Abstract

This study explores the influence of financial statement audits on tax compliance directly and indirectly through access to finance, and it examines gender roles to improve tax compliance through access to finance and financial statement audits. The sample for this study consisted of 45,504 businesses located in developing countries, as determined by The World Bank Enterprise Survey 2006–2018. The primary findings of this study demonstrate that the audit of financial statements has a positive impact on tax compliance through access to finance. Another result is that firms with female top managers are more likely to comply with their tax obligations than those with male top managers. The key to improving tax compliance is that policymakers should encourage financial institutions to provide more significant opportunities for companies that audit financial statements to access larger amounts of capital and faster disbursement of funds. Firms should provide greater opportunities for women to occupy positions as top managers. It is the company’s responsibility to promote gender sharing programs, particularly for the human resources department. Our study integrates the concepts of financial statement audits, access to finance, and the gender of firm managers into a model to predict how firms comply with their tax obligations.

1. Introduction

To date, the role of financial statement audits is primarily limited to its involvement in solving agency problems and reducing financial reporting inaccuracies (Kassem and Turksen 2021). However, studies indicate that financial statement audits affect tax compliance (Kasper and Alm 2020). They can help prevent firms from engaging in opportunistic behavior in financial reporting, which is likely present regarding taxation (Downing and Langli 2018).

Auditing financial statements in private companies is interesting because the economic role of auditing financial statements in private companies is less significant than in public companies. In contrast to public companies, the managers of most private companies are owners, which results in less agency conflict in private companies. Therefore, the audit of financial statements in private companies is voluntary (Francis et al. 2011; Vanstraelen and Schelleman 2017), while it is mandatory for public companies (Svanström 2014). This also underlies why research on private companies is more about the role of external auditors than the results of the auditor’s opinion (modified or unmodified opinion).

According to previous research, tax compliance is also influenced by financial access (Kong et al. 2021; Alm et al. 2019). Companies with easy access to finance will be more financially secure and cooperative in fulfilling their tax obligations (Kong et al. 2021). Firms with easy access to finance will be more financially secure and cooperative in meeting their tax obligations (Kong et al. 2021).

In contrast, firms with financial constraints may compensate for their limited resources by reducing costs, including tax costs, one of which is tax non-compliance (Elbannan and Farooq 2020). Access to finance is determined by an audit of financial statements (Alrashidi et al. 2021). There are at least two reasons why financial audit reports impact financial access. First, the company will be more aware of credible information received by creditors, including tax avoidance behavior, so as not to lose funding sources (Beck et al. 2014). Second, because companies receive reciprocal services, they will be more willing to disclose their income honestly to the public (Gökalp et al. 2017). As a result, the audit of financial statements is assumed to affect the company’s ability to obtain finance, which in turn affects tax compliance.

In recent years, the gender role of top management has received attention from both academics and policymakers (Arnaboldi et al. 2020). Concerning tax compliance, the issue of top management’s gender is noteworthy because some studies have shown that female-led firms have higher tax compliance rates than male-led firms (e.g., D’attoma et al. 2020; Hoseini and Gerayli 2018; Damayanti and Supramono 2019). Integrating these findings allows the researcher to propose that the effects of financial statement audits and financial access on tax compliance cannot ignore the gender role of top management. Therefore, this study aims to examine the effect of auditing corporate financial statements on tax compliance, both directly and through financial access, and whether this differs according to the gender of top management.

This study helps address gaps in earlier research in four ways. First, the following steps can be taken to increase the knowledge of the benefits of financial statement audits in businesses that are more focused on economic gains (Moalla and Baili 2019; Orazalin and Akhmetzhanov 2019; Bacha et al. 2021): (1) maintaining compliance, (2) more accurate reports, (3) accuracy of determination in profit, (4) simplification of the loan process, (5) detection of cheating, (6) business growth enhancement, and (7) assistance with planning and budgeting. Second, access to finance is used as a moderating factor between financial statement audits and voluntary tax compliance. Previous research has established a direct association between financial statement audits and access to finance (Alrashidi et al. 2021), financial statement audits and tax compliance (Kasper and Alm 2020), and access to finance and tax compliance (Kong et al. 2021; Alm et al. 2019). Third, the gender of company managers can be used to predict differences in the impact of financial statement audits on private companies’ access to finance and tax compliance. Fourth, developing nations can be used as research subjects. Studies on developed countries have dominated research on the role of financial statement audits in private firms. It is essential to use developing countries as research subjects since they have lower governance features than developed countries.

