Abstract

In this article, daily CO2 emissions for the years 2019–2022 are examined using fractional integration for Brazil, China, EU-27 (and the UK), India, and the USA. According to the findings, all series exhibit long memory mean-reversion tendencies, with orders of integration ranging between 0.22 in the case of India (with white noise errors) and 0.70 for Brazil (under autocorrelated disturbances). Nevertheless, the differencing parameter estimates are all considerably below 1, which supports the theory of mean reversion and transient shocks. These results suggest the need for a greater intensification of green policies complemented with economic structural reforms to achieve the zero-emissions target by 2050.

1. Introduction

The threat of climate change has progressively established itself across the world, with a rising number of countries promising to reduce their carbon emissions and applying green policies, such as strategic planning, carbon taxes, and sectorial standards. Nevertheless, the gap between the actions that are taken and those that are needed in order to reach net-zero emissions by 2050 remains vast (Yao & Zhao, 2022).

It is widely acknowledged that CO2 emissions are the primary factor causing climate change (Zickfeld et al., 2012, 2013, 2016; McMillan & Wohar, 2013) and are the key indicator for measuring green damage (Apergis & Payne, 2009a; Du et al., 2012; Shahbaz et al., 2016a). Accordingly, to achieve net-zero CO2 emissions, carbon footprint levels must decrease significantly and at a pace that has infrequently been observed historically, except for during the pandemic. Measuring the evolution of carbon footprints across time, and identifying transitory vs. permanent effects in carbon emissions patterns, are both crucial milestones towards reinforcing green policymaking.

In the literature, there are many studies that observe models and forecasts concerning economic activity and environmental effects, and their consequences on climate change regulations (Aye & Edoja, 2017). Furthermore, some of them have investigated the impact of COVID-19 on CO2 emissions (Rume & Islam, 2020; Liu et al., 2020) and post-pandemic evolution (X. P. Nguyen et al., 2021). These studies analyzing CO2 emissions rely on models with a limited long-term perspective, often failing to account for the fractional integration or long-memory properties of emissions data. As a result, they may underestimate the persistence of shocks and overstate the effectiveness of short-term policies. Additionally, these models frequently assume stationarity or impose unit roots without properly testing for intermediate cases, which can bias forecasts and misguide policy recommendations. A further limitation is the inadequate treatment of structural breaks—such as those caused by the COVID-19 pandemic—which are often modeled as temporary deviations, rather than fundamental shifts in emissions dynamics.

The contribution of this research article is two-fold. First, our methodological analysis (fractional integration) is observed more often in fields such as finance or economics (Sephton, 2008; Al-Shboul & Anwar, 2016; Q. T. Nguyen et al., 2019; Caporale et al., 2020), but here we extrapolate to carbon emissions evolution to determine whether the series’ shocks are predicted to be temporary or persistent. Second, climate change policies must be strengthened to attain zero emissions by 2050, considering the duration and magnitude of their impact. This is important for policymakers because understanding whether CO2 emissions exhibit temporary or persistent behavior directly affects the design and timing of climate actions. If shocks to emissions are found to be persistent, as fractional integration suggests, then policies must be long-term, consistent, and adaptive to prevent rebound effects.

The rest of the research article is structured in the following order. The relevant literature is reviewed in Section 2; the technique applied and the data exploited are discussed in Section 3; the empirical findings are presented in Section 4; and the conclusions and policy discussion are displayed in Section 5.

2. Review of the Literature

One of the most crucial metrics for gauging the state of the environment today (Apergis & Payne, 2009a; Du et al., 2012; Shahbaz et al., 2016b), and, therefore, for explaining climate change in the world (McMillan & Wohar, 2013; Zickfeld et al., 2012, 2016), is CO2 emissions.

According to Tiseo (2023), the carbon dioxide emissions emitted by fossil fuel combustion and the industrial sector have undergone a breathtaking increase since the origin of industrial modernization. CO2 emissions started to grow more sharply from 1950, and the highest annual rates were reached between 2000 and 2010. In 2020, the outbreak of COVID-19 caused CO2 emissions to plummet significantly, but after the pandemic, the levels of emissions seem to have gradually recovered (Liu et al., 2022), although the intensity and duration of this trend are not sufficiently clear.

Numerous studies have described how emissions changed throughout the epidemic using a variety of methods. Le Quéré et al. (2020) combined public regulations and growth data to explain declines in CO2 emissions around the world. To predict increases in CO2 emissions in China, Europe, and the US, Liu et al. (2020) used activity data from a variety of industries, including domestic energy consumption, industry, power production, and transport. Other studies have used the demand for fossil fuel energy to evaluate the global decline in carbon emissions (International Energy Agency (IEA), 2020), or GDP variations and inventory data from the Chinese economy (Han et al., 2021). Using Wavelet Coherence, Kirikkaleli (2020) also provides evidence for the detrimental effects of economic growth on CO2 emissions in China. Shahbaz et al. (2021) investigated the impact of per capita income, energy usage, trade openness, and oil price on carbon emissions in India from 1980 to 2019. They demonstrated that the fluctuations in independent variables have an unequal long-term influence on CO2 emissions by using a non-linear autoregressive distributed lag (NLARDL) technique. The outcomes show that the existing economic development pattern, which depends on the consumption of fossil fuels, is not environmentally sustainable. Similar results were obtained by Udemba et al. (2021) for India.

