Early Warning Early Action for the Banking Solvency Risk in the COVID-19 Pandemic Era: A Case Study of Indonesia

Abstract

1. Introduction

2. Literature Review

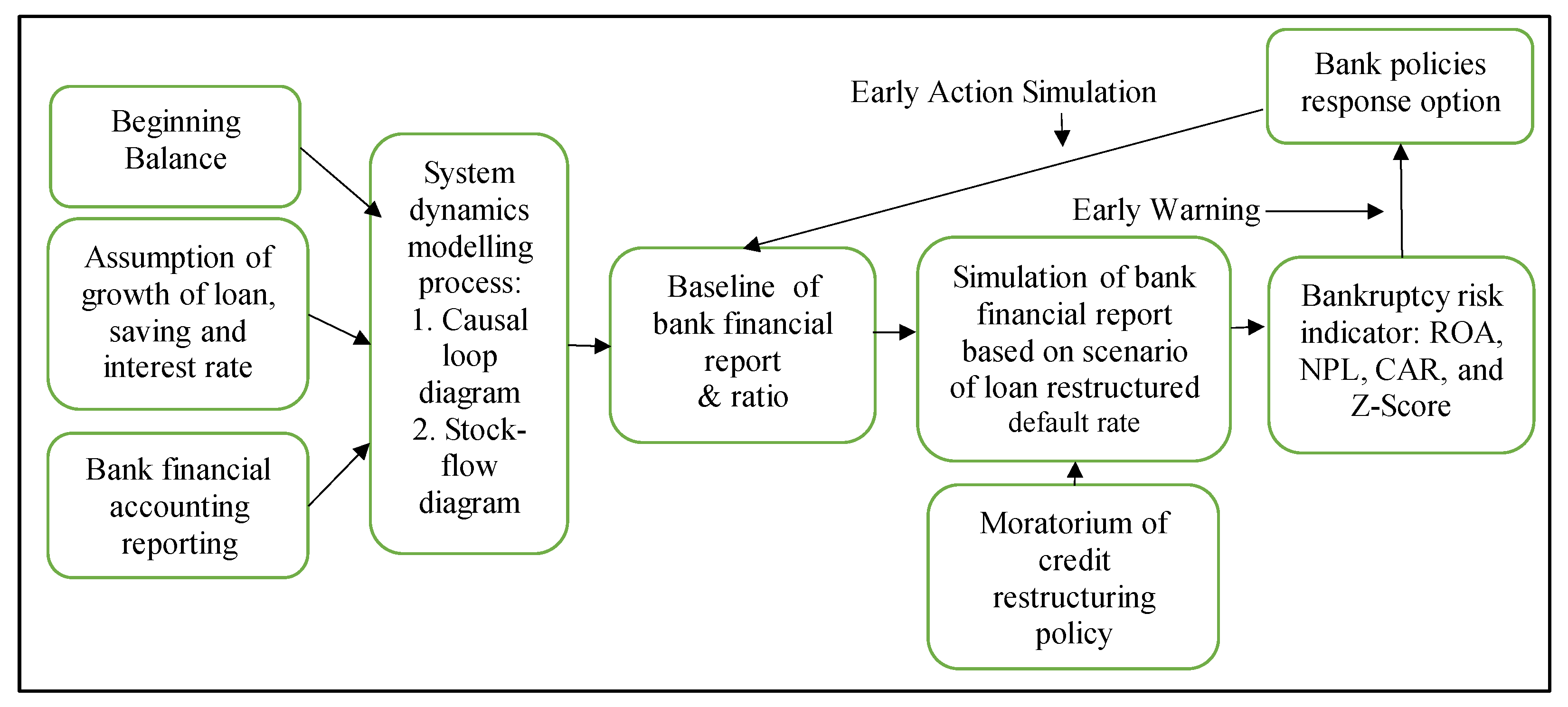

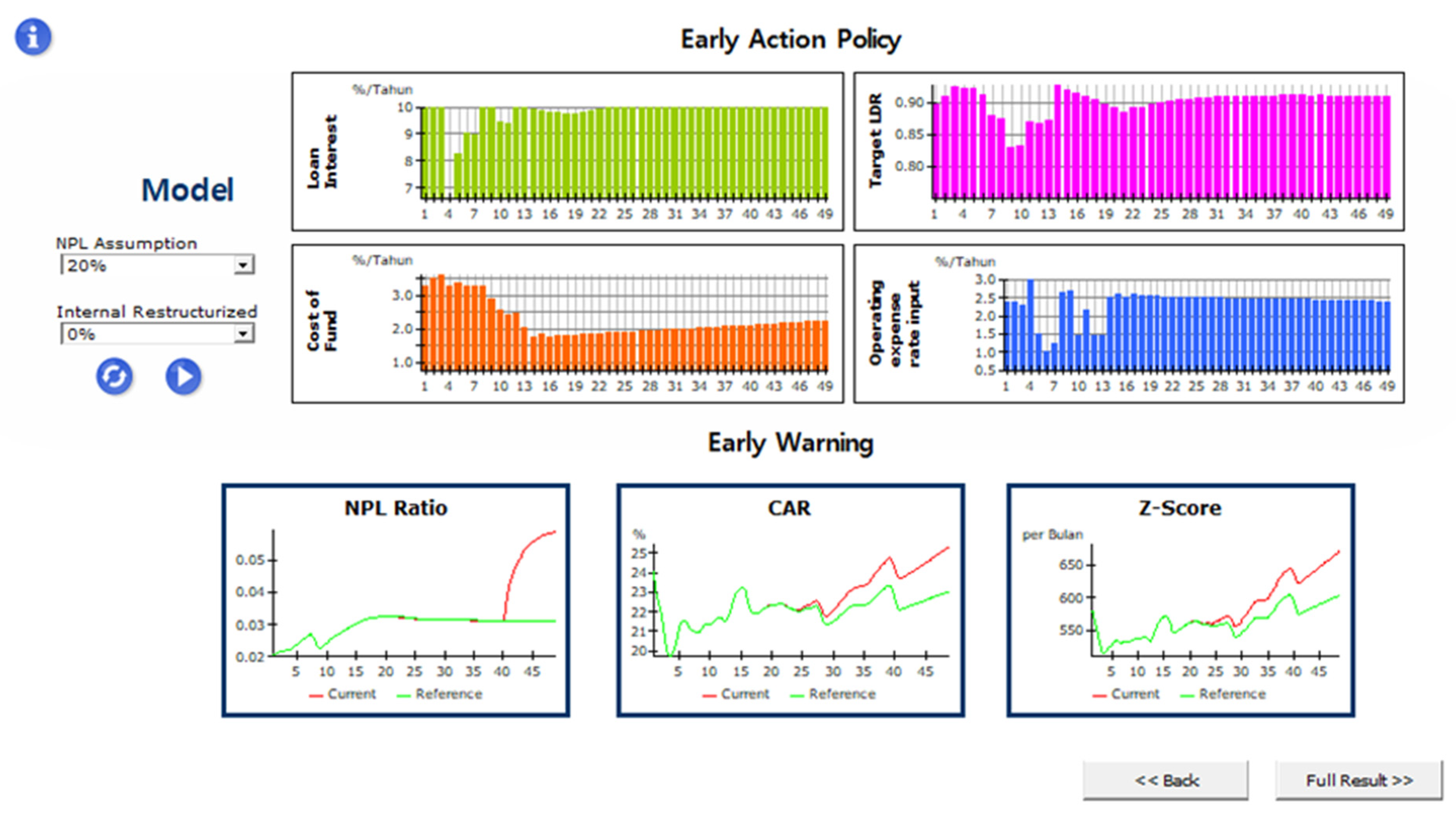

3. Methodology

3.1. Causal Loop Diagram of Early Warning Early Action Simulation Model

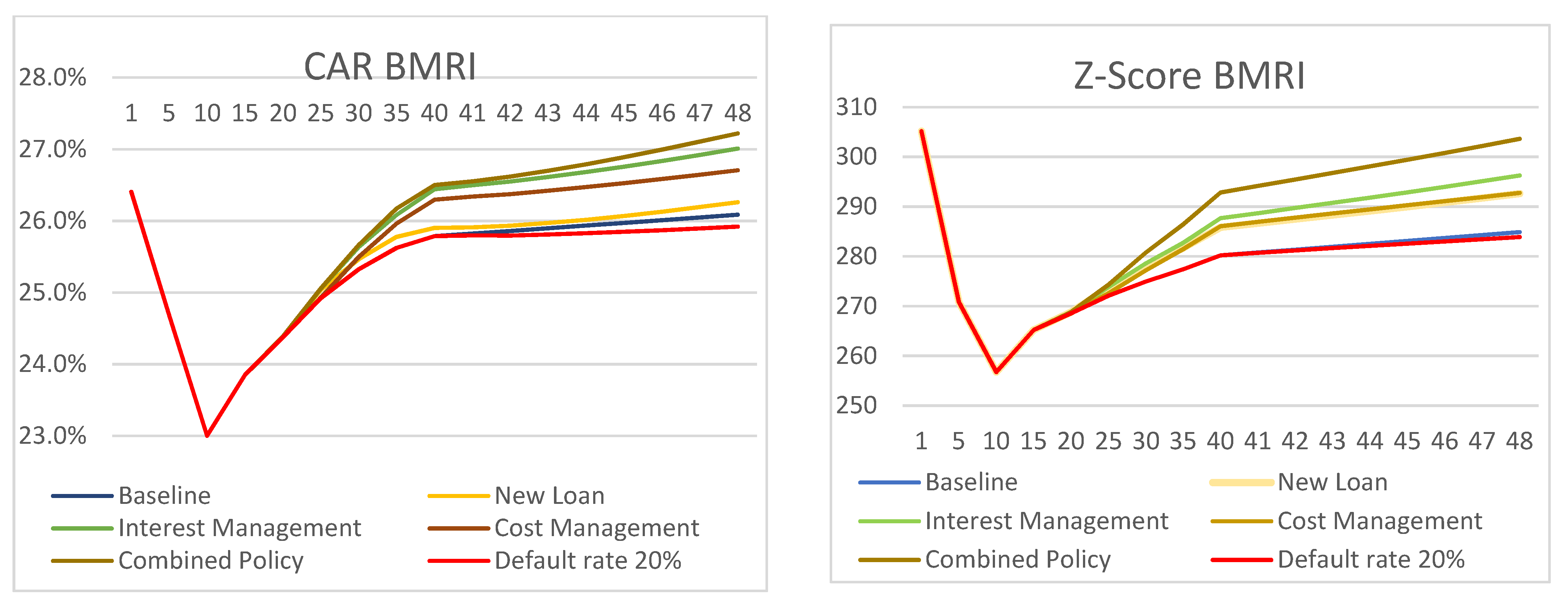

- Promoting loan growth or new loan policy to increase performing loans, to obtain more interest income and strengthen ROA, CAR, and Z-Score. However, when economic growth is abnormal, new loans should be selectively added to avoid additional NPL.

- Interest management is carried out by adjusting the loan interest rate and the savings interest rate to obtain an optimum net interest margin.

- The efficiency of operating expenses, including bank overhead, employee costs, and other expenses could reduce the ratio of operating expenses to income.

- Combined policy of (a), (b) and (c) above.

