1. Introduction

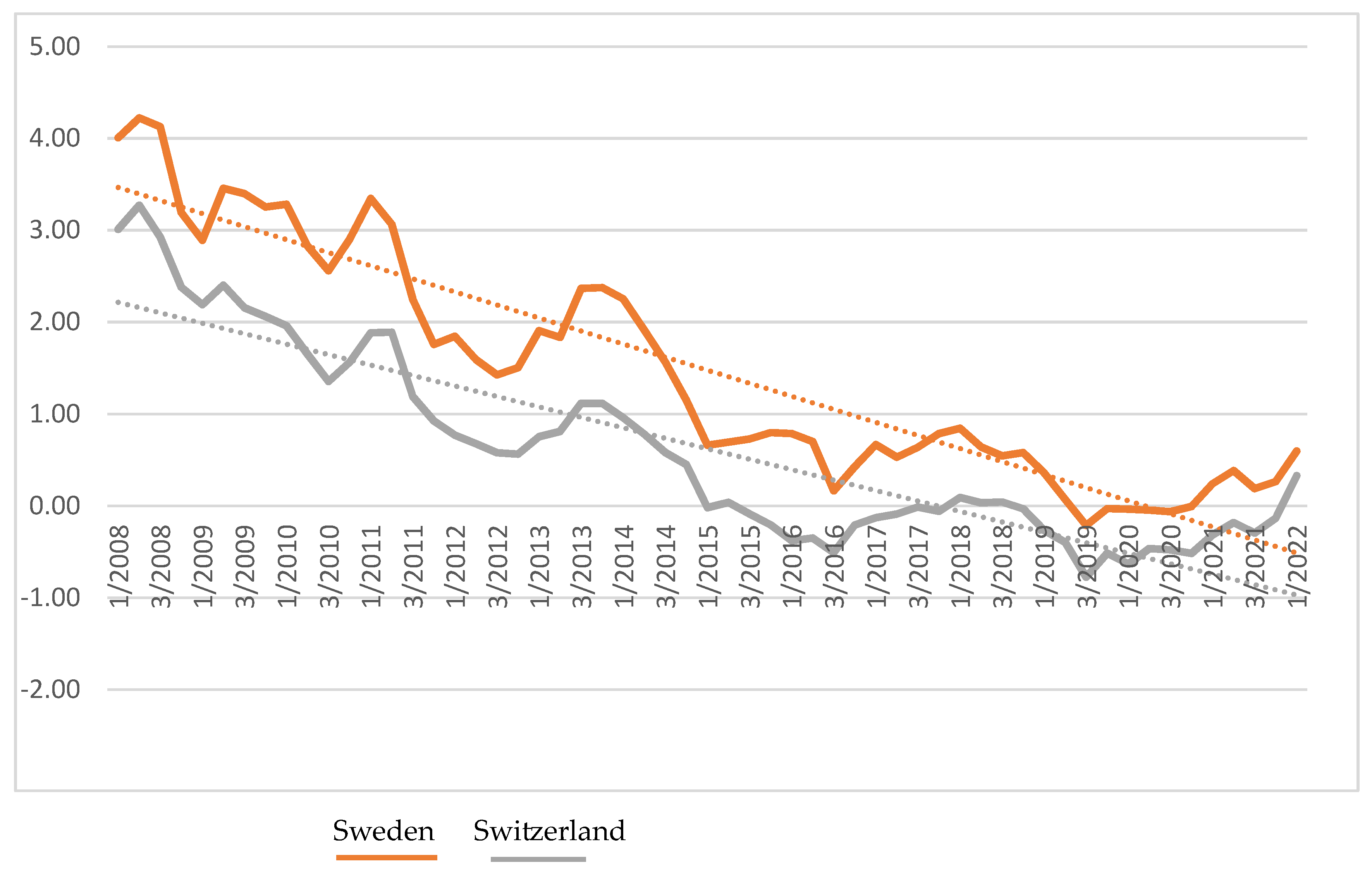

To overcome the consequences of the global financial crisis in 2008–2009, central banks made many extraordinary steps to increase the money supply and to force commercial banks to lend money to other subjects. One of the most controversial measures was the implementation of negative interest rate policy (NIRP) that implies setting nominal target interest rates below the zero percent bound. Sweden’s central bank was the first to deploy negative interest rates (NIRs). In July 2009, the Riksbank cut its overnight deposit rate to −0.25%. The European Central Bank (ECB) lowered its deposit rate to −0.1% in June 2014. Several other central banks followed this policy—Denmark adopted an NIRP in September 2014, Switzerland in December 2014, Sweden in February 2015, Norway in September 2015, Bulgaria in January 2016, Japan in February 2016 and Hungary in March 2016 (

Arteta et al. 2016;

Czudaj 2020). Commercial banks operating in these countries were supposed to pay central banks a small fee to hold their excess reserves at central banks. The main objective of these decisions (

de Groot and Haas 2020) was to promote bank lending, which stimulates economic growth and fights against low inflation and the increasing threat of deflation. Negative interest rates should encourage commercial banks to lend more money to households and companies, rather than hold it at the central bank. As such, a business can invest more, using even lower rates.

The implementation of NIRP has triggered concerns about the possible impact of this policy on banks’ profitability. The overall effect of negative monetary policy rates on banks’ profitability is not immediately obvious. According to one of the authors (e.g.,

Borio et al. 2018), negative rates may erode banks’ profitability, primarily by narrowing their net interest margin (the gap between bank lending and deposit rates), given their reluctance to introduce negative retail deposit rates. However, another group of authors (e.g.,

Jobst and Lin 2016) was not so skeptical, pointing out that other channels include the development of wholesale funding costs, as well as lending volumes, credit losses, or fee and commission income. Moreover, asset purchases and other measures contributing to lower interest rates increase the value of the securities held by banks, with a positive impact on profits. Such a dual outcome raises important questions about the effectiveness and consequences of expansionary monetary policy.

