Fixed and Long Time Span Jump Tests: New Monte Carlo and Empirical Evidence

Abstract

1. Introduction

2. Setup

3. Heuristic Discussion

4. Long Time Span Jump Intensity Test

5. Fixed Time Span Realized Jump Tests

5.1. Aït-Sahalia and Jacod (ASJ: 2009) Test

5.2. Barndorff-Nielsen and Shephard (BNS: 2006) Test

5.3. Podolskij and Ziggel (PZ: 2010) Test

6. Monte Carlo Simulations

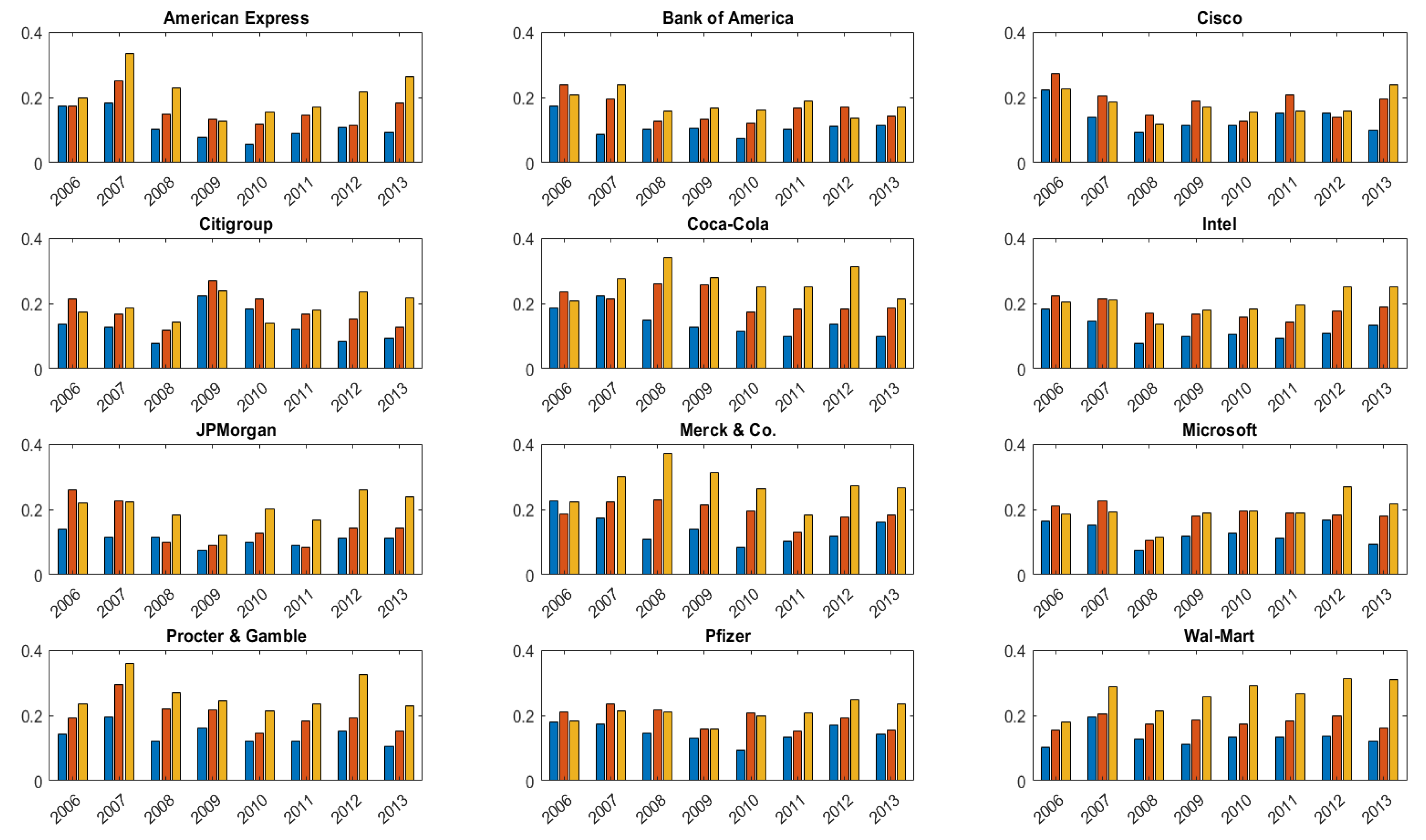

7. Empirical Examination of Stock Market Data

7.1. Data

7.2. Empirical Findings

8. Concluding Remarks

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aït-Sahalia, Yacine. 2002a. Maximum likelihood estimation of discretely sampled diffusions: A closed-form approximation approach. Econometrica 70: 223–62. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine. 2002b. Telling from discrete data whether the underlying continuous–time model is a diffusion. The Journal of Finance 57: 2075–112. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine, and Jean Jacod. 2009. Testing for jumps in a discretely observed process. The Annals of Statistics 37: 184–222. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine, and Jean Jacod. 2011. Testing whether jumps have finite or infinite activity. The Annals of Statistics 39: 1689–719. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine, Jean Jacod, and Jia Li. 2012. Testing for jumps in noisy high frequency data. Journal of Econometrics 168: 207–22. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine, Julio Cacho-Diaz, and Roger J. A. Laeven. 2015. Modeling financial contagion using mutually exciting jump processes. Journal of Financial Economics 117: 585–606. [Google Scholar] [CrossRef]

- Aït-Sahalia, Yacine, Jianqing Fan, Roger J. A. Laeven, Christina Dan Wang, and Xiye Yang. 2017. Estimation of the continuous and discontinuous leverage effects. Journal of the American Statistical Association 112: 1744–58. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Francis X. Diebold. 2007a. Roughing it up: Including jump components in the measurement, modeling, and forecasting of return volatility. The Review of Economics and Statistics 89: 701–20. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Dobrislav Dobrev. 2007b. No-arbitrage semi-martingale restrictions for continuous-time volatility models subject to leverage effects, jumps and iid noise: Theory and testable distributional implications. Journal of Econometrics 138: 125–80. [Google Scholar] [CrossRef]

- Andrews, Donald W. K., and Xu Cheng. 2012. Estimation and inference with weak, semi-strong, and strong identification. Econometrica 80: 2153–211. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E. 2002. Econometric analysis of realized volatility and its use in estimating stochastic volatility models. Journal of the Royal Statistical Society: Series B (Statistical Methodology) 64: 253–80. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., and Neil Shephard. 2003. Realised power variation and stochastic volatility variance. Bernoulli 9: 243–65. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., and Neil Shephard. 2004. Power and bipower variation with stochastic volatility and jumps. Journal of Financial Econometrics 2: 1–37. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., and Neil Shephard. 2006. Econometrics of testing for jumps in financial economics using bipower variation. Journal of Financial Econometrics 4: 1–30. [Google Scholar] [CrossRef]

- Benjamini, Yoav, and Yosef Hochberg. 1995. Controlling the false discovery rate: a practical and powerful approach to multiple testing. Journal of the Royal Statistical Society. Series B (Methodological) 57: 289–300. [Google Scholar] [CrossRef]