2. Literature Review and Hypothesis Development

Financial statement audits for private companies can help reduce opportunistic behavior in financial reporting, including taxation, as well as helping companies in tax planning activities (Downing and Langli 2018). Especially for private companies, there is no obligation to audit financial statements (Svanström 2014). Therefore, holding financial statement audits in private companies to improve the quality of financial information is carried out for tax purposes (Hope et al. 2021). One of the objectives of financial statement audits is to ensure the quality of financial reports and mitigate the possibility of earnings management (Dobija 2020). Additionally, auditing needs firms to have a solid accounting system that assists them in complying with tax legislation while also assisting tax authorities in verifying the business’s tax obligations (Downing and Langli 2018). The following justifications could well be made: First, the auditors of private firms—which are almost certainly smaller than public corporations—have the opportunity to provide non-audit advice, such as taxation, that assists firms in complying with tax regulations. Second, audits decrease the likelihood of businesses bribing corrupt government officials, as auditors examine all records and the evidence of transactions and assess firm risks (Elbannan and Farooq 2020). Meanwhile, the decreased likelihood of using firm resources for bribery requires firms to utilize them for tax purposes, improving their ability to comply with tax regulations (Guo and Hung 2020). The following hypothesis can therefore be formulated:

Hypothesis 1 (H1).

Financial statement audits have a positive effect on corporate tax compliance.

Access to finance is associated with the ability of enterprises to obtain financial services (Giang et al. 2019), such as credit, savings, payments, insurance, and other risk management services, to finance their capital. Firms’ preference for debt financing over equity financing is partly due to tax protection (Modigliani and Miller 1958) and does not reduce the control rights held by owners.

However, firms often have difficulties acquiring finance (Kong et al. 2021), even though access to finance can increase productivity (Lim and Foster 2020; Ferrando and Ruggieri 2018; Galasso et al. 2018). The owner’s willingness to allow firm access to finance is significantly influenced by risk assessment, which, among other things, may be found in their financial statements. Financial statement audits are sometimes seen as a guarantee that the financial statements have been presented accurately and without substantial misstatement (Dobija 2020). Good audit quality is determined by whether the audit of financial statements can strengthen the company’s financial information credibility. This enables external financial providers to better assess the company’s performance and business prospects, resulting in a more reliable risk assessment. In addition, external financial providers are better equipped to direct their investment to companies with audited financial statements by giving them increased access to capital (Trpeska et al. 2017). Other research findings also show that financial statement audits improve access to finance (Alrashidi et al. 2021). As a result, the hypothesis being investigated is as follows:

Hypothesis 2 (H2).

Financial statement audits have a positive effect on access to finance at private firms.

Companies that have easy access to finance will have increased finances for operating costs, resulting in a sense of financial security and a willingness to cooperate with tax authorities (Kong et al. 2021). However, firms that face financial constraints grab the opportunity to compensate for their limited resources by decreasing costs, including tax costs, in a variety of ways, including through tax non-compliance (Luo et al. 2020; Elbannan and Farooq 2020); taxes are often considered as costs that do not bring economic benefits (Tomkiewicz and Marta 2020).

In addition to this, companies that rely on external financing sources will be wary of negative information obtained by external financial providers, such as information about tax avoidance (Beck et al. 2014). Firms are concerned that negative information will result in their inability to acquire financial sources. Numerous studies have also established the influence of easy access to finance on taxpayer compliance (Kong et al. 2021; Alm et al. 2019). Thus, it is assumed that financial statement audits impact the ease of access to finance, which in turn influences tax compliance; therefore, the hypothesis to be investigated is as follows:

Hypothesis 3 (H3).

Financial statement audits positively affect private firms’ tax compliance through access to finance.

According to the upper echelon theory, the characteristics of top managers in an organization impact the organization’s behavior and decisions (Hambrick and Mason 1984) and play a critical role in corporate management (Jabari and Muhamad 2020; Ibrahim et al. 2019). Top managers make critical organizational decisions, and their decision-making processes are very certainly influenced by personal attributes, one of which is gender.

