1. Introduction

Debt financing is important for financing major investments like R&D in the biopharmaceutical industry. Debt financing allows companies to raise funds without giving up ownership or control through indenture and covenants of the company. Debt financing provides greater flexibility for firms in biopharmaceutical industry to finance highly intensive research and development (R&D).

Debt financing is a factor that can significantly impact a company’s net revenue (

Kruk, 2021;

Gill et al., 2011). Debt financing or the borrowing of funds to finance a company’s operations and investments can have two impacts on the firm. Debt financing provides the necessary capital for expansion and innovation. Conversely, it introduces financial commitments that may place considerable pressure on a firm’s resources, particularly in industries characterized by high capital intensity and intense innovation-driven competition. The biopharmaceutical industry in the United States is an example of such a sector, making it an ideal place to investigate these relationships. When firms are selecting debt to finance their operations and investments, they face decisions regarding the appropriate types of debt.

Debt financing is a key consideration for firms seeking to fund projects. This study explores the following: how do short-term and long-term debt influence profitability in the biopharmaceutical sector? Through what mechanisms do they affect profitability? The diverse range of debt instruments, both short- and long-term, provides flexibility in financial strategies. The impact of debt on profitability remains a subject of debate, with conflicting findings in previous studies. While some suggest that debt can lower the cost of capital and enhance profitability (

Tailab, 2014;

Abor, 2005), others argue that higher interest payments may decrease overall profitability (

Bhutta & Hasan, 2013).

Focusing specifically on the biopharmaceutical industry, my interest in analyzing the impact of debt financing is driven by the industry’s unique characteristics. The biopharmaceutical sector attracts significant attention due to continuous advancements in R&D, strong investor demand for higher returns, and the imperative for companies to replenish their pipelines. Furthermore, the industry’s critical role in addressing global health challenges, such as the COVID-19 pandemic, underscores its financial and economic significance.

Debt financing is essential to the biopharmaceutical industry, allowing companies to undertake large R&D activities, grow medication pipelines, and respond quickly to global health emergencies. In this capital-intensive industry, debt provides the financial resources required to drive innovation, maintain competitive market positions, and cover operating costs. It helps biopharmaceutical companies negotiate the complexity of medication discovery, manufacturing, and market dynamics, hence promoting long-term growth and breakthroughs in healthcare.

As the biopharmaceutical industry stands at the intersection of innovation, healthcare, and economic impact, understanding the dynamics of debt financing and its influence on profitability is important because debt financing minimizes agency costs (

Jensen & Meckling, 1976), serve as indicators of firm quality (

Myers & Majluf, 1984), and might influence firm’s profit. The strategic decisions made by companies in this sector not only shape their financial performance but also contribute to advancements in healthcare, making it a focal point for financial and strategic analysis (

Thakor & Lo, 2015). The strategic decisions made by companies in this sector not only shape their financial performance but also contribute to advancements in healthcare, making it a focal point for financial and strategic analysis. Therefore, debt financing decisions raise important questions regarding how biopharmaceutical firms use their financial structures to influence profitability.

This study addresses several important gaps in the existing literature. First, it separates the impacts of short-term and long-term debt on firm profitability, rather than using a single aggregated debt measure. Second, it provides an industry-specific focus on the biopharmaceutical sector, known for its high R&D intensity and financial complexity. Third, it investigates how lagged R&D investments and financial distress affect the debt–profitability relationship—two often overlooked factors. Lastly, by comparing firms in the U.S. and Europe, this study highlights how institutional differences influence the effect of financial structure on performance. This study explores the intricate relationship between debt financing and firm profitability in the biopharmaceutical industry. It tests three main hypotheses: first, whether total debt financing significantly influences profitability; second, whether short-term debt has a more negative impact on profitability than long-term debt; and third, whether this relationship is moderated by lagged R&D intensity and financial distress. Given the capital-intensive nature and long innovation cycles in the biopharmaceutical sector, debt structure can play a critical role in shaping firm performance. Prior studies often consider debt in aggregate terms, overlooking the distinct implications of debt maturity and contextual industry dynamics. This study aims to fill that gap by providing industry-specific evidence on how short- and long-term debt, when interacted with firm innovation efforts and financial health, influence profitability.

