Green Banking Practices, Opportunities, and Challenges for Banks: A Systematic Review

Abstract

1. Introduction

- RQ1:

- What are the most prevalent green banking practices banks are engaged in in response to the global challenge of climate change?

- RQ2:

- What are the most prevalent challenges banks encounter while implementing green banking or financing initiatives across diverse geographical contexts?

- RQ3:

- What are the key green banking and financing opportunities available to commercial banks arising from climate change and how do these opportunities vary across regions?

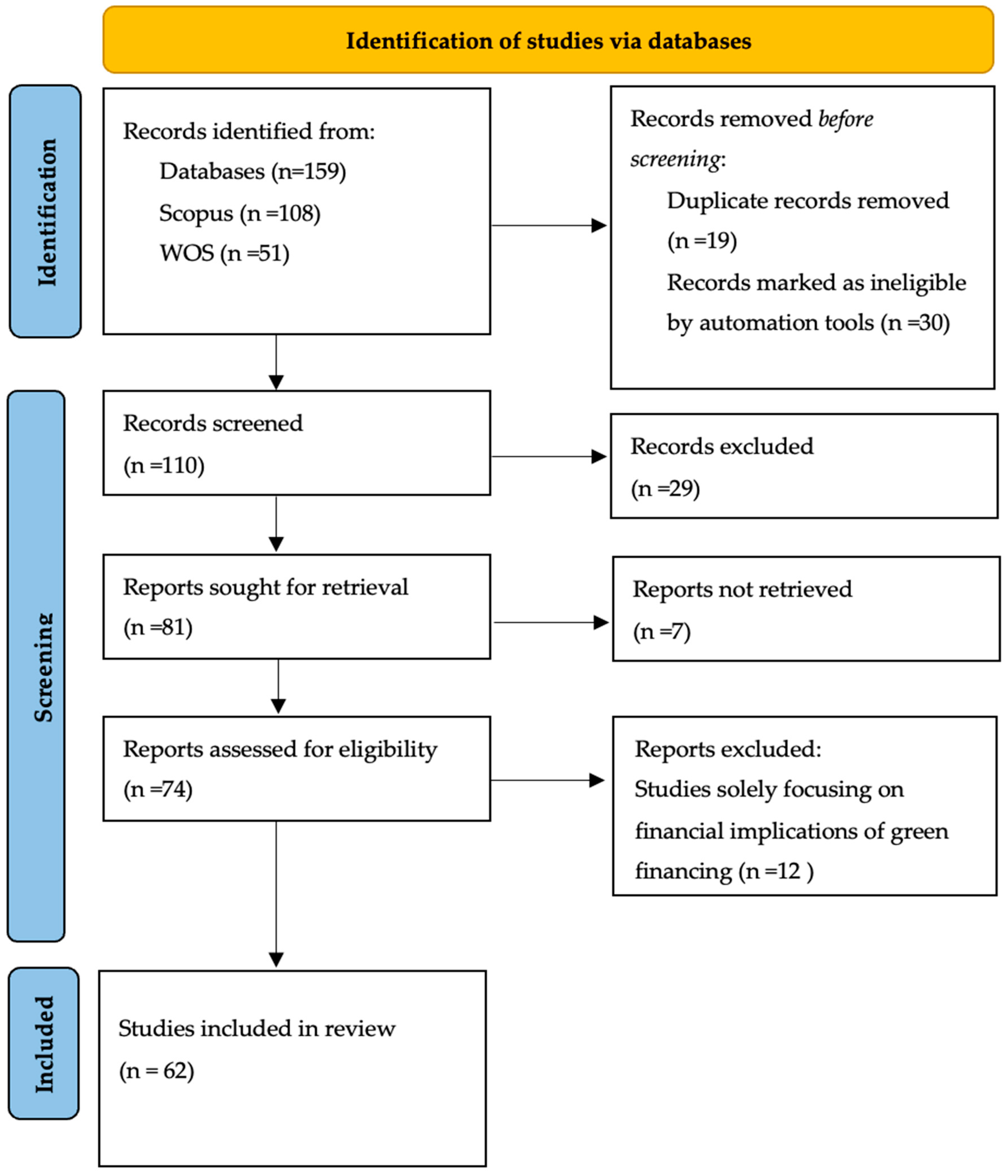

2. Materials and Methods

3. Results

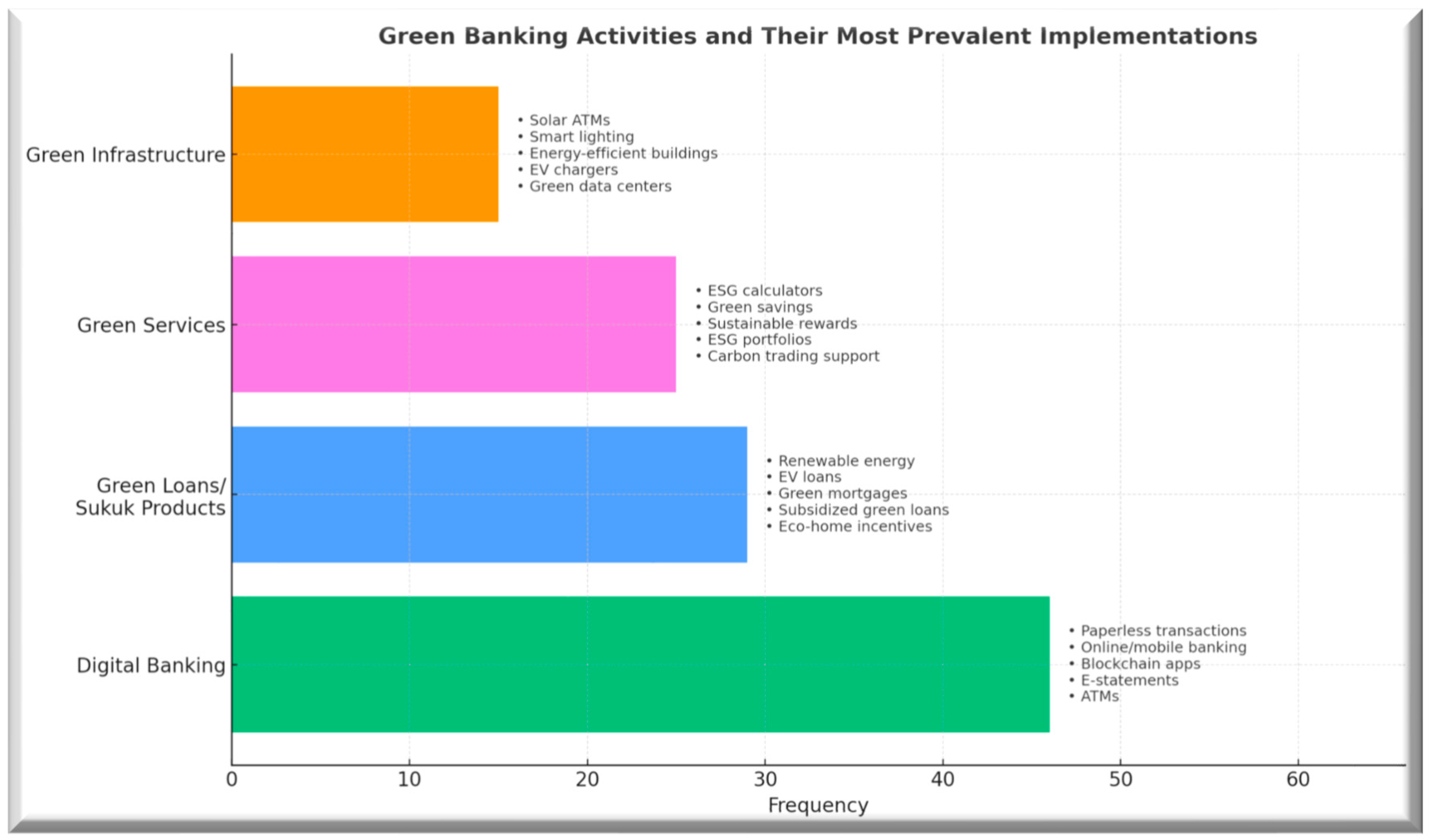

3.1. Most Prevalent Green Banking Activities

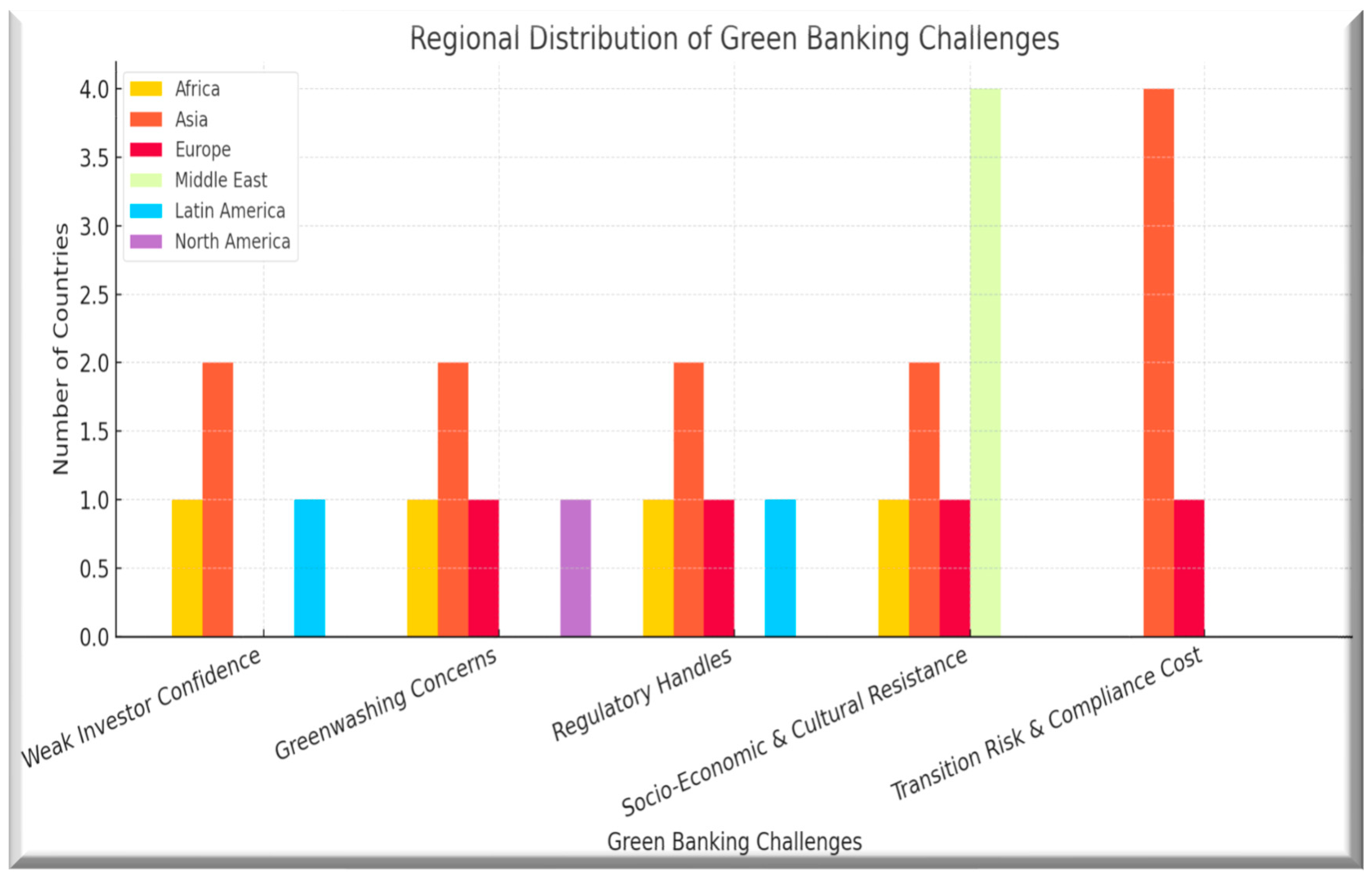

3.2. RQ2: Green Banking Challenges

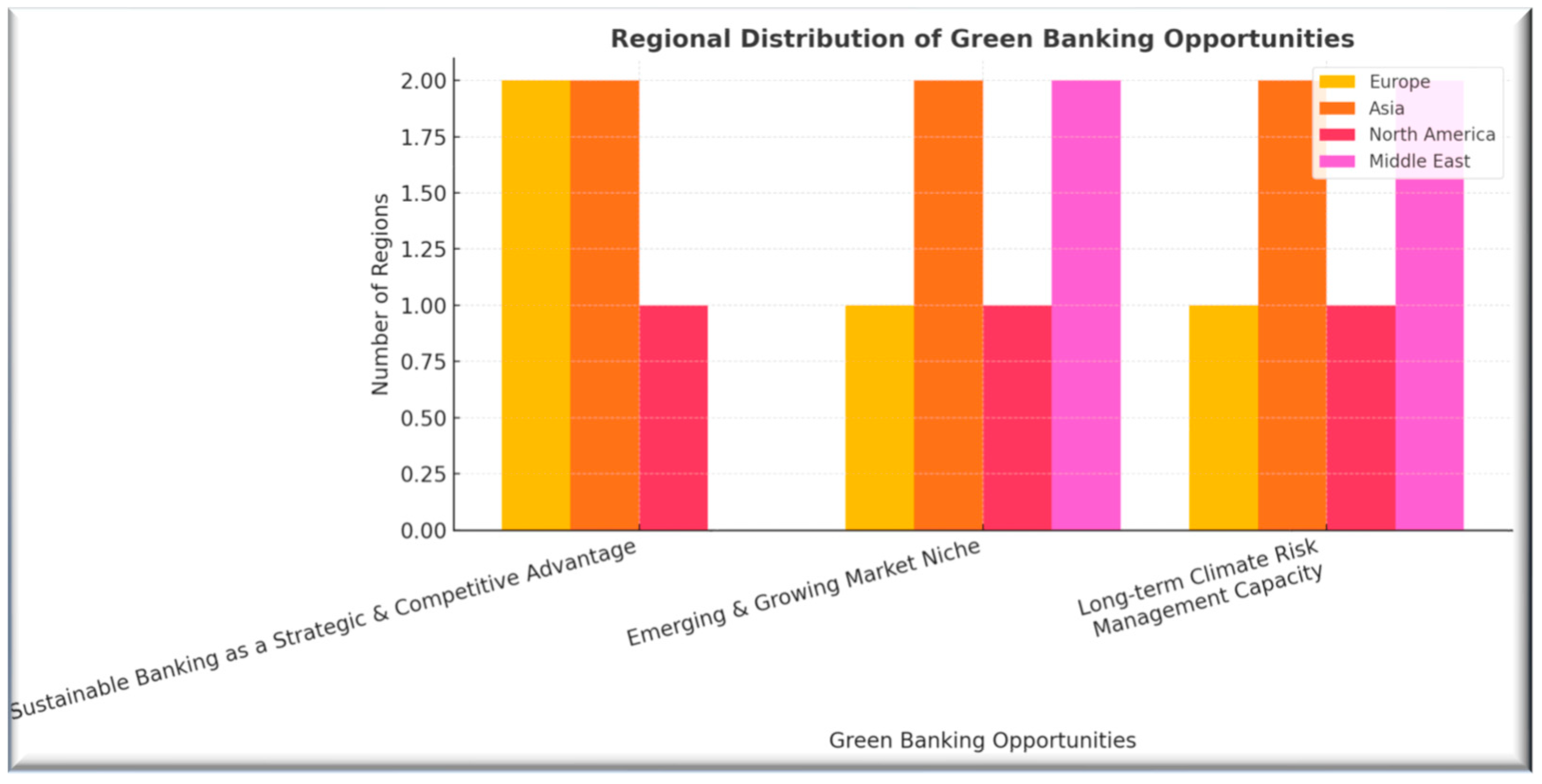

3.3. Green Banking Opportunities

4. Discussion

4.1. Green Banking Practices

4.2. Green Banking Challenges

4.3. Green Banking Opportunities

5. Conclusions, Recommendations, and Limitations

5.1. Conclusions

5.2. Implications

5.3. Limitations and Recommendations

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Risal, N.; Joshi, S.K. Measuring Green Banking Practices on Bank’s Environmental Performance: Empirical Evidence from Kathmandu valley. J. Bus. Soc. Sci. 2018, 2, 44–56. [Google Scholar] [CrossRef]

