Abstract

The aim of this paper is to provide empirical evidence about the effect of organizational competition (OC) as a contextual factor on the relationship between the effectiveness of information technology governance (ITG), which informs accounting information systems, and the financial performance of banks. Financial performance is identified by return on investment (ROI), return on equity (ROE), and Tobin’s Q. Averages of these variables were calculated for five years from 2015 to 2019. In fact, there is evidence for the general argument that banks will improve their performance by implementing ITG. Specifically speaking, the basic idea presented in this study is that the relation between ITG and bank performance depends on the appropriate interaction and matching between ITG and the OC. The study population includes the senior managers of banks in Jordan. Accordingly, a questionnaire consisting of 16 paragraphs was developed and distributed to senior managers in 23 banks during January to May 2021. As a result, 142 valid questionnaires were collected, which represented 61.7% of the questionnaires expected to be collected. Data are analyzed and processed by using descriptive statistical measures, t-test, exploratory factor analysis, along with multiple regression. The results show that despite the significant effect of OC on ITG, no relation exists between the interaction of ITG and OC, and bank performance in the three proxies of performance. The results of the study suggest that either banks do not benefit from ITG to improve their performance or that the chief executive officers’ perceptions about ITG in their banks is erroneous. However, it should be clarified that the respondents could have been affected by their values and beliefs when evaluating effective ITG use in their banks.

1. Introduction

The banking sector in Jordan witnessed great development since the 1970s, whether by increasing the number of banks operating in the sector, increasing the number of operating bank branches, or increasing the number of services provided by these banks. According to the Association of Banks in Jordan, the number of ATMs belonging to the Jordanian banking sector increased from 377 at the end of 2000 to 1023 at the end of 2009. The number of ATMs continued to increase until it reached 2038 ATMs at the end of 2019. In addition, banks operated through 862 branches at the end of 2019. The total number of branches was 446 at the end of 2000 and 619 at the end of 2009. In addition, there is a remarkable growth in the volume of deposits with banks, an increase in credit facilities, and an increase in the volume of their assets. Additionally, not only that, but the sector witnessed a development in financial policies and a shift towards liberalizing the interest rate, which is expected to lead to an increase in the demand for savings and in turn an increase in deposits with banks, which may increase the investment ability of these banks. Hopefully this will improve banking performance.

Much of the empirical work shows that market concentration leads to high profitability, and highly concentrated markets tend to be less competitive than markets in which many small organizations operate. Moreover, a concentrated market enables market practices to collude and to protect their market position with strategic behavior (Khan and Hanif 2019). Therefore, competition is particularly important in the banking sector because it affects the performance of practices. According to the structure-performance hypothesis, the structure of the market determines the degree of competition in the market and the degree of competition affects the performance of banks.

Information technology is expected to help banks by reducing costs, managing risks, predicting crises, achieving customer satisfaction, and promoting and diversifying services, this in turn would positively affect the financial performance of banks. However, to achieve the desired goals of information technology, there must be rules, procedures, and mechanisms that govern this technology, which are called information technology governance. It aims to ensure effective utilization of information technology (IT) by focusing on performance measurement, strategic alignment, resource management, risk management, and value delivery (Wilkin and Chenhall 2010), and this goes beyond focusing on investing in information technology only. It is worth noting that there is no consensus about the definition of ITG, although studies in the area, such as Simonsson and Johnson (2005) and Wu et al. (2015), include several definitions of ITG.

There is evidence for the general argument that banks will improve their performance by implementing ITG (Lunardi et al. 2014; Prasad et al. 2010; Weill and Ross 2004; Weill 2004). However, empirical evidence supporting this relation between ITG and bank performance is quite limited especially in emerging markets. In addition, performance impact may be affected by the proper match between ITG and the situational factors that exist in the environment of the corporation. These factors play critical roles in affecting how ITG impacts bank performance. An example that supports this perspective is the literature of the field of IT value in which it is well documented that situational factors affect the relationship between IT and the bank performance (e.g., Cao 2010; Kohli and Grover 2008; Grant 2005; Tanriverdi 2005; Melville et al. 2004; Brynjolfsson 2003; Barney 2001). It should be emphasized that using IT guarantees neither the existence of ITG nor the effectiveness of ITG (if it exists). Therefore, one may wonder how performance is affected by ITG when taking into account the situational variables of the corporation.

The current study relies heavily on the contingency theory. Based on the contingency theory, it can be argued that for ITG to be effective in achieving the organization goals, it should be designed in a way that takes into consideration the effect of the external environment factors. Specifically speaking, an organization or a bank should adjust its system to establish an appropriate fit between ITG and its competitive environment, as is the case in the current study. A situational factor that is expected to influence the relationship between the effectiveness of ITG and bank performance, is the bank organizational competition (OC). It is assumed in this study that the appropriate match between the effectiveness of ITG and OC affects the corporate performance positively. Therefore, the aim of this study is to examine the validity of this assumption. To make things easier, it examines how the market power of an individual bank affects its behavior toward establishing a proper ITG to improve its performance. It aims to investigate the relationship between competition and ITG. Then, the effect of the appropriate match between competition and ITG on the performance of banks in Jordan is examined.

The remainder of the paper is organized as follows: In addition to the previous introduction, the next section presents the relevant background and prior research, it also includes the study hypotheses. The third section explains the research methodology. Results are reported in the fourth section. The last section includes the conclusions, limitations, and suggestions for further research.

2. Background and Prior Research

The market sector in Jordan as well as in many countries can be described as an oligopoly market (Dong et al. 2021; Wadi and Saqfalhait 2016). It is worth noting that concentration level plays a major role in forming an idea about the level of competition in a particular sector. Concerning concentration in the Jordanian banking sector, its ratios show a considerable decline over time, especially during the last 25 years. This reduction in the concentration level could be attributed to the increase in the number of banks operating during that period. However, despite the decrease in concentration level, which is expected to lead to an increase in competition, Demirgüç-Kunt and Martínez Pería (2010) found that competition has also decreased. The concentration level was decreased from 53.2% in 2000 to 47.5% in 2009 (Association of Banks in Jordan 2010) and to 39.83% in 2019 (Association of Banks in Jordan 2020), for the first three banks based on their total assets. In developed countries, previous literature showed a statistically negative relationship between market concentration and performance (see as examples: Delorme et al. 2002; Berger and Hannan 1989; Clarke et al. 1984; Connolly and Hirschey 1984).

2.1. ITG and Performance

It is presumed that banks that seek to improve their performance are working hard to develop their capabilities in line with the level of competition they are exposed to in the market. That is, there should be a match between these resources and the level of competition to improve their performance. One of the important resources that banks depend on, to improve their competitive position in the market, is information technology. However, in order for this technology to be mature and helpful in achieving goals, it must be in harmony with the business, which can be achieved by setting the foundations and standards for the governance of information technology. De Haes and Van Grembergen (2009) found that there is a positive relationship between ITG and business/IT alignment. It is also assumed that the existence of proper governance to these capabilities aids in maximizing the utilization of these capabilities. Furthermore, in the same context, Dixit and Panigrahi (2014) show that the effect of increasing investment in information technology leads to higher profits for enterprises with higher exports. Dadoukis et al. (2021) show that banks with high IT investment performed better, in terms of market returns, Tobin’s q and lending, than other banks during the COVID-19 pandemic. Arora and Arora (2013) found that investment in information technology has had a significant positive impact on the profitability of the Indian public sector. Ho and Mallick (2010) found that although investment in information technology improves the work of banks, it may increase the level of competition between banks.

However, it should be emphasized that improving performance requires not only the use of IT capabilities but also having the suitable ITG that is composed of these capabilities. Zhang et al. (2016) states that the stronger the ITG is, the more likely that the bank becomes an IT leader. Soliman and Zaky (2017) found that ITG mediates the effect of IT investment on the financial and non-financial performance of Egyptian banks. It is worth noting that having the ability to measure ITG helps achieve this goal, such as the methodology of Weill and Ross (2004), which depends on measuring governance by linking the importance of the desired goals of using information technology and the success of companies in achieving these goals. In this context, the extent to which managers are aware of the importance of these goals for their companies and the success of these companies in achieving these goals can be questioned, and this is one of several things that the current study seeks to test. This argument leads to the formation of Hypothesis 1 as follows:

Hypothesis 1 (H1).

