Abstract

This study investigates the liquidity dynamics in non-traditional financial markets by simulating trading environments for fractional ownership of illiquid alternative investments, grounded in empirical tick data from a Swiss FinTech platform covering December 2022 to June 2024. The research translates an operational digital secondary market into a heterogeneous agent-based simulation model within the theoretical framework of market microstructure and complex systems theory. The main objective is to assess whether a simple agent-based model (ABM) can replicate empirical liquidity patterns and to evaluate how market rules and parameter changes influence simulated liquidity distributions. The findings show that (i) the simulated liquidity closely matches empirical distributions not only in mean and variance but also in higher-order moments; (ii) the ABM reproduces key stylized facts observed in the data; and (iii) seemingly simple interventions in market rules can have unintended consequences on liquidity due to the complex interplay between agent behavior and trading mechanics. These insights have practical implications for digital platform designers, investors, and regulators, highlighting the importance of accounting for agent heterogeneity and endogenous market dynamics when shaping secondary market structures.

1. Introduction

The rapid growth of FinTech has led to platforms that offer fractional ownership of traditionally illiquid, “unbankable” assets—fine wines, artwork, luxury cars, and watches. These markets let investors buy slices of those assets and often trade them through secondary venues. However, compared to more liquid, bankable instruments like stocks and bonds, fractional-ownership platforms face distinct liquidity constraints. Although economic research has long explored optimal market design for liquid securities, it has paid relatively little attention to the unique dynamics of these emerging fractional markets.

Liquidity is a critical factor in any financial system, determining how easily investors can buy or sell units and access capital when needed. In fractional ownership markets, liquidity is shaped by factors such as the number of tradable shares, valuation mechanisms, and platform-specific trading rules. For market providers, the accurate modeling of liquidity is essential for understanding trading dynamics and designing effective mechanisms for improvement. Despite growing interest in fractionalized assets, there remains a lack of empirical studies that examine liquidity in such contexts using theoretically grounded simulation-based approaches.

This paper addresses that research gap by developing a simulation environment that leverages a heterogeneous agent-based model (ABM) to approximate liquidity patterns on an operational trading platform for fractionalized assets. ABMs are particularly well suited for simulating complex financial markets involving heterogeneous agents and endogenous feedback effects. By capturing the behaviors and interactions of individual agents, they offer a more nuanced representation of market dynamics than traditional models and can generate synthetic data to explore counterfactual market states, something classical econometric or machine learning approaches typically cannot provide.

Unlike prior ABM studies based on stylized assumptions, the model developed here is empirically calibrated using micro-level transaction data from 37 trading windows (December 2022 to June 2024) provided by a Swiss FinTech startup specializing in fractional ownership of non-bankable assets. This enables the realistic simulation of agent heterogeneity, replication of key stylized facts from the real market, and an evaluation of how specific platform rules impact liquidity outcomes. By combining empirical calibration with simulation, this study contributes to both theory and practice, offering insights into the emergent liquidity properties of alternative markets and the unintended consequences of design interventions.

The remainder of this paper is structured as follows: Section 2 outlines the motivation for the study and defines the research questions. Section 3 reviews related work on illiquid markets and agent-based modeling. Section 4 describes the empirical data and market environment. Section 5 details the agent-based simulation model. Section 6 presents the simulation findings and Section 7 discusses theoretical and practical implications.

2. Motivation and Research Question

This study is driven by two main considerations. First, agent-based models (ABMs) for markets are composed of non-bankable assets, particularly those without a centralized liquidity provider, which are scarce in the literature, despite the suitability of ABMs for capturing complex interactions. Second, the surge of interest in alternative illiquid assets is largely a byproduct of FinTech platforms that broaden retail investor access, fundamentally transforming traditional financial services. Within this landscape, distributed ledger technology (DLT) and asset tokenization play a pivotal role, unlocking markets that were previously off-limits to small investors. These innovations bring forth several challenges, chief among them the need for sufficient market liquidity. Adequate liquidity is critical, as it enables investors to enter and exit positions swiftly, preserving portfolio flexibility and immediate cash access. As a result, investors are likely to require a liquidity premium, or accept a discount, when comparing these novel assets to conventional stocks and bonds, since diminished liquidity entails greater risk and delayed exit options. This aligns with the concept of liquidity preference, which asserts that investors favor assets that can be converted into cash with minimal friction (Keynes, 1936). Moreover, the analysis of market illiquidity in Tirole (2011) and the empirical findings on liquidity impacts in Amihud et al. (2006) highlight the effects on pricing, stability, and efficiency. To enhance the attractiveness of secondary markets for non-bankable assets, platforms must account for the adverse effects of low liquidity on investor choices and develop a thorough understanding of liquidity dynamics. Building on the framework of Fluri et al. (2024), our research advances in three key respects. We embed empirically justified heterogeneity into agents’ decision-making processes beyond their initial asset and cash endowments (see Section 5.2). We also refine the market simulation to more closely reflect its real-world counterpart. Finally, we employ econometric analysis on the simulation outputs to identify the primary drivers of liquidity.

3. Literature Review

This paper contributes to four areas of the economics and finance literature: (1) research on markets for non-bankable assets; (2) zero-learning-agent models used to analyze trading systems; (3) studies on liquidity dynamics in illiquid markets; and (4) investigations into tokenized and alternative asset markets.

3.1. Markets for Non-Bankable Assets

The study of non-bankable or illiquid asset markets remains underexplored within the current literature. Traditional economic theories often model complex financial markets with the assumption that market participants are rational and possess homogeneous beliefs Muth (1961). However, these models often fall short to capture the nuances of markets for fractionalized assets, which are typically illiquid, lack centralized market makers and involve agents with not perfectly rational behaviors and decision-making processes. Sornette (2009) critiques traditional models for their inability to represent systems nearing bifurcations and phase transitions, such as bubbles or market crashes, highlighting the unrealistic nature of these assumptions in certain market conditions. Furthermore, Bouchaud (2008) emphasizes the necessity for new modeling frameworks that incorporate behavioral aspects to more accurately depict the dynamics of financial markets. This research gap underscores the need for ABMs specifically designed to simulate the trading of non-bankable assets, a challenge this paper seeks to address. For instance, Bardoscia et al. (2025) employ a large-scale ABM to assess the effects of capital requirements and loan-to-income caps on UK housing and credit markets.

3.2. Zero-Learning-Agent Models

ABMs have gained prominence as effective tools for studying market mechanisms due to their ability to capture heterogeneous agent behaviors and complex interactions LeBaron (2000); Tesfatsion and Judd (2006). While many ABMs incorporate learning and adaptive strategies, distinguishing the effects of market mechanisms from agent strategies can be challenging Anufriev et al. (2013); Fosco and Mengel (2011). To address this, zero-intelligence (ZI) models, as proposed by Gode and Sunder (1993), eliminate complex strategies by assuming that agents act randomly with minimal intelligence. This simplification allows researchers to isolate and examine the impact of different market regimes without the confounding influence of sophisticated agent behaviors. In contrast to fully adaptive models, the current study employs agents with limited intelligence and no learning capabilities, positioning it within the ZI framework to focus specifically on the effects of market structure on asset trading. Relatedly, Seo et al. (2025) apply a macroeconomic ABM to investigate how debt-to-sales limits and interest-rate policies affect market concentration and growth dynamics.

3.3. Liquidity Dynamics in Illiquid Markets

Liquidity is a cornerstone of efficient financial markets, relying on robust processes, rules and infrastructures that facilitate asset trading Barclay and Hendershott (2003). Harris (2002) delineates two fundamental trading mechanisms: order-driven and quote-driven trading. Order-driven trading involves participants placing buy and sell orders with specified prices and quantities, which are then matched and settled based on predefined rules, often through central order books or auctions. Conversely, quote-driven trading relies on designated market makers or dealers who provide continuous prices and quantities for securities, enabling trades either through centralized entities or over-the-counter (OTC) markets. These trading mechanisms are frequently modeled using ABMs due to their capacity to simulate complex interactions and liquidity dynamics. Traditional models often assume liquid markets by design or incorporate central liquidity providers to maintain two-sided order books, stabilize spreads, and ensure trading volumes. However, these assumptions do not hold in less liquid or one-sided offer book markets, which are the focus of this study. This paper adds to the body of research by analyzing liquidity dynamics in single-sided offer book markets and explores complex liquidity-related parameter interactions that would not be captured by studying the effects of those parameters individually. Similarly, Kopp et al. (2022) replicates the key stylized facts of yield–curve dynamics in US Treasury markets using an ABM framework to study fixed-income liquidity risk, and Yang et al. (2025) examine how asymmetric price limits influence volatility and liquidity in industrial markets.

3.4. Tokenized and Alternative Asset Markets

The advent of tokenization has paved the way for alternative asset markets, allowing fractional ownership and increased accessibility to a variety of assets. Despite the growing interest, ABMs tailored to tokenized and alternative asset markets are scarce as most existing research predominantly focuses on traditional equity markets (see, e.g., Palmer et al. (1994)), which are inherently more liquid and supported by established market infrastructures. This study seeks to bridge this gap by developing an ABM that simulates the trading of typically illiquid, tokenized assets on a platform characterized by a one-sided offer book and the absence of a central market maker. By doing so, it addresses the unique challenges associated with liquidity dynamics and market mechanisms in alternative asset markets, providing new insights into their functioning and stability.

3.5. Synthesis and Contribution

While previous models have provided valuable insights into market microstructure and liquidity, they often rely on theoretical assumptions, lack empirical calibration, or focus on highly liquid and traditional markets. These limitations reduce their applicability to emerging fractional ownership markets that feature agent heterogeneity, structural illiquidity, and unique trading constraints. This study addresses these gaps by developing an empirically grounded agent-based simulation model that reflects real-world transaction data from a functioning secondary market for illiquid assets. By incorporating heterogeneity in agent behavior and platform-specific rules, the model enables a more realistic and granular analysis of liquidity dynamics and contributes to a better understanding of how design interventions influence market outcomes.

