Digital Finance, New Quality Productive Forces, and Government Environmental Governance: Empirical Evidence from Chinese Provincial Panel Data

Abstract

1. Introduction

2. Theoretical Mechanisms and Research Hypotheses

3. Research Design

3.1. Data Sources

3.2. Description of Variables

3.2.1. Dependent Variable

3.2.2. Independent Variable

3.2.3. Control Variables

3.2.4. Mediating Variable

3.2.5. Moderating Variable

3.2.6. Threshold Variable

3.3. Descriptive Statistics

3.4. Correlation Analysis

3.5. Model Setting

3.5.1. Setting of the Benchmark Model

3.5.2. Setting of the Spatial Effect Model

3.5.3. Setting of the Mediating Effect Model

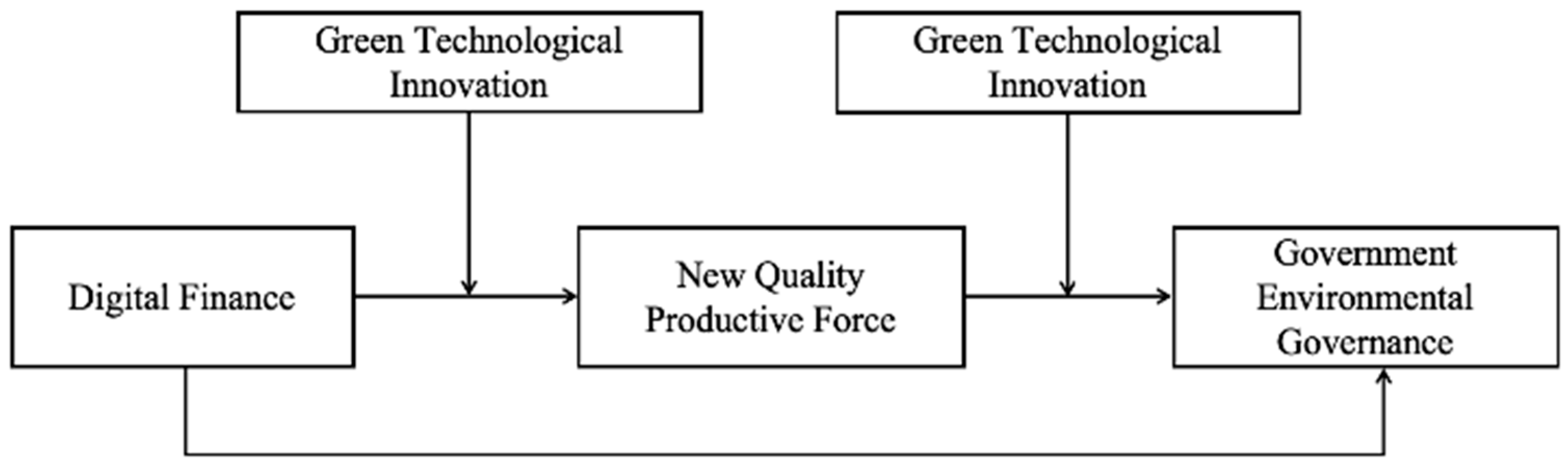

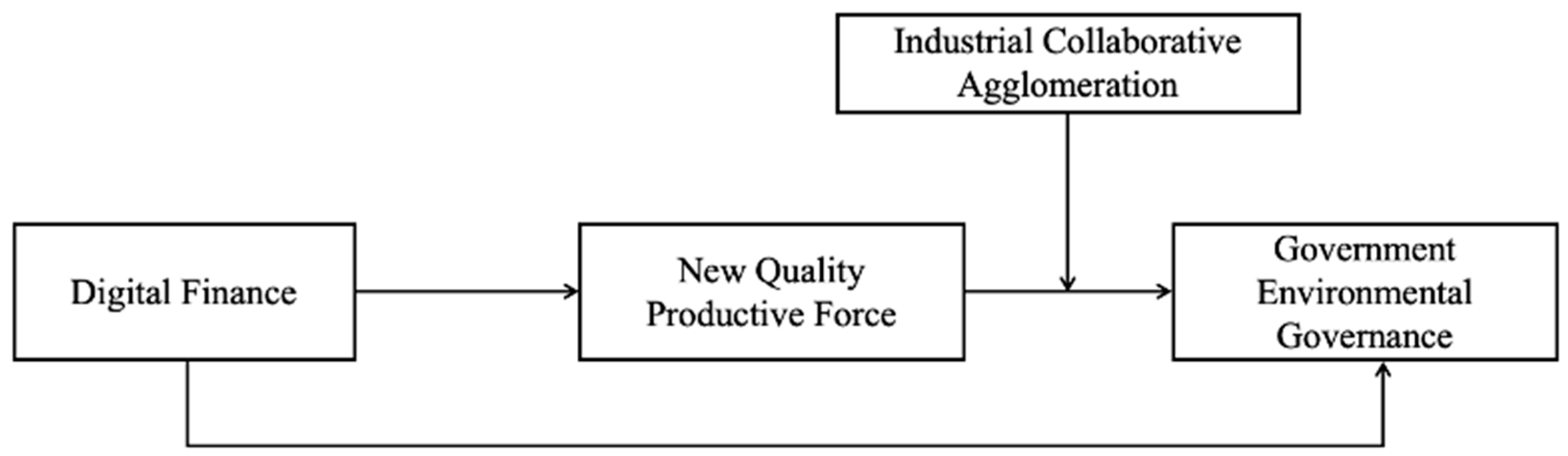

3.5.4. Setting of the Moderated Mediation Effects Model

3.5.5. Setting of the Threshold Effect Model

4. Empirical Testing and Analysis of Results

4.1. Benchmark Regression Analysis

4.2. Heterogeneity Analysis

4.2.1. Regional Heterogeneity Effect

4.2.2. Heterogeneity Effect of Economic Development Level

4.3. Spatial Effects Analysis

4.3.1. Spatial Weight Matrix Construction

- The adjacency matrix (W1)

- 2.

- The geographic distance matrix (W2)

- 3.

