Abstract

The purpose of the present paper is to provide an advanced overview of the practical applications of Banking 4.0 in Industry 4.0. This paper examines the technology trends in the Fourth Industrial Revolution and identifies the key indicators behind the creation of a strategic map for the fourth-generation banks and their readiness to enter Industry 4.0. This paper examines a systematic review of fully integrated Banking 4.0 and the application of the technologies of Industry 4.0 and illustrates a distinct pattern of integration of Banking 4.0 and Industry 4.0. One of the prominent features of this article is the performance of successful global banks in applying these technologies. The results showed that Banking 4.0 in Industry 4.0 is an integrative value creation system consisting of six design principles and 14 technology trends. The roadmap designed for banks to enter Industry 4.0 and how they work with industrial companies will be a key and important guide.

1. Introduction

The technology landscape, which is evolving thanks to the introduction of 5G networks, has affected all sectors of the banking industry. Emerging technologies have opened the door to a range of applications and inter-industrial collaborations that were previously only imagined in dreams. New applications have changed current business models, paved the way for innovation, and created new opportunities for revenue generation.

The term “Industry 4.0” refers to the concept that technology has permeated all areas of society: production, finance, services, transportation, and communications (Cividino et al. 2019). Such developments are driven by digital integration (with devices and processes capable of transmitting and processing huge masses of data) and automation (the availability of machines capable of carrying out tasks of medium–high complexity) (Muscio and Ciffolilli 2019; Rossini et al. 2019). The pervasiveness of the Internet and smart mobile phones, along with the emergence of technologies such as the Internet of Things, biometrics, big data, advanced analytics, artificial intelligence, blockchain, etc., has created an organizational focus on designing and developing pre-designed products and services, and personalized and customized services are provided for each customer. One of the industries that have changed a lot as a result of the advancement of technology is the banking industry, but it seems that these changes continue. “The development of technology has revolutionized all industries in the world, and the banking industry is no exception,” Banker (2019) wrote in a recent report.

Some researchers suggested that the notion of Industry 4.0 supposes blurring the differences between the work of people and the work of machines (Ślusarczyk 2018). Lu (2017) argued that the concept of Industry 4.0 can be summarized as an integrated, adapted, optimized, service-oriented, and interoperable manufacturing process that is correlated with algorithms, big data, and advanced technologies. The Fourth Industrial Revolution, also known as Industry 4.0, provides smart, efficient, effective, individualized, and customized production at reasonable cost (Erol et al. 2016). According to Stock and Seliger (2016), the concept of Industry 4.0 includes three fundamental dimensions of integration: (1) the horizontal integration across the entire value creation network, (2) vertical integration and networked manufacturing systems, and finally (3) end-to-end engineering across the entire product life cycle.

Today, a significant portion of bank customers are young people and middle-aged people who have different expectations and preferences than the previous generation. Meeting these expectations and preferences is no longer possible with existing banking models, and it will only be possible with the use of fourth-generation tools, technologies, and mechanisms. Entering Industry 4.0 has two distinct natures: first satisfying new needs through new products and processes, and second, higher productivity thanks to the implementation of process innovations (Zambon et al. 2019). Entering the new generation of customers into the marketplace and doing business in this revolution requires a thorough rethinking of existing banking services and products. Productivity enhancement, innovative products, speedy transactions seamless transfer of funds, real-time information system, and efficient risk management are some of the advantages derived through the technology in banks (Saravanan and Muthu Lakshmi 2016).

The current global economy is constantly changing, so innovation and technological development are key issues in the context of a sustainable approach. Industry 4.0 should be perceived as a great opportunity due to its new technologies. Moreover, Ślusarczyk (2018) argued that the main objective of Industry 4.0 is to achieve a higher level of operational effectiveness and productivity, and simultaneously a higher level of automation. Certain researchers also suggested that the four major pillars of Industry 4.0 are the following: Internet of Things (IoT), Industrial Internet of Things (IIoT), cloud-based manufacturing, and smart manufacturing, which contribute significantly to the metamorphosis of the manufacturing process into a completely digitized and intelligent process (Vaidya et al. 2018). Companies are interested in meeting their customers’ needs, but also in obtaining useful information from them, which can be used for innovation (Nethravathi et al. 2020).

Remarkably, Industry 4.0 needs its banking system. The use of Industry 4.0 technologies for digitizing assets, creating a digital identity, providing special offers to customers, offering customization, etc., is one of the most central strategies of Banking 4.0. For example, South Korea currently has the third-largest cryptocurrency market after Japan and the United States, and Shinhan Bank, South Korea’s second-largest bank, has recently joined KT Corp, the second largest provider of services, and the country’s telecommunications has cooperated. The subject of this collaboration has been the development of a block chain-based platform. For a long time, it was the banking industry that decided how to interact and provide customer service. In Generation Banking, the optimal combination of interaction is determined by the customer. As a result, banks need to fundamentally reconsider their business model.

According to an IBM World Business Partner in Taiwan, the company is ready to enter the era of Bank 4.0 (IBM 2018). Accordingly, banks will be set up to provide an integrated system that will improve mobile banking by providing solutions to help facilitate the automation of banking processes. In classifying the evolution of the bank over the past few decades, the Internet has helped Banking 1.0 to grow into Banking 2.0, and with the rapid rise of smartphone popularity, Banking 3.0 has come to life. Now, the third generation bank is moving forward to Banking 4.0, but not because of new inventions, but because of the maturity and growth of new technologies such as artificial intelligence and virtual reality systems and voice recognition, which together make a powerful team for better banking services and solving modern problems. Banks are globally readjusting their business strategies toward e-banking in order to achieve rapid growth in financial development (David and Kaulihowa 2018). E-banking represents an innovative process by which a customer performs banking transactions electronically without having to physically enter a bank or financial institution (Simpson 2002). Banking 4.0 provides its customers with personalized, integrated, and customized experiences that are transforming customer interactions with the bank. Becoming a Bank 4.0 means providing a convincing presentation of both customer experience and performance experience based on open, flexible, and integrated architecture.

Jack Ma (who is the founder of the e-commerce platform Alibaba) founded MyBank four years ago. The bank has introduced a new era of offering services to small and medium-sized enterprises (SMEs). In recent years, MyBank has loaned 2 trillion yuan to 16 million small and medium-sized Chinese companies. This is done by real-time data and 3000-variable risk-based credit management models. In addition to the advantages of the MyBank lending system, transactions are carried out at a high rate. Loan applications are processed and approved within 3 minutes. Now, compare this technology trend in MyBank with the 30-day time required by traditional banks! The difference is extremely obvious and indisputable, and the gap can no longer be covered by traditional banking.

Due to the high volume of data collected by Alibaba and other related e-commerce platforms, it uses the business information and social credit rating of potential customers with their consent. Capgemini (2017a) argued that high-class BigTechs such as Google, Facebook, Apple, and Amazon imposed a very high upper limit on the customer expectations using superior personalized and digital customer interactions. As a result, this amount of big data and analytics makes it easier for small and medium-sized companies to approve loans and, of course, pay less ineffective loans. These are loans that are spent for non-strategic and non-practical purposes. MyBank says it has been able to lend to SMEs up to four times more than traditional banks. However, traditional banks reject about 80% of SMEs’ lending applications due to insufficient credit or data.

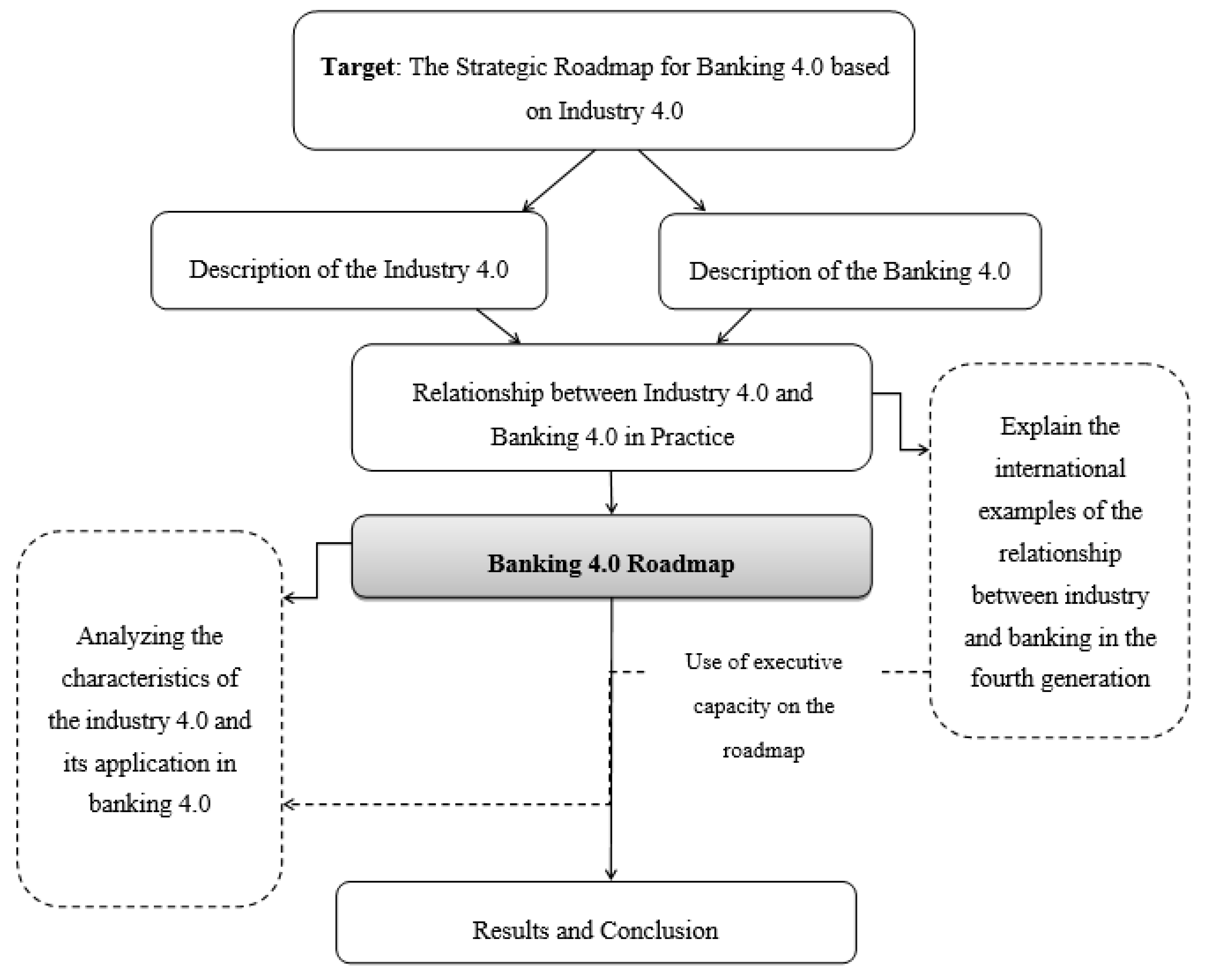

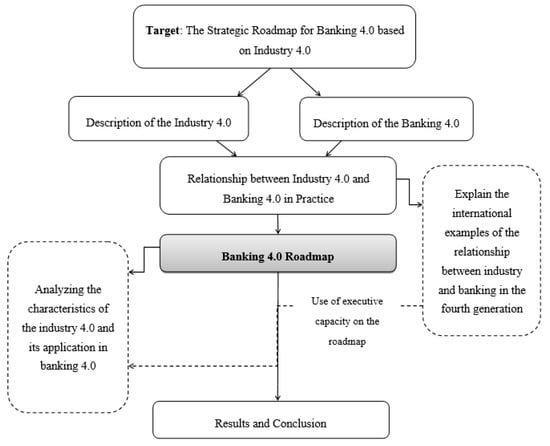

Industry 4.0 provides competitive advantages based on advanced technologies and practices for companies in the manufacturing industry. Having a deep understanding of the particularities of Industry 4.0 is a prerequisite for the development of the strategic and technological roadmap in bank 4.0. Therefore, the present study first examines the technologies used in Industry 4.0 and examines them as applied examples in prestigious banks in the world. Then, by integrating the views, we present an applied model of the fourth generation banking approach in the context of Industry 4.0. Finally, a clear roadmap for achieving fourth-generation banking has been formulated. Figure 1 shows the research plan. So, the researchers are asking three main questions:

Figure 1.

Research plan. Source: Own contribution of the authors.

- Is it necessary for the banking sector to join Banking 4.0?

- In practice, is there an interaction between Industry 4.0 and Banking 4.0 within the organizations?

- Is it possible to develop a codified roadmap for entering Industry 4.0?