Other types of models have been used prior to the pandemic to analyze trends in CO2 emissions and their relationship with economic activity. Acharya (2009) employed OLS for India; Apergis and Payne (2009b) analyzed the correlation between energy consumption and economic growth in eleven Commonwealth of Independent States nations from 1991 to 2005 using a multivariate panel data approach; Balsalobre-Lorente et al. (2018) utilized Panel Least Squares for EU-5 countries; Kalmaz and Kirikkaleli (2019) applied an ARDL methodology for Turkey; Boopen and Vinesh (2011) implemented Ordinary Lest Squares for Mauritius; Dash (2009) used Two-stage Least Squares for India; Lee (2013) applied Panel Regression for G20 countries; and Gil-Alana and Trani (2019) used fractional integration for the BRICS and G7 countries and for Europe, respectively. Shahbaz et al. (2016b), utilizing the Stochastic Impacts by Regression on Population, Affluence and Technology (STIRPAT) model, examined the effect of urbanization on CO2 emissions in Malaysia from the first quarter of 1970 to the fourth quarter of 2011. Finally, since economic development always increases environmental issues, Xiong and Xu (2021) examined the effect of energy expenditure and environmental pollution on economic development and found a causal relationship between them in China. Their research used an ARDL regression model to improve time series econometrics when nonstationary values showed co-integration.

The contribution of this research paper is relevant because there is no evidence of applications of the fractional integration methodology to assess the evolution of CO2 emissions before the pandemic period and after it up until December 2022. In addition, we also focus on the world’s largest CO2 emitters: Brazil, the USA, India, EU-27, the UK, and China. Finally, we examine whether the impact of COVID-19 on major CO2 emitters is temporary or permanent, which will provide some insight regarding future green policymaking.

3. Methodology and Data

3.1. Methodology

When dealing with the analysis of time series shocks, fractional integration seems to be a very appropriate technique, since with a single parameter (the differencing parameter, d), we can conclude whether a given shock will have a permanent or a transitory effect. A process {xt, t = 0, ±1, …} is said to be d-integrated, where d is a real value and thus potentially fractional, and denoted as I(d), if it can be expressed as

where is the lag-operator and ut is a covariance stationary I(0) process, characterized because its spectral density function is positive and bounded at all frequencies; thus, it may have some temporal dependency in its weak (e.g., ARMA) version. We may explore a wide range of requirements with the I(d) modelization, including the following:

- (i)

- The case of anti-persistence, if d < 0;

- (ii)

- Short-memory processes or I(0), if d = 0;

- (iii)

- Long-memory stationary processes, if 0 < d < 0.5;

- (iv)

- Processes which are nonstationary, though with mean-reverting behavior, if 0.5 ≤ d < 1;

- (v)

- Unit roots or I(1) behavior, if d = 1;

- (vi)

- Explosive patterns, if d ≥ 1.

Clearly, if is ARMA (p, q) in (1), xt is an AutoRegressive Fractionally Integrated Moving Average, i.e., ARFIMA (p, d, q), which is more general than other approaches that impose the value d = 0 (e.g., ARMA for stationary series) or d = 1 (e.g., ARIMA for nonstationary ones). Thus, if d can be any real value, much richer flexibility is permitted in the specification of the model. From Equation (1), the polynomial may be written in terms of a binomial expansion, where for the non-integer , depends not only on a finite number of past values, but also on the whole of its history. So, a high value of implies a higher level of dependence between the observations, and this dependence holds even if they are very distant in time.

We estimate the differencing parameter d by using the maximum-likelihood method in the frequency domain, and use a simple version of a testing procedure developed in Robinson (1994) and widely used in empirical applications in time series data. Among the many advantages of this methodology, we can mention that it is the most efficient method, in the Pitman sense, among local alternatives, and perhaps more importantly, it is valid for any real value d, i.e., including values which are distant from the stationary region (d ≥ 0.5). In this sense, we do not need preliminary differentiation in the case of nonstationary data.

3.2. Data Description

The raw data used in this study include the metric tons of CO2 emissions per day provided by Carbon Monitor (https://carbonmonitor.org/, accessed on 1 June 2024). This data source offers daily updated data for monitoring CO2 emissions at the national and global levels. We utilized the total emissions from all divisions considered by Carbon Monitor: Domestic Aviation, Ground Transport, Industry, International Aviation, Power, and Residential. This dataset has been broadly used for analyzing CO2 emissions around the world, since it shows the carbon emissions dynamics on a daily basis (Liu et al., 2020).