In terms of tax compliance, numerous prior studies have established that firms led by female managers adhere to a higher standard of tax compliance than firms led by male managers (e.g., Kangave et al. 2021; Damayanti and Supramono 2019; D’attoma et al. 2020). The fundamental assumption frequently cited for disparities in gender compliance is linked to risk preference and overconfidence. Previous research has revealed that female managers are more risk averse (Suherman et al. 2021; Fisk 2018; Gomez-Mejia et al. 2019) and less confident than male managers. Female top managers who tend to be risk averse and lack self-confidence are more likely to ask their firms to comply with rules and tax obligations to avoid tax penalties and investigation risks.

According to previous assumptions, this study predicts that the beneficial effects of auditing financial statements and financial access on tax compliance will be more pronounced in female-led firms than in male-led firms. Therefore, the hypotheses that can be proposed are as follows:

Hypothesis 4a (H4a).

Female top managers’ financial statement audits have a stronger positive effect on tax compliance than those of male top managers.

Hypothesis 4b (H4b).

Female top managers enhance the positive effect of access to finance on tax compliance more so than male top managers.

3. Methodology

3.1. Data and Sample

The present study draws on data from the 2006–2018 World Bank Survey, including business features across 136,887 private companies in 139 countries. The survey asked various questions related to infrastructure, marketing, competition, crime, government relations (including taxes), finance, labor, and performance issues. Several studies have developed the results of the survey in various fields, such as bribery (Clarke 2021); domestic and multinational company relations (Olayinka and Loykulnanta 2019); tax compliance (Gökalp et al. 2017); and access to finance (Beck et al. 2004).

The survey uses face-to-face interviews with respondents who are company owners, top managers, accountants, and human resource managers. The population in this survey comprises private companies from various industries, namely, all manufacturing, construction, service, transportation, storage and communication, and other industries. The sample frames are drawn from various sources, such as state statistical offices and other government agencies or tax authorities or business licenses. Company lists are obtained from business associations or marketing databases in some cases. The survey uses a stratified random sampling method using three criteria, namely, company size, business sector, and geographic area in each country (World Bank 2009). Companies are categorized into small, medium, and large companies based on their size. Companies are categorized into manufacturing, retail, and other service companies based on their business sector. The survey selects a sample of firms from the cities/regions that collectively represent the most significant economic activity in the country deemed to increase the sample’s geographic representation. Because this study focuses on corporate tax compliance, the data used for this study concern formal companies (Gökalp et al. 2017). Considering these criteria, the researcher excluded outlier data; thus, the number of companies used in this study is 45,504.

3.2. Measurement

The dependent variable in this study is tax compliance, which is assessed using World Bank survey queries, such as “Over the last year, how many times was this establishment either inspected by tax officials or required to meet them?”. The more the tax office audits the firm, the more it shows tax problems (OECD 2014). Tax compliance can be classified into three categories: no compliance, partial compliance, and full compliance (Amponsah and Adu 2017). Tax compliance is measured based on the tax audit conducted by the tax office. The absence of compliance shows that the tax office often checks a company. Partial compliance indicates that the company is under tax audit. However, because some items of non-compliance can be clarified and immaterial, the company is not subject to tax audit and, at the last level, is included in the category of full compliance if the tax office never investigates the company.

Access to finance as a mediating variable is assessed by the query “To what degree is access to finance an obstacle to the current operations of this establishment?” and quantified on a scale from 0 (no obstacle) to 5 (very severe obstacle). Because this question evaluates financial restrictions that conceptually conflict with access to finance, this study reverses the value of the answers to this question (reverse scaling). Financial statement audit is the independent variable of this research and is measured by yes/no questions, such as “In last fiscal year, did the establishment have its financial statements checked and certified by an external auditor?”. Meanwhile, this study examines the gender of top managers with the question “Is the top manager female?”. This study uses various firm-level control variables, including firm size, firm age, and family ownership. These measurements are presented in more detail in Table 1.

Table 1.

Measurements of variables.

3.3. Model Specification

The first and second equations are used to assess the study’s first and second hypotheses (financial statement audits affect access to finance and tax compliance), respectively:

TC = a + β1AUDIT + β2SIZE + β3AGE + β4FAM + e

FINACC = a + β1AUDIT + β2SIZE + β3AGE + β4FAM + e

Meanwhile, to investigate the influence of financial statement audits on tax compliance as mediated by access to finance, it is necessary to utilize the following equation:

where TC is tax compliance, AUDIT is an audit of financial statements, FINACC is access to finance, SIZE is company size, AGE is company age, FAM is a family company, and e is a symbol of error in statistical equations.

