Influence of Transparency and Disclosures on the Dividend Distribution Decisions in the Firms: Do Profitability and Efficiency of Firms Matter?

Abstract

:1. Introduction

2. Review of Literature

2.1. Impact of Corporate Governance Mechanism on Various Factors

2.2. Impact of Transparency and Disclosure on Various Factors

2.3. Impact of Transparency and Disclosure on Dividends

2.4. Impact of Profitability and Technical Efficiency (Moderating Variables) on Transparency and Disclosure and Dividends Connection

3. Results

3.1. Statistical Summary

3.2. Correlation and Endogeneity

3.3. Regression Outcomes

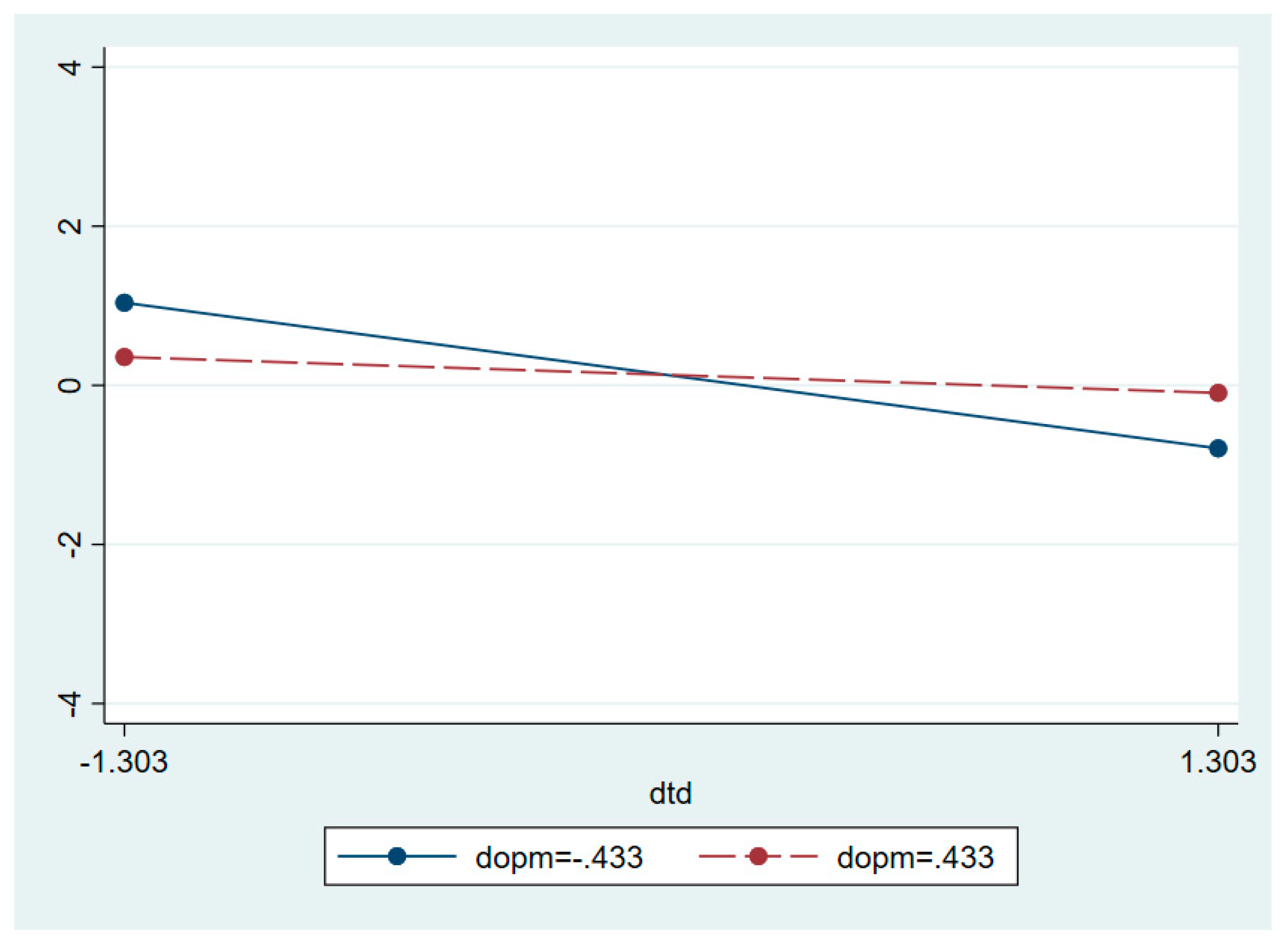

3.4. Results’ Robustness

4. Data and Research Methodology

4.1. Data

4.2. Methodology

4.3. Transparency and Disclosure

4.4. Efficiency

4.5. Profitability

4.6. Control Variables

5. Discussion

6. Conclusions

6.1. Contribution

6.2. Implications

6.3. Limitations and Study’s Future Scope

Author Contributions

Funding

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abor, Joshua, and Godfred A. Bokpin. 2010. Investment opportunities, corporate finance, and dividend payout policy: Evidence from emerging markets. Studies in Economics and Finance 27: 180–94. [Google Scholar] [CrossRef]

- ACGA. 2021. CG Watch 2020: Future Promise: Aligning Governance and ESG in Asia, Asian Corporate Governance Association. Special Report—May 2021. Hongkong: ACGA. [Google Scholar]

- Acharya, Viral V., Stewart C. Myers, and Raghuram G. Rajan. 2011. The Internal Governance of Firms. Journal of Finance 66: 689–720. [Google Scholar] [CrossRef]

- Adawi, Mohamed, and Kami Rwegasira. 2013. Corporate governance and firm valuation in emerging markets: Evidence from uae listed companies in the middle east. Corporate Ownership and Control 11: 637–56. [Google Scholar] [CrossRef]

- Aebi, Vincent, Gabriele Sabato, and Markus Schmid. 2012. Risk management, corporate governance, and bank performance in the financial crisis. Journal of Banking and Finance 36: 3213–26. [Google Scholar] [CrossRef]

- Akhigbe, Aigbe, James E. Mcnulty, and Bradley A. Stevenson. 2017. Additional evidence on transparency and bank financial performance. Review of Financial Economics 32: 1–6. [Google Scholar] [CrossRef]

