1. Introduction

Natural Gas (NG) storage units are used to reconcile the variable seasonal demand for gas with the more constant rate of natural gas production. These gas storage facilities are mainly owned by distribution companies which use them for system supply regulation, and for reducing the risk of shortages. In fact, regulation requires that local distribution companies own storage units, in order to secure their gas supply and to be able to meet any sudden increase in demand or any disruption in the pipeline transportation system.

Traditionally, say prior to about 2005, gas storage units were valued using a discounted cash flow, also called intrinsic, method. The idea was to project an optimal schedule of injections and withdrawals, using the term structure of future prices, and compute the corresponding discounted cash flow, which provided a lower bound to the storage value. Following this strategy, the storage manager observed the futures curve at the beginning of the storage contract and bought/sold futures contracts, thereby determining once and for all the complete schedule of injection and withdrawals; essentially, this lead to buying cheap summer futures and selling expensive winter futures and the corresponding storage value greatly depended upon the summer-winter spread.

Since the late 2000s, however, the seasonal spread has consistently shrunk, putting into question the futures-based methodology. The

2011 State of the Markets report, issued by the US Federal Energy Regulatory Commission (

FERC 2012), noticed the following: We have also seen a decline in the seasonal difference between winter and summer natural gas prices. Falling seasonal spreads reflect increased production and storage capacity, as well as greater year-round use of natural gas by power generators. This decline has developed over the past several years and we expect the trend to continue.

This narrowing winter/summer spread was mainly due to two factors that simultaneously put a downward pressure on winter gas prices and an upward pressure on summer prices. The first factor was the recent surge in non conventional shale gas supply, with geographical locations that were closer to gas consumption areas. The main effect of this new abundant supply was a downward pressure on winter prices. The second factor is related to power consumption by cooling systems during summer periods and the growing use of natural gas as a fuel for electricity generation. This puts an upward pressure on summer gas prices. The combination of these two factors had the logical consequence of narrowing the seasonal spreads between winter and summer prices, diminishing the intrinsic value of gas storage units. The phenomenon has even amplified over time to the point that, as of January 2018, the maximum summer-winter spread is about 50 cents.

Static strategies based on futures contracts were no longer adequate to monetize the value of gas storage facilities; they even sometimes failed to recover the operating expenses. This motivated an interest in dynamic strategies that took advantage of the real options embedded in gas storage facilities. These methods are called extrinsic because they take into account the time value of the embedded calendar spread options. As intended, they evaluated the storage units, in particular the units with a high injection/withdrawal rate, at a much higher value than the traditional intrinsic value. However, switching from an intrinsic to an extrinsic valuation method was a major paradigm shift in risk management, and this for two reasons:

The extrinsic method relies on a precise model of the dynamics of the Natural Gas term structure, and in particular on the modeling of correlation between futures contracts, and between the futures prices and the cash price of Natural Gas. Contrast this with the intrinsic method, which takes the term structure as a given, and does not require any model of the price dynamics.

The traditional intrinsic method assigned to the storage unit a value that could be recovered for certain by implementing a static trading strategy in Natural Gas Futures. In contrast, the extrinsic method, by analogy with financial options, determines the expected discounted value of future cash flows. The analogy with a financial option stops here however, because, contrary to an option on a stock, for example, the hedging strategy is far from being as readily available.

The purpose of this paper is to stress the magnitude of this paradigm shift, and its contributions are two-fold.

Firstly, we provide a model of the dynamics of the NG market, that incorporates all the features relevant for the evaluation of options embedded in a storage unit. To this end, we introduce a new modeling framework that unifies the dynamics of the futures curve and spot price, and is consistent with the two stylized facts that are essential to the gas storage valuation problem: price seasonality and spot price spikes.

Secondly, we attempt to quantify the model uncertainty inherent to the extrinsic method. We highlight in particular the significant sensitivity of gas storage value to the specification and estimation of the spot model. This result puts into perspective the extensive literature on gas storage valuation, and calls for a more careful assessment of the model risk inherent to these valuations. We conclude that in the current state of the art, a significant portion of the extrinsic value cannot be monetized in a reliable manner.

Summary of Findings

We find that the switch from an intrinsic to an extrinsic valuation method introduces a significant level of model risk in the pricing and risk management of storage units. We have identified a model formulation for the dynamics of the asset price that somehow mitigates this risk, but model risk still remain a full order of magnitude larger than for standard financial options. In this context, the extrinsic method, should be understood as providing a broad indicator of value rather than a firm price. This puts into perspective the concentration of effort in the literature on the specification of an optimal valuation strategy. More attention should probably be devoted to the discussion of modeling assumptions.

After this introduction the paper is organized as follows. In

Section 2, we provide a summary of the literature with respect to both the storage valuation methods and the modeling of the dynamics of the Natural Gas term structure. Next, we introduce in

Section 3 our model for the price process, and motivate our modeling choices by an investigation of the stylized facts observed in the Natural Gas market. In

Section 4 we use our models to price typical storage facilities, using both the

extrinsic and

intrinsic methods.

Section 5 is devoted to the measure of model risk in

extrinsic methods. We introduce two natural model risk measures to quantify the sensitivity of a class of models with respect to the parameters; those risk measures are computed in several test cases.

3. Modeling Framework for the Price Process

In order to motivate our model, we first present some stylized facts about the prices of natural gas, then present the model formulation and its estimation.

3.1. Natural Gas Stylized Facts

In this section, we highlight important stylized facts about natural gas markets that may influence the value of a storage unit. These properties are related to the demand and use of natural gas. In fact, the demand for natural gas for heating in cold periods of the year produces a seasonal price pattern, while unpredictable changes in weather can cause sudden shifts in gas prices. These facts are the two main sources of value for a gas storage unit, since the ownership of a storage facility enables one to take advantage of seasonality and price spikes.

As for all other commodities, the price of natural gas (NG) is influenced by its point of delivery. In this study, we will be interested in the United States market, specifically in a storage location near Henry Hub (Louisiana), which justifies the use of gas daily spot prices and the NYMEX natural gas futures as hedge instruments. One can buy natural gas in the spot market for next-day delivery, or in the futures market for rated delivery over a future period of one calendar month. The NYMEX futures market provides quotes for the next 72 monthly futures contracts, but only the first 24 or so are actively traded.

In what follows, will denote the spot price of natural gas at date t, and represent the futures contracts prices at t, for a set of maturities. We consider monthly spaced maturities, so every futures contract is related to a delivery month. Also, we denote by the price of prompt contract, i.e., the futures contract with the closest maturity to current time t. Natural gas prices are quoted in U.S. dollars per million British thermal units (MMBtu).

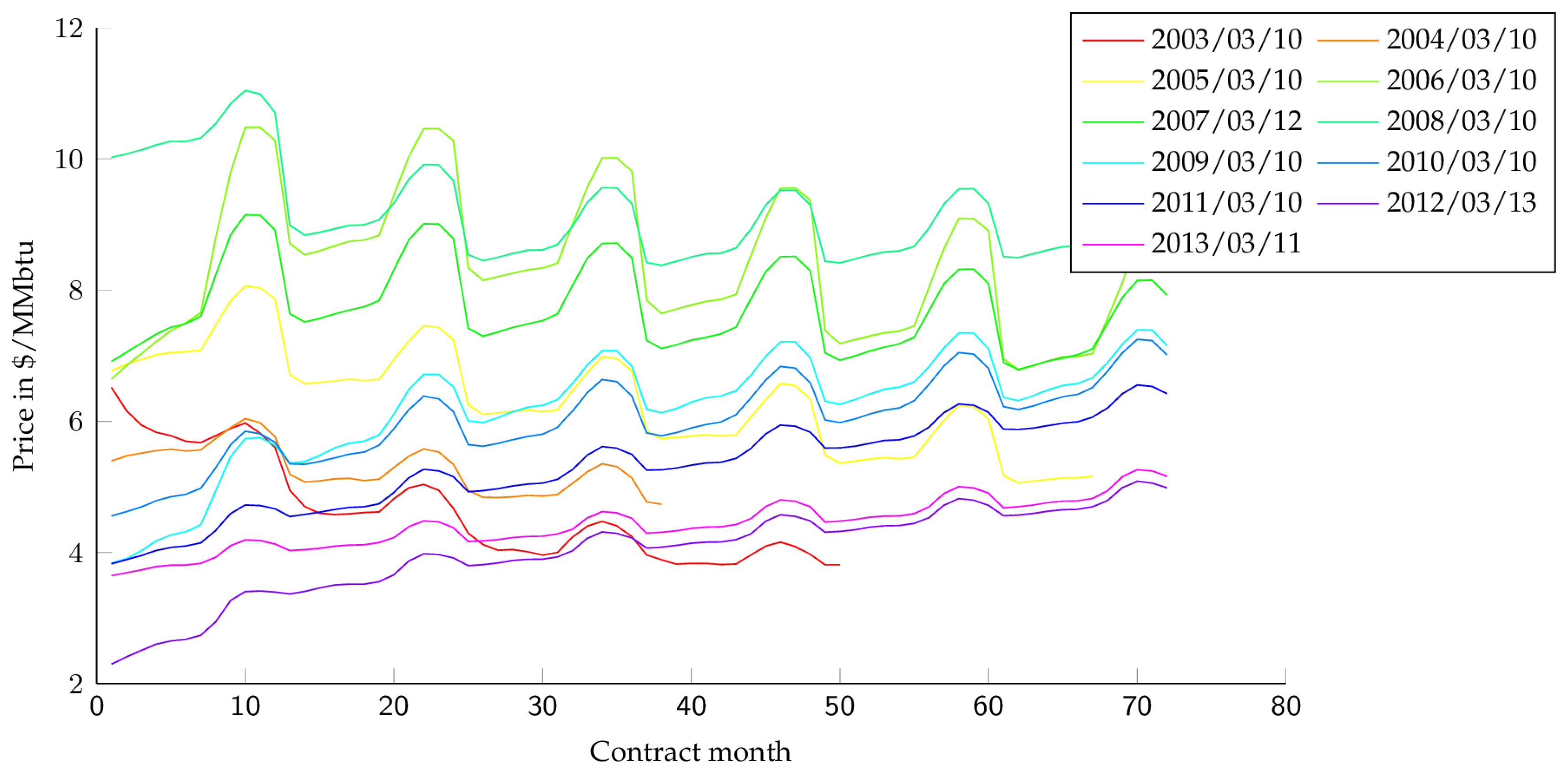

As mentioned above, the first main feature of natural gas prices is constituted by the presence of a seasonal component. We plot the NG futures curve for several dates in

Figure 1 and observe a periodic winter increase in price, which are clearly due to the demand for heating during cold periods of the year. In addition to this traditional seasonal feature, the use of natural gas for electricity generation has created a second smaller increase during the summer period, related to the increasing demand for cooling. These expected patterns in natural gas prices are the first source of value for a storage unit, and have inspired the

intrinsic strategy described in

Section 1: buy gas for summer delivery and simultaneously sell gas for winter delivery. Store it in between, and you have locked a certain profit which is the summer-winter spread less the storage cost.

