Abstract

The rapid development of digital technology is reshaping the global economic landscape. However, its impact on firms’ capacity utilization rate (CUR), particularly through technological innovation, remains unclear. This study investigates this issue by developing an endogenous growth model that connects digital technology to CUR. The empirical analysis is based on data from Chinese A-share manufacturing firms. The methods employed include quantile regression, instrumental variable techniques, and various tests to explore underlying mechanisms. CUR is calculated using a special model that looks at random variations, and digital transformation is assessed using text analysis powered by machine learning. The findings indicate that digital transformation significantly enhances CUR, especially for firms with average capacity utilization levels, but has a limited effect on low- and high-end firms. Moreover, technological innovation mediates this relationship; however, factors like “double arbitrage” (involving policy and capital markets) and “herd effects” tend to prioritize quantity over quality, which constrains innovation potential. Improvements in CUR lead to enhanced firm performance and productivity, generating industry spillovers and demonstrating the broader economic externalities of digitalization. This study uniquely applies endogenous growth theory to examine the role of digital transformation in optimizing CUR. It introduces the “quantity-quality” technology innovation paradox as a crucial mechanism and highlights industry spillovers to address overcapacity while offering insights for fostering sustainable economic and social development in emerging markets.

Keywords:

digital transformation; capacity utilization rate; technological innovation; industry spillover effect JEL Classification:

G18; O31; O16; D82

1. Introduction

The advent of digital technology is fundamentally reshaping conventional economic growth models and productivity frameworks within the context of the global economy’s ongoing digital transformation. Digital innovations have elevated data to a pivotal role in production. This transformation assigns data the same level of importance as traditional economic factors—capital, labor, and land—in fostering economic growth and development.

These emerging technologies not only promote the cross-border operation between the real economy and the virtual economy but also cause “creative destruction” to traditional industries. This has resulted in numerous new industries, forms, and models. These innovations have emerged as a potent force driving the metamorphosis and elevation of the real economy, steering it toward high-quality development. Furthermore, they also provide new possibilities for enterprises to improve capacity utilization rate. The incorporation of digital technology into organizations optimizes and reconstructs traditional production components, creating new production functions. By incorporating digital technology, enterprises broaden their operational scope, fine-tune the allocation of innovation elements, and accelerate the speed of organizational innovation (Climent & Haftor, 2021). By limiting the supply of low-end capacity, the demand for high-end capacity grows, improving enterprise capacity utilization.

A low-capacity utilization rate indicates overcapacity, which impedes industrial development and structural upgrading. Overcapacity also reflects the extensive mode of national economic development and the imperfection of institutional mechanisms. This situation leads to idle equipment and waste of resources, reduces enterprise benefits, causes workers to lose their jobs, damages social welfare, decreases industry investment in innovation, and results in unreasonable resource allocation. The existing literature tells us that enterprise production inefficiencies and a lack of industry competitiveness severely constrain high-quality economic development. Although China’s manufacturing sector has advanced rapidly, it continues to struggle with widespread overcapacity—a deeply rooted issue that hampers the nation’s economic progress. The phenomenon of overcapacity in China is characterized by low-end overcapacity and high-end overcapacity, which is closely related to the backward level of innovation (M. Liu, 2024). In the formation stage of overcapacity, backward technology leads to repeated investment in low-threshold industries. Turning to the governance stage of overcapacity, these technologies limit the ability of industrial structure adjustment and product export, thus aggravating the problem of overcapacity in the industry. Improving the capacity utilization rate is essential for boosting overall competitiveness and promoting high-quality growth in businesses, as well as for better use of social resources and strengthening economic stability (Ran et al., 2024). In this context, exploring how digital technology influences the capacity utilization rate of enterprises, particularly through technological innovation, has become a critical area of focus. Additionally, identifying strategies to optimize capacity decisions in the manufacturing sector has emerged as a key issue deserving closer attention. This paper aims to uncover the mystery of the capacity utilization rate under digital transformation, examining it from both qualitative and quantitative perspectives of technological innovation. The goal is to offer fresh ideas for solving the issue of overcapacity and promoting high-quality growth in the manufacturing industry. This research advances the theoretical foundations of technological innovation in the digital age and provides helpful insights for emerging markets. Understanding how emerging market enterprises adapt to and leverage digital trends is crucial both theoretically and practically. Improving capacity utilization rates is central to fostering the sustainable and robust growth of these markets.

Related literature initially concentrated on how information and communication technology influence the capacity utilization rates of enterprises. Related research mainly focuses on information and communication technology to improve the capacity utilization of enterprises by influencing inventory volatility, production processes, production costs, and consumer purchase decisions. Mouelhi’s research demonstrated that the widespread adoption of information and communication technologies enables manufacturing enterprises to perform production tasks more accurately (Mouelhi, 2009) and improve capacity utilization rates. Hubbard’s research demonstrates that the implementation of information technology enhances the capacity utilization rate and contributes to a reduction in average costs (Hubbard, 2003). Dermisi shows that using information technology to sell can improve the inventory turnover speed (Dermisi, 2004). Marini and Pannone highlighted that using information and communication technology (ICT) helps manage complicated data more effectively, improves coordination among different operations, and makes better use of capacity (Marini & Pannone, 2007). The commodity production process achieves this by minimizing production downtime and enhancing the alignment between inputs and outputs. Dana and Orlov built a capacity decision-making model and studied how consumers get more information through the Internet to affect their purchase decisions (Dana & Orlov, 2014), thus affecting the equilibrium price and capacity utilization rate of products.

Recent advancements in digital technology have sparked a growing body of literature examining its effects on enterprise capacity utilization. However, the research in this area remains sparse. Regarding the direct impact of digital transformation on enterprise capacity utilization, the majority of studies indicate that digital transformation enhances enterprise capacity utilization by optimizing resource allocation, lowering transaction costs, enhancing the information environment, and forecasting market trends (Ma et al., 2024). However, Zhao and Ren argue that this effect is non-linear, showing an inverted U-shaped relationship (N. Zhao & Ren, 2023). Specifically, they find that the impact of digital transformation on firm capacity utilization diminishes once it reaches a certain threshold. The study also reveals significant heterogeneity in the impact of digital transformation on firms’ capacity utilization. Ran et al. observe that the impact of digital transformation is more pronounced in firms that are less market-oriented, have more advanced information infrastructures, and are manufacturing firms (Ran et al., 2024).

Concerning the mechanisms through which digital transformation influences firms’ capacity utilization, Ma et al. found that firms’ digital development can significantly improve the accuracy of management forecasts and reduce investment impulses (Ma et al., 2024). It will boost the capacity utilization rate. Digital transformation has the potential to replace traditional labor inputs and facilitate knowledge spillovers, thereby enhancing the “smile curve.” (Meng et al., 2020). N. Zhao and Ren (2023) demonstrated that technological innovation and specialization within enterprises mediate the relationship between digital transformation and the optimization of capacity utilization, and Guo et al. discovered that digital transformation can enhance the capacity utilization rate by fostering technological innovation, improving internal control, mitigating the impact of information technology, and improving the quality of information. Ran et al. (2024) documented that digital transformation increases a firm’s capacity utilization rate by improving resource allocation, easing financing limitations, fostering innovation, and boosting market demand.

In this paper, we apply Romer’s (1990) endogenous growth model to examine the impact of digital transformation on the capacity utilization rate of manufacturing firms and explore the mechanisms from both quantitative and qualitative perspectives of technological innovation. In addition, we offer an extended analysis of the economic outcomes and industry spillover effects, aiming to deliver a holistic understanding of the broader economic implications of digital transformation. We use A-share manufacturing companies listed on China’s Shanghai and Shenzhen stock exchanges from 2011 to 2020 as our research sample. During recent years, China has achieved notable advancements in digital transformation, which has been pivotal in the transition from “made in China” to “wisdom in China.” Therefore, studying digital transformation in Chinese manufacturing enterprises can provide us with a wealth of practical cases and data support. We emphasize that China presents a uniquely compelling context for this investigation due to its dual role as the world’s largest developing economy and a global frontrunner in digitalization adoption and scale. This combination offers valuable, transferable insights for peer developing nations navigating similar digital transformation journeys, while our analysis remains firmly grounded in the specific dynamics of the Chinese manufacturing sector. Chinese manufacturing enterprises face fierce competition in both domestic and international markets, which prompts them to continuously seek to improve capacity utilization rate and competitiveness through digital transformation. The behavior of firms in this market environment provides us with a valuable opportunity to study how digital transformation affects capacity utilization rate.

This paper contributes to the extant literature in the following three aspects. First, we apply digital transformation as a technological progress to Romer’s (1990) endogenous growth model and theoretically discuss the impact of digital transformation on enterprise capacity utilization rate. Digital transformation has led to the creation of new industries, new formats, and fresh models, resulting in more production links and more product categories. Digital transformation also boosts overall production by adding value from both the extra help provided by intermediate inputs and the additional benefits gained from research and development activities. In addition, digital transformation facilitates an increase in the number of new intermediate products, which in turn leads to increased productivity and ultimately to increased capacity utilization.

Second, this paper investigates the enigma of the capacity utilization rate in the context of digital transformation, examining it from both the quantity and quality perspectives of technological innovation. Theoretically, it is assumed that digital transformation can improve the “quantity and quality” of technological innovations of enterprises and thus increase the capacity utilization of enterprises. Through empirical analysis, we find that enterprises take into account government behavior, market dynamics, and the strategies of other enterprises when choosing innovation paths and ultimately make optimal decisions on the basis of their own interests to balance the quantity and quality of innovation. In the digital transformation of enterprises, “double arbitrage” and “cohort effect” are the main factors restricting the “quality” of enterprise innovation. To obtain government subsidies or arbitrage in the capital market, enterprises tend to apply digital technology to increase the number of innovations, which impedes the improvement in innovation “quality” stemming from enterprise digital initiatives. The “cohort effect” causes companies going through digital transformation to use similar innovation strategies, which focus more on producing a lot of innovations rather than improving their quality. This means that when companies in the same group prioritize quantity over quality, it limits the overall quality of innovation that can come from their digital changes. This restricts the innovation “quality” effect of enterprise digital transformation.