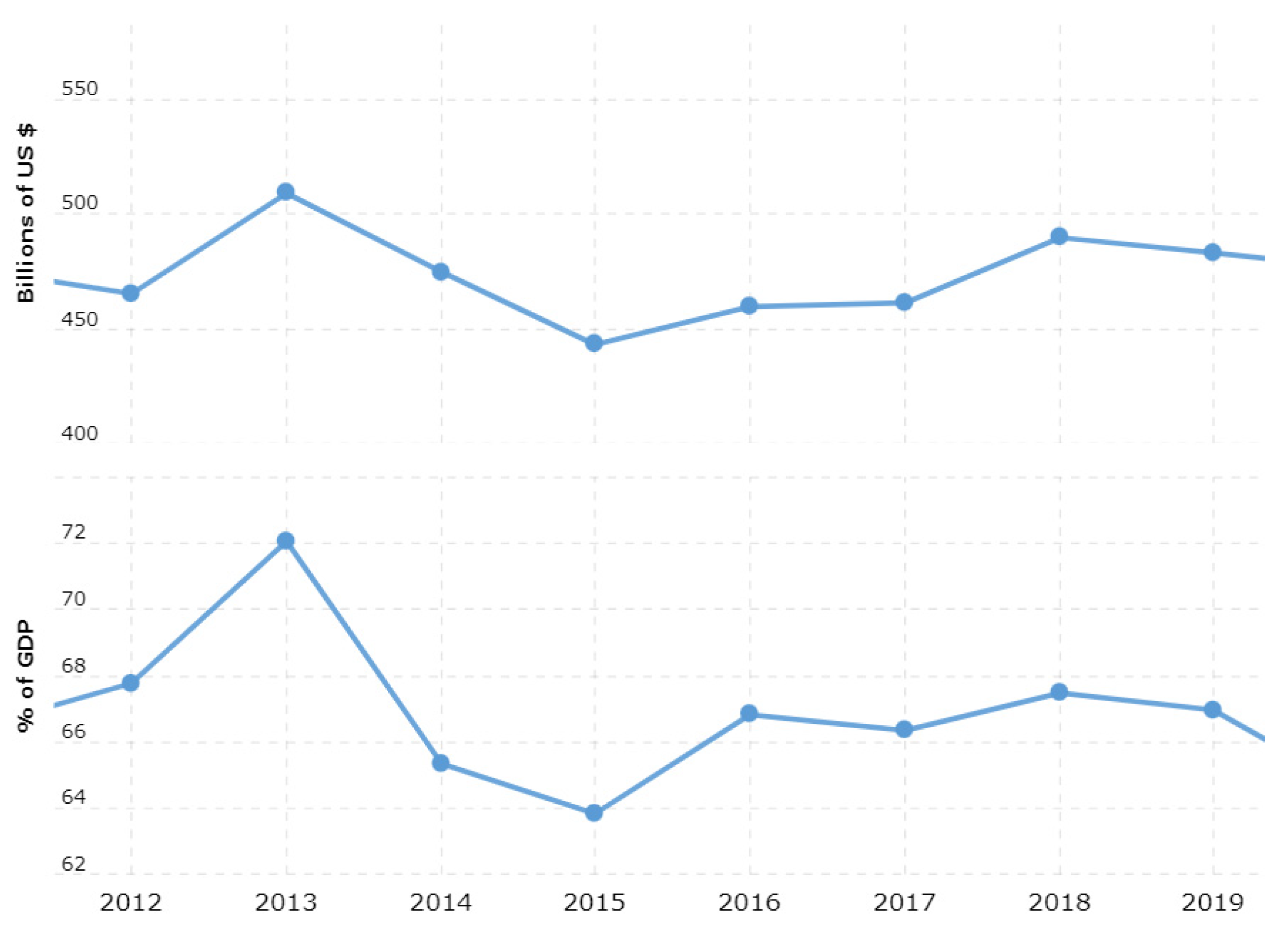

The main research aim of this article is to quantify the impact of NIR on foreign direct investment, GDP and banks’ profitability in the two aforementioned countries—Switzerland and Sweden. The countries were intentionally chosen. Although they differ in some aspects, they also have many in common. Both have a quite similar population—approximately 10.38 million inhabitants in Switzerland and 8.60 million in Sweden. Both still keep their national currency with the floating exchange regime and both currencies are considered a relatively safe haven in the case of financial turmoil (

Fabozzi and Jones 2019). They are also quite similar in their relationships with the European Union (EU)—Sweden is a full member, but is not part of the Eurozone; whilst Switzerland is not a member state of the EU but remains associated with the EU through a series of bilateral treaties in which Switzerland has adopted various provisions of European Union law in order to participate in the EU’s single market, including the free movement of capital. Both countries are some of the richest states in the world: if GDP per capita measured in purchasing power parity (USD) is used, then Switzerland ranked 6th place with a value of 71,032 in 2021; Sweden was 16th with a value of 53,613 (

The Global Economy 2023). Both are considered business-friendly (both were ranked a value of approximately 80 by the Doing Business evaluation in the long term, where 0 represents the lowest and 100 represents the best performance, with only a few countries obtaining a better score—see (

Doing Business 2023) for details). They are also considered to have low levels of corruption: both, according to Transparency International and its Corruption Perception Index, have historically belonged the ten least corrupt countries (

Transparency International 2023;

Otáhal et al. 2013;

Wawrosz and Valenčík 2014;

Wawrosz 2019). One of the big differences concerns the share of the banking sector in GDP (=bank assets to GDP). The share of the banking sector has historically been high in Switzerland and now (2020) it represents almost 500% of GDP. In Sweden, the share is much smaller, representing approximately 160% of GDP (

Helgi Library 2023).