We took the daily data from January 2019 to December 2022 for countries that ranked highly in terms of cumulative carbon emissions in 2022. Thus, the number of observations amounted to 1430. These countries were China, the United States of America, India, the European Union 27 (as a whole and plus the UK), and Brazil. In total, these 32 economies accumulated more than 85 percent of the world’s total aggregate emissions as of 2022.

Table 1 shows the main descriptive statistics. We see that the economy with the highest accumulative CO2 emissions between 2019 and 2022 is Brazil (3031 million MtCO2), followed by the USA and India. China presents the lowest level of carbon emissions (1986 million) among our sample of countries, highly influenced by the pandemic collapse and the aggrupation of European economies. Indeed, the highest Chinese emissions level was observed before the COVID-19 pandemic. Finally, the two most volatile countries, considering the standard deviation, are China and Brazil, the least volatile being India and the EU-27 and the UK.

Table 1.

Descriptive analysis (MtCO2), January 2019–December 2022.

4. Empirical Results and Discussion

We begin this empirical section by estimating the parameter d in a model given by Equation (1), and where xt may be the errors in a regression model of the following form:

where yt stands for the series of interest, and β0 and β1 denote the intercept and the coefficient on a (linear) time trend, respectively. Thus, the model under examination is

First, we suppose that the d-differenced process, i.e., ut in (3), is a white noise process, (i.e., ut = εt), so that all the dependence over time in the data is described throughout the differencing parameter. Table 2 presents the estimates of d, along with their 95% confidence bands, under three different set-ups in relation to the non-stochastic terms: first, under the assumption of no terms, i.e., imposing that β0 and β1 are both set equal to zero a priori; then, including an intercept or a constant, i.e., with β1 = 0; and finally, supposing that the two terms are unknown. These coefficients are obtained throughout the joint implementation of the two equalities in Equation (3), which may be written as

where , , and where 1 represents a vectors of 1s and t is a linear time trend. Noting that ut is I(0) by construction, β0 and β1 can be consistently estimated by least squares.

Table 2.

Estimates of d: white noise errors.

The values in bold in Table 2 indicate the chosen specification for each series in relation to the deterministic terms. This selection is based on the t-values of their associated coefficients, and the specific values of these selected models are reported in Table 3, referring to d and its confidence band (in column 2), the intercept and its associated t-value (in column 3), and the time trend and t-value (in column 4); “---” indicates that the coefficient was found to be statistically insignificant.

Table 3.

Estimated coefficients. White noise errors.

We see that only for China is the time trend found to be significant at the 5% level, and it is negative, as reported in Table 3. Focusing on the values of d, we observe that all of them are in the interval (0, 1), ranging from 0.22 for India to 0.56 in the case of Brazil. Nevertheless, all the values are significantly below 1, supporting the hypothesis of reversion to the mean and transitory shocks.

We conducted several diagnostic checks to verify that the errors were in fact white noise. In particular, we employed the methodologies of Box and Pierce (1970) and Ljung and Box (1978), as well as the Lagrange Multiplier (LM) test of Breusch and Godfrey (Breusch, 1978; Godfrey, 1978), and the results were ambiguous, providing evidence of serial correlation in some cases. Due to this, we extended the analysis to cover weak autocorrelation in the error term.

In Table 4 and Table 5, we extend the analysis to allow for weak time dependence in the error term. In particular, we impose the old non-parametric approach developed in Bloomfield (1973) that approximates autoregressive (AR) structures throughout the frequency domain. It is a non-parametric method in the sense that it does not have an explicit model, since it is implicitly determined by its spectral density function, which is given by

where σ2 is the variance of the error term and m is the number of short-run components. Bloomfield (1973) showed that the logged form of the above expression approximates very well the log-spectrum of autoregressive structures, being stationary across the full range of values for τ. Moreover, it was found that it is excellently suited to the context of I(d) models. Further, the results are similar to those based on white noise errors. Thus, the time trend is only shown to be significantly (negative) in China, and the differencing parameter ranges between 0.28 in India and 0.70 in the case of Brazil, with all values being significantly below 1.

Table 4.

Estimates of d: Bloomfield autocorrelated errors.

Table 5.

Estimated coefficients. Bloomfield autocorrelated errors.

The estimate of d ≈ 0.48 for EU-27 + UK suggests that environmental indicators show weak long memory and are mean-reverting. This means that while shocks (e.g., from policy or crises) have persistent effects, they gradually fade over time. Green policies, therefore, must be sustained and reinforced to ensure lasting environmental improvements. One-off measures may produce temporary gains but risk reversals without ongoing support. Continuous monitoring and adaptive policy design are key to achieving long-term climate goals. Furthermore, it is important to notice differences among European countries. Claudio-Quiroga and Poza (2024) show evidence of a “two-speed Europe” in terms of EU countries’ advancement towards sustainability. Leading countries, those most advanced in pursuing operation according to circular economy principles, include Germany, Belgium, Spain, France, Italy, the Netherlands and the United Kingdom. The second pole accommodates EU countries in which transformation towards circular economy is happening at the slowest pace. This group includes mainly countries of Central and Eastern Europe and the countries of the south of Europe.