Third, we conduct an extended analysis of the economic consequences and industry spillovers of digital transformation affecting firms’ capacity utilization. We find that enhancing enterprise digital transformation can boost capacity utilization, thereby enhancing enterprise performance and total factor productivity. The increase in the capacity utilization of enterprises means the increase in the utilization rate of idle factors, which realizes the intensive utilization of factors, alleviates the problem of resource waste, and reduces the enterprise’s inventory expenditure, thus improving enterprise performance and total factor productivity. We also find that digital transformation improves enterprise capacity utilization with industry spillovers, but with a certain lag. The evidence suggests that enterprise digital transformation can improve its own capacity utilization and exert a positive externality on the capacity utilization of other enterprises in the same industry.

2. Theoretical Framework

Building upon Wang and Zheng (2022), we develop a theoretical framework to examine the impact of digital transformation on enterprise capacity utilization rate, utilizing the endogenous growth model. From neoclassical growth theory to endogenous growth theory, the key to the evolution of economic growth theory is to regard technological progress as the transformation from exogenous to endogenous. According to Romer (1990), technological change increases the final output. Labor () and intermediate products () are used to produce final products. Firstly, the Cobb-Douglas production function is extended to:

Capital investment is redefined as an increase in the variety of intermediate products following technological change. We model digital transformation through microeconomic mechanisms as an increase in the variety of intermediate products (N). Digital transformation reduces R&D costs through data sharing and AI-assisted design, enabling modular production systems to reorganize existing knowledge into new varieties, and reduces search and coordination costs through digital integration of supply chains. This process enables companies to create new varieties of intermediate products more easily and cost-effectively. In Equation (1), N thus represents the endogenous expansion of intermediate product categories driven by digital transformation. Digital transformation gives rise to new industries, new business models, and new patterns, generating more production stages and thereby forming more intermediate product varieties.

Assuming that the same number of intermediate products are used, we can transform Equation (1) into:

In Equation (2), represents the total amount of intermediate products. Fixed-scale remuneration is applicable to the labor force (L) and the total amount of intermediate products (NX). makes the final output (Y) increase with the increase of the number of intermediate products. When is assumed to be fixed, the larger N is, the lower the level represented by , and the marginal yield of each intermediate product that declines will increase.

In Equation (2), represents the total amount of intermediate products. Fixed-scale remuneration is applicable to the labor force (L) and the total amount of intermediate products (NX). makes the final output (Y) increase with the increase of the number of intermediate products. When it is assumed that is fixed, a greater N equates a lower level of , and the marginal product of each intermediate will increase.

The positive impact of digital transformation on final output stems from the marginal incremental effect generated by the continuous accumulation of technology (knowledge) in the R&D department, as well as the marginal incremental effect generated by intermediate products. Digital transformation improves the efficiency of knowledge accumulation in enterprises by accelerating the speed of experimentation, reducing duplication of work through data sharing, and supporting collaboration through digital platforms. This can be reflected in the new intermediate product productivity parameter (B) in Equation (3):

Among these, represents the quantity of new intermediate products. In the R&D department, is determined by labor (L), intermediate products (N), and the accumulation of technological change (B). Digital transformation means technological change. In the context of China’s manufacturing sector, B reflects the accumulation of technological change enabled by core digital technologies such as artificial intelligence, blockchain, cloud computing, and big data. Under Chinese policy support, industrial internet of things platforms amplify the effect of B by integrating R&D resources across the supply chain, shortening innovation cycles, and accelerating the diversification of intermediate products. This parameter thus reflects how the digital technology foundation and policy incentives jointly enhance final productivity within China’s innovation ecosystem. This paper argues that digital transformation helps create more new intermediate products, thereby boosting productivity. We further expand the capacity utilization rate (CUR) and set it as follows:

In Equation (4), represents the potential maximum final output that can be achieved using state-of-the-art technology, fixed labor, and intermediate products, i.e., the production frontier. Digital transformation significantly increases actual final output () primarily through increasing the number of new intermediate products (N), improving the productivity parameters (B) of new intermediate products, optimizing resource allocation efficiency, and achieving customized production. Although digital transformation itself may involve the exploration of cutting-edge technologies, its key contribution to improving capacity utilization rate (CUR) lies in significantly increasing actual output (). The CUR indicator effectively reflects the extent to which actual output approaches the fixed potential maximum output under the current production frontier, thereby revealing improvements in operational efficiency and flexibility. Therefore, digital transformation effectively improves capacity utilization rate (CUR) by increasing actual final output ().

Hypothesis 1.

Digital transformation can improve enterprise capacity utilization.

Digital transformation reconfigures the value creation system and goes beyond the classic assumptions of many innovation theories (Tilson et al., 2010; Nambisan, 2017). Digital transformation enables firms to overcome technical constraints and advance innovation, promoting enterprises to update technology, explore new knowledge, and accelerate the formation of an innovative and entrepreneurial ecology. Digital transformation empowers through technological innovation, promotes the effective use of idle resources, continuously optimizes the innovation activities of enterprises, and is conducive to maximizing market value (Obukhova et al., 2020). Digital transformation can dig deep into consumer data, accurately identify consumer preferences, and obtain consumer feedback so as to meet the individual needs of consumers (Rangaswamy et al., 2022), which helps enterprises accurately identify market opportunities for new product development, thus reducing their concerns about the uncertain future market demand of new products. The development of new products has been sped up by technological advancements, and new products with more steady performance, better technical content, and efficient manufacturing methods have sped up the removal of outdated production capacity. Enterprises constantly meet diversified and personalized demand through innovation with the purpose of inventory cost reduction, adapt to the fierce and rapidly changing market environment, and then alleviate the problem of overcapacity.

Currently, China is steadily advancing the development of its manufacturing capabilities. Digital transformation in manufacturing firms will promote technological innovation of manufacturing firms, increase resource allocation efficiency for innovation, and contribute to the construction of an open innovation system for the entire manufacturing industry chain (Kinkel et al., 2022). Emerging digital technology can integrate existing R&D resources, improve innovation processes, and enhance innovation efficiency (Vărzaru & Bocean, 2024). Technological innovation is an activity with huge resource input, and its success hinges on the efficient integration of both internal and external resources. As enterprises’ own capabilities become insufficient to meet innovation demands, they increasingly turn to external resources for support. Digital transformation enhances businesses’ capacity to access outside resources, promotes the cooperation among innovation organizations, and is conducive to enterprises obtaining heterogeneous knowledge at low cost, thus strengthening the knowledge width of enterprises and increasing the supply of high-quality technological innovation. Moreover, the investment cycle of technological innovation is long, and there are many uncertain factors, especially the high cost of high-quality technology. Digital transformation can speed up the affordable sharing of knowledge, lower the costs of trying out new technologies for businesses (X. Zhao & Qian, 2023), and help increase both the amount and quality of technological innovation. This study makes the following assumptions on the basis of the theoretical analysis mentioned above:

Hypothesis 2.

Digital transformation can promote the “quantity and quality” of an enterprise’s technological innovation, thus improving the enterprise’s capacity utilization rate.

3. Research Design

3.1. Data Sources and Processing

We select A-share manufacturing companies listed in China’s Shanghai and Shenzhen stock markets from 2011 to 2020 as the research sample and perform the following treatments. Firms marked as ST and PT during the study period are not included; we also leave out samples with missing information on important variables and those with clear issues in financial measures like profit margins and asset-liability ratios; finally, we adjust continuous variables at the 1% and 99% quartiles to reduce the impact of extreme values on the results. The sources of the data include the Wind Database (Wind), the China Stock Market & Accounting Research Database (CSMAR), and the China Research Data Services Platform (CNRDS). The annual report data are from the official websites of the Shanghai Stock Exchange and the Shenzhen Stock Exchange.

3.2. Model Specification

3.2.1. Benchmark Regression Model

To test the influence of digital transformation on the capacity utilization rate of manufacturing enterprises, we construct the following regression model:

where is the capacity utilization rate of enterprise i in the t period, represents digital transformation level of firm i in the t period, include all control variable, is the firm fixed effect, is the time fixed effect, and is the random error. is the concerned coefficient of this paper, which indicates the influence of digital transformation on the capacity utilization rate. To address potential heteroscedasticity and autocorrelation issues, the standard errors of the regression coefficients are adjusted through enterprise-level clustering.

3.2.2. Quantile Regression Model

Considering the differences in the capacity utilization rates of Chinese manufacturing enterprises, its trailing left characteristic indicates that the capacity utilization rates of individual enterprises are lower. This study uses the quartile regression model to mitigate the limitations of the general mean-reversion model to fully explore the differentiated influence of digital transformation on different levels of capacity utilization rates in manufacturing enterprises and to investigate the law of the influence of digital transformation on the conditional distribution of capacity utilization rates of manufacturing enterprises. We construct the model in the following way:

where is the conditional quantile of the firm’s capacity utilization rate (CUR), the regression coefficient of digital transformation (DTA) is a function of and varies with the quantile , is the conditional distribution function of the firm’s capacity utilization rate (CUR), is the quantile level of the conditional distribution of the explanatory variables, which ranges from [0, 1].

3.2.3. Mechanism Test Model

Digital transformation can enhance both the “quantity and quality” of an organization’s technological innovation, thereby improving the firm’s capacity utilization rate, as outlined in the earlier theoretical framework. Following Y. Chen et al. (2020), this study constructs a mechanism test model as described below:

In Equation (7), represents mechanism variables.