- Chen, Y.-C.; Lin, T.-Y.; Chiu, Y.-H.; Yang, C.-I. An exploration of operational efficiency, market efficiency, and sustainable development in the banking industry. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 4819–4848. [Google Scholar] [CrossRef]

- Anjalidevi, S.; Sreedevi, R.S.; Harikrishnan, R.; Shivdas, A. Green Banking Awareness: A Study on Tier 3 Locations—With Special Reference to Kerala. In Lecture Notes in Networks and Systems (LNNS); Springer: Singapore, 2024; Volume 997, pp. 581–597. [Google Scholar] [CrossRef]

- Begum, N.; Bhuiyan, M.M.I.; Hashmi, N.; Sadhu, N.K.; Imran, M.A.; Rahid, A.O.; Ahmed, I. Green banking: An indispensable step for the bank to save our environment. Am. Int. J. Bus. Manag. Stud. 2021, 3, 1–11. [Google Scholar] [CrossRef]

- Sharma, S.; Gupta, C.; Khanna Malhotra, R.; Upreti, H. Sustainable Banking Practices: Impact, challenges and opportunities. Presented at the E3S Web of Conferences, Barcelona, Spain, 25–27 June 2024. [Google Scholar]

- Khan, Y.; Szegedi, K. The concept of green banking in Pakistan. Sarhad J. Manag. Sci. 2019, 5, 357–367. [Google Scholar]

- Park, H.; Kim, J.D. Transition towards green banking: Role of financial regulators and financial institutions. Asian J. Sustain. Soc. Responsib. 2020, 5, 5. [Google Scholar] [CrossRef]

- Nyikos, G.; Kondor, Z. The Involvement of National Development Banks in Promoting Sustainable Finance. Deturope 2022, 14, 147–163. [Google Scholar] [CrossRef]

- Shukla, S.S.; Bajpai, S.; Pankajam, A.; Gupta, A.; Veeraiah, V.; Pramanik, S.; Bag, S. The central bank of India as an example of the green revolution in the banking sector. In Recent Developments in Financial Management and Economics; IGI Global Scientific Publishing: Hershey, PA, USA, 2024; pp. 166–184. [Google Scholar]

- Mirza, S.S.; Xu, N.; Corbet, S.; Scrimgeour, F. Green innovation under financial and policy uncertainty: Evidence from China. Res. Int. Bus. Financ. 2025, 76, 102856. [Google Scholar] [CrossRef]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E.; et al. The PRISMA 2020 statement: An updated guideline for reporting systematic reviews. BMJ 2021, 372, n71. [Google Scholar] [CrossRef] [PubMed]

- Falagas, M.E.; Pitsouni, E.I.; Malietzis, G.A.; Pappas, G. Comparison of PubMed, Scopus, Web of Science, and Google Scholar: Strengths and weaknesses. FASEB J. 2008, 22, 338–342. [Google Scholar] [CrossRef]

- Lakner, Z.; Plasek, B.; Kasza, G.; Kiss, A.; Soós, S.; Temesi, Á. Towards Understanding the Food Consumer Behavior–Food Safety–Sustainability Triangle: A Bibliometric Approach. Sustainability 2021, 13, 12218. [Google Scholar] [CrossRef]

- Saeedi, M.; Ashraf, B.N. The Role of Technology in Promoting Green Finance: A Systematic Literature Survey and the Development of a Framework. J. Risk Financ. Manag. 2024, 17, 472. [Google Scholar] [CrossRef]

- Putri, P.I.; Rahayu, K.N.; Rahmayani, D.; Siregar, M.E.S. The Effect of Green Banking and Financial Performance on Banking Profitability. Calitatea 2022, 23, 38–44. [Google Scholar] [CrossRef]

- Shang, X.; Niu, H. Does the digital transformation of banks affect green credit? Financ. Res. Lett. 2023, 58, 104394. [Google Scholar] [CrossRef]

- Sutrisno, S.; Widarjono, A.; Hakim, A. The Role of Green Credit in Bank Profitability and Stability: A Case Study on Green Banking in Indonesia. Risks 2024, 12, 198. [Google Scholar] [CrossRef]

- Probojakti, W.; Utami, H.N.; Prasetya, A.; Riza, M.F. Building Sustainable Competitive Advantage in Banking through Organizational Agility. Sustainability 2024, 16, 8327. [Google Scholar] [CrossRef]

- Miah, M.D.; Rahman, S.M.; Mamoon, M. Green banking: The case of commercial banking sector in Oman. Environ. Dev. Sustain. 2021, 23, 2681–2697. [Google Scholar] [CrossRef]

- Yun, J.; Jin, S. The Degree of Big Data Technology Transformation and Green Operations in the Banking Sector. Systems 2024, 12, 135. [Google Scholar] [CrossRef]

- Mirza, N.; Afzal, A.; Umar, M.; Skare, M. The impact of green lending on banking performance: Evidence from SME credit portfolios in the BRIC. Econ. Anal. Policy 2023, 77, 843–850. [Google Scholar] [CrossRef]

