Examining the Impact of International Financial Reporting Standards Adoption on Financial Reporting Quality of Multinational Companies

Abstract

1. Introduction

2. Literature Reviews

2.1. International Financial Reporting Standards (IFRSs)

2.2. IFRS Adoption

2.3. Financial Reporting Quality (FRQ)

2.4. Internal Control System (ICS)

2.5. Indian Accounting Profession and Adoption of IFRSs in India

3. Methods

4. Results

4.1. Descriptive Analysis

4.2. Measurement Model Assessment

4.3. Contruct Quality Criteria Assessment

4.4. Model Fit Assessement

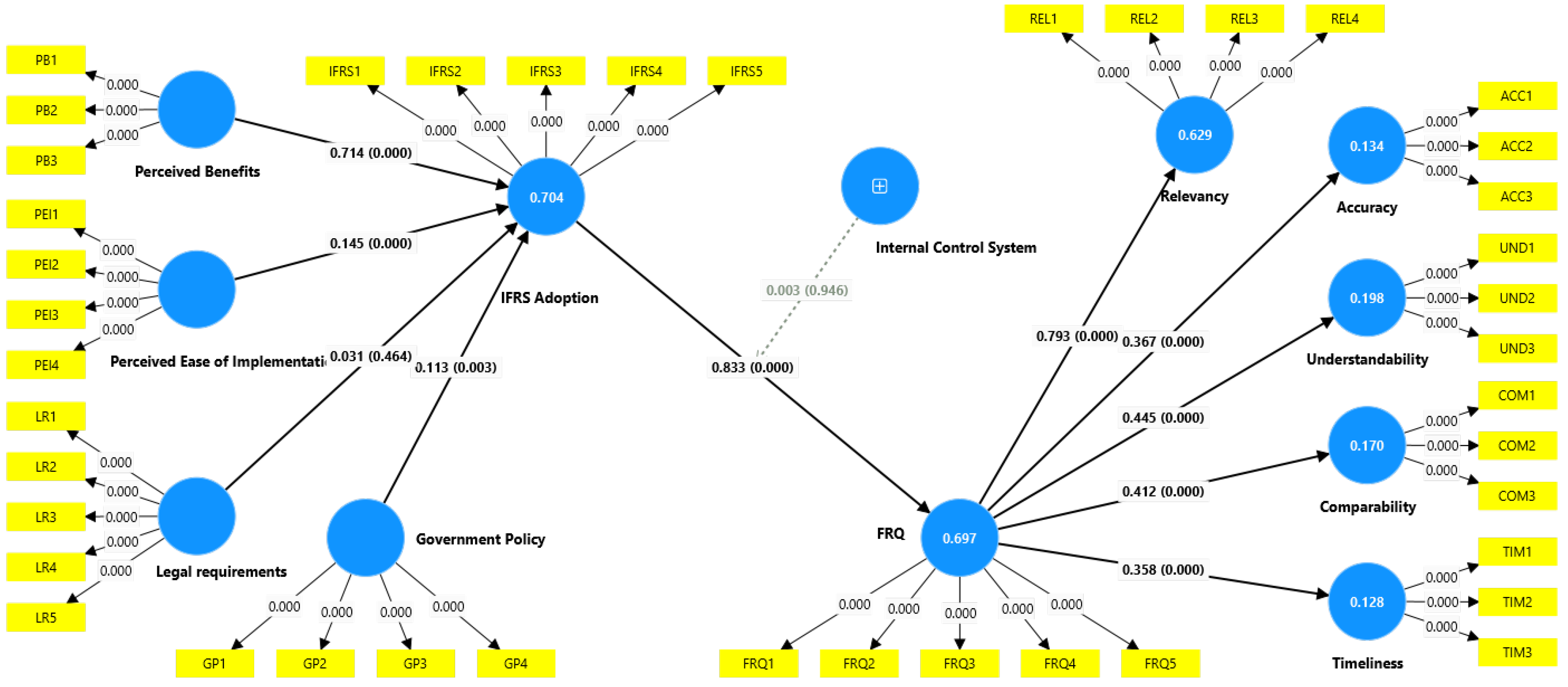

4.5. Structural Model Assessment

5. Discussion

6. Implications

7. Conclusions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A. Questionnaire

| Variables | Scale | Source |

|---|---|---|

| Perceived Benefits | I have greater confidence in the reliability of financial information presented under IFRS. | Zahid and Simga-Mugan (2024). Tlemsani et al. (2024); Kausar and Park (2024). |

| IFRS allows for a more accurate comparison of companies within the same industry. | ||

| Financial statements prepared under IFRS make assessing a company’s financial performance easier. | ||

| Perceived Ease of Implementation | Our organization has the necessary financial resources to implement IFRS effectively. | |

| Our accounting staff has the knowledge and expertise required to adopt IFRS. | ||

| Our IT systems are compatible with the data requirements of IFRS. | ||

| Obtaining management support for the IFRS adoption process will be easy. | ||

| Legal Requirements | There are clear and well-defined legal requirements for adopting IFRS in our country. | |

