Highlighting the Role of Morality in News Framing and Its Short-Term Effects on Stock Market Fluctuations

Abstract

1. Introduction

2. The Model of Intuitive Morality and Exemplars

3. Morality in News Frames

4. News Frames and Stock Market Movement

5. Results

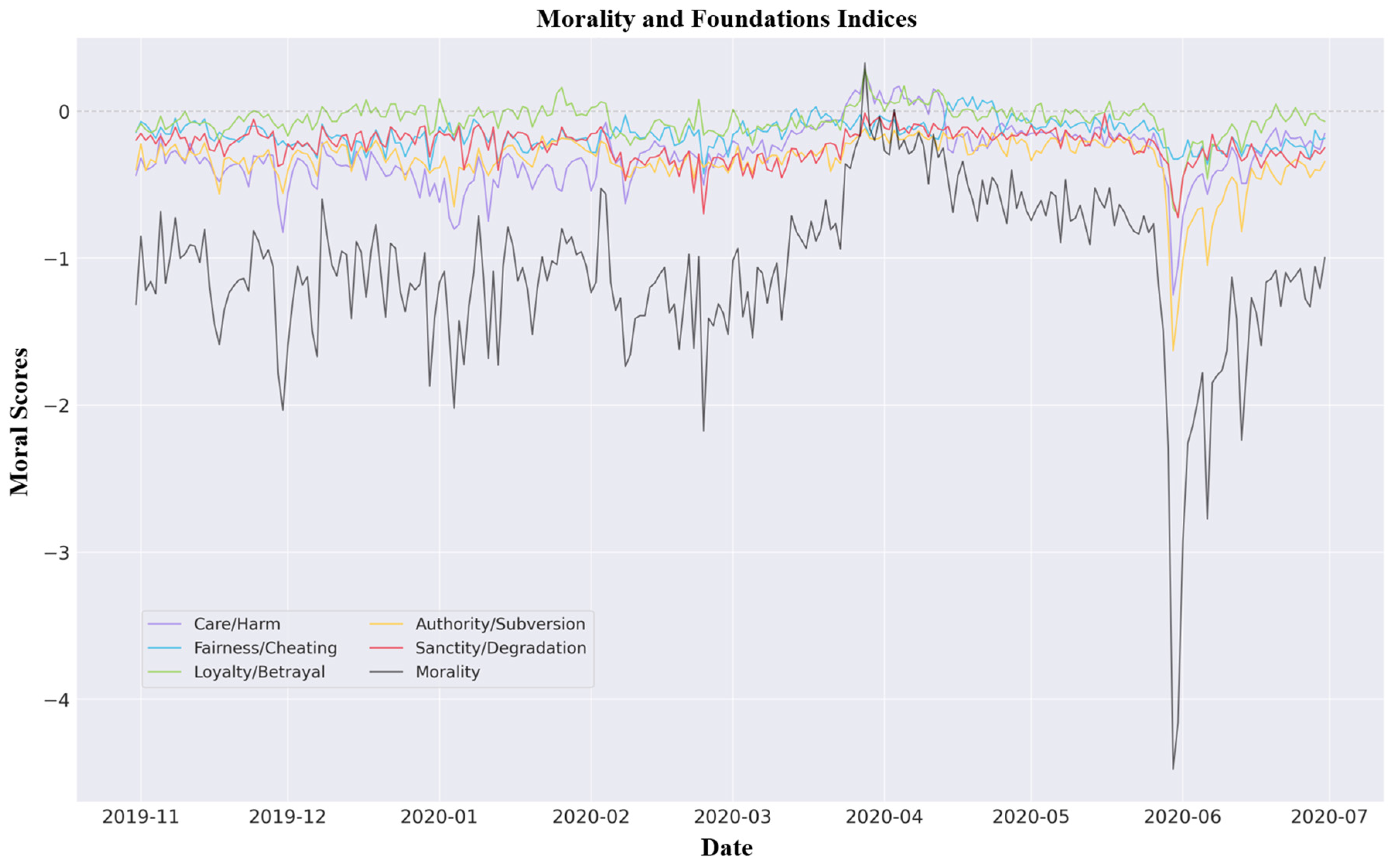

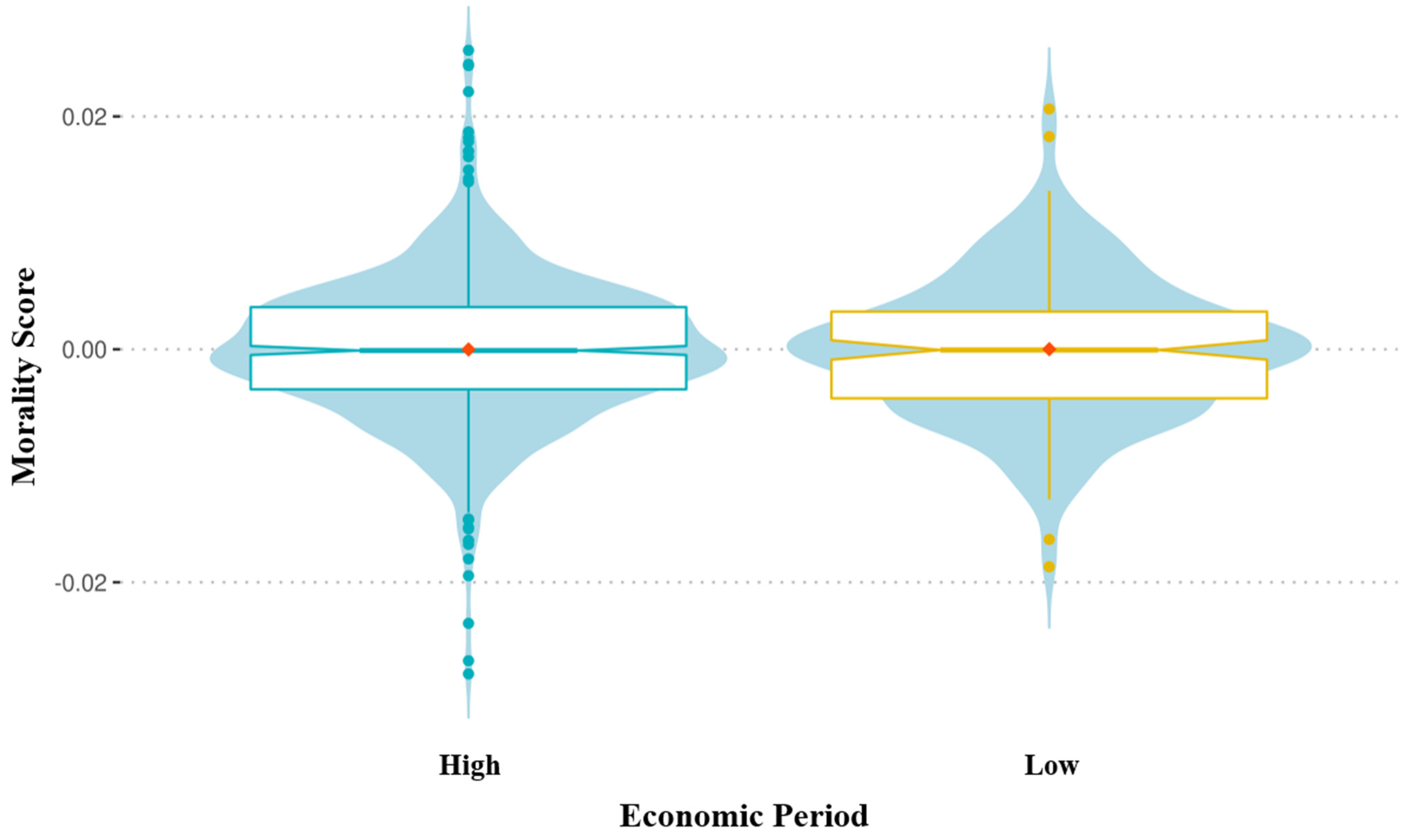

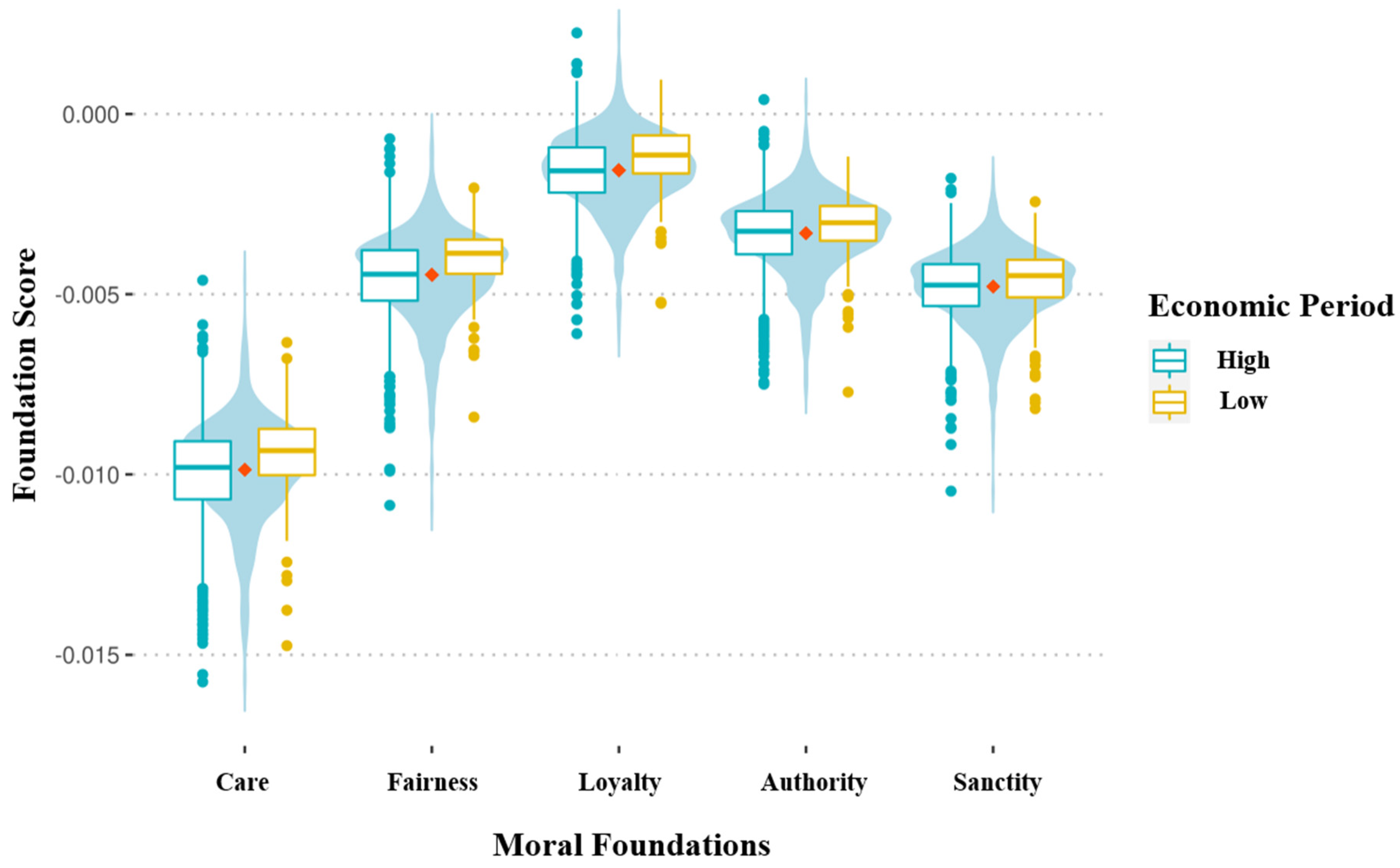

5.1. Exploration

5.2. Model Fit

5.3. Model Parameters

5.4. Predictive Causality

6. Discussion

7. Method

Data Collection

8. Variables

8.1. Stock Market Data

8.2. News Sources

8.3. Morality

9. Analysis

9.1. Data Aggregation

9.2. Model Building

9.3. Predictive Causality

10. Data and Code

11. Limitations and Future Research

12. Conclusions

Supplementary Materials

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

| 1 | https://en.wikipedia.org/wiki/2020_stock_market_crash (accessed on 29 May 2025). |

| 2 | |

| 3 | |

| 4 | |

| 5 |

References

- Amin, A. B., Bednarczyk, R. A., Ray, C. E., Melchiori, K. J., Graham, J., Huntsinger, J. R., & Omer, S. B. (2017). Association of moral values with vaccine hesitancy. Nature Human Behaviour, 1(12), 873–880. [Google Scholar] [CrossRef] [PubMed]

- Antweiler, W., & Frank, M. Z. (2004). Is all that talk just noise? The information content of internet stock message boards. The Journal of Finance, 59(3), 1259–1294. [Google Scholar] [CrossRef]