- Salim, K.; Disli, M.; Ng, A.; Dewandaru, G.; Nkoba, M.A. The impact of sustainable banking practices on bank stability. Renew. Sustain. Energy Rev. 2023, 178, 113249. [Google Scholar] [CrossRef]

- Conlon, T.; Ding, R.; Huan, X.; Zhang, Z. Climate risk and financial stability: Evidence from syndicated lending. Eur. J. Financ. 2024, 30, 2001–2031. [Google Scholar] [CrossRef]

- Chalabi-Jabado, F.; Ziane, Y. Climate risks, financial performance and lending growth: Evidence from the banking industry. Technol. Forecast. Soc. Change 2024, 209, 123757. [Google Scholar] [CrossRef]

- Julia, T.; Rahman, M.P.; Kassim, S. Shariah compliance of green banking policy in Bangladesh. Humanomics 2016, 32, 390–404. [Google Scholar] [CrossRef]

- Ali, Q.; Parveen, S.; Senin, A.A.; Zaini, M.Z. Islamic bankers’ green behaviour for the growth of green banking in Malaysia. Int. J. Environ. Sustain. Dev. 2020, 19, 393–411. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Rashid, A.; Islam, S. What drives green banking disclosure? An institutional and corporate governance perspective. Asia Pac. J. Manag. 2018, 35, 501–527. [Google Scholar] [CrossRef]

- Rahman, S.; Moral, I.H.; Hassan, M.; Hossain, G.S.; Perveen, R. Review A systematic review of green finance in the banking industry: Perspectives from a developing country. Green Financ. 2022, 4, 347–363. [Google Scholar] [CrossRef]

- Faizi, F.; Kusuma, A.S.; Widodo, P. Islamic green finance: Mapping the climate funding landscape in Indonesia. Int. J. Ethics Syst. 2024, 40, 711–733. [Google Scholar] [CrossRef]

- Afridi, F.E.A.; Jan, S.; Ayaz, B.; Irfan, M. Green finance incentives: An empirical study of the Pakistan banking sector. Amazon. Investig. 2021, 10, 169–176. [Google Scholar] [CrossRef]

- Zehir, E. Green Banking: What Is Changing in the Banking Sector? Catak, C., Oner, M., Eds.; Peter Lang Gmbh: Berlin, Germany, 2023; pp. 129–145. ISBN 978-3-631-90581-4. [Google Scholar]

- Wang, Q.; Zhang, Y.; Li, Y.; Wang, P. ESG performance and green innovation in commercial banks: Evidence from China. PLoS ONE 2024, 19, e0308513. [Google Scholar] [CrossRef]

- Bedendo, M.; Nocera, G.; Siming, L. Greening the Financial Sector: Evidence from Bank Green Bonds. J. Bus. Ethics 2023, 188, 259–279. [Google Scholar] [CrossRef]

- Aslam, W.; Jawaid, S.T. Green banking adoption practices: The pathway of meeting sustainable goals. Environ. Dev. Sustain. 2025, 27, 1015–1040. [Google Scholar] [CrossRef]

- Singh, N.; Vaish, A. Digital Banking and Gig Workers’ Green Behaviour: The Intervening Role of Financial Inclusion and Sustainable Bank Initiatives. Eng. Econ. 2024, 35, 535–548. [Google Scholar] [CrossRef]

- Lapinskiene, G.; Danileviciene, I. Assessment of Green Banking Performance. Sustainability 2023, 15, 14769. [Google Scholar] [CrossRef]

- Development of Islamic Banks by Creating Islamic Branding: Challenges, Importance, and Strategies of Islamic Branding. Int. J. Sustain. Dev. Plan. 2024, 19, 637–650. [CrossRef]

- Tyagi, S.; Gupta, A.; Ansari, N. Adoption and perception of banking customers towards green mode of banking: A demonstration of structural equation modelling. J. Financ. Serv. Mark. 2024, 29, 826–842. [Google Scholar] [CrossRef]

- Qureshi, M.H.; Hussain, T. Status of Green Banking in Islamic and Traditional Banks of Pakistan. Indones. J. Sustain. Account. Manag. 2021, 5, 247–263. [Google Scholar] [CrossRef]

- Qureshi, M.H.; Hussain, T. Challenges and Issues of Green Banking in Islamic and Traditional Banks of Pakistan. J. Innov. Sustain. RISUS 2022, 13, 4–24. [Google Scholar] [CrossRef]

- Safitri, R.; Hartiwiningsih, H.; Purwadi, H. The Role of Law on the Implementation of Green Banking in Indonesia. J. Cita Huk. 2019, 7, 115–138. [Google Scholar] [CrossRef]

- Okyere-Kwakye, E.; Nor, K.M. The intention of banks to adopt green banking in an emerging market: The employees’ perspective. Econ. Political Stud. 2021, 9, 497–504. [Google Scholar] [CrossRef]

- Sun, H.; Rabbani, M.R.; Ahmad, N.; Sial, M.S.; Cheng, G.; Zia-Ud-Din, M.; Fu, Q. CSR, Co-Creation and Green Consumer Loyalty: Are Green Banking Initiatives Important? A Moderated Mediation Approach from an Emerging Economy. Sustainability 2020, 12, 10688. [Google Scholar] [CrossRef]

- Istudor, N.; Nitescu, D.C.; Dumitru, V.F.; Anghel, C. Banking, Competitiveness and Sustainability: The Perspective of the Three Global Actors: US, China, Europe. J. Compet. 2022, 14, 59–75. [Google Scholar] [CrossRef]

