Key Innovations in Financing Nature-Based Solutions for Coastal Adaptation

Abstract

1. Introduction

2. State of the Art

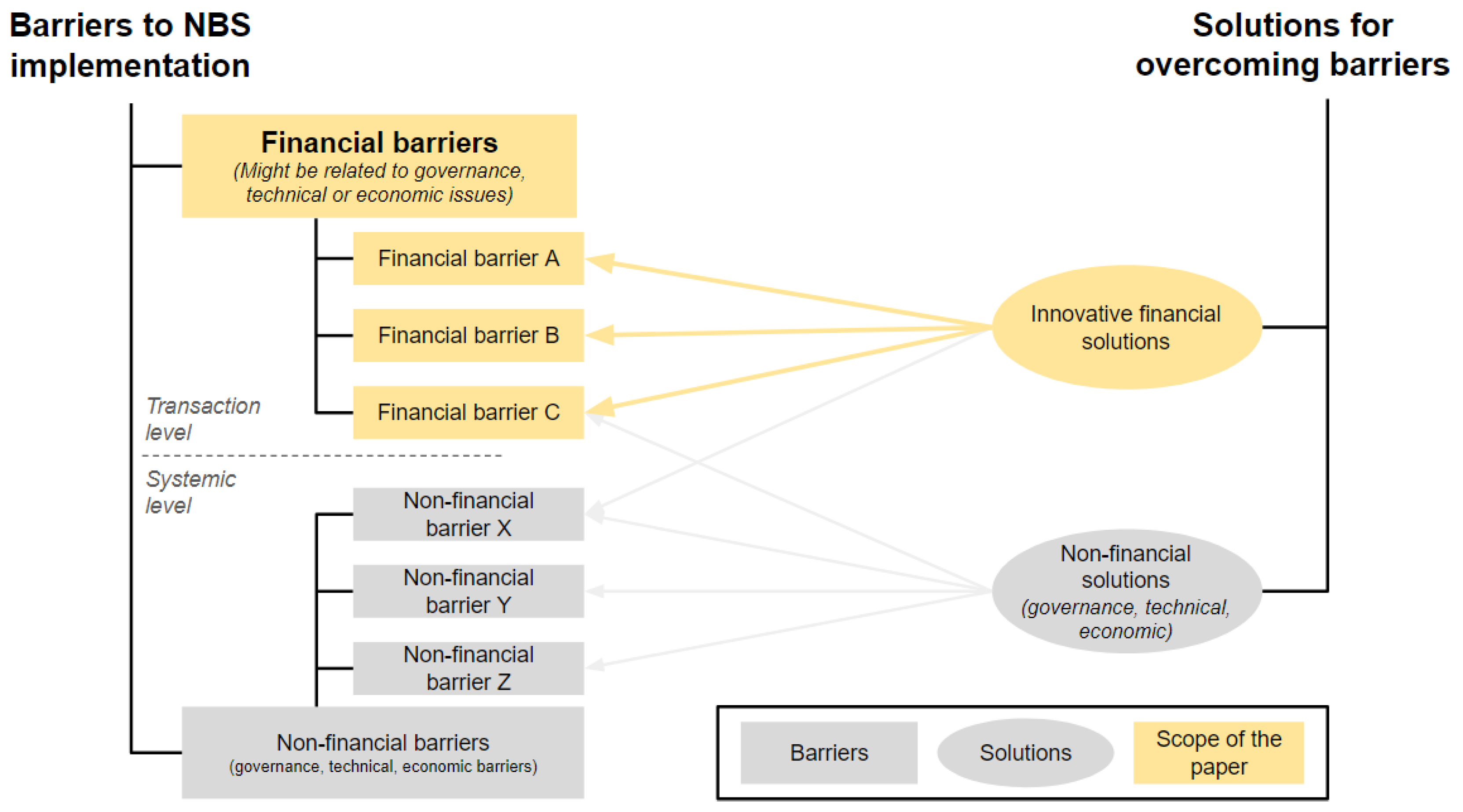

2.1. Barriers to Funding and Financing of NBSs

- Technical/knowledge barriers: impediments arising due to limited expertise, technology, and information;

- Governance barriers: impediments arising due to fragmented and incoherent policy frameworks, institutional inertia, and conflicts among stakeholders;

- Economic/effectiveness barriers: impediments due to the overall benefits or effects of NBSs being “less” than their overall costs;

- Financial barriers: impediments arising in accessing sufficient financial resources for implementing NBSs.

