Abstract

The global energy transition, characterized by the proliferation of intermittent renewables and the evolution of electricity markets, has positioned virtual power plants (VPPs) as crucial aggregators of distributed energy resources. However, their participation in competitive markets is fraught with multifaceted uncertainties stemming from price volatility, renewable generation intermittency, and unpredictable prosumer behavior, which necessitate sophisticated, risk-averse bidding strategies to ensure financial viability. This review provides a comprehensive analysis of the state-of-the-art in risk-averse bidding for VPPs. It first establishes a resource-centric taxonomy, categorizing VPPs into four primary archetypes: DER-driven, demand response-oriented, electric vehicle-integrated, and multi-energy systems. The paper then delivers a comparative assessment of different optimization techniques—from stochastic programming with conditional value-at-risk and robust optimization to emerging paradigms such as distributionally robust optimization, game theory, and artificial intelligence. It critically evaluates their application contexts and effectiveness in mitigating specific risks across diverse market types. Finally, the review synthesizes these insights to identify persistent challenges—including computational bottlenecks, data privacy, and a lack of standardization—and outlines a forward-looking research agenda. This agenda emphasizes the development of hybrid AI–physical models, interoperability standards, multi-domain risk modeling, and collaborative VPP ecosystems to advance the field towards a resilient and decarbonized energy future.

1. Introduction

The global energy landscape has been undergoing a profound transformation driven by the urgent need to transition towards sustainable and low-carbon energy systems. Since the industrial revolution, access to clean, affordable, and reliable energy has been a cornerstone of economic growth and prosperity [1]. However, the increasing penetration of intermittent renewable energy source (RES) poses significant challenges to the stability, reliability, and operational efficiency of power systems. Unlike conventional thermal power plants, RESs are characterized by inherent variability and uncertainty, which complicate grid management, frequency regulation, and power quality maintenance. The intermittency of RESs not only affects local grid stability but also has broader implications for energy security and economic efficiency, particularly as countries worldwide commit to decarbonization targets. This transition necessitates innovative approaches to resource aggregation, forecasting, and grid integration to ensure that the power system remains resilient amid increasing renewable generation.

Concurrent with the global shift toward renewable energy, electricity markets have undergone a fundamental restructuring from monopolistic models to liberalized, competitive frameworks aimed at enhancing efficiency and fostering innovation. Market reforms, such as those discussed in Reference [2], have direct impacts on the synergy between economic, energy, and environmental systems through price mechanisms. Meanwhile, extreme events—such as the 2021 Texas winter storm—highlight the need for robust market designs and regulatory interventions to maintain system reliability during crises [3]. In Europe, the energy crisis triggered by geopolitical conflicts has spurred discussions on market redesign, including the promotion of long-term contracts and regulated retail pricing [4]. Amid this period of significant volatility and change, the virtual power plant (VPP) has emerged as a critical enabling technology for integrating distributed energy resource (DER) into the grid and electricity markets, which could be modeled as a risk-averse decision maker under market uncertainties [5]. By leveraging advanced communication and control technologies, VPPs enhance the visibility, controllability, and market participation of DERs, which underscore their role in facilitating the transition towards decentralized, digitalized energy systems.

Participating in electricity markets offers VPPs significant opportunities to maximize operational profits, provide grid services, and support renewable energy integration. However, this participation is fraught with multifaceted challenges, chief among them being the management of significant uncertainties. On the one hand, VPPs can optimize the allocation of diverse resources—such as electric vehicles, heat pumps, and distributed generation—across multiple energy carriers (e.g., electricity, heat, gas). On the other hand, VPPs face uncertainties arising from internal resource variability, such as renewable generation intermittency and prosumer behavior, and external market dynamics, particularly price volatility. The development of robust, risk-averse bidding frameworks is therefore essential to enhance competitiveness and ensure financial viability against these uncertainties. The absence of such frameworks could lead to suboptimal participation, reduced revenue, and even systemic risks during market volatility or extreme events.

A substantial body of review literature has been devoted to understanding VPP technologies, operations, and market interactions. References [6,7,8,9,10,11,12,13,14,15] provide comprehensive surveys on various aspects of VPPs. For instance, Reference [6] involved analyzing the three-layer architecture of VPPs, with a critical focus on the dispatch optimization layer. This includes examining core technologies like resource response capacity assessment and optimal scheduling models and strategies. The authors of [7] bridged theory and practice by reviewing VPP technologies and real-world applications, while Reference [8] focused on the cyber security risks faced by VPPs. Reference [9] offered a detailed analysis of resource coordination and decision-making processes in VPPs, and Reference [10] classified VPP models based on their market participation mechanisms. Uncertainty management in VPPs was systematically reviewed in References [11,12], with the latter summarizing mathematical descriptions and optimization approaches. The authors of [13] took a data-centric perspective on VPP energy management, and the authors of [14] carries out a comprehensive analysis of how a carbon-constrained future impacts the development of virtual power plants towards carbon reduction in the power sector. Finally, Reference [15] systematically summarizes the integration, uncertainties, scheduling methods, and real-world cases of using EVs in VPPs, which is playing a crucial role as both energy consumers and providers.

In parallel, reviews on bidding strategies and market participation have been conducted from the perspective of traditional market entities. References [16,17,18,19,20] fall into this category. In Reference [16], evolutionary game theory is applied to long-term strategic bidding, highlighting its advantages in capturing bounded rationality and dynamic adaptation. Reference [17] provided a state-of-the-art review of bidding models for generation companies, and Reference [18] analyzed the business models for resource aggregators in demand response (DR) programs. Reference [19] summarized bidding strategies in spot markets, and Reference [20] reviewed optimization methods for pumped hydro storage under uncertainty. These works collectively address the bidding behavior of conventional generators, renewable producers, and storage operators, but they do not specifically focus on VPPs as integrated aggregators of diverse DERs.

Despite the extensive literature on VPPs and bidding strategies, there is a notable lack of comprehensive reviews that systematically address risk-averse bidding for VPPs in electricity markets. This gap is critical because VPPs operate at the complex nexus of physical power systems, information networks, and financial markets. Their unique attributes—such as the ability to aggregate heterogeneous and geographically dispersed DERs, manage multi-energy flows, and navigate both technical (e.g., renewable intermittency) and market-based (e.g., price volatility) uncertainties simultaneously—demand tailored risk-management approaches. Existing reviews on VPPs often focus on architectural design or general operations [6,7,8,9,10,11,12,13,14,15], while those on bidding concentrate on traditional market participants [16,17,18,19,20], leaving a void in synthesizing the specialized strategies needed for risk-averse VPP participation.

To address the above research gap, this review paper aims to consolidate and analyze the state-of-the-art research on VPP bidding strategies with a specific emphasis on risk aversion under competitive electricity market environment. The contributions of this review are summarized as follows.

- (1)

- It establishes a comprehensive, resource-centric taxonomy and an integrated analytical framework for risk-averse VPP bidding. The review categorizes VPPs into four primary archetypes based on their dominant aggregated resource and the primary source of flexibility they provide—DER-driven, demand response-oriented, electric vehicle-integrated, and multi-energy systems. This classification, while acknowledging that real-world VPPs are often hybrids, provides a structured lens to examine how each category’s unique characteristics shape its market participation strategies, dominant risk exposures, and suitable optimization methodologies.

- (2)

- It delivers a detailed and comparative analysis of the risk-averse optimization techniques employed across different VPP archetypes. The review meticulously surveys a spectrum of methods, from established approaches like stochastic programming with Conditional Value at Risk (CVaR) and robust optimization to emerging paradigms such as distributionally robust optimization and AI-driven learning. It critically assesses their application contexts, computational trade-offs, and effectiveness in mitigating specific uncertainties related to price volatility, renewable generation, and prosumer behavior, providing a practical guide for method selection.

- (3)

- It synthesizes cutting-edge research trends, identifies critical unresolved challenges, and outlines a forward-looking research agenda. The review consolidates the latest advancements while highlighting persistent barriers such as computational bottlenecks, data privacy issues, and a lack of interoperability standards. Building upon this diagnosis, it proposes concrete pathways to advance the field, including the development of hybrid AI–physical models, the creation of standardized interfaces and novel market mechanisms, and the promotion of collaborative VPP ecosystems, thereby providing a comprehensive roadmap for future research and development.