- Aveh, F. K., & Awunyo-Vitor, D. (2017). Firm-specific determinants of stock prices in an emerging capital market: Evidence from Ghana stock exchange. Cogent Economics & Finance, 5(1), 1339385. [Google Scholar] [CrossRef]

- Bates, D., Mächler, M., Bolker, B., & Walker, S. (2015). Fitting linear mixed-effects models using lme4. Journal of Statistical Software, 67(1), 1–48. [Google Scholar] [CrossRef]

- Bollen, J., Mao, H., & Zeng, X. (2011). Twitter mood predicts the stock market. Journal of Computational Science, 2(1), 1–8. [Google Scholar] [CrossRef]

- Bouazizi, M., & Ohtsuki, T. (2015, August 25–28). Opinion mining in twitter how to make use of sarcasm to enhance sentiment analysis. 2015 IEEE/ACM International Conference on Advances in Social Networks Analysis and Mining (pp. 1594–1597), Paris, France. [Google Scholar] [CrossRef]

- Brady, W. J., Wills, J. A., Jost, J. T., Tucker, J. A., & Bavel, J. J. V. (2017). Emotion shapes the diffusion of moralized content in social networks. Proceedings of the National Academy of Sciences USA, 114(28), 7313–7318. [Google Scholar] [CrossRef]

- Chan, E. Y. (2021). Moral foundations underlying behavioral compliance during the COVID-19 pandemic. Personality and Individual Differences, 171, 110463. [Google Scholar] [CrossRef]

- Chan, W. S. (2003). Stock price reaction to news and no-news: Drift and reversal after headlines. Journal of Financial Economics, 70(2), 223–260. [Google Scholar] [CrossRef]

- Checkley, M. S., Higón, D. A., & Alles, H. (2017). The hasty wisdom of the mob: How market sentiment predicts stock market behavior. Expert Systems with Applications, 77, 256–263. [Google Scholar] [CrossRef]

- Clifford, S., & Jerit, J. (2013). How words do the work of politics: Moral foundations theory and the debate over stem cell research. The Journal of Politics, 75(3), 659–671. [Google Scholar] [CrossRef]

- Cohen-Charash, Y., Scherbaum, C. A., Kammeyer-Mueller, J. D., & Staw, B. M. (2013). Mood and the market: Can press reports of investors’ mood predict stock prices? PLoS ONE, 8(8), e72031. [Google Scholar] [CrossRef]

- D’Angelo, P. (2017). Framing: Media frames. In P. Rössler, C. A. Hoffner, & L. Zoonen (Eds.), The international encyclopedia of media effects (1st ed., pp. 1–10). Wiley. [Google Scholar] [CrossRef]

- Das, S. R., & Chen, M. Y. (2007). Yahoo! for Amazon: Sentiment extraction from small talk on the web. Management Science, 53(9), 1375–1388. [Google Scholar] [CrossRef]

- Davis, A. K., Piger, J. M., & Sedor, L. M. (2012). Beyond the numbers: Measuring the information content of earnings press release language. Contemporary Accounting Research, 29(3), 845–868. [Google Scholar] [CrossRef]

- Ferguson, N. J., Philip, D., Lam, H., & Guo, J. M. (2015). Media content and stock returns: The predictive power of press. Multinational Finance Journal, 19(1), 1–31. Available online: https://ssrn.com/abstract=2611046 (accessed on 29 May 2025). [CrossRef]

- Gan, B., Alexeev, V., Bird, R., & Yeung, D. (2020). Sensitivity to sentiment: News vs social media. International Review of Financial Analysis, 67, 101390. [Google Scholar] [CrossRef]

- Garcia, D. (2013). Sentiment during recessions. The Journal of Finance, 68(3), 1267–1300. [Google Scholar] [CrossRef]

- Goonatilake, R., & Herath, S. (2007). The volatility of the stock market and news. International Research Journal of Finance and Economics, 3(11), 53–65. [Google Scholar]

- Graham, J., Haidt, J., Koleva, S., Motyl, M., Iyer, R., Wojcik, S. P., & Ditto, P. H. (2013). Moral foundations theory: The pragmatic validity of moral pluralism. In P. Devine, & A. Plant (Eds.), Advances in experimental social psychology (Vol. 47, pp. 55–130). Academic Press. [Google Scholar] [CrossRef]

