Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample

Abstract

1. Introduction

2. Review of Literature

2.1. Security, Perceived Risk, and Trust

2.2. Literacy and Fintech Use

2.3. Perceived Usefulness of Fintech

2.4. Demographic Factors

2.5. Satisfaction and Usage of Fintech

2.6. Country-Level Evidence and Heterogeneity

2.7. Fintech and Financial Inclusion

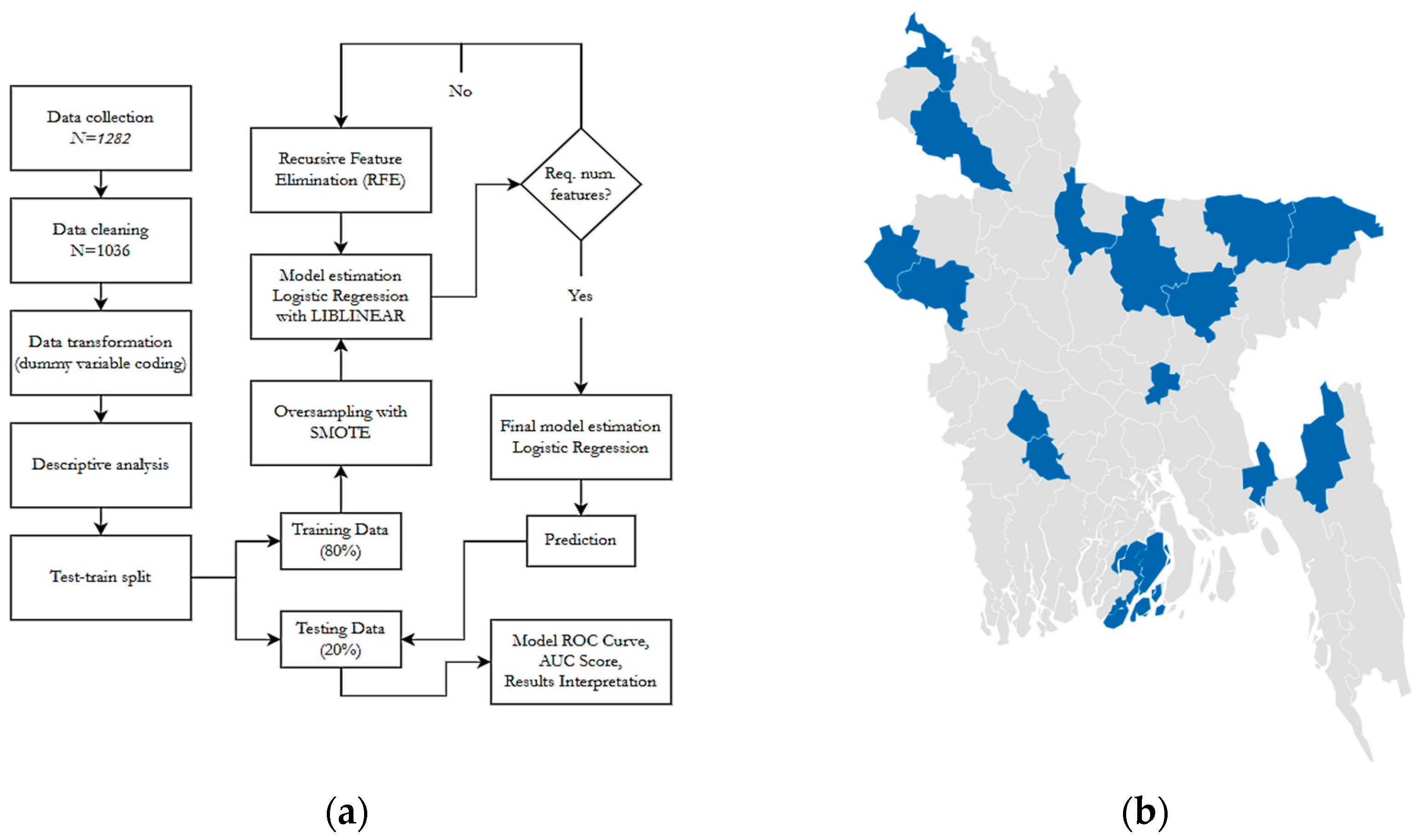

3. Materials and Methods

3.1. Dataset

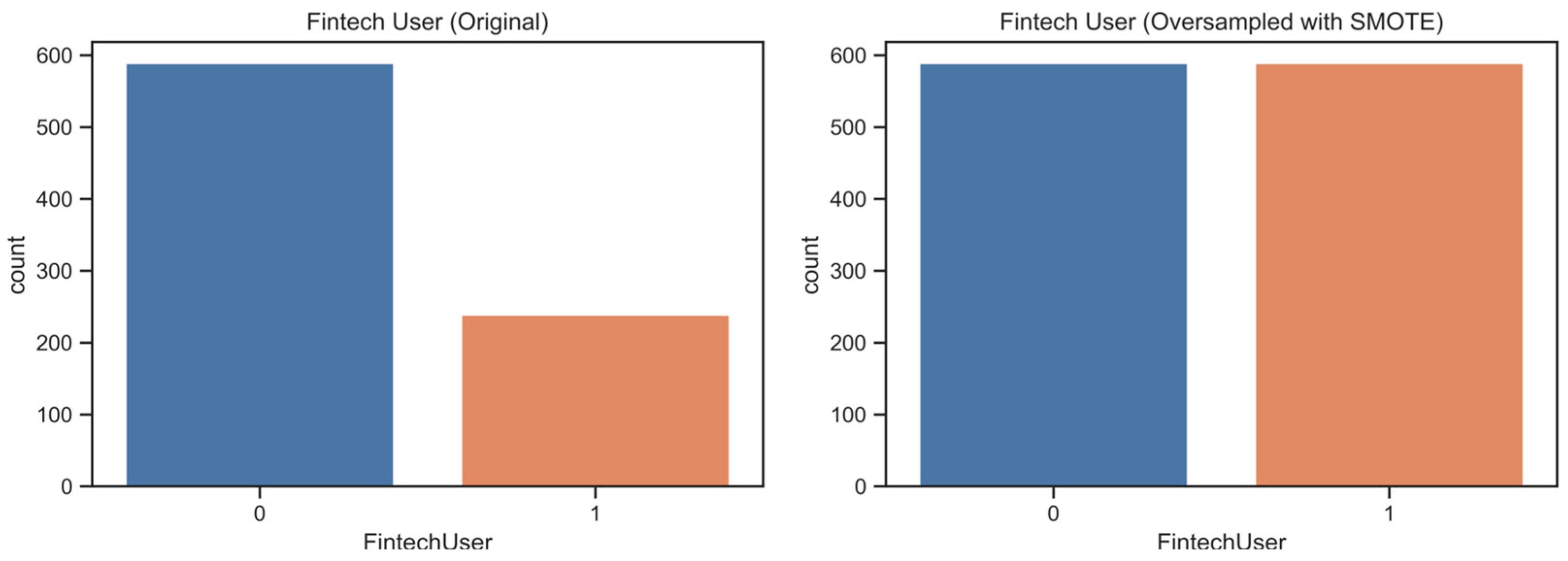

3.2. Dataset Train-Test Splitting and Oversampling

3.3. Recursive Feature Elimination (RFE)

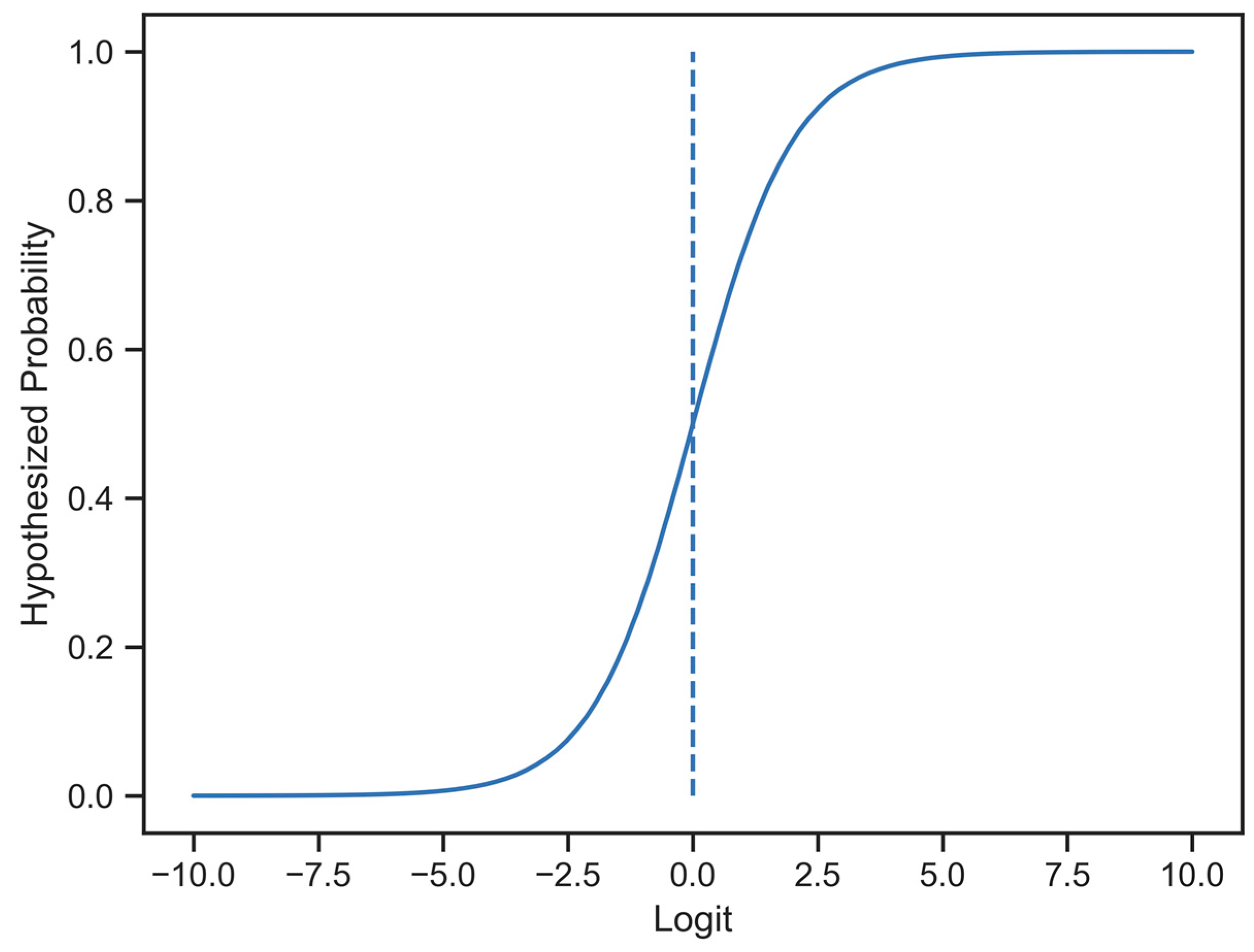

3.4. Logistic Regression

3.5. Model Estimation with LIBLINEAR

4. Results and Discussion

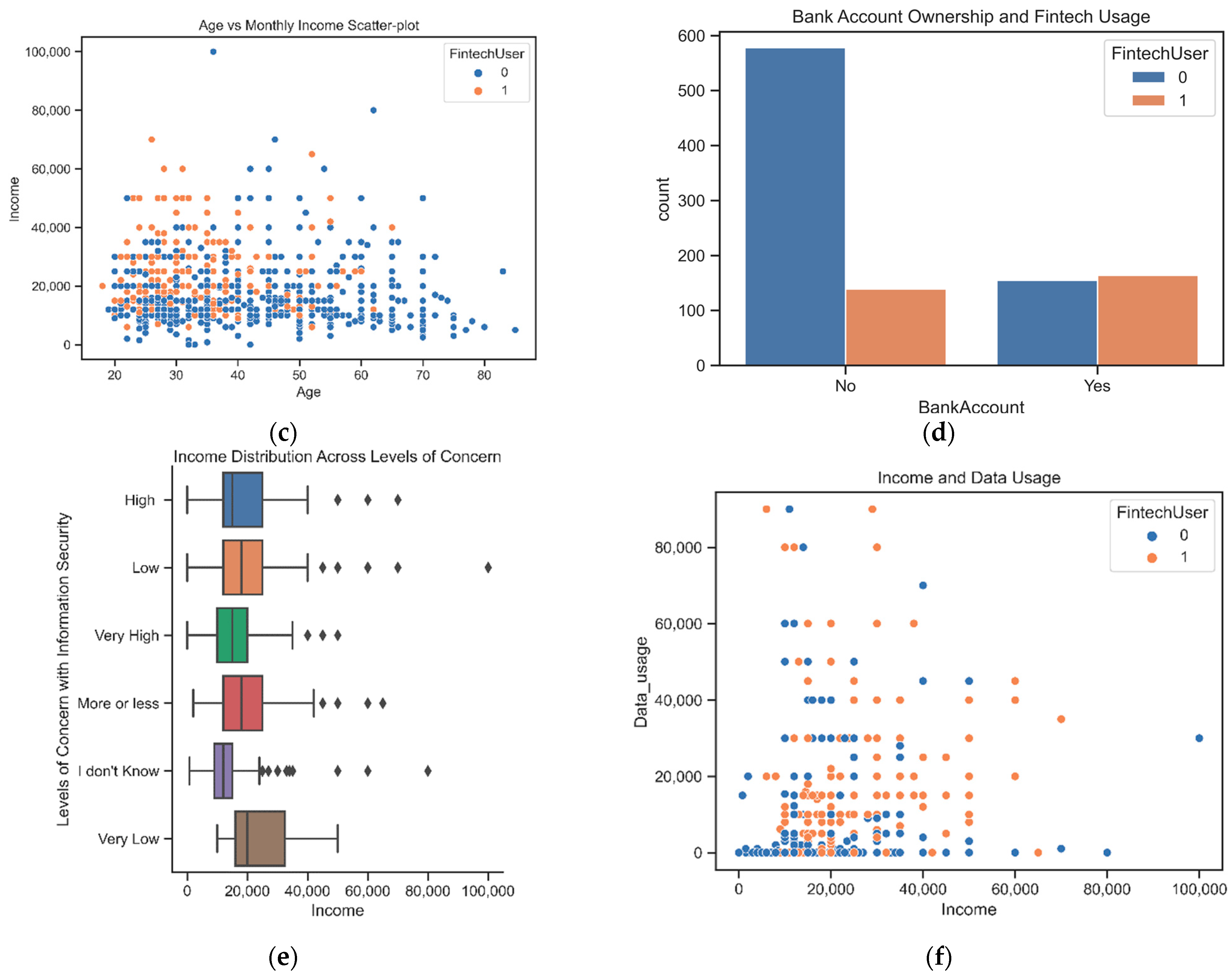

4.1. Description of Sample and Fintech Use

4.1.1. Demographic Variables

4.1.2. Economic Variables

4.1.3. Bank Account Ownership

4.1.4. Internet Usage

4.1.5. Concerns Related to Fintech Usage

4.1.6. Mental Preparedness for Fintech Usage

4.1.7. Obstacles, Affordability, and Costliness

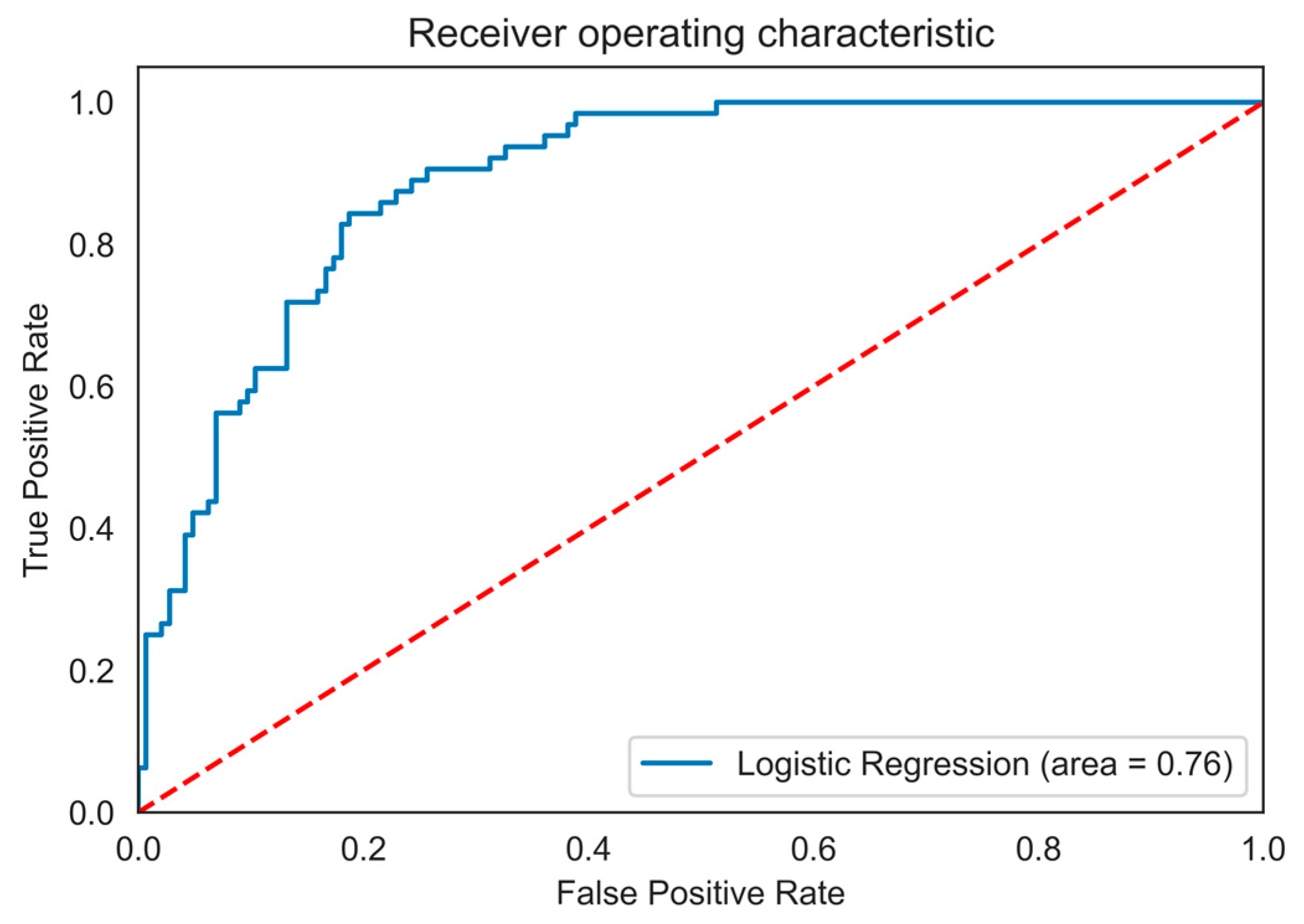

4.2. Logistic Regression Results

4.3. Discussion

4.3.1. Theoretical Contribution

4.3.2. Practical Implication

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Division | District | Total | (1) | (2) | (3) | (4) | (5) | Weighted Average Score |

|---|---|---|---|---|---|---|---|---|

| Barisal | Barguna | 6 | 0 | 0 | 1 | 5 | 0 | 3.83 |

| Barisal | 10 | 0 | 0 | 4 | 5 | 1 | 3.70 | |

| Bhola | 7 | 0 | 5 | 0 | 2 | 0 | 2.57 | |

| Jhalokati | 4 | 0 | 1 | 2 | 0 | 1 | 3.25 | |

| Patuakhali | 8 | 0 | 0 | 2 | 4 | 2 | 4.00 | |