2. Resources and Decision Framework

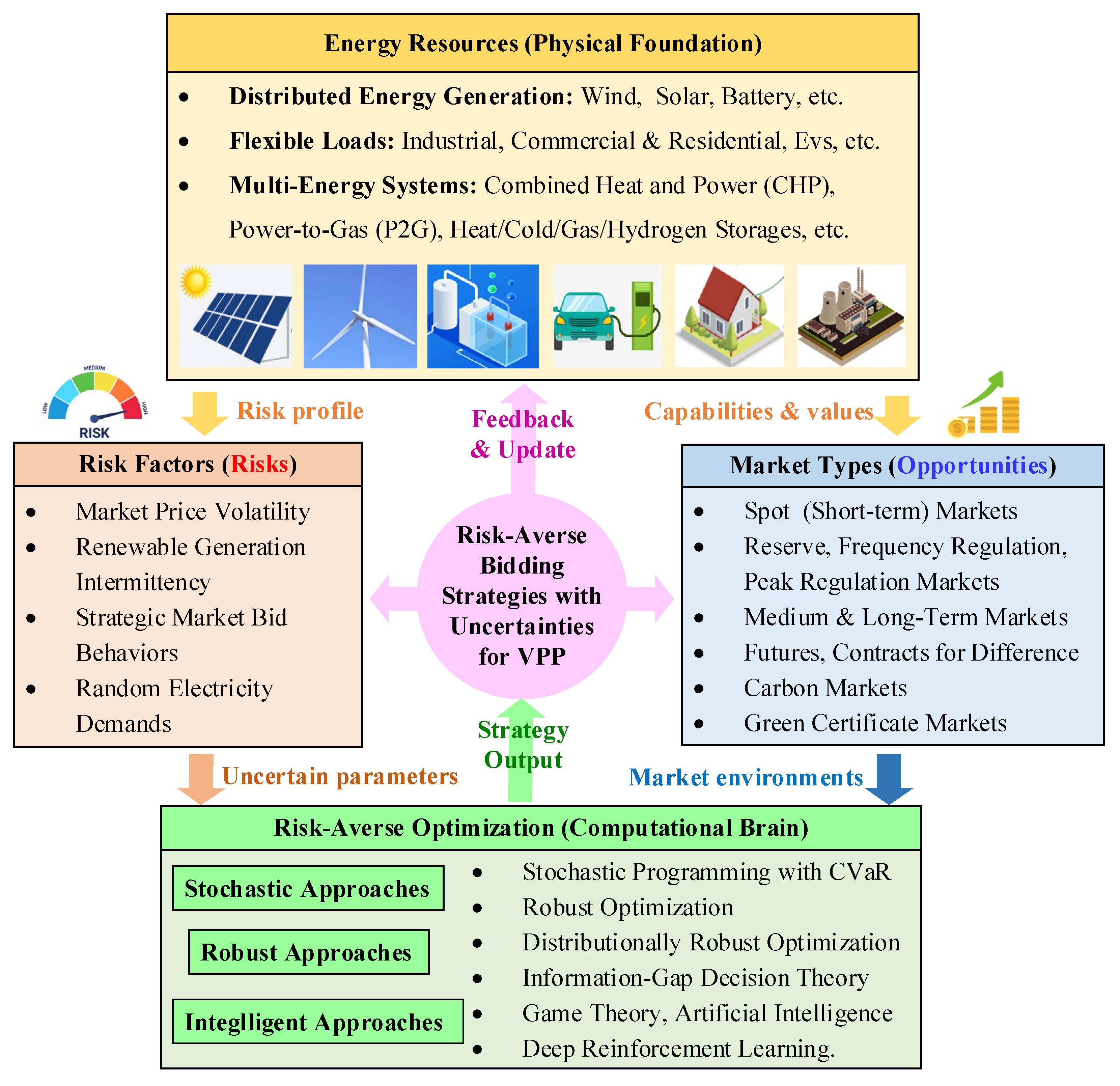

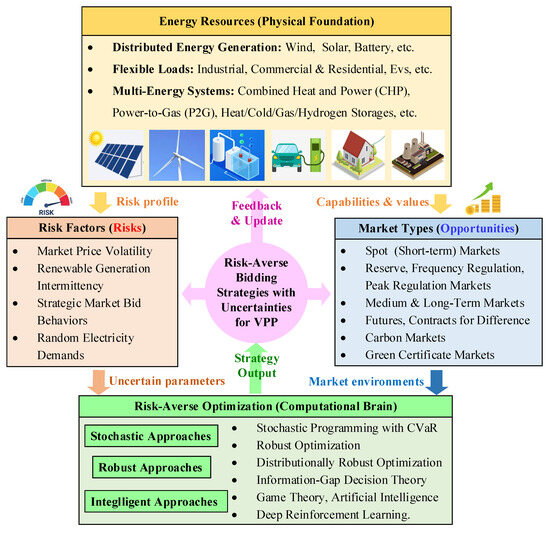

As shown in Figure 1, the overall decision-making framework for risk-averse bidding by VPP is a sophisticated system built upon four interconnected pillars: the resource portfolio, market structures, risk factors, and optimization methodologies. The resource portfolio forms the foundational layer, comprising diverse assets such as stochastic DERs like solar and wind [1,7], flexible DR programs [18], and resilient multi-energy systems that couple electricity, heat, and gas [8]. These resources enable participation in a hierarchy of electricity markets, including volatile spot markets [3,17], ancillary service markets for grid stability [18], and long-term contracts like contracts for differences for revenue certainty [4]. Inherent to operating in these environments are significant risk factors, primarily stemming from price uncertainty [2,3], generation intermittency of renewables [12], and behavioral uncertainties of loads and EVs [11]. Among these, market price volatility is a primary financial hazard, directly impacting profitability. To navigate this complex landscape, a suite of optimization methods—ranging from stochastic and robust programming [12,19] to game-theoretic [16] and data-driven artificial intelligence (AI) approaches [11,13]—are employed to formulate bids that strategically balance expected profit against potential risks. The efficacy of a VPP hinges on the dynamic interactions between these components, rather than their isolated performance.

Figure 1.

The overall decision-making framework for risk-averse bidding by VPP in electricity markets.

The relationship between the resource portfolio, market participation, and risk exposure is cyclical and deterministic. The specific composition and attributes of a VPP’s aggregated resources directly dictate its viable market opportunities and corresponding risk profile. A VPP rich in fast-responding assets, such as battery storage or DR, is inherently suited for high-value, high-volatility ancillary service markets, where its flexibility can capitalize on rapid price signals but also faces significant price risk [18]. Conversely, a VPP dominated by predictable, albeit intermittent, renewables may primarily target day-ahead energy markets, where its primary risk shifts from price volatility to the quantity risk of generation forecast errors [12,19]. The integration of EVs introduces a layer of behavioral uncertainty [15], while multi-energy coupling provides a risk-mitigating mechanism by allowing arbitrage across different energy vectors, thus reducing dependency on a single, potentially unfavorable, electricity price [8]. Critically, market rules amplify or attenuate these inherent resource risks. For example, an “energy-only” market design can lead to extreme price events during system stress, turning resource inadequacy into severe financial risk [3], whereas long-term contracts for difference can shield a VPP from spot price volatility, effectively transferring price risk to a counterparty and making revenue streams more predictable [4]. Therefore, the risk is not an isolated property of the resources or the market but emerges from their interaction.

Optimization methods serve as the crucial computational engine that integrates the other three components, translating resource constraints, market rules, and risk tolerance into executable bidding strategies. The choice of optimization technique is profoundly influenced by the nature of the VPP’s resources and the dominant risks in its target markets. For a VPP with a high penetration of renewables, stochastic optimization is a natural fit, as it explicitly incorporates a range of scenarios for uncertain parameters like wind power and market prices, seeking to maximize expected profit [19,20]. When probability distributions are unknown or the decision maker is highly risk-averse, robust optimization provides a safeguard by optimizing against the worst-case realization within an uncertainty set, leading to more conservative but reliable bids [12]. The increasing complexity of strategic interactions in liberalized markets has spurred the use of game-theoretic models, particularly evolutionary game theory, which captures the bounded rationality and adaptive learning of competing market participants, offering a realistic framework for long-term strategic bidding [16]. Meanwhile, data-driven approaches like deep reinforcement learning (DRL) represent a paradigm shift [11,13]; they bypass the need for explicit mathematical models of uncertainty by allowing the VPP to learn optimal bidding policies directly from market interactions, effectively capturing the non-linear relationships between actions and outcomes. This entire process is supported by a vital feedback loop. Post-market settlement, the outcomes (realized prices, actual resource performance) are compared against forecasts and bids. The resulting data is used to refine forecasting models, adjust uncertainty sets, and retrain AI algorithms [13], enabling the VPP to adaptively improve its strategies over time. This continuous learning cycle embeds resilience into the decision framework, allowing the VPP to evolve alongside the dynamic energy landscape.

3. DER-Driven VPP

3.1. Basic Structure

The foundational premise of a VPP lies in its ability to aggregate a diverse portfolio of DERs into a single, coordinated, and dispatchable entity. Most existing research on VPPs mainly focus on the methodologies for integrating, managing, and optimizing heterogeneous resources. In Reference [7], a comprehensive review detailed the fundamental structure of a VPP, including its operator, members, and communication architecture, emphasizing the aggregation of varied energy assets like wind turbines and solar panels. The authors of [9] provided a detailed analysis of resource coordination within VPPs, discussing the challenges posed by stochastic resource characteristics and heterogeneous information structures. The overarching theme across these studies is the development of sophisticated aggregation frameworks that enable diverse DERs—including renewable generation (wind, solar), conventional generation, energy storage systems (ESS), electric vehicles, and flexible loads—to act in concert. This aggregation is not merely a technical consolidation but involves complex decision-making processes to optimize the collective operation and market participation of the inherently diverse and distributed resource base. The participation of a DER-driven VPP in electricity markets is fraught with uncertainties originating from both internal resource variability and external market dynamics. Key risk factors identified in the literature include the intermittency of RES, fluctuations in market prices, load demand uncertainty, and potential component outages.

3.2. Market Types and Opportunities

Different market types present distinct opportunities and risks, and the main trading floors for VPPs mainly include spot market [21,22,23,24,25,26,27,28,29,30,31,32,33,34,35,36,37,38,39,40,41,42,43,44,45,46,47,48,49,50,51,52,53,54,55,56,57], medium and long-term markets [58,59,60,61,62,63], reserve market [64,65,66,67], frequency regulation market [68,69], carbon market [70,71,72], peak regulation market [73], futures market [74,75] and flexible ramping product market [76], which are summarized in Table 1.

Table 1.

Market types considered by the DER-driven VPPs in the references.

In the spot market, VPPs must balance day-ahead and real-time commitments amid uncertain renewable outputs and prices. Reference [21] used a two-step optimization model to distribute energy storage power based on forecasting errors, reducing deviation penalties. In Reference [28], distributionally robust optimization is applied to handle price and wind uncertainties, enhancing reliability. Reference [40] analyzed the impact of China’s spot market rules on VPP revenues, incorporating CVaR to manage price risks. In medium- and long-term markets, VPPs engage in futures contracts and bilateral agreements to hedge against short-term volatility. Reference [59] explored VPP trading optimization in these markets, considering renewable energy derivatives and green certificate mechanisms. References [60,61] incorporated unit failure risks and auction-based coalition formation into medium-term stochastic models. Reference [62] used robust optimization to optimize bilateral contracting portfolios with price risks. Frequency regulation and reserve markets offer additional revenue streams for VPPs with fast-responding resources. Reference [68] proposed a two-stage stochastic model for joint participation in day-ahead and frequency regulation markets, using CVaR to balance profit and risk. References [47,64] analyzed VPP bidding strategies in spinning reserve markets, highlighting the value of flexible DERs in providing ancillary services. Peak regulation markets are particularly relevant in systems with high renewable penetration. Reference [73] studied VPP participation in peak regulation ancillary services, using CVaR to manage wind and solar uncertainties and Shapley value for cost allocation among members. Flexible ramping products (FRPs) are emerging as critical tools for managing real-time balancing needs. Reference [76] incorporated FRPs into a two-stage distributionally robust optimization model, enhancing VPP flexibility and revenue in multi-market environments. Carbon markets provide economic incentives for low-carbon operation. References [70,71] integrated carbon trading into VPP bidding strategies, using distributionally robust optimization and machine learning-based forecasting to manage joint electricity–carbon uncertainties.

3.3. Risk-Averse Optimization Methods

VPPs face multifaceted risks stemming from market price volatility, renewable generation uncertainty, load forecasting errors, and regulatory changes. These risks are managed through participation in various electricity markets, each requiring distinct bidding and operational strategies. A variety of risk-averse optimization techniques have been applied to manage uncertainties in VPP operations.