2. Literature Review

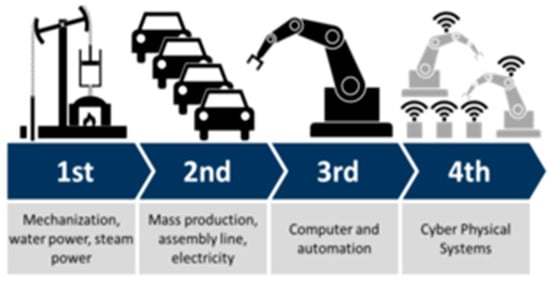

2.1. Industry 4.0

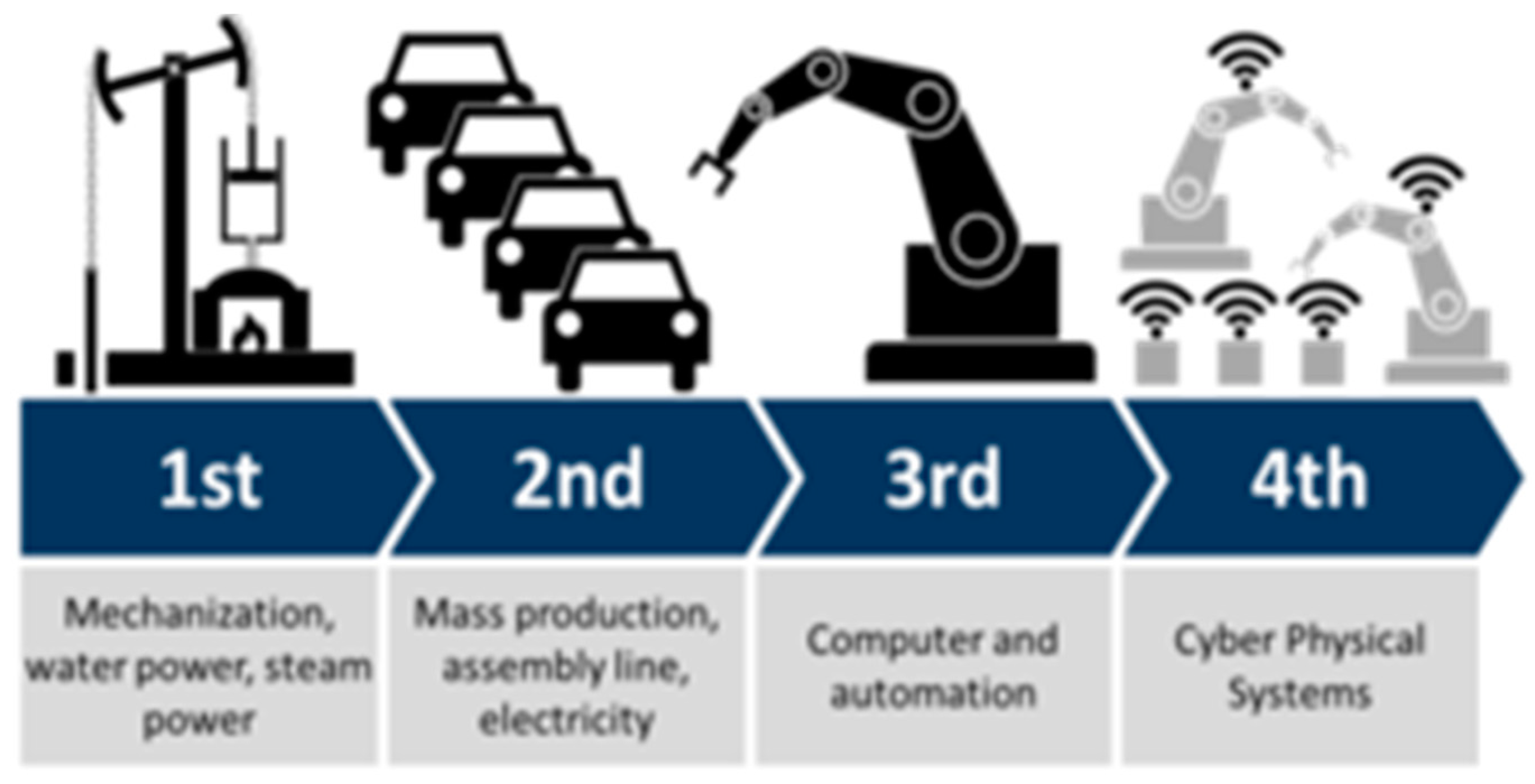

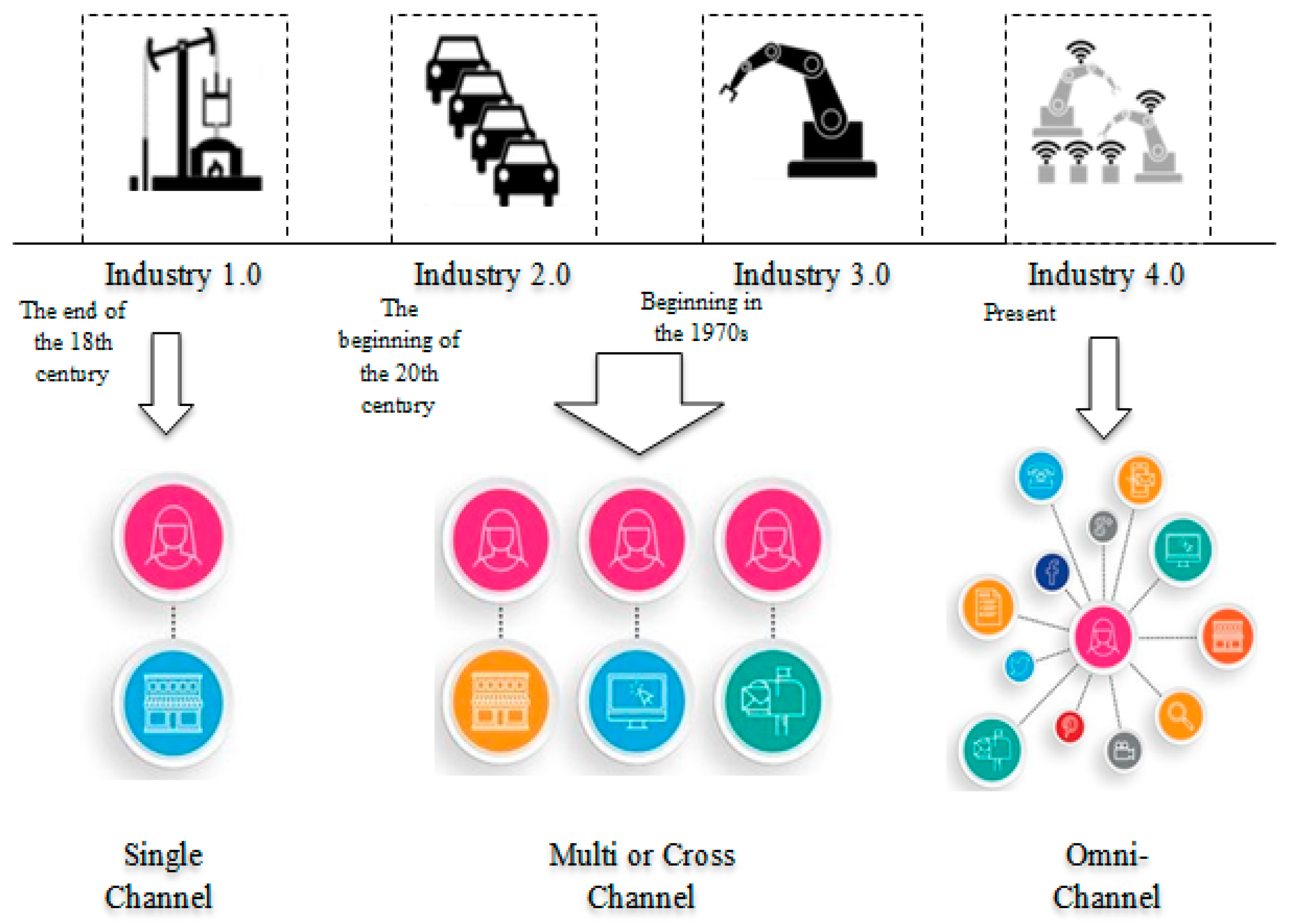

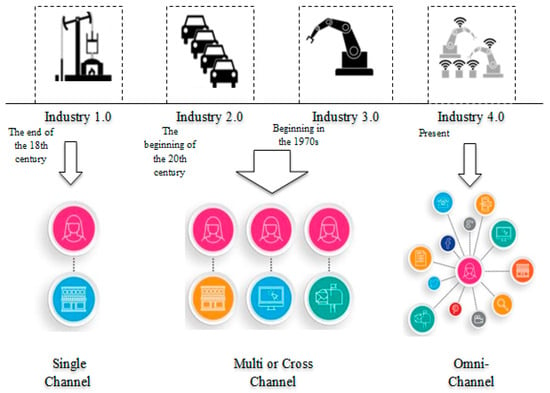

Our current business environment is radically changing, and the increasingly demanding and rapidly changing customer needs are the underlying reason that has driven industry revolutions at different periods (Mohamed 2018). These revolutions have brought to the world drastic changes in diverse areas, posed huge challenges for industries and manufacturers, led to massive innovations and transformations, and remarkably affected people’s way of life (Huang 2017). Industry 4.0 is also known as the Digital Revolution or the Fourth Industrial Revolution. The First Industry Revolution encompasses the use of the steam engine in manufacturing facilities, followed by the introduction of electrically powered mass production (Second Industry Revolution) (Pagliosa et al. 2019). The Third Industry Revolution corresponds to the use of electronics and information technology (IT) to automate manufacturing (Kagermann et al. 2013). I4.0, deemed as the Industry 4.0, focuses on the digitalization of all physical assets and the massive integration of value chain participants (PwC 2017) (see Figure 2 and Figure 3).

Figure 2.

Through the industry revolutions. Source: Own contribution of the authors.

Figure 3.

The Concept of the Fourth Industry Revolution. Source: Own contribution of the authors.

There are various definitions for Industry 4.0 considering that many researchers and practitioners define this term according to their level of understanding and unique perspective. There are also inter-relating terms such as IoT, Cyber-Physical Systems (CPS), Smart Systems, Digitalization, and Digital Factory (Khan and Turowski 2016).

Certain researchers define Industry 4.0 as the concept of automation and data exchange in the manufacturing technologies, which enables the use of Internet of Things (IoT), Cyber–Physical Systems (CPS), big data analytics, cloud computing, and cognitive computing, with the main goal of achieving a higher level of progress (Herčko et al. 2015). Other researchers suggested that the crown jewel of Industry 4.0 is the networking of smart digital devices with products, tools, robots, and people based on intelligent factories (Mekinjić 2019).

Moreover, I4.0 is the latest trend when it comes to automation and data exchange in production systems (I-SCOOP 2017; CNI 2016). The adoption of technologies, such as CPS, big data, and IoT provides relevant information and creates new possibilities for process improvement (Bohács et al. 2013; Schuh et al. 2017). In addition, one of I4.0’s main advantages is the ability to adapt quickly to volatile demand scenarios and products with short life cycles (Sanders et al. 2016). According to Tamás and Illés (2016), I4.0 has generated important changes in production systems and created demand for new jobs. Recent research on this subject indicates a lack of studies about the impact of I4.0 on manufacturing environments (Zuehlke 2010; Landscheidt and Kans 2016; Gjeldum et al. 2016; Xu and Chen 2016; Martinez et al. 2016; Sanders et al. 2016; Kolberg et al. 2017; Santorella 2017).

Anirudh et al. (2017) argues that Industry 4.0 can be identified as an emerging platform of technologies that revolutionize the rate of productivity per employee while reducing the cost of controlling and compliance incurred by corporations. According to Berger (2017), Industry 4.0 provides flexibility to the production processes; thus, it helps to create products that are tailored to the target segment while satisfying personalized needs through a low marginal cost. Vaidya et al. (2018) discusses the challenges incorporated with the applications of Industry 4.0, namely, intelligent decision making and negotiation mechanism, high-speed networking protocols, manufacturing specific big data and analytics, system modeling and analysis, cyber security, modularized and flexible physical artifacts, investment, etc. Lu (2017) mentions that Industry 4.0 creates a value-added integration horizontally and vertically in the manufacturing processes. Thus, horizontal integration was done through value creation modules from the material flow to the logistics of product life cycle, whereas the vertical integration through product, equipment, and human needs with different aggregation levels of the value creation and manufacturing systems.

2.2. Banking 4.0

Today, the rate of technological change in the banking sector and the entire economic ecosystem is extremely high. These changes have a significant impact on the dynamism of individuals and the socio-political community that no one could have imagined. Increasing data usage, machine learning based on artificial intelligence, the Internet of Things, and digital technologies play an important role in this process.

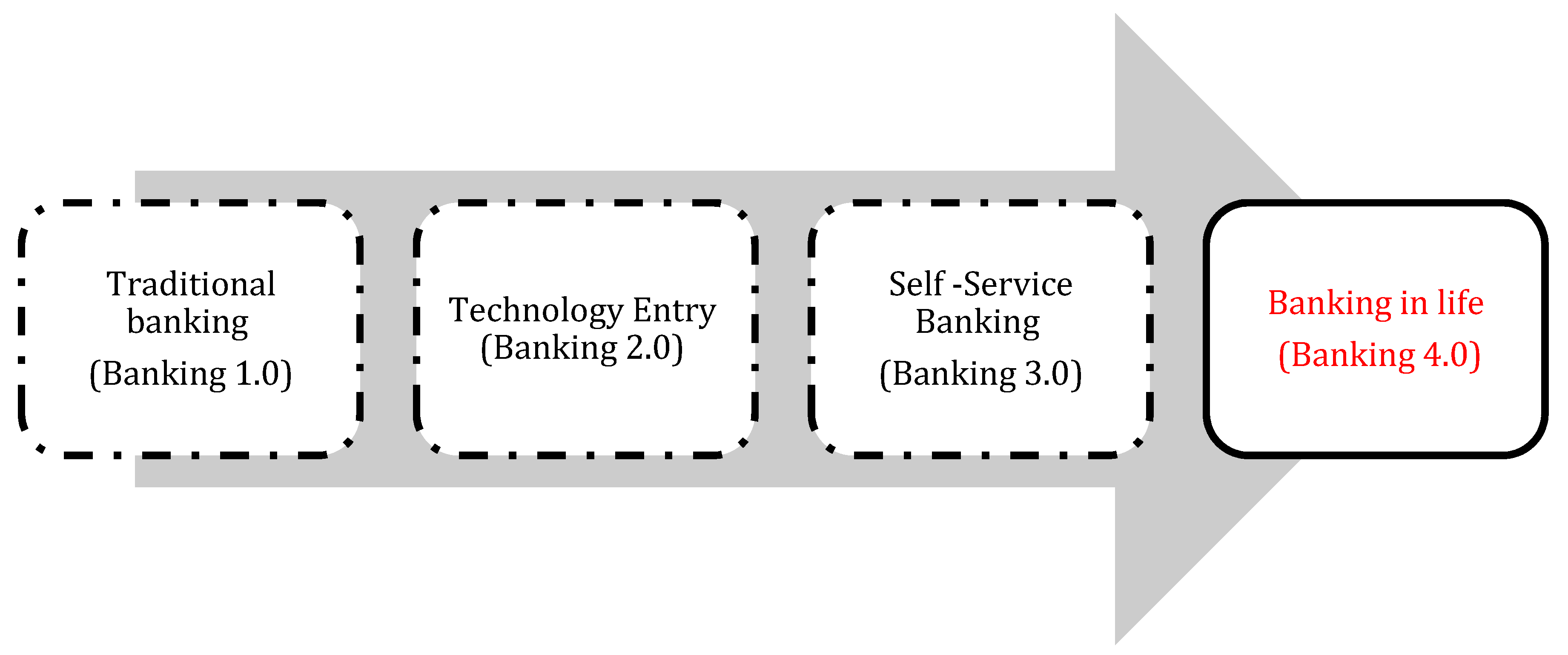

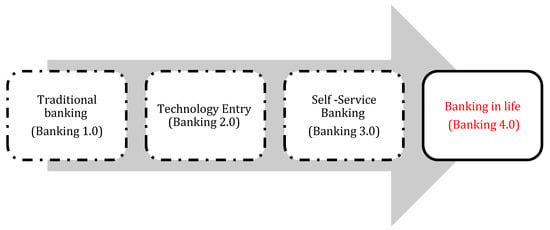

Banking 1.0 is what we call banking, and this is the same traditional banking that services are provided at certain times in the branch. The contemporary banking theory argues that commercial banks, composed with other financial mediators, are essential in the distribution of wealth in the economy (Bhattacharya and Thakor 1993). Then came the introduction of technologies such as the Internet and some Banking 2.0 services that were slowly pushing banking out of the branches. This is possible with the advent of ATMs and card readers, since we are witnessing the formation of off-branch services at different times. This period began in 1980 and lasted until 2007. With the advent of self-service banking, things have changed, and we have come to realize that banking can also be portable, which is Banking 3.0 (It is related to the supply and expansion of mobile services. These services may be provided on a smartphone platform or even portable card readers. This period lasted from 2007 to 2015), but banking 4.0 is a major transformation that will live with you (Figure 4). Topics such as intelligence, sharing, and evolutionary computing are discussed.

Figure 4.

The banking revolution. Source: Own contribution of the authors.

Harjanti et al. (2019) argued that digital transactions necessitate an improved banking experience, so the banking industry also conducts experiments by applying innovative technology in order to support mobility and increase transaction speeds and efficiency for its customers. Some previous studies suggested that the highest dilemma for the current banking system is to explain the high costs of branch banking but also to obtain an increase in profitability as branch-driven revenue growth (Capgemini 2012). According to Athanasoglou et al. (2006), the size of banks contributes to recognizing possible economies or diseconomies of scale in the banking area considering cost differences, products, and risk diversification.

The banking system represents a fundamental pillar of the economic growth and macroeconomic stability, especially in the context of globalization. However, the evolution of the banking sector in each country is affected by continuous changing dynamics of the international banking architecture and financial environment (Spulbar and Birau 2019b). Nowadays, a company or startup can provide banking services by providing financial technology (FinTech)-based applications. The use of artificial intelligence and intelligent, cognitive, and voluntary algorithms has entered banking in this period). The banking sector has been immensely benefited from the implementation of superior technology during the recent past almost in every nation in the world. Productivity enhancement, innovative products, speedy transactions, the seamless transfer of funds, real-time information system, and efficient risk management are some of the advantages derived through the technology (Saravanan and Muthu Lakshmi 2016). The new era of financial deregulation is supported by the revolution in information and communication technology, which helps banks ensuring innovation in their products and services at competitive prices (Turk Ariss 2008).

