Abstract

This study aims to provide an understanding of the impact of professionalism theory constructs on the applicability of forensic accounting services, as well as reviewing the obstacles to implementing the profession of forensic accounting through a literature review. The accounting side of the study explores the profession of forensic accounting and the sociological side of the study will focus on professionalism theory, more specifically Pavalko’s 1988 model. A quantitative method was used in this study; 154 questionnaires from Certified Public Accountants (CPAs) were validated and used in the data analysis. Data analysis was conducted using SmartPLS, which was used for testing the study’s hypotheses. The results demonstrated that the professionalism theory constructs have a significant impact on the applicability of forensic accounting services. There was an indication that six out of eight constructs had a positive impact, which are, code of ethics, commitment, intellectual technique, motivation, training, and relevance to social values, leaving only autonomy and sense of community with no impact shown. This study recommends that forensic accountants and practitioners contribute to developing the profession of forensic accounting and to provide services with high quality. The study’s significant constructs can inform the development of training programs for aspiring forensic accountants in Jordan, emphasizing ethics, commitment, technical expertise, motivation, training, and social values. These findings may also apply to other countries.

1. Introduction

Global innovation and rapid economic growth around the world require smart and advanced solutions and there is no doubt that with every stage of progress comes extra complications. However, each period of time has its own answers when it comes to questioning the accuracy of new financial tools. At the present time, the research into fraud and corruption is not just for discovering the causes but rather for inventing accurate and effective tools to prevent and combat fraud to end up with as few losses as possible (Al Shbeil et al. 2023).

Furthermore, after many economic scandals related to the increase in fraud and financial corruption of all kinds in developing and developed countries, forensic accounting has been recognized as a valuable tool to solve such issues (Alli et al. 2018). With the spotlight on the accounting profession, a new market with a new breed of forensic accountants has emerged (Davis et al. 2010). Forensic accounting practice is probably one of the most active and modern areas that helps to assess business, resolve professional negligence practice, and assist in conflict resolutions of fraud-related internal investigations (Tiwari and Debnath 2017).

Likewise, forensic accounting in the context of the developed world has progressed further than in developing countries. According to Huber (2012), forensic accounting in the United States is a profession not only because it is defined as a profession by statute, but because it also fulfills a significant number of sociological criteria to be accepted as a profession. Nevertheless, things are slightly different in developing countries, more specifically Jordan. There is no question that the forensic accounting field in Jordan is getting more attention lately as there are a sizable number of research contributions related to the profession (Alhusban et al. 2020). On the other hand, the debate continues as to whether this field of accounting has reached a point where it can be called a “profession” rather than just an occupation (Huber 2012; Ismail et al. 2022).

This debate and confusion concerning the professionalism of forensic accounting is not new. Huber (2012) questioned whether forensic accounting is becoming a profession in the United States or not. On the other hand, Alshurafat (2021) brought up a similar issue where Australia was the targeted country using a unique way to argue his case. The latter used a sociological perspective with specific criteria to examine that matter. These sociological criteria (intellectual technique, relevance to social values, training, motivation, autonomy, commitment, sense of community, and code of ethics) are discussed in this study using the Pavalko (1988) model to shed light on its impact on the applicability of the forensic accounting services in Jordan.

This study aims to provide an understanding of the impact of professionalism theory constructs on the applicability of forensic accounting services. As well as exploring the obstacles that stand in the way of implementing the profession of forensic accounting, the sociological side of the study will focus on the professionalism theory, more specifically using the eight constructs model that was conducted by the sociologist (Pavalko 1988).

As a developing country, Jordan has encountered several challenges where it faced many obstacles regarding forensic accounting (Al-Abbadi et al. 2021). The applicability of forensic accounting is still to this day a trending issue that needs to be settled. The research gap we have identified concerns the limited studies that focus on the sociological effect on forensic accounting in Jordan. Based on the articulated literature review, the main two questions are as follow:

What are the factors that affect the applicability of forensic accounting in Jordan?Do professionalism theory constructs explain the factors that affect the applicability of forensic accounting?

The Jordanian context has been chosen as a research context for many reasons. First, Jordan is ranked 60 among 180 countries by the Corruption Perceptions Index (CPI) in 2019, which means that Jordan is one of the countries most affected by the risk of fraud and corruption. Therefore, forensic accounting applications would be of benefit to many businesses in the Jordanian context. Second, it has been noticed that there is a dearth of forensic accounting applications in the Jordanian context (Shanikat and Khan 2013).

Third, before the increase in awareness, regulators in Jordan have recently shown awareness of detecting fraud and corruption and have developed and implemented effective policies to consolidate the principles of national integrity by developing effective mechanisms and strategies to combat corruption from 2013–2017 (Alhusban et al. 2020), which can detect the sources of fraud and corruption and reduce its spread in society.

A general examination of the major financial scandals that occurred would lead to a common pattern for the responsibility of independent auditors (external) for material misstatements, derived from financial statement fraud (Fortvingler and Szívós 2016). However, the external audit cannot give an opinion with absolute certainty that confirms or denies the existence of manipulation (Dimitrijevic et al. 2020).

Thus, many indicators reflect the increasing attention forensic accounting is receiving (Alshurafat 2021) as the interest in forensic accounting increases (Botes and Saadeh 2018), and it is necessary to understand how to construct the administrative and regulative infrastructures of the profession (Alshurafat et al. 2019a). Professionalism theory provides a set of constructs to examine whether to recognize a profession or not (Pavalko 1988). Huber (2012) reported that the professionalism theory includes eight main constructs, which all relate to the sociology of the professions. These constructs are necessary to examine its impact on forensic accounting services. These constructs are intellectual techniques, training, relevance to social values, code of ethics, sense of community, motivation, autonomy, and commitment.

In summary, the study’s significant constructs of code of ethics, commitment, intellectual technique, motivation, training, and relevance to social values can be used to develop training programs for aspiring forensic accountants in Jordan. These constructs can help to cultivate necessary skills and qualities for success in the profession, such as ethical conduct, technical expertise, and commitment to the profession. The findings may have implications for the development of training programs in other countries as well. The remainder of this paper is organized as follows. The next section reviews the literature and theory and develops the study hypotheses. The study methodology is illustrated in the third section. The fourth section shows the study results. The fifth section discusses the study results and section six concludes the paper.

2. Literature Review, Theoretical Framework and Hypotheses Development

2.1. Definition of Forensic Accounting

Bologna and Lindquist (1995) define forensic accounting as the application of financial skills and investigative mentality to unresolved issues, conducted within the context of the rules of evidence. Following this definition, forensic accounting focuses on identifying and reviewing fraudulent transactions to identify the real intent of the perpetrator. Such reviews may take the form of document reviews and interviews.

“Forensic” means “suitable for use in a court of law”, and it is to that standard and potential outcome that forensic accountants generally must work (Crumbley et al. 2007). Forensic accounting is a science dealing with the application of accounting facts and concepts gathered through auditing methods, techniques, and procedures to resolve legal problems which requires the integration of investigative, accounting, and auditing skills (Koh et al. 2009).

Okoye and Gbegi (2013) stated that forensic accounting is based on studying financial statements and reports by forensic accountants who have complete knowledge about accounting aspects, judicial laws, and connected procedures to reveal points of defect and manipulation and to decide those cases for all relevant parties. Clavería Navarrete and Carrasco Gallego (2022) concluded that the use of forensic accounting techniques and tools could contribute to the prevention of fraud in financial reporting.

Hence, forensic accounting can be summarized as the science of detecting and investigating fraud and corruption within financial statements and any other financial matters, using forensic experts with strong accounting and legal backgrounds. Thus, it is evident at this point that the combination of both accounting and legal knowledge represent the foundation stone for the forensic accounting profession.

2.2. Forensic Accounting in Action

According to Bhasin (2007), forensic accountants are trained to look beyond the numbers and deal with the business realities of situations. Analysis, interpretation, summarization, and the presentation of complex financial business-related issues are prominent features of the profession. He further reported that the activities of forensic accountants involve investigating and analyzing financial evidence; developing computerized applications to assists in the analysis and presentation of financial evidence; communicating their findings in the form of reports, exhibits, and collections of documents; and assisting in legal proceedings, including testifying in courts as an expert witness, and preparing visual aids to support trial evidence. In addition, Ahmad (2013) found out in his research tagged with the title “The Role of Forensic Accounting in Limiting the Financial Corruption practices” that forensic accounting in the public sector is used in many areas like cheat investigation, tax evasion, and the assessment of internal controls and facilities in case of disputes. Alshurafat et al. (2019a) categorized the services that forensic accounting firms provide into four categories: fraud investigation service, litigation services, business valuation, and IT forensic.

