Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries

Abstract

1. Introduction

2. Literature Review

2.1. Review of Empirical Literature

2.1.1. Technological Innovation and Inequality

2.1.2. Financial Development and Inequality

3. Methodology

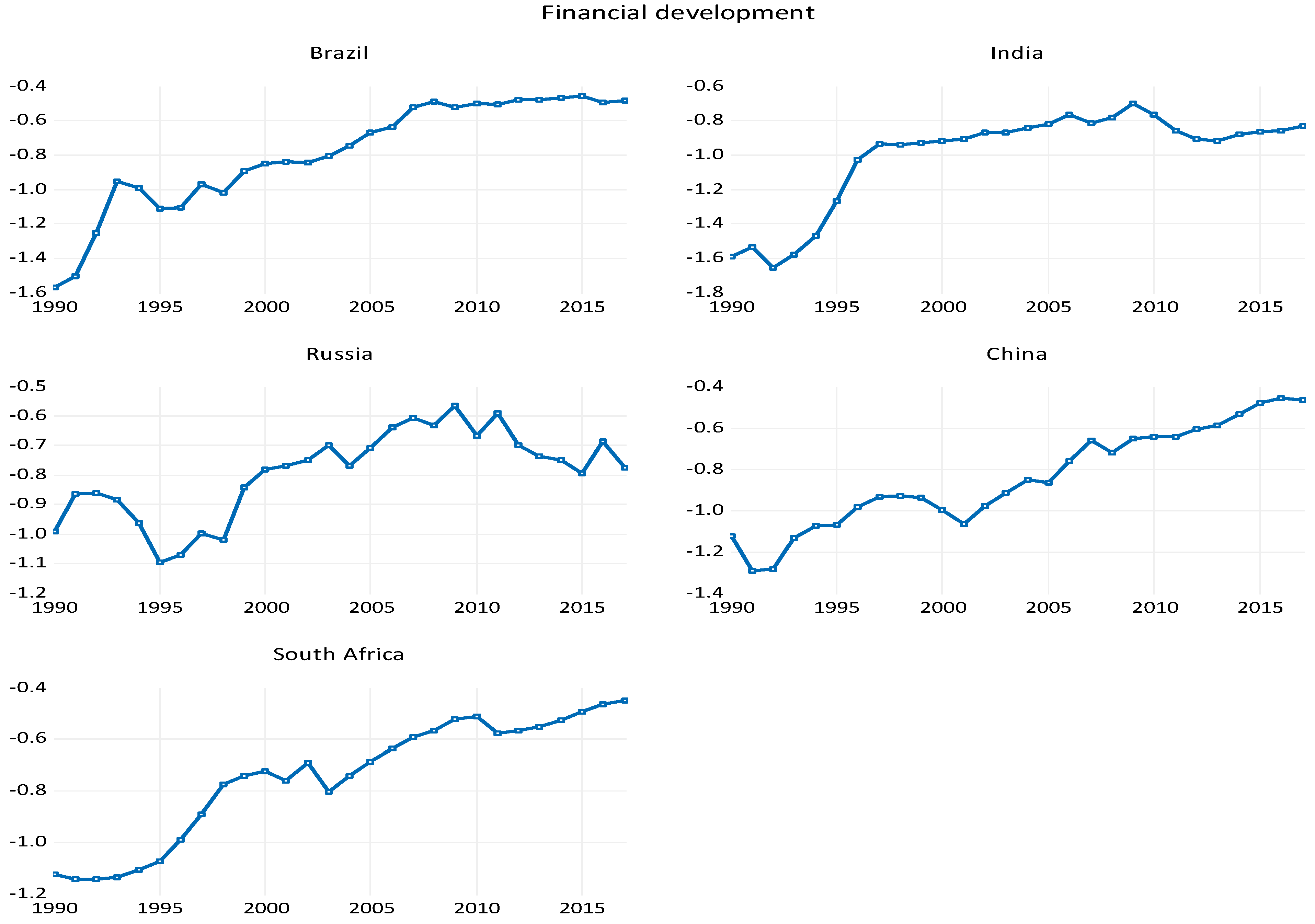

Data and Model Specification

4. Empirical Analysis

5. Results of Cross-Sectional Dependence and Panel Unit Root Tests

Empirical Results: FMOLS and DOLS Estimates

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Adebayo, Tomiwa Sunday. 2023. Exploring the heterogeneous impact of technological innovation on income inequality: Formulating the SDG policies for the BRICS-T economies. Energy & Environment. [Google Scholar] [CrossRef]

