Abstract

Purpose: the objective is to measure the financial and social performance of 127 microfinance institutions (MFIs) and observe the effects with explanatory factors such as “type”, “geography region”, and “secular and faith” variables. Design/methodology/approach: The time-series performance analysis of microfinance institutions is determined in two stages. In the first stage, both the social and financial efficiencies are measured with Data Envelopment Analysis (DEA) approach. The two explanatory factors along with faith and secular variables show the effect on these determined efficiencies by the second stage of the Tobit regression Random effect Model. Findings: Financial performance is greater than the social performance from the first stage analysis. When considering the explanatory variables, the social performances are not significant with religious factors. When the regression is performed in a group, the financial score is more significant with religious and other explanatory variables. Faith-based and secular-based microfinance institutions are strongly significant if the performances (efficiencies) are highly maintained. Originality/Value: faith and secular variables are identified based on the background/history information of each microfinance institution (MFI).

1. Introduction

Financial services for an individual ameliorate inclusion and performing business activities for obtaining a smooth economy (Li et al. 2019). Organizational performance promotes good outcomes irrespective of size, type, or faith, but is achieved by good loan repayment rates. The self-employed destitute have strong capabilities and commitments to structure their living and the microfinance institutions (MFIs) extend the frontiers with small credits and other financial services such as insurance, policies, mutual funds, etc. (Alimukhanedova 2013), while the access to traditional banks for the same destitute has been difficult for financial advancement activities. MFI finances with low-security risks and has a critical role in the progress of the economic system in emerging countries by showing their significant financial services (such as group lending, self-monitoring, short-repayment methods, etc.) to millions of poor households globally (Daley-Harris 2009; Hadi and Kamaluddin 2015) in addition with the digitalized services (Agrawal and Sen 2017). It is observed that MFIs emerged from traditional banks to calculate and function their administration based on the profit efficiency, operating costs, and returning capital constraints which leads to economical profit being more important than social outreach (Kar 2012). Although one or group of efficiency (financial, social, and technological) is important in the functioning of a financial organizations to sustain bankruptcy or shutting down. At a certain point, the financial, social, and technological efficiencies are interconnected. Few dimensions of MFIs (NBFC1, credit unions, micro-credits, rural banks, NGOs2) were taken into consideration for the influence of their services and functionalities. Few operate with the spirit of capitalism (private ownership) but always abide by the reserve bank guidelines.

The capital structuring for an MFI (faith or secular) is obtained from sources such as government subsidiaries, public-private investments (shareholders), debt capital, profits, and third-party donations (Tchuigoua 2015). Apart from the public and the commercial funders, both provide funds as a charity for certain types of microfinance organizations for global development (Cobb et al. 2016). The level of profits, revenues, ROA3, and ROE4 ratios from operating costs, loan size, cost per borrower, etc., describes the performance of an MFIs. For better sustainability of MFI, it is important to maintain the average returns from the clients on timely basis agreements. It is also important to merge the economic and social gaps for proper and smooth functionality (Liñares-Zegarra and Wilson 2018). The profit-based institutions extend links with capital markets to ensure maintaining profitability and high-rate efficiency. The traditional MFIs are profit-based because the drawn-out monetary usefulness is a higher priority than the social effort (Leite et al. 2019; Liñares-Zegarra and Wilson 2018; Schwarz et al. 2015).

We drew the financial data from the World Bank catalog with the Mix-market collaboration and the data were extracted from 25 countries with 127 microfinance institutions and similar data were used in several studies (Aggarwal et al. 2015; Leite et al. 2019; Navajas and Tejerina 2006; Sainz-Fernandez et al. 2018; Wijesiri et al. 2015, 2017). The dual efficiency is a technique to understand the organization’s performances and may estimate by diverse variables while we considered financial and social variables that reflect the performance factors of each microfinance institution. The data envelopment analysis (DEA) (Charnes et al. 1978), is a non-parametric approach bootstrap method that analyses the sensitivity of measured efficiency score by decision-making units (DMUs) (Simar and Wilson 2007). The DMUs have non-specified measurable properties and are neither classified in categories nor groups of faith and secular but the assumption is made for all MFIs in the analysis.