| The legal penalties for non-compliance with IFRS adoption are severe. | ||

| Our organization has a legal obligation to adopt IFRS. | ||

| The legal framework surrounding IFRS adoption is complex and challenging to understand. | ||

| There is a lack of legal guidance on implementing IFRS in our organization. | ||

| Government Policy | The government has provided adequate resources and support for companies to transition to IFRS. | |

| The government’s policy on IFRS adoption considers the specific needs of different industries in India. | ||

| The government effectively communicates the benefits of IFRS adoption to stakeholders. | ||

| The government’s enforcement of IFRS adoption is fair and consistent. | ||

| IFRS Adoption | IFRS adoption will improve the comparability of financial statements across different countries. | |

| IFRS adoption will lead to more transparent and informative financial reporting. | ||

| IFRS adoption will increase investor confidence in financial statements. | ||

| IFRS adoption will improve companies’ access to resources. | ||

| IFRS adoption will reduce the cost of capital for companies. | ||

| FRQ | The information presented in the financial statements is supported by reliable and verifiable evidence. | Vitolla et al. (2020b); Mardessi (2022); Kateb (2024) |

| The financial statements provide sufficient disclosures, allowing for independent information verification. | ||

| I am confident that an external auditor could effectively assess the accuracy of the financial statements. | ||

| The data can be used to identify areas for improvement in financial reporting practices. | ||

| It can be used to compare financial reporting practices across different companies or over time. | ||

| Relevancy | The financial statements provide information that is useful for making investment decisions. | |

| The financial statements contain current information that reflects the company’s recent performance. | ||

| The financial statements focus on key financial metrics that are relevant to the company’s industry. | ||

| The financial statements under IFRS allow for a clearer understanding of the company’s global operations. | ||

| Accuracy | The financial statements accurately reflect the company’s financial position and performance. | |

| The accounting policies used in the financial statements are appropriate and consistently applied. | ||

| I am confident that the financial statements are free from material errors or misstatements. | ||

| Understandability | The financial statements are presented clearly and concisely. | |

| The financial statements use terminology that is easy for users to understand. | ||

| The accompanying notes to the financial statements provide sufficient explanation of complex accounting concepts. | ||

| Comparability | The financial statements allow for company performance comparisons across different periods. | |

| The company uses accounting policies that are consistent with industry standards. | ||

| The financial statements are presented clearly and consistently from year to year. | ||

| Timeliness | The timeliness of financial reporting allows me to make informed decisions based on current information. | |

| IFRS adoption has streamlined the financial reporting process, leading to faster completion of financial statements. | ||

| The company releases its financial statements more promptly after the end of the reporting period than before IFRS adoption. |

References

- Abed, Ibtihal, Nazimah Hussin, Hossam Haddad, Tareq Hammad Almubaydeen, and Mostafa Ali. 2022. Creative accounting determination and financial reporting quality: The integration of transparency and disclosure. Journal of Open Innovation: Technology, Market, and Complexity 8: 38. [Google Scholar] [CrossRef]

- Adams, Carol, and Subhash Abhayawansa. 2022. Connecting the COVID-19 pandemic, environmental, social and governance (ESG) investing and calls for ‘harmonisation of sustainability reporting. Critical Perspectives on Accounting 82: 102309. [Google Scholar] [CrossRef]

- Ahmad, Ahmad Y. A. Bani, Hesham Abusaimeh, Abedalqader Rababah, Mohammad Alqsass, Nofan Hamed Al-Olima, and Mohammad Naser Hamdan. 2024. Assessment of effects in advances of accounting technologies on quality financial reports in Jordanian public sector. Uncertain Supply Chain Management 12: 133–42. [Google Scholar] [CrossRef]

- Almaqtari, Faozi A., Abdulwahid Abdullah Hashed, Mohd Shamim, and Waleed M. Al-Ahdal. 2021. Impact of corporate governance mechanisms on financial reporting quality: A study of Indian GAAP and Indian Accounting Standards. Problems and Perspectives in Management 18: 1. [Google Scholar] [CrossRef]

- Alruwaili, Waleed S., Abdullahi D. Ahmed, and Mahesh Joshi. 2023. IFRS adoption, firms’ investment efficiency and financial reporting quality: A new empirical assessment of moderating effects from Saudi listed firms. International Journal of Accounting & Information Management 31: 376–411. [Google Scholar]

- Alshamsi, Khuloud Humaid Saeed Mohammed, and Ahmad Nur Aizat Ahmad. 2024. Developing A Framework: Adoption of International Financial Reporting Standards (IFRS) and Its Implications on Organizational Performance. International Journal of Sustainable Construction Engineering and Technology 15: 112–26. [Google Scholar]

- Amin, Rubel, Bijay Prasad Kushwaha, and Md Helal Miah. 2023. The process optimisation method of the optimal online sales model of information product demand concerning the spillover effect. Journal of International Logistics and Trade 21: 62–83. [Google Scholar] [CrossRef]