The analytical findings indicate that all time series exhibit mean-reversion trends. The temporal influence of shocks on the trajectory of CO2 emissions from January 2019 to December 2022 indicates that the impact of COVID has not resulted in a lasting decrease in carbon emissions, as was apparently observed by Rume and Islam (2020). Thus, green measures should not only be maintained, but should be further increased and supplemented with economic structural changes in order to attain the zero-emissions goal by 2050. In this regard, Zhao et al. (2022) state that the global public health crisis and socio-economic slump have slowed SDG development. Under lockdowns and geopolitical disputes, COVID-19 has braked SDG development, exacerbated geographical inequities, hampered connection, and fueled anti-globalization sentiment. Giancaterini et al. (2022) observed time irreversibility in greenhouse gas emissions, global temperatures, sea levels, sea ice areas, and several natural oscillation indices. While not definitive, the findings suggest that adjustment measures should be implemented to prevent the worst effects of climate change.

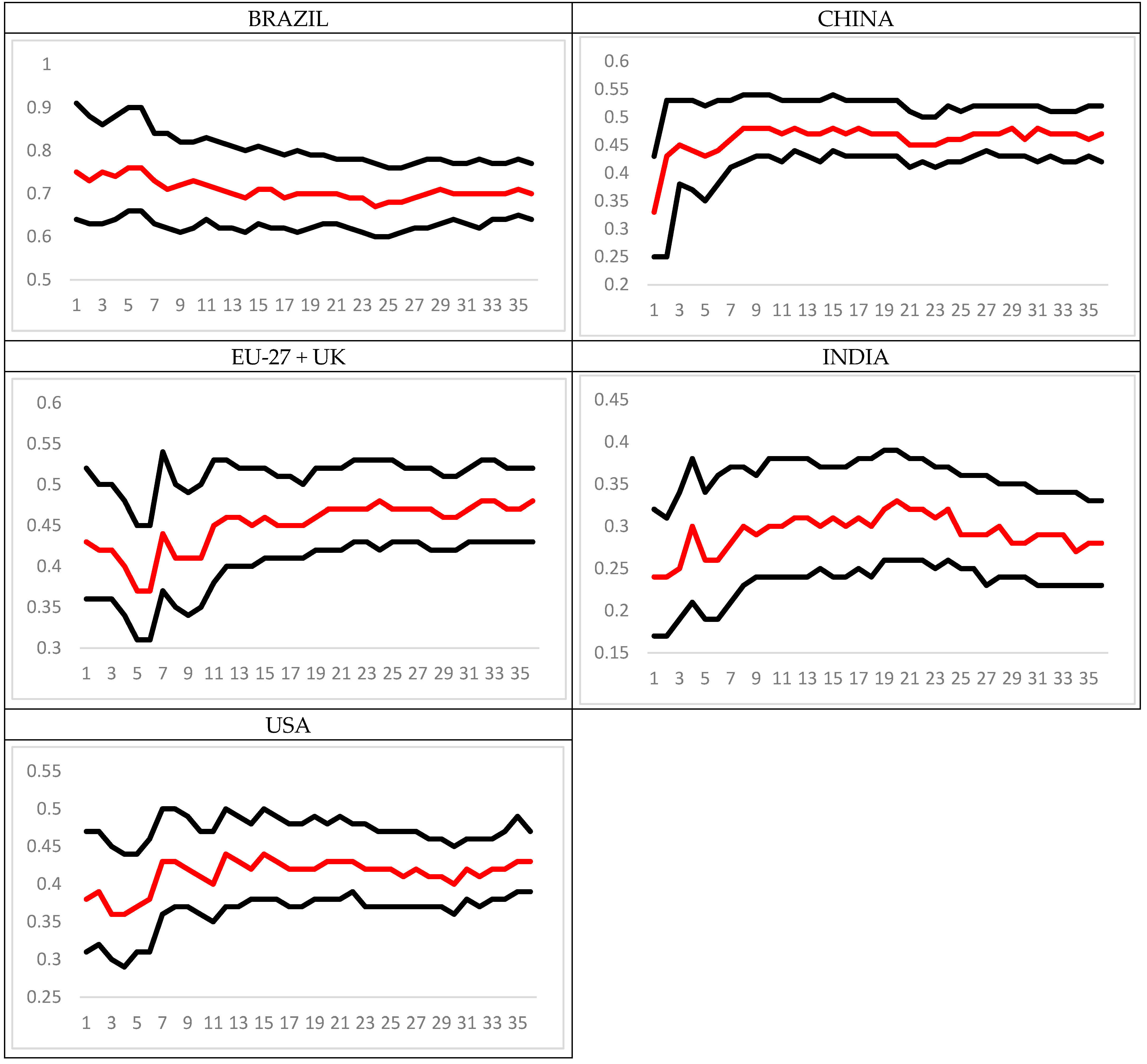

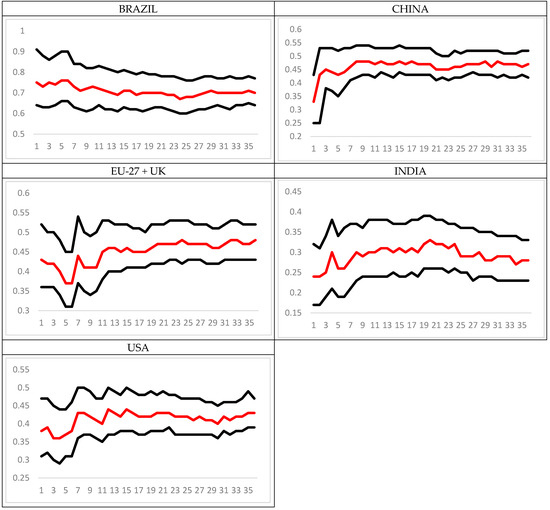

Finally, we conducted the analysis recursively, starting with a subsample of one complete year (1 January 2019–31 December 2019), and then successively adding one complete month each time. For this purpose, we used the model with autocorrelated (Bloomfield) disturbances. The results are reported in Figure 1.

Figure 1.

Recursive estimates of d, starting with a sample of 1 year of observations (1 January 2019, 31 December 2019). Red values indicate the estimates of d while the black ones refer to the 95% confidence intervals.

It can be seen that in all cases, there was a sharp increase in the estimation of d due to COVID-19 pandemic. This increase seems to have occurred earlier in China, around subsample number 2 (corresponding to data ending on 31 January 2020); in India, the sharp increase takes place at subsample no. 4 (i.e., with data ending on 31 March 2020), and in Brazil, it occurs one month later (April, 2020); finally, for the USA and EU-27 + UK, the increase in the degree of persistence occurs at subsample no. 7, which is the one ending on (30 June 2020). In general, we observe a slight increase in the values of d for EU-27 + UK, and also for the USA; it seems to be stable for China, and we observe a slight decrease in the other two series.

China was the first to implement strict lockdowns, leading to an immediate and sharp drop in emissions. The high and stable persistence suggests that the initial reduction had a lasting impact, possibly due to delayed recovery of heavy industry and transportation and some degree of structural change, such as digitalization and decarbonization policies already underway.