- Bowsher, Clive G. 2007. Modelling security market events in continuous time: Intensity based, multivariate point process models. Journal of Econometrics 141: 876–912. [Google Scholar] [CrossRef]

- Chernov, Mikhail, Andrew Ronald Gallant, Eric Ghysels, and George Tauchen. 2003. Alternative models for stock price dynamics. Journal of Econometrics 116: 225–57. [Google Scholar] [CrossRef]

- Christensen, Kim, Roel C. A. Oomen, and Mark Podolskij. 2014. Fact or friction: Jumps at ultra high frequency. Journal of Financial Economics 114: 576–99. [Google Scholar] [CrossRef]

- Corradi, Valentina, Mervyn J. Silvapulle, and Norman R. Swanson. 2014. Consistent Pretesting for Jumps. Working Paper. New Brunswick: Rutgers University. [Google Scholar]

- Corradi, Valentina, Mervyn J. Silvapulle, and Norman R. Swanson. 2018. Testing for jumps and jump intensity path dependence. Journal of Econometrics 204: 248–67. [Google Scholar] [CrossRef]

- Corsi, Fulvio, Davide Pirino, and Roberto Reno. 2009. Volatility Forecasting: The Jumps Do Matter. Working Paper. Siena: University of Siena. [Google Scholar]

- Corsi, Fulvio, Davide Pirino, and Roberto Reno. 2010. Threshold bipower variation and the impact of jumps on volatility forecasting. Journal of Econometrics 159: 276–88. [Google Scholar] [CrossRef]

- Dumitru, Ana-Maria, and Giovanni Urga. 2012. Identifying jumps in financial assets: A comparison between nonparametric jump tests. Journal of Business & Economic Statistics 30: 242–55. [Google Scholar]

- Holm, Sture. 1979. A simple sequentially rejective multiple test procedure. Scandinavian Journal of Statistics 6: 65–70. [Google Scholar]

- Huang, Xin, and George Tauchen. 2005. The relative contribution of jumps to total price variance. Journal of Financial Econometrics 3: 456–99. [Google Scholar] [CrossRef]

- Kalnina, Ilze, and Dacheng Xiu. 2017. Nonparametric estimation of the leverage effect: A trade-off between robustness and efficiency. Journal of the American Statistical Association 112: 384–96. [Google Scholar] [CrossRef]

- Lee, Suzanne S., and Per A. Mykland. 2008. Jumps in financial markets: A new nonparametric test and jump dynamics. Review of Financial Studies 21: 2535–63. [Google Scholar] [CrossRef]

- Mancini, Cecilia. 2009. Non-parametric threshold estimation for models with stochastic diffusion coefficient and jumps. Scandinavian Journal of Statistics 36: 270–96. [Google Scholar] [CrossRef]

- Patton, Andrew J., and Kevin Sheppard. 2015. Good volatility, bad volatility: Signed jumps and the persistence of volatility. Review of Economics and Statistics 97: 683–97. [Google Scholar] [CrossRef]

- Podolskij, Mark, and Mathias Vetter. 2009a. Bipower-type estimation in a noisy diffusion setting. Stochastic Processes and Their Applications 119: 2803–31. [Google Scholar] [CrossRef]

- Podolskij, Mark, and Mathias Vetter. 2009b. Estimation of volatility functionals in the simultaneous presence of microstructure noise and jumps. Bernoulli 15: 634–58. [Google Scholar] [CrossRef]

- Podolskij, Mark, and Daniel Ziggel. 2010. New tests for jumps in semimartingale models. Statistical Inference for Stochastic Processes 13: 15–41. [Google Scholar] [CrossRef]

- Romano, Joseph P., and Michael Wolf. 2005. Stepwise multiple testing as formalized data snooping. Econometrica 73: 1237–82. [Google Scholar] [CrossRef]

- Storey, John D. 2003. The positive false discovery rate: A bayesian interpretation and the q-value. The Annals of Statistics 31: 2013–35. [Google Scholar] [CrossRef]

- Theodosiou, Marina, and Filip Zikes. 2011. A Comprehensive Comparison of Alternative Tests for Jumps in Asset Prices. Working Paper. Nicosia: Central Bank of Cyprus. [Google Scholar]

- Todorov, Viktor. 2015. Jump activity estimation for pure-jump semimartingales via self-normalized statistics. The Annals of Statistics 43: 1831–64. [Google Scholar] [CrossRef]

- Todorov, Viktor, and George Tauchen. 2011. Volatility jumps. Journal of Business & Economic Statistics 29: 356–71. [Google Scholar]

- White, Halbert. 2000. A reality check for data snooping. Econometrica 68: 1097–126. [Google Scholar] [CrossRef]

| 1 | In risk management and financial engineering, investors and researchers often require knowledge of the data generating process (DGP) that governs asset price movements. For example, asset prices are frequently modeled as continuous-time processes, such as (Itô-)semimartingales (see, e.g., Aït-Sahalia (2002a, 2002b); Chernov et al. (2003); and Andersen et al. (2007b)). At the same time, investors and researchers are also interested in nonparametrically estimable quantities such as spot/integrated volatility (see, e.g., Barndorff-Nielsen (2002); Barndorff-Neilsen and Shephard (2003); Todorov and Tauchen (2011); and Patton and Sheppard (2015)), jump variation (see, e.g., Barndorff-Nielsen and Shephard (2004); Andersen et al. (2007a); and Corsi et al. (2009)), leverage effect (see, e.g., Kalnina and Xiu (2017) and Aït-Sahalia et al. (2017)), and jump activity (see e.g., Aït-Sahalia and Jacod (2011) and Todorov (2015)). |

| 2 | Specifically, when focusing on long time span tests, we evaluate the CSS test of Corradi et al. (2018), and the CSS1 test of Corradi et al. (2014). |

| 3 | In an interesting paper related to this paper, Huang and Tauchen (2005) discuss issues associated with applying asymptotic approximations used in fixed time span jump tests over an (long time span) entire sample. They suggest that an appropriate way to solve both inconsistency and size distortion problems associated with fixed time span jump tests is to use test statistics that are asymptotically valid under a double asymptotic scheme where both and This is the approach taken by Corradi et al. (2018). |

| 4 | It is important to note that these tests have a different null hypotheses than fixed time span tests. However, our objective in this paper is not only to examine the finite sample properties of both types of test, but also to compare and contrast the two classes of tests, since both are often used as pre-tests, prior to specifying and estimating involving jumps. |

| 5 | For a detailed comparison of more fixed span tests, refer to Theodosiou and Zikes (2011) and Dumitru and Urga (2012). These authors concisely summarize and compare a large group of existing jump tests via extensive Monte Carlo experiments. |

| 6 | The test is a “leverage robust” variant of the test, and is discussed in detail in Section 4. |

| 7 | Note that 0 if and only if E 0. |

| 8 | The key difference between the and tests is that the former utilizes thresholding, while the latter does not. |