It is necessary to explore the marginal changes and impact of environmental indicators on the dual efficiencies. Several studies (Lebovic 2004; Wijesiri et al. 2015) used a censored model to investigate the determinants of efficiency estimates. The Tobit regression truncated random effect method is preferred as the correlation exists with an error term for both input and output variables (Amemiya 1984), the censored regression is used to analyze the impact of indicators such as type, religion, and region on efficiency performances. It is believed that an indirect relationship exists between the social/economical factors with the organizational principles (type, region, and religion). The religion and region indicators are organized by faith, secular institutions by the life cycle of MFIs, and they were identified and represented by three regions (Asia, Africa, and Latin America). The straightforward time-series Tobit censored linear regression model is assumed with a minimum of two autonomous variables/indicators individually for dual efficiencies. The second stage regression exhibits the indicators over efficiencies, and it is significantly seen that faith-adopted MFIs show better social outreach than traditional institutions.

The study is organized in sections and the following literature (Section 2) describes the important classification that is concentrated to determine the efficiencies, the effect of efficiencies over the observatory variable on women in microfinance, religious performance, effectiveness. Section 3 has empirical literature followed with the data and Section 4 has the methodology, Section 5 has the results of the performances and impaction with the regression model. Section 6 has the discussion and conclusions.

2. Literature Review

Microfinance institutions serve the development of society assisting the poor with turning out to be little business visionaries by micro-credits/grants without accepting interest rates (faith-operated) or little interest rates (traditionally operated). The clustered faith-based institutions are differentiated with the functionalities. To strike the difference between outreach and poverty alleviation, the institutional performance varies on the technical operations, attractiveness, strategies, methodologies, etc., and these categories have importance depending on the secular-based microfinance institutions (SB-MFIs) or the faith-based microfinance institutions (FB-MFIs). The cross-country MFIs are some laid out privately but are regulated under government policies with suitable regulatory acts, credit information companies, Reserve/Central bank, and Microfinance Regulatory Authority. Loan portfolios, recovering activities, are managed by financial managers and legal teams, apart from tradition/religion, MFIs raise funds with savings mobilizations (Wijesiri et al. 2015), donations (with the risk of liquidity management, this is considered as the minimal investment), deposits, and other cumulative surpluses. Partially, few MFIs are controlled and managed by women with profiting terms and policies, this is considered as a business activity or entrepreneurial establishment. We further discuss the role of gender (women) in microfinance.

2.1. Microfinance and Women

Business with opportunity-driven strategies in low-income countries satisfies basic needs and enhance the welfare of the poor (Schwarz et al. 2015). Gender orientation contrasts in microfinance are particularly critical because women have a crucial impact on money-related progressions, especially in the turn of advancements. Women are granted lower importance than men because of their educational levels, discrimination, etc. Women in microfinance promote and strengthen the International Labor Organizations (ILOs) which has a decent work agenda. MFIs are established in urban/rural areas, where the women borrowing rate is increasing in annual periods (from the cross-country data). In the rural areas, the increase in small enterprises by women allows to mitigate patriarchal practices and make women empowerment grow in significant proportions. Trust is the main concern that the financial institution believes, and MFIs assist with entrepreneurial training skills to women in some regions and provide confidence in the establishment of small-scale industries in rural areas with low-interest rates (Hadi and Kamaluddin 2015). There is a 54.6% increase in active women borrowers since 2009, which increased the financial inclusion in microfinance. The combination of microfinance and social assert, brings norms, trust, and networks to connect people and coordinate with their actions. The average borrowing rate of female borrowers and only 16 countries have at least 50% and 9 countries have 70% access in rural areas, the average rate is much increased from the year 2008. MFIs grant capital with low-interest rates for entrepreneurial enterprises, especially female borrowers are better with loan repayment, and analytically the financial outreach is significantly high (Aggarwal et al. 2015; Belwal et al. 2012; Ul-Hameed et al. 2018). Indeed, we chose “women borrower” as a significant indicator for determining the social efficiency for regions in Asia, Africa, Latin America, and the Caribbean, where women’s participation plays a decisive role in the analysis. From the religious point of view women are playing a more valuable role than in traditional institutions.