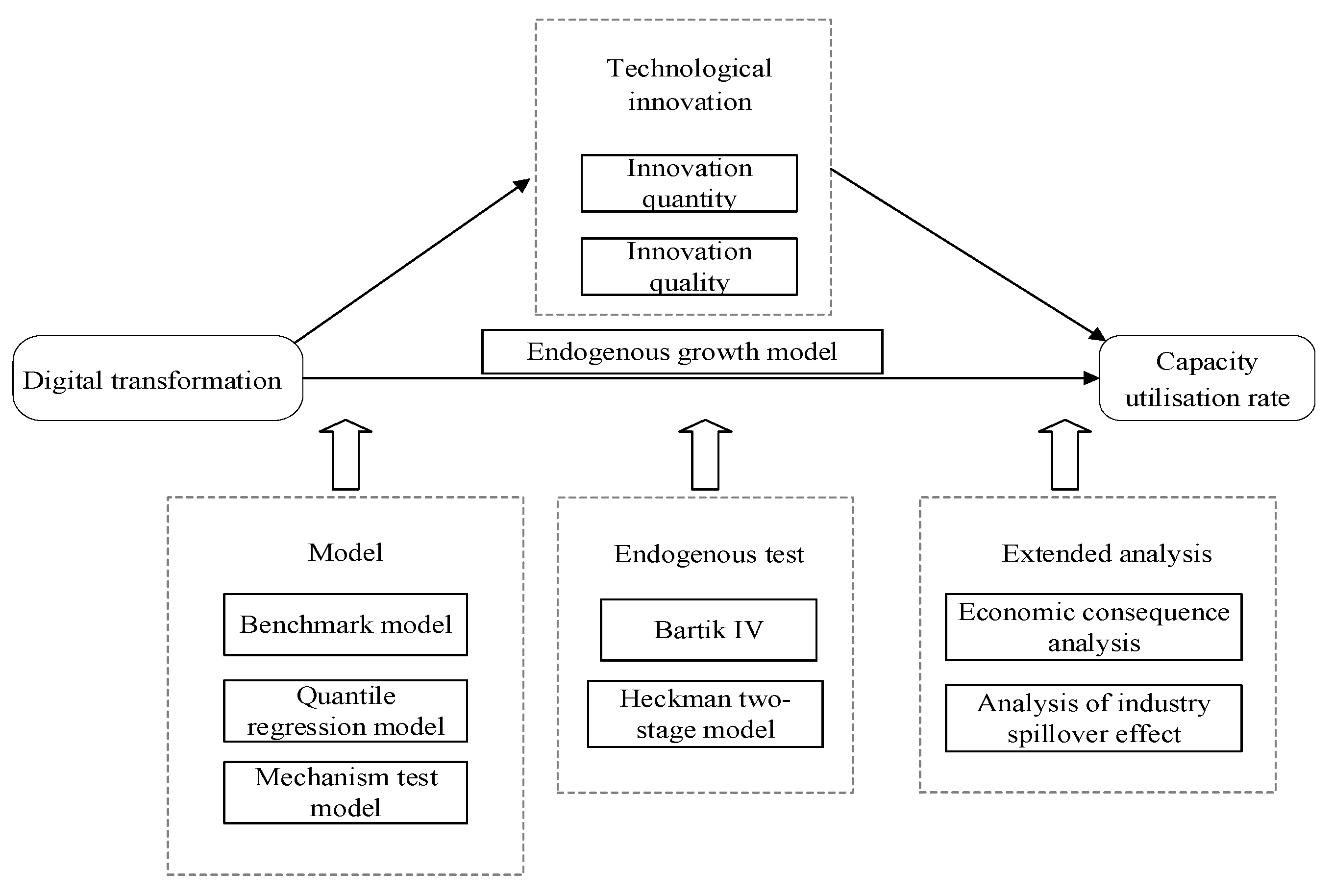

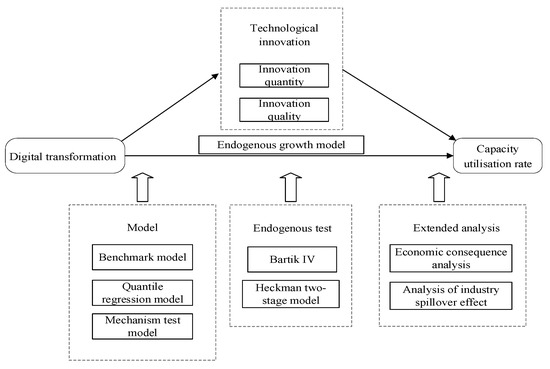

The research framework of this paper is shown in Figure 1.

Figure 1.

Research framework.

3.3. Variable Definition

3.3.1. Digital Transformation Indicators

- (1)

- Index construction idea

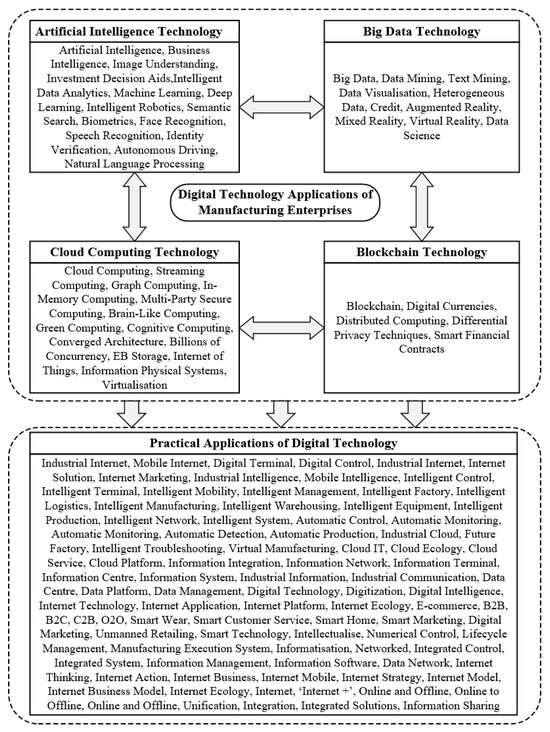

The deployment of core digital technologies largely drives digital transformation (Cao, 2024). Among all available technologies, artificial intelligence, blockchain, cloud computing, and big data—collectively referred to as “ABCD” technology—form the core architecture of enterprise digital transformation (Vărzaru & Bocean, 2024). With the development of digital technology integration, enterprises increasingly emphasize collaboration and innovation between these basic technologies and complex business ecosystems, aiming to establish new growth drivers.

To summarize, this paper divides the structured level of enterprise digital transformation into two dimensions, namely, “underlying technology application” and “practical application of technology.” Within the “underlying technology application” dimension, we divide “ABCD” into four major digital technologies. As for the “technology practice application” dimension, it includes several major fields such as intelligent manufacturing, modern information systems, and Internet business models.

- (2)

- Index construction process

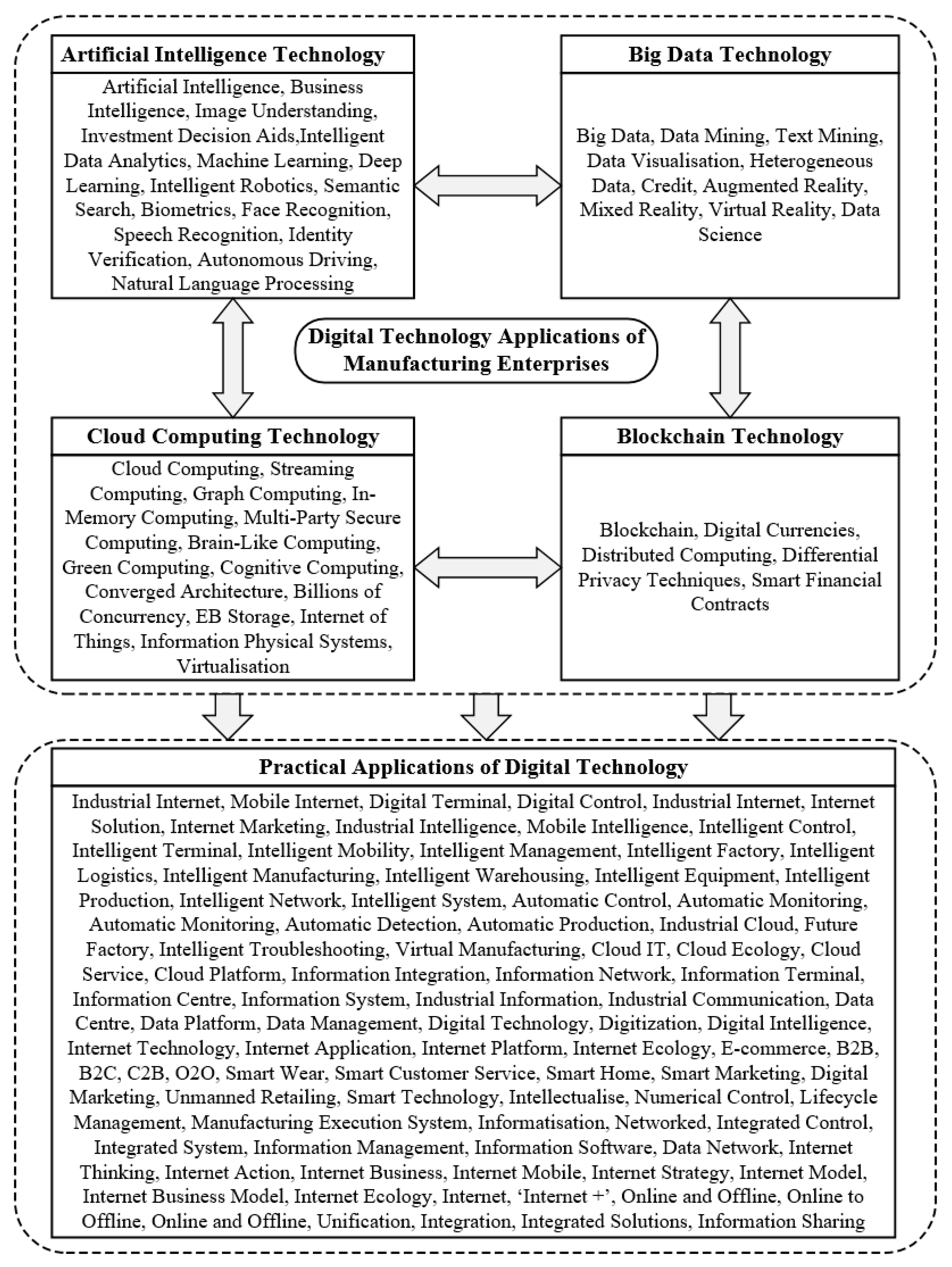

Methods including machine learning and big data analytics have emerged under the development of digital technology, which makes up for the limitations of traditional research methods by processing unstructured data such as text and images through data mining. This paper uses the text analysis method based on machine learning to measure the level of digital transformation in enterprises (W. Liu et al., 2024; Zhang, 2023; S. Chen, 2023; Tu & He, 2022). In particular, the machine learning text analysis looks at the annual reports of Chinese manufacturing companies and uses the Java PDFbox library to pull out all the text, which is then used to find important words related to digital transformation (see Figure 2). In the determination of enterprise digital transformation feature words, structured classification is carried out based on the above analysis, which constitutes a feature word map. In parallel, accounting for variations in the length of annual reports, this study measures digital transformation by calculating the frequency of relevant terms within the report, normalized by the total number of sentences. This metric reflects the extent of an enterprise’s engagement with digital technologies. Additionally, there may be a problem with strategic disclosure, which this study addresses in part of the robustness test in four ways.