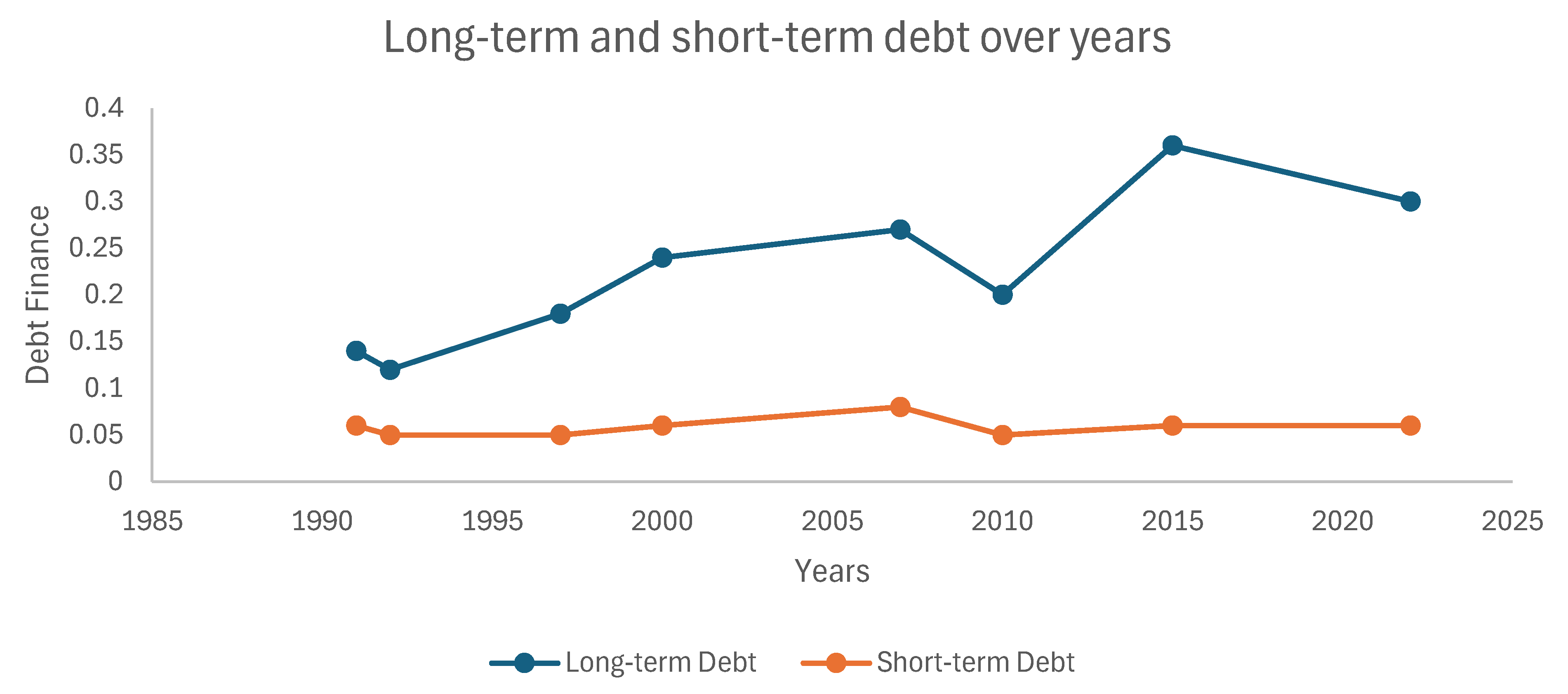

In this study, I examine 687 publicly traded biopharmaceutical firms in the U.S. and Europe using Compustat data from 1990 to 2022, yielding 4284 firm-year observations. Using two-way fixed effects and dynamic panel estimations, I find that both short-term and long-term debt have a negative impact on firm profitability. This is primarily due to increased interest expenses associated with higher debt levels, which reduce profits. From an economic significance standpoint, I find that a one-standard-deviation increase in short-term debt leads to a 13.7% decline in profitability, after accounting for firm-specific and macroeconomic controls. This negative effect is more pronounced for U.S. firms than for their European counterparts. In addition, the result shows that long-term debt reduces profitability for biopharmaceutical firms. The economic significance of the negative relationship between long-term debt and profitability is that an increase in one standard deviation of long-term debt relates to a 2.55 percent standard deviation decrease in profitability. This highlights a strong negative effect of long-term debt on profitability among pharmaceutical firms in the U.S.

Total debt, which combines both short-term and long-term debt, has a negative effect on profitability and is statistically significant at 1 percent. There is a strong negative impact of long-term debt on profitability for pharmaceutical firms in the USA as compared to European biopharmaceutical firms.

Furthermore, I examine the mechanisms through which debt financing affects profitability. The results show that short-term and long-term debt impact profitability negatively with 10-year lagged R&D intensity and financial distress. Biopharmaceutical firms heavily invest in R&D, often necessitating debt financing. However, the finding reveals that long-term debt negatively impacts profitability when combined with 10-year lagged R&D intensity and financial distress. This suggests that, while R&D is essential for innovation, high levels of R&D spending paired with long-term debt can strain profitability. Similarly, financial distress exacerbates the negative effects of long-term debt, highlighting the need for effective financial distress management.

This paper contributes to the existing literature that relates how the composition of debt affects profitability. Some studies (

Tyagi & Nauriyal, 2016;

Pervan et al., 2019) overlook how short-term and long-term debt impact profitability separately.