| Pirojpur | 7 | 0 | 0 | 4 | 2 | 1 | 3.57 | |

| Chittagong | Bandarban | 7 | 0 | 0 | 0 | 1 | 6 | 4.86 |

| Brahmanbaria | 9 | 7 | 2 | 0 | 0 | 0 | 1.22 | |

| Chandpur | 8 | 0 | 0 | 3 | 3 | 2 | 3.88 | |

| Chittagong | 30 | 8 | 11 | 8 | 3 | 0 | 2.20 | |

| Comilla | 17 | 0 | 6 | 11 | 0 | 0 | 2.65 | |

| Cox’s Bazar | 8 | 0 | 4 | 2 | 1 | 1 | 2.88 | |

| Feni | 6 | 5 | 1 | 0 | 0 | 0 | 1.17 | |

| Khagrachhari | 9 | 0 | 0 | 0 | 1 | 8 | 4.89 | |

| Lakshmipur | 5 | 0 | 0 | 2 | 1 | 2 | 4.00 | |

| Noakhali | 9 | 2 | 2 | 2 | 1 | 2 | 2.89 | |

| Rangamati | 10 | 0 | 0 | 1 | 1 | 8 | 4.70 | |

| Dhaka | Dhaka | 55 | 45 | 8 | 1 | 1 | 0 | 1.24 |

| Faridpur | 9 | 6 | 3 | 0 | 0 | 0 | 1.33 | |

| Gazipur | 13 | 7 | 6 | 0 | 0 | 0 | 1.46 | |

| Gopalganj | 5 | 0 | 0 | 3 | 2 | 0 | 3.40 | |

| Kishoreganj | 13 | 0 | 0 | 0 | 1 | 12 | 4.92 | |

| Madaripur | 4 | 4 | 0 | 0 | 0 | 0 | 1.00 | |

| Manikganj | 7 | 0 | 2 | 4 | 1 | 0 | 2.86 | |

| Munshiganj | 6 | 6 | 0 | 0 | 0 | 0 | 1.00 | |

| Narayanganj | 5 | 5 | 0 | 0 | 0 | 0 | 1.00 | |

| Narsingdi | 6 | 4 | 2 | 0 | 0 | 0 | 1.33 | |

| Rajbari | 5 | 0 | 0 | 2 | 3 | 0 | 3.60 | |

| Shariatpur | 6 | 0 | 4 | 2 | 0 | 0 | 2.33 | |

| Tangail | 12 | 0 | 3 | 7 | 2 | 0 | 2.92 | |

| Khulna | Bagerhat | 9 | 0 | 2 | 6 | 1 | 0 | 2.89 |

| Chuadanga | 4 | 0 | 0 | 3 | 1 | 0 | 3.25 | |

| Jessore | 8 | 0 | 0 | 4 | 4 | 0 | 3.50 | |

| Jhenaidah | 6 | 0 | 0 | 1 | 4 | 1 | 4.00 | |

| Khulna | 15 | 0 | 1 | 1 | 13 | 0 | 3.80 | |

| Kushtia | 6 | 1 | 3 | 2 | 0 | 0 | 2.17 | |

| Magura | 4 | 0 | 0 | 0 | 0 | 4 | 5.00 | |

| Meherpur | 3 | 0 | 0 | 2 | 0 | 1 | 3.67 | |

| Narail | 3 | 1 | 2 | 0 | 0 | 0 | 1.67 | |

