Financial and Economic Assessment of Tidal Stream Energy—A Case Study

Abstract

1. Introduction

- Which combination of RE-technologies is the best to save cost and to contribute towards the decarbonisation of a remote place?

- How can financial and economic methods help to calculate the true cost and to help reducing uncertainty for potential investors?

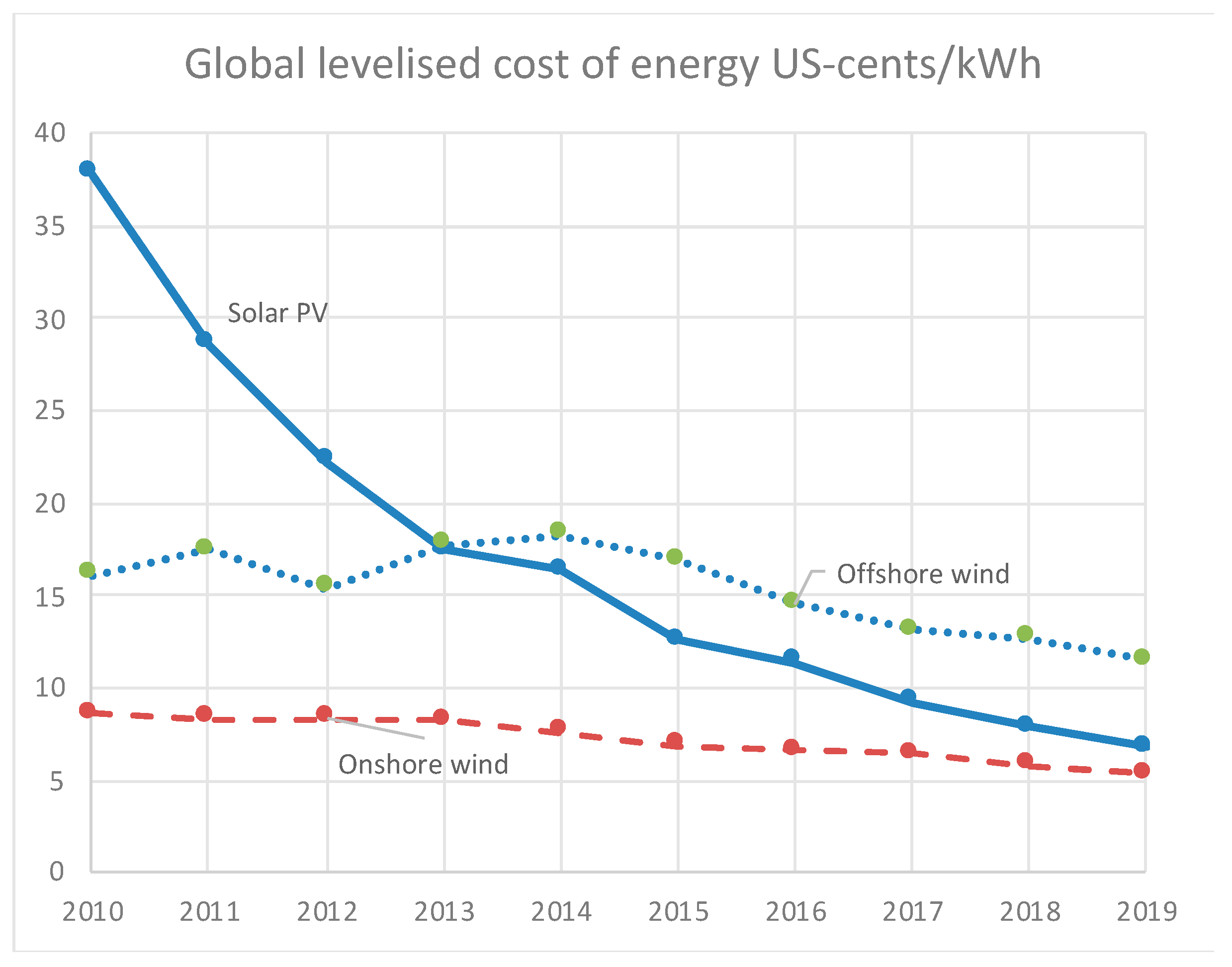

- Can learning effects be expected to bring the cost down?