3.3.1. Stochastic Approaches

The most commonly used measure is the Stochastic programming using CVaR, which quantifies the expected loss beyond a certain confidence level. A fundamental mathematical structure underpinning most risk-averse VPP bidding models is a two-stage stochastic programming framework incorporating the CVaR measure. Let the first-stage decision variable, x, represent the day-ahead market bid, which must be decided before the resolution of uncertainties. The second-stage variable, y(w), represents real-time recourse actions under a specific scenario ω. If the profit in scenario ω is denoted by , and the classical risk-neutral objective is to maximize the following expected profit:

To incorporate risk aversion, for a given confidence level ∈ (0,1) (e.g., = 0.95), the Value-at-Risk () is the -quantile of the profit distribution. CVaR, denoted , measures the expected loss given that the loss exceeds . Using the seminal Rockafellar-Uryasev formulation, the CVaR-constrained optimization problem can be transformed into a tractable linear problem with the objective function as follows:

where is an auxiliary variable representing , is the non-negative shortfall in scenario ω, and λ ∈ [0, 1] is a risk-aversion coefficient that balances the trade-off between expected profit (λ = 0) and risk minimization (λ = 1). References [24,25] applied two-stage stochastic models where first-stage decisions (e.g., contract signing) are made before uncertain parameters (e.g., prices, renewable output) are realized, and CVaR was employed to control profit variability under uncertainties. In Reference [55], the authors extended this to multi-stage stochastic programming for intraday market bidding with additional risks.

3.3.2. Robust Approaches

For cases where the probability distribution of uncertainties is unknown or difficult to characterize, robust optimization immunizes the solution against the worst-case realization within an uncertainty set U. A typical objective function of a robust optimization model for VPP bidding is:

A common polyhedral uncertainty set for market price π can be defined as:

where is the forecasted price, is the maximum deviation, is the perturbation variable, and is the “budget of uncertainty” controlling the conservatism of the solution. Reference [22] used Information Gap Decision Theory (IGDT) to model price and renewable uncertainty. Reference [27] combined stochastic and adaptive robust approaches to handle price and PV uncertainties. References [50,62,65] applied robust optimization to medium-term scheduling and bidding with price uncertainty. Distributionally robust optimization bridges stochastic and robust methods by considering ambiguity sets of probability distributions. Reference [28] used a Wasserstein metric-based DRO to improve out-of-sample performance. References [70,76] applied DRO to joint electricity–carbon markets and flexible ramping products, respectively.

3.3.3. Game-Theoretic Approaches

Game-theoretic approaches are used for profit allocation and coalition formation. References [35,36,47,66] applied cooperative game theory to allocate profits among DERs fairly. References [56,72] modeled non-cooperative games between VPPs and multi-VPP cooperation under carbon markets. Hybrid and metaheuristic algorithms are often employed to solve complex nonconvex models. Reference [27] used binding scenario identification to reduce computational burden. Reference [43] applied an enhanced bacterial foraging algorithm. Reference [51] used self-adaptive particle swarm optimization. Reference [71] introduced the White Shark Optimizer for risk-aware bidding with carbon integration.

In summary, the body of work on DER-driven VPPs reveals a clear trajectory from basic risk-neutral optimization towards increasingly sophisticated risk-averse game thetical frameworks. The extensive application of CVaR-based stochastic programming demonstrates the field’s focus on quantifying and hedging against tail-end financial risks. Furthermore, the emergence of distributionally robust optimization and hybrid models signifies a growing recognition of the limitations of perfect probability information, pushing the frontier towards methods that are both computationally tractable and robust against distributional ambiguity. Collectively, these advancements highlight a maturing field that is moving beyond expected profit maximization to ensure reliability and financial stability under uncertainty.

4. DR-Oriented VPP

DR stands as a cornerstone capability for VPP, transforming passive consumers into active participants capable of providing significant flexibility to the grid and markets. The current research on DR-oriented VPP delves into the critical role of DR resources within VPPs, exploring innovative aggregation strategies, sophisticated risk-averse optimization models, enabling communication architectures, coalition management, and emerging peer-to-peer (P2P) paradigms. The references on DR-Oriented VPP are summarized and compared in Table 2.

Table 2.

Comparison of references on DR-Oriented VPP considering application focus, methodology and markets.

4.1. The Centrality of DR in VPP Resource Aggregation

The inherent flexibility of DR resources is increasingly recognized as essential for mitigating the variability introduced by RES integrated within VPPs and for enhancing overall operational resilience and profitability. Reference [77] studied the significant potential of market mechanisms to unlock customer flexibility, emphasizing how VPPs offer surplus benefits by coordinating demand-side flexibility under uncertainty, particularly through Local Energy Communities (LECs). Reference [78] focused on the emerging Customer Directrix Load (CDL) model as an essential form for supporting power system flexible regulation. They argued that aggregating decentralized DR resources, which typically have large scale but small individual capacity, is an urgent task for VPPs, enabling indirect participation in grid regulation services. Reference [79] explicitly stated that DR is becoming increasingly important for enhancing VPP operation and mitigating risks associated with RES fluctuations, proposing a DR program specifically designed to minimize the VPP’s deviation penalties in power markets by incorporating consumer risk attitudes. Reference [80] reinforced this, stating that DR (alongside Battery Energy Storage—BES) are two critical resources increasing VPP operational flexibility and reducing short-term market economic risks, necessitating data-driven customer selection for optimal planning. References [81,82] for industrial Technical VPPs, demonstrating that appropriate DR programs can reduce costs and improve load shedding outcomes during grid contingencies.

4.2. Risk-Averse DR Scheduling Optimization

VPPs face multiple uncertainties in DR behavior, RES generation, and market prices, necessitating the integration of robust risk management frameworks into their scheduling and bidding processes. To effectively harness DR flexibility, advanced optimization models capable of operating across multiple timescales and markets—encompassing scheduling, bidding, and real-time control—are essential. In this context, References [83,84] proposed a risk-averse stochastic framework for VPP energy and reserve scheduling that incorporates DR and accounts for uncertainties in load, wind, electricity prices, and N-1 contingencies, demonstrating how DR participation influences reserve provision. Reference [85] extended this approach to a two-stage risk-constrained stochastic VPP bidding problem spanning day-ahead, real-time, and spinning reserve markets. Their work explicitly models how customers participate in DR programs to reduce costs and provide reserve services, integrating supply- and demand-side capabilities for risk-managed market participation.

Further research has focused on enhancing the practicality and economic performance of these models. Reference [86] aimed to reduce the conservatism of traditional robust optimization by constructing a polyhedral uncertainty set based on conditional value-at-risk (CVaR) for VPP participation in energy and DR markets, showing a significant reduction in total cost compared to conventional methods. Reference [87] introduced an integrated risk preference concept combining VaB and CVaR, proposing a windfall profit-aware stochastic scheduling model for industrial VPPs. This model leverages multiple types of flexible resources and virtual transactions to jointly manage high profits and extreme losses.

Another important research direction involves multi-timescale coordination and market interaction strategies. Reference [88] developed a reconfigurable hierarchical multi-time-scale framework combining dynamic storage virtualization and intent profiling with model predictive control (MPC). This allows VPPs to participate simultaneously in different energy markets based on aggregator criteria and risk factors, optimizing day-ahead bids and subsequently using a control stage to mitigate deviations and penalties. Reference [89] pioneered the application of a direct load control (DLC) algorithm for a VPP aggregator managing thermostatically controlled loads, optimizing control schedules to maximize load reduction bids in real-time markets and minimize grid congestion and generation-demand deviations. Reference [90] focused on the emerging high-frequency spot market, proposing a trading incentive mechanism for VPP-grid interaction and emphasizing the importance of data-driven forecasting and optimization models for real-time response to price and load variations. Finally, Reference [91] explored optimal VPP dispatch and bidding within a Stackelberg game framework, showing that coordinated internal power output and trading strategies can mitigate intermittent renewable risks, reduce penalty costs, and improve overall operational economy, thereby maximizing VPP profit while minimizing end-user electricity costs.

4.3. Integrated Coordination Mechanisms for DR-Oriented VPPs

Effective communication, coordination, and fairness are essential as VPPs expand in scale and complexity. Feng et al. [92] tackled communication congestion in large-scale prosumer VPPs by introducing an online partial-update algorithm that selects a subset of prosumers for ADMM-based energy sharing each round. This approach prioritizes convergence-critical participants while ensuring equitable update opportunities, thereby reducing negotiation delays and overhead. Similarly, Reference [93] highlighted the role of P2P platforms in coordinating small-scale generators and consumers within VPPs, leveraging energy diversity to manage uncertainty. Their model combines internal physical trading with external financial contracts, using a two-stage stochastic game to mitigate overbidding risks. Further emphasizing fairness, Reference [94] proposed a risk scheduling model for a sharing-based VPP, deriving a shared power price mechanism through consistency theory to enhance equity and efficiency.

Building on these coordination frameworks, the shift toward decentralized and prosumer-driven VPP models is increasingly evident. Reference [95] further advanced this concept with an urban VPP model centered on P2P trading, classifying prosumers by preferences such as financial return, green energy affinity, and risk aversion. This classification supports a dynamic bidding mechanism that improves supply-demand matching and operational stability. These efforts underscore the growing recognition of prosumers as active, preference-driven participants, a perspective also reflected in the communication strategy of the tariff-alignment model of Reference [96].

The formation of VPPs often resembles a coalition, necessitating fair and sustainable mechanisms for value and risk distribution. Reference [97] applied a cooperative game framework to model VPP alliances, using an improved Shapley value method to distribute profits based on risk contribution and marginal benefits. This approach significantly enhanced cost-effectiveness and stakeholder engagement. Similarly, Reference [96] addressed tariff heterogeneity by sharing arbitrage benefits with users—ensuring that participants directly benefit from VPP market activities. Together, these mechanisms reinforce the viability and attractiveness of VPP coalitions by aligning individual and collective interests.

4.4. Advanced Methodologies and Market Integration

Leveraging cutting-edge techniques is crucial for overcoming the complexities of DR-driven VPPs. Reference [98] tackled the challenge of predicting aggregate VPP output with geographically dispersed PV and limited observability. Their solution was a Bayesian Vector Autoregression approach generating synthetic data for unobserved prosumers using observed prosumers’ local correlation microstructure and temporal cross-correlation. This non-parametric method provided more accurate variance forecasts, enabling better market risk management. Reference [99] concentrated on the foundational challenge of integrating heterogeneous Behind-the-Meter (BTM) grid-edge technologies into wholesale markets under structures like FERC Order 2222. Their proposed methodology calculated risk-based VPP energy offers via supply functions derived from offline sampling of actual DER usage data, aiming to maximize the DER value from market participation. Reference [90] also underscored the integration challenges for VPPs in high-frequency spot markets, emphasizing the necessity for advanced data-driven forecasting/optimization, robust technical infrastructure (data processing, communication), and strong market risk management/regulatory compliance frameworks.

Collectively, the research in this section signals a pivotal shift in the role of the DR-oriented VPP, from a simple aggregator of kilowatt-hours to a sophisticated portfolio manager of information and flexibility. The move towards advanced probabilistic forecasting [98] and risk-based supply functions [99] demonstrates that the primary bottleneck is no longer just the physical control of loads, but the ability to accurately quantify and value the flexibility held within a diverse, often unobservable, prosumer portfolio. This evolution is critical for translating the theoretical potential of demand-side resources into tradable, bankable assets in competitive markets, thereby unlocking a new era of reliability and economic efficiency for the grid.

