Blockchain-Enabled Corporate Governance and Regulation

Abstract

1. Introduction

2. Literature Review

2.1. Corporate Governance

2.2. Blockchain and Corporate Governance

2.3. Legal and Governance Aspects of Blockchains and Applications

3. Research Design

3.1. Systematic Review

3.1.1. Definition of Research Questions

3.1.2. Collating Articles

3.1.3. Final Article Sample Selection

3.1.4. Textual Analysis and Thematic Coding

Resource Maps

3.2. Empirical Data Collection and Methodology

4. Blockchain Technology

4.1. Smart Contracts

4.2. Decentralized Autonomous Organizations (DAO)

5. Results and Discussion

5.1. Systematic Literature Review Results

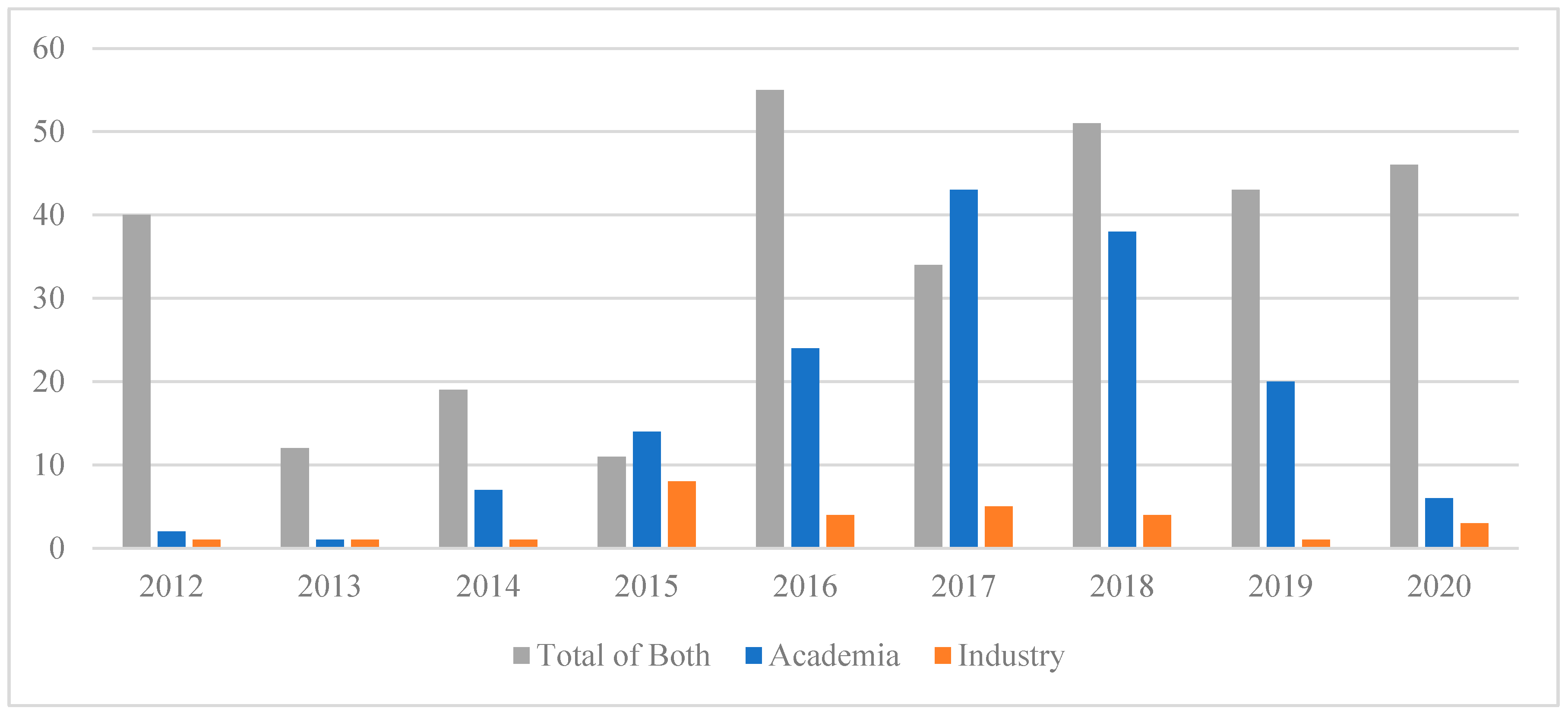