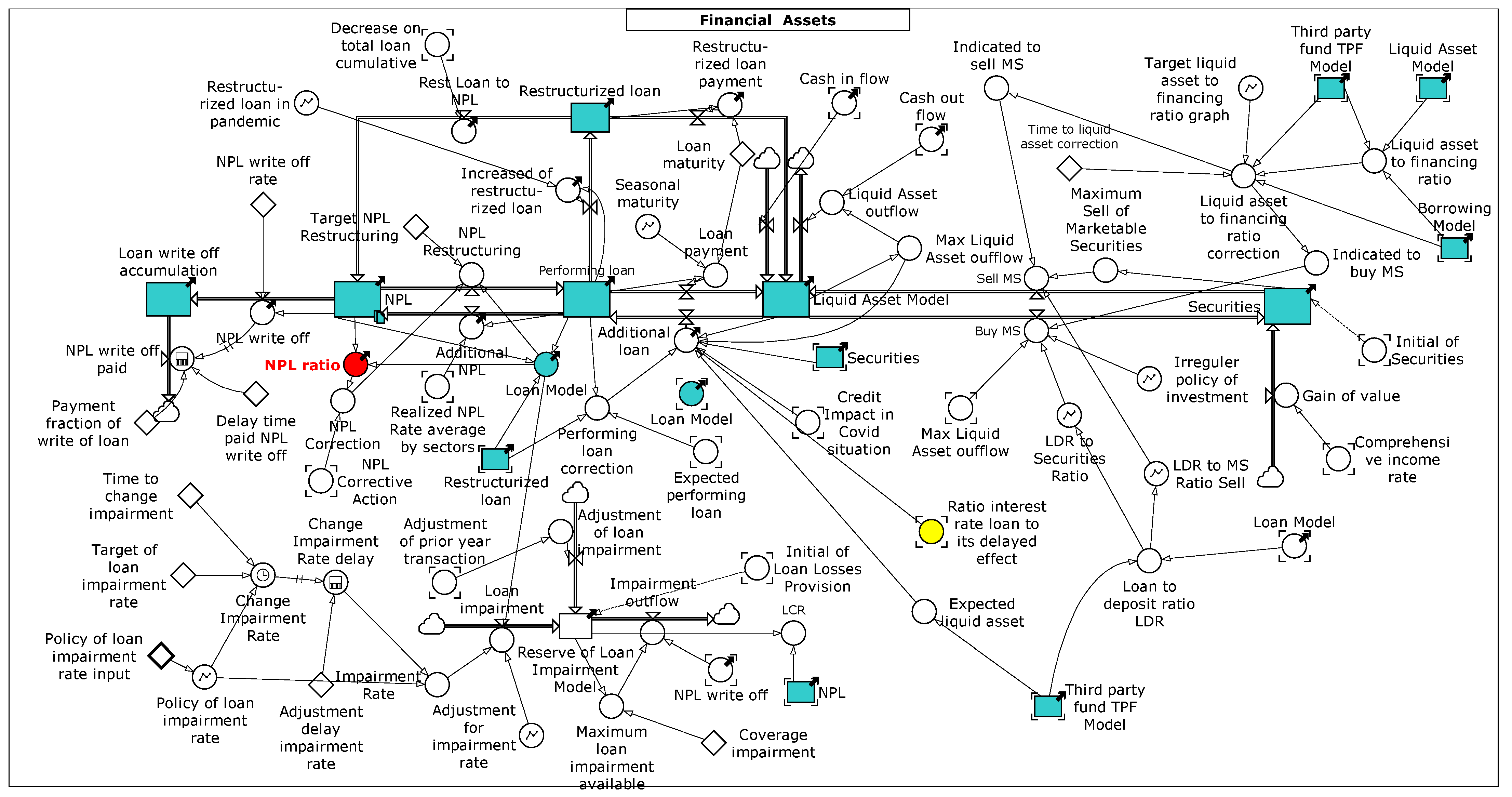

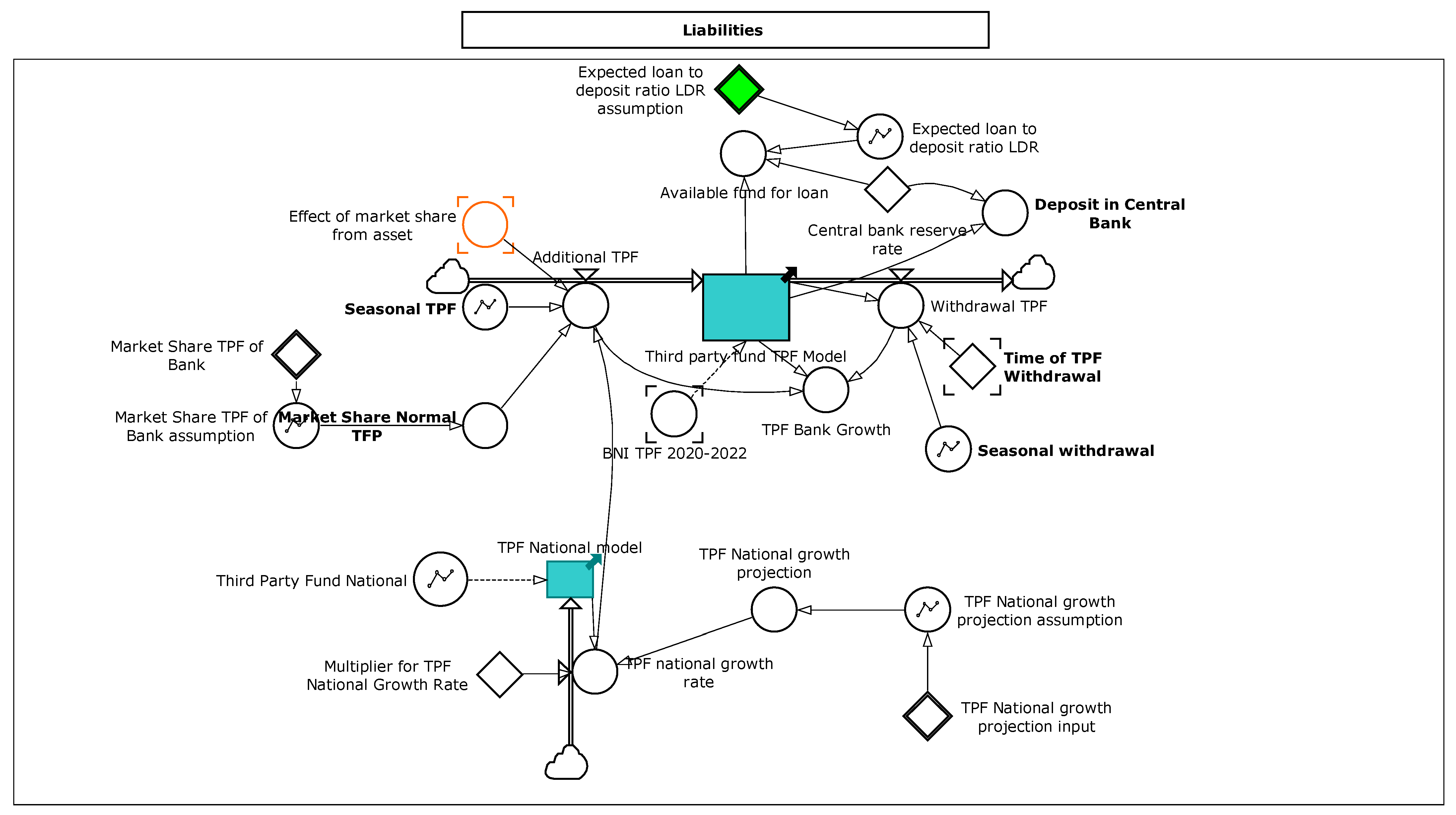

3.2. Stock Flow Diagram of Early Warning, Early Action Simulation Model

4. Results and Discussion

4.1. Model Validation and Baseline of Bank Financial Ratios

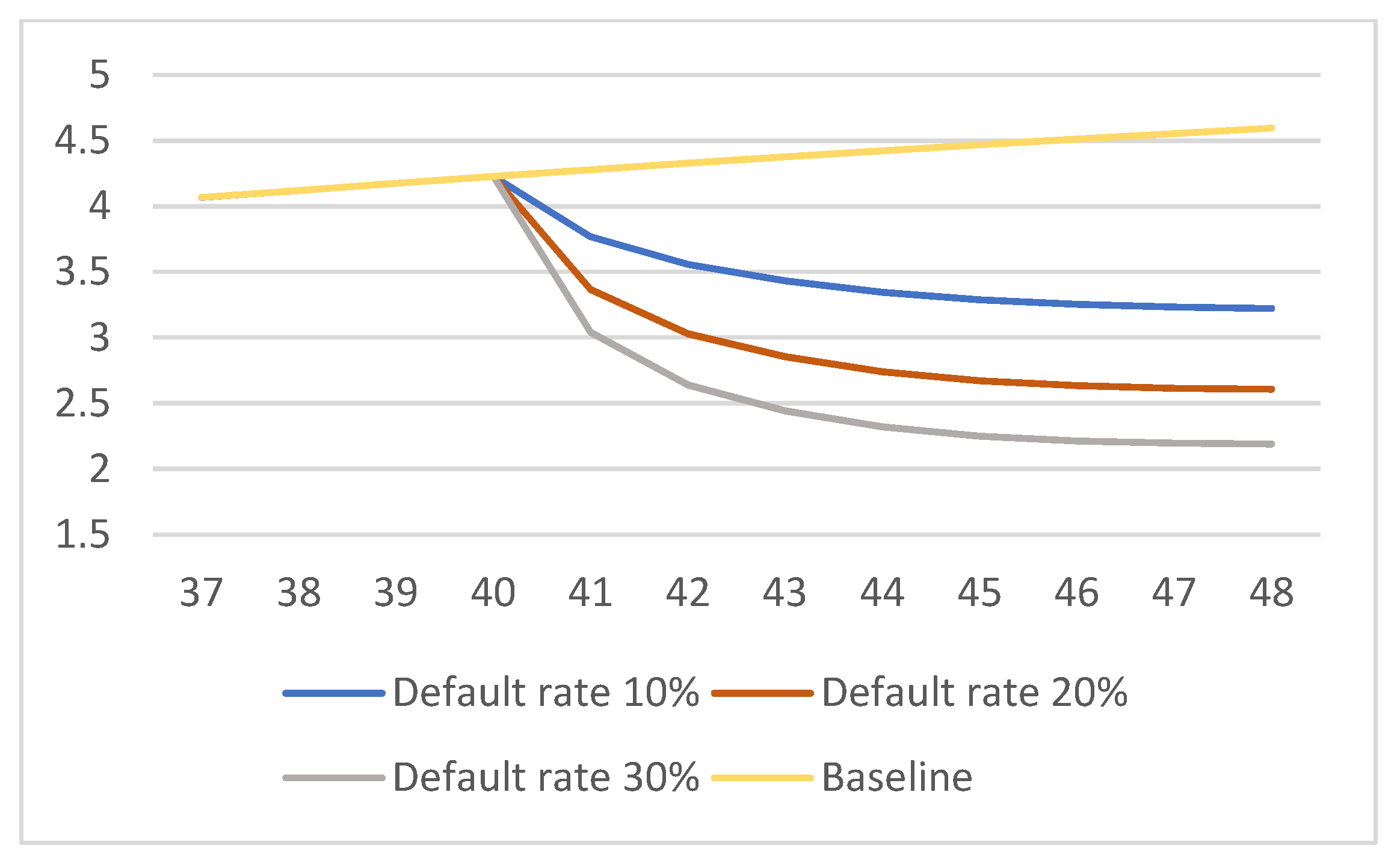

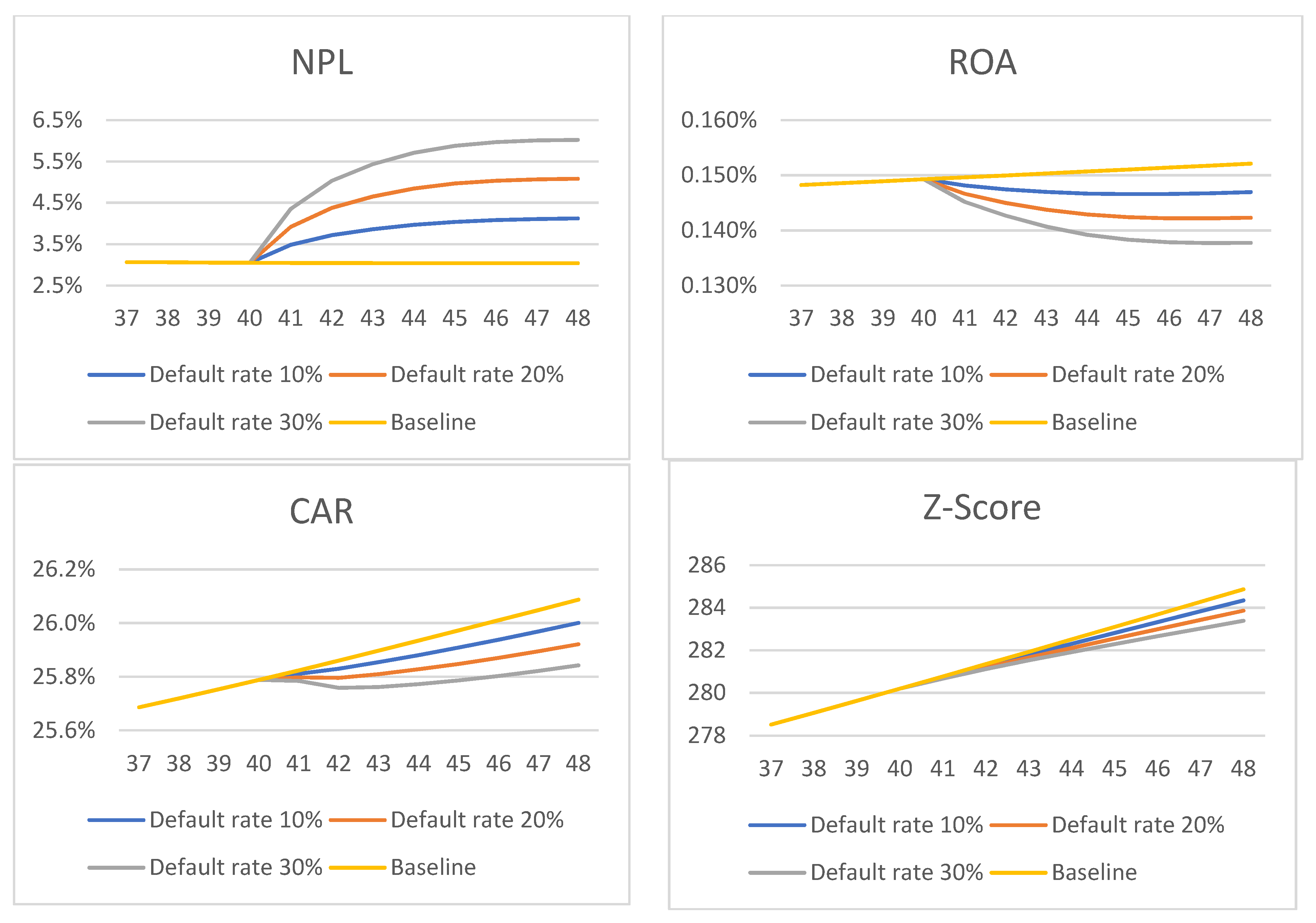

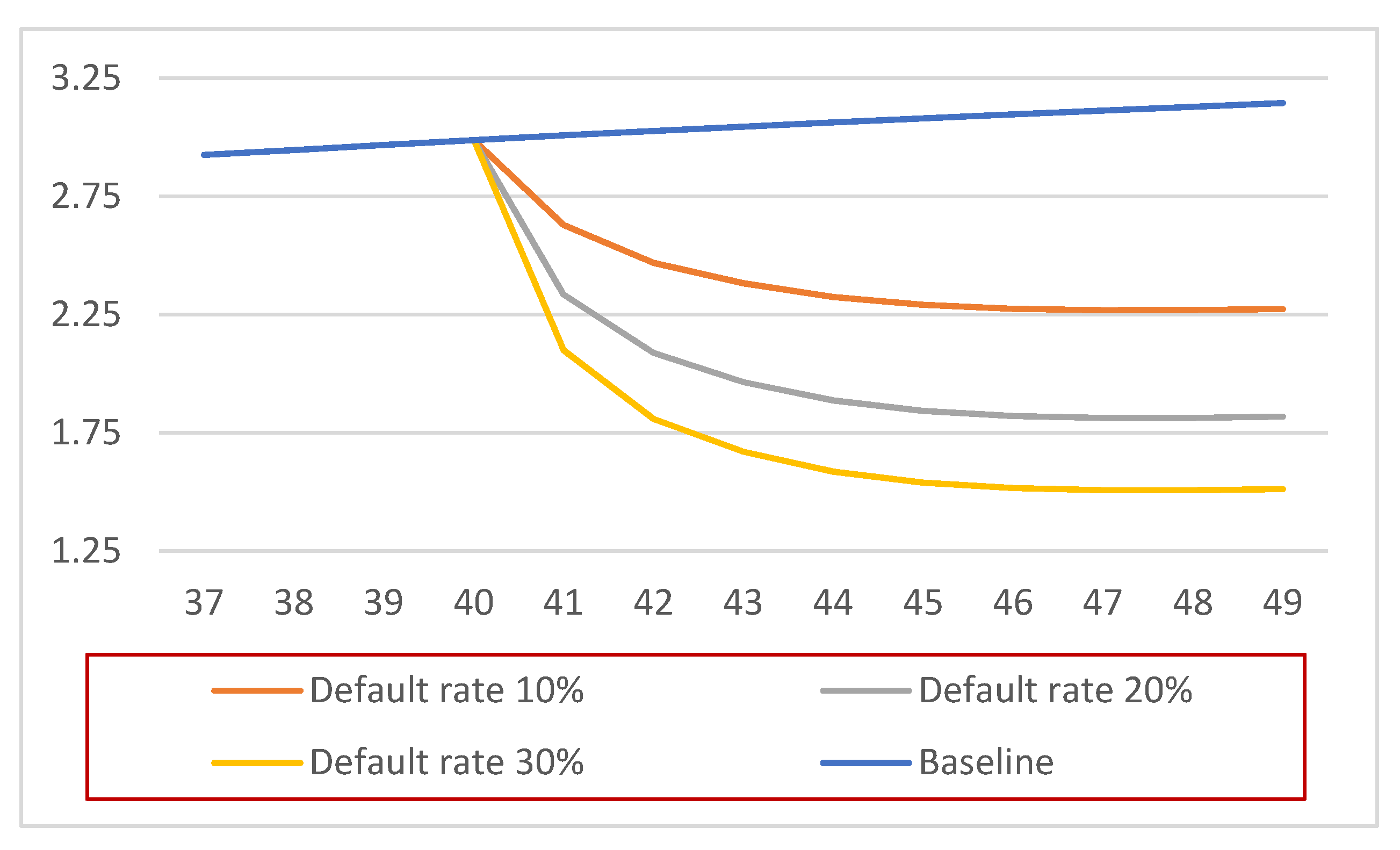

4.2. Early Warning on the Impact of Loan Restructuring Policy Revocation in March 2023

4.3. Early Action to Strengthen Bank Solvency

4.4. Discussion

- The increase in new loans is not only influenced by loan interest rates, which tend to decline during the pandemic, but is greatly influenced by the COVID-19 condition with the level of public and business trust as potential debtors being quite low due to the tightening economic activities and doubts about their ability to loan repayment.

- The increase in new loans is influenced by the level of bank liquidity, which was quite abundant during a pandemic. However, with the level of trust from the public and business that had not recovered as well as the economic activity that had not yet recovered, the bank could not carry out the new loan growth optimally.