There is a significant difference between managers’ awareness of the importance of ITG and their awareness of the success of it in achieving the objectives of the organization.

Ko and Fink (2010) found that one of the large gaps between theory and practice that needs attention is increasing the awareness and understanding of the concept of ITG among senior managers. They consider that chief information officers (CIOs) or information technology directors of organizations are the key personnel involved in ITG. They argue that ITG can be seen as an integral part of corporate governance that needs the attention and care of senior management. This argument demands that there is a coherence between IT directors and the other senior managers in banks in dealing with ITG in order for the bank to achieve its desired objective. In addition, Weill and Hoffmann (2007) referred to measuring the awareness of CIO compared to the other senior managers in a regional New England bank concerning the importance of ITG elements. Inspired by these studies, the following hypothesis can be formulated:

Hypothesis 2 (H2).

There is no significant difference between the perception of chief technology officers (CTOs) and other executive managers toward ITG effectiveness in their organizations.

2.2. Banks Performance

Interest in the performance of banks has been the focus of researchers around the world. Among this interest is the focus on the factors that could improve it, which has led to the emergence of many studies that seek to accomplish this task. For example, Muller and Watkins-Fassler (2021) found that banks’ performance, in Curacao, is negatively affected by gender diversity and board size and it is positively affected by multiple directorships. Baugh et al. (2021) found that material weaknesses in internal control are negatively associated with future bank performance, which means that internal control quality improves the bank’s performance. Hoang et al. (2021) found that bank performance in Vietnam is improved by both geographic and income diversification strategies. However, their results showed that the interaction of these two variables together leads to a negative impact on the performance of banks. That is because adapting geographical diversification with diversification in income leads to increased competition which in turn reduces performance.

2.3. Competition and Performance

It is well established, conceptually and empirically, within the previous literature that intensity of competition is a fundamental problem for corporations. It plays an active role in the design of a company’s accounting information system (Wallace 2013). In addition, it urges the bank to be efficient in the business it carries out. Arrawatia et al. (2015) found that increased competition in the Indian market can positively affect efficiency levels in the banking industry and vice-versa. Tian et al. (2020) found that an increase in competition leads to an improvement in innovation efficiencies, whether through the investment in R&D or in terms of the resulted patents and profits generated by R&D. Căpraru et al. (2021) also state that when competition is at a low level, this leads to an increase in the tendency of banks to take risks, which destabilizes the banking sector. This result agrees with the study of Aldomy et al. (2020), which found that increase concentration leads to higher risk in the Jordanian banking sector. However, it is necessary here to emphasize that the decrease in concentration may not necessarily lead to an increase in competition. The result of Demirgüç-Kunt and Martínez Pería’s (2010) study should be recalled here, which found that a decrease in concentration did not lead to an increase in competition in the same sector.

In the study by Alhassan and Ohene-Asare (2016), which was conducted on the Ghanaian banking industry, it was found that competition improves the cost efficiency of banks positively. This result is consistent with the results of El Moussawi and Mansour (2022), who found that competition increases both cost efficiency and stability of commercial banks operating in the Middle East and North Africa (MENA) region. Wibowo (2017) reveals that banking competition in ASEAN countries, especially in Indonesia, tend to be a monopolistic competition. Wibo found that banking competition decreases banking profitability while it does not affect banking efficiency. Carlson and Mitchener (2006) found that branch banking increases competition, which in turn improves the stability of the banking system by removing inefficient and weak banks. Canta et al. (2020) found that competition affects risk exposure positively. In addition, they found that competition decreases interest rates and increases loan volumes. However, they found that competition leads to difficulty in obtaining loans for small and newly established companies.

It can be seen from the literature above that there has been no attempt to empirically examine the effect of a competitive environment on ITG, let alone the effect of the matching between ITG and company’s competitive intensity on the bank’s performance. It is expected that the effectiveness of ITG will increase when the bank’s competitive intensity is high because banks nowadays rely heavily on electronic services to increase their market share and thus increase their competitiveness, it is presumed that a greater interest in ITG should accompany this. On the contrary, the expansion in using IT could lead to a lack of control of it. Accordingly, the following hypothesis can be formulated to judge how bank competitiveness affects ITG:

Hypothesis 3 (H3).

The level of OC has a significant impact on the level ITG effectiveness.

2.4. The Role of Situational Factors

Based on this presumption, in Section 2.1 above, we can say that banks are trying to not only increase their investment in IT, but also to have the proper ITG that enables them to maximize IT utilization. It can be said that the effect of ITG on bank performance may also be affected by contingency factors, of which competition is one. Concerning this situational factor, banks are assumed to achieve a proper match between competition that they face in the market and the level of ITG to improve their financial performance. Therefore, this Sub-section of the paper will review the literature that is related to situational factors affecting banks’ performances.

It is well known that AIS is concerned with providing accurate, relevant, and cost-effective information in a timely manner to support business activities and processes. In this way AIS enables banks to be economically and socially effective in their competitive environment (Wilkin and Chenhall 2010). Mia and Clarke (1999) found that information mediates the relationship between competition and performance. By using information, organizations can face competition in the market effectively, and in turn improve their performance. Furthermore, the proper utilization of IT in improving the efficiency and the effectiveness of AIS, and in turn the proper ITG, will enable banks to be competitive. This is what Boso et al. (2013) confirm, although they talk about variables that differ from the variables covered by the current study, but they emphasize the need for a link between innovations within the company and the external environmental conditions of the company. They show that the extent to which companies benefit from innovations varies according to the company’s competitive environment, as this benefit increases when competition is high, while these innovations do not work when competition is weak. Kobelsky et al. (2008) found that the effect of IT investments on performance is contingent upon three situational factors, which are size, unrelated diversification, and sales growth. They suggest that their results may help explain the productivity paradox of IT investments. Gordon et al. (2009) found that the relation between enterprise risk management and firm performance is contingent upon five factors, which are environmental uncertainty, industry competition, firm size, firm complexity, and board of directors monitoring. Their basic argument depends on examining the effect of the appropriate match between these contingent variables and enterprise risk management on firm performance. Sirisomboonsuk et al. (2018) found that ITG, project governance, and the alignment between ITG and project governance have a positive effect on project performance.

Zhouhua (2021) reviewed previous literature on situational factors that affect bank performance in China. He found that business strategy and organizational structure positively and significantly affect bank performance. However, regarding competition, Zhouhua found a negative and insignificant effect of competition on bank performance. Saiful (2017) found that the effect of enterprise risk management and credit risk management on Indonesian bank performance is strengthened in large banks and in banks operating in higher environmental uncertainty. In addition, Sailul found that this effect is also strengthened by higher complexity and lower independent board monitoring. Jungo et al. (2022) examined how the effect of financial regulation on competitiveness and financial inclusion is moderated by financial stability in the banking sector in 15 countries in the South Africa Development Community region and eight countries in the South Asian Association for Regional Cooperation region. They found that financial regulation obstructs financial inclusion and negatively affects competitiveness. They also found that financial stability strengthened the negative effect of financial regulation on competitiveness and financial inclusion. Finally, Wu et al. (2015) found that the strategic alignment mediates the relationship between ITG and performance. Maji and Hazarika (2018) examined the influence of competition on the association between regulatory capital of Indian banks and their risk-taking behavior. They found a negative effect of competition on risk, which suggests that improving operational efficiency is vital in competitive markets.

Therefore, it is expected that the effect of ITG on a bank’s performance will increase when the company’s ITG is highly matched with its competitive intensity. That is because competitive intensity should motivate the company to increase its ITG effectiveness in order to be competitive, and it should affect the design of the bank’s ITG system in a way that improves its performance.

Based on the literature reviewed above, it seems that a bank’s performance is affected by the bank’s competition and ITG. However, will the interaction between them have an impact on performance? To answer such a question, we may hypothesize that:

Hypothesis 4 (H4).

The proper match between OC and ITG has a significant positive impact on ROI.

Hypothesis 5 (H5).

