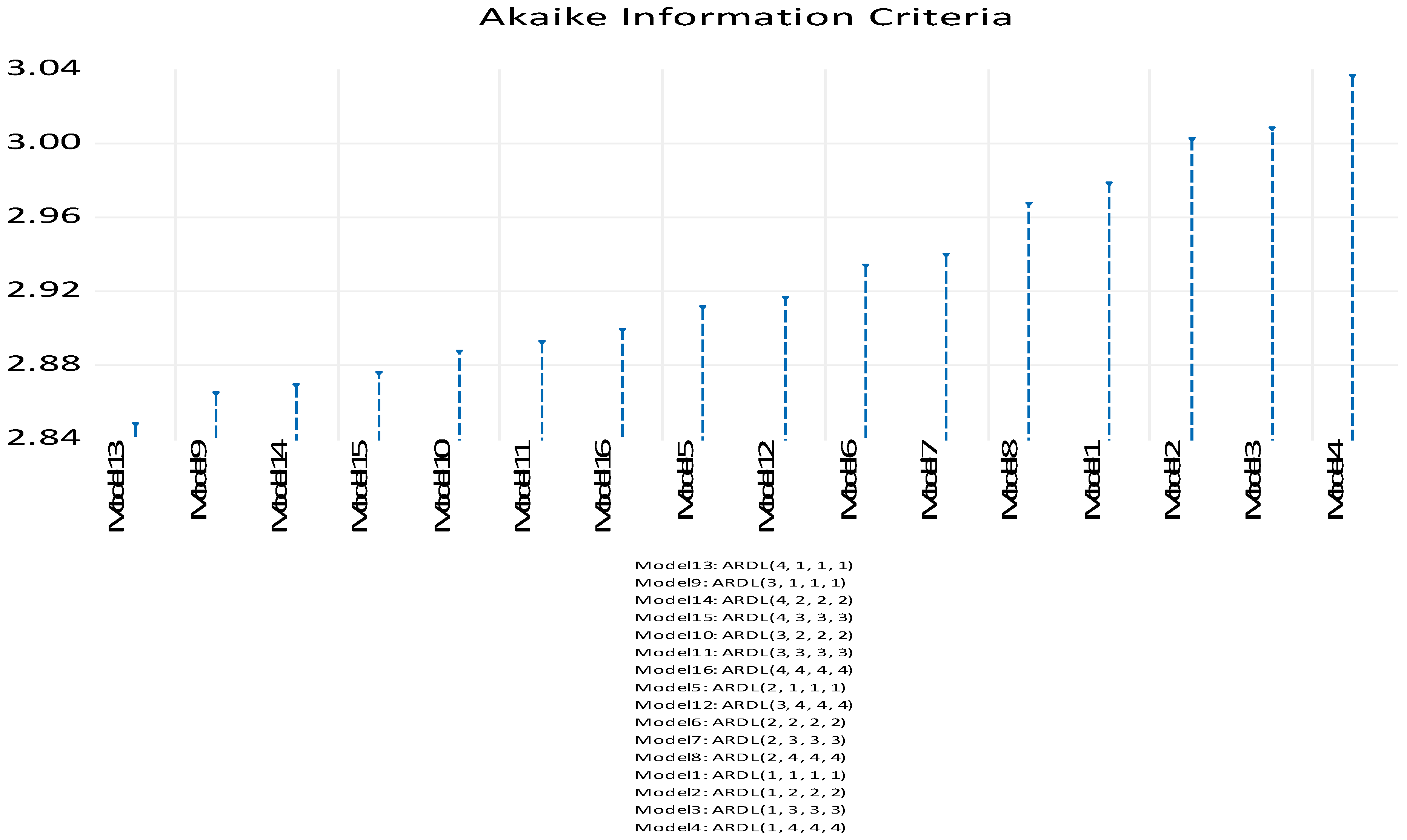

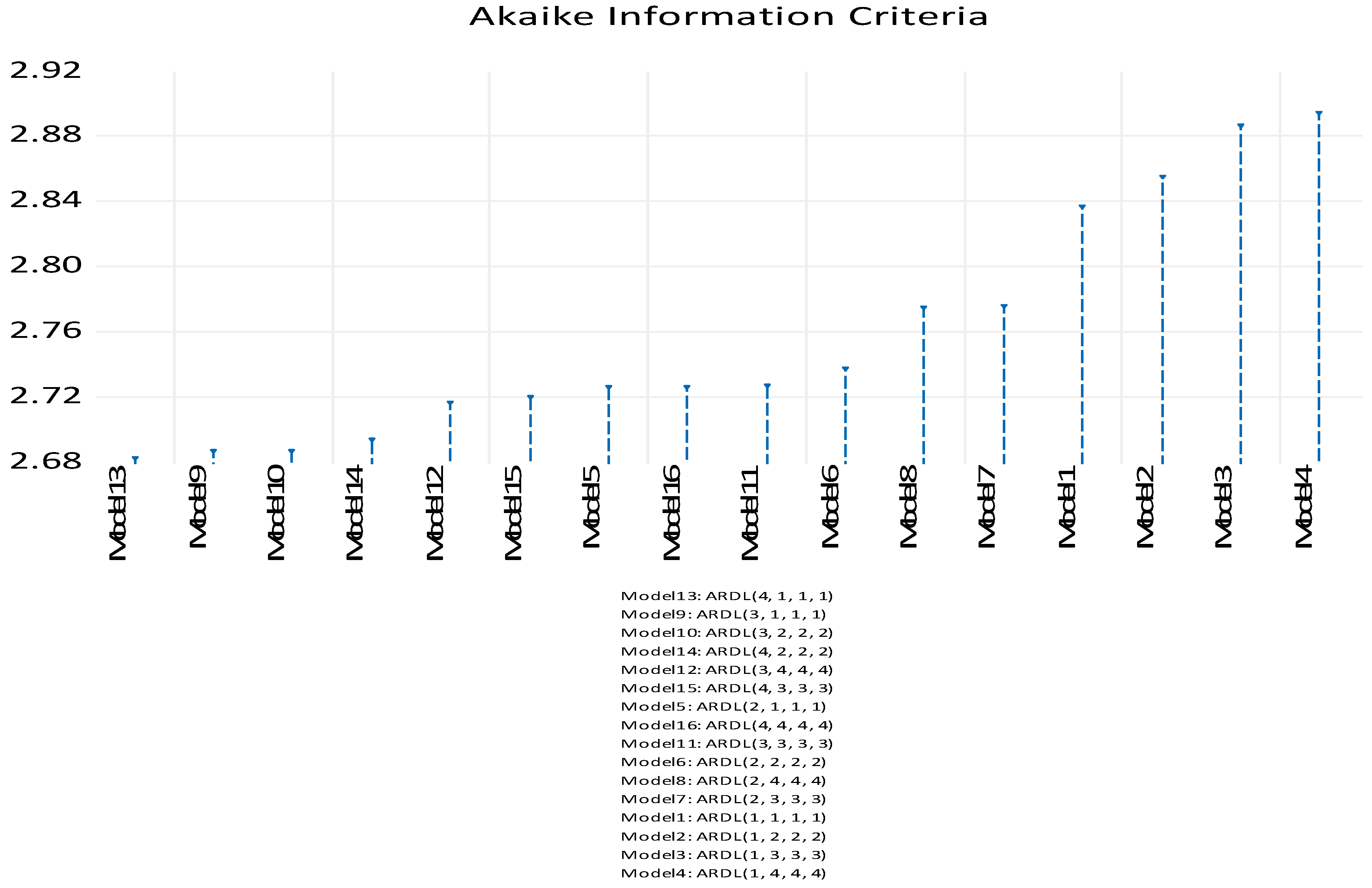

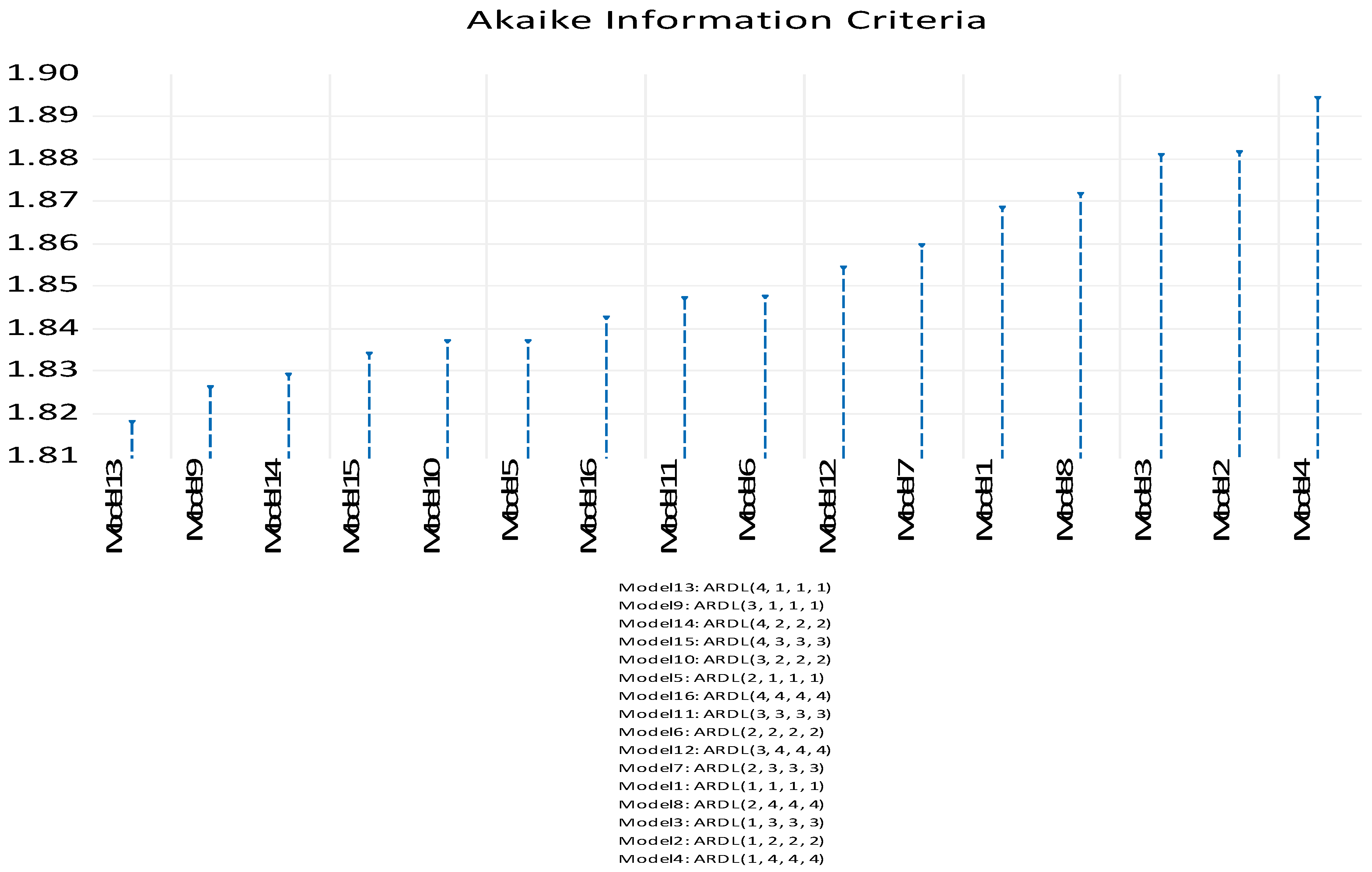

Appendix A. Optimal Lag Length Selection

Appendix A.1. Segment A: ETFs with Domestic Benchmarks

Appendix A.2. Segment B: ETFs with International Benchmarks

| 1 | Market (or trading) liquidity which relates to how easily a security can be traded is different from funding liquidity which relates to how easily funding can be obtained (Brunnermeier and Pedersen 2009). This study focuses on market liquidity. |