TC = a + β1AUDIT + β2FINANCE + β3 SIZE + β4AGE + β5FAM + e

3.4. Data Analysis

This study uses two statistical analyses: (1) descriptive statistics (mean, standard deviation, minimum, and maximum) to describe the research variables and (2) inferential statistics to test model estimates. Tax compliance as the dependent variable is measured on an ordinal scale (full compliance, partial compliance, and non-compliance); the model is tested using multinomial regression analysis. Furthermore, testing financial access as a mediation of the effect of auditing financial statements on tax compliance is carried out on several grounds according to MacKinnon (2008): (1) if the estimated coefficient of the independent variable (β1) is in Equation (1) and the coefficient of estimation of the mediator variable (β2) is in Equation (3), each being significant, then there is a mediating effect; (2) if coefficient 1 in Equation (3) is more significant than the same coefficient in Equation (1), then (3) uses three tests, namely, the Sobel test, Aroian test, and Goodman test, with the formula taken from Mackinnon and Dwyer (1993) and MacKinnon et al. (1995) as follows:

Sobel test

Aroian test

Goodman test

a = regression coefficient of the relationship between financial statement audits on tax compliance and mediators, and b = regression coefficient of the relationship between financial access and tax compliance. Sa = standard error a, and Sb = standard error b. If the calculated z value is greater than the z-table value, access to finance plays a role in mediating the effect of financial audits on tax compliance.

To determine whether the effect of audits on tax compliance varies by gender, the sample is divided into two sub-samples based on the gender of the manager.

4. Results

4.1. Descriptive Statistics

Of the 45,504 firms examined, 61.99% already have audited financial statements, and 31% see no barriers in access to finance. The majority of firms (55.97%) are rated as partially compliant with tax regulations. Based on gender differences in top management, 14,988 (32.9%) of the firms are led by female managers, while male managers manage the remaining 30,516 firms (67.1%). The complete results of the audit of the financial statements, access to finance, and tax compliance in the sample firms based on gender disparities among the managers are shown in Table 2.

Table 2.

Descriptive statistics.

4.2. Verification of Hypothesis

Model 1 in Table 3 shows that the financial statement audit variables have a negative impact on tax compliance. The results of this test are in direct opposition to what was projected in terms of the positive influence of financial statement audits on corporate tax compliance. Thus, H1 is not supported. These findings may imply that firms with financial statement audits are not abiding by their tax obligation or may even result in the opposite conduct. Additionally, the findings of this study contradict those of prior research (Kasper and Alm 2020) that demonstrated a positive effect of financial statement audits on tax compliance. This is possible because many external auditors perform financial statement attestation services and perform non-assurance services, including tax planning (Maydew and Shackelford 2007). Therefore, auditors in private companies and that maintain the quality of commercial, financial reports through attestation of financial statements can also assist in the preparation of fiscal financial statements through tax planning. Table 3 shows that company size has a negative effect on tax compliance. Previous empirical studies have also shown that firm size has a negative effect on tax compliance, for example, the studies of Wang et al. (2014), Dyreng et al. (2008), and Mills et al. (2013). Meanwhile, the sample companies in this study that have audited financial statements are dominated by large companies (37.22%) and medium-sized companies (32.45%). Thus, it can be concluded that there is an effect of firm size on the relationship between the existence of a financial statement audit and tax compliance.

Table 3.

The regression results of tax compliance.

The results of the control variable test demonstrate that tax compliance has a negative effect on firm size and firm age. Meanwhile, control variables, such as family ownership, have been shown not to affect tax compliance since their significance value exceeds 0.10.

Model 2 shows that the audit of financial statements positively affects financial access in private companies. Therefore, the audits of a financial statement have a beneficial impact on access to finance, resulting in the support of H2. The findings of this study are consistent with the findings of previous studies (e.g., Alrashidi et al. 2021) that demonstrated that financial statement audits improve access to finance. Firms that have audited financial statements are more likely to receive financing from financial and non-financial entities.

The control variable has a significance value of 0.000. However, the direction of the significant value varies. The firm size variable has a value of 0.131, the firm age variable has a coefficient of −0.002, and the family ownership variable has a coefficient of 0.052. As a result, firm size and family ownership impact access to finance, whereas firm age has a negative impact on access to finance.