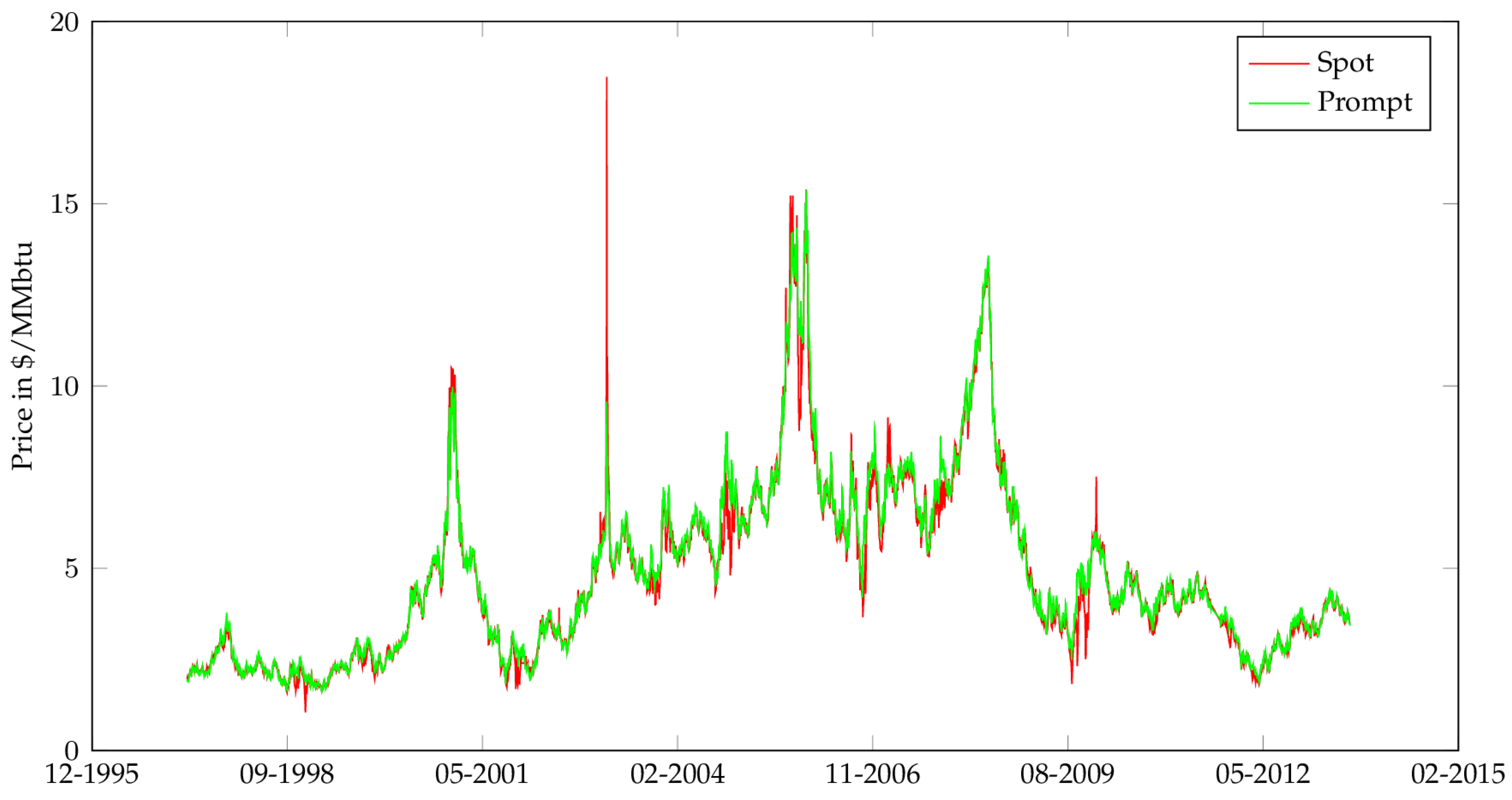

The second important aspect of natural gas prices is the presence of sudden moves due to unexpected imbalances between supply and demand, caused by such factors as unpredicted weather changes, disruptions in the supply chain, or poor anticipations of the global amount of gas in storage. Such events are almost instantaneously reflected in the spot dynamics, resulting in large price swings that are rapidly absorbed, however, by the storage capacities available in the market. These large and quickly absorbed jumps, commonly called spikes, can be viewed in

Figure 2, which shows many sudden dislocations between spot and prompt prices.

1 For example, we can notice a large spike in the spot price during late February 2003, when the natural gas price jumped by almost

and

in two successive days, then went down by

and

during the two following days. As noted by the US Federal Energy Regulatory Commission (

FERC 2003), this spike in gas price was due to “physical market conditions leading to low supply and high demand for a short time.” The author also observed that “similar natural gas price spikes are possible when episodes of cold weather occur at times when storage inventories are limited”.

In our study, we detect spikes by identifying the outliers from the time series

of the spread between the spot price

and the prompt price

given by

; we study separately the positive and negative spikes, since they reflect different market conditions. Positive spikes are often caused by unpredicted weather changes, such as a cold front or a heat wave. On the other hand, negative spikes are generally due to a poor anticipation of market-wide gas storage levels. In

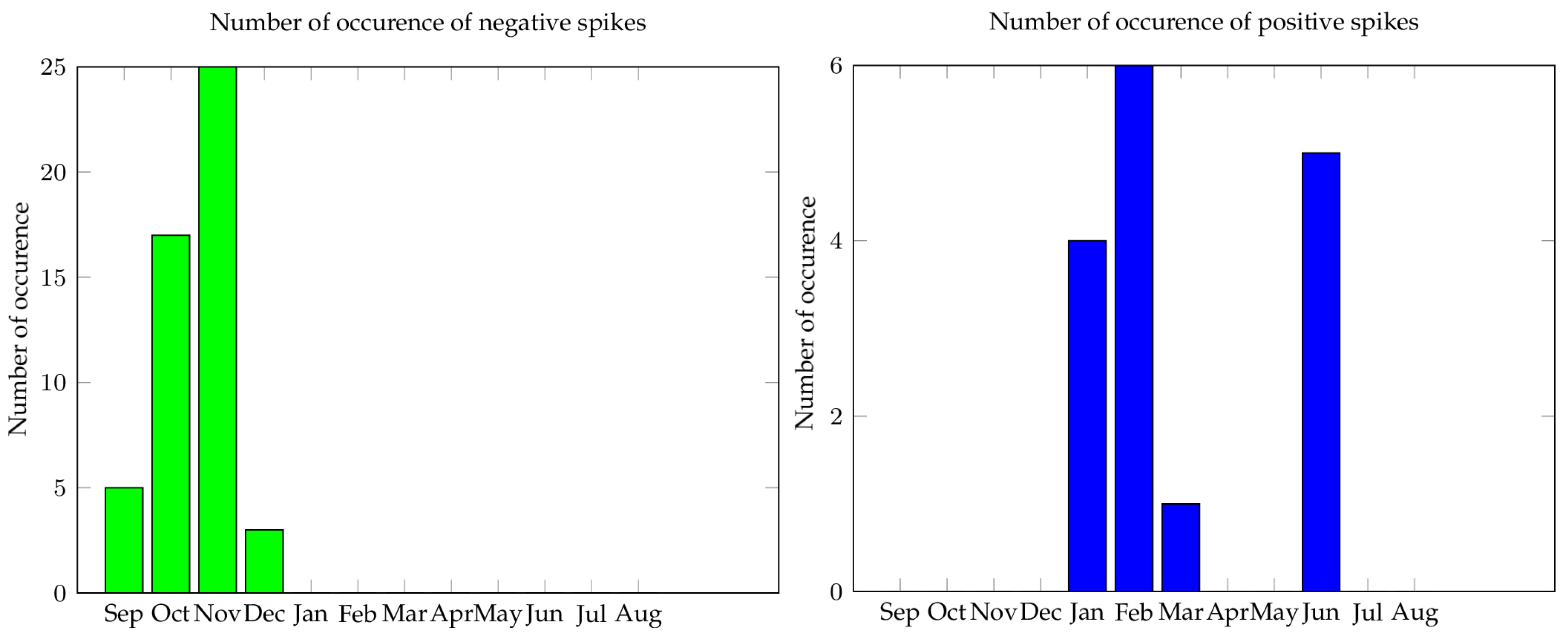

Figure 3 we plot the number of occurrences of negative and positive spikes during each month. We remark that the distribution of spikes is clearly dependent on their sign: most of the positive spikes happen during the winter months of January and February and the summer month of June, which can be explained by the occurrence of an unpredicted cold front or heat wave. On the other hand, negative spikes appear during the Fall. One plausible explanation is given by

Mastrangelo (

2007), which states: “October is the last month of the refill season. There may be increased competition from storage facilities looking to meet end-of-season refill goals as well as increased anticipation regarding the upcoming heating season”.

