This section describes in detail our Monte Carlo simulation analysis and gives numerical results about the performance of different equity volatility estimators in their capability of: (i) filtering the microstructure noise and extracting equity volatility correctly; (ii) backing out asset volatility and (iii) predicting default probabilities.

In order to avoid arbitrage opportunities, all securities written on the underlying firm value

must have the same Sharpe ratio, see [

1] Equation (6). The same underlying assumption on the Sharpe ratio is made for the asset volatility calibration procedure described in [

9]. Therefore, the following equation must be satisfied:

where

is the total asset risk premium,

is the historical equity risk premium and we replace

by the value

, that is any of the equity volatility estimates described in

Section 2. Equation (

8) is the technical tool we use in order to back out the asset volatility

that exactly fits the 5-years probability of default given in Equation (

5) according to the given equity volatility estimate. More precisely, we plug relation (

8) into (

5) and solve for

. This step enables us to tie down the risk-neutral distribution with the objective distribution without resorting to a certain arbitrary assumption or noisy estimate of the asset return process. Once noisy equity prices are generated, we compare the performance of different volatility estimators in their ability of inferring the ”true” equity volatility

. Then, we analyze the influence of this results on the underlying asset volatility calibration and default probability computation.

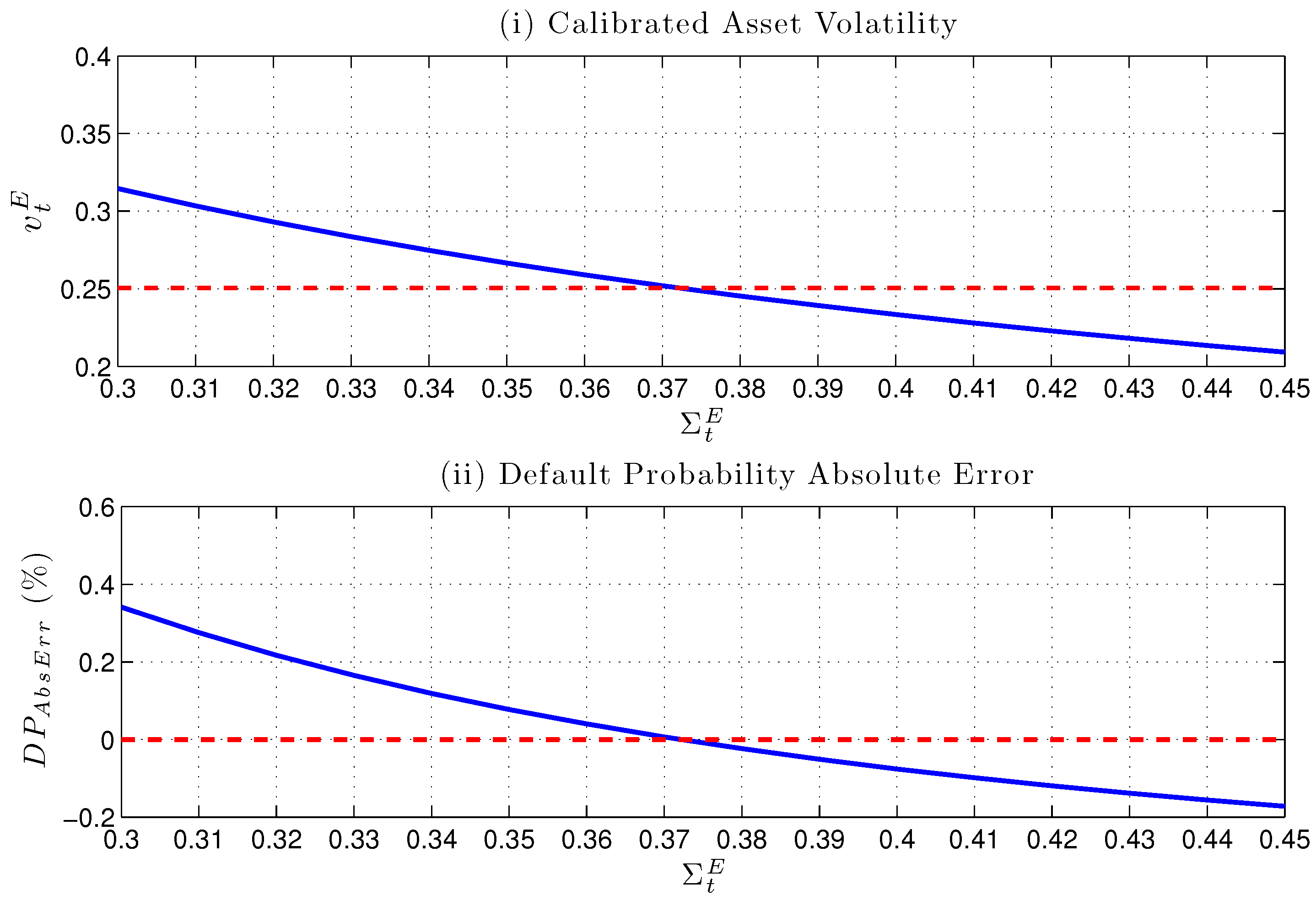

In order to understand the influence of alternative equity volatility estimators on both asset volatility calibration and default probability computation, we preliminarily show in