- The economic distance matrix (W3)

4.3.2. Spatial Econometric Regression Analysis

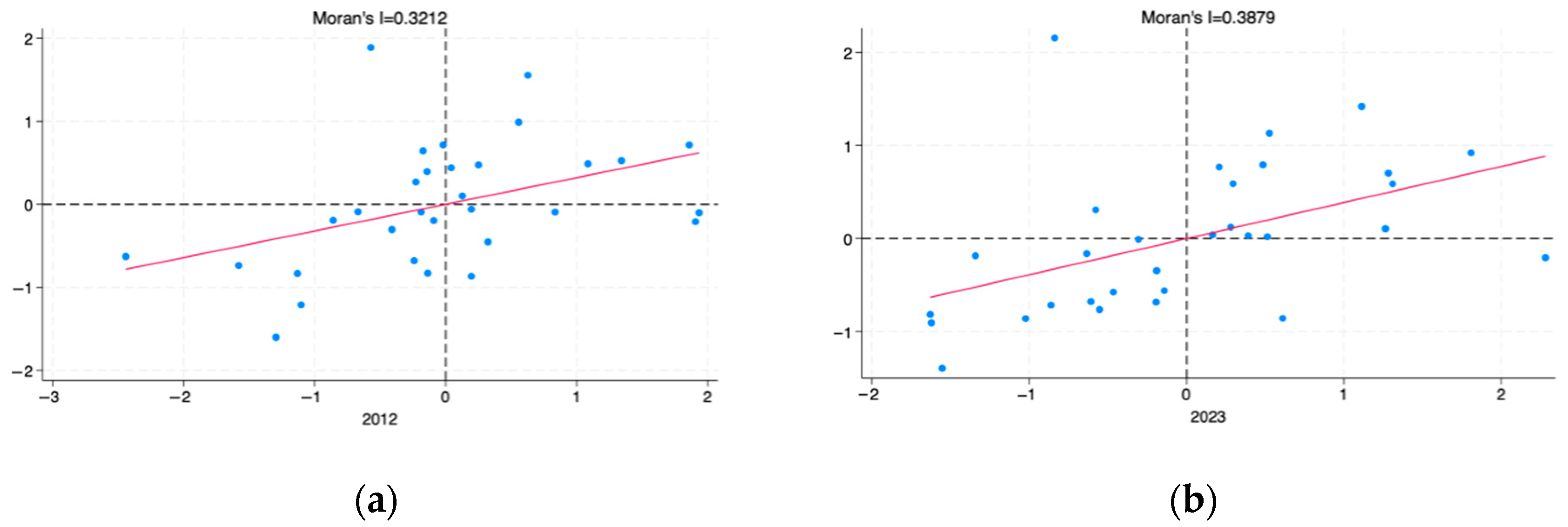

4.3.3. Tests for Spatial Effects

Model Selection

Spatial Effects Results Analysis

4.4. Mediating Effects Analysis

4.5. Moderated Mediation Effects Analysis

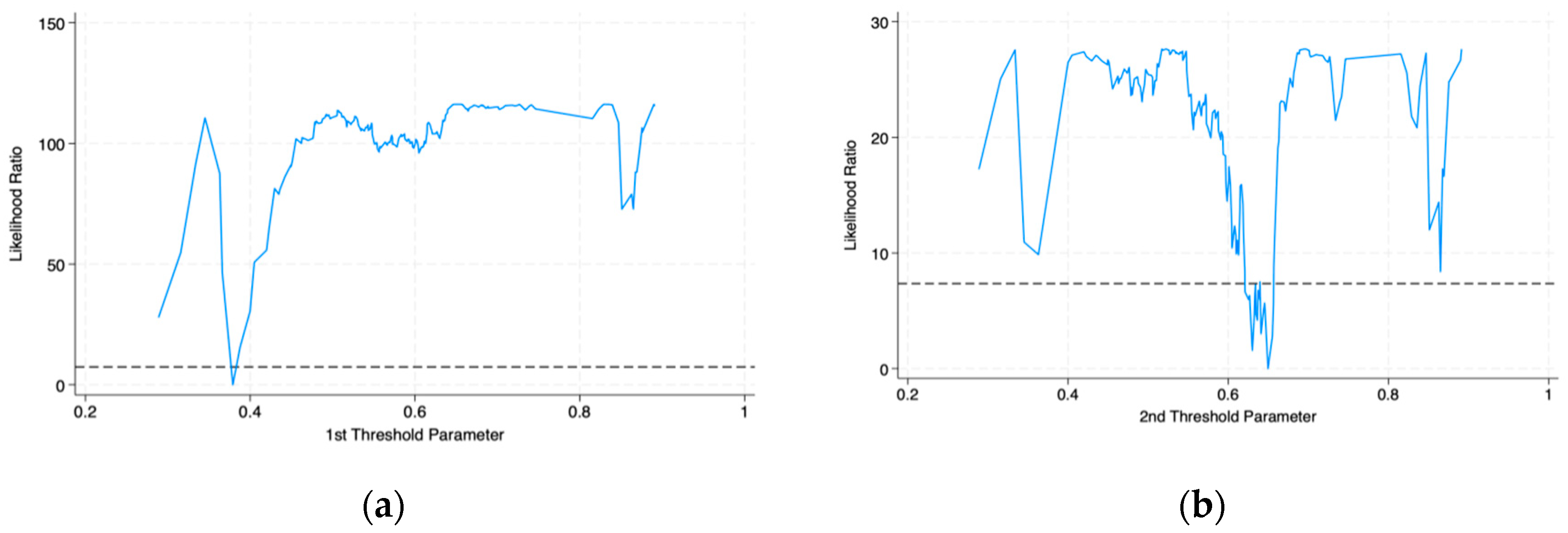

4.6. Threshold Effect Analysis

4.7. Endogeneity and Robustness Tests

4.7.1. Endogeneity Test

4.7.2. Robustness Test

5. Conclusions and Recommendations

5.1. Conclusions

5.2. Recommendations

5.2.1. Accelerate the Digital Infrastructure Construction

5.2.2. Improve the Digital Financial Supervision System

5.2.3. Accelerate the Digital Transformation of the Government

5.2.4. Increase Green Technological Innovation

5.2.5. Develop New Quality Productive Forces Considering Local Conditions

5.2.6. Improve the Industrial Synergy and Regional Collaboration Mechanisms

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Cai, X., & He, Z. (2024). How new quality productivity affects total factor productivity: The mechanism and test of science and technology innovation effect. Contemporary Economic Management, 1–15. (In Chinese). [Google Scholar] [CrossRef]