| 2 | This includes ETFs which track a variety of asset classes including stocks, bonds, real estate, commodities, and currencies. |

| 3 | The CGREEN and CSEW40 ETFs were removed from the sample due to insufficient data. |

| 4 | |

| 5 | Specifically, the magnitudes of the effects of political risk on the Amihud ratio and high–low spread. |

References

- Aitken, Michael, and Carole Comerton-Forde. 2003. How should liquidity be measured? Pacific-Basin Finance Journal 11: 45–59. [Google Scholar] [CrossRef]

- Al Mustofa, M. U., I. Mawardi, and T. Widiastuti. 2020. Impact of political risk, financial risk and economic risk on trading volume of Islamic stocks exchange in Indonesia. In Advances in Business, Management and Entrepreneurship. Boca Raton: CRC Press, pp. 410–14. [Google Scholar]

- Amihud, Yakov. 2002. Illiquidity and stock returns: Cross-section and time-series effects. Journal of Financial Markets 5: 31–56. [Google Scholar] [CrossRef] [Green Version]

- Baltagi, Badi H., Qu Feng, and Chihwa Kao. 2012. A Lagrange Multiplier test for cross-sectional dependence in a fixed effects panel data model. Journal of Econometrics 170: 164–77. [Google Scholar] [CrossRef] [Green Version]