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variabel | Formula |

|---|---|

| Performing Loan | Initial Performing Loan + (Loan Payment − Additional Loan) + (NPL Restructuring − Additional NPL) − Performing Loan to Restructured Loan |

| Loan Payment | (Loan Maturity ∗ Performing Loan) ∗ (1 + Seasonal maturity) |

| Additional Loan | (MIN (Max Liquid Asset Outflow, If ((Marketable Securities Model + Liquid Asset Model)>Expected liquid Asset, Performing loan correction, 0<<IDR Million/Month>>) ∗ (Credit Impact in COVID situation/Ratio interest rate loan to its delayed effect))) |

| Additional NPL | Performing loan ∗ Realized NPL Rate Average by Sectors |

| NPL Restructuring | (MAX (Target NPL Restructuring, (Target NPL Restructuring + NPL Correction))/Time to Restructuring) ∗ Loan Model |

| NPL | Initial NPL + (Additional NPL − NPL Restructuring) + Rest Loan to NPL − NPL Write off |

| Rest Loan to NPL | MIN (Maximum Restructurized Loan Outflow, decrease on total loan cumulative) |

| NPL write off | (Non performing loan NPL ∗ NPL write-off rate) |

| Restructurized Loan | Initial Restructurized Loan + Performing Loan to Restructured Loan − Rest Loan to NPL − Restructurized Loan Payment |

| Restructurized Loan Payment | MAX(0<<IDR Million/month>>,MIN(Maximum Restructurized Loan Outflow, Loan Maturity/Multiplier Maturity Rate in Restructurized Implemented ∗ Restructurized Loan)) |

| Liquid Asset Model | Initial Liquid Asset + Loan Payment − Additional Loan + Restructurized Loan Payment + Cash Inflow − Cash Outflow − Buy Marketable Securities (MS) − Sell MS |

| Cash Inflow | Interest income + Operating income + New borrowing + Additional TPF + NPL Write Off Paid + Fixed Asset Disposals |

| Cash Inflow | (Operating expense − Depreciation)+ Additions of Fixed Asset + Borrowing Payment + Withdrawal TPF + Interest Expense + Dividen Payment + Tax expense + Buyback Stock |

| Sell MS | MIN (Maximum Sell of Marketable Securities, Indicated to sell MS ∗ LDR to MS Ratio Sell) |