Maturity models offer a complex guidance to define, assess, and evaluate the progress of the current state of the banking sector in its journey of Industry 4.0. (Bandara et al. 2019). Other researchers developed a maturity model using the existing model of Software Process Improvement and Capability Determination (SPICE) considering only two main dimensions, i.e., capability dimension and aspect dimension (Gökalp et al. 2017).On the other hand, the technology acceptance model is generally considered as the most influential theory in IT and information systems (Benbasat and Barki 2007).

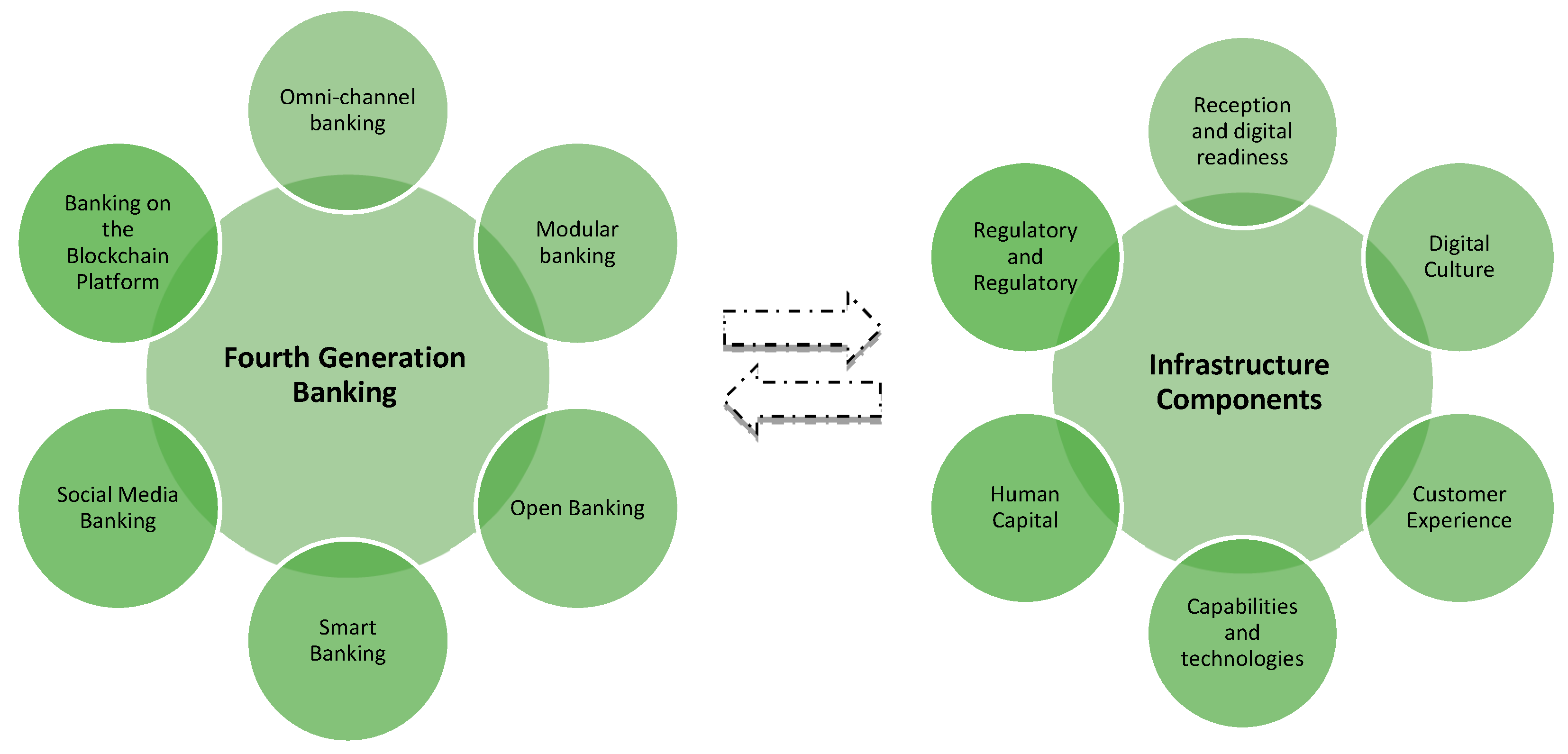

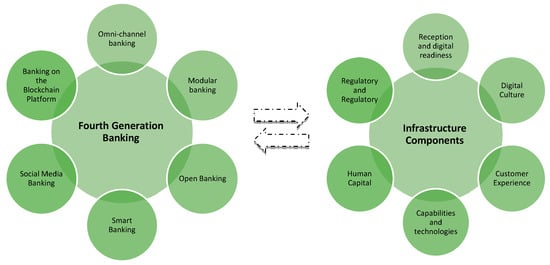

The paradigm shift from the concentrated market structure under financial repression to the competitive framework under financial liberalization has laid down the foundation for the emergence of private and foreign banks originally in developed countries and afterward in developing countries (Sohrab Uddin and Sohel 2018). Today, a significant portion of bank customers are young people and middle-aged people who have different expectations and preferences than the previous generation. Meeting these expectations and preferences is no longer possible with existing banking models and will only be possible with the use of fourth generation tools, technologies, and mechanisms.Banks can no longer begin their design with business goals and market share, but they need to know how to get their attention and preferences without directly interacting with the customer, thereby achieving business goals.Based on the definition of Temenos (2018), properly digitizing, or in other words Banking 4.0, means “Experience-Driven Banking” capability that requires coverage of both “Customer Experience” and “Execution Experience”(see Figure 5).

Figure 5.

The relationship between Banking 4.0 and infrastructure. Source: Own contribution of the authors.

Industry 4.0 needs its own banking structure. Industries 4.0 are largely international in scope, and customers from all over the world choose them. A radical change in the marketing and segmentation of banking customers makes it unique for each customer. There seems to be only one type of banking, and that is proprietary banking in a new way. With the development and maturation of technologies such as the Internet of Everything (IoE) (by creating a connected network of people, processes, data, objects, etc.), Internet of Value, blockchain technology, cloud technology, advanced robotics, virtual reality, 3D printing, miniaturization of sensors, and the exponential development of emerging technologies and innovations are coming across completely different generations of banking.

Certain researchers provide a Maturity Model to assess the level of readiness in adapting to Industry 4.0 of the banking sector, which includes the following maturity levels, i.e., Initial, Managed, Defined, Established, and Digital Oriented (Bandara et al. 2019).

2.3. The Relationship between Industry 4.0 and Banking 4.0 in Practice

2.3.1. Replacing Banks with Organizations and Institutions

Heffernan (2005) considers that banks represent financial firms, offering loan and deposit products on the market and catering to the changing liquidity needs of their consumers, such as borrowers and depositors. However, banks hope that by improving the level of technology and technological development, they will be able to provide more services to customers at a higher rate and have greater transparency in this process. The establishment of an efficient and solid banking system is an important prerequisite for sustainable economic growth (Spulbar and Birau 2019a). A significant part of the bank’s resources each year are spent securing the system and complying with other principles approved by the world’s financial system, and it is in this environment that financial institutions grow. Institutions that are responsible for providing services to the people but do not comply with the cumbersome rules of the banking system in the countries. Since these financial institutions spend a large portion of their financial resources on upgrading their financial and banking technologies, the efficiency of these institutions is higher, and they can be more creative with the tools available. Therefore, in the next 5 years, banks can be considered the financial and economic body of large countries, but small and medium-sized financial institutions are responsible for the micro-tasks of the banking system, and more people will be in contact with these institutions.

