Abstract

The Constant Leverage covering strategy for the equity momentum portfolio (CLvg) developed in this project cannot mask its shortcomings by increasing leverage. It has to successfully forecast and avoid more losses than profits to perform better than the momentum portfolio. This approach is different from other covering strategies available in the literature that focus on increasing the right tail of the momentum returns distribution at a faster rate than they increase the left tail. The CLvg strategy only depends on past information and uses the daily volatility of the loser portfolio to determine episodes of high and low volatility. The daily volatility of the loser portfolio has a stronger relationship with large negative momentum returns than the daily volatility of the momentum portfolio. The daily volatility of the loser portfolio also has a weaker relationship with larger positive monthly returns, and it is more predictable because it has a higher volatility persistence. The negative effects of transaction costs on the CLvg strategy are measured using bid and ask prices reported by CRSP from 1992 to 2021. During this period, the stock market presented an average excess return of 9.19% and a Sharpe ratio of 0.61, and 9.74% of its returns were crashes, which is a better performance than the momentum portfolio. The CLvg adjusted by transaction costs presented excess returns of 16.93% and a Sharpe ratio of 0.84, and only 8.31% of its returns were crashes.

1. Introduction

The momentum portfolio is a market anomaly because it outperforms the market using information stored in past monthly returns. Jegadeesh and Titman (1993) show that, if stocks are ranked by their past returns, the worst past performers will also underperform the following month (loser portfolio) and the best past performers will also overperform the following month (winner portfolio). The momentum portfolio is formed by buying the winner portfolio and selling the loser portfolio (WmL).

The literature has developed several covering strategies to minimize the main problem of the momentum portfolio: the existence of crashes (monthly losses larger than −5%), as documented by Barroso and Santa-Clara (2015). The problem of the available covering strategies for the momentum portfolio is that they depend on past information. Grundy and Martin (2001) use forward-looking information. Barroso and Santa-Clara (2015) and Daniel and Moskowitz (2016) minimize the use of forward-looking data, but their covering strategies still depend on the in-sample average volatility of the stock market, which is problematic because practitioners should know this value before they implement the covering strategies.

This project identifies a U-shaped relationship between the volatility of the loser portfolio and momentum returns and uses it to construct a covering strategy for the momentum portfolio that only depends on past information. This strategy also accounts for transaction costs, which makes it implementable by practitioners.

The development of a Constant Leverage (CLvg) covering strategy avoids exploiting the returns distributions of the momentum portfolio in a way that is unpalatable for practitioners: increasing the average return by increasing the right tail of the distribution at a faster rate than increasing the left tail of the distribution. The covering strategy of the CLvg is different from the Constant Volatility (CVol) strategy proposed by Barroso and Santa-Clara (2015). The CVol strategy focuses on increasing future returns when the expected volatility of the momentum portfolio is low. This turns mild positive returns into large positive returns, but it also transforms mild negative returns into large negative returns.

The CLvg strategy has higher expected returns and smaller standard deviations, and it minimizes the presence of crashes when compared against the stock market, the momentum portfolio, and the CVol covering strategy. This project uses the bid and ask prices reported by the CRSP from 1992 to 2021 to compute transaction costs at the individual stock level. During this period, the stock market presented an average excess return of 9.19% and a Sharpe ratio of 0.61, and 9.74% of the stock market’s returns were crashes. The WmL portfolio adjusted by transaction costs presented excess returns of 10.99% and a Sharpe ratio of 0.31, and 18.05% of the momentum portfolio’s returns were crashes. The CLvg covering strategy adjusted by transaction costs presented excess returns of 16.93% and a Sharpe ratio of 0.84, and only 8.31% of its returns were crashes.

Section 5 shows how to use the symmetrical U-shaped relationship between momentum returns volatility and momentum returns to explain the weaknesses of the CVol. The CVol buys multiple momentum portfolios in episodes of low volatility to compensate for cutting extremely positive returns during episodes of high volatility. However, this increase in leverage causes a second problem: It turns mild negative returns associated with low volatility into large negative returns.

The CVol strategy exploits the positive average of the momentum returns distributions to mask its shortcomings (the trough of the U-shaped relationship between momentum returns volatility and momentum returns lies to the right of zero percent, as discussed in Section 5. However, the introduction of transaction costs significantly reduces the positive effects of increasing leverage and reduces the profitability of the CVol.

2. Literature Review: Momentum Everywhere

The momentum literature is mostly a collection of empirical findings. Singh and Walia (2020) explain that there is no unified theoretical framework that explains momentum. Instead, there are two leading theories. Some researchers explain the excess returns of momentum as a compensation for risk: Conrad and Kaul (1998), Moskowitz and Grinblatt (1999), Li (2017), and Ruenzi and Weigert (2018). Other research explains the excess returns of momentum using behavioral finance: Barberis et al. (1998), Vayanos and Woolley (2013), Booth et al. (2016), Chen and Lu (2017), and Hur and Singh (2019).

Momentum returns are not constrained to the American stock market. Rouwenhorst (1998) finds positive momentum returns in international assets. Chan et al. (2000) document profitable momentum strategies on international stock market indices. Jostova et al. (2013) record significant momentum returns for noninvestment-grade corporate bonds. Gorton et al. (2012) find momentum returns in commodity markets. Finally, Okunev and White (2003) note momentum in currency markets.

However, the momentum portfolio has two shortcomings. The first weakness is the negative effects of transaction costs. The momentum portfolio has a lower Sharpe ratio than the stock market after considering transaction costs. Lesmond et al. (2004) estimate transaction costs for the momentum strategy and argue that the momentum portfolio will not be profitable under transaction costs. Korajczyk and Sadka (2004) find similar results.

The second shortcoming is the existence of large and frequent crashes. Investors with standard risk aversion should not be interested in the momentum portfolio, because it presents frequent crashes that offset the appeal of a high Sharpe ratio. Crashes plague the momentum portfolio even if transaction costs are ignored. Between 1927 and 2021, the largest monthly loss of the momentum portfolio was −77.46% in August 1932. Meanwhile, the largest monthly loss of the stock market was −29.21% in September 1939. Crashes represent 10.9% of the stock market returns but 12.6% of the momentum portfolio returns. Investors might not be interested in the momentum portfolio because it takes years to recover from one crash.

Literature Review: Covering Strategies with Forward-Looking Biases and Volatility

Cujean and Hasler (2017) reported that there are narrowly defined points in time when equity returns become predictable: after a major sell-off during a financial crisis, most equities bounce back aggressively as there is a fast adjustment between current depressed prices and more optimistic expectations.

Barroso and Santa-Clara (2015) documented that this predictability of a widespread rebound in asset prices creates large losses from selling the loser portfolio, and it tends to occur after periods of high volatility. Understanding the relationship between volatility and momentum portfolio underperformance rekindled academic interest. The following researchers have identified a strong relationship between the momentum portfolio performance and volatility: Wang and Xu (2015), Fan et al. (2018), Lim et al. (2018), and Demirer and Zhang (2019).

The first generation of covering strategies for the momentum portfolio has a forward-looking bias. Grundy and Martin (2001) develop the first covering strategy for the momentum portfolio. Their insight is that the beta of the momentum portfolio is a useful signal of future crashes because it takes negative values after the momentum portfolio presents crashes. During an upside stock market, the winner portfolio tends to have high beta stocks while the loser portfolio tends to have low beta stocks. However, if the stock market falls during the formation period, the loser portfolio will tend to have the high beta stocks that fall in tandem with the market, while the winner portfolio will have low beta stocks. Therefore, when the market rebounds, the momentum portfolio crashes because it has a net negative beta. Unfortunately, they estimate dynamic betas using the whole sample. They assess the profitability of the beta-hedged portfolio based on in-sample beta estimates. However, practitioners may not reach the same level of profitability with out-of-sample beta estimates.