- Aghion, Philippe, Ufuk Akcigit, Antonin Bergeaud, Richard Blundel, and David Hemous. 2019. Innovation and Top Income Inequality. Review of Economic Studies 86: 1–45. [Google Scholar] [CrossRef]

- Altunbaş, Yener, and John Thornton. 2019. The impact of financial development on income inequality: A quantile regression approach. Economics Letters 175: 51–56. [Google Scholar] [CrossRef]

- Anginer, Deniz, Asli Demirgüç-Kunt, and David Mare. 2018. Bank Capital, Institutional Environment and Systemic Stability. Journal of Financial Stability 37: 97–106. [Google Scholar] [CrossRef]

- Ayres, Clarence. 1953. The Role of Technology in Economic Theory. The American Economic Review 43: 279–87. [Google Scholar]

- Biyase, Mduduzi, and Carolyn Chisadza. 2023. Symmetric and asymmetric effects of financial deepening on income ine-quality in South Africa. Development Southern Africa 1–18. [Google Scholar] [CrossRef]

- Blanchard, Emily, and Gerald Willmann. 2011. Trade, Education and the Shrinking Middle Class. CESifo Working Paper Series No. 4141. Available online: https://ssrn.com/abstract=2228634 (accessed on 28 February 2023).

- Bogliacino, Francesco. 2014. Essay: A critical review of the technology-inequality debate. Suma De Negocios 5: 124–35. [Google Scholar] [CrossRef]

- Brei, Michael, Giovanni Ferri, and Leonardo Gambacorta. 2018. Financial Structure and Income Inequality. BIS Working Papers 756. Basel: Bank for International Settlements. Available online: https://www.bis.org/publ/work756.pdf (accessed on 3 March 2023).

- Caselli, Francesco. 1999. Technological Revolutions. American Economic Review 89: 78–102. [Google Scholar] [CrossRef]

- Cetin, Murat, Harun Demir, and Selin Saygin. 2021. Financial Development, Technological Innovation and Income Inequality: Time Series Evidence from Turkey. Social Indicators Research: An International and Interdisciplinary Journal for Quality-of-Life Measurement 156: 47–69. [Google Scholar] [CrossRef]

- Chege, Samwel, and Daoping Wang. 2019. Information technology innovation and its impact on job creation by SMEs in developing countries: An analysis of the literature review. Technology Analysis & Strategic Management 32: 256–71. [Google Scholar] [CrossRef]

- Chisadza, Carolyn, and Biyase Mduduzi. 2022. Financial Development and Income Inequality: Evidence from Advanced, Emerging and Developing Economies. Working Paper Series 2022-21. Pretoria: University of Pretoria Department of Economics. 27p. [Google Scholar]

- Chiu, Yi-Bin, and Chien-Chiang Lee. 2019. Financial development, income inequality, and country risk. Journal of International Money and Finance 93: 1–18. [Google Scholar] [CrossRef]

- Čihák, Martin, and Ratna Sahay. 2020. Finance and Inequality. IMF Staff Discussion Notes 2020/001. Washington, DC: International Monetary Fund. [Google Scholar]

- Costanza, Naguib. 2017. The Relationship between Inequality and Growth: Evidence from New Data. Swiss Journal of Economics and Statistics 153: 183–225. [Google Scholar] [CrossRef]

- Dachs, Bernhard. 2018. The Impact of New Technologies on the Labour Market and the Social Economy. Available online: https://www.europarl.europa.eu/RegData/etudes/STUD/2018/614539/EPRS_STU(2018)614539_EN.pdf (accessed on 22 February 2023).

