4.1. Structure of Raw Material Potential for Biogas Production

Biogas products are naturally produced through the direct use of various energy products. The economic investment is a massive investment in the biogas sector, providing a favorable investment environment for investors. In addition, the economic feasibility of projects depends on the prices of traditional energy sources and the cost of raw materials.

Regulatory barriers include complicated licensing and insufficient government support, which hinders the development of the sector. Technological limitations are related to the efficiency of technologies and the variability of the composition of raw materials; it is necessary to create an infrastructure for the integrated transfer of biogas to the energy system and ensure the environmentally safe use of digestate. Unlike addressing these risks, a comprehensive approach includes government support, rationalizing regulations, encouraging innovation, and raising awareness of the benefits of biogas.

However, it should be noted that, unlike the European Union, the system of separate collection and disposal of waste in Ukraine is poorly developed, which may affect the vision of the European Union as a source of biogas with energy independence.

This prevents the efficient use of waste as a feedstock for biogas production. Waste disposal in Ukraine is widespread and inefficient, and the transition to biogas production requires waste management and investment changes. Economic problems include insufficient studies of the economic feasibility of investments, failure to take into account the state of the infrastructure for biogas integration, high equipment costs, lack of government support, and low awareness of the benefits of biogas.

Technological challenges include the absence of a comparative analysis of different biogas production technologies. Other factors, such as the need to improve preferential tariff policies and attract significant financial resources, are also important. These challenges may slow down the development of the biogas industry in Ukraine and its integration into the European energy market.

Bioenergy development contributes to realizing opportunities for agrarian countries to become food producers and energy carriers. Crops, animal husbandry, and the food industry generate large volumes of waste, which can be used as raw materials for biogas and/or biomethane production. A well-developed agro-industrial complex infrastructure and agriculture and food industry infrastructure can be adapted to produce this type of biofuel. At the same time, biogas production at the local level can contribute to regional energy independence and reduce the load on centralized energy systems. Ukraine has significant potential for biogas production as the country has diverse sources of organic raw materials suitable for this purpose. Among the main types of raw materials, the following can be distinguished:

Organic waste residues of agricultural production (hay, crop residues of crops), food waste in the form of food scraps from households, grocery store chains, and markets, and the organic part of municipal waste that ends up in landfills.

Plant biomass is certain types of plants which, due to their high content of organic matter, can serve as a source of biogas. Energy crops such as corn, sorghum, and energy willow are promising.

Animal waste, manure, slurry, and other animal wastes generated on farms and agricultural enterprises can also be effectively processed into biogas.

Industrial organic waste is food industry waste (expired food products, non-standard goods) or organic waste from the main activities of agricultural enterprises.

Clean biological waste comes from forest park areas and gardens and vegetation residues from urban areas that require disposal (

Figure 2).

To ensure efficient biogas production at large plants, we researched different types of organic raw materials, systematically summarizing data on biogas yield and considering their composition and properties. The analysis results (

Table 2) showed that the optimal substrate combines molasses, chicken manure, and corn silage or crop residues.

Biogas production from organic waste is a promising direction for the development of renewable energy in Ukraine, which contributes to reducing dependence on traditional fuels, improving the environment, and developing agriculture.

The economic feasibility of biogas production is determined not only by output volumes but also by economic factors such as raw material costs, investment expenses, and energy prices. In Ukraine, unlike EU countries, there are certain challenges, including insufficiently developed infrastructure for waste collection and processing, which can increase the cost of biogas production. To successfully implement projects, it is necessary to create favorable economic conditions and attract investment.

A biogas project was successfully implemented in Ukraine at “Yuzefo-Mykolaivska BGC” LLC, where a sugar factory was modernized and efficient biogas and organic fertilizer (digestate) production was established (

Table 3).

The results of this enterprise’s operation, in particular the technical and economic indicators of the Yuzefo-Mykolaivka biogas plant with a capacity of 2445 MW per year (commissioned in 2021), with an average annual biogas production volume of over 1.02 million m3, are noteworthy.

Modern equipment of the studied enterprise can produce 2800 m3 of biogas, which ensures the generation of 5200 kW/h of electricity. At the same time, electricity consumption does not exceed 150 kW under 80% loads. The annual volume of digestate produced is 100 thousand tons.

