A Component Expected Shortfall Approach to Systemic Risk: An Application in the South African Financial Industry

Abstract

:1. Introduction

2. Literature Review

2.1. Theoretical Framework

2.2. Empirical Literature

3. Methodology

4. Results

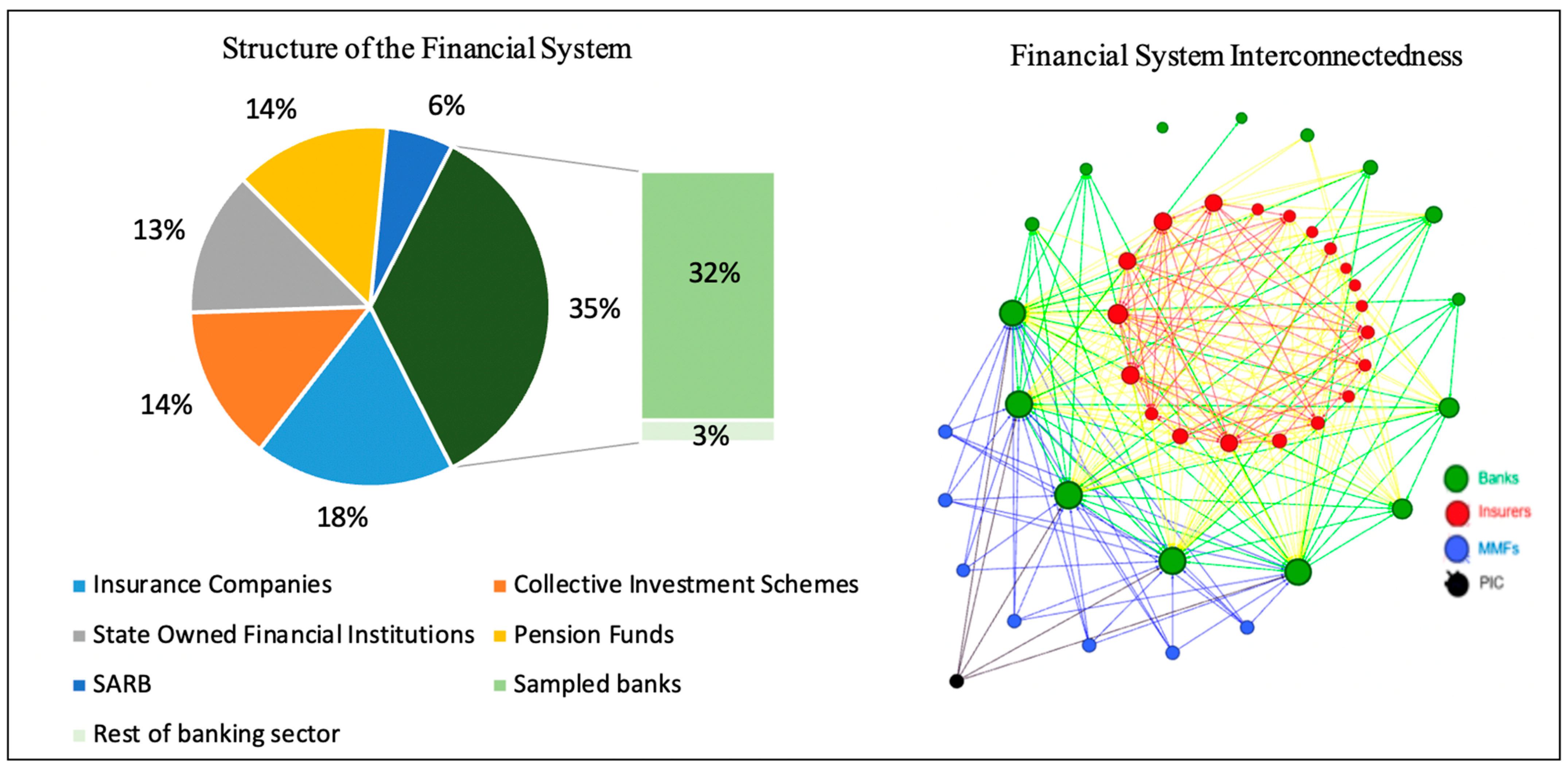

4.1. Data

Descriptive Statistics

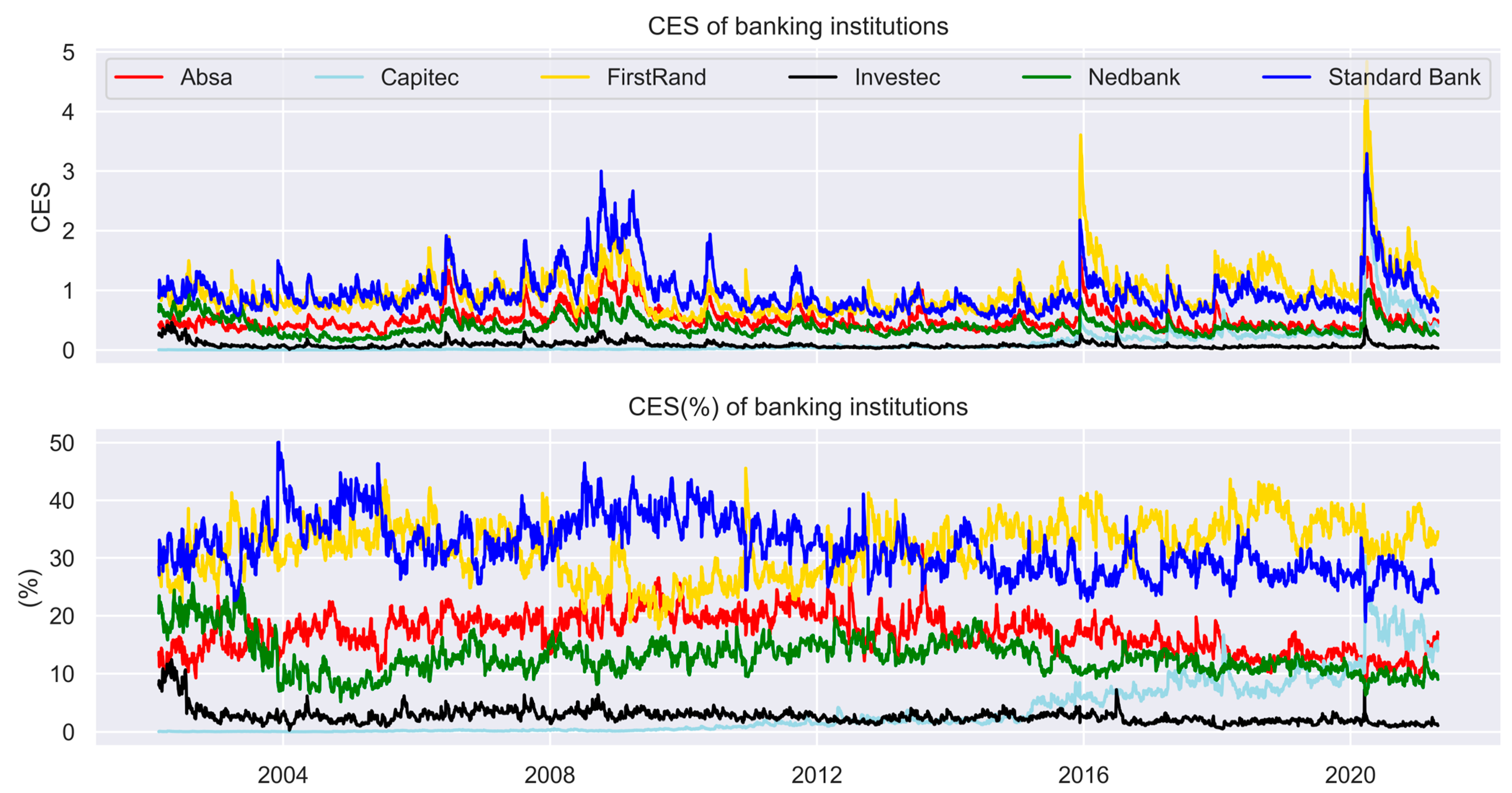

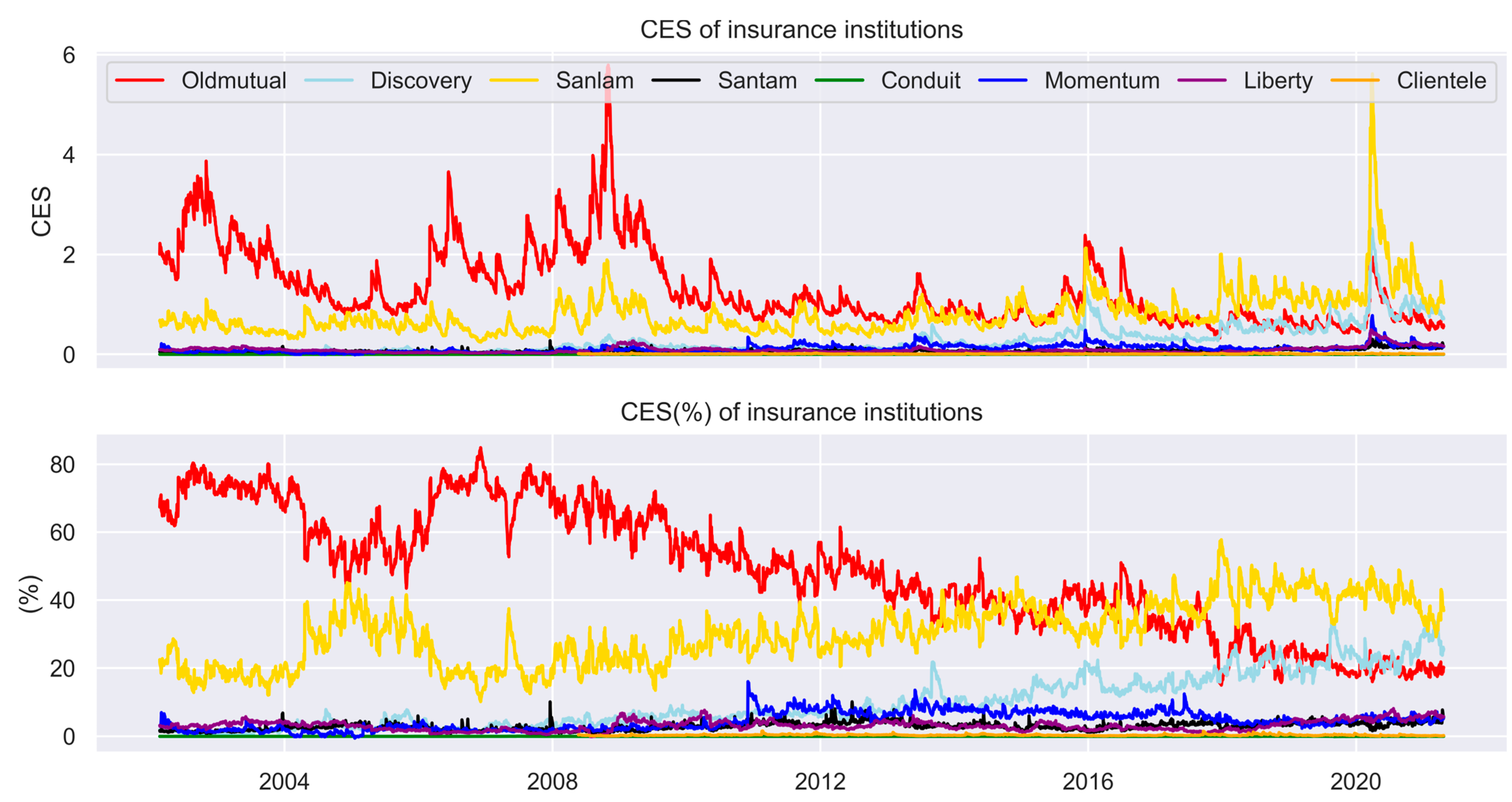

4.2. Empirical Results

5. Conclusions

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A. Capital Framework for South Africa Based on the Basel III Framework

| Capital Tiers | CET1 Capital Requirement | Tier Capital Requirement | Total Capital Requirement |

| BCBS Basel III minima | 8.0% | ||

| South African minima | P2A (<=2.0%) | ||

| Systemic risk add-on2 (Total Pillar 2A range 0.5–2.0%) | 8.0% + P2A | ||

| South African base minima | ICR | ||

| Bank-specific ICR add-on (Pillar 2B) | 8.0% + P2A + ICR | ||

| South African minima (prudential minima) | 8.0% + P2A + ICR | ||

| Domestic Systemically Important Bank capital add-on (0–2.5%) | DSIB (max of 2.5%) | ||

| Conservation buffer range (0–2.5%) | CB (<=2.5%) | ||

| Countercyclical buffer range3 (0–2.5%) | CCyB | ||

| SA minima, including countercyclical buffer, conservation buffer, and D-SIB requirements4 | 10.5% + ICR + CCyB the lower of (3.5% or (P2A + DSIB)) |