- Amiri, Amiri Mdoe, Bijay Prasad Kushwaha, and Amitabh Mishra. 2024. Extending the reach of small-medium enterprises through new-age marketing technologies: Drivers of adoption and their impact on business performance. International Journal of Technoentrepreneurship 5: 26–48. [Google Scholar] [CrossRef]

- Amiri, Amiri Mdoe, Bijay Prasad Kushwaha, and Rajkumar Singh. 2023. Visualisation of global research trends and future research directions of digital marketing in small and medium enterprises using bibliometric analysis. Journal of Small Business and Enterprise Development 30: 621–41. [Google Scholar] [CrossRef]

- Anssari, Majid Ahmed A. L., and Suhail Abdullah Al-Tamimi. 2023. The Impact of International Financial Reporting Standards (IFRS) on Conditional Conservatism in the Financial Statements of Non-Financial Industry Sectors in the United Arab Emirates. Journal of Namibian Studies: History Politics Culture 33: 5392–419. [Google Scholar]

- Araya, Mónica. 2022. Exploring Terra Incognita: Non-Financial Reporting in Corporate Latin America. In Corporate Citizenship in Latin America: New Challenges for Business. London: Routledge, pp. 25–38. [Google Scholar]

- Arvidsson, Susanne, and John Dumay. 2022. Corporate ESG reporting quantity, quality and performance: Where to now for environmental policy and practice? Business Strategy and the Environment 31: 1091–110. [Google Scholar] [CrossRef]

- Ashraf, Musaib, Paul N. Michas, and Dan Russomanno. 2020. The impact of audit committee information technology expertise on the reliability and timeliness of financial reporting. The Accounting Review 95: 23–56. [Google Scholar] [CrossRef]

- Babu, Dinesh, and Bijay Prasad Kushwaha. 2024. Does Transformational Leadership Influence Employees’ Innovativeness and Mediate the Role of Organisational Culture? Empirical Evidence. International Research Journal of Multidisciplinary Scope 5: 428–40. [Google Scholar] [CrossRef]

- Ball, Ray, and Lakshmanan Shivakumar. 2006. The role of accruals in asymmetrically timely gain and loss recognition. Journal of Accounting Research 44: 207–42. [Google Scholar] [CrossRef]

- Ball, Ray, Sudarshan Jayaraman, and Lakshmanan Shivakumar. 2012. Audited financial reporting and voluntary disclosure as complements: A test of the confirmation hypothesis. Journal of Accounting and Economics 53: 136–66. [Google Scholar] [CrossRef]

- Barth, Mary E., Leslie D. Hodder, and Stephen R. Stubben. 2013. Financial reporting for employee stock options: Liabilities or equity? Review of Accounting Studies 18: 642–82. [Google Scholar] [CrossRef]

- Barth, Mary E., Wayne R. Landsman, Mark H. Lang, and Christopher D. Williams. 2018. Effects on comparability and capital market benefits of voluntary IFRS adoption. Journal of Financial Reporting 3: 1–22. [Google Scholar] [CrossRef]

- Beshimovna, Kilicheva Farida, Bazarova Ozoda Rakhimovna, and Irmukhamedova Muslima Dilshodovna. 2024. The need to transition to international financial reporting standards (ifrs) in Uzbekistan. European Journal of Emerging Technology and Discoveries 2: 1–5. [Google Scholar]

- Bland, J. Martin, and Douglas G. Altman. 1997. Statistics notes: Cronbach’s alpha. BMJ 314: 572. [Google Scholar] [CrossRef]

- Bose, Sudipta, Amitav Saha, Habib Zaman Khan, and Shajul Islam. 2017. Non-Financial Disclosure and Market-Based Firm Performance: The Initiation of Financial Inclusion. Journal of Contemporary Accounting & Economics 13: 263–81. [Google Scholar]

- Chen, Dong, Yi Li, Jiani Lu, and Chenming Li. 2024. Do international tax treaties govern financial report quality? Research in International Business and Finance 69: 102246. [Google Scholar] [CrossRef]

- Chen, Tai-Yuan, Chen-Lung Chin, Shiheng Wang, and Wei-Ren Yao. 2015. The effects of financial reporting on bank loan contracting in global markets: Evidence from mandatory IFRS adoption. Journal of International Accounting Research 14: 45–81. [Google Scholar] [CrossRef]

- Cheng, Qiang, Young Jun Cho, and Holly Yang. 2018. Financial reporting changes and the internal information environment: Evidence from SFAS 142. Review of Accounting Studies 23: 347–83. [Google Scholar] [CrossRef]

- Chi, Wuchun, Ling Lei Lisic, Linda A. Myers, Mikhail Pevzner, and Timothy A. Seidel. 2022. Does the visibility of an engagement partner’s association with recent client restatements increase fee pressures from non-restating clients? Accounting Horizons 36: 19–45. [Google Scholar] [CrossRef]

- Cohen, Jacob. 1988. Set correlation and contingency tables. Applied Psychological Measurement 12: 425–34. [Google Scholar] [CrossRef]