- Chen, S., & Chen, D. (2018). Smog pollution, government governance, and high-quality economic development. Economic Research Journal, 53(2), 20–34. (In Chinese). [Google Scholar]

- Chen, Z., Kahn, M. E., Liu, Y., & Wang, Z. (2018). The consequences of spatially differentiated water pollution regulation in China. Journal of Environmental Economics and Management, 88, 468–485. [Google Scholar] [CrossRef]

- Dong, K., Liu, Y., Wang, J., & Dong, X. (2024). Is the digital economy an effective tool for decreasing energy vulnerability? A global case. Ecological Economics, 216, 108028. [Google Scholar] [CrossRef]

- Guo, F., Wang, J., Wang, F., Kong, T., Zhang, X., & Cheng, Z. (2020). Measuring the development of digital financial inclusion in China: Index compilation and spatial characteristics. China Economic Quarterly, 19(4), 1401–1418. (In Chinese). [Google Scholar]

- Han, W. (2024). The political economy interpretation of new quality productivity. Studies on Marxism, (3), 100–115. Available online: https://link.cnki.net/urlid/11.3591.A.20240611.1317.018 (accessed on 4 July 2025). (In Chinese).

- Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93(2), 345–368. [Google Scholar] [CrossRef]

- Hansen, B. E. (2000). Sample splitting and threshold estimation. Econometrica, 68(3), 575–603. [Google Scholar] [CrossRef]

- He, H. (2020). Digital finance to promote the integrated development of rural industry: Advantages, dilemmas and the way forward. Journal of Northwest A&F University (Social Science Edition), 20(3), 118–125. (In Chinese). [Google Scholar]

- Hu, J., & Gu, J. (2017). Research on the regional heterogeneity of the impact of population aging on housing prices—An empirical analysis based on panel data from 31 provinces in China. Journal of East China Normal University (Philosophy and Social Sciences Edition), 49(3), 155–160+176. (In Chinese). [Google Scholar]

- Huang, Q., Yu, Y., & Zhang, S. (2019). Internet development and the improvement of manufacturing productivity: Internal mechanisms and Chinese experience. China Industrial Economics, (8), 5–23. (In Chinese) [Google Scholar] [CrossRef]

- Li, L. (2024). The impact of digital finance on farmers’ rural common wealth—Mediating effect based on innovation and entrepreneurship vigor. Statistics & Decision, 40(7), 144–149. (In Chinese). [Google Scholar]

- Li, L., & Sheng, D. (2018). Local environmental legislation and the optimization of industry resource allocation efficiency in China’s manufacturing sector. China Industrial Economics, (7), 136–154. (In Chinese) [Google Scholar] [CrossRef]

- Li, W., Wang, S., & Deng, X. (2024). The impact of digital finance on business environment: Mediating role of industrial structural upgrading and moderating role of digital infrastructure. Finance Research Letters, 67, 105775. [Google Scholar] [CrossRef]

- Li, X., & Ran, G. (2021). Digital financial development, capital allocation efficiency and industrial structure upgrading. Journal of Southwest Minzu University (Humanities and Social Sciences Edition), 42(7), 152–162. (In Chinese). [Google Scholar]

- Lu, J., Guo, Z., & Wang, Y. (2024). The development level of new productivity, regional differences and the path of enhancement. Journal of Chongqing University (Social Science Edition), 30(3), 1–17. (In Chinese). [Google Scholar]

- Nepal, R., Liu, Y., Dong, K., & Jamasb, T. (2024). Green financing, energy transformation, and the moderating effect of digital economy in developing countries. Environmental & Resource Economics, 87, 3357–3386. [Google Scholar] [CrossRef]

- Pang, S., Liu, H., & Hua, G. (2024). How does digital finance drive the green economic growth? New discoveries of spatial threshold effect and attenuation possibility boundary. International Review of Economics & Finance, 89, 561–581. [Google Scholar] [CrossRef]

- Peng, X., & Li, B. (2016). Research on the green transformation of China’s industry under different types of environmental regulations. Journal of Finance and Economics, 42(7), 134–144. (In Chinese). [Google Scholar]

- Preacher, K. J., & Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behavior Research Methods, 40(3), 879–891. [Google Scholar] [CrossRef]

- Qian, H., Tao, Y., Cao, S., & Cao, Y. (2020). Theoretical and empirical evidence on digital financial development and economic growth in China. Journal of Quantitative & Technical Economics, 37(6), 26–46. (In Chinese). [Google Scholar]

- Ren, Y., Niu, C., Niu, T., & Yao, X. (2014). Theoretical modeling and empirical research on green innovation efficiency. Journal of Management World, (7), 176–177. (In Chinese). [Google Scholar]

- Ren, Y., Wu, Y., & Wu, Z. (2024). Financial agglomeration, industry-university-research cooperation and new quality productivity. The Theory and Practice of Finance and Economics, 45(3), 27–34. (In Chinese). [Google Scholar]

- Su, Z., Liu, Y., Gao, Y., Park, K. S., & Su, M. (2024). Critical success factors for green port transformation using digital technology. Journal of Marine Science and Engineering, 12(12), 2128. [Google Scholar] [CrossRef]

- Tao, Y., Cao, Y., Zhang, J., & Zou, K. (2021). The impact of digital finance on entrepreneurship-evidence from regional and Chinese household tracking surveys (CFPS). Journal of Zhejiang University (Humanities and Social Sciences), 51(1), 129–144. (In Chinese). [Google Scholar]

- The Central People’s Government of the People’s Republic of China. (2023). The central financial work conference was held in Beijing. Available online: https://www.gov.cn (accessed on 31 October 2023).

- The Central People’s Government of the People’s Republic of China. (2024a). Opinions of the central committee of the communist party of China and the state council on accelerating the comprehensive green transformation of economic and social development. Available online: https://www.gov.cn (accessed on 11 August 2024).

- The Central People’s Government of the People’s Republic of China. (2024b). The decision of the central committee of the communist party of China on further comprehensively deepening reform and promoting Chinese-style modernization. Available online: https://www.gov.cn (accessed on 21 July 2024).