Figure 4 the theoretical relationship between these quantities. The idea is to take as base case the pair of parameters

and evaluate the impact of different equity volatility values

through our calibration device on both calibrated asset volatility and default probability, as if

was the equity volatility estimate obtained through the non-parametric estimator

E. The theoretical dependence of the calibrated asset volatility

and the default probability is shown in

Figure 4 for the Bates model, but the qualitative behaviour is the same also for the Heston model: as we can see, the equity volatility estimate is a key variable determining both the calibration of asset volatility and the default probability. The impact on default probability is measured in terms of the absolute error defined as

. The calibrated asset volatility depicted in Subplot (i) is obtained by matching the 5-years default probability

, then this value is used to compute the absolute error on the 3-years default probability reported in Subplot (ii). To generalize the outcome of the analysis, the relationship between calibrated asset volatility and equity volatility estimation is nonlinear (convex) monotonous decreasing: overestimating equity volatility generates an underestimation of the calibrated asset volatility. The same monotonous decreasing relation holds between

and the absolute error

, but the absolute magnitude of the error changes may depend on whether we are under-estimating or over-estimating

and which time horizon we are considering. As a general feature, the influence of a non-correct equity volatility estimation can be not negligible. Thus, from a credit risk perspective, a robust equity volatility estimator is crucial to properly evaluate default probability at each maturity.

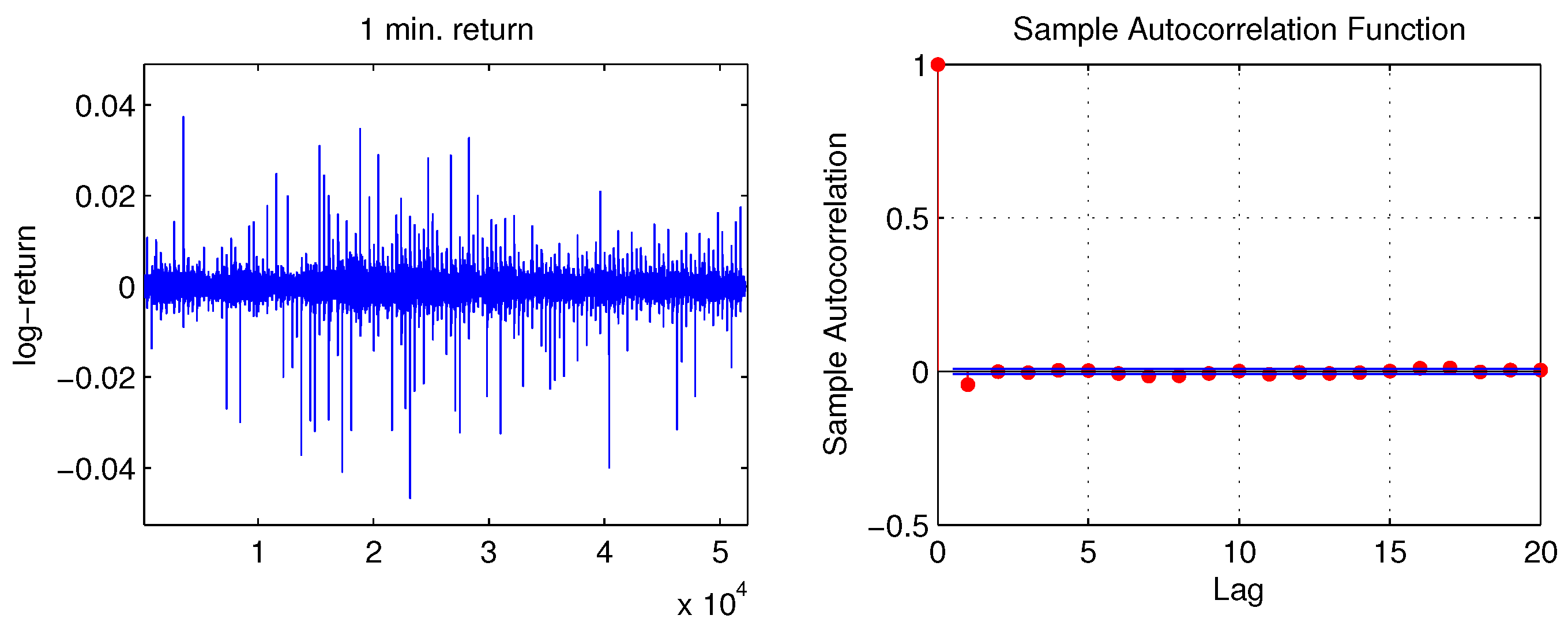

5.1. Equity Volatility Estimation with High-Frequency Data

We perform a Monte Carlo simulation by generating a sample of 1000 trading days and equispaced intra-day data at the frequency

min (i.e.,

). Once the underlying asset value dynamics is generated by model (

2), high-frequency equity prices are obtained through the no arbitrage method given by Equation (

3). Market microstructure noise is considered, alternatively, for both cases described by Equations (

6) and (

7). The random shocks

are i.i.d Gaussian random variables with zero mean and standard deviation equal to

times the log-equity return standard deviation. We set

in the dependent noise case (

7).

In the case of Bates model, the generated dataset is cleaned for jumps according to the jump removal procedure sketched in

Section 3. This procedure allows to eliminate around 7.5%–10% of days from our sample. Nevertheless, some days in the cleaned sample may still exhibit small jumps that can affect volatility estimation. In particular, days in our sample can present different statistical autocorrelation structures.