- Correa-Garcia, Jaime Andres, Maria Antonia Garcia-Benau, and Emma Garcia-Meca. 2020. Corporate governance and its implications for sustainability reporting quality in Latin American business groups. Journal of Cleaner Production 260: 121142. [Google Scholar] [CrossRef]

- Craja, Patricia, Alisa Kim, and Stefan Lessmann. 2020. Deep learning for detecting financial statement fraud. Decision Support Systems 139: 113421. [Google Scholar] [CrossRef]

- Daske, Holger, Luzi Hail, Christian Leuz, and Rodrigo Verdi. 2008. Mandatory IFRS reporting around the world: Early evidence on the economic consequences. Journal of Accounting Research 46: 1085–142. [Google Scholar] [CrossRef]

- Daske, Holger, Luzi Hail, Christian Leuz, and Rodrigo Verdi. 2013. Adopting a label: Heterogeneity in the economic consequences around IAS/IFRS adoptions. Journal of Accounting Research 51: 495–547. [Google Scholar] [CrossRef]

- De Villiers, Charl, and Umesh Sharma. 2020. A critical reflection on the future of financial, intellectual capital, sustainability and integrated reporting. Critical Perspectives on Accounting 70: 101999. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Weili Ge, Chad R. Larson, and Richard G. Sloan. 2011. Predicting material accounting misstatements. Contemporary Accounting Research 28: 17–82. [Google Scholar] [CrossRef]

- Doni, Federica, Silvio Bianchi Martini, Antonio Corvino, and Michela Mazzoni. 2020. Voluntary versus mandatory non-financial disclosure: EU Directive 95/2014 and sustainability reporting practices based on empirical evidence from Italy. Meditari Accountancy Research 28: 781–802. [Google Scholar] [CrossRef]

- Eshonqulov, Akmal Qudratovich. 2024. Assessing the Impact of International Cash Accounting Standards on Financial Statements of Enterprises. European Journal of Contemporary Business Law & Technology: Cyber Law, Blockchain, and Legal Innovations 1: 54–62. [Google Scholar]

- Francis, Jere R., Shawn Huang, Inder K. Khurana, and Raynolde Pereira. 2009. Does corporate transparency contribute to efficient resource allocation? Journal of Accounting Research 47: 943–89. [Google Scholar] [CrossRef]

- Ghosh, Saibal. 2011. Firm ownership type, earnings management and auditor relationships: Evidence from India. Managerial Auditing Journal 26: 350–69. [Google Scholar] [CrossRef]

- Hair, Joseph, and Abdullah Alamer. 2022. Partial Least Squares Structural Equation Modeling (PLS-SEM) in second language and education research: Guidelines using an applied example. Research Methods in Applied Linguistics 1: 100027. [Google Scholar] [CrossRef]

- Hair, Joseph F., Christian M. Ringle, and Marko Sarstedt. 2013. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning 46: 1–12. [Google Scholar] [CrossRef]

- Hamad, Salaheldin, Muhammad Umar Draz, and Fong-Woon Lai. 2020. The impact of corporate governance and sustainability reporting on integrated reporting: A conceptual framework. Sage Open 10: 2158244020927431. [Google Scholar] [CrossRef]

- Harymawan, Iman, Adib Minanurohman, Mohammad Nasih, Rohami Shafie, and Ismaanzira Ismail. 2023. Chief financial officer’s educational background from reputable universities and financial reporting quality. Journal of Accounting & Organizational Change 19: 566–87. [Google Scholar]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Hope, Ole-Kristian, Heng Yue, and Qinlin Zhong. 2020. China’s anti-corruption campaign and financial reporting quality. Contemporary Accounting Research 37: 1015–43. [Google Scholar] [CrossRef]

- Hosiyatovich, Jumaev Nadir, Rizaev Nurbek Kadirovich, and Isaev Fakhriddin Ikromovich. 2023. Organization of turkic states: Interoperation and accounting system. British Journal of Global Ecology and Sustainable Development 13: 116–29. [Google Scholar]

- Hsu, Yu-Lin, and Ya-Chih Yang. 2022. Corporate governance and financial reporting quality during the COVID-19 pandemic. Finance Research Letters 47: 102778. [Google Scholar] [CrossRef] [PubMed]

- Hu, Li-tze, and Peter M. Bentler. 1998. Fit indices in covariance structure modeling: Sensitivity to underparameterized model misspecification. Psychological Methods 3: 424. [Google Scholar] [CrossRef]

- Kateb, Ines. 2024. The bridge to quality financial reporting: Audit committees’ mediating role in IFRS implementation for emerging markets. Journal of Corporate Accounting & Finance 35: 250–68. [Google Scholar]

- Kausar, Asad, and You-il Park. 2024. International Financial Reporting Standards and the Macroeconomy. The Accounting Review 99: 1–22. [Google Scholar] [CrossRef]