- Tian, H., & Pan, M. (2021). Research on digital financial development and urban economic performance—Spatial effect and threshold characteristic. Economic Problems, (12), 22–28. (In Chinese) [Google Scholar] [CrossRef]

- Wang, F., Cao, Y., & Chen, S. (2020). Rethinking the environmental Kuznets curve hypothesis. China Economic Quarterly, 19(1), 81–100. (In Chinese). [Google Scholar]

- Wang, Q. (2015). Fixed-Effect panel threshold model using Stata. The Stata Journal: Promoting Communications on Statistics and Stata, 15(1), 121–134. [Google Scholar] [CrossRef]

- Wang, Q., & Tian, Y. (2021). The evolution of government attention in environmental governance in China—A text analysis based on the government work report (1978–2021) of the state council. Journal of Fujian Normal University (Philosophy and Social Sciences Edition), 4, 74–84+170171. (In Chinese). [Google Scholar]

- Wang, W., & Sui, Y. (2022). Research on the spatial effects of the synergistic agglomeration of producer services and high-tech industries on regional innovation efficiency. Journal of Management, 19(5), 696–704. (In Chinese). [Google Scholar]

- Wang, X., & Zhao, Y. (2020). Is there a Matthew effect in digital financial development?—An empirical comparison between poor and non-poor households. Journal of Financial Research, (7), 114–133. Available online: https://kns.cnki.net/kcms2/article/abstract?v=__pNPjlwk1qU0y_GvAalnCiUuy9SBN_EiyCHHhguNaF_JrdEB46Ju9P8ijLpHxTxDp9aSaNJznSlf2iZX3YP1kRDdPR3rD3hCGFMXf4-keDeliJsgjNKDHK8_eBK82IpkY2p_WXVSFysTN6F2wxZH-qw0EgkqR_842bAC4rK6IzEiyE5wwyzREGXwYoX_0oP0gZ50vAs9mg=&uniplatform=NZKPT&language=CHS (accessed on 4 July 2025). (In Chinese).

- Wang, Y., Ye, X., & Xu, L. (2020). Can digital finance boost the real economy. Finance & Economics, (3), 1–13. Available online: https://kns.cnki.net/kcms2/article/abstract?v=__pNPjlwk1p2cx0sNnkIXC1imootDVqbF_AQnuNxCOHf2kaIyeTE7BdI5pSGgt3vjzqqtBS-v_-YmC99-A5-UDM1sIpQCTWLfS7oU04uXQV2tGNZHiMGiC8h5f48-Wi3jezD3H-_M6GjDz9i0iTpwVfwpY8ZyYx7ErUcTQV5vx155DabBUEfX6BxvEMPbSKPy4F3KeSd_n8=&uniplatform=NZKPT&language=CHS (accessed on 4 July 2025). (In Chinese).

- Wang, Y., Zhang, Y., & Li, J. (2022). Digital finance and carbon emissions: A study based on microdata and machine learning models. China Population, Resources and Environment, 32(6), 1–11. (In Chinese). [Google Scholar]

- Wen, Z., & Ye, B. (2014). Mediation effects analysis: Methods and model development. Advances in Psychological Science, 22(5), 731–745. (In Chinese). [Google Scholar] [CrossRef]

- Wu, Z., Xu, Y., & Sun, K. (2022). Research on the impact of urban agglomeration effect on green technology innovation—A spatial econometric analysis based on 232 prefecture-level and above cities in China. Economic Geography, 42(10), 25–34+71. (In Chinese). [Google Scholar]

- Xu, W., Zhou, J., & Liu, C. (2022). Spatial effects of digital economy development on urban carbon emissions. Geographical Research, 41(1), 111–129. (In Chinese). [Google Scholar]

- Yi, J., Dai, S., Li, L., & Cheng, J. (2024). How does digital economy development affect renewable energy innovation? Renewable and Sustainable Energy Reviews, 192, 114221. [Google Scholar] [CrossRef]

- Yu, Z., Li, Y., & Dai, L. (2023). Digital finance and regional economic resilience: Theoretical framework and empirical test. Finance Research Letters, 55, 103920. [Google Scholar] [CrossRef]

- Zhang, C., Zhu, Y., & Zhang, L. (2024). Effect of digital inclusive finance on common prosperity and the underlying mechanisms. International Review of Financial Analysis, 91, 102940. [Google Scholar] [CrossRef]

- Zhang, G., & Wang, R. (2023). How does the development of the digital economy empower high-quality employment for migrant workers? Chinese Rural Economy, (1), 58–76. (In Chinese). [Google Scholar] [CrossRef]

- Zhang, M., & Liu, Y. (2022). Influence of digital finance and green technology innovation on China’s carbon emission efficiency: Empirical analysis based on spatial metrology. Science of the Total Environment, 838(3), 156463. [Google Scholar] [CrossRef] [PubMed]

- Zhang, P., & Xu, Y. (2024). Research on the influence mechanism of green bonds on capital allocation and local government environmental governance. Statistics & Decision, 40(1), 163–167. (In Chinese). [Google Scholar]

- Zhang, W., Wang, J., & Jin, H. (2024). Digital finance, innovation transformation, and resilient city growth. Scientific Reports, 14, 7056. [Google Scholar] [CrossRef] [PubMed]

- Zhao, Q., & Li, H. (2024). Whether ESG ratings promote corporate green technology innovation—Micro evidence from Chinese listed companies. South China Journal of Economics, (2), 116–135. (In Chinese). [Google Scholar] [CrossRef]