The proper match between OC and ITG has a significant positive impact on ROE.

Hypothesis 6 (H6).

The proper match between OC and ITG has a significant positive impact on Tobin’s q.

This study makes several contributions. First, it provides evidence about how bank organizational competition as a situational factor affects the relationship between ITG effectiveness and the bank performance, which is a distinctive feature of it from the literature in the area, not only on the national but also on the international level. This knowledge is expected to help IT governors while managing IT issues by understanding the contextual conditions under which ITG is effective in influencing bank performance. Second, it is the first study to investigate the effect of banks’ ITG effectiveness on banks’ performances in Jordan, which is expected to help relate ITG effectiveness with its ultimate goal of the corporation that demands improving its performance. In addition, it will hint at the direction of banks in Jordan toward matching the competition it faces in the market with ITG practices in order to improve their performance. Finally, this study is important for ITG decision makers to take the contingent factors that interact with the design of information systems into consideration to maximize the effect of these systems on bank performance.

3. Research Methodology

This section represents the study design, which reveals how the relationship between ITG and bank performance is examined by taking into consideration the effect of OC. It also explains how the variables of the study, including ITG, are calculated. In addition, it clarifies how data are collected and how the sample is chosen. Finally, it represents a diagram that depicts the relationships among the study variables.

3.1. Study Design

In this study, it is presumed that the proper fit between (ITG) and the bank competition would affect the bank’s performance. It is expected that the more the fit between ITG and bank competition, the better the performance achieved would be. In other words, what matters is not the level of ITG as much as the proper match between ITG and competition, which requires a proper analysis. It is worth clarifying that there are several perspectives of fit along with several mathematical and statistical tests to examine the appropriate match between two variables (Venkatraman 1989). In this study, residual analysis is used to examine the appropriate match between ITG and competition.

Building upon that, two basic equations will be used to test the hypotheses of the study. Equation (1) examines the relationship between OC and the ITG effectiveness. It describes what the matching is like between ITG effectiveness and OC.

where:

= information technology governance effectiveness of bank ,

= organizational competition of bank during 2015–5019,

= residuals (error term).

Equation (2) investigates the relationship between the appropriate match and a bank’s performance by regressing the absolute values of the residuals calculated in Equation (1) on the bank’s performance. The relationship between the bank’s performance and the residual values is controlled by two variables that are expected to affect performance, which are the bank size and the bank age. This procedure is consistent with the perspective that bank performance is affected by its size and age, which is a well-established procedure in the literature regarding bank performance (Dias et al. 2020).

where:

= bank’s performance of bank during 2015–2019,

= absolute value of residuals from Equation (1),

= logarithm total assets of bank during 2015–2019,

= age of bank in 2017 “the middle of the study period”,

= residuals (error term).

According to the residual analysis, it is presumed that the lower the residuals derived from Equation (1) the higher the proper fit is between (ITG) and the bank competition, and hence higher performance is expected (Gordon et al. 2009; Gordon and Smith 1992; Duncan and Moores 1989; Venkatraman 1989; and Drazin and Van de Ven 1985). This means that the absolute values of residuals have an inverse effect on bank performance. To judge that ITG level affects bank’s performance, one can rely upon the performance of one year only, However, measuring the performance of banks over a period of five years instead of one year, for example, results in an indicator that is less biased and less affected by the circumstances of one year regarding the bank’s performance. However, the model will be rerun with one year, which is 2019, to check the consistency of the study results.

3.2. Measurement of Variables

This section of the study provides information about the variables used to examine the hypotheses of the study, which are ITG, OC, and bank performance.

Regarding ITG, a review of the literature on ITG effectiveness shows lack of consensus on the definition of ITG as well as on how to measure ITG effectiveness. Simonsson and Johnson (2005) and Wu et al. (2015), as examples, include several definitions of ITG. In the current study the definition of Weill and Ross (2004, p. 2) is adopted, which defines ITG as “specifying the decision rights and accountability framework to encourage desirable behaviour in using IT”. Concerning measuring ITG, Goodhue and Thompson (1995), for example, suggest that ITG can be assessed based on the utilization of IT and the fit of IT with the tasks it supports. Van Grembergen and De Haes (2005) developed an ITG-balanced scorecard to evaluate ITG. Bowen et al. (2007) found that ITG can be assessed based on the understanding of both business and IT objectives, business and IT personnel involvement in IT decisions, communicating IT strategies and policies, and on business and IT personnel involvement in IT decisions. Prasad et al. (2010) measured ITG effectiveness through the effectiveness of an IT steering committee. Weill and Ross (2004) focus on the external quality of ITG by showing how ITG is successful in achieving four outcomes by using information technology, which are the cost-effective use of information technology, the effective use of information technology for growth, the effective use of information technology for asset utilization, and the effective use of information technology for business flexibility. The success in achieving these four outcomes is weighted by the importance of each outcome for the organization. This approach measures the performance of information technology governance through the value of the services provided by information technology from the point of view of the organization, and in a manner is characterized by direct understanding and simplicity. This approach is well accepted and used by researchers, and it is considered by the Information Systems Audit and Control Association and the Information Technology Governance Institute. Therefore, this approach is adopted in the current study. However, a fifth objective of (ITG) is also added to calculate ITG in this study, which is the compliance of the company with legal and regulatory requirements. This objective was introduced by Bowen et al. (2007).

Based on the foregoing definition and objectives and using a seven-point Likert scale, ITG will be calculated according to the following equation:

where:

n1: cost effective use of IT,

n2: the effective use of IT for growth,

n3: the effective use of IT for asset utilization,

n4: the effective use of IT for business flexibility,

n5: the use of IT for compliance of the bank with legal and regulatory requirements.

Given that there are five objectives, the maximum score is 100 and the minimum score is 14.29. Compared to Weill and Ross (2004) and Bowen et al. (2007), their maximum scores were 100 and minimum scores were 20. The difference between the minimum score in this study and the minimum scores in the former two studies is due to using a seven-point Likert scale in this study instead of a five-point Likert scale.

As for the measurement of organizational competition of banks, the competition situational factor involvement in the relationship between ITG and bank performance is evaluated by the concentration ratio of each bank. These types of measures are suitable for testing the hypotheses of the current study because they can be calculated on the bank level. They result in a score for each bank (i.e., they measure the intra competitiveness of each bank). The concentration ratio or the market share of each bank is calculated based on the averages of five variables during the period 2015–2019, which are the percentages of total assets (TA%), credit facilities (CF%), total deposits (TD%), number of branches of each bank to the total of all banks (Branches%), and the number of ATMs of each bank to the total of all banks (ATMs%). The five variables will be condensed into one construct using exploratory factor analysis. In this study, the five observed variables above are used to extract or to develop the competition variable, which is a dimension or a latent variable. Factor analysis is a technique that can be used in order to extract latent variables. Under this analysis, the variance of each ratio is not taken as it is, but only the common variance of all ratios is taken. In addition, this analysis requires that these ratios are loaded on one construct or factor, which will be tested in the Results section. Factor analysis is followed in many fields of knowledge, especially in the field of financial ratios (see, for example, the model of Hasan et al. (2020, p. 55).

The higher value of concentration ratio represented by the factor score indicates higher market power of an individual bank, and thus its higher ability to create a higher price by differentiating products from those of other competitor banks. The ability of banks these days depends largely on information technology to distinguish their products in the banking sector, and the possibility of benefiting from information technology increases with the presence of a system that defines the rights and responsibilities assigned to users of this technology, that is, the existence of a system for IT governance. Therefore, it is expected that the presence of an adequate level of IT governance in these banks, in a manner commensurate with their market power, will increase the chances of improving the financial performance of these banks.