4.2. Experience in Implementing Projects in the Field of Biogas Production and Processing

At the same time, there is the experience of successful cases of biogas production from crop production waste of LLC “RISE-SHID” in the Myrhorod district, Poltava region, where 71% of all arable land is allocated for corn and the remaining 29% for industrial crops. The use of practical research of this enterprise in biogas production made it possible to assess the potential for biogas production from crop residues of the primary crop production [

29].

According to the data in

Table 4, it can be stated that the potential for biogas production from crop residues of grain crops in Ukraine during 2021–2023 decreased only due to the loss of a significant part of the territories as a result of military operations and amounted theoretically to more than 32 billion m

3, including 8.2 billion m

3 of corn. Based on the needs of agriculture for straw and bedding for cattle, the practical potential will be 80% of the theoretical potential (24 billion m

3).

Analysis of

Table 4 demonstrates that the calculation of biogas potential from crop residues of grain crops in Ukraine is performed through the sequential multiplication of indicators: sown areas, estimated dry matter yield per hectare, the proportion of organic matter in this mass, and the biogas yield coefficient per ton of organic dry matter. Individual coefficients are used for corn, which differs from the averaged indicators for general grains, notably a higher biogas yield coefficient per unit of organic dry matter. The projected biogas yield per hectare is the result of this complex multiplication. The total potential biogas production volume is determined as the sum of the potential obtained from all grain crops, including corn, taking into account their respective sown areas. A direct correlation is observed between the dynamics of the total biogas production potential and changes in sown areas during 2021–2023, which is attributed to the occupation of part of Ukrainian territories.

At the same time, it should be noted that there are examples of biogas plants of significantly greater capacity in the EU, which indicates the leadership of the European Union countries in developing biogas production on the continent (

Table 5) [

33]. In 2023, 59 bio-LNG production plants were operating in Europe; a significant increase in their number is expected during 2024–2027.

The construction of 134 plants is planned to be completed by 2027. Based only on confirmed projects, the projected bio-LNG production capacity by 2027 is 21.1 TWh per year.

According to estimates by the European Biogas Association, in 2030, Europe will potentially be able to produce 40 billion m

3 of biomethane, and in 2040—already 111 billion m

3, of which 101 billion will be in the EU [

35]. Considering Ukraine’s potential of 33 billion m

3, the total potential of the EU will be more than 144 billion m

3 of biogas, which will make it possible to shorten the timeline for the implementation of the European Green Deal to 2048.

The calculated energy potentials indicate the possibility for Ukraine to partially meet its own energy needs and contribute to the transition to a low-carbon economy. Correspondingly, the actual yield of biogas may vary depending on the type and storage of raw materials, the efficiency of processing technology, and other factors. Therefore, the possibility of collapsing biogas production must be considered when planning the project. Animal waste in Ukraine is a valuable resource for biomethane production, the potential of which is estimated at 9.59 billion m3.

Considering the trend towards increasing yields and the development of technologies, this will contribute to strengthening the country’s energy security.

Table 6 shows the biomethane potential from livestock waste in 2023.

For each animal type (cattle, pigs, poultry), the daily biogas production per head is calculated by multiplying it by their population. The resulting biogas potential is converted to biomethane equivalent using a coefficient of 0.6. The total biomethane potential amounts to 9.59 billion m3. The calculation is based on average indicators and the total livestock population.