- Zhou, L., Zhang, X., & Dong, K. (2024). Does digital financial innovation help promote the high-quality development of real economy?—Mechanism analysis and spatial measurement based on financial service efficiency. Journal of Xi’an University of Finance and Economics, 37(1), 60–72. (In Chinese). [Google Scholar]

| Variable | Keywords |

|---|---|

| GEG | Environmental protection, Environmental conservation, Pollution, Energy consumption, Emission reduction, Pollutant discharge, Ecology, Green, Low-carbon, Air, Chemical oxygen demand (COD), Sulfur dioxide, Dioxide, carbon dioxide, PM10, PM2.5 |

| 1st Class Indicator | 2nd Class Indicator | 3rd Class Indicator | 4th Class Indicator | Meaning of the 4th Class Indicator | Indicator Properties |

|---|---|---|---|---|---|

| NQPFs | Scientific and technological productivity | Technological productivity | Technical production | Robot mounting density (%) | + |

| Technical R&D | Full-time equivalent of R&D personnel in industrial enterprises above the designated size (h) | + | |||

| Innovative productivity | Innovative industries | Business income from high-tech industries (per 1000 yuan) | + | ||

| Innovative products | Funding for industrial innovation in industrial enterprises above the designated size (per 10,000 yuan) | + | |||

| Innovative R&D | Number of patents granted in the region | + | |||

| Creative entrepreneurship | Number of new start-ups (per 100 people) | + | |||

| Digital productivity | Digital industry productivity | Telecommunications business communications | Total telecommunication services (per hundred million yuan) | + | |

| Electronic information manufacturing | Number of IC production (per hundred million) | + | |||

| Broadband China Strategy | Number of provincial (city) broadband China pilot cities Share in the number of provincial (municipal) prefecture-level cities (%) | + | |||

| Industrial digital productivity | Software service | Revenue from software operations (per 10,000 yuan) | + | ||

| E-commerce | E-commerce sales (per 10,000 yuan) | + | |||

| Internet penetration | Number of Internet broadband access ports | + | |||

| Green productivity | Resource-efficient productivity | Energy intensity | Energy consumption as a share of GDP (%) | − | |

| Water intensity | Industrial water consumption as a share of GDP (%) | − | |||

| Environmentally friendly productivity | Wastewater discharge | Industrial wastewater discharges as a share of GDP (%) | − | ||

| Exhaust emission | Industrial SO2 emissions as a share of GDP (%) | − | |||

| Waste material utilization | Comprehensive utilization of industrial solid waste as a percentage (%) | + | |||

| Eco-governance-based productivity | Ecological resource | Area forest cover (%) | + | ||

| Pollution prevention and control potential | Treatment capacity of waste gas treatment facilities (number of machines) | + | |||

| Pollution prevention and control of quality | COD emissions as a percentage of GDP (%) | − |

| Variable | Variable Name | Obs | Mean | SD | Median | Min | Max |

|---|---|---|---|---|---|---|---|

| GEG | Government environmental governance | 372 | 3.8778 | 1.0802 | 3.7600 | 1.4482 | 7.4988 |

| DIF | Digital finance | 372 | 5.5358 | 0.4313 | 5.6434 | 4.1185 | 6.2520 |

| DIF_CB | Coverage breadth | 372 | 5.4432 | 0.5138 | 5.5846 | 3.4923 | 6.1997 |

| DIF_UD | Usage depth | 372 | 5.4975 | 0.4325 | 5.6114 | 3.9484 | 6.3175 |

| DIF_DL | Digitization level | 372 | 5.8015 | 0.3461 | 5.9381 | 4.6735 | 6.3046 |

| GOV | Government intervention | 372 | 0.2824 | 0.2068 | 0.2286 | 0.1066 | 1.3792 |

| URBAN | Urbanization level | 372 | 0.6041 | 0.1263 | 0.5973 | 0.2287 | 0.896 |

| EDU | Education quality | 372 | 0.1608 | 0.028 | 0.1641 | 0.0711 | 0.2222 |

| MARKET | Degree of marketization | 372 | 2.5518 | 0.3545 | 2.6207 | 0.0646 | 3.0544 |

| AGR | Agricultural development level | 372 | 2.3953 | 0.3441 | 2.4504 | 1.3963 | 3.0148 |

| OPEN | Level of openness | 372 | 0.3508 | 0.2653 | 0.2406 | 0.0325 | 1.5407 |

| STRU | Industrial structure | 372 | 1.3505 | 0.7462 | 1.1989 | 0.5493 | 5.5621 |

| FIN | Level of traditional financial development | 372 | 0.8212 | 0.1628 | 0.8089 | 0.3232 | 1.2361 |

| NQPFs | New quality productive forces | 372 | 0.1375 | 0.1124 | 0.1006 | 0.0119 | 0.7612 |

| ICA | Industrial collaborative agglomeration | 372 | 2.4146 | 1.1149 | 2.1952 | 0.9248 | 7.6345 |

| GTEC | Green technological innovation | 372 | 2.3941 | 0.2747 | 2.4446 | 0.0335 | 2.7964 |

