Abstract

Sustainable and responsible investing (SRI) is a strategy that seeks to combine both financial return and social good. The need to create and preserve SRI represents a key argument in investment decision-making, which leads other firms and investors to make strategic decisions beyond financial logic, based on environmental, social, and governance (ESG) factors. Within this framework, this paper aims to further clarify the understanding of potentially profitable strategies for firms during a global crisis such as a pandemic. Both primary and secondary data were gathered, and descriptive analyses were conducted. In Spain, several IBEX-35 companies announced donations amid the COVID-19 crisis. First, companies were classified into two groups based on donations made. For this, we searched for ESG online news. Then, profitability records amongst companies were identified and compared. In the trading session after the announcements, we found 12 of the 35 companies that made donations had a higher performance index of more than 2 and 3 points over the companies that did not make donations. With a weekly perspective, the difference was 91 and 60 basis points, respectively. These results suggest that in times of upheaval, investors base their strategy on ESG factors, contributing to the emerging literature on individual motives of SRI. Second, by conducting a survey and collecting data from 575 Spanish citizens, we conclude that after this crisis, people’s perceptions towards corporate social responsibility (CSR) will change, affecting consumption preferences in those companies that exhibited socially irresponsible or unsupportive behaviour. Hence, the reputation of firms, their social image, and social trust will play an important role in the near future.

Keywords:

socially responsible investing; corporate social responsibility; strategic management; performance; COVID-19 JEL Classification:

M14; G21; 035

1. Introduction

The interest in sustainable and responsible investing (SRI) has grown significantly over the last two decades due to the foreseen implications for companies to engage in corporate social responsibility (CSR) activities (Cooper and Weber 2020; Daugaard 2020; Larcker and Watts 2020; Leins 2020; Risalvato et al. 2018). Nowadays, investors marketwide value sustainability (Hartzmark and Sussan 2019; PRI 2020; Sutopo et al. 2018). As a result, companies are advised to strategically communicate their actions due to the specific ways in which equity investors and stakeholders perceive and respond to environmental, social, and governance (ESG) factors (Cooper and Weber 2020; Holder-Webb et al. 2009; Larcker and Watts 2020). Hence, the relevance to gather, evaluate, and weight information on ESG factors by the investor is also implicit (Capelle-Blancard and Petit 2019; Gödker and Mertins 2018).

Under the umbrella of CSR and its strategic nature, SRI refers to the strategy used by investors to consider the firms’ environmental, social, and ethical impact and their corporate governance before investment decisions (Cooper and Weber 2020; Daugaard 2020). Based on the theory that companies have a duty to society that supersedes the maximisation of shareholders’ wealth, the engagement in CSR practices or corporate citizenship to benefit other stakeholders groups represents a valuable strategy (Aguilera et al. 2007; Fernández et al. 2017; Mackey et al. 2007; McWilliams and Siegel 2001; Scherer and Palazzo 2008). In addition, as noted by other scholars, companies are increasingly pressured both internally and externally to fulfil broader social goals and engage in social responsibility initiatives (Capelle-Blancard and Petit 2019; Orlitzky 2013; Scherer and Palazzo 2008), as well as pressed by investors towards the adoption of ESG management processes and the implementation of sustainability strategies (Crifo et al. 2019; Shafiq et al. 2019).

In March 2020, the World Health Organization declared a COVID-19 pandemic crisis worldwide as the number of infected people and deaths increased at an exponential rate (WHO 2020). Most countries have declared a state of emergency disrupting many aspects of economic, political, and social action, imposing confinements and social isolation measures, eventually putting diverse economic sectors at risk (Fana et al. 2020). Such a state of emergency declaration together with the measures across countries has sensitised many companies to solidarize and engage in CSR actions. Current CSR practices, such as donations to contend the virus in such times of upheaval, are present-day examples of voluntary firm actions for the social good. News coverage and media content on CSR actions are given a particular coverage amid COVID-19 efforts.

There is no precedent for an infectious disease that has impacted the volatility of stock markets as intensely as this COVID-19 pandemic, triggering a global financial crisis (Baker et al. 2020; Morales and Andreosso-O’Callaghan 2020; Onali 2020). In mid-March, most stock indices worldwide registered one of their worst days of trading in history (Fernandes 2020; WEF 2020), which posed potential problems of internal conflicts (Khoma et al. 2018). Stock markets gyrated 5 to 10% a day, most of the time down (Baldwin and Weder di Mauro 2020). Subsequently, on 27 March 2020, the Principles for Responsible Investment Association in partnership with United Nations Global Compact issued a COVID-19 resource notice about the serious threat and crisis impact for all investors regardless of holdings, strategy, or role in the investment chain, in addition to outlining a series of immediate investor actions to respond to COVID-19 (PRI 2020).

On the dates following the state of emergency declaration in Spain (Royal Decree 463/2020), many companies listed on the IBEX-35 major stock exchange announced millionaire donations and specific aid programs to fight this pandemic (i.e., Santander, BBVA, Iberdrola, Telefónica or Inditex). News coverage and media content on such CSR actions have been broadly publicised, particularly online.

Therefore, an opportunity arises with the current disrupted context amid COVID-19 to explore the following research questions: Did the information about the CSR actions by such corporations affect their stock performance? Have the shares of donor companies had better returns on the stock market? Do investors prefer to invest in companies that are supportive in times of crisis, such as the COVID-19 pandemic? Will people’s perceptions of companies change when normality is restored? If so, will we avoid consuming in companies that showed socially irresponsible or unsupportive behaviour? Will this change be greater among citizens with higher incomes? In doing so, we answer recent calls to further clarify the understanding of the potentially profitable strategies during such a pandemic (Aslam et al. 2020).