- Bartov, Eli, and Gordon M. Bodnar. 1996. Alternative accounting methods, information asymmetry and liquidity: Theory and evidence. Accounting Review 71: 397–418. [Google Scholar]

- Będowska-Sójka, Barbara. 2018. The coherence of liquidity measures. The evidence from the emerging market. Finance Research Letters 27: 118–23. [Google Scholar] [CrossRef]

- Belkhir, Mohamed, Narjess Boubakri, and Jocelyn Grira. 2017. Political risk and the cost of capital in the MENA region. Emerging Markets Review 33: 155–72. [Google Scholar] [CrossRef]

- Ben Nasr, Adnen, Juncal Cunado, Riza Demirer, and Rangan Gupta. 2018. Country risk ratings and stock market returns in Brazil, Russia, India, and China (BRICS) countries: A nonlinear dynamic approach. Risks 6: 94. [Google Scholar] [CrossRef] [Green Version]

- Ben-David, Itzhak, Francesco Franzoni, and Rabih Moussawi. 2018. Do ETFs increase volatility? The Journal of Finance 73: 2471–535. [Google Scholar] [CrossRef] [Green Version]

- Bidirici, Melike, and Eda Bohur. 2015. Design and economic growth: Panel cointegration and causality analysis. Procedia-Social and Behavioral Sciences 210: 193–202. [Google Scholar] [CrossRef] [Green Version]

- Brunnermeier, Markus K., and Lasse H. Pedersen. 2009. Market liquidity and funding liquidity. The Review of Financial Studies 22: 2201–38. [Google Scholar] [CrossRef] [Green Version]

- Cannon, Susanne E., and Rebel A. Cole. 2011. Changes in REIT liquidity 1988–2007: Evidence from daily data. The Journal of Real Estate Finance and Economics 43: 258–80. [Google Scholar] [CrossRef] [Green Version]

- Chen, Louisa, Liya Shen, and Zhiping Zhou. 2021. Understand funding liquidity and market liquidity in a regime-switching model. International Journal of Finance & Economics. Online First Article. [Google Scholar]

- Chiu, Junmao, Huimin Chung, and Keng Y. Ho. 2014. Fear sentiment, liquidity, and trading behavior: Evidence from the index ETF market. Review of Pacific Basin Financial Markets and Policies 17: 1450017. [Google Scholar] [CrossRef]

- Chordia, Tarun, Richard Roll, and Avanidhar Subrahmanyam. 2001. Market liquidity and trading activity. The Journal of Finance 56: 501–30. [Google Scholar] [CrossRef]

- Chordia, Tarun, Richard Roll, and Avanidhar Subrahmanyam. 2008. Liquidity and market efficiency. Journal of Financial Economics 87: 249–68. [Google Scholar] [CrossRef]

- Chung, Kee H., and Hao Zhang. 2014. A simple approximation of intraday spreads using daily data. Journal of Financial Markets 17: 94–120. [Google Scholar] [CrossRef]

- Corwin, Shane A. 2014. Dealing with Negative Values in the High–low Spread Estimator. Working Paper. Notre Dame: University of Notre Dame. [Google Scholar]

- Corwin, Shane A., and Paul Schultz. 2012. A simple way to estimate bid–ask spreads from daily high and low prices. The Journal of Finance 67: 719–60. [Google Scholar] [CrossRef]

- da Silva, Patricia P., Pedro A. Cerqueira, and Wojolomi Ogbe. 2018. Determinants of renewable energy growth in Sub-Saharan Africa: Evidence from panel ARDL. Energy 156: 45–54. [Google Scholar] [CrossRef]

- Debata, Byomakesh, and Jitendra Mahakud. 2018. Economic policy uncertainty and stock market liquidity: Does financial crisis make any difference? Journal of Financial Economic Policy 10: 112–35. [Google Scholar] [CrossRef]

- Demsetz, Harold. 1968. The cost of transacting. The Quarterly Journal of Economics 82: 33–53. [Google Scholar] [CrossRef]

- Duong, Huu N., Chandra Krishnamurti, Justin H. Nguyen, My Nguyen, and S. Ghon Rhee. 2018. The Impact of Economic Policy Uncertainty on Stock Liquidity: Cross-Sectional Effects and Economic Channels. SSRN 3088922. Rochester: SSRN. [Google Scholar]

- Erdem, Ekrem, Bulent Guloglu, and Saban Nazlioglu. 2010. The macroeconomy and Turkish agricultural trade balance with the EU countries: Panel ARDL analysis. International Journal of Economic Perspectives 4: 371–79. [Google Scholar]

