1. Introduction

The recent 2014–2015 oil price slump has negatively affected the macroeconomic performance of oil exporting economies and their banking systems. With the current global macroeconomic conditions, international oil markets could enter a sustained period of low oil prices. While the macroeconomic consequences of low oil prices on oil exporting economies are well documented, the impact of the oil price slump on financial stability has not received as much attention. This paper, therefore, focuses on the effect of the oil price slump on the GCC (Gulf Cooperation Council) banking stability. The works of Espinoza and Prasad [

1], Nkusu [

2], Louzis et al. [

3], and Klein [

4] find evidence that supports the role of macroeconomic variables in determining the movements of nonperforming loans. While Espinoza and Prasad [

1] study the macroeconomic determinants of nonperforming loans across GCC banks, they do not test the role of oil price in their model arguing that oil price does not vary across GCC countries and therefore brings less country specific information about these economies. While the argument sounds reasonable, it ignores the severe impact that oil price fluctuations might have on the entire GCC economies and banking systems.

1 Therefore, this paper aims to explore the impact of oil prices on GCC banks’ balance sheets and assess how oil price shock propagates within the macroeconomy. The first objective of this paper is to assess the oil price shock transmission channels, along with other macroeconomic shocks, to GCC banks’ balance sheets. This part of the paper implements a System Generalized Method of Moments (GMM) model of Blundell and Bond [