The second generation of covering strategies identifies a signal that uses only past information to forecast crashes. Barroso and Santa-Clara (2015) document that episodes of high daily returns volatility in the momentum portfolio occur at the same time as large negative monthly returns in the momentum. They document that episodes of high volatility are forecastable because the daily returns volatility of the momentum portfolio has a high volatility persistence. Section 5 shows that this is a successful signal because the daily returns volatility of the momentum portfolio has a symmetrical U-shaped relationship with monthly returns of the momentum portfolio. Using episodes of high volatility to reduce leverage and cut future monthly returns will reduce crashes but will also reduce large positive monthly returns. This negative effect is not discussed by Barroso and Santa-Clara (2015). Furthermore, the negative effects of cutting leverage are masked by the positive effects of increasing leverage.

However, the second generation of covering strategies for the momentum portfolio adjusts the volatility with a forward-looking bias. Barroso and Santa-Clara (2015) input an ad hoc volatility target of 12% after observing the whole sample and without discussing the negative effects of increasing or decreasing this target. Daniel and Moskowitz (2016) use the same signal, but they adjust the volatility to be equal to the in-sample average volatility of the stock market. Also, they do not discuss negative effects of a larger or smaller volatility target. This is problematic because practitioners should know which volatility target to select at the time of implementation.

The negative effects of a forward-looking target are even more concerning when the covering strategy consists of increasing and decreasing leverage. The Constant Volatility covering strategy (CVol) (Barroso and Santa-Clara 2015) and the Dynamic Volatility covering strategy (Daniel and Moskowitz 2016) consist of the same relationship between signal and target: increasing leverage (buy multiple momentum portfolios) when the signal is below the target and decreasing leverage (buy a fraction of the momentum portfolio) when the signal is above the target. The daily returns volatility of the momentum portfolio is highly persistent, but it is not always successful at predicting crashes.

Covering strategies for the momentum portfolio focus on forecasting and avoiding crashes using information stored in past daily returns. This is remarkable because the momentum portfolio already outperforms the stock market by using information stored in monthly returns that had been publicly known for more than twelve months.

3. Contribution: Covering Strategies without Forward-Looking Biases

The main contribution of this project is the development of a covering strategy for the momentum portfolio that is implementable by practitioners because it only depends on past information. The Constant Leverage covering strategy (CLvg) is more profitable than the stock market even after accounting for transaction costs. This project compares the CLvg against the CVol strategy developed by Barroso and Santa-Clara (2015) under transaction costs. The CVol focuses on increasing the average return of the momentum portfolio while increasing negative returns that are related to highly persistent volatility. The CLvg focuses on avoiding extremely high returns and crashes that can be forecasted because they are related to highly persistent volatility.

The CLvg developed in this project lacks a compensation mechanism to mask its shortcomings. The CLvg buys the momentum portfolio when the signal is below the target, and it buys one month of treasury bills when the signal is above the target. Therefore, the CLvg can only have a better performance than the momentum portfolio if it successfully forecasts and avoids more negative monthly returns than positive monthly returns.

The CLvg uses the daily returns volatility of the loser portfolio as a signal because the largest crashes in the momentum portfolio come from selling the loser portfolio and not from buying the winner portfolio. Additionally, the volatility persistence of the loser portfolio is even higher than the volatility of the momentum portfolio, which increases the accuracy of the volatility forecasts. This paper documents a U-shaped relationship between daily loser portfolio returns volatility and monthly momentum returns that leans to the left. High daily volatility in the loser portfolio has a stronger relationship with large negative monthly losses in the momentum portfolio than with large monthly profits.

This project develops a methodology to select the volatility targets using only past information. It constructs an optimization grid that has multiple volatility targets. The volatility target for the next month is equal to the volatility target that maximized the Sharpe ratio over the past ten years. The ten-year window is updated every month.

The CLvg covering strategy does not improve the performance of the momentum portfolio by predicting the future, but by avoiding the empirically regular momentum portfolio crashes that are predictable and related to periods of high volatility in the loser portfolio. The momentum portfolio presents unpredictable, large losses from holding the winner portfolio when a large negative shock hits the whole stock market. However, the stock market tends to process the unpredictable shocks in the same way, making some momentum portfolio crashes predictable, as shown in Section 5. The arrival of the negative shock increases the returns volatility of all stocks, but the increases in volatility are more acute in the stocks that form the loser portfolio. The high-volatility episodes in the loser portfolio start when the large negative shock arrives and end after the large negative shock dissipates. Momentum portfolio crashes that occur when the sell-off ends can be avoided by not holding the momentum portfolio during episodes of high volatility in the loser portfolio (even when no one knows when the high volatility in the loser portfolio will end).

The high retention rates of the winner and loser portfolios mitigate the negative effects of transaction costs. Section 4.1 shows that the momentum portfolio becomes unprofitable under transaction costs if the turnover rate is one hundred percent: the expected excess return falls from 17.99% to −4.38%. However, not all shares enter and leave the winner and loser portfolios each month. About 55% of the shares in the loser and winner portfolios do not pay transaction costs in a given month, because they remain in the same portfolio the following month. About 35% of the shares pay only half of the transaction cost because they enter or leave the portfolio in the same month. Only about 10% of the shares enter and leave the winner and loser portfolios in the same month and pay the full transaction costs. After adjusting transaction costs for actual turnover, momentum portfolios have an average excess return of 10.99%, which is higher than the 9.19% of the stock market.

The CLvg has a higher expected return and Sharpe ratio than the CVol, the momentum portfolio, and the stock market even after considering transaction costs adjusted by turnover. This project uses closing bid and ask prices reported by the Center for Research in Security Prices (CRSP) from 1992 to 2021 to compute transaction costs at the individual stock level. In this period, the stock market presented an average excess return of 9.19% and a Sharpe ratio of 0.61, and 9.74% of its returns were crashes. The momentum portfolio presented excess returns of 10.99% and a Sharpe ratio of 0.31, and 18.05% of its returns were crashes. The CVol presented an average excess return of 16.58% and a Sharpe ratio of 0.55, and 18.65% of its returns were crashes. The CLvg presented excess returns of 16.93% and a Sharpe ratio of 0.84, and only 8.31% of its returns were crashes.

3.1. Methodology: Individual Stock Returns with Transaction Costs

This project reproduces the quoted spread estimate used by Bhardwaj and Brooks (1992) and Lesmond et al. (2004) to measure transaction costs. Returns with transaction costs are equal to the individual stock returns with dividends adjusted by the price spread at the closing price, as shown in Equation (1), where is the individual stock price return plus the dividend return adjusted by transaction costs assuming that the stock is bought and sold in the same period t. is the share price in the previous period. is the share price in the current period, is a price adjustment factor that the CRSP uses to correct for splits or new stock issues, and is the dividend return that the stock receives at time t. and are the last representative ask and bid prices before the market closes at trading day t.

Equation (1). Stock returns including transaction cost for a round trip.

3.2. Methodology: Momentum Portfolio Algorithm

The algorithm used to construct the momentum portfolio has three stages. The first stage is the formation, or ranking, period. Stocks are ranked by their individual returns over the past twelve months and classified into deciles. Each decile will become a portfolio. The second stage is the skipping stage. This stage skips one month after the formation period to avoid short-term price reversals before the holding period. The third stage is the holding stage.

The momentum portfolio is formed by buying the highest decile (winner portfolio) and selling the lowest decile (loser portfolio) for one month. The momentum portfolio is updated every month. The returns of individual stocks are value-weighted to control for small caps. This project follows Daniel and Moskowitz (2016)’s definition of momentum portfolio excess returns, as shown in Equation (2). Individuals invest the proceeds of selling the loser portfolio in American one month treasury bills. Thus, the total returns of holding the momentum portfolio for one month are equal to the returns of the winner portfolio minus the returns of the loser portfolio plus the risk-free rate.

Equation (2). Momentum portfolio excess return.

3.3. Methodology: Covering Strategies

Covering strategies for the momentum portfolio are different from derivatives because they change the composition of the portfolio based on past information to prevent losses instead of compensating the portfolio after a loss. Covering strategies for the momentum portfolio have three components: a weight, a proxy, and a target. The returns of the momentum portfolio after the hedging strategy, , is the product of the uncovered momentum portfolio excess return, , and the weight, W(target, proxy). An implementable covering strategy uses past information to change future returns of the momentum portfolio, as seen in Equation (3).

Equation (3). Implementable covering strategy.