Figure 2.

Feature word mapping of digital transformation.

3.3.2. Capacity Utilization Rate Index

This study draws on the methods of Aretz and Pope (2018) to measure the capacity utilization rate of Chinese manufacturing enterprises from an input perspective using an improved stochastic frontier model. The theoretical foundation of this method lies in the fact that capacity decisions by firms are essentially irreversible investment behaviors that require balancing current inputs with the value of future flexibility in an uncertain environment. The real options model provides a rigorous microeconomic framework for this—the optimal capacity setting must simultaneously consider expected returns, cost structures, market risks, and the option value of irreversible investments. The derivation process of the capacity utilization rate indicator constructed in this paper is as follows:

The existing capacity of enterprise i at time t can be decomposed into optimal capacity and overcapacity .

In Equation (8), , the two sides of the equal sign are logarithmed to obtain:

where . The conclusion drawn by Aretz and Pope (2018) is that surplus capacity is non-negative, which is also consistent with the reality of Chinese manufacturers. obeys a normal distribution truncated from zero, i.e., , which is a set of factors that determines excess capacity.

Based on the real options theory, the optimal capacity of an enterprise is determined by the equilibrium condition that maximizes the value of the investment option. Thus, the optimal capacity is specified as a function of sales revenue, operating costs, non-operating costs (including selling and administrative expenses), earnings volatility (annual share price volatility), systematic risk (Beta weighted by market capitalization outstanding), risk-free rate of return, and industry fixed effects1. It is shown below:

Among them, represents the factors that determine the optimal capacity, represents the fixed effect, is a random interference term, and is a composite interference term.

The maximum likelihood estimation is performed to obtain estimates of each parameter as well as of . Define and , to obtain the conditional expectation of :

where stands for standard normal distribution density and stands for cumulative distribution density. estimated by Equation (12) is the gap between the existing capacity and the optimal capacity of the enterprise, that is, overcapacity, and the capacity utilization rate is obtained by using 1 minus overcapacity.

3.3.3. Mechanism Variable: Technological Innovation

In this study, both quantitative and qualitative dimensions of technological innovation serve as mechanism variables. To measure the amount of technological innovation, we use the natural logarithm of how much money a company spends on R&D to show the number of innovation inputs (Inno), and we add 1 to the number of patents granted to the company, then take the natural logarithm again to represent the number of innovation outputs. Regarding the quality of technological innovation, the width of enterprise patent knowledge is constructed based on the information of invention patents applied by enterprises to measure the quality of enterprise innovation.

The breadth of a company’s patent knowledge and the quality of its innovations are significantly positively correlated (X. Zhao & Qian, 2023). While an application for a utility model or design patent is typically considered a strategic innovation, an application for an invention patent is considered a substantive innovation. Substantive innovations bring technological progress and are high-quality technological innovations, while strategic innovations are usually minor innovations at a low technological level to meet government policies. Therefore, this paper only counts information about applied invention patents.

Building on data from invention patents filed by firms, this paper constructs a patent knowledge width indicator to measure the quality of enterprise innovation. Patent knowledge width is a measure of patent quality in terms of the breadth and complexity of knowledge contained in patents, which can help to compensate for the shortcomings of using the number of patents to measure an enterprise’s technological innovation capability. A patent is an important carrier of innovative knowledge, and the complexity of the knowledge it contains is directly related to the quality of the patent (Ananthraman et al., 2024). In this paper, we use the number of IPC classification numbers to measure the patent knowledge breadth of enterprises (Zhou et al., 2023). Due to the differences in the formats of classification numbers across various patents, relying solely on the number of classification numbers does not accurately measure the knowledge complexity of patents, which may lead to bias in assessing patent quality. Therefore, this paper uses a method similar to the Herfindahl-Hirschman index to create a weighted measure of the number of IPC classification numbers, which helps us calculate the enterprise patent knowledge width index (PKW). In addition, in order to comprehensively reflect the multidimensional characteristics of innovation quality, this paper also refers to the research of Bradley et al. to measure innovation quality using the patent citation count (PEC) of listed companies (Bradley et al., 2017).

3.3.4. Control Variables

Control variables for this article are selected from aspects of corporate governance and financial operations at both the company and industry levels, such as financial leverage (lev), operating cash flow (ocf), firm size (size), market value (Q), firm age (age), capital intensity (cap), stock liquidity (liqui), the percentage of sole directors (indr), shareholding concentration (top1), and industry concentration (hhi). See Table 1 for a description of the variable definitions.

Table 1.

Descriptive statistics for variables.

4. Results and Discussion

4.1. Benchmark Model

To accurately identify the impact of digital transformation on enterprise capacity utilization, model (5) is applied to conduct a benchmark regression test, and the results are shown in Table 2 columns (1) and (2) indicate the impact of digital transformation (DTA) on enterprise capacity utilization (CUR) when no control variables are added and when control variables are added, respectively. As can be seen, the coefficients of digital transformation (DTA) are all significantly positive at the 1% level, indicating that digital transformation significantly increases firm capacity utilization. In terms of economic significance, taking the estimated coefficients in column (2) of Table 2 as an example, for every 1% increase in the level of enterprise digital transformation, its capacity utilization rate increases by 0.2581% on average, which means that the promotion of enterprise digital transformation is of great significance in improving enterprise capacity utilization rate and solving the problem of overcapacity. Table 2, column (3), shows digital transformation’s impact on capacity utilization through underlying technologies (AU) is insignificant because AU typically refers to foundational digital technologies that support business operations but do not directly integrate with specific business scenarios. In contrast, practical applications (AP) of digital technologies directly engage with business processes, offering immediate improvements in operational efficiency. Therefore, practical applications (AP) are far more impactful than underlying technologies (AU) in optimizing capacity utilization, as they are better integrated into enterprise operations and provide direct business value, such as enhancing automation, optimizing resource allocation, and improving production schedules. Table 2 column (4), shows the effect of practical application of digital technology (AP) on enterprise capacity utilization. It can be seen that the coefficient of the effect of practical application of digital technology on enterprise capacity utilization is 0.3511, which is significant at the 1% level. This indicates that digital transformation for improving enterprise capacity utilization is mainly due to the enterprise’s application of digital technology practices; this level of digital transformation is more concerned about the integration of digital technology and business scenarios of innovation and is more direct and effective than the impact of the underlying digital technology applications on enterprise capacity utilization. The effect of the control variable level on enterprise capacity utilization is mostly in line with what previous studies have found.

Table 2.

The impact of digital transformation on capacity utilization in manufacturing firms.