In the case of India, its sharp lockdown led to a sudden fall in emissions, particularly from transportation and industry. The increase in d indicates that these effects persisted, but the plateau suggests a gradual return to pre-COVID-19 emissions patterns. This may reflect a rebound in coal usage in 2021–22.

Regarding Brazil, the delayed but pronounced rise in d shows that emissions dropped meaningfully, and these changes were not immediately reversed. Possible explanations include reduced urban mobility and industrial activity, as well as agricultural emissions being less affected by lockdowns.

In UE27 and the UK, the sustained increase in d points to a structural decline in emissions, supported by strong climate action, accelerated renewable energy adoption, and behavioral shifts such as increased remote work and reduced travel within the bloc.

As far as the USA is concerned, this country showed a similar delayed increase in emissions persistence around mid-2020, followed by a steady but modest upward trend. This indicates that while the immediate decline in emissions during the pandemic was temporary, certain effects—such as decreased commuting, increased energy efficiency, and an ongoing shift from coal to cleaner sources—have had a lasting impact. However, the lower magnitude of change compared to the EU suggests more limited structural transformation, partly due to policy uncertainty during the period.

5. Conclusions and Policy Implications

In this study, we used fractional integration methods to analyze the time series characteristics of the CO2 emissions in Brazil, China, EU-27 (and the UK), India, and the USA. By doing this, depending on the precise value of the estimate of the order of integration, we could identify the level of persistence in the series and, in particular, whether shocks were temporary or permanent.

The results of the analysis show that all the time series present patterns of mean reversion, with orders of integration varying between 0.22 in India (with white noise errors) and 0.70 in Brazil (under autocorrelated disturbances). The estimations of the differencing parameters are all considerably below 1, which supports the claim that transient shocks and long-memory mean reversion apply to all the analyzed nations.

This temporal impact of shocks on the evolution of CO2 emissions between January 2019 and December 2022 suggests two main conclusions: First, the effect of COVID in 2020 and 2021 and inflation pressures during 2021 and 2022 have not caused a permanent reduction in carbon emissions. They have only provoked a kind of “step effect” on series whose trends are recovering (commonly observed in economics when, for example, VAT increases and has a transitory effect on year-to-year inflation). Second, green policies, far from being relaxed, should be intensified and complemented with economic structural reforms to achieve the zero-emissions target by 2050. We should take into account structural issues that are, to some extent, related to the environment, such as a shift in the economy’s focus from energy-intensive to fewer intensive industries.