Academic and Industry Article Comparison

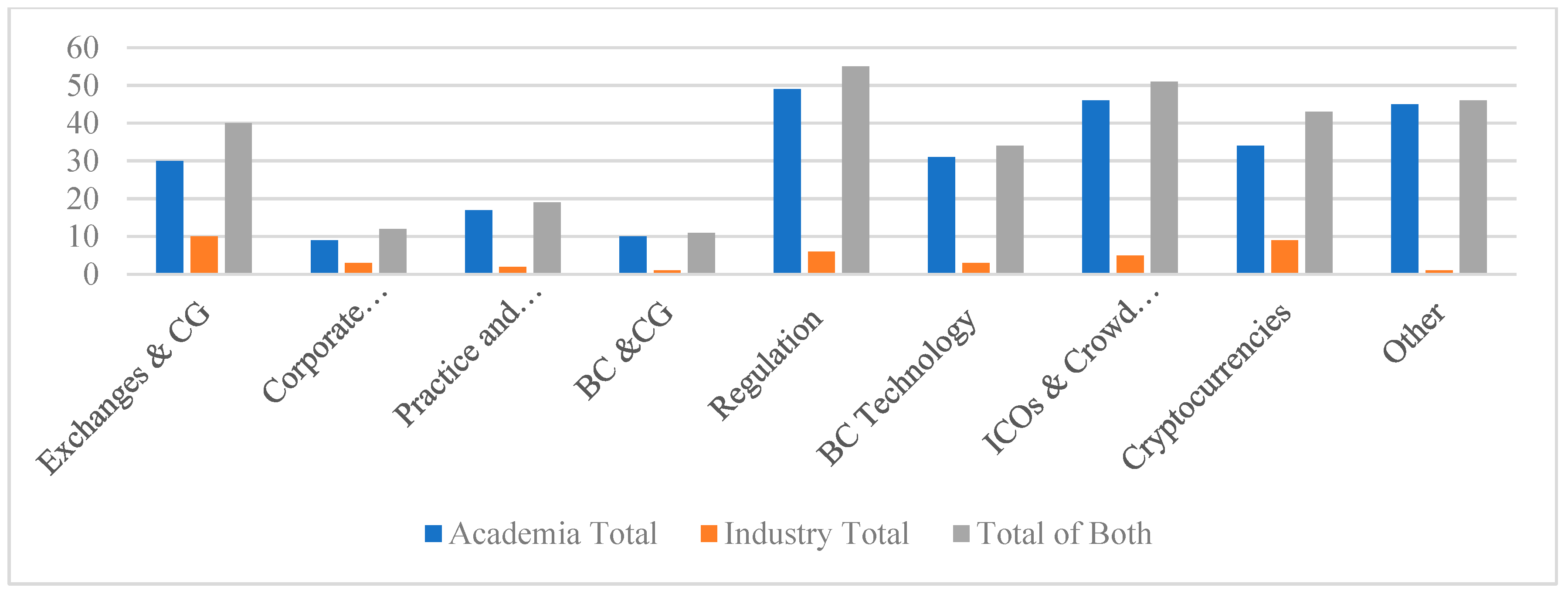

5.2. Textual Analysis

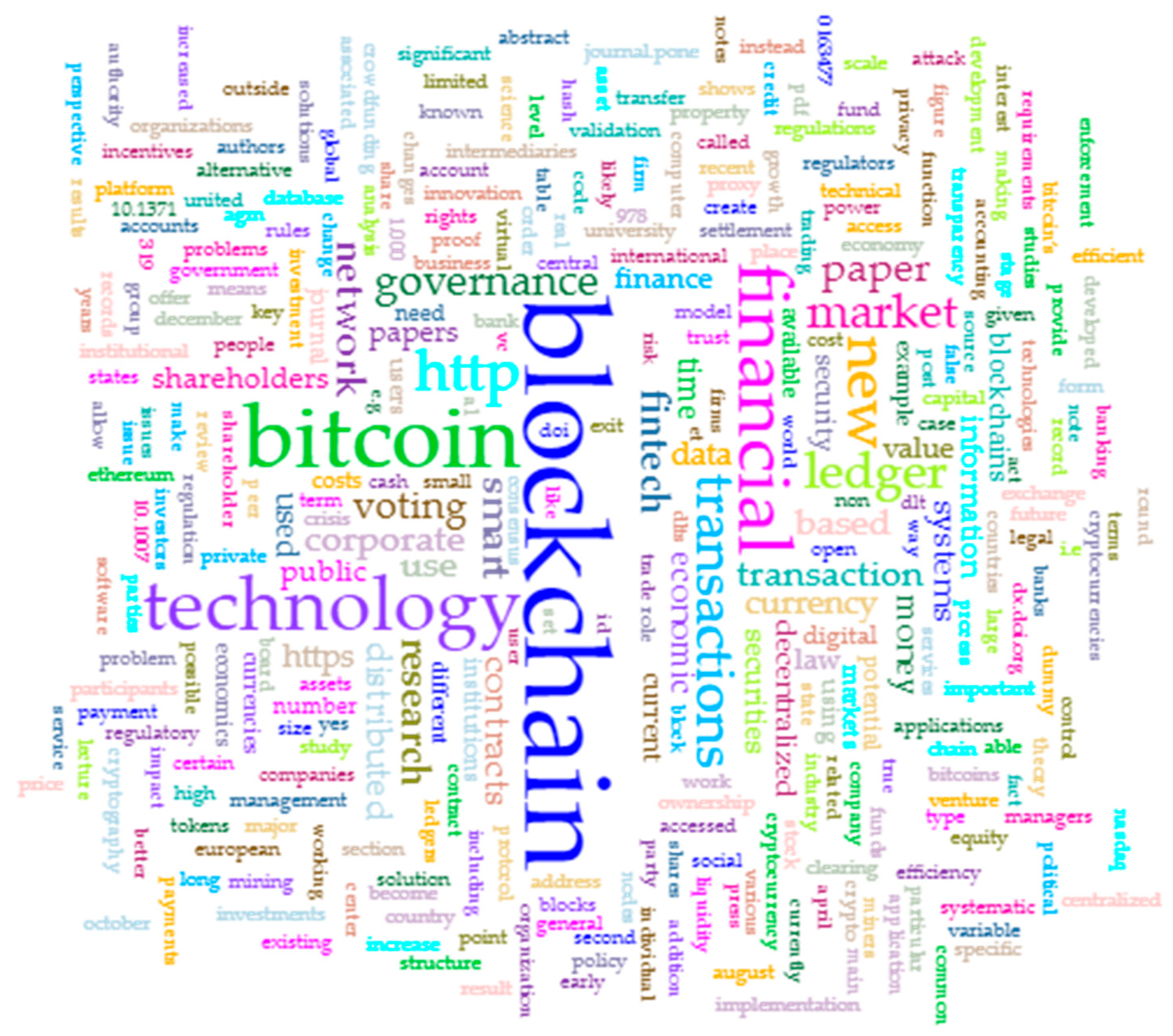

The Map

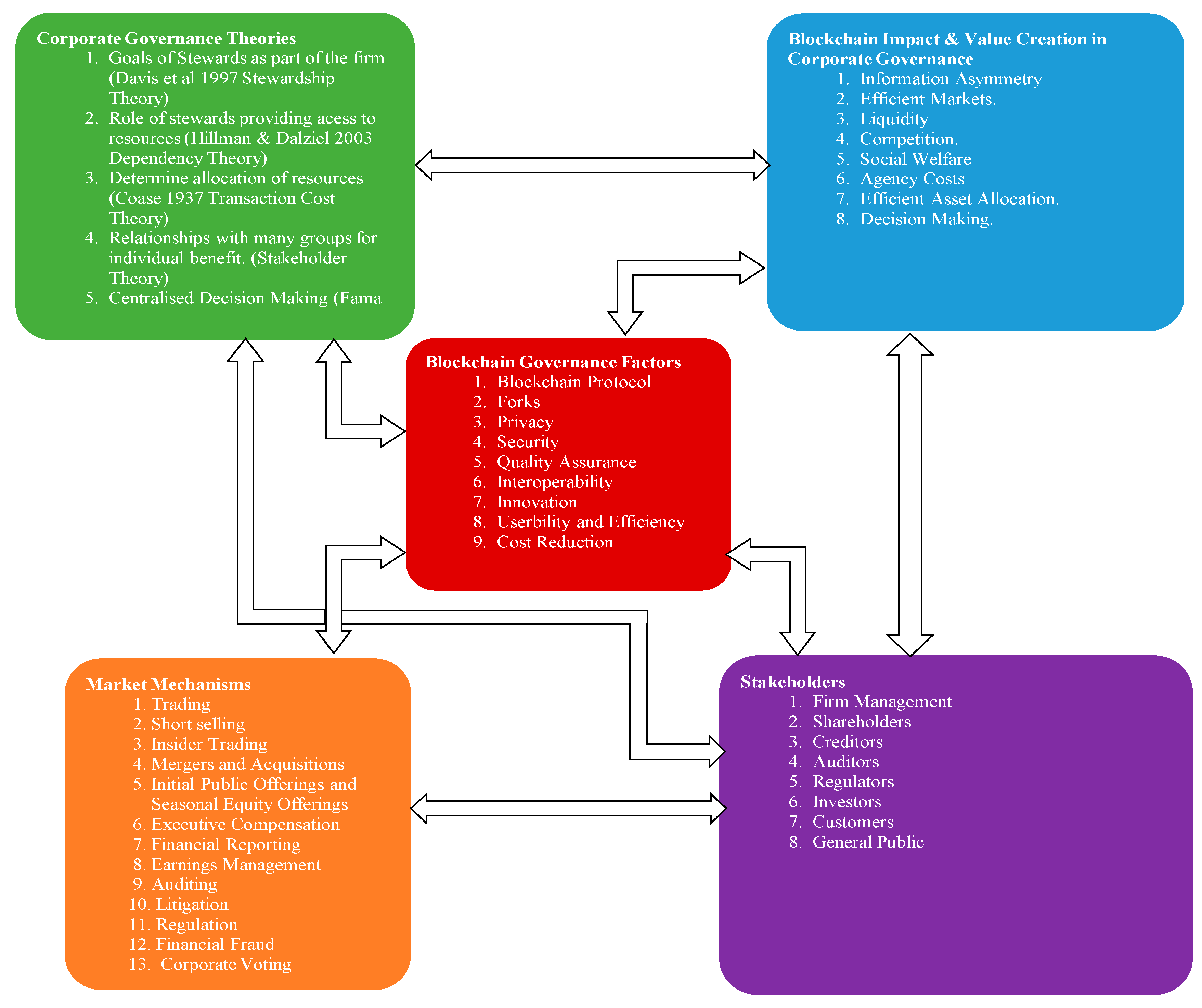

5.3. Decentralized Autonomous Corporate Governance (DACG) Framework

5.3.1. Why Use the DACG Framework?

5.3.2. Corporate Governance Theories Relevant to Blockchain Adoption

5.3.3. Blockchain Impact and Value Creation

5.3.4. Stakeholders

5.3.5. Market Mechanisms

5.3.6. Blockchain Governance

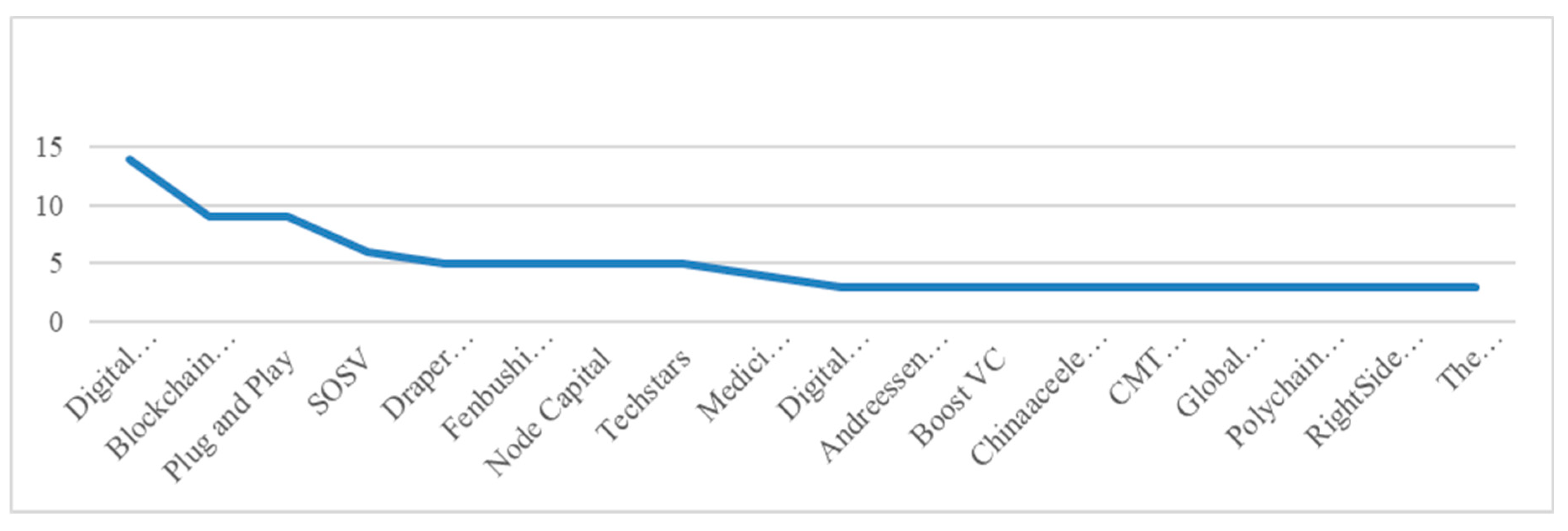

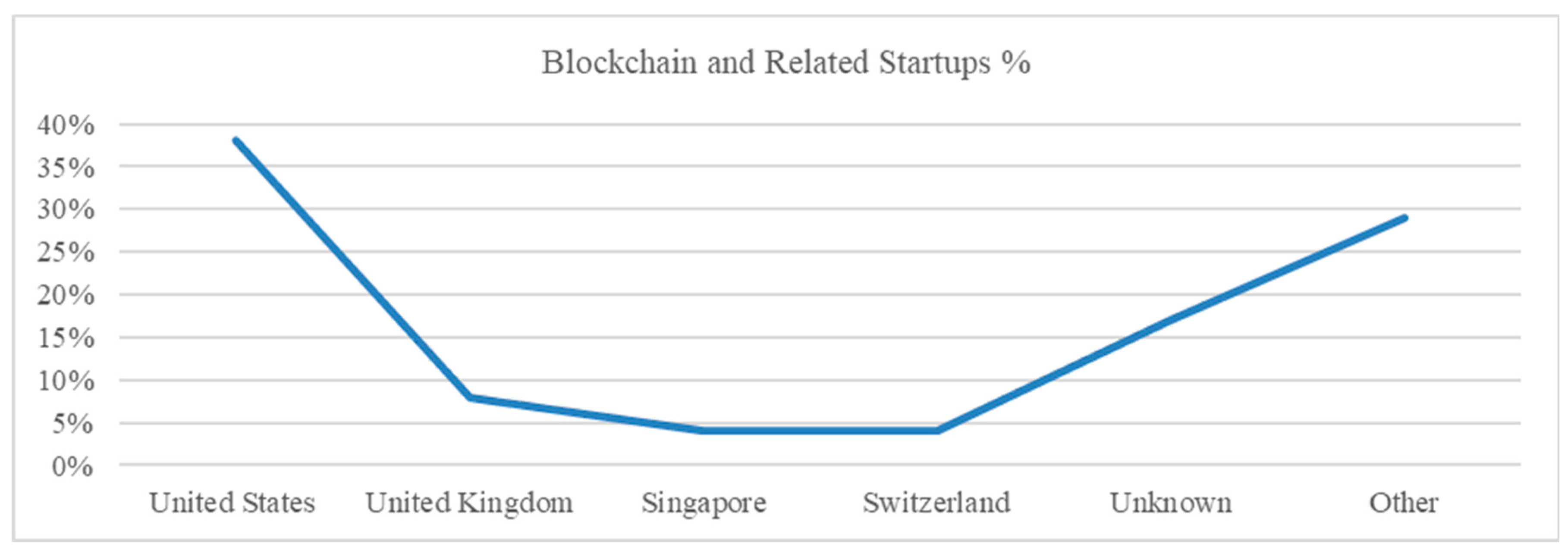

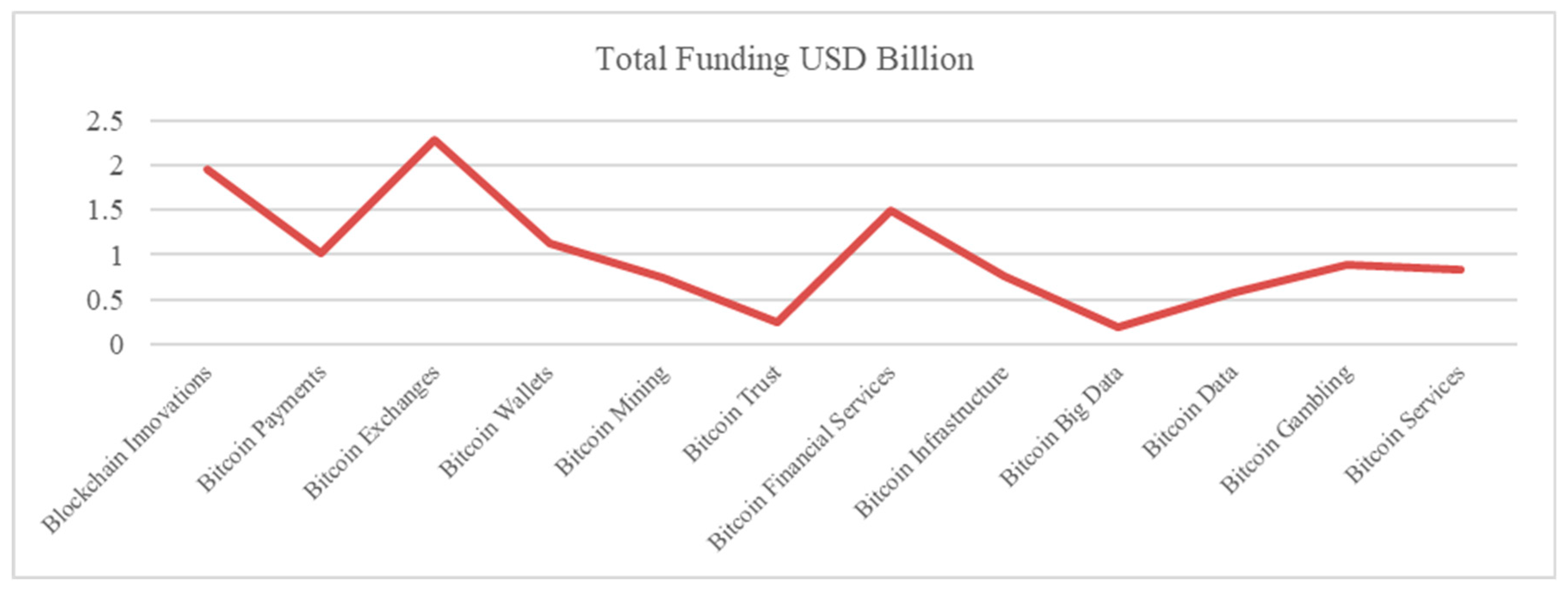

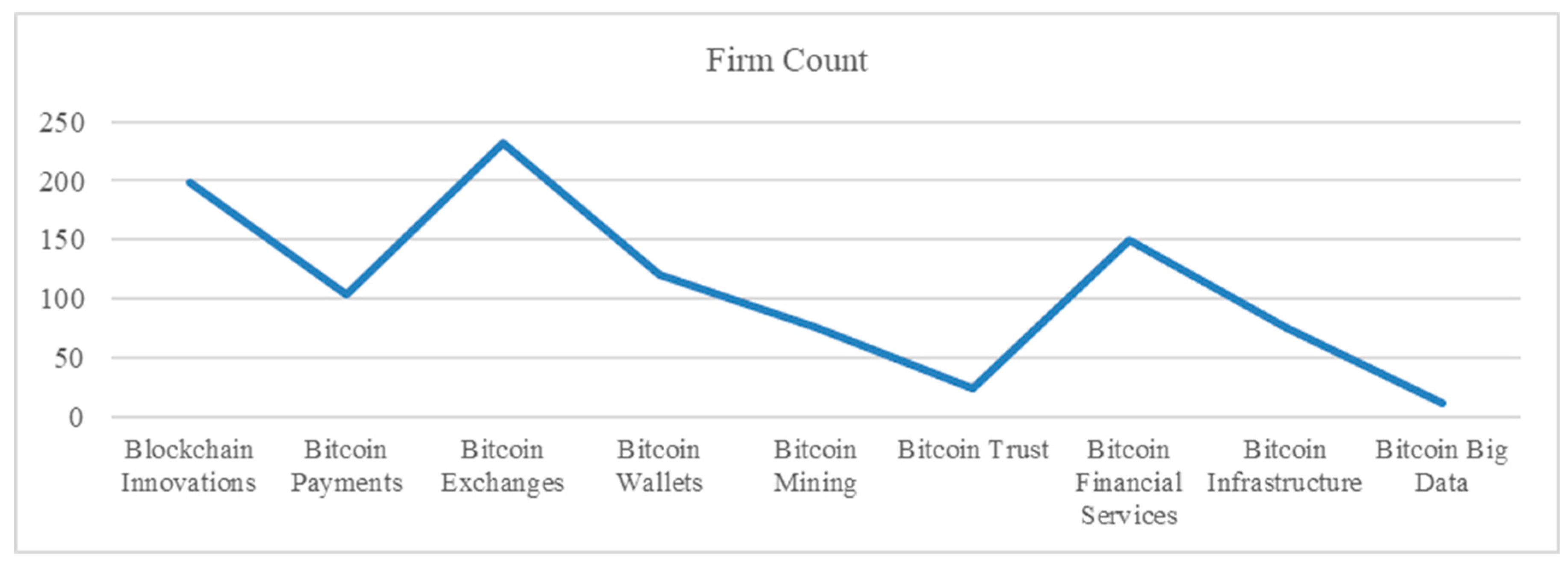

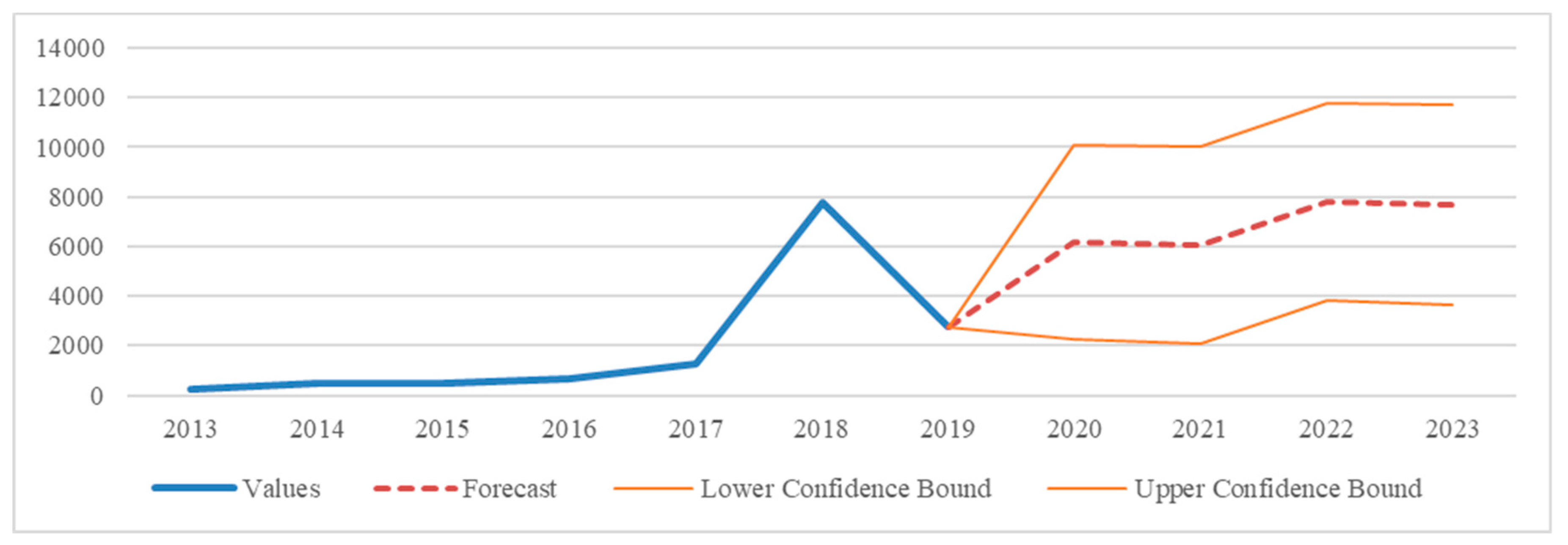