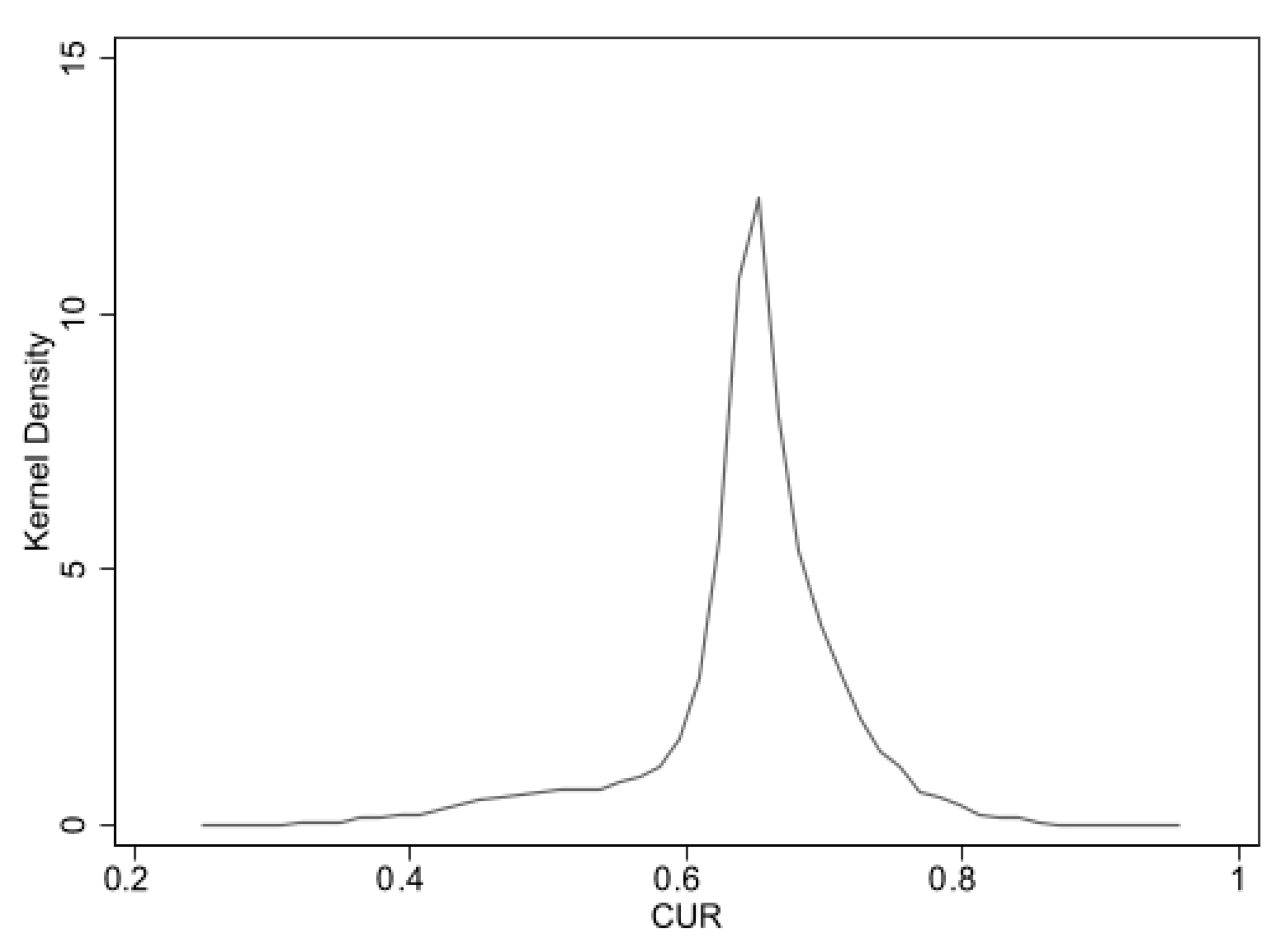

4.2. Quantile Regression Results and Analysis

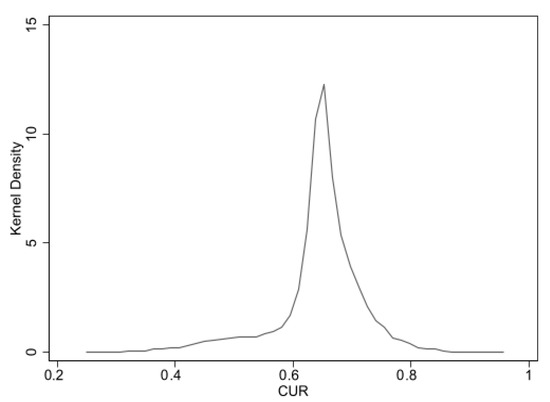

Given the variability in the capacity utilization rates among Chinese manufacturing enterprises, its trailing to the left indicates that many individual enterprises experience lower capacity utilization, as shown in Figure 3. This paper employs a quantile regression approach to provide a thorough analysis of the varying effects of digital transformation on capacity utilization at different levels and to explore the conditional distributional impact on the capacity utilization rates of manufacturing firms. We employ this approach to overcome the limitations of traditional mean regression models (see Equation (6)).

Figure 3.

Kernel density of capacity utilization rate of manufacturing firms in China.

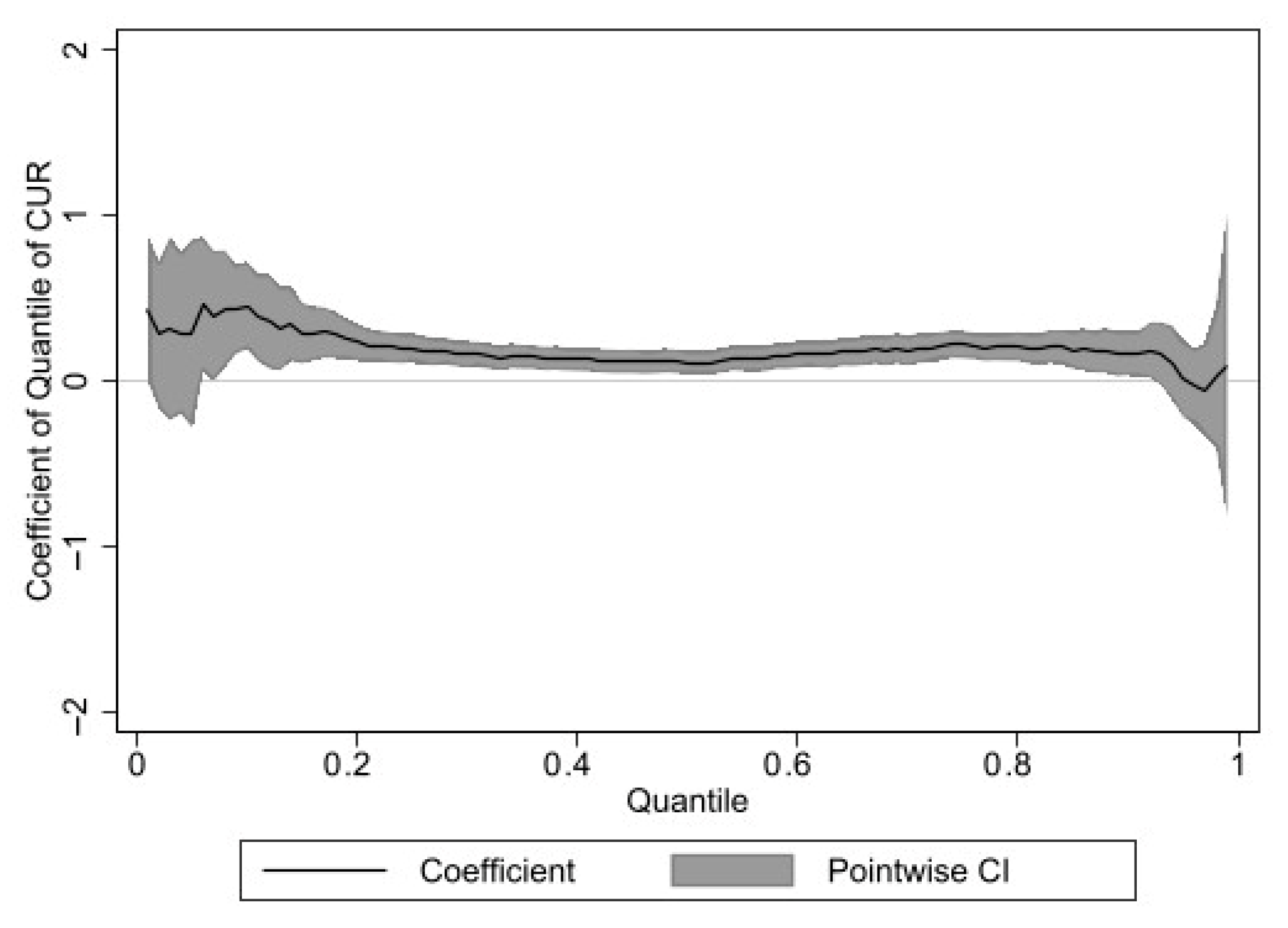

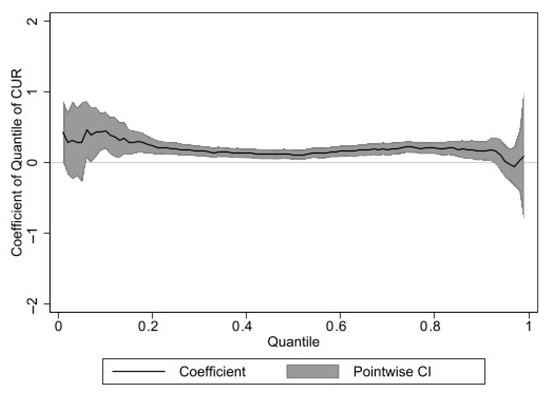

Figure 4 shows the impact coefficients of digital transformation on corporate capacity utilization rate (CUR) at percentiles ranging from 1% to 99%, along with their confidence intervals. Overall, digital transformation has a significant positive impact on CUR, consistent with the findings of the baseline regression analysis. However, the strength of this impact exhibits a distinct inverted U-shaped distribution across different percentiles. The coefficient reaches its peak at moderate CUR levels (approximately the 40–60% percentile range) and is relatively weak or even insignificant in low CUR (left tail, e.g., <30% percentile) and high CUR (right tail, e.g., >80% percentile) regions. Possible reasons include:

Figure 4.

Quartile effects of digital transformation on capacity utilization rate.

(1) For firms in the lower end of the capacity utilization distribution, they typically have high debt-to-equity ratios, low R&D intensity, and weak cash flows, consistent with the “resource constraints” emphasized in the theoretical framework. These constraints severely limit their ability to convert digital investments into capacity utilization, thereby restricting the positive impact of digital transformation on capacity utilization. (2) For companies in the middle range of capacity utilization rates, they typically have relatively balanced resource allocation and operational flexibility. This enables them to more effectively utilize digital transformation to optimize production processes and align supply and demand, thereby significantly increasing actual output. Therefore, digital transformation can best leverage its advantages in such companies to maximize the marginal improvement in capacity utilization rates. The quantile regression captures the peak effect of this “optimal response interval.” (3) For companies at the top end of the capacity utilization distribution, their equipment is often already operating at or near full capacity. The primary role of digital transformation for such enterprises may lie in further increasing potential maximum output through more advanced technologies. However, this typically requires significant incremental investments (such as purchasing more advanced equipment or undergoing comprehensive technological upgrades), resulting in high marginal costs. Therefore, even if DTA investments increase, the resulting growth in actual output is easily offset or surpassed by concurrent or even faster expansion at the technological frontier, leading to minimal or insignificant improvements in CUR. At this stage, digital transformation may be more focused on maintaining high efficiency and preventing failures rather than significantly enhancing CUR, which is already nearing its limits.

From an economic perspective, this quantile regression analysis not only reveals the heterogeneity of digital transformation effects but more importantly identifies precise targets for policy interventions and corporate digital strategies. For low-CUR firms, the primary task is to alleviate their foundational resource constraints; for high-CUR firms, the cost-benefit of investing in cutting-edge technologies must be assessed; and for medium-CUR firms, digital transformation can yield the most significant productivity optimization benefits and should be the focus of policy support and promotion.

4.3. Endogenous Discussions

The analysis above shows that digital transformation greatly improves how well capacity is used, but this effect varies at different levels of capacity utilization. However, the study has some limitations, including potential endogeneity issues such as omitted variable bias, bidirectional causality, and sample selection bias. To mitigate these concerns, the regression model incorporates several control variables and accounts for both temporal and individual fixed effects, thereby reducing the risk of bias from omitted variables. Despite these adjustments, some unobservable factors may still bias the estimation coefficients. Additionally, reverse causality could be a concern, as firms with higher capacity utilization rates may be more likely to adopt digital technology. To address this, the study uses the share shift method to construct instrumental variables, which helps to alleviate this issue. Moreover, to tackle sample selection bias, the paper applies the Heckman two-stage model for testing and correction.