| Variable | GEG | DIF | ICA | GTEC | NQPFs | GOV | URBAN | EDU |

|---|---|---|---|---|---|---|---|---|

| GEG | 1 | |||||||

| DIF | 0.270 *** | 1 | ||||||

| ICA | 0.178 *** | 0.218 *** | 1 | |||||

| GTEC | 0.502 *** | 0.385 *** | 0.416 *** | 1 | ||||

| NQPFs | 0.490 *** | 0.581 *** | 0.551 *** | 0.614 *** | 1 | |||

| GOV | 0.127 ** | 0.332 *** | 0.340 *** | 0.779 *** | 0.402 *** | 1 | ||

| URBAN | 0.389 *** | 0.228 *** | 0.216 *** | 0.133 ** | 0.235 *** | 0.042 | 1 | |

| EDU | 0.160 *** | 0.261 *** | 0.201 *** | 0.355 *** | 0.253 *** | 0.465 *** | 0.234 *** | 1 |

| MARKET | 0.143 *** | 0.102 * | 0.730 *** | 0.380 *** | 0.531 *** | 0.293 *** | 0.489 *** | 0.178 *** |

| AGR | 0.320 *** | 0.181 *** | 0.271 *** | 0.305 *** | 0.120 ** | 0.250 *** | 0.266 *** | 0.361 *** |

| OPEN | 0.492 *** | 0.547 *** | 0.593 *** | 0.603 *** | 0.538 *** | 0.514 *** | 0.481 *** | 0.139 ** |

| STRU | 0.197 *** | 0.256 *** | 0.673 *** | 0.491 *** | 0.580 *** | 0.439 *** | 0.238 *** | 0.153 *** |

| FIN | 0.429 *** | 0.603 *** | 0.507 *** | 0.857 *** | 0.662 *** | 0.816 *** | 0.121 ** | 0.321 *** |

| DIF_CB | 0.962 *** | 0.223 *** | 0.189 *** | 0.499 *** | 0.526 *** | 0.136 ** | 0.415 *** | 0.142 *** |

| DIF_UD | 0.909 *** | 0.172 *** | 0.277 *** | 0.549 *** | 0.606 *** | 0.178 *** | 0.434 *** | 0.173 *** |

| DIF_DL | 0.897 *** | 0.263 *** | 0.228 *** | 0.332 *** | 0.383 *** | 0.224 *** | 0.293 *** | 0.206 *** |

| MARKET | AGR | OPEN | STRU | FIN | DIF_CB | DIF_UD | DIF_DL | |

| MARKET | 1 | |||||||

| AGR | 0.355 *** | 1 | ||||||

| OPEN | 0.730 *** | 0.634 *** | 1 | |||||

| STRU | 0.781 *** | 0.247 *** | 0.734 *** | 1 | ||||

| FIN | 0.538 *** | 0.414 *** | 0.727 *** | 0.676 *** | 1 | |||

| DIF_CB | 0.167 *** | 0.327 *** | 0.516 *** | 0.225 *** | 0.107 ** | 1 | ||

| DIF_UD | 0.274 *** | 0.214 *** | 0.547 *** | 0.343 *** | 0.189 *** | 0.928 *** | 1 | |

| DIF_DL | 0.252 *** | 0.294 *** | 0.296 *** | 0.352 *** | 0.185 *** | 0.844 *** | 0.734 *** | 1 |

| Variable | Mixed Regression | Mixed Regression | Time Fixed Effect | Individual Fixed Effect | Two-Way Fixed Effects |

|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | |

| GEG | GEG | GEG | GEG | GEG | |

| DIF | 0.2182 *** | 0.3355 *** | 0.1381 *** | 0.3869 ** | 0.6701 *** |

| (0.0468) | (0.0649) | (0.0465) | (0.1785) | (0.1938) | |

| GOV | 0.0221 ** | −0.0097 | 0.0252 ** | −0.0099 | |

| (0.0107) | (0.0148) | (0.0115) | (0.0118) | ||

| URBAN | −0.0805 ** | −0.1607 ** | −0.0978 ** | −0.1245 ** | |

| (0.0381) | (0.0618) | (0.0389) | (0.0539) | ||

| EDU | 0.1087 | 0.5183 * | 0.0353 | 0.5315 ** | |

| (0.1474) | (0.2544) | (0.1622) | (0.2348) | ||

| MARKET | 0.0709 | 0.0296 | 0.2954 | 1.1526 | |

| (0.6989) | (0.8348) | (0.8387) | (1.3443) | ||

| AGR | −0.0126 | 0.0460 | −0.2371 | 0.0036 | |

| (0.1497) | (0.2346) | (0.2108) | (0.0161) | ||

| OPEN | −0.0559 | 0.1712 | −0.0298 | 0.3370 | |

| (0.0512) | (0.3443) | (0.0519) | (0.4070) | ||

| STRU | 1.3590 * | 1.7566 | −0.5092 | 0.0288 | |

| (0.7146) | (1.4684) | (1.8201) | (0.1200) | ||

| FIN | −0.0296 | 0.1802 | −0.0260 | 0.3142 | |

| (0.0527) | (0.3533) | (0.0546) | (0.3326) | ||

| CONS | 2.8191 *** | 2.3708 *** | 1.9915 | 3.4050 | −0.5366 * |

| (0.2610) | (0.4798) | (1.3301) | (2.1092) | (0.2818) | |

| N | 372 | 372 | 372 | 372 | 372 |

| R2 | 0.2711 | 0.7554 | 0.7558 | 0.8818 | 0.8873 |

| Province FE | No | No | No | Yes | Yes |

| Year FE | No | No | Yes | No | Yes |

| Variables | Eastern | Central | Western | Northeast | Developed Area | Sub-Developed Area | Underdeveloped Area |

|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| GEG | GEG | GEG | GEG | GEG | GEG | GEG | |

| DIF | 0.6584 *** | 0.5424 ** | 0.4811 *** | 0.4394 ** | 0.4693 ** | 0.6332 ** | 0.3961 ** |

| (0.2022) | (0.1618) | (0.1358) | (0.0867) | (0.2160) | (0.2154) | (0.1638) | |

| CONTROLS | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| CONS | 0.5902 | 0.2544 * | 0.0145 *** | 0.1114 * | 0.0174 * | 0.2371 *** | 0.0642 |

| (0.3504) | (0.1147) | (0.0044) | (0.0260) | (0.0079) | (0.0605) | (0.0767) | |

| N | 120 | 72 | 144 | 36 | 60 | 252 | 60 |

| R2 | 0.9325 | 0.8958 | 0.9120 | 0.9018 | 0.9414 | 0.9562 | 0.9321 |

| Province/Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Classification | Names of Provinces |

|---|---|

| Developed area | Beijing, Shanghai, Zhejiang, Jiangsu, Guangdong |

| Sub-developed area | Shandong, Henan, Sichuan, Hubei, Hunan, Fujian, Hebei, Anhui, Shaanxi, Jiangxi, Chongqing, Guangxi, Yunnan, Inner Mongolia, Shanxi, Tianjin, Heilongjiang, Guizhou, Jilin, Xinjiang |