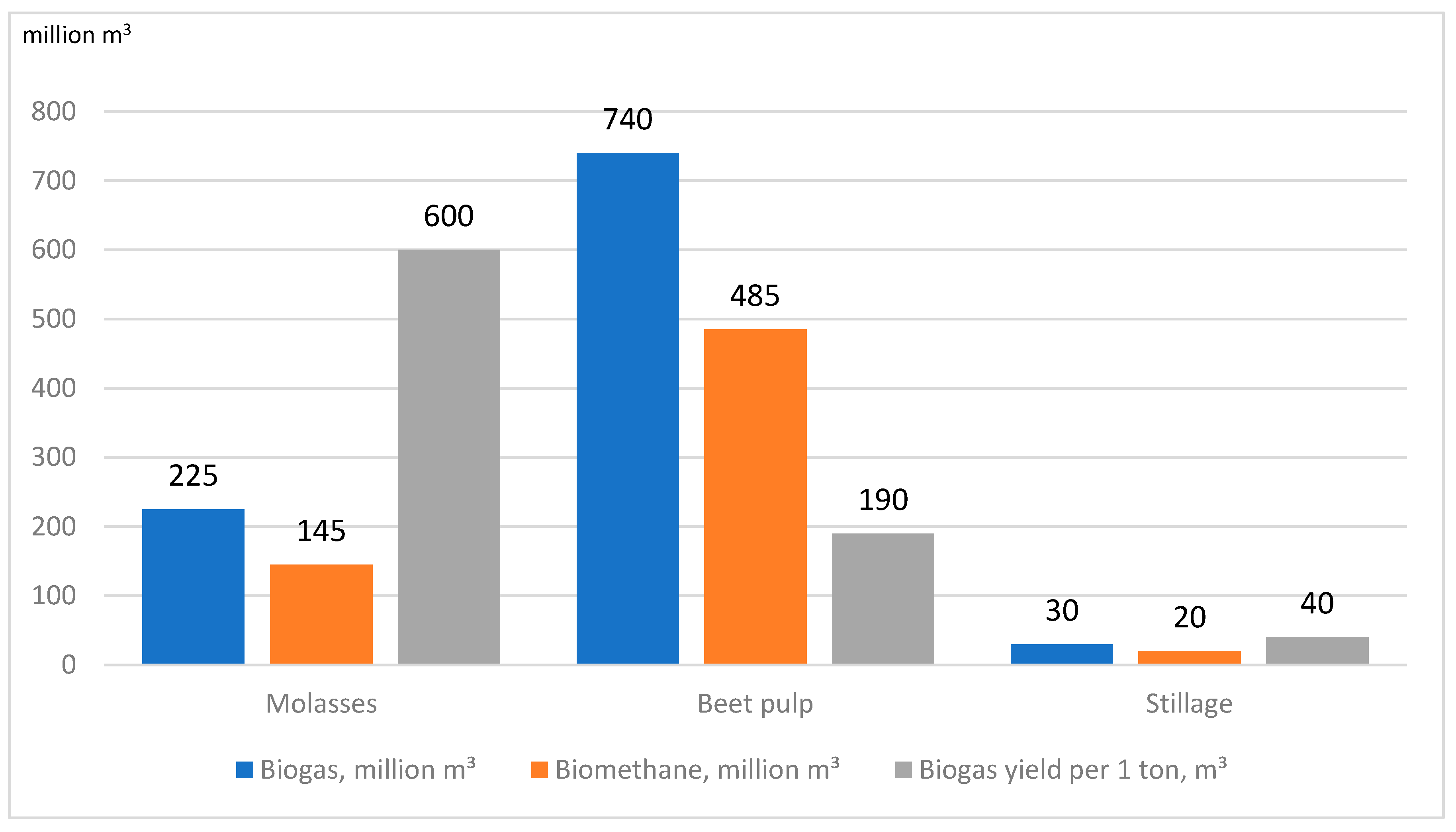

The raw material potential of the processing industry of the agro-industrial complex in Ukraine is mainly based on molasses, beet pulp, and alcohol stillage. In terms of bio methane, this potential is estimated at 0.65 billion m

3, and the potential for biogas production is 1 billion m

3 (

Figure 3).

Thus, the total potential for biogas production from animal waste and agro-industrial processing enterprises is 10.59 billion m3 of biogas; this can be increased up to 34.59 billion m3 by using the organic fraction of crop residues from crop production, or in terms of biomethane, to 20.75 billion m3.

Investment opportunities in the context of a wartime economy limit biogas development in Ukraine and its integration into the EU energy market. Instability or insufficient government support, difficulties in attracting domestic and foreign investment due to high risks and economic uncertainty may also hinder progress. The destruction of infrastructure, logistical problems, and competition from other, possibly cheaper, energy sources pose additional obstacles. Limited domestic demand for biomethane may also reduce the economic attractiveness of large-scale projects. Ukraine’s economic realities differ significantly from those of the European Union. High levels of risk, difficulty in accessing financing, weak infrastructure, high energy intensity of the economy and a diverse regulatory environment pose additional challenges to successfully integrating Ukraine’s biogas sector into the EU’s energy sector.

4.3. Challenges and Prospects for Biogas and Electricity Production

At the same time, it should be indicated that when 1 m

3 of gas is burned, 0.72 kg of CO

2 is generated, while in the production of biomethane, this figure will be zero since this volume of carbon dioxide is released during the decomposition of waste, that is, the use of biogas will make it possible to reduce CO

2 emissions by 3.98 billion m

3 [

36,

37,

38].