The article has the following hypotheses:

Hypothesis 1. Decreasing interest rates cause a decrease in foreign direct investment (FDI) flowing into the country. It can be argued that lower yields connected with NIR in both countries and the fact that foreign investors had many possibilities to invest their money (sources) in other countries non-affected by NIRP during the period of NIR can outweigh other factors (some of which were mentioned above) that favor both countries for foreign investors.

Hypothesis 2. Negative interest rates introduced by the central banks of Switzerland and Sweden helped both countries stimulate the economy (i.e., GDP growth). This hypothesis is consistent with the main NIR objective (see

de Groot and Haas 2020).

Hypothesis 3. The financial indicators of the commercial banks of Sweden and Switzerland are correlated with the interest rate. We assume that NIR affects the financial performance of commercial banks. We intentionally did not formulate in which way the indicators are affected—the formulation allows one to test both possibilities: both a positive and negative impact.

This article is organized as follows: the second chapter contains a literature review and overviews the theoretical background concerning NIRP. The third chapter introduces our materials and methods. Results are presented in the fourth chapter and discussed in the fifth chapter. The fifth chapter also extends some (especially problematic) aspects of NIRP. The conclusion summarizes main points.

2. Literature Review and Theoretical Background

For most of history, nominal interest rates have been positive. There were some theoretical attempts concerning tax holding money (negative interest rates can be seen as a form of money holding taxation, see (

Ilgmann and Menner 2011) for details)—among which the most famous was that of Gesell (e.g.,

Gesell 1916), who introduced new notes with coupons when the coupon represented a part of the nominal value of the note and coupons lost their value over time. The suggestion was taken up by various prominent economists such as Irving Fisher (

Fisher 1933) and John Maynard Keynes (

Keynes 1936); however, after the second world war, the idea of NIR or other forms of money holding taxation did not play a significant role in economic thinking. Some authors (

Buiter and Panigirtzoglou 1999,

2003;

Goodfriend et al. 2000;

Fukao 2005;

Buiter 2005a,

2005b,

2007,

2009) took up Gesell’s proposal of a tax on money as a means of overcoming the zero bound on interest rates, which was seen, for instance, in the case of Japanese experience, when the country faced a liquidity trap during the 1990s (

Koo 2008); however, this experience was mainly considered a curiosity and a rare exception (

Ullersma 2002;

Yates 2004).

The situation changed after the financial crisis in 2007 (the so-called Great Recession—see, for instance,

Blanchard 2021). Due to this crisis, an increasing number of central banks (CBs) resorted to low-rate policies. Several CBs, as mentioned in the introduction, started experimenting with negative interest rates —essentially charging banks for holding their excess cash at the central bank (

Haksar and Kopp 2020). In theory (

European Central Bank 2014), banks would rather lend money to borrowers and earn at least some interest as opposed to being charged for holding their money at a central bank. Commercial banks cannot lower their deposit rates below zero in the same amount as the central bank since depositors have the option to substitute deposits for cash holdings (

Czudaj 2020). This should lead to a higher number of loans and thus to higher investments and consumption, generally leading to a higher GDP and a positive value of inflation. With regard to GDP,

Czudaj (

2020) found a significantly positive effect of this unconventional monetary policy tool on GDP growth for all aforementioned countries—it was on average more than 1 percentage point higher in comparison with countries that did not adopt NIRP.

Among the most likely negatives outcomes of NIRs (for instance,

Heider et al. 2019) is their effect on bank profitability. The main source of the bank’s profit is a spread, i.e., the difference between what they pay savers (depositors) and what they charge on the loans they make. When central banks lower their policy rates, the spread is reduced, as overall lending and longer-term interest rates tend to fall. When rates go below zero, banks may be reluctant to levy negative interest rates on their depositors for fear that they will withdraw their deposits. If banks refrain from negative rates on deposits, this could in principle make the lending spread negative, because the return on a loan would not cover the cost of holding deposits. This could in turn lower banks´ profitability and net worth and undermine the stability of the financial system. A fall in net worth forces banks to curtail lending. NIRP can be counterproductive if lending and thus consumption and investment really decline (

Groot and Haas 2020).