| Underdeveloped area | Gansu, Hainan, Ningxia, Qinghai, Tibet |

| Variable | W1 | W2 | W3 | |||

|---|---|---|---|---|---|---|

| (1) | (2) | (1) | (2) | (1) | (2) | |

| Moran’s I | Z-Score | Moran’s I | Z-Score | Moran’s I | Z-Score | |

| 2012 | 0.321 *** | 3.014 | 0.181 *** | 2.747 | 0.067 * | 1.301 |

| 2013 | 0.328 *** | 3.072 | 0.192 *** | 2.879 | 0.082 * | 1.503 |

| 2014 | 0.407 *** | 3.750 | 0.255 *** | 3.690 | 0.167 *** | 2.612 |

| 2015 | 0.380 *** | 3.561 | 0.240 *** | 3.541 | 0.179 *** | 2.808 |

| 2016 | 0.422 *** | 3.831 | 0.268 *** | 3.811 | 0.203 *** | 3.043 |

| 2017 | 0.383 *** | 3.512 | 0.240 *** | 3.461 | 0.176 *** | 2.701 |

| 2018 | 0.376 *** | 3.453 | 0.233 *** | 3.376 | 0.149 *** | 2.357 |

| 2019 | 0.375 *** | 3.445 | 0.237 *** | 3.429 | 0.133 ** | 2.154 |

| 2020 | 0.396 *** | 3.627 | 0.240 *** | 3.475 | 0.115 ** | 1.917 |

| 2021 | 0.431 *** | 3.914 | 0.253 *** | 3.631 | 0.150 *** | 2.367 |

| 2022 | 0.434 *** | 3.935 | 0.254 *** | 3.645 | 0.152 *** | 2.388 |

| 2023 | 0.388 *** | 3.536 | 0.234 *** | 3.374 | 0.140 ** | 2.227 |

| Type of Test | Statistic | p-Value | |

|---|---|---|---|

| LM test | LM-lag | 13.631 | 0.000 |

| R-LM-lag | 6.354 | 0.012 | |

| LM-error | 21.532 | 0.000 | |

| R-LM-error | 14.254 | 0.000 | |

| Wald and LR tests | Wald-spatial-lag | 45.70 | 0.000 |

| LR-spatial-lag | 3.91 | 0.048 | |

| Wald-spatial- error | 46.74 | 0.000 | |

| LR-spatial-error | 383.85 | 0.000 | |

| Variable | W1 | W2 | W3 |

|---|---|---|---|

| (1) | (2) | (3) | |

| GEG | GEG | GEG | |

| DIF | 0.5416 *** | 0.4287 *** | 0.4882 *** |

| (0.0556) | (0.0532) | (0.0299) | |

| 0.2804 *** | 0.1760 *** | 0.1824 *** | |

| (0.1041) | (0.0133) | (0.0140) | |

| W × DIF | 0.2023 *** | 0.1002 ** | 0.1840 *** |

| (0.0562) | (0.0412) | (0.0565) | |

| Control | Yes | Yes | Yes |

| Province/Year FE | Yes | Yes | Yes |

| N | 372 | 372 | 372 |

| R2 | 0.2885 | 0.3242 | 0.5354 |

| Direct effect | 0.3248 *** | 0.4298 *** | 0.3088 *** |

| (3.1057) | (0.0533) | (0.0681) | |

| Indirect effect | 0.2107 *** | 0.1486 *** | 0.1736 *** |

| (0.0114) | (0.0059) | (0.0527) | |

| Total effect | 0.5355 *** | 0.5785 *** | 0.4824 *** |

| (0.0529) | (0.0807) | (0.0285) |

| Effect | Estimated Coefficient | Bootstrap Standard Error | Z-Value | 95% CI | Control | Province/Year FE |

|---|---|---|---|---|---|---|

| Direct effect | 0.1984 ** | 0.0925 | 2.14 | [0.0170, 0.3797] | Yes | Yes |

| Indirect effect | 0.4718 ** | 0.2307 | 2.04 | [0.0196, 0.9240] | Yes | Yes |

| Variable | (1) | (2) | (3) |

|---|---|---|---|

| GEG | NQPF | GEG | |

| DIF | 0.6701 *** | 0.6441 *** | 0.4718 ** |

| (0.1938) | (0.0840) | (0.2108) | |

| NQPF | 0.3080 ** | ||

| (0.1338) | |||

| CONTROLS | Yes | Yes | Yes |

| CONS | −0.5366 * | 0.0003 | −0.5367 * |

| (0.2818) | (0.1222) | (0.2798) | |

| N | 372 | 372 | 372 |

| 0.8873 | 0.7290 | 0.8300 | |

| Sobel Z | 2.205 ** | ||

| Province/Year FE | Yes | Yes | Yes |

| Regression Coefficient | SD | t-Value | Significance Level | |

|---|---|---|---|---|

| Mediating effect model | ||||

| DIF | 0.1940 ** | 0.0694 | 2.79 | 0.019 |

| GTEC | 0.3099 ** | 0.1212 | 2.56 | 0.016 |

| DIF × GTEC | 0.0581 ** | 0.0239 | 2.44 | 0.021 |

| CONS | 0.0148 * | 0.0081 | 1.83 | 0.077 |

| Dependent variable model | ||||

| DIF | 0.3458 ** | 0.1152 | 3.00 | 0.013 |

| NQPFs | 0.3227 * | 0.1455 | 2.22 | 0.051 |

| GTEC | 0.0959 *** | 0.0263 | 3.64 | 0.005 |

| DIF × GTEC | 0.2447 *** | 0.0579 | 4.23 | 0.002 |

| NQPFs × GTEC | 0.1541 *** | 0.0387 | 3.98 | 0.003 |

| CONS | −0.2958 * | 0.1386 | −2.13 | 0.059 |

| Tests for the moderated mediation effect | ||||

| GTEC (NQPFs) | indirect effect | significance | 95% CIs | |

| Minus one SD | 0.1187 ** | 0.042 | [0.0042, 0.2332] | |

| Average value | 0.3791 *** | 0.036 | [0.0256, 0.7326] | |

| Add one SD | 0.3835 *** | 0.000 | [0.1685, 0.5986] | |

| CONTROLS | Yes | |||

| N | 372 | |||

| Province/Year FE | Yes | |||

| Regression Coefficient | SD | t-Value | Significance Level | |

|---|---|---|---|---|

| Mediating effect model | ||||

| DIF | 0.1546 *** | 0.0402 | 3.84 | 0.003 |

| CONS | 0.1996 *** | 0.0524 | 3.81 | 0.003 |

| Dependent variable model | ||||

| DIF | 0.2612 *** | 0.0527 | 4.96 | 0.001 |

| NQPF | 0.0960 *** | 0.0263 | 3.64 | 0.005 |

| ICA | 0.0878 *** | 0.0270 | 3.25 | 0.009 |

| NQPFs × ICA | 0.1644 *** | 0.0365 | 4.50 | 0.001 |

| CONS | −0.2598 * | 0.1386 | −2.13 | 0.059 |

| Tests for the moderated mediation effect | ||||

| ICA (NQPFs) | indirect effect | significance | 95% CIs | |

| Minus one SD | 0.0561 ** | 0.039 | [0.0029, 0.1094] | |

| Average value | 0.2522 *** | 0.001 | [0.1033, 0.4012] | |

| Add one SD | 0.3922 *** | 0.000 | [0.1731, 0.6113] | |

| CONTROLS | Yes | |||

| N | 372 | |||

| Province/Year FE | Yes | |||

| Number of Threshold | F-Statistic | p-Value | Threshold Value | Threshold Value | 95% CIs | ||