4. Market Setup and Data

The data used for the analysis in this paper were provided by a FinTech startup that specializes in the fractional ownership of non-bankable assets such as fine wines, artworks, luxury cars, and watches. An asset is split into initial shares, worth EUR 50 each, and sold to investors via the primary market. The entire asset is held over a pre-defined investment horizon, during which individual investors can sell their shares on a secondary market to other users. The present paper aims at simulating the platform’s secondary market as accurately as possible by leveraging empirical data for agent identification and specification. The key aspects of the platform’s trading mechanisms and rules, more specifically the environment in which market participants (agents) operate, are defined as follows:

- Market organization: The secondary market for trading shares opens at least once per month.1 Sellers may list shares for sale between 09:00 and 21:00 on designated trading days; buyers may make purchases only between 18:00 and 21:00 on those same days. Because buyers cannot place buy orders directly but can only accept existing sell offers, the market operates as an offer book driven by sellers. Any sell offers that remain unmatched are automatically deleted at the end of each trading day.

- Trading rules: Sell offers must be priced between 75% and 110% of the asset’s monthly updated reference valuation provided by the platform, ensuring that buyers are protected from offers that deviate substantially from current values. Sellers incur a two percent exit fee when a transaction completes on the secondary market; buyers pay no fees for successful trades.

- Order matching and market dynamics: Sell offers are processed in the sequence they arrive, ordered first by price and then by listing timestamp. Buyers are served in the order of arrival. The system allows both exact matches and partial matches between buy and sell orders.

- Interactive trading interface: Sellers may modify or withdraw their offers at any time. Buyers view offers in real time and make purchase decisions based on prevailing market conditions.

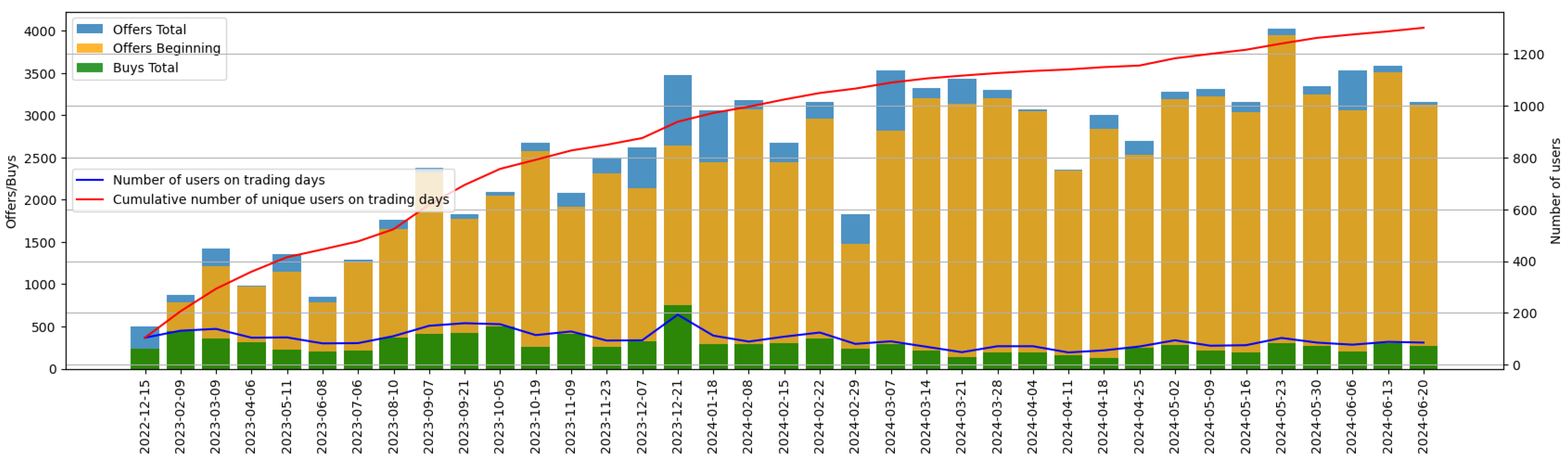

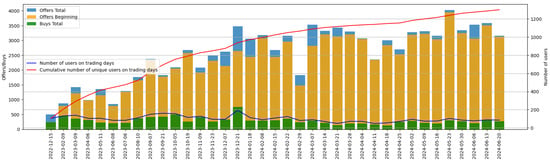

The dataset provided by the FinTech company encompasses 37 regular trading windows spanning from December 2022 to June 2024 (see Figure 1). It comprises a total of 26,884 offers and 4898 matched trades on the secondary market, culminating in a trading volume of EUR 454,330 across 308 distinct assets. Throughout the entire sample period, the platform registered 1365 individual users that bought and/or sold at least one share of an asset on the secondary market. The empirical data shows that the number of users is relatively stable over the trading windows, while the total user base of the platform grew continuously over time. Furthermore, the large majority of the sell offers in the offer book is entered during the pre-trading phase.

Figure 1.

Empirical trading activity on the secondary market.

The correlation between the number of offers and trades per trading day ensures a stable liquidity ratio (i.e., traded-to-offered assets), supporting its suitability as the key performance metric in the simulated market. Economically, the liquidity ratio is considered a target figure because, from an investor’s perspective, the absolute trading volume is not necessarily the most relevant factor. Instead, it is more relevant to assess the proportion of shares offered for sale that actually find a counterpart, as unmatched offers negatively impact platform satisfaction by limiting the user’s ability to divest.

Based on the empirical behavior in the secondary market, three distinct agent types for the simulation environment are defined:

- Pure Buyer (PB): Agents of this type purchase solely in the secondary market; the empirical dataset contains 727 such agents.

- Pure Seller (PS): Agents of this type sell exclusively in the secondary market after initially acquiring assets on the primary market; the empirical dataset contains 413 such agents.

- Buyer Seller (BS): Agents of this type both purchase and sell in the secondary market; the empirical dataset contains 225 such agents.

The offer and purchase behavior of the three agent types is modeled based on their empirical counterparts across all trading windows. This includes parameters such as the offer probability of Pure Seller and Buyer Sellers, as well as the purchase ratio (i.e., the proportion of available cash allocated to asset purchases) for Pure Buyers. Further details on the agents and market specifications can be found in Section 5.2.

5. Materials and Methods

This section introduces the modeling approach, focusing on how an ABM is used to simulate trading behavior in an illiquid financial market.2 Section 5.1 discusses the theoretical foundations and motivation for using ABMs. Section 5.2 outlines the implementation and agent setup. Section 5.3 describes the simulation process, while Section 5.4 covers the model initialization. Finally, Section 5.5 presents the strategy for synthetic data generation and the analytical framework used to assess market outcomes.

5.1. Methodology

In contrast to traditional economic theory, which often models complex financial markets under the assumption that participants behave rationally and share homogeneous beliefs, this study challenges these assumptions by considering more diverse and realistic participant behaviors to better capture the dynamics of illiquid markets. According to Sornette (2009), traditional economic theories struggle to model dynamics near bifurcation points and phase transitions—such as financial bubbles or sudden market crashes. Bouchaud (2008) contends that more realistic representations of financial markets require new modeling frameworks that incorporate behavioral factors. Agent-based models (ABMs) fulfill this role by adopting a bottom-up microstructure approach, allowing for heterogeneous and non-rational agent behavior. In the general setting, agents are endowed with an action strategy that describes how they interact with their surrounding (the market). Typically, these strategies are linked to an implicit or explicit utility function that describes the underlying preferences of the individual agent types. In the context of finance and financial markets, agents are most often endowed with a budget and a number of assets they hold. They then interact with each other within the given market rules on the basis of their endowments and utility functions. Unlike other methodologies that impose rigid frameworks and narrow parameter bounds, agent-based models provide researchers with a wide range of design choices. As a result, instructional materials resembling standard textbooks are scarce. LeBaron (2001) provides an overview of design options for implementing ABMs in research. Agents may follow purely random actions subject only to their budget constraints. Gode and Sunder (1993) demonstrate that such agents can reproduce key market phenomena. Chen and Yeh (2001) apply genetic programming to evolve trading strategies in an artificial market. Researchers may also define trading rules based on real world heuristics. Agents can be given learning capabilities to adjust their strategies over time. Arthur et al. (2018) implements adaptive learning agents in the Santa Fe Institute artificial market. Arifovic (1996) presents a similar adaptive framework in that context.

In this paper, an ABM of market microstructures is employed to simulate the trading dynamics of illiquid secondary markets. This approach was chosen for two key reasons. First, the empirical data provided by the platform contains detailed information on the market’s microstructure. This data enables both the design and specification of the model based on real-world conditions, as well as direct comparisons between observed and simulated behavior. Second, modeling agents at the individual level allows for flexible adjustments to their behavior and decision-making processes, facilitating the observation of how localized interactions give rise to new market equilibria and liquidity patterns.

5.2. Implementation

This section provides a detailed specification of the trading conditions underlying the simulations, along with the design of agent behavior. Key components of the model include agent descriptions, the process governing agent interaction, and the initialization of agents. Additionally, the approach for synthetic data generation and analysis is outlined. The simulation results of the model are presented in Section 6.

5.2.1. Agents

The agent descriptions (decentralized, micro-level) cover the inputs for their decision making, along with the rules, variables, parameters, and outputs that govern their behavior. The model defines three agent types: Pure Seller, Pure Buyer, and Buyer Seller. These agent types are derived from the empirical evidence presented in Section 4 and are further elaborated upon in the following paragraphs.

