Abstract

This article estimates the impact of government subsidies on productivity growth in South Africa, joining the ongoing debate among economists regarding the effectiveness of subsidies as a driver of industrial productivity. While some argue that subsidies address market failures, facilitate R&D, and improve efficiency, others criticise the attendant dependence, which reduces the incentive for industries to operate efficiently. This article contributes by examining the specific channels—efficiency and technical changes—through which subsidies affect productivity in South Africa. The analysis is based on a panel dataset comprising 64 three-digit industries observed between 1993 and 2023. Estimation is performed through an endogeneity robust panel stochastic frontier model, which treats subsidies as both an inefficiency driver and a technology variable. An additional estimation approach is proposed integrating the true fixed effects with a control function in a bid to account for both unobserved heterogeneity and idiosyncratic endogeneity. The results show that subsidies are detrimental to productivity, particularly through stifling technological progress. This result supports the view that subsidies reduce the incentive for beneficiaries to innovate. This evidence calls for a reevaluation and a possible restructuring of subsidy programmes in South Africa in a bid to mitigate their adverse effects on industrial productivity.

1. Introduction

Economists have disagreed for decades on how subsidies affect productivity growth. Some argue that subsidies address market failures, such as imperfect credit markets and underinvestment in research and development (R&D). By easing financial constraints, subsidies allow industries to invest in R&D, improve production processes, and adopt advanced technologies that ultimately increase productivity. Others cite market distortions and a dependence syndrome, which potentially destroy the incentive of recipients to innovate and operate productively. It is particularly argued that beneficiaries of subsidies may not rationalise their operations, knowing that the government will absorb their inefficiencies (Martin & Page, 1983). Empirically, the evidence has been equally mixed. On the one hand, studies, including Zhang et al. (2024); M. Zhu et al. (2024); and Kumbhakar et al. (2023), have reported a positive productivity effect of government subsidies. Others, including Krueger and Tuncer (1982); Beason and Weinstein (1996); Branstetter et al. (2023); Karhunen and Huovari (2015); and X. Jin (2018), have found government subsidies detrimental to productivity growth.

A look at cross-country experiences does not provide much clarity as historical experiences with government subsidies have similarly been a mixture of successes and failures. Examples of successful cases include Japan, which provided targeted subsidies to key industries such as automobiles, steel, and electronics in the 1980s, South Korea, which aggressively used subsidies to promote heavy and chemical industries between 1960 and 1980 (Rodrik, 1995), and more recently China, where state support for targeted industries is believed to have raised productivity (Aiginger & Rodrik, 2020; Juhász et al., 2023). However, despite subsidies appearing to have worked in these countries, policy efforts by Latin American countries to raise productivity through subsidies are argued to have yielded little to no rewards (Devlin & Moguillansky, 2013). These conflicting experiences make it difficult for policymakers to draw firm conclusions about how subsidies, as an industrial policy strategy, affect productivity.

What explains the conflicting empirical findings? In the main, Rodrik (2019) argues that the problem reflects two weaknesses: the level of analysis and the misspecification of empirical models. Regarding the former, much of the evidence (Li et al., 2022; Cin et al., 2017) has mostly relied on firm-level datasets that are susceptible to endogeneity arising from the notion of the government picking winners. Regarding the latter, empirical specifications have hardly addressed the specific channels through which subsidies affect productivity. In view of these limitations, this paper seeks to answer the following research question. What are the main channels through which government subsidies affect productivity in South Africa? To answer this question, it makes three empirical contributions. First, it focusses on two specific channels through which government subsidies affect productivity in the context of South Africa. The analysis specifically tests the hypotheses that government subsidies affect productivity by influencing efficiency and technical changes. The former captures the x-inefficiency argument, in which subsidies are argued to destroy the incentive to operate efficiently. The latter captures the proposition that subsidies facilitate R&D expenditure which culminates in technical changes that facilitate productivity growth. Second, unlike the practice of using firm-level datasets, it examines the impact of subsidies on productivity using a panel dataset comprising three-digit industries. An industry-level dataset is less susceptible to endogeneity compared to firm-level datasets. In addition, it acknowledges the traditional notion that industrial policies target industries rather than specific firms. Third, unlike previous studies, the sample used in this analysis comprises both the manufacturing and service industries. This contribution is based on Rodrik’s (2022) recent recommendation that the traditional focus of industrial policy on manufacturing industries must be broadened to include service sectors. These contributions are likely to shed light not only on the specific channels through which subsidies affect the productivity of manufacturing and service industries but also on their relative importance.

The study is related to three strands of literature. The first strand comprises studies that have examined the impact of subsidies on total factor productivity and partial measures of productivity. This includes Kumbhakar et al. (2023); Obeng and Sakano (2008); Mattsson (2019); and X. Zhu et al. (2024). The second strand consists of studies probing the impact of government subsidies on either technical efficiency or scale efficiency. Examples include Martin and Page (1983); Minviel et al. (2024); Latruffe et al. (2017); and Agostino et al. (2024). The third group of studies focusses on the effects of industrial policies, and it comprises Juhász et al. (2023); Greenwald and Stiglitz (2006); and Jongwanich and Kohpaiboon (2020). Within this literature, there is little to no evidence on the impact of government subsidies on productivity in South Africa. This is despite the fact that South Africa has actively supported industrial development using subsidies since gaining independence in 1994. Between 1995 and 2015, according to the Department of Trade, Industry and Competition (DTIC), South Africa spent ZAR 84.3 billion on industrial support and development initiatives. Recently, during the state of the nation address, the government announced ZAR 100 billion worth of industrial support. Given that subsidies are largely financed by a tight budget against the background of sluggish growth and dwindling fiscal revenues, understanding their actual effects on industrial productivity becomes imperative. The few available studies that address the impact of subsidies in South Africa have focussed primarily on their effects on employment and poverty alleviation. Although these outcome variables have important policy implications, productivity is a critical driver of long-term economic growth and industrial competitiveness. Examining the relationship between subsidies and productivity is necessary to understand whether these subsidies lead to increased efficiency, innovation, and global competitiveness within South Africa’s industries. In particular, a study addressing the productivity effects of subsidies would shed light on the effectiveness of government subsidies in promoting sustainable economic development and guide future policy decisions aimed at fostering more productive and globally competitive industries.