In the context of European integration processes in Ukraine, organic waste has a significant potential to provide partial energy to a single European energy space [

39].

As part of the green transition, technological improvements are constantly being made to increase biogas production, especially in future-oriented research, and measures are being taken, including decarbonizing the economy and switching to sustainable energy [

34]. Developing renewable energy sources, particularly biogas, is a key area of the European Green Deal [

35]. In support of the development of biogas production through European investments, in addition to the relatively lower cost of production than in the EU, the use of biogas boilers for heating buildings makes it possible to obtain a return on investment of 4–5% higher than when using traditional gas boilers [

40]. At the same time, there are several problems with the development of biogas production in Ukraine, namely the high cost of equipment, construction of biogas plants, and relevant investments in new technologies, which are significant and require state support.

However, there is no clear state policy in renewable energy sources; that is, there is an insufficiently developed regulatory framework and a lack of incentives for investment in biogas production. This is relevant in military agribusiness, where energy sustainability is critical with strategic marketing [

41] and management to ensure sustainability, fiscal regulation, and energy marketing in promoting energy efficiency [

42].

It should be noted that nowadays, there is a low awareness of the benefits of biogas; that is, farmers and other stakeholders are insufficiently informed about the possibilities of using biogas. The ways to solve these problems are as follows: the development and implementation of state programs to support bioenergy by creating incentives for investment in biogas projects, for example, through tax incentives, green tariffs, and state guarantees; creation of an effective system for the collection and processing of organic waste; development of scientific research in the field of bioenergy by developing technologies and universal substrates for biogas production and expanding the range of its application; popularization of the benefits of biogas among farmers, entrepreneurs, and the public; and cooperation with international organizations in the field of exchange of experience in the production of this energy carrier and investments for the development of bioenergy in Ukraine (

Table 7).

The production of biogas by agricultural processing enterprises could increase the production volumes in Ukraine. The implementation of the European Green Deal creates favorable conditions for the development of this direction. If an effective state policy is implemented and investments attracted, Ukraine could become one of the leaders in European biogas production.

Traditionally, biogas is used for electricity generation. However, the decrease in purchase prices for electricity from Renewable Energy Sources (RESs) is forcing the search for more efficient ways to use this resource. A significant portion of the thermal energy generated during biogas combustion was lost. Therefore, creating complexes based on powerful sugar factories to produce sugar, biogas, and alcohol is proposed. This will ensure more efficient use of resources and the creation of a closed production cycle. Biogas production is associated with significant formation of carbon dioxide, which is environmentally harmful. One way to solve this problem is to purify biogas from CO2 for further use.

Biogas purified to 96% methane content, known as biomethane, can be transported through existing gas transportation systems without modernization. It is worth noting that although “green” hydrogen is a promising direction for energy development, biomethane has advantages such as a notably higher energy density and the readiness of existing infrastructure for its use. In addition, the current cost of biomethane is lower than that of “green” hydrogen, making it more competitive in the market.

4.4. Prospects for Creating Bioenergy Clusters Based on Agricultural Processing Enterprises

The current market demonstrates that biomethane is economically competitive with green hydrogen. The average price of green hydrogen is approximately USD 7 per kilogram, with projected reductions of USD 3 per kilogram by 2030, and USD 2 per kilogram by 2050. Conversely, biomethane is currently priced at an average of USD 900 per 1000 cubic meters, with forecasts indicating a decrease to USD 850 per 1000 cubic meters by 2030, USD 600 per 1000 cubic meters by 2050, and potentially USD 500 per 1000 cubic meters in the future [

43].

The next step is biogas production through the anaerobic digestion of biomass (waste from agricultural enterprises). The biogas produced, which is rich in methane, is used to generate electricity and heat in cogeneration units. This process provides the cluster with energy and allows the sale of surplus electricity at a “green” tariff, generating additional income. Biomass fermentation within bioenergy clusters produces energy and digestates, which are nutrient-dense residues. This digestate is then transformed into valuable biofertilizers suitable for internal or external sales.