5. Electric Vehicle-Integrated VPP

The integration of electric vehicles into VPPs has emerged as a critical strategy to enhance grid flexibility, facilitate renewable energy absorption, and unlock new revenue streams in electricity markets. However, the inherent uncertainties associated with EV mobility patterns, charging behaviors, and market price volatility introduce significant risks that complicate bidding and operational decisions. This section systematically reviews advances in this domain, categorizing them into three interconnected themes: uncertainty modeling and risk quantification, optimization frameworks for decision-making, and strategies for multi-market participation.

5.1. Uncertainty Modeling and Risk Quantification

A foundational step in designing risk-averse bidding strategies is the accurate modeling of uncertainties and the formal quantification of associated risks. As shown in Table 3, the research in this area has employed a variety of stochastic and robust optimization techniques, often enhanced with risk measures. Reference [100] pioneered a multi-stage risk-constrained stochastic optimization framework for the coordinated operation of an EV fleet with a wind power producer. The model explicitly incorporated uncertainties in market prices and wind generation through scenario trees and used a risk measure to hedge against unfavorable outcomes, demonstrating significant cost reductions and profit increases compared to disjoint operations. Complementing this, Reference [101] adopted a two-stage robust optimization approach to manage the uncertainties of wind, photovoltaic power, and load. This model focused on calculating the available capacity of an EV aggregation, treating it as virtual energy storage, and used robust parameters to adjust the conservatism of the solution, effectively balancing economic benefits with operational risks under worst-case scenarios. Beyond optimization-based methods, machine learning techniques have been leveraged to handle ambiguity. Reference [102] introduced a hybrid uncertainty modeling approach where a reinforcement learning (RL) agent dynamically adjusted the VPP portfolio based on real-time market conditions and fleet demand uncertainties. This study highlighted the critical role of accurate mobility demand forecasting and showed that advanced RL could substantially increase balancing power offers while reducing costs. Similarly, Reference [103] investigated RL for constructing VPP offering curves in the day-ahead market, demonstrating its superiority in handling ambiguous DER performance from both risk-averse and profit-seeking perspectives. These studies collectively underscore the importance of sophisticated uncertainty modeling as a prerequisite for effective risk management.

Table 3.

Comparison of references on electric vehicle-integrated VPP considering application focus, methodology and markets.

5.2. Risk-Averse Optimization for EV Charging and Discharging

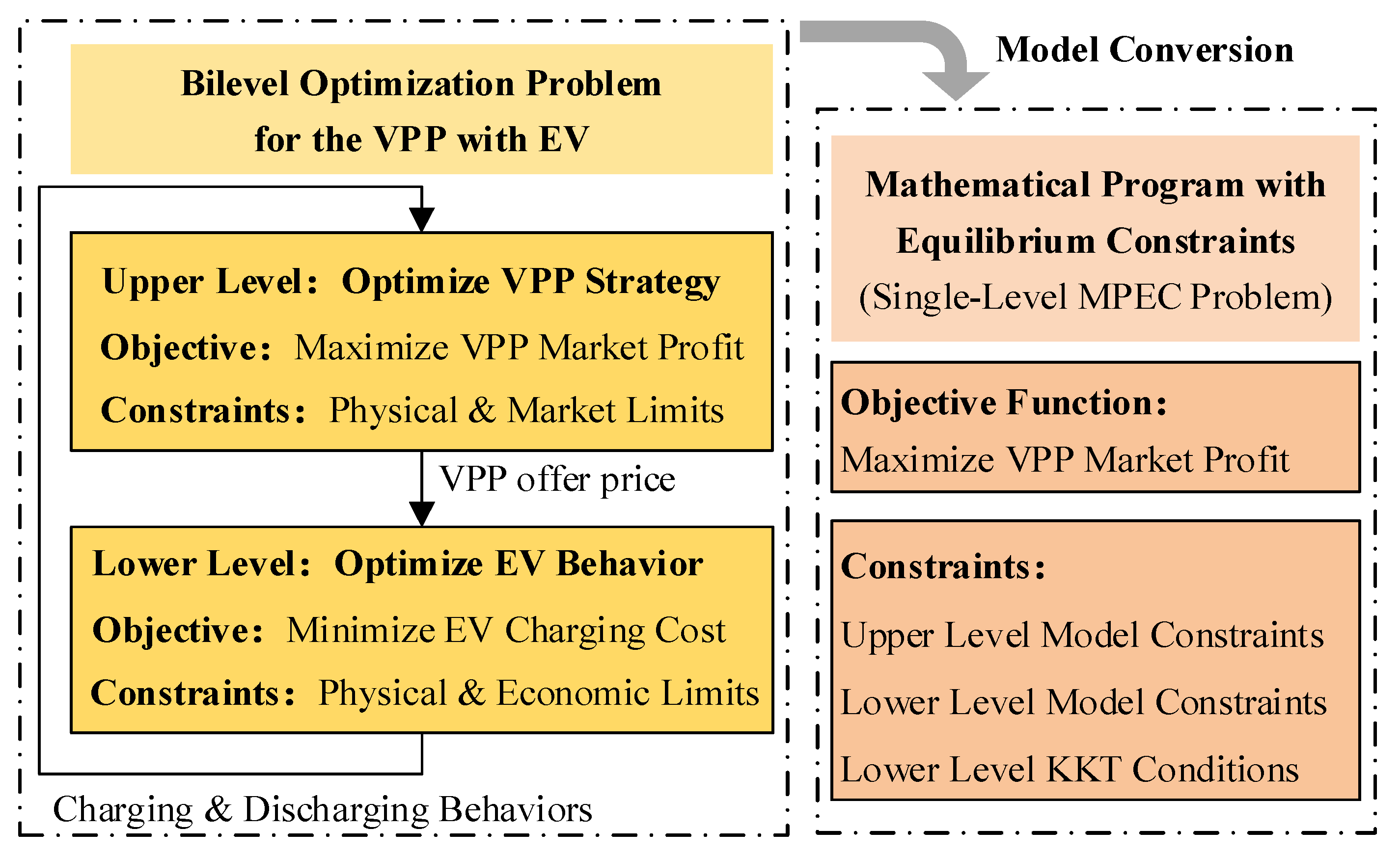

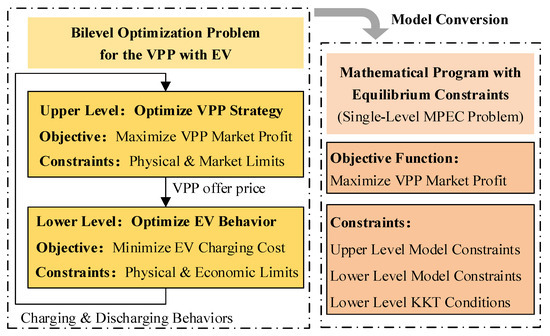

Building upon uncertainty modeling, the field has seen the development of advanced optimization frameworks that explicitly integrate risk measures into the decision-making process of EV-integrated VPPs. A prominent trend is the use of bi-level or hierarchical models to capture the strategic interaction between the VPP (leader) and EV users (followers). Specifically, as shown in Figure 2, the strategic interaction between a VPP and EV users can be modeled as a bilevel optimization problem as follows.

Figure 2.

Bilevel Optimization problem for the VPP with EV.

- Upper Level (VPP—Leader): Maximizes its profit, considering the response of EVs.

- Lower Level (EV—Follower): Each EV minimizes its charging cost based on the VPP’s offered price πEV.

The above bilevel problem is typically solved by replacing the lower-level problem with its Karush–Kuhn–Tucker (KKT) optimality conditions, transforming it into a single-level Mathematical Program with Equilibrium Constraints (MPEC). Reference [104] devised a bi-level stochastic optimization model structured as a Stackelberg game for VPP trading in energy, ancillary services, and carbon markets. The VPP sets prices to incentivize EVs, and the model is transformed into a single-level problem using duality theory, with CVaR employed to quantify and manage the risk from renewable energy uncertainties. This approach successfully increased expected profit while optimizing price signals. Echoing this game-theoretic structure, Reference [105] proposed a bi-level optimization strategy where the upper-level VPP model uses CVaR to manage EV-related uncertainties and set risk-aware prices, while the lower-level EV users minimize their costs. The solution via particle swarm optimization led to a significant reduction in the peak-valley load gap and user costs, highlighting the framework’s ability to balance VPP profit with user satisfaction. Furthermore, DRL has been applied to solve complex scheduling problems under constraints. Reference [106] proposed a novel scheduling method for a residential VPP using a GRU-integrated constrained soft actor-critic algorithm. The Lagrangian relaxation technique was introduced to handle constraints rigorously, enabling a fully distributed, plug-and-play architecture that enhanced responsiveness and balanced supply and demand. These frameworks represent a significant evolution from traditional linear models towards more adaptive, scalable, and risk-informed optimization paradigms.

5.3. Multi-Market Participation and Risk Management

To maximize revenue and utilization of flexibility, EV-integrated VPPs are increasingly designed to participate simultaneously in multiple markets, such as energy, frequency regulation, and ancillary services. This multi-market engagement necessitates strategies that can coordinate bids across different timeframes and manage compounded risks. Reference [107] addressed this by proposing a joint optimization strategy for VPP participation in both the main energy market and the auxiliary frequency regulation market. The study considered uncertainties in wind-solar power and market prices, established a dispatchable domain for an EV cluster, and incorporated CVaR into a day-ahead bidding model to balance revenue and risk. Simulations confirmed that providing frequency regulation services significantly enhanced comprehensive revenue. Expanding on the multi-temporal aspect, Reference [108] proposed a multi-temporal optimization strategy for the energy-frequency regulation market. It integrated a day-ahead Stackelberg game model with CVaR risk management and emphasized the fast response characteristics of resources like battery storage and EVs, demonstrating improved revenue through coordinated temporal decision-making. In contrast to these centralized coordination models, Reference [109] explored a decentralized paradigm by proposing a P2P market trading mechanism for VPP internal prosumers, including EVs. This approach decomposed the centralized problem into decentralized sub-problems, reducing computational burden and protecting privacy, while a real-time deviation adjustment mechanism based on VCG rules ensured operational security. This body of work illustrates that successful multi-market participation relies on sophisticated coordination mechanisms and robust risk-management tools to navigate the intricate landscape of modern electricity markets.