- Ratnasari, T.; Surwanti, A.; Pribadi, F. Implementation of green banking and financial performance on commercial banks in Indonesia. Int. Symp. Econ. Theory Econom. 2021, 28, 323–336. [Google Scholar] [CrossRef]

- Bouteraa, M.; Hisham, R.R.I.R.; Zainol, Z. Challenges affecting bank consumers’ intention to adopt green banking technology in the UAE: A UTAUT-based mixed-methods approach. J. Islam. Mark. 2023, 14, 2466–2501. [Google Scholar] [CrossRef]

- Bukhari, S.A.A.; Hashim, F.; Amran, A. Pathways towards Green Banking adoption: Moderating role of top management commitment. Int. J. Ethics Syst. 2022, 38, 286–315. [Google Scholar] [CrossRef]

- Elsner, C.; Neumann, M. Caught between path-dependence and green opportunities—Assessing the impetus for green banking in South Africa. Earth Syst. Gov. 2023, 18, 100194. [Google Scholar] [CrossRef]

- Jia, F.; Li, Z. Development of green finance, tourism, and corporate access to bank loans in China. Environ. Sci. Pollut. Res. 2023, 30, 75532–75548. [Google Scholar] [CrossRef]

- Zhang, X.; Wang, Z.; Zhong, X.; Yang, S.; Siddik, A.B. Do Green Banking Activities Improve the Banks’ Environmental Performance? The Mediating Effect of Green Financing. Sustainability 2022, 14, 989. [Google Scholar] [CrossRef]

- Dzingirai, M.; Mhlanga, D. Overcoming Challenges in Green Banking for Sustainable Development in Africa. In Financial Inclusion and Sustainable Development in Sub-Saharan Africa; Routledge: London, UK, 2025; pp. 246–257. [Google Scholar]

- Markhayeva, B.; Ibrayev, A.S.; Beisenova, M.; Serikbayeva, G.; Arrieta-López, M. Green Banking Tools for the Implementation of a State’s Environmental Policy: Comparative Study. J. Environ. Manag. Tour. 2023, 14, 160–167. [Google Scholar] [CrossRef]

- Rahman, M.H.; Rahman, J.; Tanchangya, T.; Esquivias, M.A. Green banking initiatives and sustainability: A comparative analysis between Bangladesh and India. Res. Glob. 2023, 7, 100184. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Rothovius, T.; Uddin, G.S. Climate risk and green investments: New evidence. Energy 2023, 265, 126376. [Google Scholar] [CrossRef]

- Zhang, K.; Li, Y.; Qi, Y.; Shao, S. Can green credit policy improve environmental quality? Evidence from China. J. Environ. Manag. 2021, 298, 113445. [Google Scholar] [CrossRef]

- Tian, G.; Wang, K.T.; Wu, Y. Does the market value the green credit performance of banks? Evidence from bank loan announcements. Br. Account. Rev. 2023, 101282. [Google Scholar] [CrossRef]

- Ullah, S.; Jan, S. Exploring Motivation and Barriers to Green Banking Practices in Khyber Pakhtunkhwa. J. Manag. Sci. 2024, 18, 1–34. [Google Scholar]

- Sharma, M.; Choubey, A. Green banking initiatives: A qualitative study on Indian banking sector. Environ. Dev. Sustain. 2022, 24, 293–319. [Google Scholar] [CrossRef] [PubMed]

- Cardona Valencia, D.; Calabuig-Tormo, C. The Impact of Green Banking Activities on Banks’ Green Financing and Environmental Performance. Sci. Pap. 2023, 31, 1681. [Google Scholar] [CrossRef]

- Bose, S.; Khan, H.Z.; Monem, R.M. Does green banking performance pay off? Evidence from a unique regulatory setting in Bangladesh. Corp. Gov. 2021, 29, 162–187. [Google Scholar] [CrossRef]

- Deng, X.; Hao, H.; Chang, M.; Ren, X.; Wang, L. Influencing Factors of Green Credit Efficiency in Chinese Commercial Banks. Front. Environ. Sci. 2022, 10, 941053. [Google Scholar] [CrossRef]

- Gutiérrez-Ponce, H.; Wibowo, S.A. Do sustainability practices contribute to the financial performance of banks? An analysis of banks in Southeast Asia. Corp. Soc. Responsib. Environ. Manag. 2024, 31, 1418–1432. [Google Scholar] [CrossRef]

- Firmansyah, A.; Kartiko, N.D. Exploring the association of green banking disclosure and corporate sustainable growth: The moderating role of firm size and firm age. Cogent Bus. Manag. 2024, 11, 2312967. [Google Scholar] [CrossRef]

- Laskowska, A. Green banking as the prospective dimension of banking in Poland. Ecol. Quest. 2018, 29, 129–135. [Google Scholar] [CrossRef]

- Emmanuel, Y.L.; Doorasamy, M.; Kwarbai, J.D.; Kolawole, P.; Otekunrin, A.O.; Osakede, U.A. Relationship of Environmental Disclosure of Renewable Energy, Carbon Emissions, Waste Management, Water Consumption, and Banks’ Financial Performance. Int. J. Energy Econ. Policy 2024, 14, 584–593. [Google Scholar] [CrossRef]

- Raberto, M.; Ozel, B.; Ponta, L.; Teglio, A.; Cincotti, S. From financial instability to green finance: The role of banking and credit market regulation in the Eurace model. J. Evol. Econ. 2019, 29, 429–465. [Google Scholar] [CrossRef]