This study contributes to the literature by providing a comprehensive examination of the interaction between long-term debt, lagged R&D, and financial distress within the biopharmaceutical industry. It offers practical insights for financial managers and policymakers seeking to align debt financing strategies with long-term profitability and sustainability.

This study focuses on the biopharmaceutical industry, which is characterized by increased competitiveness, which drives innovation. In response to the need for constant innovation, biopharmaceutical businesses frequently rely on higher debt to fund projects. However, my findings show that increased debt levels are associated with a decrease in profitability, defying the understanding that debt drives growth and financial success in this dynamic market.

The rest of this paper is organized as follows:

Section 2 reviews the relevant theoretical and empirical literature.

Section 3 outlines the data and empirical methodology, which includes empirical estimation methods. The empirical findings are presented in

Section 4. In

Section 5, this study’s summary and conclusion are presented. The data and variables used in this study is described in the

Appendix A.

2. Literature Review and Development of Hypotheses

According to

Modigliani and Miller (

1958);

Frank and Goyal (

2009); and

DeAngelo and Roll (

2015), debt does not affect the value of the firm, so any structure of debt adopted by any firm at any point in time is as good as any other in the absence of corporate tax. Relaxing certain assumptions of the M&M theory from their original proposition in the earlier literature has shown that capital structure can influence profitability

1.

Tyagi and Nauriyal (

2016) examined the profitability of the Indian biopharmaceutical sector. Their study employed an OLS regression model with Driscoll–Kraay standard errors and used inflation-adjusted panel data from 2000 to 2013. Export intensity, advertising and market intensity, firm market power, and a stronger patent regime all contribute positively to profitability. According to MM theory, firms can enhance profitability by increasing debt financing to take advantage of tax shields. Therefore, higher leverage is expected to have a positive impact on profitability.

Some authors, including

Myers (

1977),

Jensen and Meckling (

1976),

Jensen and Meckling (

1976),

Harris and Raviv (

1991),

Ahmed et al. (

2017), and

Fosu (

2013), have improved the classic capital structure by incorporating control variables. The authors conducted empirical studies based on several capital structure theories. Various theories include trade off, pecking-order, information asymmetry, signaling, product/input market interaction, and market-timing theories.