- Aksu, Mine, and Arman Kosedag. 2006. Transparency and disclosure scores and their determinants in the Istanbul Stock Exchange. Corporate Governance: An International Review 14: 277–96. [Google Scholar] [CrossRef]

- Amir, Eli, and Baruch Lev. 1996. Value-Relevance of Non-Financial Information: The Wireless Communications Industry. Journal of Accounting and Economics 22: 3–30. [Google Scholar] [CrossRef]

- Arsov, Sasho, and Vesna Bucevska. 2017. Determinants of transparency and disclosure–evidence from post-transition economies. Economic Research-Ekonomska Istraživanja 30: 745–60. [Google Scholar] [CrossRef]

- Azrak, Tawfik, Buerhan Saiti, Ali Kutan, and Engku Rabiah Adawiah Engku Ali. 2020. Does information disclosure reduce stock price volatility? A comparison of Islamic and conventional banks in Gulf countries. International Journal of Emerging Markets 16: 1769–92. [Google Scholar] [CrossRef]

- Baltagi, Badi H., ed. 2008. A Companion to Theoretical Econometrics. Hoboken: John Wiley & Sons. [Google Scholar]

- Bebchuk, Lucian, Alma Cohen, and Allen Ferrell. 2009. What matters in corporate governance? The Review of Financial Studies 22: 783–827. [Google Scholar] [CrossRef]

- Bebczuk, Ricardo. 2007. Corporate governance, ownership, and dividend policies in Argentina. In Investor Protection and Corporate Governance: Firm-Level Evidence across Latin America. Washington, DC: World Bank Publications, pp. 157–211. [Google Scholar]

- Berglöf, Erik, and Anete Pajuste. 2005. What do firms disclose and why? Enforcing corporate governance and transparency in central and eastern Europe. Oxford Review of Economic Policy 21: 178–97. [Google Scholar] [CrossRef]

- Bhattacharya, Debarati, Chia-Wen Chang, and Wei-Hsien Li. 2020. Stages of firm life cycle, transition, and dividend policy. Finance Research Letters 33: 101226. [Google Scholar] [CrossRef]

- Botosan, Christine A. 2006. Disclosure and the cost of capital: What do we know? Accounting and Business Research 36: 31–40. [Google Scholar]

- Bushman, Robert M., Joseph D. Piotroski, and Abbie J. Smith. 2004. What determines corporate transparency? Journal of Accounting Research 42: 207–52. [Google Scholar] [CrossRef]

- CLSA. 2020. Corporate Governance Watch 2020. Available online: https://www.clsa.com/corporate-governance-watch-2020-australia-ranks-no-1-by-market-materials-capital-goods-best-performing-sector/ (accessed on 4 August 2023).