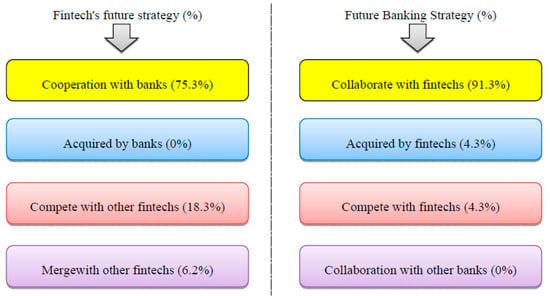

2.3.2. Advantages and Disadvantages of FinTech Development in Banking

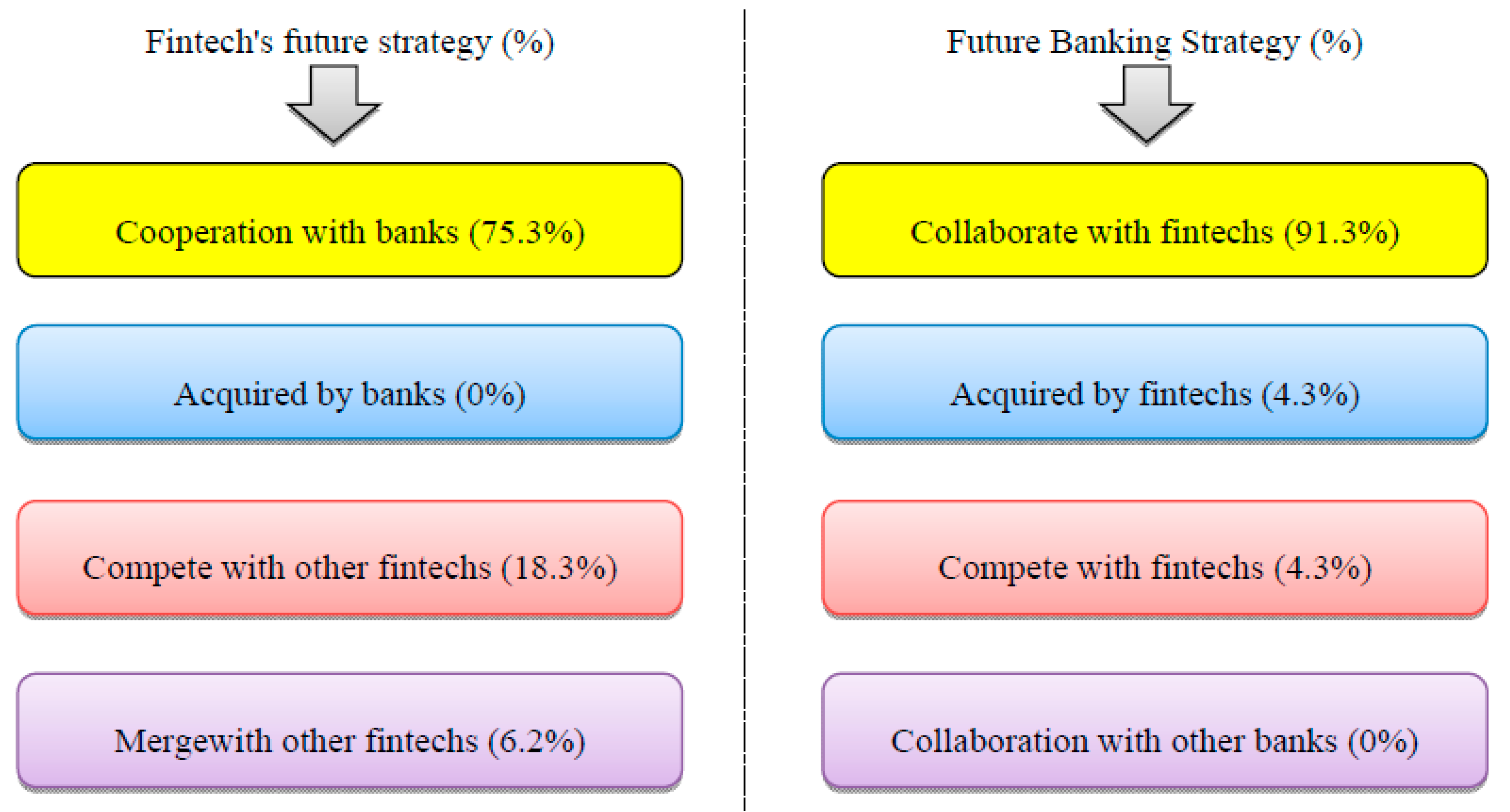

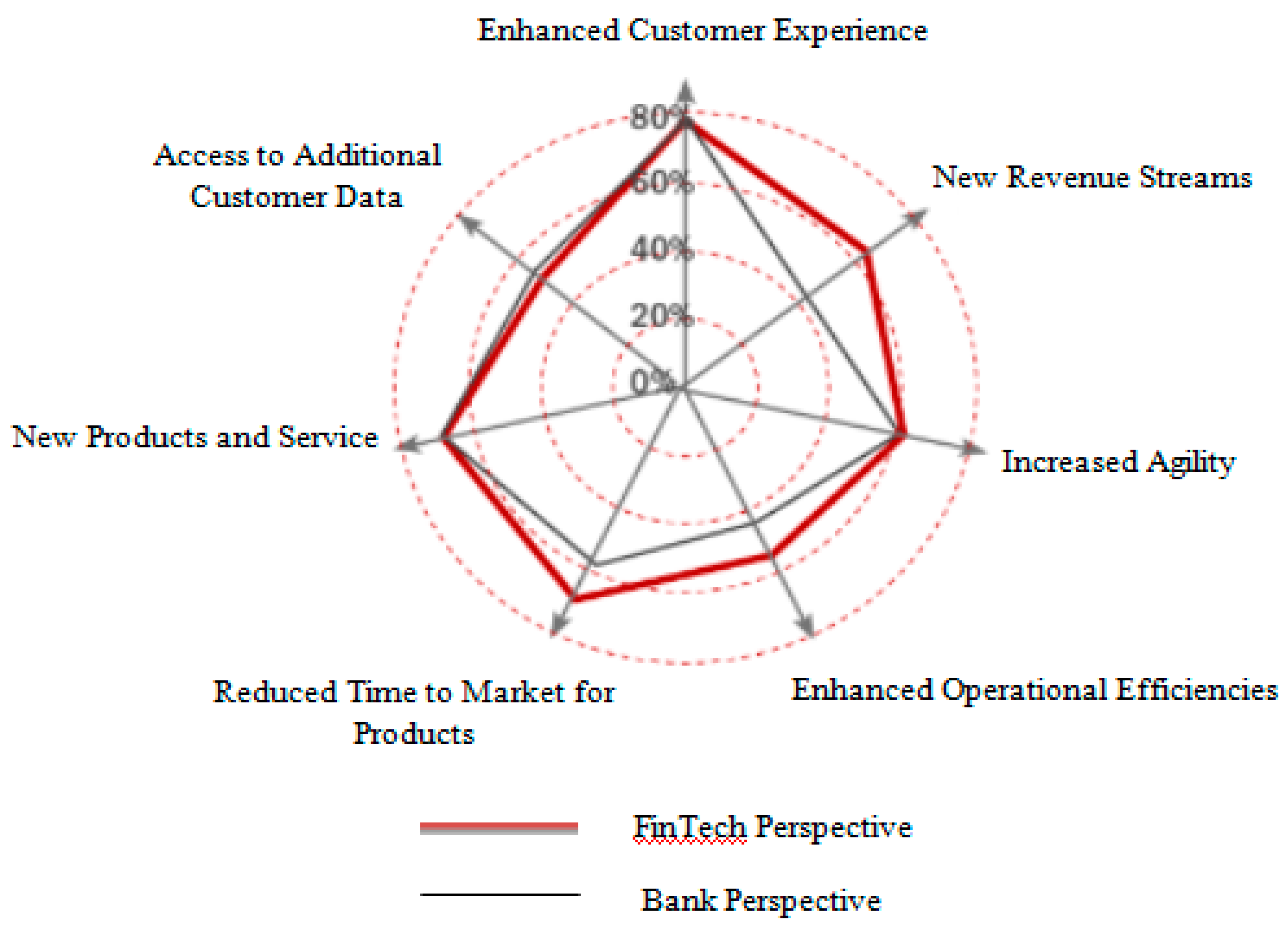

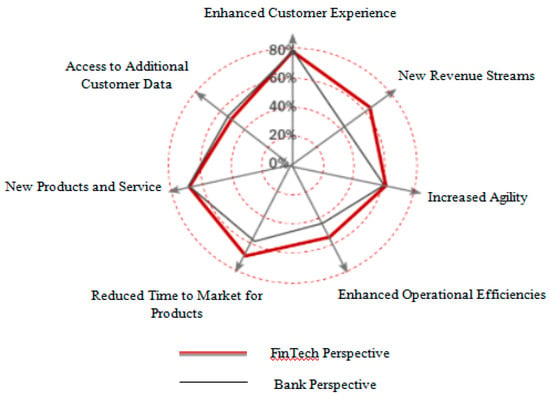

FinTech has found a broader meaning day by day and now plays its role as a disruptor of order in various parts of the financial and monetary system, including micro payments, money transfer, lending, comparison and online sales of various types of insurance policies, capital increase, and asset management. It has even been recognized in the formation of new paradigms such as the Bitcoin currency. The industry has expanded the number of online solutions in the above fields to the extent that it has become one of the most important threats to traditional banking and portfolio management. In addition, today, FinTech is seen as a good platform for implementing ideas based on the sharing economy and crowdfunding. That is why Ernst and Young (2016) cited consumers’ main reasons for accepting FinTech’s solutions: easy account opening (43.3%), more attractive rates/costs (15.4%), access to various products and services (12.4%), better online experience and performance (11.2%), better service quality (10.3%), more innovative products than products available in traditional banks (5.5%), and a higher level of trust than traditional solutions (1.8%). They also remove barriers that prevent consumers from accepting FinTech solutions: the lack of knowledge of Fintech products and services (53.2%), lack of needing to use them (32.3%), Prefer to use traditional financial service providers (27.7%), Not being aware of how to use them (21.3%), not trusting them (11.2%), and Fin-techs have been used in the past, but they don’t want to use them again (0.8%). Instead of attacking each other, banks and FinTech are increasingly partnering with each other (see Figure 6).

Figure 6.

The future strategy of banks and financial technology (FinTech). Source: Capgemini Financial Services Analysis (Capgemini 2017a).

2.3.3. JAK Bank: Interest-Free Banking

Looking at the outside world, we will see that the government, non-governmental public institutions, military institutions, philanthropists, and even in some cases the private sector have established banks that bear a strong resemblance to what we call Islamic banking. Nonprofits need bank accounts to collect revenues used in moving the nonprofit’s mission forward. A nonprofit is a corporation given “exempt organization” status by the Internal Revenue Service. Banks usually follow the same rules for opening and maintaining accounts as they do with for-profit organizations with some variations. Individual banks and individual nonprofits may have their own rules and regulations for added security (Leonard 2019). Unity Trust Bank, Meezan Bank, and JAK Bank are examples of nonprofit banking that have taken steps toward fourth-generation banking goals.

The JAK bank was started in 1930 following a massive recession in Denmark (Ielasi and Vichi 2013). Unemployment and high interest rates at the time led farmers to form a co-operative in one year. This cooperative was named in honor of the three founders of classical economics, JAK: Jord (Land), Arbejde (Work Force), and Kapital (Capital). JAK’s members concluded that earning profits was the main cause of economic instability and, as a result, inflation and unemployment. So, they started three nonprofit projects to demonstrate the idea of nonprofit loans. JAK Bank may be the first nonprofit bank in the world (Williams and Anielski 2004). A membership of approximately 39,000 (as of December 2015) dictates the bank’s policies and direction. The Board of Directors is elected annually by members, who are each allowed only one share in the bank. The JAK Members Bank does not offer any interest on saved money. All of the bank’s activities occur outside of the capital market, as its loans are financed solely by member savings. JAK Bank differs significantly from other banks in the following areas, as shown in Table 1.

Table 1.

JAK Bank differences.

The global crisis and the inability of the conventional banking system to prevent and deal with it, on the one hand, and the relative stability of Islamic banking in the face of this crisis, on the other, have attracted the attention of financial and banking experts and policymakers on Islamic banking. However, Islamic banks have many similarities with conventional banking in the type of transactions and services they provide, so that sometimes these similarities are questioned. Thus, these banks follow the principles and rules, the correct and complete observance of which leads to the stability of the banking system and the fair distribution of income throughout the economy. According to the doctrine of the Islamic Economic Sector, although human beings are free to design financial contracts, invent production methods, and organize economic activities, this freedom is within the limits set for justice and public welfare.

The main similarity between Islamic banking and JAK is the lack of interest. In fact, they both share an ideology. The only difference in religion (fighting corruption, usury, and the spiritual upliftment of man) is that it affects Islamic banking (Hyder 2013). Ahmad (2000) Islamic banking policy that is also in line with JAK principles: (1) the need for spiritual and moral awakening; (2) the rediscovery of the importance of physical and human capital information and the production of real services and goods; (3) a market economy with social responsibility, (4) moral commitment, and the positive role of government. The following Table 2 shows the main differences between Islamic Banking and JAK.

Table 2.

Main differences between Islamic Banking and JAK.

It is clear that bankinginterest rates cause unemployment, poverty, and social harm. In 1931, JAK members concluded that profit was the main cause of economic instability, resulting in high inflation and unemployment. So, they started profit-free projects to show that the idea of profit-free loans is coming true. High interest rates mean the rising cost of goods and services in all production and trading activities associated with lending. In the face of such price increases, industries are forced to (1) decrease wages or dismiss part of staff; (2) increase the price of their goods or services and; (3) increase the production of your goods or services by producing them on a large scale, in whichcosts are staggering and economical in scale.

2.3.4. Atom Bank and Gobank: Branchless Banking (BB)

Atom Bank is the first bank in the United Kingdom to be established based on BB and mobile application architecture (Atombank 2016a, 2016b). In order to achieve better customer service, the specialized focus of the branch staff and cutting costs is a convenient and cost-effective way. BB requires changes inside and outside the bank branches so that the role of the physical branches will not be the same as before, and out-of-the-box changes require up-to-date technology and the use of payment tools such as the Internet, telephony, mobile, ATM, POS, VTM, etc. (Dzombo et al. 2017). BB involves the delivery of financial services outside conventional bank branches, using retail agents or other third-party intermediaries as the principal point of contact with customers, and use of technologies such as card-reading point-of-sale (POS) terminals and mobile phones to transmit transaction details (CGAP 2011).

Banks are being innovative, largely due to intense competition, and they are therefore at the forefront of new developments, not only in banking but also in wider financial markets (Faure 2013). The BB concept began in South America, specifically in Brazil and Mexico (CGAP 2008). Based on early experiences, BB has made a significant contribution toward financial inclusion in developing countries. Most financial service providers collaborate and use partnerships with businesses that have a substantial local retail presence as a key competitive strategy (CGAP 2008).

Delloite (2012) believes that this type of banking is one of the distribution channel strategies used to provide financial services.BB enables customers to reduce costs through instant access. This model of banking to organizations reduces the costs associated with conducting low volume transactions as well as the costs associated with physical presence. There are two main advantages of this type of banking nowadays: first, diversifying services and adapting to market needs, and second, responding to market-created needs (Delloite 2012).

In addition, in many different parts of the world, the development of BB has been emphasized in various ways (CGAP 2010). In Brazil, private and state-owned banks provide services through micro agents such as supermarkets, pharmacies, post offices, and lottery shop. These agents are called “banking correspondents”. Municipalities in Brazil belong to this category. In January 2006, The Central Bank of India issued guidelines for banks to use micro agents. The ICICI Bank in India is one of them. In South Africa, BB through micro agents is only permitted for approved financial institutions. ABSA and MTN banks are examples of this type of banking. In the Philippines, since the year 2000, mobile telecom operators and smartphones have been offering BB services. Safaricom in Kenya, a wholly owned subsidiary of Vodafone and a pioneering operator, offers its M-Pesa account to its customers who can fill or empty the account in ways similar to those in mobile electronic money. Gobank is another one of the best and most practical examples of offshore banking that has been launched solely for Americans (Gobank 2016). Go Bank is a real bank that works entirely on mobile. There are five important reasons that drive customers to this type of banking in the US: quick inventory checking, online check-in, money transfer, an extensive ATM network, and security.

2.3.5. Financial Technology (FinTech)

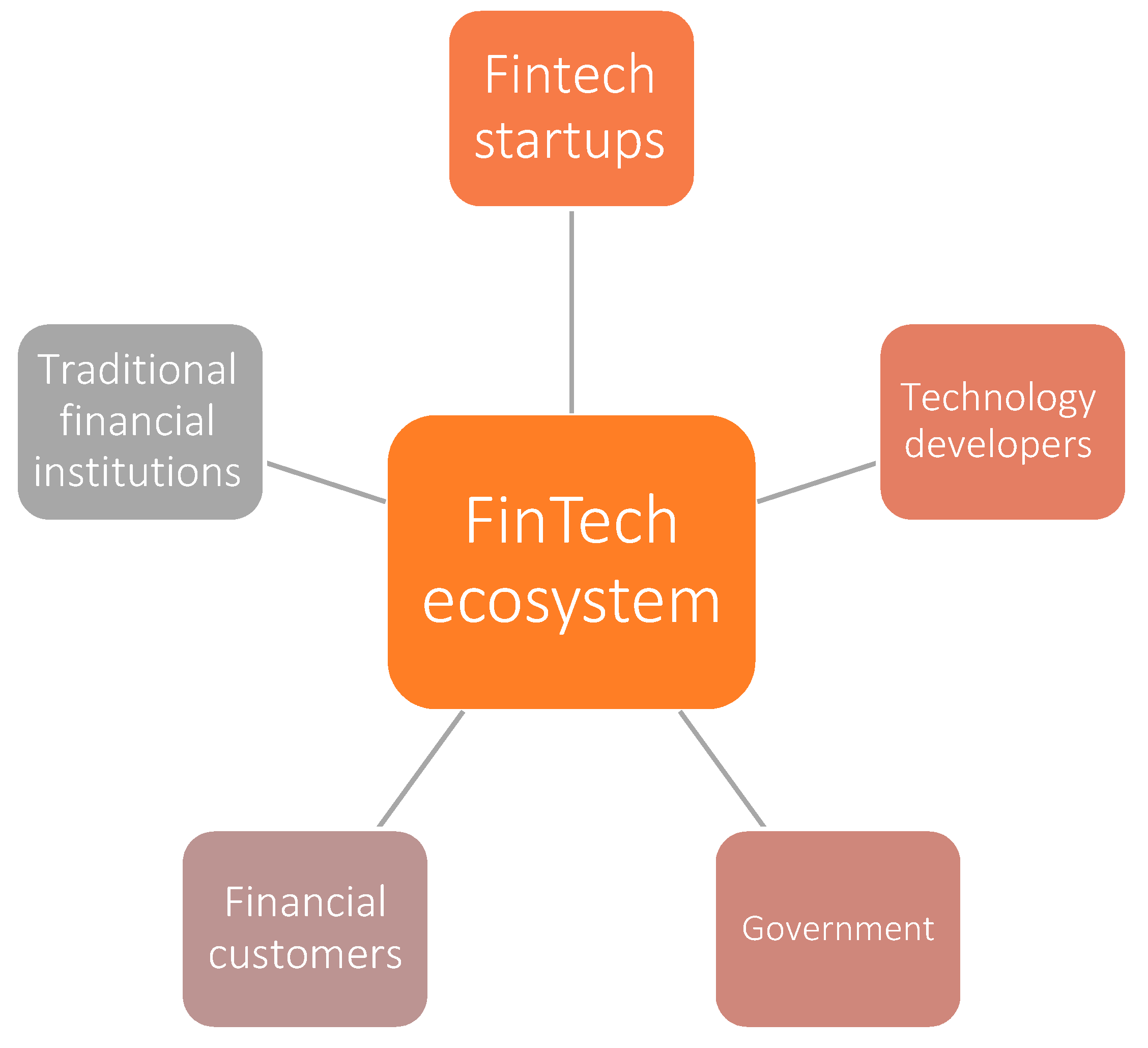

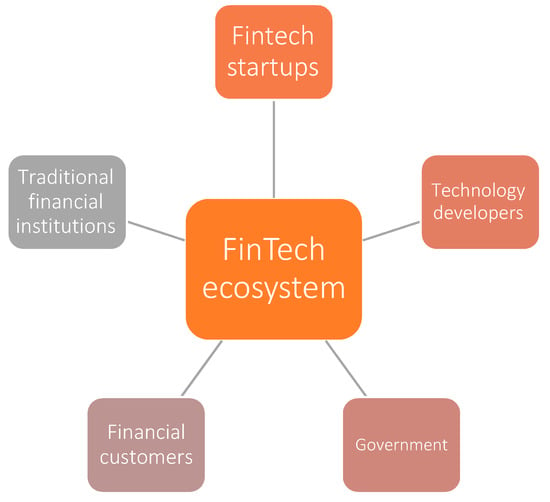

Financial technology (FinTech) is recognized as one of the most important innovations in the financial industry and is evolving at a rapid speed, which is driven in part by the sharing economy, favorable regulation, and information technology (Lee and Shin 2018). FinTech systems provide new and advanced business models such as crowdfunding, P2P, and B2B using disruptive technology, and as a consequence, the traditional banking business model faces a major challenge (Dasho et al. 2017). The progress of FinTech is defined as an uninterrupted process during which finance and technology have evolved together based on rapidly developing technology (Arner et al. 2015). FinTech promises to reshape the financial industry by cutting costs, improving the quality of financial services, and creating a more diverse and stable financial landscape. After all, it can be perceived as a FinTech revolution. According to PwC (2017), 83%of financial institutions believe that various aspects of their business are at risk to FinTech startups. Figure 7 presents the five components of the FinTech ecosystem.

Figure 7.

The five elements of the FinTech ecosystem. Source: Lee and Shin (2018).

- FinTech startups (e.g., payment, wealth management, lending, crowdfunding, capital market, and insurance FinTech companies);

- Technology developers (e.g., big data analytics, cloud computing, cryptocurrency, and social media developers);

- Government (e.g., financial regulators and legislature);

- Financial customers (e.g., individuals and organizations);

- Traditional financial institutions (e.g., traditional banks, insurance companies, stock brokerage firms, and venture capitalists).