In addition to measuring competition on a bank level, it will also be measured at the level of the banking industry as a whole to provide a brief description about the level of competition in the study sample and during the study period. It is worth noting that some sectors have begun to appear in the market, such as eFAWATEERcom and mutual fund companies, which would compete with banks in some services. To achieve this goal, the concentration ratio is calculated on the industry level based on the market share of the largest three banks along with another measure, which is Hirchman–Herfindahl Index (). This type of measure results in one score for all banks. The concentration ratio is calculated as follows:

where, concentration ratio based on the market share () of the largest three banks based on total assets, credit facilities, and total deposits. The higher value of concentration ratio on the industry level indicates higher monopoly power. Meanwhile, Hirchman-Herfindahl Index () is calculated as follows:

where = Hirchman–Herfindahl Index of the market shares () for all banks in the market based on total assets, credit facilities, and total deposits. The upper level of the HHI is 1, while its lower level is 1/n. The higher value of HHI indicates the lower level of competition.

The bank performance is evaluated by three measures, which are return on investment (ROI), return on equity (ROE), and Tobin’s q. These measures are used in the study because they are the most common measures of a bank’s financial performance. ROI ratio can be calculated in different forms depending on what return means and what investment means. In general, this ratio measures the efficiency of the management in utilizing its assets to generate income despite the financial position of the bank. Therefore, and to isolate the effect of financial expenses, returns would mean net income before interest, and to isolate the effect of tax, return would mean net income before tax. However, in the current study, ROI ratio is calculated by dividing net income after interest and before tax by average assets during the year, because the nature of the work of banks results in the interest expense being within the operating expenses of the bank and not a financing expense outside the basic work of it, as, for example, the situation of the manufacturing banks. ROE ratio, which measures the return on the investments of shareholders, is calculated by dividing net income after interest and tax by average shareholders’ equity during the year. Finally, Tobin’s q, which measures the ability of management to improve the market value of the bank through the operations of the business, is calculate by dividing the sum of market capitalization and the book value of total liabilities by the book value of total assets.

3.3. Data and Sample

To test the hypotheses of the study, data were collected to measure the three study variables, which are: ITG, organizational competition, and bank performance. To build the ITG construct, a survey was carried out to investigate the views of senior managers of banks in Jordan. Strictly speaking, the survey was used to collect data that enable the researcher to calculate the effectiveness of information technology governance. A carefully designed questionnaire was prepared through careful study of previous research and then constructs were developed to measure the effectiveness of information technology governance (Weill and Ross 2004). Several concerns have been expressed for the use of perceptual measures that require respondents to evaluate the effective use of IT in the five objectives of (ITG) that are mentioned in the subsection above. The key issues center on the use of a single informant, which is the case in this study. When relying on only one informant there is a risk of underestimating the true parameters due to dishonesty and/or systematic bias (Ketokivi and Schroeder 2004). It should be clarified that the respondents could be affected by their own values and beliefs when evaluating the effective use of ITG. Although it is acknowledged that there is such a risk in this study, and thus this is a potential limitation, any risk of bias has been minimized by ensuring that the questionnaire was answered by senior managers including chief technology officers (CTOs) in charge of ITG who knows about the systems of their banks. Then the questionnaire was sent to a number of specialists in this field, and modified into its final form in light of the suggestions made by the arbitrators. The reliability of the questionnaire was also checked using Cronbach’s α-values, which amounted to 90%, indicating that there was internal consistency between the items, and confirming the reliability of the constructs employed (Hair et al. 2006). The value of alpha was also calculated for each part of the questionnaire as shown in Table 1.

Table 1.

The degree of reliability of the study tool.

Regarding the data of organizational competition, corporate performance variables, and the control variables, they were collected from the annual reports of banks and from the pamphlet series of the Association of Banks in Jordan (2022) (https://www.abj.org.jo/AR/List/%D9%83%D8%B1%D8%A7%D8%B3%D8%A7%D8%AA_%D8%A7%D9%84%D8%AC%D9%85%D8%B9%D9%8A%D8%A9 (accessed on 3 October 2022).

It is worth noting that the population of the study consists of all senior managers working in the licensed banks operating in Jordan during 2021. These banks are distributed into 13 Jordanian commercial banks, 4 Jordanian Islamic banks, and 6 foreign commercial banks. This definition of licensed banks does not include the financial institutions operating in Jordan. By virtue of a letter from the Association of Banks in Jordan, each operating bank in Jordan was requested to fill out 10 copies of the questionnaire by its senior managers, provided that the director of information technology was among them. The banking sector in Jordan was chosen among other sectors in this study due to the increasing interest of this sector in ITG. This growing interest in ITG in banks operating in Jordan led to the issuance of the instructions of governance pertaining to information and related technologies No. 65/2016 on the 25 of October 2016 (Central Bank of Jordan 2016b). This is based on the interest of the Central Bank of Jordan to implement the rules and foundations of institutional governance in order to reduce the risks of banks and to protect them from involving useless investments and unjustified expenses in information technology that may lead to huge losses. These instructions are consistent with the instructions of institutional governance of banks including the instructions of institutional governance in Islamic banks. According to these instructions, every bank must send an achievement report to the Central Bank of Jordan related to compliance with these instructions every six months, indicating the level of achievement for each item of the instructions. They are also required to publish guidance of governance pertaining to information and related technologies on their electronic sites and they should disclose the existence of this guidance in their annual reports. The instructions also require that banks form ITG committees, IT steering committees, and IT auditing committees.

3.4. Study Model

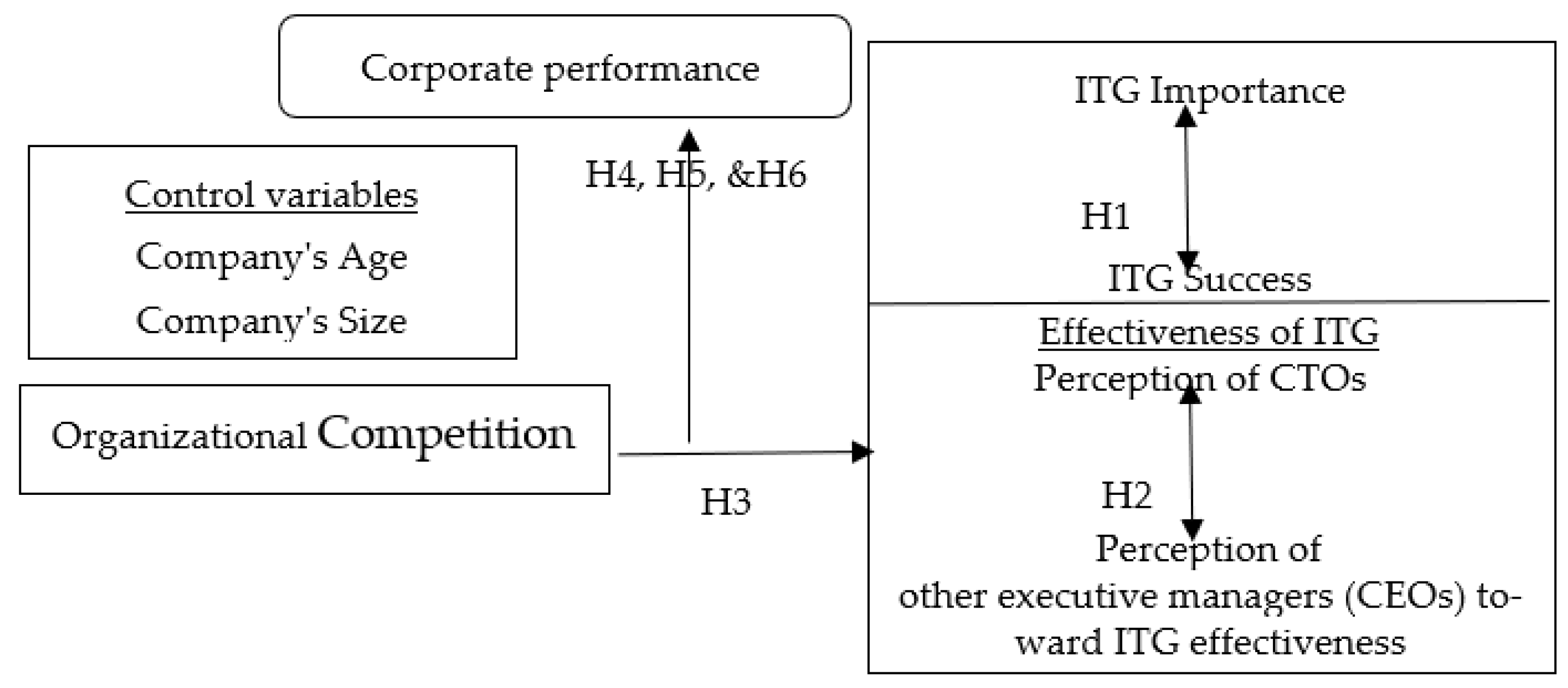

Figure 1 below summarizes the effect of the proper match between ITG effectiveness and the company’s competitive environment on the bank performance:

Figure 1.