Given the mean-reverting but persistent nature of CO2 emissions, policies should not be short-lived or reactive. Governments must design and maintain stable, long-term climate policies, avoiding the risk of relaxing efforts after temporary drops in emissions (e.g., those seen during COVID-19). Stability enhances the credibility of policy and encourages sustained investment in green technologies. At the same time, policymakers should shift the economic structure toward low-carbon sectors, promoting energy efficiency, digitalization, and service-based industries over heavy, energy-intensive production. Incentivizing innovation and green industrial transformation is key to addressing the underlying causes of emissions. Finally, traditional econometric models may misrepresent the persistence of emissions. Decision-makers should incorporate fractional integration methods into climate policy assessment frameworks to better anticipate the durability of emissions shocks and to design policies that align with the real dynamic behavior of emissions. This approach enhances evidence-based policymaking and helps to avoid overestimation of the impact of short-term interventions.

Finally, this work presents some limitations; in particular, the possibility of breaks in the data is a topic that has not been investigated, in spite of its importance for determining the precise dates of changes. This becomes even more relevant when we consider that such structural breaks are very much related to the methodology used here, based on fractional integration (see, e.g., Diebold & Inoue, 2001; Granger & Hyung, 2004; Banerjee & Urga, 2005; etc.). Nevertheless, we have conducted a recursive estimation approach in relation to the differencing parameter, which is more informative with regard to the evolution of the degree of persistence in response to shocks like the COVID-19 pandemic. In this context, an even more relevant issue may be the use of non-linear structures, considering that structural breaks generally produce abrupt changes in models. In this respect, we can change the linear trends specified in Equations (1) and (3) to non-linear ones like those based on Chebyshev polynomials in time (Cuestas & Gil-Alana, 2016), Fourier functions, or neural networks (Furuoka et al., 2024); all of these still work under the assumption that the detrended series are fractionally integrated. Work in this research direction is now in progress.

Author Contributions

L.A.G.-A. and C.P. conceived of the presented idea. C.P. developed the theory, extracted the data, and described the data source. L.A.G.-A. performed the computations and described the fractional integration techniques. L.A.G.-A. and C.P. verified the analytical methods. L.A.G.-A. and C.P. supervised the findings of this work. All the authors discussed the results and contributed to the final manuscript. All authors have read and agreed to the published version of the manuscript.

Funding

Luis A. Gil-Alana gratefully acknowledges financial support from the MINEIC-AEI-FEDER ECO2017-85503-R project from ‘Ministerio de Economía, Industria y Competitividad’ (MINEIC), ‘Agencia Estatal de Investigación’ (AEI), Spain, and ‘Fondo Europeo de Desarrollo Regional’ (FEDER). He also acknowledges support from an internal Project of the Universidad Francisco de Vitoria.

Institutional Review Board Statement

All the authors complied with ethical responsibilities.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data of the study are available on request.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper.

References

- Acharya, J. (2009). FDI, growth and the environment: Evidence from India on CO2 emissions during the last two decades. Journal of Economic Development, 34(1), 43–58. [Google Scholar] [CrossRef]

- Al-Shboul, M., & Anwar, S. (2016). Fractional integration in daily stock market indices at Jordan’s Amman stock exchange. The North American Journal of Economics and Finance, 37, 16–37. [Google Scholar] [CrossRef]

- Apergis, N., & Payne, J. E. (2009a). CO2 emissions, energy usage, and output in Central America. Energy Policy, 37(8), 3282–3286. [Google Scholar] [CrossRef]

- Apergis, N., & Payne, J. E. (2009b). Energy consumption and economic growth: Evidence from the Commonwealth of Independent States. Energy Economics, 31(5), 641–647. [Google Scholar] [CrossRef]

- Aye, G. C., & Edoja, P. E. (2017). Effect of economic growth on CO2 emission in developing countries: Evidence from A dynamic panel threshold model. Cogent Economics and Finance, 5(1), 1379239. [Google Scholar] [CrossRef]

- Balsalobre-Lorente, D., Shahbaz, M., Roubaud, D., & Farhani, S. (2018). How economic growth, renewable electricity and natural resources contribute to CO2 emissions? Energy Policy, 113, 356–367. [Google Scholar] [CrossRef]

- Banerjee, A., & Urga, G. (2005). Modelling structural breaks, long memory and stock market volatility: An overview. Journal of Econometrics, 129(1–2), 1–34. [Google Scholar] [CrossRef]

- Bloomfield, P. (1973). An exponential model in the spectrum of a scalar time series. Biometrika, 60, 217–226. [Google Scholar] [CrossRef]

- Boopen, S., & Vinesh, S. (2011). On the relationship between CO2 emissions and economic growth: The Mauritian experience. In Mauritius environment outlook report. University of Mauritius. [Google Scholar]