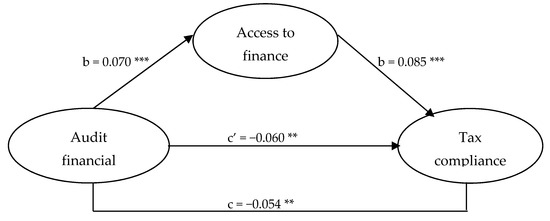

Before analyzing the mediating effect of financial access on the effect of financial statement audits, it is important to understand financial access to tax compliance. As shown in Model 3, access to finance positively impacts tax compliance (β = 0.085, p = 0.000). Companies with better finances tend to be cooperative in fulfilling tax obligations (Gökalp et al. 2017). To determine whether financial access can act as a mediating variable, one can start by investigating the path coefficient (β1) in Equation (1) and coefficient (β2) in Equation (3), which both show significant results (Figure 1); financial access leads to the intermediary variable. Furthermore, if the coefficient on financial statements audits in Model 3 is higher than the same coefficient in Equation (1), the mediating role of access to finance is confirmed. Model 3 indicates a coefficient of −0.066, which is somewhat higher than the coefficient of −0.060 in Model 1. This demonstrates that the audit of financial statements has an indirect impact on the tax compliance of private enterprises through access to finance. Finally, the Sobel test, Aroian test, and Goodman test results in Table 4 show that the Z test results are more than 2.576 (α = 1%), so financial access has a mediating role in the effect of auditing financial statements on tax compliance. Therefore, H3 is supported.

Figure 1.

Mediation effect. Note: *** and ** indicate statistical significance at 1% and 5% levels, respectively.

Table 4.

Mediation tests.

Further analysis is conducted to determine whether there are differences in the effects of financial statement audits and access to finance on tax compliance based on the gender of top managers.

In Table 5, Panel A displays the effect of auditing financial statements on tax compliance, and the results show that the coefficient for female-run companies is 0.008, with a significance level of 0.064. In contrast, the coefficient for male-managed firms is 0.091, with a significance level of 0.005. The findings of this study are in line with H4a. This shows that audits of financial statements that negatively impact tax compliance are more likely to occur in companies managed by men than in companies managed by women. That is, in companies led by female managers, financial statement audits positively impact tax compliance.

Table 5.

Gender contextual roles in tax compliance.

In Table 5, Panel B demonstrates that the regression coefficient on the influence of access to finance on tax compliance is more substantial for female managers than for male managers, with each having a significance of 0.000. As a result, H4b is supported. When comparing firms with female top managers to firms with male top managers, the positive effect of access to finance on tax compliance is stronger for female-led firms. The difference in impacts between firms managed by female and male managers empirically demonstrates that attributes such as gender play a critical role in how an organization’s top management approaches tax compliance. These results confirm the findings of Morsy (2020), which demonstrate that the gender of top management has an impact on access to finance, and they support the findings of Kangave et al. (2021); Damayanti and Supramono (2019); D’attoma et al. (2020); and Hoseini and Gerayli (2018), which demonstrate that the gender of top management has an impact on tax compliance.

5. Conclusions

The present study’s findings indicate that financial statement audits do not directly lead firms to adhere to their tax obligations. The findings suggest that the favorable impact of financial statement audits on tax compliance should be considered regarding their relationship with other variables, such as access to finance and top management’s gender. Through easy access to finance from financial and non-financial entities, auditing financial statements could benefit tax compliance. Financial statement audits contribute to reducing agency conflicts between financial service providers and enterprises that require financing. Firms with greater access to finance are more compliant with their tax obligations. The results regarding the role of mediating access to finance also underpin the relationship mentioned above; firms auditing financial statements prefer to comply with their tax duties once they have access to financing. As a result of this research, it was also discovered that female top management has a beneficial impact on tax compliance.

This study successfully incorporated the role of financial statement audits, access to finance, and gender into the framework of tax compliance. Previous research (Alrashidi et al. 2021) only examined a portion of the relationship between financial statement audits and access to finance and the relationship between financial statement audits and tax compliance (Kasper and Alm 2020). This study adds to the growing body of evidence indicating a positive relationship between financial statement audits and access to finance and tax compliance. Moreover, this study helps to improve corporate managers’ gender role awareness of tax compliance in developing nations, thereby enhancing financial statement audits and access to finance.