In order to answer these questions, we expand the literature by exploring the ESG-CSR disclosure practices and the impact on the stock performance of a stratified sample of 35 publicly-traded Spanish firms, performing a content analysis on identifiable public donation news and advertisement provided by these firms during March 2020. In addition, by conducting a survey, we gathered data (n = 575) from Spanish citizens to assess to what extent—and how—their perceptions of companies will change once society returns to normality.

This paper is organised into four sections, including this introduction, where an up-to-date theoretical overview and its implications are addressed. Section 2 describes the methodology and presents the empirical results of this study. The discussion is shown in Section 3. Finally, conclusions, limitations, and future lines of research are addressed in Section 4.

1.1. Theoretical Overview: Definitions and Conceptualisations

Corporate social responsibility (CSR) is a multidimensional concept that lacks a unique definition (Kot 2014). Be that as it may, responsibility implies that firms deliberately accomplish actions based on ethics and moral rules. Even when the literature is not conclusive, most studies suggest that CSR has a positive impact on firm performance, which also holds in Spain (Martín Rives and Rubio Bañon 2008; Pava and Krausz 1996; Prado-Lorenzo et al. 2008). Not surprisingly, CSR reporting—which usually increases stock prices (Sutopo et al. 2018)—is of utmost importance for IBEX-35 companies (Sierra et al. 2013) providing that CSR news is accessible in the web sites of these companies (Capriotti and Moreno 2007; Jackson and Apostolakou 2010).

Within the CSR framework, research on sustainable and responsible investment (SRI) is gaining momentum. The European Sustainable Investment Forum (Eurosif) is the leading association for the promotion of sustainable and responsible investment across Europe. Eurosif, together with other organisations in different regions worldwide, belongs to the Global Sustainable Investment Alliance to deepen the impact and visibility of sustainable investment organisations (GSIA 2019). In 2016, Eurosif reached a consensus on the definition of SRI as “a long-term oriented investment approach which integrates ESG factors in the research, analysis and selection process of securities within an investment portfolio. It combines fundamental analysis and engagement with an evaluation of ESG factors to capture long-term returns for investors and to benefit society by influencing the behaviour of companies” (Eurosif 2018, p. 12). Consequently, ESG factors have become an integral part of most strategies to foster SRI (Leins 2020; Risalvato et al. 2018).

SRI has taken different conceptualisations over the years, such as ethical investing, environmental investing, sustainable investing, impact investing, socially responsible investing, and ESG investing (for a recent systematic literature review on SRI see (Daugaard 2020)). The interest on SRI has grown in importance by considering environmental, social, and governance (ESG) factors, and even including ethical and religious considerations into investment decisions (Cooper and Weber 2020; Crifo et al. 2019; Renneboog et al. 2008). In summary, authors have addressed the association of ESG factors with CSR practices and investors’ decision-making (Capelle-Blancard and Petit 2019; Larcker and Watts 2020) (for an interesting discussion on the paradigm shift and institutionalisation of SRI, see (Nath 2019)).

1.2. Investors’ Preferences for ESG

The importance of SRI as an investment strategy is well embodied in the theory proposed by Mackey et al. that “sometimes, equity holders may have interests besides simply maximising their wealth when they make their investment decisions… they may want the firms they invest in to pursue socially responsible activities, even if these activities reduce the present value of the cash flows generated by these firms” (Mackey et al. 2007) (p. 818). This is in line with the theory proposed by Statman, which states that investors are looking for expressive and not only monetary benefits (Statman 2004). Both theoretical arguments are supported by the increasing pressure from different stakeholders for ethical conduct and social responsibility (Bilbao-Terol et al. 2016; Gómez-Bezares et al. 2016; Shafiq et al. 2019; Zerbib 2019). Thus, when it comes to ESG, there is a subjective component to consider.

Recent studies have found evidence that personal values have an impact on investment decisions, particularly for SRI (Brodback et al. 2019). Thus, investors seek to align their investments with specific moral values or codes of conduct (Nath 2019). For example, green investors refuse to invest in firms that do not meet their ethical criteria (Heinkel et al. 2001). As a result, investors may be willing to renounce financial benefits and invest in environmentally friendly or socially responsible firms (Larcker and Watts 2020; Riedl and Smeets 2017). Not surprisingly, during the last decade, scholars have advanced studies concerning the relevance of non-financial factors (psychic dividends) or social preferences to explain SRI decisions (Ainsworth et al. 2018; Brodback et al. 2019; Riedl and Smeets 2017; Wiesel et al. 2016). Other reasons to engage in SRI have also been addressed in the literature, such as the positive return expectations for SRI and investors, who try to diversify their portfolios (Bauer and Smeets 2015; Gómez-Bezares et al. 2016), or the enhancement of the investors’ social image or reputation (Riedl and Smeets 2017).

1.3. SRI in Times of Upheaval

Authors have shed insights into investors being poorly diversified at the onset of the global financial crisis in 2008 (L. Yang et al. 2017). Since 2008, the interest in ESG and CSR has evolved to become an essential matter into mainstream finance (Dumas and Louche 2016). The most common SRI strategy has been excluding from portfolios those companies involved in polemic, harming, or negatively perceived practices (i.e., environmental damages, unethical behaviours, corruption, harassment scandals, gender inequality, and so on) (Trinks and Scholtens 2017). Previous works have analysed the role of the media in SRI (i.e., Lei and Zhang 2020); however, to the best of our knowledge, no previous studies have addressed SRI during times of severe threat and crisis impact due to COVID-19, where investors may have a different view about those companies engaging in ESG and CSR practices.