2.2.1. Fraud Investigation

By the late 1940s, forensic accounting had proven its worth during World War II; however, formalized procedures were not put in place until the 1980s when major academic studies in the field were published (Rasey 2009). From an auditor’s perspective, forensic accounting deals with the application of auditing methods, techniques, or procedures to resolve legal issues that require the integration of investigative, accounting, and auditing skills (Koh et al. 2009).

Furthermore, forensic investigation is the utilization of specialized investigative skills in carrying out an inquiry conducted in such a manner that the outcome will have application to a court of law. Investigation is the act of determining whether illegal matters such as employee theft, security fraud including falsification of financial statements, identity theft, and insurance fraud have occurred. Fraud investigation is often associated with investigations into criminal matters (Okoye 2009).

A typical investigative assignment would be an investigation into employee theft. Other examples include securities fraud, insurance fraud, kickbacks, and proceeds of crime investigations, as businesses and society become more enlightened and complex methods of perpetrating frauds become more sophisticated (Okoye 2009). Moreover, forensic accounting practitioners participate in the investigation of financial crimes such as financial misstatement, money laundering, identity theft, administration fraud, and government corruption (Brickner et al. 2010). They also play a significant role in detecting, preventing, and prosecuting those individuals who are involved in criminal activity (Brickner et al. 2010).

In seeking fraud detection through the fraud examination process, forensic accountants are associated with many tasks such as collecting and analyzing documentary evidence (Van Akkeren et al. 2016). In terms of fraud investigation, the effective services of forensic accountants are to investigate, prevent, and detect fraud within individuals and at corporate and governmental levels (Alshurafat et al. 2019a).

2.2.2. Litigation Support

The Litigation and Dispute Resolution Subcommittee of The American Institute of Certified Public Accountants (AICPA) defines litigation services as services that involve pending or potential formal legal or regulatory proceedings before a trier of fact in connection with the resolution of a dispute between two or more parties. The subcommittee identifies a wide range of services that an accounting expert witness or litigation consultant might provide.

Likewise, litigation support and appearing as an expert witness are two of the major sources of revenue for forensic accountants. Additionally, forensic accountants are asked to provide lawyers with a variety of information and advice about case-related accounting and financial issues. In some cases, forensic accountants are not asked to testify in the case but rather to provide the lawyer with the accounting and financial information required to effectively and efficiently litigate the case (Heitger and Heitger 2008).

Forensic accounting provides accounting analysis that is suitable for the court, which will form the basis for discussion, debate, and, ultimately, dispute resolution. In the context of a legal dispute, the knowledge, skills, and experience of a good forensic accountant are extremely useful as a consultant to litigation counselor judges (Okoye 2009). Moreover, forensic accountants investigate the financial operations of an enterprise and prepare information that may be used in a criminal or civil court case as well as providing investigative services or provide support for litigation (Koh et al. 2009).

Hence, forensic accountants may act as an advisor providing professional assistance to lawyers in the litigation process or present evidence in a financial lawsuit (Hegazy et al. 2017). Furthermore, forensic accounting is even considered to be a broad legal concept in states where auditors do not legally determine whether fraud has occurred. It clarifies that the interest of the auditor (understood as the financial auditor) refers specifically to acts that result in a material misstatement of the financial statements (PCAOB 2020).

On the other hand, the Jordanian Companies Law No. (22) of 1977 dealt with regulating the profession of the Jordanian auditor. In addition, article No. (193) of the previous law mentioned the obligatory duties of the auditor which included:

- A

- Monitoring the company’s business.

- B

- Auditing its accounts in accordance with the approved auditing rules, the requirements of the profession, and its scientific and technical principles.

- C

- Examining the financial and administrative systems of the company and its internal financial control systems and ensuring that it is suitable for the smooth running of the company’s business and the preservation of its funds.

- D

- Verify the company’s assets and ownership thereof and ensure the legality of the obligations arising from company and health.

- E

- View the decisions of the Board of Directors and the General Assembly and the instructions issued by the company data their work requires the need to obtain and verify.

- F

- Any other duties that the auditor is required to perform under this law and the law of the auditing profession and other related systems.

- G

- The auditors shall submit a written report addressed to the General Assembly, and they or whoever they delegate must read the report before the General Assembly.

Therefore, the resemblance between the forensic accountant duties and the auditor’s duties are noticeable. However, the Jordanian legal system did not specify nor mention any specific laws concerning the forensic accountant but rather settled for the Articles No. (192-203) regarding regulating the profession of the auditor.

2.2.3. Business Valuation

Business valuation is a specialization that forensic accountants may also practice (DiGabriele 2012). Many cases brought to the court’s attention require testimony from an expert in business valuation (Durtschi and Rufus 2017). Legal frameworks, regulatory, and court procedures are important components of forensic accounting (Curtis 2008).

Moreover, business valuation is the process of determining the estimated value of a business entity. It is also a valuable tool for forensic accountants. According to Smith (2012) business valuation is regularly applied to give an independent valuation report for a range of purposes. It includes a detailed understanding and analysis of the business being valued, the industry in which it operates, and the local and national economic climates. A valuation performed in accordance with a fair market value standard is both an art and a science and represents the price at which a business interest would change hands between a willing buyer and a willing seller that have reasonable knowledge of the relevant facts (Smith 2012).

Furthermore, business valuation services began in the 1920s. In response to the Eighteenth Amendment, which enacted prohibition, The Internal Revenue Service (IRS) issued Appeals and Revenue Memorandum (ARM) 34 to establish guidelines and methodologies for determining the amount of loss sustained by a taxpayer as a result. Business valuation services are utilized in a multitude of circumstances, including the following: Mergers or acquisitions, shareholder disputes, buy–sell agreements, gift and estate purposes, and employee stock option plans (Smith 2012; Haloush et al. 2021; Alshurafat et al. 2023).

2.2.4. IT Forensics

The increasing usage of information technologies (IT) in committing fraud and financial crimes required many technological tools to help in the fight to prevent and detect fraud and minimize the consequences. Hence, cybercrimes can be defined as the “use of smart devices to commit a crime, store illegal information or data, or target a critical IT infrastructure”. The need to obtain, manage, and analyze digital data is critical for the success of future accounting professionals (Meraj 2022).

Moreover, Pearson and Singleton (2008) summarize the content knowledge for fraud and forensic accounting in a digital environment, which includes prevention and deterrence of IT risk and cybercrime, how IT is used in fraud, rules and laws of digital evidence, detection and investigation tools and techniques, and using IT to report and communicate results in the legal environment. In addition, businesses have grown their use of technology and their reliance on computer-based systems over the last few decades.

Forensic practitioners have become aware of the need and usefulness of using IT in investigations, especially for the purpose of fraud detection (Pearson and Singleton 2008; Alshurafat et al. 2019b, 2020, 2021b; Alshurafat 2019). There are so many technical and specialized issues involving cybercrimes and digital evidence that it is likely an investigation into a cybercrime would need a cyber-forensic specialist. When computers and technology are an integral part of the crime or sophisticated computers or technology is utilized, there is more need for a specialist (Khan et al. 2022). There is also the possibility that legal implications might require the incorporation of a legal expert.

Forensic accountants need to understand the use of specialists to support the detection or investigation of cyber issues and transactions. Without a doubt, the forensic accountant should have a fair amount of expertise to deal with such cyber fraud and have access to the needed IT tools to prevent them from occurring again (Denhere 2022).

2.3. Obstacles towards Implementing Forensic Accounting

Forensic accounting is a comprehensive field of professional practice for fraud investigation services. The high demand for forensic accounting is being noticed in most companies and industries (Alshurafat 2021). The profession of forensic accounting arises from the cause and effect of fraud and technical errors made by people. In fact, the more the profession can apply its services, the more obstacles get in its way. According to Abdulrahman (2019), the attention to forensic accounting in some countries started very late, which caused challenges in applying it.