| 9 | Note that in all of our experiments, we do not consider jumps in the volatility process, as mentioned in Section 2. |

| 10 | In all experiments, we first simulate asset log-prices using a Milstein approximation scheme, with a finer interval h = 1/312. We then construct 5-min returns, i.e., with = 1/78. Other numerical simulation strategies can also be used. For example, one can first simulate 1-s frequency data, then sample the data at a 5-min frequency, as in Christensen et al. (2014). However, considering the great computational burden associated with simulating long-span data, this is left to future research. |

| 11 | It would be interesting to analyze results for the case where fixed time span tests are sequentially conducted, but the FWER is controlled for, as discussed in Section 3. This is left to future research. |

| 12 | We assume that the sample over an increasing time span, used in the construction of the test, is observed and we examine a subsample with time span, T. For more details, see Corradi et al. (2018). |

| 13 | We only report results associated with less frequent and weak jumps (i.e., = 0.1 and 0.4) and for jump sizes that are i.i.d normally distributed with = 0, = 0.25 and 1.25 (i.e., small and symmetric jumps, corresponding to the “worst” alternatives considered). Complete results are available upon request. |

| 14 | It will be interesting to use data sampled at a higher frequency, as suggested in Christensen et al. (2014), and to carry out inference on the relative discovery rate of the jump tests, as recommended by a referee. However, given that the tests considered in this paper do not address microstructure noise, this is left to future research. |

| 15 | Only a small subset of our empirical findings are included in the table. These findings are illustrative of those based on examination of our complete set of findings, which are available upon request. In addition, note that for the CSS test, T and should be carefully chosen to guarantee good finite sample properties, as shown in Section 6. Thus, when our data are sampled at 5-min frequency, we are mostly interested in the CSS test results based on the quarterly data. |

| Panel A: Parameter Values |

|---|

| = {5, 0.12, 0.5} |

| = 0.05 |

| = 1/78 |

| = {0, −0.5} |

| = {0.1, 0.4, 0.8} |

| , {, } = {0, 0.25}, {, } = {0, } |

| {, } = {, 0.25}, {, } = {, } |

| Panel B: Data Generating Processes |

| DGP 1: Equation (25) with = 0.05, = 0, = 5, = 0.12, = 0.5 |

| DGP 2: Equation (25) with = 0.05, = −0.5, = 5, = 0.12, = 0.5 |

| DGP 3: DGP 1 + |

| DGP 4: DGP 2 + |

| DGP 5: DGP 1 + |

| DGP 6: DGP 2 + |

| DGP 7: DGP 1 + |

| DGP 8: DGP 2 + |

| DGP 9: DGP 1 + |

| DGP 10: DGP 2 + |

| Test | Subject | T = 1 | T = 5 | T = 50 | T = 150 | T = 300 | T = 500 |

|---|---|---|---|---|---|---|---|

| DGP 1 | |||||||

| Jump Days | 0.112 0.058 | 0.115 0.058 | 0.118 0.059 | 0.120 0.059 | 0.119 0.059 | 0.120 0.060 | |

| ASJ | Sequential Testing Bias | 0.112 0.058 | 0.458 0.256 | 0.999 0.953 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| DGP 2 | |||||||

| Jump Days | 0.100 0.052 | 0.116 0.057 | 0.121 0.059 | 0.120 0.059 | 0.120 0.059 | 0.120 0.059 | |

| Sequential Testing Bias | 0.100 0.052 | 0.458 0.256 | 0.998 0.950 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| DGP 1 | |||||||

| Jump Days | 0.122 0.071 | 0.150 0.094 | 0.155 0.095 | 0.152 0.093 | 0.153 0.094 | 0.153 0.095 | |

| BNS | Sequential Testing Bias | 0.122 0.071 | 0.557 0.380 | 1.000 0.992 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| DGP 2 | |||||||

| Jump Days | 0.141 0.098 | 0.153 0.094 | 0.156 0.096 | 0.154 0.095 | 0.154 0.095 | 0.154 0.095 | |

| Sequential Testing Bias | 0.141 0.098 | 0.571 0.398 | 1.000 0.993 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| DGP 1 | |||||||

| Jump Days | 0.120 0.043 | 0.081 0.031 | 0.123 0.050 | 0.113 0.049 | 0.110 0.046 | 0.108 0.045 | |

| PZ | Sequential Testing Bias | 0.120 0.043 | 0.347 0.146 | 0.999 0.921 | 1.000 0.999 | 1.000 1.000 | 1.000 1.000 |

| DGP 2 | |||||||

| Jump Days | 0.105 0.046 | 0.075 0.029 | 0.122 0.048 | 0.113 0.049 | 0.110 0.046 | 0.108 0.045 | |

| Sequential Testing Bias | 0.105 0.046 | 0.331 0.140 | 0.998 0.916 | 1.000 0.999 | 1.000 1.000 | 1.000 1.000 | |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| ASJ | ||||||||

| = 0.1 | 0.127 0.068 | 0.124 0.067 | 0.143 0.077 | 0.135 0.077 | 0.160 0.093 | 0.160 0.093 | 0.186 0.118 | 0.185 0.125 |

| = 0.4 | 0.183 0.104 | 0.170 0.103 | 0.244 0.150 | 0.232 0.143 | 0.285 0.167 | 0.284 0.172 | 0.353 0.262 | 0.353 0.262 |

| = 0.8 | 0.232 0.137 | 0.242 0.138 | 0.345 0.210 | 0.356 0.219 | 0.415 0.240 | 0.431 0.252 | 0.548 0.411 | 0.533 0.425 |

| BNS | ||||||||

| 0.201 0.154 | 0.185 0.124 | 0.222 0.179 | 0.208 0.150 | 0.247 0.208 | 0.230 0.177 | 0.250 0.211 | 0.232 0.179 | |

| 0.315 0.264 | 0.274 0.225 | 0.379 0.339 | 0.359 0.313 | 0.432 0.403 | 0.404 0.371 | 0.441 0.413 | 0.411 0.378 | |

| 0.427 0.377 | 0.392 0.336 | 0.560 0.526 | 0.534 0.499 | 0.625 0.600 | 0.611 0.583 | 0.633 0.612 | 0.615 0.588 | |

| PZ | ||||||||

| = 0.1 | 0.191 0.107 | 0.182 0.101 | 0.218 0.136 | 0.211 0.131 | 0.239 0.159 | 0.234 0.157 | 0.241 0.163 | 0.235 0.158 |

| = 0.4 | 0.295 0.217 | 0.287 0.210 | 0.377 0.311 | 0.369 0.298 | 0.425 0.366 | 0.416 0.352 | 0.431 0.372 | 0.424 0.360 |

| = 0.8 | 0.424 0.357 | 0.397 0.339 | 0.560 0.510 | 0.548 0.498 | 0.634 0.589 | 0.624 0.587 | 0.640 0.595 | 0.628 0.591 |