Boltanski and Chiapello’s (2005) theory of convention focuses on analysing cognitive interactions and the diversity of equilibriums using discourse and conventions. This theory embraces the concept of collective belief, being a shared understanding of the future progression of financial markets. Under uncertainty, collective views will aid investors in decision-making, thereby influencing economic value and the adoption of new practices (Dumas and Louche 2016).

1.4. The Role of the Media in Communicating ESG-CSR Practices

As previously introduced, companies are advised to strategically communicate their actions due to the specific ways in which investors and stakeholders perceive and respond to ESG factors (Mackey et al. 2007). Hence, media coverage represents a common strategy in shaping public opinion and social norms. Based on Barkemeyer et al. (2010), “media coverage can influence the level of awareness of specific issues and could act as a general barometer of the contextual framing of issues such as business ethics, sustainable development, corporate citizenship, and accountability within society” (p. 382). Thus, an examination of media coverage in a specific context offers understandings about current interests and concepts of social importance (Barkemeyer et al. 2010; Montes et al. 2001).

The study of media coverage remains an emerging topic in SRI literature (Dumas and Louche 2016; Lei and Zhang 2020). Typically, both finance and CSR studies use data from the media. Recent studies have investigated the role of the media in financial markets and CSR (Capelle-Blancard and Petit 2019; Dumas and Louche 2016; Holder-Webb et al. 2009), and others have analysed the quality of disclosure sources of ESG-CSR in aiding investment decisions (Cooper and Weber 2020; Dela Cruz et al. 2020; Lei and Zhang 2020). Previous results show how the media influenced investors’ attitudes about the evaluation of the stock market and their investment decisions afterwards (W. Yang et al. 2017). CSR contributions in CSR-related news articles are positively associated with SRI (Lei and Zhang 2020). We build on these latest studies to consider media coverage of CSR actions to reflect on the collective beliefs about COVID-19. Thus, we propose the following hypothesis:

H0:

In times of upheaval, investors base their investment strategy on ESG factors and therefore favour firms taking CSR actions better than the rest of the stocks.

2. Results

To answer the research questions and contrast the hypothesis, the study involved two phases. The first phase considered a sample of 35 IBEX-35 companies, while the second phase involved the participation of 575 Spanish citizens in a survey study. The following activities were performed during the first phase:

- The IBEX-35 companies were classified into two groups based on donations made related to COVID-19: those that have made donations (n = 12) and those that have not (n = 23).

- This aggrupation criterion considered whether news appeared on the first page of Google Web Search for “company name + donation + coronavirus.” If the search did not show any results, it was assumed that the company had made no donations, or that their communication departments did not seek publicity (which for the nature of this study represents the same for the investor).

- With this segregation, the returns of these two groups of companies were averaged.

This first phase of the study was made on 24 March 2020. Data was acquired from https://www.investing.com/. Results are shown in Table 1.

Table 1.

Average return of IBEX-35 companies.

We conclude that the companies that made donations had a better average performance both in the previous session and the last week. The companies that expressed their commitment to the fight against the epidemic obtained, on average, 3.35% more profitability than the companies that did not, deviating 2.20% upwards on the index. Throughout the week, the shares of the companies identified with donations had an additional 0.91% return on the average of the companies that did not show donations, 0.60% on the index.

The second phase of this study involved a survey among Spanish citizens (n = 575) as part of a more comprehensive research project directed by the Camilo Prado Foundation about Companies’ legitimacy during the COVID-19 crisis (Blanco-González 2020). This phase of the study allowed us to substantiate and support the results from phase one. Precisely, we aimed to assess to what extent—and how—will the Spanish citizens’ perceptions of companies change once society returns to normality. The results help us understand the factors that might well be behind firms’ investment appetite for SRI.

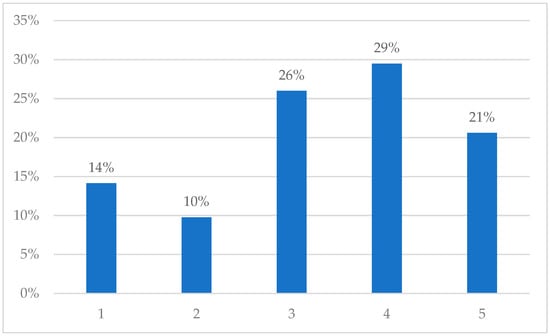

Precisely, we asked two questions, namely “when we return to normality, will your perceptions of companies change?” (Question 1) and “will this make you decide not to consume in companies that have not done well?” (Question 2). Both questions were assessed using multiple items on five-point Likert scales, ranging from 1 (“least agree”) to 5 (“most agree”). Figure 1 provides a summary of the responses to Question 1. Results show that 50% of respondents admitted that their perception of companies that have made donations will change after confinement, while 24% indicated that their perception will not change.

Figure 1.

Summary of the responses to Question 1.