- Cooper, William W., Lawrence M. Seiford, and Joe Zhu, eds. 2011. Handbook on Data Envelopment Analysis. New York: Springer. [Google Scholar]

- Dewasiri, N. Jayantha, Weerakoon Banda Yatiwelle Koralalage, Athambawa Abdul Azeez, P. G. S. A. Jayarathne, Duminda Kuruppuarachchi, and V. A. Weerasinghe. 2019. Determinants of dividend policy: Evidence from an emerging and developing market. Managerial Finance 45: 413–29. [Google Scholar] [CrossRef]

- Dimitropoulos, Panagiotis E., and Athanasios Tsagkanos. 2012. Financial Performance and Corporate Governance in the European Football Industry. International Journal of Sport Finance 7: 280+. [Google Scholar]

- Easterbrook, Frank H. 1984. Two agency-cost explanations of Dividends. The American Economic Review 74: 650–59. [Google Scholar]

- Elshandidy, Tamer, and Lorenzo Neri. 2015. Corporate Governance, Risk Disclosure Practices, and Market Liquidity: Comparative Evidence from the UK and Italy. Corporate Governance: An International Review 23: 331–56. [Google Scholar] [CrossRef]

- Falavigna, Greta, and Roberto Ippoliti. 2022. Financial constraints, investments, and environmental strategies: An empirical analysis of judicial barriers. Business Strategy and the Environment 31: 2002–18. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1999. The Corporate Cost of Capital and the return on Corporate Investment. Journal of Finance 54: 1939–67. [Google Scholar] [CrossRef]

- Filer, Randall K., and Devra L. Golbe. 2003. Debt, operating margin, and investment in workplace safety. The Journal of Industrial Economics 51: 359–81. [Google Scholar] [CrossRef]

- Frost, Carol Ann, Elizabeth A. Gordon, and Grace Pownall. 2005. Transparency, Disclosure, and Emerging Market Companies’ Access to Capital in Global Equity Markets (Working Paper). Available online: http://papers.ssrn.com/sol3/papers.cfm?abstract_id=802824 (accessed on 14 October 2013).

- Garay, Urbi, and Maximiliano González. 2008. Corporate Governance and Firm Value: The Case of Venezuela. Corporate Governance: An International Review 16: 194–209. [Google Scholar] [CrossRef]

- Gebka, Bartosz. 2019. Asymmetric price reactions to dividend announcements: Always irrational? Economics Letters 185: 108713. [Google Scholar] [CrossRef]

- Hail, Luzi. 2002. The impact of voluntary corporate disclosures on the ex-ante cost of capital for Swiss firms. The European Accounting Review 11: 741–73. [Google Scholar] [CrossRef]

- Hanifa, Mohamed Hisham, and Hafiz-Majdi Ab Rashid. 2005. The determinants of voluntary disclosures in Malaysia: The case of internet financial reporting. Unitar E-Journal 2: 22–42. [Google Scholar]

- Hasan, Fakhrul. 2021. Dividend Changes as Predictors of Future Profitability. The Journal of Prediction Markets 15: 37–66. [Google Scholar] [CrossRef]

- Hasan, Md. Bokhtiar, Abu N. M. Wahid, Md. Ruhul Amin, and Md. Delowar Hossain. 2021. Dynamics between ownership structure and dividend policy: Evidence from Bangladesh. International Journal of Emerging Markets 18: 588–606. [Google Scholar] [CrossRef]

- Hassan, Mostafa Kamal. 2012. A disclosure index to measure the extent of corporate governance reporting by UAE listed corporations. Journal of Financial Reporting and Accounting 10: 4–33. [Google Scholar] [CrossRef]

- Hsiao, Cheng. 2007. Panel data analysis—Advantages and challenges. Test 16: 1–22. [Google Scholar] [CrossRef]

- Ittner, Christopher D., and David F. Larcker. 1999. Are Non-financial Measures Leading Indicators of Financial Performance? An Analysis of Customer Satisfaction. Journal of Accounting Research 36: 1–46. [Google Scholar] [CrossRef]

- Jones, Jeffrey S., Wayne Y. Lee, and Timothy J. Yeager. 2012. Opaque banks, price discovery, and financial instability. Journal of Financial Intermediation 21: 383–408. [Google Scholar] [CrossRef]