- Box, G. E. P., & Pierce, D. A. (1970). Distribution of residual autocorrelations in autoregressive integrated moving average time series models. Journal of the American Statistical Association, 65, 1509–1526. [Google Scholar] [CrossRef]

- Breusch, T. S. (1978). Testing for autocorrelation in dynamic linear models. Australian Economic Papers, 17, 334–355. [Google Scholar] [CrossRef]

- Caporale, G. M., Gil-Alana, L. A., & Poza, C. (2020). Persistence, non-linearities and structural breaks in European stock market indices. The Quarterly Review of Economics and Finance, 77, 50–61. [Google Scholar] [CrossRef]

- Claudio-Quiroga, G., & Poza, C. (2024). Measuring the circular economy in Europe: Big differences among countries, great opportunities to converge. Sustainable Development, 32(5), 4707–4725. [Google Scholar] [CrossRef]

- Cuestas, J. C., & Gil-Alana, L. A. (2016). Testing for long memory in the presence of non-linear Chebyshev polynomials in time. Studies in Nonlinear Dynamics and Econometrics, 20(1), 57–74. [Google Scholar]

- Dash, R. K. (2009). Revisited export-led growth hypothesis: An empirical study on India. South Asia Economic Journal, 10(2), 305–324. [Google Scholar] [CrossRef]

- Diebold, F. X., & Inoue, A. (2001). Long memory and regime switching. Journal of Econometrics, 105(1), 1–39. [Google Scholar] [CrossRef]

- Du, L., Wei, C., & Cai, S. (2012). Economic development and carbon dioxide emissions in China: Provincial panel data analysis. China Economics Review, 23(2), 371–384. [Google Scholar] [CrossRef]

- Furuoka, F., Gil-Alana, L. A., Yaya, O. S., Aruchunan, E., & Ogbonna, A. E. (2024). A new fractional integration approach based on neural network nonlinearity with an application to testing unemployment hysteresis. Empirical Economics, 66, 2471–2499. [Google Scholar] [CrossRef]

- Giancaterini, F., Hecq, A., & Morana, C. (2022). Is climate change time-reversible? Econometrics, 10(4), 36. [Google Scholar] [CrossRef]

- Gil-Alana, L. A., & Trani, T. (2019). Time trends and persistence in the global CO2 emissions across Europe. Environmental and Resource Economics, 73, 213–228. [Google Scholar] [CrossRef]

- Godfrey, L. G. (1978). Testing against general autoregressive and moving average error models when the regressors include lagged dependent variables. Econometrica, 46(6), 1293–1301. [Google Scholar] [CrossRef]

- Granger, C. W. J., & Hyung, N. (2004). Occasional structural breaks and long memory with an application to the S&P 500 absolute stock returns. Journal of Empirical Finance, 11(3), 399–421. [Google Scholar] [CrossRef]

- Han, P., Cai, O., Oda, T., Zeng, N., Shan, Y., Lin, X., & Liu, D. (2021). Assessing the recent impact of COVID-19 on carbon emissions from China using domestic economic data. Science of The Total Environment, 750, 141688. [Google Scholar] [CrossRef] [PubMed]

- International Energy Agency (IEA). (2020). Global energy review 2020: The impacts of the COVID-19 crisis on global energy demand and CO2 emissions. Available online: https://www.iea.org/reports/global-energy-review-2020 (accessed on 1 June 2024).

- Kalmaz, D. B., & Kirikkaleli, D. (2019). Modeling CO2 emissions in an emerging market: Empirical finding from ARDL-based bounds and wavelet coherence approaches. Environmental Science and Pollution Research, 26(5), 5210–5220. [Google Scholar] [CrossRef] [PubMed]

- Kirikkaleli, D. (2020). New insights into an old issue: Exploring the nexus between economic growth and CO2 emissions in China. Environmental Science and Pollution Research, 27(32), 40777–40786. [Google Scholar] [CrossRef] [PubMed]

- Le Quéré, C., Jackson, R. B., Jones, M. W., Smith, A. J., Abernethy, S., Andrew, R. M., De-Gol, A. J., Willis, D. R., Shan, Y., Canadell, J. G., Friedlingstein, P., Creutzig, F., & Peters, G. P. (2020). Temporary reduction in daily global CO2 emissions during the COVID-19 forced confinement. Natural Climate Change, 10, 647–653. [Google Scholar] [CrossRef]

- Lee, J. W. (2013). The contribution of foreign direct investment to clean energy use, carbon emissions and economic growth. Energy Policy, 55, 483–489. [Google Scholar] [CrossRef]

- Liu, Z., Ciais, P., & Schellnhuber, H. J. (2020). Near-real-time monitoring of global CO2 emissions reveals the effects of the COVID-19 pandemic. Nature Communications, 11, 5172. [Google Scholar] [CrossRef] [PubMed]