- Khan, Habib Zaman, Sudipta Bose, Abu Taher Mollik, and Harun Harun. 2021. “Green washing” or “authentic effort”? An empirical investigation of the quality of sustainability reporting by banks. Accounting, Auditing & Accountability Journal 34: 338–69. [Google Scholar]

- Kliestik, Tomas, Jaroslav Belas, Katarina Valaskova, Elvira Nica, and Pavol Durana. 2021. Earnings management in V4 countries: The evidence of earnings smoothing and inflating. Economic Research-Ekonomska Istraživanja 34: 1452–70. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad. 2021. Paradigm shift in traditional lifestyle to digital lifestyle in Gen Z: A conception of consumer behaviour in the virtual business world. International Journal of Web Based Communities 17: 305–20. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, Atul Shiva, and Vikas Tyagi. 2023. How Investors’ Financial Well-being Influences Enterprises and Individual’s Psychological Fitness? Moderating Role of Experience under Uncertainty. Sustainability 15: 1699. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, and Md Helal Miah. 2023. Decision-making process of knowledge push service to improve organizational performance and efficiency: Developing knowledge push algorithm. VINE Journal of Information and Knowledge Management Systems. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, Gurleen Kaur, Navjit Singh, and Ambu Sharma. 2022a. Integrating employees, customers and technology to build an effective sustainable marketing strategy. International Journal of Sustainable Society 14: 310–22. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, Raj Kumar Singh, and Nikhil Varghese. 2024. Building a sustainable relationship between customers and marketers. International Journal of Business and Globalisation 36: 241–58. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, Vikas Tyagi, and Atul Shiva. 2021. Investigating the role of reinforcement and environmental factors in balancing the state of apprehension: Evidence from India. World Review of Entrepreneurship, Management and Sustainable Development 17: 142–60. [Google Scholar] [CrossRef]

- Kushwaha, Bijay Prasad, Vikas Tyagi, Pardeep Bawa Sharma, and Raj Kumar Singh. 2022b. Mediating role of growth needs and job satisfaction on talent sustainability in BPOs and call centres: An evidence from India. Journal of Public Affairs 22: e2400. [Google Scholar] [CrossRef]

- La Torre, Matteo, Svetlana Sabelfeld, Marita Blomkvist, and John Dumay. 2020. Rebuilding trust: Sustainability and non-financial reporting and the European Union regulation. Meditari Accountancy Research 28: 701–25. [Google Scholar] [CrossRef]

- Lashitew, Addisu. 2021. Corporate uptake of the Sustainable Development Goals: Mere greenwashing or an advent of institutional change? Journal of International Business Policy 4: 184–200. [Google Scholar] [CrossRef]

- Leisenring, James, Thomas Linsmeier, Katherine Schipper, and Edward Trott. 2012. Business-model (intent)-based accounting. Accounting and Business Research 42: 329–44. [Google Scholar] [CrossRef]

- Leuz, Christian. 2010. Different approaches to corporate reporting regulation: How jurisdictions differ and why. Accounting and Business Research 40: 229–56. [Google Scholar] [CrossRef]

- Libby, Robert, and Timothy Brown. 2013. Financial statement disaggregation decisions and auditors’ tolerance for misstatement. The Accounting Review 88: 641–65. [Google Scholar] [CrossRef]

- Lobo, Erwin P., Naomi C. Delic, Alex Richardson, Vanisri Raviraj, Gary M. Halliday, Nick Di Girolamo, Mary R. Myerscough, and J. Guy Lyons. 2016. Self-organized centripetal movement of corneal epithelium in the absence of external cues. Nature Communications 7: 12388. [Google Scholar] [CrossRef] [PubMed]

- Lobo, Gerald J., and Jian Zhou. 2005. To swear early or not to swear early? An empirical investigation of factors affecting CEOs’ decisions. Journal of Accounting and Public Policy 24: 153–60. [Google Scholar] [CrossRef]

- Mardessi, Sana. 2022. Audit committee and financial reporting quality: The moderating effect of audit quality. Journal of Financial Crime 29: 368–88. [Google Scholar] [CrossRef]

- Mosteanu, Narcisa Roxana, and Alessio Faccia. 2020. Digital systems and new challenges of financial management–FinTech, XBRL, blockchain and cryptocurrencies. Quality–Access to Success 21: 159–66. [Google Scholar]

- Nobes, Christopher. 2008. Accounting classification in the IFRS era. Australian Accounting Review 18: 191–98. [Google Scholar] [CrossRef]

- Nobes, Christopher. 2013. The continued survival of international differences under IFRS. Accounting and Business Research 43: 83–111. [Google Scholar] [CrossRef]

- O’Dwyer, Brendan, and Jeffrey Unerman. 2020. Shifting the focus of sustainability accounting from impacts to risks and dependencies: Researching the transformative potential of TCFD reporting. Accounting, Auditing & Accountability Journal 33: 1113–41. [Google Scholar]

- Parrondo, Luz, and Oriol Amat. 2024. Introduction to the Research Handbook on Financial Accounting. In Research Handbook on Financial Accounting. Cheltenham: Edward Elgar Publishing, pp. 1–3. [Google Scholar]