- Demirgüç-Kunt, Asli, and Ross Levine. 2009. Finance and Inequality: Theory and Evidence. World Bank Policy Research Working Paper No. 4967. Available online: https://ssrn.com/abstract=1427627 (accessed on 1 September 2022).

- Destek, Mehmet Akif, Avik Sinha, and Samuel Asumadu Sarkodie. 2020. The relationship between financial development and income inequality in Turkey. Journal of Economic Structures 9: 1–14. [Google Scholar] [CrossRef]

- Erkişi, Kemal. 2018. Financial Development and Economic Growth in BRICS Countries and Turkey: A Panel Data Analysis. Istanbul Gelisim University Journal of Social Sciences 5: 1–17. [Google Scholar]

- Faisal, Faisal, Azizullah, Turgut Tursoy, and Pervaiz Ruqiya. 2020. Does ICT lessen CO2 emissions for fast-emerging economies? An application of the heterogeneous panel estimations. Environmental Science and Pollution Research 27: 10778–89. [Google Scholar] [CrossRef] [PubMed]

- Farooqi, Hira, and Kai Wegerich. 2014. Institutionalizing inequities in land ownership and water allocations during colonial times in Punjab, Pakistan. Water Hist 7: 131–46. [Google Scholar] [CrossRef]

- Fayomi, Ojo S.I., Ojo J. Adelakun, and Kunle O. Bbaremu. 2019. The Impact of Technological Innovation on Production. In Journal of Physics: Conference Series. Bristol: IOP Publishing, vol. 1378, p. 022014. [Google Scholar] [CrossRef]

- Fernandes, Cristina, Pedro Mota Veiga, Joao Ferreira, and Mathew Hughes. 2021. Green growth versus economic growth: Do sustainable technology transfer and innovations lead to an imperfect choice? Business Strategy and the Environment 30: 2021–37. [Google Scholar] [CrossRef]

- Fourie, Frederick, and Philli Burger. 2012. How to Think and Reason in Macroeconomics, 3rd ed.Pretoria: Juta. [Google Scholar]

- Giri, Arun Kumar, Rajan Pandey, and Geetilaxmi Mohapatra. 2021. Does technological progress, trade or financial globalization stimulate income inequality in India? Journal of Asia Finance, Economics and Business 8: 111–22. [Google Scholar]

- Goldin, Claudia, and Lawrence Katz. 1998. The Origins of Technology-Skill Complementarity. Quarterly Journal of Economics 113: 693–732. [Google Scholar] [CrossRef]

- Greenhalgh, Christine, and Mark Rogers. 2010. Innovation, Intellectual Property and Economic Growth. Princeton: Princeton University Press. [Google Scholar]

- Greenwood, Jeremy, Zvi Hercowtiz, and Per Krusell. 1997. Long-Run Implications of Investment-Specific Technological Change. American Economic Review 87: 342–62. [Google Scholar]

- Hasan, Iftekhar, Roman Horvath, and Jan Mares. 2020. Finance and wealth inequality. Journal of International Money and Finance 108: 102161. [Google Scholar] [CrossRef]

- Hicks, John. 1969. A Theory of Economic History. Oxford: Clarendon Press. [Google Scholar]

- Jerome, Harry. 1934. Changes in Mechanization in Selected Manufacturing Industries. Available online: http://www.nber.org/chapters/c5242.pdf (accessed on 3 March 2023).

- Jung, Samuel, and Hyungju Cha. 2021. Financial development and income inequality: Evidence from China. Journal of the Asia Pacific Economy 26: 73–95. [Google Scholar] [CrossRef]

- Kapingura, Forget Mingiri. 2017. Financial sector development and income inequality in South Africa. African Journal of Economic and Management Studies 8: 420–32. [Google Scholar] [CrossRef]

- Khan, Danish, and Recep Ulucak. 2020. How do environmental technologies affect green growth? Evidence from BRICS economies. Science of The Total Environment 712: 136504. [Google Scholar] [CrossRef]

- Kharlamova, Ganna, Andriy Stavytskyy, and Grigoris Zarotiadis. 2018. The impact of technological changes on income inequality: The EU states case study. Journal of International Studies 11: 76–94. [Google Scholar] [CrossRef]