- Fong, Kingsley Y., Craig W. Holden, and Charles A. Trzcinka. 2017. What are the best liquidity proxies for global research? Review of Finance 21: 1355–401. [Google Scholar] [CrossRef]

- Foster, F. Douglas, and Subramanian Viswanathan. 1993. Variations in trading volume, return volatility, and trading costs: Evidence on recent price formation models. The Journal of Finance 48: 187–211. [Google Scholar] [CrossRef]

- Hadri, Kaddour. 2000. Testing for stationarity in heterogeneous panel data. The Econometrics Journal 3: 148–61. [Google Scholar] [CrossRef]

- Han, Qian, and Jufang Liang. 2017. Index futures trading restrictions and spot market quality: Evidence from the recent Chinese stock market crash. Journal of Futures Markets 37: 411–28. [Google Scholar] [CrossRef]

- Harvey, Campbell R. 2004. Country Risk Components, the Cost of Capital, and Returns in Emerging Markets. Working Paper. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Hoti, Suhejla. 2005. Modelling country spillover effects in country risk ratings. Emerging Markets Review 6: 324–45. [Google Scholar] [CrossRef]

- Howell, Llewellyn D. 2011. International Country Risk Guide Methodology. New York: PRS Group. [Google Scholar]

- Huang, Roger D., and Hans R. Stoll. 2001. Exchange rates and firms’ liquidity: Evidence from ADRs. Journal of International Money and Finance 20: 297–325. [Google Scholar] [CrossRef]

- Huberman, Gur, and Dominika Halka. 2001. Systematic liquidity. Journal of Financial Research 24: 161–78. [Google Scholar] [CrossRef]

- IOL. 2020. Exchange-traded Funds are Still Popular Trading Instruments after 20 Years. Available online: https://www.iol.co.za/personal-finance/investments/exchange-traded-funds-are-still-popular-trading-instruments-after-20-years-51115810 (accessed on 25 February 2022).

- Kim, Soyoung, and Doo Y. Yang. 2011. The impact of capital inflows on asset prices in emerging Asian economies: Is too much money chasing too little good? Open Economies Review 22: 293–315. [Google Scholar] [CrossRef] [Green Version]

- Kim, Suk J., and Eliza Wu. 2008. Sovereign credit ratings, capital flows and financial sector development in emerging markets. Emerging Markets Review 9: 17–39. [Google Scholar] [CrossRef] [Green Version]

- Kinlaw, Will, Mark Kritzman, and David Turkington. 2013. Liquidity and portfolio choice: A unified approach. The Journal of Portfolio Management 39: 19–27. [Google Scholar] [CrossRef] [Green Version]

- Krinsky, Itzhak, and Jason Lee. 1996. Earnings announcements and the components of the bid–ask spread. The Journal of Finance 51: 1523–35. [Google Scholar] [CrossRef]

- Kunjal, Damien, and Faeezah Peerbhai. 2021. Investor overconfidence in the South African exchange-traded fund market. Cogent Economics & Finance 9: 1978190. [Google Scholar]

- Kunjal, Damien, Faeezah Peerbhai, and Paul F. Muzindutsi. 2021. The performance of South African exchange-traded funds under changing market conditions. Journal of Asset Management 22: 350–59. [Google Scholar] [CrossRef]

- Kunjal, Damien, Faeezah Peerbhai, and Paul F. Muzindutsi. 2022. Political, economic, and financial country risks and the volatility of the South African Exchange-traded Fund market: A GARCH-MIDAS approach. In Risk Management. London: Palgrave Macmillan UK. [Google Scholar]

- Kyle, Albert S. 1985. Continuous auctions and insider trading. Econometrica: Journal of the Econometric Society 53: 1315–35. [Google Scholar] [CrossRef] [Green Version]

- Lee, Charles M., Belinda Mucklow, and Mark J. Ready. 1993. Spreads, depths, and the impact of earnings information: An intraday analysis. The Review of Financial Studies 6: 345–74. [Google Scholar] [CrossRef]

- Lee, Chi C., and Chien C. Lee. 2018. The impact of country risk on income inequality: A multilevel analysis. Social Indicators Research 136: 139–62. [Google Scholar]

- Lee, Chien C., and Mei P. Chen. 2021. The effects of investor attention and policy uncertainties on cross-border country exchange-traded fund returns. International Review of Economics & Finance 71: 830–52. [Google Scholar]