2.2. Pathways for Overcoming Barriers to Funding and Financing NBSs

2.3. Financial Innovation

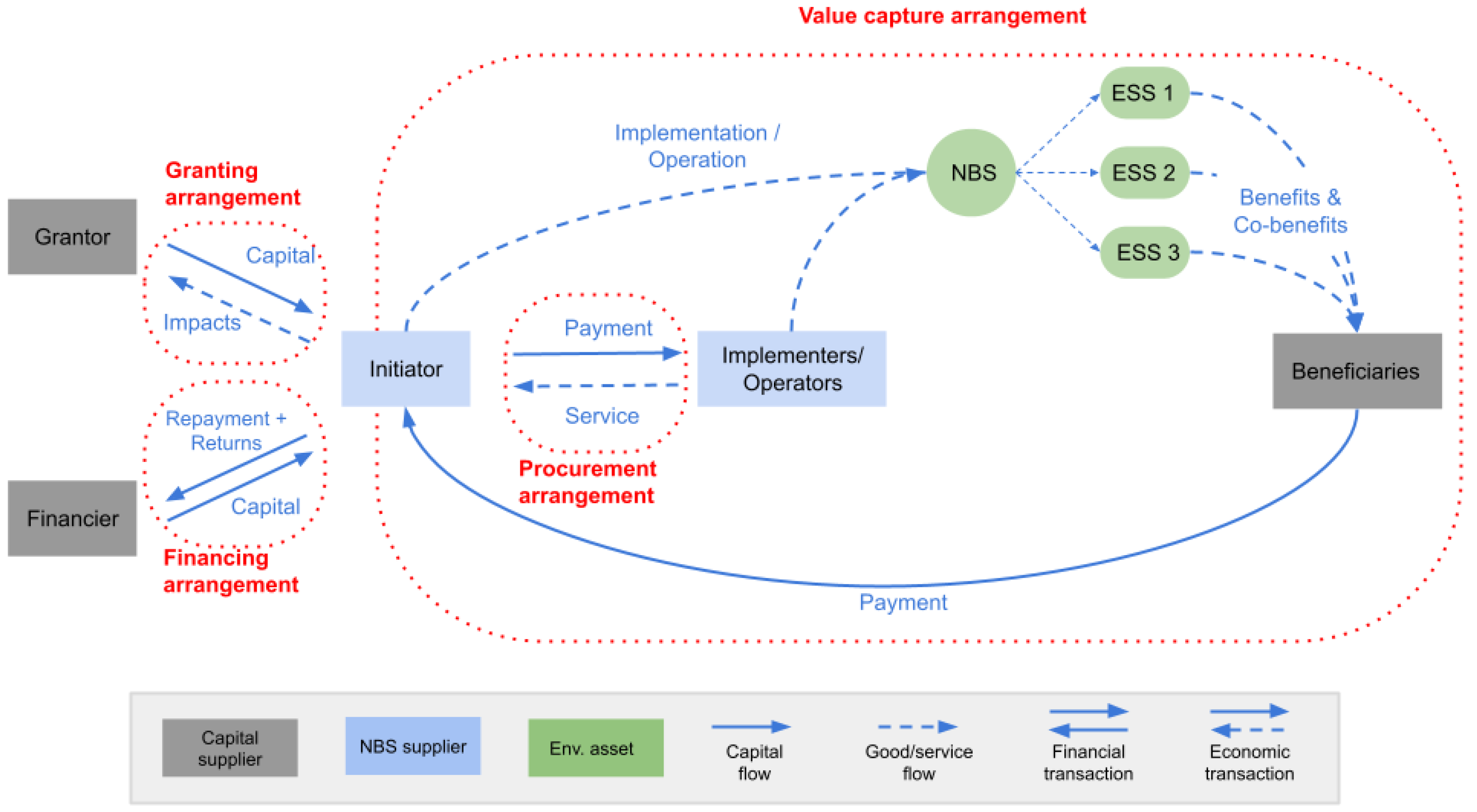

3. Theoretical Framework from Transaction Cost Economics

3.1. Transactions

3.2. Core Properties of Nature-Related Transactions

- Frequency. Frequency indicates how often a transaction occurs. Frequent transactions tend to have lower transaction costs because parties acquire knowledge, establish standardised processes, and do not need continuous negotiation. In contrast, infrequent transactions may require more negotiation and information gathering among the parties, leading to higher transaction costs.

- Uncertainty. Uncertainty denotes the level of risk and predictability involved in a transaction. High uncertainty results in higher transaction costs due to the need for more extensive information gathering, risk mitigation measures, and enforcement mechanisms.

- Asset specificity. Asset specificity refers to how specialised the assets involved in a transaction are. Due to high specificity, assets cannot be easily redeployed for other uses, parties become more dependent on each other, and this dependence can lead to opportunistic behaviour. This, in turn, may necessitate more detailed contracts and monitoring, increasing transaction costs.

- Excludability. Transaction costs are lower when access to environmental goods can be excluded and the property rights of land and ESSs are well defined. Well-defined property rights reduce the potential for conflicts and the need for costly monitoring and enforcement. However, when access to environmental goods is open and non-excludable, transaction costs increase due to costly monitoring and enforcement activities, as well as high incentives to free ride.

- Separability. Separability refers to the degree of functional interdependence of a transaction with other transactions that originate within the same biophysical system. Highly interconnected systems result in transactions with low separability, which in turn require additional coordination efforts.

- Modularity. Modularity refers to the decomposability of the structures of transactions or the possibility to reduce a system to smaller sub-parts that are practically independent from one another. Modular structures allow for less complex transactions that can be managed more easily.

- Observability. Observability refers to the degree to which transaction-relevant conditions, activities, and outcomes can be monitored and assessed. The lower the observability property, the higher the transaction costs will be for accessing these types of information.

- Dimensions of time and scale. Time and scale dimensions play a critical role in transactions. Longer time horizons and larger spatial scales generally result in higher transaction costs. The former require long-term planning, coordination, and possibly adaptive management and periodic reassessment, while the latter might imply physical relational distance [47] and other coordination issues related to cross-scale dynamics.

4. Methodology

4.1. Barriers and Solutions Considered in This Study

4.2. Literature Selection and Coding

- First, we generated a list of targeted financial barriers. In our literature review, we used the key properties of NBS transactions to identify a list of financial barriers that can be addressed through the implementation of innovative financial solutions. The financial barriers found in the literature that originated from the same property of transaction were clustered in our typology as financial challenges associated with a single, overarching financial barrier.

- Second, we selected a list of targeted financial innovations. As financial innovation unfolds in a multitude of possible arrangements and variations [48], it is impossible to exhaustively cover all financial innovations. Hence, we focused on the innovative financial instruments proposed in the existing NBS literature that are supported by empirical evidence of practical implementation in NBSs [4,9,32,35,36,49,50,51]. We therefore focused specifically on innovations aimed at leveraging investments and other resources from the private sector, given the acknowledged potential for the significant upscaling of NBS finance. Consequently, we excluded from our selection innovative financial solutions such as (government intermediate) payments for ESSs, debt-for-nature swaps, ecological fiscal transfers, and crowd-funding, as they are associated with the currently prevailing financial model based on public and philanthropic granting.

- Third, for each selected financial innovation, we describe how they lower financial barriers by adapting contractual structures to NBS transaction properties.

- Finally, we gathered empirical evidence on each solution’s conditions of applicability, i.e., factors that typically affect (positively or negatively) their implementation and transfer in other NBS projects. Towards this end, we searched for and analysed 48 case studies. This list of analysed case studies, together with contextual information (e.g., country, type of NBS, project size, project status, and public and private external support), can be found in Tables S1–S4 in the Supplementary Materials. References to the specific case studies (CSs) supporting our propositions on the conditions of applicability are provided in the text.

5. Results

5.1. Overview

5.2. Financial Barriers

5.2.1. Financial Barrier 1 (FB 1)—High Performance Risks

5.2.2. Financial Barrier 2 (FB 2)—Low Measurability of Impacts

- The low measurability of ESSs represents a disincentive for investors considering not only financial returns but also positive social and environmental investment outcomes. The inability to effectively quantify social and environmental impacts undermines their ability to assess the success of their investments. Investors might even question the project for green washing.

- Since contractual arrangements often rely on clear and measurable indicators to set goals, define success, and outline penalties and incentives, low measurability may hinder the ability of the parties to incorporate precise performance metrics into their contract. Such circumstances introduce ambiguity and make it difficult to clearly define and enforce contractual obligations.

- Outcomes that are difficult to measure tend to be sacrificed when competing with other outcomes that can be easily quantified (e.g., provisional services, cost savings, and other financial goals) [54], leading, for instance, to trade-offs between public welfare and cost-saving interests.

- Principal–agent problems resulting in moral hazard can arise when a principal (who delegates a task) cannot monitor the activity of an agent (who performs the task) or assess its outcomes. This may result in conflicts of interest and moral hazard whereby the agent prioritises personal interests over those of the principal.

5.2.3. Financial Barrier 3 (FB 3)—Site Specificity of NBS Assets

- The site specificity of NBSs makes related investments illiquid, as it is difficult to divert these to alternative productive uses or convert them into cash without losing significant value [44]. This represents a potential problem for investors because, in case of necessity, they would not be able to rely on efficient asset liquidation and may be exposed to losses [24].

- Site specificity implies that NBS investments are difficult to scale by means of direct replications in other locations [10].

- Site specificity may also result in hold-up problems [56]. A hold-up problem occurs when the asset specificity of an investment also implies specificity in the relationship with certain actors. In the case of NBSs, this would typically be the relationship with the owner of the site, the suppliers of particular products, services or information, or other key stakeholders. These irreplaceable partners acquire a disproportionate bargaining power once the illiquid investment is made, which could be exploited through an opportunistic renegotiation of contractual terms [44].