|---|---|---|---|---|---|---|---|

| 1% | 5% | 10% | |||||

| Single | 125.76 | 0.0000 | 36.5803 | 26.9304 | 25.2667 | 0.3789 *** | [0.3661, 0.3878] |

| Double | 27.98 | 0.0700 | 37.2931 | 31.6046 | 25.5880 | 0.6496 * | [0.6429, 0.6551] |

| Triple | 25.48 | 0.2200 | 27.0759 | 20.7286 | 34.3531 | 0.8650 | [0.8549, 0.8676] |

| Threshold Variables | Coefficient Estimate | Standard Error | t-Value | 95% Confidence Intervals |

|---|---|---|---|---|

| 0.9439 *** | 0.2194 | 4.30 | [0.4958, 1.3920] | |

| 1.5349 *** | 0.3916 | 3.92 | [0.7351, 2.3346] | |

| 2.6936 *** | 0.3146 | 8.56 | [2.0511, 3.3360] | |

| CONTROLS | Yes | |||

| CONS | 3.9916 *** | 0.5857 | 6.81 | [2.7954, 5.1878] |

| N | 372 | |||

| R2 | 0.9020 | |||

| Province/Year FE | Yes | |||

| Variable | Heckman’s Two-Stage Method | IV Method | Dynamic Panel GMM | PSM | |||

|---|---|---|---|---|---|---|---|

| First-Stage Regression | Second-Stage Regression | First-Stage Regression | Second-Stage Regression | DIF-GMM | SYS-GMM | ||

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | |

| DIF_use | GEG | DIF | GEG | GEG | |||

| L.GEG | 0.3587 ** | 0.3555 *** | |||||

| (0.1425) | (0.0753) | ||||||

| DIF | 0.0721 *** | 0.4792 *** | 0.1846 *** | 0.2151 *** | 0.0929 ** | ||

| (0.0223) | (0.1598) | (0.0308) | (0.0566) | (0.0310) | |||

| IMR | 0.0348 *** | ||||||

| (0.0107) | |||||||

| IV | 0.0459 *** | 0.0399 ** | |||||

| (0.0128) | (0.0143) | ||||||

| CONTROLS | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| CONS | 0.2811 *** | 0.7585 ** | −0.2193 | 0.1143 ** | 0.0097 *** | 0.0410 *** | 0.9957 *** |

| (0.0371) | (0.3682) | (0.2215) | (0.0410) | (0.0037) | (0.0155) | (0.0307) | |

| AR (1) | 0.012 | 0.007 | |||||

| AR (2) | 0.496 | 0.375 | |||||

| Hansen | 0.717 | 0.375 | |||||

| N | 372 | 372 | 372 | 372 | 341 | 310 | 246 |

| R2 | 0.6913 | 0.5362 | 0.2573 | 0.3478 | - | - | 0.0274 |

| Province/Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Kleibergen-Paap rk LM | 85.779 (0.0000) | ||||||

| Kleibergen-Paap rk Wald F | 86.54 (16.38) | ||||||

| Variable | Substitution of Independent Variable | Substitution of Dependent Variable | Excluding Municipality Samples | Excluding Time Samples | 1% Winsorization | 5% Winsorization | ||

|---|---|---|---|---|---|---|---|---|

| (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | |

| GEG | GEG | GEG | GEG_Replace | GEG | GEG | GEG | GEG | |

| DIF | 0.6737 *** | 0.4794 ** | 0.4069 *** | 0.5465 *** | 0.4902 *** | |||

| (0.1604) | (0.1575) | (0.1023) | (0.1281) | (0.1219) | ||||

| DIF_CB | 0.1644 ** | |||||||

| (0.0544) | ||||||||

| DIF_UD | 0.2389 *** | |||||||

| (0.0488) | ||||||||

| DIF_DL | 0.1830 ** | |||||||

| (0.0649) | ||||||||

| CONTROLS | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| CONS | 0.3607 | 0.4095 | 0.3951 | 0.0363 | −0.7515 | 0.1506 * | −0.0375 | −0.0653 * |

| (0.3238) | (0.2809) | (0.2702) | (0.0332) | (0.4176) | (0.0877) | (0.0367) | (0.0360) | |

| N | 372 | 372 | 372 | 372 | 324 | 279 | 372 | 372 |

| R2 | 0.8336 | 0.8341 | 0.8258 | 0.9653 | 0.7851 | 0.8538 | 0.9207 | 0.9143 |

| Province/Year FE | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Variable | Keywords |

|---|---|

| GEG_replace | environment, environmental protection, energy consumption, pollution, emission reduction |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Xu, Y.; Zhang, S. Digital Finance, New Quality Productive Forces, and Government Environmental Governance: Empirical Evidence from Chinese Provincial Panel Data. Int. J. Financial Stud. 2025, 13, 129. https://doi.org/10.3390/ijfs13030129

Xu Y, Zhang S. Digital Finance, New Quality Productive Forces, and Government Environmental Governance: Empirical Evidence from Chinese Provincial Panel Data. International Journal of Financial Studies. 2025; 13(3):129. https://doi.org/10.3390/ijfs13030129

Chicago/Turabian StyleXu, Yunsong, and Shanfei Zhang. 2025. "Digital Finance, New Quality Productive Forces, and Government Environmental Governance: Empirical Evidence from Chinese Provincial Panel Data" International Journal of Financial Studies 13, no. 3: 129. https://doi.org/10.3390/ijfs13030129

APA StyleXu, Y., & Zhang, S. (2025). Digital Finance, New Quality Productive Forces, and Government Environmental Governance: Empirical Evidence from Chinese Provincial Panel Data. International Journal of Financial Studies, 13(3), 129. https://doi.org/10.3390/ijfs13030129