- King, Robert, and Ross Levine. 1993. Finance and growth: Schumpeter might be right. The Quarterly Journal of Economics 108: 717–37. [Google Scholar] [CrossRef]

- Knell, Mark. 2016. Technological revolutions and inequality in economic thought. Paper Prepared at 20th Annual ESHET (European Society for the History of Economic Thought) Conference, University Paris 1 Panthéon-Sorbonne, Paris, France, May 26–28. [Google Scholar]

- Kooli, Chokri, Mohammed Shanikat, and Raed Kanakriyah. 2022. Towards a new model of productive Islamic financial mechanisms. International Journal of Business Performance Management 23: 17–33. [Google Scholar] [CrossRef]

- Krueger, Alan B. 1993. How Computers Have Changed the Wage Structure: Evidence from Microdata, 1984–1989. Quarterly Journal of Economics 110: 33–60. [Google Scholar] [CrossRef]

- Lacasa, Iciar D., Björn Jindra, Slavo Radosevic, and Mahmood Shubbak. 2019. Paths of technology upgrading in the BRICS economies. Research Policy 48: 262–80. [Google Scholar] [CrossRef]

- Levine, Linda. 2012. The US Income Distribution and Mobility: Trends and International Comparisons. CRS Report R42400. Washington, DC: Congressional Research Service. Available online: https://fas.org/sgp/crs/misc/R42400.pdf (accessed on 18 October 2022).

- Levine, Ross. 2021. Finance, Growth, and Inequality. IMF Working Paper 21/164. Available online: https://www.imf.org/-/media/Files/Publications/WP/2021/English/wpiea2021164-print-pdf.ashx (accessed on 22 February 2023).

- Maddison, Angus. 2001. The World Economy: A Millennial Perspective. Paris: Organization for Economic Cooperation and Development (Development Centre Studies). [Google Scholar] [CrossRef]

- Manhaes Marins, Luciana. 2008. The Challenge of Measuring Innovation in Emerging Economies’ Firms: A Proposal of a New Set of Indicators on Innovation. Working Paper No. 2008-044. Maastricht: United Nations University—Maastricht Economic and Social Research Institute on Innovation and Technology (MERIT). 28p. [Google Scholar]

- Mbona, Nokulunga. 2022. Impacts of Overall Financial Development, Access and Depth on Income Inequality. Economies 10: 118. [Google Scholar] [CrossRef]

- Mirza, Usman, Andries Richter, Egbert van Nes, and Marten Scheffer. 2019. Technology driven inequality leads to poverty and resource depletion. Ecological Economics 160: 215–26. [Google Scholar] [CrossRef]

- Mncube, Zinhle, and Teresia Kaulihowa. 2022. Financial Innovation and Income Inequality in Upper-Middle Income Countries. African Journal of Development Studies (AJDS) 12: 83–103. [Google Scholar] [CrossRef]

- Mnif, Sirine. 2016. Bilateral relationship between technological changes and income inequality in developing countries. Atlantic Review of Economics 1: 1–16. [Google Scholar]

- Nelson, Richard, and Edmund Phelps. 1966. Investment in Humans, Technological Diffusion and Economic Growth. American Economic Association Papers Proceedings 56: 69–75. [Google Scholar]

- Nemati, Morteza, and Raisi Ghasem. 2015. Economic growth and income inequality in developing countries. International Journal of Life Sciences 9: 79–82. [Google Scholar] [CrossRef]

- Ngo, Thanh, Hai Hong Trinh, Ilham Haoyas, and Subhan Ullah. 2022. Examining the bidirectional nexus between financial development and green growth: International evidence through the roles of human capital and education expenditure. Resources Policy 79: 102964. [Google Scholar] [CrossRef]

- Nguyen, Cong, Ngoc Vu, Hong Vo, and Thi-Thieu Ha. 2019. Financial Development and Income Inequality in Emerging Markets: A New Approach. Journal of Risk and Financial Management 12: 173. [Google Scholar] [CrossRef]