The progression of strategies from single-market to multi-market and from centralized to decentralized models [107,108,109] reflects a field maturing in its understanding of EV fleet value. The key insight from this collective research is that the highest value of EVs to the grid is not merely their energy capacity, but their unique temporal and spatial flexibility. This allows them to act as a “swing resource” across different market products and timeframes. However, this body of work also highlights a fundamental trade-off: while centralized, co-optimized models promise theoretically higher efficiency, decentralized, privacy-preserving approaches are essential for scalability and participant adoption. The future pathway, therefore, lies not in choosing one over the other, but in developing hierarchical or federated architectures that can capture the benefits of coordinated action while respecting the autonomy and privacy of a massive, decentralized EV fleet. (R3, C7)

6. Multi-Energy VPP

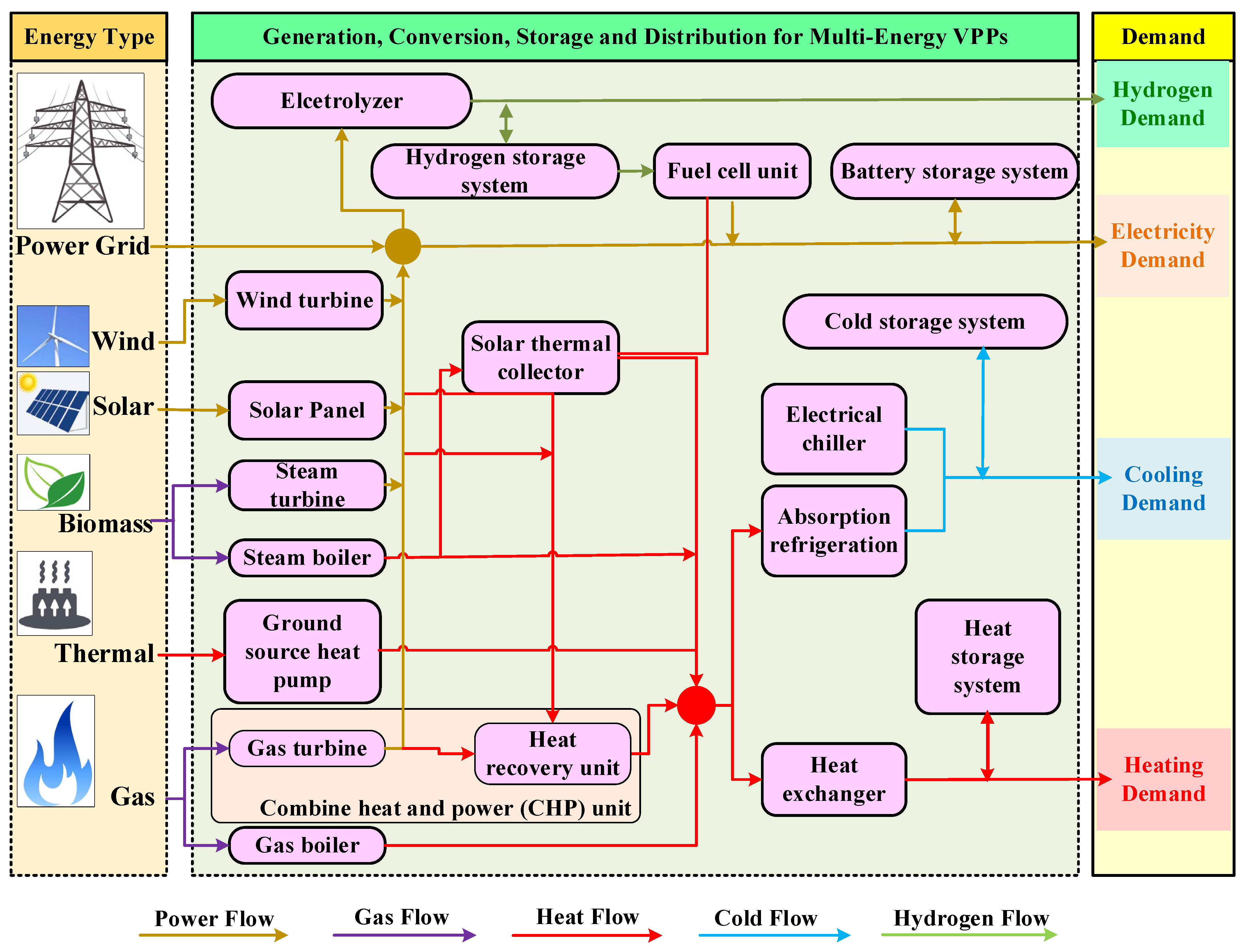

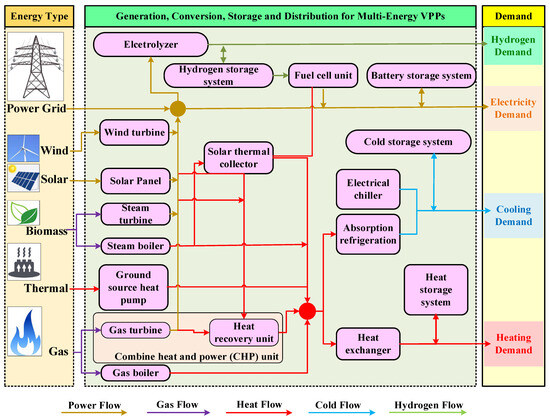

The integration of heterogeneous energy carriers—electricity, heat, hydrogen, and natural gas—into multi-energy virtual power plants (MEVPPs) represents a paradigm shift in the operational flexibility and risk resilience of modern power systems. As shown in Figure 3, by leveraging the complementary characteristics of different energy forms, MEVPPs can enhance renewable energy absorption, provide cross-sectoral balancing services, and participate more effectively in multiple markets under uncertainty. This section systematically reviews recent advances in risk-averse bidding strategies for MEVPPs, with a particular emphasis on the modeling of multi-energy synergies, the quantification and management of uncertainties, and the development of sophisticated optimization frameworks that incorporate risk measures such as CVaR, information-gap decision theory (IGDT), and robust optimization. The discussion is organized into three interconnected themes: the modeling of multi-energy flexibility and complementarity, risk-aware optimization under uncertainty, and strategic participation in multi-market environments.

Figure 3.

Generation, conversion, storage and distribution of multi-energy VPPs.

6.1. Modeling Multi-Energy Flexibility and Complementarity

As shown in Figure 3, the core advantage of MEVPPs lies in their ability to integrate and coordinate diverse energy resources, thereby unlocking synergistic flexibility that is not achievable in single-energy systems, which is facilitated by using energy conversion devices, such as Combined Heat and Power (CHP) and Power-to-Gas (P2G). For instance, A key constraint involves the operation of a CHP unit, which links electricity () and heat () output:

where is the heat-to-power ratio. This coupling creates a feasible operating region, often represented as a polytope, which the optimization must navigate. This set of equations is the mathematical basis that allows the MEVPP to perform arbitrage across electricity and gas/heat markets. By dynamically adjusting the CHP’s output within this feasible region, the VPP can shift energy between carriers to enhance revenue and providing an inherent mechanism to mitigate risks associated with price volatility in a single market. For example, when electricity prices are high, the CHP can be dispatched to maximize power output, and the concomitant heat can be stored or used to offset gas-fired boilers.

These equations allow the MEVPP to perform arbitrage across electricity and gas markets. Reference [110] provides a comprehensive review of multi-energy coupled VPPs, highlighting their evolution from aggregating a single energy type to managing complementary electricity, heat, and gas systems. This integration enhances operational stability, economic efficiency, and risk management capability. Reference [111] designed a novel power-to-gas (P2G)-based VPP that establishes a “power-gas-power” recycling mode, using combined heat and power (CHP) and thermal storage to improve renewable utilization. The study introduced a flexible risk aversion model combining CVaR and robust optimization, demonstrating how P2G and DR can mitigate operational risks while increasing clean energy usage. Reference [112] further advanced the modeling of gas-electricity VPPs by incorporating P2G, gas storage, and price- and incentive-based DR. The authors showed that such integration smooths load profiles and reduces carbon emissions, with robust stochastic optimization effectively handling wind and solar uncertainties. Hydrogen integration has also emerged as a key enabler of flexibility. Reference [113] proposed an aggregated flexibility estimation method for an electricity-hydrogen VPP, abstracting the temporal coupling of virtual storage resources as polytopes and using a Minkowski sum to characterize the VPP’s schedulable region. This method increased the power range and net income significantly, highlighting the role of hydrogen in enhancing peak-regulation capability. Reference [114] modeled a hydrogen-integrated MEVPP with hybrid (daily and seasonal) hydrogen storage, enabling intraday and cross-seasonal peak shaving and improving capacity adequacy and flexibility in joint capacity, energy, and ancillary service markets. Reference [115] proposed an electricity-hydrogen VPP with shared energy storage, demonstrating through IGDT-based optimization that hydrogen systems together with DR can significantly improve energy utilization efficiency and market returns under both risk-averse and risk-seeking modes. These studies collectively underscore that the modeling of multi-energy complementarity is foundational to unlocking the operational flexibility necessary for effective risk management in MEVPPs.

6.2. Risk-Aware Multi-Energy Scheduling

The coordination of multiple energy carriers introduces additional layers of uncertainty, necessitating advanced optimization frameworks that explicitly account for risk. CVaR has been widely adopted to quantify and hedge against financial risks arising from renewable generation and price volatilities. Reference [116] developed a stochastic mixed-integer non-linear programming model for a VPP containing wind, photovoltaic, CHP, and storage, applying CVaR to mitigate low-profit scenarios and balance economic and environmental objectives. Reference [117] constructed a three-level market optimization model for a VPP with carbon capture and P2G, using copula-CVaR theory to capture the risk dependence between electricity and gas prices, thereby supporting multi-objective decision-making under uncertainty. Reference [118] introduced a denoising diffusion probabilistic model for scenario generation and integrated CVaR into the MEVPP scheduling model to analyze the impact of the operator’s risk aversion on operational outcomes. Alternatively, IGDT has been employed for non-probabilistic robust optimization. Reference [119] formulated both robust and opportunistic bidding strategies for a wind-P2G VPP using IGDT, allowing operators to choose strategies based on risk appetite without relying on probability distributions. Reference [115] also applied a two-stage IGDT approach to optimize day-ahead and real-time schedules for an electricity–hydrogen VPP, effectively addressing the uncertainty in renewable generation. Hybrid risk modeling approaches have further enriched the field. Reference [120] combined copula theory with CVaR to model correlated wind and solar forecast errors in a P2P multi-energy trading context, reducing both risk costs and total costs significantly. Reference [121] used downside risk constraints and a modified robust optimization model for a large-scale VPP participating in energy and reserve markets, demonstrating effective risk control across numerous distributed resources. Reference [122] proposed an aggregation model for a Combined Heat and Power VPP (CHP-VPP) to participate in electricity markets. The model is formulated as an adjustable robust optimization problem and solved with a custom algorithm to manage the integrated electric and thermal systems.