| Test | T = 5 | T = 25 | T = 50 | T = 150 | T = 300 | T = 500 |

|---|---|---|---|---|---|---|

| DGP 1 | ||||||

| ASJ | 0.113 0.051 | 0.109 0.057 | 0.119 0.067 | 0.114 0.066 | 0.135 0.072 | 0.147 0.072 |

| DGP 2 | ||||||

| 0.106 0.045 | 0.131 0.075 | 0.148 0.069 | 0.136 0.065 | 0.132 0.072 | 0.145 0.080 | |

| DGP 1 | ||||||

| BNS | 0.132 0.070 | 0.136 0.071 | 0.142 0.075 | 0.150 0.081 | 0.194 0.109 | 0.215 0.127 |

| DGP 2 | ||||||

| 0.127 0.081 | 0.122 0.065 | 0.142 0.080 | 0.162 0.095 | 0.192 0.104 | 0.227 0.132 | |

| DGP 1 | ||||||

| PZ | 0.116 0.069 | 0.288 0.279 | 0.504 0.484 | 0.849 0.846 | 0.962 0.950 | 0.994 0.993 |

| DGP 2 | ||||||

| 0.119 0.071 | 0.290 0.265 | 0.504 0.482 | 0.869 0.856 | 0.974 0.964 | 0.995 0.995 | |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| T = 5 | ||||||||

| = 0.1 | 0.214 0.151 | 0.227 0.169 | 0.341 0.285 | 0.352 0.286 | 0.409 0.345 | 0.408 0.351 | 0.436 0.395 | 0.447 0.405 |

| = 0.4 | 0.498 0.401 | 0.482 0.400 | 0.750 0.678 | 0.731 0.668 | 0.838 0.769 | 0.846 0.784 | 0.876 0.856 | 0.872 0.854 |

| = 0.8 | 0.670 0.565 | 0.653 0.563 | 0.901 0.839 | 0.899 0.833 | 0.941 0.897 | 0.936 0.895 | 0.947 0.934 | 0.939 0.923 |

| T = 25 | ||||||||

| = 0.1 | 0.544 0.480 | 0.510 0.454 | 0.835 0.812 | 0.803 0.779 | 0.913 0.907 | 0.913 0.900 | 0.924 0.921 | 0.924 0.918 |

| = 0.4 | 0.908 0.872 | 0.898 0.870 | 0.993 0.993 | 0.996 0.994 | 0.992 0.991 | 0.991 0.991 | 0.986 0.986 | 0.984 0.984 |

| = 0.8 | 0.988 0.985 | 0.988 0.977 | 0.995 0.995 | 0.995 0.994 | 0.979 0.978 | 0.984 0.980 | 0.989 0.986 | 0.985 0.978 |

| T = 50 | ||||||||

| = 0.1 | 0.711 0.663 | 0.714 0.655 | 0.960 0.954 | 0.956 0.949 | 0.989 0.985 | 0.986 0.985 | 0.991 0.990 | 0.990 0.990 |

| = 0.4 | 0.987 0.979 | 0.989 0.983 | 0.997 0.997 | 0.998 0.997 | 0.992 0.992 | 0.996 0.994 | 0.993 0.993 | 0.994 0.992 |

| = 0.8 | 0.995 0.995 | 0.997 0.994 | 0.996 0.995 | 0.996 0.995 | 0.990 0.989 | 0.990 0.988 | 0.997 0.995 | 0.996 0.994 |

| T = 150 | ||||||||

| = 0.1 | 0.965 0.954 | 0.961 0.947 | 0.999 0.999 | 0.999 0.999 | 0.998 0.997 | 0.997 0.997 | 0.996 0.996 | 0.996 0.996 |

| = 0.4 | 0.998 0.998 | 1.000 0.999 | 1.000 1.000 | 1.000 1.000 | 0.998 0.998 | 0.999 0.998 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.999 0.999 | 0.999 0.999 | 0.999 0.999 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 300 | ||||||||

| = 0.1 | 0.996 0.995 | 0.996 0.995 | 0.999 0.999 | 0.999 0.999 | 0.998 0.998 | 0.998 0.998 | 0.999 0.999 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 500 | ||||||||

| = 0.1 | 0.998 0.998 | 0.999 0.999 | 0.999 0.999 | 0.999 0.999 | 0.999 0.999 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| T = 5 | ||||||||

| = 0.1 | 0.264 0.197 | 0.270 0.207 | 0.396 0.340 | 0.390 0.344 | 0.452 0.408 | 0.446 0.410 | 0.464 0.423 | 0.458 0.423 |

| = 0.4 | 0.588 0.533 | 0.599 0.540 | 0.802 0.771 | 0.798 0.768 | 0.885 0.871 | 0.883 0.872 | 0.889 0.880 | 0.887 0.878 |

| = 0.8 | 0.817 0.768 | 0.815 0.776 | 0.948 0.942 | 0.961 0.953 | 0.983 0.979 | 0.981 0.978 | 0.986 0.984 | 0.984 0.981 |

| T = 25 | ||||||||

| = 0.1 | 0.537 0.471 | 0.550 0.476 | 0.824 0.796 | 0.833 0.804 | 0.915 0.906 | 0.917 0.907 | 0.928 0.923 | 0.930 0.923 |

| = 0.4 | 0.945 0.923 | 0.943 0.928 | 0.998 0.998 | 0.997 0.997 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 50 | ||||||||

| = 0.1 | 0.707 0.625 | 0.720 0.650 | 0.950 0.946 | 0.958 0.944 | 0.987 0.983 | 0.988 0.985 | 0.993 0.993 | 0.995 0.994 |

| = 0.4 | 0.997 0.994 | 0.996 0.995 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 150 | ||||||||

| = 0.1 | 0.947 0.917 | 0.958 0.934 | 1.000 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 300 | ||||||||

| = 0.1 | 0.994 0.993 | 0.996 0.994 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 500 | ||||||||

| = 0.1 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| T = 5 | ||||||||

| = 0.1 | 0.316 0.277 | 0.317 0.284 | 0.418 0.385 | 0.413 0.387 | 0.465 0.433 | 0.456 0.433 | 0.471 0.439 | 0.464 0.441 |

| = 0.4 | 0.682 0.656 | 0.661 0.645 | 0.829 0.818 | 0.810 0.801 | 0.888 0.881 | 0.879 0.874 | 0.890 0.883 | 0.880 0.875 |

| = 0.8 | 0.874 0.864 | 0.865 0.851 | 0.962 0.960 | 0.965 0.960 | 0.981 0.979 | 0.984 0.980 | 0.982 0.980 | 0.985 0.981 |

| T = 25 | ||||||||

| = 0.1 | 0.788 0.780 | 0.777 0.766 | 0.911 0.907 | 0.900 0.896 | 0.936 0.934 | 0.935 0.933 | 0.939 0.937 | 0.939 0.937 |

| = 0.4 | 0.993 0.993 | 0.992 0.992 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 50 | ||||||||