Pure Seller

It is assumed that the Pure Seller experiences an exogenous liquidity shock and therefore decides to sell their assets in order to generate liquidity. With a probability given by the external liquidity shock (PS offer probability), the agent decides to take action, i.e., to offer assets on the market, provided they hold more than zero assets. If the agent opts to act, they offer a quantity based on the offer ratio (PS offer ratio), defined as the proportion of their total assets they are willing to sell, multiplied by their total assets. The offer ratio for the Pure Seller agent i, denoted by , is calculated as follows:

where

- represents the median number of assets held by all Pure Seller agents;

- is the number of assets of the individual agent i;

- is a Gaussian noise term with and .

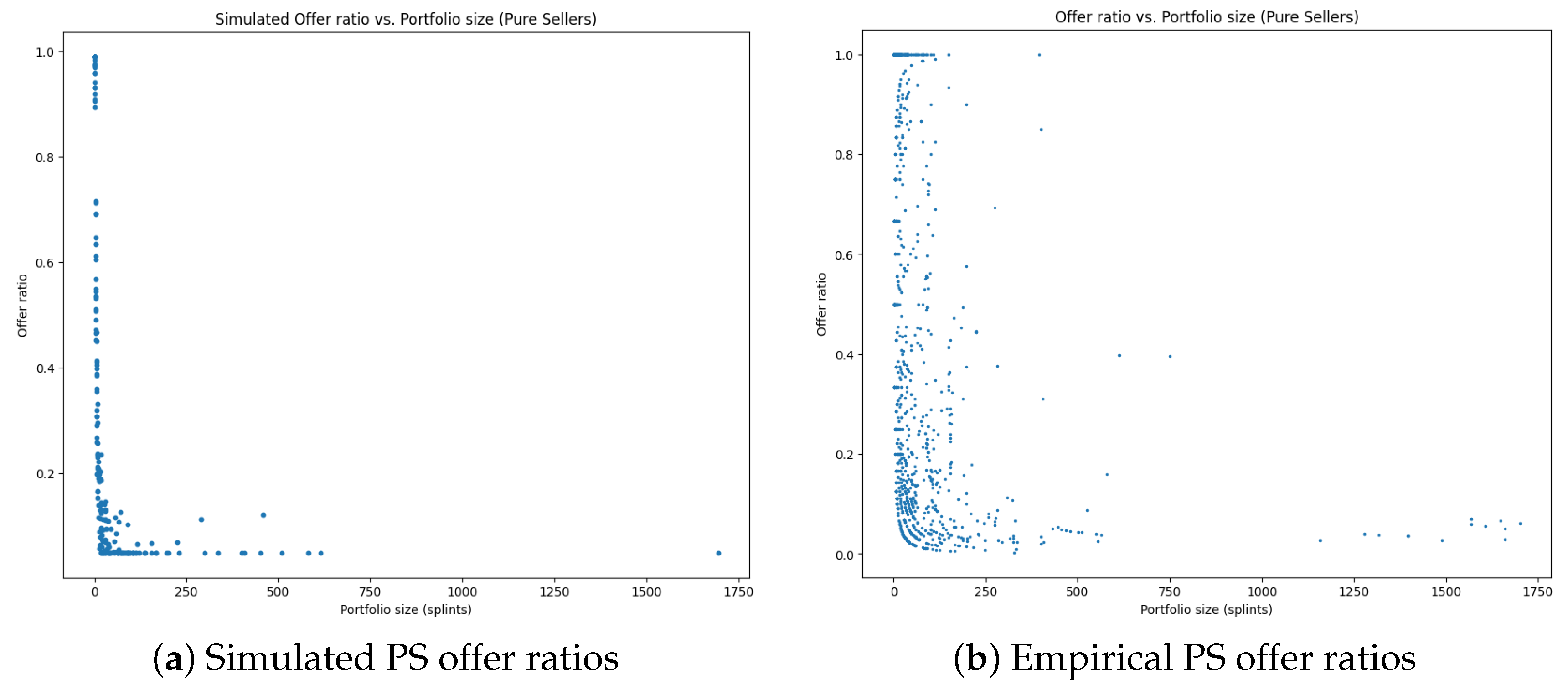

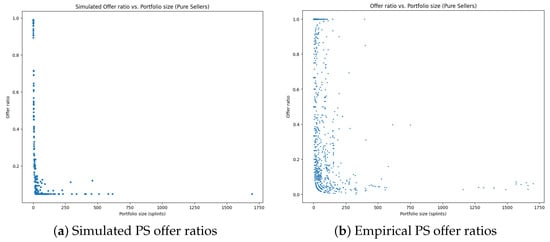

The resulting is clipped at the level to ensure that the agents have valid offer ratios. Hence, Pure Seller agents with a larger amount of assets trade a smaller fraction of their total portfolio in our simulation. This is justified by the empirical data which shows similar behavior, as illustrated in Figure 2.

Figure 2.

Comparison of empirical offer ratios with simulated data from one exemplary experiment for the Pure Seller.

The price for each unit of the offered asset by an individual agent is identical and drawn from the uniform distribution

where represents the lower and upper bounds of the Pure Seller’s price range relative to , the reference price representing the current asset valuation as provided by the platform operator. The offer book O is then updated with an offer , where consists of a price , a number of assets , and the agent ID of the seller .

Pure Buyer

The Pure Buyer agent participates in the market according to the average empirical activity level (PB trading probability). This agent does not focus on profit realization but rather on obtaining assets that were out of reach in the primary market. The model represents the agent as an emotional buyer driven by the prospect of the partial ownership of a desired asset. When the agent decides to act it selects one offer at random from the offer book O and evaluates it based on the offered price . The Pure Buyer is more inclined to accept offers with lower prices but may still accept offers with higher prices on occasion. The decision to purchase is governed by the following probability function

where is the probability of accepting the offer i at price , is the reference price or current asset valuation and k is the steepness of the decision curve. The Pure Buyer examines a single offer and then decides whether to act. If the agent opts to purchase, they allocate cash according to its purchase ratio (PB purchase ratio) and its available funds. When the total cost of the offered units is less than or equal to the allocated cash, the Pure Buyer acquires all units, removes the offer from the book, and retains any leftover cash. If the total cost exceeds the available cash, the agent buys as many units as it can afford, updates the remaining quantity of offer in the book, and exhausts its cash balance.

Buyer Seller

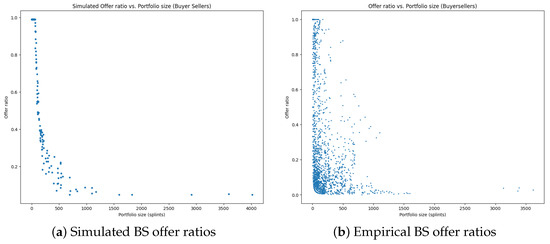

According to the market organization, there is a pre-trading phase and a trading phase. As the offer book is mainly formed during the pre-trading phase (see Figure 1) and settled in the trading phase, the Buyer Seller agent may act in both phases. The Buyer Seller agent seeks to maximize profit. In the pre-trading phase, the agent enters the market with the probability given by empirical data (BS offer probability) provided its asset balance is positive. If the agent becomes active, it sells a fraction of its assets based on the BS offer ratio. Similar to Pure Seller agents, the Buyer Seller agents exhibit heterogeneity in their offer ratios. The offer ratio for the Buyer Seller agent i, denoted by , is defined as follows:

where

- represents the median number of assets held by all Buyer Seller agents;

- is the number of assets of the individual agent i;

- is a Gaussian noise term with with .