- Zhou, X.Y.; Caldecott, B.; Hoepner, A.G.F.; Wang, Y. Bank green lending and credit risk: An empirical analysis of China’s Green Credit Policy. Bus. Strategy Environ. 2022, 31, 1623–1640. [Google Scholar] [CrossRef]

- Cucinelli, D.; Nieri, L.; Piserà, S. Climate and Environment Risks and Opportunities in the Banking Industry: The Role of Risk Management. Int. J. Financ. Econ. 2024, 29, 123–145. [Google Scholar] [CrossRef]

- Elisabeth, P.; Chabot, M.; Relano, F. Banking with Ethics: Strategic Moves and Structural Changes of the Banking Industry in the Aftermath of the Subprime Mortgage Crisis. J. Bus. Ethics 2014, 131, 199–207. [Google Scholar] [CrossRef]

- Zhou, G.; Sun, Y.; Luo, S.; Liao, J. Corporate social responsibility and bank financial performance in China: The moderating role of green credit. Energy Econ. 2021, 97, 105190. [Google Scholar] [CrossRef]

- Ben Ltaifa, M.; Chouari, W.; Derbali, A.M.S. Green finance and its impact on improving the performance of Saudi banks: Case of a sample of Saudi bank employees. In Smart Strategies and Societal Solutions for Sustainable International Business; IGI Global Scientific Publishing: Hershey, PA, USA, 2023; pp. 1–30. ISBN 979-8-3693-0534-8. [Google Scholar]

- An, X.; Ding, Y.; Wang, Y. Green credit and bank risk: Does corporate social responsibility matter? Financ. Res. Lett. 2023, 58, 104349. [Google Scholar] [CrossRef]

- Liu, H.; Huang, W. Sustainable Financing and Financial Risk Management of Financial Institutions—Case Study on Chinese Banks. Sustainability 2022, 14, 9786. [Google Scholar] [CrossRef]

- Harahap, B.; Risfandy, T.; Futri, I.N. Islamic Law, Islamic Finance, and Sustainable Development Goals: A Systematic Literature Review. Sustainability 2023, 15, 6626. [Google Scholar] [CrossRef]

- Khan, M.A.; Riaz, H.; Ahmed, M.; Saeed, A. Does green finance really deliver what is expected? An empirical perspective. Borsa İstanbul Rev. 2022, 22, 586–593. [Google Scholar] [CrossRef]

- Khairunnessa, F.; Vazquez-Brust, D.A.; Yakovleva, N. A Review of the Recent Developments of Green Banking in Bangladesh. Sustainability 2021, 13, 1904. [Google Scholar] [CrossRef]

- Venkatachalam, D.K.; Subhash, M.D. Customers Perception And Willingness To Adopt Green Banking. Educ. Adm. Theory Pract. 2024, 30, 1221–1224. [Google Scholar]

- Alamri, R. The Effectiveness of Green Banking in Saudi Arabia. Access Justice East. Eur. 2023, 6, 196–221. [Google Scholar] [CrossRef]

- Mohamed, H. The role of development banks in green finance and sustainability. In Public Policy’s Role in Achieving Sustainable Development Goals; IGI Global Scientific Publishing: Hershey, PA, USA, 2023; pp. 150–166. [Google Scholar]

- Azeez, H.; Clark, T.M.; Haralampieva, V.; Pak, C.; Strauss, M. Advancing paris agreement alignment in multilateral development banks. In Routledge Handbook of Climate Law and Governance: Courage, Contributions and Compliance; Routledge: London, UK, 2024; pp. 301–308. [Google Scholar]

- Huang, H.; Xing, X.; He, Y.; Gu, X. Combating greenwashers in emerging markets: A game-theoretical exploration of firms, customers and government regulations. Transp. Res. Part E Logist. Transp. Rev. 2020, 140, 101976. [Google Scholar] [CrossRef]

- Niyazbekova, S.; Brizhak, O.; Gavrilova, E.; Rastimeshina, T.; Dobrynina, M.; Berezhnova, E. The «Green» economy: The specifics of financing and subsidizing projects in modern conditions. Reliab. Theory Appl. 2024, 19, 1586–1594. [Google Scholar] [CrossRef]

- Nguyen, A.H.; Do, M.H.T.; Hoang, T.G.; Nguyen, L.Q.T. Green financing for sustainable development: Insights from multiple cases of Vietnamese commercial banks. Bus. Strategy Environ. 2023, 32, 321–335. [Google Scholar] [CrossRef]

- Ning, Y.; Cherian, J.; Sial, M.S.; Álvarez-Otero, S.; Comite, U.; Zia-Ud-Din, M. Green bond as a new determinant of sustainable green financing, energy efficiency investment, and economic growth: A global perspective. Environ. Sci. Pollut. Res. 2023, 30, 61324–61339. [Google Scholar] [CrossRef]

- dos Santos, V.P.; Jucá, M.N. The impact of sustainable practices on creating value for banks in emerging countries. Rev. Gest. Soc. Ambient. 2024, 18, 1–16. [Google Scholar] [CrossRef]

- Waktola, B.S.; Singh, M.; Singh, S. Enhancing Strategic Performance Through Sustainable Practices: The Nexus of Social Responsibility Practice and Competitive Advantage—Moderating Role of Business Ownership Type. Bus. Strategy Dev. 2024, 7, e70043. [Google Scholar] [CrossRef]