In order to take into account the stylized facts mentioned above, our futures model incorporates seasonality in the futures curve, and the spot model describes the existence of spikes and takes into account the correlation between spot and futures prices, through the prompt contract. To the best of our knowledge, these two facts have not yet been taken into account in the literature related to gas storage valuation, although, in our opinion, they constitute the two main sources of storage value.

In

Section 3.1 we discussed the main stylized facts of natural gas prices, which are seasonality and spikes. We believe that the incorporation of these two features is essential in order to monetize these two sources of value. Also, we emphasize that it is crucial to use a modeling framework that combines spot and futures curve dynamics, and that accounts for the presence of a basis between the spot and prompt prices.

In

Section 3.2, we introduce a two-factors model for the futures curve, with a seasonal component for instantaneous volatility. This parsimonious model has easy-to-interpret parameters and can be efficiently calibrated using futures curve historical data.

In

Section 3.3, we discuss the spot price model: we consider two formulations, with a clear relation to the prompt contract. We also include spikes by means of a fast-reverting jump process, similar to a model by

Hambly et al. (

2009), which was applied to the electricity market.

3.2. Modeling the Futures Curve

Our framework slightly modifies Gabillon’s model, adding a seasonality component and introducing parameters that have an economical significance.

We will call it the Seasonal Gabillon two-factor model. It is formulated as

where

and

are two correlated Brownian motions, with

. The letters

L and

S stand respectively for Long term and Short term;

,

and

are positive constants. The function

weights instantaneous volatility with a periodic behavior. It takes into account the winter seasonal peaks (resp. the secondary summer peak) by taking for example

equal to January (resp.

equal to August). There exist alternative ways to model price seasonality, e.g., in

Nowotarski et al. (

2013), in the context of electricity markets. The coefficients

and

quantify the winter and summer seasonal contribution to volatility: we expect the winter parameter

to be larger, in absolute value, than the summer parameter

.

This model constitutes an efficient framework, whose parameters are economically meaningful. Indeed, the parameters and can be interpreted as ‘long-term’ and ‘short term’ volatility. Note that even if the model is expressed with a continuous set of maturities, in the real world we only have access to a finite number of maturities, for example, monthly spaced futures contracts.

In the next section we give more details about the meaning of each parameter and their estimation, using historical data of futures prices.

Model Estimation

Initial Estimate. Many of the model parameters are almost observable, if we have sufficient historical data of futures curves at hand. In fact, and could be approximated by the volatility of short and long-dated continuous futures contracts, and by their empirical correlation.

For

, we can formally write

, so a good approximation for the long-term volatility is

where

is the log-return of a constant maturity long-dated contract, four years for example, and

.

Similarly, for small times to maturity, i.e.,

, we can ignore the long-term noise effect, and write

, so that a good proxy for the spot volatility is the volatility of the rolling prompt contract, i.e., the contract with the nearest maturity

where

is the log-return of a prompt futures contracts and

.

We can also give an initial estimate for the correlation parameter

as

We use these rough estimates as initial values for a more rigorous statistical estimation procedure which is described next.

Maximum Likelihood Estimation. We use a time series over dates

of futures prices maturing at

. Let

be the vector of price returns,

being the corresponding step

and

the vector of the model parameters:

. We have

where

. An Euler discretization of the SDE (

14) gives the equation

where

are independents Gaussian 2-d vectors such that

where

The likelihood maximization can then be written as the minimization of the function

and the

are given by

, i.e.,

To summarize, the maximum likelihood estimate is obtained by solving

To illustrate, we apply this estimation procedure, using daily futures curves from 1997 to 2007. As mentioned, the estimation problem (15) is solved using an optimization algorithm, with the rough estimates of

,

and

as initial point for the algorithm. We report in

Table 2 the estimated parameters of the futures curve model.

As expected, the short-term volatility is larger than the long-term volatility, which is a common feature in energy futures curve dynamics, and the winter contribution in the seasonality component is larger than summer contribution .

3.3. Modeling Spot Price

We have argued in

Section 3.1 that the spot price should be considered as a separate stochastic process correlated to the prompt price. It is, however, understood that the spot price is not the limit of the prompt price when time to maturity tends to 0:

A model in that sense was proposed by

Gray and Palamarchuk (

2010), where the logarithm of the spot is a mean reverting process, whose mean-reversion level is a stochastic process equal to the prompt price. For a family of maturities

, the futures contract

is a log-normal process fulfilling

and the spot price

evolves according to

where

B and

W are two correlated Brownian motions, and for the current date

t,

denotes the prompt price, i.e.,

In our opinion it is crucial to incorporate futures curve dynamics into the modeling of the spot prices, for instance a dynamics relating the spot and prompt futures price. Indeed, as shown by the historical paths of spot and prompt prices in

Figure 2, the two processes are closely related. In fact they seem to move very often in the same direction, with some occasional dislocations of spot and prompt prices.

In what follows we will study two spot models, connected to our futures curve model. They will be stated in discrete time.

3.3.1. Spot Model 1

Our first spot model is similar to (16), which was introduced by

Gray and Palamarchuk (

2010). Its dynamics, based on the spot log-return

, is given by

where

is a GARCH

process and again

P is the prompt price.

Recall that a GARCH

process

verifies an autoregressive moving-average equation for its conditional variance

:

where

is a white noise.

This model captures both the heteroscedasticity of the natural gas spot price and the correlation between the spot price and the prompt futures price. Similarly to (16), the spot price dynamics described by (17) is mean reverting around a stochastic level equal to the prompt price. In addition, the prompt log return is a supplementary explanatory variable of the spot log return. Recall that our futures model (14) incorporates seasonality in the futures curve dynamics; this implies that the spot dynamics itself follows a seasonal pattern, transmitted by the prompt price.

3.3.2. Spot Model 2

As an alternative, we model the spot process by modeling the return of the spot to prompt spread: , using the so-called front-back spread as independent variable.

This alternate model is:

where

is the price of the second nearby futures (also known as the back contract) and

is a GARCH

process. This model has the advantage of directly handling the spread between the spot and the prompt price, which is a key variable in gas storage management. Intuitively, a large positive spread value will generally induce the decision to withdraw gas, while the reverse is likely to motivate a gas injection. Also, as we pointed out in the introduction, the narrowing of the seasonal spread in the futures curve during last years has diminished the

intrinsic value of gas storage units. Consequently, almost all the storage value is now concentrated in the

extrinsic value, which is heavily dependent on the spot-prompt spread.

3.3.3. Spikes Modeling

In

Section 3.1, we showed that natural gas prices have two distinct characteristics: seasonality and presence of spikes. The first feature (seasonality), is captured by the seasonal factor in the futures curve dynamics (14). This seasonal pattern is transferred to the spot process by means of models that include the prompt and/or the back contract price as explanatory variables. There is no need to include a separate seasonal element in the spot dynamics.

Price spikes are another matter. These large and rapidly absorbed jumps are an essential feature of the spot process, since they can be source of value for gas storage and can be monetized if injection/withdrawal rates are high enough.

They are mostly observed in the spot market, and we account for them by including a fast mean-reverting jump process in the spot model, in the same spirit as the electricity price model of

Hambly et al. (

2009).

These authors propose a spot model for the power price that incorporates spikes via a process

Y, which is the solution of the equation

where

Z is a compound Poisson process of the type

,

is a Poisson process with intensity

and

is a family of independent identically distributed (iid) variables representing the jump size. Furthermore (

) and (

) are supposed to be mutually independent. The process

Y can be written explicitly as

We recall that the spot model is directly expressed as a discrete time process, indexed on the grid

introduced in

Section 2.1.1. For that reason

Y will be restricted to the same time grid.

Choosing a high value for the mean-reversion parameter forces the jump process Y to revert very quickly to zero after the jump times , which constitutes a desired feature for natural gas spikes. In practice, the jumps in natural gas spot prices are rapidly absorbed, precisely thanks to the existence of storage facilities.

Models (17) and (19) alone do not take into account the possibility of sudden spikes in the spot price. In order to add a jump component, the dynamics in (17) and (19) are multiplied by the process

:

As noted in

Section 3.1, the natural gas spikes are clearly distinguished by their signs. Positive spikes, due to unpredicted weather changes, occur exclusively during the winter and summer months. Conversely, negative spikes, generally caused by a poor market anticipation of the storage situation, happen mostly during ‘shoulder months’ such as October and November. This motivates a separate modeling for these two categories of spikes. We will consider two processes

and

for positive and negative spikes, each one verifying a slightly modified version of Equation (21):

where

(resp.

) represents the time period where positive (resp. negative) spikes are observed, i.e., winter and summer (resp. shoulder months), as we observed in

Section 3.1.

Putting the pieces together, the spot process that we consider for our gas storage valuation is

This formulation possesses all the desired properties: it includes seasonality in both futures and spot prices, and it features positive and negative spikes in the spot process, each one generated by a separate jump process and .

Model Estimation

As for the futures model, we estimate the spot models with historical data for spot and futures prices. The parameters estimation for the two spot dynamics (17), (19) is based on regression techniques and the classic estimation procedure for GARCH processes. Following

Hambly et al. (

2009), we use the likelihood method to estimate the spike process parameters, after filtering the underlying time series to extract the jumps. Note that the coefficient

is heuristically fixed.

An analysis of the spot and futures historical data shows that a GARCH(1, 1) process is adequate. As mentioned before, we use a large value for the spike reversion parameter .

To illustrate, the estimation of spot model 1, using a GARCH(1, 1) process and a historical data from 1997 to 2007, yields the parameters summarized in

Table 3.

4. Numerical Results

In this section we use our futures-spot models to value various storage contracts, and compare our results to the intrinsic value of storage units. We consider two types of storage units, characterized by their maximum injection/withdrawal rates. A fast gas storage can be filled in, say, one month, but it often has limited capacity: salt caverns are a common example of high deliverability storage units. Depleted oil/gas fields, or aquifers can also be used as storage facilities. They have very large capacities, but they suffer from low injection/withdrawal rates.