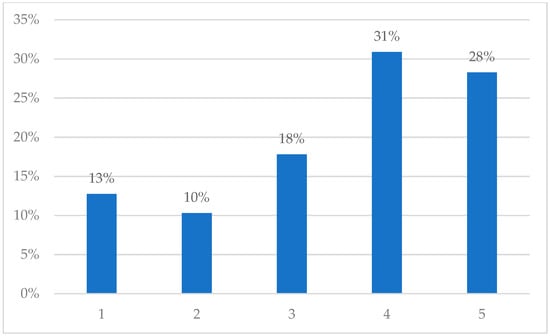

Regarding Question 2, results were similar. Precisely, 59% of the respondents indicated that they had decided not to procure the products and services of firms that did not behave socially responsibly during the crisis, which supports the idea of punishing eco-harmful behaviour (Flammer 2013; Huang et al. 2017). Only 23% of those surveyed indicated that the actions of companies during the crisis would not change their consumption habits (see Figure 2).

Figure 2.

Summary of the responses to Question 2.

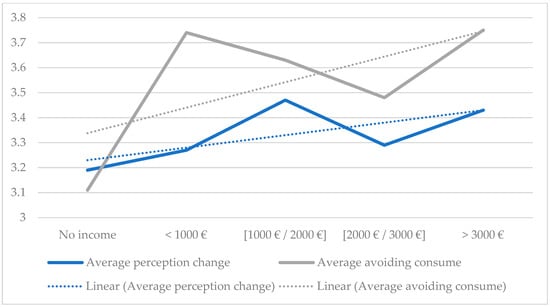

The sample disposition also provides valuable insights that support our results. Interestingly, the respondents’ propensities towards to change their perception of companies after the COVID-19 crisis and to stop consuming products of those companies that have not behaved socially responsibly is higher as the income of the respondents increases (see Figure 3).

Figure 3.

Change propensity analysis by monthly income.

To sum up, the results of the second part of this study are in line with our previous findings and help us better interpret the rationale behind firms’ behaviour. We can conclude that investors opt to buy shares of companies that have behaved socially responsibly during the crisis—at least to some extent. This is because, when the crisis is over, customers will have a better perception of firms and will have a greater propensity to purchase their products or services. Hence, our results confirm that CSR activities build up the social trust of organisations (Parida and Wang 2018).

3. Discussion

While we are unable to definitively determine the specific personal reason(s) behind SRI, this study allowed us to contribute to the emerging literature on individual motives of SRI (find a recent review of emerging themes in Daugaard 2020) and expand on three possibilities. First, this study provides additional evidence of how CSR-related news influence investors’ attitudes about the evaluation of the stock market and their investment decisions afterwards, which appears positively associated with SRI (Lei and Zhang 2020; W. Yang et al. 2017). Consequently, we provide further insights into how investors value non-financial aspects of stocks to engage in SRI. Previous studies suggest that companies reported to behave responsibly toward the environment experience a significant stock price increase (Flammer 2013). Similarly, this study offers evidence that, in times of severe upheaval, investors re-evaluate their trading portfolios and revisit their corporate performance selection criteria to favour ESG factors above stock performance. These results are in line with previous research that underlies the benefits of social aspects on investments (i.e., Hartzmark and Sussan 2019; Dumas and Louche 2016), suggesting that investors are motivated by social criteria which meet their beliefs, specific moral values, or codes of conduct (Larcker and Watts 2020; Nath 2019). As a result, this paper highlights the potential role of ESG factors in guiding investment decisions (Lapanan 2018; Vanwalleghem and Mirowska 2020) by examining investors’ behaviour in an extreme context such as a pandemic crisis.

Second, investors in such difficult times filled with financial market uncertainty are particularly inclined to favour those companies using news coverage and media content to communicate their CSR actions. Since the study of media coverage remains an emerging topic in the SRI literature (e.g., Lei and Zhang 2020), media coverage of CSR actions was considered to reflect on the collective beliefs about COVID-19. As Bourghelle (2005) noted, financial investors usually all read the same press and listen to the same experts, so the media is an essential mediator in the formation of collective beliefs. The results suggest that firms’ CSR actions impact the expectations of future performance and also lead investors to make choices based on non-pecuniary motivations (such as altruism, donations, collective beliefs, and social norms) (Hartzmark and Sussan 2019; Martin and Moser 2016). Much has been said about CSR policies and their economic and social performance (i.e., Cooper and Weber 2020). It seems that in times of severe upheaval, investors’ SRI strategy is to sympathise with companies that are committed to society and exhibit solidarity efforts and business policies.

Third, people’s perceptions of companies will change when normality is restored after the pandemic; in fact, we will avoid procuring the products and services of those companies that behaved socially irresponsibly during the COVID-19 crisis. This disidentification will lead to unsupportive behaviour towards those firms, which highlights the relationship between CSR and financial performance, yet, contingent upon the investor’s possessing power with immediate consequences in the short-term (Peloza and Papania 2008). Such disidentification or change in perception is strengthened in people with higher incomes, who are ultimately the ones with greater power and invest more (Chen et al. 2019; Nwibo et al. 2017). This supports and expands our previous conclusions; investors might well have in mind that customers will penalise firms’ unsupportive behaviour, which would, in turn, condition their decision-making. All in all, we extend the view of “environment-as-a-resource” suggested in previous studies (e.g., Flammer 2013) by providing empirical evidence on the positive SRI impact on firms’ performance during a global health crisis.