Consequently, in 1958, Modigliani–Miller’s MM theory was developed into trade-off theory

2. The trade-off theory focuses on debt repayment and costs of debt issuance, and it predicts that a desirable target debt ratio would add value to the business. Rather than constantly issuing debt to improve firm value, the trade-off theory asserts that firms must strive towards a specific level of debt financing to achieve the optimal company value.

Kraus and Litzenberger (

1973);

López-Gracia and Sogorb-Mira (

2008); and

Graham and Leary (

2011) stated that firms should aim for debt levels that maximize tax benefits while minimizing bankruptcy risks.

Jawade (

2014) analyzed the effect of capital structure on biopharmaceutical company performance across a range of market capitalizations. The author showed that capital structure provides growth prospects, maintains solvency, and provides an excellent return to stakeholders without the dilution of management control; firms must trade-off between the tax benefits of debt and the consequences of bankruptcy.

Myers and Majluf (

1984) and

Lemmon et al. (

2008) posited the pecking order theory as an alternative to the trade-off theory. According to this hypothesis, when a company needs external funding, it favors debt over equity. It also predicts that riskier firms will have higher leverage ratios. Investors and managers have a greater incentive to take on riskier projects when a firm’s debt financing allocation rises.

Mohammadzadeh et al. (

2013) examined the relationship between capital structure and profitability in Iranian bio-pharmaceutical enterprises. The top 30 Iranian biopharmaceutical businesses were studied, and their financial data was collected from 2001 to 2010. This study used the net margin profit and the debt ratio as profitability and capital structure indices, respectively, with sales growth as a control variable. The findings revealed a significant negative association between debt and profitability. The results also support the pecking order theory in Iranian biopharmaceutical companies. They indicate that increased debt financing negatively affects profitability, consistent with the theory’s emphasis on prioritizing internal financing over external debt due to its associated costs and risks. Other researchers have similarly concluded that internal funds, such as retained earnings, are the preferred first source of financing, with debt securities used only when internal resources are insufficient (

Frank & Goyal, 2009;

Rasiah & Kim, 2011).

Thus, the use of debt to finance investment projects in the biopharmaceutical industry can positively or negatively affect profitability in a competitive environment. I argue that debt financing does not only affect profitability directly but also influences biopharmaceutical firms’ profitability indirectly through 10-year lagged R&D and financial distress.

2.1. Development of Hypotheses

Three key testable hypotheses are established based on theoretical predictions and historical empirical evidence.

The relationship between debt financing and profitability

Debt financing involves borrowing funds to support business operations or investments, which is either short-term or long-term debt (

Allen, 2019). The combination of short-term and long-term debt is the total debt. Debt requires firms to make periodic interest payments, which not only reduce profits in the current accounting period but may also limit available cash for operations in the subsequent period. Debt financing can provide a tax shelter for profits associated with high financial risk; hence, all firms should consider how much debt capital they should maintain to benefit from such trade-offs. The costs of securing new external financing are generally higher than those of using internal funds, as internal financing avoids transaction costs. Previous studies have found mixed evidence regarding the relationship between debt financing and profitability: some report a positive association (

Habib et al., 2016;

Margaritis & Psillaki, 2010), while others observe a negative link (

Habib et al., 2016;

Sadiq & Sher, 2016).

Weill et al. (

2008) further demonstrate that the impact of debt financing on firm performance can be either positive or negative, depending on industry history, current economic conditions, and broader macroeconomic factors. Given these complexities, it is important to empirically test how different levels of debt relate to firm profitability. Accordingly, I examine the following:

Hypothesis 1. Debt finance has a significant relationship with profitability.