1.1. Literature Review

1.1.1. Technology and Quantitative Development

1.1.2. Cost and Finance

1.1.3. Reduction of Carbon Emissions

2. Evaluation Methods for Renewable Energy (RE)

2.1. The Cost of Capital: Financial and Social Discount Rates

2.2. Weighted Average Cost of Capital (WACC)

- rf = risk free interest rate

- rm = market rate (required or estimated return)

- ß = coefficient of the systemic risk of the firm or the project

2.3. Levelised Cost of Electricity (LCOE)

- It = Investment cost

- Mt = Operation and maintenance cost

- Ft = Fuel Cost

- Et = Electricity generated (minus losses) in KWh or MWh

- (all values in period “t” = time)

- r = discount rate

3. The Project

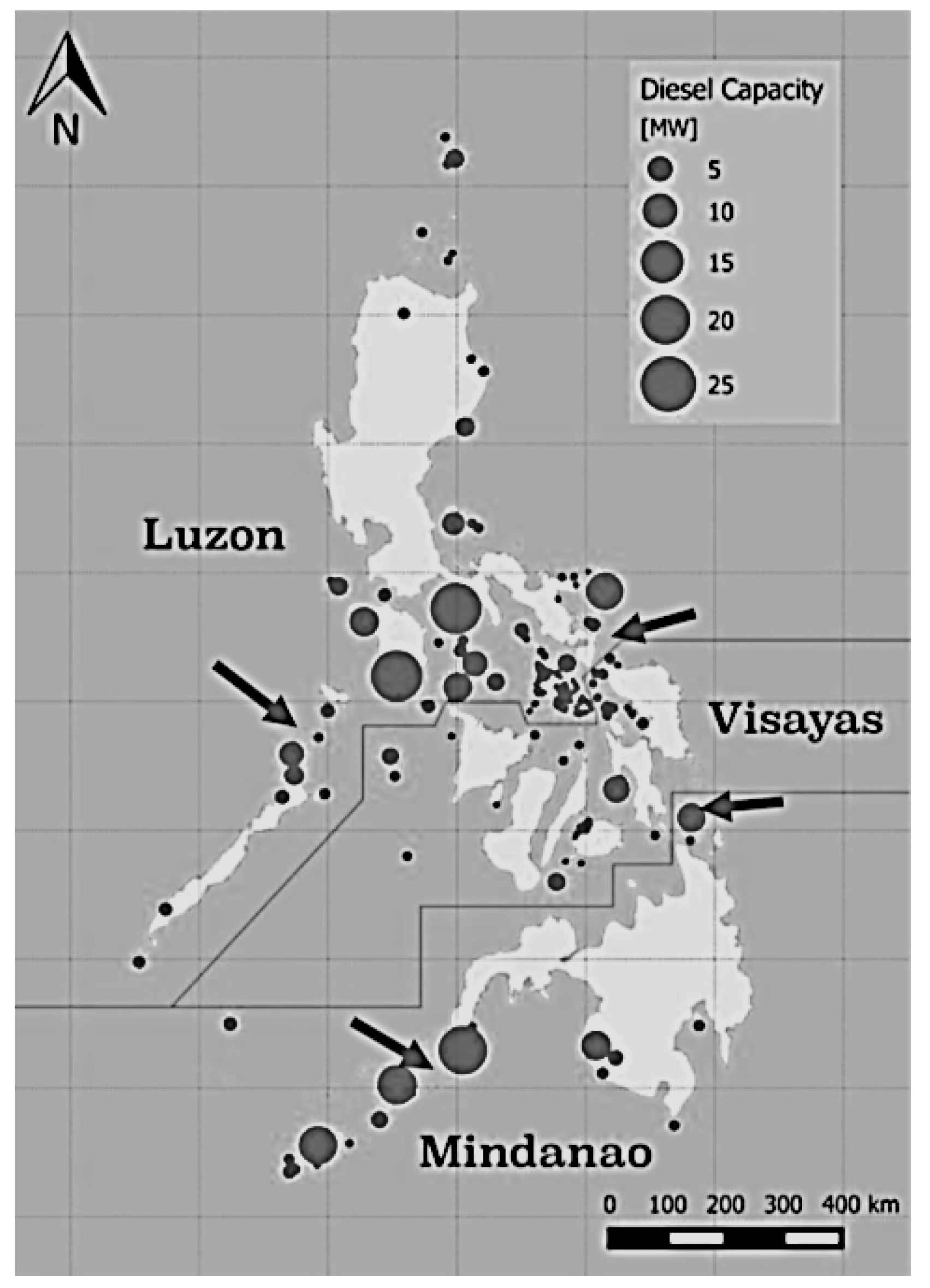

3.1. Suitable Locations

3.2. Electricity Tariffs

3.3. Hybrid Tidal Stream Energy (TSE) Systems

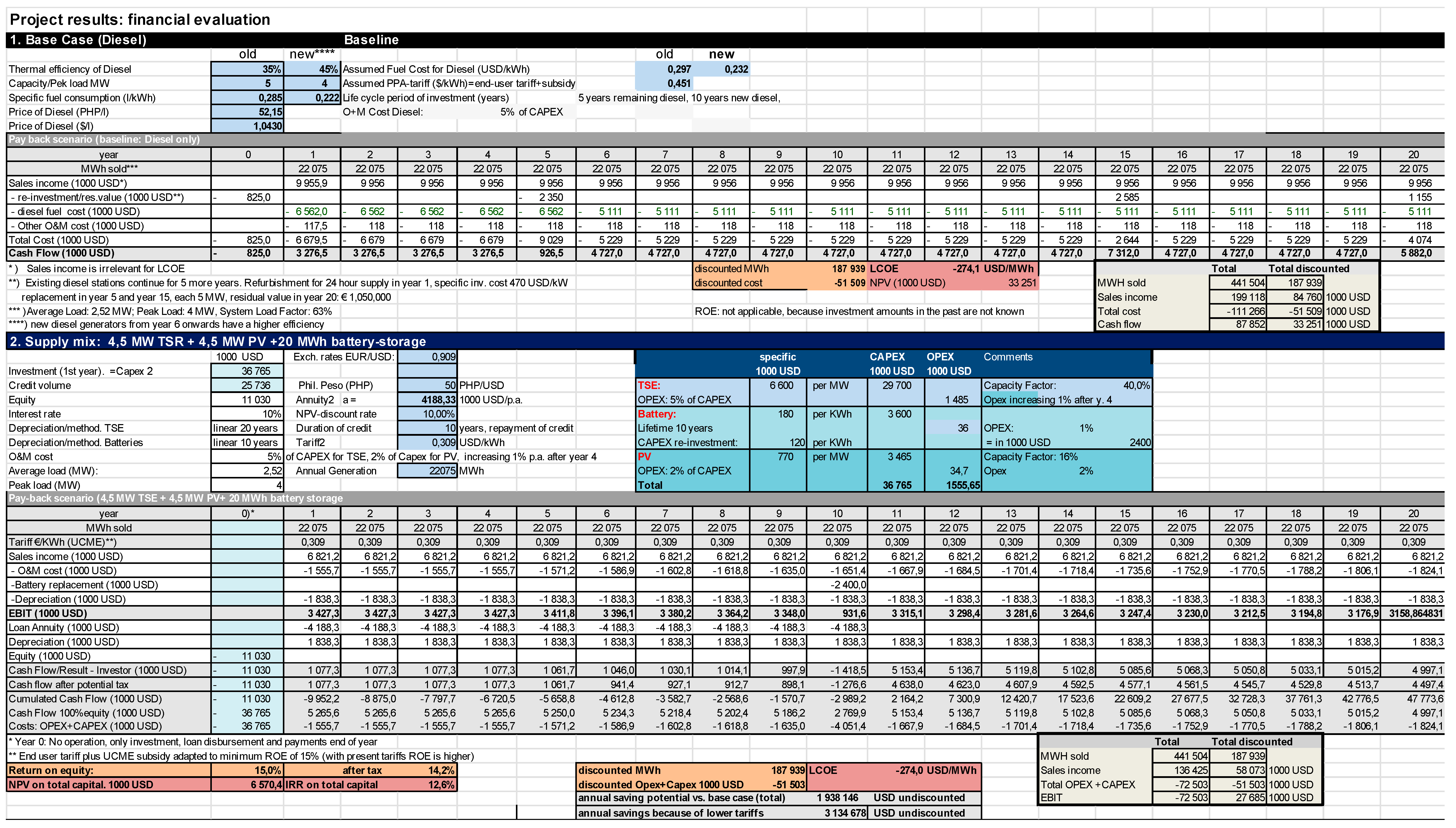

3.4. Financial Evaluation

- The base case, being the continuation of existing diesel stations (which is the case on more or less every island) with some improvement to reach a 24/7 service.

- The hybrid combination of TSE, PV and battery storage.