- Kahneman, Daniel, and Amos Tversky. 1979. On the interpretation of intuitive probability: A reply to Jonathan Cohen. Cognition 7: 1. [Google Scholar] [CrossRef]

- Kanoujiya, Jagjeevan, Rebecca Abraham, Shailesh Rastogi, and Venkata Mrudula Bhimavarapu. 2023. Transparency and Disclosure and Financial Distress of Non-Financial Firms in India under Competition: Investors’ Perspective. Journal of Risk and Financial Management 16: 217. [Google Scholar] [CrossRef]

- Klapper, Leora F., and Inessa Love. 2004. Corporate governance, investor protection, and performance in emerging markets. Journal of Corporate Finance 10: 703–28. [Google Scholar] [CrossRef]

- Korent, Dina, Ivana Đunđek, and Marina Klačmer Čalopa. 2014. Corporate governance practices and firm performance measured by Croatian Corporate Governance Index (CCGI®). Economic Research-Ekonomska Istraživanja 27: 221–31. [Google Scholar] [CrossRef]

- Kowalewski, Oskar, Ivan Stetsyuk, and Oleksandr Talavera. 2008. Corporate governance and dividend policy in Poland. Post-Communist Economies 20: 203–18. [Google Scholar] [CrossRef]

- La Porta, Rafael, Florencio Lopez-De-Silanes, Andrei Shleifer, and Robert W. Vishny. 2000. Agency Problems and Dividend Policies Around the World. Journal of Finance 55: 1–33. [Google Scholar] [CrossRef]

- Lai, Shu-Miao, Chih-Liang Liu, and Taychang Wang. 2014. Increased disclosure and investment efficiency. Asia-Pacific Journal of Accounting and Economics 21: 308–27. [Google Scholar] [CrossRef]

- Lawrence, Alastair. 2013. Individual investors and financial disclosure. Journal of Accounting and Economics 56: 130–47. [Google Scholar] [CrossRef]

- Lo, Shih-Fang, and Wen-Min Lu. 2006. Does size matter? Finding the profitability and marketability benchmark of financial holding companies. Asia-Pacific Journal of Operational Research 23: 229–46. [Google Scholar] [CrossRef]

- López-Iturriaga, Félix, and Domingo J. Santana-Martín. 2015. Do Shareholder Coalitions Modify the Dominant Owner’s Control? The Impact on Dividend Policy. Corporate Governance: An International Review 23: 519–33. [Google Scholar] [CrossRef]

- Majumdar, Sumit K., and Pradeep Chhibber. 1999. Capital structure and performance: Evidence from a transition economy on an aspect of corporate governance. Public Choice 98: 287–305. [Google Scholar] [CrossRef]

- Mallin, Chris. 2002. The relationship between corporate governance, transparency and financial disclosure: Editorial. Corporate Governance: An International Review 10: 253–55. [Google Scholar] [CrossRef]

- Marito, Basaria Christina, and Andam Dewi Sjarif. 2020. The impact of current ratio, debt to equity ratio, return on assets, dividend yield, and market capitalization on stock return (Evidence from listed manufacturing companies in Indonesia Stock Exchange). Economics 7: 10–16. [Google Scholar]

- Megginson, William L., Robert C. Nash, and Matthias Van Randenborgh. 1994. The financial and operating performance of newly privatized firms: An international empirical analysis. The Journal of Finance 49: 403–52. [Google Scholar] [CrossRef]

- Mishra, Chandra Sekhar, and Vunyale Narender. 1996. Dividend policy of SOEs in India: An analysis. Finance India 10: 633–45. [Google Scholar]

- Mitton, Todd. 2004. Corporate governance and dividend policy in emerging markets. Emerging Markets Review 5: 409–26. [Google Scholar] [CrossRef]

- Nair, Rajiv, Mohammad Muttakin, Arifur Khan, Nava Subramaniam, and V. S. Somanath. 2019. Corporate social responsibility disclosure and financial transparency: Evidence from India. Pacific Basin Finance Journal 56: 330–51. [Google Scholar] [CrossRef]

- Nashier, Tripti, and Amitabh Gupta. 2020. Ownership Concentration and Firm Performance in India. Global Business Review 24: 353–70. [Google Scholar] [CrossRef]