- Pedroni, Peter. 1999. Critical Values for Cointegration Tests in Heterogeneous Panels with Multiple Regressors. Oxford Bulletin of Economics and Statistics 61: 653–70. [Google Scholar] [CrossRef]

- Pesaran, M. Hashem. 2004. General Diagnostic Tests for Cross Section Dependence in Panels. Cambridge: Faculty of Economics, University of Cambridge. 42p. [Google Scholar]

- Qureshi, Zia. 2019. Inequality in the Digital Era. In Work in the Age of Data. Madrid: BBVA. Available online: https://www.brookings.edu/wp-content/uploads/2020/02/BBVA-OpenMind-Zia-Qureshi-Inequality-in-the-digital-era.pdf (accessed on 22 February 2023).

- Rastogi, Charu, and Sanjaykumar Gaikwad. 2017. A study on determinants of human capital development in BRICS nations. FIIB Business Review 6: 38–50. [Google Scholar] [CrossRef]

- Romer, Paul. 1986. Increasing Returns and Long-Run Growth. The Journal of Political Economy 94: 1002–37. [Google Scholar] [CrossRef]

- Sala-I-Martin, Xavier. 1997. I Just Ran Two Million Regressions. American Economic Review 87: 178–83. [Google Scholar]

- Sampson, Thomas. 2014. Selection into Trade and Wage Inequality. American Economic Journal: Microeconomics 6: 157–202. [Google Scholar] [CrossRef]

- Schultz, Theodore. 1975. The Value of the Ability to Deal with Disequalibria. Journal of Economic Literature 13: 827–46. [Google Scholar]

- Schumpeter, Joseph. 1912. Theory of Economic Development. London: Routledge. 254p. [Google Scholar]

- Shah, Tushaar. 2010. Taming the Anarchy: Groundwater Governance in South Asia, 1st ed. New York: Routledge. [Google Scholar] [CrossRef]

- Sharma, Rajesh, and Suman Dahiya. 2020. Linkage between Financial Development and Income Inequality in India. Research Square, pre-print. [Google Scholar] [CrossRef]

- Shinhye, Chang, Rangan Gupta, and Stephen M. Miller. 2015. Causality between per capita real GDP and income inequality in the U.S.: Evidence from a Wavelet Analysis. Social Indicators Research: An International and Interdisciplinary Journal for Quality-of-Life Measurement 135: 269–89. [Google Scholar] [CrossRef]

- Sobolieva, Tetiana O., Nataliia Holionko, Liudmyla Batenko, and Tetiana I. Reshetniak. 2021. Global technology trends through patent data analysis. In IOP Conference Series: Materials Science and Engineering. Paper Presented at 24th Innovative Manufacturing Engineering and Energy International Conference (IManEE 2020), Athens, Greece, December 14–15. Bristol: IOP Publishing, vol. 1037, p. 012059. [Google Scholar] [CrossRef]

- Solt, Frederick. 2020. Measuring income inequality across countries and over time: The standardized world income inequality database. Social Science Quarterly 101: 1183–99. [Google Scholar] [CrossRef]

- Stiglingh, Abigail. 2015. Financial Development and Economic Growth in BRICS and G-7 Countries: A Comparative Analysis. Master’s dissertation, North-West University, Vanderbijlpark, South Africa. Unpublished. [Google Scholar]

- Tabash, Mosab, Suhaib Anagreh, and Opeulowa Adeosum. 2022. Revisiting the impact of financial development on income inequality and poverty reduction: Empirical evidence from selected sub-Saharan African countries. International Journal of Organizational Analysis, ahead-of-print. [Google Scholar] [CrossRef]

- Ummalla, Mallesh, Samal Asharani, and Goyari Phanindra. 2019. Nexus among the hydropower energy consumption, economic growth, and CO2 emissions: Evidence from BRICS countries. Environmental Science and Pollution Research 26: 35010–22. [Google Scholar] [CrossRef]

- United Nations. 2018. Inequality in Asia and the Pacific in the era of the 2030 Agenda for Sustainable Development. Bangkok: UN Economic and Social Commission for Asia and the Pacific. [Google Scholar]