Theoretical model of the study.

4. Results

This section of the study reveals the characteristics of the study sample along with the description of ITG questions used in the study survey. In addition, it presents the percentages of concentration ratio and HHI scores. Moreover, the variables of the study will be statistically described. Finally, it discusses the results of testing the study’s hypotheses.

4.1. Characteristics of the Study Sample

Table 2 shows that CTOs in all banks (23) responded to the survey. It also shows that the respondents are qualified to answer the study’s questions, as almost all of them hold at least a bachelor degree, with one third of them hold a master’s or doctoral degree. As for the area of qualification, Table 2 reveals that one third of the respondents are IT specialists. In addition to that, two thirds of the respondents hold professional certificates in their field of work. They also have long years of experience, as the percentage of those with 10 years of experience or more reached 89.4%, which gives the impression that their answers to the questionnaire questions were more realistic and objective. The experience in this field is of an important nature because it indicates that the highest percentage of respondents in this study were present during the stages of development of information technology governance in their banks, which increases the objectivity of this study that has a role in studying the performance of information technology governance in banks. It can also be seen from Table 2 that 90% of respondents are over 30 years of age. Finally, the survey shows that 10% of the respondents are specialized in more than one area, and 11% of them hold more than one professional certificate.

Table 2.

The characteristics of the study sample.

To find out how senior managers perceive the effectiveness, importance, and success of ITG in their banks, each of the 23 banks working in Jordan was kindly asked to fill in the questionnaire of the study by 10 executive managers including the chief technology officer (CTO). The actual responses of banks were 142 (61.7% response rate), that is with an average of six responses including the CTO in each bank. As for measuring ITG effectiveness, the survey includes ten questions, five of them to measure the importance of ITG and the other five to measure the success of ITG in achieving the bank goals. It is worth noting that the approach taken in the current study to measure the effectiveness of ITG depends on the achievement of five goals, which are the cost-effective use of information technology, the effective use of information technology for growth, the effective use of information technology for asset utilization, the effective use of information technology for business flexibility, and the compliance of the bank with legal and regulatory requirements. The measurement of ITG effectiveness links the success of ITG in achieving these goals and the importance of using ITG to achieve them. As long as the success of ITG is in line with its importance in achieving these objectives, this will lead to effective ITG. So, the managers’ perception about both importance and success of ITG, determines the effectiveness of ITG. Therefore, to explore how managers perceive the success and importance of ITG in their banks, a comparison was made between these two dimensions. The results show that the managers’ perception of the ITG importance is higher than that of ITG success. The results reveal that there is significant evidence (p < 0.01) that supports this finding. This shows the extent to which executive managers perceive the importance of ITG in their banks. It means that the first hypothesis, which states that there is a significant difference between managers’ awareness of the importance of ITG and their awareness of the success of it in achieving the objectives of the organization, is accepted. This result agrees with the argument of Lunardi et al. (2007), who state that although managers agree on the importance of ITG, implementing corporate governance procedures remains a challenge for their companies.

4.2. Banking Sector Competition

In order to identify the extent of the consensus of the impressions of managers in the upper management about ITG in their banks, the responses were divided into two parts, which are the CTOs’ responses and the responses of the other executive managers (CEOs). Then a comparison was made between them. The results indicate that there is a coherence between the views of CTOs and the other executive managers toward the effectiveness level of ITG. The results of a non-parametric test reveal that there is significant evidence (p = 0.23) that supports this finding. This harmony in the views of managers is not only limited to ITG performance, but also includes their assessment of ITG importance along with its success in achieving its objectives. The p values of a non-parametric test reveals that there is no difference between the conceptions of CTOs and the other executives toward the importance and the success of ITG (p = 0.76 and 0.24, respectively). It is this alignment that leads to the consistent assessment of the effectiveness of IT governance between CTOs and other executive managers in banks. This intuition was supported by the statistical test, which showed that there were no differences between the CTOs and the other executive managers in evaluating ITG performance, which reflects the coherence among all executive managers including CTOs upon their evaluation of ITG effectiveness. This means that the second hypothesis, which states that there is no significant difference between the perception of CTOs and other executive managers toward ITG effectiveness in their organizations, is accepted. Table 3 shows the averages of the respondents’ answers to the ten questions related to the importance and success of ITG in their banks.

Table 3.

Importance and success of ITG in the respondents’ banks a.

Table 4 reveals the values of concentration ratio of the largest three banks () and Hirchman–Herfindahl Index () during the periods from 2015 to 2019 based on total assets, credit facilities, and deposits. It is clear from the concentration ratios that the banking sector is characterized by monopolistic power during these five years. At the same time, the shows that the market is unconcentrated, according to The US Department of Justice (2010) interpretation of HHI, which is presented in Table 5.

Table 4.

Percentages of concentration ratio and for all banks operating in Jordan.

Table 5.

Interpretation of “HHI” a.

4.3. Descriptive Statistics of the Study Variables

The sample of the study varied in size in terms of total assets and in age. Banks ranged in size from small (total assets = JOD 138,316,000) to large (total assets = JOD 9,340,600,000), with most banks being of intermediate size (mean = JOD 2,108,912,174 and median = JOD 1,779,440,000). More than two thirds of the banks (16 banks) were Jordanian banks, and the rest of the sample were foreign banks and work in Jordan (7 banks). As for the descriptive statistics related to the measurement of the dependent variable and the independent study variables, they are shown for each variable separately in Table 6.

Table 6.

Descriptive statistics of the study variables.

It can be seen from Table 6 that banks ranged in age from 6 to 83 years old in 2017, the middle of the study period. The mean of ITG is 82.57%, which is close to the result of Barbosa et al. (2014) with an average of 79.6. It is worth emphasizing that they used almost the same methodology as in the current study.

4.4. Impact of the Relationship between OC and ITG on Banks’ Performance

This section reports the results related to the relationship between OC and ITG, and in turn the results of examining the effect of this relationship on bank performance.

In order to examine the effect of OC on ITG, a construct called OC was firstly built using factor analysis as explained in the Measurement of Variables subsection. The results reveal that the five concentration ratios, which are the percentages of total assets, credit facilities, total deposits, branches, and ATMs, are loaded on one factor. Table 7 reveals the factor loadings of the five concentration ratios that quantify the extent to which each ratio is related to the OC construct. It can be seen from Table 7 that the loadings are high, since a loading of 0.7 is usually accepted to report that an observed variable is related to a latent variable. It is argued that observed variables with less than 50% common variation with the latent variable, which equals the square of 0.7 times 100, are considered too weak to report (Pinches et al. 1973; Ezzamel et al. 1987). In addition, the results show that the OC factor accounts for 93.4% of the total variance in the original five concentration ratios. This suggests that these five observed variables reflect one latent variable, which is the OC in the current study.

Table 7.

Concentration ratios and factor loadings defining the OC construct.

Secondly, to test the effect of OC on ITG, a regression model was run after deleting outliers. In this model, ITG was regressed on the OC factor. The results in Table 8 reveal that the OC variable in the regression model explains 3.1% of the variation of the variance in ITG as shown by (adjusted R2). The results also show that the Durbin–Watson statistic is 1.837, which indicates that the autocorrelation in the sample is positive, but it does not raise an alarm that there is an auto-correlation in the data because the value is above 1.5. In addition, the Durbin–Watson statistic is more than the upper value for the Durbin–Watson static in this study sample, which equals 1.74 at level of significance equal to 0.05. This indicates that there is no statistical evidence that the data are positively correlated and thus the standard error is not undervalued, which means there is no reason to believe that competition is not actually important in the event that it is statistically significant.

Table 8.

OC and the ITG model summary b.