2.2. Religion Performance and Effectiveness

Religion rehearses impact and changes the human mind despite literacy (Barro and McCleary 2003). Non-profit and regional MFIs primarily focus on developments in poverty alleviation. On the other hand, faith MFIs follow the community and religiously implemented principles and the results are more explored from the conviction-based institutions. In Islamic law, there is a prohibition to apply interest rates on loans (Imam and Kpodar 2016) and there are more potential in attaining social performance with counterparts with conventional organizations, and fundings are made with profits (Fersi and Boujelbéne 2016). Catholic microfinance institutions are better with financial performance in developing efforts (Mersland et al. 2013). It is empirically analyzed that women are more concerned with religious practices and ethics (Gyapong et al. 2021). The religious institutions are risk aversion and have low stock returns. In an Islamic country such as Bangladesh, social efficiency is 22% more than financial efficiency (Khan and Sulaiman 2015; Mia and Chandran 2016). We took the religion factor (irrespective of belief) as a dependent variable to differentiate the efficiencies socially and financially with profit/non-profit microfinance organizations.

The faith-based institutions follow the principles imposed by their religion and run administration to reach social and financial objectives. In countries such as Pakistan, Afghanistan, Bangladesh, and Middle Eastern countries, religion (Islam) is very important and treated in almost every activity. Mansori et al. (2020) collected questionaries from each Muslim and the gender classification (majority men have favor towards religion) showed importance. Spotted the difference in the risks between FB-MFIs and conventional Islamic MFIs cross-sectionally from the period 1998–2014 from the MIX database, the results show financial stability with SB-MFIs with low risk, evidence from OSS regression. The DEA-CRS5 analysis on 72 MFIs (NGOs and NBFIs) in MENA regions where MFI performances in Islamic nations are significant socially and financially, and these efficiencies are concerning to age (Mature, Young, and New) (Ben Abdelkader and Mansouri 2019). It is feasible to identify institutions and Table 1 shows the institution type with the religious status of each country. The background and historical analysis are perfectly performed to explore the religious status of the microfinance institution itself, it is observed many MFIs are integrated with Vision fund in Latin American regions (Catholic), and East Asian countries.

Table 1.

Microfinance country, type, and religious status.

3. Research Design

3.1. Research Questions

The research questions are developed in two parts:

- To determine the social and financial efficiency of 129 cluster MFIs (faith and secular) with a frontier non-parametric methodology (Simar and Wilson 2007; Seiford and Zhu 2014; Wijesiri et al. 2015). This helps to identify the microfinance status in established countries;

3.2. Data Selection

The performance and the selection of variables were inspired by the contributions in the microfinance industry (Gutiérrez-Nieto et al. 2009; Gyapong et al. 2021; Mersland et al. 2013; Schwarz et al. 2015; Wijesiri et al. 2015; Wijesiri and Meoli 2015), etc. The sample of 127 MFIs was selected from the World Bank financial database (Mix market) with annual periods 2008–2018. The specific variable “Female borrowers” is inspiring with the increase in clients annually in many countries. Table 2 discusses the MFIs list and the percentage of borrowers, investments, and equity in each type of MFIs.

Table 2.

Financial funding of different microfinance institutions.

3.3. Variable Selection

Table 3 describes the explanation of dependent and independent variables for efficiency measurement with definitions. The selection of indicators is influenced by the previous works published in the articles where cross-country data have importance. The analysis is not based on specific country performance instead, it is cross-country productivity impaction.

Table 3.

Selection and description of input/output variables for the first stage of analysis.

The financial revenue is an output variable to determine the financial performance of MFIs. The financial performance tends to raise if there are more dependents and good repayment rates irrespective in rural or urban regions, for this purpose the variable borrowers are used to determine the social outreach performance of MFI. (Microfinance-Barometer-2019_web-1, n.d.) report specifies there is an incremental increase with women entrepreneurs annually for a decade so, women/female borrowers help to determine the social efficiency. The following Table 4 has numerical statistics of input and output variables along with the correlations between the variables are in Table 5.

Table 4.

Mean and standard deviation of input/output variables.

Table 5.

Correlations of input/output variables.

3.4. Borrowing Rate

Women workers in developing countries all through the world contribute their development in financial turn and microfinance helps to empower them and helps with making their commitment (Somavia 2007). According to the data, women clients are up to 73% on average. The average female borrowing rate is classified in Table 6, from the countries which are considered in the analysis. Ghana and Pakistan which have faith-based MFIs are dominating in the second position and Azerbaijan, Tanzania takes the last position in the female borrowing rate.

Table 6.

Percentage of female borrowers in 25 countries.