| = 0.1 | 0.960 0.956 | 0.954 0.950 | 0.991 0.991 | 0.987 0.987 | 0.997 0.997 | 0.993 0.993 | 0.998 0.998 | 0.994 0.994 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 150 | ||||||||

| = 0.1 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 300 | ||||||||

| = 0.1 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 500 | ||||||||

| = 0.1 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| Test Statistic | Leverage | T = 5 | T = 25 | T = 50 | T = 150 | T = 300 | T = 500 |

|---|---|---|---|---|---|---|---|

| CSS1 | ⌀ | 0.202 0.145 | 0.151 0.094 | 0.129 0.072 | 0.123 0.076 | 0.106 0.055 | 0.112 0.057 |

| √ | 0.264 0.185 | 0.316 0.221 | 0.461 0.341 | 0.858 0.775 | 0.987 0.968 | 0.999 0.997 | |

| ⌀ | 0.075 0.048 | 0.007 0.003 | 0.001 0.000 | 0.000 0.000 | 0.000 0.000 | 0.000 0.000 | |

| √ | 0.089 0.053 | 0.002 0.001 | 0.000 0.000 | 0.000 0.000 | 0.000 0.000 | 0.000 0.000 |

| T = 40 | T = 50 | T = 60 | T = 70 | T = 80 | T = 90 | ||

|---|---|---|---|---|---|---|---|

| No Leverage | |||||||

| = 2 | 0.049 0.019 | 0.057 0.032 | 0.114 0.057 | 0.105 0.060 | 0.147 0.079 | 0.169 0.103 | |

| = 5 | 0.055 0.025 | 0.078 0.042 | 0.089 0.048 | 0.117 0.053 | 0.111 0.059 | 0.153 0.097 | |

| = 10 | 0.061 0.021 | 0.076 0.033 | 0.091 0.042 | 0.113 0.067 | 0.123 0.067 | 0.152 0.089 | |

| Leverage | |||||||

| = 2 | 0.047 0.021 | 0.117 0.059 | 0.176 0.099 | 0.269 0.189 | 0.341 0.242 | 0.459 0.361 | |

| = 5 | 0.085 0.046 | 0.136 0.077 | 0.203 0.128 | 0.275 0.182 | 0.350 0.249 | 0.437 0.330 | |

| = 10 | 0.085 0.046 | 0.128 0.062 | 0.180 0.116 | 0.284 0.171 | 0.386 0.253 | 0.436 0.332 | |

| T = 120 | T = 140 | T = 160 | T = 180 | T = 200 | T = 220 | ||

| No Leverage | |||||||

| = 2 | 0.030 0.008 | 0.024 0.004 | 0.046 0.015 | 0.057 0.020 | 0.068 0.033 | 0.083 0.045 | |

| = 5 | 0.033 0.015 | 0.047 0.020 | 0.038 0.021 | 0.068 0.029 | 0.070 0.037 | 0.083 0.040 | |

| = 10 | 0.046 0.015 | 0.056 0.022 | 0.067 0.028 | 0.075 0.032 | 0.079 0.038 | 0.089 0.048 | |

| Leverage | |||||||

| = 2 | 0.041 0.017 | 0.075 0.042 | 0.123 0.066 | 0.160 0.086 | 0.234 0.151 | 0.270 0.174 | |

| = 5 | 0.062 0.032 | 0.087 0.043 | 0.127 0.064 | 0.170 0.086 | 0.227 0.139 | 0.290 0.185 | |

| = 10 | 0.071 0.027 | 0.101 0.050 | 0.156 0.091 | 0.167 0.084 | 0.246 0.138 | 0.283 0.187 | |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| T = 5 | ||||||||

| = 0.1 | 0.346 0.274 | 0.361 0.291 | 0.435 0.374 | 0.463 0.396 | 0.487 0.436 | 0.517 0.463 | 0.507 0.461 | 0.540 0.491 |

| = 0.4 | 0.572 0.498 | 0.585 0.514 | 0.717 0.665 | 0.712 0.650 | 0.895 0.879 | 0.883 0.865 | 0.901 0.890 | 0.895 0.887 |

| = 0.8 | 0.664 0.600 | 0.677 0.615 | 0.790 0.752 | 0.784 0.737 | 0.968 0.962 | 0.973 0.964 | 0.969 0.964 | 0.976 0.970 |

| T = 25 | ||||||||

| = 0.1 | 0.472 0.400 | 0.535 0.447 | 0.713 0.656 | 0.733 0.670 | 0.913 0.895 | 0.921 0.896 | 0.926 0.917 | 0.941 0.928 |

| = 0.4 | 0.630 0.560 | 0.634 0.537 | 0.690 0.604 | 0.676 0.598 | 0.997 0.996 | 0.998 0.997 | 1.000 0.998 | 1.000 1.000 |

| = 0.8 | 0.650 0.583 | 0.645 0.569 | 0.647 0.580 | 0.650 0.572 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 50 | ||||||||

| = 0.1 | 0.559 0.459 | 0.587 0.492 | 0.719 0.644 | 0.736 0.657 | 0.982 0.977 | 0.981 0.975 | 0.990 0.989 | 0.990 0.988 |

| = 0.4 | 0.641 0.557 | 0.656 0.561 | 0.642 0.548 | 0.628 0.559 | 1.000 1.000 | 1.000 1.000 | 0.999 0.999 | 0.999 0.999 |

| = 0.8 | 0.623 0.534 | 0.604 0.527 | 0.628 0.531 | 0.627 0.539 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 150 | ||||||||

| = 0.1 | 0.763 0.722 | 0.786 0.732 | 0.847 0.804 | 0.828 0.788 | 1.000 1.000 | 1.000 0.999 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.762 0.716 | 0.768 0.717 | 0.807 0.759 | 0.802 0.764 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.761 0.715 | 0.750 0.704 | 0.805 0.756 | 0.795 0.751 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 300 | ||||||||

| = 0.1 | 0.766 0.709 | 0.784 0.738 | 0.819 0.784 | 0.825 0.786 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.789 0.742 | 0.768 0.713 | 0.780 0.733 | 0.791 0.755 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.759 0.711 | 0.756 0.702 | 0.808 0.764 | 0.802 0.757 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 500 | ||||||||

| = 0.1 | 0.791 0.755 | 0.819 0.790 | 0.865 0.833 | 0.855 0.825 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.819 0.771 | 0.808 0.774 | 0.838 0.804 | 0.827 0.795 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.786 0.753 | 0.776 0.739 | 0.823 0.784 | 0.836 0.795 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| Jump Intensity | DGP 3 | DGP 4 | DGP 5 | DGP 6 | DGP 7 | DGP 8 | DGP 9 | DGP 10 |

|---|---|---|---|---|---|---|---|---|

| T = 5 | ||||||||

| = 0.1 | 0.181 0.145 | 0.221 0.162 | 0.300 0.272 | 0.337 0.287 | 0.374 0.348 | 0.401 0.355 | 0.406 0.390 | 0.438 0.407 |