The results in Table 9 reveal that OC has an effect on ITG. The unstandardized coefficient of OC is negative and significant at 0.05 evidence level (p = 0.02). This means that (OC) has a negative effect on ITG. This result leads to accepting Hypothesis 3, which states that the level of OC has a significant impact on the ITG effectiveness level. It can be inferred from this result that the greater the competitiveness of the bank and the greater its market share, the less effective its ITG. This result can be explained by the fact that banks rely heavily on electronic services to increase their market share and thus increase their competitiveness, which requires an increase in the use of information technology. To obtain a closer look at this result, the relationships between ITG and the five concentration ratios are examined individually. The results reveal that the relationships between ITG and each concentration ratio is statistically significant and negative. These results suggest that each of the five concentration ratios affects the effectiveness of ITG negatively.

Table 9.

Results of regression between OC and the effectiveness of ITG a.

Finally, to investigate the effect of the appropriate match between OC and ITG on a bank’s performance, three regressions are run. In each regression performance is regressed on the absolute values of the residuals calculated in the equation that examines the effect of OC on ITG. The bank’s performance is expressed by one of three proxies in each regression, which are ROI, ROE, and Tobin’s q. The relationship between the bank’s performance and the residual values is controlled by two variables that are expected to affect performance, which are the bank size and the bank’s age. The results showed that there was no statistically significant effect of the compatibility between the bank’s competitive strength (OC) and the effectiveness of information technology governance (ITG) on the bank’s performance as measured by the aforementioned measures. This results in that the fourth hypothesis, which states that the proper match between OC and ITG has a significant impact on ROI, the fifth hypothesis, which states that the proper match between OC and ITG has a significant impact on ROE, and the sixth hypothesis, which states that the proper match between OC and ITG has a significant impact on Tobin’s q, are rejected. Table 10 below reveals the statistical results of the three regressions. It can be noticed from the results that the three models are significant at 0.05 level, which means that there are significant relationships between all the independent variables together and performance.

Table 10.

Absolute values of residuals and banks’ performance model (ANOVA).

It can be also seen from Table 11 that size in terms of total assets is significantly and positively related to performance, which indicates that the larger the bank is the higher its performance. The age variable is also significant and negatively related to performance in terms of ROE.

Table 11.

Results of regressions between absolute values of residuals and banks’ performance.

The results of rerunning the model with one year, which was 2019, showed consistency with the above study results. The unstandardized coefficient of regressing OC on ITG is negative and significant at 0.05 evidence level (p = 0.02). The results also revealed that there is no statistically significant effect of the compatibility between the bank’s competitive strength (OC) and the effectiveness of information technology governance (ITG) on the bank’s performance as measured by the aforementioned measures.

4.5. Bank Type Robustness Test

It is worth noting that, if we talk about a bank’s performance in general, bank type matters. However, in this study it is argued that whatever the bank type is, ITG should be set out to suit bank competition if banks want to improve their performance. Thus, it is a matter of the appropriate match between ITG and competition rather than ITG or competition on performance. Nevertheless, and to confirm that bank type does not matter, a robustness test was applied on the commercial banks only. The results confirm the above argument. The results of Table 8, Table 9 and Table 10 are reproduced below in Table 12, Table 13 and Table 14. It can be noticed from these results that there is no material change in the solution.

Table 12.

OC and the ITG model summary b.

Table 13.

Results of regression between OC and the effectiveness of ITG a.

Table 14.

Absolute values of residuals and banks performance model (ANOVA).

5. Conclusions and Recommendations

The banking sector in Jordan is characterized as an oligopoly market in which banks are able to determine the prices of their revenues and services, but nowadays banks are forced to use information technology heavily to be competitive in the market and to comply with the instructions issued by the authorities concerned with the work of banks such as the Central Bank of Jordan. Additionally, in turn this usage of information technology requires that banks are able to control it and to determine the appropriate procedures to manage it and thus be able to obtain the desired benefits from this technology. That is, this usage requires that information technology is accompanied by governance measures, processes, and mechanisms. It is expected that the interaction between the bank’s competitive ability and effectiveness of its ITG has a positive effect on its performance. Therefore, the current study aimed at examining the effect of the alignment between competition and the effectiveness of ITG on a bank’s performance.

It can be concluded from the results that there is a synergy between the efforts of all executive managers, including CTOs, in the bank to raise the level of ITG in their banks and this indicates that coordination exists between them. In addition, it seems that this expansion of the use of information technology is not accompanied by an increase in ITG commensurate with this expansion. This conclusion is supported by another result of the study, which shows that bank executives consider that ITG helps to achieve the goals of banks successfully, but their level of awareness of the importance of this governance to achieve the goals of the banks exceeds the level of their success in achieving these goals. When it comes to the alignment between a bank’s competitive ability and its performance, it was shown that the alignment between competition and ITG does not affect the bank’s performance, whether it is expressed in terms of ROI, ROE, or Tobin’s q. The results of the study suggest that either banks do not benefit from ITG to improve their performance or that the chief executive officers’ perception about ITG in their banks is erroneous. Another explanation is that the respondents could have been affected by their values and beliefs when evaluating effective ITG use in their banks.

Therefore, a major limitation of the study was the inability to measure ITG in a more objective manner than relying on the awareness of senior management only to measure ITG, such as developing an index to measure it using the content of the annual reports of banks as is the case when measuring corporate governance and disclosure. It was also not possible to use the results of reports related to the assessment (risks-controls) of information and associated technology that banks must periodically submit to the Central Bank because the Central Bank is not allowed to publish any individual bank-level data according to article No. 45/b of the Central Bank of Jordan (2016a), law No. 24. Finally, it was not possible to take into consideration all of the factors that may affect a bank’s performance either because they are not known or because they cannot be quantified.

Based on the results of the study, it can be recommended that:

- Practitioners should work harder at increasing the level of ITG success to match the level of feeling perceived by managers that ITG is important to achieve the objectives of using information technology.

- It can also be recommended that policymakers in banks should keep and support the coherence that exists between all of the executive managers including CTOs, which is expected to improve the performance of ITG.

- The design of information technology governance systems in banks be reconsidered by practitioners to suit their competitive environment, which may improve the bank’s financial performance.

- Concerning competition, we are here before a dilemma that causes confusion for legislators. Will the field for banking work be opened to a larger number of banks, which would increase competition, but at the same time it might lead to setbacks in this sector with unimaginable consequences? Or to support the large banks, which may lead to a decrease in competition and thus a decrease in the efficiency of the banking sector.

- Finally, future research could be directed towards examining the effect of other situational factors that can affect the relationship between ITG and bank performance such as the organizational culture or the organizational structure.

Funding

This research received no external funding.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data sources are shown in Section 3.

Acknowledgments

This study is a scientific applied national research paper in which the Association of Banks in Jordan contributed to facilitate the researcher’s task.

Conflicts of Interest

There are no conflict of interest.

References

- Aldomy, Rakan Fuad, Chan Kok Thim, Nguyen Thi Phuong Lan, and Mariati Binti Norhashim. 2020. Bank concentration and financial risk in Jordan. Montenegrin Journal of Economics 16: 31–44. [Google Scholar] [CrossRef]

- Alhassan, Abdul Latif, and Kwaku Ohene-Asare. 2016. Competition and bank efficiency in emerging markets: Empirical evidence from Ghana. African Journal of Economic and Management Studies 7: 268–88. [Google Scholar] [CrossRef]

- Arora, Hitesh, and Padmasai Arora. 2013. Effect of investments in information technology on bank performance: Empirical evidence from Indian public sector banks. International Journal of Business Information Systems 13: 400–17. [Google Scholar] [CrossRef]

- Arrawatia, Rakesh, Arun Misra, and Varun Dawar. 2015. Bank competition and efficiency: Empirical evidence from Indian market. International Journal of Law and Management 57: 217–31. [Google Scholar] [CrossRef]

- Association of Banks in Jordan. 2010. The Development of the Jordanian Banking Sector, (2000–2010). Amman: Association of Banks in Jordan, p. 67. [Google Scholar]

- Association of Banks in Jordan. 2020. Comparative Performance of Banks Operating in Jordan during 2018 and 2019. Pamphlet Series. Amman: Association of Banks in Jordan, p. 11. [Google Scholar]

- Association of Banks in Jordan. 2022. Available online: https://www.abj.org.jo/AR/List/%D9%83%D8%B1%D8%A7%D8%B3%D8%A7%D8%AA_%D8%A7%D9%84%D8%AC%D9%85%D8%B9%D9%8A%D8%A9 (accessed on 3 March 2023).