6.3. Strategic Participation Considering Multi-Energy Market Environments

To maximize economic and environmental benefits, MEVPPs are increasingly designed to participate simultaneously in multiple markets—including energy, ancillary services, capacity, carbon, and green certificate markets—which requires coordinated bidding strategies that manage cross-market risks.

The research on risk-averse bidding for multi-energy VPPs are compared in Table 4, which demonstrates significant advances in the modeling of energy synergies, the application of sophisticated risk-management tools, and the strategic integration into multi-market environments. The consistent emphasis on flexibility—achieved through technologies such as P2G, hydrogen storage, and multi-DR—enables MEVPPs to transform uncertainty into opportunity. Reference [123] presented a stochastic model for VPP participation in futures markets, pool markets, and contracts with withdrawal penalties, showing that diversified market engagement can increase expected profit while allowing risk customization through CVaR weighting. Reference [124] focused on the joint energy and ancillary service bidding of a photothermal-wind VPP, using stochastic programming and CVaR to leverage the rapid regulation characteristics of thermal storage for frequency regulation and wind fluctuation suppression. The study demonstrated that electric heating and DR could further enhance revenues. Carbon and green certificate markets have become integral to low-carbon operation. Reference [125] proposed a low-carbon scheduling model for a CHP VPP that uses CVaR to assess carbon price risk and employs P2G-carbon capture and storage with ground-source heat pumps to decouple heat-power constraints, thereby reducing emissions and improving renewable consumption. Reference [126] designed a blockchain-enabled cross-chain trading mechanism for electricity-carbon-green certificate markets, integrating carbon capture and P2G to achieve synergistic optimization. The approach significantly reduced carbon intensity and increased renewable consumption, demonstrating Pareto improvements in economic and environmental performance. Reference [127] proposed a stochastic optimization model for an electric-thermal-gas VPP participating in gas and electricity markets, using the superquantile method to optimize the sale schemes of multiple energy carriers while managing price and renewable uncertainty.

Table 4.

Comparison of the research on risk-averse bidding for multi-energy VPPs.

Cooperative operation among multiple VPPs has also been explored to enhance system-wide resilience. Reference [128] proposed a multi-VPP shared operation strategy based on distributionally robust chance constraints, enabling P2P electricity-heat-carbon trading and fair benefit allocation through an asymmetric Nash negotiation mechanism. This approach improved the robustness, economy, and low-carbon nature of the overall system. Additionally, References [129,130] investigated hydrogen-based VPP participation in energy and frequency control ancillary services markets using IGDT, achieving substantial profitability improvements and securing grid stability through dynamic operational boundaries. These studies highlight that multi-market participation not diversifies revenue streams but also necessitates integrated risk management strategies that account for cross-commodity price correlations and regulatory uncertainties [131].

7. Conclusions and Discussions

This review has examined the state of the art in risk-averse bidding strategies for VPPs participating in competitive electricity markets. The analysis, structured around the core pillars of resource aggregation, market structures, risk factors, and optimization methodologies, underscores that the effective operation of a VPP is an exercise in sophisticated multi-dimensional risk management. The evolution from single-energy aggregators to multi-energy systems integrating electricity, heat, hydrogen, and transport sectors marks a significant paradigm shift, as highlighted in reviews like that described in Reference [113]. This review has highlighted how DER-driven VPPs leverage portfolios of stochastic renewables, flexible DR, and electric vehicle fleets to participate across a spectrum of markets—from day-ahead and real-time spot markets to ancillary services, capacity markets, and emerging carbon/green certificate schemes. A critical insight is the symbiotic relationship between a VPP’s resource composition and its risk profile; a diverse and flexible portfolio not only unlocks higher-value market opportunities but also provides inherent risk-mitigation capabilities through cross-vector arbitrage and complementary operation. The extensive application of risk-measures, particularly CVaR, alongside robust optimization [119,126], distributionally robust optimization [129], and game-theoretic models [112], demonstrates the field’s maturity in moving beyond expected profit maximization towards strategies that explicitly quantify and hedge against financial risks arising from price volatility, renewable generation uncertainty, and behavioral unpredictability. Furthermore, the emergence of P2P trading [112], blockchain-enabled coordination [126], and AI-driven forecasting and control algorithms [121] points to a future where VPPs are not merely passive price-takers but active, intelligent nodes in a decentralized, digitalized, and democratized energy ecosystem.

The overarching conclusion of this review is that risk-averse bidding is not an optional add-on but a fundamental prerequisite for the financial viability and operational resilience of VPPs. It enables them to fulfill their crucial role in the transition to a sustainable, reliable, and efficient power system. Our analysis underscores that the effective operation of a VPP is an exercise in sophisticated multi-dimensional risk management. Despite the significant advancements documented in this review, several formidable challenges persist, hindering the widespread and optimal deployment of risk-averse VPPs, which can be summarized as follows. (R3, C3)

- (1)

- Firstly, a primary challenge lies in the escalating complexity of modeling and computation. As VPPs evolve to encompass multi-energy carriers, numerous distributed assets, and participation in multiple simultaneous markets [127], the resulting optimization problems become high-dimensional, non-convex, and computationally intractable for real-world applications. While techniques like scenario reduction offer partial solutions, efficiently solving large-scale stochastic or distributionally robust models for real-time bidding remains a significant hurdle, a challenge acknowledged in studies dealing with complex multi-objective problems [131].

- (2)

- Secondly, there is a critical gap in standardization and interoperability. The lack of universal communication protocols and market interfaces creates friction for integrating diverse DERs and for seamless participation in different regional markets, which complicates the aggregation process and limits scalability, an issue that decentralized approaches like P2P trading [112] and blockchain [126] aim to address but have not yet solved at scale.

- (3)

- Thirdly, data availability and quality pose a substantial obstacle. Accurate risk assessment and bidding rely heavily on high-resolution data for forecasting prices, renewable output, and consumer behavior. Issues of data privacy, ownership, and the cost of acquiring reliable data can impede the development of robust models, a challenge particularly acute when dealing with unobservable prosumers [90]. Moreover, existing risk-management frameworks often struggle with multi-domain risk correlation. Many models treat uncertainties in isolation, failing to capture the complex tail dependencies between different market commodities [125] and external factors like extreme weather events, which can lead to an underestimation of systemic risk.

- (4)

- Finally, regulatory and market design barriers remain a significant impediment. The absence of clear long-term signals for flexibility can stifle innovation, a context in which studies often assume perfect market access rather than tackling these real-world institutional hurdles [113,114].

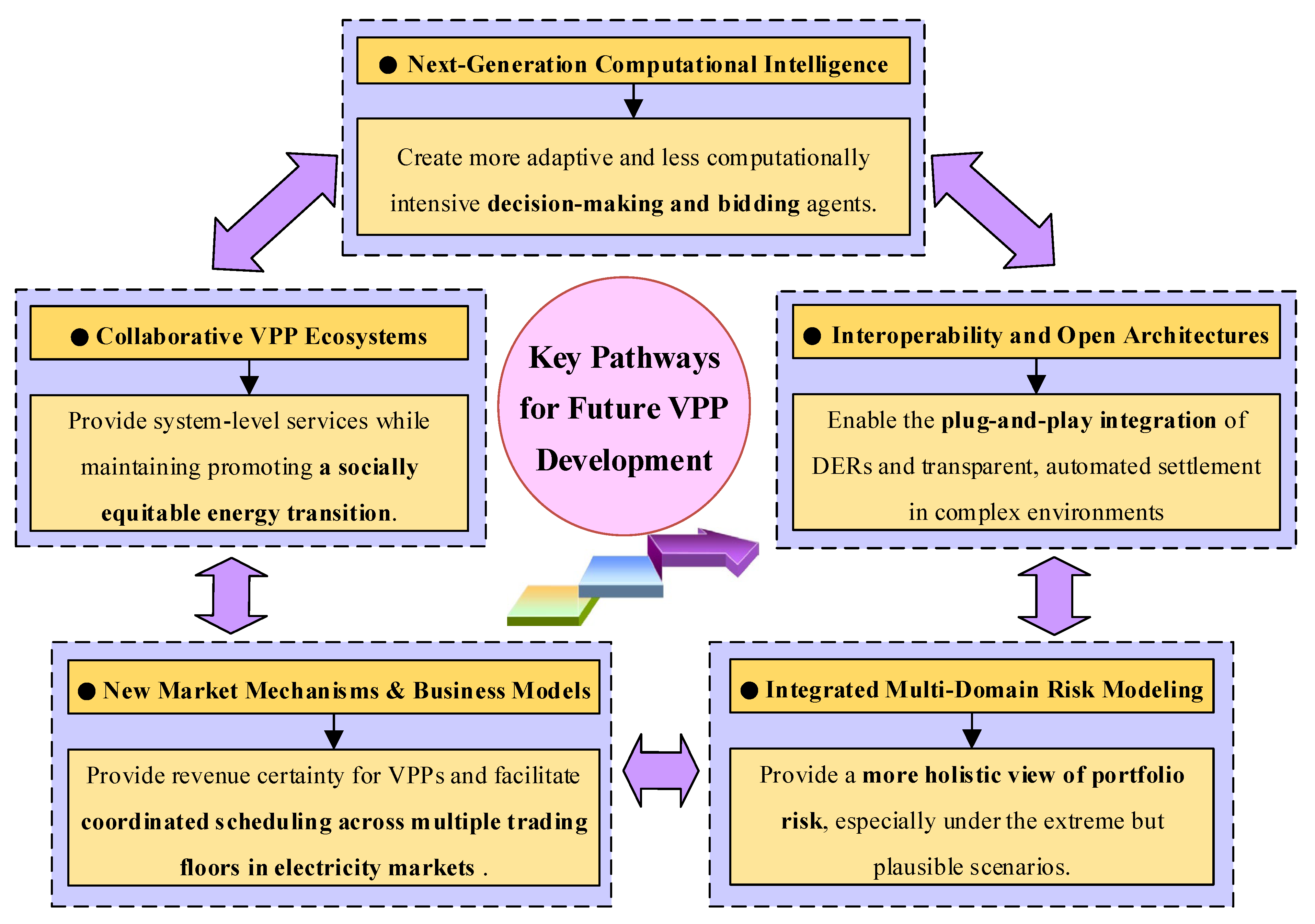

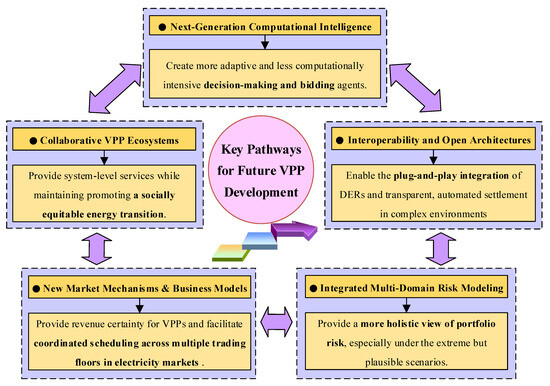

8. Future Directions

To overcome these challenges mentioned in the last section and fully realize the potential of VPPs, future research and development should focus on several key pathways, which is depicted in Figure 4 and illustrated as follows.