According to Kaur et al. (2022), the major factors that restrict forensic accounting are a lack of awareness and education. Hence, it is essential to incorporate forensic accounting into undergraduate and postgraduate courses. Therefore, it is evident that the application of forensic accounting faces many obstacles.

2.4. Professionalism Theory

Professionalism theory lies under the sociology of the professions, which is a domain within the sociology of work whose object is the study of professions as a special category of occupations (Monteiro 2015). It has been observed earlier that there is some distinction between the terms “profession” and “occupation”. An American sociologist called Andrew Abbot explained how the two previous terms are far from close in meaning. He explained how the sociology of the professions’ main object is the study of professions.

As a matter of fact, the distinction between “profession” and “occupation” is quite understandable. Whereas “occupation” means every activity, work, function, or job that is the main source of someone’s livelihood (Monteiro 2015), the term “profession” distinguishes a more or less specialized, well-paid, and prestigious occupation. Thus, professionalizing occupations improves the reputation and public understanding of the work undertaken in the field (Cervero 1992). Moreover, there is a distinction between occupation and profession, so that every profession is an occupation but not every occupation is a profession (Monteiro 2015). Additionally, through the professionalization process, an occupation transforms into a profession (McGill 2018).

In this study, the researcher is using the Pavalko (1988) model of the eight constructs to test the applicability of those constructs to forensic accounting as a dependent variable. The sociologist Pavalko was born in Youngstown, Ohio. He was a graduate of University of California, Los Angeles (UCLA) where he earned his Doctorate in Sociology. Dr. Pavalko had been an Assistant Professor of Sociology at the University of Wisconsin-Madison, Associate Professor and Professor of Sociology, Florida State University from 1967 until 1979, Professor of Sociology, University of Wisconsin-Parkside, and Dean at the School of Liberal Arts, University of Wisconsin-Parkside. He retired in 1999. He passed away on 23 January 2017.

Furthermore, the criteria or attributes of a profession are the constructs of professionalism theory; they are “attempts to identify attributes, traits, categories, characteristics or dimensions of professions” (Huber 2012). Alshurafat (2021) concluded that understanding these constructs allows judging whether forensic accounting is a profession.

2.5. Hypotheses Development

This study adopts the professionalism theory to understand the factors that most affect the applicability of forensic accounting. The following model was initially conducted by (Pavalko 1988) which was recently developed by (Alshurafat 2021). Professionalism theory represents the theoretical framework used in this study. Sociologists have not only debated the attributes of professions but have also debated which professions meet the sociological criteria of a profession (Alshurafat 2021).

Pavalko developed a model from the study of occupations between the 1930s and the 1970s by exploring the social phenomenon of work and noting the various roles work plays in life as a link to the social structure and as a source of identity to address the ability of an occupation to influence the power structure in society through social stratification (McGill 2018). Pavalko (1988) was concerned with “understanding the sources of occupational differentiation, the motivations and strategies used by occupational groups in the quest for power and prestige in the workplace, and the consequences of achievement or failing to achieve collective power and prestige”. From the study of the sociological literature of professions, Pavalko developed eight dimensions of ideal professions: Intellectual technique, relevance to social values, training, motivation, autonomy, commitment, sense of community, and code of ethics.

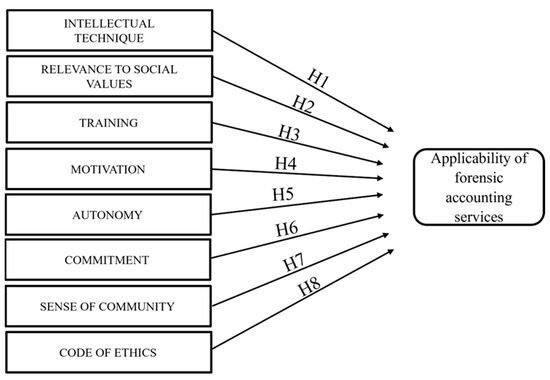

Thus, the consideration for an occupational group was based on the degree to which an occupation exhibits qualities of a profession in each of these dimensions, rather than merely on a checklist of whether it meets the criteria or not. Figure 1 illustrates the impact of the professionalism theory’s eight constructs on the applicability of the forensic accounting services. Based on the above theoretical model, this study formulates the following hypotheses.

Figure 1.

Study model.

2.5.1. Intellectual Technique

Intellectual technique sees a profession as one that has developed a special expertise. It is a specific form of intrinsic motivation; it is also a desire to learn something. It has been recognized as critical in effective education and learning. Intellectual need or technique arises when someone poses a question to themselves or others, either out of curiosity or to solve a specific problem (Pavalko 1988).

Intellectual need is often greatest when there is a hole in an otherwise well-connected web of knowledge. Merely understanding a question and being unable to answer it is not sufficient to create intellectual need; intellectual need arises when a person believes the question to be interesting or important, and usually this involves fitting the question into a framework of well-understood ideas (Alshurafat 2021). Therefore, the following hypothesis has been formulated.

H1.

High level of intellectual technique among the practitioners leads to high applicability of forensic accounting.

2.5.2. Relevance to Social Values

Relevance to social values involves the application of that knowledge to social problems (Schooler 2007). Social values form an important part of the culture of a society. Values account for the stability of social order. They provide the general guidelines for social conduct. Values such as fundamental rights, patriotism, respect for human dignity, rationality, sacrifice, individuality, equality, democracy, etc., guide our behavior in many ways. Values are the criteria people use in assessing their daily lives; it is how they arrange their priorities and choose between alternative courses of action (Nehra and Singh 2018).

According to (Worsley 1970), “Values are general conceptions of “the good”, ideas about the kind of ends that people should pursue throughout their lives and throughout the many different activities in which they engage. Values are standards of social behaviors derived from social interaction and accepted as constituent facts of social structure. They are objects that social conditions desire. These are culturally defined goals and involve “sentiments and significance”. These consist of “aspirational references”.

Values are expected to be followed for judging and evaluating social interaction, goals, means, ideas, feelings, and the expected conduct. Without such evaluating standards, it would be difficult to judge individual behaviors or social action. Furthermore, values aim to integrate expected individual behaviors and social action. They tend to forestall tension and as such have a tension management role. Values provide for stabilities and uniformities in group interaction. They hold the society together because they are shared in common. Some sociologists argue that shared values form the basis for social unity. Since they share the same values with others, the members of society are likely to see others as “people like themselves”. They will, therefore, have a sense of belonging to a social group. They will feel a part of the wider society (Patel 2018).

Indian sociologist (Mukerjee 1949) writes: “By their nature, all human relations and behaviors are embedded in values”. In simple words, values may be defined as a measure of goodness or desirability. Therefore, the following hypothesis has been formulated.

H2.

High level of relevance to social values among the practitioners leads to high applicability of forensic accounting.

2.5.3. Training

The training dimension includes both the amount and the content of the training relevant to the profession. Today every organization’s top priority is to manage human resources. The human capital of each organization must reach the highest level for profit maximization and organizational growth (Greer 2021).

Many strategies have been implemented to increase the productivity of employees, such as job and organization design, public relations, staffing, motivation, rewards, and training & development. Among these, training is the most significant factor required to obtain maximum output from human resources. It can be used to improve or develop job-related performance requirements of the employees (Jamrizal 2022).

Additionally, training refers to a set of programs designed to enhance the job performance of the employees and organizational productivity. In the modern workplace, these efforts have taken on a broad range of applications, from training in highly specific job skills to long-term professional development and are applicable to all sorts of employees ranging from line workers to the Chief Executive Officer (Upadhyay and Khandelwal 2022).

Researchers, in the past two decades, have tried their best to establish a link between training & development and the job performance of an employee. The above-mentioned matters can be best explained with the help of correlation and regression modeling (Andriani et al. 2021). Therefore, the following hypothesis has been formulated.

H3.

High level of training among the practitioners leads to high applicability of forensic accounting.

2.5.4. Motivation

Motivation considers the desire to serve society as a mark of a profession (Alshurafat et al. 2021a). The extent to which forensic accountants are motivated in their work depends on how well those accountants are able to provide outputs in their job. Motivation is expected to have a positive effect on quality performance and the high applicability of forensic accounting services. Accountants who are characterized by a high level of motivation show a higher work and life satisfaction. A high level of motivation is therefore in itself valuable for accountants and a decrease in motivation might affect them negatively (Rifani and Hasan 2022). According to Dunham (1984), motivated employees are happy, committed, and are continually looking for ways to improve their performance, on the other hand, demotivated employees often have low productivity and high turnover rates.