The weight is a function of the target and the proxy. The proxy is a variable that forecasts the crashes in the momentum portfolio that should be avoided. The target is a cutoff value that determines when the proxy is most likely to predict a crash. The selection of the target and the proxy depends on the understanding of the empirical regularities that surround momentum crashes.

3.4. Methodology: Measuring Volatility

This project uses two measures of volatility. The first is the Realized Variance (RVar) (Equation (4)). The RVar is expressed in decimals and is equal to the addition of the second power of daily portfolio returns over a given J-day period1, where is the last trading day of each month. The RVar allows the comparison of daily returns volatility of different portfolios that have the same J-specification period.

Equation (4). Realized Variance for J-day specification period.

The second measure of volatility is the realized volatility (RVol) (Equation (5)). The RVol is expressed in an annualized percentage and allows the comparison of RVar values that have different J-specification periods.

Equation (5). Realized volatility for J-day specification period. The values of the RVol are expressed in annualized percent.

An AR(1) regression is estimated to analyze the volatility persistence of the stock market, the momentum portfolio, the winner portfolio, and the loser portfolio. As seen in Table 1, the AR(1) model regresses the 21-day RVar of the current period against the 21-day RVar of the previous period. The 21-day RVar avoids overestimating volatility persistence because it is a nonoverlapping time series. It counts twenty-one trading days since the last day of each month to avoid including a trading day of the previous month. represents a constant parameter, represents the volatility persistence parameter, and represents a random shock.

Table 1.

Volatility persistence for several portfolios. The volatility persistence analysis uses 21-day nonoverlapping RVar values in decimal form to run the following AR(1) regression: . The t-statistic is shown in brackets. The volatility persistence analyzes monthly data from 1927 to 2021.

The momentum portfolio volatility persistence is increased by the information stored in the loser portfolio but decreases by the information stored in the winner portfolio. As seen in Table 1, the winner portfolio volatility persistence is below the volatility persistence of the momentum portfolio while the loser portfolio volatility is above it. A given month’s volatility persistence explains 68% of following month’s loser portfolio volatility, 64% of the momentum portfolio’s volatility, but only 45% of the winner portfolio’s volatility. Thus, the loser portfolio volatility is a better candidate for the proxy variable because its higher volatility persistence makes it more predictable from current observations than the momentum portfolio volatility.

4. Data

The data come from the CRSP. The estimations use individual stock returns that include dividends for all the common shares listed on NYSE, AMEX, and NASDAQ. The sample period for returns without transaction costs runs from 1 January 1927 to 31 December 2021. The sample period for returns with transaction costs runs from 1 December 1992 to 31 December 2021.

4.1. Data: Momentum Returns without Transaction Costs (1927 to 2021)

The results of Table 2 exclude transaction costs and are in line with the findings of Daniel and Moskowitz (2016). This table expands their results by adding turnover ratios, which will be fundamental to limiting the negative effects of the transaction costs. Appendix A shows how investing in the momentum portfolio significantly outperforms the stock market portfolio in the long run if transaction costs are ignored.

Table 2.

Excess returns for several portfolios without transaction costs. This table shows the properties of the excess returns of the following portfolios: ten value-weighted portfolio deciles sorted by past returns, the momentum portfolio, and the stock market for the period between 1927 and 2021. The mean excess return, standard deviation, and Sharpe ratio (SR) are displayed in annualized percentage. The skewness (SK) and excess kurtosis (KT) are estimated from the monthly log return, ln(1+r). The variable “Crashes” shows the percentage of returns that consist of monthly losses larger than 5% or annualized losses larger than −46% in one month.

The high Sharpe ratio masks the effects of crashes on the momentum portfolio. Researchers who ignore the negative effects of transaction costs have praised the momentum portfolio for exhibiting a Sharpe ratio that is more than 35% greater than that of the stock market, as seen in Table 2. It is important to note that, in the Sharpe ratio, the large number of positive monthly returns decreases the importance of one very large monthly negative return. Nevertheless, it takes decades for the momentum portfolio cumulative return to recover from one crash, as seen in the black line in Appendix A.

The high stock retention rates of the first and tenth decile challenge the predictions of the Efficient Market Hypothesis and explain the existence of momentum returns. If the market prices in all the information available over the past year and all available stocks returns were classified into ten deciles, it would be reasonable to expect that the retention rate of each decile would be 10% because future price returns would depend on the arrival of independently distributed shocks. However, as seen in Table 2, only deciles three to eight have retention rates of around 10%. The retention rates of decile one (loser portfolio) and decile ten (winner portfolio) are around 55%. These high retention rates explain momentum because past overperformers tend to remain in the tenth decile and past underperformers tend to remain in the first decile.

4.2. Data: Momentum Returns with Transaction Costs (1992 to 2021)

Transaction costs should be considered, especially by covering strategies that increase the number of transactions because they are significant. Transaction costs are measured at the individual stock level as described in Equation (1). This allows us to report the price spread that each stock2 would face if it were bought and sold every month.

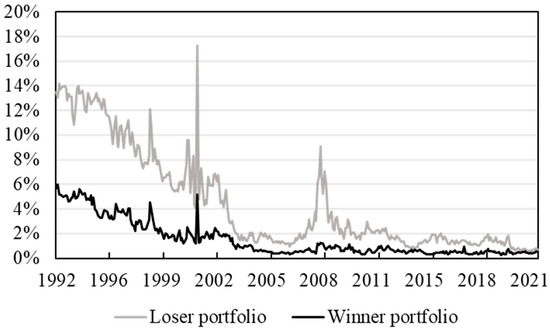

The average price spread changes significantly over time. Figure 1 displays the average round-trip cost for all the stocks in the loser and winner portfolios. The loser portfolio has consistently higher average price spreads than the winner portfolio. Overall, price spreads have decreased significantly since the early-1990s for both portfolios. Nevertheless, both portfolios faced considerable spikes in transaction costs during periods of financial stress.

Figure 1.

Average price spread by portfolio. The gray and black lines represent the average price spread for stocks in the loser and winner portfolios between December 1992 and December 2021. The average price spread does not directly affect the portfolio return, because individual stock returns are value-weighted, and costs are adjusted by turnover.

Nevertheless, the negative effects of transaction cost should not be overestimated. The loser and winner portfolios are updated every month, but that does not mean that all stocks enter and leave the portfolios each month. If a stock is bought and held, or held and sold, from one month to another, the transaction cost is equal to half the price spread reported in Equation (1). Transaction costs are not paid if the stock remains in the same portfolio.

The momentum portfolio has higher expected excess returns but a lower Sharpe ratio than the market after adjusting transaction costs for turnover. As seen in Table 3, between 1992 and 2021, the stock market presented an expected excess return of 9.19% and a Sharpe ratio of 0.61, and 9.7% of its returns were crashes. During the same period, the momentum portfolio without transaction costs presented an expected excess return of 17.99% and a Sharpe ratio of 0.50, and 16.9% of its returns were crashes. After adjusting by transaction costs and turnover, the momentum portfolio presented an expected excess return of 10.99% and a Sharpe ratio of 0.31, and 18.1% of its returns were crashes.

Table 3.

Effect of transaction costs on momentum returns. This table shows the properties of the excess returns of the momentum, loser, winner, and market portfolios between December 1992 and December 2021. It shows the returns without transaction costs, the returns if all stocks are sold and full transaction costs are paid at the end of each month, and the returns if transaction costs are adjusted by turnover. The mean excess return, standard deviation, and Sharpe ratio (SR) are displayed in annualized percentage. The skewness (SK) and excess kurtosis (KT) are estimated from the monthly log return, ln(1+r). The variable “Crashes” shows the percentage of returns that are monthly losses larger than 5% or annualized losses larger than −46% in one month.

5. Stylized Facts about Momentum Returns

Covering strategies available in the literature use momentum portfolio volatility as the proxy variable to avoid momentum crashes after considering two stylized facts: First, crashes in the momentum portfolio occur at the end of a sell-off period in the stock market. Second, these periods are related to episodes of high volatility in the momentum portfolio. Appendix B shows the patterns of the fifteen largest crashes of the momentum portfolio: extreme losses arise from shorting the loser portfolio in episodes of high volatility in the loser portfolio.