- Graham, J., Haidt, J., Motyl, M., Meindl, P., Iskiwitch, C., & Mooijman, M. (2017). Moral foundations theory: On the advantages of moral pluralism over moral monism. In K. Gray, & J. Graham (Eds.), Atlas of moral psychology (pp. 211–222). The Guilford Press. [Google Scholar]

- Graham, J., Haidt, J., & Nosek, B. A. (2009). Liberals and conservatives rely on different sets of moral foundations. Journal of Personality and Social Psychology, 96(5), 1029–1046. [Google Scholar] [CrossRef]

- Graham, J., Nosek, B. A., Haidt, J., Iyer, R., Koleva, S., & Ditto, P. H. (2011). Mapping the moral domain. Journal of Personality and Social Psychology, 101(2), 366–385. [Google Scholar] [CrossRef]

- Granger, C. W. J. (1969). Investigating causal relations by econometric models and cross-spectral methods. Econometrica, 37(3), 424–438. [Google Scholar] [CrossRef]

- Groß-Klußmann, A., König, S., & Ebner, M. (2019). Buzzwords build momentum: Global financial Twitter sentiment and the aggregate stock market. Expert Systems with Applications, 136, 171–186. [Google Scholar] [CrossRef]

- Haidt, J., & Graham, J. (2007). When morality opposes justice: Conservatives have moral intuitions that liberals may not recognize. Social Justice Research, 20(1), 98–116. [Google Scholar] [CrossRef]

- Harris, C., Myers, A., & Kaiser, A. (2023). The humanizing effect of market interaction. Journal of Economic Behavior & Organization, 205, 489–507. [Google Scholar] [CrossRef]

- Hoffmann, M., Santos, F. G., Neumayer, C., & Mercea, D. (2022). Lifting the veil on the use of big data news repositories: A documentation and critical discussion of a protest event analysis. Communication Methods and Measures, 16(4), 283–302. [Google Scholar] [CrossRef]

- Hoover, J., Johnson, K., Boghrati, R., Graham, J., & Dehghani, M. (2018). Moral framing and charitable donation: Integrating exploratory social media analyses and confirmatory experimentation. Collabra: Psychology, 4(1), 9. [Google Scholar] [CrossRef]

- Hopp, F. R., Fisher, J. T., Cornell, D., Huskey, R., & Weber, R. (2021). The extended Moral Foundations Dictionary (eMFD): Development and applications of a crowd-sourced approach to extracting moral intuitions from text. Behavior Research Methods, 53, 232–246. [Google Scholar] [CrossRef]

- Hopp, F. R., Schaffer, J. A., Fisher, J. T., & Weber, R. (2019). iCoRe: The GDELT interface for the advancement of communication research. Computational Communication Research, 1(1), 13–44. [Google Scholar] [CrossRef]

- Iyer, R., Koleva, S., Graham, J., Ditto, P., & Haidt, J. (2012). Understanding libertarian morality: The psychological dispositions of self-identified libertarians. PLoS ONE, 7(8), e42366. [Google Scholar] [CrossRef]

- Jang, S. M., & Hart, P. S. (2015). Polarized frames on “climate change” and “global warming” across countries and states: Evidence from Twitter big data. Global Environmental Change, 32, 11–17. [Google Scholar] [CrossRef]

- Jegadeesh, N., & Wu, D. (2013). Word power: A new approach for content analysis. Journal of Financial Economics, 110(3), 712–729. [Google Scholar] [CrossRef]

- Jiao, P., Veiga, A., & Walther, A. (2020). Social media, news media and the stock market. Journal of Economic Behavior & Organization, 176, 63–90. [Google Scholar] [CrossRef]

- Kanavos, A., Vonitsanos, G., Mohasseb, A., & Mylonas, P. (2020, October 29–30). An entropy-based evaluation for sentiment analysis of stock market prices using Twitter data. 15th International Workshop on Semantic and Social Media Adaptation and Personalization (pp. 1–7), Zakynthos, Greece. [Google Scholar] [CrossRef]

- Kearney, C., & Liu, S. (2014). Textual sentiment in finance: A survey of methods and models. International Review of Financial Analysis, 33, 171–185. [Google Scholar] [CrossRef]

- Lecheler, S., & De Vreese, C. H. (2019). News framing effects: Theory and practice (p. 138). Taylor & Francis. [Google Scholar] [CrossRef]