The economic viability of these clusters is driven by income from energy and fertilizer sales coupled with savings in energy and mineral fertilizer purchases. Furthermore, these clusters offer significant environmental benefits by reducing emissions, processing organic waste, and improving soil quality. The development of bioenergy clusters is an important step towards energy independence for Ukraine and the EU, as well as the sustainable development of the agricultural sector. Their implementation contributes to creating new jobs, attracting investment, and developing innovative technologies. In EU countries, this is a promising platform due to sustainable access to biomass, support at the EU level, and the development of the local economy within the ‘green transition’ policy framework. There is a developed infrastructure and proximity to sources of raw materials, which contributes to the efficient processing of biomass into energy and the development of the regional economy.

The functioning of such clusters offers significant environmental benefits, including reduced greenhouse gas emissions, waste recycling, renewable energy generation, and organic fertilizers, as well as economic benefits, such as lower energy costs and additional income from biofertilizer sales. The most promising direction is the integrated use of biomethane and electricity generated from biogas. The following measures are proposed to improve their efficiency at sugar factories:

Construction of biogas plants (it is necessary to build biogas plants and installations for biogas production and its conversion into electricity near sugar factories);

Conversion of biogas into biomethane;

Sale of biomethane and electricity (injecting biomethane produced by the biogas plant into the gas transportation system and selling electricity at a “green tariff”).

Based on the research conducted, we have systematized the functions of the main participants of the relevant entities (

Table 8).

It is proposed that regional bioenergy clusters be created to optimize the production and production of biogas, which will unite various companies and organizations. Such an approach could result in a more efficient use of resources, a lesser drain on waste, and a reduction in additional economic benefits. It is important to note that the cluster model is already being successfully developed in the EU, and its potential effectiveness is evident in Ukraine.

It should be noted that agricultural processing enterprises are the central link of the cluster, ensuring the collection, sorting, and primary processing of organic waste (production waste, plant residues). They have access to significant volumes of biomass, necessary infrastructure, and experience processing agricultural products.

Municipalities can implement MSW collection and sorting systems for biogas feedstock to address the challenges in organic waste management. Concurrently, agricultural enterprises are vital suppliers of organic raw materials such as manure and crop residues for biogas production.

A corresponding matrix was formed to establish the interaction between the participants in the relevant clusters.

Table 9 visually demonstrates the complex and interconnected system in which each participant uniquely creates and functions within the cluster. It systematizes the key connections and functions between various entities such as agricultural processing enterprises, territorial communities, agricultural enterprises, biogas plants, cogeneration units, sorting factories, and biofertilizer processing plants. The matrix shows that agricultural processing enterprises are the central link, as they are responsible for the collection, sorting, and primary processing of organic waste, receiving raw materials from both agricultural enterprises and the territorial community (the organic fraction of MSW).

The raw materials were then transferred to a biogas plant for biogas production. In addition to supplying organic waste, the territorial community is also interested in consuming the energy produced from biogas and using biofertilizers. Agricultural enterprises, in turn, are suppliers of raw materials and consumers of energy and biofertilizers, making them direct beneficiaries of the functioning of the cluster. The role of the biogas plant is to process the received raw materials into biogas, and the cogeneration unit converts biogas into electricity and heat. Both these elements are critical for ensuring the energy efficiency and independence of the cluster.

The sorting factory, which sorts MSW, and the biofertilizer processing plant, which converts digestate into valuable fertilizers, complete the cycle, ensuring comprehensive and environmentally sound resource processing. Thus, the interaction matrix demonstrates that each cluster participant is an important part of a unified mechanism to achieve the common goal of sustainable development and the region’s energy independence (community, municipality). It is advisable to build a relevant interaction matrix to determine the priorities for developing cooperation between cluster participants (

Table 10). The bioenergy cluster, depicted on the heat map matrix, is a complex and interconnected system where each participant plays a unique role.

Agricultural processing enterprises are the central link in the cluster, as they are responsible for the collection, sorting, and primary processing of organic waste, receiving raw materials from both agricultural enterprises and the local authority (organic fraction of MSW). They then transfer this raw material to the biogas plant for biogas production.

Thus, the interaction matrix demonstrates that each cluster participant is an important part of a unified mechanism to achieve sustainable development and the region’s energy independence (municipality). The development of biogas and biomethane production in Ukraine is contingent upon the modernization of agricultural enterprises, with sugar factories being a critical focus. The EU’s introduction of a tax on imports of products manufactured using “dirty” energy, which took effect in 2023, will be a significant driver for this modernization. This tax will particularly impact metallurgical plants, incentivizing them to switch to biomethane to enhance their competitiveness. In the early stages, a substantial portion of the produced biomethane is anticipated to be exported to EU countries, where market conditions are favorable.