Appendix B. SARB SIFI Indicators and Weights

| Indicator | Weighting (%) |

| Size | 40 |

| Interconnectedness and substitutability | 40 |

| Global activity | 10 |

| Complexity | 10 |

| 1 | The six banks included in this study account for almost 91 percent of banking sector assets. |

| 2 | Aggregate requirement for Pillar 2A and D-SIB will not exceed 2.0 per cent for CET1, 2.5 per cent for Tier 1 and 3.5 per cent in respect of the total capital-adequacy ratio. |

| 3 | In line with the BCBS’s paper released in December 2010, entitled ”Basel III: Global Regulatory Framework for more Resilient Banks and Banking Systems”, revised June 2011, under paragraph 137, the countercyclical buffer is likely to be imposed on an infrequent basis in order to serve its intended purpose. |

| 4 | As specified in regulation 38(9)(a) of the amended Regulations, the South African minima ratios, including the HLA requirement for D-SIBs, the capital conservation buffer and the countercyclical buffer, shall not be lower than 6,5 per cent for CET1, 8 per cent for Tier 1 and 10 per cent in respect of the total capital-adequacy ratio. |

References

- Acharya, Viral, Robert Engle, and Matthew Richardson. 2012. Capital shortfall: A new approach to ranking and regulating systemic risks. American Economic Review 102: 59–64. [Google Scholar] [CrossRef]

- Allen, Franklin, and Elena Carletti. 2013. What is systemic risk? Journal of Money, Credit and Banking 45: 121–27. [Google Scholar] [CrossRef]

- Banulescu, Georgiana-Denisa, and Elena-Ivona Dumitrescu. 2015. Which are the SIFIs? A Component Expected Shortfall approach to systemic risk. Journal of Banking & Finance 50: 575–88. [Google Scholar]

- Baumöhl, Eduard, Elie Bouri, Syed Jawad, Hussain Shahzad, and Tomáš Výrost. 2022. Measuring systemic risk in the global banking sector: A cross-quantilogram network approach. Economic Modelling 109: 105775. [Google Scholar] [CrossRef]

- BCBS. 2013. Global Systemically Important Banks: Updated Assessment Methodology and the Higher Loss Absorbency Requirement. Technical report. Basel: Bank for International Settlements, Basel Committee on Banking Supervision. [Google Scholar]

- Billio, Monica, Mila Getmansky, Andrew W. Lo, and Loriana Pelizzon. 2012. Econometric measures of connectedness and systemic risk in the finance and insurance sectors. Journal of Financial Economics 104: 535–59. [Google Scholar] [CrossRef]

- Bisias, Dimitrios, Mark Flood, Andrew W. Lo, and Stavros Valavanis. 2012. A survey of systemic risk analytics. Annual Review of Financial Economics 4: 255–96. [Google Scholar] [CrossRef]

- Brownlees, Christian T., and Robert Engle. 2012. Volatility, Correlation and Tails for Systemic Risk Measurement. Available online: https://creates.au.dk/fileadmin/site_files/filer_oekonomi/subsites/creates/Seminar_Papers/2012/mes.pdf (accessed on 2 January 2023).

- Brownlees, Christian, and Robert Engle. 2017. SRISK: A conditional capital shortfall measure of systemic risk. The Review of Financial Studies 30: 48–79. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K., and Patrick Cheridito. 2019. Measuring and allocating systemic risk. Risks 7: 46. [Google Scholar] [CrossRef]

- Chatterjee, Somnath, and Marea Sing. 2021. Measuring Systemic Risk in South African Banks. South African Reserve Bank SARB Working Paper (No. 11004). Pretoria: South African Reserve Bank. [Google Scholar]

- Chen, Hua, J. David Cummins, Krupa S. Viswanathan, and Mary A. Weiss. 2014. Systemic risk and the interconnectedness between banks and insurers: An econometric analysis. Journal of Risk and Insurance 81: 623–52. [Google Scholar] [CrossRef]