3.5. Financing

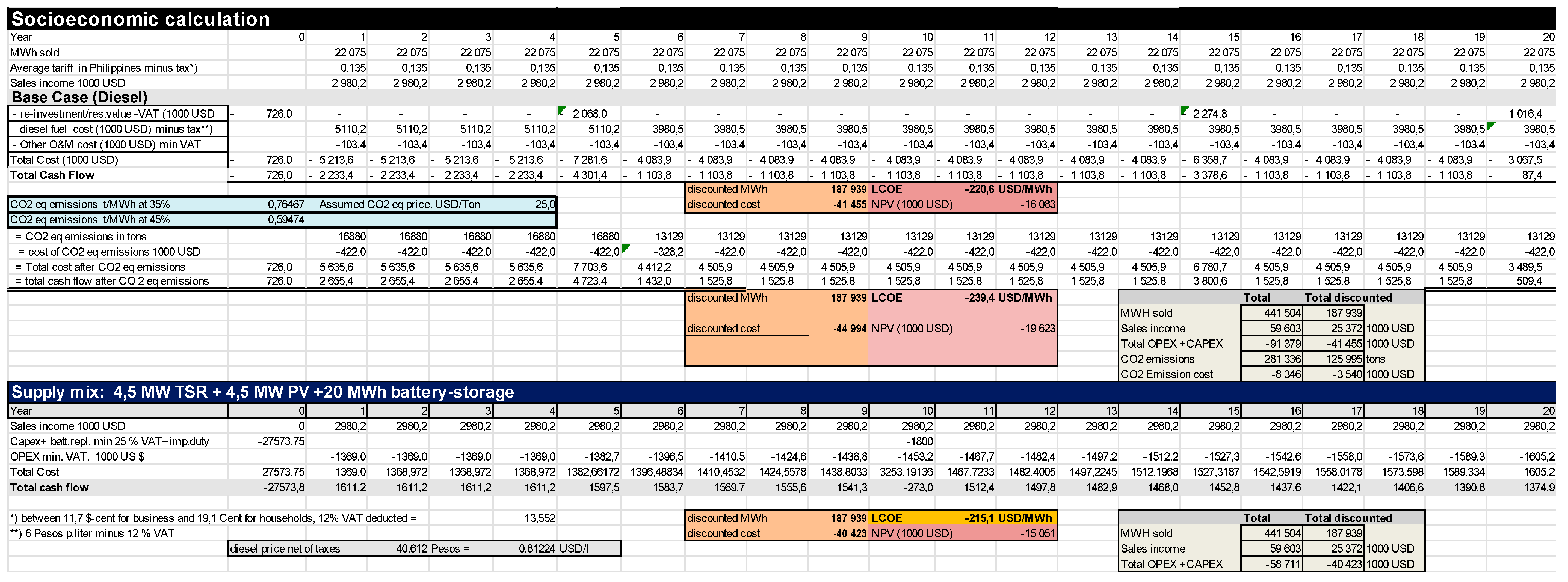

3.6. Socio-Economic Evaluation

- The residents of the island because of reduction of pollution and noise;

- Electricity consumers and small businesses from a more reliable 24 h supply of electricity;

- Philippine electricity consumers from reduced subsidy requirements;

- Local grid-operators (distribution utilities, cooperatives) through predictable grid management and secure supply;

- Project developers from new options to extend hybrid RE systems;

- Employees in construction and maintenance of hybrid RE systems as well as indirect job creation through more reliable electricity in business and tourism.

3.7. Environmental Impact Assessment (EIA)

4. Discussion

4.1. More Alternatives

4.2. The Influence of Discount Rate

4.3. Other Parameters

4.4. Learning

5. Conclusions

- A hybrid combination of TSE with photovoltaics and supported by storage facilities proved to be the most suitable solution for a pollution-free and economically superior alternative to the present diesel-operated generators in remote areas where present prices are still high. This result holds unless rather extreme conditions are assumed, like constantly low crude oil prices or a very high discount rate. The exact dimensioning of this hybrid solution must be refined during detailed project planning and adapted to the situation of particular locations.

- Usual financial and economic appraisal methods can be used, but it should be noted that even mathematically exact calculations results can be deceptive and open for manipulation: the discussion about the market risk (Beta) of RE companies and projects showed that there are no reliable empirical data available yet and even if there are, conditions are changing too fast to make past data really a trustworthy predictor of the future. Discount rates will have a decisive influence on RE-investments in comparison to fossil technologies and, therefore, results can easily be inverted by changing discount rates, even if they remain within a conventional range. Hence, when looking at an appraisal result of RE-projects we should always have a very thorough look at the parameters used. Since financing of RE-projects with usually long payback periods and front-loaded cost remains a crucial issue, utmost care must be taken to arrive at appraisal results which are trustworthy and at the same time appealing to potential investors.