However, these stylized facts are only a subset of more general properties. First, high volatility in the momentum portfolio is associated with crashes in the momentum portfolio but also with extremely high profits. Episodes of mild volatility in the momentum portfolio are associated with mild positive and mild negative returns in the momentum portfolio. Second, the ability of momentum portfolio volatility to predict extreme momentum returns comes from the information stored in the loser portfolio. Furthermore, the ability of momentum portfolio volatility to predict extreme momentum returns is undermined by the information stored in the winner portfolio.

These stylized facts can be summarized thusly: The U-shaped relationship between loser portfolio volatility and momentum returns is stronger than the U-shaped relationship between momentum portfolio volatility and momentum returns. Therefore, loser portfolio volatility is the best proxy variable to avoid momentum crashes.

5.1. Stylized Facts about Momentum Returns: U-Shaped Relationships between Momentum Returns and Volatility

The covering strategies literature has been built on the understanding that extreme negative returns are associated with episodes of high volatility. However, these stylized facts can be summarized by the U-shaped relationship between momentum returns and volatility described in this section.

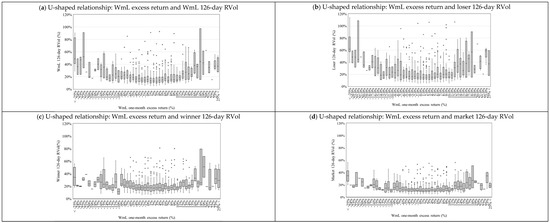

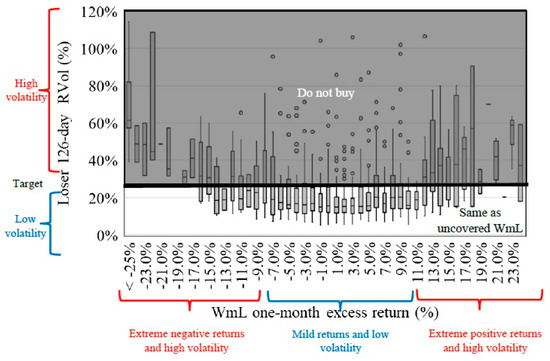

Researchers should understand the relationship between momentum returns and volatility, beyond momentum crashes, to comprehend the strengths and weaknesses of their covering strategies. There are 1134 monthly observations of momentum portfolio excess returns and the 126-day RVol of momentum, winner, loser, and market portfolios between 1927 and 2021. The results are presented after reorganizing the traditional scatter plot using a box-and-whiskers plot, as seen in Figure 2. The box-and-whiskers plot rounds momentum returns to the nearest integer. Thus, the box-and-whiskers plot displays all the variation in volatility that takes place for each 1% change in the excess returns of the momentum portfolio.

Figure 2.

The U-shaped relationship between momentum portfolio excess returns and the 126-day realized volatility of several portfolios. There are 1134 monthly observations between 1927 and 2021. The monthly excess returns are rounded to the nearest integer to form the box-and-whisker plot. Note: The box-and-whiskers plot is formed in the following way: (1) Sort the one-month momentum returns in ascending order. (2) Round the momentum returns to the nearest integer. (3) Make each percentage point of momentum returns a bracket or box-and-whiskers plot. For each bracket, show the distribution of realized volatility in a bidimensional vertical plane. (4) Make the horizontal line at the bottom of the lower whisker represent the 10th percentile, the bottom of the box represent the 25th percentile, the horizontal line in the middle of the box represent the median, the top of the box represent the 75th percentile, and the horizontal line at the top of the superior whisker represent the 90th percentile. Points outside the whiskers represent outliers.

There is a U-shaped relationship between momentum returns and the volatility of different portfolios. Figure 2 shows that mild returns and mild losses in the momentum portfolio take place at the same time as low-volatility episodes in the momentum, loser, winner, and market portfolios. Also, crashes and extreme profits in the momentum portfolio tend to take place at the same time as high-volatility episodes in the momentum, loser, winner, and market portfolios.

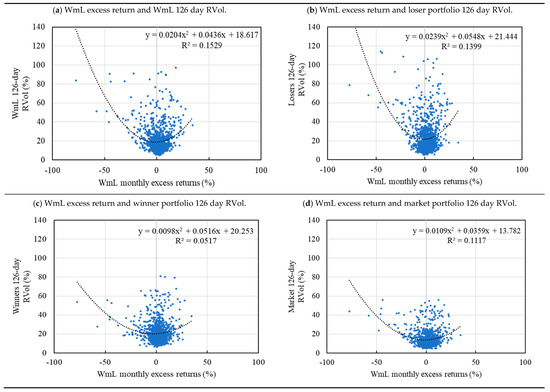

A quadratic regression is used to assess the strength of the U-shaped relationship between momentum returns and the volatility of different portfolios. Table 4 shows that the 126-day RVols of the momentum, loser, winner, and market portfolios are used as the dependent variable in four different quadratic regressions. Each of these regressions has three parameters: is the intercept with the independent axis, represents the linear effect of the momentum excess return on the volatility, and represents the quadratic effect of momentum excess return on volatility.

Table 4.

Quadratic regression between several volatilities and momentum returns. The quadratic regression tests the U-shaped relationship between momentum returns and the realized volatility of different portfolios. The OLS regression estimates the quadratic relationship between momentum excess returns, y, and the 126-day realized volatility, x, of the momentum portfolio, the loser portfolio, the winner portfolio, and the stock market. There are 1134 monthly observations between 1927 and 2021.

The coefficient determines the direction and steepness of the curvature of the parabola. is statistically significant in all four regressions, which means that the excess return of the momentum portfolio has a statistically significant relationship with the volatility of the momentum, loser, winner, and market portfolios. The parameter is positive on all four regressions, which means that the apexes of the parabolas are at the bottom, and they open upwards.

The quadratic regressions show that the strongest U-shaped relationship is between the momentum portfolio returns and loser portfolio volatility. Figure 3 shows the parabola estimated by the quadratic equation. For example, a −77% excess return in the momentum portfolio is expected to be associated with a six-month realized volatility of 153.6% in the loser portfolio, 133.8% in the momentum portfolio, 70.3% in the market portfolio, and 69.6% in the winner portfolio. Thus, momentum returns have a stronger effect on the volatility of the loser portfolio.

Figure 3.

Quadratic regression: U-shaped relationship between momentum returns and volatility. This figure shows the scatter plot and the fitted regression equation for the relationship between momentum returns and the volatility of several portfolios. There are 1134 monthly observations between 1927 and 2021.

The information stored in the winner portfolio volatility weakens the ability of the momentum portfolio volatility to prevent crashes. As seen in Figure 2 (bottom left), and corroborated by the third regression of Table 4, the U-shaped relationship between momentum returns and winner portfolio volatility is weak. Furthermore, the winner portfolio tends to reach episodes of higher volatility when the momentum portfolio has high returns than when it has crashes. Thus, the ability of the momentum portfolio volatility to forecast crashes in the momentum portfolio comes from the information stored in the loser portfolio volatility.

5.2. Covering Strategies: CVol Covering Strategy

The CVol covering strategy of Barroso and Santa-Clara (2015) uses the momentum portfolio 126-day RVol as a proxy because it is persistent, and it is related to momentum crashes. The weight of the CVol covering strategy is designed to buy less than one momentum portfolio the next month if the volatility of the momentum portfolio is above the target the previous month. Also, the weight buys less than one momentum portfolio the next month if the volatility of the momentum portfolio is below the previous month target, as seen in Equation (6).

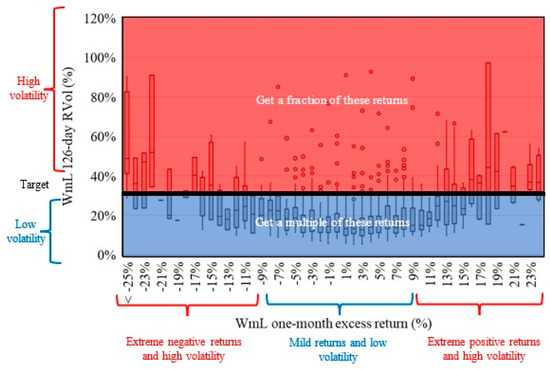

Equation (6). Constant Volatility (CVol) covering strategy.