- Coleman, Thomas F., Alex LaPlante, and Alexey Rubtsov. 2018. Analysis of the SRISK measure and its application to the Canadian banking and insurance industries. Annals of Finance 14: 547–70. [Google Scholar] [CrossRef]

- Cummins, J. David, and Mary A. Weiss. 2013. Systemic risk and the US insurance sector. Journal of Risk and Insurance 81: 489–528. [Google Scholar] [CrossRef]

- Denis, Vintu, and Loana Alina Negotei. 2018. Analysis of Financial Stability: The Construction of a New Composite Financial Stability Index for Euro Area. Ovidius University Annals, Constanța, Romania, Economic Sciences Series; Constanța: Ovidius University of Constantza, Faculty of Economic Sciences, pp. 264–70. [Google Scholar]

- Dow, James. 2000. What Is Systemic Risk? Moral Hazard, Initial Shocks, and Propagation. Monetary and Economic Studies 18: 1–24. [Google Scholar]

- Eijffinger, Sylvester. 2012. Rating agencies: Role and influence of their sovereign credit risk assessment in the eurozone. JCMS: Journal of Common Market Studies 50: 912–21. [Google Scholar] [CrossRef]

- Eling, Martin, and David Pankoke. 2014. Systemic Risk and the Insurance Industry: Principal Linkages and Dependencies. In Macroprudential Supervision in Insurance: Theoretical and Practical Aspects. London: Palgrave Macmillan, pp. 38–65. [Google Scholar]

- Financial Services Board. 2018. Annual Report. Financial Services Board Working Paper. Washington, DC: Financial Services Board. [Google Scholar]

- Foggitt, Gregory M., Andre Heymans, van Gary W. Vuuren, and Anmar Pretorius. 2017. Measuring the systemic risk in the South African banking sector. South African Journal of Economic and Management Sciences 20: 1–9. [Google Scholar] [CrossRef]

- Girardi, Giulio, and A. Tolga Ergün. 2013. Systemic risk measurement: Multivariate GARCH estimation of CoVaR. Journal of Banking & Finance 37: 3169–80. [Google Scholar]

- Hasse, J. B. 2022. Systemic risk: A network approach. Empirical Economics 63: 313–44. [Google Scholar] [CrossRef]

- Hesse, M. H., and M. K. Miyajima. 2022. South Africa: The Financial Sector-Sovereign Nexus. Washington, DC: International Monetary Fund. [Google Scholar]

- Huang, Xin, Hao Zhou, and Haibin Zhu. 2009. A framework for assessing the systemic risk of major financial institutions. Journal of Banking & Finance 33: 2036–49. [Google Scholar]

- IAIS. 2019. Global Systemically Important Insurers: Proposed Assessment Methodology. Basel: International Association of Insurance Supervisors. [Google Scholar]

- International Monetary Fund. 2022. South Africa: Financial Sector Assessment Program. IMF Country Report No 22/39. Washington, DC: IMF. [Google Scholar]

- Kaserer, Christoph, and Christian Klein. 2019. Systemic risk in financial markets: How systemically important are insurers? Journal of Risk and Insurance 86: 729–59. [Google Scholar] [CrossRef]

- Kyoud, Ayoub, Cherif El Msiyah, and Jaouad Madkour. 2023. Modelling Systemic Risk in Morocco’s Banking System. International Journal of Financial Studies 11: 70. [Google Scholar] [CrossRef]

- Manguzvane, Mathias, and Muteba John Weirstrass Mwamba. 2019. Modelling systemic risk in the South African banking sector using CoVaR. International Review of Applied Economics 33: 624–41. [Google Scholar] [CrossRef]

- Muteba Mwamba, John Weirstrass, and Ehounou Serge Eloge Florentin Angaman. 2021. Modeling System Risk in the South African Insurance Sector: A Dynamic Mixture Copula Approach. International Journal of Financial Studies 9: 29. [Google Scholar] [CrossRef]

- Naeem, Muhammad Abubakr, Sitara Karim, and Aviral Kumar Tiwari. 2022. Quantifying systemic risk in US industries using neural network quantile regression. Research in International Business and Finance 61: 101648. [Google Scholar] [CrossRef]

- Rahman, Md. Lutfur, Victor Troster, Gazi Salah Uddin, and Muhammad Yahya. 2022. Systemic risk contribution of banks and non-bank financial institutions across frequencies: The Australian experience. International Review of Financial Analysis 79: 101992. [Google Scholar] [CrossRef]