However, as the Ukrainian economy develops and domestic demand for biomethane increases, a corresponding rise in its consumption within the national market is expected.

Currently, the first batches of biomethane arrive from Ukraine; in February 2025, the Energy Customs (processed) export the first 2 million m

3 of biomethane [

42]. Considering the potential for biomethane production at the level of 20.75 billion m

3, taking into account the level of domestic consumption at 19 billion m

3 and domestic natural gas production at 18 billion m

3, the total export of biomethane could amount to 19.75 billion m

3 [

44]. This becomes a significant source because, for further development of gas condensate fields, there may be various technical, technological, and economic limitations to ensure more stable and long-term production of hydrocarbons. Therefore, the processing of agro-waste additionally expands the resource base for producing biomethane and other alternative energy sources in Ukraine [

45].

Despite the current gas consumption volumes in the EU, which reach 412 billion m

3, the projected biomethane production by 2050, which amounts to 165 billion m

3, opens up significant prospects. This could cover up to 40% of current gas needs. Considering the expected decrease in overall gas demand to 271 billion m

3 by 2050, biomethane could cover up to 61% of this demand. Furthermore, Ukraine’s integration into the EU will allow it to provide 5–6% of the EU’s biomethane needs [

46].

An alternative path is biogas processing at Ukrainian biogas plants, which will make obtaining 2–2.5 kW of electricity, meaning that the total potential ranges from 69,180,000 MW to 86,475,000 MW.

Regulating the volume of biomethane and electricity exports produced from biogas is advisable according to the price situation. For example, in the summer months, it is expedient to process biogas and export electricity to the EU’s unified energy system. Simultaneously, in winter, it is expedient to export biomethane. It should be noted that investments in constructing and launching a biomethane production plant with a capacity of 3 million m

3/year amount to about 6 million euros. Considering biogas and electricity prices, the respective projects pay off within 4 years [

47,

48]. It is important to note that biogas plants created based on sugar factories can also process other types of agro-industrial raw materials such as straw, cattle manure, and stillage. This will ensure full capacity utilization of biogas plants that can be used in agriculture.

Developing bioenergy clusters is important for energy independence and sustainable agricultural development in Ukraine and the EU. Their implementation contributes to the creation of new jobs, attracting investment and developing innovative technologies. However, there are some differences in the operating conditions of the clusters in Ukraine and the EU. In Ukraine, it is necessary to focus on infrastructure development, attract investment, and create a favorable regulatory environment. In the EU, where infrastructure is more developed, the emphasis shifts to the use of advanced technologies, diversification of the raw material base, and integration with other sectors of the economy.

Despite these differences, bioenergy clusters have significant potential for development in both Ukraine and the EU. Joint efforts and exchanges of experience between countries will contribute to the successful implementation of this model and the achievement of positive results in energy security, sustainable agricultural development, and environmental protection.

At the same time, it should be noted that biogas production has a significant positive impact on the environment due to the reduction in greenhouse gas emissions through the utilization of organic waste (agricultural, food, municipal), preventing it from entering landfills, and the production of valuable organic fertilizer—digestate, which reduces the need for chemical fertilizers; the development of bioenergy clusters promotes the integrated and sustainable use of local resources, strengthening the country’s energy security and contributing to the decarbonization of the economy within the framework of the European Green Deal.