- United Nations. 2021. Technology and Innovation Report: Catching Technological Waves Innovation with Equity. Geneva: United Nations. [Google Scholar]

- Wang, Li-Min, and Xiang-Li Wu. 2023. Financial development, technological innovation and urban-rural income gap: Time series evidence from China. PLoS ONE 18: e0279246. [Google Scholar] [CrossRef]

- Weiss, Linda. 1999. Globalization and National Governance: Antinomy or Interdependence? Review of International Studies 25: 59–88. [Google Scholar] [CrossRef]

- Younsi, Moheddine, and Marwa Bechtini. 2018. Economic growth, financial development and income inequality in BRICS countries: Evidence from panel granger causality tests. Journal of Knowledge Economy 11: 721–42. [Google Scholar] [CrossRef]

- Zhang, Huan. 2021. Technology Innovation, Economic Growth and Carbon Emissions in the Context of Carbon Neutrality: Evidence from BRICS. Sustainability 13: 11138. [Google Scholar] [CrossRef]

- Zhang, Qian, Tomiwa Sunday Adebayo, Ridwan Lanre Ibrahim, and Mamdouh Abdulaziz Saleh Al-Faryan. 2022. Do the asymmetric effects of technological innovation amidst renewable and nonrenewable energy make or mar carbon neutrality targets? International Journal of Sustainable Development & World Ecology 2022: 1–13. [Google Scholar] [CrossRef]

- Zhu, Susan C., and Daniel Trefler. 2005. Trade and Inequality in Developing Countries: A General Equilibrium Analysis. Journal of International Economics 65: 21–24. [Google Scholar] [CrossRef]

| LIE | LTI | LGDPpc | LFD | LFI | LFM | |

|---|---|---|---|---|---|---|

| Mean | 3.825 | 8.232 | 8.341 | −0.835 | −0.866 | −0.906 |

| Median | 3.835 | 8.149 | 8.721 | −0.805 | −0.782 | −0.797 |

| Maximum | 4.151 | 10.584 | 9.392 | −0.449 | −0.301 | −0.371 |

| Minimum | 3.388 | 4.927 | 6.355 | −1.654 | −1.638 | −2.085 |

| Std. Dev. | 0.208 | 1.250 | 0.954 | 0.268 | 0.359 | 0.427 |

| Skewness | 0.078 | 0.065 | −0.799 | −0.866 | −0.301 | −1.170 |

| Kurtosis | 1.882 | 2.228 | 2.126 | 3.711 | 2.026 | 3.347 |

| Jarque–Bera | 7.215 | 3.474 | 18.806 | 19.873 | 7.438 | 31.694 |

| Probability | 0.027 | 0.176 | 0.000 | 0.000 | 0.024 | 0.000 |

| Observations | 136 | 136 | 136 | 136 | 136 | 136 |

| Variables | Breusch–Pagan LM | Pesaran Scaled LM | Bias-Corrected Scaled LM | Pesaran CD |