Figure 4.

Key pathways for future VPP development.

The first pathway involves the development of next-generation computational intelligence. This includes leveraging advanced machine learning, particularly DRL and generative models like the denoising diffusion probabilistic model used in [121], to create more adaptive and less computationally intensive bidding agents. These systems can learn directly from market interactions, capturing complex, non-linear relationships without relying exclusively on pre-defined stochastic models. Hybrid models that combine the interpretability of traditional optimization with the adaptability of AI will be crucial.

Secondly, future efforts must prioritize interoperability and open architectures. Research should focus on developing and adopting standardized, open-source frameworks and common information models, potentially based on the cross-chain concepts explored in [126], to facilitate plug-and-play integration of DERs and transparent, automated settlement in multi-VPP and cross-market environments.

A third critical pathway is the advancement of integrated multi-domain risk modeling. Future frameworks must move beyond single-risk measures to incorporate coupled uncertainties across energy, carbon, and finance domains. Techniques like vine copulas [112,125] should be integrated with CVaR and robust optimization to provide a more holistic view of portfolio risk, especially under extreme but plausible scenarios.

Fourthly, there is a pressing need for new market mechanisms and business models tailored to VPPs. This includes designing local flexibility markets, standardizing aggregation-friendly products, and creating long-term capacity remuneration mechanisms that provide revenue certainty, as hinted at in the coordinated scheduling model for capacity, energy, and ancillary service markets proposed in [127]. Research should also explore innovative business models, such as VPP-as-a-Service, to lower entry barriers.

Finally, the focus must expand from single-VPP optimization to collaborative VPP ecosystems and community-centric models. Research is needed on coordination mechanisms for federated VPPs, perhaps building upon the multi-VPP cooperation frameworks with distributionally robust chance constraints proposed in [129], that can pool resources to provide system-level services while maintaining participant autonomy. Furthermore, ensuring energy justice by designing inclusive VPP models that benefit low-income and rental households through community-based asset ownership will be essential for a socially equitable energy transition.

In conclusion, while significant progress has been made, the journey towards truly resilient, efficient, and fair VPP-dominated energy systems is ongoing. By embracing these future pathways—spanning computational advances, interoperability standards, holistic risk management, market innovation, and social inclusion—VPPs can solidify their role as the cornerstone of a decarbonized and digitalized power future.

Funding

This research work was supported by the National Natural Science Foundation of China under Grant 52207104; the Natural Science Foundation of Guangdong Province under Grant 2024A1515010426; the Philosophy and Social Sciences Foundation of Guangdong Province under GD23YYJ25.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Dataset available on request from the authors.

Conflicts of Interest

The author declares no conflicts of interest.

References

- Chu, S.; Majumdar, A. Opportunities and challenges for a sustainable energy future. Nature 2012, 488, 294–303. [Google Scholar] [CrossRef]

- Zhang, W.; Chen, C.; Li, M. Impacts of electricity market reforms: From the perspective of economic-energy-environment system synergies. J. Clean. Prod. 2025, 509, 145603. [Google Scholar] [CrossRef]

- Danielian, A. Regulating electricity spot markets during extreme events: The 2021 Texas case. Util. Policy 2025, 93, 101891. [Google Scholar] [CrossRef]

- Fabra, N. Reforming European electricity markets: Lessons from the energy crisis. Energy Econ. 2023, 126, 106963. [Google Scholar] [CrossRef]

- Holt, C.A.; Laury, S.K. Risk aversion and incentive effects. Am. Econ. Rev. 2002, 92, 1644–1655. [Google Scholar] [CrossRef]

- Huang, J.; Li, H.; Zhang, Z. Review of Virtual Power Plant Response Capability Assessment and Optimization Dispatch. Technologies 2025, 13, 216. [Google Scholar] [CrossRef]

- Esfahani, M.; Alizadeh, A.; Cao, B.; Kamwa, I.; Xu, M. Bridging theory and practice: A comprehensive review of virtual power plant technologiesand their real-world applications. Renew. Sust. Energy Rev. 2025, 222, 115929. [Google Scholar] [CrossRef]

- Alajlan, R.; Rahman, M.H.; Alnaeem, M.; Almaiah, M. A literature review on cybersecurity risks and challenges assessments in virtual power plants: Current landscape and future research directions. IEEE Access 2024, 12, 188813–188827. [Google Scholar] [CrossRef]

- Gao, H.; Jin, T.; Feng, C.; Li, C.; Chen, Q.; Kang, C. Review of virtual power plant operations: Resource coordination and multidimensional interaction. Appl. Energy 2024, 357, 122284. [Google Scholar] [CrossRef]

- Naval, N.; Yusta, J.M. Virtual power plant models and electricity markets—A review. Renew. Sust. Energy Rev. 2021, 149, 111393. [Google Scholar] [CrossRef]

- Rouzbahani, H.M.; Karimipour, H.; Lei, L. A review on virtual power plant for energy management. Sustain. Energy Technol. Assess. 2021, 47, 101370. [Google Scholar] [CrossRef]

- Yu, S.; Fang, F.; Liu, Y.; Liu, J. Uncertainties of virtual power plant: Problems and countermeasures. Appl. Energy 2019, 239, 454–470. [Google Scholar] [CrossRef]

- Ruan, G.; Qiu, D.; Sivaranjani, S.; Awad, A.S.A.; Štrbac, G. Data-driven energy management of virtual power plants: A review. Adv. Appl. Energy 2024, 14, 100170. [Google Scholar] [CrossRef]

- Wang, G.; Lin, Z.; Chen, Y.; Qiu, R.; Zhang, H.; Yan, J. Carbon-billed future for virtual power plants: A comprehensive review. Renew. Sust. Energ. Rev. 2025, 217, 115719. [Google Scholar] [CrossRef]

- Yang, X.; Zhang, Y. A comprehensive review on electric vehicles integrated in virtual power plants. Sustain. Energy Technol. Assess. 2021, 48, 101678. [Google Scholar] [CrossRef]

- Cheng, L.; Huang, P.; Zou, T.; Zhang, M.; Peng, P.; Lu, W. Evolutionary game-theoretical approaches for long-term strategic bidding among diverse stakeholders in large-scale and local power markets: Basic concept, modelling review, and future vision. Int. J. Electr. Power 2025, 166, 110589. [Google Scholar] [CrossRef]

- Li, G.; Shi, J.; Qu, X. Modeling methods for GenCo bidding strategy optimization in the liberalized electricity spot market-A state-of-the-art review. Energy 2011, 36, 4686–4700. [Google Scholar] [CrossRef]

- Lu, X.; Li, K.; Xu, H.; Wang, F.; Zhou, Z.; Zhang, Y. Fundamentals and business model for resource aggregator of demand response in electricity markets. Energy 2020, 204, 117885. [Google Scholar] [CrossRef]

- Peng, F.; Zhang, W.; Zhou, W.; Tao, J.; Sun, H.; Hu, S.; Lyu, Q.; Wang, Y.; Fan, X. Review on bidding strategies for renewable energy power producers participating in electricity spot markets. Sustain. Energy Technol. 2023, 58, 103329. [Google Scholar] [CrossRef]

- Toufani, P.; Karakoyun, E.C.; Nadar, E.; Fosso, O.B.; Kocaman, A.S. Optimization of pumped hydro energy storage systems under uncertainty: A review. J. Energy Storage 2023, 73, 109306. [Google Scholar] [CrossRef]

- Mei, S.; Tan, Q.; Trivedi, A.; Srinivasan, D. A two-step optimization model for virtual power plant participating in spot market based on energy storage power distribution considering comprehensive forecasting error of renewable energy output. Appl. Energy 2024, 376, 124234. [Google Scholar] [CrossRef]

- Ghanuni, A.; Sharifi, R.; Feshki-Farahani, H. A risk-based multi-objective energy scheduling and bidding strategy for a technical virtual power plant. Electr. Power Syst. Res. 2023, 220, 109344. [Google Scholar] [CrossRef]

- Ghamarypour, S.; Rahimiyan, M. Energy resources investment for industrial virtual power plants under techno-economic uncertainties. Int. J. Electr. Power 2025, 164, 110409. [Google Scholar] [CrossRef]

- Emarati, M.; Keynia, F.; Rashidinejad, M. A two-stage stochastic programming framework for risk-based day-ahead operation of a virtual power plant. Int. Trans. Electr. Energy 2020, 30, 12255. [Google Scholar] [CrossRef]

- Lima, R.M.; Conejo, A.J.; Giraldi, L.; Le Maître, O.; Hoteit, I.; Knio, O.M. Sample average approximation for risk-averse problems: A virtual power plant scheduling application. EURO J. Comput. Optim. 2021, 9, 100005. [Google Scholar] [CrossRef]

- Lima, R.M.; Conejo, A.J.; Giraldi, L.; Le Maître, O.; Hoteit, I.; Knio, O.M. Risk-Averse Stochastic Programming vs. Adaptive Robust Optimization: A Virtual Power Plant Application. INFORMS J. Comput. 2022, 34, 1795–1818. [Google Scholar] [CrossRef]

- Sun, G.; Qian, W.; Huang, W.; Xu, Z.; Fu, Z.; Wei, Z.; Chen, S. Stochastic adaptive robust dispatch for virtual power plants using the binding scenario identification approach. Energies 2019, 12, 1918. [Google Scholar] [CrossRef]

- Liu, H.; Qiu, J.; Zhao, J. A data-driven scheduling model of virtual power plant using Wasserstein distributionally robust optimization. Int. J. Electr. Power 2022, 137, 107801. [Google Scholar] [CrossRef]

- Akkaş, O.P.; Çam, E. Risk-based Optimal Bidding and OperationalScheduling of a Virtual Power Plant Considering Battery Degradation Cost and Emission. Adv. Electr. Comput. Eng. 2023, 23, 19–28. [Google Scholar] [CrossRef]

- Kardakos, E.G.; Simoglou, C.K.; Bakirtzis, A.G. Optimal Offering Strategy of a Virtual Power Plant: A Stochastic Bi-Level Approach. IEEE Trans. Smart Grid 2016, 7, 794–806. [Google Scholar] [CrossRef]

- Shafiekhani, M.; Ahmadi, A.; Homaee, O.; Shafie-Khah, M.; Catalão, J.P.S. Optimal bidding strategy of a renewable-based virtual power plant including wind and solar units and dispatchable loads. Energy 2022, 239, 122379. [Google Scholar] [CrossRef]