4. Methodology

Data envelopment analysis (DEA) is a non-parametric bootstrap approach that requires simple time-series data (with no financial gaps) to analyze the competence scores without any complex assumptions in any industry. Charnes et al. 1978 first developed the efficiency measuring model, later applied to identify the organizational performances in the banking sector (Wijesiri et al. 2015, 2017). Bootstrapping has the simple notion of repeated data generating process (DGP) and applying the original simulant to each outcome model (Wijesiri et al. 2015). The selection of appropriate input and output variables depends on the input-oriented and output-oriented methods. In this analysis, we restricted the non-parametric, output-orientated, and constant return to scale DEA approach to determine the production performances. The MFI identities are disclosed and are represented by the normal series from 1, 2, 3…., 127 which act as the decision-making units to produce efficiency scores (Simar and Wilson 2010). We assume for the development of efficiencies from the decision-making units “p” (DMUs), it is necessary to select “m” different inputs and “n” output/s from the available dataset. Each DMU (“p”) has one positive input and one positive output.

We assume:

The virtual output to the virtual input to maximize the efficiency of each DMU (p) is formulated and should be less than or equal to zero.

where for all i and r.

The censored Tobit truncated random effect regression (as we have time-series data) was discussed to exhibit the relation between the measured dual efficiency scores (act as dependent variables) in the first stage of DEA analysis on the explanatory factors. Tobit model aids in determining the marginal changes on dependent variables by concerning lower and upper impediments. It represents the effect of an independent variable over the conditional variable. The regression provides the validation by considering the dual efficiencies and the overall empirical performance of the microfinance industry is obtained and controls different parameters. The linear regression is followed:

where represents the social efficiency score, represents the financial efficiency score, the , , are the coefficients for the explanatory variables and is the statistical error term, where p represents the DMSs/MFIs (127). Equation (3) represents the social efficiency depending on all the three explanatory indicators. Whereas Equations (4)–(6) represent two explanatory indicators. The indicators imply the religious status, geographic region, and type of financial organization. The religious status, geographic position, and type of the institutions are imported as dummy variables and represent binary numbers. For instance, if religion is a faith, I considered it as 1 otherwise 0. The same with the location and type. We tabulate the results from the analysis in Table 6.

5. Results

5.1. First Stage Non-Parametric Constant Rail Scale DEA Approach

Table 7 reports the efficiency scores of 127 MFIs globally. The aggregate efficiency score of MFI in 10 years and the individual scores are calculated separately. It is observed that financial outreach is dominating with social outreach.

Table 7.

The DEA social and financial efficiencies.

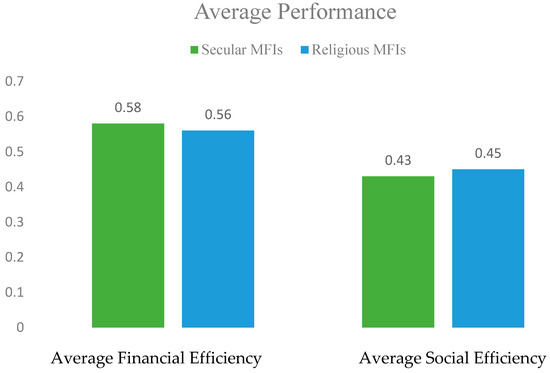

The efficiency scores, aggregate efficiency (θa), determined efficiency (θ) are bounded between 0 and 1. The MFIs with the efficiency scores of 1 are assumed developed or highly productive with high outreaches either socially or financially or both. Hence, we had clustered data with both religious and non-religious institutions, it is a bit challenging to spot the differences. The graphical representation of dual efficiency scores of faith and traditional institutions is exhibited in Figure 1.

Figure 1.

Faith and secular MFIs efficiency scores representation.

5.2. Second Stage Tobit Random Effect Model Regression

The Tobit regression model is an alternative to ordinary least squares regression and is employed when the dependent variable is bounded from below or above or both with positive probability pileup at the interval ends, either by being censored or by being corner solution. The regression with random effect model (unobservable effects are uncorrelated with the observed exploratory variables) shows strong/weak significance levels, the same effect on financial efficiency is vice versa and shows negative relation. The dependent variable aggregate social efficiency (SE) shows an effect with the independent indicators to test the significance of the type of institution and region. The type of order is followed by NBFC, Bank, Microcredit, Credit corporation, and NGOs which are the five types of microfinance institutions located in three different regions, Asia, Africa, Latin America, and the Caribbean. Table 8 represents the censored regression values, how the religious status depends on the explanatory factors.