|---|---|---|---|---|

| LIE | 165.855 *** | 34.850 *** | 34.758 *** | 2.568 ** |

| LTI | 96.708 *** | 19.388 *** | 19.296 *** | 7.773 *** |

| GDPpc | 228.296 *** | 48.812 *** | 48.720 *** | 15.046 *** |

| LFD | 177.127 *** | 37.371 *** | 37.278 *** | 13.171 *** |

| LFI | 190.308 *** | 40.318 *** | 40.225 *** | 13.627 *** |

| LFM | 117.239 *** | 23.979 *** | 23.887 *** | 7.859 *** |

| LFIA | 180.253 *** | 38.070 *** | 37.977 *** | 13.103 *** |

| LFID | 132.025 *** | 27.286 *** | 27.193 *** | 10.710 *** |

| LFIE | 88.081 *** | 17.459 *** | 17.367 *** | 2.847 *** |

| LFMA | 73.542 *** | 14.209 *** | 14.116 *** | 7.836 *** |

| LFMD | 141.015 *** | 29.296 *** | 29.203 *** | 10.822 *** |

| LFME | 72.985 *** | 14.084 *** | 13.991 *** | 4.542 *** |

| Variables | Level | First Difference |

|---|---|---|

| LIE | −2.35518 | −2.08581 ** |

| LTI | −1.01444 | −3.18422 *** |

| GDPpc | −1.18865 | −3.35261 *** |

| LFD | −3.10462 *** | −3.69644 *** |

| LFI | −1.92061 | −5.81213 *** |

| LFM | −2.01697 | −3.75861 *** |

| LFIA | −1.93827 | −3.79056 *** |

| LFID | −3.93349 *** | −3.2067 *** |

| LFIE | −1.30072 | −3.77653 *** |

| LFMA | −2.116 | −3.38511 *** |

| LFMD | −1.71778 | −3.71317 *** |

| LFME | 0.03154 | −3.81207 *** |

| Alternative Hypothesis: Common AR Coefs. (Within Dimension) | ||||

| Weighted | ||||

| Statistic | Prob. | Statistic | Prob. | |

| Panel v-Statistic | −1.784405 | 0.9628 | −2.057926 | 0.9802 |

| Panel rho-Statistic | −0.062532 | 0.4751 | 0.282503 | 0.6112 |

| Panel PP-Statistic | −1.800677 | 0.0359 | −1.159556 | 0.1231 |

| Panel ADF-Statistic | −2.073806 | 0.0190 | −1.639674 | 0.0505 |

| Alternative Hypothesis: Individual AR Coefs. (Between Dimension) | ||||

| Statistic | Prob. | |||

| Group rho-Statistic | 1.022071 | 0.8466 | ||

| Group PP-Statistic | −1.263227 | 0.1033 | ||

| Group ADF-Statistic | −1.893584 | 0.0291 | ||

| Variable | Model 1 | Model 2 | Model 3 | Model 4 | Model 5 | Model 6 |

|---|---|---|---|---|---|---|

| FMOLS | FMOLS | FMOLS | DOLS | DOLS | DOLS | |

| LGDPpc | 0.063557 | 0.136283 | 0.087178 | 0.080515 | 0.121946 | 0.132695 |

| −3.945118 | −6.30602 | −5.099509 | −2.12853 | −2.794 | −3.08062 | |

| LTI | 0.026348 | 0.021643 | 0.028882 | 0.012413 | 0.032821 | 0.010997 |

| −2.58501 | −1.90179 | −2.880528 | −0.50979 | −1.49421 | −0.39096 | |

| LFD | −0.076125 | −0.14539 | ||||

| (−4.267533) | (−3.461030) | |||||

| LFM | −0.02106 | −0.04166 | ||||

| (−2.192593) | (−2.218460) | |||||

| LFI | −0.156106 | −0.16197 | ||||

| (−6.661735) | (−4.99779) | |||||

| Variable | Model 1 | Model 2 |

|---|---|---|

| FMOLS | DOLS | |

| LGDPPC | 0.690018 | 0.155521 |

| (2572.807) | (2.575152) | |

| LTI | 0.728064 | 0.001012 |

| (370.2441) | (0.132285) | |

| LFD_CRE | −0.151436 | −0.023617 |

| (−132.9438) | (−2.142315) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Biyase, M.; Zwane, T.; Mncayi, P.; Maleka, M. Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries. Int. J. Financial Stud. 2023, 11, 43. https://doi.org/10.3390/ijfs11010043

Biyase M, Zwane T, Mncayi P, Maleka M. Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries. International Journal of Financial Studies. 2023; 11(1):43. https://doi.org/10.3390/ijfs11010043

Chicago/Turabian StyleBiyase, Mduduzi, Talent Zwane, Precious Mncayi, and Mokgadi Maleka. 2023. "Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries" International Journal of Financial Studies 11, no. 1: 43. https://doi.org/10.3390/ijfs11010043

APA StyleBiyase, M., Zwane, T., Mncayi, P., & Maleka, M. (2023). Do Technological Innovation and Financial Development Affect Inequality? Evidence from BRICS Countries. International Journal of Financial Studies, 11(1), 43. https://doi.org/10.3390/ijfs11010043