- Reboredo, Juan, and Andrea Ugolini. 2015. Systemic risk in European sovereign debt markets: A CoVaR-copula approach. Journal of International Money and Finance 51: 214–44. [Google Scholar] [CrossRef]

- Salim, M. Zulkifli, and Kevin Daly. 2021. Modelling systemically important banks vis-a-vis the Basel prudential guidelines. Journal of Risk and Financial Management 14: 295. [Google Scholar] [CrossRef]

- South African Reserve Bank. 2020. A Methodology to Determine Which Insurers Are Systemically Important within the South African Context. SARB Discussion Paper. Pretoria: SARB Financial Stability Department. [Google Scholar]

- Smaga, Pawet. 2014. The Concept of Systemic Risk. Systemic Risk Centre Special Paper. Frankfurt am Main: European Central Bank. [Google Scholar]

- Tobias, Adrian, and Markus K. Brunnermeier. 2016. CoVaR. The American Economic Review 106: 1705. [Google Scholar]

- Wang, Ze, Xiangyun Gao, Shupei Huang, Qingru Sun, Zhihua Chen, Renwu Tang, and Zengru Di. 2022. Measuring systemic risk contribution of global stock markets: A dynamic tail risk network approach. International Review of Financial Analysis 84: 102361. [Google Scholar] [CrossRef]

- Zhang, Zhiwei, Dayong Zhang, Fei Wu, and Qiang Ji. 2021. Systemic risk in the Chinese financial system: A copula-based network approach. International Journal of Finance & Economics 26: 2044–63. [Google Scholar]

| Banks | Insurance | |

|---|---|---|

| Life | Non-LIFE | |

| Absa Limited (ABG) | Old Mutual Limited (OML) | Santam Limited (SNT) |

| Capitec Bank Limited (CPI) | Discovery Limited (DSY) | Conduit Capital (CND) |

| FirstRand Limited (FSR) | Sanlam Limited (SLM) | |

| Investec Limited (INL) | Momentum Metropolitan Holdings Limited (MTM) | |

| Nedbank Limited (NED) | Liberty Holdings Limited (LBH) | |

| Standard Bank Group Limited (SBK) | Clientele Limited (CLI) | |

| Mean | Standard Deviation | Minimum | Maximum | Skewness | Kurtosis | Observation | |

|---|---|---|---|---|---|---|---|

| Banks | |||||||

| ABG | 0.03 | 2.03 | −16.89 | 16.96 | −0.05 | 5.75 | 4793 |

| CPI | 0.14 | 2.64 | −32.74 | 48.95 | 1.17 | 42.89 | 4793 |

| FSR | 0.04 | 2.05 | −16.06 | 12.91 | −0.18 | 4.05 | 4793 |

| INL | 0.01 | 2.29 | −54.56 | 16.76 | −2.89 | 5.56 | 4793 |

| NED | 0.00 | 2.07 | −17.17 | 12.81 | −0.17 | 5.56 | 4793 |

| SBK | 0.03 | 1.97 | −14.55 | 11.70 | −0.06 | 3.61 | 4793 |

| Insurers | |||||||

| OML | 0.01 | 2.11 | −17.61 | 14.65 | −0.15 | 6.54 | 4793 |

| DSY | 0.06 | 1.90 | −16.37 | 16.40 | −0.24 | 7.82 | 4793 |

| SLM | 0.04 | 1.90 | −15.39 | 11.87 | −0.34 | 3.88 | 4793 |

| MTM | 0.02 | 1.94 | −19.13 | 12.20 | −0.29 | 6.18 | 4793 |

| LBH | 0.00 | 1.81 | −16.22 | 22.43 | 0.16 | 12.43 | 4793 |

| CLI | 0.01 | 2.64 | −28.77 | 24.78 | −0.44 | 17.18 | 3232 |

| SNT | 0.04 | 1.67 | −20.97 | 11.81 | −0.34 | 10.44 | 4793 |

| CND | 0.02 | 7.82 | −138.63 | 142.71 | 0.01 | 84.42 | 4793 |

| October 2008 | December 2015 | March 2020 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Rank | CES | Rank | VaR | Rank | CES | Rank | VaR | Rank | CES | Rank | VaR |