- Lee, Hyun H., Hyeon S. Huh, and Donghyun Park. 2013. Financial integration in East Asia: An empirical investigation. The World Economy 36: 396–418. [Google Scholar] [CrossRef] [Green Version]

- Lee, Kuan H., Horacio Sapriza, and Yangru Wu. 2016. Sovereign debt ratings and stock liquidity around the World. Journal of Banking & Finance 73: 99–112. [Google Scholar]

- Lesmond, David A. 2005. Liquidity of emerging markets. Journal of Financial Economics 77: 411–52. [Google Scholar] [CrossRef]

- Levin, Andrew, Chien F. Lin, and Chia S. J. Chu. 2002. Unit root tests in panel data: Asymptotic and finite-sample properties. Journal of Econometrics 108: 1–24. [Google Scholar] [CrossRef]

- Lin, Crystal Y., Hamid Rahman, and Kenneth Yung. 2010. Investor overconfidence in REIT stock trading. Journal of Real Estate Portfolio Management 16: 39–57. [Google Scholar] [CrossRef]

- Liu, Shuming. 2015. Investor sentiment and stock market liquidity. Journal of Behavioral Finance 16: 51–67. [Google Scholar] [CrossRef]

- Ma, Xinxin, Pengcheng Song, and Xuan Zhang. 2020. The structural changes of liquidity risk, and liquidity risk premium in China stock market. Emerging Markets Finance and Trade 56: 3507–21. [Google Scholar] [CrossRef]

- Malamud, Semyon. 2016. A Dynamic Equilibrium Model of ETFs. Available online: https://ssrn.com/abstract=2831973 (accessed on 10 January 2022).

- Marshall, Ben R., Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2018. Do liquidity proxies measure liquidity accurately in ETFs? Journal of International Financial Markets, Institutions and Money 55: 94–111. [Google Scholar] [CrossRef]

- Mensi, Walid, Shawkat Hammoudeh, Seong M. Yoon, and Mehmet Balcilar. 2017. Impact of macroeconomic factors and country risk ratings on GCC stock markets: Evidence from a dynamic panel threshold model with regime switching. Applied Economics 49: 1255–72. [Google Scholar] [CrossRef]

- Munir, Qaiser, Hooi H. Lean, and Russell Smyth. 2020. CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: A cross-sectional dependence approach. Energy Economics 85: 104571. [Google Scholar] [CrossRef]

- Nagar, Venky, Jordan Schoenfeld, and Laura Wellman. 2019. The effect of economic policy uncertainty on investor information asymmetry and management disclosures. Journal of Accounting and Economics 67: 36–57. [Google Scholar] [CrossRef]

- O’Hara, Maureen. 2004. Liquidity and Financial Market Stability. Working Paper No. 55. Brussels: National Bank of Belgium. [Google Scholar]

- Onuoha, F. C., I. C. Okonkwo, P. Okoro, and K. Okere. 2018. The causal relationship between Foreign Direct Investment (FDI) and the macro-economy of selected west African countries: Panel ARDL/granger causality analysis. African Research Review 12: 140–63. [Google Scholar] [CrossRef] [Green Version]

- Pedroni, Peter. 1999. Critical values for cointegration tests in heterogeneous panels with multiple regressors. Oxford Bulletin of Economics and Statistics 61: 653–70. [Google Scholar] [CrossRef]

- Pedroni, Peter. 2004. Panel cointegration: Asymptotic and finite sample properties of pooled time series tests with an application to the PPP hypothesis. Econometric Theory 20: 597–625. [Google Scholar] [CrossRef] [Green Version]

- Pesaran, M. Hashem, Yongcheol Shin, and Ron P. Smith. 1999. Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American Statistical Association 94: 621–34. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. Working Paper No. 1240. Cambridge: University of Cambridge. [Google Scholar]

- Pesaran, M. Hashem. 2007. A simple panel unit root test in the presence of cross-section dependence. Journal of Applied Econometrics 22: 265–312. [Google Scholar] [CrossRef] [Green Version]

- Pham, Son D., Ben R. Marshall, Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2021a. Liquidity Spillover between ETFs and Their Constituents. SSRN 3806140. Rochester: SSRN. [Google Scholar]

- Pham, Son D., Ben R. Marshall, Nhut H. Nguyen, and Nuttawat Visaltanachoti. 2021b. The liquidity of active ETFs. Global Finance Journal 49: 100572. [Google Scholar] [CrossRef]