5.2.4. Financial Barrier 4 (FB 4)—Long Lead Time

- Private investment opportunities are affected, as the longer the time horizons, the greater the uncertainty surrounding ecosystem dynamics, policy and regulatory changes, market conditions, and other factors affecting project effectiveness and financial outcomes.

- The delayed generation of revenues and profits generally does not match investors’ preference for near-term, competitive returns [53].

- The long-term nature of NBS projects may require sustained cooperation and commitment from various stakeholders. A lack of trust among stakeholders, especially in the context of new partnerships, can constitute a financial barrier if there are doubts about long-term commitments.

5.2.5. Financial Barrier 5 (FB 5)—Insufficient Project Size

- A lack of access to large-scale investment opportunities is one of the most relevant barriers that prevents asset owners and managers from investing in natural capital [24]. Although the long-term liabilities of institutional investors align well with projects with long time horizons [22], small investment sizes and the related low rates of return do not fit with the requirements of institutional investors [21].

- Transaction costs are high relative to project size and project revenues and, hence, worsen the risk–return profile of smaller-sized projects due to constrained budgets and the lack of economies of scale [10].

5.2.6. Financial Barrier 6 (FB 6)—Jointness

- Each ESS can potentially be subject to its own property rights regime (access, management, withdrawal, exclusion, and alienation rights), so the interdependencies between the flows of ESSs and the related transactions often result in a complex legal and administrative environment.

- In addition to co-benefits, ESSs can result in disbenefits for certain stakeholders [59], for instance, due to increased pollen and/or mosquitos, or social displacement due to increased property value. The inseparability of NBS benefits and disbenefits may result in conflicts and trade-offs, thus requiring coordination efforts.

- Due to the multiple, distributed NBS benefits that yield low returns, the diversification and stacking of multiple sources of funding and financing is considered a useful approach to cover all relevant activities and potential values [6,10,34]. However, coordinating multiple funders and financiers can be a complex and time-consuming challenge [53], as different funders and financiers may have different criteria and conditions for supporting or investing in a project. Harmonising private and public preferences is particularly delicate due to the existing trade-offs between profitability and welfare generation [28]. While an initiator may secure an initial funding source, they may lack the resources or financial expertise to organise and coordinate subsequent arrangements.

5.2.7. Financial Barrier 7 (FB 7)—Low Revenues

5.3. Innovative Financial Solutions

5.3.1. Green Bonds

5.3.2. Environmental Impact Bonds (EIBs)

5.3.3. Project Bundling

5.3.4. Smart Contracts

5.3.5. Blockchain Tokens

5.3.6. Public–Private Partnerships (PPPs)

5.3.7. Carbon Credits

5.3.8. Eco-Labels

5.3.9. Ecotourism User Fees

5.3.10. Betterment Levies

6. Discussion

7. Conclusions

Supplementary Materials

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- UNEP. State of Finance for Nature 2022, UNEP, ELD, Nairobi. 2022. Available online: https://wedocs.unep.org/20.500.11822/41333 (accessed on 8 August 2023).

- Deutz, A.; Kellet, J.; Zoltani, T. Innovative Finance for Resilient Coasts and Communities; The Nature Conservancy: Arlington, VA, USA; UNDP: New York, NY, USA, 2018. [Google Scholar]

- Droste, N.; Schröter-Schlaack, S.; Hansjürgens, B.; Horst, Z. (Eds.) Implementing Nature-Based Solutions in Urban Areas: Financing and Governance Aspects. In Nature-Based Solutions to Climate Change Adaptation in Urban Areas: Theory and Practice of Urban Sustainability Transitions; Springer International Publishing: Cham, Switzerland, 2017; pp. 307–321. [Google Scholar] [CrossRef]

- Altamirano, M.A.; De Rijke, H.; Carrera, L.B.; Jaimerena, B.A. Handbook for the Implementation of Nature-Based Solutions for Water Security: Guidelines for Designing an Implementation and Financing Arrangement; EU Horizon 2020 NAIAD Project, Grant Agreement N°730497 Dissemination; Deltares: Delft, The Netherlands, 2021. [Google Scholar]

- EIB. Investing in Nature: Financing Conservation and Nature-Based Solutions; European Commission: Brussels, Belgium; EIB: Luxembourg, 2020. [Google Scholar]

- Eiselin, M.; Schep, S.; Duinmeijer, C.; Van Pul, J. Financing Nature-Based Solutions for Coastal Protection; IUCN—Netherlands Enterprise Agency: Amsterdam, The Netherlands, 2022. [Google Scholar]

- König, A.-N.; Club, C.; Apampa, A. Innovative Development Finance Toolbox; KfW Development Bank: Frankfurt am Main, Germany, 2020. [Google Scholar]

- Agardy, T.; Pascal, N. Innovative financial mechanisms for coastal management in the Pacific: A state of the art. In Proceedings of the ESCCUE Experts Meeting on Project Approach and Methodology, Noumea, New Caledonia, 11 July 2014. [Google Scholar]

- Baroni, L.; Whiteoak, K.; Nicholls, G. Approaches to Financing Nature-Based Solutions in Cities. 2019. Available online: https://growgreenproject.eu/wp-content/uploads/2019/03/Working-Document_Financing-NBS-in-cities.pdf (accessed on 6 April 2023).

- EIB. Investing in Nature-Based Solutions: State of Play and Way forward for Public and Private Financial Measures in Europe; European Investment Bank: Luxembourg, 2023; Available online: https://data.europa.eu/doi/10.2867/031133 (accessed on 24 July 2023).

- Cohen-Shacham, E.; Walters, G.; Janzen, C.; Maginnis, S. Nature-Based Solutions to Address Global Societal Challenges; IUCN: Gland, Switzerland, 2016. [Google Scholar] [CrossRef]

- Nesshöver, C.; Assmuth, T.; Irvine, K.N.; Rusch, G.M.; Waylen, K.A.; Delbaere, B.; Haase, D.; Jones-Walters, L.; Keune, H.; Kovacs, E.; et al. The science, policy and practice of nature-based solutions: An interdisciplinary perspective. Sci. Total Environ. 2017, 579, 1215–1227. [Google Scholar] [CrossRef] [PubMed]

- Kabisch, N.; Frantzeskaki, N.; Pauleit, S.; Naumann, S.; Davis, M.; Artmann, M.; Haase, D.; Knapp, S.; Korn, H.; Stadler, J.; et al. Nature-based solutions to climate change mitigation and adaptation in urban areas: Perspectives on indicators, knowledge gaps, barriers, and opportunities for action. Ecol. Soc. 2016, 21, art39. [Google Scholar] [CrossRef]

- Narayan, S.; Beck, M.W.; Reguero, B.G.; Losada, I.J.; Van Wesenbeeck, B.; Pontee, N.; Sanchirico, J.N.; Ingram, J.C.; Lange, G.-M.; Burks-Copes, K.A.; et al. Costs and Coastal Protection Benefits of Natural and Nature-Based Defences. PLoS ONE 2016, 11, e0154735. [Google Scholar] [CrossRef] [PubMed]

- Sutton-Grier, A.; Gittman, R.; Arkema, K.; Bennett, R.; Benoit, J.; Blitch, S.; Burks-Copes, K.; Colden, A.; Dausman, A.; DeAngelis, B.; et al. Investing in Natural and Nature-Based Infrastructure: Building Better Along Our Coasts. Sustainability 2018, 10, 523. [Google Scholar] [CrossRef]