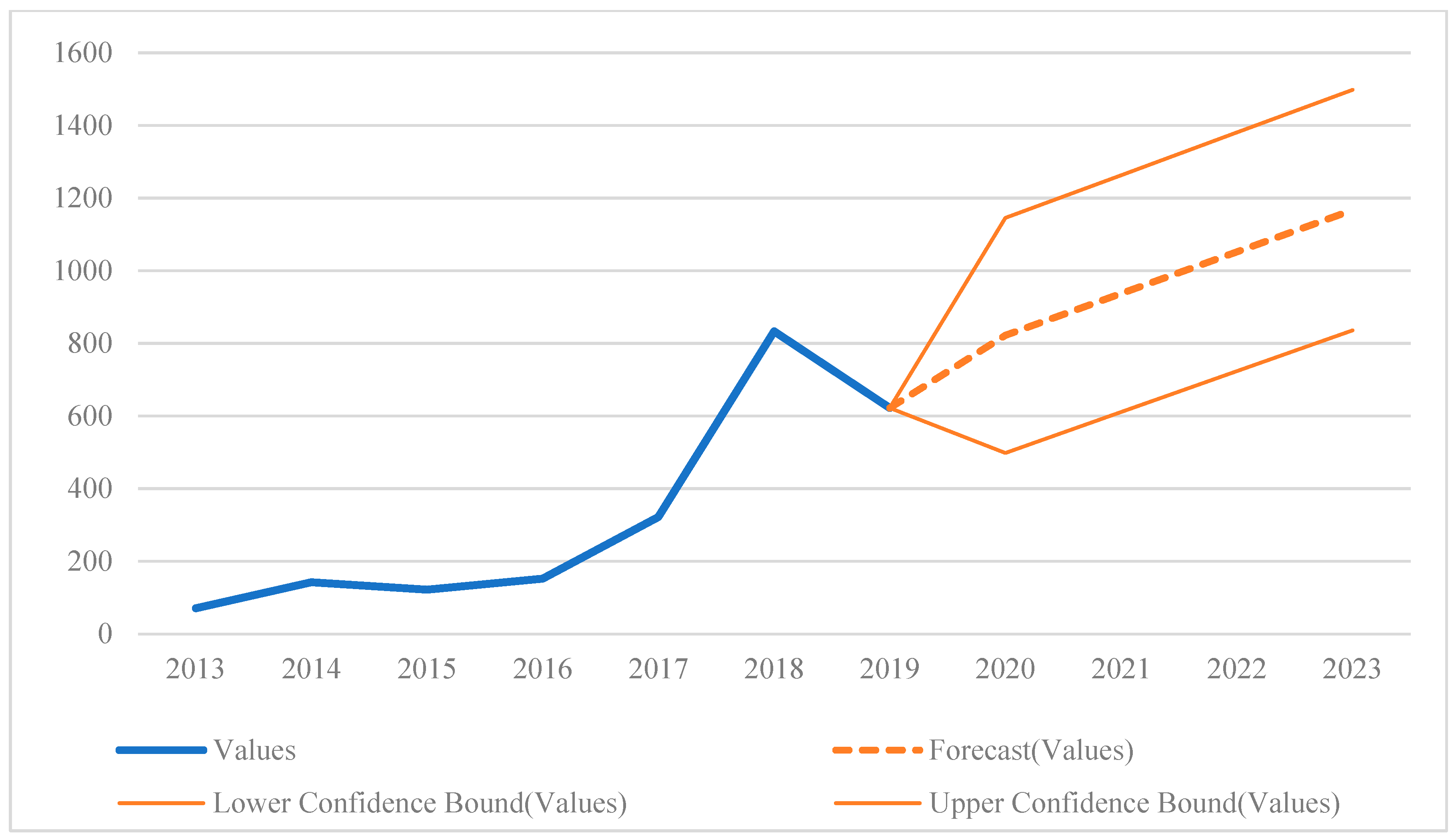

5.4. Empirical Analysis

6. Blockchain Adoption in Corporate Governance

6.1. Firm Share Tokenization

6.2. Corporate Elections

6.3. Empty Voting

6.4. Reg Tech and Corporate Governance

7. Blockchain Governance and Ethical Aspects

Ethical Aspects of Blockchain

8. Blockchain Adoption and Corporate Governance during the COVID-19 Crisis

9. Limitations of Our Study

10. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

References

- Abadi, Joseph, and Markus Brunnermeier. 2018. Blockchain Economics (No. w25407). National Bureau of Economic Research. Available online: https://www.nber.org/papers/w25407 (accessed on 1 June 2020).