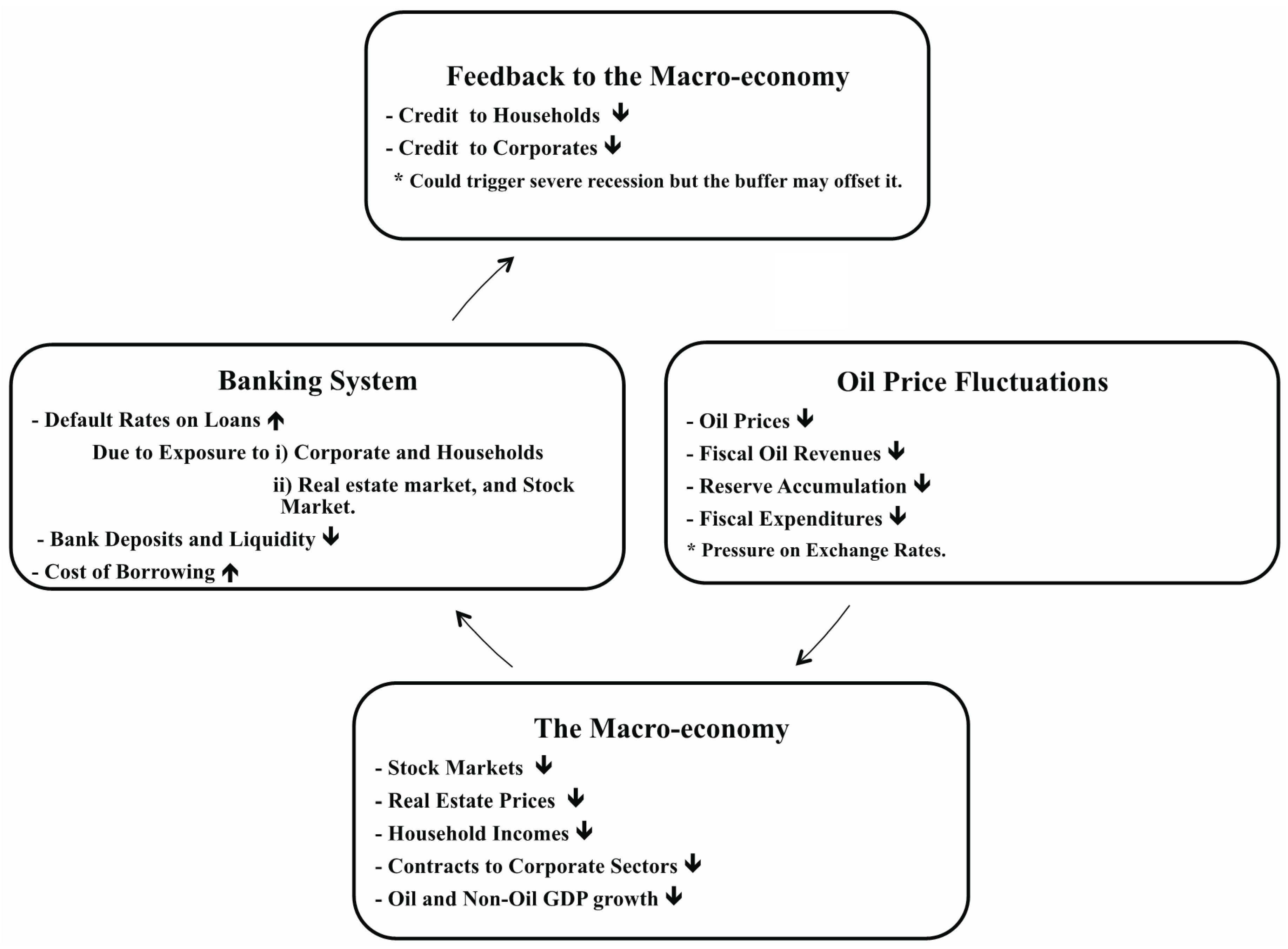

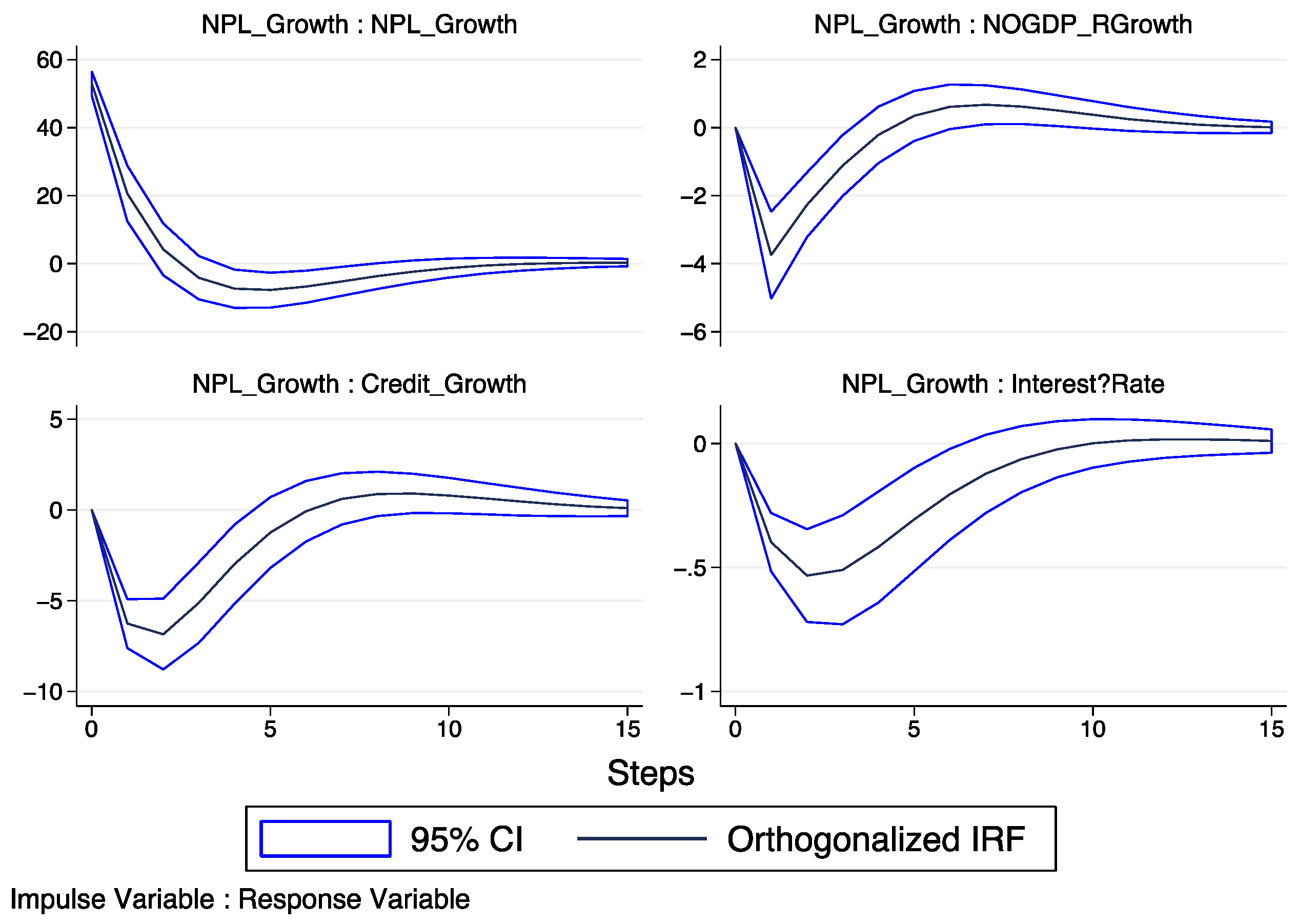

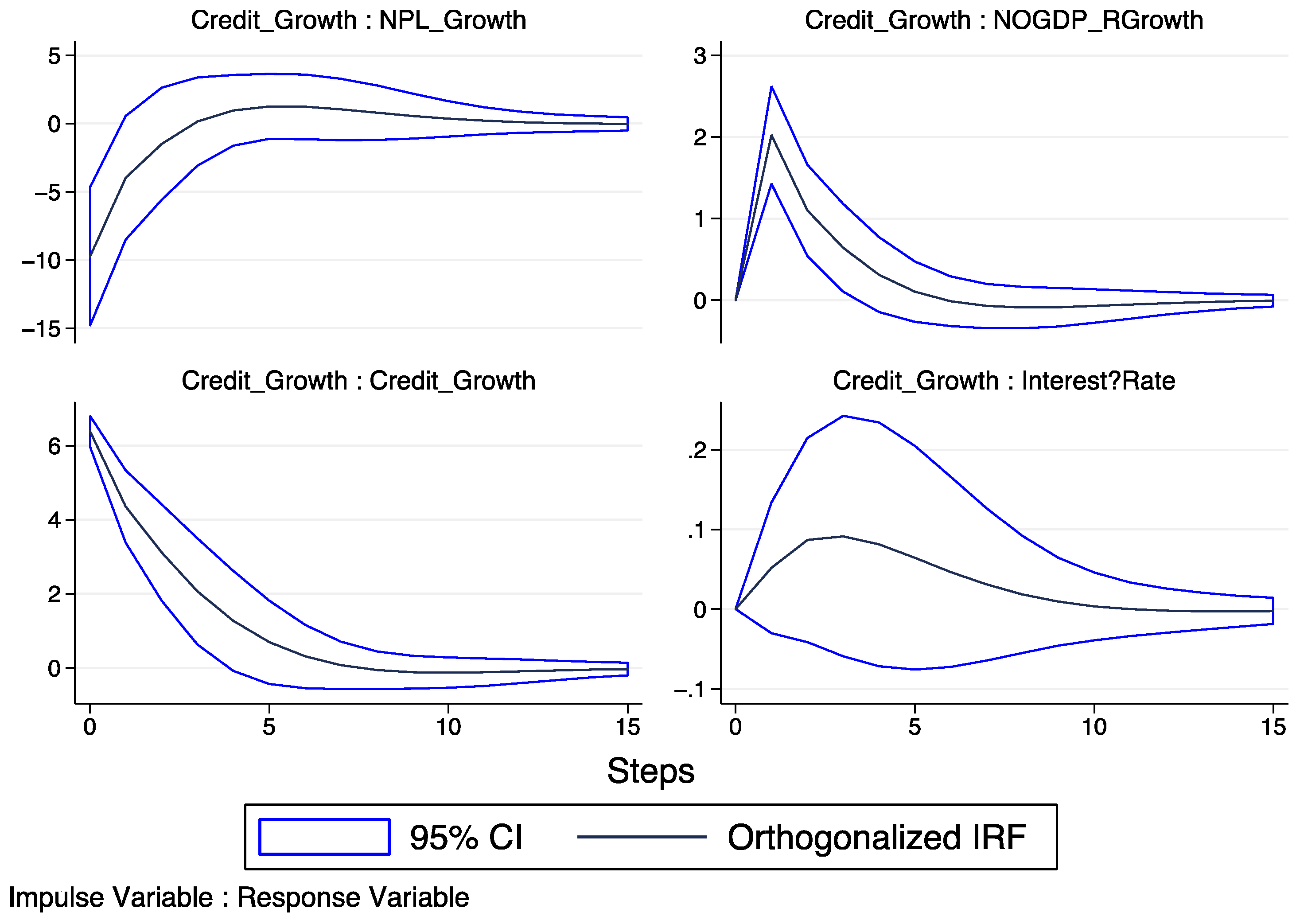

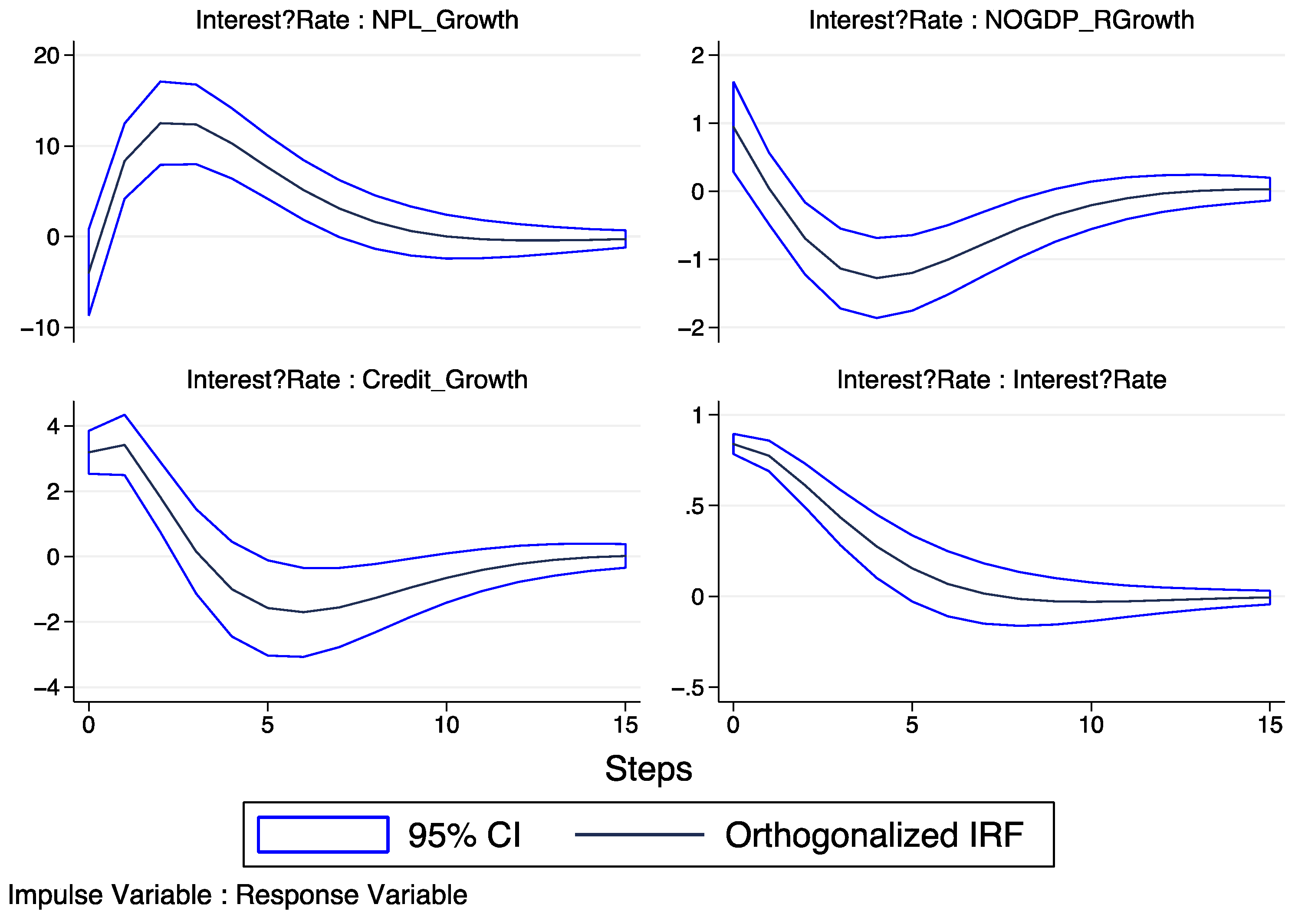

5] and a Panel Fixed Effect Model to estimate the response of nonperforming loans (NPLs) to its macroeconomic determinants. The second objective of this paper is to assess any negative feedback effects between the GCC banking systems and the real economy. This second part of the paper implements a Panel VAR model to explore financial linkages between GCC banking systems and the real economy. The results find strong linkages between oil price fluctuations and NPLs and further negative feedback effects from instability in banking systems to the GCC macroeconomy. Declines in oil prices increase NPLs, as do the declines in non-oil GDP and stock.

2. Literature Review

The global financial crisis triggered interest in the two-way linkages between financial system stability and macroeconomic performance. The work of Bernanke et al. [