The CVol successfully mitigates the negative effects of crashes. Figure 4 shows how the CVol covering strategy interacts with the U-shaped relationship between momentum returns and momentum volatility. The solid black line shows the cutoff value (target), which differentiates between high and low volatility. The weight will be less than one for the returns that are in the red area and greater than one for returns that are in the blue area. The CVol covering strategy reduces extreme negative returns (top left corner) because it multiplies the momentum returns by a weight smaller than one.

Figure 4.

Interaction between the CVol and U-shaped relationship between momentum returns and momentum 126-day RVol. The weight of the CVol covering strategy is determined thusly: . The weight is less than one in the red area because the proxy is above the target. The weight is more than one in the blue area because the proxy is below the target.

However, the CVol also mistakenly decreases the size of large positive returns and increases the size of mild losses. The top right corner Figure 4 shows large positive returns that are associated with episodes of high volatility. In this case, the weight of the CVol is less than one, which decreases returns. The bottom center left of the same figure shows small negative returns associated with episodes of low volatility. Here, the weight of the CVol is more than one, which increases the size of mild negative returns.

However, the CVol has a compensation mechanism that masks its drawbacks. The small positive returns (Figure 4, center right) will increase because they are associated with episodes of low volatility and will be multiplied by a weight greater than one. This compensation mechanism increases the already-high positive mean of the momentum returns distribution but does not significantly reduce the heavy left tail. The CVol does not eradicate crashes; it only reduces them. Unfortunately, a fraction of the crash is still a significant loss for the portfolio.

The compensation mechanism of the CVol is successful because it ignores transaction costs. The U-shaped relationship between momentum returns and momentum volatility from Figure 4 would shift to the left if transaction costs were considered. All profits would decrease, and all losses would increase. Therefore, the negative consequences of increasing leverage when the momentum portfolio presents losses would significantly impact the performance of the CVol.

5.3. Covering Strategies: CLvg Covering Strategy

The main strength of the CLvg is that it depends only on past information. The CLvg buys the momentum portfolio when the proxy variable is below the target and buys one month of U.S. treasury bills when the proxy variable is above the target (Equation (7)). The CLvg uses the previous month’s value of the 126-day RVol of the loser portfolio as a proxy because of its strong relationship with momentum crashes, as discussed in Section 5. The target is selected using only past information.

Equation (7). Constant Leverage (CLvg) covering strategy.

The CLvg can only increase the expected return and Sharpe ratio by forecasting and cutting more losses than profits. As seen in Figure 5, the CLvg aims to cut the tails of the momentum returns distribution (associated with episodes of high volatility) while preserving the center of the momentum returns distribution (associated with episodes of low volatility). However, the CLvg performance will improve only if it cuts the left tail more accurately than it cuts the right tail.

Figure 5.

Interaction between the CVol and U-shaped relationship between momentum returns and loser 126-day RVol. The weight of the CLvg covering strategy is determined thusly: . If the proxy is above the target, the hedging strategy invests in the risk-free interest rate instead of the WmL portfolio. If the proxy is below the target, the hedging strategy buys the uncovered WmL portfolio.

A strong feature of the CLvg is that it is equal to the momentum portfolio if the proxy is never greater than the target. Keeping leverage constant prevents the covering strategy from developing compensation mechanisms to cover up its shortcomings. All covering strategies will make mistakes if they do not have a forward-looking bias. The CLvg mistakenly eliminates extreme profits that are associated with episodes of high volatility. However, CLvg does not deform the center of the momentum returns distribution and does not ignore transaction costs to conceal its weaknesses.

5.4. Covering Strategies: Targets without Forward-Looking Bias

This project develops an algorithm that makes it possible to estimate a target without a forward-looking bias. It constructs an optimization grid in which each point represents a different target. The values on the grid run from zero to the highest value of the proxy. Then, for each target, the Sharpe ratio for the covering strategy over the past ten years is estimated. The target that yields the highest Sharpe ratio is selected and used as the target for the next month. The algorithm requires a rolling optimization window, so the ten-year optimization window and the optimal target for the next month are updated every month.

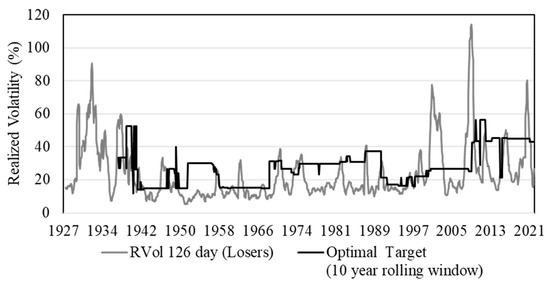

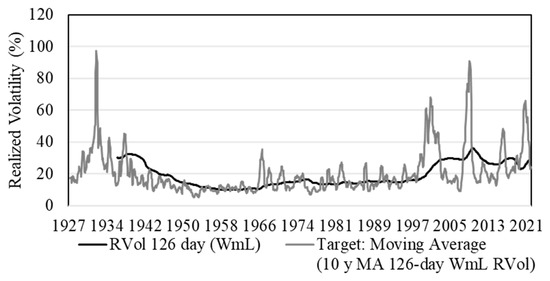

Under this optimization algorithm, the CLvg selects a target that is an interior solution. The CLvg is constantly facing a trade-off between increasing or decreasing the volatility threshold for the proxy variable. A high target cuts the tails of the distribution more aggressively (and prevents more crashes), but it also cuts more of the center of the distribution (which is associated with frequent mild positive returns). Figure 6 shows the evolution of the optimal target for the CLvg while using the loser portfolio 126-day RVol as the proxy. The optimal target makes it possible to clearly distinguish between episodes of high and low volatility without the need for a forward-looking bias.

Figure 6.

Implementable target for the CLvg and six-month RVol of the loser portfolio.

The optimal target of the CLvg shows that high loser portfolio volatility is not always bad for the momentum portfolio. From the stylized facts discussed in the previous section, only sudden and acute episodes of volatility should be targeted because they represent the culmination of periods of financial turmoil that are regularly associated with momentum crashes. As the financial turmoil ends, the aggressive market rebound will create extreme profits in the loser portfolio.

The CVol always selects a target that is a corner solution under the optimization process without a forward-looking bias. The CVol always selects the largest available target in the grid. This problem reveals the structural flaws in the design of the CVol covering strategy. The CVol can improve the Sharpe ratio without cutting more losses than profits because it does not face a restrictive trade-off. The CVol can increase the Sharpe ratio even if losses are increasing as long as profits increase at a faster rate, given its built-in compensation mechanisms. It is possible to infinitely increase the Sharpe ratio with never-ending increases in leverage, which would be impossible for practitioners to replicate.

However, it is possible to select a target for the CVol without a forward-looking bias by selecting the proxy variable’s ten-year moving average as target. This is similar to setting a target equal to the sample average, as in Barroso and Santa-Clara (2015), but without a forward-looking bias. Figure 7 shows the evolution of the optimal target for the CVol with respect to the 126-day momentum portfolio RVol, which is the proxy.

Figure 7.

Implementable target for the CVol and 126-day RVol of the momentum portfolio. It is possible to define a target without a forward-looking bias for the CVol by using the previous month’s value of the 126-day RVol momentum portfolio moving average over the past ten years.

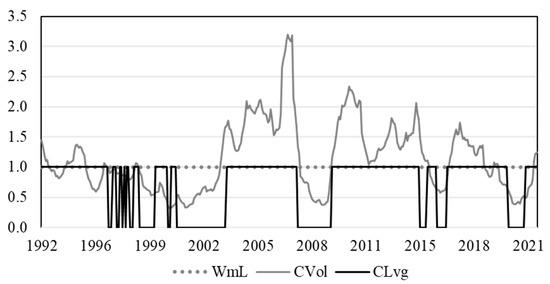

The weight summarizes a covering strategy by generating a number that adjusts the returns of the momentum portfolio after considering the interaction between the proxy and the target. Figure 8 shows the weight of CVol and CLvg. As a reference, the weight of the momentum portfolio (WmL) is always one because the leverage is not changing. The weight of the CVol is the ratio of the last month’s 126-day momentum RVol divided by the last month’s value of the ten-year moving average of the 126-day momentum RVol. The weight of the CLvg is equal to one if the last month’s 126-day loser portfolio RVol is less than the optimal target estimated from the ten-year rolling window and is zero otherwise.