Table 8.

Censored regression to test social efficiency as a response variable.

6. Discussion and Conclusions

This study examines the cross-country efficiency analysis of 127 MFIs followed by the religious beliefs and principles from 25 countries. In the literature section, we discussed the importance of women in microfinance and the religiosity effects from the published studies. The DEA is a meta-frontier approach that gained attention in determining the efficiencies with technological gaps in time series with the decision-making units (DMUs). The DMUs are the identities of organizations (financial institutions in our case) with heterogeneous financial properties from various groups and types of institutions (Walheer 2018), here the methodology is applied for the European data in different sectors. The cross-country dual efficiency scores from the first stage results show that social performance is weaker in traditional institutions and financial performance is greater and vice versa. It is also observed that the change in selecting variables does not lead to a change in the efficiency score. This observation leads to the general suggestion that management is inefficient to maintain the outreaches accurately. The conclusion also reaches the management is well established to collect the revenues (loans, interest, profits, etc.) or the clients are more responsible with their repayment to main the health of the economy. The Tobit random effect model uses the efficiency scores (social efficiency, in Table 7) to check the effectiveness of the explanatory indicators. The religion, type of the MFI, and location are artificially created dummy variables chosen in groups to establish a relation between the explanatory factors and the efficiencies (SE). The observation is made with the change in the group, there is a change in the significance level. The main intention is to determine the faith and secular performances, and it is observed with the cross-sectional efficiency scores the financial efficiencies show positive significance level at 0.95 and 0.90 but there is no strong significance level at 0.99. If the microfinance institution is healthily maintained with both social and financial outreaches, there is a high significance to determine the religious status will have stronger significance either financially or socially.

The religious factors have positive aspects to certain limits in accessing the loans, indeed the household poor can gain in their business establishments (women). It is well-known from the literature studies that women are more in accessing loans and good in their repayments. When it comes to traditional organizations, there are several formalities for loan assessment and therefore social outreach can damage in the rural areas where there is an absence of absolute empowerment. The financial organization has strategic moves but if there is no sufficient repayment rate in both secular/faith-based MFIs it leads to negative financial health. Therefore, the efficiency determination should be explored by consideration of the repayment rate in MFIs in future studies.

Microfinance organizations are vanishing the barriers with digital approaches. Although we analyzed with other variables (input and output factors), the results lead to the same conclusions with efficiencies. There should be a combination of dual efficiencies along with technical efficiency which would conclude better results in minimizing the resources in religious and secular microfinance institutions.

The efficiency analysis and regression dealt with the religious, locality, and type of institution factors. There are only a few studies concentrated purely on religious institutions because the count (of religious MFIs) is small in some countries. There is a scope to analyze the performances by considering and concentrating on religious institutions irrespective of religiosity, along with the technical performance.

Author Contributions

A.K.K.—Data curation: Creating and organizing the variables for clear visualization, Data extracting form world bank (Mix market database), selection of variables; Formal analysis: The prior study and understanding of methodology along with study of variables and relation between them; software: Stata 13; Investigation: Study of results, troubleshoots, technical errors; Original draft preparation: Theory and literature design with sectional structures; and conceptualization: The draft concept, ordering data, research questions, tables, figures, and sections. M.M.—Conceptualization: The review, design ideas, methodologies; review and editing: The table structures, definitions, concepts, tables structure (internally); Visualization: sectional organization, study of results, rectifying error terms; Project administration: The resources with assistance; Software: Stata 13; Investigation: Study of results, troubleshoots, technical errors; Methodology: The teaching and explanation of appropriate study to conduct and perform the analysis. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The data was extracted from the Mix market database (world bank).

Conflicts of Interest

The authors declare no conflict of interests.