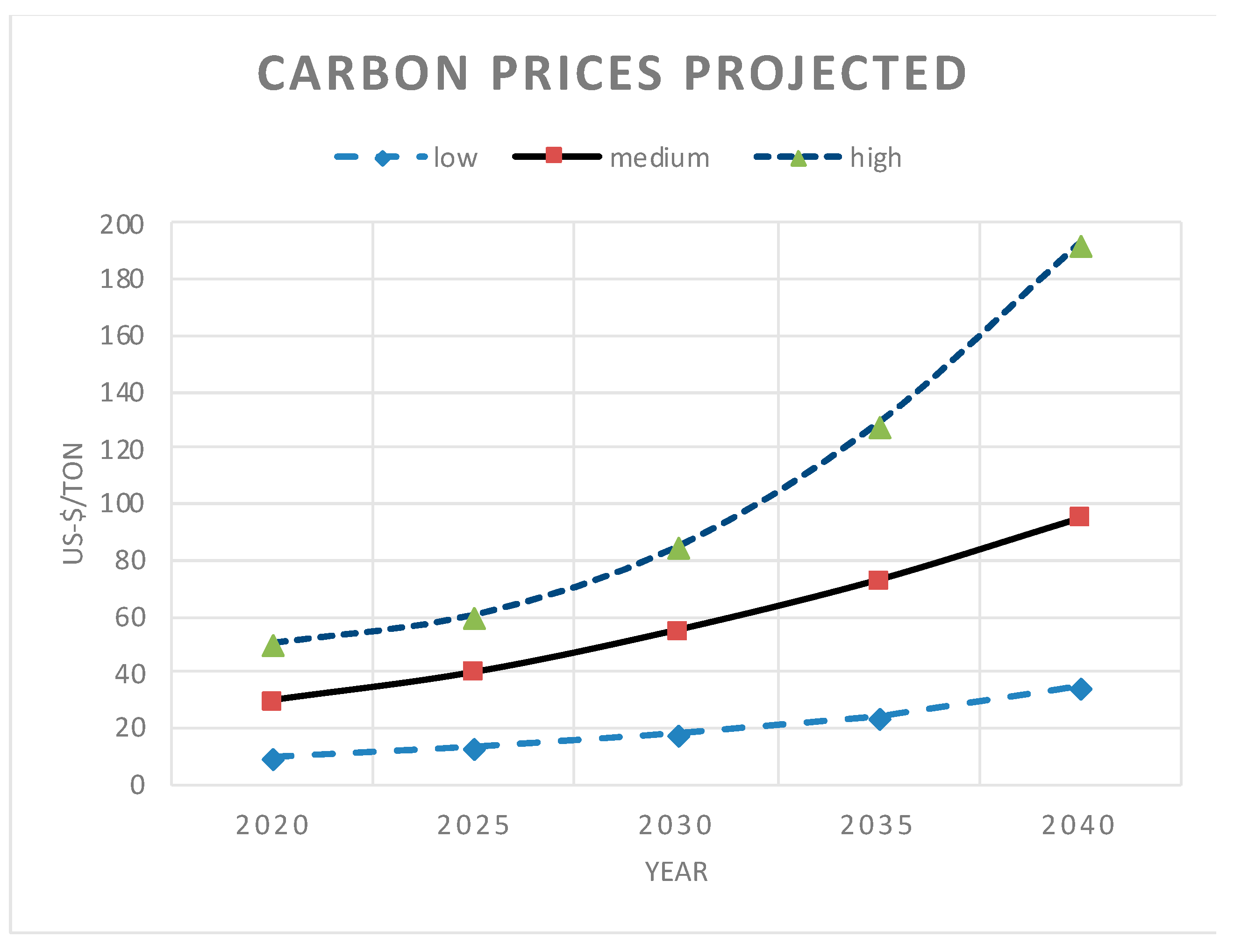

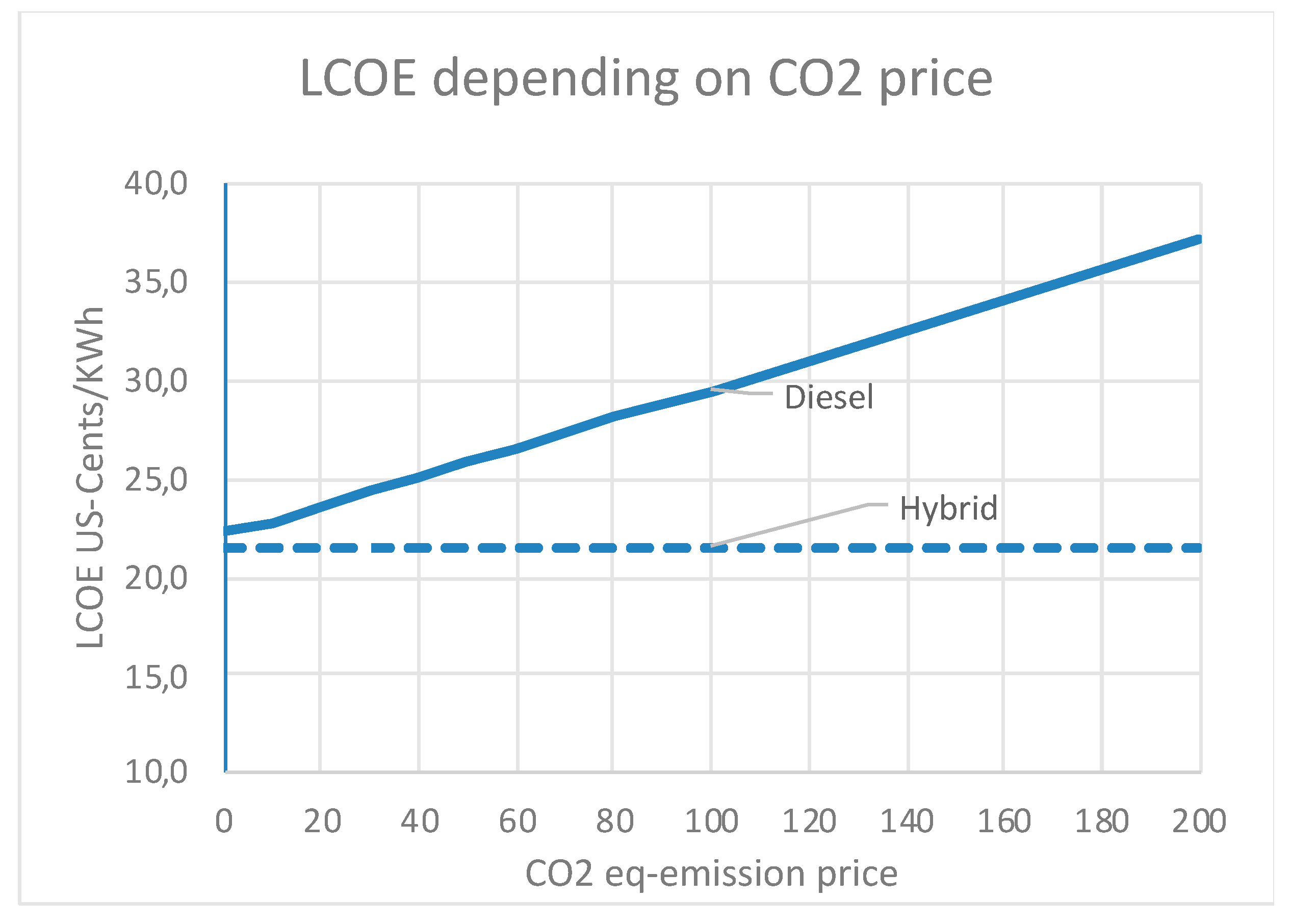

- An open question is the measurement of pollution. As long as there is no emission trading system or a greenhouse gas (GHG) tax set by the government, the calculation of CO2 or GHG prices remains an academic exercise which makes little impression on private investors. But for project developers this issue remains important, because governments and international financing institutions put an increasing emphasis on environmental aspects and require investors to present an analysis of ecological consequences if asking for public finance or support. Often banks do require such assessments too in order to avoid later claims for damages. In the long run, especially if we prefer market solutions, an emission trading scheme would be preferable to government interventions.

Funding

Conflicts of Interest

Appendix A

Appendix B

References

- Ahmed, Sara Jane, and Jose D. Logarta. 2017. Electricity-Sector Opportunity in the Philippines. The Case for Wind- and Solar-Powered Small Island Grids. Lakewood: Institute for Energy Economics and Financial Analysis. [Google Scholar]

- Al-Hammad, Hirak, Thorsten Becker, Andrea Bode, Srishti Gupta, and Silvia Kreibiehl. 2015. Renewable Energy in Hybrid Mini Grids: Economic Benefits and Business Cases. Frankfurt: School UNEP Collaborating Centre. [Google Scholar]

- Borghesi, Simone. 2010. The European Emission Trading Scheme and Renewable Energy Policies: Credible Targets for Incredible Results? International Journal of Sustainable Economy 3: 312–27. [Google Scholar] [CrossRef]

- Campos, Javier, Tomás Serebrisky, and Ancor Suárez-Alemán. 2015. Time Goes by: Recent Developments on the Theory and Practice of the Discount Rate. Washington, DC: Technical Note of Inter-American Development Bank. [Google Scholar]