Figure 8.

Weights for different portfolios. The following graph shows the weights of the momentum portfolio (WmL), the Constant Volatility (CVol) covering strategy, and the Constant Leverage (CLvg) covering strategy using monthly data from December 1992 to December 2021. The WmL weight is always equal to one, . The weight of the CLvg is , where is selected using the optimization grid and the ten-year rolling window shown in Figure 6. The weight of the CVol is . The ten-year moving average of the 126-day momentum portfolio RVol is shown in Figure 7.

5.5. Results: Implementable CVol and CLvg Strategies under Transaction Costs

The CLvg performs better than the stock market, the momentum portfolio, and the CVol even after adjusting by transaction costs at the individual stock level. The weights without forward-looking bias from Figure 8 are used to estimate portfolio returns. As seen in Table 5, for the period between December 1992 and December 2021, the stock market presented an average excess return of 9.19%; the momentum portfolio, 10.99%; the CVol, 16.58%; and the CLvg, 16.93%.

Table 5.

Returns statistics of several portfolios under transaction costs. This table shows the properties of the excess returns of the following portfolios for the period between December 1992 and December 2021: the stock market (Market), the momentum portfolio (WmL), the Constant Volatility (CVol) covering strategy, and the Constant Leverage (CLvg) covering strategy. The mean excess return, standard deviation, and Sharpe ratio (SR) are displayed in an annualized percentage. The skewness (SK) and excess kurtosis (KT) are estimated from the monthly log return, ln(1+r). The variable “Crashes” shows the percentage of returns that are monthly losses larger than 5% or annualized losses larger than −46% in one month. The weights are displayed in Figure 8.

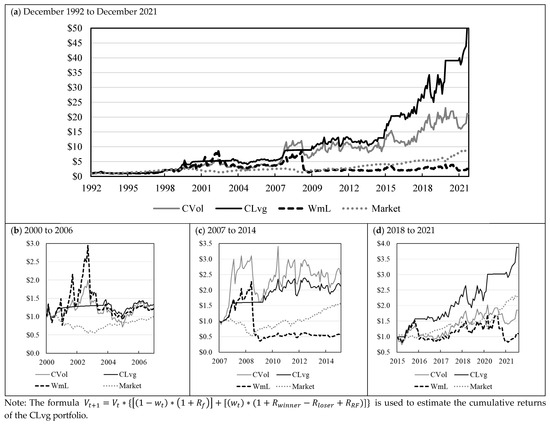

At first glance, the CVol and the CLvg have similar performances. However, the high average excess returns of the CVol disguise the outcome that almost one out of every five returns is a crash. Meanwhile, only one in twelve of the returns of the CLvg is a crash. The negative effect of a high number of crashes is better reflected in the cumulative returns for a USD 1 investment at the beginning of the period. A USD 1 investment in December 1992 would have yielded USD 21.11 on the CVol or USD 50.25 on the CLvg by December 2021.

The CVol presented losses even when it successfully predicted crashes in the momentum portfolio. Figure 9 shows the cumulative return for a USD 1 investment for several hedging strategies. The CVol successfully predicted the momentum crashes that occurred after the dot-com bubble, the Great Recession of 2008, and the COVID-19 crisis. The CVol presented fewer extreme losses than the momentum portfolio (Figure 8) because its weight was smaller than one. The problem is that buying a fraction of a crash still represents a significant loss for the CVol. Recovering from these losses required several years (Figure 9), and unrealistic increases in leverage that are not available to practitioners.

Figure 9.

Cumulative returns for a USD 1 investment with transaction costs. This figure shows the cumulative returns for a USD 1 investment in the stock market (Market), the momentum portfolio (WmL), the Constant Volatility (CVol) covering strategy, and the Constant Leverage (CLvg) covering strategy between December 1992 and December 2021. The weight of the CLvg is , where is selected using the optimization grid and the ten-year rolling window shown in Figure 6. The weight of the CVol is . The ten-year moving average of the 126-day momentum portfolio RVol is shown in Figure 7.

The essence of the CLvg is to avoid the momentum portfolio during the high-volatility periods that are associated with momentum crashes. The momentum portfolio is so profitable that it does not need unrealistic compensation mechanisms, like increasing leverage, if crashes are avoided. The CLvg eliminated its exposure to the momentum portfolio during the highly volatile periods following the dot-com bubble, the start of the Great Recession of 2008, and the start of the COVID-19 crisis. Instead, the CLvg bought one month of treasury bills during these volatile periods (as represented by the flat line in Figure 9). The CLvg hedging strategy does not improve the performance of the momentum portfolio by predicting the future but by avoiding highly empirically regular and forecastable episodes of high volatility in the loser portfolio that are related to momentum portfolio crashes.

5.6. Results: The Effects of Covering Strategies on the Momentum Portfolio Returns Distributions

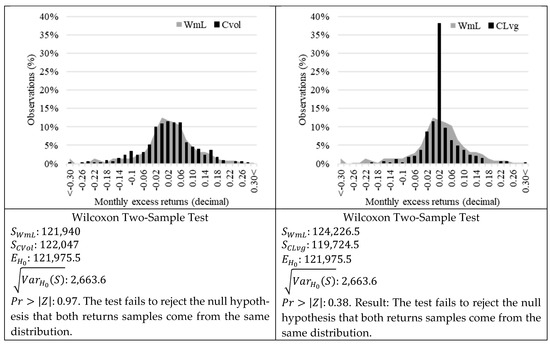

The CLvg strategy and the CVol strategy improve the performance of the momentum portfolio without significantly distorting the returns distribution. The Wilcoxon Rank-Sum Test analyzes if two distributions are statistically different. This is a non-parametric test. It does not assume that the samples have any specific distribution. It does not test if they have the same mean, or the same standard deviation, but if both come from the same distribution, as described in Appendix C. The results of Figure 10 show that the returns distributions of the CLvg strategy and the CVol strategy are statistically equal to the returns distribution of the uncovered momentum portfolio. Figure 10 shows the same results as Table 5 but in monthly returns instead of annualized returns.

Figure 10.

Distribution of monthly excess returns and Wilcoxon test. The following table shows the distribution of monthly returns for the uncovered momentum portfolio, the CVol strategy, and the CLvg strategy. There are 349 observations between 1992 and 2021. The table also shows the results of the Wilcoxon Two-sample test.

The CLvg and the CVol covering strategies have minimal effects on the returns distribution of the momentum portfolio because they are able to successfully target the heavy tails of the distribution. There are not a lot of extreme-volatility episodes, but they are strongly correlated with crashes or extreme positive returns as shown in the U-shaped relationship of Section 5.1. Therefore, the covering strategies are not triggered often enough to change the whole distribution. Just avoiding some of the worst crashes has significant positive effects on the returns of the covering strategies.

Nevertheless, there are significant differences between the CVol and CLvg strategy. The CLvg eradicates the left heavy tail and moves the mass of the probability distribution from both tails to the center of the distribution, as shown in Figure 10. There is an increase in the center of the distribution from the returns that are equal to treasury bills when the CLvg hedging strategy is activated. However, they are not enough to statistically change the average and standard deviation of the distribution, because the CLvg avoids positive and negative returns that are related to extreme but infrequent volatility. Meanwhile, the CVol reduces but does not eliminate the heavy left tail of the returns distribution. This occurs because the CVol strategy buys a fraction of the crash when it predicts high volatility.

6. Conclusions

The most important contribution of the momentum returns literature has been to display the empirical limitations of the Efficient Market Hypothesis. Information stored in past monthly returns can be used to generate portfolios that outperform the stock market while exhibiting higher Sharpe ratios. Furthermore, covering strategies have shown that it is possible to use information stored in past daily returns to further increase the expected returns and Sharpe ratios of momentum portfolios.