| Buy MS | MIN ((Indicated to buy MS ∗ LDR to MS Ratio Buy)∗1+Irreguler policy of investment, Max Liquid Asset oufflow) |

| Securities | Initial Securities + Buy MS − Sell MS + Gain of Value |

| Reserve of Loan Impairment Model | Initial of Reserve of Loan Impairment Model + Loan Impairment − Impairment Outflow + Adjustment of Loan Impairment |

| Loan Impairment | (Loan Model ∗ Impairment Rate) |

| Impairment Outflow | (MIN (Maximum Loan Impairment Available, NPL write off)) |

| NPL Ratio | Non performing loan NPL/Loan Model |

| Loan Loss Provision (LLP) | Reserve of Loan Impairment Model/Non performing loan NPL |

| Third Party Fund (TPF) | Initial TPF + Additional TPF − Withdrawal TPF |

| Additional TPF | TPF national growth rate ∗ Seasonal TPF ∗ (Market Share Normal TPF ∗ Effect of market share from asset) |

| Withdrawal TPF | (Third party fund TPF Model/Time of TPF Withdrawal) ∗ (Seasonal withdrawal) |

| Equity Model | Initial Equity + Net Profit − Equity Adjustment − Dividend Payment − Buy back of Stock |

| Net Profit | (Interest Income − Interest Expense + Operating Income − Operating Expense − Loan Impairment -Tax expense) |

| Equity Adjustment | Adjustment of prior year transaction + Employment Benefit Adjustment |

| Dividend Payment | Profit After Tax ∗ Dividend Payout Ratio |

| Buy Back of Stock | Buy back decision or event |

| Capital Adequacy Ratio (CAR) | Equity Model/Risk Weighted Asset ∗ 100<<%>> |

| ROA | Profit After Tax/Asset Model |

| Z-Score | (ROA + (Equity Model/Asset Model))/Standard Deviation of ROA |

References

- Agenor, Pierre-Richard, and Roy Zilberman. 2015. Loan Loss Provisioning Rules, Procyclicality, and Financial Volatility. Journal of Banking and Finance 61: 301–15. [Google Scholar] [CrossRef]

- Aksu, İbrahim, and Mehmet Tursun. 2021. Analysis of Responsibility Centers Performance in Businesses By System Dynamics Method. Journal of Accounting and Taxation Studies 14: 949–66. [Google Scholar] [CrossRef]

- Al-Kharusi, Sami, and Sree Rama Murthy. 2020. Financial stability of GCC banks in the COVID-19 Crisis: A simulation approach. The Journal of Asian Finance, Economics, and Business 7: 337–44. [Google Scholar] [CrossRef]

- Asadollahi, Seyyed Yahya, Ali Asghar Taherabadib, Farhad Shahvisic, and Farshid Kheirollahi. 2021. Modeling Liquidity Risk Management in Banking Using System Dynamics Approach. Advances in Mathematical Finance and Applications 6: 493–514. [Google Scholar] [CrossRef]

- Bala, Atkinson, Arshad Bilash Kanti, Fatimah Mohamed, and Kusairi Mohd Noh. 2017. System Dynamics: Modelling and Simulation. Singapore: Springer Science & Business Media. [Google Scholar]

- Bank Indonesia. 2021. Financial Stability Review No. 37. September. Available online: https://www.bi.go.id/id/publikasi/kajian/Pages/KSK_3721.aspx# (accessed on 24 October 2021).

- Barua, Bipasha, and Soburna Barua. 2021. COVID-19 Implications for Banks: Evidence from an Emerging Economy. SN Business & Economics 1: 19. [Google Scholar]

- Bastana, Mahdi, Mohammad Bagheri Mazraeha, and Ali Mohammad Ahmadvand. 2016. Dynamics of Banking Soundness Based on CAMELS Rating System. Paper presented at the 34th International Conference of the System Dynamics Society, Delft, The Netherlands, July 17–21. [Google Scholar]

- Bauer, W. Andreas, R. Sean Craig, José Garrido, Kenneth H. Kang, Kashiwase Kenichiro, Sung Jin Kim, Yan Liu, and Sohrab Rafiq. 2021. Flattening the Insolvency Curve: Promoting Corporate Restructuring in Asia and the Pacific in the Post-C19 Recovery. IMF Working Paper 2021/016. Washington, DC: International Monetary Fund. [Google Scholar]

- Danielsson, Jon, Robert Macrae, Dimitri Vayanos, and Jean-Pierre dan Zigrand. 2020. We Shouldn’t Be Comparing the Coronavirus Crisis to 2008—This Is Why? Available online: https://www.weforum.org/agenda/2020/04/the-coronavirus-crisis-is-no-2008 (accessed on 10 October 2021).

- De Vany, Arthur S. 1984. Modeling the banking firm: Comment. Journal of Money, Credit and Banking 16: 603–9. [Google Scholar] [CrossRef]

- Donnellan, John, and Wanda Rutledge. 2016. Agency Theory in Banking—‘Lessons from the 2007–2010 Financial Crisis’. International Journal of Business and Applied Social Science 2: 1–12. Available online: https://ssrn.com/abstract=2940060 (accessed on 11 October 2021).

- Duggan, Jim. 2016. System Dynamics Modeling with R. Cham: Springer International Publishing Switzerland. [Google Scholar]

- Duong, Tam Thanh Nguyen, Hai Thanh Phan, Tien Ngoc Hoang, and Tien Thuy Thi Vo. 2020. The Effect of Financial Restructuring on the Overall Financial Performance of the Commercial Banks in Vietnam. The Journal of Asian Finance, Economics, and Business 7: 75–84. [Google Scholar] [CrossRef]

- García, Juan Martín. 2019. Common Mistakes in System Dynamics. Chicago: Independently Publishers. ISBN 9781791578787. [Google Scholar]

- Goodell, John W. 2020. COVID-19 and Finance: Agendas for Future Research. Finance Research Letters 35: 101512. [Google Scholar] [CrossRef]

- Gunnersen, Sverre Edvard. 2014. Predicting Corporate Failure Through a Combination of Intelligent Techniques. Ph.D. dissertation, Monash University, Melbourne, Australia. [Google Scholar]

- Hardiyanti, Siti Epa, and Lukmanul Hakim Aziz. 2021. The Case of COVID-19 Impact on the Level of Non-Performing Loans of Conventional Commercial Banks in Indonesia. Banks and Bank Systems 16: 62–68. [Google Scholar] [CrossRef]

- Henrard, Luc, and Ruben Olieslagers. 2004. Risk management of a financial conglomerate. In Forum Financier-Revue Bancaire et Financiaire Bank en Financiewezen. Brussels: Larcier, pp. 52–64. [Google Scholar]