Furthermore, motivation refers to the arousal or drive to follow a particular course of action or achieve a specific goal. When employees are motivated, they focus their efforts on the achievement of set goals. Different research studies indicated that there is a direct positive relationship between worker motivation and job performance and applicability (Said et al. 2015; Sharma and Sharma 2017). Therefore, the following hypothesis has been formulated.

H4.

High level of motivation among the practitioners leads to high applicability of forensic accounting.

2.5.5. Autonomy

Autonomy refers to the ability of the members of a profession to regulate their own behavior, which is crucial to a profession, although this does not preclude any form of regulation (Alshurafat 2021). Moreover, autonomy is a person’s need to perceive that they have choices, that what they are doing is of their own volition, and that they are the source of their own actions (Agich 1994). The way managers and leaders frame information and situations either promotes the likelihood that a person will perceive autonomy or undermines it (Fowler 2014).

The term autonomy admits a wide range of meanings which includes qualities such as self-rule, self-determination, freedom of will, dignity, integrity, individuality, independence, and self-knowledge. In ethical thought, it is identified with the qualities of self-assertion, critical reflection, responsibility, absence of external causation, and knowledge of one’s own interest; it is also thought of in connection to actions, beliefs, principles, reasons for acting, and rules (Christman 1988; Dworkin 1988). Therefore, the following hypothesis has been formulated.

H5.

High level of autonomy among the practitioners leads to high applicability of forensic accounting.

2.5.6. Commitment

The commitment attribute is the degree to which members of a profession are committed to their work, which for a profession must be strong. Practitioners’ commitment is an attachment which the practitioner has for their own organization from their experiences. It will indicate the level of satisfaction and engagement among practitioners. It is also crucial to assess practitioner commitment since it is a key element in organizational success (Princy and Rebeka 2019).

Committed practitioners give a significant contribution to organizations because their performance and behavior is aimed at achieving an organizations’ goals. Furthermore, practitioners who are committed to their organization are happy to be members of it, believe in it, feel good about the organization and what it stands for, and intend to do what is good for the profession (Sutanto 1999). Therefore, the following hypothesis has been formulated.

H6.

High level of commitment among the practitioners leads to high applicability of forensic accounting.

2.5.7. Sense of Community

This concept was developed by McMillan and Chavis (1986). They define a sense of community as “a feeling that members have of belonging, a feeling that members matter to one another and to the group, and a shared faith that members’ needs will be met through their commitment to be together”. Following McMillan and Chavis (1986), it is theorized that a sense of community is represented by four elements: membership, influence, integration and fulfillment of needs, and shared emotional connection.

Additionally, a sense of community considers whether members have a common identity and how closely they interact with each other hence, it is essential for a successful, ongoing, sustainable community (Mayer and Frantz 2004). Therefore, the following hypothesis has been formulated.

H7.

High level of sense of community among the practitioners leads to high applicability of forensic accounting.

2.5.8. Code of Ethics

Practitioners who are ethically positive, honest, hardworking, and driven by principles of fairness and decency in the workplace, increases the overall morale and enhances the performance and the applicability of a profession (Lantos 2002). Additionally, forensic accounting encompasses investigating fraudulent activities, providing testimony at trial, and cross-examination within the court, therefore the highest ethical standards are essential for practitioners (Kern and Weber 2016).

Displaying good ethical behavior has an effect on company morale and client relations. It is easier for a business to retain employees when they work for a company that they believe in. Practitioners want to work for companies that treat everyone and their clients fairly and have good and ethical business practices (Derr 2012). The International Auditing and Assurance Standards Board (IAASB) has recently introduced ISQC1 (ISQC 2005), which aims to help firms establish a system of quality control for audits and reviews of historical financial information as well as other assurance and related services engagements.

The standard applies to all members of the International Federation of Accountants (IFAC) and requires all firms to have policies and processes in place to ensure their human resources are both technically and ethically competent (ISQC1, p. 36). The purpose of the standard is to improve auditor performance and audit quality by strengthening the ethical environment. Given the significant burden upon firms to comply with ISQC1 mandatory changes, there is need for timely research on this standard (Pflugrath et al. 2007). Furthermore, it is expected that following a code of ethics leads to positive benefits for a profession, leading to improved performance and future success. Therefore, the following hypothesis has been formulated.

H8.

High level of code of ethics among the practitioners leads to high applicability of forensic accounting.

3. Methodology

3.1. Study Design

In this study, a quantitative approach is adopted, as the questionnaire is the main data collection instrument used. The questionnaire was developed and tested through a pilot study conducted before the actual study. The choice of the quantitative study approach depends on the study questions (Perecman and Curran 2006) and since this study aims to determine the impact of professionalism theory constructs on the applicability of forensic accounting services the questionnaire was deemed to be an appropriate data collection instrument.

3.2. Population and Sampling Procedure

According to Neuman (2006), population refers to a large group of cases from which a sample is drawn by the researcher and to which the outcome from a sample can be generalized. The population in this study comprises certified public accountants working in Jordan. The unit of sample is both the certified public accountants (CPAs), and the Jordanian certified public accountants (JCPAs), who were selected mostly from auditing firms in Jordan as well as the big four firms.

Sekaran and Bougie (2010) described the sample selection process as involving the determination of the appropriate number of population elements so that the sample characteristics can be generalized to the entire population. Accordingly, random sampling was used to select the sample to make sure the representation of data in an equivalent and independent manner (Hair et al. 2007).

It is important to note that the use of CPAs and professional practitioners in forensic accounting studies is not uncommon (Al Shbeil et al. 2023; Rezaee et al. 2004; Rezaee and Wang 2019), especially in contexts where there is a lack of an established forensic accounting professionalism structure, as is the case in Jordan (Alhusban et al. 2020; Ismail et al. 2022). This paper also acknowledges that many CPAs and JCPAs in Jordan perform forensic accounting services, and they are, therefore, appropriate participants for this study. While the sample may not be entirely representative of all individuals working in the field of forensic accounting, the results of this study provide valuable insights into the impact of professionalism theory constructs on the applicability of forensic accounting services in Jordan.

3.3. Questionnaire Design

The study questionnaire was designed to have nine sections with the following contents and focus: demographic information, intellectual technique, relevance to social values, training, motivation, autonomy, commitment, sense of community, and code of ethics. In the demographic section, the gender, age, academic qualifications, job title, practical experience, academic major, and professional certifications of the respondents were inquired about, while the rest of the questionnaire parts focused on measuring the major study constructs within the theoretical framework.

The focus of the study is certified public accountants in various positions in the firms and holding different tenures. The study instrument had to be translated from English into Arabic. The Arabic questionnaire was distributed, and all items’ responses were measured using a 5-point Likert scale that ranged from strongly disagree to strongly agree.

3.4. Data Analysis Technique

Data analysis was conducted using one software application SmartPLS, Version 3.0 for testing the formulated study hypotheses. PLS-SEM is a path-modeling statistical tool used to model complex multivariate analysis of observed and latent variable relationships. It is a robust, superior, and flexible approach for building statistical models and for theoretical testing and prediction (Ringle et al. 2014). Moreover, PLS-SEM is a statistical technique that has been extensively utilized in literature by researchers in different fields of social sciences and business studies (Hair et al. 2017). It is capable of assessing latent variables and their relationships with the items in the outer model and testing the latent variables in the inner model, in terms of their relationships (Henseler et al. 2009).

This study therefore uses PLS-SEM by using the descriptive analysis, multicollinearity test, and Cronbach’s test for several reasons, with the top one being that structural equation models are superior to other models in their estimation, and this holds true for regressions mediation assessment (Hayes 2013). The robustness of the model is supported by the provision of measurement error and accurate mediating impacts estimates (Chin 1998).

4. Results

4.1. Survey Instrument Response Rate and Data Collection Process

The data collection was conducted using a survey questionnaire with the sample being certified public accountants in Jordan. There were 208 certified accountants who were surveyed. From the 208 questionnaire copies distributed to various CPAs in Jordan, 154 were deemed valid for further analysis. This indicated a rate of response of 74%, which is considered satisfactory in the literature (Spector 1992), and sufficient to run the PLS-SEM analysis (Reinartz et al. 2009).