However, the credibility of these findings had been questioned because researchers have depended on forward-looking biases to construct covering strategies and have disregarded transaction costs. Furthermore, to compensate for their mistakes, these strategies depend on deforming the momentum portfolio even in periods that do not present crashes. The covering strategies deform the momentum portfolio using unrealistically increasing leverage.

This research project develops a Constant Leverage covering strategy that depends only on past information and that accounts for transaction costs at the individual stock level. One of its most important features is that, if the proxy is smaller than the target, it behaves exactly like the momentum portfolio. These improvements are built on an understanding of momentum returns that goes beyond crashes. Momentum returns present a U-shaped relationship with the volatility of the loser portfolio. Momentum returns also present a weaker U-shaped relationship with the volatility of the momentum portfolio.

The main contribution of this project is a deeper understanding of the empirical regularities that surround momentum crashes. The future is unpredictable, and no one knows when a stock market sell-off will start or end. However, these periods of financial turmoil are marked by high volatility in the loser portfolio. These periods are predictable because the loser portfolio volatility presents high-volatility persistence and volatility clusters. A ten-year rolling window is used to find the volatility threshold at which the loser portfolio volatility is likely to predict the start of a financial crisis that will end when the momentum portfolio presents crashes.

The stylized facts of the momentum crashes documented in this paper could be used to develop new asset pricing models. Researchers have studied the Efficient Market Hypothesis and financial anomalies, but there has been little interest in developing models that merge the findings of both fields. The momentum anomaly states only that the first and tenth deciles do not behave like the EMH, but it does not contradict the Efficient Market Hypothesis in the other deciles. The momentum anomaly might be the bridge to bring the two models together.

Funding

A grant from CONACyT supported my graduate studies at The Ohio State University. I developed the majority of the ideas presented in this project while writing my doctoral dissertation. The Lenfest Grant from the Washington and Lee University supported the final stage of this project during the Summer of 2023.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data come from the Center for Research in Security Prices (CRSP). The estimations use individual stock returns that include dividends for all the common shares listed on NYSE, AMEX, and NASDAQ. Any researcher that pays the subscription fee can access the CRSP dataset from the Wharton Research Data Services.

Conflicts of Interest

The author declares no conflict of interest.

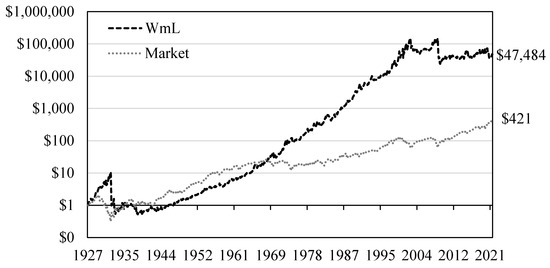

Appendix A. Momentum Portfolio without Transaction Costs (1927 to 2021)

If transaction costs are ignored, the long-run profitability of the momentum portfolio is extraordinary. As seen in Figure A1, a USD 1 investment in the stock market between 1927 and 2021 yielded USD 42, with an average excess return of 8.41% and a Sharpe ratio of 0.45. Meanwhile, a USD 1 investment in the momentum portfolio during the same period yielded USD 47,484, with an average excess return of 18.01% and a Sharpe ratio of 0.61. Using past information to form a portfolio that outperforms the stock market with a lower relative standard deviation is an anomaly under the Efficient Market Hypothesis.

Figure A1.

Cumulative returns for a USD 1 investment. This figure shows the cumulative returns of a USD 1 investment on the stock market and the momentum portfolio without transaction costs. It shows the total return to investment, not the cumulative excess returns.

Appendix B. Fifteen Largest Crashes in the Momentum Portfolio

Table A1 shows that the fifteen largest monthly losses of the momentum portfolio have occurred when the stock market sell-off ended and the stock market bounced back. The momentum portfolio crashed when the stock market recovered from the Great Depression, the dot-com bubble, the Great Recession, and the COVID-19 sell-off. These episodes were marked by high volatility in the momentum portfolio. During these months, the momentum portfolio consistently presented volatility that was more than twice its historic average value. Researchers used these two stylized data points to design covering strategies that use the momentum portfolio volatility as a proxy to prevent future crashes.

Table A1.

Largest crashes in the momentum portfolio without transaction costs. The following table shows the fifteen largest crashes for the momentum portfolio as well as the simultaneous returns of the loser portfolio, winner portfolio, and the stock market. It also shows the values of its six-month RVol divided by the average RVol in the sample. The average 126-day RVol for the momentum portfolio is 19.23%, that for the loser portfolio is 22.23%, that for the winner portfolio is 19.77%, and that for the stock market is 13.89%. The estimations use monthly data from 1927 to 2021.

Table A1.

Largest crashes in the momentum portfolio without transaction costs. The following table shows the fifteen largest crashes for the momentum portfolio as well as the simultaneous returns of the loser portfolio, winner portfolio, and the stock market. It also shows the values of its six-month RVol divided by the average RVol in the sample. The average 126-day RVol for the momentum portfolio is 19.23%, that for the loser portfolio is 22.23%, that for the winner portfolio is 19.77%, and that for the stock market is 13.89%. The estimations use monthly data from 1927 to 2021.

| Monthly Excess Returns (%) | Realized Volatility (Multiples of Average) | |||||||

|---|---|---|---|---|---|---|---|---|

| yyyy-mm | WmL | Loser | Winner | Market | WmL | Loser | Winner | Market |

| 1932-08 | −77.46 | 93.84 | 16.38 | 37.11 | 6.5 | 4.1 | 3.5 | 3.3 |

| 1932-07 | −57.88 | 74.53 | 16.65 | 34.04 | 3.1 | 3.6 | 1.5 | 3.0 |

| 2001-01 | −47.93 | 40.72 | −7.20 | 3.43 | 3.4 | 3.5 | 1.6 | 2.0 |

| 1933-04 | −45.89 | 72.27 | 26.38 | 39.32 | 3.0 | 3.7 | 1.9 | 3.9 |

| 2009-04 | −45.23 | 44.59 | −0.64 | 10.94 | 6.2 | 5.7 | 0.7 | 2.3 |

| 2009-03 | −43.97 | 48.35 | 4.38 | 8.67 | 6.9 | 6.7 | 1.4 | 3.4 |

| 2002-11 | −37.52 | 40.51 | 3.00 | 6.01 | 2.8 | 3.2 | 1.2 | 1.6 |

| 1938-06 | −32.24 | 43.40 | 11.15 | 23.79 | 3.0 | 3.2 | 0.8 | 2.2 |

| 2009-08 | −30.91 | 31.11 | 0.20 | 3.14 | 2.0 | 2.1 | 0.8 | 1.3 |

| 1933-05 | −29.75 | 46.37 | 16.62 | 21.29 | 1.8 | 2.3 | 1.8 | 2.5 |

| 1931-06 | −28.45 | 36.79 | 8.33 | 13.98 | 1.8 | 2.4 | 1.1 | 2.5 |

| 2020-04 | −27.75 | 43.32 | 15.58 | 12.97 | 2.5 | 3.0 | 2.4 | 3.0 |

| 1939-09 | −26.73 | 34.79 | 8.06 | 16.17 | 1.5 | 1.8 | 0.8 | 1.6 |

| 2020-11 | −24.81 | 37.33 | 12.53 | 12.36 | 4.8 | 3.4 | 1.8 | 1.3 |

| 1970-09 | −23.75 | 26.80 | 3.05 | 4.25 | 1.6 | 1.7 | 0.4 | 0.9 |

However, the information stored in the loser portfolio is what gives the momentum portfolio its ability to predict crashes. Selling the loser portfolio when it presented large positive returns explains the crashes of the momentum portfolio. Furthermore, the loser portfolio volatility consistently reached values that were more than three times its historical average during these periods.

Meanwhile, the information stored in the winner portfolio weakened the ability of the momentum portfolio to predict crashes. Buying the winner portfolio during the market rebound periods contributed with positive returns to the momentum portfolio, which partially offsets the losses from selling the loser portfolio. Furthermore, the momentum portfolio volatility consistently presented values that were close to its historical average during these periods of market stress, which contributed to the decrease in the volatility of the momentum portfolio. Therefore, researchers have incorrectly used the momentum portfolio volatility as the proxy variable to predict momentum crashes. They should have focused on the loser portfolio volatility.