- Ooi, Joseph. 2001. Dividend Payout Characteristics of UK Property Companies. Journal of Real Estate Portfolio Management 7: 133–42. [Google Scholar] [CrossRef]

- Park, Byung-Sang, Yong-Kyoon Lee, and Yoon-Shin Kim. 2009. Factors affecting profitability of general hospitals focused on operating margin. The Journal of the Korea Contents Association 9: 196–206. [Google Scholar] [CrossRef]

- Premuroso, Ronald F., and Somnath Bhattacharya. 2007. Is there a relationship between firm performance, corporate governance, and a firm’s decision to form a technology committee? Corporate Governance: An International Review 15: 1260–76. [Google Scholar] [CrossRef]

- Rajput, Monika, and Shital Jhunjhunwala. 2019. Corporate governance and payout policy: Evidence from India. Corporate Governance: The International Journal of Business in Society 19: 1117–32. [Google Scholar] [CrossRef]

- Ray, Subhash C. 2020. Data envelopment analysis: A nonparametric method of production analysis. In Handbook of Production Economics. Singapore: Springer Nature, pp. 1–62. [Google Scholar]

- Sawicki, Julia. 2009. Corporate governance and dividend policy in Southeast Asia pre- and post-crisis. European Journal of Finance 15: 211–30. [Google Scholar] [CrossRef]

- Setiawan, Doddy, and Lian-Kee Phua. 2013. Corporate governance and dividend policy in Indonesia. Business Strategy Series 14: 135–43. [Google Scholar] [CrossRef]

- Shao, Liuguo, Xiao Yu, and Chao Feng. 2019. Evaluating the eco-efficiency of China’s industrial sectors: A two-stage network data envelopment analysis. Journal of Environmental Management 247: 551–60. [Google Scholar] [CrossRef]

- Shleifer, Andrei, and Robert W. Vishny. 1997. A Survey of Corporate Governance. The Journal of Finance 52: 737–83. [Google Scholar] [CrossRef]

- Temiz, Hüseyin. 2021. The effects of corporate disclosure on firm value and firm performance: Evidence from Turkey. International Journal of Islamic and Middle Eastern Finance and Management 14: 1061–80. [Google Scholar] [CrossRef]

- Tversky, Amos, and Daniel Kahneman. 1992. Advances in prospect theory: Cumulative representation of uncertainty. Journal of Risk and Uncertainty 5: 297–323. [Google Scholar] [CrossRef]

- Von Neumann, John, and Oskar Morgenstern. 2007. Theory of Games and Economic Behavior (60th Anniversary Commemorative Edition). Princeton: Princeton University Press. [Google Scholar]

- Wilson, Paul W. 2018. Dimension reduction in nonparametric models of production. European Journal of Operational Research 267: 349–67. [Google Scholar] [CrossRef]

- Woodward, Jim. 2006. Some varieties of robustness. Journal of Economic Methodology 13: 219–40. [Google Scholar] [CrossRef]

- Wooldridge, Jeffrey M. 2015. Introductory Econometrics: A Modern Approach. Belmont: Cengage Learning. [Google Scholar]

- Yarram, Subba Reddy. 2015. Corporate governance ratings and the dividend payout decisions of Australian corporate firms. International Journal of Managerial Finance 11: 162–78. [Google Scholar] [CrossRef]

| Variables | (1) | (2) | (3) | (4) | (5) | (6) | (7) | (8) | (9) |

|---|---|---|---|---|---|---|---|---|---|

| (1) TD | 1.0000 | ||||||||

| (2) dtd | 1.0000 ** | 1.0000 | |||||||

| (0.0000) | |||||||||

| (3) dtd2 | −0.4746 ** | −0.4746 ** | 1.0000 | ||||||

| (0.0000) | (0.0000) | ||||||||

| (4) dcrs_te | 0.2348 ** | 0.2348 ** | 0.0378 | 1.0000 | |||||

| (0.0000) | (0.0000) | (0.2979) | |||||||

| (5) i_dtd_dcrs_te | 0.0616 | 0.0616 | 0.2596 ** | −0.1199 ** | 1.0000 | ||||

| (0.0897) | (0.0897) | (0.0000) | (0.0009) | ||||||

| (6) dvrs_te | 0.2090 ** | 0.2090 ** | 0.0139 | 0.8845 ** | −0.1799 ** | 1.0000 | |||