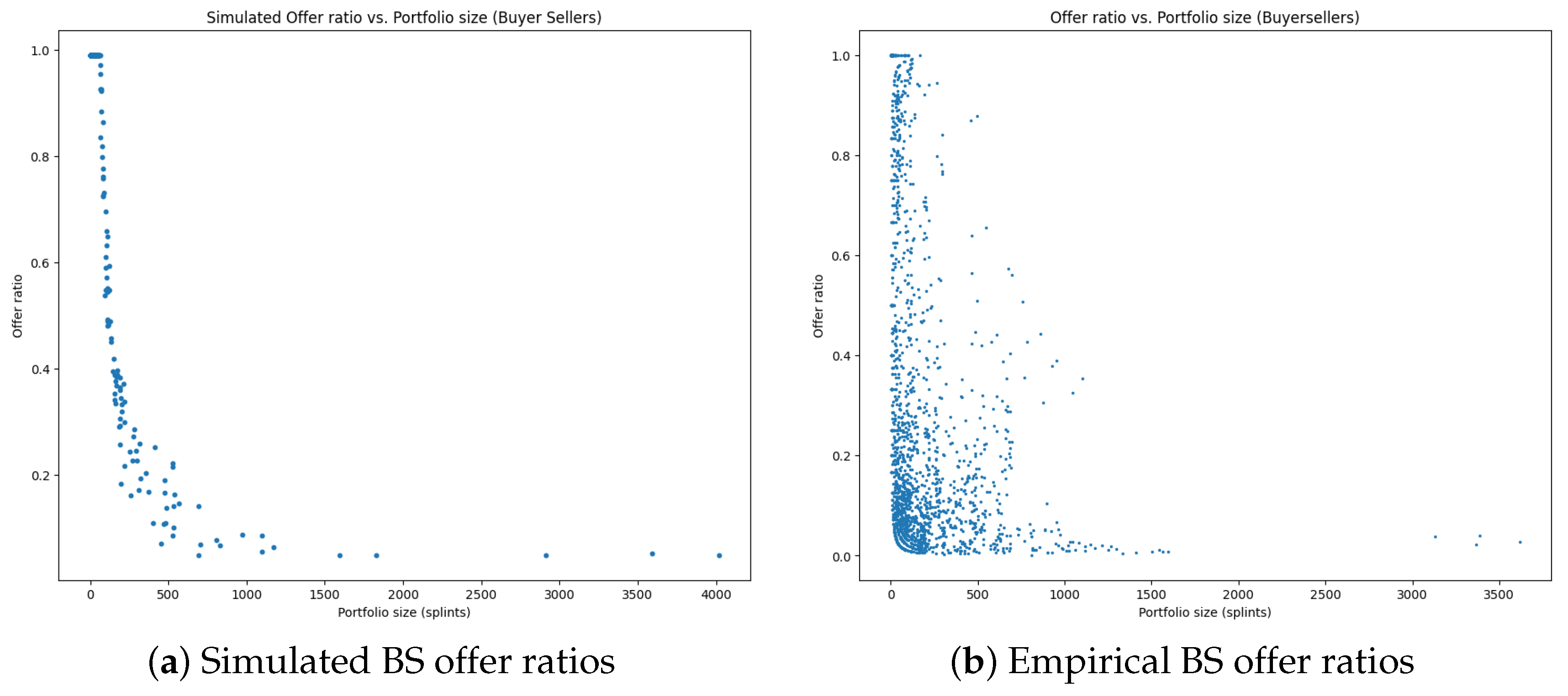

The resulting is clipped at the level to ensure that the agents have valid offer ratios. Hence, Buyer Seller agents with a larger amount of assets are designed to trade a smaller fraction of their total portfolio. A comparison of the simulated and empirical Buyer Seller offer ratios is provided in Figure 3.

Figure 3.

Comparison of the empirical offer ratios with simulated data from one exemplary experiment for the Buyer Seller.

The price for the assets in offer i is drawn from the following uniform distribution:

where represents the lower and upper bounds of the Buyer Seller’s price range relative to , with the reference price representing the current valuation of the asset. The offer book O is then jointly constructed with the Pure Seller agents, where each offer consists of a price , a corresponding quantity of assets , and the seller agent’s ID . This is necessary to prevent individual Buyer Seller agents from purchasing their own offers. During the trading phase, the Buyer Seller agent may purchase assets if it decides to act based on the BS trading probability. Given its search capacity (BS search length), the agent examines a set of offers chosen at random from those priced below the current asset valuation. The platform does not present a list sorted by price, so users filter for offers below the current valuation but see them in no particular order. It is therefore reasonable to assume that the agent cannot review every available offer. The agent thus selects the cheapest offer among the examined. This decision process is represented as follows:

is the agent’s search length, whereas is the price of the selected offer i and is the reference price. All offers are sampled uniformly from all the offers in the offer book below the reference price and do not have to be adjacent.

The agent selects the offer with the lowest price among the sampled offers. The agent allocates cash according to its purchase ratio (BS purchase ratio) and its available funds. If the total cost of units does not exceed the allocated cash, the Buyer Seller purchases all units, removes offer from the offer book, and retains any remaining cash. If the total cost exceeds the available cash, then the agent buys as many units as it can afford, updates offer in the offer book, and exhausts its cash.

5.3. Process

The macro-level interaction of agents produces collective behaviors and system dynamics that cannot be derived from individual actions alone. In accordance with the platform operation, the market is divided into pre-trading and trading phases. The model simulates a single trading day. The pre-trading phase runs from 09:00 to 18:00 and allows Pure Sellers and Buyer Sellers to submit sell offers. This phase is implemented in one iteration because empirical data show that most offers are entered before the trading phase begins as shown in Figure 1. The trading phase runs from 18:00 to 21:00 during which no new sell offers may be placed and all agents except Pure Sellers may match offers from the offer book. Each agent is endowed with cash and assets based on user data from the platform up to the closing of trading on 20 June 2024. These endowments provide snapshots from the empirical data by assigning each simulated agent the same cash and asset holdings as an actual user. Agents follow a two-step decision procedure. First, they decide whether to become active based on empirical activation probabilities. If they become active, they decide to sell or to buy according to their behavior rules, and their offer or purchase ratios derived from the data. The trading phase is divided into 12 settlement points corresponding to 15 min intervals. At each settlement point, matched offers are removed and agent variables are updated. The model contains one market with the asset reference price set at 50 reflecting the initial share value in the primary market.

5.4. Initialization

Parameters that are initialized are the offer probabilities for both Pure Seller and Buyer Seller, offer ratios for both Pure Seller and Buyer Seller, the trading probabilities for the Pure Buyer and the Buyer Seller, the purchase ratios for the Pure Buyer and the Buyer Seller, the decision steepness for the Pure Buyer, the search length for the Buyer Seller, the asset’s reference price, the price range of the market, and corresponding price ranges for the Pure Seller and Buyer Seller. The parameter specification of the baseline model can be found in Table 1, where the values are defined based on the empirical data for the three agent types.

Table 1.

Parameter specifications for Pure Seller (PS), Pure Buyer (PB), and Buyer Seller (BS) in the baseline model.

5.5. Synthetic Data Generation and Analysis

To analyze how different market regimes affect liquidity dynamics, two sampling strategies for synthetic data generation are employed: univariate and multivariate sampling. The parameter sampling ranges for both approaches are identical and specified in Table 2. For each experiment, we measure the total offering volume, total trading volume, and market liquidity. Market liquidity, referred to as the liquidity ratio, is defined as follows:

Table 2.

Parameter support for Pure Seller (PS), Pure Buyer (PB), and Buyer Seller (BS) to sample from.

The rationale for selecting the liquidity ratio as the key metric is explained in Section 4. In the following, the two sampling approaches are described in more detail.

5.5.1. Univariate Sampling

In this approach, one of the market parameters listed in Table 2, is randomly sampled in the range described. This leads to data where one of the parameter varies when all the remaining parameters are kept constant (ceteris paribus).

We measure the impact of the individual parameter using a multiple linear regression model of the form:

where

- Y is the simulated liquidity ratio;

- is the parameter of interest.

Note that both Y and are first transformed using the natural logarithm and then standardized and scaled. Furthermore, we used HC3-robust standard errors for the regression. In general, this approach gives an indication of whether a parameter is individually relevant and a significant driver of the liquidity dynamic in the simulated market.

5.5.2. Multivariate Sampling

In this approach, all the parameters described in Table 2 are randomly drawn from the parameter range described beforehand. The multiple linear regression has the form:

where

- Y is the simulated liquidity ratio;

- denotes the independent variable i, corresponding to one of the total m parameters of interest.

6. Results

This section presents the empirical validation and analysis of the agent-based simulation model. The results are structured as follows: Section 6.1 assesses the model’s ability to replicate empirical liquidity ratio distributions and stylized facts. Section 6.2 examines the impact of individual market parameters on liquidity using single linear regression. Section 6.3 extends the analysis to a multivariate setting, capturing joint and interaction effects among parameters.

6.1. Replication of Empirical Distribution

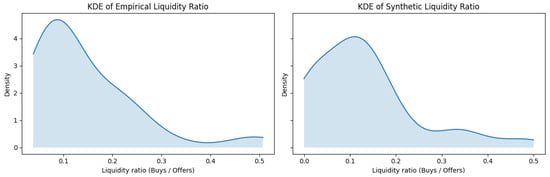

To ensure that the simulation environment reflects real-world market conditions, we compare the simulated market liquidity from 10,000 repeated experiments under the baseline parameter configuration (as defined in Table 1) with the average liquidity observed in the empirical data over 37 trading windows.

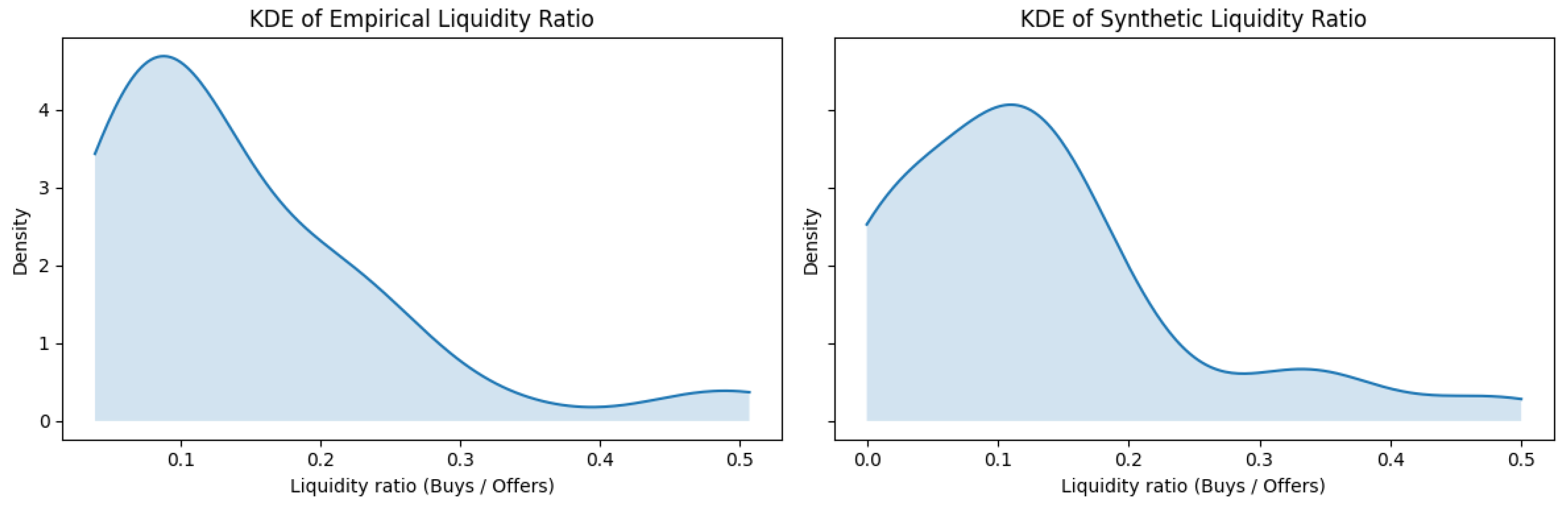

The simulations yield an average liquidity ratio of 12.8%, closely approximating the empirical average of approximately 14.5%, as shown in Table 3. Beyond this alignment in mean values, the model also replicates key distributional characteristics of the observed liquidity ratios. The simulated and empirical series are similar in terms of median, skewness, and kurtosis. The means differ by only 0.0152, and the medians by 0.0151. Furthermore, both series exhibit positive skewness and excess kurtosis (leptokurtosis), reflecting the heavy-tailed nature of liquidity shocks: the empirical data show a skew of 1.8 and excess kurtosis of 3.3, while the ABM yields a skew of 1.3 and excess kurtosis of 1.7. The similarity of these higher-order moments demonstrates that the model captures not only the central tendency but also the pronounced asymmetry and tail thickness observed in real-world liquidity distributions. Although discrepancies become more pronounced in the higher moments, this is acceptable given the focus of the study. Since the aim is to understand general liquidity dynamics rather than to model extreme events or outliers, we intentionally avoid overfitting or adding unnecessary complexity to address rare tail behaviors.