- Rompotis, Gerasimos G. 2017. The impact of terrorism on Islamic exchange-traded funds. Journal of Islamic Economics, Banking and Finance 13: 71–95. [Google Scholar] [CrossRef]

- Sakarya, Burchan, and Aykut Ekinci. 2020. Exchange-traded funds and FX volatility: Evidence from Turkey. Central Bank Review 20: 205–11. [Google Scholar] [CrossRef]

- Salisu, Afees A., and Kazeem O. Isah. 2017. Revisiting the oil price and stock market nexus: A nonlinear Panel ARDL approach. Economic Modelling 66: 258–71. [Google Scholar] [CrossRef]

- Sari, Ramazan, Mehmet Uzunkaya, and Shawkat Hammoudeh. 2013. The relationship between disaggregated country risk ratings and stock market movements: An ARDL approach. Emerging Markets Finance and Trade 49: 4–16. [Google Scholar] [CrossRef]

- Smales, Lee A., and Brian M. Lucey. 2019. The influence of investor sentiment on the monetary policy announcement liquidity response in precious metal markets. Journal of International Financial Markets, Institutions and Money 60: 19–38. [Google Scholar]

- Soltani, Hayet, Abderrahmen Aloulou, and Mouna B. Abbes. 2017. The impact of political instability on investor sentiment and market performance: Evidence from Tunisian revolution. IUP Journal of Applied Finance 23: 5–17. [Google Scholar]

- Steyn, Johan. 2019. The tracking efficiency of exchange-traded funds listed on the Johannesburg Stock Exchange. Management Dynamics 28: 2–14. [Google Scholar]

- Strydom, Barry, Ailie Charteris, and Kerry McCullough. 2015. The relative tracking ability of South African exchange-traded funds and index funds. Investment Analysts Journal 44: 117–33. [Google Scholar] [CrossRef]

- Subrahmanyam, Avanidhar. 1991. A theory of trading in stock index futures. The Review of Financial Studies 4: 17–51. [Google Scholar] [CrossRef]

- Tseng, Yung C., and Wo C. Lee. 2016. Investor sentiment and ETF liquidity-evidence from Asia markets. Advances in Management and Applied Economics 6: 89. [Google Scholar]

- Vengesai, Edson, and Paul F. Muzindutsi. 2020. Effect of disaggregated country risk shocks on financing decisions of the JSE listed firms. International Journal of Economics and Finance Studies 12: 32–49. [Google Scholar] [CrossRef]

| ETFs with Domestic Benchmarks | ETFs with International Benchmarks | Political Risk Ratings | Economic Risk Ratings | Financial Risk Ratings | |||

|---|---|---|---|---|---|---|---|

| Amihud Ratio | High–Low Spread | Amihud Ratio | High–Low Spread | ||||

| Mean | 0.0730 | 0.0019 | 0.0076 | 0.0032 | 66.3413 | 34.6696 | 38.2022 |

| Maximum | 11.2624 | 0.0415 | 0.5753 | 0.0154 | 72.0000 | 38.5000 | 42.0000 |

| Minimum | 0.0000 ^ | 0.0000 ^ | 0.0000 ^ | 0.0000 ^ | 61.5000 | 29.0000 | 31.5000 |

| Std. Dev. | 0.4002 | 0.0021 | 0.0435 | 0.0023 | 2.6572 | 2.1806 | 1.8996 |

| Skewness | 16.2988 | 2.9457 | 9.9137 | 1.5169 | 0.1734 | 0.0453 | −0.6408 |

| Kurtosis | 342.0805 | 32.0415 | 111.5863 | 6.6411 | 2.1024 | 2.2203 | 3.2277 |

| Jarque-Bera | 22,845,021 | 172,879.1 | 426,444.1 | 787.1047 | 8.8736 | 5.9039 | 16.2383 |

| Probability | 0.0000 | 0.0000 | 0.0000 | 0.0000 | 0.0118 | 0.0522 | 0.0003 |

| Breusch-Pagan LM | Pesaran Scaled LM | Pesaran CD | Bias-Corrected Scaled LM | |