| (0.0000) | (0.0000) | (0.7026) | (0.0000) | (0.0000) | |||||

| (7) i_dtd_dvrs_te | 0.0251 | 0.0251 | 0.2228 | −0.1785 ** | 0.9164 ** | −0.2135 ** | 1.0000 | ||

| (0.4888) | (0.4888) | (0.0000) | (0.0000) | (0.0000) | (0.0000) | ||||

| (8) dopm | 0.0454 | 0.0454 | 0.0433 | 0.1917 ** | −0.1018 ** | 0.1736 ** | −0.1129 ** | 1.0000 | |

| (0.2117) | (0.2117) | (0.2330) | (0.0000) | (0.0050) | (0.0000) | (0.0018) | |||

| (9) i_dtd_dopm | 0.0636 | 0.0636 | 0.0178 | −0.0987 ** | 0.2804 ** | −0.1104 ** | 0.2490 ** | 0.0943 ** | 1.0000 |

| (0.0799) | (0.0799) | (0.6246) | (0.0064) | (0.0000) | (0.0023) | (0.0000) | (0.0093) | ||

| Descriptive Statistics | |||||||||

| Variables | Mean | SD | Min | Max | |||||

| Div | 0.1282356 | 0.4034409 | −0.0405 | 7.5 | |||||

| TD | 0.57444 | 0.0922634 | 0.3103448 | 0.7793103 | |||||

| dtd | −0.0020011 | 0.0923241 | −0.2660937 | 0.2028718 | |||||

| dtd2 | 0.0085165 | 0.0122646 | 8.25 × 10−6 | 0.0708058 | |||||

| dcrs_te | −5.04 × 10−16 | 0.3283297 | −0.5378434 | 0.4281566 | |||||

| i_dtd_dcrs_te | 0.0071088 | 0.0292741 | −0.0903073 | 0.1146847 | |||||

| dvrs_te | 2.43 × 10−16 | 0.3580748 | −0.5963618 | 1.213638 | |||||

| i_dtd_dvrs_te | 0.0069009 | 0.0321929 | −0.1699376 | 0.1281372 | |||||

| dopm | −1.83 × 10−16 | 0.1445518 | −0.591205 | 1.019934 | |||||

| i_dtd_dopm | 0.0006044 | 0.0132884 | −0.1133964 | 0.1010025 | |||||

| lsales | 9.479545 | 1.476338 | 4.110874 | 13.33065 | |||||

| lmcap | 10.46412 | 1.284616 | 3.955634 | 13.83282 | |||||

| DV: Div | Model 1 (Base_Model) | Model 2 (Quadratic_Model) | Model 3 (Interaction_1) | Model 4 (Interaction_2) | Model 5 (Interaction_3) |

|---|---|---|---|---|---|

| Coeff. | Coeff. | Coeff. | Coeff. | Coeff. | |

| Div (−1) | 0.023 *** [0.000] | 0.023 *** [0.000] | 0.006 *** [0.000] | 0.008 *** [0.000] | 0.023 *** [0.000] |

| TD | −0.291 *** [0.010] | - | - | - | - |

| dtd | - | −0.299 *** [0.024] | 0.173 *** [0.017] | −0.059 *** [0.018] | −0.271 *** [0.015] |

| dtd2 | - | 0.652 *** [0.024] | - | - | - |

| dcrs_te | - | - | −0.182 *** [0.003] | - | - |

| i_dtd_dcrs_te | - | - | −0.860124 *** [0.040] | - | - |

| dvrs_te | - | - | - | −0.138 *** [0.002] | - |

| i_dtd_dvrs_te | - | - | - | −0.597 *** [0.026] | - |

| dopm | - | - | - | - | −0.05 [0.005] |

| i_dtd_dopm | - | - | - | - | 0.629 *** [0.098] |

| lsales | −0.045 *** [0.000] | −0.046 *** [0.000] | −0.041 *** [0.001] | 0.044 *** [0.001] | 0.047 *** [0.000] |

| lmcap | −0.061 *** (0.001) | −0.060 *** [0.001] | −0.026 *** [0.001] | −0.033 *** [0.002] | −0.057 *** |

| Cons. | 1.347 *** [0.019] | 1.182 *** [0.016] | 0.800 *** [0.029] | 0.896 *** [0.029] | 1.163 * |

| Sragan Test | 51.014 ** (0.0393) | 50.636 ** (0.0424) | 56.653 ** (0.0117) | 61.812 ** (0.0034) | 53.482 (0.0236) ** |