- Barbosa, Sara C. Boni, Ildeberto Aparecido Rodello, and Silvia Inês Dallavalle de Pádua. 2014. Performance measurement of information technology governance in Brazilian financial institutions. JISTEM-Journal of Information Systems and Technology Management 11: 397–414. [Google Scholar]

- Barney, Jay B. 2001. Is the Resource-Based “View” a Useful Perspective for Strategic Management Research? Yes. The Academy of Management Review 26: 41–56. [Google Scholar]

- Baugh, Matthew, Matthew S. Ege, and Christopher G. Yust. 2021. Internal Control Quality and Bank Risk-Taking and Performance. AUDITING: A Journal of Practice & Theory 40: 49–84. [Google Scholar]

- Berger, Allen N., and Timothy H. Hannan. 1989. The price-concentration relationship in banking. The Review of Economics and Statistics 71: 291–99. [Google Scholar] [CrossRef]

- Boso, Nathaniel, Vicky M. Story, John W. Cadogan, Milena Micevski, and Selma Kadić-Maglajlić. 2013. Firm innovativeness and export performance: Environmental, networking, and structural contingencies. Journal of International Marketing 21: 62–87. [Google Scholar] [CrossRef]

- Bowen, Paul L., May-Yin Decca Cheung, and Fiona H. Rohde. 2007. Enhancing IT Governance Practices: A Model and Case Study of An Organization’s Efforts. International Journal of Accounting Information Systems 8: 191–221. [Google Scholar] [CrossRef]

- Brynjolfsson, Erik. 2003. ROI Valuation: The IT Productivity Gap. Optimize Magazine 2: 26–43. [Google Scholar]

- Canta, Chiara, Øivind A. Nilsen, and Simen A. Ulsaker. 2020. Competition in Local Bank Markets: Risk Taking and Loan Supply. Bergen: Mimeo, Norwegian School of Economics. [Google Scholar]

- Cao, Guangming. 2010. A Four-Dimensional View of IT Business Value. Systems Research and Behavioral Science 27: 267–84. [Google Scholar] [CrossRef]

- Căpraru, Bogdan, Iulian Ihnatov, and Nicoleta-Livia Pintilie. 2021. Bank competition and risk-taking in the European Union: Evidence of a non-linear relationship. Economic Annals 66: 35–65. [Google Scholar] [CrossRef]

- Carlson, Mark, and Kris James Mitchener. 2006. Branch banking, bank competition, and financial stability. Journal of Money, Credit and Banking 38: 1293–328. [Google Scholar] [CrossRef]

- Central Bank of Jordan. 2016a. Law No. 24 of 2016; The Official Gazette No. 5402 on 16/06/2016. Amman: Ministry of Industry and Trade.

- Central Bank of Jordan. 2016b. The Instructions of Governance Pertaining to Information and Related Technologies No. 65/2016, 25th of October 2016. Available online: https://www.cbj.gov.jo/EchoBusV3.0/SystemAssets/2a28e1aa-160b-43a7-a0eb-3aff92462675.pdf (accessed on 3 October 2022).

- Clarke, Roger, Stephen Davies, and Michael Waterson. 1984. The profitability-concentration relation: Market power or efficiency? The Journal of Industrial Economics 32: 435–50. [Google Scholar] [CrossRef]

- Connolly, Robert A., and Mark Hirschey. 1984. R & D, Market Structure and Profits: A Value-Based Approach. The Review of Economics and Statistics 66: 682–86. [Google Scholar]

- Dadoukis, Aristeidis, Maurizio Fiaschetti, and Giulia Fusi. 2021. IT adoption and bank performance during the COVID-19 pandemic. Economics Letters 204: 109904. [Google Scholar] [CrossRef]

- De Haes, Steven, and Wim Van Grembergen. 2009. An exploratory study into IT governance implementations and its impact on business/IT alignment. Information Systems Management 26: 123–37. [Google Scholar] [CrossRef]

- Delorme, Charles D., Jr., David R. Kamerschen, Peter G. Klein, and Lisa Ford Voeks. 2002. Structure, conduct and performance: A simultaneous equations approach. Applied Economics 34: 2135–41. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, and María Soledad Martínez Pería. 2010. A Framework for Analyzing Competition in the Banking Sector: An Application to the Case of Jordan. World Bank Policy Research Working Paper 5499. Washington, DC: World Bank. [Google Scholar]

- Dias, Alexandre Teixeira, Flávia Silva Monteiro Rossi, Jersone Tasso Moreira Silva, Marcos Antônio de Camargos, and Julia Pinto de-Carvalho. 2020. The Effects of Competitive Environment and Strategic Factors on US Firm Performance before and after the Global Financial Crisis. Latin American Business Review 21: 37–59. [Google Scholar] [CrossRef]

- Dixit, Gaurav, and Prabin Panigrahi. 2014. Information technology impact and role of firm age and export activity: An emerging economy context. Journal of Global Information Technology Management 17: 169–87. [Google Scholar] [CrossRef]

- Dong, Mei, Stella Huangfu, Hongfei Sun, and Chenggang Zhou. 2021. A macroeconomic theory of banking oligopoly. European Economic Review 138: 103864. [Google Scholar] [CrossRef]

- Drazin, Robert, and Andrew H. Van de Ven. 1985. Alternative forms of fit in contingency theory. Administrative Science Quarterly 30: 514–39. [Google Scholar] [CrossRef]

- Duncan, Keith, and Ken Moores. 1989. Residual analysis: A better methodology for contingency studies in management accounting. Journal of Management Accounting Research 1: 103. [Google Scholar]

- El Moussawi, Chawki, and Rana Mansour. 2022. Competition, cost efficiency and stability of banks in the MENA region. The Quarterly Review of Economics and Finance 84: 143–70. [Google Scholar] [CrossRef]

- Ezzamel, Mahmoud, Judith Brodie, and Cecilio Mar-Molinero. 1987. Financial Patterns of UK Manufacturing Companies. Journal of Business Finance & Accounting 14: 519–36. [Google Scholar]

- Goodhue, Dale L., and Ronald L. Thompson. 1995. Task-Technology Fit and Individual Performance. MIS Quarterly 19: 213–36. [Google Scholar] [CrossRef]

- Gordon, Lawrence A., and Kimberly J. Smith. 1992. Postauditing capital expenditures and firm performance: The role of asymmetric information. Accounting, Organizations and Society 17: 741–57. [Google Scholar] [CrossRef]

- Gordon, Lawrence A., Martin P. Loeb, and Chih-Yang Tseng. 2009. Enterprise risk management and firm performance: A contingency perspective. Journal of Accounting and Public Policy 28: 301–27. [Google Scholar]

- Grant, Robert M. 2005. Contemporary Strategy Analysis, 5th ed. Malden: Blackwell Publishing. [Google Scholar]

- Hair, Joseph F., Jr., William C. Black, Barry J. Babin, Rolph E. Anderson, and Ronald L. Tatham. 2006. Multivariate Data Analysis, 6th ed. Upper Saddle River: Prentice Hall. [Google Scholar]

- Hasan, M. Shamimul, Normah Omar, Morrison Handley-Schachler, and A. H. Chowdhury. 2020. A Cross-Country Study on Corporate Accruals and Financial Ratios Using Confirmatory Factor Analysis. Journal of Knowledge Globalization 12: 35–72. [Google Scholar]

- Ho, Shirley J., and Sushanta Kumar Mallick. 2010. The impact of information technology on the banking industry. Journal of the Operational Research Society 61: 211–21. [Google Scholar] [CrossRef]

- Hoang, Khanh, Liem Nguyen, and Son Tran. 2021. Multimarket contact, income diversification and bank performance. International Journal of the Economics of Business 28: 439–55. [Google Scholar] [CrossRef]