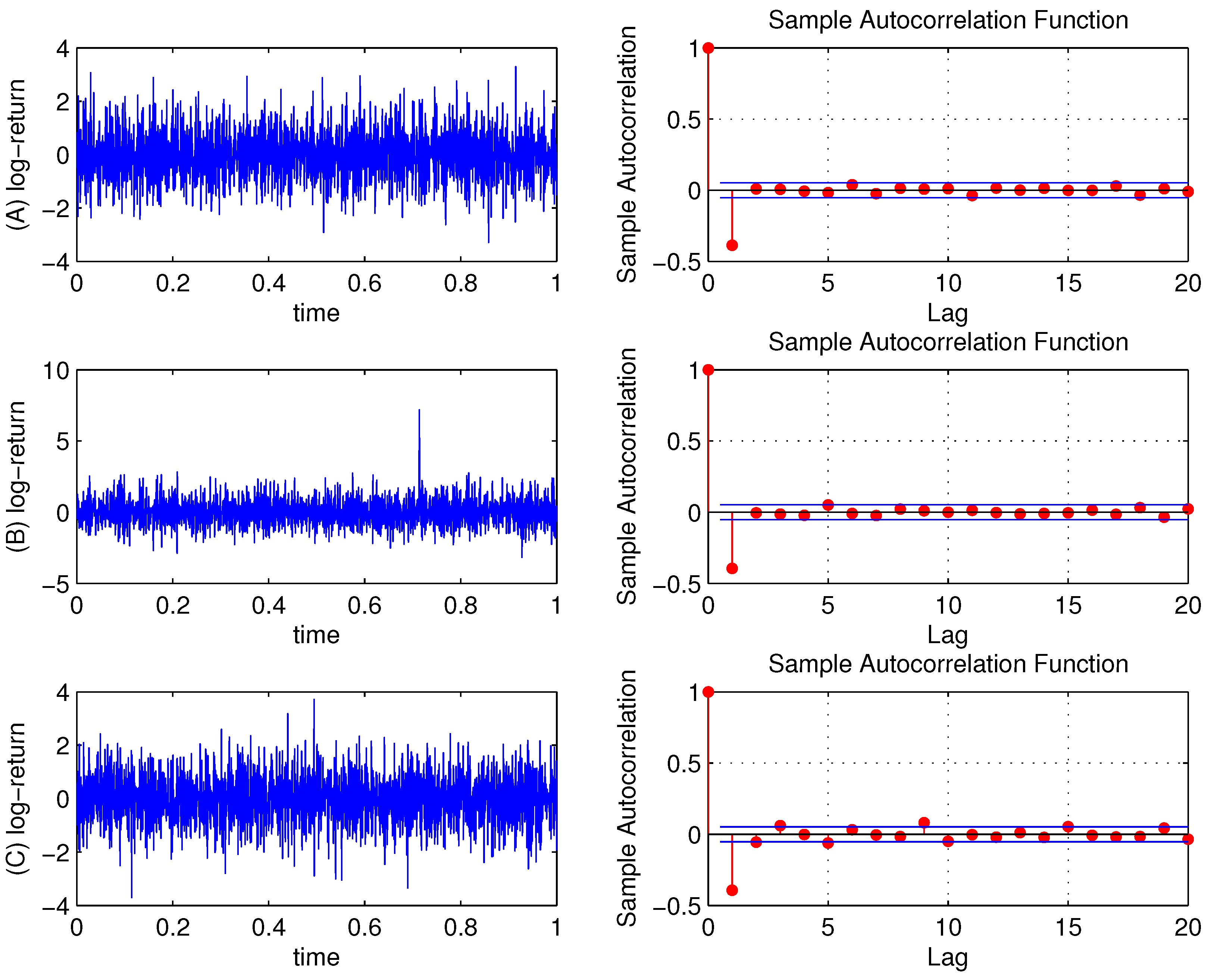

Figure 5 shows the intraday log-returns, normalized to have mean zero and standard deviation one, for the model with Gaussian uncorrelated noise. Panel (A) refers to a day with no jumps and first order autocorrelation structure; panel (B) shows a big spike corresponding to a jump in the equity log-price process, still retaining a first order autocorrelation structure; (C) refers to a day with no jumps and autocorrelation at lags 3, 5, 9 and 15.