- Coles, Daniel, Tom Walsh, Yusaku Kyozuka, and Yoichi Oda. 2020. Preliminary Techno-Economic Assessment of Phased Tidal Turbine Array Development in Naru Strait, Japan. London: SIMEC Atlantis Energy. [Google Scholar]

- Ecorys and Fraunhofer. 2017. Study on Lessons for Ocean Energy Development. Final Report for the European Commission Directorate-General for Research & Innovation. Brussels: European Commission. [Google Scholar]

- EIA. 2020. Levelized cost and levelized avoided cost of new generation resources. In Annual Energy Outlook 2020. Washington, DC: EIA. [Google Scholar]

- European Commission. 2018. Directorate-General for Maritime Affairs and Fisheries: Market Study on Ocean-Energy. Final Report. Brussels: European Commission. [Google Scholar]

- European Marine Energy Center (EMEC). n.d. Tidal Devices. Available online: http://www.emec.org.uk/marine-energy/tidal-devices (accessed on 23 June 2020).

- Fisher, Irvin. 1954. The Theory of Interest, New York 1930. New York: Kelley and Millman. First published 1930. [Google Scholar]

- Genovese, Frederica, and Endre Tvinnereim. 2019. Who opposes climate regulation? Business preferences for the European emission trading scheme. Review of International Organizations 14: 511–42. [Google Scholar] [CrossRef]

- Goodin, Robert E. 1982. Discounting Discounting. Journal of Public Policy 2: 53–72. [Google Scholar] [CrossRef]

- Harberger, Arnold C., and Glenn P. Jenkins. 2002. Cost-Benefit Analysis for Investment Decisions. Kingston: Queen’s University. [Google Scholar]

- Hendry, Charles. 2016. The Role of Tidal Lagoons. Available online: https://hendryreview.files.wordpress.com/2016/08/hendry-review-final-report-english-version.pdf (accessed on 22 May 2020).