This study’s findings have several implications. First, in terms of managerial implications, firms that place a high priority on financial statement audits have a greater possibility to obtain financing from financial institutions than firms that place a low priority on financial statement audits, considering that the audit of financial statements might provide trustworthy information to facilitate financial institutions. Firms require additional capital to examine performance and risk thoroughly. Second, to increase tax compliance, policymakers should encourage financial institutions, particularly those under government control, to create greater chances for firms auditing financial statements to access larger amounts of capital and faster disbursement of funds. Moreover, the gender equality program should continue to be promoted, allowing more women to take roles as top managers.

The limitation of this study is that it tested the theory at the firm level as a control variable and not at the country level. A suggestion for future research is to consider the theory at the country level because this research covers multiple countries.

Author Contributions

Conceptualization, S.S. (Sunardi Sunardi), and T.W.D.; methodology, S.S. (Supramono Supramono); software, Y.B.H.; validation, Y.B.H., S.S. (Supramono Supramono) and T.W.D.; formal analysis, S.S. (Sunardi Sunardi); investigation, T.W.D.; resources, S.S. (Sunardi Sunardi) and Y.B.H.; data curation, S.S. (Sunardi Sunardi); writing—original draft preparation, Y.B.H.; writing—review and editing, Y.B.H.; supervision, Y.B.H.; project administration, T.W.D. All authors have read and agreed to the published version of the manuscript.

Funding

This study received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The study does not report any data.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alm, James, Liu Yongzheng, and Zhang Kewei. 2019. Financial constraints and firm tax evasion. International Tax and Public Finance 26: 71–102. [Google Scholar] [CrossRef] [Green Version]

- Alrashidi, Rasheed, Diogenis Baboukardos, and Thankom Arun. 2021. Audit fees, non-audit fees and access to finance: Evidence from India. Journal of International Accounting, Auditing and Taxation 43: 1–15. [Google Scholar] [CrossRef]

- Amponsah, Stephen, and Kofi Osei Adu. 2017. Socio-demographics of tax stamp compliance in Upper Denkyira East Municipal and Upper Denkyira West District in Ghana. International Journal of Law and Management 59: 1315–30. [Google Scholar] [CrossRef]

- Arnaboldi, Francesca, Barbara Casu, Elena Kalotychou, and Anna Sarkisyan. 2020. The performance effects of board heterogeneity: What works for EU banks? European Journal of Finance 26: 897–924. [Google Scholar] [CrossRef]

- Bacha, Sami, Aymen Ajina, and Ben Sourour Saad. 2021. CSR performance and the cost of debt: Does audit quality matter? Corporate Governance (Bingley) 21: 137–58. [Google Scholar] [CrossRef]

- Beck, Thorsten, Asli Demirguc-Kunt, and Vojislav Maksimovic. 2004. Bank Competition and Access to Finance: International Evidence. Journal of Money, Credit, and Banking 36: 627–48. [Google Scholar] [CrossRef]

- Beck, Thorsten, Chen Lin, and Yue Ma. 2014. Why do firms evade taxes? The role of information sharing and financial sector outreach. Journal of Finance 69: 763–817. [Google Scholar] [CrossRef] [Green Version]

- Clarke, George R. G. 2021. How do women managers avoid paying bribes? Economies 9: 19. [Google Scholar] [CrossRef]

- D’attoma, John W., Clara Volintiru, and Antoine Malézieux. 2020. Gender, Social Value Orientation, and Tax Compliance. CESifo Economic Studies 66: 265–84. [Google Scholar] [CrossRef]

- Damayanti, Theresia Woro, and Supramono Supramono. 2019. Women in control and tax compliance. Gender in Management 34: 444–64. [Google Scholar] [CrossRef]

- Dobija, Dorota. 2020. Institutionalizing corporate governance reforms in Poland: External auditors’ perspective. Journal of Management and Business Administration. Central Europe 27: 28–54. [Google Scholar] [CrossRef]

- Downing, Jeff, and John Christian Langli. 2018. Audit exemptions and compliance with tax and accounting regulations. Accounting and Business Research 49: 28–67. [Google Scholar] [CrossRef]

- Dyreng, Scott, Michelle Hanlon, and Edward Maydew. 2008. Long-run corporate tax avoidance. The Accounting Review 83: 61–82. [Google Scholar] [CrossRef]

- Elbannan, Mohammad, and Omar Farooq. 2020. Do more financing obstacles trigger tax avoidance behavior? Evidence from Indian SMEs. Journal of Economics and Finance 44: 161–78. [Google Scholar] [CrossRef]