Table 3.

Descriptive moments of empirical vs. agent-based model (ABM) liquidity ratios.

To visualize the shape of the two distributions more clearly, Figure 4 presents kernel density estimates (KDEs) for the empirical and simulated liquidity ratios. The plots show that both distributions are right-skewed and share a similar mode close to 0.1, yet the simulated synthetic data exhibit higher density in the lower tail. This supports earlier observations that the simulation slightly oversamples days with very low liquidity, a trade-off we accept to preserve model tractability.

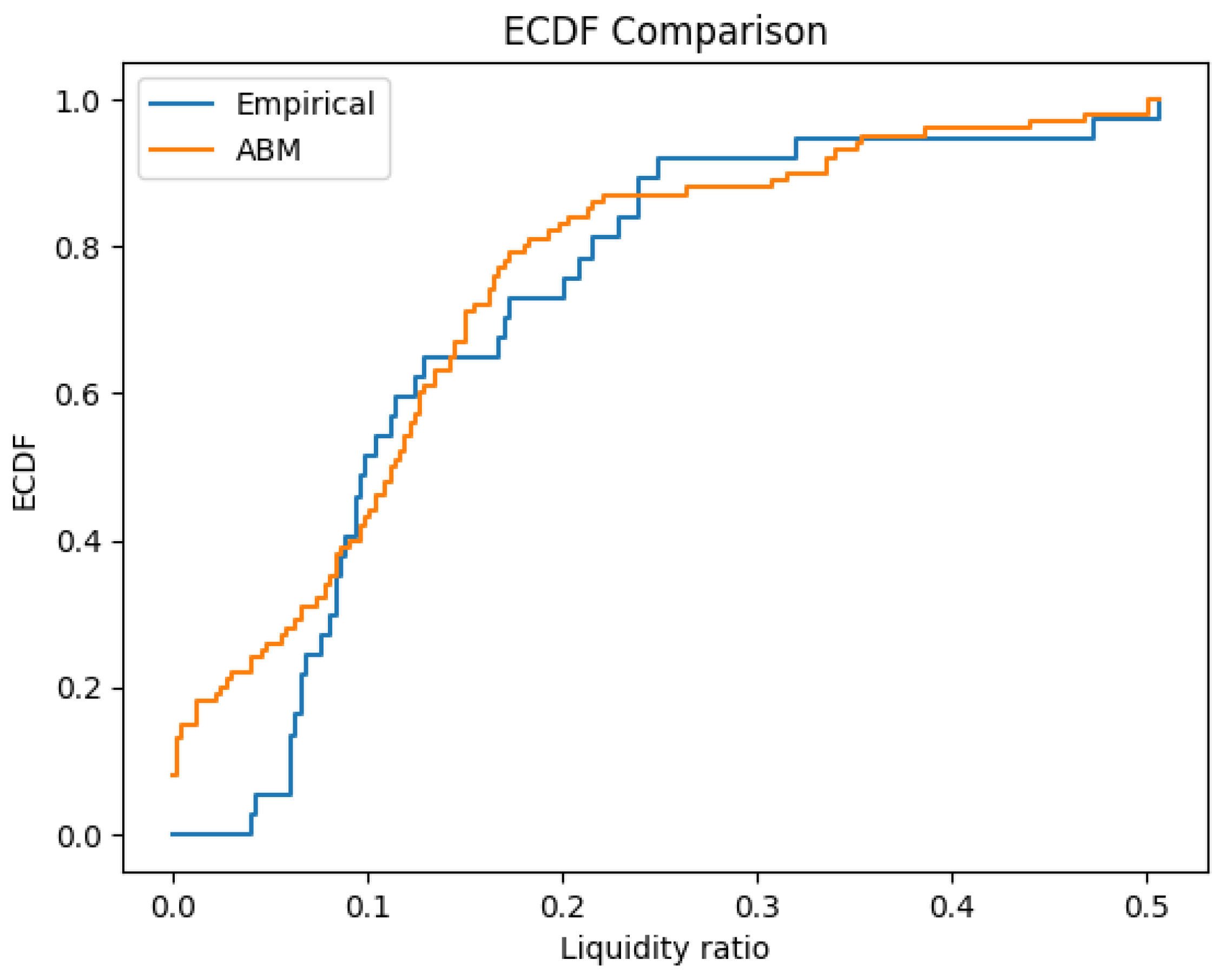

Figure 4.

Comparison of distribution between empirical and synthetic liquidity ratio.

To complement the descriptive moment comparison, we now turn to formal statistical testing to assess whether the simulated and empirical liquidity distributions differ in a statistically meaningful way. While summary statistics offer valuable insight into distributional similarity, hypothesis tests provide a more rigorous evaluation of whether observed differences could plausibly arise by chance. We apply two non-parametric tests, the Kolmogorov–Smirnov (KS) test and the Mann–Whitney U (MWU) test, to examine the alignment between the empirical and simulated distributions in terms of overall shape and central tendency, respectively.

The results of two non-parametric statistical tests are reported in Table 4. Both the KS and MWU tests yield p-values well above the conventional 5% significance threshold, 13.5% and 75.8%, respectively, indicating that we cannot reject the null hypotheses of equal distributions (KS) or equal central tendencies (MWU).

Table 4.

Statistical tests comparing empirical vs. agent-based model (ABM) liquidity ratios.

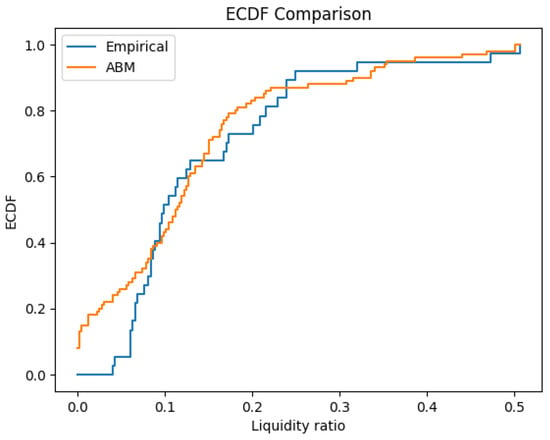

While both tests assess distributional similarity, they do so in distinct ways. The KS test evaluates the maximum vertical distance between the empirical cumulative distribution functions (ECDFs) of the two samples, making it sensitive to differences in location, dispersion, and tail behavior. In our case, a KS statistic of 0.216 and a p-value of 13.5% provides no statistically significant evidence that the overall shapes of the empirical and simulated liquidity ratio distributions differ meaningfully.

Figure 5 visualizes the ECDFs. It reveals that the simulated data contain more trading days with very low liquidity, particularly near zero—which are not observed in the empirical sample. However, for liquidity ratios above 0.1, both distributions follow similar cumulative patterns. While it may be possible to reduce the frequency of these near-zero outcomes by adding further model complexity, we deliberately avoid such adjustments to preserve the model’s tractability and transparency.

Figure 5.

Comparison of ECDF between empirical and synthetic distribution.

In contrast, the MWU test is a rank-based procedure that specifically assesses the differences in central tendency (medians). The large p-value of 78.8% suggests no detectable difference in typical values between the empirical and simulated distributions. Taken together, the KS and MWU results suggest that, while the model and empirical data share a similar central tendency, the KS test may detect marginal differences in spread or tail behavior that are not captured by the MWU test.

This implies that the simulation reproduces the core behavior of the real market’s liquidity dynamics quite faithfully, particularly in the central range. Although extreme liquidity events are not perfectly matched, the high p-values and the close alignment of descriptive moments provide strong evidence that the ABM approximates the empirical liquidity distribution sufficiently well for our analytical purposes.

Moreover, the model replicates key stylized facts observed in the empirical data. First, both distributions exhibit leptokurtosis, reflecting occasional days of extremely low or high liquidity. Second, the simulated series also displays a longer right tail, capturing sporadic bursts of buying pressure relative to offers. While certain edge cases, such as near-zero liquidity days, are slightly oversampled, the model successfully captures the main dynamics of secondary market liquidity ratio.

In summary, the ABM liquidity outcomes are statistically indistinguishable from the empirical benchmark, confirming that the simulation environment effectively approximates the real-world liquidity behavior of fractional ownership markets. Moreover, the emergence of stylized facts such as right skewness, excess kurtosis, and heavy tails, without any learning or strategic behavior, demonstrates that these phenomena can arise endogenously from a market entirely populated by zero-intelligence agents.