- Hubler, Michael, Sebastian Voigt, and Andreas Löschel. 2014. Designing an emissions trading scheme for China—An up-to-date climate policy assessment. Energy Policy 74: 57–72. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). 2014. Final Report 2014. Geneva: IPCC. [Google Scholar]

- Intergovernmental Panel on Climate Change (IPCC). 2018. Final Government Draft 2018. Geneva: IPCC. [Google Scholar]

- International Energy Agency (IEA). 2019. Renewables 2019. Market Analysis and Forecast 2019–2024. Washington, DC: IEA. [Google Scholar]

- International Renewable Energy Agency (IRENA). 2017. Electricity Storage and Renewables: Costs and Markets to 2030. Bonn: IRENA. [Google Scholar]

- International Renewable Energy Agency (IRENA). 2020. Renewable Power Generation Costs in 2019. Bonn: IRENA. [Google Scholar]

- Kappatos, Vassilios, George Georgoulas, Nicolas P. Avdelidis, and Konstantinos Salonitis. 2016. Tidal stream generators, current state and potential opportunities for condition monitoring. Vibroengineering Procedia 8: 285–93. [Google Scholar]

- KPMG. 2018. Philippines Tax Profile 2018. Produced in conjunction with the KPMG Asia Pacific Tax Centre. Geneva: KPMG. [Google Scholar]

- Lewis, Matt, James McNaughton, Concha Márquez-Dominguez, Grazia Todeschini, Michael Togneri, Ian Masters, Matthew Allmark, Tim Stallard, Simon Neill, Alice Goward-Brown, and et al. 2019. Power variability of tidal-stream energy and implications for electricity supply. Energy 183: 1061–74. [Google Scholar] [CrossRef]

- Lintner, John. 1965. Security prices, risk, and maximal gains from diversification. Journal of Finance 20: 587–615. [Google Scholar]

- Lochinvar, Michael, and Abundo Sim. 2018. Ocean Renewable Energy in South East Asia. Renewable and Sustainable Energy Reviews 41: 799–817. [Google Scholar]

- Magagna, Davide, Riccardo Monfardini, and Andreas Uihlein. 2016. Ocean Energy Status Report. Petten: Joint Research Center (JRC). [Google Scholar]

- Nordhaus, William D. 1999. Discounting and public policies that affect the distant future. In Discounting and Intergenerational Equity. Edited by P. R. Portney and J. P. Weyant. Washington, DC: Springer, pp. 145–62. [Google Scholar]

- Nordhaus, William D. 2013. The Climate Casino. London: Yale University Press. [Google Scholar]

- Norris, Jenny. 2009. (EMEC): The Development of a Targeted Environmental Monitoring Strategy and the Streamlining of Marine Renewables Consents in Scotland. Stromness: European Marine Energy Centre (EMEC) Ltd., Old Academy. [Google Scholar]

- Ocean Energy Europe. 2020. Key Trends and Statistics, Brussels 2020. Available online: https://www.oceanenergy-europe.eu/category/publication-library (accessed on 23 June 2020).

- Rezec, Michael, and Bert Scholtens. 2017. Financing energy transformation: The role of renewable energy equity indices. International Journal of Green Energy 14: 368–78. [Google Scholar] [CrossRef]

- Rink, Sebastian. 2017. Tidal Stream Energy in Philippine Island Grids. Master’s thesis, Frankfurt School of Finance, Frankfurt, Germany. [Google Scholar]

- Roth, Ian F., and Lawrence L. Ambs. 2004. Incorporating externalities into a full cost approach to electric power generation life-cycle costing. Energy 29: 2125–44. [Google Scholar] [CrossRef]

- Sharpe, William F. 1964. Capital asset prices: A theory of market equilibrium under conditions of risk. Journal of Finance 19: 425–42. [Google Scholar]

- Steffen, Bjarne. 2020. Estimating the cost of capital for renewable energy projects. Energy Economics. [Google Scholar] [CrossRef]

- Stern, Nicholas, and Nicholas Herbert Stern. 2006. The Economics of Climate Change: The STERN Review. Cambridge: Cambridge University Press. [Google Scholar]

- Turvey, Ralph. 1963. Present Value Versus Internal Rate of Return-An Essay in the Theory of the Third Best. The Economic Journal 73: 93–98. [Google Scholar] [CrossRef]

- Ueckerdt, Falko, Lion Hirth, Gunnar Luderer, and Ottmar Edenhofer. 2013. System LCOE: What are the costs of variable renewables? Energy 63: 61–75. [Google Scholar] [CrossRef]

- Weitzmann, Martin L. 2015. Internalizing the climate externality: Can a uniform price commitment help? Economics of Energy and Environmental Policy 4: 37–50. [Google Scholar] [CrossRef]

- World Bank. 2005. When and How to Use NPV. IRR and Modified IRR. Transport Note No. TRN-6. Washington, DC: World Bank. [Google Scholar]

- World Bank and IDA. 2017. High Level Commission. Paper presented at the 22nd Conference of the Parties (COP) of the United Nations Framework Convention on Climate Change (UNFCCC), Marrakech, Morocco, November 7–18. [Google Scholar]