4.3.1. Bartik Instrumental Variable Method

The Bartik instrumental variable method involves constructing instrumental variables using the share movement method, simulating annual estimates based on the initial share of the analysis unit (exogenous variable) and the overall growth rate (common shock). These estimates are highly correlated with actual values, satisfying the correlation assumption, but are uncorrelated with the residual terms, satisfying the exclusivity assumption. This paper follows Bartik’s approach to construct a Bartik instrumental variable. This method has been widely applied due to its superiority (Becker & Egger, 2022; Lee & Lin, 2021). Considering that digital transformation relies on information networks as a key medium, on the one hand, China’s internet access technology initially began with dial-up systems via telephone lines. Before the widespread adoption of fixed-line telephones, most information transmission relied on postal systems, which were also the primary entities responsible for deploying fixed-line telephone infrastructure. Therefore, the distribution of postal facilities would inevitably influence the distribution of fixed-line telephones, thereby affecting the early adoption of internet access. Historical postal and telecommunications infrastructure in a region may be influenced by technical issues and usage habits, thereby affecting the subsequent popularization and application of internet information technology, which is related to a company’s digital transformation. This satisfies the assumption of tool variable relevance. On the other hand, the influence of postal and telecommunications services, as traditional communication tools, on economic development is gradually weakening. Therefore, historical postal and telecommunications services are not correlated with enterprises’ current capacity utilization rates, satisfying the assumption of instrumental variable exclusivity. Based on this logic, drawing on the research of Zou (2024), Cette et al. (2021), Niu et al. (2024), and Jiang and Li (2024), this paper selects the proportion of postal and telecommunications services in each province in 1984 relative to the national total as the initial exogenous share, then multiplies it by the national manufacturing enterprise digital transformation growth rate (common shock) excluding the province, to construct the Bartik instrumental variable for enterprise digital transformation.

The validity of the Bartik instrumental variable is checked below; the Anderson LM statistic shows that there is a strong link between the instrumental variable and the main variable being studied, rejecting the idea that the instrumental variables are not identified at a 1% significance level. Additionally, the Cragg-Donald Wald F-statistic rejects the null hypothesis of weak instrument identification, confirming the absence of weak instrument issues. In conclusion, the aforementioned test findings confirm the validity of the instrumental variable in this work. Table 3’s columns (1) and (2) display the instrumental variable’s first and second stage regression results. The first stage regression indicates a strong positive relationship between how much companies are digitally transforming and the work of regional post and telecommunications companies, meaning the Bartik instrumental variable has a very positive value at the 1% level. The second-stage regression results show that the values estimated using the instrumental variables method vary from those in the benchmark regression, but the main variable (digital transformation of the firm) still has a significant effect, indicating that the benchmark regression results in this paper are fairly strong.

Table 3.

Bartik instrumental variable regression results.

4.3.2. Time-Vary DID Model

This article refers to the research of Qiu and Zhou (2021), setting the policy cutoff date for Guizhou Province as 2015 and for other pilot regions as 2016. The traditional difference-in-differences (DID) model is based on a single-point-in-time model design, which is unable to effectively evaluate policy effects. Therefore, this paper draws on the research of Beck et al. (2010) to construct a multi-point-in-time DID model for analysis. The multi-point-in-time DID model replaces the interaction term between the treatment group and time in the traditional DID model with a policy dummy variable that varies over time for each individual, enabling the identification of the effects of gradually implemented policies. The specific model specification is as follows:

In this equation, i represents the firm, c represents the city where the firm is located, t represents the year, represents the firm’s capacity utilization rate, and represents the policy variable of the national-level big data experimental zone. If the prefecture-level city c where firm i is located is a national-level big data comprehensive experimental zone, then = 1; otherwise, = 0. is the control variable, representing the fixed effect of the industry in which the firm operates, is the annual fixed effect, and is the random disturbance term. is the coefficient of interest in this study, indicating the impact of the construction of national-level big data comprehensive experimental zones on the capacity utilization rate of enterprises. The regression results are shown in Table 4. The regression results all indicate that the construction of national-level big data comprehensive experimental zones has a significant positive impact on the capacity utilization rate of enterprises.

Table 4.

Time-vary DID regression results.

4.3.3. Heckman Two-Stage Model

Not all of the sample companies have undergone digital transformation. In this paper, the Heckman two-stage model is used to deal with the possible sample selection errors. In this study, we use the yearly median of the company’s capacity utilization rate (CUR) to create a dummy variable CUR_D in the first-stage probit model, where a value greater than the median is marked as 1, and a value less than or equal to the median is marked as 0, following Naghi et al. (2022). At the same time, the average value of other enterprises’ capacity utilization rate (CUR_P) is added as an instrumental variable, and the inverse Mills ratio (IMR) is calculated according to the regression results, and it is substituted into IMR for fitting in the second stage. Table 5 displays the estimated outcomes. After accounting for self-selection bias, it is evident that the coefficient of DTA is significantly positive at the 1% level, indicating that the core conclusion that digital transformation can improve the capacity utilization rate is still valid.

Table 5.

Heckman two-stage regression results.

4.3.4. Robustness Tests

- (1)

- Ease the Strategic Information Disclosure Behavior of Enterprises

Firstly, we adopt alternative digital transformation measurement methods. For one alternative proxy, the machine learning method is used to count the number of digital technology patents filed by the firm each year. Its natural logarithm value is then used to measure digital technology, denoted as DTA1. If there are no digital technology patents, a value of 0 is assigned to DTA1. For the other alternative proxy, according to Foster and Grim (2023), DTA2 shows how much of a company’s intangible assets are connected to digital transformation compared to all its intangible assets, which helps to understand how much companies are using digital transformation. After replacing the measure of firms’ digital transformation, columns (1) and (2) of Table 6 show that digital transformation can still significantly improve firms’ capacity utilization.

Table 6.

Empirical tests to exclude firms’ strategic disclosure behaviour.

Second, control the quality of enterprise accounting information on the basis of a benchmark regression model. Firstly, it is the accounting earnings aggressiveness index (EA) that reflects the delay in recognizing losses or expenses and the acceleration in recognizing income, and secondly, it is the earnings smoothness index (ES) that reflects the matching degree between accounting earnings and cash flow. Table 6’s column (3) demonstrates that after controlling for indicators of accounting information quality, firms are still able to significantly improve capacity utilization through digital transformation.

Third, we add information disclosure quality as a control variable. This paper constructs an information transparency index as well as a KV index to measure disclosure quality. Referring to Y. Kim et al. (2013), the transparency (Trans) of the company is measured in terms of the quality of surplus, disclosure appraisal index, the number of analysts tracking, analysts’ surplus forecasts, and whether to employ the international Big Four. In addition, drawing on the approach of O. Kim and Verrecchia (2001), we construct the KV index to assess the quality of disclosure. This index reflects how investors view the differences in information available to them and includes both required news and optional news, giving a complete picture of how well listed companies share information. Table 6’s columns (4) and (5) show that even after considering the quality of disclosure indicators (like information transparency and the KV index), digital transformation can still greatly enhance how well companies use their resources.

Fourth, only the samples of firms with excellent or good disclosure assessment ratings during the sample period are retained for retesting. Information disclosure assessment and evaluation results refer to the comprehensive evaluation of the quality of information disclosure by the stock exchange based on the annual information disclosure behavior of listed companies, which is classified into four grades: excellent, good, passing, and failing. Table 6’s column (6) demonstrates a significant improvement in the capacity utilization rate through the use of digital transformation.

- (2)

- Alternative Dependent Variable

The earlier benchmark regression uses Aretz & Pope (2018) to find the capacity utilization rate using a better stochastic frontier model method. As an alternative for the enterprise’s capacity utilization rate, we create the excess capacity indicator (abCUR), which is the difference between a firm’s present level of capacity utilization and the industry’s average level of current capacity utilization. Table 7’s column (1) demonstrate that digital transformation can still greatly boost their capacity utilization rate.

Table 7.

Replace the interpreted variable.

Additionally, we re-measured the capacity utilization rate of manufacturing firms using a stochastic frontier model from an output perspective. Below, we present the measurement model.

where represents the actual output level of firm i in year t, as measured by operating revenues. is the production factor of labor, represented by the number of employees on board. is the factor of capital production, measured by net fixed assets. is a symmetric random error term representing statistical noise, and is the efficiency loss. As defined by Coelli et al. (1998), a firm’s capacity utilization rate is the ratio of its actual level of output to the level of efficient production fitted by Equation (15), i.e.,

Table 7’s column (1) show that the technical efficiency of the capacity utilization rate, as calculated by the output-based stochastic frontier model, is included in the basic regression model. It is evident that after replacing the measurement method of capacity utilization rate, digital transformation by enterprises can still significantly contribute to the improvement of their capacity utilization rate.

- (3)

- Adding Omitted Variables

Firstly, considering the macro-control effect of the economic cycle and regional macroeconomic environment on the rate of capacity utilization, this paper includes GDP growth rate (GDP1), per capita GDP (GDP2), consumption rate2 (Consum), and other factors in the estimation specification. Even after controlling for macro-level factors, Table 8’s column (1) demonstrate that digital transformation significantly increases the capacity utilization rate of businesses. Secondly, consider that some macro factors have different influences on different provinces and industries in different years, thus interfering with the research conclusion. Building on the benchmark regression model, this paper controls the province × year fixed effect, industry × year fixed effect, and province × industry × year fixed effect and tests the high-order joint fixed effect. Table 8’s columns (2) and (3) display the regression findings. It is evident that, after controlling the high-order joint fixed effect, enterprises still significantly improve their capacity utilization rate through digital transformation.

Table 8.

Multidimensional control of omitted variables.

- (4)

- Subsample Regression

In order to remove the influence of the COVID-19 pandemic, observations collected after the onset of the pandemic were excluded from the sample. In 2015, the China Municipal Government proposed supply-side structural reform, put the de-capacity in the first place, shortened the sample period to before the reform, excluded the influence of the reform, and re-estimated the regression. Table 9’s columns (1) and (2) demonstrate that after excluding the impact of the COVID-19 epidemic and supply-side structural reform, enterprises can still significantly promote their capacity utilisation rate by applying digital technology.