Short-term debt refers to obligations that last shorter than a year and are typically related to internal or external company concerns while long-term debt refers to a company’s borrowing or external finance that is repayable over a longer period of time. Short-term debt is riskier and has a greater impact on profitability than long-term debt due to several factors. The frequent and immediate repayment schedules associated with short-term debt create significant liquidity pressures, forcing firms to allocate substantial cash flow to debt servicing. This can strain resources, limit funds available for strategic investments like R&D and reduce overall financial flexibility. Additionally, short-term debt often comes with higher and more volatile interest rates, increasing interest expenses and financial uncertainty. Short-term debt has a greater negative influence on biopharmaceutical industry profitability than long-term debt because of higher periodic interest payments and the urgency of repayment. I hypothesize that

Hypothesis 2. Short-term debt has a more negative impact on profitability than long-term debt.

2.2. Mechanisms Through Which Debt Financing Affects Profitability

Interaction between debt and lagged of R&D on Profitability

R&D investments in the biopharmaceutical industry typically take considerable time to impact a firm’s profitability. Firstly, new drugs undergo extensive preclinical and clinical trials spanning approximately 10 years. Secondly, FDA approval is essential to ensure safety, efficacy, and quality, adding complexity and time to the process. Thirdly, translating successful R&D into economic benefits involves patenting innovations, a time-consuming process to protect against competitors. Therefore, immediate financial gains from R&D investments may not be realized if the benefits of innovative products do not sufficiently outweigh their costs. Thus, the impact of debt on profitability when combined with lagged R&D investments in the biopharmaceutical industry can vary.

Wang and Wu (

2014) and

Lim and Rokhim (

2020) found a negative impact of current expenditure on performance using the ROA but a positive and significant effect of one-year lagged expenditure on profitability. Debt may provide necessary funding for R&D activities, contributing positively to future profitability through innovation and market competitiveness. However, excessive debt levels could increase financial risk and interest expenses, potentially negatively impacting profitability. I hypothesized that

Hypothesis 3a. There is a significant effect of debt and lagged R&D on a firm’s profitability.

2.3. Interaction Between Debt and Financial Distress on Profitability

Financially distressed biopharmaceutical firms with high debt face adverse impacts on profitability due to increased interest expenses, the risk of default, reduced investor confidence and market valuation, strategic constraints on R&D and growth investments, heightened regulatory scrutiny, and competitive disadvantages against financially stable peers. These factors collectively hinder financial stability, operational effectiveness, and long-term growth prospects in a competitive industry reliant on innovation and regulatory compliance. Therefore, I hypothesize that

Hypothesis 3b. There is a negative effect of debt and financially distressed firms on a firm’s profitability.

6. Conclusions and Recommendations

Debt financing is important for financing major investments like R&D in the biopharmaceutical industry. Debt financing allows companies to raise funds without giving up ownership or control through indenture and covenants of the company. Debt financing provides greater flexibility for firms in the biopharmaceutical industry to finance highly intensive research and development (R&D).

The choice of debt financing is an important decision for companies aiming to fund their projects. This paper poses research questions: How do short-term and long-term debt impact profitability within the biopharmaceutical industry? What are the ways through which short-term and long-term debt affect profitability? The diverse range of debt instruments, both short and long term, provides flexibility in financial strategies.

The results show that short-term debt, long-term debt, and total debt negatively impact the return on assets (ROA) as a firm’s profitability measure. A comparison is made between American and European biopharmaceutical firms, and the result shows that the negative effects of short-term and long-term debt on profitability persist more for US biopharmaceutical firms than European firms. Short-term and long-term debt both impact profitability negatively with 10-year lagged R&D intensity and financial distress. Short-term debt’s negative impact is stronger post-COVID-19, indicating increased financial strain. Long-term debt consistently affects profitability negatively, with relatively stable effects during the pre- and post-COVID-19 periods.

The empirical findings from this research have some interesting implications for policymakers in the biopharmaceutical industry. Firstly, they emphasize the importance of prudent debt management strategies, particularly for US biopharmaceutical firms, where the negative impact of both short-term and long-term debt on profitability is more pronounced compared to European counterparts. This suggests a need for careful monitoring and sustainable debt practices to mitigate financial strain, especially post-COVID-19.