6] lays a theoretical model with financial acceleration that links incomplete financial markets and the real economy; and provide insights on how endogenously determined credit frictions propagate disturbance and spread to the macroeconomy. The theoretical foundation of the role of credit risk shocks and its implications on the real economy are also well grounded in the literature. The relevant literature to this paper are (i) the determinants of nonperforming loans, as a measurement for credit risk in the banking systems; and (ii) the feedback relationship between the financial instability in banking systems and the real economy.

The literature on NPLs recognizes two major determinants of the variation in NPLs. The first strand of the literature assesses the macroeconomic determinants of NPLs, which influence the banks’ balance sheets and the debt-service capacity of the borrowers. The macroeconomic determinants of NPLs include business cycles, exchange rate pressure, unemployment rates, and lending rates. The second strand of this literature focuses on bank-specific determinants of NPLs, which vary across banks. The bank-specific determinants of NPLs include differences in risk managements, operation costs, and the sizes of the banks. A review of both these strands of literature is covered by Kaminsky and Reinhart [

7], Espinoza and Prasad [

1], Nkusu [

2], and Klein [

4].

The work of Keeton and Morris [

8] is one of the early studies that discuss the causes of loan loss variation across banks. They study the insured commercial banks in the United States and the effect of loan loss variations across these banks on managerial risk preferences and the local economic conditions. Berger and DeYoung [

9] use Granger causality techniques to examine the relationships among loan quality, cost efficiency, and bank capital across commercial banks in the United States. They find loan quality Granger causes cost efficiency and vice-versa. Furthermore, the study finds that a low level of cost efficiency is preceded by an increase in NPLs.

Kaminsky and Reinhart [

7] demonstrate that the instability of banking systems may trigger the beginning of a financial crisis. The study finds evidence from the 1990s crisis of emerging economies, which indicates that credit risks in banking systems typically lead to a currency crisis. The study finds that a currency crisis deepens the banking system crises and later spreads to the entire economy. This strand of the literature focuses on the adverse impact of credit risks on the stability of the financial sector.

Jesus and Gabriel [

10] find empirical evidence of a positive lagged relationship between rapid credit growth and NPLs. Their work examines the lending cycle and the required conditions and standards of the loans. The study empirically confirms that the banks, during the economic booms, tend to be more tolerant in both screening borrowers and collateral requirements.