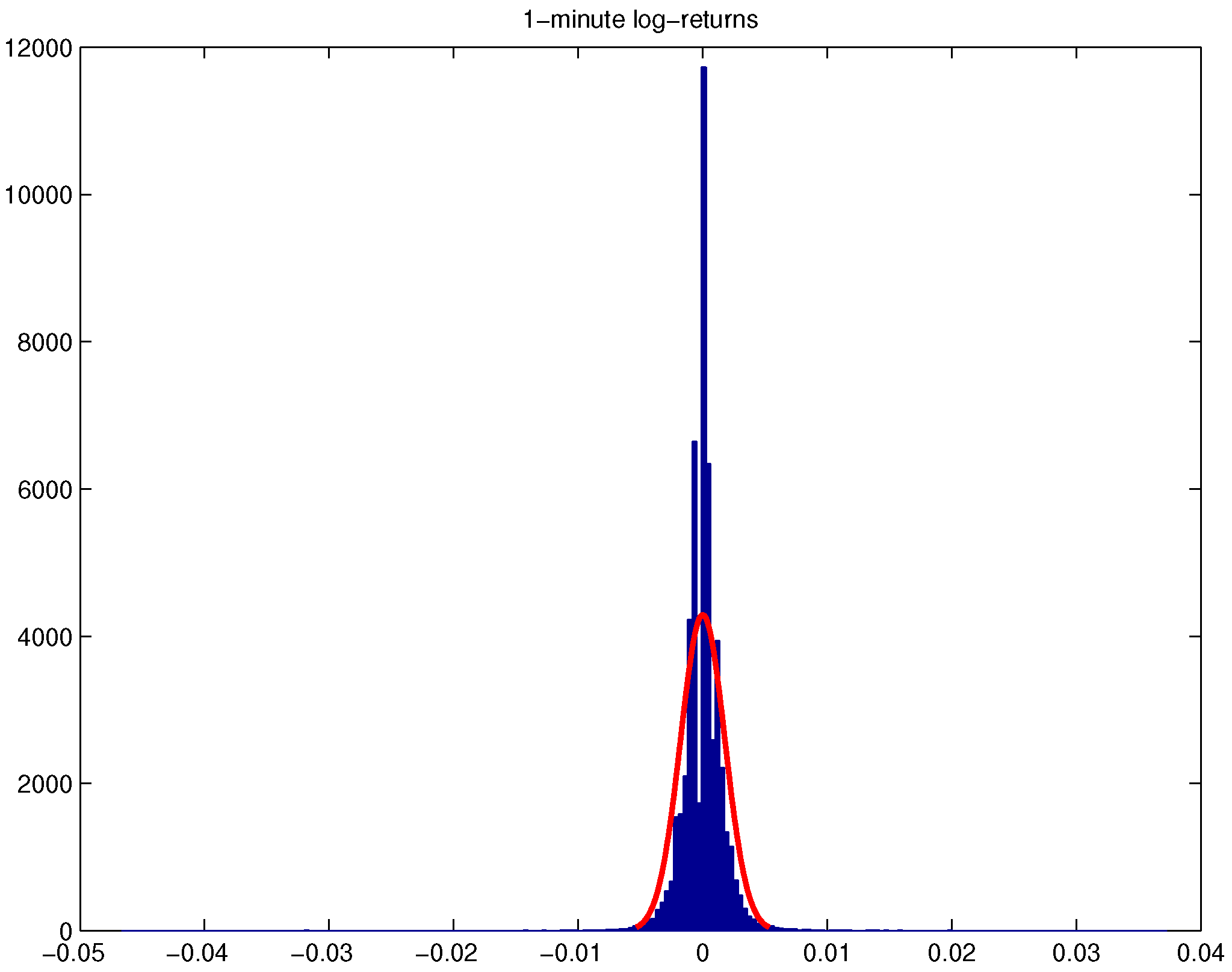

Next we plot the histograms of the intraday returns of equity log-prices.

Figure 6 displays the histogram along with the standard normal density function, which is essentially confined within

. Clearly, the histograms display a slightly high peak and asymmetric heavy tails. The distribution in case (B) is leptokurtic, i.e., more outlier-prone than the normal distribution. Moreover, skewness is positive, i.e., the data are spread out more to the right of the mean than to the left and the returns have heavier right tail.

Table 5 and

Table 6 present numerical evidence for each equity volatility estimator introduced in

Section 2 and used in our comparison when (a) trading noise is independent of intra-day equity log-returns and (b) trading noise is correlated with intra-day equity log-returns, respectively; both Heston [

17] and Bates [

18] dynamics are considered. All the estimators are applied on the equity log-price series after jump removal. The only exception is for the jump-robust Bipower Variation which is applied to the original dataset including jumps after optimal sparse sampling.

Table 5 and

Table 6 list the mean squared error (MSE) and bias (BIAS) achieved by the different non-parametric equity volatility estimators.

represents the sparse sampled Realized Volatility estimator based on 5-min returns, while

refers to the sparse sampled Realized Volatility estimator where the sampling frequency is optimized in order to filter the microstructure effects, as explained in

Section 2. Our results strongly confirm well known stylized facts documented by the econometric literature and highlighted by [

24]:

estimates are strongly affected by noise and sparse sampling can only moderately provide efficient estimates. The 5-min Realized Volatility estimator has the worst performance in terms of both MSE and BIAS among all estimators for Heston and Bates settings, with a MSE of order

and BIAS of order

. This performance can be even worst when considering the 1-min Realized Volatility estimator: results are not reported in the table, but equity volatility estimates are completely swamped by trading noise in such a case. The performance of the Bipower Variation estimator

for equity volatility is comparable to the one obtained through the Realized Volatility estimator based on sparse sampling

. This is particularly relevant in the Bates model simulation of

Table 6. In fact, jumps have been removed from our samples using the procedure sketched in

Section 2. Although some of the jumps may still be present after jump removal, this procedure seems to be effective in eliminating the most relevant jumps.

As an alternative to sparse sampling, the first order correction of can reduce the bias due to the spurious first order autocorrelation in equity returns introduced by the trading noise: overall, this estimator performs much better than in both models and for both assumptions on the trading noise. However, the BIAS reduction is more effective in the Heston model.