Building on this foundation, the regression approach described in Section 5.5 provides a deeper understanding of the factors driving market liquidity. While Section 6.2 focuses on the isolated effects of individual parameters through univariate analysis, Section 6.3 extends this perspective by examining the combined and interactive effects of multiple parameters. Together, these analyses offer a comprehensive view of how different variables, both independently and in conjunction, shape the dynamics of liquidity in the simulated market.

6.2. Single Linear Regression

The results presented in Table 5 highlight the influence of individual model parameters on market liquidity. The regression analysis reveals that most parameters have a statistically significant impact on the liquidity measure. This underscores their importance in shaping the dynamics of the simulated market.

Table 5.

Regression results for single regression analysis with univariate data sampling and 10,000 reruns of the market simulation.

Notably, the Pure Seller offer probability () and Buyer Seller offer probability () exhibit substantial negative effects on liquidity, with coefficients of −0.358 and −0.746, respectively. These values indicate that increases in the offer probabilities of these agents significantly reduce the liquidity ratio, with Buyer Sellers having a stronger disruptive effect compared to Pure Sellers. This suggests that heightened offering activity, particularly from Buyer Sellers, overwhelms market demand, exacerbating supply–demand imbalances.

In contrast, the Buyer Seller trading probability (), with a coefficient of 1.298, has the largest positive impact on liquidity among all parameters. This underscores the critical importance of trading activity in absorbing excess supply and stabilizing market conditions. Similarly, the Pure Buyer trading probability (), with a coefficient of 0.793, demonstrates a strong positive influence, reflecting the importance of Pure Buyers’ active participation in maintaining liquidity.

The purchase ratios for Buyer Sellers (, coefficient 0.229) and Pure Buyers (, coefficient 0.131) also positively contribute to liquidity. These effects, though smaller in magnitude than trading probabilities, highlight the role of buyer-side demand in supporting market operations.

Price-related parameters, such as the lower and upper price bounds for both Pure Sellers and Buyer Sellers, show consistently positive effects on liquidity. For instance, the coefficients for and are 0.048 and 0.125, respectively, indicating that higher lower ranges improve liquidity. One possible explanation for this dynamic is agent substitution effects. For instance, an increase in the Pure Seller lower bound () triggers a shift where matched offers from Pure Sellers are replaced by matched offers from Buyer Sellers, who, on average, offer greater quantities.

Furthermore, the Buyer Seller search length () has a small but statistically significant positive effect (coefficient 0.001), suggesting a limited yet detectable influence of search strategies on liquidity. Conversely, the logistic function steepness for Pure Buyers () is the only parameter that does not exhibit a statistically significant effect, with a near-zero coefficient and a p-value of 0.413, indicating that decision rigidity in Pure Buyers does not materially affect the liquidity ratio.

To ensure the validity of the regression results, Durbin–Watson tests were conducted for each model specification. The resulting statistics ranged from 1.97 to 2.03, indicating no evidence of serial correlation in the residuals across any of the models. This supports the reliability of the estimated coefficients and the appropriateness of the OLS assumptions.

Overall, the regression analysis confirms the critical role of agent behaviors and market parameters in determining liquidity outcomes. It highlights that active trading engagement are essential for maintaining a well-functioning market. Conversely, excessive selling activity or misaligned parameter configurations can lead to liquidity imbalances, underscoring the need for careful design of secondary markets.

6.3. Multiple Linear Regression

While the univariate regression analysis effectively isolates the impact of individual parameters, it does not account for potential interdependencies between parameters. Table 6 presents the results of a multiple regression analysis conducted on multivariate data sampling, incorporating all relevant parameters into a single model to evaluate their impact on market liquidity while controlling for the influence of other factors. The model achieves an value of 0.743, indicating that it explains approximately 74.3% of the variability in the liquidity ratio, demonstrating significant explanatory power. Note that, since the parameters were sampled independently in the simulation approach, multicollinearity is effectively eliminated. This is supported by variance inflation factors (VIFs), all of which were close to 1, confirming the absence of multicollinearity. Moreover, the Durbin–Watson statistic of 2.0 indicates no evidence of autocorrelation in the residuals, supporting the validity of the classical linear regression assumptions. The absence of both multicollinearity and autocorrelation allows for a more precise interpretation of the relationships between parameters and their individual effects on liquidity, thereby enhancing the robustness and reliability of the findings in understanding the market’s underlying dynamics.

Table 6.

Regression results for multiple regression analysis with multivariate data sampling and 10,000 reruns of the market simulation.

The findings from the multivariate analysis generally align with the results of the univariate regression analysis but also reveal notable differences when parameter dependencies are accounted for. In both analyses, the Pure Seller offer probability () exhibits a significant negative impact on liquidity, with a coefficient of −0.082 in the multivariate model, compared to −0.358 in the univariate analysis. This reduction in magnitude suggests that the impact of is partially mediated by interactions with other parameters. The Pure Seller price bounds ( and ) remain positive, significant and of similar magnitude, with coefficients of 0.049 and 0.060, respectively, implying complex dynamics between seller agents with differing offering bounds.

For Buyer Seller parameters, the multivariate analysis continues to show a strong negative effect of the Buyer Seller offer probability () on liquidity, with a coefficient of −0.374, compared to −0.746 in the univariate analysis. This result indicates that the detrimental impact of excessive offering activity by Buyer Sellers is moderated when considering other factors. The Buyer Seller trading probability (), with a coefficient of 0.472, constitutes a positive driver of liquidity in both analyses. While attenuated from the univariate coefficient (1.298), this parameter continues to underscore the critical importance of trading activity in offsetting potential disruptions caused by oversupply. Similarly, the Buyer Seller purchase ratio () and price bounds ( and ) contribute significantly and positively to liquidity, with coefficients of 0.148, 0.020, and 0.156, respectively. The smaller coefficients for the price bounds in the multivariate model suggest that their contribution to liquidity is partially absorbed through interaction effects with other parameters, reflecting shared influences rather than independent contributions. The Buyer Seller search length (), though modest, remains statistically significant, with a larger coefficient of 0.027.

For Pure Buyer parameters, the Pure Buyer trading probability () maintains a strong positive impact on liquidity, with a coefficient of 0.184, reflecting its consistent importance in absorbing supply and stabilizing liquidity. The Pure Buyer purchase ratio () also retains a positive effect, with a coefficient of 0.061, though its influence is smaller compared to trading probabilities. Furthermore, the logistic function steepness (), which was insignificant in the univariate analysis, becomes statistically significant in the multivariate model, with a coefficient of −0.017. This shift suggests that increased decision rigidity among Pure Buyers slightly hinders liquidity when considered alongside other parameters.

Overall, the multivariate analysis builds upon the univariate findings by capturing the combined and relative importance of parameters. While the general trends and significance levels are consistent across both analyses, the multivariate results provide a more nuanced understanding of how parameters interact to shape liquidity.

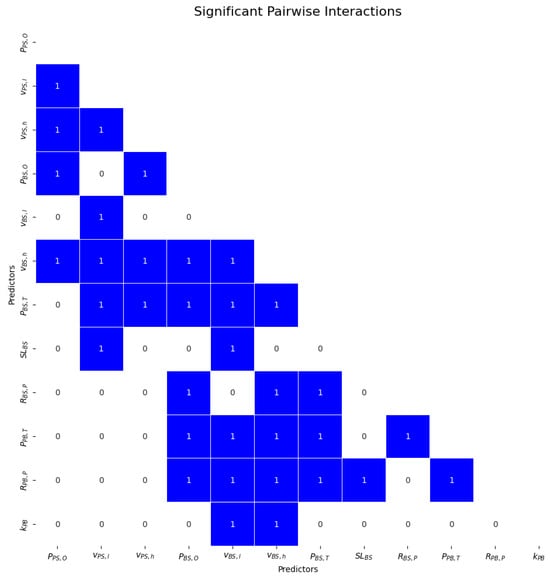

Building on these insights, the next step is to explicitly investigate whether relationships between parameters are influenced by their interactions, as market dynamics often reflect combined effects rather than isolated impacts. This involves conducting an auxiliary regression that includes all possible interaction terms to identify those that are statistically significant. The significant interaction terms are then incorporated into an extended multiple regression analyses. Examining interaction effects allows for an assessment of how the influence of one parameter changes based on the level of another, providing a deeper understanding of the dependencies and joint influences shaping liquidity. This approach offers a more nuanced framework for analyzing the mechanisms driving liquidity in illiquid markets.