Appendix C. The Wilcoxon Rank-Sum Test

The Wilcoxon Rank-Sum Test analyzes if two distributions are statistically different. This is a non-parametric test. It does not assume that the samples have any specific distribution. It does not test if they have the same mean, or the same standard deviation, but if both come from the same distribution. Let “M” be the 349 monthly returns between 1992 and 2021 for the momentum portfolio. Let “” be the 349 monthly returns between 1992 and 2021 for the i-th covering strategy. The null hypothesis tests if the returns distribution of the uncovered momentum portfolio is equal to the returns distribution of each covering strategy, as seen in Equation (A1).

Equation (A1). Hypothesis for equality of distributions

H0: M = Di for i = CVol or CLvg

H1: M ≠ Di for i = CVol or CLvg

H1: M ≠ Di for i = CVol or CLvg

The test starts from the null hypothesis that both samples come from the same distribution. Let be the number of observations in the first sample. Let be the number of observations in the second sample. The first step is to pool together both samples. Therefore, the total number of observations is N =+. Let be the k-th observation in the pooled sample.

The second step is to rank the N observations in ascending order and assign to each observation its ranking number. Let R() be the function that assigns the k-th observation its corresponding ranking. For example, the smallest observation will have R() = 1, while the largest observation will have R() = N. The average ranking is defined as . Let be a dummy variable that takes values of 1 if the k-th observation belongs to the first sample, and 0 if the k-th observation belongs to the second sample.

The third step is to determine the linear rank sum statistic of each sample. The statistic of each sample is equal to the addition of all the ranking of its elements. Thus, the linear rank sum statistic of the first sample is equal to .

The intuition behind the Wilcoxon Two-Sample test is simple: If two samples are drawn from the same distribution, the ranking should follow a uniform distribution from 1 to N. There is no reason why the rankings of one sample should be smaller or larger than the other one.

In the end, the null hypothesis is that the expected value of the ranking of each sample should be equal to the expected value of a uniform distribution from 1 to N, and the standard deviation of the ranking should be equal to the standard deviation of a uniform distribution from 1 to N. Let be the expected value of the statistic S under the null hypothesis. Let be the variance under the null hypothesis. The Z statistic used to test the linear rank sum statistic is shown in Equation (A2).

Equation (A2). Z statistic for a linear rank sum statistic

Notes

| 1 | Since the estimations are based on daily returns, it assumes that one month has twenty-one trading days, J = 21, and six months have one hundred and twenty-six trading days, J = 126. |

| 2 | Less than three percent of the stocks are missing bid or ask prices or both between December 1992 and December 2021. I input the average monthly price spread of the portfolio (loser or winner) to each stock that is missing data. |

References

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Barroso, Pedro, and Pedro Santa-Clara. 2015. Momentum has its moments. Journal of Financial Economics 116: 111–20. [Google Scholar] [CrossRef]

- Bhardwaj, Ravinder K., and Leroy D. Brooks. 1992. The January anomaly: Effects of low share prices, transaction costs, and bid-ask bias. The Journal of Finance 47: 553–75. [Google Scholar]

- Booth, G. Geoffrey, Hung-Gay Fung, and Wai Kin Leung. 2016. A risk-return explanation of the momentum-reversal “anomaly”. Journal of Empirical Finance 35: 68–77. [Google Scholar] [CrossRef]

- Chan, Kalok, Allaudeen Hameed, and Wilson Tong. 2000. Profitability of momentum Strategies in the International Equity Markets. Journal of Financial and Quantitative Analysis 35: 153–72. [Google Scholar] [CrossRef]

- Chen, Zhuo, and Andrea Lu. 2017. Slow diffusion of information and price momentum in stocks: Evidence from options markets. Journal of Banking and Finance 75: 98–108. [Google Scholar] [CrossRef]

- Conrad, Jennifer, and Gautam Kaul. 1998. An anatomy of trading strategies. Review of Financial Studies 11: 489–519. [Google Scholar] [CrossRef]

- Cujean, Julien, and Michael Hasler. 2017. Why does return predictability concentrate in bad times? The Journal of Finance 72: 2717–58. [Google Scholar] [CrossRef]

- Daniel, Kent, and Tobias J. Moskowitz. 2016. Momentum crashes. Journal of Financial Economics 122: 221–47. [Google Scholar] [CrossRef]

- Demirer, Riza, and Huacheng Zhang. 2019. Industry herding and the profitability of momentum strategies during market crises. Journal of Behavioral Finance 20: 195–212. [Google Scholar] [CrossRef]

- Fan, Minyou, Youwei Li, and Jiadong Liu. 2018. Risk adjusted momentum strategies: A comparison between constant and dynamic volatility scaling approaches. Research in International Business and Finance 46: 131–40. [Google Scholar] [CrossRef]

- Gorton, Gary B., Fumio Hayashi, and K. Geert Rouwenhorst. 2012. The Fundamentals of Commodity Futures Returns. Review of Finance 17: 35–105. [Google Scholar] [CrossRef]

- Grundy, Bruce D., and J. Spencer Martin. 2001. Understanding the nature of the Risk and the Source of the Rewards of the momentum Investing. The Review of Financial Studies 14: 29–78. [Google Scholar] [CrossRef]

- Hur, Jungshik, and Vivek Singh. 2019. How do disposition effect and anchoring bias interact to impact momentum in stock returns? Journal of Empirical Finance 53: 238–56. [Google Scholar] [CrossRef]

- Jegadeesh, Narasimhan, and Sheridan Titman. 1993. Returns to Buying Winners and Selling Losers: Implications for Stock Market Efficiency. The Journal of Finance 48: 65–91. [Google Scholar] [CrossRef]

- Jostova, Gergana, Stanislava Nikolova, Alexander Philipov, and Christof W. Stahel. 2013. Momentum in Corporate Bond Returns. The Review of Financial Studies 26: 1649–93. [Google Scholar] [CrossRef]

- Korajczyk, Robert A., and Ronnie Sadka. 2004. Are Momentum Profits Robust to Trading Costs? The Journal of Finance 59: 1039–82. [Google Scholar] [CrossRef]

- Lesmond, David A., Michael J. Schill, and Chunsheng Zhou. 2004. The illusory nature of momentum profits. Journal of Financial Economics 71: 349–80. [Google Scholar] [CrossRef]

- Li, Jun. 2017. Explaining momentum and value simultaneously. Management Science 64: 4239–60. [Google Scholar] [CrossRef]

- Lim, Bryan Y., Jiaguo (George) Wang, and Yaqiong Yao. 2018. Time-series momentum in nearly 100 years of stock returns. Journal of Banking and Finance 97: 283–296. [Google Scholar] [CrossRef]

- Moskowitz, Tobias J., and Mark Grinblatt. 1999. Do industries explain momentum? Journal of Finance 54: 1249–90. [Google Scholar] [CrossRef]

- Okunev, John, and Derek White. 2003. Do momentum-based strategies still work in Foreign Currency Markets? Journal of Financial and Quantitative Analysis 38: 425–47. [Google Scholar] [CrossRef]

- Rouwenhorst, K. Geert. 1998. International momentum Strategies. The Journal of Finance 53: 267–84. [Google Scholar] [CrossRef]

- Ruenzi, Stefan, and Florian Weigert. 2018. Momentum and crash sensitivity. Economics Letters 165: 77–81. [Google Scholar] [CrossRef]

- Singh, Simarjeet, and Nidhi Walia. 2020. Momentum investing: A systematic literature review and bibliometric analysis. Management Review Quarterly 72: 87–113. [Google Scholar] [CrossRef]

- Vayanos, Dimitri, and Paul Woolley. 2013. An institutional theory of momentum and reversal. Review of Financial Studies 26: 1087–145. [Google Scholar] [CrossRef]

- Wang, Kevin Q., and Jianguo Xu. 2015. Market volatility and momentum. Journal of Empirical Finance 30: 79–91. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).