The best results in terms of MSE are obtained when considering the set of estimators specifically designed to handle microstructure effects, i.e., , , and .

If we want to try to rank the estimators according to the noise provision, we can state that both the Two-Scale and the Kernel estimators have the best performance in Heston setting, with having a smaller BIAS. The performance of the pre-averaging estimator and the Fourier estimator are comparable in both models.

5.2. Asset Volatility Calibration

This section analyzes how the choice of different volatility estimators affects the calibration of the underlying asset volatility. In order to study the influence of different equity volatility estimators on the default probability predicted by Merton model (see [

1]), we proceed by developing the following calibration exercise for the underlying asset volatility. For each equity volatility estimator, generically denoted by

E, and each day

t in our sample, we find the corresponding daily asset volatility estimate

by matching the 5-years default probability coming from our equity volatility estimate

with the one evaluated through the model using the parameter values of

Table 4. This is done for each day in the sample. In this calibration exercise we act as if we did not know the asset values to mimic the real-life estimation situation and we conduct inference only based on observable quantities such as measurable equity volatility and the 5-years default probabilities. Default probabilities are computed, for any maturity, according to Equation (

5). In order to avoid arbitrage opportunities, following [

9], we consider as key assumption that all securities written on the underlying firm value

must have the same Sharpe ratio, see (

8) (cfr. Equation (6) in [

1]). This consideration enables us to express the instantaneous asset return

μ as a function of the unknown asset volatility, given each equity volatility estimate

, and then to solve Equation (

5) for the 5-years default probability with respect to the asset volatility, to obtain the corresponding asset volatility estimate

. Once asset volatility is known, we can compute default probabilities for any other maturity according to Equation (

5).

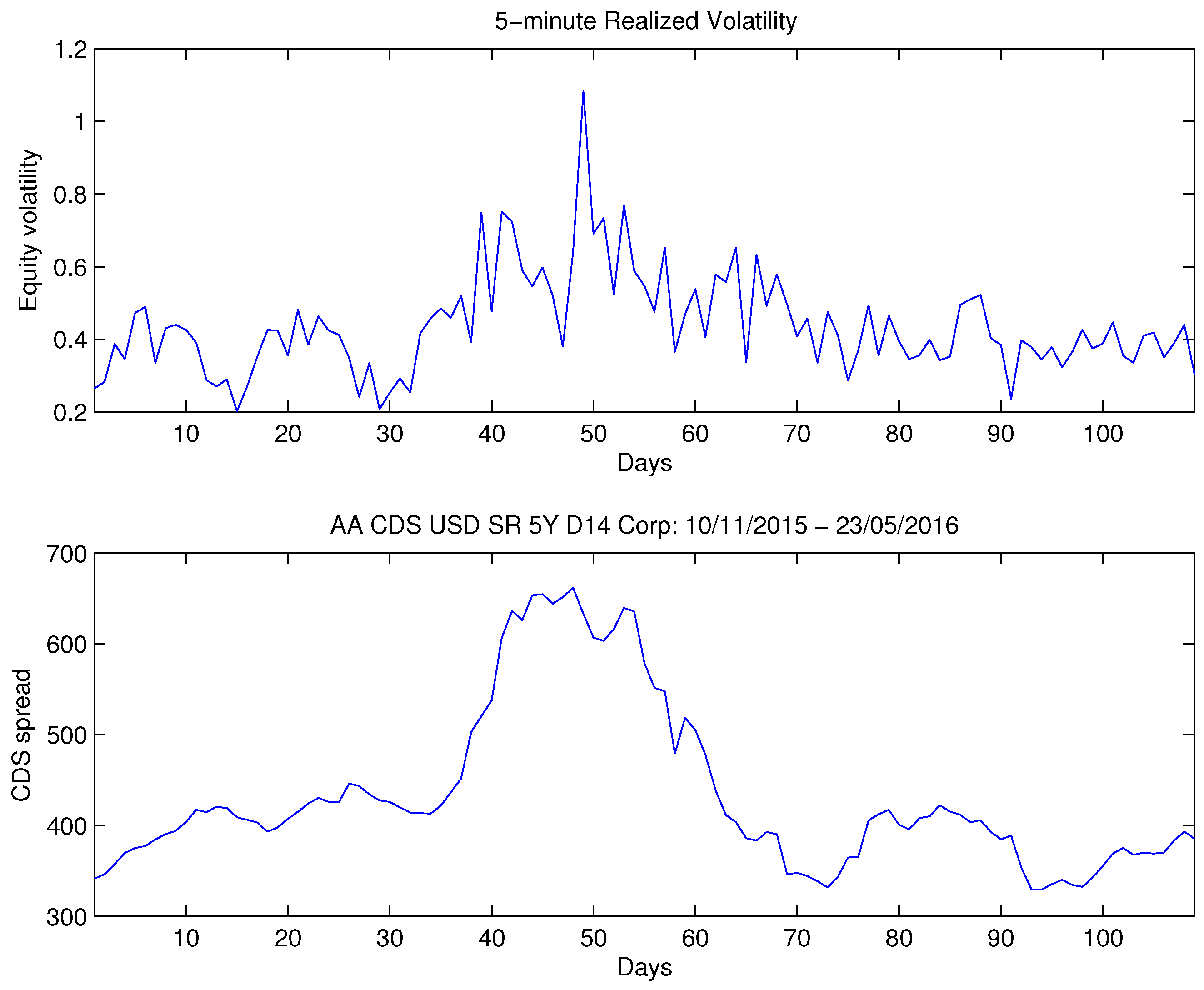

Table 7 shows descriptive statistics of calibrated asset volatility for the Heston model,