- Hidayat, Taufiq, Dian Masyita, Sulaeman Rahman Nidar, Erie Febrian, and Fauzan Ahmad. 2021. The Effect of COVID-19 to Credit Risk and Capital Risk of State-Owned Bank in Indonesia: A System Dynamics Model. WSEAS Transactions on Business and Economics 18: 1121–36. [Google Scholar] [CrossRef]

- Islam, Tuahith, Christos Vasilopoulos, and Erik Pruyt. 2013. Stress-Testing Banks under Deep Uncertainty. Paper presented at 31st International Conference of the System Dynamics Society, Cambridge, MA, USA, July 21–25. [Google Scholar]

- Istiaq, Muhammad. 2015. Risk Management in Banks: Determination of Practices and Relationship with Performance. Ph.D. dissertation, The University of Bedfordshire, Luton, UK. [Google Scholar]

- Jensen, Michael C., and William H. Meckling. 1976. Theory of the Firm: Managerial Behavior, Agency Costs and Ownership Structure. Journal of Financial Economics 3: 305–60. [Google Scholar] [CrossRef]

- Knowles, John, Ken Nicholls, and Chris Bloor. 2020. Outcomes from a COVID-19 stress test of New Zealand banks. Reserve Bank of New Zealand Bulletin 83: 1–12. [Google Scholar]

- Korzeb, Zbigniew, and Pawel Niedziółka. 2020. Resistance of commercial banks to the crisis caused by the COVID-19 pandemic: The case of Poland. Equilibrium. Quarterly Journal of Economics and Economic Policy 15: 205–34. [Google Scholar] [CrossRef]

- Kunc, Martin, Michael J. Mortenson, and Richard Vidgen. 2018. A computational literature review of the field of System Dynamics from 1974 to 2017. Journal of Simulation 12: 115–27. [Google Scholar] [CrossRef]

- Kuritzkes, Andrew, Til Schuermann, and Scott M. Weiner. 2003. Risk Measurement, Risk Management and Capital Adequacy in Financial Conglomerates. Brookings-Wharton Papers on Financial Services 2003: 141–93. [Google Scholar] [CrossRef]

- Lang, Jan Hannes, Tuomas A. Peltonen, and Peter Sarlin. 2018. A Framework for Early-warning Modelling with an Application to Banks. European Central Bank Working Paper Series, No. 2182/October 2018. Frankfurt: European Central Bank. [Google Scholar]

- Leaning, Jennifer. 2016. The Path to Last Resort: The Role of Early Warning & Early Action. Daedalus. Ethics, Technology & War 145: 101–12. [Google Scholar]

- Lepetit, Laetitia, Frank Strobel, and Thu Ha Tran. 2020. An Alternative Z-score Measure for Downside Bank Insolvency Risk. Applied Economics Letters 28: 137–42. [Google Scholar] [CrossRef]

- Mayes, David G., and Hanno Stremmel. 2012. The Effectiveness of Capital Adequacy Measures in Predicting Bank Distress. Financial Markets & Corporate Governance Conference. Available online: https://ssrn.com/abstract=2191861 (accessed on 10 October 2021).

- Morecroft, John D. W. 2015. Strategic Modeling and Business Dynamics: A Feedback Systems Approach, 2nd ed. Chichester: John Wiley and Sons Ltd. [Google Scholar]

- Oladimeji, Olufunke Olufunmi, Heather Keathley-Herring, and Jennifer A. Cross. 2020. System dynamics applications in performance measurement research: A systematic literature review. Journal of Productivity and Performance Management 69: 1541–78. [Google Scholar] [CrossRef]

- Paiva, Bernardo M. R., Fernando A. F. Ferreira, Elias G. Carayannis, Constantin Zopounidis, João J. M. Ferreira, Leandro F. Pereira, and Paulo J. V. L. Dias. 2020. Strategizing sustainability in the banking industry using fuzzy cognitive maps and system dynamics. International Journal of Sustainable Development & World Ecology 28: 93–108. [Google Scholar] [CrossRef]

- Pavlov, Oleg V., and Evangelos Katsamakas. 2021. COVID-19 and Financial Sustainability of Academic Institutions. Sustainability 13: 3903. [Google Scholar] [CrossRef]

- Petropoulos, Anastasios, Vassilis Siakoulis, Konstantinos P. Panousis, Theodoros Christophides, and Sotirios Chatzis. 2020. A Deep Learning Approach for Dynamic Balance Sheet Stress Testing. Available online: https://arxiv.org/abs/2009.11075 (accessed on 15 September 2021).

- Pierson, Kawika. 2020. Operationalizing Accounting Reporting in System Dynamics Models. Systems 8: 9. [Google Scholar] [CrossRef]

- Rahmi, Yulia, and Erman Sumirat. 2021. A Study of The Impact of Alma on Profitability During the COVID-19 Pandemic. International Journal of Business, Economics, and Law 24: 54–65. [Google Scholar]

- Rose, Peter S. 1992. Agency Theory and Entry Barriers in Banking. The Financial Review 27: 323–54. [Google Scholar] [CrossRef]

- Samorodov, Borys, Halyna Azarenkova, Olena Holovko, Kateryna Oriekhova, and Maksym Babenko. 2019. Financial stability management in banks: Strategy maps. Banks and Bank Systems 14: 10–21. [Google Scholar] [CrossRef][Green Version]

- Sapiri, Hasimah, Jafri Zulkepli, Norazura Ahmad, Norhaslinda Zainal Abidin, and Nurul Nazihah Hawari. 2020. Introduction to System Dynamics Modelling and Vensim Software. Sintok: UUM Press. [Google Scholar]

- Schuermann, Til. 2014. Stress Testing Banks. International Journal of Forecasting 30: 717–28. [Google Scholar] [CrossRef]

- Siregar, Reza Y., Anton H. Gunawan, and Adhi N. Saputro. 2021. Impact of The COVID-19 Shock on Banking and Corporate Sector Vulnerabilities in Indonesia. Bulletin of Indonesian Economic Studies 57: 147–73. [Google Scholar] [CrossRef]

- Smith, Alan D. 2010. Agency Theory and The Financial Crisis from a Strategic Perspective. International Journal of Business Information Systems 5: 248–67. [Google Scholar] [CrossRef]

- Sterman, Jhon D. 2000. Business Dynamics: Systems Thinking and Modeling for a Complex World. Boston: McGraw-Hill. [Google Scholar]

- Wu, Xiaoyu. 2014. Banking Crisis Dynamics and Financial Risk Management. Doctor of. Philosophy dissertation, The City University of Hong Kong, Hong Kong, China. [Google Scholar]