Marcucci and Quagliariello [

11] study credit risks and the business cycles across different credit risk regimes in Italy. Their results confirm that the effect of business cycles on credit risks is more evident in weak financial conditions and hence there is a strong relationship between the severity of the financial crisis and the state of the economy. In another study, Marcucci and Quagliariello [

12] further examine the default rates of borrowers on Italian banks and their cyclical behavior. The results find default rates in the Italian banking system fall in economic booms and rise in economic recessions. The results confirm the intuitive relationship between credit risk and weak economic conditions.

The paper of Espinoza and Prasad [

1] is one of the few studies in the literature that examines the determinants of NPLs in the GCC region. They find that the NPL ratio increases as economic growth weakens and interest rates rises. However, Espinoza and Prasad [

1] cover the GCC banks before the financial crisis of 2008 and do not include oil prices. As oil exporting economies, oil prices are major and relevant determinant of NPLs across this region. The main focus of this paper is to examine the effect of the oil price slump on the GCC banking stability.

Nkusu [

2] studies the link between NPLs and macroeconomic variables in advanced economies. The study finds that an adverse macroeconomic shock leads to a higher level of NPLs. Furthermore, the study shows that a sharp increase in NPLs leads to poor macroeconomic performance and weak economic growth. Louzis et al. [

3] examine the determinants of NPLs in the Greek banking system. The study finds that macroeconomic determinants in Greece have a strong impact on NPLs across the banks. In particular, NPLs are largely explained by the GDP growth, the unemployment rate, the lending rate, and the public debt.

The work of Klein [

4] examines the NPLs in Central, Eastern and South-Eastern Europe (CESEE). The study looks at both bank-specific and macroeconomic factors and finds that the macroeconomic conditions have a stronger explanatory power across the CESEE region. Particularly, NPLs respond to GDP growth, unemployment and inflation across the region. Messai and Jouini [

13] study the determinants of NPLs in Italy, Greece and, Spain which suffered the most from the 2008 subprime crisis. The study finds that the increase in GDP growth lowers the credit risk as does a decline in unemployment rates.