The empirical results on whether NIRs reduce commercial banks´ performance are ambiguous. For instance,

Bongiovanni et al. (

2021), on a sample of 2584 banks from 33 OECD countries from 2012 to 2016, found that NRIP is associated with reductions in banks’ loan growth and average loan price (by 3.7 percentage points and 59 basis points) and a rebalancing of asset portfolios towards safer assets.

Altavilla et al. (

2022) argued that, in the case of ECB and NIR in the Eurozone, deposits on average increased during the NIRP period as households and firms were looking for liquidity and safe assets. According to the authors (p. 7): “Since there has been no broad-based outflow of deposits from banks charging negative rates, which instead appear to have attracted new deposits, the overall cost of funding of sound banks has decreased. … banks charging negative rates extend relatively more credit. These results suggest that the ECB has not reached the reversal rate, at which the negative effect of a lower interest rate on bank profits may lead to a contraction in lending and economic activity.”

Boungou and Mawusi (

2023) found, using a dataset of 9638 banks from 41 countries during the period 2009–2018, that bank margins have contracted in countries where negative rates were implemented. Their results suggest that, in a negative interest rate environment, the rate on loans declines faster than the rate on retail deposits. The effects of NIRP on bank lending margins were stronger for smaller, less capitalized, deposit-dependent banks. These findings are supported by the theoretical model of

Brunnermeier and Koby (

2019) which demonstrates that a NIRP has contractionary effects on the economy when the liquidity and capital constraints of the banking sector bind. In such a situation, the reduction in bank profits negatively affects the net worth and translates into a decline in the volume of loans.

On the other hand,

Bats et al. (

2023), based on the sample of European commercial banks, argue that NIRs matter for bank stock prices. The study discovered, controlling for broad stock market movements, that an unanticipated downward shift in the yield curve and a flattening of the shorter end of the yield curve resulting from monetary policy announcements persistently reduce bank stock prices in a low and especially negative interest rate environment. Bank stocks thus face a disadvantage compared to other firms listed in a stock market in the situation of NIR. The accounting data of the investigated banks further confirms that a drop in the yield curve in an NIR environment hurts banks through shrinking deposit margins. Similarly,

Freriks and Kakes (

2021) used data from over 300 European monetary and financial institutions from the third quarter of 2007 to the second quarter of 2019 in the Eurozone to confirm that banks´ interest margins are reduced if NIRs are introduced and banks’ profitability declines due to this reduction. Their finding does not include institutions from Greece and Cyprus as their results were affected by the financial crisis ‚Great Recession) that had hit these countries, institutions from Estonia, Latvia, Lithuania, Luxemburg, Slovenia and Slovakia were not also included due to limited availability of some data.”

The comprehensive study of

Brandao-Marques et al. (

2021) that investigates the effects of NIRP on financial markets, banks, households, firms and the macroeconomy concluded that lending and deposit rates decrease following the adoption of NIRPs. Based on the experience to date, bank lending volumes have risen, and bank profits have not significantly deteriorated, although there is considerable heterogeneity in the effects.

We did not find any empirical article investigating the impact of NIR on capital inflows and outflows. Some theoretical texts deal with this relationship but mainly concentrate on how NIR affects the exchange rate (e.g.,

Ruprecht 2020). In the case of Switzerland,

Yesin (

2015) investigated capital flow waves to and from this county between the first quarter of 2000 and the second quarter of 2014, i.e., before and after the financial crisis, and revealed that both inflows and outflows of private capital have become significantly less volatile in the post-crisis period than in the pre-crisis period, but the study did not research the issue of NIR. In their comprehensive and worldwide study,

Forbes and Warnock (

2020) mentioned that in Switzerland was the only country to experience a sharp decrease in gross capital outflows in the second decade of the 20th century, specifically between 2008 and 2017. During that period, Sweden experienced one sharp increase in gross capital inflow between 2013 and 2014, one sharp decrease in gross capital outflows between 2014 and 2015, and in opposition, one sharp increase in gross capital outflows in 2017.