Table 1 shows that (89%) of the respondents were males, while the remaining (11%) were females, indicating the low percentage of female CPAs in the country. Half of the total respondents (51%) appeared to be less than 30 years, and most of them (70%) held a bachelor’s degree. Moreover, almost half of the respondents (48%) answered the job title question with the option “other”, which showed that most of them responded with “Auditor” and the rest responded with “Tax auditor/advisor and financial analysts”, however (30%) of the respondents have the job of an accountant according to their answers. Surprisingly, (40%) of the respondents had work experience of less than 5 years. In addition, almost all the respondents (95%) majored in accounting, and (40%) of them hold a professional certificate in CPA.

Table 1.

Respondents’ demographic information (n = 154).

4.2. Multicollinearity Test

A multicollinearity test was conducted prior to assessing the structural model outcomes. A multicollinearity issue arises when there is high correlation between independent variables (Hair et al. 2010) in which case the information carried may become redundant and keeping them in the analysis would lead to enhanced error terms. Tolerance value consists of the sum of the variability of the chosen independent variable described by others of its kind, with Variance Inflation Factor (VIF) being the reverse of tolerance value (Hair et al. 2010). Values of VIF that are lower than five shows the absence of a multicollinearity issue (Hair et al. 2011). The collinearity statistics for the indicator’s values are all lower than five (1.461–4.474) (refer to Table 2). The results revealed no multicollinearity issue.

Table 2.

Multicollinearity test.

4.3. Measurement Model Assessment

The internal consistency reliability of a measurement model is deemed to be satisfactory when each construct’s composite reliability (CR) is higher than 0.7 (Hair et al. 2017). The CR of each construct for the study is tabulated in Table 3 and they vary from 0.901 to 0.969, indicating that the items used to measure the constructs had satisfactory internal consistency reliability.

Table 3.

Measurement scales, reliability, and convergent validity.

The convergent validity of the measurement model is examined through AVE value and convergent validity is considered to be sufficient when the AVE of the constructs are 0.5 or more (Hair et al. 2017). The constructs’ AVE values ranged from 0.650 to 0.711 as is notable in Table 3. This shows sufficient convergent validity of the measurement model.

The discriminant validity of the measures refers to the level at which the items are distinct from the constructs, or they measure distinct concepts. Hair et al. (2013) stated that the construct measures are theoretically distinct from each other and that the Fornell–Larcker criterion is the best conventional approach to assess discriminant validity. On the other hand, the HTMT was mentioned by Henseler et al. (2015) as the most appropriate to use for the discriminant validity assessment.

The Fornell–Larcker criterion has been used in past literature to evaluate the discriminant validity, which is confirmed when the square root value of each construct’s AVE is higher than the highest correlation of the construct with any latent construct (Henseler et al. 2016).

The discriminant validity evaluation involves the calculation of each constructs’ AVE square root and the correlations in the correlation matrix. The Fornell–Larcker criterion outcome with the constructs’ square roots is tabulated in Table 4. It is clear from the table that the AVE squared exceeded the highest construct’s correlation with other constructs, indicating the presence of sufficient discriminant validity (Henseler et al. 2016).

Table 4.

Discriminant Validity.

The Heterotrait–Monotrait Ratio (HTMT) was proposed by Henseler et al. (2015) to examine the discriminant validity of latent variables and, in PLS-SEM, the approach is used to evaluate the construct’s discriminant validity. HTMT was employed as a strict criterion rather than the other two traditional methods. The criterion was estimated using Smart-PLS calculations. Table 4 presents the HTMT criterion results, with values lower than 0.85 for every latent variable, indicating the presence of the discriminant validity (Henseler et al. 2015). Therefore, the outer model analysis outcome confirms that the survey items measured the constructs that were developed and meant to measure, which means they had sufficient reliability and validity (Henseler et al. 2015). Therefore, the outer model analysis outcome confirms that the survey items measured the constructs that were developed and meant to measure, which means they had sufficient reliability and validity.

4.4. Structural Model

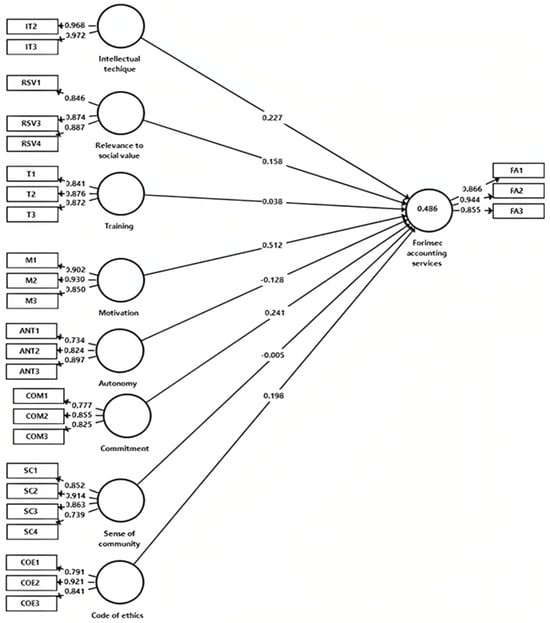

The most generally used criterion in assessing the structural model is the coefficient of determination (R2) of endogenous latent variables (Hair et al. 2013). According to (Chin 2010), the (R2) value that is equal or higher than 0.67 is considered to be substantial, that of 0.33 is moderate, and that of 0.19 is considered weak. The outcome shows that (R2) applying forensic accounting services is 0.481 (refer to Figure 2). These are considered to be high values, indicating sufficiency of the structural model.

Figure 2.

Item loadings, path coefficient, and R2.

The Stone–Geisser’s Q-test indicates model fit and determines the ability of the model to predict the parameter estimation. It is available in PLS software using the blindfolding routine and, accordingly, during the blindfolding procedure, the number of the omission distance was kept at a constant seven. The cross-validated redundancy values for the endogenous latent variables exceeded zero as suggested by (Tenenhaus et al. 2005). Accordingly, for applying forensic accounting services, it was 0.415 (see Table 5). The structural model’s estimated results indicated its ability to predict the related estimations (Henseler et al. 2016).

Table 5.

R2, R2 Adjusted, and Q2.

4.5. Model Fit

In addition to the precondition of the model assessment in PLS-SEM involving a measurement model’s reliability and validity, researchers are using the standardized root mean square residual (SRMR) criterion as a condition of structural model assessment (Ringle et al. 2014). The SRMR illustrates the fit of the model, and, from its name, it refers to the square root of the sum of the squared differences between the model-implied and the empirical correlation matrix. It represents the Euclidean distance between two matrices and, in this study, the value of SRMR for the reduced model produced by PLS-SEM is 0.059 (refer to Table 6). In this regard, the value linked with the composite model SRMR in PLS is employed because of the reflective and formative constructs contained in the inner model. The value remained less than 0.08, indicating a satisfactory cut-off threshold for the PLS-path model fit (Henseler et al. 2016). This shows that the significant difference between the theoretical model and empirical correlation matrix is non-existent, with a 0.059 value being indicative of the sufficient data set-theoretical model fit (Henseler et al. 2016).

Table 6.

Fit Summary (SRMR).

4.6. Assessing the Inner Model and Hypotheses Testing Procedures

Following the determination of the outer model’s goodness of fit, the hypothesized relationships among the constructs are tested and this was conducted in the study using a PLS algorithm in Smart PLS Version 3.0. Figure 2 presents the developed path coefficients.

The bootstrapping method is generally used to assess the path coefficients, with a minimum bootstrap sample of 5000, and the case number tallying with the total initial sample observations. In a one-tailed test, the critical t-value is 1.65, significant at the level of 5%. The generation of standard errors and t-statistics entailed 5000 re-samplings with a replacement number from the bootstrap cases that is equal to the original sample number of 154. Figure 2 and Table 7 present the path coefficients and the hypothesized relationships testing.

Table 7.

Hypotheses Verification (direct relationships).

There are eight hypothesized relationships involving one variable in the structural model and they were tested using PLS-SEM. Specifically, eight exogenous constructs were tested against one endogenous construct. The final structural model was found to have a good fit (refer to Table 7), with six paths at 5% significance level (p < 0.05). Table 7 contains the summarized hypotheses results and based on it, autonomy showed to be a not supported decision (β = −0.128, t = 1.624, p = 0.105), which means that there is an absence of autonomy and that it has less contribution in applying forensic accounting services. The same result was revealed as not supported regarding sense of community (β = −0.005, t = 0.044, p = 0.965).