| Satkhira | 7 | 1 | 6 | 0 | 0 | 0 | 1.86 | |

| Mymensingh | Jamalpur | 7 | 0 | 0 | 0 | 0 | 7 | 5.00 |

| Mymensingh | 13 | 0 | 1 | 5 | 6 | 1 | 3.54 | |

| Netrokona | 10 | 0 | 0 | 0 | 7 | 3 | 4.30 | |

| Sherpur | 5 | 0 | 0 | 0 | 3 | 2 | 4.40 | |

| Rajshahi | Bogra | 12 | 1 | 2 | 5 | 4 | 0 | 3.00 |

| Joypurhat | 5 | 0 | 2 | 3 | 0 | 0 | 2.60 | |

| Naogaon | 11 | 0 | 0 | 1 | 7 | 3 | 4.18 | |

| Natore | 7 | 0 | 3 | 2 | 2 | 0 | 2.86 | |

| Chapai Nawabganj | 5 | 0 | 0 | 0 | 1 | 4 | 4.80 | |

| Pabna | 9 | 0 | 0 | 6 | 1 | 2 | 3.56 | |

| Rajshahi | 15 | 3 | 10 | 1 | 1 | 0 | 2.00 | |

| Sirajganj | 9 | 0 | 0 | 3 | 6 | 0 | 3.67 | |

| Rangpur | Dinajpur | 13 | 0 | 0 | 0 | 0 | 13 | 5.00 |

| Gaibandha | 7 | 0 | 0 | 0 | 0 | 7 | 5.00 | |

| Kurigram | 9 | 0 | 0 | 0 | 0 | 9 | 5.00 | |

| Lalmonirhat | 5 | 0 | 0 | 0 | 3 | 2 | 4.40 | |

| Nilphamari | 6 | 0 | 0 | 0 | 0 | 6 | 5.00 | |

| Panchagarh | 5 | 1 | 1 | 2 | 1 | 0 | 2.60 | |

| Rangpur | 8 | 0 | 0 | 0 | 4 | 4 | 4.50 | |

| Thakurgaon | 5 | 0 | 0 | 0 | 5 | 0 | 4.00 | |

| Sylhet | Habiganj | 9 | 1 | 6 | 2 | 0 | 0 | 2.11 |

| Moulvibazar | 7 | 3 | 2 | 2 | 0 | 0 | 1.86 | |

| Sunamganj | 11 | 0 | 6 | 3 | 1 | 1 | 2.73 | |

| Sylhet | 13 | 4 | 9 | 0 | 0 | 0 | 1.69 |

Appendix B

| Variable | Levels |

|---|---|

| Gender | Male, Female |

| Age | - |

| Education | Primary, Secondary, None, Higher secondary, Graduate, Post-graduate, Madrasa_(kawmi) |

| Marriage | Married, Single |

| Occupation | Business, Day Laborer, Homemaker, Non-government Job, Retired, Student, Unemployed, Driver (Rickshaw/Van/Engine Vehicle), Farmer/Fisherman/Boatman, Government Job, Government Allowance, Non-resident. Others |