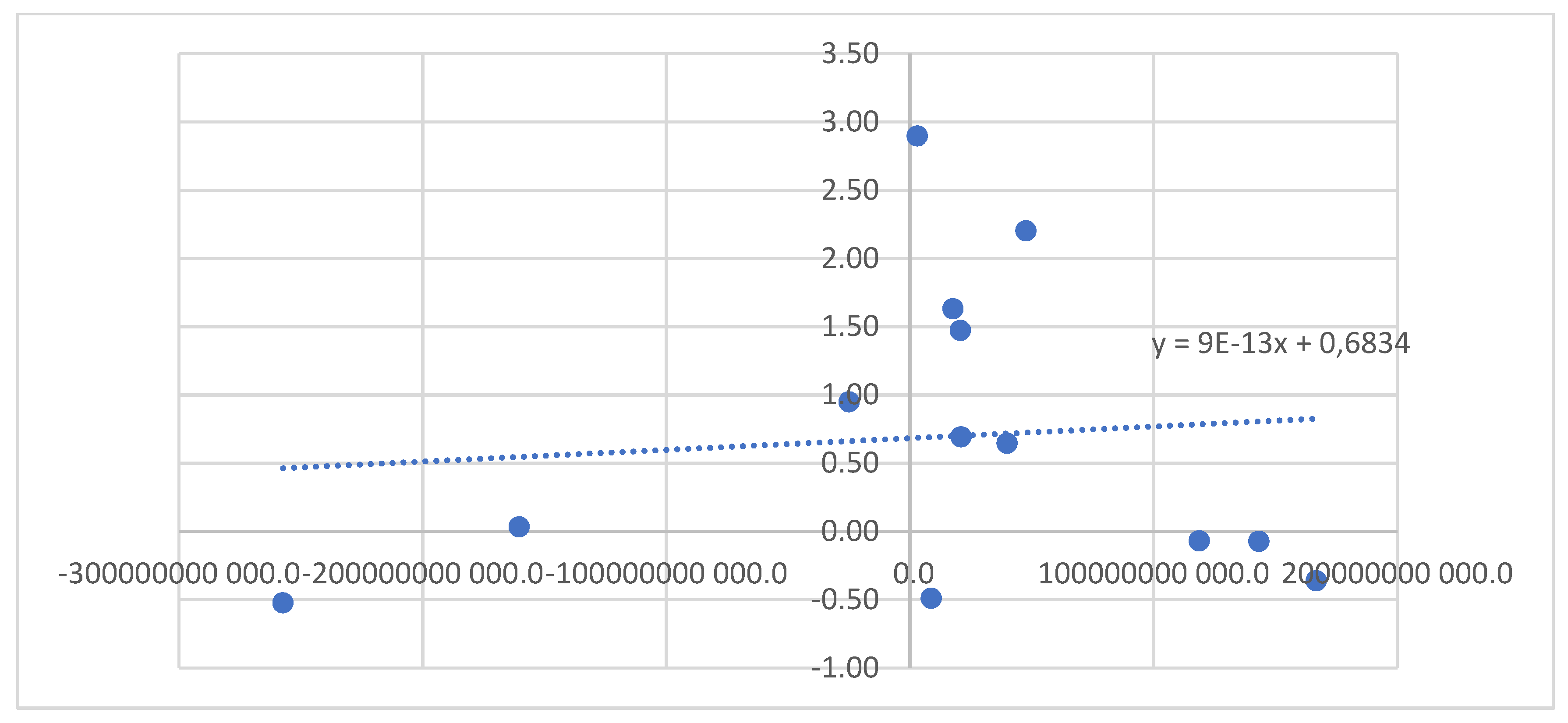

3. Material and Methods

We investigated the relationship between the central bank interest rate (an independent variable) and some dependent variables such FDI (net flow), GDP, and indicators of bank performance (see below) separately for Switzerland and for Sweden using the correlations coefficient, which was calculated as (