- Abramowicz, Michael. 2016. Cryptocurrency-Based Law. Arizona Law Review 58: 359–420. Available online: http://arizonalawreview.org/cryptocurrency-based-law/ (accessed on 1 June 2020).

- Accenture. 2017. Banking on Blockchain. In A Value Analysis for Investment Banks. Dublin: Accenture. [Google Scholar]

- Adhami, Saman, Giancarlo Giudici, and Stefano Martinazzi. 2018. Why do Businesses Go Crypto? An Empirical Analysis of Initial Coin Offerings. Journal of Economics and Business 100: 64–75. [Google Scholar] [CrossRef]

- Admati, Anat R., and Paul Pfleiderer. 2009. The ‘Wall Street Walk’ and Shareholder Activism: Exit as a Form of Voice. The Review of Financial Studies 22: 2645–85. [Google Scholar] [CrossRef]

- Aggarwal, Reena, and Peer Stein. 2016. The Complex Regulatory Landscape for FinTech: An Uncertain Future for Small and Medium-Sized Enterprise Lending. Cologny: World Economic Forum. [Google Scholar]

- Aguilera, R Ruth V., and Alvaro Cuervo-Cazurra. 2009. Codes of Good Governance. Corporate Governance: An International Review 17: 376–87. [Google Scholar] [CrossRef]

- Ahlering, Beth, and Simon Deakin. 2007. Labour Regulation, Corporate Governance and Legal Origin: A Case of Institutional Complementarity? Law & Society Review 41: 865–908. [Google Scholar]

- Allan, Gareth, and Yuki Hagiwara. 2018. Bitcoin Futures Get Cold Shoulder From Japanese Regulator. New York: Bloomberg. Available online: https://www.bloomberg.com/news/articles/2018-01-24/bitcoin-futures-get-cold-shoulder-from-japan-financial-regulator (accessed on 1 June 2020).

- Amsden, Ryan, and Denis Schweizer. 2018. Are Blockchain Crowdsales the New “Gold Rush”? Success Determinants of Initial Coin Offerings. Proceedings of the Decentralized Identity Foundation Conference, Chiemsee, Germany, May 16. [Google Scholar] [CrossRef]

- An, Jiafu, Tinghua Duan, Wenxuan Hou, and Xinyu Xu. 2019. Initial Coin Offerings and Entrepreneurial Finance: The Role of Founders’ Characteristics. The Journal of Alternative Investments 21: 26–40. [Google Scholar] [CrossRef]

- Ante, Lennart, Sandner G. Philip, and Ingo Fiedler. 2018. Blockchain-based ICOs: Pure Hype or the Dawn of a New Era of Startup Financing? Journal of Risk and Financial Management 11: 80. [Google Scholar] [CrossRef]

- Aoyagi, Jun, and Daisuke Adachi. 2018. Economic Implications of Blockchain Platforms. arXiv arXiv:1802.10117. [Google Scholar]

- Arner, Douglas W., Janos Nathan Barberis, and Ross P. Buckley. 2017. FinTech, RegTech and the Re-Conceptualization of Financial Regulation. Northwestern Journal of International Law and Business 37: 371–413. [Google Scholar]

- Asharaf, S., and S. Adarsh. 2017. Decentralized Computing Using Blockchain Technologies and Smart Contracts: Emerging Research and Opportunities. Hershey Pennsylvania: IGI Global. [Google Scholar]

- Atzei, Nicola, Massimo Bartoletti, and Tiziana Cimoli. 2017. A Survey of Attacks on Ethereum Smart Contracts (SoK). Proceedings of the International Conference on Principles of Security and Trust, Uppsala, Sweden, April 22–29; pp. 164–86. [Google Scholar] [CrossRef]

- Atzori, Marcella. 2015. Blockchain Technology and Decentralized Governance: Is the State Still Necessary? Available online: https://doi.org/10.2139/ssrn.2709713 (accessed on 1 June 2020).

- Babich, Volodymyr, and Gilles Hilary. 2019. Distributed Ledgers and Operations: What Operations Management Researchers Should Know About Blockchain Technology. Manufacturing & Service Operations Management 22: 223–428. [Google Scholar] [CrossRef]

- Badertscher, Christian, Ueli Maurer, Daniel Tschudi, and Vassilis Zikas. 2017. Bitcoin as a Transaction Ledger: A Composable Treatment. Proceedings of the Annual International Cryptology Conference, Santa Barbara, CA, USA, August 20–24; Cham: Springer, pp. 324–56. [Google Scholar] [CrossRef]

- Bagby, John W., David Reitter, and Philip Chwistek. 2018. An Emerging Political Economy of the Blockchain: Enhancing Regulatory Opportunities. Available online: https://ssrn.com/abstract=3299598 (accessed on 1 June 2020).

- Bakos, Yannis, and Hanna Halaburda. 2018. The Role of Cryptographic Tokens and ICOs in Fostering Platform Adoption. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3207777 (accessed on 1 June 2020).

- Barber, Simon, Xavier Boyen, Elaine Shi, and Ersin Uzun. 2012. Bitter to Betterhow to Make Bitcoin a Better Currency. Financial Cryptography and Data Security. Berlin/Heidelberg: Springer, pp. 399–414. [Google Scholar]

- Barefoot, Jo Ann S. 2015. Disrupting Fintech Law. Fintech Law Reporter 18: 1–18. [Google Scholar]

- Barsan, Iris M. 2017. Legal Challenges of Initial Coin Offerings (ICO). Paris: Revue Trimestrielle de Droit Financier (RTDF), pp. 5–65. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3064397 (accessed on 1 June 2020).

- Bebchuk, Lucian A., and Robert J. Jackson, Jr. 2012. The Law and Economics of Blockholder Disclosure. Harvard Business Law Review 2: 39–60. [Google Scholar] [CrossRef][Green Version]

- Beck, Roman, Michel Avital, Matti Rossi, and Jason Bennett Thatcher. 2017. Blockchain Technology in Business and Information Systems Research. Business and Information Systems Engineering 59: 381384. [Google Scholar] [CrossRef]

- Beck, Roman, Christoph Mueller-Bloch, and John Leslie King. 2018. Governance in the Blockchain Economy: A Framework and Research Agenda. Journal of the Association for Information Systems 19: 1020–34. [Google Scholar] [CrossRef]

- Benedetti, Hugo, and Leonard Kostovetsky. 2018. Digital Tulips? Returns to Investors in Initial Coin Offerings. Returns to Investors in Initial Coin Offerings. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3182169 (accessed on 1 June 2020).

- Blaseg, Daniel. 2018. Dynamics of Voluntary Disclosure in the Unregulated Market for Initial Coin Offerings. Available online: https://ssrn.com/abstract=3207641 (accessed on 1 June 2020).

- Böhme, Rainer, Nicolas Christin, Benjamin Edelman, and Tyler Moore. 2015. Bitcoin: Economics, Technology, and Governance. Journal of Economic Perspectives 29: 213–38. [Google Scholar] [CrossRef]

- Boucher, Philip Nicholas. 2016. What If Blockchain Technology Revolutionized Voting? Luxembourg: European Parliament. [Google Scholar]

- Bourveau, Thomas, Emmanuel T. De George, Atif Ellahie, and Daniele Macciocchi. 2019. Information Intermediaries in the Crypto-Token Market. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3193392 (accessed on 1 June 2020).

- Braggion, Fabio, Alberto Manconi, and Haikun Zhu. 2020. Can Technology Undermine Macroprudential Regulation? Evidence from Online Marketplace Credit in China. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2957411 (accessed on 1 June 2020). [CrossRef]

- Brainard, Lael. 2016. Distributed Ledger Technology: Implications for Payments, Clearing, and Settlement. International Institute of Finance Annual Meeting, Washington, DC, October 7, vol. 7. Available online: https://www.federalreserve.gov/newsevents/speech/brainard20161007a.pdf (accessed on 1 June 2020).

- Bray, Alon, and Richmond D. Mathews. 2011. Empty Voting and the Efficiency of Corporate Governance. Journal of Financial Economics 99: 289–307. [Google Scholar]

- Brenig, Christian, Rafael Accorsi, and Günter Müller. 2015. Economic Analysis of Cryptocurrency Backed Money Laundering. Proceedings of the ECIS, Münster, Germany, May 26–29. [Google Scholar]

- Briner, Rob B., and David Denyer. 2012. Systematic Review and Evidence Synthesis as a Practice and Scholarship Tool. In The Oxford Handbook of Evidence-Based Management. Oxford: Oxford University Press, pp. 112–29. [Google Scholar]

- Briner, Rob B., David Denyer, and Denise M Rousseau. 2009. Evidence Based Management: Concept Cleanup Time? The Academy of Management Perspectives 23: 19–32. [Google Scholar] [CrossRef]

- Brochet, F. 2010. Information Content of Insider Trades Before and After the Sarbanes-Oxley Act. The Accounting Review 85: 419–46. [Google Scholar] [CrossRef]

- Brummer, Chris. 2015. Disruptive Technology and Securities Regulation. Fordham Law Review 84: 977–1051. [Google Scholar] [CrossRef]

- Butenko, Anna, and Pierre Larouche. 2015. Regulation for Innovativeness or Regulation of Innovation? Law, Innovation and Technology 7: 52–82. [Google Scholar] [CrossRef]

- Buterin, Vitalik. 2014. Ethereum White Paper. Available online: http://www.the-blockchain.com/docs/Ethereum_white_paper-a_next_generation_smart_contract_and_decentralized_application_platform-vitalik-buterin.pdf (accessed on 1 June 2020).

- Cadbury. 1992. Shared Vision and Beyond. Available online: http://wwwdata.unibg.it/dati/corsi/900002/79548-Beyond%20Cadbury%20Report%20Napier%20paper.pdf (accessed on 1 June 2020).