However, the rest of the relationships showed that they were supported with the following results, code of ethics (β = 0.198, t = 2.066, p = 0.039), which indicates that it has a positive relationship with applying forensic accounting services. In addition, commitment was revealed to have a significant relationship with applying forensic accounting services, with the results of (β = 0.241, t = 2.051, p = 0.041). Another supported decision was revealed by intellectual technique, with the results of (β = 0.227, t = 3.191, p = 0.002). Motivation has the result of (β = 0.512, t = 7.046, p = 0). Regarding relevance to social values, the results were as follows, respectively (β = 0.158, t = 2.238, p = 0.026). Finally, training has the results of (β = 0.221, t = 1.967, p = 0.026).

5. Discussion

This paper utilizes the Pavalko (1988) model of professionalism criteria to examine the constructs of professionalism theory in the context of forensic accounting services in Jordan. Pavalko’s model provides a taxonomy of eight major constructs to identify attributes of professions, including intellectual technique, relevance to social values, training, motivation, autonomy, commitment, sense of community, and code of ethics. Pavalko’s model has been widely used in previous research on professionalism in various professions, including forensic accounting (Huber 2012). Furthermore, this study’s findings suggest that intellectual technique, relevance to social values, training, motivation, commitment, and code of ethics are important factors in the applicability of forensic accounting services in Jordan. While autonomy and sense of community were not significant factors, these findings still contribute to our understanding of professionalism in the context of forensic accounting services in Jordan. This paper aims to contribute to the literature by identifying the significant constructs of professionalism theory that impact the applicability of forensic accounting services in Jordan, thereby enhancing the effectiveness of forensic accounting practices in the country.

Autonomy and sense of community were included as constructs in this study based on Pavalko’s model of professionalism theory, which identifies eight major constructs that contribute to defining a profession. However, in the context of forensic accounting in Jordan, it is possible that these two constructs may not be significant factors in determining the professional behavior and identity of CPAs and JCPAs when it comes to forensic accounting professionalism. Autonomy, for example, may not be as critical in this context since there may be other regulations in place that limit the ability of practitioners to organize and regulate their own professional behavior. Similarly, the sense of community may not be as important in Jordan since there may not be a strong tradition of practitioners developing a common identity and interacting closely with each other. Therefore, the lack of significance of these two constructs in this study may reflect the unique cultural and regulatory context in Jordan and should not be taken as a generalization for forensic accounting practices in other countries or contexts.

This study’s findings offer valuable insights into the factors that affect the applicability of forensic accounting services in Jordan. By highlighting the importance of these constructs, this study contributes to the development of effective strategies that can improve the quality and effectiveness of forensic accounting services in the country.

These findings can be used to help educate and train the newer generation of forensic accountants in Jordan. With regards to code of ethics, forensic accountants should be trained to uphold professional ethical standards and conduct their work in an unbiased and independent manner. Furthermore, commitment and motivation are important factors that can contribute to the success of forensic accountants, and training programs should focus on cultivating these qualities in aspiring forensic accountants.

Intellectual technique and training are also significant constructs that should be considered in the education and training of new forensic accountants in Jordan. Forensic accountants should be trained to develop a strong understanding of various investigative techniques and financial analysis tools, which can help them to identify and uncover fraudulent activities. Additionally, training programs should focus on enhancing the technical skills of forensic accountants, so that they can effectively analyze complex financial data.

Finally, the relevance to the social values construct is also significant, as forensic accountants play a crucial role in promoting transparency and accountability in financial transactions. Forensic accountants should be trained to recognize the importance of their role in society, and to conduct their work in a manner that is aligned with societal expectations.

In terms of how the findings may differ from best practices adopted currently in Jordan and the rest of the world in molding their accountants that have forensic inclinations, it is important to note that the study’s findings are specific to Jordanian CPAs. However, the implications of the findings may be relevant for other countries as well. For instance, the significance of constructs such as code of ethics and commitment are likely to be relevant across different cultures and societies, as these are fundamental values that underpin the accounting profession.

6. Conclusions

6.1. Theoretical Implications

In this study, the sociological side was affected by the results, meaning that the obvious impact of the professionalism theory has been presented. Moreover, the constructs of the theory were tested in a way that can provide scientific indicators about forensic accounting in any context available, which, in this case, was Jordan.

6.2. Managerial Implications

This study provides a deep understanding for managers, standard setters, and practitioners to contribute to developing the profession of forensic accounting, which is, most importantly, the ability to present and provide services with high quality. Additionally, merging the theory’s constructs with the qualifications of the profession in corporations will indeed bring out a more developed version of the profession.

6.3. Contextual Implications

As a developing country, Jordan’s humble contribution to forensic accounting needs to expand more. This study created a new understanding for forensic accounting users in Jordan, which leads them to stand on strong ground regarding combating fraud and corruption in several financial cases.

6.4. Limitations and Future Research Guidelines

Although the present study provides several contributions to the Jordanian accounting field, this study has multiple limitations. Firstly, the results of this study are limited to the Jordanian practitioner’s perception of who answered the questionnaire. In addition, this study is limited to the factors of the proposed research model that are tested in the hypothesis. Lastly, this study used a set of statistical procedures from previous literature with one data source.

6.5. Recommendations

According to the thesis conduction process, collection and results, the researcher recommends the following points. First, including a forensic accounting subject in universities to enhance the understanding of the field among future accountants. Second, offering training programs regarding forensic accounting services for working accountants to build their skills in dealing with forensic and fraud cases. Third, including a forensic accounting section as part of the fulfillment requirements in the CPA exams. Fourth, further studies and research related to forensic accounting are needed, as there is a lack of research, particularly in Jordan. Fifth, there should be an official inclusion of regulation of the profession of forensic accounting in the Jordanian legal system.

Author Contributions

Conceptualization, R.N.A., H.A. and H.A.A.; methodology, R.N.A., H.A. and H.A.A.; software, R.N.A., H.A. and H.A.A.; validation, R.N.A., H.A. and H.A.A.; formal analysis, R.N.A., H.A. and H.A.A.; investigation, R.N.A., H.A. and H.A.A.; resources, R.N.A., H.A. and H.A.A.; data curation, R.N.A., H.A. and H.A.A.; writing—original draft preparation, R.N.A., H.A. and H.A.A.; writing—review and editing, R.N.A., H.A. and H.A.A.; visualization, R.N.A., H.A. and H.A.A.; supervision, R.N.A., H.A. and H.A.A.; project administration, R.N.A., H.A. and H.A.A.; funding acquisition, R.N.A., H.A. and H.A.A. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the declaration of the Hashemite University, and the protocol was approved by the Ethics Committee of Business school (Project identification code: H00014).

Informed Consent Statement

All subjects gave their informed consent for inclusion before they participated in the study.

Data Availability Statement

The data presented in this study is available upon request from the corresponding author.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Abdulrahman, S. 2019. Forensic accounting and fraud prevention in Nigerian public sector: A conceptual paper. International Journal of Accounting & Finance Review 4: 13–21. [Google Scholar]

- Agich, George J. 1994. Key concepts: Autonomy. Philosophy, Psychiatry, & Psychology 1: 267–69. [Google Scholar]

- Ahmad, K. 2013. The Role of Forensic Accounting in Limiting the Financial Corruption practices. Paper presented at the First Internation Conference in Accounting and Auditing, Faculty of Commerce, BaniSweif University. [Google Scholar]

- Al Shbeil, Seif, Hashem Alshurafat, Noor Taha, Al Shbail, and Mohannad Obeid. 2023. What Do We Know About Forensic Accounting? A Literature Review. In European, Asian, Middle Eastern, North African Conference on Management & Information Systems. Cham: Springer. [Google Scholar]

- Al-Abbadi, Haitham Mamdouh, Badi Alrawashdeh, Mohammed Nadem Dabaghia, and Riyad Neman Darwazeh. 2021. The challenges of application of forensic accounting in Jordan. Academy of Strategic Management Journal 20: 1–10. [Google Scholar]

- Alhusban, Ahmad Abed Alla, Haitham A. Haloush, Hashem Alshurafat, Jebreel Mohammad Al-Msiedeen, Ali Abdel Mahdi Massadeh, and Rawan J. Alhmoud. 2020. The regulatory structure and governance of forensic accountancy in the emerging market: Challenges and opportunities. Journal of Governance and Regulation 9: 149–61. [Google Scholar] [CrossRef]