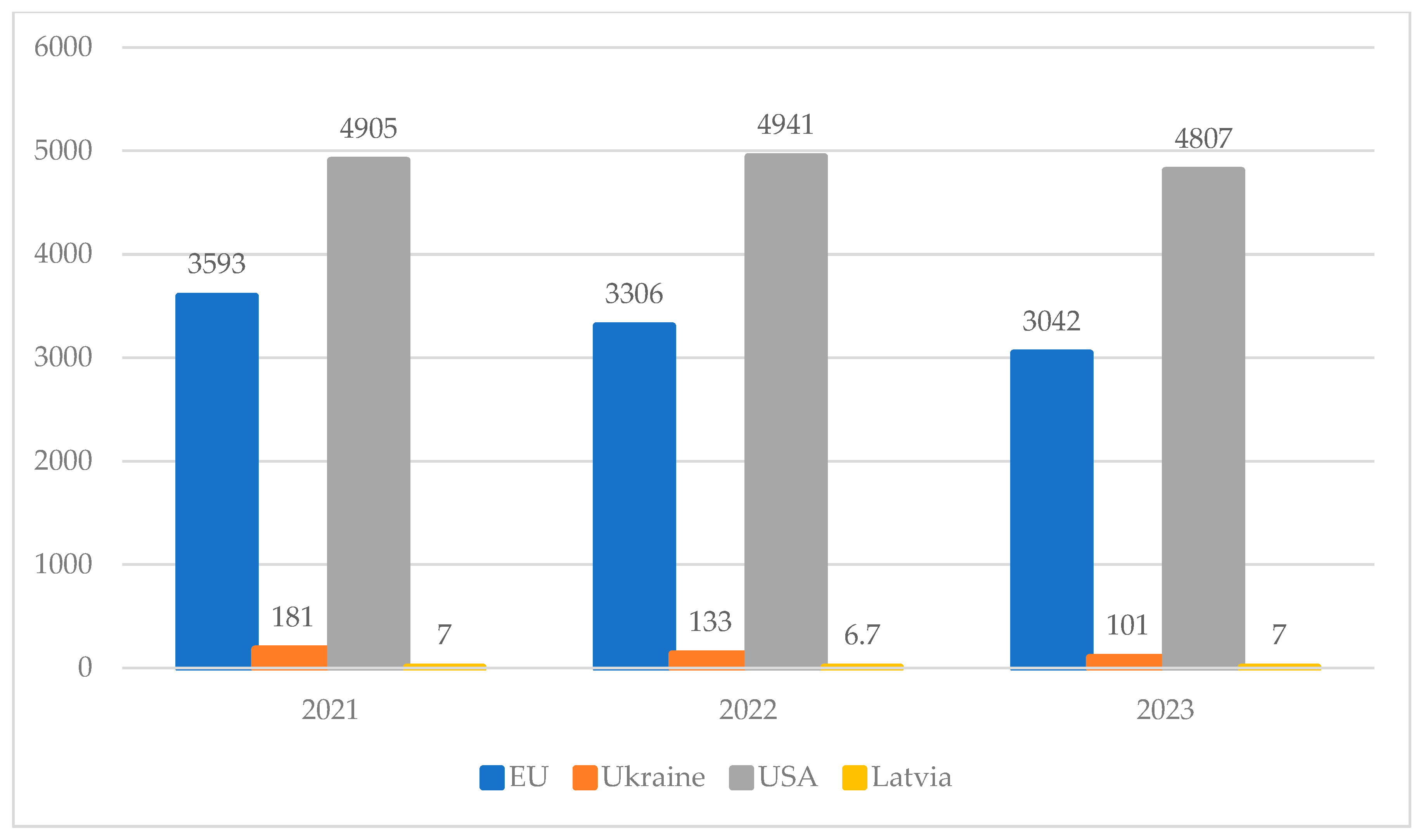

Given the significant volumes of carbon dioxide formation in the EU and the USA, the trend of reducing greenhouse gas emissions in the EU is confirmed by the use of alternative energy sources on the continent (

Figure 4).

Creating territorial biogas clusters based on agricultural processing enterprises is an important step towards ensuring energy security for Ukraine and the EU. This mechanism will help reduce dependence on energy imports, diversify energy sources, achieve climate goals, and develop renewable energy. In addition, the development of bioenergy clusters will contribute to the sustainable development of agriculture, creation of new jobs, and attraction of investment.