- Carvalho, Arthur. 2020. A Permissioned Blockchain-Based Implementation of lMSR Prediction Markets. Decision Support Systems 130: 113228. [Google Scholar] [CrossRef]

- Catalini, Christian, and Joshua S. Gans. 2016. Some Simple Economics of the Blockchain (No. w22952). Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Catalini, Christopher, and Joshua S. Gans. 2018. Initial Coin Offerings and the Value of Crypto Tokens (No. w24418). Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Chemla, Gilles, and Katrin Tinn. 2017. Learning through Crowdfunding. Management Science 66: 1783–1801. [Google Scholar] [CrossRef]

- Chen, Yan. 2018. Blockchain Tokens and the Potential Democratization of Entrepreneurship and Innovation. Business Horizons 61: 567–75. [Google Scholar] [CrossRef]

- Chen, Mark A., Qinxi Wu, and Baozhong Yang. 2019. How Valuable Is FinTech Innovation? Review of Financial Studies 32: 2062–106. [Google Scholar] [CrossRef]

- Chiu, Iris H.-Y., and Edward Greene. 2018. Can ICO Markets Offer Insights into Marketizing Sustainable or Social Finance? Proposals for a Revolutionary Regulatory Framework. Available online: https://papers.ssrn.com/abstract_id=3290762 (accessed on 1 June 2020).

- Chod, Jiri, and Evgeny Lyandres. 2018. A Theory of ICOs: Diversification, Agency, and Information Asymmetry. Available online: https://ssrn.com/abstract=3159528 (accessed on 1 June 2020).

- Chohan, Usman W. 2017. Initial Coin Offerings (ICOs): Risks, Regulation, and Accountability. Discussion Paper Series: Notes on the 21st Century. Available online: https://ssrn.com/abstract=3080098 (accessed on 1 June 2020).

- Christensen, Clayton M., Michael E. Raynor, and Rory McDonald. 2015. What Is Disruptive Innovation? Harvard Business Review 93: 44–53. [Google Scholar]

- Christoffersen, Susan E. K., Christopher C. Geczy, David K. Musto, and Adam V. Reed. 2007. Vote Trading and Information Aggregation. Journal of Finance 62: 2897–927. [Google Scholar] [CrossRef]

- Clements, Ryan. 2018. Assessing the Evolution of Cryptocurrency: Demand Factors, Latent Value, and Regulatory Developments. Michigan Business & Entrepreneurial Law Review 8: 73–97. [Google Scholar]

- Coase, Ronald H. 1937. The Nature of the Firm. Economica 4: 386–405. [Google Scholar] [CrossRef]

- Cocco, Luisanna, Andrea Pinna, and Michele Marchesi. 2017. Banking on Blockchain: Costs Savings Thanks to the Blockchain Technology. Future Internet 9: 25. [Google Scholar] [CrossRef]

- Cohen, Lewis Rinaudo, Lee Samuelson, and Hali Katz. 2017. How Securitization can Benefit from Blockchain Technology. The Journal of Structured Finance 23: 51–54. [Google Scholar] [CrossRef]

- Collomb, Alexis, Primavera De Filippi, and Klara Sok. 2018. From IPOs to ICOs: The Impact of Blockchain Technology on Financial Regulation. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3185347 (accessed on 1 June 2020).

- Cong, Lin William, and Zhiguo He. 2019. Blockchain Disruption and Smart Contracts. The Review of Financial Studies 32: 1754–97. [Google Scholar] [CrossRef]

- Cong, Lin. William, Ye Li, and Neng Wang. 2020. Tokenomics: Dynamic Adoption and Valuation Columbia Business School Research Paper No. 18-46. Available online: https://papers.ssrn.com/abstract=3222802 (accessed on 1 June 2020).

- Conley, John. P. 2017. Blockchain and the Economics of Cryptotokens and Initial Coin Offerings. Vanderbilt University Department of Economics No. 17-00008. Nashville: Vanderbilt University Department of Economics. Available online: https://ideas.repec.org/p/van/wpaper/vuecon-sub-17-00007.html (accessed on 1 June 2020).

- Cortez, Nathan. 2014. Regulating Disruptive Innovation. Berkeley Technology Law Journal 29: 175–228. [Google Scholar] [CrossRef]

- Da Rin, Marco, and María Fabiana Penas. 2017. Venture Capital and innovation strategies. Industrial and Corporate Change 26: 781–800. [Google Scholar] [CrossRef][Green Version]

- Dapp, Thomas F. 2014. Fintech—The Digital (r)Evolution in the Financial Sector. Frankfurt: Deutsche Bank Research. [Google Scholar]

- Davidson, Sinclair, Primavera De Filippi, and Jason Potts. 2016. Economics of Blockchain. [Google Scholar] [CrossRef]

- Davis, Gerald F., and Tracy A. Thompson. 1994. A Social Movement Perspective on Corporate Control. Administrative Science Quarterly 39: 141–73. [Google Scholar] [CrossRef]

- Davis, James H., F. David Schoorman, and Lex Donaldson. 1997. Toward a Stewardship Theory of Management. The Academy of Management Review 22: 20–47. [Google Scholar] [CrossRef]

- Filippi, Primavera, and Samer Hassan. 2016. Blockchain Technology as a Regulatory Technology: From Code is Law to Law is Code. arXiv arXiv:1801.02507. [Google Scholar] [CrossRef]

- De Filippi, Pilippi, and Aarron Wright. 2018. Blockchain and the Law: The Rule of Code. Cambridge, Massachusetts: Harvard University Press. [Google Scholar]

- De Lis, Santiago Fernández. 2016. RegTech, the New Magic Word in FinTech, Banking Outlook. Madrid: Madrid. [Google Scholar]

- de Reuver, Mark, Carsten Sørensen, and Rahul C. Basole. 2018. The Digital Platform: A Research Agenda. Journal of Information Technology 33: 1–12. [Google Scholar] [CrossRef]

- Dean, Tobia, D. Dulani Jayasuriya, and Alastair Marsden. 2019. Predictability of ICO Success and Returns. Available online: https://www.arx.cfa/-/media/regional/arx/post-pdf/2019/11/19/predictability-of-ico-success-and-returns.ashx? (accessed on 1 June 2020).

- Deer, Luke, Jackson Mi, and Yu Yuxin. 2015. The Rise of Peer-To-Peer Lending in China: An Overview and Survey Case Study. London: Association of Chartered Certified Accountants. [Google Scholar]

- Deloitte. 2016. Over the Horizon. Blockchain and the Future of Financial Infrastructure. Available online: https://www2.deloitte.com/content/dam/Deloitte/nl/Documents/financial-services/deloitte-nl-fsi-blockchain-and-the-future-of-financial-infrastructure.pdf (accessed on 1 June 2020).

- Deng, Xin, Yen Teik Lee, and Zhengting Zhong. 2018. Decrypting Coin Winners: Disclosure Quality, Governance Mechanism, and Team Networks. Governance Mechanism and Team Networks. Available online: https://ssrn.com/abstract=3247741 (accessed on 1 June 2020).

- Dierksmeier, Claus, and Peter Seele. 2018. Cryptocurrencies and Business Ethics. Journal of Business Ethics 152: 1–14. [Google Scholar] [CrossRef]

- Drobetz, Wolfgang, Paul P. Momtaz, and Henning Schröder. 2019. Investor Sentiment and Initial coin Offerings. The Journal of Alternative Investments 21: 41–55. [Google Scholar] [CrossRef]

- du Plessis, Jean Jacques, Anil Hargovan, and Mirko Bagaric. 2005. Principles of Contemporary Corporate Governance. Melbourne: Cambridge University Press. [Google Scholar] [CrossRef][Green Version]

- DuPont, Quinn. 2017. Experiments in Algorithmic Governance: A history and Ethnography of “The DAO,” A Failed Decentralized Autonomous Organization. In Bitcoin and Beyond. Abingdon: Routledge, pp. 157–75. [Google Scholar]

- Easley, David, Maureen O’Hara, and Soumya Basu. 2017. From Mining to Markets: The Evolution of Bitcoin Transaction Fees. Journal of Financial Economics 134: 91–109. [Google Scholar] [CrossRef]

- Edmans, Alex. 2014. Blockholders and Corporate Governance. Annual Review of Financial Economics 6: 23–50. [Google Scholar] [CrossRef]

- Edmans, Alex, Doron Levit, and Devin Reilly. 2016. Governing Multiple Firms. London: London Business School. [Google Scholar]

- Evans, David S. 2014. Economic Aspects of Bitcoin and Other Decentralized Public-Ledger Currency Platforms. Available online: https://ssrn.com/abstract=2424516 (accessed on 1 June 2020).

- Eyal, Ittay, and Emin Gün Sirer. 2018. Majority is not Enough: Bitcoin Mining is Vulnerable. Communications of the ACM 61: 95–102. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Michael C. Jensen. 1983. Separation of Ownership and Control. The Journal of Law and Economics 26: 301–25. [Google Scholar] [CrossRef]

- Fanning, Kurt, and David P. Centers. 2016. Blockchain and its Coming Impact on Financial Services. Journal of Corporate Accounting Finance 27: 53–57. [Google Scholar] [CrossRef]

- Felix, T. H., and H. von Eije. 2019. Underpricing in the Cryptocurrency World: Evidence from Initial Coin Offerings. Managerial Finance 45: 563–78. [Google Scholar] [CrossRef]

- Feng, Chen, Nan Li, M. H. Franco Wong, and Mingyue Zhang. 2018. Initial Coin Offerings, Blockchain Technology, and Voluntary Disclosures. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3256289 (accessed on 1 June 2020).

- Fenwick, Mark, Wulf A. Kaal, and Erik P. M. Vermeulen. 2018. Regulation Tomorrow: What Happens When Technology Is Faster Than the Law? Lex Research Topics in Corporate Law & Economics. Available online: https://papers.ssrn.com/abstract_id=2834531 (accessed on 1 June 2020).