We will consider fast and slow storage units whose characteristics are described in

Table 4. For simplicity, all the quantities are expressed in

MMBtu

2, while the storage values are expressed in million of US dollars. This means that the fast storage unit can be filled in 25 days, and emptied in 17 days. The slow storage unit needs 125 days to be completely filled and 83 days to be completely emptied. In all calculations, we ignore transaction costs.

The experiments were run using the Matlab software, version 7 (Mathworks, Natick, MA, USA). We use 5000 simulations for the Monte Carlo method, with independent paths for the backward and forward phases of the Longstaff and Schwartz algorithm: First, we simulate a set of spot and futures paths, then we apply the dynamic programming algorithm (5) to estimate the optimal spot strategy; in parallel we evaluate the hedging strategy, based on futures contracts, according either to (8) or (9). We then re-simulate a new set of spot and futures paths, independent from the paths used in the preceding backward phase, and we apply the estimated optimal spot strategy, combined with the futures hedging strategy, to the new trajectories. We store the cumulative cash flows

resulting from these physical and financial operations for each sample path, and we compute the empirical mean and standard deviations of those cash flows. The mean of the cumulative wealth gives an estimate of the

extrinsic value

of the gas storage unit, given in (5), while the standard deviation is an indicator of the dispersion of the realized cash flows around the

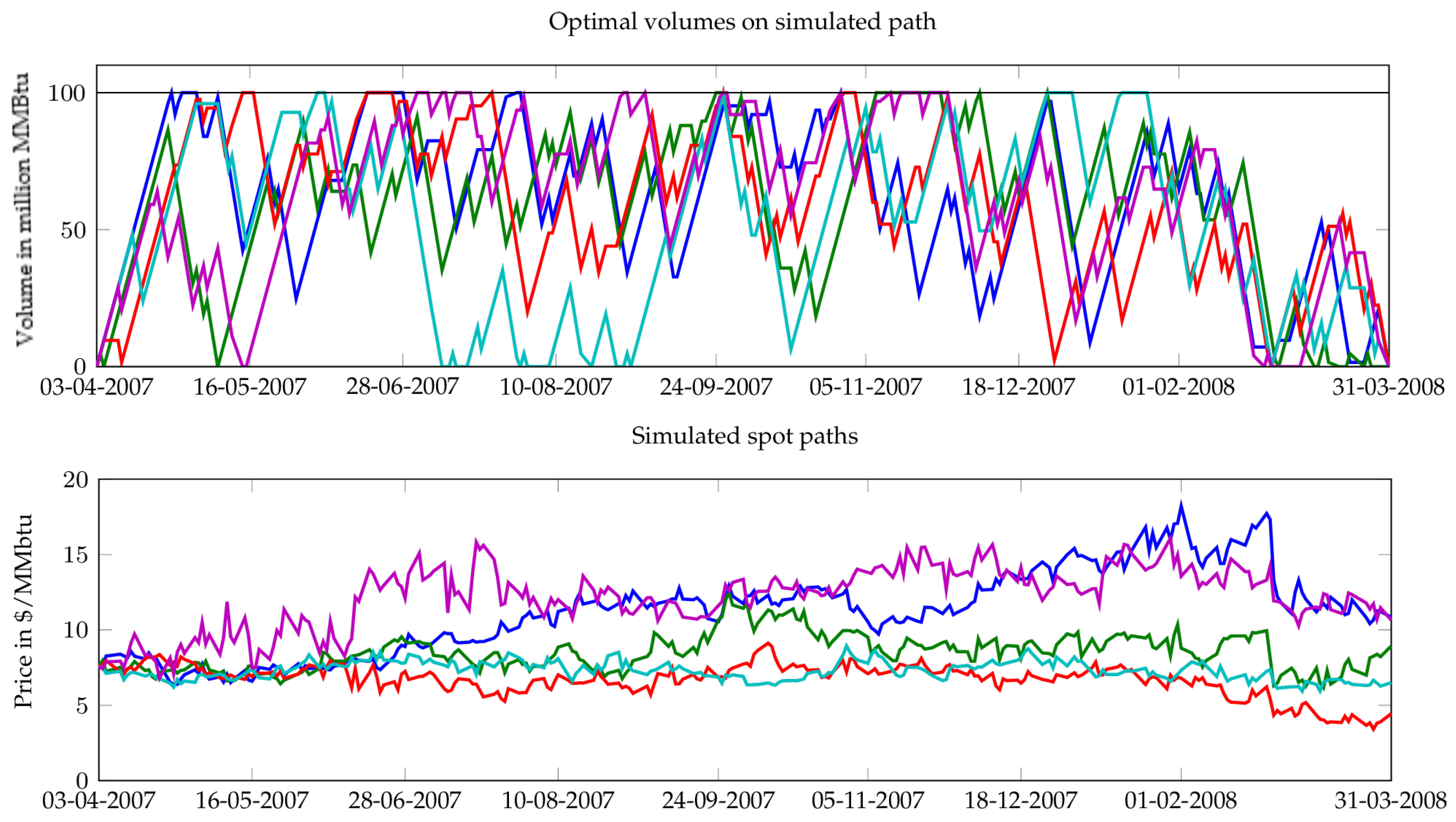

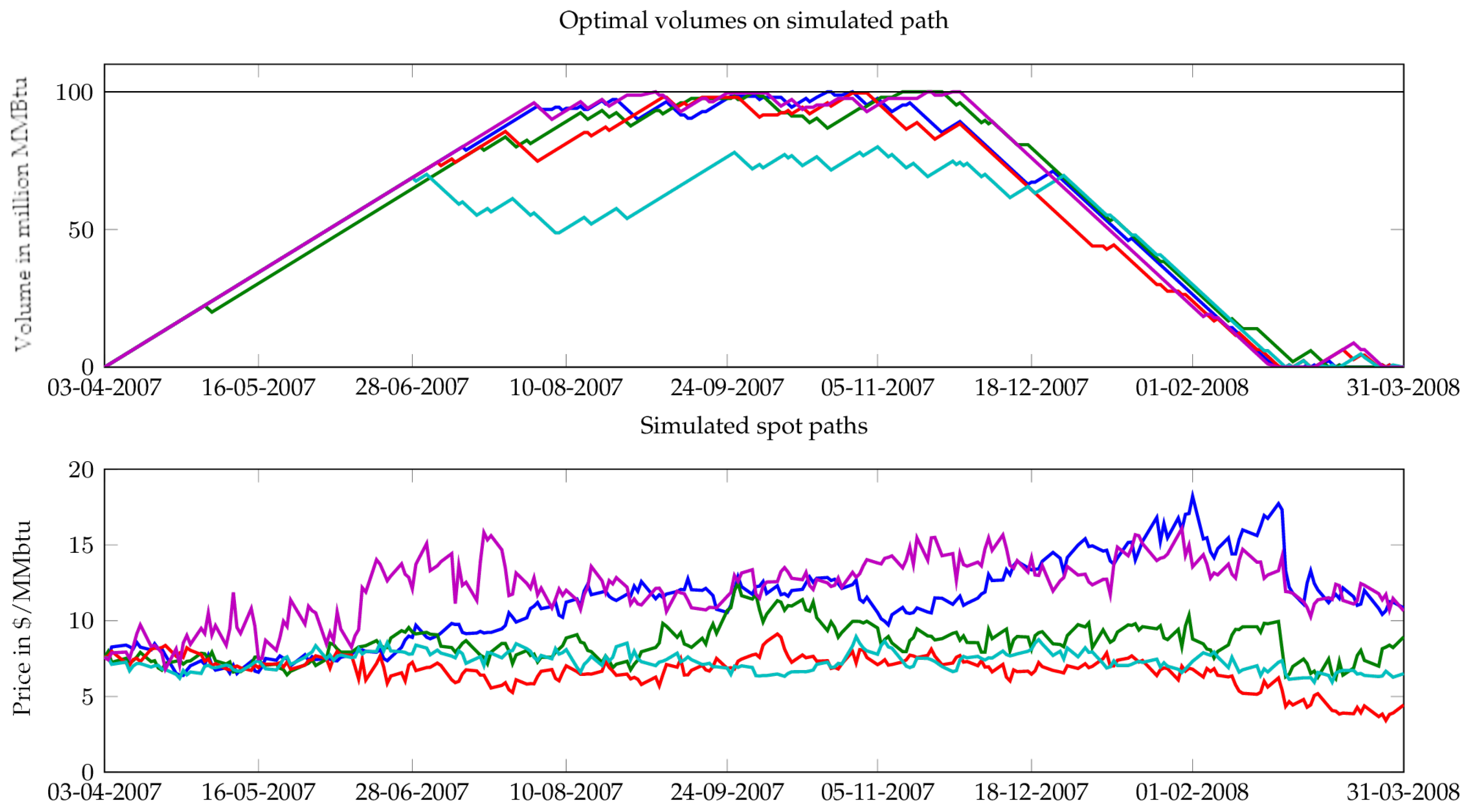

extrinsic value. We emphasize that the empirical mean estimates the cash flow generated by the optimal strategy, while the empirical standard deviation gives an indicator of the variance reduction obtained through the financial hedging strategy. A lower standard deviation means that the manager will face less uncertainty on a single realization of the spot and futures prices. Numerical results confirm that the hedging strategy provides a significant reduction in the variance of the cumulative cash flows. Sample outputs from this valuation procedure are presented in

Figure 4 (fast storage) and

Figure 5 (slow storage). In these figures, different colors correspond to different simulated spot trajectories.

Note also that the analysis described above depends on the choice of the model, because the backward and forward phases are executed on the sample paths generated by the model itself. In order to make the comparison less model-dependent, we calculate the cumulative cash flows of the estimated optimal strategy, based on spot and futures

historical paths. For this reason, we will consider a series of spot and futures curve data from 2003 to 2012, and split it into periods of one year: the storage lease contracts specified in

Table 4 start in April of each year, for a one-year period. We run the optimal strategy obtained in the backward phase (for the corresponding storage duration) on the spot and futures historical paths for the related period.