- Cicchiello, A.F.; Cotugno, M.; Foroni, C. Does competition affect ESG controversies? Evidence from the banking industry. Financ. Res. Lett. 2023, 55, 103972. [Google Scholar] [CrossRef]

- Ma, Y.; Feng, G.-F.; Yin, Z.-J.; Chang, C.-P. ESG disclosures, green innovation, and greenwashing: All for sustainable development? Sustain. Dev. 2024, 33, 1797–1815. [Google Scholar] [CrossRef]

- Doosti-Irani, M.; Basouli, M.; Asadi, M.M. The Effect of Perceived Greenwashing on Achieving Green Marketing Goals (Case Study: Isfahan Province Eco-Lodges). J. Environ. Stud. 2023, 49, 279–296. [Google Scholar] [CrossRef]

- Ren, X.; Xia, X.; Taghizadeh-Hesary, F. Uncertainty of uncertainty and corporate green innovation—Evidence from China. Econ. Anal. Policy 2023, 78, 634–647. [Google Scholar] [CrossRef]

- Hagspiel, V.; Kort, P.M.; Wen, X. Green technology investment: Announced vs. unannounced subsidy retraction. J. Econ. Dyn. Control 2025, 170, 105030. [Google Scholar] [CrossRef]

| Factor Considered | Inclusion Criteria | Exclusion Criteria | Nature of Inclusion/Exclusion |

|---|---|---|---|

| Period | 2018–2025 | Articles published before 2018 | Database automatic filtering tools |

| Language | English | Other languages other than English | Database automatic filtering tools |

| Document type | Peer-reviewed articles | WOS (reviews, early access papers, proceeding papers, retracted publications) Scopus (book chapters, reviews, conference papers, erratum) | Database automatic filtering tools |

| Relevance | Relevant to at least one of the research questions | Articles not relevant to at least one research question | Manual title and abstract reviews |

| Green Banking Activities | Total Freq | Top Five Most Prevalent Activities | Sources |

|---|---|---|---|

| Digital Banking | 46 | Paperless transactions Online and mobile banking AI and blockchain-based sustainability apps for green financing tracking Digital reporting and e-statements ATMs | [13,14,15,16,17,18] |

| Green loans/Sukuk products | 29 | Renewable energy projects Financing the purchase of electric vehicles Green mortgages for energy-efficient homes, Subsidized loans for green transition-related investments and projects among others Offering financial incentives for eco-friendly home improvements | [19,20,21,22,23,24,25,26,27,28,29,30] |

| Green Services | 25 | Personal ESG calculators and management Savings linked to green investments Offering rewards or cashback for sustainable lifestyle Offering sustainability investment portfolios Facilitating and supporting carbon credit trading transactions | [27,28,31,32,33,34,35,36,37] |

| Green Infrastructure | 15 | Solar-powered ATMs Smart lighting Energy-efficient buildings Installation of EV chargers in the bank’s buildings Investing in green data centers among others | [38,39,40,41,42,43,44,45,46] |

| Major Thematic Challenges | Frequencies | Most Prevalent Countries | Sources |

|---|---|---|---|

| Weak investor confidence in green bonds and related products | 6 | Nigeria, Colombia, Bangladesh, Indonesia | [23,40,41,47,48] |

| Greenwashing concerns | 5 | South Africa, Europe, India, North America, China | [23,24,42,49,50] |

| Regulatory handles | 8 | Indonesia, Poland, India, Nigeria and Colombia | [1,16,19,40,41,42,51,52] |

| Social economic and cultural resistance | 11 | UAE, Pakistan, Saudi Arabia, Bangladesh, Nigeria, Qatar, Russia | [16,19,23,26,39,40,41,42,43,53] |

| Transition risk and high cost of compliance | 6 | Pakistan, India, China, Poland, Indonesia | [23,40,41,47,51,54] |

| Major Thematic Opportunities | Freq | Most Prevalent Regions | Sources |

|---|---|---|---|

| Sustainable banking as a strategic and competitive advantage | 18 | Italy, North America, India, China, Europe | [16,18,44,45,46,48,50,51,55,56,57,58,59,60,61,62,63,64] |

| Emerging and growing market Niche | 6 | Europe, Qatar, North America, Saudi Arabia, China and India | [3,28,65,66,67,68] |

| Long-term climate risk management capacity | 12 | Europe, Qatar, North America, Saudi Arabia, China and India | [16,51,57,61,68,69,70,71,72,73,74,75] |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Muchiri, M.K.; Erdei-Gally, S.K.; Fekete-Farkas, M. Green Banking Practices, Opportunities, and Challenges for Banks: A Systematic Review. Climate 2025, 13, 102. https://doi.org/10.3390/cli13050102

Muchiri MK, Erdei-Gally SK, Fekete-Farkas M. Green Banking Practices, Opportunities, and Challenges for Banks: A Systematic Review. Climate. 2025; 13(5):102. https://doi.org/10.3390/cli13050102

Chicago/Turabian StyleMuchiri, Martin Kamau, Szilvia Kesmarki Erdei-Gally, and Maria Fekete-Farkas. 2025. "Green Banking Practices, Opportunities, and Challenges for Banks: A Systematic Review" Climate 13, no. 5: 102. https://doi.org/10.3390/cli13050102

APA StyleMuchiri, M. K., Erdei-Gally, S. K., & Fekete-Farkas, M. (2025). Green Banking Practices, Opportunities, and Challenges for Banks: A Systematic Review. Climate, 13(5), 102. https://doi.org/10.3390/cli13050102