| = 0.4 | 0.428 0.371 | 0.443 0.388 | 0.651 0.597 | 0.642 0.585 | 0.856 0.835 | 0.837 0.819 | 0.871 0.865 | 0.866 0.863 |

| = 0.8 | 0.596 0.515 | 0.586 0.513 | 0.761 0.717 | 0.738 0.710 | 0.950 0.943 | 0.951 0.944 | 0.951 0.948 | 0.952 0.948 |

| T = 25 | ||||||||

| = 0.1 | 0.262 0.228 | 0.278 0.233 | 0.670 0.644 | 0.680 0.656 | 0.887 0.875 | 0.879 0.863 | 0.915 0.915 | 0.918 0.915 |

| = 0.4 | 0.567 0.505 | 0.565 0.492 | 0.824 0.798 | 0.811 0.783 | 0.998 0.996 | 0.999 0.998 | 0.998 0.998 | 0.998 0.998 |

| = 0.8 | 0.646 0.602 | 0.643 0.579 | 0.793 0.766 | 0.801 0.766 | 0.997 0.997 | 0.998 0.996 | 1.000 1.000 | 1.000 1.000 |

| T = 50 | ||||||||

| = 0.1 | 0.169 0.129 | 0.192 0.149 | 0.694 0.630 | 0.687 0.624 | 0.946 0.933 | 0.959 0.947 | 0.983 0.978 | 0.983 0.978 |

| = 0.4 | 0.436 0.349 | 0.416 0.342 | 0.708 0.632 | 0.696 0.634 | 0.998 0.998 | 0.999 0.997 | 0.998 0.995 | 0.997 0.996 |

| = 0.8 | 0.489 0.411 | 0.469 0.386 | 0.654 0.584 | 0.635 0.586 | 0.996 0.995 | 0.993 0.990 | 0.999 0.997 | 0.999 0.997 |

| T = 150 | ||||||||

| = 0.1 | 0.163 0.120 | 0.149 0.099 | 0.766 0.726 | 0.740 0.695 | 0.997 0.996 | 1.000 0.998 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.320 0.245 | 0.307 0.215 | 0.743 0.701 | 0.742 0.709 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.390 0.311 | 0.353 0.286 | 0.709 0.659 | 0.712 0.657 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 300 | ||||||||

| = 0.1 | 0.090 0.058 | 0.093 0.064 | 0.769 0.728 | 0.753 0.719 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.223 0.158 | 0.216 0.154 | 0.733 0.696 | 0.744 0.708 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.274 0.199 | 0.248 0.188 | 0.702 0.659 | 0.708 0.646 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 500 | ||||||||

| = 0.1 | 0.054 0.026 | 0.063 0.038 | 0.757 0.710 | 0.751 0.700 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.4 | 0.153 0.091 | 0.158 0.106 | 0.717 0.650 | 0.700 0.651 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| = 0.8 | 0.188 0.126 | 0.171 0.129 | 0.667 0.607 | 0.649 0.585 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 |

| T = 40 | T = 50 | T = 60 | T = 70 | T = 80 | T = 90 | ||

|---|---|---|---|---|---|---|---|

| = 0.1 | |||||||

| DGP 3 | 0.450 0.411 | 0.473 0.429 | 0.514 0.455 | 0.571 0.513 | 0.633 0.565 | 0.617 0.559 | |

| DGP 4 | 0.465 0.412 | 0.485 0.438 | 0.550 0.499 | 0.647 0.594 | 0.652 0.593 | 0.702 0.642 | |

| DGP 5 | 0.821 0.810 | 0.872 0.863 | 0.922 0.917 | 0.952 0.947 | 0.965 0.964 | 0.975 0.968 | |

| DGP 6 | 0.829 0.817 | 0.876 0.867 | 0.928 0.918 | 0.953 0.948 | 0.974 0.968 | 0.978 0.972 | |

| = 0.4 | |||||||

| DGP 3 | 0.806 0.762 | 0.835 0.812 | 0.843 0.822 | 0.847 0.819 | 0.868 0.846 | 0.872 0.859 | |

| DGP 4 | 0.792 0.753 | 0.831 0.807 | 0.828 0.804 | 0.862 0.829 | 0.866 0.831 | 0.887 0.865 | |

| DGP 5 | 0.997 0.996 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| DGP 6 | 0.996 0.994 | 0.997 0.997 | 0.997 0.997 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| T = 120 | T = 140 | T = 160 | T = 180 | T = 200 | T = 220 | ||

| = 0.1 | |||||||

| DGP 3 | 0.863 0.838 | 0.890 0.872 | 0.884 0.862 | 0.899 0.889 | 0.919 0.905 | 0.917 0.894 | |

| /2 | DGP 4 | 0.865 0.835 | 0.892 0.869 | 0.907 0.895 | 0.903 0.885 | 0.913 0.898 | 0.918 0.903 |

| DGP 5 | 1.000 1.000 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| DGP 6 | 0.997 0.997 | 1.000 1.000 | 0.999 0.998 | 0.998 0.998 | 0.998 0.998 | 0.999 0.999 | |

| = 0.4 | |||||||

| DGP 3 | 0.946 0.939 | 0.943 0.938 | 0.944 0.938 | 0.958 0.950 | 0.962 0.954 | 0.965 0.959 | |

| DGP 4 | 0.964 0.958 | 0.954 0.949 | 0.961 0.952 | 0.957 0.949 | 0.959 0.948 | 0.967 0.958 | |

| DGP 5 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| DGP 6 | 1.000 1.000 | 0.999 0.999 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | 1.000 1.000 | |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| SPY | 3.264 (***) | 1.694 (**) | 0.002 | 2.579 (***) | 5.213 (***) | 0.745 | 0.874 | 1.745 (**) |

| XLB | 5.011 (***) | 2.528 (***) | 1.941 (**) | 3.207 (***) | 4.161 (***) | 0.870 | 2.682 (***) | 0.986 |

| XLE | 0.952 | 4.862 (***) | 0.019 | 7.023 (***) | 1.061 | 0.058 | 5.665 (***) | 1.772 (**) |

| XLF | 3.207 (***) | 4.128 (***) | 1.825 (**) | 1.774 (**) | 0.843 | 0.822 | 1.286 (*) | 1.663 (**) |

| XLI | 4.233 (***) | 5.903 (***) | 1.625 (*) | 1.827 (**) | 7.367 (***) | 1.486 (*) | 0.951 | 1.813 (**) |

| XLK | 7.909 (***) | 4.214 (***) | 0.991 | 1.766 (**) | 1.384 (*) | 0.759 | 0.922 | 2.492 (***) |

| XLP | 3.180 (***) | 8.996 (***) | 7.979 (***) | 4.212 (***) | 0.373 | 1.493 (*) | 6.078 (***) | 1.565 (*) |

| XLU | 7.066 (***) | 2.730 (***) | 1.481 (*) | 10.000 (***) | 0.528 | 0.642 | 2.769 (***) | 3.324 (***) |

| XLV | 7.030 (***) | 6.084 (***) | 1.828 (**) | 2.386 (***) | 2.352 (***) | 1.729 (**) | 0.866 | 2.530 (***) |

| XLY | 3.368 (***) | 1.845 (**) | 3.279 (***) | 4.399 (***) | 0.457 | 0.735 | 0.022 | 2.721 (***) |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| SPY | 2.04 | −3.88 | 4.87 (***) | 2.65 | 1.65 | −1.19 | −3.15 | −2.90 (**) |