- Fichman, Robert. Brian L. Dos Santos, and Zhiqiang (Eric) Zheng. 2014. Digital Innovation as a Fundamental and Powerful Concept in the Information Systems Curriculum. Management Information Systems Quarterly 38: 329–43. [Google Scholar] [CrossRef]

- Fisch, Christian. 2018. Initial Coin Offerings (ICOs) to Finance New Ventures: An Exploratory Study. Journal of Business Venturing 34: 1–22. [Google Scholar] [CrossRef]

- Foley, Sean, Jonathan R. Karlsen, and Tālia J. Putniņš. 2019. Sex, Drugs, and Bitcoin: How Much Illegal Activity is Financed through Cryptocurrencies? The Review of Financial Studies 32: 1798–853. [Google Scholar] [CrossRef]

- Frame, W Scott, and Lawrence J. White. 2014b. Technological Change, Financial Innovation, and Diffusion in Banking. In The Oxford Handbook of Banking, 2nd ed. Oxford: Oxford University Press. [Google Scholar]

- Goldstein, Itay, Wei Jiang, and G. Andrew Karolyi. 2019. To FinTech and Beyond. The Review of Financial Studies 32: 1647–61. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current research and Future Research Directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Governatori, Guido, Florian Idelberger, Zoran Milosevic, Regis Riveret, Giovanni Sartor, and Xiwei Xu. 2018. On Legal Contracts, Imperative and Declarative Smart Contracts, and Blockchain Systems. Artificial Intelligence and Law 26: 377–409. [Google Scholar] [CrossRef]

- Graglia, J. Michael, and Christopher Mellon. 2018. Blockchain and Property in 2018: At the End of the Beginning. Innovations: Technology, Governance, Globalization 12: 90–116. [Google Scholar] [CrossRef]

- Grossman, Sanford J., and Oliver D. Hart. 1980. Takeover Bids, the Free Rider Problem, and the Theory of the Corporation. Bell Journal of Economics 11: 42–64. [Google Scholar] [CrossRef]

- Hardy, Robert Augustus, and Julia R. Norgaard. 2016. Reputation in the Internet Black Market: An Empirical and Theoretical Analysis of the Deep Web. Journal of Institutional Economics 12: 515–39. [Google Scholar] [CrossRef]

- Harwick, Cameron. 2016. Cryptocurrency and the Problem of Intermediation. The Independent Review 20: 569–88. [Google Scholar]

- Hileman, Garrick, and Michel Rauchs. 2017. Global Blockchain Benchmarking Study. Cambridge: Cambridge Centre for Alternative Finance. [Google Scholar]

- Hillman, Amy J., Albert A. Cannella, and Romona L. Paetzold. 2000. The Resource Dependence Role of Corporate Directors: Strategic Adaptation of Board Composition in Response to Environmental Change. Journal of Management Studies 37: 235–56. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Thomas Dalziel. 2003. Boards of Directors and Firm Performance: Integrating Agency and Resource Dependence Perspectives. Academy of Management Review 28: 383–96. [Google Scholar] [CrossRef]

- Holden, Windor, and James Moar. 2017. Blockchain Enterprise Survey: Deployments, Benefits & Attitudes. Hampshire: Juniper Research. [Google Scholar]

- Houy, Nicolas. 2014. The Economics of Bitcoin Transaction Fees. Available online: https://papers.ssrn.com/abstract_id=2400519 (accessed on 1 June 2020).

- Hong, Harrison, Terence Lim, and Jeremy C. Stein. 2000. Bad News Travels Slowly: Size, Analyst Coverage, and the Profitability of Momentum Strategies. Journal of Finance 55: 265–95. [Google Scholar] [CrossRef]

- Howell, Sabrina T., Marina Niessner, and David Yermack. 2018. Initial Coin Offerings: Financing Growth with Cryptocurrency Token Sales (No. w24774). Cambridge: National Bureau of Economic Research. Available online: https://www.nber.org/papers/w24774 (accessed on 1 June 2020).

- Hsieh, Ying-Ying, Jean-Philippe Vergne, and Sha Wang. 2017. The Internal and External Governance of Blockchain-Based Organizations: Evidence from Cryptocurrencies. In Bitcoin and Beyond. Abingdon: Routledge, pp. 48–68. [Google Scholar]

- Hu, Henry T. C., and Bernard S Black. 2006. The New Vote Buying: Empty Voting and Hidden (Morphable) Ownership. Southern California Law Review 79: 811–908. [Google Scholar]

- Hughes, Sarah Jane, and Stephen T. Middlebrook. 2015. Advancing a Framework for Regulating Cryptocurrency Payments Intermediaries. Yale Journal on Regulation 32: 495–559. [Google Scholar]

- Humphries, Chris A, and James Smith. 2018. Cayman Islands: Initial Coin Offerings (ICO) In The Cayman Islands. London: Modaq. Available online: http://www.mondaq.com/caymanislands/commoditiesderivativesstock-exchanges/667952/initial-coin-offerings-ico-in-the-cayman-islands (accessed on 1 June 2020).

- Infoholic Research. 2018. Global Regulatory Technology (RegTech) Market: Drivers, Restraints, Opportunities, Trends, and Forecast up to 2023. Bengaluru: Infoholic Resarch LLP. Available online: https://www.researchandmarkets.com/reports/4614548/global-regulatory-technology-regtech-market#pos-0 (accessed on 1 June 2020).

- Jayasuriya, D. Dulani, and Alexandra Sims. 2019. From the Abacus to Enterprise Resource Planning: Is Blockchain the Next Big Accounting Technology? Unpublished Working Paper. [Google Scholar]

- Jensen, Michael C. 1993. The Modern Industrial Revolution, Exit, and the Failure of Internal Control Systems. The Journal of Finance 48: 831–80. [Google Scholar] [CrossRef]

- Kaal, Wulf A. 2016. Dynamic Regulation for Innovation, Perspectives in Law, Business & Innovation. U of St. Thomas (Minnesota) Legal Studies Research Paper No. 16-22. New York: Springer. [Google Scholar]

- Kaal, Wulf A., and M. Dell’Erba. 2017. Initial Coin Offerings: Emerging Practices, Risk Factors, and Red Flags. Available online: https://papers.ssrn.com/abstract_id=3067615 (accessed on 1 June 2020).

- Kaal, Wulf A., and Erik P. M. Vermeulen. 2017. How to Regulate Disruptive Innovation—From Facts to Data. Jurimetrics 57: 169–209. [Google Scholar] [CrossRef][Green Version]

- Kahan, Marcel, and Edward B. Rock. 2008. The Hanging Chads of Corporate Voting. Georgetown Law Journal 96: 1227–81. [Google Scholar]

- Kanzler, Viktor. 2015. How Do Fintech Startups and a Changing Consumer Behaviour Reshape the Financial Services Industry? Bachelor’s thesis, Frankfurt School of Finance and Management, Frankfurt am Main, Germany. [Google Scholar]

- Kim, T. 2017. On the transaction cost of bitcoin. Finance Research Letters 23: 300–5. [Google Scholar] [CrossRef]

- Kim, Seoyoung, Atulya Sarin, and Daljeet Virdi. 2018. Crypto-Assets Unencrypted. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3117859 (accessed on 1 June 2020).

- Lee, Larissa. 2016. New Kids on the Blockchain: How Bitcoin’s Technology Could Reinvent the Stock Market. Hastings Business Law Journal 12: 81–132. [Google Scholar] [CrossRef]

- Lee, Jeongmin, and Christine A. Parlour. 2019. Consumers as Financiers: Crowdfunding, Initial Coin Offerings and Consumer Surplus. Working Paper. Available online: https://papers.ssrn.com/abstract_id=3300297 (accessed on 1 June 2020).

- Li, Jiasun, and William Mann. 2018. Initial Coin Offering and Platform Building. Available online: https://papers.ssrn.com/abstract_id=3088726 (accessed on 1 June 2020).

- Listokin, Yair. 2008. Management Always Wins the Close Ones. American Law and Economics Review 10: 159–84. [Google Scholar] [CrossRef]

- Liu, Chen, and Haoquan Wang. 2019a. Crypto Tokens and Token Offerings: An Introduction. In Cryptofinance and Mechanism of Exchange: The Making of Virtual Currency. Edited by Stéphane Goutte, Khaled Guesmi and Samir Saadi. Boston: Springer. [Google Scholar]

- Liu, Chen, and Haoquan Wang. 2019b. Initial Coin offerings (ICOs): What do we Know and What are the Success Factors? In Cryptofinance and Mechanism of Exchange: The Making of Virtual Currency. Edited by Stéphane Goutte, Khaled Guesmi and Samir Saadi. Boston: Springer. [Google Scholar]

- Luther, William J. 2016. Cryptocurrencies, Network Effects, and Switching Costs. Contemporary Economic Policy 34: 553–71. [Google Scholar] [CrossRef]

- Lyandres, Evengy, Berardino Palazzo, and Daniel Rabetti. 2019. Do Tokens Behave Like Securities: An Anatomy of Initial Coin Offerings. Available online: https://papers.ssrn.com/abstract_id=3287583 (accessed on 1 June 2020).

- Malinova, Katya, and Andreas Park. 2017. Market Design for Trading with Blockchain Technology. Available online: https://papers.ssrn.com/abstract_id=2785626 (accessed on 1 June 2020).

- Mathew, Susan, and Anna Irrera. 2017. Australia’s ASX Selects Blockchain to Cut Costs. Toronto: Reuters. [Google Scholar]

- McWaters, Jesse, Rob Galaski, and Soumak Chatterjee. 2016. The Future of Financial Infrastructure: An Ambitious Look at How Blockchain Can Reshape Financial Services. Cologny: World Economic Forum. [Google Scholar]

- Mik, Eliza. 2017. Smart Contracts: Terminology, Technical Limitations and Real World Complexity. Law, Innovation and Technology 9: 269–300. [Google Scholar] [CrossRef]

- Mills, David, Kathy Wang, Brendan Malone, Anjan Ravi, Jeff Marquardt, Clinto Chen, Anton Badev, Timothy Brezinski, Linda Fahy, Kimberley Liao, and et al. 2016. Distributed Ledger Technology in Payments, Clearing, and Settlement; Finance and Economics Discussion Series 2016-095; Washinton: Federal Reserve Board of Governors. [CrossRef]

- Moher, David, Alessandro Liberati, Jennifer Tetzlaff, and Douglas G. Altman. 2009. Preferred Reporting Items for Systematic Reviews and Meta-analyses: The PRISMA statement. PLoS Medicine 6: e1000097. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2018. Initial Coin Offerings. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3166709 (accessed on 1 June 2020).

- Momtaz, Paul P. 2019a. Token Sales and Initial Coin Offerings: Introduction. The Journal of Alternative Investments 21: 7–12. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2019b. The Pricing and Performance of Cryptocurrency. The European Journal of Finance. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2019c. CEO Emotions and Underpricing in Initial Coin Offerings. Available online: https://papers.ssrn.com/abstract_id=3305765 (accessed on 1 June 2020).

- Momtaz, Paul P. 2020a. Initial Coin Offerings, Asymmetric Information, and Loyal CEOs. Small Business Economics. [Google Scholar] [CrossRef]

- Momtaz, Paul P. 2020b. Entrepreneurial Finance and Moral Hazard: Evidence from Token Offerings. Journal of Business Venturing. [Google Scholar] [CrossRef]

- Monks, Robert A. G., and Nell Minow. 1995. Corporate Governance. Cambridge: Basil Blackwell. [Google Scholar]

- Nabilou, Hossein, and André Prum. 2019. Ignorance, Debt and Cryptocurrencies: The Old and the New in the Law and Economics of Concurrent Currencies. Journal of Financial Regulation 5: 29–63. [Google Scholar] [CrossRef]

- Nakamoto, Satoshi. 2008. Bitcoin: A Peer-To-Peer Electronic Cash System. Available online: https://bitcoin.org/bitcoin.pdf (accessed on 1 June 2020).