Zaiontz 2022):

where

r—correlation coefficient;

x—the first variable;

y—the second variable;

mx—the mean of

x; and

my—the mean of

y. Based on the value

r, correlation is defined (

Zaiontz 2022): up to 0.2—very weak correlation; from 0.2 to 0.5—weak correlation; from 0.5 to 0.7—moderate correlation; from 0.7 to 0.9—high correlation; over 0.9—very high correlation. If the correlation coefficient is 0, both variables are linearly independent of each other. Although it can be objected that correlation statistics constitute a simple method, it still gives sufficient insight into the relationship among the investigated variables. We are aware of the fact that our data can be distorted by the serial correlation, which cannot be detected by our approach. However, we do not think that a serial correlation affects all data.

According to the theory (e.g.,

Dorman 2014), we assume that changes in interest rates in the economy do not immediately affect macroeconomic indicators. Therefore, within the framework of statistical analysis, it should be considered that, after the introduction of the interest rate correction, some time passes before economic subjects begin to react. We set up this time as three months. Accordingly, economic indicators will be taken one quarter later (since the calculation will be based on quarterly data). The data for analysis are taken from 2008, as the world experienced a financial and economic crisis that year, to which central banks also react by introducing monetary measures. The key indicators of bank financial performance that will be considered in this paper are described in

Table 1.

When analyzing the effect of negative interest rates on financial indicators in the banking sector, it should be considered (

Dorman 2014) that a temporary delay of 1 year must be observed for the financial indicators. This is the reporting period for banks, and after a year may the perspective change in the financial policy of commercial banks be reflected in financial statements. Additionally, the 1-year delay can be justified in such a way that, after the publication of new instructions from a central bank on interest rates for commercial banks, there comes a certain period for the implementation of these rates in commercial practice. After the introduction of new financial conditions, it takes some time before bank customers begin to respond to innovations. All these periods constitute a long-term reaction, so a year of delay in these banks’ financial indicator of will be an adequate period.

6. Conclusions

Monetary policy usually pays attention not only to inflation but also to general economic development. Different central banks select different approaches regarding the interest rates that affect the economy and the activity of commercial banks in the market. One of the tools that central banks use is the interest rate, which depends on the economic situation in the country. This article analyzed the relationship between GDP growth and the financial indicators of commercial banks in two European countries (Switzerland and Sweden) on the one hand and interest rates on the other hand for the period of negative interest rates.

As the main sources of banks’ income are 1. interest on deposits; 2. interest on loans provided; and 3. commission fees from transactions on financial markets, it was first tested whether negative interest rates affected the inflow of foreign direct investment into countries. We found no statistically significant correlation for both countries. However, we found strong negative correlations between negative interest rates and GDP in both countries. Our results indicate that NIR is being associated with undesirable effects with regard to economic growth and bank performance in Switzerland and Sweden. Furthermore, the financial indicators of banks were analyzed. In Switzerland, there was greater correlation between the changes in interest rates and the financial indicators of commercial banks than in Sweden. In some respects, this also reflects Switzerland’s special position with respect to foreign investors, their confidence in the country and its currency, which the state can regulate with the help of conventional and unconventional monetary policy instruments.

This article has intentionally only concentrated on two countries, both of which experienced NIRP, had their own currency with a flexible exchange rate, and shared close ties with European Union. It should be interesting in the next research to compare Swiss and Swedish results with situations in countries with different characteristics (for instance, countries with a similar number of inhabitants but using the euro) and to investigate how the aforementioned specifics affect the decisions of investors regarding their FDI, bank performance, the relationship between NIR and GDP, or other indicators.