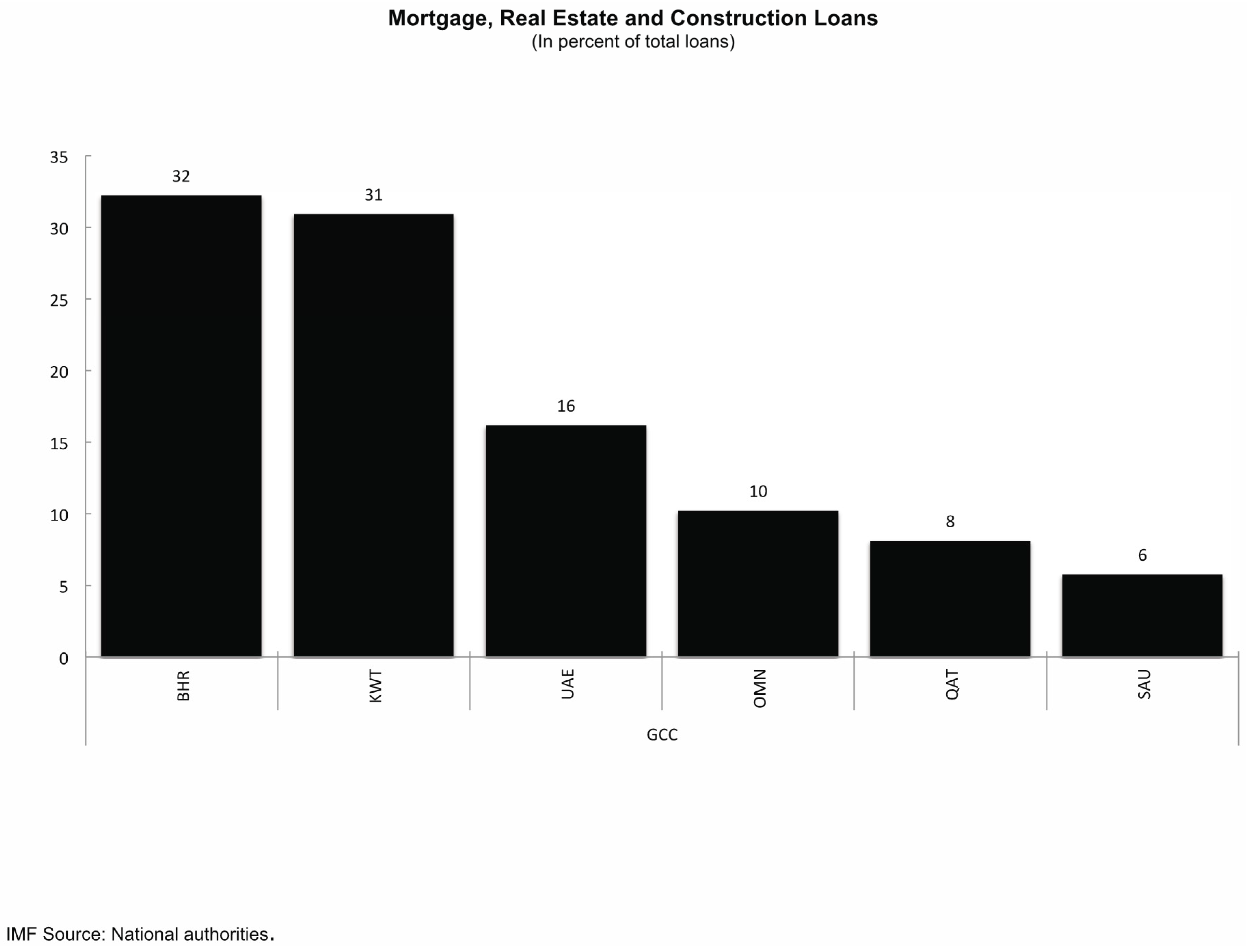

4. Data Description

This paper considers a panel data of GCC individual banks’ balance sheets from Fitch’s database spanning 2000–2014 and macroeconomic data from the IMF. These include nonperforming loans ratio (NPL), international oil price, real non-oil GDP, lending interest rate, three-year average of credit growth, stock prices, and housing prices. There are no indexes for GCC housing prices; however, this paper utilizes CPI components of Housing, Water, Electricity and Other Fuels as a proxy for the housing price indexes. In the GCC region, the water and electricity are subsidized and the movements in this component of the CPI are mostly due to movements in housing prices. The paper acknowledges that it may not be the optimal proxy for GCC housing prices, but it might be the best feasible proxy for these prices. The list of all the banks used in this paper are reported in

Table A1 in

Appendix A. The variables and data sources are reported in

Table A2 in

Appendix A under data descriptions. Overall, however, this paper acknowledges that the sample size (38 banks) and the time span (2000–2014) of the GCC banks considered for this paper are relatively small for obtaining precise estimates or a precise causal effect between oil price fluctuations and GCC banking stability.

6. Conclusions

While the macroeconomic implications of oil price fluctuations on GCC economies are significant and well studied, its implications on GCC banking systems has received less attention. This paper aims to understand the impact of the recent oil price slump on GCC banks’ balance sheets and examine any negative feedback effects between the GCC banking systems and the macroeconomy. The results show that macro economic variables, including the oil price, Non-oil GDP, interest rate, stock prices, and housing prices are major determinants of NPLs across GCC banks, and, therefore, of financial stability in the region. The Credit risk shock adversely impacts non-oil GDP, and credit growth across GCC economies. A higher level of NPLs restricts banks’ credit growth and can dampen economic recovery in these economies. These results support the notion that disturbances in banking systems lead to adverse economic consequences in the real sector. The results are qualitatively robust across different specifications. Counter-cyclical policies that limit the GDP slowdown can promote financial stability across the GCC region. Policy makers with financial stability objectives need to monitor the developments in international oil markets and smooth the potential effects to GCC banking systems. GCC countries implement fixed exchange rate regimes, and, therefore, exchange rates do not impose serious credit risks in the region. The GCC economies, however, accumulated a large amount of oil stabilization buffers and have the fiscal space to limit any negative feedback to the real economy.