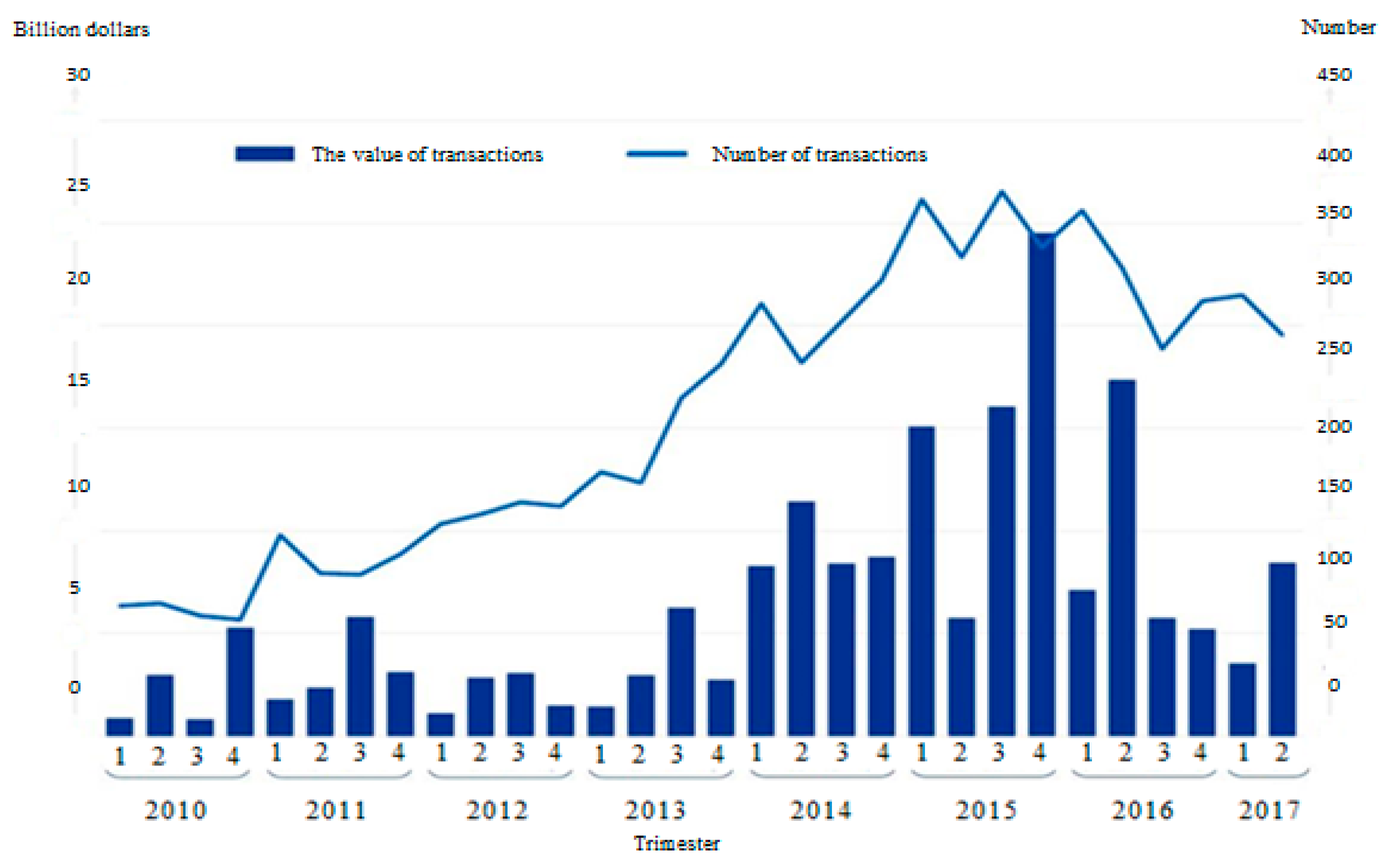

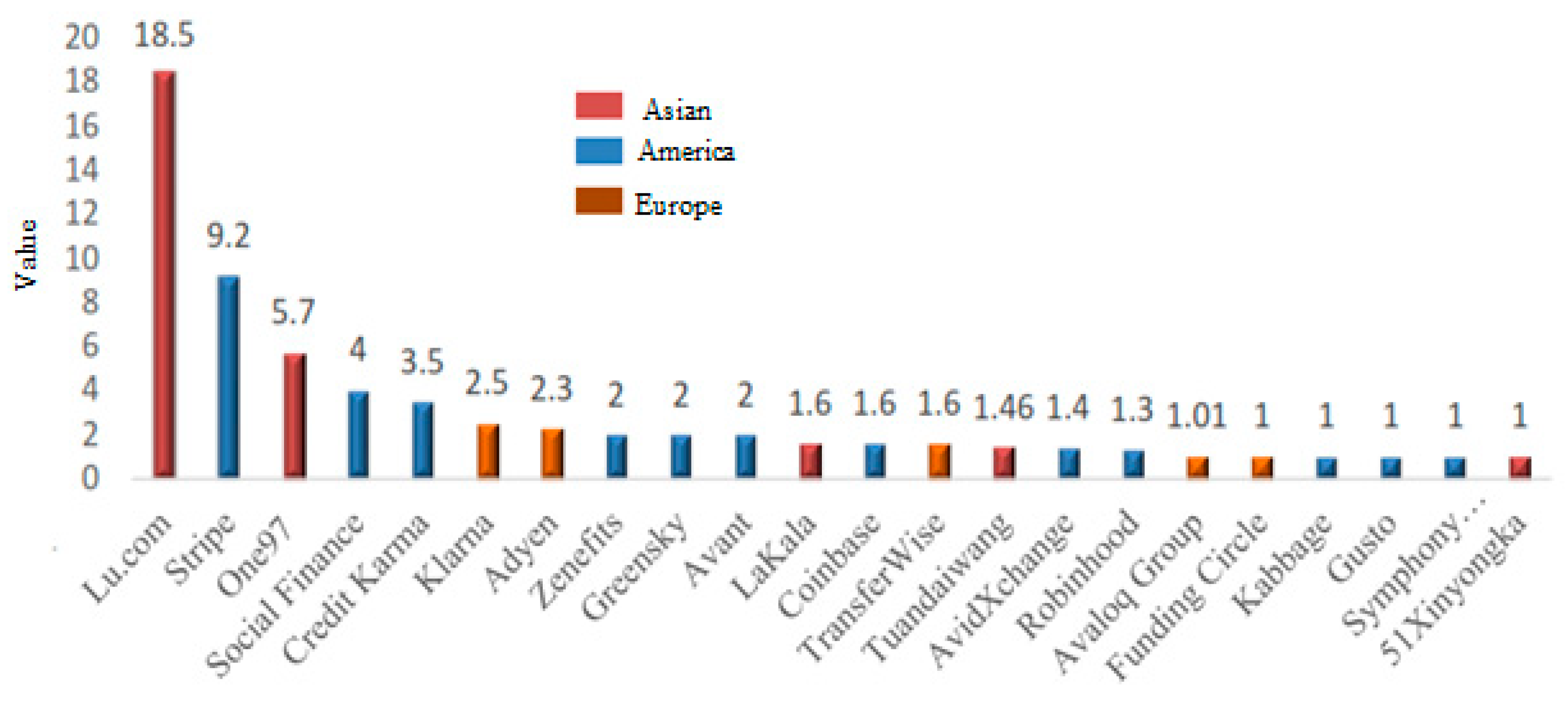

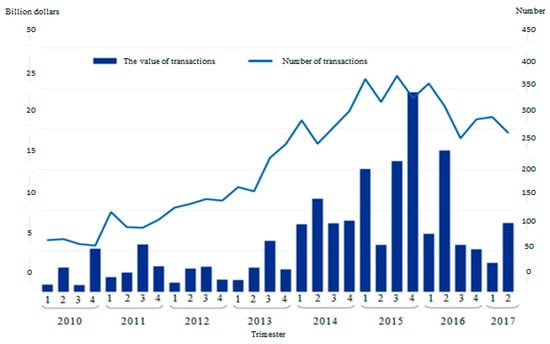

At the center of the ecosystem are FinTech entrepreneurial organizations that represent the Industry 4.0 in a very good way. The core of these organizations in Industry 4.0: innovation in payment, wealth management, lending, financial aggregation, capital markets, lower operating cost insurance, targeting the niche market, and providing personalized services in facing traditional companies. Figure 8 shows the investment in FinTech companies from 2010 to 2017.

Figure 8.

Investing in FinTech companies. Source: (KPMG 2017).

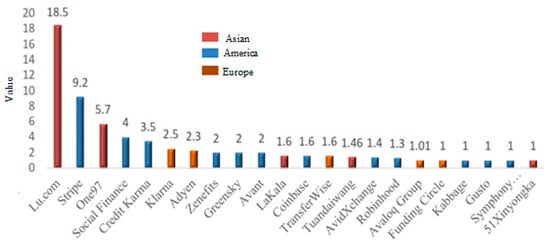

As a result, venture capitalists have invested more than $12 billion in FinTech startups over the past five years. In Figure 9, you can see the list of companies in the field of FinTechnologies up to Year 2017 that have become Unicorn companies (with a market value of $1 billion).

Figure 9.

Unicorn companies. Source: (KPMG 2018).

Certain researchers stated that the FinTech structure of business is digital-based financial services that range from payment systems, banking services, insurance services, loans, and fund collections, to mere advice or learning to the public through digital media (Koesworo et al. 2019).

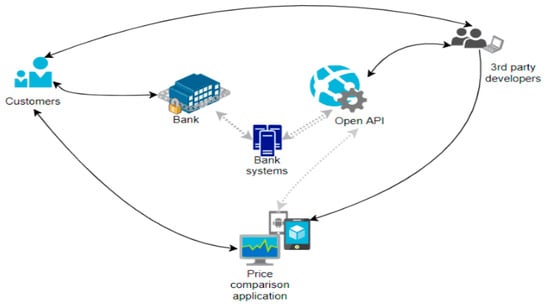

2.3.6. Open Banking (OB): APIs and Fidor Bank

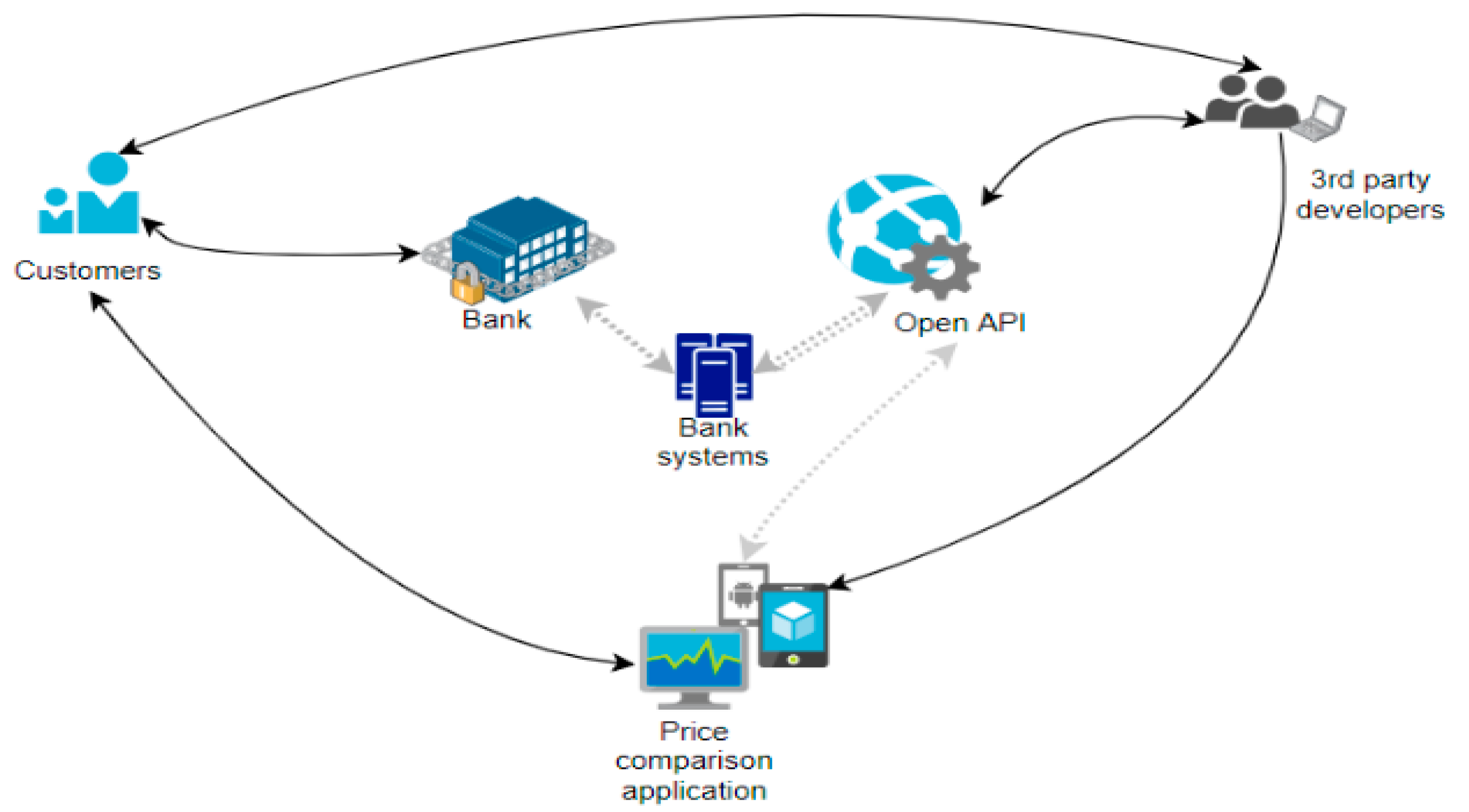

OB is a newly emerging and rapidly developing area in financial systems (OB homepage 2018). The focus is on sharing data using the Open Application Programming Interfaces (Apiacademy homepage 2018). Applications that collect banking data from different institutions through API (application program interface) and present them on a single platform can be developed. APIs or application program interfaces are sets of rules that functions (applications) that can follow to communicate with each other and act as an interface between different applications. In addition to other benefits and advantages, APIs also save on costs; APIs can be used to implement app data from one app to another on a platform or service in a relatively inexpensive and simple way. The technology also adds value to the services provided. These applications can be developed by the in-house software developers as well as by the developers from outside of the organization (Kandırmaz and Tiryaki 2018). Customers can make better decisions by monitoring all their financial information in a single application (Figure 10).

Figure 10.

The structure of open banking (OB). Source: (Kandırmaz and Tiryaki 2018).