4. Conclusions, Limitations and Further Lines of Research

With this study, we have contributed to the literature by documenting evidence on SRI and investment decision-making during the pandemic effects (in situ). The two phases incurred in our study are complementary, allowing us to substantiate and support our results. We present valuable evidence that both investors and firms favour social investments in extreme situations. In short, investors bet on SRI, a fact that can be observed in stock market trading also during a severe sanitary crisis. Consumer behaviour might explain the markets’ CSR appetite. Hence, we reinforce the idea that consumers’ perceptions with respect to companies that have carried out CSR activities during this current crisis will influence their consumption of products, penalizing those that have not responded equally. Nevertheless, there is a need to further investigate what motivates such actions, for example, by exploring reputation and social image/social trust-related facts. In this line, future research can also assess how cognitive factors change the rationale behind investing decisions in extreme contexts, such as a pandemic and a global crisis.

Similarly, our results suggest that the market accommodates—at least apparently—non-fully rational investment decisions in times of upheaval. The market reacts favourably to firms’ donations during a severe social and economic crisis, which yields clear guidelines for managerial purposes towards socially and responsibly investing. Even though the second part—primary data based—of our analyses support this notion, it must be acknowledged that due to the timeline of our study, it is too soon to be able to fully demonstrate that these companies have seen improvements in their rate of return due to their CSR investment strategy. Thus, when overcoming such data limitations, the impact of the different news could be analysed with longitudinal studies. This would allow a better interpretation of how exactly different types of donation-related announcements affect the stock market in times of unusually adverse contexts. Similarly, gathering primary data in the near future to corroborate to what extent customers have penalised those firms’ not engaging in CSR practices would also be of interest. Advancing on these points would enable studies to fully demonstrate that companies have actually seen improvements in their rate of return due to their CSR investment strategy, offering clear practical implications. Furthermore, our sample is limited to Spain, and results could differ among different countries and contexts. In this sense, comparing results between different settings–and further analysing the potential reasons behind the possible differences–would improve the consistency and robustness of our results.

Using new analytic tools such as Necessary Condition Analysis (NCA) would also provide additional insights (see, for example, Richter et al. 2020). Precisely, one could assess whether announcing donations is necessary—but not sufficient—if donations are to affect stock markets positively. Finally, by conducting further complementary analyses using partial least squares structural equation modelling (PLS-SEM) (Hair et al. 2019; Hwang et al. 2020; Rigdon et al. 2017; Sarstedt et al. 2017) on data from financial contexts affected by the pandemic crisis—or shocks alike– one could test to what extent well-established models are still applicable in extreme settings. Furthermore, by using PLS-SEM, researchers can stress the predictive nature of their analyses (Liengaard et al. 2020; Shmueli et al. 2019), which would help different stakeholders better address the future challenges that potential new global sanitation crisis—or shocks alike—might bring.

Author Contributions

R.G.-M., J.C.-A. and J.M.P.-R. wrote this paper; R.G.-M. conceived the idea; J.M.P.-R. and J.C.-A. designed the structure of the paper; R.G.-M. collected and analysed the data and provided the technical details; J.M.P.-R. and J.C.-A. wrote the draft of Section 1, Section 3 and Section 4, while R.G.-M. wrote Section 2; J.M.P.-R. and J.C.-A. made a final revision of the entire paper. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Acknowledgments

We appreciate the support received from the Camilo Prado Foundation. We would like to thank the anonymous reviewers for their insights and acknowledge the administrative and technical support given by the editors.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Aguilera, Ruth V., Deborah E. Rupp, Cynthia A. Williams, and Jyoti Ganapathi. 2007. Putting the S back in corporate social responsibility: A multilevel theory of social change in organizations. Academy of Management Review 32: 836–63. [Google Scholar] [CrossRef]

- Ainsworth, Andrew, Adam Corbett, and Steve Satchell. 2018. Psychic dividends of socially responsible investment portfolios. Journal of Asset Management 19: 179–90. [Google Scholar] [CrossRef]

- Aslam, Faheem, Wahbeeah Mohti, and Paulo Ferreira. 2020. Evidence of Intraday Multifractality in European Stock Markets during the recent Coronavirus (COVID-19) Outbreak. International Journal of Financial Studies 8: 31. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, Steven J. Davis, Kyle J. Kost, Marco C. Sammon, and Tasaneeya Viratyosin. 2020. The Unprecedented Stock Market Impact of COVID-19. NBER Working Paper No. 26945. NBER Working Paper Series, Issue April; Cambridge: Cambridge University Press. [Google Scholar]

- Baldwin, Richard, and Beatrice Weder di Mauro. 2020. Mitigating the COVID Economic Crisis: Act Fast and Do Whatever It Takes. London: CEPR Press. [Google Scholar]

- Barkemeyer, Ralf, Diane Holt, Frank Figge, and Giulio Napolitano. 2010. A longitudinal and contextual analysis of media representation of business ethics. European Business Review 22: 377–96. [Google Scholar] [CrossRef]

- Bauer, Rob, and Paul Smeets. 2015. Social identification and investment decisions. Journal of Economic Behavior & Organization 117: 121–34. [Google Scholar] [CrossRef]

- Bilbao-Terol, Amelia, Mar Arenas-Parra, Verónica Cañal-Fernández, and Celia Bilbao-Terol. 2016. Multi-criteria decision making for choosing socially responsible investment within a behavioral portfolio theory framework: A new way of investing into a crisis environment. Annals of Operations Research 247: 549–80. [Google Scholar] [CrossRef]

- Blanco-González, Alicia. 2020. Proyecto COVID19 LEGITIMIDAD. Available online: http://www.mberesearch.com/proyectos/proyecto-covid19-legitimidad (accessed on 30 May 2020).