- Egusquiza, A.; Cortese, M.; Perfido, D. Mapping of innovative governance models to overcome barriers for nature based urban regeneration. IOP Conf. Ser. Earth Environ. Sci. 2019, 323, 012081. [Google Scholar] [CrossRef]

- Sánchez-Arcilla, A.; Cáceres, I.; Roux, X.L.; Hinkel, J.; Schuerch, M.; Nicholls, R.J.; Otero, D.M.; Staneva, J.; De Vries, M.; Pernice, U.; et al. Barriers and enablers for upscaling coastal restoration. Nat.-Based Solut. 2022, 2, 100032. [Google Scholar] [CrossRef]

- Sarabi, S.E.; Han, Q.; Romme, A.G.L.; Vries, B.d.; Wendling, L. Key Enablers of and Barriers to the Uptake and Implementation of Nature-Based Solutions in Urban Settings: A Review. Resources 2019, 8, 121. [Google Scholar] [CrossRef]

- Seddon, N.; Chausson, A.; Berry, P.; Girardin, C.A.J.; Smith, A.; Turner, B. Understanding the value and limits of nature-based solutions to climate change and other global challenges. Philos. Trans. R. Soc. B Biol. Sci. 2020, 375, 20190120. [Google Scholar] [CrossRef] [PubMed]

- Frantzeskaki, N.; McPhearson, T.; Collier, M.J.; Kendal, D.; Bulkeley, H.; Dumitru, A.; Walsh, C.; Noble, K.; Van Wyk, E.; Ordóñez, C.; et al. Nature-Based Solutions for Urban Climate Change Adaptation: Linking Science, Policy, and Practice Communities for Evidence-Based Decision-Making. BioScience 2019, 69, 455–466. [Google Scholar] [CrossRef]

- Mayor, B.; Toxopeus, H.; McQuaid, S.; Croci, E.; Lucchitta, B.; Reddy, S.E.; Egusquiza, A.; Altamirano, M.A.; Trumbic, T.; Tuerk, A.; et al. State of the Art and Latest Advances in Exploring Business Models for Nature-Based Solutions. Sustainability 2021, 13, 7413. [Google Scholar] [CrossRef]

- Bisaro, A.; Hinkel, J. Mobilizing private finance for coastal adaptation: A literature review. WIREs Clim. Change 2018, 9, e514. [Google Scholar] [CrossRef]

- OECD. A Comprehensive Overview of Global Biodiversity Finance, Paris. 2020. Available online: https://www.oecd.org/environment/resources/biodiversity/report-a-comprehensive-overview-of-global-biodiversity-finance.pdf (accessed on 10 August 2023).

- Cooper, G.; Trémolet, S. Investing in Nature: Private Finance for Nature-Based Resilience; The Nature Conservancy: Arlington, VA, USA; Environmental Finance: London, UK, 2019. [Google Scholar]

- Dworczyk, C.; Burkhard, B. Challenges Entailed in Applying Ecosystem Services Supply and Demand Mapping Approaches: A Practice Report. Land 2022, 12, 52. [Google Scholar] [CrossRef]

- WWF. Nature Based Solutions—A Review of Current Financing Barriers and How to Overcome These; WWF: Gland, Switzerland; Terranomics: London, UK, 2022. [Google Scholar]

- Shilland, R.; Grimsditch, G.; Ahmed, M.; Bandeira, S.; Kennedy, H.; Potouroglou, M.; Huxham, M. A question of standards: Adapting carbon and other PES markets to work for community seagrass conservation. Mar. Policy 2021, 129, 104574. [Google Scholar] [CrossRef]

- Toxopeus, H.; Polzin, F. Reviewing financing barriers and strategies for urban nature-based solutions. J. Environ. Manag. 2021, 289, 112371. [Google Scholar] [CrossRef] [PubMed]

- Adhikari, B.; Chalkasra, L.S.S. Mobilizing private sector investment for climate action: Enhancing ambition and scaling up implementation. J. Sustain. Financ. Invest. 2021, 13, 1110–1127. [Google Scholar] [CrossRef]

- Davies, C.; Lafortezza, R. Transitional path to the adoption of nature-based solutions. Land Use Policy 2019, 80, 406–409. [Google Scholar] [CrossRef]

- Colgan, C.S. Financing Natural Infrastructure for Coastal Flood Damage Reduction. Clim. Change 2017, 45, 8. [Google Scholar]

- GPC. A Market Review of Nature-Based Solutions, Green Purposes Company, Finance Earth. 2021. Available online: https://finance.earth/wp-content/uploads/2021/05/Finance-Earth-GPC-Market-Review-of-NbS-Report-May-2021.pdf (accessed on 22 August 2023).

- Barkley, L.; Short, C.; Chivers, C.A. Long-Term Agreements and Blended Finance for Landscape Recovery; Countryside and Community Research Institute: Gloucestershire, UK, 2022. [Google Scholar]

- Security, E. The Blended Finance Playbook for Nature-Based Solutions; Earth Security: London, UK, 2021. [Google Scholar]

- Brears, R.C.; Solutions, F.N.-B. Private, and Blended Finance Models and Case Studies; Springer International Publishing: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Kok, S.; Bisaro, A.; de Bel, M.; Hinkel, J.; Bouwer, L.M. The potential of nature-based flood defences to leverage public investment in coastal adaptation: Cases from the Netherlands, Indonesia and Georgia. Ecol. Econ. 2021, 179, 106828. [Google Scholar] [CrossRef]

- Den Heijer, C.; Coppens, T. Paying for green: A scoping review of alternative financing models for nature-based solutions. J. Environ. Manag. 2023, 337, 117754. [Google Scholar] [CrossRef] [PubMed]

- Lerner, J.; Tufano, P. The Consequences of Financial Innovation: A Counterfactual Research Agenda. Annu. Rev. Financ. Econ. 2011, 3, 41–85. [Google Scholar] [CrossRef]

- Merton, R.C. A Functional Perspective of Financial Intermediation. Financ. Manag. 1995, 24, 23. [Google Scholar] [CrossRef]

- Silber, W.L. The Process of Financial Innovation. Am. Econ. Rev. 1983, 73, 89–95. [Google Scholar]

- Frame, W.S.; White, L.J. Empirical Studies of Financial Innovation: Lots of Talk, Little Action? J. Econ. Lit. 2004, 42, 116–144. [Google Scholar] [CrossRef]

- Hagedorn, K. Particular requirements for institutional analysis in nature-related sectors. Eur. Rev. Agric. Econ. 2008, 35, 357–384. [Google Scholar] [CrossRef]

- D.C. North. Institutions, Institutional Change, and Economic Performance; Cambridge University Press: Cambridge, UK; New York, NY, USA, 1990. [Google Scholar]

- Williamson, O.E. The Economic Institutions of Capitalism; Free Press: New York, NY, USA, 1985. [Google Scholar]

- Williamson, O.E. The New Institutional Economics: Taking Stock, Looking Ahead. J. Econ. Lit. 2000, 38, 595–613. [Google Scholar] [CrossRef]