This constitutes a real case test for the optimal strategy and corroborates the relevance of the spot modeling, since it provides the profit that would have been accumulated by the storage manager in a realized path.

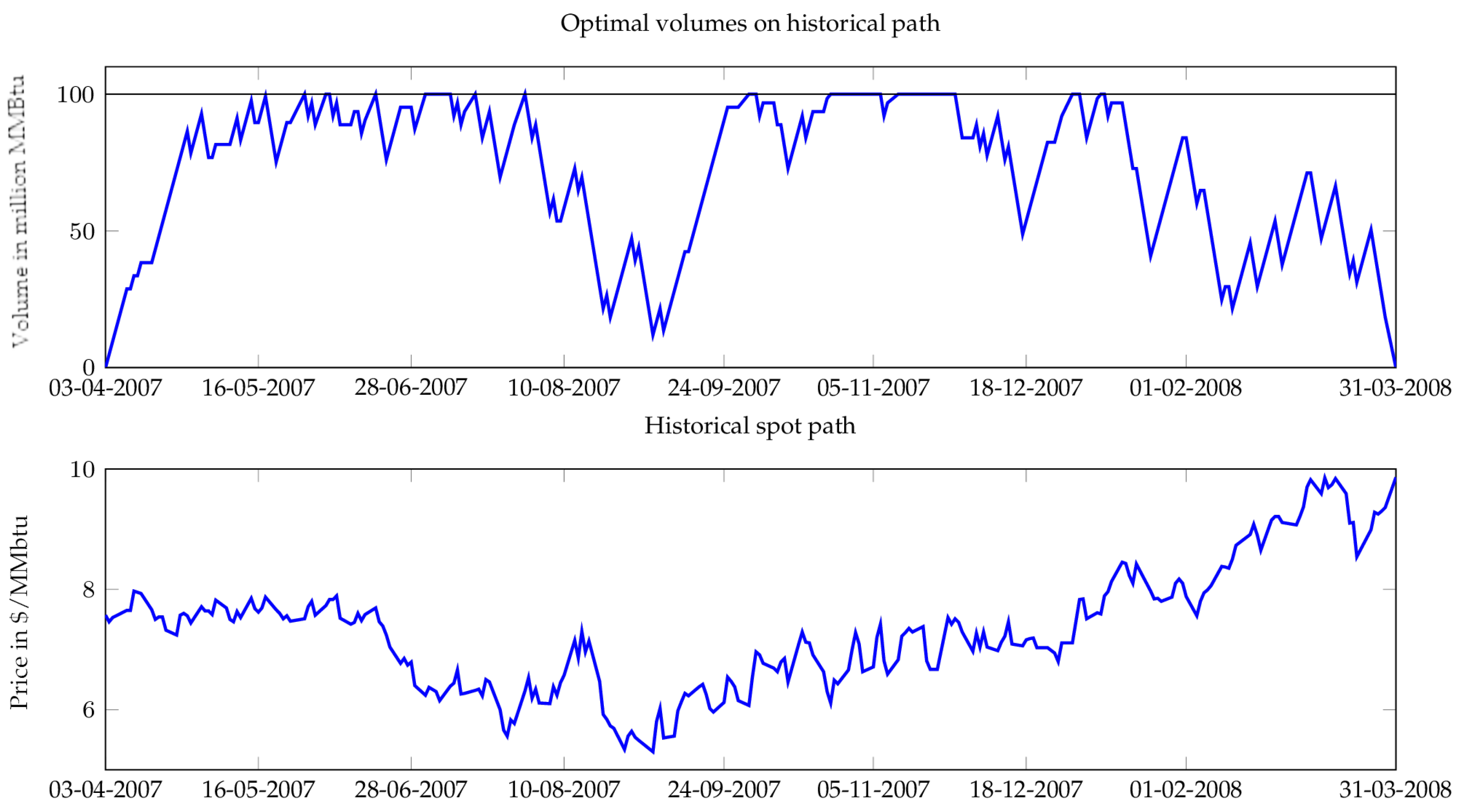

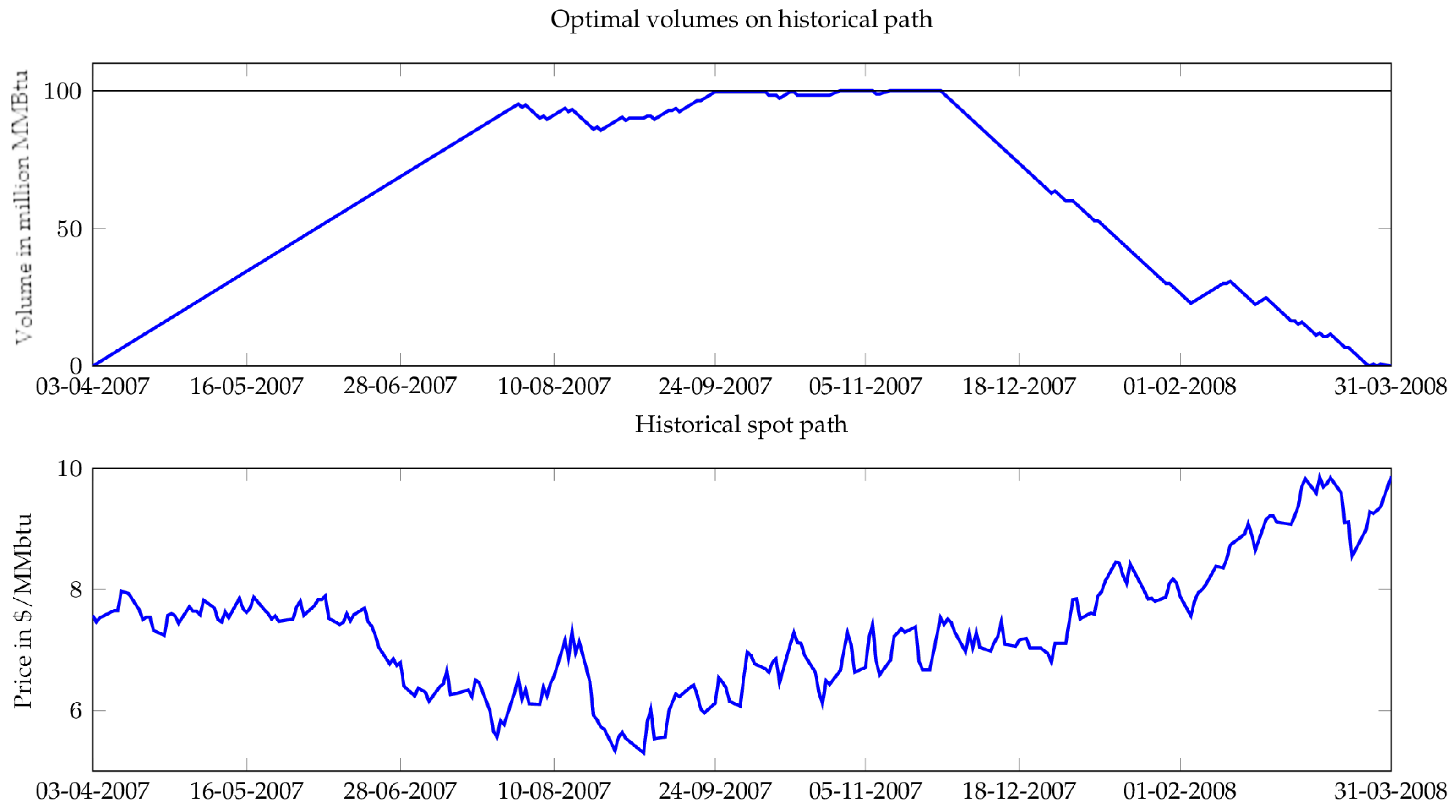

Figure 6 and

Figure 7 represent the historical spot path realized during the contract period (for both slow and fast units) from April 2007 to April 2008, and the natural gas volumes resulting from the optimal strategy computed on simulated paths (see

Figure 4 and

Figure 5 for examples of these simulated paths).

We summarize the results of the valuation algorithm for each period in

Table 5 and

Table 6, for the fast and slow storage units, when the spot paths are generated according to spot model 2 (19). The tables report, for each period, the

intrinsic value (IV) computed according to (

3), the estimated

extrinsic value (EV) computed by applying the optimal trading strategy (5) to simulated paths, and finally the actual cumulative cash flow obtained by applying the optimal strategy to the actual historical path. The last two columns show the standard deviation of the cumulative cash flows, computed on simulated paths under the optimal strategy.

We expect that the extrinsic spot-based strategy will give a larger value than the intrinsic physical futures-based strategy, while our financial hedging strategy is supposed to reduce the uncertainty of gas storage cash flows. For example, the fast storage contract starting in April 2007 has an intrinsic value of while the spot-based strategy gives an extrinsic value of . As expected, the extrinsic strategy allows better financial exploitation of the rights (without obligation) of injection/withdrawal natural gas compared to the conservative intrinsic strategy. In other words, the extrinsic strategy allows better extraction of the optionality of storage. We also note that the hedging strategy yields a significant empirical variance reduction of the cumulative cash flows from to . On the other hand, the intrinsic value of slow storage is equal to , while the spot-based strategy captures a larger optionality value of . Similarly to fast storage, the financial hedging strategy allows an important reduction in variance, from to .

Previous observations about year 2007 remain valid for the other test periods; indeed the

extrinsic spot-based strategy always out-performs the

intrinsic futures-based strategy, along both simulated and historical paths. The historical back testing over the period 2003–2012 shows that the

extrinsic strategy allows for better extraction of storage unit optionality, with a ratio of

extrinsic value to

intrinsic value as high as

for a fast storage unit. This performance of the

extrinsic strategy is less significant in the case of slow storage unit, with a ratio up to

. This is due to limitations in the deliverability of slow storage. The optimal strategy is not able to fully benefit from gas price volatility, and cannot respond rapidly to favorable price movements. In all cases, hedging with financial instruments provides a significant reduction in the cumulative cash flows uncertainty. The last two columns of

Table 5 and

Table 6 show a standard deviation reduction factor of up to 10, with better performance for slow storage. This gives the storage manager more insurance to recover a large percentage of the value of the storage contract. Similar conclusions on the advantages of a dynamic hedging with futures are stated by

De Jong (

2015) in his back tests.