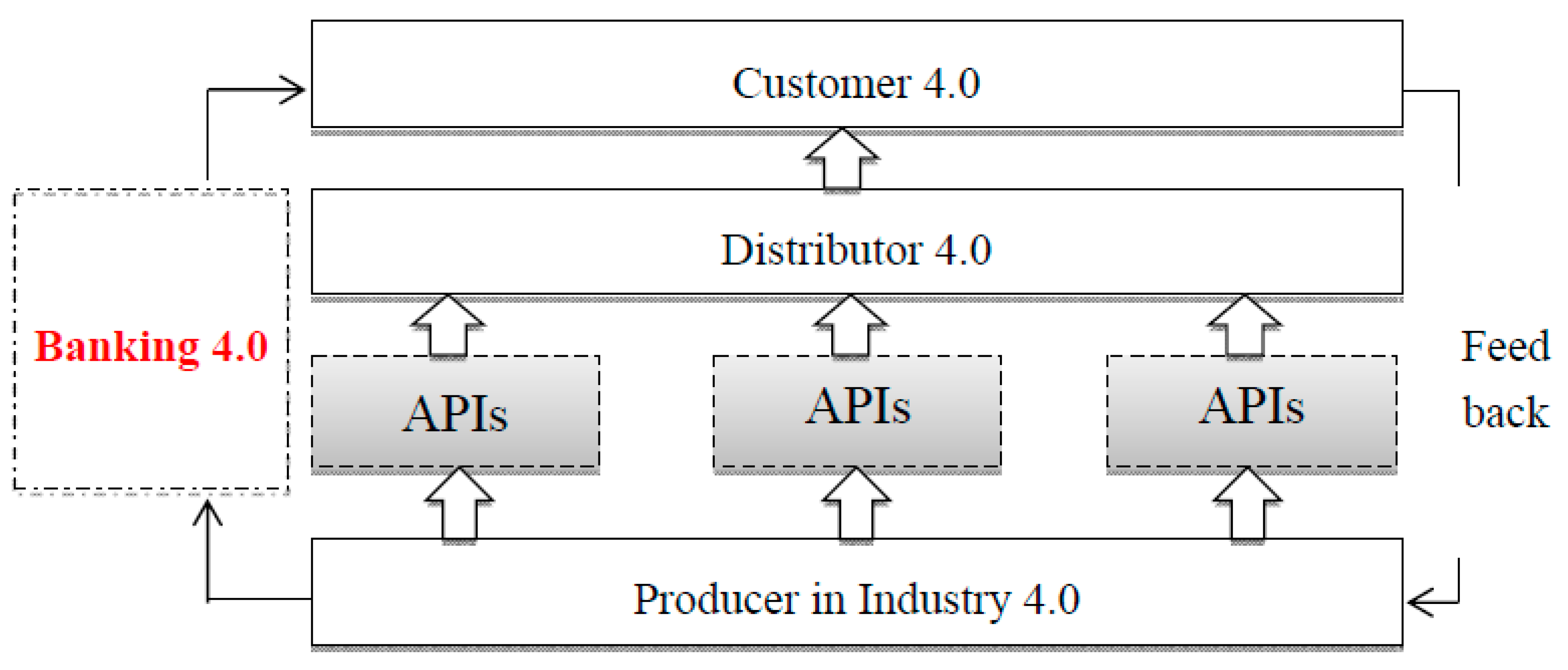

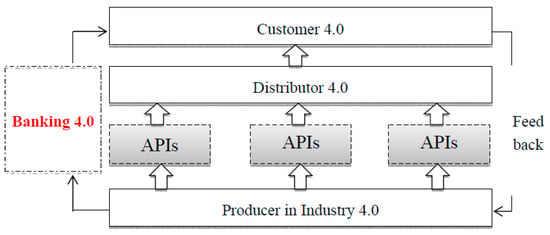

OB has enabled the organizations of Industry 4.0 to disclose data, algorithms, and processes through application programming interfaces and to generate new revenue streams. AnOB model also presents new opportunities for product creation and distribution (Figure 11). In the approach of Industry 4.0, the banking industry has made major changes by involving a large number of partners who are able to incorporate themselves into the product development process. In this new approach, the importance of APIs is emphasized.

Figure 11.

The role of application programming interfaces (APIs) in Industry 4.0. Source: Own contribution of the authors.

Fidor Bank, given its relatively long focus on providing APIs, has significant experience developing revenue streams around API-based businesses. Figure 12 shows the benefits of implementing banks APIs. While the bank often earns its income through the community-banking model, net interest income, fees, and commissions, about one-third of its revenue comes from activities that provide open APIs and white-label (a product or service that is manufactured by one company but re-marketed by another company, as if it were made by a second company) solutions. Fidor Bank is growing as much as its white-label partnerships, the revenue generated by shared revenue streams will grow, and partners will expand their businesses.

Figure 12.

Benefits of implementing banks’ APIs. Source: Capgemini (2017b) Retail Banking Executive Interview Survey, Capgemini Global Financial Service.

OB and BB are both on the path to fourth-generation banking development. The difference is that having open APIs, in particular, enables banks to collect operational data from a variety of sources, including customer buying habits, financial requirements, and risk appetite. Therefore, banks can offer products and services to customers with different tools and channels. However, banks also need to provide personalized services and products to different audiences through different channels. To this end, banks will work with FinTech to design a variety of products from platforms and tools, which will greatly improve product distribution. Therefore, in BB, by maximizing the potential of information and communication technology to customers without visiting the branch, through customer distribution and the supply of products and services with the same platforms and tools, customer satisfaction increases.

2.3.7. Omni-Channel (O-C): Disney Company and Starbucks

The O-C approach can be seen as the evolution of the multi-channel and having its origins in the retail industry (Rosman 2015). According to the multi-channel view, the customer gets a diverse experience across channels and acts as an integrator of information, whereas the O-C view focuses on bridging the gaps between different channels with the aim to provide a consistent and seamless customer experience (Rosman 2015; Saghiri et al. 2017). Based on this, three key principles or factors of O-C can be defined as follows: (1) seamless interaction between the channels (i.e., seamless transition to a second channel, enabling continuation of what was already started in the first channel), (2) optimization across channels (i.e., designing tasks and functionalities for different devices adapted to their unique context and strengths), and (3) consistent experience across channels (e.g., presentation and language or that task models are found consistent over different devices) (see McKinney 2014; Rosman 2015).

It should be noted in the first place that the concept of the O-C is in fact an organizational strategy. The O-C concept is not limited to banks and financial institutions, but it can be applied to any business dealing with customers (Figure 13).

Figure 13.

The relationship of communication channels in the Industry Revolution. Source: Own contribution of the authors.

According to Figure 10, in Industry 4.0, where human resources face plenty of new technologies, sensitivity, creativity, and communication in enterprises should be improved (Lee et al. 2018). Industry 4.0 is based on the unique involvement of human resources in the use of technology. All previous revolutions were limited only to increasing efficiency through the use of modern work methods and technical inventions. Currently, ensuring comprehensive integration of the human and technological sphere requires profound changes in the social sphere—also among employees of enterprises (Jasińska and Jasiński 2019). The following are the types of communication channels simultaneously with the developments of the Industry Revolution:

Single Channel: The most primitive way of connecting businesses with customers has been around for centuries. In this way, customers are connected to the business in only one way, mainly through physical communication (shop, bank branch, insurance office, etc.).

Multi-Channel: In this way, businesses can communicate with customers in several ways or ports, but each of these ports is completely independent of the other ports. The emergence of electronic tools such as phones, mobile phones, and computers has greatly helped to expand this way of communication, as most businesses today use the multi-channel method to communicate with their customers. In the case of banks and financial institutions, the advent of systems such as ATMs, telephone banks, internet banking, mobile banking, etc., has practically led to the relationship of customers with banks in a multi-channel manner.

Cross-Channel: This is a higher level of multi-channel mode. As stated in the multi-channel method, each communication port is completely independent of the other ports and virtually a single client is seen as a separate and separate identity in each port. In contrast, in the cross-channel approach, each customer has a single identity that is recognized in all ports with the same identity. It should be noted that in the cross-channel method, communication ports are still independent of each other.

Omni-Channel: In this case, not only does the customer have a single identity across all ports, but virtually all ports see it as a unified system. In the O-C style, customer communication is performed seamlessly, anytime, anywhere on all devices. In this way, the customer and the activities he/she does are central to the way the services are provided to him/her. Accordingly, the service to each customer is personalized based on the activities he has done on all ports. As a result, it not only responds to the customer’s explicit requests, but also their interests and implied needs.

The most important difference between multi-channel and O-C is that multi-channel puts the brand at the center of the strategy and sends a similar message to customers on all communication channels. However, omni puts the customer channel at the center of the strategy. In this way, the message that is to be sent to the customer changes and will be appropriate to the way the customer interacts with other communication channels. So, the five main features of the O-C in Banking 4.0 are:

- Port uniformity

- Integration of ports versus independent ports

- Customer-centric versus bank-centric

- Interaction versus transaction

- Guessing customer needs versus making requests

Technically, in order for an O-C-based architecture to meet these needs, it needs to take advantage of new technologies such as responsive design. Big data, NoSQL database, data mining, data analysis, etc., which emerged in Industry 4.0. For instance, a NoSQL (originally referring to “non SQL” or “non-relational”) database provides a mechanism for storage and retrieval of data that is modeled in means other than the tabular relations used in relational databases.

- Disney Company: Disney is one of the companies that has good communication with customers by using the O-C concept. It is based on fiction and creative stories, and it is no wonder that in the real world, it also uses creative ways to omni-channel. Disney paid close attention to details and made it possible to access all parts of the website via mobile. After logging in, the user can plan each minute of the trip through the app. Visitors can follow the park through the app, the location of all sights, and the length of time they need to queue. Users also get their rooms through the app and charge all the purchases they make to room service. All Disney communication channels are interconnected and provide a good user experience.

- Starbucks: Starbucks is another brand that has made good use of the omni-channel concept. Starbucks has branches in most cities around the world and provides a good customer experience.Each time a user pays his account via bank or mobile card, the purchase points he has are added to his account. The Starbucks app also introduces the nearest branch to the user and prepares the coffee by the time the user arrives. Users can also view the new coffee list in the menu and be informed of the song played in each branch (Starbuck works with many companies. Playing all kinds of music and having a lot of branches around the world has made customers understand different pleasures. So, customers can choose their Starbucks according to the music played). Surely every user after experiencing such features will become a permanent customer of the brand.

2.3.8. Robotics in Banking

Robotics is revolutionizing the way lots of banking and finance companies do business through something called robotic process automation (RPA). According to Romao et al. (2019), RPA represents the use of software with artificial intelligence (AI) and machine learning capabilities in order to drive high-volume, repeatable tasks that previously required only humans to perform. It is essentially a virtual workforce based on software that frees up human employees to focus on less tedious tasks that only humans do well. For example, PayPal and credit institutions also use robots to provide services to their customers. PayPal uses the robot to transfer money from person to person on its own program. PayPal also interacts with robots from companies such as Uber. MasterCard has also built a robot for its customer service department as well as for its Masterpass application. Bank of America has also created a robot on Facebook for its cardholders. Robotic process automation is a quick and simple way for banks to automate a wide range of processes (Mlađenović 2018):

- Secure efficient interaction between different systems, thus eliminating the need for employees to manually source data

- Upgrade middle and back-office processes (faster execution, fewer errors)

- Speed up the processing of big data

- Free up employees to focus more on clients and provide a better customer experience

- Reduce time-to-market and total cost of ownership (TCO)

- Simplify regulatory compliance with greater transparency

- Pave the way for a new wave of transformation toward 100% digital banking.

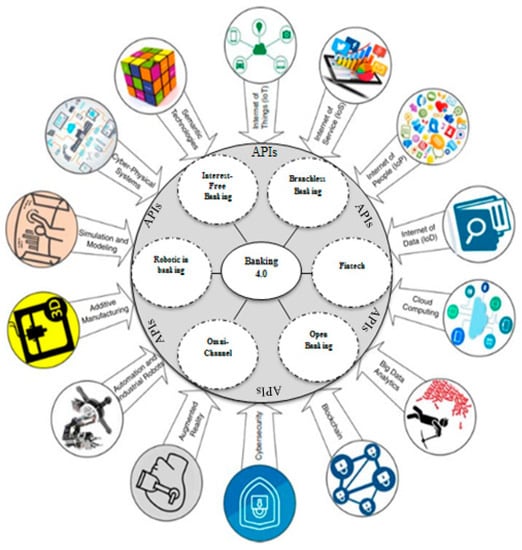

3. Banking 4.0 Roadmap in Industry 4.0

It is imperative to create a roadmap for Banking 4.0 in Industry 4.0. While technology acts as an empowering factor for banks to move in the right direction, it has also led to the growth of non-traditional companies in Industry 4.0. Companies use technology to provide simple, easy, convenient, and affordable financial products and services to customers. Since the emergence of the technologies of Industry 4.0 has had a significant impact on both industry and financial services, there has been a growing trend in the banking industry that focuses on innovation using these new technologies.

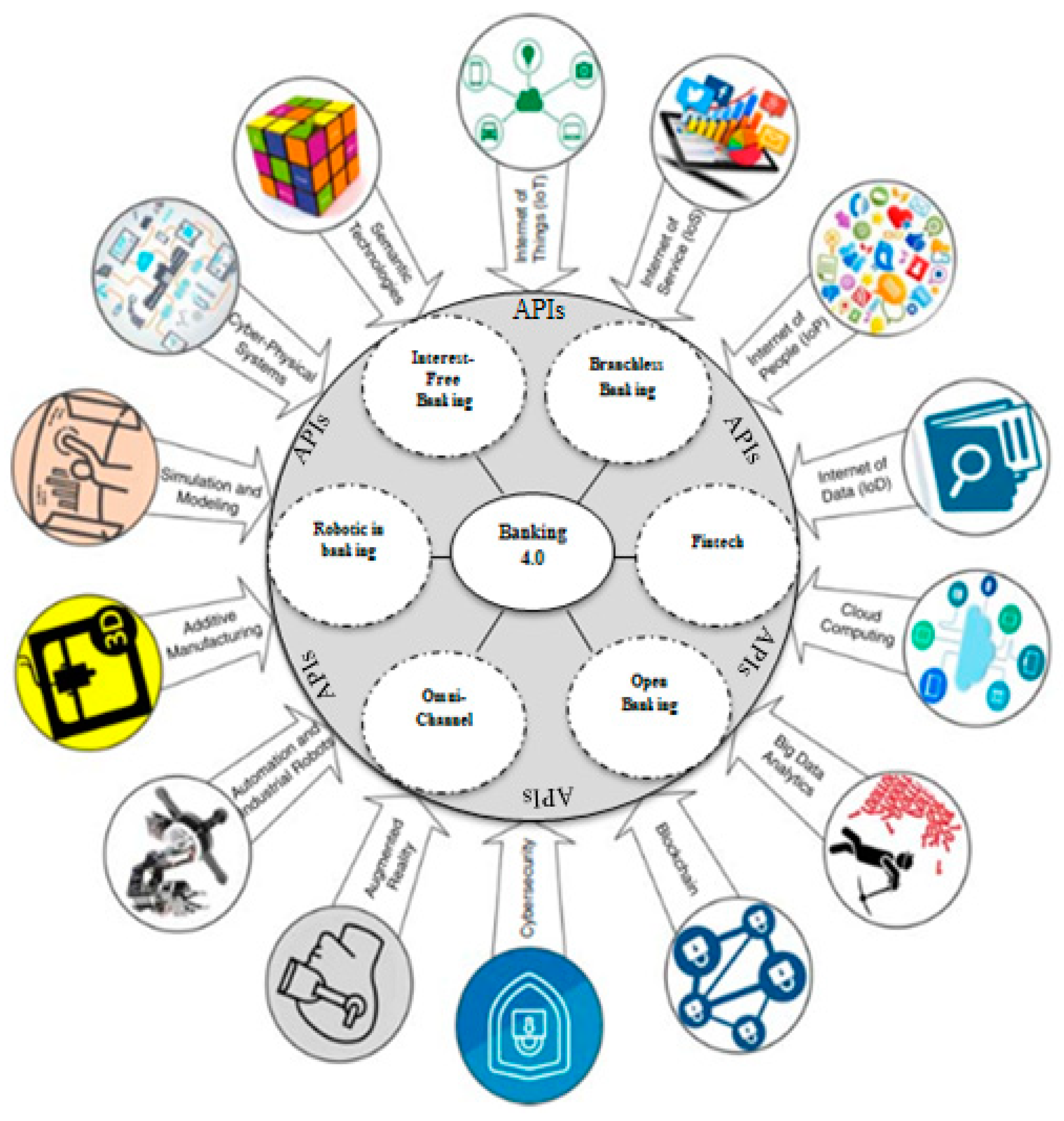

Figure 14 shows the most important components of the Fourth Industrial Revolution and its relationship to fourth-generation banking. There is a great deal of ambiguity about the definition of IoT, as each stakeholder has defined it according to its user (Atzori et al. 2010). IoT refers to IIoT in the Fourth Industrial Revolution, which deals with industrial applications of IoT (Wang et al. 2016a). Physical objects can work through IoT to communicate with each other and to better coordinate decision making (Al-Fuqaha et al. 2015).

Figure 14.

Design principles of Banking 4.0 in Industry 4.0. Source: Own contribution of the authors.