- Williamson, O.E. Transaction-Cost Economics: The Governance of Contractual Relations. J. Law Econ. 1979, 22, 233–261. [Google Scholar] [CrossRef]

- Thiel, A.; Schleyer, C.; Hinkel, J.; Schlüter, M.; Hagedorn, K.; Bisaro, S.; Bobojonov, I.; Hamidov, A. Transferring Williamson’s discriminating alignment to the analysis of environmental governance of social-ecological interdependence. Ecol. Econ. 2016, 128, 159–168. [Google Scholar] [CrossRef]

- Tufano, P. Financial Innovation. In Handbook of the Economics of Finance; Elsevier: Amsterdam, The Netherlands, 2003; pp. 309–335. [Google Scholar]

- Marsters, L.; Morales, G.; Ozment, S.; Silva, G.; Watson, G.; Netto, M.; Frisari, G.L. Nature-Based Solutions in Latin-America and the Caribbean Financing Mechanisms for Regional Replication; Inter-American Development Bank and World Resources Institute: Washington, DC, USA, 2021. [Google Scholar]

- Schletz, M.; Nassiry, D.; Lee, M.-K. Blockchain and Tokenized Securities: The Potential for Green Finance; Asian Development Bank: Tokyo, Japan, 2020; Available online: https://www.adb.org/publications/blockchain-tokenized-securitiespotential-green-finance (accessed on 26 May 2023).

- Somarakis, G.; Stagakis, S.; Chrysoulakis, N. ThinkNature Nature-Based Solutions Handbook; European Commission: Brussels, Belgium, 2019. [Google Scholar] [CrossRef]

- Bordt, M.; Saner, M. A critical review of ecosystem accounting and services frameworks. One Ecosyst. 2018, 3, e29306. [Google Scholar] [CrossRef]

- Kedward, K.; Ermgassen, S.O.S.E.Z.; Ryan-Collins, J.; Wunder, S. Nature as an Asset Class or Public Good? The Economic Case for Increased Public Investment to Achieve Biodiversity Targets. SSRN Electron. J. 2022, 1–21. [Google Scholar] [CrossRef]

- Holmstrom, B.; Milgrom, P. Multitask Principal-Agent Analyses: Incentive Contracts, Asset Ownership, and Job Design. J. Law Econ. Organ. 1991, 7, 24–52. [Google Scholar] [CrossRef]

- Cohen-Shacham, E.; Andrade, A.; Dalton, J.; Dudley, N.; Jones, M.; Kumar, C.; Maginnis, S.; Maynard, S.; Nelson, C.R.; Renaud, F.G.; et al. Core principles for successfully implementing and upscaling Nature-based Solutions. Environ. Sci. Policy 2019, 98, 20–29. [Google Scholar] [CrossRef]

- Schmitz, P.W. The Hold-Up Problem and Incomplete Contracts: A Survey of Recent Topics in Contract Theory. Bull. Econ. Res. 2001, 53, 1–17. [Google Scholar] [CrossRef]

- Bayraktarov, E.; Saunders, M.I.; Abdullah, S.; Mills, M.; Beher, J.; Possingham, H.P.; Mumby, P.J.; Lovelock, C.E. The cost and feasibility of marine coastal restoration. Ecol. Appl. 2016, 26, 1055–1074. [Google Scholar] [CrossRef] [PubMed]

- Gómez-Baggethun, E.; Kelemen, E.; Martín-López, B.; Palomo, I.; Montes, C. Scale Misfit in Ecosystem Service Governance as a Source of Environmental Conflict. Soc. Nat. Resour. 2013, 26, 1202–1216. [Google Scholar] [CrossRef]

- Ommer, J.; Bucchignani, E.; Leo, L.S.; Kalas, M.; Vranić, S.; Debele, S.; Kumar, P.; Cloke, H.L.; Di Sabatino, S. Quantifying co-benefits and disbenefits of Nature-based Solutions targeting Disaster Risk Reduction. Int. J. Disaster Risk Reduct. 2022, 75, 102966. [Google Scholar] [CrossRef]

- Commission, E. The Vital Role of Nature-Based Solutions in a Nature Positive Economy; European Commission Directorate General for Research and Innovation: Luxembourg, 2022; Available online: https://data.europa.eu/doi/10.2777/307761 (accessed on 7 June 2023).

- Iyer, V.; Mathias, K.; Meyers, D.; Victurine, R.; Walsh, M. Finance Tools for Coral Reef Conservation: A Guide; The Ocean Agency: New Port, RI, USA; Wildlife Conservation Society: New York, NY, USA; Conservation Finance Alliance: Washington, DC, USA, 2018; Available online: https://www.conservationfinancealliance.org/s/50-Reefs-Finance-Guide-FINAL-sm.pdf (accessed on 22 August 2023).

- Tirumala, R.D.; Tiwari, P. Innovative financing mechanism for blue economy projects. Mar. Policy 2022, 139, 104194. [Google Scholar] [CrossRef]

- NIB. Baltic Blue Bond—Additional Focus/Finance on Blue Economy: Blue Economy Investment Opportunities for Baltic Sea Solutions; Nordic Investment Bank: Helsinky, Finland, 2019; Available online: https://strategyforum2019.pomorskie.eu/wp-content/uploads/2023/01/4.-NIB_Tiina-Salonen_presentation_20190613_clean.pdf (accessed on 20 August 2023).

- Tuhkanen, H. Green Bonds: A Mechanism for Bridging the Adaptation Gap? Stockholm Environment Institute: Stockholm, Sweden, 2020. [Google Scholar]

- OECD. Green Bonds—Mobilising the Debt Capital Markets for a Low-Carbon Transition; OECD: Paris, France, 2015. [Google Scholar]

- World Bank Group. PPP Reference Guide—PPP Basics; World Bank Group: Washington, DC, USA, 2017. [Google Scholar]

- EDF. Financing Resilient Communities and Coastlines: How Environmental Impact Bonds Can Accelerate Wetland Restoration in Louisiana and Beyond; EDF: New York, NY, USA, 2018. [Google Scholar]

- Hall, D.; Lindsay, S.; Judd, S. Permanent Forest Bonds: A Pioneering Environmental Impact Bond for Aotearoa New Zealand; Victoria University of Wellington—Institute for Governance and Policy Studies: Wellington, New Zeland, 2017. [Google Scholar]

- Brand, M.W.; Quesnel Seipp, K.; Saksa, P.; Ulibarri, N.; Bomblies, A.; Mandle, L.; Allaire, M.; Wing, O.; Tobin-de la Puente, J.; Parker, E.A.; et al. Environmental Impact Bonds: A common framework and looking ahead. Environ. Res. Infrastruct. Sustain. 2021, 1, 023001. [Google Scholar] [CrossRef]

- Goldman Sachs. FACT SHEET: DC Water Environmental Impact Bond; Goldman Sachs: New York, NY, USA, 2016; Available online: https://www.goldmansachs.com/media-relations/press-releases/current/dc-water-environmental-impact-bond-fact-sheet.pdf (accessed on 18 May 2023).

- Quantified Ventures, Hampton, VA: An Environmental Impact Bond to Fight Flooding. Quantified Ventures: Washington, DC, USA, 2023. Available online: https://www.quantifiedventures.com/hampton-eib (accessed on 28 April 2023).