| Household | - |

| Expenses | - |

| ExpRent | - |

| ExpFood | - |

| ExpUtilities | - |

| ExpEducation | - |

| ExpHealthcare | - |

| ExpEntertainment | - |

| ExpClothing | - |

| ExpHouseHelp | - |

| ExpMisc | - |

| Income | - |

| AnnualSaving | - |

| House | Traditional House, Cemented House |

| BankAccount | No, Yes |

| BankVisit | - |

| BankAwareness | Very low knowledge (only deposited and withdrawal), Some knowledge (deposited scheme and loan scheme), No knowledge at all, Above average knowledge (LC, stock market, financial report, ratios etc.), Expert (certified financial analyst) |

| Computer | No, Yes |

| Mobile | No, Yes |

| SmartphoneSkill | Not skilled at all, Very low skills, Some skills, Skilled, Very skilled |

| Internet | No, Yes |

| Data_usage | - |

| Concern_Information_Secrecy | I don’t Know, Very Low, Low, More or less, High, Very High |

| Concern_Unknown_Issues | I don’t Know, Very Low, Low, More or less, High, Very High |

| Concern_Limited_GovControl | I don’t Know, Very Low, Low, More or less, High, Very High |

| Concern_Financial_Scandal | I don’t Know, Very Low, Low, More or less, High, Very High |

| Concern_Cashless_Community | I don’t Know, Very Low, Low, More or less, High, Very High |

| Concern_Information_Security | I don’t Know, Very Low, Low, More or less, High, Very High |

| MentalPreparedness | Low prepared, Not prepared at all, Average preparedness, Prepared, Adequately prepared |

| Fintech_satisfaction | I don’t use fintech, Satisfied, Neutral, Dissatisfied, Highly dissatisfied, Highly satisfied |

| Max_fee_per_1000 | - |

| Obstacle_economic_condition | Very low, Low, Neutral, High, Very high |

| Obstacle_geographic_location | Very low, Low, Neutral, High, Very high |

| Obstacle_confidence_in_technolog | ery low, Low, Neutral, High, Very high |

| Obstacle_service_intuitiveness | Very low, Low, Neutral, High, Very high |

| Fintech_service_affordability | Very low, Low, Neutral, High, Very high |

| Fintech_costliness | I don’t know, Not affordable at all, Not affordable, Neutral, Affordable, Highly affordable |

Appendix C

| Feature | Coef. | Std. Err. | z-Value | p-Value | [95% Conf. | Interval] | Sig. |

|---|---|---|---|---|---|---|---|

| Gender_Male | 0.242 | 0.612 | 0.395 | 0.693 | −0.958 | 1.442 | |

| Education_Madrasa_(kawmi) | 1.535 | 0.93 | 1.65 | 0.099 | −0.288 | 3.358 | |

| Marriage_Married | −0.73 | 0.373 | −1.957 | 0.05 | −1.461 | 0.001 | |

| Occupation_Government Allowance | −21.912 | 31200 | −0.001 | 0.999 | −61,100 | 61,100 | |

| Occupation_Homemaker | −1.065 | 0.693 | −1.536 | 0.124 | −2.424 | 0.294 | |

| Occupation_Non-government Job | 0.669 | 0.388 | 1.723 | 0.085 | −0.092 | 1.431 | |

| Occupation_Others | −1.076 | 0.863 | −1.246 | 0.213 | −2.768 | 0.617 | |

| Occupation_Retired | −0.877 | 0.865 | −1.015 | 0.31 | −2.572 | 0.817 | |

| Occupation_Student | 0.527 | 0.571 | 0.924 | 0.356 | −0.591 | 1.646 | |

| Occupation_Unemployed | −1.208 | 0.581 | −2.081 | 0.037 | −2.346 | −0.07 | *** |

| House_Traditional House | −0.69 | 0.262 | −2.63 | 0.009 | −1.203 | −0.176 | *** |

| BankAccount_No | −0.372 | 0.266 | −1.399 | 0.162 | −0.892 | 0.149 | |

| BankAwareness_Above average knowledge (LC, stock market, financial report, ratios etc. | 2.103 | 1.601 | 1.313 | 0.189 | −1.035 | 5.242 | |

| BankAwareness_Expert (certified finanical analyst) | −42.155 | 832,000,000 | 0 | 1 | −1,630,000,000 | 1,630,000,000 | |

| BankAwareness_Some knowlede (deposite scheme and loan scheme) | −0.628 | 0.328 | −1.914 | 0.056 | −1.272 | 0.015 | |

| Mobile_No | −15.358 | 36,300 | 0 | 1 | −71,200 | 71,200 | |

| Mobile_Yes | 9.052 | 1.271 | 7.122 | 0 | 6.561 | 11.543 | *** |

| Internet_No | −0.944 | 0.262 | −3.599 | 0 | −1.458 | −0.43 | *** |

| Concern_Information_Secrecy_High | −1.621 | 0.474 | −3.422 | 0.001 | −2.549 | −0.692 | *** |

| Concern_Information_Secrecy_Low | −1.23 | 0.511 | −2.408 | 0.016 | −2.23 | −0.229 | *** |

| Concern_Information_Secrecy_More or less | −0.748 | 0.467 | −1.602 | 0.109 | −1.663 | 0.167 | |

| Concern_Unknown_Issues_I don’t Know | −0.834 | 0.853 | −0.978 | 0.328 | −2.506 | 0.837 | |

| Concern_Unknown_Issues_Very High | −0.749 | 0.562 | −1.333 | 0.183 | −1.851 | 0.353 | |

| Concern_Unknown_Issues_Very Low | −1.143 | 0.809 | −1.413 | 0.158 | −2.728 | 0.443 | |

| Concern_Limited_GovControl_High | −1.961 | 0.809 | −2.424 | 0.015 | −3.546 | −0.375 | *** |

| Concern_Limited_GovControl_I don’t Know | −1.358 | 1.084 | −1.253 | 0.21 | −3.483 | 0.766 | |

| Concern_Limited_GovControl_Low | −1.61 | 0.824 | −1.953 | 0.051 | −3.225 | 0.006 | |

| Concern_Limited_GovControl_More or less | −1.811 | 0.813 | −2.227 | 0.026 | −3.404 | −0.217 | *** |

| Concern_Limited_GovControl_Very High | −2.365 | 0.894 | −2.645 | 0.008 | −4.116 | −0.613 | *** |

| Concern_Financial_Scandal_I don’t Know | −2.853 | 0.636 | −4.489 | 0 | −4.099 | −1.607 | *** |

| Concern_Financial_Scandal_More or less | −1.338 | 0.343 | −3.897 | 0 | −2.011 | −0.665 | *** |

| Concern_Financial_Scandal_Very Low | −2.718 | 1.346 | −2.019 | 0.044 | −5.357 | −0.079 | *** |

| Concern_Cashless_Community_High | −0.545 | 0.312 | −1.747 | 0.081 | −1.157 | 0.066 | |

| Concern_Cashless_Community_Very High | −1.064 | 0.492 | −2.161 | 0.031 | −2.029 | −0.099 | *** |

| Concern_Information_Security_High | −2.326 | 0.831 | −2.798 | 0.005 | −3.955 | −0.696 | *** |

| Concern_Information_Security_I don’t Know | −2.177 | 1.034 | −2.106 | 0.035 | −4.203 | −0.151 | *** |

| Concern_Information_Security_Low | −2.437 | 0.837 | −2.91 | 0.004 | −4.078 | −0.795 | *** |

| Concern_Information_Security_More or less | −2.362 | 0.844 | −2.797 | 0.005 | −4.017 | −0.707 | *** |

| Concern_Information_Security_Very High | −1.832 | 0.89 | −2.059 | 0.04 | −3.576 | −0.088 | *** |

| MentalPreparedness_Average preparedness | −0.931 | 0.291 | −3.199 | 0.001 | −1.501 | −0.36 | *** |

| MentalPreparedness_Not prepared at all | −1.181 | 0.595 | −1.986 | 0.047 | −2.347 | −0.015 | *** |

| MentalPreparedness_Prepared | −1.653 | 0.377 | −4.387 | 0 | −2.392 | −0.915 | *** |

| Fintech_satisfaction_Highly satisfied | −1.309 | 0.763 | −1.715 | 0.086 | −2.805 | 0.187 | |

| Fintech_satisfaction_I don’t use fintech | −2.487 | 0.487 | −5.107 | 0 | −3.441 | −1.533 | *** |

| Fintech_satisfaction_Neutral | 0.47 | 0.291 | 1.616 | 0.106 | −0.1 | 1.039 | |

| Obstacle_geographic_location_High | −1.425 | 0.546 | −2.609 | 0.009 | −2.496 | −0.355 | *** |

| Obstacle_geographic_location_Very high | −0.799 | 1.182 | −0.676 | 0.499 | −3.117 | 1.518 | |

| Obstacle_geographic_location_Very low | 1.045 | 0.421 | 2.484 | 0.013 | 0.22 | 1.87 | *** |