- Boltanski, Luc, and Eve Chiapello. 2005. The New Spirit of Capitalism. London: Verso. [Google Scholar]

- Bourghelle, David. 2005. Flux D’ordres et Coordination Sur Les Marchés Financiers. In Croyances, Représentations Collectives et Conventions en Finance. Edited by David Bourghelle, Olivier Brandouy, Roland Gillet and André Orléan. Paris: Economica. [Google Scholar]

- Brodback, Daniel, Nadja Guenster, and David Mezger. 2019. Altruism and egoism in investment decisions. Review of Financial Economics 37: 118–48. [Google Scholar] [CrossRef]

- Capelle-Blancard, Gunther, and Aurélien Petit. 2019. Every Little Helps? ESG News and Stock Market Reaction. Journal of Business Ethics 157: 543–65. [Google Scholar] [CrossRef]

- Capriotti, Paul, and Angeles Moreno. 2007. Communicating corporate responsibility through corporate web sites in Spain. Corporate Communications: An International Journal 12: 221–37. [Google Scholar] [CrossRef]

- Chen, Kuo-Shing, Chien-Chiang Lee, and Huolien Tsai. 2019. Taxation of Wealthy Individuals, Inequality Governance and Corporate Social Responsibility. Sustainability 11: 1851. [Google Scholar] [CrossRef]

- Cooper, Lauren A., and Jill Weber. 2020. Does Benefit Corporation Status Matter to Investors? An Exploratory Study of Investor Perceptions and Decisions. Business & Society. [Google Scholar] [CrossRef]

- Crifo, Patricia, Rodolphe Durand, and Jean-Pascal Gond. 2019. Encouraging Investors to Enable Corporate Sustainability Transitions: The Case of Responsible Investment in France. Organization & Environment 32: 125–44. [Google Scholar] [CrossRef]

- Daugaard, Dan. 2020. Emerging new themes in environmental, social and governance investing: A systematic literature review. Accounting & Finance 60: 1501–30. [Google Scholar] [CrossRef]

- Dela Cruz, Aeson Luiz, Chris Patel, Sammy Ying, and Peipei Pan. 2020. The relevance of professional skepticism to finance professionals’ Socially Responsible Investing decisions. Journal of Behavioral and Experimental Finance 26: 100299. [Google Scholar] [CrossRef]

- Dumas, Christel, and Céline Louche. 2016. Collective Beliefs on Responsible Investment. Business & Society 55: 427–57. [Google Scholar] [CrossRef]

- Eurosif. 2018. European SRI Study 2018, Revised ed. Brussels: Eurosif, pp. 1–116. [Google Scholar] [CrossRef]

- Fana, Marta, Songul Tolan, Sergio Torrejón Pérez, Maria Cesira Urzi Brancati, and Enrique Fernández-Macías. 2020. The COVID confinement measures and EU labour markets. In JCR Technical Reports. Brussels: Publications Office of the European Union. [Google Scholar] [CrossRef]

- Fernandes, Nuno. 2020. Economic Effects of Coronavirus Outbreak (Covid-19) on the World Economy. April 13. Available online: https://ssrn.com/abstract=3557504 (accessed on 4 May 2020).

- Fernández, Angie, Santiago Calero, Humberto Parra, and Raúl Fernández. 2017. Corporate social responsibility and the transformation of the productive matrix for Ecuador sustainability. Journal of Security and Sustainability Issues 6: 575–84. [Google Scholar] [CrossRef]

- Flammer, Caroline. 2013. Corporate Social Responsibility and Shareholder Reaction: The Environmental Awareness of Investors. Academy of Management Journal 56: 758–81. [Google Scholar] [CrossRef]

- Gödker, Katrin, and Lasse Mertins. 2018. CSR Disclosure and Investor Behavior: A Proposed Framework and Research Agenda. Behavioral Research in Accounting 30: 37–53. [Google Scholar] [CrossRef]

- Gómez-Bezares, Fernando, Wojciech Przychodzen, and Justyna Przychodzen. 2016. Corporate Sustainability and Shareholder Wealth—Evidence from British Companies and Lessons from the Crisis. Sustainability 8: 276. [Google Scholar] [CrossRef]

- GSIA. 2019. Sustainable Investor Poll on TCFD Implementation (Issue December). Available online: http://www.japansif.com (accessed on 4 May 2020).

- Hair, Joseph F., G. Tomas M. Hult, Christian M. Ringle, Marko Sarstedt, Julen Castillo-Apraiz, Gabriel A. Cepeda Carrión, and José Luis Roldán. 2019. Manual de Partial Least Squares Structural Equation Modeling (PLS-SEM), Segunda ed. Terrasa: OmniaScience. [Google Scholar] [CrossRef]

- Hartzmark, Samuel M., and Abigail B. Sussan. 2019. Do Investors Value Sustainability? A Natural Experiment Examining Ranking and Fund Flows. The Journal of Finance 74: 2789–837. [Google Scholar] [CrossRef]

- Heinkel, Robert, Alan Kraus, and Josef Zechner. 2001. The Effect of Green Investment on Corporate Behavior. The Journal of Financial and Quantitative Analysis 36: 431. [Google Scholar] [CrossRef]

- Holder-Webb, Lori, Jeffrey R. Cohen, Leda Nath, and David Wood. 2009. The Supply of Corporate Social Responsibility Disclosures Among U.S. Firms. Journal of Business Ethics 84: 497–527. [Google Scholar] [CrossRef]