- Leetaru, K., & Schrodt, P. A. (2013). GDELT: Global data on events, location and tone, 1979–2012. International Studies Association Meeting, 2(4), 1–49. [Google Scholar]

- Malik, M., Hopp, F. R., Chen, Y., & Weber, R. (2021). Does regional variation in pathogen prevalence predict the moralization of language in COVID-19 news? Journal of Language and Social Psychology, 40(5–6), 653–676. [Google Scholar] [CrossRef]

- Malik, M., Youk, S., Hopp, F. R., Curry, O. S., Cheong, M., Alfano, M., & Weber, R. (2025). The extended Morality as Cooperation Dictionary (eMACD): A crowd-sourced approach via the moral narrative analyzer platform. Communication Methods and Measures, 1–31. [Google Scholar] [CrossRef]

- Malik, M., Youk, S., & Weber, R. (2024). Beyond the screen: Exploring moral understanding via user comments on YouTube short films. Journal of Media Psychology: Theories, Methods, and Applications, 36(4), 231–243. [Google Scholar] [CrossRef]

- Malkiel, B. G. (2003). The efficient market hypothesis and its critics. Journal of Economic Perspective, 17(1), 59–82. [Google Scholar] [CrossRef]

- Mian, G. M., & Sankaraguruswamy, S. (2012). Investor sentiment and stock market response to earnings news. The Accounting Review, 87(4), 1357–1384. [Google Scholar] [CrossRef]

- Mooijman, M., Hoover, J., Lin, Y., Ji, H., & Dehghani, M. (2018). Moralization in social networks and the emergence of violence during protests. Nature Human Behaviour, 2(6), 389–396. [Google Scholar] [CrossRef]

- Morgan, G. S., Skitka, L. J., & Wisneski, D. C. (2010). Moral and religious convictions and intentions to vote in the 2008 presidential election: Moral and religious convictions. Analyses of Social Issues and Public Policy, 10(1), 307–320. [Google Scholar] [CrossRef]

- Narayan, P. K., Narayan, S., & Singh, H. (2014). The determinants of stock prices: New evidence from the Indian banking sector. Emerging Markets Finance and Trade, 50(2), 5–15. [Google Scholar] [CrossRef]

- Nyman, R., Kapadia, S., & Tuckett, D. (2021). News and narratives in financial systems: Exploiting big data for systemic risk assessment. Journal of Economic Dynamics and Control, 127, 104119. [Google Scholar] [CrossRef]

- Oliveira, N., Cortez, P., & Areal, N. (2017). The impact of microblogging data for stock market prediction: Using Twitter to predict returns, volatility, trading volume and survey sentiment indices. Expert Systems with Applications, 73, 125–144. [Google Scholar] [CrossRef]

- Prabhu, S., Hahn, L., Tamborini, R., & Grizzard, M. (2020). Do morals featured in media content correspond with moral intuitions in media users?: A test of the MIME in two cultures. Journal of Broadcasting & Electronic Media, 64(2), 255–276. [Google Scholar] [CrossRef]

- Price, S. M., Doran, J. S., Peterson, D. R., & Bliss, B. A. (2012). Earnings conference calls and stock returns: The incremental informativeness of textual tone. Journal of Banking & Finance, 36(4), 992–1011. [Google Scholar] [CrossRef]

- Priniski, J. H., Mokhberian, N., Harandizadeh, B., Morstatter, F., Lerman, K., Lu, H., & Brantingham, P. J. (2021). Mapping moral valence of tweets following the killing of George Floyd. arXiv, arXiv:2104.09578. Available online: http://arxiv.org/abs/2104.09578 (accessed on 29 May 2025).

- R Core Team. (2021). R: A language and environment for statistical computing. R Foundation for Statistical Computing. Available online: https://www.R-project.org/ (accessed on 29 May 2025).