- Jungo, João, Mara Madaleno, and Anabela Botelho. 2022. Financial regulation, financial inclusion and competitiveness in the banking sector in SADC and SAARC countries: The moderating role of financial stability. International Journal of Financial Studies 10: 22. [Google Scholar] [CrossRef]

- Ketokivi, Mikko A., and Roger G. Schroeder. 2004. Perceptual Measures of Performance: Fact or Fiction? Journal of Operations Management 22: 247–64. [Google Scholar] [CrossRef]

- Khan, Mahmood Ul Hasan, and Muhammad Nadim Hanif. 2019. Empirical evaluation of ‘structure-conduct-performance’and ‘efficient-structure’paradigms in banking sector of Pakistan. International Review of Applied Economics 33: 682–96. [Google Scholar] [CrossRef]

- Ko, Denise, and Dieter Fink. 2010. Information technology governance: An evaluation of the theory-practice gap. Corporate Governance: The International Journal of Business in Society 10: 662–74. [Google Scholar] [CrossRef]

- Kobelsky, Kevin, Starling Hunter, and Vernon J. Richardson. 2008. Information technology, contextual factors and the volatility of firm performance. International Journal of Accounting Information Systems 9: 154–74. [Google Scholar] [CrossRef]

- Kohli, Rajiv, and Varun Grover. 2008. Business Value of IT: An Essay on Expanding Research Directions to Keep up with the Times. Journal of the Association for Information Systems 9: 23–39. [Google Scholar] [CrossRef]

- Lunardi, Guilherme Lerch, Pietro Cunha Dolci, João Luiz Becker, and Antonio Carlos Gastaud Maçada. 2007. IT Governance in Brazil: An Analysis of Two More Widespread Mechanisms among National Companies. In Symposium of Excellence in Management and Technology. Porto Alegre: IT Governance. [Google Scholar]

- Lunardi, Guilherme Lerch, Joao Luiz Becker, Antonio Carlos Gastaud Maçada, and Pietro Cunha Dolci. 2014. The Impact of Adopting IT Governance on Financial Performance: An Empirical Analysis Among Brazilian Firms. International Journal of Accounting Information Systems 15: 66–81. [Google Scholar] [CrossRef]

- Maji, Santi Gopal, and Preeti Hazarika. 2018. Capital regulation, competition and risk-taking behavior of Indian banks in a simultaneous approach. Managerial Finance 44: 459–77. [Google Scholar] [CrossRef]

- Melville, Nigel, Kenneth Kraemer, and Vijay Gurbaxani. 2004. Review: Information Technology and Organisational Performance: An Integrative Model of IT Business Value. MIS Quarterly 28: 283–322. [Google Scholar] [CrossRef]

- Mia, Lokman, and Brian Clarke. 1999. Market competition, management accounting systems and business unit performance. Management Accounting Research 10: 137–58. [Google Scholar] [CrossRef]

- Muller, Sherma, and Karen Watkins-Fassler. 2021. Board composition and bank performance in a small island developing state: The case of Curacao. Estudios Gerenciales 37: 590–600. [Google Scholar] [CrossRef]

- Pinches, George E., Kent A. Mingo, and J. Kent Caruthers. 1973. The Stability of Financial Patterns in Industrial Organisations. The Journal of Finance 28: 389–96. [Google Scholar] [CrossRef]

- Prasad, Acklesh, Jon Heales, and Peter Green. 2010. A Capabilities-Based Approach to Obtaining a Deeper Understanding of Information Technology Governance Effectiveness: Evidence from IT Steering Committees. International Journal of Accounting Information Systems 15: 214–32. [Google Scholar] [CrossRef]

- Saiful, Saiful. 2017. Contingency factors, risk management, and performance of Indonesian banks. Asian Journal of Finance & Accounting 9: 35. [Google Scholar]

- Simonsson, Mårten, and Pontus Johnson. 2005. Defining IT Governance—A Consolidation of Literature. In CAiSE’06: Proceedings of the 18th Conference on Advanced Information Systems Engineering. Berlin and Heidelberg: Springer, vol. 6. [Google Scholar]

- Sirisomboonsuk, Pinyarat, Vicky Ching Gu, Ray Qing Cao, and James R. Burns. 2018. Relationships between project governance and information technology governance and their impact on project performance. International Journal of Project Management 36: 287–300. [Google Scholar] [CrossRef]

- Soliman, Mohammed, and Ahmed Hamdy Mohamed Zaky. 2017. The Mediating Role of IT Governance Effectiveness between ITG and Financial/Non-Financial Performance: Empirical Research on Egyptian Banking Sector. Non-Financial Performance: Empirical Research on Egyptian Banking Sector, February 7. [Google Scholar]

- Tanriverdi, Hüseyin. 2005. Information Technology Relatedness, Knowledge Management Capability, and Performance of multibusiness Firms. MIS Quarterly 29: 311–34. [Google Scholar] [CrossRef]

- The US Department of Justice. 2010. Horizontal Merger Guidelines. Available online: https://www.justice.gov/atr/horizontal-merger-guidelines-08192010#5c (accessed on 3 March 2023).

- Tian, Lin, Liang Han, and Biao Mi. 2020. Bank competition, information specialization and innovation. Review of Quantitative Finance and Accounting 54: 1011–35. [Google Scholar] [CrossRef]

- Van Grembergen, Wim, and Steven De Haes. 2005. Measuring and Improving IT Governance through the Balanced Scorecard. Information Systems Control Journal 2: 35–42. [Google Scholar]

- Venkatraman, Nenkat. 1989. The concept of fit in strategy research: Toward verbal and statistical correspondence. Academy of Management Review 14: 423–44. [Google Scholar] [CrossRef]

- Wadi, Rami Mohammad Abu, and Nahil Ismail Saqfalhait. 2016. Analysing the structure of the banking industry in Jordan. International Journal of Applied Business and Economic Research 14: 3663–76. [Google Scholar]

- Wallace, Sandra. 2013. Competition and Management Accounting Information and Control System Design: Survey of Australian Manufacturing and Service Organisations. Working Paper. Douglas: College of Business, Law and Governance, SSRN 2132763. [Google Scholar]

- Weill, P. 2004. Don’t Just Lead, Govern: How Top-Performing Firms Govern IT. MIS Quarterly Executive 3: 1–17. [Google Scholar]

- Weill, Peter, and Francisco Gonzalez-Meza Hoffmann. 2007. Banknorth: Designing IT Governance for a Growth-Oriented Business Evironment. MIT Sloan School of Management Working Paper 4526-04 Center for Information Systems Research 350. Available online: https://dspace.mit.edu/handle/1721.1/37282 (accessed on 3 March 2023).

- Weill, Peter, and Jeanne W. Ross. 2004. IT Governance: How Top Performers Manage IT Decision Rights for Superior Results. Boston: Harvard Business School. [Google Scholar]

- Wibowo, Buddi. 2017. Banking Competition Measurement and Banking Sector Performance: Analysis of 4 ASEAN Countries. Signifikan: Jurnal Ilmu Ekonomi 6: 1–28. [Google Scholar] [CrossRef]

- Wilkin, Carla L., and Robert H. Chenhall. 2010. A Review of IT Governance: A Taxonomy to Inform Accounting Information Systems. Journal of Information Systems 24: 107–46. [Google Scholar] [CrossRef]

- Wu, Shelly Ping-Ju, Detmar W. Straub, and Ting-Peng Liang. 2015. How Information Technology Governance Mechanisms and Strategic Alignment Influence Organizational Performance: Insights from a Matched Survey of Business and IT Managers. MIS Quarterly 39: 497–518. [Google Scholar] [CrossRef]

- Zhang, Peiqin, Kexin Zhao, and Ram L. Kumar. 2016. Impact of IT governance and IT capability on firm performance. Information Systems Management 33: 357–73. [Google Scholar] [CrossRef]

- Zhouhua, Valliappan Raju. 2021. Strategic Literature Review on contingency factors and bank performance in China. The International Journal of Business Management and Technology 5: 135–44. [Google Scholar]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).