Notes

| 1 | NBFC—Non-bank Financial corporation. |

| 2 | NGO—Non-Government Organization. |

| 3 | ROA—Return on Assets. |

| 4 | ROE—Return on Equity. |

| 5 | Data envelopment analysis—constant return to scale. |

| 6 | All three external variables. |

| 7 | Two external variables individually. |

References

- Aggarwal, Raj, John W. Goodell, and Lauren J. Selleck. 2015. Lending to women in microfinance: Role of social trust. International Business Review 24: 55–65. [Google Scholar] [CrossRef]

- Agrawal, Pawan, and Shayan Sen. 2017. Digital economy and microfinance. The MIBM Research Journal 5: 27–35. [Google Scholar]

- Alimukhamedova, Nargiza. 2013. Contribution of microfinance to economic growth: Transmission channel and the ways to test it. Business and Economic Horizons 9: 27–43. [Google Scholar] [CrossRef]

- Amemiya, Takeshi. 1984. Tobit Models: A Survey. Journal of Econometrics 24: 3–61. [Google Scholar] [CrossRef]

- Barro, Robert J., and Rachel Mccleary. 2003. Religion and economic growth across countries. American Sociological Review 68: 760–781. [Google Scholar] [CrossRef] [Green Version]

- Belwal, Rakesh, Misrak Tamiru, and Gurmeet Singh. 2012. Microfinance and Sustained Economic Improvement: Women Small-Scale Entrepreneurs in Ethiopia. Journal of International Development 24: 84–99. [Google Scholar] [CrossRef]

- Ben Abdelkader, Ines, and Faysal Mansouri. 2019. Performance of microfinance institutions in the MENA region: A comparative analysis. International Journal of Social Economics 46: 47–65. [Google Scholar] [CrossRef]

- Charnes, Abraham, William W. Cooper, and Edwardo Rhodes. 1978. Measuring the efficiency of decision making units. Company European Journal of Operational Research 2: 429–44. [Google Scholar] [CrossRef]

- Cobb, J. Adam, Tyler Wry, and Eric Yanfei Zhao. 2016. Funding Financial Inclusion: Institutional Logics and the Contextual Contingency of Funding for Microfinance Organizations. Academy of Management Journal 59: 2103–31. [Google Scholar] [CrossRef] [Green Version]

- Daley-Harris, S. 2009. State of the Microcredit Summit Campaign Report 2009 Sam Daley-Harris. Available online: https://www.researchgate.net/publication/265114804_State_of_the_Microcredit_Summit_Campaign_Report_2009 (accessed on 11 February 2022).

- Fersi, Marwa, and Mouna Boujelbéne. 2016. The Determinants of the Performance and the Sustainability of Conventional and Islamic Microfinance Institutions. Economics World 4: 197–215. [Google Scholar] [CrossRef] [Green Version]

- Gutiérrez-Nieto, Begoña, Carlos Serrano-Cinca, and Cecilio Mar Molinero. 2009. Social efficiency in microfinance institutions. Journal of the Operational Research Society 60: 104–19. [Google Scholar] [CrossRef] [Green Version]

- Gyapong, Ernest, Daniel Gyimah, and Ammad Ahmed. 2021. Religiosity, borrower gender and loan losses in microfinance institutions: A global evidence. In Review of Quantitative Finance and Accounting. New York: Springer, vol. 57. [Google Scholar] [CrossRef]

- Hadi, Nabawiyah Abdul, and Amrizah Kamaluddin. 2015. Social Collateral, Repayment Rates, and the Creation of Capital among the Clients of Microfinance. Procedia Economics and Finance 31: 823–828. [Google Scholar] [CrossRef]

- Imam, Patrick, and Kangni Kpodar. 2016. Islamic banking: Good for growth? Economic Modelling 59: 387–401. [Google Scholar] [CrossRef]

- Kar, Ashim Kumar. 2012. Does capital and financing structure have any relevance to the performance of microfinance institutions? International Review of Applied Economics 26: 329–48. [Google Scholar] [CrossRef]

- Khan, Zahoor, and Jamalludin Sulaiman. 2015. Social and Financial Efficiency of Microfinance Institutions in Pakistan. The Pakistan Development Review 54: 389–403. [Google Scholar] [CrossRef] [Green Version]

- Lebovic, James H. 2004. Uniting for peace? Democracies and United Nations peace operations after the cold war. Journal of Conflict Resolution 48: 910–36. [Google Scholar] [CrossRef]

- Leite, Rodrigo de Oliveira, Layla Mendes, and Luiz Claudio Sacramento. 2019. To profit or not to profit? Assessing financial sustainability outcomes of microfinance institutions. International Journal of Finance & Economics, 1–13. [Google Scholar] [CrossRef]

- Li, Linyang, Niels Hermes, and Aljar Meesters. 2019. Convergence of the performance of microfinance institutions: A decomposition analysis. Economic Modelling 81: 308–24. [Google Scholar] [CrossRef]