Table 8 contains statistics for the Bates case. We report results obtained by matching 5-years default probabilities for each equity volatility estimator

E. Panel (a) of both tables refers to a trading noise of the form (

6); panel (b) refers to results obtained for a trading noise of the form (

7). The set of equity volatility estimators represented by Two-scale, Kernel, Fourier and Pre-Average estimators provides the most accurate estimation of the resulting calibrated daily asset volatility for Heston case, showing the smallest standard deviation. The same behavior is confirmed by results under Bates setting in

Table 8. These results are confirmed by statistics for the ratio

, where the variable

is the underlying asset volatility calibrated by considering the model daily equity volatility

on each day

t in the Monte Carlo sample. In particular, it is evident how the high-frequency Realized Volatility procedure largely underestimates the underlying asset volatility:

is strongly biased due to microstructure effects, while the optimized

is less biased, even if a slightly larger variance appears.

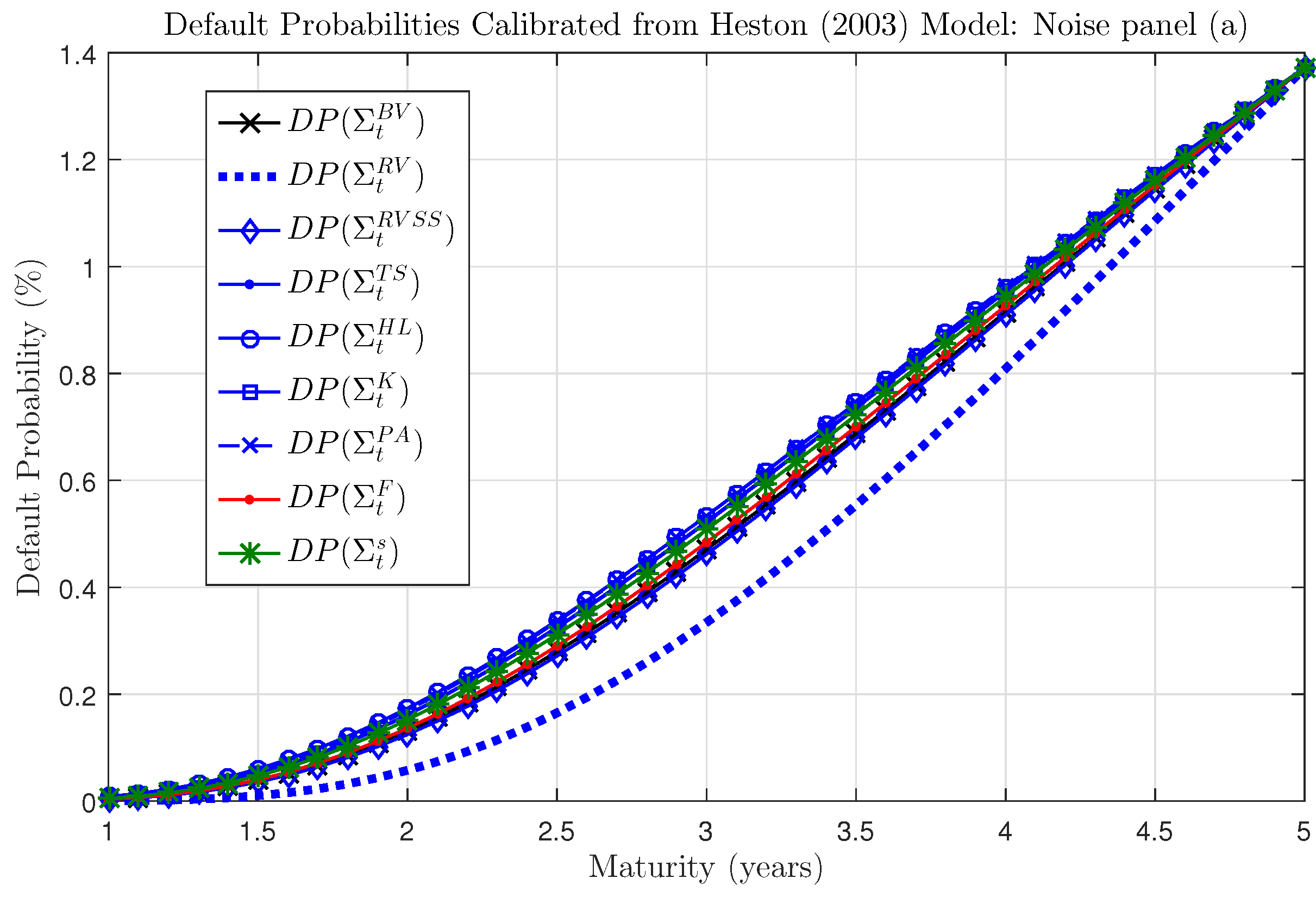

5.3. Default Probability Computation

Once asset volatility is calibrated, we can turn to default probability computation. The average (over the daily Monte Carlo replications) default probabilities for different maturities obtained from alternative equity volatility estimation procedures are plotted in

Figure 7 for Heston case, Gaussian noise. For each day in the sample and for each volatility estimator

we use the calibrated asset volatility

in order to compute the default probabilities for any maturity (from 1 to 5 years) through Equation (

5). The figure highlights how the Realized Volatility approach based on high frequency noisy data drastically underestimates default probabilities, thus sparse sampling becomes mandatory when equity data are affected by microstructure effects. On the whole, all the other procedures seem to provide sensible results and only a deeper analysis reveals differences among different specific estimators, as shown in

Table 9 and

Table 10 where relative errors are reported.