Table 9.

Subsample regression.

- (5)

- Excluding the impact of supply-side structural reform policies

To correct distortions in factor allocation and promote high-quality economic development, the supply-side structural reform implemented starting in November 2015 emphasized “accelerating scientific and technological system reform and promoting the development of high-tech, high-value-added industries.” During the supply-side structural reform process, relevant policy support may also improve corporate capacity utilization rates. Therefore, to exclude the impact of supply-side structural reforms and conduct an in-depth policy impact analysis, this paper defines treat_2015 as a dummy variable for the supply-side structural reform policy experiment group (if treat_2015 = 1, the enterprise’s main business belongs to the “capacity reduction” industry; if treat_2015 = 0, the enterprise’s main business is not within the scope of the “capacity reduction” industry3). A dummy variable post_2015 is defined to represent the supply-side structural reform (assigned a value of 1 after 2015, otherwise 0), and the estimation is re-conducted. The regression results are shown in Table 10. The estimated coefficient of the interaction term post × treat_2015 is significantly positive, indicating that after excluding the impact of supply-side structural reform policies, corporate digital transformation still has a significant promotional effect on improving capacity utilization rates.

Table 10.

Excluding the impact of supply-side structural reform policies.

- (6)

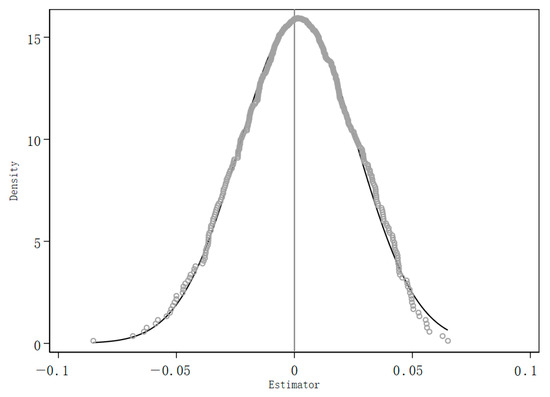

- Placebo Test

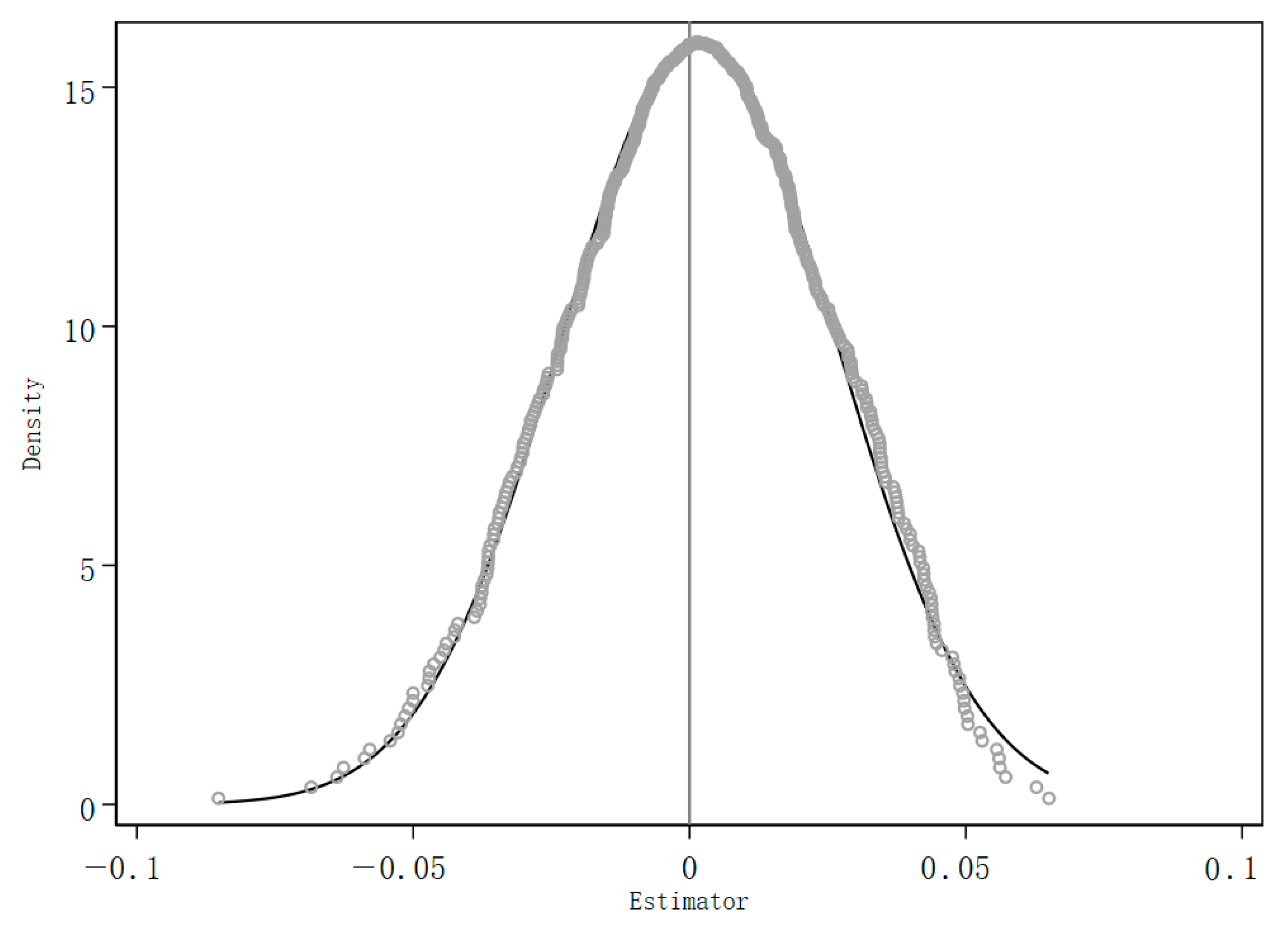

This paper extracts numerical values for corporate digital transformation and randomly assigns them to each observation value, performing 500 regressions. If a placebo effect exists, then due to the influence of unconsidered factors, the processed digital transformation should be significantly positively correlated with capacity utilization. The placebo coefficient estimates in Figure 5 are uniformly distributed on both sides of 0, thus ruling out the existence of a placebo effect.

Figure 5.

Placebo test chart.

5. Further Analysis

5.1. Test Results and Analysis of Influence Mechanism

Digital transformation enables firms to effectively integrate innovative resources, thereby enhancing their technological innovation capabilities (Li et al., 2023). Enterprises digital transformation can record and integrate information and data from product development, production, marketing, after-sales, and other links and mine new products from them, but also extend the original product chain, update and replace the original products, and improve the enterprise’s independent innovation ability. Simultaneously, digital transformation by firms helps alleviate information asymmetry in traditional business models. Notably, when faced with limited resources, firms will tradeoff between the innovation’s quantity and quality. Moreover, the effects of both quantity and quality of innovation on capacity utilization rate differ (Wang & Zheng, 2022).

5.1.1. Digital Transformation Enables “Incremental” Enterprise Innovation

Emerging digital technologies offer significant advantages, including the acquisition of information at minimal cost, the efficient transmission of data across geospatial boundaries, and enhanced data mining and analysis capabilities (Srinivasan & Seetharaman, 2021), which can effectively alleviate the contradiction between supply and demand for research and development factors and new products in the innovation system of the enterprises and increase their propensity to carry out breakthrough innovation.

We use the amount of enterprise R&D investment to take the natural logarithm to represent the amount of inputs of enterprise innovation (Inno) and use the amount of patents granted by the enterprise (Patent) plus 1 to take the natural logarithm to represent the number of outputs of enterprise innovation. And the amount of invention patents granted (Patent 1), the amount of utility model patents granted (Patent 2), and the amount of design patents granted (Patent 3) plus 1 to take the natural logarithm of the regression. Table 11 displays the results of the innovation ‘incremental’ mechanism test. The results suggest that digital transformation significantly enhances both the innovation inputs and outputs of enterprises. When examining the specific categories of innovation output, digital transformation has the most pronounced impact on the number of utility model patents and the least on the number of design patents.

Table 11.

The influence of digital transformation on the quantity of enterprises’ innovation.

5.1.2. Digital Transformation and “Quality Improvement” of Enterprise Innovation

A large number of patents with no market potential, often referred to as “patent bubbles,” can lead to the waste of societal R&D funds, suppress companies’ motivation for high-quality technological innovation, and deteriorate the technological innovation environment. Ultimately, this can result in the “bad money drives out good money” phenomenon in the technological innovation market. Improving the quality of corporate innovation is of great significance for seizing the initiative in global industrial development during the next round of technological revolution and addressing critical technological challenges. Due to factors such as national policies and market environments, companies often adopt innovation strategies that prioritize quantity over quality to maintain their existing market positions and competitive advantages, driven by considerations of stability.

The results of the regression analysis of digital transformation on the quality of corporate innovation are shown in Table 12 (1)–(2). The regression coefficients for digital transformation on the patent knowledge width (PKW) and patent citation count (PEC) indicators are not significant, indicating that digital transformation does not significantly improve the quality of corporate innovation.

Table 12.

The impact of digital transformation on the quality of innovation in firms.

When selecting innovation strategies, companies comprehensively consider the actions of governments, markets, and other businesses, and make “optimal” decisions between the quantity and quality of innovation based on their own interests. When arbitrage can yield short-term profits, and strategic innovation can significantly reduce such arbitrage costs, “rational” companies typically opt for an innovation strategy that prioritizes quantity over quality. In intense market competition, rational companies typically observe the innovation choices of peer companies and respond similarly (López & García, 2021).