- Huang, Haifeng, Di Wu, and Gaya J. 2017. Chinese shareholders’ reaction to the disclosure of environmental violations: A CSR perspective. International Journal of Corporate Social Responsibility 2: 1–16. [Google Scholar] [CrossRef]

- Hwang, Heungsun, Marko Sarstedt, Jun Hwa Cheah, and Christian M. Ringle. 2020. A concept analysis of methodological research on composite-based structural equation modeling: Bridging PLSPM and GSCA. Behaviormetrika 47: 219–41. [Google Scholar] [CrossRef]

- Jackson, Gregory, and Androniki Apostolakou. 2010. Corporate Social Responsibility in Western Europe: An Institutional Mirror or Substitute? Journal of Business Ethics 94: 371–94. [Google Scholar] [CrossRef]

- Khoma, Iryna, Liudmyla Moroz, and Pavlo Horyslavets. 2018. Diagnostics of Conflicts within the Business Social Responsibility Forming System. Journal of Competitiveness 10: 16–33. [Google Scholar] [CrossRef]

- Kot, Sebastian. 2014. Knowledge and Understanding of Corporate Social Responsibility. Journal of Advanced Research in Law and Economics V: 109–19. [Google Scholar]

- Lapanan, Nicha. 2018. The investment behavior of socially responsible individual investors. The Quarterly Review of Economics and Finance 70: 214–26. [Google Scholar] [CrossRef]

- Larcker, David F., and Edward M. Watts. 2020. Where’s the greenium? Journal of Accounting and Economics, 101312. [Google Scholar] [CrossRef]

- Lei, Shan, and Yafei Zhang. 2020. The role of the media in socially responsible investing. International Journal of Bank Marketing. [Google Scholar] [CrossRef]

- Leins, Stefan. 2020. ‘Responsible investment’: ESG and the post-crisis ethical order. Economy and Society 49: 71–91. [Google Scholar] [CrossRef]

- Liengaard, Benjamin Dybro, Pratyush Nidhi Sharma, G. Tomas M. Hult, Morten Berg Jensen, Marko Sarstedt, Joseph F. Hair, and Christian M. Ringle. 2020. Prediction: Coveted, Yet Forsaken? Introducing a Cross-Validated Predictive Ability Test in Partial Least Squares Path Modeling. Decision Sciences, 1–31. [Google Scholar] [CrossRef]

- Mackey, Alison, Tyson B. Mackey, and Jay B. Barney. 2007. Corporate social responsibility and firm performance: Investor preferences and corporate strategies. Academy of Management Review 32: 817–35. [Google Scholar] [CrossRef]

- Martin, Patrick R., and Donald V. Moser. 2016. Managers’ green investment disclosures and investors’ reaction. Journal of Accounting and Economics 61: 239–54. [Google Scholar] [CrossRef]

- Martín Rives, Longinos, and Alicia Rubio Bañon. 2008. ¿Moda o Factor Competitivo? Un Estudio Empirico de Responsabilidad Social Corporativa en PYME. Tribuna de Economía 842: 177–93. [Google Scholar]

- McWilliams, Abagail, and Donald Siegel. 2001. Corporate Social Responsibility: A Theory of the Firm Perspective. Academy of Management Review 26: 117–27. [Google Scholar] [CrossRef]

- Montes, Manuel, Alexander Gelbukh, and Aurelio López-López. 2001. Mining the News: Trends, Associations, and Deviations. Computación y Sistemas 5: 14–24. [Google Scholar] [CrossRef]

- Morales, Lucía, and Bernadette Andreosso-O’Callaghan. 2020. Covid-19—Global Stock Markets “Black Swan”. Critical Letters in Economics & Finance 1: 1–14. [Google Scholar]

- Nath, Saheli. 2019. The Business of Virtue: Evidence from Socially Responsible Investing in Financial Markets. Journal of Business Ethics. [Google Scholar] [CrossRef]

- Nwibo, Simon Uguru, Cletus Nwakpu, and Anayochukwu Victor Eze. 2017. Income and Investment Portfolio of Smallholder Farmers in Ezza South Local Government Area of Ebonyi State, Nigeria. European Journal of Scientific Research 145: 328–35. [Google Scholar]

- Onali, Enrico. 2020. COVID-19 and Stock Market Volatility. SSRN Electronic Journal, 1–25. [Google Scholar] [CrossRef]

- Orlitzky, Marc. 2013. Corporate social responsibility, noise, and stock market volatility. Academy of Management Perspectives 27: 238–54. [Google Scholar] [CrossRef]

- Parida, Sitikantha, and Zhihong Wang. 2018. Financial Crisis and Corporate Social Responsible Mutual Fund Flows. International Journal of Financial Studies 6: 8. [Google Scholar] [CrossRef]

- Pava, Moses L., and Joshua Krausz. 1996. The association between corporate social-responsibility and financial performance: The paradox of social cost. Journal of Business Ethics 15: 321–57. [Google Scholar] [CrossRef]

- Peloza, John, and Lisa Papania. 2008. The Missing Link between Corporate Social Responsibility and Financial Performance: Stakeholder Salience and Identification. Corporate Reputation Review 11: 169–81. [Google Scholar] [CrossRef]

- Prado-Lorenzo, José Manuel, Isabel Gallego-Álvarez, Isabel Maria García-Sánchez, and Luis Rodríguez-Domínguez. 2008. Social responsibility in Spain: Practices and Motivations in Firms. Management Decision 46: 1247–71. [Google Scholar] [CrossRef]

- PRI. 2020. How Responsible Investors Should Respond to the COVID-19 Coronavirus Crisis. Principles for Responsible Investment. March 27. Available online: https://www.unpri.org/covid-19-resources/how-responsible-investors-should-respond-to-the-covid-19-coronavirus-crisis/5627.article (accessed on 5 May 2020).