Remark 2. 1. In Section 2.1.2, we presented two heuristic hedging strategies, (8) and (9), based on financial futures contracts. The numerical tests that we have conducted show that the hedging strategy defined by (9) gives better results in the variance reduction of the simulated cash flows under the optimal strategy; in addition, in the historical back testing, (9) yields a better cumulative wealth performance than (8). We emphasize that we have only reported about the better performing hedging strategy (9). 2. We also note that the historical intrinsic value of the gas storage attains a peak in 2006, and shows a clear decline afterwards. This can be intuitively explained by observing the futures curve samples in Figure 1: in 2006, the seasonal spreads were very pronounced, but have been shrinking steadily ever since. We conclude from the numerical results presented above that the joint modeling of the natural gas spot price and futures curve is a pertinent framework for the gas storage valuation and hedging problem. It allows the unit manager to better exploit storage optionality by monetizing the spot price volatility and seasonality. Indeed, the historical back testing shows that the extrinsic value under this modeling always outperforms the classical intrinsic value, even in the case of slow storage. A joint model for the futures curve with its own risk factors is a more realistic framework for spot and futures markets, since it takes into account the seasonality of the futures curve and the non-convergence of the futures price to the spot price, an unrealistic hypothesis that is often made in the literature. This also allows for a more relevant hedging strategy based on futures contracts, and better tracking of the extrinsic value of gas storage in real market conditions.

5. Model Risk

As previously mentioned, seasonal spreads have become narrower these last years, which means that the bulk of a gas storage value is

extrinsic, and needs to be extracted by trading the spread between the spot price and prompt. It is, therefore, important to look closely into the spot modeling and its effect on storage valuation and hedging. We believe that the uncertainty surrounding storage value is primarily due to the modeling of the spot process, since it is the evolution of the spot process ((17) and (19)) that by and large determine the optimal trading strategy. In turn, the futures model mostly affects the quality of the hedge or variance reduction, not the expected value of the storage unit. At least another author (

Bjerksund et al. 2011) reaches a similar conclusion while using the

rolling intrinsic valuation method.

The purpose of this section is to quantify these statements in the formal framework of model risk measurement, and the section is divided in two parts: we first compare the performances of the two spot models proposed in

Section 3.3, using historical data. We focus on the effect of various modeling hypotheses, and on the sensitivity of the storage estimated value with respect to the model parameters. We next define a model risk measure to quantify these uncertainties, following

Cont (

2006).

5.1. Spot Modeling

In

Section 3.3, we proposed two discrete models for the spot price dynamics. The first model, defined in (17), is a discrete version of a mean-reverting model, with a stochastic mean-reversion level equal to the prompt price. The second model (19), directly captures the spread between the spot and the prompt prices, which is a key variable in the optimal management of a storage unit: one tends to buy and store gas when the spot-prompt spread is negative and withdraw it in the opposite case. Since the seasonality of gas prices has been getting weaker in recent years, the principal source of value for the storage unit is the spot-prompt spread rather than the winter-summer spread, so we expect the second model (19) to give good results in recent years.

We run the valuation procedure explained in

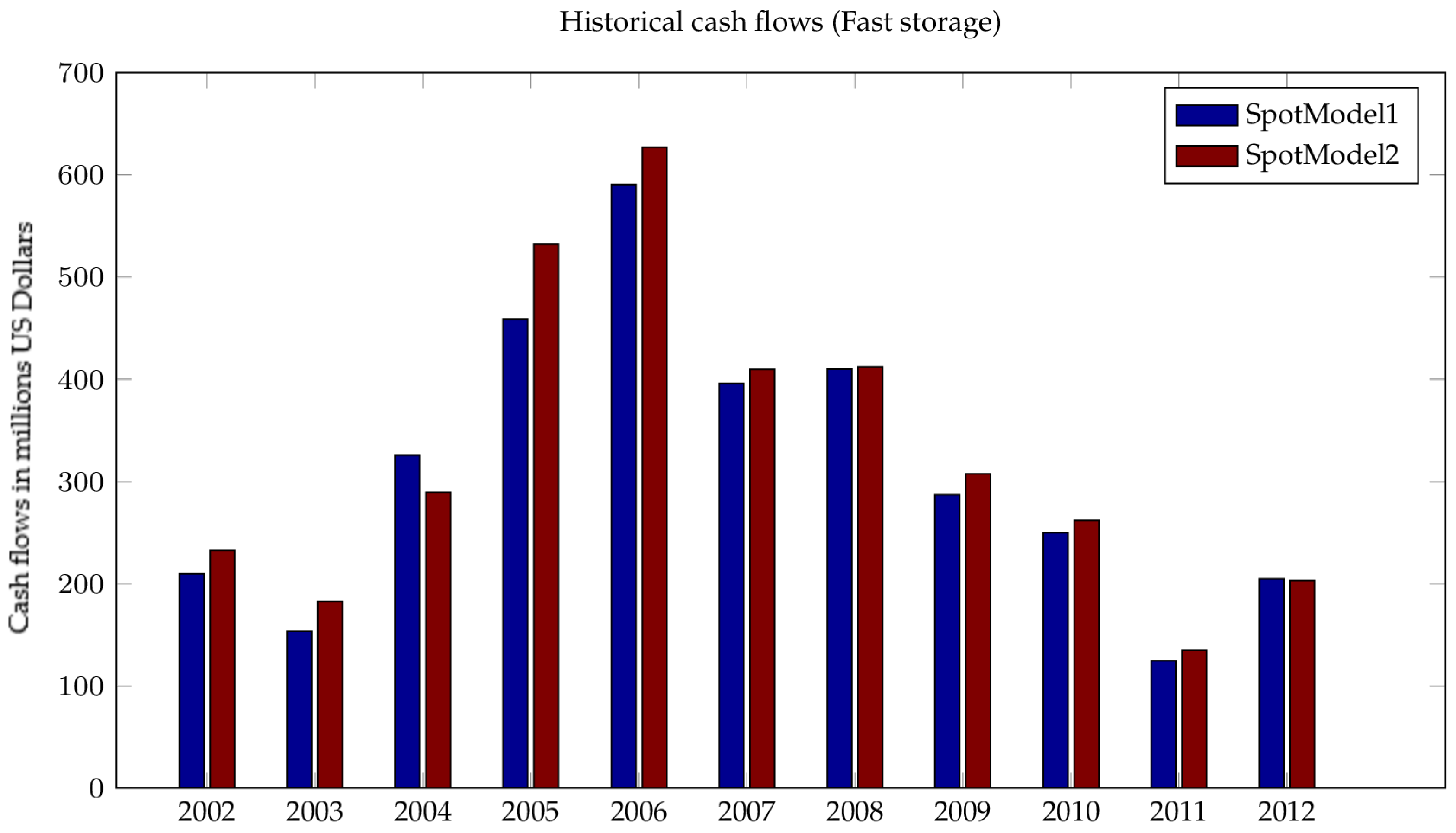

Section 4, using the two spot models, over a testing period starting in 2003 till 2012. For each year, we compute the actual performance of each model; in particular, we report in

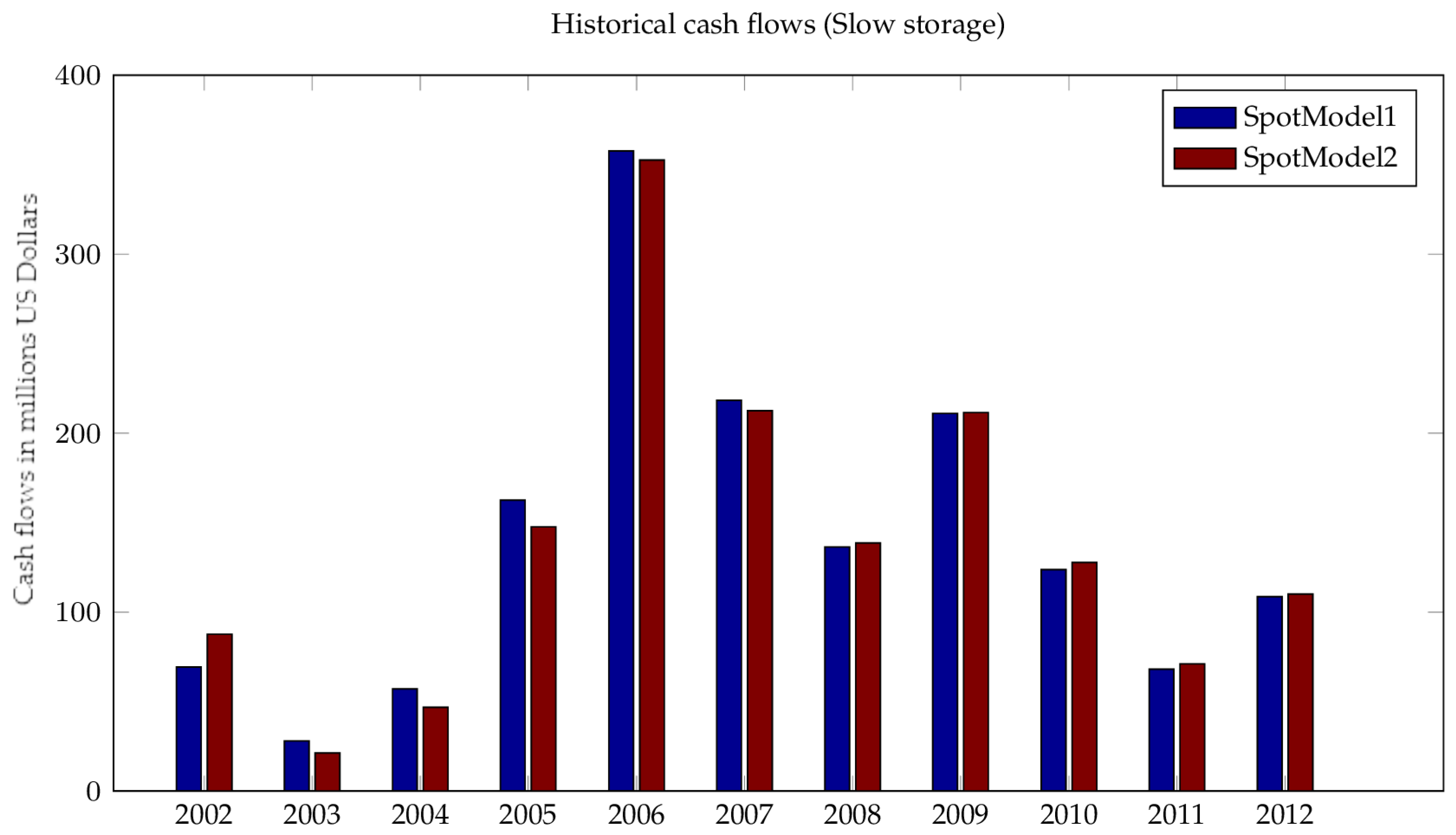

Figure 8 and

Figure 9 the cumulative cash flows using the optimal spot strategy for historical spot and futures trajectories.