- Nowiński, Witold, and Miklós Kozma. 2017. How can Blockchain Technology Disrupt the Existing Business Models? Entrepreneurial Business and Economics Review 5: 173–88. [Google Scholar] [CrossRef]

- Ofir, Moran, and Ido Sadeh. 2019. ICO vs IPO: Empirical Findings, Market Frictions and the Appropriate Regulatory Framework. International Journal of Organizational Leadership 7: 120–28. [Google Scholar]

- Paech, Philpp. 2017. The Governance of Blockchain Financial Networks. Modern Law Review 80: 1073–110. [Google Scholar] [CrossRef]

- Papadopoulos, Georgios. 2015. Blockchain and Digital Payments: An Institutionalist Analysis of Cryptocurrencies. In Handbook of Digital Currency. Edited by David Lee Kuo Chuen. London: Academic Press, pp. 153–72. [Google Scholar]

- Philippon, Thomas. 2016. The FinTech Opportunity. NBER Working Paper, No. 22476. Available online: https://www.nber.org/papers/w22476 (accessed on 1 June 2020).

- Piazza, Fiammetta S. 2017. Bitcoin and the Blockchain as Possible Corporate Governance Tools: Strengths and Weaknesses. Penn State Journal of Law & International Affairs 5: 262–301. [Google Scholar]

- Pilkington, Marc. 2018. The Emerging ICO Landscape-Some Financial and Regulatory Standpoints. Available online: https://ssrn.com/abstract=3120307 (accessed on 1 June 2020).

- Primm, Harold. 2016. Regulating the Blockchain Revolution: A Financial Industry Transformation. Review of Banking & Financial Law 36: 75–91. [Google Scholar]

- Proskurovska, Anetta, and Sabine Dörry. 2018. Is a Blockchain-Based Conveyance System the Next Step in the Financialisation of Housing? The Case of Sweden. Available online: https://papers.ssrn.com/bstract_id=3267138 (accessed on 1 June 2020).

- Rabah, Kefa V. O. 2017. Overview of Blockchain as the Engine of the 4th Industrial Revolution. Mara Research Journal of Business & Management 1: 125–35. [Google Scholar]

- Rhue, Lauren. 2018. Trust Is All You Need: An Empirical Exploration of Initial Coin Offerings (ICOs) and ICO Reputation Scores. Available online: https://papers.ssrn.com/abstract_id=3179723 (accessed on 1 June 2020).

- Robinson, Randolph II. 2017. The New Digital Wild West: Regulating the Explosion of Initial Coin Offerings. Available online: https://papers.ssrn.com/abstract_id=3087541 (accessed on 1 June 2020).

- Robinson, Randolph II. 2018. The New Digital Wild West: Regulating the Explosion of Initial Coin Offerings. Tennessee Law Review 85: 897–960. [Google Scholar] [CrossRef]

- Rohr, Jonathan, and Aaron Wright. 2017. Blockchain-Based Token Sales, Initial Coin Offerings, and the Democratization of Public Capital Markets. Available online: https://papers.ssrn.com/abstract_id=3048104 (accessed on 1 June 2020).

- Ron, Dorit, and Adi Shamir. 2013. Quantitative Analysis of the Full Bitcoin Transaction Graph. Berlin and Heidelberg: Springer, pp. 6–24. [Google Scholar]

- Rossow, Andew. 2018. Appraising the Luxury Goods Market with Blockchain Technology. Jersey City: Forbes. [Google Scholar]

- Schindler, John. 2017. FinTech and Financial Innovation: Drivers and Depth; Finance and Economics Discussion Series 2017-081; Washington: Board of Governors of the Federal Reserve System. [CrossRef]

- Schroeder, Jeanne L. 2015. Bitcoin and the Uniform Commercial Code. University of Miami Business Law Review 24: 1–80. [Google Scholar] [CrossRef][Green Version]

- Scott, Brett, John Loonam, and Vikas Kumar. 2017. Exploring the Rise of Blockchain Technology: Towards Distributed Collaborative Organizations. Strategic Change 26: 423–28. [Google Scholar] [CrossRef]

- Shermin, Voshmgir. 2017. Disrupting Governance with Blockchains and Smart contracts. Strategic Change 26: 499–509. [Google Scholar] [CrossRef]

- Sims, Alexandra, Kanchana Kariyawasam, and David Mayes. 2018. Regulating Cryptocurrencies in New Zealand. Wellington: The New Zealand Law Foundation. [Google Scholar]

- Sims, Alexandra. 2019. Blockchain and Decentralised Autonomous Organsiations (DAOs): The Evolution of Companies? New Zealand Universities Law Review 28: 423–458. [Google Scholar]

- Sisli-Ciamarra, Elif. 2012. Monitoring by Affiliated Bankers on Board of Directors: Evidence from Corporate Financing Outcomes. Financial Management 41: 665–702. [Google Scholar] [CrossRef]

- Sockin, Michael, and Wei Xiong. 2020. A Model of Cryptocurrencies. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3550965 (accessed on 1 June 2020).

- Suzuki, Shigeya, and Jun Murai. 2017. Blockchain as an Audit-Able Communication Channel. Proceedings of the 2017 IEEE 41st Annual Computer Software and Applications Conference (COMPSAC), Turin, Italy, July 4–8; pp. 516–22. [Google Scholar]

- Szabo, Nick. 1994. Smart Contracts. Available online: https://www.fon.hum.uva.nl/rob/Courses/InformationInSpeech/CDROM/Literature/LOTwinterschool2006/szabo.best.vwh.net/smart.contracts.html (accessed on 1 June 2020).

- Tama, Bayu Aadhi, Bruno Joachim Kweka, Youngho Park, and Kyung- Hyune Rhee. 2017. A Critical Review of Blockchain and its Current Applications. Proceedings of the 2017 International Conference on Electrical Engineering and Computer Science (ICECOS), Palembang, August 22–23; pp. 109–13. [Google Scholar]

- Tanaka, Kenji, Kosuke Nagakubo, and Rikiya Abe. 2017. Blockchain-Based Electricity Rrading with Digitalgrid Router. Proceedings of the 2017 IEEE International Conference on Consumer Electronics, Taipei, Taiwan, June 12–14; pp. 201–2. [Google Scholar]

- Tapscott, Don, and Alex Tapscott. 2017. How Blockchain will Change Organizations. MIT Sloan Management Review 58: 10–13. [Google Scholar]

- Tasca, Paolo. 2015. Digital Currencies: Principles, Trends, Opportunities, and Risks. Available online: https://ssrn.com/abstract=2657598 (accessed on 1 June 2020).

- Trimborn, Simon, Mingyang Li, and Wolfgang K. Härdle. 2018. Investing with Cryptocurrencies-a Liquidity Constrained Investment Approach. Available online: https://papers.ssrn.com/abstract_id=2999782 (accessed on 1 June 2020).

- Tsukerman, Misha. 2015. The Block is Hot: A Survey of the State of Bitcoin Regulation and Suggestions for the Future. Berkeley Technology Law Journal 30: 1127. [Google Scholar]

- Vranken, Harald P.E. 2017. Sustainability of Bitcoin and Blockchains. Current Opinion in Environmental Sustainability 38: 1–9. [Google Scholar] [CrossRef]

- Wang, Huaiqing, Kun Chen, and Dongming Xu. 2016. A Maturity Model for Blockchain Adoption. Financial Innovation 2: 12. [Google Scholar] [CrossRef]

- Wang, Sha, and Jean-Philippe Vergne. 2017. Buzz Factor or Innovation Potential: What Explains Cryptocurrencies’ Returns? PLoS ONE 12: e0169556. [Google Scholar] [CrossRef]

- White, Gareth R. T. 2017. Future Applications of Blockchain in Business and Management: A Delphi Study. Strategic Change 26: 439–51. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 1996. Economic Organization: The Case for Candor. The Academy of Management Review 21: 48–57. [Google Scholar] [CrossRef]

- Wright, Aaron, and Primavera De Filippi. 2015. Decentralized Blockchain Technology and the Rise of Lex Cryptographia. Available online: https://papers.ssrn.com/abstract_id=2580664 (accessed on 1 June 2020).

- Wu, Tong, and Xiubo Liang. 2017. Exploration and Practice of Inter-Bank Application Based on Blockchain. Proceedings of the ICCSE 2017 12th International Conference on Computer Science and Education, Houston, TX, USA, August 22–25; pp. 219–24. [Google Scholar]

- Yamada, Yuki, Tatsuo Nakajima, and Mizuki Sakamoto. 2016. Blockchain-LI: A Study on Implementing Activity-Based Micro-Pricing Using Cryptocurrency Technologies. Proceedings of the 14th International Conference on Advances in Mobile Computing and Multimedia, Singapore, November 28–30; pp. 203–7. [Google Scholar] [CrossRef]

- Yeoh, Peter. 2017. Regulatory Issues in Blockchain Technology. Journal of Financial Regulation and Compliance 25: 196–208. [Google Scholar] [CrossRef]

- Yermack, David. 2017. Corporate Governance and Blockchains. Review of Finance 21: 7–31. [Google Scholar] [CrossRef]

- Ying, Wenchi, Suling Jia, and Wenyu Du. 2018. Digital Enablement of Blockchain: Evidence from HNA group. International Journal of Information Management 39: 1–4. [Google Scholar] [CrossRef]

- Yli-Huumo, Jesse, Deokyoon Ko, Sujin Choi, Sooyong Park, and Kari Smolander. 2016. Where is Current Research on Blockchain Technology?—A Systematic Review. PLoS ONE 11: e0163477. [Google Scholar] [CrossRef]

- Yoo, Minjae, and Yoojae Won. 2018. Study on Smart Automated Sales System with Blockchain-Based Data Storage and Management. In Advances in Computer Science and Ubiquitous Computing. Singapore: Springer, vol. 474, pp. 734–40. [Google Scholar]

- Zalan, Tatiana. 2018. Born Global on Blockchain. Review of International Business and Strategy 28: 19–34. [Google Scholar] [CrossRef]

- Zavolokina, Liudmila, Mateusz Dolata, and Gerhard Schwabe. 2016. The FinTech Phenomenon: Antecedents of Financial Innovation Perceived by the Popular Press. Financial Innovation 2: 1–16. [Google Scholar] [CrossRef]

- Zetzsche, Dirk. A., Ross P. Buckley, Douglas W. Arner, and Janos Nathan Barberis. 2017. From FinTech to TechFin: The Regulatory Challenges of Data-Driven Finance. Available online: https://ssrn.com/abstract=2959925 (accessed on 1 June 2020).