- CBF. Environmental Impact Bonds; Chesapeake Bay Foundation: Annapolis, MA, USA, 2023; Available online: https://www.cbf.org/how-we-save-the-bay/programs-initiatives/environmental-impact-bonds-eib.html (accessed on 6 July 2023).

- CBF. Environmental Impact Bonds: Lessons Learned in the Chesapeake Bay; Chesapeake Bay Foundation: Annapolis, MA, USA, 2023; Available online: https://www.cbf.org/document-library/cbf-guides-fact-sheets/expanded-eib-lessons-learned-brief.pdf (accessed on 6 June 2023).

- Quantified Ventures. Equitable Green Infrastructure in Buffalo, NY; Quantified Ventures: Washington, DC, USA, 2023; Available online: https://www.quantifiedventures.com/buffalo-eib (accessed on 28 April 2023).

- Quantified Venture. Atlanta: First Publicly Offered Environmental Impact Bond; Quantified Ventures: Washington, DC, USA, 2023; Available online: https://www.quantifiedventures.com/atlanta-eib (accessed on 28 April 2023).

- BFC. Fighting Fire with Finance. A roadmap for Collective Action; Blue Forest Conservation: San Francisco, CA, USA, 2017; Available online: https://static1.squarespace.com/static/5e9a1c0d4e0c2e67582026f2/t/5f1b7a5533dc544479ee9dcf/1595636395891/FRB%2B2017%2BRoadmap%2BReport.pdf (accessed on 25 July 2023).

- Hall, D.; Lindsay, S. Climate Finance Landscape for Aotearoa New Zealand: A Preliminary Survey (Report Prepared for the Ministry for the Environment); Mohio Consultancy: Auckland, New Zealand, 2018; Available online: https://openrepository.aut.ac.nz/items/a6702880-6661-414f-bc8a-3268efb1ba79 (accessed on 22 August 2023).

- Green Finance Institute. The Rhino Bond; The Green Finance Institute: London, UK, 2023; Available online: https://www.greenfinanceinstitute.com/gfihive/case-studies/the-wildlife-conservation-bond-the-rhino-bond/ (accessed on 9 November 2023).

- Arjaliès, D.L. Deshkan Ziibi Conservation Impact Bond Project: On Conservation Finance, Decolonization, and Community-Based Participatory Research (No. 01); Western University: London, ON, Canada, 2021. [Google Scholar] [CrossRef]

- Huwyler, F.; Käppeli, J.; Tobin, J. Conservation Finance—From Niche to Mainstream: The Building of an Institutional Asset Class, Credit Suisse: Zurich, Switzerland; McKinsey Center for Business and Environment: New York, NY, USA; IUCN: Gland, Switzerland, 2016. [Google Scholar]

- Rode, J.; Pinzon, A.; Stabile, M.C.C.; Pirker, J.; Bauch, S.; Iribarrem, A.; Sammon, P.; Llerena, C.A.; Alves, L.M.; Orihuela, C.E.; et al. Why ‘blended finance’ could help transitions to sustainable landscapes: Lessons from the Unlocking Forest Finance project. Ecosyst. Serv. 2019, 37, 100917. [Google Scholar] [CrossRef]

- Bath, P.; Guzmán-Valladares, A.; Luján-Gallegos, V.; Mathias, K. Conservation Trust Funds 2020: Global Vision, Local Action; Conservation Finance Alliance: New York, NY, USA, 2020; Available online: https://www.conservationfinancealliance.org/10-year-review (accessed on 29 June 2023).

- Gibbon, A. Innovations in Conservation Finance—Althelia; Althelia Ecosphere: London, UK, 2017; Available online: https://www.tropicalforests.ox.ac.uk/wp-content/uploads/sites/2/2017/09/Adam-Gibbon-presentation.pdf (accessed on 30 June 2023).

- Michaelowa, A.; Hoch, S.; Weber, A.-K.; Kassaye, R.; Hailu, T. Mobilising private climate finance for sustainable energy access and climate change mitigation in Sub-Saharan Africa. Clim. Policy 2021, 21, 47–62. [Google Scholar] [CrossRef]

- Green Finance Institute. Althelia Sustainable Ocean Fund; The Green Finance Institute: London, UK, 2023; Available online: https://www.greenfinanceinstitute.co.uk/gfihive/case-studies/sustainable-ocean-fund/ (accessed on 9 November 2023).

- Green Finance Institute. The Meloy Fund; The Green Finance Institute: London, UK, 2023; Available online: https://www.greenfinanceinstitute.co.uk/gfihive/case-studies/the-meloy-fund/ (accessed on 9 November 2023).

- USAID. Catalyzing Private Finance for Climate Action: Case Study Analysis; USAID: Washington, DC, USA, 2021. Available online: https://www.usaid.gov/documents/catalyzing-private-finance-climate-action-case-study-analysis (accessed on 6 June 2023).

- Sutton-Grier, A.E.; Wowk, K.; Bamford, H. Future of our coasts: The potential for natural and hybrid infrastructure to enhance the resilience of our coastal communities, economies and ecosystems. Environ. Sci. Policy 2015, 51, 137–148. [Google Scholar] [CrossRef]

- Halaburda, H.; Levina, N.; Min, S. Understanding Smart Contracts as a New Option in Transaction Cost Economics. ICIS 2019 Proc. 2019, 19, 1–17. [Google Scholar]

- Casey, A.J.; Niblett, A. Self-Driving Contracts. SSRN Electron. J. 2017, 43, 1. [Google Scholar] [CrossRef][Green Version]

- Savelyev, A. Contract law 2.0: ‘Smart’ contracts as the beginning of the end of classic contract law. Inf. Commun. Technol. Law 2017, 26, 116–134. [Google Scholar] [CrossRef]

- Czura, C. Blockchain for Biodiversity Finance: An Overview of Various Blockchain Applications to Help Increase Biodiversity Funding; UNEP: Nairobi, Kenya, 2022. [Google Scholar]

- Howell, B.E.; Potgieter, P.H. Governance of Smart Contracts in Blockchain Institutions. SSRN Electron. J. 2019, 1–11. [Google Scholar] [CrossRef]

- GainForest. GainForest Whitepaper; Gainforest: Zurich, Switzerland, 2023; Available online: https://docs.gainforest.earth/whitepaper/chapter-zero (accessed on 30 June 2023).

- Kotsialou, G.; Kuralbayeva, K.; Laing, T. Forest Carbon Offsets over a Smart Ledger; SSRN; Elsevier: Amsterdam, The Netherlands, 2021. [Google Scholar] [CrossRef]

- Mulley, B. Introducing the FLRChain; Gaiachain Lab: London, UK; IUCN: Gland, Switzerland, 2021; Available online: https://medium.com/gaiachain/introducing-the-flrchain-6a80aef97f9c (accessed on 8 July 2023).

- Mulley, B. Blockchain & Forest Landscape Restoration: Lessons Learned and Next Steps; Gaiachain Lab: London, UK; IUCN: Gland, Switzerland, 2022; Available online: https://medium.com/gaiachain/blockchain-forest-restoration-lessons-learned-so-far-d68756a8e32a (accessed on 8 July 2023).