In the fast storage case,

Figure 8 shows that the spot-prompt spread model (model 2) yields slightly better results than the spot model (model 1) in all but one the test cases (year 2004).

In the slow storage case (

Figure 9), the two spot models give comparable results for all periods. In the fast storage case, other tests, not reported in this article, show that spot model 2 yields a lower standard deviation of the cumulative cash flows. This reinforces the observation that spot model 2 is globally better suited for our purpose.

Effect of Spikes Modeling

The presence of spikes in natural gas prices is an essential feature of the dynamics of spot prices. As noted in

Section 3.1, these jumps are sudden dislocations between the cash and futures markets due to unexpected imbalances between supply and demand, caused by such factors as unpredicted weather changes, disruptions in the supply chain, or poor anticipations of the global amount of gas in storage.

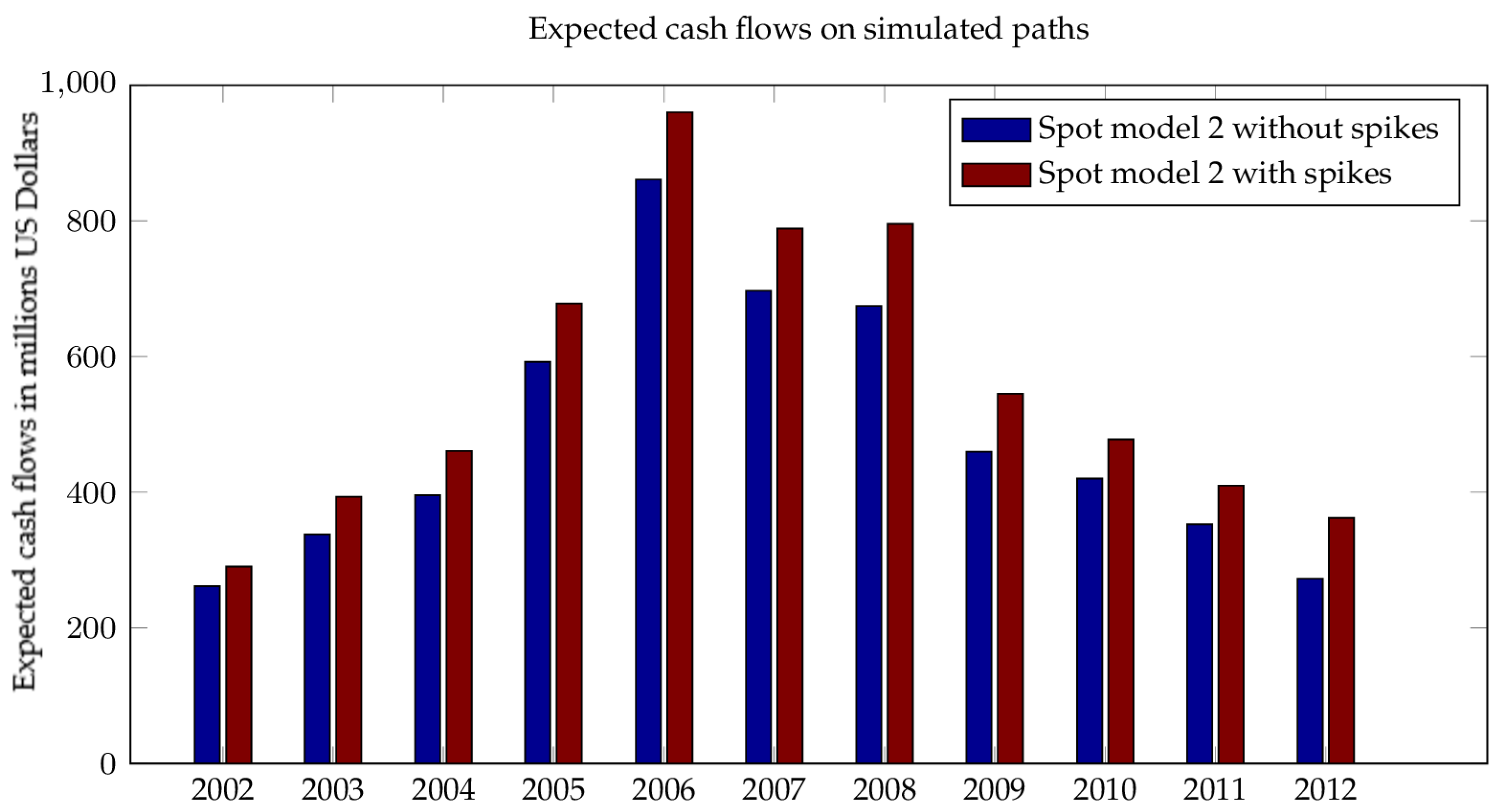

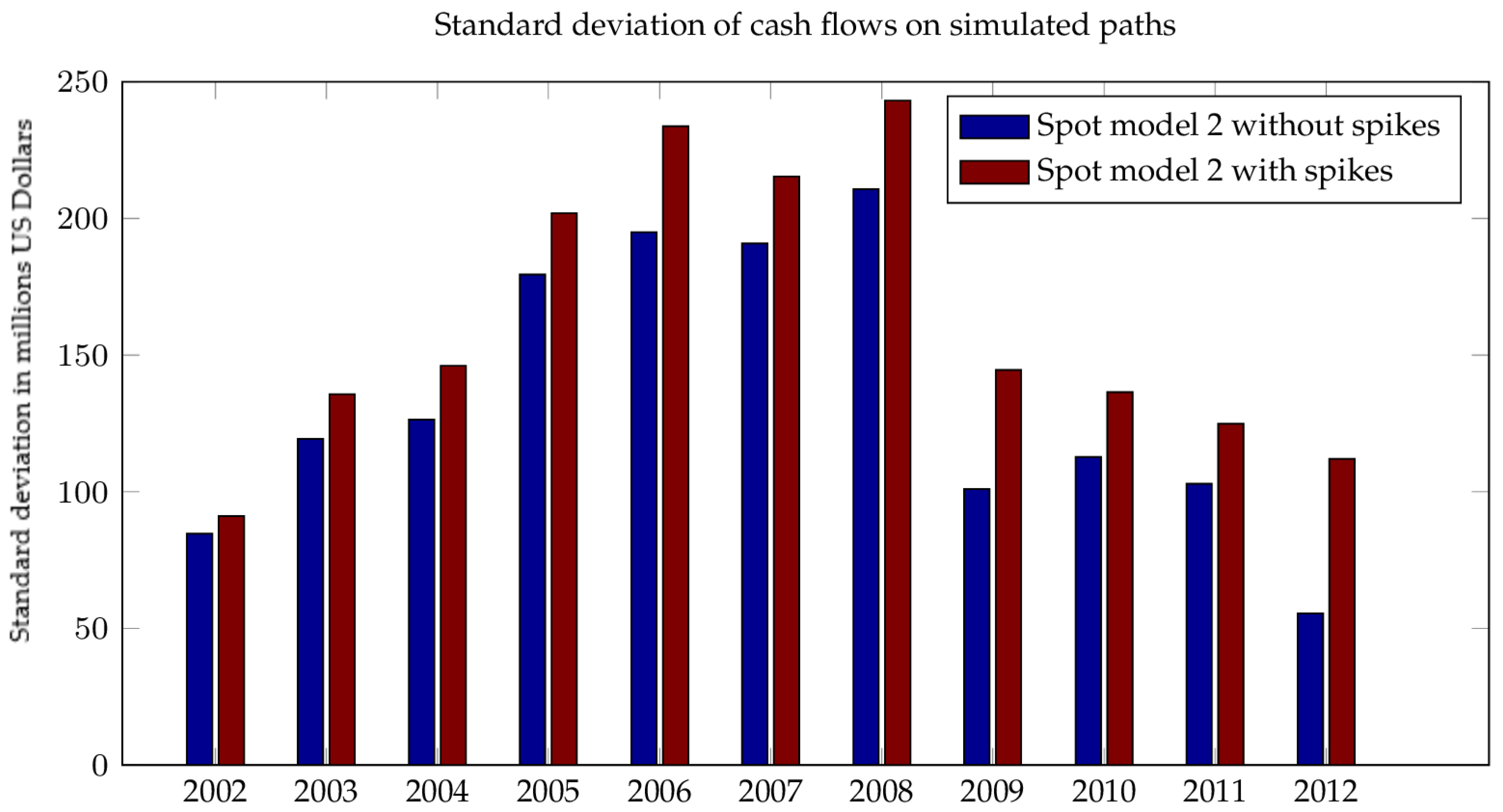

These spikes can be a source of value for the storage manager, since a large gap between spot and prompt prices can be monetized by buying gas (and selling the corresponding quantity in the futures market) during a negative spike, while doing the opposite trade during a positive spike. Since these are rapidly absorbed by the market, the value can only be captured by fast storage units.