|---|---|---|---|---|

| Panel A: ETFs with Domestic Benchmarks | ||||

| 5219.084 * | 105.0217 * | 18.9311 * | 104.9296 * | |

| 9057.362 * | 197.5170 * | 44.8418 * | 197.4249 * | |

| 15,702.53 * | 357.6531 * | 15.0576 * | 357.5610 * | |

| 8728.886 * | 189.6014 * | 23.2580 * | 189.5093 * | |

| 7460.380 * | 159.0328 * | 3.7106 * | 158.9407 * | |

| Panel B: ETFs with International Benchmarks | ||||

| 1018.320 * | 153.8898 * | 21.4172 * | 153.8692 * | |

| 234.8760 * | 33.0018 * | 5.8957 * | 32.9812 * | |

| 1840.000 * | 280.6778 * | 40.6282 * | 280.6572 * | |

| 1840.000 * | 280.6778 * | 40.6282 * | 280.6572 * | |

| 1840.000 * | 280.6778 * | 40.6282 * | 280.6572 * | |

| ETFs with Domestic Benchmarks | ETFs with International Benchmarks | Decision | |||

|---|---|---|---|---|---|

| Levels | First Diff. | Levels | First Diff. | ||

| −5.8977 * | -- | −3.5392 * | -- | I(0) | |

| −6.1900 * | -- | −5.6034 * | -- | I(0) | |

| −1.8345 | −2.6732 * | −0.9304 | −4.6783 * | I(1) | |

| −0.0855 | −3.6466 * | −0.8698 | −5.2395 * | I(1) | |

| −5.4336 * | -- | −3.6757 * | -- | I(0) | |

| Variable | ETFs with Domestic Benchmarks | ETFs with International Benchmarks | ||

|---|---|---|---|---|

| Amihud Ratio | High–Low Spread | Amihud Ratio | High–Low Spread | |

| Within-dimesion | ||||

| Panel v-Stat. | 2.6259 * | 4.6295 * | −1.2682 | 0.8217 |

| Panel rho-Stat. | −47.8144 * | −45.8030 * | −11.2359 * | −37.5923 * |

| Panel PP-Stat. | −34.6400 * | −29.5472 * | −7.9423 * | −19.5048 * |

| Panel ADF-Stat. | −16.0223 * | −11.5614 * | −3.5314 * | −9.7913 * |

| Between-dimension | ||||

| Group rho-Stat. | −47.2387 * | −53.5373 * | −9.7965 * | −28.7477 * |

| Group PP-Stat. | −41.0671 * | −39.8233 * | −9.6779 * | −20.0359 * |

| Group ADF-Stat. | −21.3164 * | −19.2236 * | −4.1344 * | −10.1029 * |

| Variable | ETFs with Domestic Benchmarks | ETFs with International Benchmarks | ||

|---|---|---|---|---|

| Amihud Ratio | High–Low Spread | Amihud Ratio | High–Low Spread | |

| Optimal Model | ARDL(3,1,1,1) | ARDL(4,1,1,1) | ARDL(4,1,1,1) | ARDL(4,1,1,1) |

| 9.2243 | −3.6785 | 96.3924 | −17.3035 | |

| 8.9494 | 0.0745 | −1.7228 | 4.9250 | |

| 0.0106 | 0.0226 | −49.5644 | −3.0041 | |

| Variable | ETFs with Domestic Benchmarks | ETFs with International Benchmarks | ||

|---|---|---|---|---|

| Amihud Ratio | High–Low Spread | Amihud Ratio | High–Low Spread | |

| −0.2932 * | −0.4838 * | |||

| −0.1503 * | −0.3154 * | |||

| −0.1632 * | ||||

| −0.4347 * | −0.3331 * | |||

| −0.2969 * | −0.1696 ** | |||

| −0.1215 * | −0.0458 | |||

| 1.3688 | 12.1392 ** | 6.0709 | 2.3972 | |

| −4.0743 | −4.6523 | −0.2089 | −2.0795 | |

| −3.9553 ** | 7.1071 * | −3.4771 *** | 0.1196 | |

| −0.4440 * | −0.3552 * | −0.0687 ** | −0.3857 * | |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kunjal, D. Evaluating the Liquidity Response of South African Exchange-Traded Funds to Country Risk Effects. Economies 2022, 10, 130. https://doi.org/10.3390/economies10060130

Kunjal D. Evaluating the Liquidity Response of South African Exchange-Traded Funds to Country Risk Effects. Economies. 2022; 10(6):130. https://doi.org/10.3390/economies10060130

Chicago/Turabian StyleKunjal, Damien. 2022. "Evaluating the Liquidity Response of South African Exchange-Traded Funds to Country Risk Effects" Economies 10, no. 6: 130. https://doi.org/10.3390/economies10060130

APA StyleKunjal, D. (2022). Evaluating the Liquidity Response of South African Exchange-Traded Funds to Country Risk Effects. Economies, 10(6), 130. https://doi.org/10.3390/economies10060130