- Liu, Z., Deng, Z., Davis, S. J., Giron, C., & Ciais, P. (2022). Monitoring global carbon emissions in 2021. Natural Reviews Earth & Environment, 3, 217–219. [Google Scholar] [CrossRef]

- Ljung, G. M., & Box, G. E. P. (1978). On a Measure of Lack of Fit in Time Series Models. Biometrika, 65(2), 297–303. [Google Scholar] [CrossRef]

- McMillan, D. G., & Wohar, M. E. (2013). The relationship between temperature and CO2 emissions: Evidence from a short and very long dataset. Applied Economics, 45(26), 3683–3690. [Google Scholar] [CrossRef]

- Nguyen, Q. T., Diaz, J. F., Chen, J. H., & Lee, M. Y. (2019). Social responsibility indices: A FIGARCH and HYGARCH approach. Asian Economic and Financial Review, 9, 7. [Google Scholar] [CrossRef]

- Nguyen, X. P., Hoang, A. T., Ölçer, A. I., & Huynh, T. T. (2021). Record decline in global CO2 emissions prompted by COVID-19 pandemic and its implications on future climate change policies. Energy Sources, Part A: Recovery, Utilization, and Environmental Effects, 47(1), 4699–4702. [Google Scholar] [CrossRef]

- Robinson, P. M. (1994). Efficient tests of nonstationary hypotheses. Journal of the American Statistical Association, 89, 1420–1437. [Google Scholar] [CrossRef]

- Rume, T., & Islam, S. M. D. U. (2020). Environmental effects of COVID-19 pandemic and potential strategies of sustainability. Heliyon, 6(9), e04965. [Google Scholar] [CrossRef] [PubMed]

- Sephton, P. (2008). Exchange rates and fractional integration revisited. Applied Financial Economics Letters, 4(6), 383–387. [Google Scholar] [CrossRef]

- Shahbaz, M., Loganathan, N., Muzaffar, A. T., Ahmed, K., & Jabran, M. A. (2016a). How urbanization affects CO2 emissions in Malaysia? The application of STIRPAT model. Renewable and Sustainable Energy Reviews, 57, 83–93. [Google Scholar] [CrossRef]

- Shahbaz, M., Mahalik, M. K., Shah, S. H., & Sato, J. R. (2016b). Time-varying analysis of CO2 emissions, energy consumption, and economic growth nexus: Statistical experience in next 11 countries. Energy Policy, 98, 33–48. [Google Scholar] [CrossRef]

- Shahbaz, M., Sharma, R., Sinha, A., & Jiao, Z. (2021). Analyzing nonlinear impact of economic growth drivers on CO2 emissions: Designing an SDG framework for India. Energy Policy, 148, 111965. [Google Scholar] [CrossRef]

- Tiseo, I. (2023). Global historical CO2 emissions from fossil fuels and industry 1750–2020. Statista, Energy & Environment. [Google Scholar]

- Udemba, E. N., Güngör, H., Bekun, F. V., & Kirikkaleli, D. (2021). Economic performance of India amidst high CO2 emissions. Sustainable Production and Consumption, 27, 52–60. [Google Scholar] [CrossRef]

- Xiong, J., & Xu, D. (2021). Relationship between energy consumption, economic growth and environmental pollution in China. Environmental Research, 194, 110718. [Google Scholar] [CrossRef] [PubMed]

- Yao, J., & Zhao, Y. (2022). Structural breaks in carbon emissions: A machine learning analysis. IMF Working Paper, WP/22/9. Strategy, Policy, and Review Department. International Monetary Fund. [Google Scholar]

- Zhao, W., Yin, C., Hua, T., Meadows, M. E., Li, Y., Liu, Y., Cherubini, F., Pereira, P., & Fu, B. (2022). Achieving the sustainable development goals in the post-pandemic era. Humanities and Social Sciences Communications, 9, 258. [Google Scholar] [CrossRef] [PubMed]

- Zickfeld, K., Arora, V. K., & Gillett, N. P. (2012). Is the climate response to CO2 emissions path dependent? Geophysics Resources Letters, 39(5), L05703. [Google Scholar] [CrossRef]

- Zickfeld, K., Eby, M., Weaver, A. J., Alexander, K., Crespin, E., Edwards, N. R., Eliseev, A. V., Feulner, G., Fichefet, T., Forest, C. E., Friedlingstein, P., Goosse, H., Holden, P. B., Joos, F., Kawamiya, M., Kicklighter, D., Kienert, H., Matsumoto, K., Mokhov, I. I., … Zhao, F. (2013). Long-term climate change commitment and reversibility: An EMIC intercomparison. Journal of Climate, 26(16), 5782–5809. [Google Scholar] [CrossRef]

- Zickfeld, K., MacDougall, A. H., & Matthews, H. D. (2016). On the proportionality between global temperature change and cumulative CO2 emissions during periods of net negative CO2 emissions. Environmental Resources Letters, 11(5), 055006. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).