- Liñares-Zegarra, J., and John O. S. Wilson. 2018. The size and growth of micro finance institutions. The British Accounting Review 50: 199–213. [Google Scholar] [CrossRef]

- Mansori, Shaheen, Meysam Safari, and Zarina Mizam Mohd Ismail. 2020. An analysis of the religious, social factors and income’s influence on the decision making in Islamic microfinance schemes. Journal of Islamic Accounting and Business Research 11: 361–76. [Google Scholar] [CrossRef]

- Mersland, Roy, D’Espallier Bert, and Magne Supphellen. 2013. The Effects of Religion on Development Efforts: Evidence from the Microfinance Industry and a Research Agenda. World Development 41: 145–56. [Google Scholar] [CrossRef] [Green Version]

- Mia, Md Aslam, and V. G. R Chandran Govindaraju. 2016. Measuring Financial and Social Outreach Productivity of Microfinance Institutions in Bangladesh. Social Indicators Research 127: 505–27. [Google Scholar] [CrossRef]

- Navajas, Sergio, and Luis Tejerina. 2006. Microfinance in Latin America and the Caribbean: How Large Is the Market? Available online: http://www.asbasupervision.com/en/bibl/financial-inclusion/microfinance/223-microfinance-in-latin-america-and-the-caribbean-how-large-is-the-market/file (accessed on 11 February 2022).

- Sainz-Fernandez, Isabel, Begoña Torre-Olmo, Carlos López-Gutiérrez, and Sergio Sanfilippo-Azofra. 2018. Development of the Financial Sector and Growth of Microfinance Institutions: The Moderating Effect of Economic Growth. Sustainability 10: 3930. [Google Scholar] [CrossRef] [Green Version]

- Schwarz, Susan, Alexander Newman, and Abu Zafar Shahriar. 2015. Profit orientation of microfinance institutions and provision of financial capital to business start-ups. International Small Business Journal 34: 532–52. [Google Scholar] [CrossRef]

- Seiford, Lawrence M., and Joe Zhu. 2014. Data Envelopment Analysis: History, Models, and Interpretations Chapter 1 (Issue August 2011). Available online: https://www.researchgate.net/publication/226038831_Data_Envelopment_Analysis_History_Models_and_Interpretations (accessed on 11 February 2022).

- Simar, Léopold Leopold, and Paul W. Wilson. 2007. Estimation and inference in two-stage, semi-parametric models of production processes. Journal of Econometrics 136: 31–64. [Google Scholar] [CrossRef]

- Simar, Léopold, and Paul W. Wilson. 2010. A general methodology for bootstrapping in non-parametric frontier models. Journal of Applied Statistics 27: 779–802. [Google Scholar] [CrossRef]

- Somavia, J. 2007. Why Target Women? Promoting Gender Equality and Decent Work through Microfinance in Tanzania. Available online: www.ilo.org/gender (accessed on 29 December 2021).

- Tchuigoua, Hubert Tchakoute. 2015. Capital Structure of Microfinance Institutions. Journal of Financial Services Research 43: 313–40. [Google Scholar] [CrossRef]

- Ul-Hameed, Waseem, Hisham Bin Mohammad, and Hanita Binti Kadir Shahar. 2018. Microfinance institute’s non-financial services and women-empowerment: The role of vulnerability. Management Science Letters 8: 1103–16. [Google Scholar] [CrossRef]

- Walheer, Barnabé. 2018. Aggregation of metafrontier technology gap ratios: The case of European sectors in 1995–2015. European Journal of Operational Research 269: 1013–26. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, and Michele Meoli. 2015. Journal of Retailing and Consumer Services Productivity change of micro finance institutions in Kenya: A bootstrap Malmquist approach. Journal of Retailing and Consumer Services 25: 115–21. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, Laura Viganò, and Michele Meoli. 2015. Efficiency of microfinance institutions in Sri Lanka: A two-stage double bootstrap DEA approach. Economic Modelling 47: 74–83. [Google Scholar] [CrossRef]

- Wijesiri, Mahinda, Jacob Yaron, and Michele Meoli. 2017. Journal of Multinational Financial Assessing the financial and outreach efficiency of microfinance institutions: Do age and size matter? Journal of Multinational Financial Management 40: 63–76. [Google Scholar] [CrossRef]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).