- Zetzsche, Dirk. A., Ross P. Buckley, Douglas W. Arner, and L. Föhr. 2018. The ICO Gold Rush: It’s a Scam, It’s a Bubble, It’s a Super Challenge for Regulators. Harvard International Law Journal 60: 267–315. [Google Scholar] [CrossRef]

- Zheng, Zibin, Shaoan Xie, Hong-Ning Dai, Xianping Chen, and Huaimin Wang. 2018. Blockchain Challenges and Opportunities: A Survey. International Journl Web and Grid Services 14: 352–75. [Google Scholar] [CrossRef]

- Zhu, Huasheng, and Zach Zhizhong Zhou. 2016. Analysis and Outlook of Applications of Blockchain Technology to Equity Crowdfunding in China. Financial Innovation 2: 29. [Google Scholar] [CrossRef]

| 1 | Several search refinement features of Scopus and Science Direct are used following specific articles that might be in a grey area with regard to interest. However, for good measure we conducted a regular Google search as well and reviewed search results so as not to miss important industry reports. |

| Selection Criteria | Article Description | Grey Literature (Literature Whose Relevance Is Unclear from the First Search) | |

|---|---|---|---|

| Inclusion | With time-frame restrictions beginning from 2012 | Peer-reviewed research articles (including articles in press), conference proceedings papers, book chapters, review papers, short surveys, serials etc. | Technical reports relating to blockchain but with factors that can be relevant or repurposed for applications in corporate governance. |

| Databases used: Google Scholar, Science Direct, Business Source Premier and Scopus. | |||

| Exclusion | Prior to importation to bibliographic manager | Non-English articles, articles with missing abstracts, notes, editorials | Generic reports related to blockchain technology without any factors relevant to corporate governance. |

| During title screening | Generic articles related to the blockchain technology and/or blockchain architecture with no application possibility in finance or relevance for corporate governance. | ||

| During abstract screening | Software-oriented articles related to blockchain technology and not related to blockchain governance | ||

| During full-text screening | Articles solely addressing technical aspects of blockchain technology and not related to blockchain governance |

| Framework | Focus on Any Factor within Theme | ||

|---|---|---|---|

| Key Themes | Total | Industry Reports | Academic Studies |

| Corporate governance theories relevant to blockchain adoption | 8 | 1 | 7 |

| Blockchain impact and value creation | 54 | 20 | 34 |

| Stakeholders | 53 | 23 | 30 |

| Market mechanisms | 74 | 14 | 60 |

| Blockchain governance | 60 | 3 | 57 |

| Corporate Governance Theory | Theory Description | Blockchain Adoption Implications |

|---|---|---|

| 1. Shares of a corporation would be issued and held on a blockchain | ||

| Agency costs | The primary goal of good governance in firms is to protect shareholders and other stakeholders from the managerial discretion | 1. Increased transparency and subsequent reduced information asymmetry would significantly change incentives and profit opportunities for managers. |

| Transaction cost theory | The organization and structure of a firm can determine price and production. | 1. Reduced cost and speed of execution would greatly improve liquidity, and information incorporation into asset prices would facilitate high frequency. 2. It would increase demand for investments in stocks and also create new investing strategies, objectives and dynamics. 3. The real-time archiving of trades would result in information being incorporated into prices more speedily, making markets more efficient |

| Stewardship theory | Stewards are company executives and managers working and protecting and making money for the shareholders. | 1. It would reduce information asymmetry and would significantly change incentives and profit opportunities for institutional investors, insiders and other traders in general |

| Resource dependency theory | Concentrates on the role of board directors in providing access to resources needed by the firm | 1. Increased transparency may change and even expand the role of shareholders in corporate governance. 2. This may also hinder the board of directors and be interrupted by shareholders with no expertise in the relevant field. |

| Political theory | Considers the approach of developing voting support from shareholders, rather than by purchasing voting power | |

| 2. Corporate Voting | ||

| Agency costs | The primary goal of good governance in firms is to protect shareholders and other stakeholders from the managerial discretion. | 1. Voters and the firm would be able to see that votes had been cast validly, but if desired, would not be able to see how particular voters voted. This in turn would greatly increase the cost and speed of voting, would increase accuracy and would reduced interference by management. |

| Transaction cost theory | The organization and structure of a firm can determine price and production. | |

| Stewardship theory | Stewards are company executives and managers working and protecting and making money for the shareholders. | 1. Increased transparency and speed and reduced costs would result in more shareholder and other interested stakeholder participation. Thus, stakeholders may get involved directly in corporate governance and petition for votes on important firm decisions. |

| Resource dependency theory | Concentrates on the role of the board directors in providing access to resources needed by the firm. | |

| Political theory | Considers the approach of developing voting support from shareholders, rather than by purchasing voting power | 1. Using blockchain for corporate elections and shares would make empty voting more difficult or even prevent it entirely. Smart contracts can be used so that there is a stand-down period following the transfer of a share, during which time that share has no voting rights. |

| Year | Number of Blockchain Wallet Users in Millions |

|---|---|

| 2016 Q3 | 8.95 |

| 2016 Q4 | 10.98 |

| 2017 Q1 | 12.89 |

| 2017 Q2 | 14.97 |

| 2017 Q3 | 17.26 |

| 2017 Q4 | 21.51 |

| 2018 Q1 | 23.95 |

| 2018 Q2 | 25.76 |

| 2018 Q3 | 28.89 |

| 2018 Q4 | 31.91 |

| 2019 Q1 | 34.66 |

| 2019 Q2 | 40.09 |

| 2019 Q3 | 42.31 |

| 2019 Q4 | 44.69 |

| Region | Correlation |

|---|---|

| Global and U.S. | 0.22 |

| Global and Europe | 0.20 |

| Global and Asia | 0.94 |

| U.S. and Europe | 0.11 |

| U.S. and Asia | 0.16 |

| Europe and Asia | −0.15 |

| Blockchain Application | Exchange | Year | Description and Use Case | Collaborating Tech Firm |

|---|---|---|---|---|

| LINQ | NASDAQ | 2015 | Blockchain platform for private bond and stock trade | |

| Toronto’s TMX Group | Blockchain platform for its Natural Gas Exchange (NGX) | |||

| Australian Stock Exchange (ASX) | 2015 | Replacing its clearing and settlement platform CHESS with blockchain technology | Implemented by Digital Asset Holdings. | |

| Japan Exchange Group (JPX) | Developing a blockchain platform for trading low liquidity securities | IBM | ||

| Korean Start-up Market | Korea Exchange | 2017 | To trade shares of start-up companies | |

| India’s National Stock Exchange (NSE) | 2017 | Conducted a blockchain trial of a KYC (know-your-customer) data protocol | ||

| Moscow Exchange (MOEX) | Exploring moving its National Settlement Depository (NSD) to a blockchain platform | |||

| Deutsche Börse and Deutsche Bundesbank | 2016 | Been testing blockchain platform prototypes for securities settlement | ||

| London Stock Exchange | Use of blockchain platforms to improve post-trade processing | |||

| Luxembourg Stock Exchange | Implemented a blockchain platform for a security system for digitally signed documents and related codes | |||

| Santiago Exchange is | Exploring blockchain technology to be applied across Chile’s financial sector | IBM | ||

| Hong Kong Exchange and Clearing (HKEX) | Enhance its post-trade infrastructure. | implemented by Digital Asset Holdings. | ||

| the Singapore Exchange (SGX) | 2018 | Integrating Blockchain technology into its core infrastructure. | ||

| Zimbabwe Stock Exchange | Exploring adoption of blockchain technology |

| Stakeholders | Behavioural Perspectives of Blockchain Adoption |

|---|---|

| 1. Market Mechanisms | Mergers where building hostile positions for takeovers may be hindered and blockchains may become a part of takeover defence mechanisms. |

| 2. Shareholders | Whilst shareholders might become more passive, similar to what is discussed in Grossman and Hart’s (1980) free-rider problem, it is more likely that the increased transparency that blockchains offer may change and even expand the role of shareholders in corporate governance. This may also hinder board of directors’ and managers’ decision-making, especially if interrupted by shareholders with no expertise in the relevant field. |

| 3. New Breed of Third-Party Identity Verification Firms | Even if aliases are used for share purchases, third parties could earn fees for ascertaining the identity of shareowners. These third parties would build upon the existing mechanisms used in financial markets to identify certain traders based on observed sequences, size and timing of trades. |

| 4. Intermediaries and Exchanges | Blockchains could reduce settlement times to minutes if not seconds, or slightly longer if public blockchains are used, and without the need for intermediaries. |

| 5. Insiders | Insiders’/managers’ buy order trades result in significant and stronger market reactions as opposed to sell orders (Brochet (2010)). Blockchains would enable easier differentiation of informed trading, subsequently increasing the information content and absorption into asset prices. |

| 6. Retail Investors | Blockchain, with its increased transparency and (considerably) faster execution, would be available to retail investors. The advantages previously available to institutional investors may be reduced and the playing field levelled. |

| 7. Block Holders | The reduction in costs especially for selling shares via increased liquidity would enhance block holder exits and would increase block holders’ power over managers (Edmans (2014)). The increased threat of exit by block holders would result in managers pursuing shareholder-value-maximizing projects and deter them from projects with private benefits (Admati and Pfleiderer (2009)). |

| Country | Regulation |

|---|---|

| United States | Enacted state laws on smart contracts, blockchain-based digital signatures and legal admissibility of blockchain ledgers as evidence. |

| Russia | Announced a regulatory framework for ICOs. |

| France | Allows crowdfunding records to be kept on blockchain ledgers. |

| United Kingdom | Started to allow sandboxes for certain fintech products including blockchains. |

| Switzerland and Luxembourg | Announced similar sandboxing initiatives to the United Kingdom. |

| Australia | The International Organization for Standardization (ISO) has set up a task force working on these internal blockchain standards and also on standards about the interoperability of separate blockchains. |

| China | Prohibition of crypto-currencies/taskforces on blockchain. |

| Japan | Reports/declarations/taskforce. |

| India | Reports/statements of intent to regulate. |

| Turkey | Taskforces on blockchains. |

| Singapore | AML regulation on c-currencies/taskforce on blockchain. |

| Canada | Reports/taskforces/sandboxing. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jayasuriya Daluwathumullagamage, D.; Sims, A. Blockchain-Enabled Corporate Governance and Regulation. Int. J. Financial Stud. 2020, 8, 36. https://doi.org/10.3390/ijfs8020036

Jayasuriya Daluwathumullagamage D, Sims A. Blockchain-Enabled Corporate Governance and Regulation. International Journal of Financial Studies. 2020; 8(2):36. https://doi.org/10.3390/ijfs8020036

Chicago/Turabian StyleJayasuriya Daluwathumullagamage, Dulani, and Alexandra Sims. 2020. "Blockchain-Enabled Corporate Governance and Regulation" International Journal of Financial Studies 8, no. 2: 36. https://doi.org/10.3390/ijfs8020036

APA StyleJayasuriya Daluwathumullagamage, D., & Sims, A. (2020). Blockchain-Enabled Corporate Governance and Regulation. International Journal of Financial Studies, 8(2), 36. https://doi.org/10.3390/ijfs8020036