- Alli, Rofiat, Rebecca Nicolaides, and Russell Craig. 2018. Detecting advance fee fraud emails using self-referential pronouns: A preliminary analysis. Accounting Forum 42: 78–85. [Google Scholar] [CrossRef]

- Alshurafat, Hashem. 2019. Forensic Accounting Curricula and Pedagogies in Australian Universities: Analysis of Academic and Practitioner Perspectives. Toowoomba: University of Southern Queensland. [Google Scholar]

- Alshurafat, Hashem. 2021. Forensic accounting as a profession in Australia? A sociological perspective. Meditari Accountancy Research. ahead-of-print. [Google Scholar] [CrossRef]

- Alshurafat, Hashem, Claire Beattie, Gregory Jones, and John Sands. 2019a. The domain of forensic accounting services: Evidence from Australia. Paper presented at the 19th Asian Academic Accounting Association (FourA) Annual Conference, Seoul, Republic of Korea, November 24–26. [Google Scholar]

- Alshurafat, Hashem, Claire Beattie, Gregory Jones, and John Sands. 2019b. Forensic accounting core and interdisciplinary curricula components in Australian universities: Analysis of websites. Journal of Forensic and Investigative Accounting 11: 353–65. [Google Scholar]

- Alshurafat, Hashem, Claire Beattie, Gregory Jones, and John Sands. 2020. Perceptions of the usefulness of various teaching methods in forensic accounting education. Accounting Education 29: 177–204. [Google Scholar] [CrossRef]

- Alshurafat, Hashem, Jebreel Mohammad Al-Msiedeen, Al Shbail, Mohannad Obeid, Husam Ananzeh, Seif Alshbiel, and Zaid Jaradat. 2023. Forensic Accounting Education Within the Australian Universities. In International Conference on Business and Technology. Cham: Springer. [Google Scholar]

- Alshurafat, Hashem, Mohannad Al Shbail, and Ebrahim Mansour. 2021a. Strengths and weaknesses of forensic accounting: An implication on the socio-economic development. Journal of Business and Socio-Economic Development 1: 135–48. [Google Scholar] [CrossRef]

- Alshurafat, Hashem, Mohannad Al Shbail, and Mohammad Almuiet. 2021b. Factors Affecting the Intention to Adopt IT Forensic Accounting Tools to Detect Financial Cybercrimes. International Journal of Business Excellence. [Google Scholar] [CrossRef]

- Andriani, Pauline Tricia, I. Gde Wawan Sudatha, and I. Kadek Suartama. 2021. E-Summary Teaching Materials with Hannafin & Peck Models for Training Participants in the Human Resources Development Agency. Indonesian Journal of Educational Research and Review 4: 534–42. [Google Scholar]

- Bhasin, M. L. 2007. Forensic Accounting and Auditing- Perspectives and Prospects, Accounting World Magazine. Forensic Accounting Auditing, 40–45. [Google Scholar]

- Bologna, G. Jack, and Robert J. Lindquist. 1995. Fraud Auditing and Forensic Accounting: New Tools and Techniques. New York: Wiley. [Google Scholar]

- Botes, Vida, and Ahmed Saadeh. 2018. Exploring evidence to develop a nomenclature for forensic accounting. Pacific Accounting Review 30: 135–54. [Google Scholar] [CrossRef]

- Brickner, Daniel R., Lois S. Mahoney, and Stephen J. Moore. 2010. Providing an applied-learning exercise in teaching fraud detection: A case of academic partnering with IRS criminal investigation. Issues in Accounting Education 25: 695–708. [Google Scholar] [CrossRef]

- Cervero, Ronald M. 1992. Adult and continuing education should strive for professionalization. New Directions for Adult and Continuing Education 1992: 45–50. [Google Scholar] [CrossRef]

- Chin, Wynne W. 1998. The partial least squares approach to structural equation modeling. Modern Methods for Business Research 295: 295–336. [Google Scholar]

- Chin, Wynne W. 2010. How to write up and report PLS analyses. In Handbook of Partial Least Squares. Berlin/Heidelberg: Springer, pp. 655–90. [Google Scholar]

- Christman, John. 1988. Constructing the inner citadel: Recent work on the concept of autonomy. Ethics 99: 109–24. [Google Scholar] [CrossRef]

- Clavería Navarrete, Alberto, and Amalia Carrasco Gallego. 2022. Forensic accounting tools for fraud deterrence: A qualitative approach. Journal of Financial Crime. ahead-of-print. [Google Scholar]

- Crumbley, D. Larry, Lester E. Heitger, and G. Stevenson Smith. 2007. Forensic and Investigative Accounting. Chicago: CCH. [Google Scholar]

- Curtis, George E. 2008. Legal and regulatory environments and ethics: Essential components of a fraud and forensic accounting curriculum. Issues in Accounting Education 23: 535. [Google Scholar] [CrossRef]

- Davis, Charles, Ramona Farrell, and Suzanne Ogilby. 2010. Characteristics and skills of the Forensic Accountant. American Institute of Certified Public Accountants 2010: 11–26. [Google Scholar]

- Denhere, Varaidzo. 2022. Chapter 3—Financial Forensic Evidence and Acceptability in the Court of Law. In Handbook of Research on the Significance of Forensic Accounting Techniques in Corporate Governance. Hershey: IGI Global, pp. 41–61. [Google Scholar]

- Derr, Cammi L. 2012. Ethics and leadership. Journal of Leadership, Accountability and Ethics 9: 66–71. [Google Scholar]

- DiGabriele, James A. 2012. A case study on the determination of lost profits for the forensic accountant. Issues in Accounting Education 27: 751–59. [Google Scholar] [CrossRef]

- Dimitrijevic, Dragomir, Biljana Jovkovic, and Suncica Milutinovic. 2020. The scope and limitations of external audit in detecting frauds in company’s operations. Journal of Financial Crime 28: 632–46. [Google Scholar] [CrossRef]

- Dunham, Randall B. 1984. Organizational Behavior: People and Processes in Management. Homewood: Irwin. [Google Scholar]

- Durtschi, Cindy, and Robert J Rufus. 2017. Arson or accident: A forensic accounting case requiring critical thinking and expert communication. Issues in Accounting Education 32: 113–22. [Google Scholar] [CrossRef]

- Dworkin, Gerald. 1988. The Theory and Practice of Autonomy. Cambridge: Cambridge University Press. [Google Scholar]

- Fortvingler, Judit, and László Szívós. 2016. Different approaches to fraud risk assessment and their implications on audit planning. Periodica Polytechnica Social and Management Sciences 24: 102–12. [Google Scholar] [CrossRef]

- Fowler, Susan. 2014. What Maslow’s hierarchy won’t tell you about motivation. Harvard Business Review 92: 1–5. [Google Scholar]

- Greer, Charles R. 2021. Strategic Human Resource Management. Boston: Pearson Custom Publishing. [Google Scholar]

- Hair, Joseph F., Arthur H. Money, Philip Samouel, and Mike Page. 2007. Research methods for business. Education+ Training 49: 336–37. [Google Scholar] [CrossRef]

- Hair, Joseph F., Christian M. Ringle, and Marko Sarstedt. 2011. PLS-SEM: Indeed a silver bullet. Journal of Marketing Theory and Practice 19: 139–52. [Google Scholar] [CrossRef]

- Hair, Joseph F., Christian M. Ringle, and Marko Sarstedt. 2013. Partial least squares structural equation modeling: Rigorous applications, better results and higher acceptance. Long Range Planning 46: 1–12. [Google Scholar] [CrossRef]

- Hair, Joseph F., Marko Sarstedt, Christian M. Ringle, and Siegfried P. Gudergan. 2017. Advanced Issues In partial Least Squares Structural Equation Modeling. Thousand Oaks: Sage Publications. [Google Scholar]

- Hair, Joseph F., Rolph E. Anderson, Barry J. Babin, and Wiiliam C. Black. 2010. Multivariate Data Analysis: A Global Perspective (Vol. 7). Upper Saddle River: Pearson. [Google Scholar]