| Obstacle_confidence_in_technolog_Neutral | −0.704 | 0.254 | −2.771 | 0.006 | −1.202 | −0.206 | *** |

| Obstacle_service_intuitiveness_High | −1.322 | 0.542 | −2.44 | 0.015 | −2.384 | −0.26 | *** |

| Obstacle_service_intuitiveness_Low | −0.893 | 0.486 | −1.838 | 0.066 | −1.846 | 0.059 | |

| Obstacle_service_intuitiveness_Neutral | −0.888 | 0.485 | −1.832 | 0.067 | −1.838 | 0.062 | |

| Fintech_service_affordability_Highly affordable | 1.383 | 1.229 | 1.125 | 0.26 | −1.026 | 3.792 | |

| Fintech_service_affordability_I don’t know | −0.816 | 0.748 | −1.091 | 0.275 | −2.282 | 0.65 | |

| Fintech_service_affordability_Not affordable | −0.6 | 0.311 | −1.93 | 0.054 | −1.21 | 0.009 |

| 1 | South Asian Association for Regional Cooperation. |

| 2 | Association of Southeast Asian Nations. |

| 3 | Upazila is an administrative smaller than districts. |

References

- Ahmad, Ahmad Hassan, Christopher Green, and Fei Jiang. 2020. Mobile Money, Financial Inclusion and Development: A Review with Reference to African Experience. Journal of Economic Surveys 34: 753–92. [Google Scholar] [CrossRef]

- Ahmed, Ali Saeed, Mukesh Kumar, and Mahmood Asad Moh’d Ali. 2020. Adoption of FinTech and Future Perspective: An Empirical Evidence from Bahrain on Digital Wallets. Paper presented at 2020 International Conference on Decision Aid Sciences and Application (DASA), Sakheer, Bahrain, November 8–9; pp. 751–55. [Google Scholar] [CrossRef]

- Alexander, Alex J., Lin Shi, and Bensam Solomon. 2017. How Fintech Is Reaching the Poor in Africa and Asia: A Start-Up Perspective. Washington, DC: World Bank. [Google Scholar] [CrossRef]

- Ali, Muhammad, Syed Ali Raza, Bilal Khamis, Chin Hong Puah, and Hanudin Amin. 2021. How Perceived Risk, Benefit and Trust Determine User Fintech Adoption: A New Dimension for Islamic Finance. Foresight 23: 403–20. [Google Scholar] [CrossRef]

- Alkhazaleh, Ayman Mansour Khalaf, and Hossam Haddad. 2021. How Does the Fintech Services Delivery Affect Customer Satisfaction: A Scenario of Jordanian Banking Sector. Strategic Change 30: 405–13. [Google Scholar] [CrossRef]

- Al-Okaily, Manaf, Abdul Rahman Al Natour, Farah Shishan, Ahmed Al-Dmour, Rasha Alghazzawi, and Malek Alsharairi. 2021. Sustainable FinTech Innovation Orientation: A Moderated Model. Sustainability 13: 13591. [Google Scholar] [CrossRef]

- Alwi, Shaliza. 2021. Fintech As Financial Inclusion: Factors Affecting Behavioral Intention To Accept Mobile E-Wallet During COVID-19 Outbreak. Turkish Journal of Computer and Mathematics Education (TURCOMAT) 12: 2130–41. [Google Scholar] [CrossRef]

- Alwi, Shaliza, Rabiatul Munirah Alpandi, Masrina Nadia Mohd Salleh, Irfah Najihah Basir, and Farrah Fawzia Md Ariff. 2019. An Empirical Study on the Customers’ Satisfaction on Fintech Mobile Payment Services in Malaysia. International Journal of Advanced Science and Technology 28: 390–400. [Google Scholar]

- Amirruddin, Amiratul Diyana, Farrah Melissa Muharam, Mohd Hasmadi Ismail, Ngai Paing Tan, and Mohd Firdaus Ismail. 2022. Synthetic Minority Over-Sampling TEchnique (SMOTE) and Logistic Model Tree (LMT)-Adaptive Boosting Algorithms for Classifying Imbalanced Datasets of Nutrient and Chlorophyll Sufficiency Levels of Oil Palm (Elaeis Guineensis) Using Spectroradiometers and Unmanned Aerial Vehicles. Computers and Electronics in Agriculture 193: 106646. [Google Scholar] [CrossRef]

- Amofah, Dennis Owusu, and Junwu Chai. 2022. Sustaining Consumer E-Commerce Adoption in Sub-Saharan Africa: Do Trust and Payment Method Matter? Sustainability 14: 8466. [Google Scholar] [CrossRef]

- Arner, Douglas W., Ross P. Buckley, Dirk A. Zetzsche, and Robin Veidt. 2020. Sustainability, FinTech and Financial Inclusion. European Business Organization Law Review 21: 7–35. [Google Scholar] [CrossRef]

- Azad, Md Abul Kalam. 2016. Predicting Mobile Banking Adoption in Bangladesh: A Neural Network Approach. Transnational Corporations Review 8: 207–14. [Google Scholar] [CrossRef]

- Baker, Tom, and Benedict Dellaert. 2017. Regulating Robo Advice across the Financial Services Industry. Iowa Law Review 103: 713. [Google Scholar] [CrossRef]

- Bangladesh Bureau of Statistics. 2016. Poverty Maps of Bangladesh: Key Findings. Government Statistics Report; Dhaka: Statistics and Infromatics Division, Ministry of Planning.

- Barbu, Catalin, Dorian Florea, Dan-Cristian Dabija, and Mihai Barbu. 2021. Customer Experience in Fintech. Journal of Theoretical and Applied Electronic Commerce Research 16: 1415–33. [Google Scholar] [CrossRef]

- Basak, Hritam, Rohit Kundu, Sukanta Chakraborty, and Nibaran Das. 2021. Cervical Cytology Classification Using PCA and GWO Enhanced Deep Features Selection. SN Computer Science 2: 369. [Google Scholar] [CrossRef]

- Beck, Thorsten. 2020. Fintech and Financial Inclusion: Opportunities and Pitfalls. Working Paper 1165. ADBI Working Paper Series. Available online: https://www.econstor.eu/handle/10419/238522 (accessed on 13 December 2022).

- Bedo, Justin, Conrad Sanderson, and Adam Kowalczyk. 2006. An Efficient Alternative to SVM Based Recursive Feature Elimination with Applications in Natural Language Processing and Bioinformatics. In AI 2006: Advances in Artificial Intelligence. Edited by Abdul Sattar and Byeong-ho Kang. Lecture Notes in Computer Science. Berlin and Heidelberg: Springer, pp. 170–80. [Google Scholar] [CrossRef]

- Brynjolfsson, Erik, and Andrew McAfee. 2016. The Second Machine Age: Work, Progress, and Prosperity in a Time of Brilliant Technologies. First published as a Norton paperback. New York and London: W. W. Norton & Company. [Google Scholar]

- Bursac, Zoran, C. Heath Gauss, David Keith Williams, and David W. Hosmer. 2008. Purposeful Selection of Variables in Logistic Regression. Source Code for Biology and Medicine 3: 17. [Google Scholar] [CrossRef] [PubMed]

- Carlin, Bruce, Arna Olafsson, and Michaela Pagel. 2017. FinTech Adoption Across Generations: Financial Fitness in the Information Age. Working Paper No. 23798. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Cham, Tat-Huei, Suet Cheng Low, Lim Seong, Aye Khin, and Raymond Ling. 2018. Preliminary Study on Consumer Attitude towards FinTech Products and Services in Malaysia. International Journal of Engineering & Technology 7: 166–69. [Google Scholar] [CrossRef]

- Chawla, Nitesh V., Kevin W. Bowyer, Lawrence O. Hall, and W. Philip Kegelmeyer. 2002. SMOTE: Synthetic Minority Over-Sampling Technique. Journal of Artificial Intelligence Research 16: 321–57. [Google Scholar] [CrossRef]

- Chen, Sharon, Sebastian Doerr, Jon Frost, Leonardo Gambacorta, and Hyun Song Shin. 2021. The Fintech Gender Gap (SSRN Scholarly Paper No. 3886740). Available online: https://papers.ssrn.com/abstract=3886740 (accessed on 20 November 2022).

- Chowdhury, Nazmul Hasan, and Nida Hussain. 2022. Using Technology Acceptance Model for Acceptance of FinTech in Bangladesh. International Journal of Internet Technology and Secured Transactions 12: 250–64. [Google Scholar] [CrossRef]

- Clements, Ryan. 2020. Financial Inclusion in British Columbia: Evaluating the Role of Fintech (SSRN Scholarly Paper No. 3775933). Available online: https://papers.ssrn.com/abstract=3775933 (accessed on 14 November 2022).