- Renneboog, Luc, Jenke Ter Horst, and Chendi Zhang. 2008. Socially responsible investments: Institutional aspects, performance, and investor behavior. Journal of Banking & Finance 32: 1723–42. [Google Scholar] [CrossRef]

- Richter, Nicole Franziska, Christopher Schlaegel, Marian Van Bakel, and Robert L. Engle. 2020. The expanded model of cultural intelligence and its explanatory power in the context of expatriation intention. European Journal of International Management 14: 381. [Google Scholar] [CrossRef]

- Riedl, Arno, and Paul Smeets. 2017. Why Do Investors Hold Socially Responsible Mutual Funds? Journal of Finance 72: 2505–50. [Google Scholar] [CrossRef]

- Rigdon, Edward E., Marko Sarstedt, and Christian M. Ringle. 2017. On Comparing Results from CB-SEM and PLS-SEM: Five Perspectives and Five Recommendations. Marketing ZFP 39: 4–16. [Google Scholar] [CrossRef]

- Risalvato, Giuseppe, Claudio Venezia, and Federica Maggio. 2018. Social Responsible Investments and Performance. International Journal of Financial Research 10: 10. [Google Scholar] [CrossRef]

- Sarstedt, Marko, Christian M. Ringle, and Joseph F. Hair. 2017. Partial Least Squares Structural Equation Modeling. In Handbook of Market Research. Edited by Christian Homburg, Martin Klarmann and Arnd Vomberg. Issue September. Cham: Springer International Publishing, pp. 1–40. [Google Scholar] [CrossRef]

- Scherer, Andreas G., and Guido Palazzo. 2008. Introduction: Corporate Citizenship in a Globalized World. In The Handbook of Research on Global Corporate Citizenship. Edited by Andreas G. Scherer and Guido Palazzo. Cheltenham: Edward Elgar Publishing, Inc., pp. 1–21. [Google Scholar] [CrossRef]

- Shafiq, Asad, Muhammad Usman Ahmed, and Farzad Mahmoodi. 2019. Impact of supply chain analytics and customer pressure for ethical conduct on socially responsible practices and performance: An exploratory study. International Journal of Production Economics. [Google Scholar] [CrossRef]

- Shmueli, Galit, Marko Sarstedt, Joseph F. Hair, Jun-Hwa Cheah, Hiram Ting, Santha Vaithilingam, and Christian M. Ringle. 2019. Predictive model assessment in PLS-SEM: Guidelines for using PLSpredict. European Journal of Marketing 53: 2322–47. [Google Scholar] [CrossRef]

- Sierra, Laura, Ana Zorio, and María A. García-Benau. 2013. Sustainable Development and Assurance of Corporate Social Responsibility Reports Published by Ibex-35 Companies. Corporate Social Responsibility and Environmental Management 20: 359–70. [Google Scholar] [CrossRef]

- Statman, Meir. 2004. What do investors want? Journal of Portfolio Management 30: 153–61. [Google Scholar] [CrossRef]

- Sutopo, Bambang, Sebastian Kot, Arum Adiati, and Lina Ardila. 2018. Sustainability Reporting and Value Relevance of Financial Statements. Sustainability 10: 678. [Google Scholar] [CrossRef]

- Trinks, Pieter Jan, and Bert Scholtens. 2017. The Opportunity Cost of Negative Screening in Socially Responsible Investing. Journal of Business Ethics 140: 193–208. [Google Scholar] [CrossRef]

- Vanwalleghem, Dieter, and Agata Mirowska. 2020. The investor that could and would: The effect of proactive personality on sustainable investment choice. Journal of Behavioral and Experimental Finance 26: 100313. [Google Scholar] [CrossRef]

- WEF. 2020. Global Issue COVID-19. World Economic Forum. Available online: https://intelligence.weforum.org/topics/a1G0X000006O6EHUA0?tab=publications (accessed on 4 May 2020).

- WHO. 2020. WHO Timeline—COVID-19. Newsroom. Available online: https://www.who.int/news-room/detail/27-04-2020-who-timeline---covid-19 (accessed on 27 April 2020).

- Wiesel, Moritz, Kristian Ove R. Myrseth, and Bert Scholtens. 2016. Centre for Responsible Banking & Finance. In Working Papers in Responsible Banking & Finance. Working Paper No. 17-002. St Andrews: University of St Andrews School of Management. [Google Scholar]

- Yang, Libin, William Rea, and Alethea Rea. 2017. Impending Doom: The Loss of Diversification before a Crisis. International Journal of Financial Studies 5: 29. [Google Scholar] [CrossRef]

- Yang, Wen, Dongtong Lin, and Zelong Yi. 2017. Impacts of the mass media effect on investor sentiment. Finance Research Letters 22: 1–4. [Google Scholar] [CrossRef]

- Zerbib, Olivier David. 2019. The effect of pro-environmental preferences on bond prices: Evidence from green bonds. Journal of Banking & Finance 98: 39–60. [Google Scholar] [CrossRef]

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).