- Zheng, Changjun, Shumaila Meer Perhiar, Naeem Gul Gilal, and Faheem Gul Gilal. 2019. Loan loss provision and risk-taking behavior of commercial banks in Pakistan: A dynamic GMM approach. Sustainability 11: 5209. [Google Scholar] [CrossRef]

| Symbol | Definition |

|---|---|

| The symbol of STOCK is to declare variables with an accumulation derived from the previous value plus the difference between inflows and outflows. Stock(t) (Inflow(s) − Outflow(s))ds + Stock(t0) d(Stock)/dt = Inflow(t) − Outflow(t). |

| The symbol of RATE states the formulation of the amount of the stock inflow and outflow in the system in a certain time unit. For example, the rate of loan market = $100/month. |

| The symbol of AUXILIARY or AUX is used to formulate the equation rate by defining the determining factors of the rate equation separately. Additional equations are substituted for each other and several separate rate equations. For example, Aux = Aux B x Constant |

| The symbol of CONSTANT is a function of a certain number, the input for the auxiliary or equation rate in the model, its value remains in the simulation period. It is used to simulate management policies, such as loan interest rate income and saving interest rate expense policies. |

| The symbol of ARROW indicates the flow of information from one variable (auxiliary, stock, constant, level) to another. |

| The symbol of GRAPH contains certain parameter functions to explain other parameters/quantities. |

| Account | BBRI | BMRI | ||

|---|---|---|---|---|

| r | MSE | r | MSE | |

| Loan | 99.71% | 0.004% | 98.95% | 0.009% |

| Third Party Fund | 92.40% | 0.034% | 99.68% | 0.006% |

| Equity | 99.34% | 0.010% | 99.50% | 0.013% |

| Period | BBRI | BMRI | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| CAR | ROA | NPL | LLP | Z-Scored | CAR | ROA | NPL | LLP | Z-Scored | |

| 1 | 24.02% | 0.18% | 2.06% | 2.12 | 580 | 26.41% | 0.16% | 2.39% | 1.47 | 305 |

| 3 | 20.16% | 0.15% | 2.15% | 2.74 | 518 | 22.27% | 0.25% | 2.66% | 2.34 | 254 |

| 6 | 21.51% | 0.15% | 2.20% | 2.45 | 534 | 24.79% | 0.03% | 2.52% | 2.56 | 266 |

| 9 | 21.24% | 0.13% | 2.43% | 2.42 | 536 | 23.17% | 0.09% | 2.71% | 2.54 | 261 |

| 12 | 21.65% | 0.08% | 2.70% | 2.47 | 535 | 23.44% | 0.06% | 2.92% | 2.65 | 258 |

| 15 | 23.20% | 0.12% | 3.05% | 2.53 | 570 | 23.85% | 0.19% | 3.08% | 2.54 | 265 |

| 18 | 23.15% | 0.12% | 3.23% | 2.69 | 581 | 24.19% | 0.18% | 3.14% | 2.55 | 267 |

| 21 | 23.56% | 0.12% | 3.26% | 2.97 | 592 | 24.49% | 0.17% | 3.13% | 2.60 | 270 |

| 24 | 23.22% | 0.09% | 3.23% | 3.35 | 586 | 24.84% | 0.16% | 3.10% | 2.64 | 272 |

| 27 | 23.41% | 0.16% | 3.18% | 3.56 | 589 | 25.07% | 0.13% | 3.10% | 2.70 | 274 |

| 30 | 23.77% | 0.17% | 3.16% | 3.71 | 602 | 25.32% | 0.13% | 3.09% | 2.77 | 275 |

| 33 | 24.54% | 0.19% | 3.15% | 3.87 | 626 | 25.49% | 0.14% | 3.07% | 2.85 | 276 |

| 36 | 24.75% | 0.20% | 3.14% | 4.01 | 634 | 25.65% | 0.14% | 3.06% | 2.91 | 277 |

| 39 | 25.55% | 0.20% | 3.12% | 4.17 | 659 | 25.75% | 0.15% | 3.05% | 2.97 | 280 |

| 42 | 25.88% | 0.20% | 3.10% | 4.33 | 669 | 25.82% | 0.14% | 3.04% | 3.03 | 281 |

| 45 | 26.26% | 0.20% | 3.10% | 4.47 | 679 | 26.00% | 0.15% | 3.03% | 3.09 | 283 |

| 48 | 26.55% | 0.21% | 3.09% | 4.60 | 691 | 26.08% | 0.15% | 3.03% | 3.13 | 284 |

| No | Policy Scenario | Policy Options (Early Action) to Strengthen Solvency for BBRI | Policy Options (Early Action) to Strengthen Solvency for BMRI |

|---|---|---|---|

| 1 | Interest rate management (policy for managing interest rates on loans and savings/deposits) | Decrease in interest expense rate (for third party funds) from around 2.66% at baseline to 2.24% per year | Decrease in interest expense rate (for third party funds) from around 1.83% at baseline to 1.63% per year |

| Increase in interest income rate (for new loans) from around 9.97% at baseline per year to approximately 11.24% per year | Increase in interest income rate (for new loans) from around 7.09% at baseline per year to approximately 7.97% per year | ||

| 2 | Increase new loan (policy to increase new loan) | Increased loan to deposit ratio from 88% at baseline to 91% | Increased loan to deposit ratio rate from 83% at baseline to 90% |

| 3 | Decreased operating expenses (policies to save bank operational costs) | Decrease in the ratio of operating expenses to total loans from 2.56% at baseline to 2.39% per year | Decrease in the ratio of operating expenses to total loans from 2.80% at baseline to 2.32% per year |

| 4 | Combined policy (policy combination) | Combination of Policy 1 to 3 | Combination of Policy 1 to 3 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Hidayat, T.; Masyita, D.; Nidar, S.R.; Ahmad, F.; Syarif, M.A.N. Early Warning Early Action for the Banking Solvency Risk in the COVID-19 Pandemic Era: A Case Study of Indonesia. Economies 2022, 10, 6. https://doi.org/10.3390/economies10010006

Hidayat T, Masyita D, Nidar SR, Ahmad F, Syarif MAN. Early Warning Early Action for the Banking Solvency Risk in the COVID-19 Pandemic Era: A Case Study of Indonesia. Economies. 2022; 10(1):6. https://doi.org/10.3390/economies10010006

Chicago/Turabian StyleHidayat, Taufiq, Dian Masyita, Sulaeman Rahman Nidar, Fauzan Ahmad, and Muhammad Adrissa Nur Syarif. 2022. "Early Warning Early Action for the Banking Solvency Risk in the COVID-19 Pandemic Era: A Case Study of Indonesia" Economies 10, no. 1: 6. https://doi.org/10.3390/economies10010006

APA StyleHidayat, T., Masyita, D., Nidar, S. R., Ahmad, F., & Syarif, M. A. N. (2022). Early Warning Early Action for the Banking Solvency Risk in the COVID-19 Pandemic Era: A Case Study of Indonesia. Economies, 10(1), 6. https://doi.org/10.3390/economies10010006