- Ferrando, Annalisa, and Allesandro Ruggieri. 2018. Financial constraints and productivity: Evidence from euro area companies. International Journal of Finance and Economics 23: 257–82. [Google Scholar] [CrossRef]

- Fisk, Susan R. 2018. Who’s on Top? Gender Differences in Risk-Taking Produce Unequal Outcomes for High-Ability Women and Men. Social Psychology Quarterly 81: 185–206. [Google Scholar] [CrossRef]

- Francis, Jere R., Inder K. Khurana, Xuimin Martin, and Raynolde Pereira. 2011. The relative importance of firm incentives versus country factors in the demand for assurance services by private entities. Contemporary Accounting Research 28: 487–516. [Google Scholar] [CrossRef]

- Galasso, Adele, Francesco Gerotto, Giancarlo Infantino, Francesco Nucci, and Ottavio Ricchi. 2018. Does Access to Finance Improve Productivity? The Case of Italian Manufacturing. In Getting Globalization Right. Cham: Springer-Nature. [Google Scholar] [CrossRef]

- Giang, Mai Huong, Bui Hui Trung, Yuichiro Yoshida, Tran Dang Xuan, and Mai Thanh Que. 2019. The causal effect of access to finance on productivity of small and medium enterprises in Vietnam. Sustainability 11: 5451. [Google Scholar] [CrossRef] [Green Version]

- Gökalp, Ebru, Umut Şener, and P. Erhan Eren. 2017. Development of an Assessment Model for Industry 4.0: Industry 4.0-MM. Informatics Institute. Ankara: Middle East Technical University. [Google Scholar] [CrossRef]

- Gomez-Mejia, Luis, J. Samuel Baixauli-Soler, Maria Belda-Ruiz, and Gregorio Sanchez-Marin. 2019. CEO stock options and gender from the behavioral agency model perspective: Implications for risk and performance. Management Research 17: 68–88. [Google Scholar] [CrossRef]

- Guo, Jang Ting, and Fu Sheng Hung. 2020. Tax evasion and financial development under asymmetric information in credit markets. Journal of Development Economics 145: 102463. [Google Scholar] [CrossRef] [Green Version]

- Hambrick, Donald, and P Phyllis Mason. 1984. Upper Echelons: The Organization as a Reflection of Its Top Managers. Academy of Management Review 9: 193–206. [Google Scholar] [CrossRef]

- Hope, Ole Kristian, Shushu Jiang, and Dushyantkumar Vyas. 2021. Government procurement and financial statement certification: Evidence from private firms in emerging economies. Journal of International Business Studies 52: 718–45. [Google Scholar] [CrossRef]

- Hoseini, Mohammadreza, and Mahdi Safari Gerayli. 2018. The presence of women on the board and tax avoidance: Evidence from Tehran Stock Exchange. International Journal of Finance & Managerial Accounting 3: 53–62. [Google Scholar]

- Ibrahim, Hassan Bashir, Caren Ouma, and Jeremiah Koshal. 2019. Effect of gender diversity on the financial performance of insurance firms in Kenya. International Journal of Research in Business and Social Science 8: 274–85. [Google Scholar] [CrossRef]

- Jabari, Huthayfa Nabeel, and Rusnah Muhamad. 2020. Gender diversity and financial performance of Islamic banks. Journal of Financial Reporting and Accounting 19: 412433. [Google Scholar] [CrossRef]

- Kangave, Jalla, Ronald Waiswa, and Nathan Sebaggala. 2021. Are Women More Tax Compliant than Men? How Would We Know? African Tax Administration Paper 23: 1–23. [Google Scholar] [CrossRef]

- Kasper, Matthias, and James Alm. 2020. Audits, Audit Effectiveness, and Post-audit Tax Compliance. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Kassem, Rasha, and Umut Turksen. 2021. Role of Public Auditors in Fraud Detection: A Critical Review. In Contemporary Issues in Public Sector Accounting and Auditing (Contemporary Studies in Economic and Financial Analysis). Edited by S. Grima and E. Boztepe. Bingley: Emerald Publishing Limited, vol. 105, pp. 33–56. [Google Scholar] [CrossRef]

- Kong, Xiaowei, Deng Kui Si, Haiyang Li, and Dongmin Kong. 2021. Does access to credit reduce SMEs’ tax avoidance? Evidence from a regression discontinuity design. Financial Innovation 7: 1–23. [Google Scholar] [CrossRef]