- Rozin, P., & Royzman, E. B. (2001). Negativity bias, negativity dominance, and contagion. Personality and Social Psychology Review, 5(4), 296–320. [Google Scholar] [CrossRef]

- Schumaker, R. P., Zhang, Y., Huang, C.-N., & Chen, H. (2012). Evaluating sentiment in financial news articles. Decision Support Systems, 53(3), 458–464. [Google Scholar] [CrossRef]

- Sheehan, R. G., & Grieves, R. (1982). Sunspots and cycles: A test of causation. Southern Economic Journal, 48, 775–777. [Google Scholar] [CrossRef]

- Shojaie, A., & Fox, E. B. (2022). Granger causality: A review and recent advances. Annual Review of Statistics and Its Application, 9(1), 289–319. [Google Scholar] [CrossRef]

- Strauß, N., Vliegenthart, R., & Verhoeven, P. (2018). Intraday news trading: The reciprocal relationships between the stock market and economic news. Communication Research, 45(7), 1054–1077. [Google Scholar] [CrossRef]

- Strycharz, J., Strauss, N., & Trilling, D. (2018). The role of media coverage in explaining stock market fluctuations: Insights for strategic financial communication. International Journal of Strategic Communication, 12(1), 67–85. [Google Scholar] [CrossRef]

- Tamborini, R. (2011). Moral intuition and media entertainment. Journal of Media Psychology, 23(1), 39–45. [Google Scholar] [CrossRef]

- Tamborini, R. (2013). Model of intuitive morality and exemplars. In R. Tamborini (Ed.), Media and the moral mind. Routledge. [Google Scholar]

- Tamborini, R., & Weber, R. (2020). Advancing the model of intuitive morality and exemplars. In The handbook of communication science and biology (pp. 456–469). Routledge. [Google Scholar]

- Tetlock, P. C. (2007). Giving content to investor sentiment: The role of media in the stock market. The Journal of Finance, 62(3), 1139–1168. [Google Scholar] [CrossRef]

- Tetlock, P. C., Saar-Tsechansky, M., & Macskassy, S. (2008). More than words: Quantifying language to measure firms’ fundamentals. The Journal of Finance, 63(3), 1437–1467. [Google Scholar] [CrossRef]

- van Leeuwen, F., Park, J. H., Koenig, B. L., & Graham, J. (2012). Regional variation in pathogen prevalence predicts endorsement of group-focused moral concerns. Evolution and Human Behavior, 33(5), 429–437. [Google Scholar] [CrossRef]

- van Vliet, L. (2021). Moral expressions in 280 characters or less: An analysis of politician tweets following the 2016 Brexit referendum vote. Frontiers in Big Data, 4, 699653. [Google Scholar] [CrossRef]

- Veronesi, P. (1999). Stock market overreaction to bad news in good times: A rational expectations equilibrium model. The Review of Financial Studies, 12(5), 33. [Google Scholar] [CrossRef]

- Wang, T.-L. (2012). Presentation and impact of market-driven journalism on sensationalism in global TV news. International Communication Gazette, 74(8), 711–727. [Google Scholar] [CrossRef]

- Wang, Y., & Deng, H. (2018). Expectations, behavior, and stock market volatility. Emerging Markets Finance and Trade, 54(14), 3235–3255. [Google Scholar] [CrossRef]

- Welbers, K., Van Atteveldt, W., Bajjalieh, J., Shalmon, D., Joshi, P. V., Althaus, S., Chan, C. H., Wessler, H., & Jungblut, M. (2022). Linking event archives to news: A computational method for analyzing the gatekeeping process. Communication Methods and Measures, 16(1), 59–78. [Google Scholar] [CrossRef]

- Wolsko, C., Ariceaga, H., & Seiden, J. (2016). Red, white, and blue enough to be green: Effects of moral framing on climate change attitudes and conservation behaviors. Journal of Experimental Social Psychology, 65, 7–19. [Google Scholar] [CrossRef]

- Yu, Y., Duan, W., & Cao, Q. (2013). The impact of social and conventional media on firm equity value: A sentiment analysis approach. Decision Support Systems, 55(4), 919–926. [Google Scholar] [CrossRef]

- Zhang, Y., Thorgusen, S., & Fan, X. (2022). News coverage of social protests in global society. International Journal of Comparative Sociology, 63(3), 105–127. [Google Scholar] [CrossRef]