- Pizzi, Simone, Francesco Rosati, and Andrea Venturelli. 2021. The determinants of business contribution to the 2030 Agenda: Introducing the SDG Reporting Score. Business Strategy and the Environment 30: 404–21. [Google Scholar] [CrossRef]

- Pizzi, Simone, Mara Del Baldo, Fabio Caputo, and Andrea Venturelli. 2022. Voluntary disclosure of Sustainable Development Goals in mandatory non-financial reports: The moderating role of cultural dimension. Journal of International Financial Management & Accounting 33: 83–106. [Google Scholar]

- Posadas, Stefanía Carolina, Silvia Ruiz-Blanco, Belen Fernandez-Feijoo, and Lara Tarquinio. 2023. Institutional isomorphism under the test of Non-financial Reporting Directive. Evidence from Italy and Spain. Meditari Accountancy Research 31: 26–48. [Google Scholar] [CrossRef]

- Pushparaj, P., and Bijay Prasad Kushwaha. 2023. Communicate your audience through Virtual Influencer: A Systematic Literature Review. Journal of Content, Community and Communication 17: 31–45. [Google Scholar]

- Ramanna, Karthik, and Ewa Sletten. 2014. Network effects in countries’ adoption of IFRS. The Accounting Review 89: 1517–43. [Google Scholar] [CrossRef]

- ReportYak. 2024. Implementing IFRS in India: Opportunities and Considerations. Available online: https://reportyak.com/blog/ifrs-in-india/ (accessed on 12 August 2024).

- Saari, Ulla A., Svenja Damberg, Lena Frömbling, and Christian M. Ringle. 2021. Sustainable consumption behavior of Europeans: The influence of environmental knowledge and risk perception on environmental concern and behavioral intention. Ecological Economics 189: 107155. [Google Scholar] [CrossRef]

- Sarstedt, Marko, Christian M. Ringle, and Joseph F. Hair. 2014. Partial least squares structural equation modeling (PLS-SEM): A useful tool for family business researchers. Journal of Family Business Strategy 5: 105–15. [Google Scholar] [CrossRef]

- Sarstedt, Marko, Christian M. Ringle, and Joseph F. Hair. 2017. Treating unobserved heterogeneity in PLS-SEM: A multi-method approach. In Partial Least Squares Path Modeling: Basic Concepts, Methodological Issues and Applications. Cham: Springer, pp. 197–217. [Google Scholar]

- Sebrina, Nurzi, Salma Taqwa, Mayar Afriyenti, and Dovi Septiari. 2023. Analysis of sustainability reporting quality and corporate social responsibility on companies listed on the Indonesia stock exchange. Cogent Business & Management 10: 2157975. [Google Scholar]

- Senan, Nabil Ahmed Mareai. 2024. The Moderating Role of Corporate Governance on the Associations of Internal Audit and Its Quality with the Financial Reporting Quality: The Case of Yemeni Banks. Journal of Risk and Financial Management 17: 124. [Google Scholar] [CrossRef]

- Seufert, Verena, Navin Ramankutty, and Jonathan A. Foley. 2012. Comparing the yields of organic and conventional agriculture. Nature 485: 229–32. [Google Scholar] [CrossRef]

- Shiva, Atul, Bijay Prasad Kushwaha, and Bikramjit Rishi. 2023. A model validation of robo-advisers for stock investment. Borsa Istanbul Review 23: 1458–73. [Google Scholar] [CrossRef]

- Singh, Raj Kumar, Bijay Prasad Kushwaha, Tushita Chadha, and Vivek Anand Singh. 2021. Influence of digital media marketing and celebrity endorsement on consumer purchase intention. Journal of Content, Community & Communication 14: 145–58. [Google Scholar]

- Sisaye, Seleshi. 2021. The influence of non-governmental organizations (NGOs) on the development of voluntary sustainability accounting reporting rules. Journal of Business and Socio-Economic Development 1: 5–23. [Google Scholar] [CrossRef]

- Sunder, Shyam. 2010. Adverse effects of uniform written reporting standards on accounting practice, education, and research. Journal of Accounting and Public Policy 29: 99–114. [Google Scholar] [CrossRef]

- Tawiah, Vincent, and Ernest Gyapong. 2023. International financial reporting standards, domestic debt finance and institutional quality: Evidence from developing countries. International Journal of Finance & Economics 28: 2915–36. [Google Scholar]

- Thakur, Jyoti, and Bijay Prasad Kushwaha. 2024. Artificial intelligence in marketing research and future research directions: Science mapping and research clustering using bibliometric analysis. Global Business and Organizational Excellence 43: 139–55. [Google Scholar] [CrossRef]

- Tlemsani, Issam, Mohamed Ashmel Mohamed Hashim, and Robin Matthews. 2024. The impact of IFRS adoption on Saudi Arabia. Journal of Islamic Accounting and Business Research 15: 519–33. [Google Scholar] [CrossRef]