- Lim, Mark, and Jessica Foster. 2020. Credit Constraints and the Productivity of Small and Medium-sized Enterprises: Evidence from Canada. Asian Journal of Economics and Empirical Research 7: 178–85. [Google Scholar] [CrossRef]

- Luo, Jinbo, Xiaoran Ni, and Gary Gan Tian. 2020. Short selling and corporate tax avoidance: Insights from a financial constraint view. Pacific Basin Finance Journal 61: 1–21. [Google Scholar] [CrossRef]

- MacKinnon, David. 2008. Introduction to Statistical Mediation Analysis. Routledge: New York. [Google Scholar]

- Mackinnon, David, and James Dwyer. 1993. Estimating Mediated Effects in Prevention Studies. Evaluation Review 17: 144–58. [Google Scholar] [CrossRef]

- MacKinnon, David, Ghulam Warsi, and James Dwyer. 1995. A Simulation Study of Mediated Effect Measures. Multivariate Behavioral Research 30: 41–62. [Google Scholar] [CrossRef] [PubMed] [Green Version]

- Maydew, Edward, and Douglas Shackelford. 2007. The changing role of auditors in corporate tax planning. In Taxing Corporate Income in the 21st Century. Cambridge: Cambridge University Press. [Google Scholar] [CrossRef] [Green Version]

- Mills, Lilian, Sarah Nutter, and Casey Schwab. 2013. The effect of political sensitivity and bargaining power on taxes: Evidence from federal contractors. The Accounting Review 88: 977–1005. [Google Scholar] [CrossRef]

- Moalla, Hanen, and Rahma Baili. 2019. Credit ratings and audit opinion: Evidence from Tunisia. Journal of Accounting in Emerging Economies 9: 103–25. [Google Scholar] [CrossRef]

- Modigliani, Franco, and Merton Miller. 1958. The Cost of Capital, Corporate Finance and the Theory of Investment. The American Economic Review 48: 261–97. [Google Scholar]

- Morsy, Hanan. 2020. Access to finance—Mind the gender gap. Quarterly Review of Economics and Finance 78: 12–21. [Google Scholar] [CrossRef] [Green Version]

- OECD. 2014. Measures of Tax Compliance Outcomes: A Practical Guide. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Olayinka, Joshua Akinlolu, and Sirinuch Loykulnanta. 2019. How domestic firms benefit from the presence of multinational enterprises: Evidence from Indonesia and Philippines. Economies 7: 94. [Google Scholar] [CrossRef] [Green Version]

- Orazalin, Nurlan, and Rassul Akhmetzhanov. 2019. Earnings management, audit quality, and cost of debt: Evidence from a Central Asian economy. Managerial Auditing Journal 34: 696–721. [Google Scholar] [CrossRef]

- Suherman, Suherman, Berto Usman, Titis Fatarina Mahfirah, and Renhard Vesta. 2021. Do female executives and CEO tenure matter for corporate cash holdings? Insight from a Southeast Asian country. Corporate Governance 2: 939–60. [Google Scholar] [CrossRef]

- Svanström, Tobias. 2014. Audits of private companies. In The Routledge Companion to Auditing. Edited by David Hay, Robert Knechel and Marleen Willekens. New York: Routledge, pp. 148–58. [Google Scholar]

- Tomkiewicz, Jacek, and Postula Marta. 2020. State Autonomy in Shaping Tax Policies: Facts and Myths Based on the Situation in OECD Countries. Central European Management Journal 28: 83–97. [Google Scholar] [CrossRef]

- Trpeska, Marina, Atanasko Atanasovski, and Bozinovska Zorica Lazarevska. 2017. The relevance of financial information and contents of the new audit report for lending decisions of commercial banks. Journal of Accounting and Management Information Systems 16: 455–71. [Google Scholar] [CrossRef]

- Vanstraelen, Aan, and Caren Schelleman. 2017. Auditing private companies: What do we know? Accounting and Business Research 47: 565–84. [Google Scholar] [CrossRef] [Green Version]

- Wang, Ying, Michael Campbell, and Debra Johnson. 2014. Determinants of effective tax rate of China publicly listed companies. International Management Review 10: 10–20. [Google Scholar]

- World Bank. 2009. Enterprise Survey and Indicator Surveys: Sampling Methodology. Available online: www.enterprisesurveys.org (accessed on 1 March 2022).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).