- BIS. Smart Contract-Based Carbon Credits Attached to Green Bonds; Project Genesis 2.0 Report; Bank of International Settlements: Basel, Switzerland, 2022; Available online: https://www.bis.org/publ/othp58.htm (accessed on 20 August 2023).

- Uzsoki, D. Tokenization of Infrastructure: A Blockchain-Based Solution to Financing Sustainable Infrastructure; International Institute for Sustainable Development: Winnipeg, MB, Canada, 2019. [Google Scholar]

- Solid World. Vlinder Papariko; Solid World: Tallin, Estonia, 2023; Available online: https://app.solid.world/projects/4 (accessed on 25 June 2023).

- Commbank. Blockchain “BioTokens” Create New Marketplace for Biodiversity; Commonwealth Bank: Sydney, Australia, 2019; Available online: https://www.commbank.com.au/guidance/newsroom/blockchain-biotokens-biodiversity-marketplace-201908.html (accessed on 3 September 2023).

- Booman, G.; Craelius, A.; Deriemaeker, B.; Landua, G.; Szal, W.; Weinberg, B. Regen Network Whitepaper; Regen Network: Wilmington, DE, USA, 2021; Available online: https://regen-network.gitlab.io/whitepaper/WhitePaper.pdf (accessed on 30 June 2023).

- Howson, P.; Oakes, S.; Baynham-Herd, Z.; Swords, J. Cryptocarbon: The promises and pitfalls of forest protection on a blockchain. Geoforum 2019, 100, 1–9. [Google Scholar] [CrossRef]

- De Palma, A.; Leruth, L.E.; Prunier, G. Towards a Principal-Agent Based Typology of Risks in Public-Private Partnerships, Reflets Perspect. Vie Économique 2012, 2012, 57–73. [Google Scholar] [CrossRef]

- Matsumoto, C.; Monteiro, R.; Rial, I.; Sakrak, O.A. Mastering the Risky Business of Public-Private Partnerships in Infrastructure. Int. Monet. Fund 2021, 2021, 61. [Google Scholar] [CrossRef]

- Commission, E. Public Procurement of Nature-Based Solutions: Addressing Barriers to the Procurement of Urban NBS: Case Studies and Recommendations; Publications Office: Luxembourg, 2020; Available online: https://data.europa.eu/doi/10.2777/561021 (accessed on 18 July 2022).

- Tanis, M.; Vergeer, T. Long-term coastal defence and management at Pevensey Bay, UK: A public private partnership. Terra Et Aqua J. 2008, 113, 14–18. [Google Scholar]

- Brisbane City. Oxley Creek Transformation Master Plan; Brisbane City Council: Brisbane, QLD, Australia, 2018; Available online: https://www.sustainablebrisbane.com.au/wp-content/uploads/2021/11/Oxley-Creek-Transformation-Master-Plan-2018.pdf (accessed on 19 May 2023).

- Ware, D.; Banhalmi-Zakar, Z. Funding Coastal Protection in a Changing Climate: Lessons from Three Projects in Australia; ACCARNSI discussion papers; Griffith University: Nathan, QLD, Australia, 2017. [Google Scholar]

- Climate Adapt. Regional Flood Management by Combining Soft and Hard Engineering Solutions, the Norfolk Broadlands; European Environmental Agency: Copenhagen, Denmark, 2020; Available online: https://climate-adapt.eea.europa.eu/en/metadata/case-studies/regional-flood-management-by-combining-soft-and-hard-engineering-solutions-the-norfolk-broadlands (accessed on 10 June 2023).

- Climate Adapt. Public-Private Partnership for a New Flood Proof District in Bilbao; European Environmental Agency: Copenhagen, Denmark, 2016; Available online: https://climate-adapt.eea.europa.eu/en/metadata/case-studies/public-private-partnership-for-a-new-flood-proof-district-in-bilbao (accessed on 6 June 2023).

- Thomson, C.C. Private-public partnerships: Prerequisites for prime performance. EIB Pap. 2005, 10, 113–129. [Google Scholar]

- Bloomfield, P. The Challenging Business of Long-Term Public-Private Partnerships: Reflections on Local Experience. Public Adm. Rev. 2006, 66, 400–411. [Google Scholar] [CrossRef]

- Riess, A. Is the PPP model applicable across sectors? EIB Pap. 2005, 22, 11–30. [Google Scholar]

- UNDP. Mikoko Pamoja, Kenya, Equator Initiative Case Study Series; United Nations Environmental Program: Nairobi, Kenya; Equator Initiative: New York, NY, USA, 2020; Available online: https://www.equatorinitiative.org/wp-content/uploads/2020/03/Mikoko-Pamoja-Kenya.pdf (accessed on 12 June 2023).

- Wylie, L.; Sutton-Grier, A.E.; Moore, A. Keys to successful blue carbon projects: Lessons learned from global case studies. Mar. Policy 2016, 65, 76–84. [Google Scholar] [CrossRef]

- Vanniarachchy, S.A. Mangrove Restoration and Sustainable Development in Myanmar; Worldview International Foundation: Yangon, Myanmar, 2020; Available online: https://vlinderclimate.com/vlinder-myanmar-blue-carbon (accessed on 5 July 2023).

- Mack, S.K.; Lane, R.R.; Holland, K.; Bauer, J.; Cole, J.; Cowan, R. A blue carbon pilot project: Lessons learned. Carbon Manag. 2022, 13, 420–434. [Google Scholar] [CrossRef]

- Sapkota, Y.; White, J.R. Carbon offset market methodologies applicable for coastal wetland restoration and conservation in the United States: A review. Sci. Total Environ. 2020, 701, 134497. [Google Scholar] [CrossRef] [PubMed]

- VERRA. Blue Carbon Project Gulf of Morrosquillo “Vida Manglar”; VERRA: Washington, DC, USA, 2021; Available online: https://registry.verra.org/app/projectDetail/VCS/2290 (accessed on 26 August 2023).

- Conservation International. Vida Manglar—2022 Impact Report; Conservation International: Arlington County, VI, USA, 2022; Available online: https://www.conservation.org/docs/default-source/publication-pdfs/cispata-bay-mangroves-2022-impact-report.pdf?sfvrsn=2b5b6f4d_3 (accessed on 20 August 2023).

- Kuwae, T.; Watanabe, A.; Yoshihara, S.; Suehiro, F.; Sugimura, Y. Implementation of blue carbon offset crediting for seagrass meadows, macroalgal beds, and macroalgae farming in Japan. Mar. Policy 2022, 138, 104996. [Google Scholar] [CrossRef]

- Chausson, A.; Welden, E.A.; Melanidis, M.S.; Gray, E.; Hirons, M.; Seddon, N. Going beyond market-based mechanisms to finance nature-based solutions and foster sustainable futures. PLoS Clim. 2023, 2, e0000169. [Google Scholar] [CrossRef]

- IUCN. Manual for the Creation of Blue Carbon Projects in Europe and the Mediterranean. 2021. Available online: https://life-bluenatura.eu/wp-content/uploads/2021/05/manualbluecarbon_eng_lr.pdf (accessed on 26 June 2023).