- Coffie, Cephas Paa Kwasi, Hongjiang Zhao, and Isaac Adjei Mensah. 2020. Panel Econometric Analysis on Mobile Payment Transactions and Traditional Banks Effort toward Financial Accessibility in Sub-Sahara Africa. Sustainability 12: 895. [Google Scholar] [CrossRef]

- Coffie, Cephas Paa Kwasi, Zhao Hongjiang, Isaac Adjei Mensah, Rebecca Kiconco, and Abraham Emuron Otim Simon. 2021. Determinants of FinTech Payment Services Diffusion by SMEs in Sub-Saharan Africa: Evidence from Ghana. Information Technology for Development 27: 539–60. [Google Scholar] [CrossRef]

- Cook, N. R. 2007. Use and Misuse of the Receiver Operating Characteristic Curve in Risk Prediction. Circulation 115: 928–35. [Google Scholar] [CrossRef]

- Daragmeh, Ahmad, Csaba Lentner, and Judit Sági. 2021. FinTech Payments in the Era of COVID-19: Factors Influencing Behavioral Intentions of “Generation X” in Hungary to Use Mobile Payment. Journal of Behavioral and Experimental Finance 32: 100574. [Google Scholar] [CrossRef] [PubMed]

- Das, Shaily. 2021. Financial Inclusion Disclosure: Empirical Evidence from the Banking Industry of Bangladesh. Global Journal of Business, Economics and Management: Current Issues 11: 27–41. [Google Scholar] [CrossRef]

- Deng, Xiang, Zhi Huang, and Xiang Cheng. 2019. FinTech and Sustainable Development: Evidence from China Based on P2P Data. Sustainability 11: 6434. [Google Scholar] [CrossRef]

- Di Maggio, Marco, Dimuthu Ratnadiwakara, and Don Carmichael. 2022. Invisible Primes: Fintech Lending with Alternative Data. Working Paper No. 29840. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Dishaw, Mark T, and Diane M Strong. 1999. Extending the Technology Acceptance Model with Task–Technology Fit Constructs. Information & Management 36: 9–21. [Google Scholar] [CrossRef]

- Dorfleitner, Gregor, Lars Hornuf, Matthias Schmitt, and Martina Weber. 2017. Definition of FinTech and Description of the FinTech Industry. In FinTech in Germany. Edited by Gregor Dorfleitner, Lars Hornuf, Matthias Schmitt and Martina Weber. Cham: Springer International Publishing, pp. 5–10. [Google Scholar] [CrossRef]

- Dougherty, Christopher. 2011. Introduction to Econometrics, 4th ed. Oxford and New York: Oxford University Press. [Google Scholar]

- Ernst & Young. 2019a. Global Fintech Adoption Index. Available online: https://www.ey.com/en_gl/ey-global-fintech-adoption-index (accessed on 13 December 2022).

- Ernst & Young. 2019b. Unleashing the Potential of FinTech in Banking. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/banking-and-capital-markets/ey-unleashing-the-potential-of-fin-tech-in-banking.pdf (accessed on 17 October 2022).

- Fan, Rong-En, Kai-Wei Chang, Cho-Jui Hsieh, Xiang-Rui Wang, and Chih-Jen Lin. 2008. LIBLINEAR: A Library for Large Linear Classification. The Journal of Machine Learning Research 9: 1871–74. [Google Scholar]

- Gabor, Daniela, and Sally Brooks. 2017. The Digital Revolution in Financial Inclusion: International Development in the Fintech Era. New Political Economy 22: 423–36. [Google Scholar] [CrossRef]

- Gerlach, Johannes M., and Julia K. T. Lutz. 2021. Digital Financial Advice Solutions—Evidence on Factors Affecting the Future Usage Intention and the Moderating Effect of Experience. Journal of Economics and Business 117: 106009. [Google Scholar] [CrossRef]

- Gomber, Peter, Jascha-Alexander Koch, and Michael Siering. 2017. Digital Finance and FinTech: Current Research and Future Research Directions. Journal of Business Economics 87: 537–80. [Google Scholar] [CrossRef]

- Hansen, Torben. 2014. The Role of Trust in Financial Customer–Seller Relationships before and after the Financial Crisis. Journal of Consumer Behaviour 13: 442–52. [Google Scholar] [CrossRef]

- Hasan, Morshadul, Thuhid Noor, Jiechao Gao, Muhammad Usman, and Mohammad Zoynul Abedin. 2022. Rural Consumers’ Financial Literacy and Access to FinTech Services. Journal of the Knowledge Economy 31: 1–25. [Google Scholar] [CrossRef]

- Hassan, M. S., M. A. Islam, F. A. Sobhani, H. Nasir, I. Mahmud, and F. T. Zahra. 2022. Drivers Influencing the Adoption Intention towards Mobile Fintech Services: A Study on the Emerging Bangladesh Market. Information 13: 7. [Google Scholar] [CrossRef]

- Hossain, Md Nahin, and Md. Yahin Hossain. 2015. Mobile Banking and Customer Satisfaction: The Case of Dhaka City. World Review of Business Research 5: 108–20. [Google Scholar]

- Huang, Y., L. Zhang, Z. Li, H. Qiu, T. Sun, and X. Wang. 2020. Fintech Credit Risk Assessment for SMEs: Evidence from China (SSRN Scholarly Paper No. 3721218). Available online: https://papers.ssrn.com/abstract=3721218 (accessed on 17 November 2022).

- Huong, Alice, Chin-Hong Puah, and Mei-Teing Chong. 2021. Embrace Fintech in ASEAN: A Perception Through Fintech Adoption Index. Research in World Economy 12: 1–10. [Google Scholar] [CrossRef]

- Hurley, Mikella, and Julius Adebayo. 2016. Credit Scoring in the Era of Big Data. Yale Journal of Law and Technology 18: 148. [Google Scholar]

- Hwang, Sin-Hae, and Jeoung Kun Kim. 2018. An Analysis of Factors Affecting Fintech Payment Service Acceptance Using Logistic Regression. Journal of the Korea Society for Simulation 27: 51–60. [Google Scholar] [CrossRef]

- Ijaz, Muhammad Fazal, Ganjar Alfian, Muhammad Syafrudin, and Jongtae Rhee. 2018. Hybrid Prediction Model for Type 2 Diabetes and Hypertension Using DBSCAN-Based Outlier Detection, Synthetic Minority over Sampling Technique (SMOTE), and Random Forest. Applied Sciences 8: 1325. [Google Scholar] [CrossRef]

- Imam, Tasadduq, Angelique McInnes, Sisira Colombage, and Robert Grose. 2022. Opportunities and Barriers for FinTech in SAARC and ASEAN Countries. Journal of Risk and Financial Management 15: 77. [Google Scholar] [CrossRef]

- Islam, K. M. Anwarul, and Umme Salma. 2016. Mobile Banking Operations and Banking Facilities to Rural People in Bangladesh. International Journal of Finance and Banking Research 2: 147–62. [Google Scholar] [CrossRef]

- Islam, Md Shamimul, Noorliza Karia, Mohamed Soliman Mohamed Soliman, Mahmudul Hasan Fouji, Jamshed Khalid, and Muhammad Khaleel. 2017. Adoption of Mobile Banking in Bangladesh: A Conceptual Framework. Review of Social Sciences 2: 1. [Google Scholar] [CrossRef]

- Jagtiani, Julapa, and Catharine Lemieux. 2019. The Roles of Alternative Data and Machine Learning in Fintech Lending: Evidence from the LendingClub Consumer Platform. Financial Management 48: 1009–29. [Google Scholar] [CrossRef]

- Jibril, A. B., M. A. Kwarteng, M. Chovancová, and J. Bode. 2020. Do socio-economic factors impede the engagement in online banking transactions? Evidence from Ghana. Banks and Bank Systems 15: 1–14. [Google Scholar] [CrossRef]

- Jin, Chua Chang, Lim Chee Seong, and Aye Aye Khin. 2019. Factors Affecting the Consumer Acceptance towards Fintech Products and Services in Malaysia. International Journal of Asian Social Science 9: 59–65. [Google Scholar] [CrossRef]

- Jones, C. M., and T. Athanasiou. 2005. Summary Receiver Operating Characteristic Curve Analysis Techniques in the Evaluation of Diagnostic Tests. The Annals of Thoracic Surgery 79: 16–20. [Google Scholar] [CrossRef] [PubMed]

- Jünger, Moritz, and Mark Mietzner. 2020. Banking Goes Digital: The Adoption of FinTech Services by German Households. Finance Research Letters 34: 101260. [Google Scholar] [CrossRef]

- Kakinuma, Yosuke. 2022. Financial Literacy and Quality of Life: A Moderated Mediation Approach of Fintech Adoption and Leisure. International Journal of Social Economics 49: 1713–26. [Google Scholar] [CrossRef]