- Yang, Lin, Fengyu Li, and Xian Zhang. 2016. Chinese companies’ awareness and perceptions of the emissions trading scheme (ETS): Evidence from a national survey in China. Energy Policy 98: 254–65. [Google Scholar] [CrossRef]

| 1 | 97 developers were contacted, but it can be assumed that the majority of non-respondents did not plan any ocean projects, since only about 30 were identified who are currently pursuing TSE-projects. The report concedes, however, that the coverage outside Europe has not been very high. The reason for this could be that either there are not many projects outside Europa, but also that developers are more secretive about their plans. |

| 2 | LCOE show the discounted cost of production divided by the discounted amount of electricity in MWh or KWh (see ch. 3). |

| 3 | Capacity factor is a key ratio showing the actual use of the theoretical capacity, which will normally not be reached. If a power station has a capacity of 1 Megawatt (MW), its theoretical maximum output is 8760 MWh, which is 1 MW times the 8760 h of the year (365 * 24). If the actual generation in a particular year is 4380 MWh, the capacity factor is 50%. |

| 4 | Greenhouse gases are those gaseous constituents of the atmosphere… that absorb and emit radiation at specific wavelengths within the spectrum of terrestrial radiation emitted by the Earth’s surface, the atmosphere itself and by clouds. This property causes the greenhouse effect: water vapour (H2O), carbon dioxide (CO2), nitrous oxide (N2O), methane (CH4) and ozone (O3) are the primary GHGs in the Earth’s atmosphere. Moreover, there are a number of entirely human-made GHGs in the atmosphere, such as the halocarbons and other chlorine- and bromine-containing substances (Intergovernmental Panel on Climate Change (IPCC) 2018, p. 551). |

| 5 | Adapted from (Nordhaus 2013, p. 228). |

| 6 | Frequently an “after tax” formula is used, which considers that interest for debt will be part of the cost and therefore reduce taxes. Here the debt share is corrected by the tax rate (1 − t). It depends, however, on the concrete situation of the project as well as on the tax regulations if WACC after tax is more suitable than the so called “plain vanilla-WACC”. |

| 7 | Source: (Lochinvar and Sim 2018). |

| 8 | Please be reminded that the CO2-eq estimates the “warming equivalent” of all greenhouse gases. |

| 9 | Adapted from: (International Renewable Energy Agency (IRENA) 2020). |

| TSE, PV and Batteries | Base Case (Diesel) | |

|---|---|---|

| Generation mix | 4.5 MW TSE Generator; 4.5 MW Solar PV | 5 MW Diesel generator |

| Electricity Demand | 22 GWh p.a.; Peak Load: 4 MW. System capacity factor: 63%. average load 2.52 MW | |

| Storage: | 20 MWh Batteries Storage | - |

| Investment costs | 36,765,000 USD (Year 0) 2,400,000 USD (Battery replacement Year 10) 39,165,000 USD | 825,000 USD (refurbishment) 2,310,000 USD (after 5 years 2,541,000 USD (after 15 years) 5,676,000 USD (a) |

| Opex Cost p.a. (average) | 1,666,900 USD p.a. | 7,665,000 USD p.a. |

| Assumed PPA tariff $ | 0.309 USD/KWh (b) | 0.451 USD/KWh |

| LCOE (r = 10%) | 0.274 USD KWh | 0.274 USD/KWh (Diesel 1.04 $/l) 0.361 USD/KWh (Diesel 1.20 $/l) |

| Additional GHG-emissions | - | 16,880 t resp. 13,129 CO2-eq/p.a, after 5 years |

| Discount rate | 0% | 5% | 10% | 15% |

| Base case (Diesel) | 20.7–23.9 | 26.3–30.1 | 27.4–36.1 | 28.3–32.3 |

| Hybrid Case | 16.4 | 21.3 | 27.4 | 34.3 |

| Socioeconomic evaluation | ||||

| Base case (Diesel) | 22.6–24.0 | 23.2–24.7 | 22.0–25.5 | 22.6–26.2 |

| Base case plus 25 $/t CO2-eq. | 22.1–25.9 | 23.2–26.6 | 23.9–27.4 | 24.5–28.0 |

| Hybrid Case | 13.3 | 17.0 | 21.5 | 26.7 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Klaus, S. Financial and Economic Assessment of Tidal Stream Energy—A Case Study. Int. J. Financial Stud. 2020, 8, 48. https://doi.org/10.3390/ijfs8030048

Klaus S. Financial and Economic Assessment of Tidal Stream Energy—A Case Study. International Journal of Financial Studies. 2020; 8(3):48. https://doi.org/10.3390/ijfs8030048

Chicago/Turabian StyleKlaus, Stocker. 2020. "Financial and Economic Assessment of Tidal Stream Energy—A Case Study" International Journal of Financial Studies 8, no. 3: 48. https://doi.org/10.3390/ijfs8030048

APA StyleKlaus, S. (2020). Financial and Economic Assessment of Tidal Stream Energy—A Case Study. International Journal of Financial Studies, 8(3), 48. https://doi.org/10.3390/ijfs8030048