Internet of Services (IoS) refers to the purposeful use of new value creation methods through PaaS (Product-as a-Service) business models (Ghobakhloo 2018, p. 919). IoS provides the technology makers with the technological infrastructure needed to provide services and provide customers with continuous communication and increased competitiveness (Becker et al. 2014). The transformation of humans and their devices into active elements on the Internet is called a complex social and technical system called IoP (Internet of People) (Conti et al. 2017). The existence of the social devices (SDs) and People as a Service (PeaaS) constitutes the necessary infrastructure for IoP. The development of IoT, which is of great interest to researchers today, is called the Internet of Data (IoD) (Fan et al. 2012). Paying attention to the means of transmitting, storing, and processing data in the IoT environment where a lot of data is generated is one of the tasks of IoD (Anderl 2014).

Although cloud computing is not a new concept, there is no single definition for it yet (Ghobakhloo 2018, p. 920). The concept has expanded into the world of technology through the development of hardware, technology and computing, and the provision of services over the Internet (Oliveira et al. 2014). Using this concept has created a variety of applications, including web-based management dashboard and cloud-based collaboration, and it enables the integration of distributed manufacturing resources and the establishment of a collaborative and flexible infrastructure across geographically distributed manufacturing and service sites (He and Xu 2015). In fact, the concept of cloud structures will generate subsequent structures (Ooi et al. 2018).

The concept of big data has been in technology and industry for many years (Ghobakhloo 2018). Srivastava and Gopalkrishnan (2015) argued that big data has recently unlocked secrets of money movements, helped prevent major disasters and thefts, but also understand consumer behavior. For instance, the core idea of business intelligence (BI) is to recognize the behavior of the customer and to predict their purchase pattern for improvement of the business considering that building strong customer relationships is very important for companies (Nethravathi et al. 2020). Consequently, this approach benefits the banking sector, considering the flexibility and easiness of extracting useful information for the interest of their consumers. However, organizations are analyzing data to maintain good survival and make effective decisions in times of crisis as well as market competition (Hu et al. 2014). For example, big data analytics helps companies improve their performance, monitor the status of competitors in the industry, develop customized products, and take preventive measures to prevent crashes. They can also make the production chain and operations easier and more transparent (Babiceanu and Seker 2016; Wang et al. 2016b). Analyzing this type of data enables traditional organizations to better plan the future and use the results to increase system efficiency and efficiency (LaValle et al. 2011). On the other hand, customers’ buying behavior could be accurately researched in the actual market place, rather than in surveys and samples (Hawaldar et al. 2019).

Blockchain has many capabilities and is based on emerging financial currencies such as bitcoin and Ethereum (Ghobakhloo 2018). This technology is also known as distributed ledger technology. By providing transparent, secure, reliable and fast solutions, blockchain provides special conditions for public or private organizations (Underwood 2016). The application of this technology is crucial in the Fourth Industrial Revolution because the use of countless smart devices around the world makes it possible to perform transparent, secure, fast, and flawless transactions without human interference in the IoT environment (Devezas and Sarygulov 2017; Sikorski et al. 2017). Blockchain activity is not just about financial services, but any kind of digital activity developed in the Fourth Industrial Revolution based on automation. The activity that this concept offers is in fact leading the organizations and creating a trusted, independent relationship between smart factories, suppliers, and customers.

The type of technology that enables organizations to graphically visualize the real environment in the Fourth Industrial Revolution is Augmented Reality (AR) (Yew et al. 2016). The development of software and hardware applications has led AR to act in various industrial processes and products as a guide in describing, planning, and monitoring real-time performance, error detection and recovery, and various training strategies (Doshi et al. 2017; Khan et al. 2011). The search for industrial reality also shows that manufacturing organizations use AR to support employee training programs, task simplification, control, and product design (Elia et al. 2016).

Today’s organizations are turning to the use of robots due to the increasing use of automation. The use of robots is essential for world-class organizations because of the benefits such as increased efficiency and quality, increased reliability and waste reduction, the better utilization of resources, and increased competitiveness (Ghobakhloo 2018; Esmaeilian et al. 2016). The importance of cybersecurity in the Fourth Industrial Revolution was high because no organization was safe from cyber threats. Threats of recent years include The Stuxnet. Malware created a serious threat to nuclear power plants by slowing down the speed of centrifuges. There is no doubt that in the Fourth Industrial Revolution, the issue of cybersecurity and privacy for organizations and individuals is a challenge (Thames and Schaefer 2017). It is essential to create some sort of industrial integration in the chain through the Internet. Obviously, the more links there are, the more information security and transparency they will have (Mehnen et al. 2017).

One of the things that created a trusting relationship between financial organizations in the Fourth Industrial Revolution is 3D printing technology (Ghobakhloo 2018). This technology enables organizations to generate prototypes and conceptual designs that create and play an important role in simplifying activities and increasing their speed (Gilchrist 2016). The Fourth Industrial Revolution has brought organizations and customers together so that customers can come into their organization, even at home, at night, or even while swimming, and do different things. Simulation and modeling techniques have been developed to improve economic designs and evaluate their performance in the real world (Kocian et al. 2012). These concepts are needed in smart factories to evaluate the actual performance of machines, products, and employees (Rüamann et al. 2015). Simulation and modeling not only enable manufacturers to detect errors in the early stages, they also avoid significant costs and irreparable damage to the organization (Gilchrist 2016).

CPS is a suite of state-of-the-art technologies that are capable of interconnecting physical assets and computing operations (Lee et al. 2015). CPS is controlled by computer-based algorithms and integrated with its users over the Internet. The CPS also plays a human role in everything that is capable of computing, networking, and physical processes (Gilchrist 2016). Another important component of the Fourth Industrial Revolution that can be a common standard for information exchange is semantic technologies (Janev and Vraneš 2011). Semantic technologies achieve a high level by offering an abstraction layer above existing IoT technologies and infrastructure that connects data, content, and processes. Importantly, the IIoT lacks universal protocols for integrating machines and does not have the various components of smart factories to achieve a single user (Thuluva et al. 2017). In such circumstances, utilizing the integration of the semantic web with Web of Things (WoT) technologies can provide a definite framework. This feature facilitates the interoperability of assets and services as well as the way in which heterogeneous components are communicated in the Fourth Industrial Revolution.

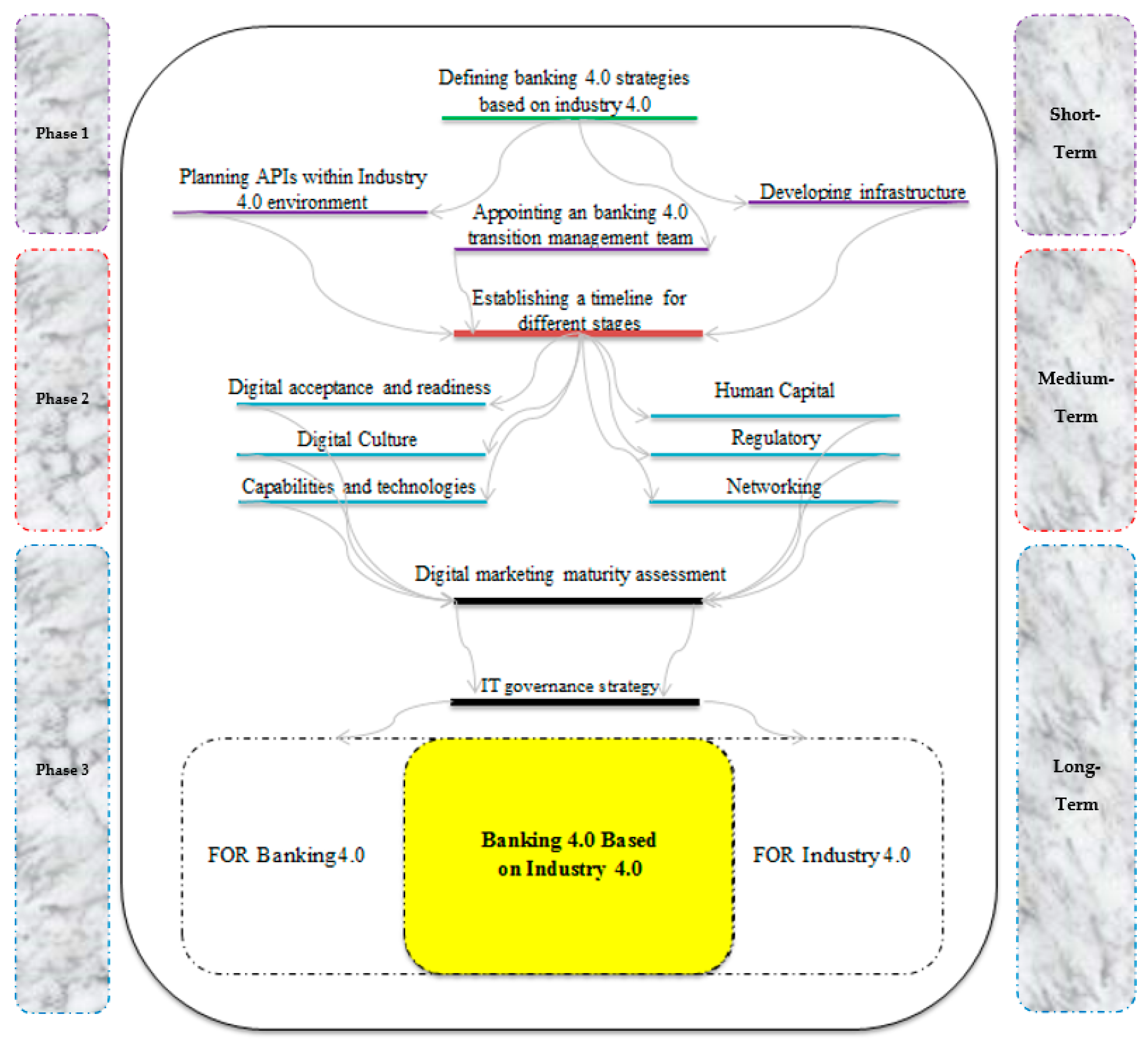

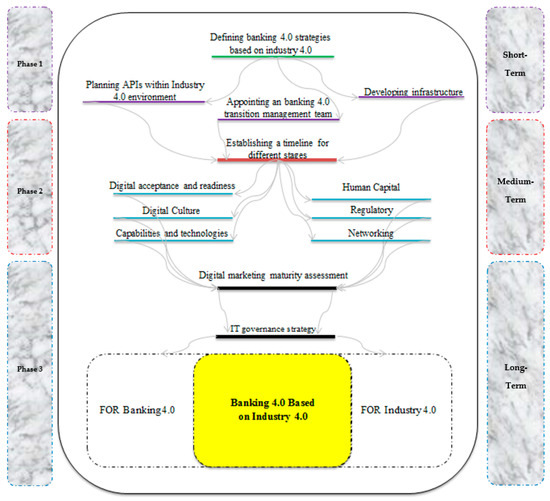

Industry 4.0 needs its own banking. Industry 4.0 is largely international in scope and customers from all over the world choose it. A radical change in the marketing and segmentation of banking customers makes it unique for each customer (Figure 15). In the short term, the fourth-generation banking strategies must first be identified in the context of the Fourth Industrial Revolution. It is necessary to set a timetable for developing the infrastructure and creating user relationships. A specific management team can be appointed in this regard. In the medium term, it is necessary to carefully monitor the timing of all aspects of the strategic plan. The Digital Acceptance and Readiness Program, Human Capital, Digital Culture, Regulatory, Capabilities and Technologies, and Networking should be delivered to the Fourth Industrial Revolution in accordance with the world schedule.

Figure 15.

The strategic roadmap for Banking 4.0 based on Industry 4.0. Source: Own contribution of the authors.

In the long run and after achieving short and medium-term goals, the two goals of digital marketing maturity assessment and IT governance strategy will be provided for fourth-generation banking.

4. Results

We are at a time when exciting things are happening in the banking industry. Non-stop technology is advancing, providing opportunities for institutions through which they can expand their services and eliminate traditional financial services altogether. These state-of-the-art technology networks will provide the opportunity to meet customer needs instantly and intelligently through various channels. This will be achieved when new strategies for computing and storage are explained, advanced analysis is performed, cyber security capabilities are upgraded, and a completely new perspective for banking services is outlined. Which technology has the greatest potential for the Industry 4.0 in Banking 4.0? The exact answer to this question is not clear, but there is no order in the application of the introduced trends, but it is these organizations that must prioritize and allocate the necessary capital to implement each of them. There are so many opportunities, and any passivity or desire to stay calm will put a high risk on the organization.

Banking and payment services must move toward the formation of a fully intelligent network. Overall, improving the customer experience, using artificial intelligence, the emergence of databases, the use of identification algorithms, the use of machine learning methods, and data analysis are among the features of the new generations of banking. However, the important thing is that digital technologies have made major changes in banking. Traditional banks are migrating more digital services to digital channels every day. Customer preference for the increased convenience and availability of services is also strongly aligned with this change and gives it more acceleration. This has led to a change in the structure of the distribution network of banks, and in addition to reducing the need for physical branches, it has also changed the function and mission of branches. However, evidence from international banks and even some traditional industries shows that non-alignment with digital and technological developments, while reducing profitability and value creation, will also jeopardize the survival of these institutions. Today, banking is a cascade of multiple technologies, rules and regulations, and demographic factors that cut the length and breadth of its value chain. These factors affect the way businesses are run by banks, so that common banking practices are not enough to meet growing customer expectations as well as improve profitability. Therefore, the factors influencing the evolution of the banking industry can be divided into two main categories: business developments and technical developments. In the area of business developments, new non-bank actors in the form of FinTech or startups have disrupted the banking business and impaired the role of intermediaries in banks. However, in the technical sector, the emergence of new technologies such as blockchain, robotics, etc., has had a significant impact on the performance of the banking industry.

5. Conclusions

Banks and FinTechs have been working for years to find common ground. The FinTechs have stepped in to gain market share and have been successful in injecting new concepts into banking. However, they ran into trouble when they tried to get a large scale of banks to be able to process and reach more customers. Banks initially looked at the FinTechs with skepticism and distrust, but since then they have praised their entrepreneurial approach. Undoubtedly, due to the existence of old systems and cultural frustration with risking within banks, FinTechs have breathed new life into the banking system. Both sides (banks and FinTechs) have increasingly come to the conclusion that by combining and synergizing their strengths, they can create value.

Banks need to change the way they think about the past and keep up with the advances in technology. Besides, the first thing they need to focus on is improving and providing services from the customer’s point of view so that they can create the key factor of customer experience in the best way. Therefore, the basis for valuing fourth-generation banks is based on the creation of cooperation between the bank and customers. Finally, banks need to work closely with technology and knowledge-based companies to introduce new operating methods. Banks will be very similar to technology companies, and they desperately need to work with these companies to accelerate the process of transformation and business transformation. From the point of view of Industry 4.0, a successful economy has the most assets, activities, and focus in digitizing its assets. The experience of using technology is very new, even in the world.

However, the most important limitations of the research are the limitations of technology and culture, as well as the type of vision of customers regarding the nature of banking. A study of the structure of various industries and the lack of attention to the necessary infrastructure for the development of technologies required by Banking 4.0 in different countries shows that more studies should be done on the use of emerging technologies in various banking and industrial sectors.

Future researchers are also advised to identify and prioritize the following: (1) the pathology of various emerging technologies in Banking 4.0 in terms of legal and regulatory structures and (2) the indicators of Industry 4.0 to enter Banking 4.0.