| SBK | 2.55 (39.7) | INL | 8.06 | FSR | 2.21 (37.1) | FSR | 6.07 | FSR | 2.89 (34.9) | INL | 17.29 |

| FSR | 1.53 (23.8) | SBK | 6.63 | SBK | 1.45 (25.8) | ABG | 5.53 | SBK | 2.08 (26.3) | CPI | 10.23 |

| ABG | 1.29 (20.0) | NED | 6.28 | ABG | 1.00 (17.5) | SBK | 5.42 | CPI | 1.68 (16.7) | NED | 7.90 |

| NED | 0.79 (12.2) | ABG | 6.09 | NED | 0.58 (10.2) | CPI | 5.39 | ABG | 0.89 (11.1) | FSR | 7.51 |

| INL | 0.26 (4.1) | FSR | 5.81 | CPI | 0.53 (6.4) | INL | 5.15 | NED | 0.63 (8.0) | ABG | 7.45 |

| CPI | 0.01 (0.2) | CPI | 4.07 | INL | 0.17 (3.1) | NED | 4.26 | INL | 0.25 (2.9) | SBK | 7.40 |

| Banks | D-SIB Capital Add-On Held in CET1 (%) * | CES ** |

|---|---|---|

| Standard Bank | 1.0 | 0.78 (25.08) |

| FirstRand | 0.8 | 1.09 (34.77) |

| Capitec | 0.5 | 0.5 (15.70) |

| Absa | 0.5 | 0.41 (13.26) |

| Nedbank | 0.5 | 0.31 (9.83) |

| Investec | 0.25 | 0.04 (1.36) |

| October 2008 | December 2015 | March 2020 | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| CES | Rank | VaR | Rank | CES | Rank | VaR | Rank | CES | Rank | VaR | |

| OML | 4.45 (65.7) | OML | 9.51 | OML | 1.73 (38.1) | DSY | 5.84 | SLM | 3.32 (45.8) | CND | 21.76 |

| SLM | 1.67 (25.1) | CND | 8.20 | SLM | 1.49 (32.1) | SLM | 5.76 | DSY | 1.52 (21.0) | DSY | 9.54 |

| DSY | 0.29 (4.4) | SLM | 6.45 | DSY | 0.94 (19.8) | CND | 5.60 | OML | 1.39 (19.7) | SLM | 7.49 |

| MTM | 0.16 (2.4) | MTM | 5.18 | MTM | 0.28 (5.9) | MTM | 4.54 | MTM | 0.41 (5.6) | OLM | 6.78 |

| SNT | 0.11 (1.6) | LBH | 4.91 | SNT | 0.09 (2.0) | OLM | 3.87 | LBH | 0.33 (4.8) | LBH | 5.40 |

| LBH | 0.05 (0.8) | DSY | 4.76 | LBH | 0.09 (2.0) | LBH | 3.74 | SNT | 0.19 (2.8) | MTM | 5.38 |

| CLI | 0.01 (0.2) | CLI | 4.71 | CLI | 0.01 (0.2) | SNT | 3.56 | CLI | 0.02 (0.3) | CLI | 5.13 |

| CND | 0.00 (0) | SNT | 3.49 | CND | 0.00 (0.1) | CLI | 3.55 | CND | 0.00 (0.0) | SNT | 3.30 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Manguzvane, M.M.; Ngobese, S.B. A Component Expected Shortfall Approach to Systemic Risk: An Application in the South African Financial Industry. Int. J. Financial Stud. 2023, 11, 146. https://doi.org/10.3390/ijfs11040146

Manguzvane MM, Ngobese SB. A Component Expected Shortfall Approach to Systemic Risk: An Application in the South African Financial Industry. International Journal of Financial Studies. 2023; 11(4):146. https://doi.org/10.3390/ijfs11040146

Chicago/Turabian StyleManguzvane, Mathias Mandla, and Sibusiso Blessing Ngobese. 2023. "A Component Expected Shortfall Approach to Systemic Risk: An Application in the South African Financial Industry" International Journal of Financial Studies 11, no. 4: 146. https://doi.org/10.3390/ijfs11040146

APA StyleManguzvane, M. M., & Ngobese, S. B. (2023). A Component Expected Shortfall Approach to Systemic Risk: An Application in the South African Financial Industry. International Journal of Financial Studies, 11(4), 146. https://doi.org/10.3390/ijfs11040146