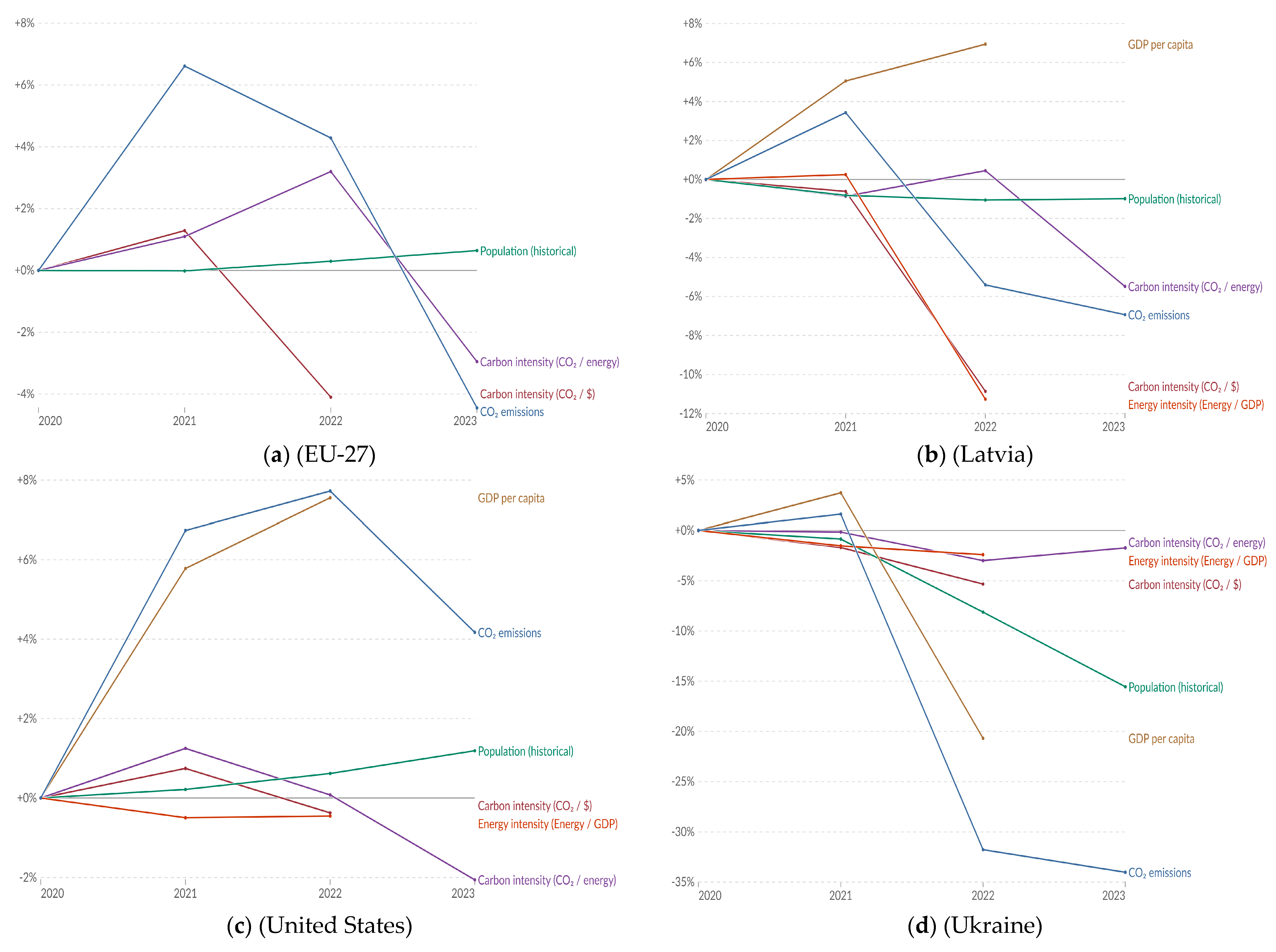

The analysis compared Ukraine, the European Union (27 countries), the United States, and Latvia for 2020–2023 (

Figure 5). The primary focus was on annual CO

2 emissions, population, GDP per capita, and specific emissions per capita. Ukraine shows a steady decline in absolute CO

2 emissions (from ~207 million tons in 2020 to ~136 million tons in 2023) and CO

2 emissions per capita (from 4.63 tons/capita to 3.62 tons/capita). However, the reduction in emissions is accompanied by a decrease in GDP per capita and population, indicating possible consequences of the economic and military crisis.

Despite a constant population, the European Union also shows a downward trend in CO2 emissions per capita (from 5.87 to 5.57 tons per capita). This may indicate progress in energy transition and decarbonization. The leader in specific emissions (more than 14 tons per capita) remains the United States due to high energy consumption and GDP per capita, despite a slight decrease in emissions in 2023.

Latvia has relatively low CO2 emissions per capita (~3.5 tons per capita) while maintaining a moderately high GDP per capita. This indicates balanced development that takes into account environmental sustainability.

Overall, the data show a need to strengthen public policies in favor of low-carbon development, especially in countries with high emissions and/or suffering from economic instability.