- Khan, Abdul Gaffar, Reshma Pervin Lima, and Md Shahed Mahmud. 2021. Understanding the Service Quality and Customer Satisfaction of Mobile Banking in Bangladesh: Using a Structural Equation Model. Global Business Review 22: 85–100. [Google Scholar] [CrossRef]

- Khatun, Nasima, and Marzia Tamanna. 2020. Factors Affecting the Adoption of Fintech: A Study Based on The Financial Institutions in Bangladesh. Copernican Journal of Finance & Accounting 9: 51–75. [Google Scholar] [CrossRef]

- Kim, Minjin, Hanah Zoo, Heejin Lee, and Juhee Kang. 2018. Mobile Financial Services, Financial Inclusion, and Development: A Systematic Review of Academic Literature. The Electronic Journal of Information Systems in Developing Countries 84: e12044. [Google Scholar] [CrossRef]

- Kim, Yonghee Jack, Young-Ju Park, Jeongil Choi, and Jiyoung Yeon. 2015. An Empirical Study on the Adoption of “Fintech” Service: Focused on Mobile Payment Services. Advanced Science and Technology Letters 114: 136–40. [Google Scholar] [CrossRef]

- Königstorfer, Florian, and Stefan Thalmann. 2020. Applications of Artificial Intelligence in Commercial Banks—A Research Agenda for Behavioral Finance. Journal of Behavioral and Experimental Finance 27: 100352. [Google Scholar] [CrossRef]

- Kuhn, Max, and Kjell Johnson. 2013. Applied Predictive Modeling. Cham: Springer Science & Business Media. [Google Scholar]

- Kumar, V., Nim Nandini, and Agarwal Amit. 2021. Platform-Based Mobile Payments Adoption in Emerging and Developed Countries: Role of Country-Level Heterogeneity and Network Effects. Journal of International Business Studies 52: 1529–58. [Google Scholar] [CrossRef]

- Laidroo, Laivi, and Mari Avarmaa. 2020. The Role of Location in FinTech Formation. Entrepreneurship & Regional Development 32: 555–72. [Google Scholar] [CrossRef]

- Lee, Jean N., Jonathan Morduch, Saravana Ravindran, Abu Shonchoy, and Hassan Zaman. 2021. Poverty and Migration in the Digital Age: Experimental Evidence on Mobile Banking in Bangladesh. American Economic Journal: Applied Economics 13: 38–71. [Google Scholar] [CrossRef]

- Li, Fan, and Yiming Yang. 2005. Analysis of Recursive Feature Elimination Methods. Paper presented at 28th Annual International ACM SIGIR Conference on Research and Development in Information Retrieval, Salvador, Brazil, August 15–19; pp. 633–34. [Google Scholar] [CrossRef]

- Loko, Boileau, and Yuanchen Yang. 2022. Fintech, Female Employment, and Gender Inequality (SSRN Scholarly Paper No. 4137201). Available online: https://papers.ssrn.com/abstract=4137201 (accessed on 14 November 2022).

- Loo, Mark Kam Loon. 2019. Enhancing Financial Inclusion in ASEAN: Identifying the Best Growth Markets for Fintech. Journal of Risk and Financial Management 12: 181. [Google Scholar] [CrossRef]

- Mandrekar, Jayawant N. 2010. Receiver Operating Characteristic Curve in Diagnostic Test Assessment. Journal of Thoracic Oncology 5: 1315–16. [Google Scholar] [CrossRef]

- Mensah, I. K., and D. S. Mwakapesa. 2022. The Drivers of the Behavioral Adoption Intention of BITCOIN Payment from the Perspective of Chinese Citizens. Security and Communication Networks. [Google Scholar] [CrossRef]

- Morisi, Teresa L. 1996. Commercial Banking Transformed by Computer Technology. Monthly Labor Review 119: 30. [Google Scholar]

- Mu, Hong-Lei, and Young-Chan Lee. 2017. An Application of Fuzzy AHP and TOPSIS Methodology for Ranking the Factors Influencing FinTech Adoption Intention: A Comparative Study of China and Korea. Journal of Service Research and Studies 7: 51–68. [Google Scholar] [CrossRef]

- Mukherjee, Partha, and Youakim Badr. 2022. Detection of Defaulters in P2P Lending Platforms Using Unsupervised Learning. Paper presented at 2022 IEEE International Conference on Omni-Layer Intelligent Systems (COINS), Barcelona, Spain, August 1–3; pp. 1–5. [Google Scholar] [CrossRef]

- Musyaffi, A. M., S. Mulyani, I. Suraida, and C. Sukmadilaga. 2021. Lack of Readiness of Digital Banking Channel Acceptance: Study on TAM 3 and Technology Readiness. Academy of Strategic Management Journal 20: 1–18. [Google Scholar]

- Nathan, Robert Jeyakumar, Budi Setiawan, and Mac Nhu Quynh. 2022. Fintech and Financial Health in Vietnam during the COVID-19 Pandemic: In-Depth Descriptive Analysis. Journal of Risk and Financial Management 15: 125. [Google Scholar] [CrossRef]

- Nawayseh, Mohammad. 2020. FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice of FinTech Applications? Journal of Open Innovation Technology Market and Complexity 6: 153. [Google Scholar] [CrossRef]

- Nguyen, Dat Dinh, Thanh Duc Nguyen, Trung Duc Nguyen, and Ha Viet Nguyen. 2021. Impacts of Perceived Security and Knowledge on Continuous Intention to Use Mobile Fintech Payment Services: An Empirical Study in Vietnam. The Journal of Asian Finance, Economics and Business 8: 287–96. [Google Scholar] [CrossRef]

- Okoli, Tochukwu Timothy, and Devi Datt Tewari. 2020. An Empirical Assessment of Fintechs Heterogeneous Transmission Channels to Financial Development among African Economies. Cogent Economics & Finance 8: 1829273. [Google Scholar] [CrossRef]

- Pears, Russel, Jacqui Finlay, and Andy M. Connor. 2014. Synthetic Minority Over-Sampling TEchnique(SMOTE) for Predicting Software Build Outcomes. arXiv arXiv:1407.2330. [Google Scholar] [CrossRef]

- Pedrosa, Jose, and Quy-Toan Do. 2011. Geographic Distance and Credit Market Access in Niger. African Development Review 23: 289–99. [Google Scholar] [CrossRef]

- Philippon, Thomas. 2019. On Fintech and Financial Inclusion. No. w26330. Cambridge: National Bureau of Economic Research. [Google Scholar] [CrossRef]

- Poerjoto, J. I., A. Gui, and K. Deniswara. 2021. Identifying Factors Affecting the Continuance Usage Intention of Digital Payment Services among Millennials in Jakarta. Paper presented at 2021 25th International Conference on Information Technology (IT), Zabljak, Montenegro, February 16–20; pp. 1–4. [Google Scholar] [CrossRef]

- Rabbani, Mustafa Raza, Shahnawaz Khan, and Eleftherios I. Thalassinos. 2020. FinTech, Blockchain and Islamic Finance: An Extensive Literature Review. Available online: https://www.um.edu.mt/library/oar/handle/123456789/54860 (accessed on 20 November 2022).

- Ratecka, Patrycja. 2020. FinTech—Definition, Taxonomy and Historical Approach. Zeszyty Naukowe Małopolskiej Wyższej Szkoły Ekonomicznej w Tarnowie 1: 53–67. [Google Scholar] [CrossRef]

- Ryu, Hyun-Sun. 2018. Understanding Benefit and Risk Framework of Fintech Adoption: Comparison of Early Adopters and Late Adopters. Available online: http://hdl.handle.net/10125/50374 (accessed on 21 November 2022).