- Zillmann, D., Chen, L., Knobloch, S., & Callison, C. (2004). Effects of lead framing on selective exposure to internet news reports. Communication Research, 31(1), 58–81. [Google Scholar] [CrossRef]

| Model 1 (Morality) | Model 2 (Foundations) | |||

|---|---|---|---|---|

| Fixed Effects | β | p | β | p |

| Intercept | 0.03 | 0.41 | 0.04 | 0.22 |

| Intraday Hours | −0.02 | 0.61 | −0.02 | 0.55 |

| Economic Period | −0.18 | 0.02 | −0.21 | 0.00 |

| Morality | 0.01 | 0.69 | ||

| Economic Period × Morality | 0.15 | 0.02 | ||

| Care | 0.01 | 0.85 | ||

| Fairness | −0.02 | 0.69 | ||

| Loyalty | −0.04 | 0.53 | ||

| Authority | 0.06 | 0.37 | ||

| Sanctity | 0.00 | 0.98 | ||

| Economic Period × Care | 0.11 | 0.58 | ||

| Economic Period × Fairness | 0.08 | 0.65 | ||

| Economic Period × Loyalty | −0.13 | 0.52 | ||

| Economic Period × Authority | −0.45 | 0.02 | ||

| Economic Period × Sanctity | 0.60 | 0.00 | ||

| Random Effects | σ | σ2 | σ | σ2 |

| Intercept | 0.37 | 0.14 | 0.00 | 0.00 |

| Slope | 0.42 | 0.18 | 0.34 | 0.12 |

| Residual | 0.82 | 0.67 | 0.93 | 0.86 |

| Observations | 1005 | 1005 | ||

| Intraclass Correlation (ICC) | 0.17 | 0.00 | ||

| AIC/BIC | 2721/2765 | 2871/2955 | ||

| Pseudo R2 (Fixed) | 0.01 | 0.03 | ||

| Pseudo R2 (Total) | 0.32 | 0.14 |

| Model 1 (Morality) | Model 2 (Foundations) | |||

|---|---|---|---|---|

| Fixed Effects | β | p | β | p |

| Intercept | 0.03 | 0.41 | 0.03 | 0.41 |

| Intraday Hours | −0.02 | 0.57 | −0.03 | 0.53 |

| Economic Period | −0.18 | 0.02 | −0.18 | 0.02 |

| Morality | 0.02 | 0.46 | ||

| Economic Period × Morality | −0.01 | 0.86 | ||

| Care | 0.02 | 0.70 | ||

| Fairness | 0.03 | 0.60 | ||

| Loyalty | 0.07 | 0.26 | ||

| Authority | −0.05 | 0.41 | ||

| Sanctity | −0.04 | 0.53 | ||

| Economic Period × Care | 0.24 | 0.17 | ||

| Economic Period × Fairness | 0.11 | 0.48 | ||

| Economic Period × Loyalty | −0.24 | 0.16 | ||

| Economic Period × Authority | −0.11 | 0.50 | ||

| Economic Period × Sanctity | 0.04 | 0.76 | ||

| Random Effects | σ | σ2 | σ | σ2 |

| Intercept | 0.37 | 0.14 | 0.37 | 0.14 |

| Slope | 0.42 | 0.18 | 0.42 | 0.18 |

| Residual | 0.83 | 0.69 | 0.83 | 0.69 |

| Observations | 1005 | 1005 | ||

| Intraclass Correlation (ICC) | 0.16 | 0.16 | ||

| AIC/BIC | 2728/2772 | 2763/2847 | ||

| Pseudo R2 (Fixed) | 0.01 | 0.01 | ||

| Pseudo R2 (Total) | 0.32 | 0.32 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Wang, P.T.; Malik, M.; Weber, R. Highlighting the Role of Morality in News Framing and Its Short-Term Effects on Stock Market Fluctuations. Int. J. Financial Stud. 2025, 13, 107. https://doi.org/10.3390/ijfs13020107

Wang PT, Malik M, Weber R. Highlighting the Role of Morality in News Framing and Its Short-Term Effects on Stock Market Fluctuations. International Journal of Financial Studies. 2025; 13(2):107. https://doi.org/10.3390/ijfs13020107

Chicago/Turabian StyleWang, Paula T., Musa Malik, and René Weber. 2025. "Highlighting the Role of Morality in News Framing and Its Short-Term Effects on Stock Market Fluctuations" International Journal of Financial Studies 13, no. 2: 107. https://doi.org/10.3390/ijfs13020107

APA StyleWang, P. T., Malik, M., & Weber, R. (2025). Highlighting the Role of Morality in News Framing and Its Short-Term Effects on Stock Market Fluctuations. International Journal of Financial Studies, 13(2), 107. https://doi.org/10.3390/ijfs13020107