Comparing the performance of alternative equity volatility estimators on default probabilities is done for different maturities (from 1 to 5 years) through the mean relative error between the estimated default probability and the theoretical one. For each maturity, we consider the following measure>

where

is the default probability evaluated through Equation (

5) when equity and asset volatility are estimated through a generic couple of estimators

;

is the corresponding theoretical default probability when equity and asset volatility are, respectively,

and

(model daily volatilities).

Table 9 and

Table 10 summarize the corresponding numerical results for both Heston and Bates cases, suggesting that the choice of the volatility estimator largely affects default probabilities.

Table 9 highlights that for the Heston model the smallest overall error on default probabilities is provided by the Fourier estimator, followed by the Two-Scales and the Kernel ones. For maturities greater than 2.5 years, even the

and Pre-Average estimators give good results. The optimally sampled Bipower Variation

provides results that are comparable with

, underestimating the default risk. The classical 5-min Realized Volatility approach can severely underestimate risk, leading to an error of more than

in absolute value for maturities before

and around 60%−70% in absolute value for maturities up to 2 years.

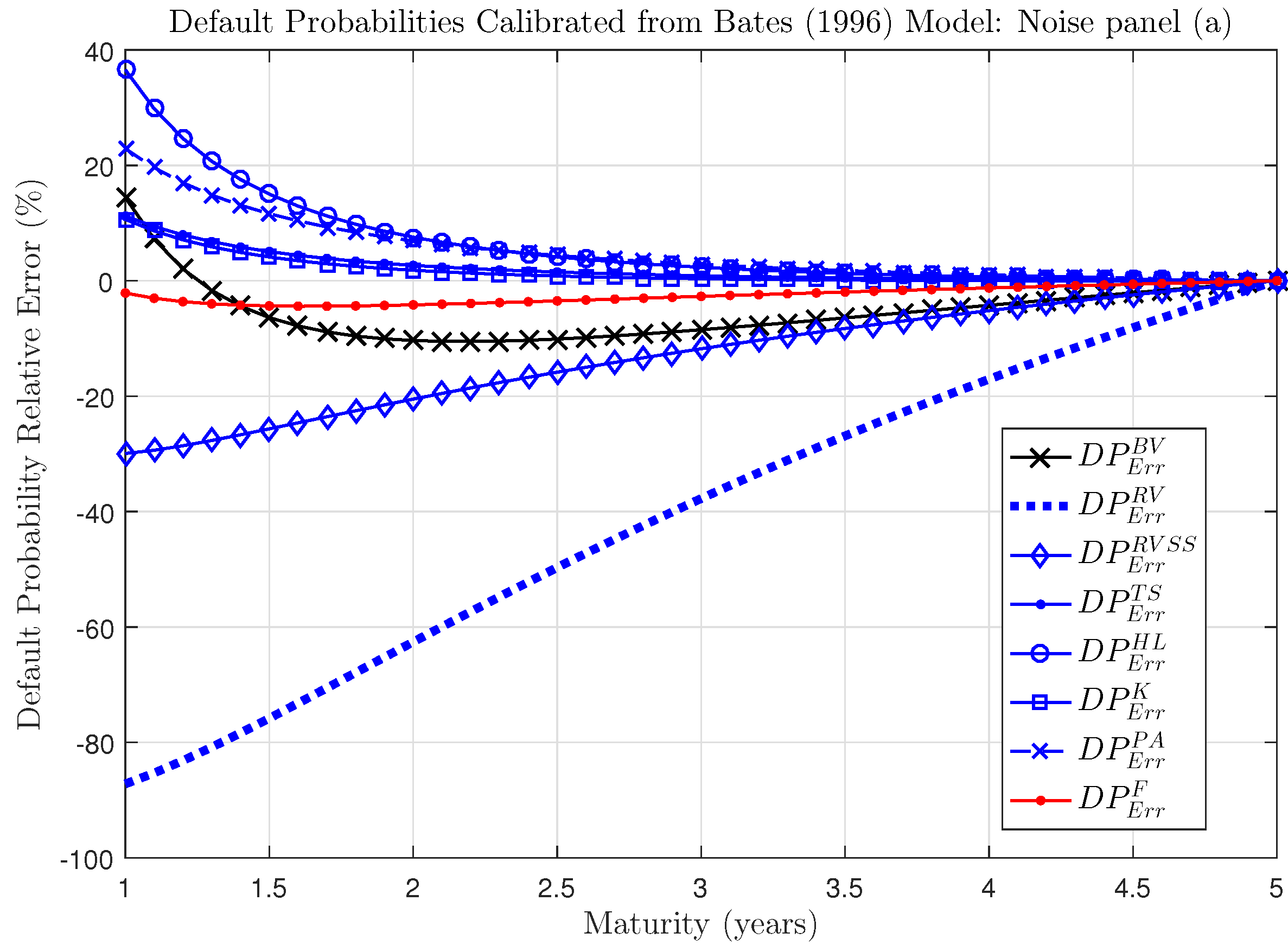

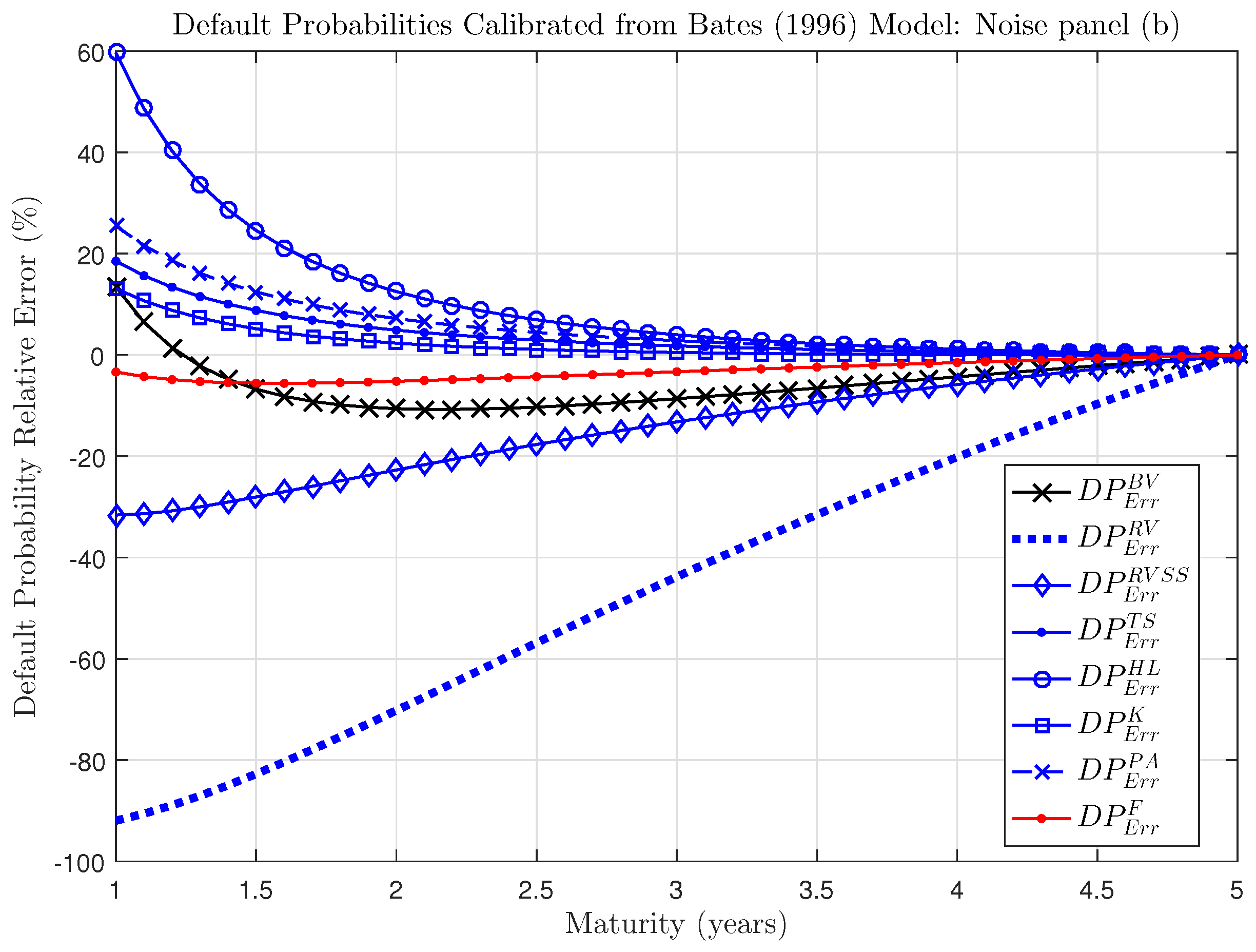

A similar ranking among estimators holds in Bates case, as reported in

Table 10. While for maturities greater than 3 years the Kernel estimator has the best performance, i.e., the smallest average error on default probabilities, overall the Fourier estimator reveals to be the more stable one, with relative errors across all maturities being below

in absolute value. Differently from the Fourier case, all other estimators show a peak in the default probability relative error for the

time horizon.

For a better visual insight,

Figure 8 and

Figure 9 show the mean relative error comparing different calibration procedures for Bates model, with, alternatively, Gaussian (a) and Correlated noise (b). A negative (positive) error reveals that the calibration procedure underestimates (overestimates) default probabilities. What emerges from the reported plots of default probability relative errors is that the Fourier estimator (red line in the Figures) is the most efficient, although it slightly underestimates default probabilities. This is due to the convexity of the non linear relationship between default probability error and asset volatility, as depicted in

Figure 4 and discussed in

Section 6. All the other estimators produce relative errors on default probabilities that are more inaccurate (and more volatile) as function of the maturity, reaching high absolute values for very short time horizons. The Realized Volatility estimator has a poor performance from 1y to 5y, always providing a significant underestimation of the default probability. This qualitative behavior reflects also results obtained for Heston setting, for both cases of Gaussian and Correlated trading noise and we omit them for brevity.