Author Contributions

All authors contributed equally to this research work. All authors discussed the results and contributed to the final manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Ahmad, Khurshid. 2000. Islamic finance and banking: The challenge and prospects. Review of Islamic Economics 9: 57–82. [Google Scholar]

- Al-Fuqaha, Ala, Mohsen Guizani, Mehdi Mohammadi, Mohammed Aledhari, and Moussa Ayyash. 2015. Internet of things: A survey on enabling technologies, protocols, and applications. IEEE Communications Surveys & Tutorials 17: 2347–76. [Google Scholar]

- Anderl, Reiner. 2014. Industrie 4.0-advanced engineering of smart products and smart production. Paper presented at the 19th International Seminar on High Technology, Technological Innovations in the Product Development, Piracicaba, Brazil, October 9; pp. 1–14. [Google Scholar]

- Agrawal, Anirudh, Sebastian Schaefer, and Thomas Funke. 2017. Incorporating Industry 4.0 in Corporate Strategy. Hershey: IGIGlobal. [Google Scholar]

- Apiacademy Homepage. 2018. Available online: https://www.apiacademy.co/lessons/2015/04/api-strategy-lesson101-what-is-an-api (accessed on 10 September 2018).

- Arner, Douglas W., Janos Barberis, and Ross P. Buckley. 2015. The Evolution of FinTech: A New PostCrisis Paradigm. Geo. J. Int’l L 47: 1271–71. [Google Scholar]

- Athanasoglou, Panayiotis P., Matthaios D. Delis, and Christos K. Staikouras. 2006. Determinants of Bank Profitability in the South Eastern European Region. Working paper no. 40. Athens: Bank of Greece. [Google Scholar]

- Atombank. 2016a. Fabulous Atom Questions. Available online: https://www.atombank.co.uk/ (accessed on 7 October 2016).

- Atombank. 2016b. The Future of Banking. Available online: https://www.atombank.co.uk/ (accessed on 7 October 2016).

- Atzori, Luigi, Antonio Iera, and Giacomo Morabito. 2010. The internet of things: A survey. Computer Networks 54: 2787–805. [Google Scholar] [CrossRef]

- Babiceanu, Radu F., and Remzi Seker. 2016. Big Data and virtualization for manufacturing cyber-physical systems: A survey of the current status and future outlook. Computers in Industry 81: 128–37. [Google Scholar] [CrossRef]

- Bandara, Oshadhi, Kasuni Vidanagamachchi, and Ruwan Wickramarachchi. 2019. A Model for Assessing Maturity of Industry 4.0 in the Banking Sector. Paper presented at the International Conference on Industrial Engineering and Operations Management, Bangkok, Thailand, March 5–7. [Google Scholar]

- Banker. 2019. Annual Report. Available online: https://www.thebanker.com/ (accessed on 18 July 2019).

- Becker, Tilman, Catherina Burghart, Kawa Nazemi, Patrick Ndjiki-Nya, Thomas Riegel, Ralf Schäfer, Thomas Sporer, Volker Tresp, and Jens Wissmann. 2014. Core technologies for the internet of services. In Towards the Internet of Services: The THESEUS Research Program. Edited by Wolfgang Wahlster, Hans-Joachim Grallert, Stefan Wess, Hermann Friedrichand and Thomas Widenka. Heidelberg: Springer, pp. 59–88. [Google Scholar]

- Benbasat, Izak, and Henri Barki. 2007. Quo vadisTAM. Journal of Association for Information Systems 8: 3–13. [Google Scholar] [CrossRef]

- Berger, Roland. 2017. Industry 4.0, New Industrial Revolution HowEurope will Succeed. Munich: Roland Berger Strategic Consultants. Available online: http://www.iberglobal.com/files/Roland_Berger_Industry.pdf (accessed on 10 March 2020).

- Bhattacharya, Sudipto, and Anjan V. Thakor. 1993. Contemporary banking theory. Journal of Financial Intermediation 3: 2–50. [Google Scholar] [CrossRef]

- Bohács, Gábor, Ivett Frikker, and Gabor Kovács. 2013. Intermodal logistics processes supported by electronic freight and warehouse exchanges. Transport and Telecommunication 14: 206–13. [Google Scholar] [CrossRef]

- Capgemini. 2012. Trends in Retail Banking Channels: Improving Client Service and Operating Costs. Available online: www.capgemini.com/banking (accessed on 25 June 2019).

- Capgemini. 2017a. Capgemini Financial Service Analysis, World_FinTech_Report_2017. Available online: https://www.capgemini.com/wp-content/uploads/2017/09/world_fintech_report_2017.pdf (accessed on 18 July 2019).

- Capgemini. 2017b. Capgemini Financial Service Analysis, Retail Banking Executive Interview Survey, Capgemini Global Financial Services. Available online: https://www.capgemini.com/at-de/wp-content/uploads/sites/25/2018/08/WorldRetailBankingReport2017.pdf (accessed on 30 July 2019).

- CGAP. 2008. Banking through Network of Retail Agents. Washington, DC: CGAP/World Bank. [Google Scholar]

- CGAP. 2010. CGAP Annual Report 2010. Available online: https://www.cgap.org/about/key-documents/cgap-annual-report-2010 (accessed on 1 December 2016).

- CGAP. 2011. Bank Agents: Risk Management, Mitigation, and Supervision. Available online: https://www.cgap.org/ (accessed on 1 December 2016).

- Cividino, Sirio, Gianluca Egidi, Ilaria Zambon, and Andrea Colantoni. 2019. Evaluating the Degree of Uncertainty of Research Activities in Industry 4.0. Future Internet 11: 196. [Google Scholar] [CrossRef]

- CNI, National Confederation of Industry. 2016. Industry 4.0: A new challenge for Brazilian industry. CNI Indicators 17. [Google Scholar]

- Conti, Marco, Andrea Passarella, and Sajal K. Das. 2017. The Internet of People (IoP): A new wave in pervasive mobile computing. Pervasive and Mobile Computing 41: 1–27. [Google Scholar] [CrossRef]

- David, Loide, and Teresia Kaulihowa. 2018. The Impact of E- Banking on Commercial Banks’ Performance in Namibia. International Journal of Economics and Financial Research 4: 313–21. [Google Scholar]

- Delloite. 2012. Are We Headed towards Branchless Banking? Available online: www.deloitte.com/ar (accessed on 7 December 2019).

- Devezas, Tessaleno, and Askar Sarygulov. 2017. Industry 4.0: Entrepreneurship and Structural Change in the New Digital Landscape. Heidelberg: Springer. [Google Scholar]

- Dzombo, Gift Kimonge, James M. Kilika, and James Maingi. 2017. The Effect of Branchless Banking Strategy on the Financial Performanof Commercial Banks in Kenya. International Journal of Financial Research 8: 167–83. [Google Scholar] [CrossRef]

- Doshi, Ashish, Ross T. Smith, Bruce H. Thomas, and Con Bouras. 2017. Use of projector based augmented reality to improve manual spot-welding precision and accuracy for automotive manufacturing. The International Journal of Advanced Manufacturing Technology 89: 1279–93. [Google Scholar] [CrossRef]

- Elia, Valerio, Maria Grazia Gnoni, and Alessandra Lanzilotto. 2016. Evaluating the application of augmented reality devices in manufacturing from a process point of view: An AHP based model. Expert Systems with Applications 63: 187–97. [Google Scholar] [CrossRef]

- Ernst and Young. 2016. FinTech on the Cutting Edge. Available online: http://www.ey.com/uk/en/industries/financial-services/banking--capital-markets/ey-uk-fintech-on-the-cutting-edge (accessed on 18 January 2020).

- Erol, Selim, Andreas Jäger, Philipp Hold, Karl Ott, and Wilfried Sihn. 2016. Tangible Industry 4.0: A scenario-based approach to learning for the future of production. Procedia CIRP 54: 13–18. [Google Scholar] [CrossRef]

- Esmaeilian, Behzad, Sara Behdad, and Ben Wang. 2016. The evolution and future of manufacturing: A review. Journal of Manufacturing Systems 39: 79–100. [Google Scholar] [CrossRef]

- Fan, Wei, Zhengyong Chen, Zhang Xiong, and Hui Chen. 2012. The internet of data: A new idea to extend the IOT in the digital world. Frontiers of Computer Science 6: 660–67. [Google Scholar] [CrossRef]

- Faure, Alexander Pierre. 2013. Banking: An Introduction, 1st ed. Western Cape: Quoin Institute (Pty) Limited. [Google Scholar]

- Ghobakhloo, Morteza. 2018. The future of manufacturing industry: A strategic roadmap toward Industry 4.0. Journal of Manufacturing Technology Management 29: 910–36. [Google Scholar] [CrossRef]

- Gilchrist, Alasdair. 2016. Industry 4.0: The Industrial Internet of Things. Heidelberg: Springer. [Google Scholar]

- Gjeldum, Nikola, Marko Mladineo, and Ivica Veža. 2016. Transfer of model of innovative smart factory to Croatian economy using Lean Learning Factory. Procedia CIRP 54: 158–63. [Google Scholar] [CrossRef][Green Version]

- GoBank. 2016. Green Dot’s GoBank Opens its US-Only Branchless Mobile Bank to the Public, Available Today. Available online: http://thenextweb.com (accessed on 20 October 2016).

- Gökalp, Ebru, Umut Şener, and P. Erhan Eren. 2017. Development of an Assessment Model for Industry 4.0: Industry 4.0-MM, Software Process Improvement and Capability Determination. New York: Springer International Publishing. [Google Scholar]

- Harjanti, Istidana, Faisal Nasution, Nerifa Gusmawati, Muhammad Jihad, Muhammad Rifki Shihab, Benny Ranti, and Indra Budi. 2019. IT Impact on Business Model Changes in Banking Era 4.0: Case Study Jenius. Paper presented at 2nd International Conference of Computer and Informatics Engineering (IC2IE), Banyuwangi, Indonesia, September 10–11; pp. 53–57. [Google Scholar]

- Hawaldar, Iqbal Thonse, Mithun S. Ullal, Felicia Ramona Birau, and Cristi Marcel Spulbar. 2019. Trapping Fake Discounts as Drivers of Real Revenues and Their Impact on Consumer’s Behavior in India: A Case Study. Sustainability 11: 4637. [Google Scholar] [CrossRef]

- He, Wu, and Lida Xu. 2015. A state-of-the-art survey of cloud manufacturing. International Journal of Computer Integrated Manufacturing 28: 239–50. [Google Scholar] [CrossRef]

- Heffernan, Shelagh. 2005. Modern Banking. Chichester: John Wiley & Sons, Ltd. [Google Scholar]

- Herčko, J., E. Slamková, and J. Hnát. 2015. Industry 4.0—New era of manufacturing. Proceedings of InvEnt 2015: Industrial Engineering–From Integration to Innovation 1: 80–83. [Google Scholar]

- Hu, Han, Yonggang Wen, Tat-Seng Chua, and Xuelong Li. 2014. Toward scalable systems for big data analytics: A technology tutorial. IEEE Access 2: 652–87. [Google Scholar]

- Huang, Taoying. 2017. Development of Small-scale Intelligent Manufacturing System (SIMS)—A case study at Stella Polaris. Master’s thesis, AS UIT Faculty of Engineering Science and Technology the Artic University of Norway, Narvik, Norway. [Google Scholar]

- Hyder, Akmal S. 2013. Interest-free banking in Sweden: How much is it Islamic? Paper presented at the Second International Conference on Emerging Research Paradigms in Business and Social Sciences, Dubai, UAE, November 26–28. [Google Scholar]

- IBM Business Partner Directory. 2018. Available online: https://www.ibm.com/partnerworld/public (accessed on 10 March 2017).

- Ielasi, Federica, and Giulia Vichi. 2013. A particular model of interest-free bank: The case of JAK bank in Italy. Available online: www.jakitalia.it (accessed on 10 March 2017).

- Janev, Valentina, and Sanja Vraneš. 2011. Applicability assessment of semantic web technologies. Information Processing & Management 47: 507–17. [Google Scholar]

- Jasińska, Katarzyna, and Bartosz Jasiński. 2019. Conditions of a Corporate Communication in the Industry 4.0: Case Study. IBIMA Publishing 1: 1–15. [Google Scholar]

- Kagermann, Henning, Johannes Helbig, Ariane Hellinger, and Wolfgang Wahlster. 2013. Recommendations for implementing the strategic initiative INDUSTRIE 4.0: Securing the future of German manufacturing industry. Final Report of the Industrie 4.0 Working Group. Munich: Forschungsunion. [Google Scholar]

- Kandırmaz, Ebru Özdoğru, and Ufuk Tiryaki. 2018. A Real Time Price Sharing Architecture for Open Banking. Paper presented at 7th Turkish National Software Architecture Conference, Istanbul, Turkey, November 29. [Google Scholar]

- Khan, Ateeq, and Klaus Turowski. 2016. A Perspective on Industry 4.0: From Challenges to Opportunities in Production Systems. Paper presented at the International Conference on Internet of Things and Big Data (IoTBD2016), Rome, Italy, April 23–25; pp. 441–48. [Google Scholar]

- Khan, Wasim Ahmed, Abdul Raouf, and Kai Cheng. 2011. Augmented reality for manufacturing. In Virtual Manufacturing. Edited by W. A. Khan, A. Raouf and K. Cheng. Heidelberg: Springer, pp. 1–56. [Google Scholar]

- Kocian, Jiri, Michal Tutsch, Stepan Ozana, and Jiri Koziorek. 2012. Application of modeling and simulation techniques for technology units in industrial control. In Frontiers in Computer Education. Edited by Sambath Sabo and Egui Zhu. Heidelberg: Springer, pp. 491–99. [Google Scholar]

- Koesworo, Yulius, Ninuk Muljani, and Lena Ellitan. 2019. Fintech in the industrial revolution era 4.0. International Journal of Research Culture Society 3: 53–56. [Google Scholar]

- Kolberg, Dennis, Joshua Knobloch, and Detlef Zuehlke. 2017. Towards a lean automation interface for workstations. International Journal of Production Research 55: 2845–56. [Google Scholar] [CrossRef]

- KPMG. 2017. The Pulse of Fintech Q2 2017 Global Analysis of Investment in Fintech. Available online: www.kpmg.com/fintechpulse (accessed on 19 June 2019).

- KPMG. 2018. Global Analysis of Investment in Unicorn Companies. Available online: https://home.kpmg/xx/en/home/campaigns/2018/12/global-review.html (accessed on 19 June 2019).

- Landscheidt, Steffen, and Mirka Kans. 2016. Automation practices in wood product industries: Lessons learned, current practices and future perspectives. Paper presented at 7th Swedish Production Symposium SPS, Lund, Sweden, October 25–27. [Google Scholar]

- LaValle, Steve, Eric Lesser, Rebecca Shockley, Michael S. Hopkins, and Nina Kruschwitz. 2011. Big data, analytics and the path from insights to value. MIT Sloan Management Review 52: 21–32. [Google Scholar]

- Lee, In, and Yong Jae Shin. 2018. Fintech: Ecosystem, Business Models, Investment Decisions, and Challenges. Business Horizons 61: 35–46. [Google Scholar] [CrossRef]

- Lee, Jay, Behrad Bagheri, and Hung-An Kao. 2015. A cyber-physical systems architecture for Industry 4.0-based manufacturing systems. Manufacturing Letters 3: 18–23. [Google Scholar] [CrossRef]

- Leonard, Kenneth. 2019. Banking Rules for Non-Profit Organizations, Small Business, Business Models & Organizational Structure. Available online: https://smallbusiness.chron.com/banking-rules-non-profit-organizations-829.html (accessed on 28 December 2019).

- Lu, Yang. 2017. Industry 4.0: A survey on technologies, applications and open research issues. Journal of Industrial Information Integration 6: 1–10. [Google Scholar] [CrossRef]