- Ribaudo, M.; Greene, C.; Hansen, L.; Hellerstein, D. Ecosystem services from agriculture: Steps for expanding markets. Ecol. Econ. 2010, 69, 2085–2092. [Google Scholar] [CrossRef]

- Froger, G.; Boisvert, V.; Méral, P.; Coq, J.-F.; Caron, A.; Aznar, O. Market-Based Instruments for Ecosystem Services between Discourse and Reality: An Economic and Narrative Analysis. Sustainability 2015, 7, 11595–11611. [Google Scholar] [CrossRef]

- Le Coq, J.F.; Soto, G.; Gonzalez, C. A Comparative Analysis of Their Limits and Opportunities to Foster Environmental Services Provision. In Ecosystem Services from Agriculture and Agroforestry; Earthscan: New York, NY, USA, 2011; pp. 237–264. [Google Scholar]

- Miro Forestry. Annual Report; Miro Forestry: London, UK, 2022; Available online: https://www.miroforestry.com/wp-content/uploads/2023/05/Miro_Annual-Report_2022_V5-Web.pdf (accessed on 15 July 2023).

- Bottema, M.J.M. Institutionalizing area-level risk management: Limitations faced by the private sector in aquaculture improvement projects. Aquaculture 2019, 512, 734310. [Google Scholar] [CrossRef]

- Altmann, A.; Berger Filho, A.G. Certification and labeling for conservation of ecosystem services in the Pampa Biome: Case study of the Aliança do Pastizal scheme. Ecosyst. Serv. 2020, 46, 101209. [Google Scholar] [CrossRef]

- Capacci, S.; Scorcu, A.E.; Vici, L. Seaside tourism and eco-labels: The economic impact of Blue Flags. Tour. Manag. 2015, 47, 88–96. [Google Scholar] [CrossRef]

- Jaung, W.; Putzel, L.; Naito, D. Can ecosystem services certification enhance brand competitiveness of certified products? Sustain. Prod. Consum. 2019, 18, 53–62. [Google Scholar] [CrossRef]

- Purbawiyatna, A.; Simula, M. Developing Forest Certification. In Towards Increasing the Comparability and Acceptance of Forest Certification Systems; International Tropical Timber Organisation: Yokohama, Japan, 2008; Available online: https://www.itto.int/direct/topics/topics_pdf_download/topics_id=40920000&no=1&disp=inline (accessed on 14 October 2023).

- Tacconi, L.; Obidzinski, K.; Agung, F. Learning Lessons to Promote Forest Certification and Control Illegal Logging in Indonesia; Center for International Forestry Research (CIFOR): Bogor, Indonesia, 2004. [Google Scholar] [CrossRef]

- Emerton, L. Sustainable Financing of Protected Areas: A Global Review of Challenges and Options; IUCN: Gland, Switzerland, 2006. [Google Scholar] [CrossRef]

- Pascal, N.; Brathwaite, A.; Bladon, A.; Claudet, J.; Clua, E. Impact investment in marine conservation. Ecosyst. Serv. 2021, 48, 101248. [Google Scholar] [CrossRef]

- Lindberg, K. Protected Area Visitor Fees—Overview; Cooperative Research Centre for Sustainable Tourism Griffith University: Gold Coast, Australia, 2001. [Google Scholar]

- Vega, E.B. Sustainable Finance of Protected Areas: Tourism Based User Fees Conservation Finance Guide, Conservation Finance Alliance. SSRN Electron. J. 2004, 1–33. [Google Scholar] [CrossRef]

- Benitez, S.; Drumm, A.; Troya, R. Visitor Use Fees and Concession Systems in Protected Areas: Galápagos National Park Case Study (Technical Report No. 3), Ecotourism Program; The Nature Conservancy: Arlington, VA, USA, 2001. [Google Scholar]

- Prefeita Municipal de Bombinhas, Lei Complementar 185 2013 de Bombinhas SC. 2013. Available online: https://leismunicipais.com.br/a/sc/b/bombinhas/lei-complementar/2013/19/185/lei-complementar-n-185-2013-institui-a-taxa-de-preservacao-ambiental-tpa-e-da-outras-providencias (accessed on 7 July 2023).

- Ministry of Business, Innovation & Employment, International Visitor Conservation and Tourism Levy (IVL)—Annual Performance Report 2021/22. 2023. Available online: https://www.mbie.govt.nz/immigration-and-tourism/tourism/tourism-funding/international-visitor-conservation-and-tourism-levy/ivl-annual-performance-reports/annual-performance-report-202122/ (accessed on 7 June 2023).

- UNEP. Funding Protected Areas in the Wider Caribbean—A Guide for Managers and Conservation Organizations; UNEP, The Nature Conservancy: Arlington, VA, USA, 2001. [Google Scholar]

- Mullin, M.; Smith, M.D.; McNamara, D.E. Paying to save the beach: Effects of local finance decisions on coastal management. Clim. Change 2018, 152, 275–289. [Google Scholar] [CrossRef]

- Dunning, R.J.; Lord, A. Viewpoint: Preparing for the climate crisis: What role should land value capture play? Land Use Policy 2020, 99, 104867. [Google Scholar] [CrossRef]

- Climate Adapt. Addressing Coastal Erosion in Marche Region, Italy; European Environmental Agency: Copenhagen, Denmark, 2020; Available online: https://climate-adapt.eea.europa.eu/en/metadata/case-studies/addressing-coastal-erosion-in-marche-region-italy (accessed on 10 June 2023).

- Woodruff, S.C.; Mullin, M.; Roy, M. Is coastal adaptation a public good? The financing implications of good characteristics in coastal adaptation. J. Environ. Plan. Manag. 2020, 63, 2082–2101. [Google Scholar] [CrossRef]

- Grafakos, S.; Tsatsou, A.; Acci, D.; Kostaras, J.; Lopez, A.; Recoms, N.R.; Summers, B. Exploring the Use of Land Value Capture Instruments for Green Resilient Infrastructure Benefits: A Framework Applied in Cali. In Colombia Working Paper WP19SG1; Lincoln Institute of Land Policy: Cambridge, MA, USA, 2019; Available online: http://rgdoi.net/10.13140/RG.2.2.35672.24322 (accessed on 15 July 2022).

- Root, L.; van der Krabben, E.; Spit, T. Bridging the financial gap in climate adaptation: Dutch planning and land development through a new institutional lens. J. Environ. Plan. Manag. 2015, 58, 701–718. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Favero, F.; Hinkel, J. Key Innovations in Financing Nature-Based Solutions for Coastal Adaptation. Climate 2024, 12, 53. https://doi.org/10.3390/cli12040053

Favero F, Hinkel J. Key Innovations in Financing Nature-Based Solutions for Coastal Adaptation. Climate. 2024; 12(4):53. https://doi.org/10.3390/cli12040053

Chicago/Turabian StyleFavero, Fausto, and Jochen Hinkel. 2024. "Key Innovations in Financing Nature-Based Solutions for Coastal Adaptation" Climate 12, no. 4: 53. https://doi.org/10.3390/cli12040053

APA StyleFavero, F., & Hinkel, J. (2024). Key Innovations in Financing Nature-Based Solutions for Coastal Adaptation. Climate, 12(4), 53. https://doi.org/10.3390/cli12040053