| AR(1) | −1.1748 (0.2401) | −1.1754 (0.2399) | −1.1506 (0.2499) | −1.1469 (0.2514) | −1.174 (0.2401) |

| AR(2) | 1.020 (0.3076) | 1.019 (0.3078) | 1.042 (0.2970) | 1.049 (0.2940) | 1.027 (0.3041) |

| Durbin Chi-2 | 6.71443 ** (0.0096) | 0.481342 (0.4878) | 5.22784 ** (0.0222) | 1.18431 (0.2765) | 1.01534 (0.3136) |

| Wu-Hausman Test | 6.73034 ** (00.0097) | 0.477701 (0.4897) | 5.21506 ** (0.0227) | 1.17486 (0.2788) | 1.00701 (0.3160) |

| SN | Variable | Type | Code | Definition | Citations |

|---|---|---|---|---|---|

| 1 | Dividend ratio | DV | Div | DIV represents dividend policy and proxies the dividend payout ratio (DPR). DPR is computed as an annual equity dividend paid to shareholders divided by net income. | Bhattacharya et al. (2020) Dewasiri et al. (2019) |

| 2 | Transparency and Disclosure (T&D) | IV † | TD | It reflects transparency and disclosure and is measured by drafting a T&D index. The framing of the T&D index is explained in Section 3.3. A higher T&D index means greater T&D by the firm. | Arsov and Bucevska (2017), Aksu and Kosedag (2006). |

| 3 | Technical efficiency (Constant return to scale) | IV †† | crs_te | It shows the firm’s technical efficiency measured via Data Envelope Analysis (DEA). It means how efficiently the firm utilises the input resources to get specific output assuming a constant return to scale. | (Ray 2020) |

| 4 | Technical efficiency (Variable return to scale) | IV †† | vrs_te | It also shows the firm’s technical efficiency assuming a variable return to scale and is measured by DEA. | Ray (2020) |

| 5 | Operating margin | IV †† | opm | One of the measures of a company’s success is operating profit on sales in Indian Rupees (opm = operating profit ÷ Sales or Revenue from Operations) | (Filer and Golbe 2003; Park et al. 2009) |

| 6 | Market Capitalisation | IV ††† | lmcap | It is calculated by multiplying the total number of a company’s shares by the share’s current market price. It serves as a gauge of a company’s valuation. The market capitalisation’s natural log is used to address discrepancies with high numbers. | (Marito and Sjarif 2020) |

| 7 | Sales | IV ††† | lsales | It is the number of products and services traded for money. A natural log of sales is calculated using the number of sales (in Indian rupees). | (Megginson et al. 1994) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Rastogi, S.; Pinto, G.; Pathak, A.K.; Singh, S.P.; Sharma, A.; Banerjee, S.; Kanoujiya, J.; Tejasmayee, P. Influence of Transparency and Disclosures on the Dividend Distribution Decisions in the Firms: Do Profitability and Efficiency of Firms Matter? Int. J. Financial Stud. 2023, 11, 142. https://doi.org/10.3390/ijfs11040142

Rastogi S, Pinto G, Pathak AK, Singh SP, Sharma A, Banerjee S, Kanoujiya J, Tejasmayee P. Influence of Transparency and Disclosures on the Dividend Distribution Decisions in the Firms: Do Profitability and Efficiency of Firms Matter? International Journal of Financial Studies. 2023; 11(4):142. https://doi.org/10.3390/ijfs11040142

Chicago/Turabian StyleRastogi, Shailesh, Geetanjali Pinto, Amit Kumar Pathak, Satyendra Pratap Singh, Arpita Sharma, Souvik Banerjee, Jagjeevan Kanoujiya, and Pracheta Tejasmayee. 2023. "Influence of Transparency and Disclosures on the Dividend Distribution Decisions in the Firms: Do Profitability and Efficiency of Firms Matter?" International Journal of Financial Studies 11, no. 4: 142. https://doi.org/10.3390/ijfs11040142

APA StyleRastogi, S., Pinto, G., Pathak, A. K., Singh, S. P., Sharma, A., Banerjee, S., Kanoujiya, J., & Tejasmayee, P. (2023). Influence of Transparency and Disclosures on the Dividend Distribution Decisions in the Firms: Do Profitability and Efficiency of Firms Matter? International Journal of Financial Studies, 11(4), 142. https://doi.org/10.3390/ijfs11040142