- Ryu, Hyun-Sun, and Kwang Sun Ko. 2020. Sustainable Development of Fintech: Focused on Uncertainty and Perceived Quality Issues. Sustainability 12: 7669. [Google Scholar] [CrossRef]

- Salampasis, Dimitrios, and Anne-Laure Mention. 2018. Chapter 18—FinTech: Harnessing Innovation for Financial Inclusion. In Handbook of Blockchain, Digital Finance, and Inclusion, Volume 2. Edited by David Lee, Kuo Chuen and Robert Deng. Cambridge: Academic Press, pp. 451–61. [Google Scholar] [CrossRef]

- Salman, Ali, and Azrilah Abd Aziz. 2015. Evaluating User Readiness towards Digital Society: A Rasch Measurement Model Analysis. Procedia Computer Science 65: 1154–59. [Google Scholar] [CrossRef][Green Version]

- Sangwan, Vikas, Harshita, Puneet Prakash, and Shveta Singh. 2019. Financial Technology: A Review of Extant Literature. Studies in Economics and Finance 37: 71–88. [Google Scholar] [CrossRef]

- Setiawan, Budi, Deni Pandu Nugraha, Atika Irawan, Robert Jeyakumar Nathan, and Zeman Zoltan. 2021. User Innovativeness and Fintech Adoption in Indonesia. Journal of Open Innovation: Technology, Market, and Complexity 7: 188. [Google Scholar] [CrossRef]

- Shareef, Mahmud Akhter, Abdullah Baabdullah, Shantanu Dutta, Vinod Kumar, and Yogesh K. Dwivedi. 2018. Consumer Adoption of Mobile Banking Services: An Empirical Examination of Factors According to Adoption Stages. Journal of Retailing and Consumer Services 43: 54–67. [Google Scholar] [CrossRef]

- Sharma, Alok Kumar, Li-Hua Li, and Ramli Ahmad. 2021. Identifying and Predicting Default Borrowers in P2P Lending Platform: A Machine Learning Approach. Paper presented at 2021 IEEE International Conference on Social Sciences and Intelligent Management (SSIM), Taichung, Taiwan, August 29–31; pp. 1–5. [Google Scholar] [CrossRef]

- Shiau, Wen-Lung, Ye Yuan, Xiaodie Pu, Soumya Ray, and Charlie C. Chen. 2020. Understanding Fintech Continuance: Perspectives from Self-Efficacy and ECT-IS Theories. Industrial Management & Data Systems 120: 1659–89. [Google Scholar] [CrossRef]

- Shim, Soyeon, Joyce Serido, and Chuanyi Tang. 2013. After the Global Financial Crash: Individual Factors Differentiating Young Adult Consumers’ Trust in Banks and Financial Institutions. Journal of Retailing and Consumer Services 20: 26–33. [Google Scholar] [CrossRef]

- Siddik, Md. 2014. Financial Inclusion through Mobile Banking: A Case of Bangladesh. Journal of Applied Finance and Banking 4: 109–36. [Google Scholar]

- Solarz, Małgorzata, and Magdalena Swacha-Lech. 2021. Determinants of The Adoption of Innovative Fintech Services by Millennials. E+M Ekonomie a Management 24: 149–66. [Google Scholar] [CrossRef]

- Soriano, Miguel Angel. 2017. Factors Driving Financial Inclusion and Financial Performance in Fintech New Ventures: An Empirical Study. Dissertations and Theses Collection (Open Access). Ph.D. dissertation, Singapore Management University, Singapore; pp. 1–258. Available online: https://ink.library.smu.edu.sg/etd_coll/145 (accessed on 17 November 2022).

- Stewart, Harrison, and Jan Jürjens. 2018. Data Security and Consumer Trust in FinTech Innovation in Germany. Information & Computer Security 26: 109–28. [Google Scholar] [CrossRef]

- Suryono, Ryan Randy, Indra Budi, and Betty Purwandari. 2020. Challenges and Trends of Financial Technology (Fintech): A Systematic Literature Review. Information 11: 590. [Google Scholar] [CrossRef]

- Wang, Zhenning, Zhengzhi (Gordon) Guan, Fangfang Hou, Boying Li, and Wangyue Zhou. 2019. What Determines Customers’ Continuance Intention of FinTech? Evidence from YuEbao. Industrial Management & Data Systems 119: 1625–37. [Google Scholar] [CrossRef]

- World Bank Group and International Monetary Fund. 2019. Fintech: The Experience So Far. Washington, DC: The World Bank, IMF. Available online: https://documents1.worldbank.org/curated/en/130201561082549144/pdf/Fintech-The-Experience-so-Far-Executive-Summary.pdf (accessed on 10 November 2022).

- Xie, Jianli, Liying Ye, Wei Huang, and Min Ye. 2021. Understanding FinTech Platform Adoption: Impacts of Perceived Value and Perceived Risk. Journal of Theoretical and Applied Electronic Commerce Research 16: 1893–1911. [Google Scholar] [CrossRef]

- Yuan, Guo-Xun, Chia-Hua Ho, and Chih-Jen Lin. 2012. Recent Advances of Large-Scale Linear Classification This Paper Is a Survey on Development of Optimization Methods to Construct Linear Classifiers Suitable for Large-Scale Applications; for Some Data, Accuracy Is Close to That of Nonlinear Classifiers. Undefined. Available online: https://www.semanticscholar.org/paper/Recent-Advances-of-Large-Scale-Linear-This-paper-is-Yuan-Ho/473d77c683199d2ee64c3576e1a70853e2bbe8bb (accessed on 27 October 2022).

- Zarrouk, Hajer, Teheni El Ghak, and Abderazak Bakhouche. 2021. Exploring Economic and Technological Determinants of FinTech Startups’ Success and Growth in the United Arab Emirates. Journal of Open Innovation: Technology, Market, and Complexity 7: 50. [Google Scholar] [CrossRef]

| Variable Class | Variable Name | Labels |

|---|---|---|

| Dependent | Fintech adoption | 1 if frequency of monthly fintech of use during the preceding month is ≥2; 0 otherwise |

| Independent/Predictor | See Appendix B for full list | - |

| Variable | Obs | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|---|

| Age | 1036 | 39.758 | 13.018 | 18 | 85 |

| Household | 1036 | 5.02 | 1.768 | 1 | 12 |

| Expenses | 1036 | 15,511.486 | 8003.895 | 2000 | 70,000 |

| ExpRent | 1036 | 430.106 | 1609.094 | 0 | 16,000 |

| ExpFood | 1036 | 8740.287 | 5840.052 | 0 | 85,000 |

| ExpUtilities | 1036 | 962.074 | 992.533 | 0 | 7000 |

| ExpEducation | 1036 | 1682.082 | 2397.988 | 0 | 30,000 |

| ExpHealthcare | 1036 | 1118.972 | 1649.737 | 0 | 20,000 |

| ExpEntertainment | 1036 | 217.693 | 347.913 | 0 | 1500 |

| ExpClothing | 1036 | 958.605 | 875.719 | 0 | 7000 |

| ExpHouseHelp | 1036 | 83.966 | 521.206 | 0 | 8000 |

| ExpMisc | 1036 | 1260.523 | 1523.562 | 0 | 10,000 |

| Income | 1036 | 18,372.201 | 10,952.253 | 0 | 100,000 |

| AnnualSaving | 1036 | 11,334.555 | 32,170.068 | 0 | 450,000 |

| BankVisit | 1036 | 0.433 | 0.918 | 0 | 5 |

| Data usage | 1036 | 5553.042 | 13,071.003 | 0 | 90,000 |

| Max fee per 1000 | 1036 | 8.145 | 3.862 | 0 | 20 |

| Mental Preparedness | Fintech User | ||

|---|---|---|---|

| 0 | 1 | Total | |

| Not prepared at all | 26.06 | 2.64 | 19.21 |

| Low prepared | 31.65 | 31.35 | 31.56 |

| Average preparedness | 30.29 | 44.88 | 34.56 |

| Prepared | 10.64 | 16.83 | 12.45 |

| Adequately prepared | 1.36 | 4.29 | 2.22 |

| Total | 100.00 | 100.00 | 100.00 |

| Affordability Perception | Fintech User | ||

|---|---|---|---|

| 0 | 1 | Total | |

| I don’t know | 23.19 | 0.99 | 16.70 |

| Not affordable at all | 0.95 | 0.66 | 0.87 |

| Not affordable | 26.88 | 14.52 | 23.26 |

| Neutral | 34.11 | 65.02 | 43.15 |

| Affordable | 14.46 | 17.16 | 15.25 |

| Highly affordable | 0.41 | 1.65 | 0.77 |

| Total | 100.00 | 100.00 | 100.00 |

| Outcome | Precision | Recall | f1-Score | Support |

|---|---|---|---|---|

| 0 | 0.85 | 0.87 | 0.86 | 144 |

| 1 | 0.69 | 0.66 | 0.67 | 64 |

| Accuracy | 0.80 | 208 | ||

| Macro Avg. | 0.77 | 0.76 | 0.77 | 208 |

| Weighted Avg. | 0.80 | 0.80 | 0.80 | 208 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mahmud, K.; Joarder, M.M.A.; Muheymin-Us-Sakib, K. Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample. Int. J. Financial Stud. 2023, 11, 9. https://doi.org/10.3390/ijfs11010009

Mahmud K, Joarder MMA, Muheymin-Us-Sakib K. Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample. International Journal of Financial Studies. 2023; 11(1):9. https://doi.org/10.3390/ijfs11010009

Chicago/Turabian StyleMahmud, Khaled, Md. Mahbubul Alam Joarder, and Kazi Muheymin-Us-Sakib. 2023. "Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample" International Journal of Financial Studies 11, no. 1: 9. https://doi.org/10.3390/ijfs11010009

APA StyleMahmud, K., Joarder, M. M. A., & Muheymin-Us-Sakib, K. (2023). Adoption Factors of FinTech: Evidence from an Emerging Economy Country-Wide Representative Sample. International Journal of Financial Studies, 11(1), 9. https://doi.org/10.3390/ijfs11010009