- Tsalis, Thomas A., Kyveli E. Malamateniou, Dimitrios Koulouriotis, and Ioannis E. Nikolaou. 2020. New challenges for corporate sustainability reporting: United Nations’ 2030 Agenda for sustainable development and the sustainable development goals. Corporate Social Responsibility and Environmental Management 27: 1617–29. [Google Scholar] [CrossRef]

- Turgunovna, Ergasheva Shakhlo, and Mannapova Rano Abrorovna. 2022. Accounting policy of the enterprise: Development and amendments. Asian Journal of Technology & Management Research (AJTMR) 11: 21–27. [Google Scholar]

- Turzo, Teresa, Giacomo Marzi, Christian Favino, and Simone Terzani. 2022. Non-financial reporting research and practice: Lessons from the last decade. Journal of Cleaner Production 345: 131154. [Google Scholar] [CrossRef]

- Vitolla, Filippo, Nicola Raimo, and Michele Rubino. 2020a. Board characteristics and integrated reporting quality: An agency theory perspective. Corporate Social Responsibility and Environmental Management 27: 1152–63. [Google Scholar] [CrossRef]

- Vitolla, Filippo, Nicola Raimo, Michele Rubino, and Antonello Garzoni. 2020b. The determinants of integrated reporting quality in financial institutions. Corporate Governance: The International Journal of Business in Society 20: 429–44. [Google Scholar] [CrossRef]

- Wang, Ruizhe, Shan Zhou, and Timothy Wang. 2020. Corporate governance, integrated reporting and the use of credibility-enhancing mechanisms on integrated reports. European Accounting Review 29: 631–63. [Google Scholar] [CrossRef]

- Watts, L. Ross. 2003. Conservatism in accounting part I: Explanations and implications. Accounting Horizons 17: 207–21. [Google Scholar] [CrossRef]

- Wiharno, Herma, Amir Hamzah, and Reza Hibar Pangestu. 2023. Determinants of accounting conservatism. Global Financial Accounting Journal 7: 14–27. [Google Scholar]

- Yusran, Indha Novitasari. 2023. Determinants of the quality of financial reports. International Journal of Professional Business Review 8: 11. [Google Scholar]

- Zahid, R. M. Ammar, and Can Simga-Mugan. 2024. The impact of International Financial Reporting Standards adoption on the integration of capital markets. International Journal of Finance & Economics 29: 229–50. [Google Scholar]