- Khandelwal, M.; Mathuria, P.; Bhakar, R. Virtual Power Plant (VPP) scheduling with uncertain multiple Locational Marginal Prices. IET Energy Syst. Integr. 2022, 4, 436–447. [Google Scholar] [CrossRef]

- Wang, W.; Wang, X.; Jiang, C.; Bai, B.; Zhang, K. Day Ahead Bidding Strategy for Virtual Power Plants Considering Sharpe Ratio. Power Syst. Technol. 2023, 47, 1512–1522. [Google Scholar]

- Singh, K.N.; Goswami, A.K.; Chudhury, N.B.D.; Shuaibu, H.A.; Ustun, T.S. Enhancing cybersecurity in virtual power plants by detecting network based cyber attacks using an unsupervised autoencoder approach. Sci. Rep. 2025, 15, 32374. [Google Scholar] [CrossRef] [PubMed]

- Rahmani-Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk-based profit allocation to DERs integrated with a virtual power plant using cooperative Game theory. Electr. Power Syst. Res. 2015, 121, 368–378. [Google Scholar] [CrossRef]

- Wang, Y.; Zhang, M.; Ao, J.; Wang, Z.; Dong, H.; Zeng, M. Profit Allocation Strategy of Virtual Power Plant Based on Multi-Objective Optimization in Electricity Market. Sustainability 2022, 14, 6229. [Google Scholar] [CrossRef]

- Baringo, A.; Baringo, L.; Arroyo, J.M. Holistic planning of a virtual power plant with a nonconvex operational model: A risk-constrained stochastic approach. Int. J. Electr. Power 2021, 132, 107081. [Google Scholar] [CrossRef]

- Castillo, A.; Flicker, J.; Hansen, C.W.; Watson, J.P.; Johnson, J. Stochastic optimisation with risk aversion for virtual power plant operations: A rolling horizon control. IET Gener. Transm. Dis. 2019, 13, 2182–2189. [Google Scholar] [CrossRef]

- Deng, J.; Guo, Q. Decentralized energy management system of distributed energy resources as virtual power plant: Economic risk analysis via downside risk constraints technique. Comput. Ind. Eng. 2023, 183, 109522. [Google Scholar] [CrossRef]

- Gao, R.; Guo, H.; Zhang, R.; Mao, T.; Xu, Q.; Zhou, B.; Yang, P. A two-stage dispatch mechanism for virtual power plant utilizing the CVaR theory in the electricity spot market. Energies 2019, 12, 3402. [Google Scholar] [CrossRef]

- Huang, M.; Cui, X.; Wang, Y. Distributed differentially private energy management of virtual power plants. Electr. Power Syst. Res. 2024, 234, 110687. [Google Scholar] [CrossRef]

- Li, N.; Tan, C.; Lin, H.; Ma, X.; Zhang, X. Three-level interactive energy management strategy for optimal operation of multiple virtual power plants considering different time scales. Int. J. Energy Res. 2021, 45, 1069–1096. [Google Scholar] [CrossRef]

- Lin, W.M.; Yang, C.Y.; Wu, Z.Y.; Tsay, M.T. Optimal control of a virtual power plant by maximizing conditional value-at-risk. Appl. Sci. 2021, 11, 7752. [Google Scholar] [CrossRef]

- Liu, J.; Song, Y. Research on Risk Assessment of Virtual Power Plant Transaction Based on Text Mining and Cloud Models. Power Syst. Technol. 2025, 49, 1089–1097. [Google Scholar]

- Qi, N.; Cheng, L.; Li, H.; Zhao, Y.; Tian, H. Portfolio optimization of generic energy storage-based virtual power plant under decision-dependent uncertainties. J. Energy Storage 2023, 63, 107000. [Google Scholar] [CrossRef]

- Qiu, J.; Meng, K.; Zheng, Y.; Dong, Z.Y. Optimal scheduling of distributed energy resources as a virtual power plant in a transactive energy framework. IET Gener. Transm. Dis. 2017, 11, 3417–3427. [Google Scholar] [CrossRef]

- Rahmani-Dabbagh, S.R.; Sheikh-El-Eslami, M.K. Risk Assessment of Virtual Power Plants Offering in Energy and Reserve Markets. IEEE Trans. Power Syst. 2016, 31, 3572–3582. [Google Scholar] [CrossRef]

- Sadeghian, O.; Mohammadpour Shotorbani, A.M.; Mohammadi-ivatloo, B. Generation maintenance scheduling in virtual power plants. IET Gener. Transm. Dis. 2019, 13, 2584–2596. [Google Scholar] [CrossRef]

- Sadeghian, O.; Oshnoei, A.; Khezri, R.; Muyeen, S.M. Risk-constrained stochastic optimal allocation of energy storage system in virtual power plants. J. Energy Storage 2020, 31, 101732. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Sheikh-El-Eslami, M.K.; Haghifam, M.R. Risk-based medium-term trading strategy for a virtual power plant with first-order stochastic dominance constraints. IET Gener. Transm. Dis. 2017, 11, 520–529. [Google Scholar] [CrossRef]

- Sreenivasulu, G.; Sahoo, N.C.; Balakrishna, P. Low economic risk operation of transactive energy markets with renewable sources and virtual power plants using self-adaptive particle swarm optimization. Electr. Eng. 2022, 104, 2729–2755. [Google Scholar] [CrossRef]

- Sučić, S.; Dragičević, T.; Capuder, T.; Delimar, M. Economic dispatch of virtual power plants in an event-driven service-oriented framework using standards-based communications. Electr. Power Syst. Res. 2011, 81, 2108–2119. [Google Scholar] [CrossRef]

- Tajeddini, M.A.; Rahimi-Kian, A.; Soroudi, A. Risk averse optimal operation of a virtual power plant using two stage stochastic programming. Energy 2014, 73, 958–967. [Google Scholar] [CrossRef]

- Wang, S.; Jia, R.; Shi, X.; Luo, C.; An, Y.; Huang, Q.; Guo, P.; Wang, X.; Lei, X. Research on Capacity Allocation Optimization of Commercial Virtual Power Plant (CVPP). Energies 2022, 15, 1303. [Google Scholar] [CrossRef]

- Wozabal, D.; Rameseder, G. Optimal bidding of a virtual power plant on the Spanish day-ahead and intraday market for electricity. Eur. J. Oper. Res. 2020, 280, 639–655. [Google Scholar] [CrossRef]

- Xu, Z.; Guo, Y.; Sun, H. Competitive Pricing Game of Virtual Power Plants: Models, Strategies, and Equilibria. IEEE Trans. Smart Grid 2022, 13, 4583–4595. [Google Scholar] [CrossRef]

- Zamani, A.G.; Zakariazadeh, A.; Jadid, S. Day-ahead resource scheduling of a renewable energy based virtual power plant. Appl. Energy 2016, 169, 324–340. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Sheikh-El-Eslami, M.K.; Haghifam, M.R. A medium-term coalition-forming model of heterogeneous DERs for a commercial virtual power plant. Appl. Energy 2016, 169, 663–681. [Google Scholar] [CrossRef]

- Wu, Y.; Wu, J.; De, G. Research on Trading Optimization Model of Virtual Power Plant in Medium- and Long-Term Market. Energies 2022, 15, 759. [Google Scholar] [CrossRef]

- Jafari, M.; Akbari Foroud, A. A medium/long-term auction-based coalition-forming model for a virtual power plant based on stochastic programming. Int. J. Electr. Power 2020, 118, 105784. [Google Scholar] [CrossRef]

- Jafari, M.; Akbari Foroud, A. A Medium-Term Virtual Power Plant Optimization Framework Considering the Failure Rate of Its Intermittent Units Using Stochastic Programming. Electr. Power Compon. Syst. 2023, 1–16. [Google Scholar] [CrossRef]

- Shabanzadeh, M.; Sheikh-El-Eslami, M.K.; Haghifam, M.R. The design of a risk-hedging tool for virtual power plants via robust optimization approach. Appl. Energy 2015, 155, 766–777. [Google Scholar] [CrossRef]

- Maiz, S.; Baringo, L.; García-Bertrand, R. Dynamic expansion planning of a commercial virtual power plant through coalition with distributed energy resources considering rival competitors. Appl. Energy 2025, 377, 124665. [Google Scholar] [CrossRef]

- Mashhour, E.; Moghaddas-Tafreshi, S.M. Bidding strategy of virtual power plant for participating in energy and spinning reserve markets-Part I: Problem formulation. IEEE Trans. Power Syst. 2011, 26, 949–956. [Google Scholar] [CrossRef]

- Mashhour, E.; Moghaddas-Tafreshi, S.M. Bidding strategy of virtual power plant for participating in energy and spinning reserve markets-Part II: Numerical analysis. IEEE Trans. Power Syst. 2011, 26, 957–964. [Google Scholar] [CrossRef]

- Rahmani-Dabbagh, S.; Sheikh-El-Eslami, M.K. A profit sharing scheme for distributed energy resources integrated into a virtual power plant. Appl. Energy 2016, 184, 313–328. [Google Scholar] [CrossRef]

- Jadidoleslam, M. Risk-constrained participation of virtual power plants in day-ahead energy and reserve markets based on multi-objective operation of active distribution network. Sci. Rep. 2025, 15, 9145. [Google Scholar] [CrossRef] [PubMed]

- Mujeeb, A.; Hu, Z.; Wang, J.; Diao, R.; Liu, L.; Bao, Z. Optimizing Virtual Power Plant Operations in Energy and Frequency Regulation Reserve Markets: A Risk-Averse Two-Stage Scenario-Oriented Stochastic Approach. Int. Trans. Electr. Energy 2025, 2025, 6640754. [Google Scholar] [CrossRef]

- Yan, X.; Gao, C.; Francois, B. Multi-objective optimization of a virtual power plant with mobile energy storage for a multi-stakeholders energy community. Appl. Energy 2025, 386, 125553. [Google Scholar] [CrossRef]

- Fan, Q.; Liu, D. A Wasserstein-distance-based distributionally robust chance constrained bidding model for virtual power plant considering electricity-carbon trading. IET Renew. Power Gen. 2024, 18, 545–557. [Google Scholar] [CrossRef]

- Singh, K.N.; Goswami, A.K.; Chudhury, N.B.D.; Cali, U.; Ustun, T.S. A risk-aware bidding model for virtual power plants: Integrating renewable energy forecasting and carbon market strategies. Energy Rep. 2025, 14, 1222–1239. [Google Scholar] [CrossRef]

- Wu, C.; Wei, Z.; Cao, Y.; Xu, Y.; Wei, T.; Han, H.; Chen, S.; Zang, H. Low-carbon scheduling model of multi-virtual power plants based on cooperative game considering failure risks. IET Renew. Power Gen. 2024, 18, 3923–3935. [Google Scholar] [CrossRef]