Figure 10 represents the expected cumulative cash flows of a fast storage unit, on simulated paths under spot model (19). All the test periods show that modeling the spikes in the spot dynamics gives a larger extrinsic value for the storage unit, but at the same time it introduces a larger standard deviation for the cumulative cash flows, as illustrated in

Figure 11.

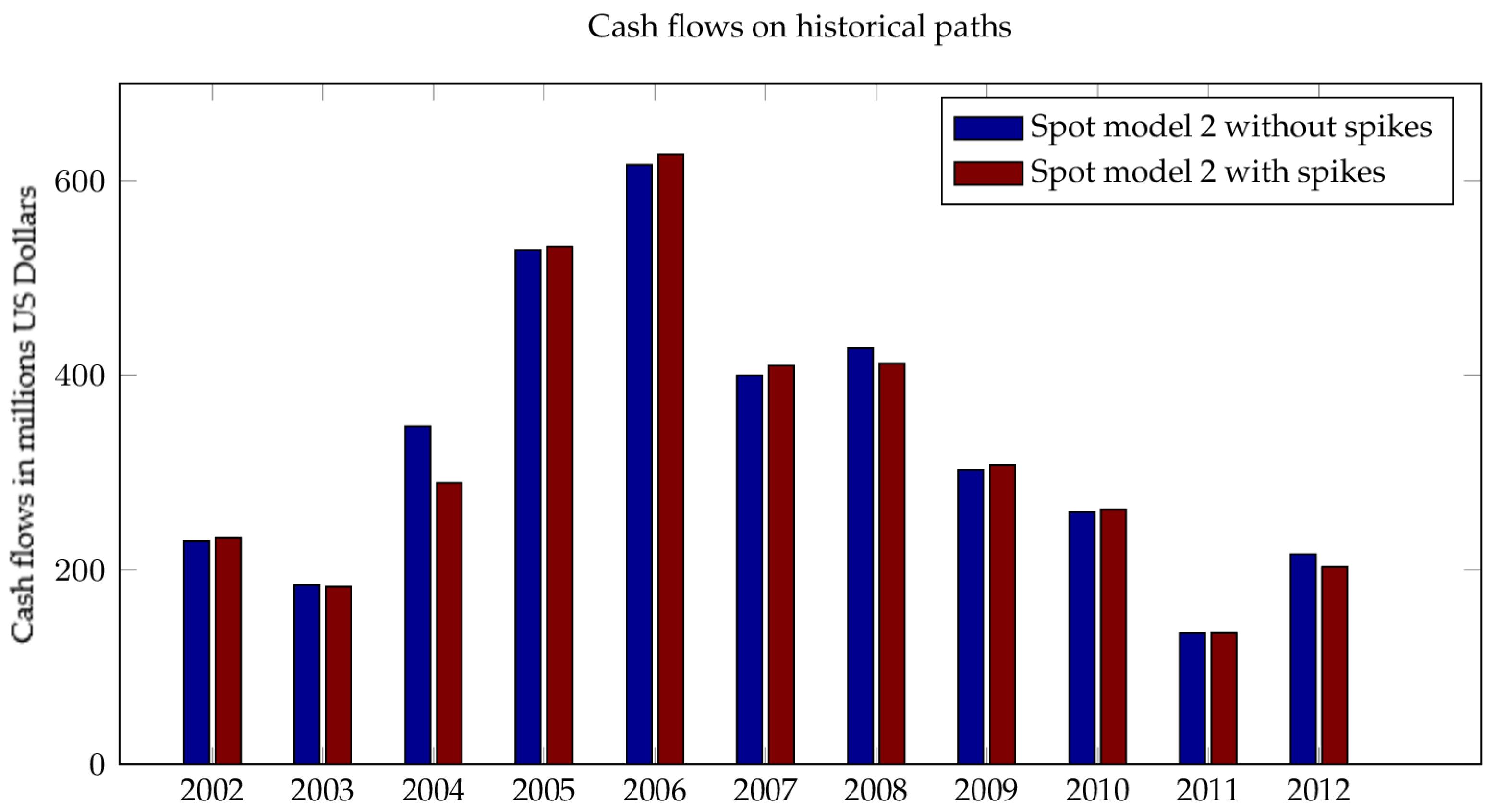

A final test of the effect of the spikes modeling is performed on historical spot paths for each test period, and results are shown in

Figure 12. The graph shows that modeling the spikes does not make a significant contribution to realized optimal value. This accords with the fact that the models with spikes produce a large standard deviation. In conclusion, and contrary to intuition, this historical back test does not support the need for incorporating spikes in the spot model.

5.2. Model Risk Measure

In order to quantify the modeling uncertainty, we use the approach introduced by

Cont (

2006) for measuring the model risk inherent in the pricing of exotic derivative products. The approach may be summarized as follows: Given a set of benchmark quotes for vanilla options (or bid/ask intervals), model uncertainty for an exotic payoff

H, is quantified by computing the range of prices of this exotic product, using a set of risk neutral models

calibrated to the benchmark vanilla prices, i.e.,

For our gas storage valuation problem, we will adapt this risk measure by using as “calibration” data the historical prices of the futures and spot contracts. The constraint of calibration on vanilla prices is replaced by the success of suitable statistical tests and closeness to the optimal likelihood objective function value of the model.

The family consists of a set of spot models, (17) or (19), which pass the statistical tests imposed by the modeling hypothesis for the noise , which is assumed to be GARCH(1,1). Moreover, the family is restricted to the models that have a likelihood function value close to the optimal one found during the model estimation.

This methodology for the generating the set

is broadly similar to the one proposed by

Dumont and Lunven (

2006), and applied to multi-asset options. In their study, the authors calibrate a multi-assets model to single-asset vanilla options, then build the set

by perturbation of the correlation matrix. This yields a family of models that price the benchmark vanilla options perfectly, but differ by their correlation matrix.

In our case, the statistical estimation of the spot model parameters, in (17) or (19), is obtained by classical maximum likelihood methods. The estimation procedure solves:

where

is the likelihood function associated with the spot model (17) or (19). This maximization yields an optimal parameters vector

, an optimal likelihood function value

, and an empirical covariance matrix

of the parameter estimates, from which confidence intervals can be computed.

In order to generate the family of spot models, we perturb the optimal parameters

by adding a Gaussian noise with the specified covariance matrix

to

. This yields a set of perturbed parameters

, from which we only retain those that satisfy two constraints: first, the inferred GARCH white noise

in (18) must pass a statistical test for normality;

3 second, the corresponding likelihood function value

has to be close to the optimal value

:

, where

is a small constant.

In the following discussion,

will be the set

, fulfilling the two conditions above. We can now define the associated model risk. The analogue risk measure to (24) can be expressed using (5), with the value function now written

to emphasize the dependence of this value function on the parameters

. The normalized risk measure is given by:

In this risk measure evaluation, each , is calculated using spot and futures paths simulated under the perturbed model .

Moreover, we propose a second model risk measure based on the performance on realized historical spot and futures paths. For this we define

where

represents the cumulative cash flows, computed on the historical path, as defined in (6).

The two risk measures

and

are computed for each of the test periods from 2003 to 2012, under the two spot models 1 and 2, using a set of 30 perturbed models. The results reported in

Table 7 again show a better performance for spot model 2. In fact, this model seems to be less subject to model risk, since it gives a smaller range of prices, compared to spot model 1.

One observation that follows clearly from

Table 7 is that the range of prices induced by the model uncertainty and measured by

and

represents a large fraction of the storage value. This shows that the dependence of gas storage valuation on spot modeling is quite significant. While the literature has concentrated its efforts until now on the specification of an optimal valuation strategy, we believe that one should pay more attention to the choice of the spot-futures modeling framework. Referring again to

Table 7, model 2 appears to be less sensitive to the change of parameters and is therefore more robust. Fortunately, this is in concordance with the better performance of spot model 2 already observed in

Section 5.1.

Table 7 shows that the spot-futures valuation framework is subject to a large model risk (average:

). For comparison, the model risk for a basket option has been evaluated to

(see

Dumont and Lunven (

2006)).

6. Conclusions

In this paper we have considered the problem of gas storage valuation and hedging, and specifically investigated the implications of switching from an intrinsic to an extrinsic method of valuation and risk management.

To this end, we have set up an experimental framework which includes a new model for the joint dynamics of the futures curve and the spot price, a back testing engine for pricing storage units and measuring the effectiveness of various hedging strategies, and a method for measuring model risk.

We have then conducted extensive back testing using historical data of futures and spot prices over a period of 10 years.

The numerical tests have confirmed, as expected, that the extrinsic method extracts, on average, more value from the storage units than the traditional intrinsic method.

In order to quantify the stability of our valuation estimates with respect to model uncertainty, we have next defined two model risk measures, inspired by the work of

Cont (

2006). Our context was however different from Cont’s, in the sense that our models have been estimated on historical data, and not on market data. This motivated a redefinition of the notion of “benchmark data”.

Using those risk measures, we have observed the great sensitivity of gas storage value to modeling assumptions. In fact the model uncertainty, as measured by the size of price range, represents a large proportion of the storage value. This puts into perspective the concentration of effort in the literature on the specification of an optimal valuation strategy. Much more attention should probably be devoted to the discussion of modeling assumptions.

The use of the term extrinsic to qualify the valuation based of stochastic optimization and dynamic hedging should even be questioned. It is borrowed from the theory of financial options, where the extrinsic, or time value of an option can be extracted by owning the option and conducting a self-financed hedging strategy. In our case, the self-funded hedging strategy is the dynamic hedging protocol with futures contract. The parallel stops here however, because this hedging strategy leaves a significant residual risk, and the so-called extrinsic value of storage cannot be safely extracted.

Therefore, the expected discounted cash flow computed by an extrinsic method should not be constructed as a “price”, but as some market index, from which a market price could be derived, probably at a significant discount. Here again, our model risk measurement framework could be of interest, since it provides a distribution of possible values for the storage units.