- Haloush, Haitham A., Hashem Alshurafat, and Ahmad Abed Alla Alhusban. 2021. Auditors’civil liability towards clients under the jordanian law: Legal and auditing perspectives. Journal of Governance and Regulation 10: 42–48. [Google Scholar] [CrossRef]

- Hayes, Andrew F. 2013. Introduction to mediation, moderation, and conditional process analysis: Methodology in the Social Sciences. Kindle Edition, 193. [Google Scholar]

- Hegazy, Sarah, Alan Sangster, and Amr Kotb. 2017. Mapping forensic accounting in the UK. Journal of International Accounting, Auditing and Taxation 28: 43–56. [Google Scholar] [CrossRef]

- Heitger, Lester E., and Dan L. Heitger. 2008. Incorporating forensic accounting and litigation advisory services into the classroom. Issues in Accounting Education 23: 561–72. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Marko Sarstedt. 2015. A new criterion for assessing discriminant validity in variance-based structural equation modeling. Journal of the Academy of Marketing Science 43: 115–35. [Google Scholar] [CrossRef]

- Henseler, Jörg, Christian M. Ringle, and Rudolf R. Sinkovics. 2009. The use of partial least squares path modeling in international marketing. In New Challenges to International Marketing. Bingley: Emerald Group Publishing Limited. [Google Scholar]

- Henseler, Jörg, Geoffrey Hubona, and Pauline Ash Ray. 2016. Using PLS path modeling in new technology research: Updated guidelines. Industrial Management & Data Systems 116: 2–20. [Google Scholar]

- Huber, Wm. 2012. Is forensic accounting in the United States becoming a profession? Journal of Forensic & Investigative Accounting 4: 255–84. [Google Scholar]

- Ismail, Sawsan, Abdallah Bader Al-zoubi, Firas N. Dahmash, Safaa Ahmad, and Mahmoud Mahmoud. 2022. A Review on Forensic Accounting Profession and Education: Global Context. Preprints.org 2022110369. [Google Scholar] [CrossRef]

- ISQC. 2005. Quality Control for Firms that Perform Audits and Reviews of Historical Financial Information, and Other Assurance and Related Services Engagements. In Assurance, and Ethics Pronouncements, 2005 ed. IFAC Handbook of International Auditing. New York: International Federation of Accountants, pp. 148–74. [Google Scholar]

- Jamrizal, Jamrizal. 2022. Human resources management in islamic education: Expertise, training and performance. Dinasti International Journal of Education Management And Social Science 3: 977–85. [Google Scholar]

- Kaur, Baljinder, Kiran Sood, and Simon Grima. 2022. A systematic review on forensic accounting and its contribution towards fraud detection and prevention. Journal of Financial Regulation and Compliance. ahead-of-print. [Google Scholar] [CrossRef]

- Kern, Sara M., and Gary J. Weber. 2016. Implementing a “real-world” fraud investigation class: The justice for fraud Victims project. Issues in Accounting Education 31: 255–89. [Google Scholar] [CrossRef]

- Khan, Abdullah Ayub, Aftab Ahmed Shaikh, Asif Ali Laghari, Mazhar Ali Dootio, M. Malook Rind, and Shafique Ahmed Awan. 2022. Digital forensics and cyber forensics investigation: Security challenges, limitations, open issues, and future direction. International Journal of Electronic Security and Digital Forensics 14: 124–50. [Google Scholar] [CrossRef]

- Koh, Adrain Nicholwa, Lawrence Arokiasamy, and Cristal Lee Ah Suat. 2009. Forensic accounting: Public acceptance towards occurrence of fraud detection. International Journal of Business and Management 4: 145–49. [Google Scholar] [CrossRef]

- Lantos, Geoffrey P. 2002. The ethicality of altruistic corporate social responsibility. Journal of Consumer Marketing 19: 205–32. [Google Scholar] [CrossRef]

- Mayer, F. Stephan, and Cynthia McPherson Frantz. 2004. The connectedness to nature scale: A measure of individuals’ feeling in community with nature. Journal of Environmental Psychology 24: 503–15. [Google Scholar] [CrossRef]

- McGill, Craig M. 2018. Leaders’ Perceptions of the Professionalization of Academic Advising: A Phenomenography. NACADA Journal 38: 88–102. [Google Scholar] [CrossRef]

- McMillan, David W., and David M. Chavis. 1986. Sense of community: A definition and theory. Journal of Community Psychology 14: 6–23. [Google Scholar] [CrossRef]

- Meraj, Mohammad. 2022. Analysis of Cyber Forensics Issues in Internet of Things (IoT). EasyChair. Available online: https://easychair.org/publications/preprint/wmFt (accessed on 2 March 2023).

- Monteiro, A. R. 2015. Sociology of the Professions. In The Teaching Profession. Cham: Springer, pp. 47–60. [Google Scholar] [CrossRef]

- Mukerjee, R. 1949. Meaning of Values. Available online: https://www.yourarticlelibrary.com/society/values-its-meaning-characteristics-types-importance/35072 (accessed on 15 January 2023).

- Nehra, Neha, and Nand Kishore Singh. 2018. A Statistical Analysis of Social Values of Siksha Mitras Teachers in (UP). Journal of Arts, Culture, Philosophy, Religion, Language and Literature 2: 107–8. [Google Scholar]

- Neuman, W. Lawrence. 2006. Social Research Methods: Qualitative and Quantitative Research. Madison: University of Wisconsin, pp. 209–309. [Google Scholar]

- Okoye, Emmanuel Ikechukwu. 2009. The role of forensic accounting in fraud investigation and litigation support. In The Nigerian Academic Forum. Abuja: National Association of the Academics, p. 17. [Google Scholar]

- Okoye, Emmanuel Ikechukwu, and Do Gbegi. 2013. Forensic accounting: A tool for fraud detection and prevention in the public sector. (A Study of Selected Ministries in Kogi State). International Journal of Academic Research in Business and Social Sciences 3: 1–19. [Google Scholar]

- Patel, Priyanka J. 2018. Role of Various Values in Education. International Journal of Research in all Subjects in Multi Languages 6: 1–4. [Google Scholar]

- Pavalko, Ronald M. 1988. Sociology of Occupations and Professions. Itasca: FE Peacock Publishers. [Google Scholar]

- Pearson, Timothy A., and Tommie W. Singleton. 2008. Fraud and forensic accounting in the digital environment. Issues in Accounting Education 23: 545. [Google Scholar] [CrossRef]

- Perecman, Ellen, and Sara R. Curran. 2006. A Handbook for Social Science Field Research: Essays & Bibliographic Sources on Research Design and Methods. Thousand Oaks: Sage. [Google Scholar]

- Pflugrath, Gary, Nonna Martinov-Bennie, and Liang Chen. 2007. The impact of codes of ethics and experience on auditor judgments. Managerial Auditing Journal 22: 566–89. [Google Scholar] [CrossRef]

- Princy, K., and E. Rebeka. 2019. Employee commitment on organizational performance. International Journal of Recent Technology and Engineering 8: 891–95. [Google Scholar] [CrossRef]

- Public Company Accounting Oversight Board (PCAOB). 2020. Available online: https://pcaobus.org/about/pcaob-issues-2020-annual-report (accessed on 10 January 2023).

- Rasey, M. 2009. History of Forensic Accounting, vol. 2.

- Reinartz, Werner, Michael Haenlein, and Jörg Henseler. 2009. An empirical comparison of the efficacy of covariance-based and variance-based SEM. International Journal of research in Marketing 26: 332–44. [Google Scholar] [CrossRef]

- Rezaee, Zabihollah, and Jim Wang. 2019. Relevance of big data to forensic accounting practice and education. Managerial Auditing Journal 34: 268–88. [Google Scholar] [CrossRef]

- Rezaee, Zabihollah, D. Larry Crumbley, and Robert C. Elmore. 2004. Forensic accounting education: A survey of academicians and practitioners. Advances in Accounting Education Teaching and Curriculum Innovations 6: 193–231. [Google Scholar]

- Rifani, Riza Amalia, and Hamida Hasan. 2022. Disclosure of Fraud Through Forensic Accounting, Audit Investigation and Auditor Professionalism. Jurnal Economic Resource 5: 307–20. [Google Scholar] [CrossRef]

- Ringle, C. M., S. Wande, and J.-M. Becker. 2014. Smartpls 3.0. Hamburg: SmartPLS. Hamburg: SmartPLS. [Google Scholar]