In the process of corporate digital transformation, “double arbitrage” and “cohort effect” are the primary factors constraining improvements in innovation quality. “Double arbitrage” refers to companies leveraging government subsidies or capital market incentives to pursue short-term policy arbitrage and capital market arbitrage, thereby driving an increase in the quantity of innovation. However, such arbitrage behavior often overlooks the depth and quality of innovation. To secure short-term gains from government subsidies or capital markets, companies are more inclined to increase low-level innovation outputs through digital transformation rather than invest in the depth of technological innovation, thereby limiting improvements in innovation quality. Meanwhile, the “herd effect” also influences companies’ innovation strategy choices to some extent. Companies are often influenced by the behavior of their peers, leading to similar innovation paths. When other companies enhance production capacity utilization through digital transformation, peer companies typically choose to mimic this strategy to avoid losing market share. This convergent behavior among peers leads to convergent innovation strategies, with companies prioritizing innovation quantity over quality, further constraining the potential for improving technological innovation quality. Therefore, the combined effects of “double arbitrage” and “cohort effect” constrain the improvement of innovation quality during digital transformation.

Enterprises with an arbitrage tendency tend to obtain government innovation subsidies by increasing the number of low-level innovations, and this paper chooses government subsidies (GS) as the policy arbitrage indicator. Table 12’s column (3) show that when companies go through digital transformation, they receive more government subsidies, which indicates that these companies are trying to take advantage of policy opportunities. For the capital market arbitrage tendency, the stock illiquidity (ILLIQ) is measured in this paper using Amihud and Mendelson’s (1986) methodology; the smaller the indicator, the more liquid the stock.

In Equation (16), represents the rate of return of enterprise i on the d trading day in t year, represents the transaction amount of enterprise i on the d trading day in t year, and the unit is one million yuan, and represents the number of trading days of enterprise i in t year. Table 12’s column (4) show that digital transformation greatly reduces the illiquidity index of stocks, meaning it makes stocks easier to buy and sell, and confirms the tendency for arbitrage in the enterprise capital market.

In what follows, we test the “cohort effect” of enterprise innovation and construct the estimation Equation (17).

where represents the innovation quality of enterprises, denotes the average innovation quality of other firms within the same region and industry, lagged by one period, represents the control variables, is the fixed effect of enterprises, is the time fixed effect, and is the residual. As in Table 12’s column (5), the effect of on PKW is significantly positive, representing the existence of the “cohort effect” on the quality of innovation in digital transformation. For further evaluation, we developed the following model:

Column (6) of Table 12 shows the regression results, which reveal that the cross-multiplier term (DTA × ) related to the average innovation quality of digital transformation and other companies in the same area and industry from the previous period is significantly negative. The result implies that the “cohort effect” associated with digital transformation has a dampening effect on the influence on the “quality enhancement” of enterprises’ innovations.

To sum up, although digital transformation greatly enhances the quantity of firms’ innovations, the existence of “double arbitrage” incentives and the “cohort effect” impede improvements in the quality of enterprise innovation.

5.2. Analysis of Economic Consequences

The most direct and obvious consequences of overcapacity are: a sharp drop in product prices, a backlog of finished goods, a sharp drop in the operating rate of enterprises, a serious decline in enterprise performance, and an increase in loss-making enterprises (M. Liu, 2024). According to the theoretical analysis and empirical test above, digital transformation can increase an organization’s capacity utilization rate. This study looks at the economic effects of digital transformation on capacity utilization as well as how it affects firm performance and total factor productivity.

Enterprise performance is evaluated through two key ratios: return on total assets (ROA) and return on net assets (ROE), which are used to measure the net profit generated by an enterprise per unit of assets and are important indicators for evaluating its profitability. Total factor productivity (TFP) is calculated using the Cobb-Douglas production function. We denote the resulting total factor productivity as TFP_OP and TFP_LP (Torrent-Sellens et al., 2022; Bournakis & Mallick, 2018; Williamson et al., 2020). The results in Table 13 show that using digital transformation to make better use of resources greatly helps both how well a company performs and its total factor productivity. Improving a company’s capacity utilization rate means using resources more effectively, reducing waste, and lowering inventory costs, which in turn boosts the company’s performance and total factor productivity.

Table 13.

Analysis on the economic effect of digital transformation on the capacity utilization rate.

5.3. Spillover Effect Analysis

Peer firms’ investment decisions are significantly impacted by the transparency of a firm’s information, and there is a phenomenon of “capacity comparison” among peer firms. This research analyzes the industry spillover effects of digital transformation on firms’ capacity utilization rates. With the regression findings shown in Table 14, this research explicitly examines how companies’ digital transformation (DTA) affects other businesses in the same industry’s capacity utilization rate (CUR_P). Digital transformation has had a significant spillover effect on the capacity utilization rates of peer companies, primarily through four channels. First, knowledge spillovers enable leading companies to disseminate their digital technologies through patent disclosures, talent mobility, or industry alliances, thereby reducing the learning costs for other companies. Second, competitive pressure drives peer companies to proactively upgrade their technologies—such as by adopting the same ERP systems—to avoid losing market share after observing competitors improve their capacity utilization rates through digital transformation. Additionally, supply chain collaboration plays a crucial role, as the digital transformation of core enterprises forces upstream and downstream suppliers to synchronize their capacity adjustment rhythms. Finally, the standard demonstration effect provides other firms with reusable digital templates through successful industry cases, thereby reducing the trial-and-error costs for peer firms.

Table 14.

Analysis of spillover effects of digital transformation affecting capacity utilization rate of firms.

In the first two periods (FCUR_P and F2CUR_P), the impact of companies’ digital transformation on the capacity utilization rate (CUR_P) of other businesses in the same industry isn’t significant; however, in the third period (F3CUR_P), it becomes significantly positive.This is due to several factors. First, the technology diffusion cycle requires peer companies to have sufficient time to assess the effectiveness of digitalization, procure new equipment, and complete commissioning and production, aligning with the three-stage model in technology diffusion theory; second, data disclosure delays mean that digitalization achievements reported in company annual reports typically lag behind the actual implementation process; finally, production capacity rigidity results in slower physical adjustments such as production line renovations and employee training, necessitating a certain amount of time before industry-wide improvements become evident.

6. Conclusions and Recommendations

With the rapid advancement of digital technology, effectively harnessing their potential to enhance firms’ capacity utilization is crucial for achieving high-quality development. This paper applies the endogenous growth model to construct a theoretical model to explore the influence of digital transformation on firms’ capacity utilization rate and explores the role of technological innovation in this context. Specifically, this study examines the complex relationship between firms’ capacity utilization rate and digital transformation. The two-dimensional mechanism of “quantity increase and quality decrease” in technological innovation serves as the framework for analyzing this relationship.

In this study, we use the endogenous growth model to create a theoretical framework showing how digital transformation affects the capacity utilization rate of businesses, and we conclude that digital transformation can enhance this rate. Through empirical research, it is found that, on the whole, digital transformation has significantly improved the capacity utilization rate of enterprises. From each sub-point, digital transformation has a significant positive impact on manufacturing enterprises with an “average” capacity utilization rate but has no significant impact on manufacturing enterprises at the end of the capacity utilization rate distribution. The evidence shows that digital transformation has played an important role in optimizing the allocation of production factors and improving production efficiency, but its influence is different among enterprises.

In the process of digital transformation to improve productivity utilization, technological innovation plays a key intermediary role. However, the existence of “double arbitrage” and “group effect” often leads enterprises to choose innovation strategies that focus on quantity rather than quality first. This trend limits the ability of digital transformation to fully realize its potential. Therefore, to ensure the effective utilization of production capacity, enterprises must balance the quantity and quality of technological innovation in the process of digital transformation.

Firms’ digital transitions enhance operational performance and total factor productivity, and the digital transformation can promote capacity utilization with industry spillover effects. Digital transformation optimizes the production process and boosts resource allocation efficiency, ultimately strengthening corporate competitiveness and holistic performance outcomes. Simultaneously, digital transformation creates an industry spillover effect that improves the capacity utilization rate, although this effect experiences a certain lag. This shows that digital transformation is beneficial to the enterprise itself and is producing positive external effects on the whole industry.

Explore the mystery of capacity utilization rate under digital transition from the dual perspectives of quantity and quality of technical innovation, and find that enterprises will comprehensively consider the behaviors of the government, the market, and other enterprises when choosing innovation strategies and make an optimal decision between quantity and quality of innovation from their own interests. Addressing the adverse impacts of “double arbitrage” and the “cohort effect” is essential to fully utilize digital technology. Encouraging enterprises to focus on high-quality technological innovation is crucial for maximizing the benefits of digital technology.

The policy recommendations are as follows.

- (1)

- Strengthen enterprise digital transformation and improve production capacity utilization efficiency. First, the government should increase policy support for enterprise digital transformation, especially through incentive tools such as fiscal subsidies and tax breaks, to lower the initial cost threshold for transformation and promote the accelerated development of digital infrastructure construction and technological innovation. Specifically, a special fund should be established to support eligible enterprises in their technological upgrades and innovation investments during the digital transformation process. Additionally, an efficient and coordinated policy implementation mechanism should be established to streamline the implementation processes of incentive tools such as fiscal subsidies and tax incentives, reducing the complexity and time costs associated with accessing these policies. This ensures that inclusive support can be quickly and accurately extended to a wide range of transforming enterprises. Concurrently, interdepartmental coordination should be strengthened to integrate resources and promote the development of common technology platforms, open-source communities, and public training systems for digital skills, providing enterprises with broader and more accessible foundational support for their digital transformation efforts.

- (2)

- Reconstruct innovation incentive mechanisms, shifting from a “quantity competition” to a “quality-driven” approach. Currently, some sectors overly rely on innovation quantity metrics, leading enterprises to prioritize quantity over quality and creating a “double arbitrage” phenomenon that distorts resource allocation. Therefore, the existing innovation incentive mechanisms should undergo systematic reform. First, the government subsidy evaluation system should shift from a purely innovation quantity-oriented approach to a comprehensive assessment of innovation quality, covering dimensions such as technological advancement, market conversion rates, and supply chain driving effects. Second, capital markets should strengthen disclosure requirements, particularly for companies receiving government innovation subsidies, mandating the disclosure of their innovation quality assessment results to enhance market transparency and resource allocation efficiency. Finally, a dynamic subsidy adjustment mechanism should be established, adjusting subsequent subsidies flexibly based on annual or project-cycle innovation quality assessment results to incentivize companies to pursue high-quality innovation continuously.

- (3)