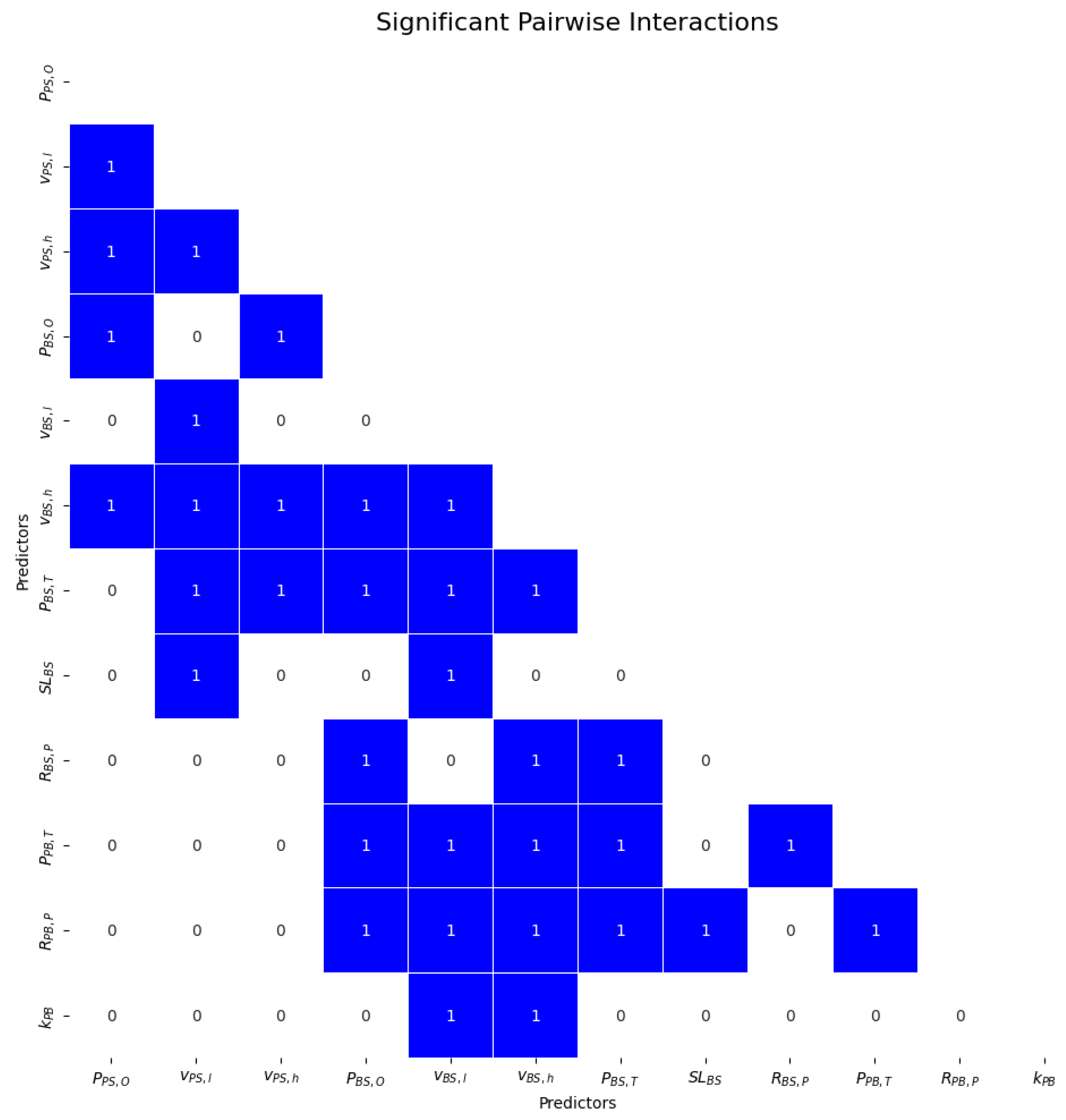

Figure 6 presents the results of the interaction term analysis, displaying all bivariate interaction terms and emphasizing their statistical significance or lack thereof. The significant interaction pairs reveal two main structural patterns in the model. First, there are notable inter-agent dependencies, where parameters associated with one agent type, such as the offer probability of Buyer Sellers (), are influenced by or dependent on the behaviors and pricing strategies of other agent types. This interdependence highlights the interconnected nature of agent actions within the market, where the decisions of one group can amplify or mitigate the impact of another. Second, price-sensitive dynamics play a central role in shaping market liquidity. Many of the significant interaction terms involve price bounds, underscoring their importance in either moderating or amplifying the effects of other parameters. Pricing bounds appear to be a critical factor in determining how effectively the market absorbs supply and maintains liquidity. Together, these patterns illustrate the complex, interconnected mechanisms that govern the simulated market dynamics.

Figure 6.

Significant interaction terms in the parameter space.

Building on these findings, the inclusion of significant interaction terms provides an opportunity to refine the multiple regression model and enhance its ability to capture the nuanced relationships between parameters. By extending the multiple regression described in Equation (8) to include interaction terms, the model can be developed to explicitly incorporate these interdependencies. The resulting regression model then takes the form:

This formulation allows for a more comprehensive exploration of how combinations of parameters jointly influence the liquidity ratio, providing deeper insights into the underlying dynamics of the market.

The results of the corresponding regression analysis can be found in Table 7. The inclusion of the interaction terms increases the model’s explanatory power, as reflected in an adjusted of 0.807, indicating that 80.7% of the variability in liquidity is explained by the model after accounting for degrees of freedom. This represents an improvement over models without interaction terms, emphasizing the importance of capturing parameter interdependencies. The high F-statistic (722.1, p < 0.001) further validates the model’s overall significance. Multicollinearity is again not a concern due to random sampling, as confirmed by variance inflation factors (VIFs), all of which were close to 1. Additionally, the Durbin–Watson statistic of 2.01 indicates no evidence of serial correlation in the residuals.

Table 7.

Regression results for multiple regression analysis including interaction terms with multivariate data sampling and 10,000 reruns of the market simulation.

The main effects remain largely consistent across both modeling approaches, confirming the robustness of key relationships with liquidity. Core drivers, such as offer probabilities and trading activity, retain their negative or positive impacts across models. However, the inclusion of interaction terms provides further insights, revealing that liquidity is influenced by complex, interdependent dynamics between variables. These interactions suggest that individual effects are not isolated but can be amplified or diminished by other factors in the market, highlighting the intricate nature of liquidity formation.

For example, the interaction between the Pure Seller offer probability () and Buyer Seller offer probability () indicates that their combined offering behaviors can moderate their individual impacts on liquidity. Similarly, several interactions between price bounds, such as , demonstrate that misaligned ranges between agent types may significantly can reduce liquidity, while interaction between some price ranges, e.g., the one among Buyer Sellers (), are strongly associated with improved liquidity.

The analysis also highlights the interplay between trading and purchase behaviors. For instance, the interaction between Buyer Seller trading probability () and Buyer Seller purchase ratio () demonstrates that their joint activity enhances liquidity. However, simultaneously high trading probabilities among Buyer Sellers and Pure Buyers () can reduce liquidity, likely due to heightened competition between agents, leading to a substitution effect where one type of buyer crowds out or replaces another in the market.3

Behavioral effects, such as Pure Buyer decision rigidity, also emerge as significant in interaction terms. For example, the interaction between Buyer Seller upper price bounds and Pure Buyer decision rigidity () indicates that these factors jointly influence liquidity. This finding underscores the nuanced ways in which behavioral and structural parameters interact in shaping market outcomes.

Overall, the inclusion of interaction effects in regression models highlights the intricate liquidity dynamics that simple or multiple regression analyses often overlook. For instance, the interplay between trading probabilities and price bounds illustrates how the coordination of market activities and pricing flexibility can either stabilize or destabilize liquidity. This nuanced understanding demonstrates that market behavior is not merely a summation of independent effects but a result of interdependent relationships among multiple factors. Consequently, the providers of secondary markets must carefully evaluate the impact of their measures on market liquidity, as seemingly straightforward interventions may yield unexpected outcomes due to the intricate interplay between agents, both among themselves and with market rules.

7. Discussion

This research demonstrates how illiquid markets for non-bankable assets can be modeled in ABMs with multiple markets and agents. A central result is that the model replicates core stylized facts of empirical liquidity distributions, such as skewness, excess kurtosis, and fat tails, even though agents follow zero-intelligence behavior. This suggests that such statistical regularities can emerge from the structural design of the market itself, rather than from strategic learning or optimization.

The findings underline the complex dynamics of liquidity in fractionalized asset markets. The ABM-based simulation shows that liquidity emerges from the interplay between agent behaviors and market structures. Contrary to the intuitive assumption that increased participation necessarily enhances liquidity, the results reveal that certain interventions can have unintended and even adverse effects.

The regression analyses identify clear drivers of liquidity in the simulated market. Most notably, trading probabilities for Buyer Sellers () and Pure Buyers () are strong positive contributors, emphasizing the role of active buyer engagement in supporting liquidity. In contrast, offer probabilities for Buyer Sellers () and Pure Sellers () have the strongest negative effects, indicating that excessive selling can overwhelm demand and reduce liquidity. Price bounds (e.g., , ), purchase ratios (, ), and behavioral parameters such as search length () and decision steepness () also influence outcomes, albeit to a lesser degree. These results highlight how liquidity depends not only on individual parameters, but also on their distribution across heterogeneous agent types. Interdependencies between parameters further reveal that seemingly straightforward changes, such as adjusting participation incentives or price constraints, can interact in unexpected ways, sometimes producing counterintuitive effects.

Taken together, these findings emphasize the need for a nuanced approach to designing secondary markets for illiquid assets. Platform providers must consider not only the direct effects of their market design choices but also their indirect and interactive consequences. This study not only advances the understanding of liquidity in illiquid markets but also offers practical guidance for building trading environments that better support liquidity in fractionalized and alternative asset markets.

7.1. Limitations

This paper is constrained by its market-specific implementation and reliance on parameters derived from a single operational investment platform. While this approach allows for detailed modeling of the platform’s trading mechanisms, it inherently limits the generalizability of the findings to other market environments. The specific rules, agent compositions, and trading structures modeled in this study may not apply to platforms with different configurations, such as double-sided offer books or those with central liquidity providers. This limitation is not unique to this research but is a common characteristic of studies employing ABMs, which are often tailored to specific use cases and therefore lack direct transferability to broader contexts.

Additionally, the study focuses exclusively on zero-intelligence agents, which act without adaptive learning or strategic decision-making capabilities. This framework simplifies the analysis by isolating the effects of market structure, but it does not capture the adaptive behaviors, learning, and strategic responses that characterize real-world market participants. As a result, the findings do not reflect the potential impact of agents adapting to market conditions over time, which could influence liquidity dynamics, pricing behavior, and market equilibria.