| Variables | Items | Outer Loadings | VIF |

|---|---|---|---|

| Accuracy | ACC1 | 0.914 | 2.870 |

| ACC2 | 0.929 | 3.205 | |

| ACC3 | 0.918 | 3.107 | |

| Comparability | COM1 | 0.926 | 3.327 |

| COM2 | 0.948 | 3.954 | |

| COM3 | 0.906 | 2.945 | |

| FRQ | FRQ1 | 0.824 | 2.467 |

| FRQ2 | 0.814 | 2.645 | |

| FRQ3 | 0.894 | 3.126 | |

| FRQ4 | 0.888 | 3.126 | |

| FRQ5 | 0.805 | 1.958 | |

| Government Policy | GP1 | 0.656 | 1.490 |

| GP2 | 0.813 | 1.756 | |

| GP3 | 0.909 | 3.591 | |

| GP4 | 0.841 | 2.975 | |

| IFRS Adoption | IFRS1 | 0.888 | 3.060 |

| IFRS2 | 0.870 | 2.941 | |

| IFRS3 | 0.844 | 2.387 | |

| IFRS4 | 0.848 | 2.473 | |

| IFRS5 | 0.918 | 4.065 | |

| Legal Requirements | LR1 | 0.709 | 1.608 |

| LR2 | 0.911 | 3.003 | |

| LR3 | 0.815 | 2.147 | |

| LR4 | 0.874 | 2.598 | |

| LR5 | 0.708 | 1.692 | |

| Perceived Benefits | PB1 | 0.82 | 2.051 |

| PB2 | 0.760 | 1.248 | |

| PB3 | 0.875 | 2.193 | |

| Perceived Ease of Implementation | PEI1 | 0.882 | 2.854 |

| PEI2 | 0.923 | 3.781 | |

| PEI3 | 0.884 | 2.602 | |

| PEI4 | 0.775 | 1.721 | |

| Relevancy | REL1 | 0.876 | 2.633 |

| REL2 | 0.900 | 4.309 | |

| REL3 | 0.888 | 4.005 | |

| REL4 | 0.842 | 2.145 | |

| Timeliness | TIM1 | 0.794 | 1.707 |

| TIM2 | 0.895 | 2.154 | |

| TIM3 | 0.910 | 2.318 | |

| Understandability | UND1 | 0.893 | 2.252 |

| UND2 | 0.891 | 2.280 | |

| UND3 | 0.869 | 2.050 |

| Variables | Alpha | CR (rho_a) | CR (rho_c) | AVE |

|---|---|---|---|---|

| Accuracy | 0.910 | 0.913 | 0.943 | 0.847 |

| Comparability | 0.918 | 0.930 | 0.948 | 0.859 |

| FRQ | 0.901 | 0.914 | 0.926 | 0.716 |

| Government Policy | 0.827 | 0.871 | 0.883 | 0.656 |

| IFRS Adoption | 0.922 | 0.924 | 0.942 | 0.763 |

| Legal Requirements | 0.867 | 0.920 | 0.903 | 0.652 |

| Perceived Benefits | 0.755 | 0.759 | 0.860 | 0.672 |

| Perceived Ease of Implementation | 0.890 | 0.900 | 0.924 | 0.753 |

| Relevancy | 0.900 | 0.901 | 0.930 | 0.769 |

| Timeliness | 0.838 | 0.872 | 0.901 | 0.753 |

| Understandability | 0.861 | 0.862 | 0.915 | 0.782 |

| Variables | Accuracy | Comparability | FRQ | GP | IFRS_A | LR | PB | PEoI | Relevancy | Timeliness | Understandability |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Accuracy | - | ||||||||||

| Comparability | 0.758 | - | |||||||||

| FRQ | 0.389 | 0.440 | - | ||||||||

| GP | 0.768 | 0.803 | 0.398 | - | |||||||

| IFRS_A | 0.461 | 0.471 | 0.890 | 0.441 | - | ||||||

| LR | 0.678 | 0.769 | 0.368 | 0.893 | 0.365 | - | |||||

| PB | 0.424 | 0.444 | 0.852 | 0.390 | 0.870 | 0.328 | - | ||||

| PEoI | 0.601 | 0.791 | 0.646 | 0.679 | 0.624 | 0.688 | 0.646 | - | |||

| Relevancy | 0.394 | 0.468 | 0.856 | 0.416 | 0.874 | 0.357 | 0.824 | 0.597 | - | ||

| Timeliness | 0.876 | 0.869 | 0.389 | 0.877 | 0.449 | 0.824 | 0.389 | 0.720 | 0.420 | - | |

| Understandability | 0.673 | 0.740 | 0.497 | 0.857 | 0.464 | 0.831 | 0.461 | 0.752 | 0.414 | 0.791 | - |

| Hypotheses | β | Mean | STDEV | T Stat | p-Values | Decision |

|---|---|---|---|---|---|---|

| H1a: Perceived Benefits -> IFRS Adoption | 0.714 | 0.714 | 0.028 | 25.11 | 0.000 | Accepted |

| H1b: PEoI -> IFRS Adoption | 0.145 | 0.145 | 0.035 | 4.184 | 0.000 | Accepted |

| H1c: Legal Requirements -> IFRS Adoption | 0.031 | 0.029 | 0.043 | 0.726 | 0.468 | Rejected |

| H1d: Government Policy -> IFRS Adoption | 0.113 | 0.113 | 0.038 | 2.947 | 0.003 | Accepted |

| H2: IFRS Adoption -> FRQ | 0.833 | 0.833 | 0.033 | 25.61 | 0.000 | Accepted |

| H3a: FRQ -> Relevancy | 0.793 | 0.793 | 0.015 | 51.641 | 0.000 | Accepted |

| H3b: FRQ -> Accuracy | 0.367 | 0.367 | 0.036 | 10.194 | 0.000 | Accepted |

| H3c: FRQ -> Understandability | 0.445 | 0.445 | 0.035 | 12.857 | 0.000 | Accepted |

| H3d: FRQ -> Comparability | 0.412 | 0.412 | 0.034 | 12.164 | 0.000 | Accepted |

| H3e: FRQ -> Timeliness | 0.358 | 0.358 | 0.035 | 10.242 | 0.000 | Accepted |

| Moderating Effects | ||||||

| Internal Control System -> FRQ | 0.001 | 0.001 | 0.051 | 0.028 | 0.978 | Rejected |

| H4: ICS × IFRS Adoption -> FRQ | 0.003 | 0.004 | 0.047 | 0.068 | 0.946 | Rejected |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Johri, A. Examining the Impact of International Financial Reporting Standards Adoption on Financial Reporting Quality of Multinational Companies. Int. J. Financial Stud. 2024, 12, 96. https://doi.org/10.3390/ijfs12040096

Johri A. Examining the Impact of International Financial Reporting Standards Adoption on Financial Reporting Quality of Multinational Companies. International Journal of Financial Studies. 2024; 12(4):96. https://doi.org/10.3390/ijfs12040096

Chicago/Turabian StyleJohri, Amar. 2024. "Examining the Impact of International Financial Reporting Standards Adoption on Financial Reporting Quality of Multinational Companies" International Journal of Financial Studies 12, no. 4: 96. https://doi.org/10.3390/ijfs12040096

APA StyleJohri, A. (2024). Examining the Impact of International Financial Reporting Standards Adoption on Financial Reporting Quality of Multinational Companies. International Journal of Financial Studies, 12(4), 96. https://doi.org/10.3390/ijfs12040096