| XLB | −1.40 | −8.45 (***) | 1.35 (***) | −1.90 (***) | −9.21 (***) | 9.39 | −1.33 | 1.87 |

| XLE | 2.38 (***) | −2.43 (**) | 1.07 (**) | −9.77 (**) | 4.74 (***) | −4.76 | −6.35 (**) | −4.45 |

| XLF | −1.11 (***) | −2.58 (***) | 2.00 (***) | −2.26 | −5.04 (**) | −3.69 | 3.76 | −6.79 (**) |

| XLI | −2.03 (***) | 9.96 (***) | 7.23 (***) | −9.39 (**) | 3.24 (***) | 9.48 | 1.98 | −2.93 (**) |

| XLK | −1.99 (***) | −6.68 (***) | 1.86 (***) | −2.68 | −1.45 (***) | −9.44 | −2.63 | −3.39 (***) |

| XLP | 5.92 (***) | 1.83 (***) | −2.02 (***) | −5.91 (***) | −2.19 (**) | −4.69 | −4.30 (***) | 8.25 |

| XLU | −9.42 (***) | 1.67 (***) | −8.17 | −1.04 (***) | 1.75 (***) | −1.91 | 7.89 (***) | −7.47 |

| XLV | −1.17 (***) | 9.52 (***) | 4.08 (***) | −4.11 (***) | −1.71 (***) | 1.24 | −8.03 | −2.53 |

| XLY | −8.05 (***) | −1.06 (***) | −2.97 (***) | −2.72 (***) | 1.62 | −1.56 | −5.33 (**) | 2.57 |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| SPY | 1.28 | −2.43 (*) | 3.05 | 1.66 | 1.03 | −7.46 | −1.98 (*) | −1.82 |

| XLB | −8.78 (*) | −5.31 (**) | 8.41 | −1.19 | −5.77 | 5.88 | −8.38 (*) | 1.17 |

| XLE | 1.49 | −1.53 | 6.71 | −6.12 | 2.97 | −2.98 | −3.99 | −2.79 |

| XLF | −6.97 | −1.62 (**) | 1.25 | −1.42 | −3.16 | −2.31 | 2.36 (*) | −4.26 |

| XLI | −1.27 | 6.25 | 4.52 | −5.88 | 2.03 (***) | 5.94 | 1.24 (*) | −1.83 |

| XLK | −1.25 (***) | −4.19 (**) | 1.16 | −1.68 | −9.06 (**) | −5.91 | −1.66 | −2.12 |

| XLP | 3.71 (*) | 1.15 | −1.26 (***) | −3.70 (**) | −1.37 (*) | −2.94 | −2.70 (***) | 5.17 |

| XLU | −5.92 | 1.05 (***) | −5.11 (*) | −6.49 (***) | 1.10 (***) | −1.19 | 4.96 | −4.68 |

| XLV | −7.37 (***) | 5.98 | 2.55 | −2.57 | −1.07 (***) | 7.76 | −5.05 (*) | −1.58 |

| XLY | −5.05 | −6.68 (**) | −1.86 (**) | −1.71 | 1.01 | −9.79 | −3.35 (*) | 1.61 |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| American Express | 3.115 (***) | 4.248 (***) | 2.044 (**) | 2.672 (***) | 0.996 | 2.343 (***) | 3.555 (***) | 2.464 (***) |

| Bank of America | 2.914 (***) | 3.014 (***) | 1.529 (*) | 3.576 (***) | 0.819 | 3.171 (***) | 1.784 (**) | 0.803 |

| Cisco | 3.811 (***) | 5.997 (***) | 0.180 | 1.818 (**) | 2.865 (***) | 1.665 (**) | 2.581 (***) | 0.922 |

| Citigroup | 3.215 (***) | 0.802 | 0.520 | 3.302 (***) | 6.023 (***) | 0.752 | 0.197 | 0.895 |

| Coca-Cola | 8.039 (***) | 10.005 (***) | 6.134 (***) | 4.563 (***) | 0.826 | 1.774 (**) | 2.551 (***) | 3.476 (***) |

| Intel | 2.632 (***) | 4.142 (***) | 3.332 (***) | 0.914 | 5.627 (***) | 6.425 (***) | 1.821 (**) | 1.772 (**) |

| JPMorgan | 3.446 (***) | 2.532 (***) | 3.232 (***) | 0.962 | 1.733 (**) | 3.461 (***) | 0.987 | 0.983 |

| Merck & Co. | 5.700 (***) | 8.016 (***) | 1.909 (**) | 3.184 (***) | 0.051 | 1.559 (*) | 2.648 (***) | 0.246 |

| Microsoft | 2.982 (***) | 6.997 (***) | 0.909 | 0.811 | 0.652 | 3.434 (***) | 4.579 (***) | 0.370 |

| Procter & Gamble | 3.285 (***) | 4.933 (***) | 1.814 (**) | 9.998 (***) | 2.387 (***) | 3.218 (***) | 9.003 (***) | 1.745 (**) |

| Pfizer | 2.356 (***) | 4.024 (***) | 0.845 | 0.890 | 7.436 (***) | 1.960 (**) | 1.740 (**) | 2.516 (***) |

| Wal-Mart | 0.823 | 4.011 (***) | 1.187 | 1.730 (**) | 0.799 | 2.439 (***) | 0.131 | 3.461 (***) |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| American Express | 1.45 (***) | −8.03 (***) | 4.57 (***) | 1.30 (**) | −7.80 | −1.34 (**) | −6.61 (***) | 6.24 (***) |

| Bank of America | −8.20 (***) | −1.58 (***) | 4.16 (***) | −2.26 (**) | −1.29 | −1.39 (***) | 4.47 | −3.16 |

| Cisco | 6.94 (***) | −7.64 (***) | 9.32 (***) | 9.61 | −2.02 (***) | 1.31 (***) | −1.85 | 8.56 |

| Citigroup | −3.93 (***) | −7.93 | −1.13 | −1.60 | −1.64 (***) | −2.61 | 6.52 (**) | −2.26 |

| Coca-Cola | 8.49 (***) | 5.56 (***) | −2.05 (***) | 1.06 (***) | −3.79 | −5.11 | −2.31 (***) | −1.46 (***) |

| Intel | 5.55 (***) | −1.49 (***) | 1.57 (***) | 2.10 (**) | 1.72 (***) | −3.69 | −1.74 | 4.64 (***) |

| JPMorgan | 4.15 | −1.83 (***) | 1.98 | −2.43 | 3.88 | 3.54 (***) | 7.16 | 1.96 |