Finally, the focus on the liquidity ratio as the primary performance metric, while crucial, neglects other dimensions of market efficiency, such as price discovery or volatility. By emphasizing liquidity, the analysis may overlook trade-offs between these factors, which are essential to understanding the broader implications of market design choices.

7.2. Extensions

This paper establishes a foundational framework for leveraging ABM to analyze liquidity dynamics in markets for non-bankable assets, serving as a starting point for future research. Building on the developed simulation environment, subsequent studies should explore a range of structural and behavioral extensions.

A promising direction is to investigate how different market design choices influence liquidity and market efficiency. For example, future work could examine the introduction of centralized mechanisms, such as market maker agents or centralized liquidity providers, which may mitigate demand–supply mismatches and enhance price stability. Additionally, transitioning from the current single-sided sell offer book to a double auction or continuous double auction system would allow for a more comprehensive order-matching process.

Further extensions could also include agents with learning or strategic behavior. Incorporating reinforcement learning, bounded rationality, or rule-adaptation mechanisms would enable an exploration of how adaptive behavior shapes market dynamics and impacts liquidity under different rule regimes. This would also allow researchers to study co-evolutionary feedback loops between agents and the market structure over time.

A promising direction for applied research involves adapting the ABM framework to institutional settings such as options markets. While structurally different, these markets exhibit some conceptual parallels, including illiquidity in certain strike/maturity combinations. Extending the current model to simulate such environments could yield insights into position dynamics and liquidity stress under constrained trading conditions.

Methodologically, another extension involves enriching the analytical layer of the model using time series approaches. Given the simulation’s ability to generate rich synthetic data, techniques such as autoregressive moving average (ARMA) or generalized autoregressive conditional heteroskedasticity (GARCH) models could be employed to extract temporal patterns in simulated liquidity, persistence in liquidity shocks, or volatility clustering. These models would provide a complementary perspective to the structural simulations and support the identification of significant predictive variables.

Finally, a related extension involves comparing static scenarios with differing liquidity regimes, specifically low- versus high-liquidity conditions. This approach, as suggested during the peer review process, could further elucidate the sensitivity of liquidity outcomes to variations in agent behavior and market settings. While such analysis was not included in the present study, we consider it a valuable direction for future work.

Together, these extensions can enrich the model’s explanatory power and support the development of more robust and adaptive trading platforms in the evolving landscape of fractionalized asset markets.

Author Contributions

Conceptualization, L.F., D.B., A.E.Y. and T.A.; software, L.F. and A.E.Y.; validation, L.F., D.B. and T.A.; resources, A.P.; supervision, T.A. Writing—original draft preparation, L.F. and D.B.; writing—review and editing, T.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by Innosuisse (Swiss Innovation Agency) grant number 107.530 IP-ICT. The APC was funded by the University of Basel and the Lucerne University of Applied Sciences and Arts.

Data Availability Statement

The data presented in this study are available upon request from the corresponding author due to partial privacy constraints, as the dataset contains individual user-level transaction records from a live trading platform.

Acknowledgments

We are grateful to Jovana Milojevic for her valuable critical feedback on the content and her support with the formal preparation of the paper. During the preparation of this manuscript, the authors used ChatGPT (OpenAI, GPT-4, used in 2024–2025) for language editing, text refinement, and assistance in drafting formal statements. GitHub Copilot (GitHub/Microsoft, powered by OpenAI Codex, used in 2024–2025) was used during the development of simulation code and data analysis scripts. The authors have reviewed and edited the output and take full responsibility for the content of this publication.

Conflicts of Interest

Aurelio Perucca is the founder of the MARK Investment Holding AG, the FinTech company that provided the empirical data used in this study. Lars Fluri is a minority shareholder in MARK Investment Holding AG. The authors declare that this affiliation did not influence the design of this study; the analysis or interpretation of the results; the writing of the manuscript; or the decision to publish the findings. All other authors declare no conflicts of interest.

Abbreviations

The following abbreviations are used in this manuscript:

| ABM | Agent-based model |

| DLT | Distributed ledger technology |

| ZI | Zero-intelligence models |

| OTC | Over-the-counter |

| PB | Pure Buyer |

| PS | Pure Seller |

| BS | Buyer Seller |

| KS | Kolmogorov–Smirnov test |

| MWU | Mann–Whitney U test |

| ECDF | Cumulative distribution function |

Notes

| 1 | Note that the platform adjusted its trading schedule from a four-week cycle to a biweekly window and then to a weekly schedule over the course of the observation period. |

| 2 | During the preparation of this manuscript, the authors used ChatGPT (OpenAI, GPT-4, 14 March 2023 release) to assist in proofreading and improving the linguistic quality of the text. Additionally, GitHub Copilot (OpenAI Codex-based, 29 June 2022 general availability release) was employed to enhance the quality and structure of the simulation code used in the agent-based model. The authors have reviewed and edited all outputs and take full responsibility for the content of this publication. |

| 3 | A corresponding dynamic is observed and described in Fluri et al. (2024). |

References

- Amihud, Y., Mendelson, H., & Pedersen, L. H. (2006). Liquidity and asset prices. Foundations and Trends in Finance, 1(4), 269–364. [Google Scholar] [CrossRef]

- Anufriev, M., Arifovic, J., Ledyard, J., & Panchenko, V. (2013). Efficiency of continuous double auctions under individual evolutionary learning with full or limited information. Journal of Evolutionary Economics, 23, 539–573. [Google Scholar] [CrossRef]

- Arifovic, J. (1996). The behavior of the exchange rate in the genetic algorithm and experimental economies. Journal of Political Economy, 104(3), 510–541. [Google Scholar] [CrossRef]

- Arthur, W. B., Holland, J. H., LeBaron, B., Palmer, R., & Tayler, P. (2018). Asset pricing under endogenous expectations in an artificial stock market. In W. B. Arthur, S. N. Durlauf, & D. A. Lane (Eds.), The economy as an evolving complex system ii (pp. 15–44). CRC Press. [Google Scholar] [CrossRef]

- Barclay, M. J., & Hendershott, T. (2003). Price discovery and trading after hours. The Review of Financial Studies, 16(4), 1041–1073. [Google Scholar] [CrossRef]

- Bardoscia, M., Carro, A., Hinterschweiger, M., Napoletano, M., Popoyan, L., Roventini, A., & Uluc, A. (2025). The impact of prudential regulation on the UK housing market and economy: Insights from an agent-based model. Journal of Economic Behavior & Organization, 229, 106839. [Google Scholar] [CrossRef]

- Bouchaud, J.-P. (2008). Economics needs a scientific revolution. Nature, 455(7217), 1181. [Google Scholar] [CrossRef]

- Chen, S.-H., & Yeh, C.-H. (2001). Evolving traders and the business school with genetic programming: A new architecture of the agent-based artificial stock market. Journal of Economic Dynamics and Control, 25(3–4), 363–393. [Google Scholar] [CrossRef]

- Fluri, L., Yilmaz, A., Bieri, D., Ankenbrand, T., & Perucca, A. (2024). Simulating liquidity: Agent-based modeling of illiquid markets for fractional ownership. arXiv, arXiv:2411.13381. [Google Scholar] [CrossRef]

- Fosco, C., & Mengel, F. (2011). Cooperation through imitation and exclusion in networks. Journal of Economic Dynamics and Control, 35(5), 641–658. [Google Scholar] [CrossRef]

- Gode, D. K., & Sunder, S. (1993). Allocative efficiency of markets with zero-intelligence traders: Market as a partial substitute for individual rationality. Journal of Political Economy, 101(1), 119–137. [Google Scholar] [CrossRef]

- Harris, L. (2002). Trading and exchanges: Market microstructure for practitioners. Oxford University Press. [Google Scholar] [CrossRef]

- Keynes, J. M. (1936). The general theory of employment, interest and money. Palgrave Macmillan. [Google Scholar] [CrossRef]

- Kopp, A., Westphal, R., & Sornette, D. (2022). Agent-based model generating stylized facts of fixed income markets. Journal of Economic Interaction and Coordination, 17, 947–992. [Google Scholar] [CrossRef]

- LeBaron, B. (2000). Agent-based computational finance: Suggested readings and early research. Journal of Economic Dynamics and Control, 24(5–7), 679–702. [Google Scholar] [CrossRef]

- LeBaron, B. (2001). A builder’s guide to agent-based financial markets. Quantitative Finance, 1(2), 254. [Google Scholar] [CrossRef]

- Muth, J. F. (1961). Rational expectations and the theory of price movements. Econometrica, 29, 315–335. [Google Scholar] [CrossRef]

- Palmer, R. G., Arthur, W. B., Holland, J. H., LeBaron, B., & Tayler, P. (1994). Artificial economic life: A simple model of a stockmarket. Physica D: Nonlinear Phenomena, 75(1–3), 264–274. [Google Scholar] [CrossRef]

- Seo, Y., Altiner, Z., Lee, S., Moon, I.-C., & Yun, T.-S. (2025). Finance and market concentration using agent-based modeling: Evidence from South Korea. Journal of Artificial Societies and Social Simulation, 28(3), 5. [Google Scholar] [CrossRef]

- Sornette, D. (2009). Why stock markets crash: Critical events in complex financial systems. Princeton University Press. [Google Scholar] [CrossRef]

- Tesfatsion, L., & Judd, K. L. (2006). Handbook of computational economics: Agent-based computational economics. Elsevier. [Google Scholar]

- Tirole, J. (2011). Illiquidity and all its friends. Journal of Economic Literature, 49(2), 287–325. [Google Scholar] [CrossRef]

- Yang, X., Zhang, J., Ye, Q., & Chang, V. (2025). Leveraging asymmetric price limits for financial stability in industrial applications: An agent-based model. Computers in Industry, 164, 104197. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).