| Merck & Co. | 1.39 (***) | 2.12 (***) | −6.85 (***) | −5.17 (***) | 3.81 (***) | 4.54 | 2.80 (***) | 6.49 |

| Microsoft | 9.93 (**) | −7.46 (***) | 1.76 | 6.35 | −4.09 | −1.23 | −6.93 (***) | 1.34 |

| Procter & Gamble | 2.76 (***) | 8.05 (***) | 1.37 | −1.29 (***) | 2.33 (***) | −2.88 (***) | 2.47 (***) | 5.72 |

| Pfizer | 2.08 (***) | −2.74 (***) | 1.11 | 6.97 | 3.96 | 8.69 (**) | 9.01 | 1.78 (***) |

| Wal-Mart | 6.75 | 8.67 (***) | 8.60 (***) | 5.27 (***) | −9.57 | 3.19 (**) | 6.87 | −9.51 |

| 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | |

|---|---|---|---|---|---|---|---|---|

| American Express | 9.09 (***) | −5.04 (*) | 2.86 | 8.13 | −4.88 | −8.42 | −4.16 | 3.91 (**) |

| Bank of America | −5.15 (***) | −9.94 (**) | 2.60 (*) | −1.42 | −8.10 | −8.69 | 2.81 (**) | −1.98 |

| Cisco | 4.36 (*) | −4.79 (***) | 5.82 | 6.02 | −1.27 (*) | 8.23 | −1.17 | 5.36 |

| Citigroup | −2.47 | −4.98 (*) | −7.08 (**) | −1.00 | −1.03 (***) | −1.64 | 4.10 (*) | −1.42 |

| Coca-Cola | 5.33 (***) | 3.49 (**) | −1.28 (**) | 6.64 | −2.37 (**) | −3.20 | −1.45 (**) | −9.15 |

| Intel | 3.48 (*) | −9.33 | 9.83 (**) | 1.32 | 1.08 (*) | −2.31 | −1.10 | 2.91 |

| JPMorgan | 2.61 (*) | −1.15 (**) | 1.24 | −1.52 | 2.43 | 2.22 (*) | 4.50 (*) | 1.23 |

| Merck & Co. | 8.72 (*) | 1.33 (***) | −4.28 (***) | −3.24 | 2.39 (***) | 2.84 | 1.76 (**) | 4.07 |

| Microsoft | 6.23 (*) | −4.68 (***) | 1.10 (*) | 3.98 | −2.56 | −7.71 | −4.36 (**) | 8.42 |

| Procter & Gamble | 1.73 (*) | 5.05 (*) | 8.58 | −8.06 (***) | 1.46 (***) | −1.81 | 1.55 (**) | 3.58 |

| Pfizer | 1.30 (**) | −1.72 (***) | 6.94 (*) | 4.37 | 2.48 | 5.44 | 5.67 (*) | 1.11 |

| Wal-Mart | 4.24 (**) | 5.44 | 5.38 (***) | 3.30 | −6.00 | 2.00 | 4.32 (*) | −5.96 |

| Bank of America | Coca-Cola | Intel | JPMorgan | Merck & Co. | Pfizer | Wal-Mart | SPY | |

|---|---|---|---|---|---|---|---|---|

| 2007-Q1 | 10.877 *** | 23.301 *** | 3.148 *** | −2.86 *** | 26.875 *** | −831.206 *** | 16.069 *** | 1.169 |

| 2007-Q2 | −14.713 *** | 79.895 *** | −1.112 | −6.327 *** | 17.705 *** | 0.065 | 33.324 *** | −2.671 *** |

| 2007-Q3 | 14.278 *** | −12.575 *** | 9.296 *** | 2.648 *** | −5.986 *** | −2.877 *** | 5.97 *** | 5.733 *** |

| 2007-Q4 | −7.383 *** | −6.614 *** | 10.763 *** | −7.326 *** | 14.327 *** | 2.291 ** | 4.186 *** | −7.235 *** |

| 2008-Q1 | 11.617 *** | −7.086 *** | 4.034 *** | 5.499 *** | −279.804 *** | 8.011 *** | 9.386 *** | 3.354 *** |

| 2008-Q2 | 0.412 | −65.435 *** | −0.965 | 1.722 * | −3.815 *** | −11.948 *** | 4.083 *** | −0.623 |

| 2008-Q3 | 3.122 *** | −171.387 *** | 2.249 ** | 1.184 | −41.319 *** | 1.016 | 0.694 | −2.105 ** |

| 2008-Q4 | 5.546 *** | −15.662 *** | −2.057 ** | 4.072 *** | 11.769 *** | 1.692 * | 11.442 *** | 8.688 *** |

| 2012-Q1 | 1.875 * | −6.077 *** | −2.785 *** | 8.731 *** | −9.687 *** | −0.516 | −1.131 | −2.851 *** |

| 2012-Q2 | −2.154 ** | −10.595 *** | −4.255 *** | 1.547 | 8.977 *** | 8.513 *** | 19.704 *** | 0.5 |

| 2012-Q3 | 2.442 ** | −7.287 *** | 6.378 *** | 6.126 *** | 26.943 *** | 3.99 *** | 6.503 *** | 2.551 ** |

| 2012-Q4 | 3.051 *** | −6.527 *** | −7.281 *** | −2.976 *** | −0.216 | −7.034 *** | −13.85 *** | −0.427 |

| 2013-Q1 | −5.007 *** | −2.223 ** | 0.194 | −1.537 | −24.992 *** | 5.515 *** | −11.386 *** | −3.096 *** |

| 2013-Q2 | −4.247 *** | −0.084 | 11.553 *** | −0.671 | 4.179 *** | 0.318 | −3.669 *** | −6.975 *** |

| 2013-Q3 | 0.853 | −1.13 | −1.009 | 4.574 *** | 17.83 *** | 1.873 * | 3.665 *** | 0.826 |

| 2013-Q4 | 8.199 *** | −12.131 *** | 4.526 *** | 11.233 *** | −0.141 | 10.736 *** | 8.329 *** | 6.538 *** |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Cheng, M.; Swanson, N.R. Fixed and Long Time Span Jump Tests: New Monte Carlo and Empirical Evidence. Econometrics 2019, 7, 13. https://doi.org/10.3390/econometrics7010013

Cheng M, Swanson NR. Fixed and Long Time Span Jump Tests: New Monte Carlo and Empirical Evidence. Econometrics. 2019; 7(1):13. https://doi.org/10.3390/econometrics7010013

Chicago/Turabian StyleCheng, Mingmian, and Norman R. Swanson. 2019. "Fixed and Long Time Span Jump Tests: New Monte Carlo and Empirical Evidence" Econometrics 7, no. 1: 13. https://doi.org/10.3390/econometrics7010013

APA StyleCheng, M., & Swanson, N. R. (2019). Fixed and Long Time Span Jump Tests: New Monte Carlo and Empirical Evidence. Econometrics, 7(1), 13. https://doi.org/10.3390/econometrics7010013