In a bid to isolate the impact of government subsidies on productivity, an instrumental variable regression is applied within the auspices of a stochastic frontier framework of Karakaplan and Kutlu (2017) and Karakaplan (2022). The analysis additionally proposes the application of a control function approach within the true fixed effects framework of both Greene (2005) and Wang and Ho (2010) in a bid to simultaneously address heterogeneity endogeneity and idiosyncratic endogeneity where lagged values of subsidies are utilised as instruments (Levinsohn & Petrin, 2003). Since controlling unobserved heterogeneity in the reduced-form equation invites the Nickell bias, the bias-adjusted least squares dummy variable approach is applied in the reduced-form equation of the control function. Results from this empirical approach are compared with those from alternative estimators: the conventional true fixed effects stochastic frontier analysis and the approach of Karakaplan (2022) to test their robustness. In the first-stage regression in which subsidies are instrumented by their past values, the results support the persistent nature of government subsidy programmes. The level of subsidies allocated in the past is found to influence current allocation decisions. Additionally, evidence shows that government subsidies mainly target industries with limited job growth, industries that are capital intensive, industries reliant on imported inputs, and those facing high labour costs. In the structural equation, the results find that government subsidies are detrimental to both frontier output and efficiency. The results reject the hypothesis that government subsidies aid productivity growth by facilitating technical progress and improving efficiency. They rather support the proposition that government subsidies destroy the incentive of industries to innovate and operate efficiently.

Although the results support Krueger and Tuncer (1982); Beason and Weinstein (1996); Branstetter et al. (2023); Karhunen and Huovari (2015); and X. Jin (2018) in the main, a novel insight emanating from this analysis is that government subsidies have a more detrimental effect on innovation (technical changes) compared to efficiency. This is the first empirical effort to document this finding. This result is crucial for policy purposes, as it suggests that government subsidies stifle technological progress that is essential for long-term economic growth and global competitiveness. Based on this insight, the government may want to carefully consider the design and structure of its subsidy programmes to mitigate their negative productivity effect. It may be necessary to embark on subsidies that incentivize research and development (R&D), facilitate competition, and encourage private-sector participation in a bid to mitigate the adverse effects observed in our empirical findings. This aligns with literature emphasizing that targeted subsidies, particularly those tied to performance outcomes or innovation incentives, can enhance long-term economic growth rather than hinder it. Increased accountability and close monitoring of these programmes can help mitigate their adverse productivity effect. Having timelines might reduce dependency and compel industries to innovate and use these subsidies more efficiently. If not carefully managed, evidence suggests that subsidies-driven industrial policies can inadvertently dampen innovation, particularly in industries where technological progress is the key to maintaining competitiveness in the global market.

The remainder of the paper is organised as follows. Section 2 reviews the existing literature on the impact of government subsidies on productivity. Section 3 discusses the methodology used in the empirical analysis. Section 4 presents the results and discusses the empirical findings. Section 5 finally provides some concluding remarks, policy recommendations, and areas for further study.

2. Review of the Literature

Theoretical literature suggests that government subsidies can influence productivity by enhancing technical efficiency and driving technical changes. In particular, subsidies may ease credit constraints, promote R&D, and support the adoption of new technologies. However, they may also distort market signals, reduce the incentives to innovate, and facilitate inefficiency if not properly targeted. This section reviews the theoretical basis that frames these dynamics.

2.1. Theoretical Literature

Government subsidies can take various forms and be implemented for many reasons. Schwartz and Clements (1999) classify government subsidies into seven categories: (1) direct financial payments made by government to its producers or consumers (also known as cash subsidies or cash grants), (2) tax breaks, (3) equity subsidies, (4) credit guarantee schemes, interest subsidies, or soft loans, (5) the provision of goods and services by the government below the prevailing market prices, (6), the purchases of goods and services by the government at above-market prices (also known as procurement subsidies), and (7) regulatory subsidies. This paper focusses narrowly on direct government payments to producers or consumers (cash subsidies or cash grants).

It is generally argued that government subsidies can play a crucial role in enhancing industrial productivity by lowering production costs, encouraging investment, and stimulating innovation. Subsidies, often in the form of financial assistance or tax breaks, reduce the immediate financial burden on firms, allowing them to reallocate resources toward more productive uses, such as upgrading capital, improving labour skills, or expanding operations. In the short term, they can increase production by making it easier for firms and industries to access critical inputs such as intermediate imports and machinery, especially in industries that face high market failures. However, while subsidies can increase industrial productivity, their critique lies in market distortions and inefficiencies (Rizov et al., 2013). Additionally, firms could become dependent on government assistance, which could reduce their incentive to innovate, reduce costs, or improve productivity (Martin & Page, 1983). Others such as Karhunen and Huovari (2015) and Minviel et al. (2024) have also argued that poorly designed subsidy programmes can distort market incentives, leading to misallocation of resources. For example, subsidies that favour certain industries or firms over others can lead to a concentration of resources in less productive sectors, ultimately reducing the overall productivity. Furthermore, excessive subsidies might encourage rent-seeking behaviour and perpetuate inefficiency, as industries might overly focus on securing government support rather than competing on the open market.

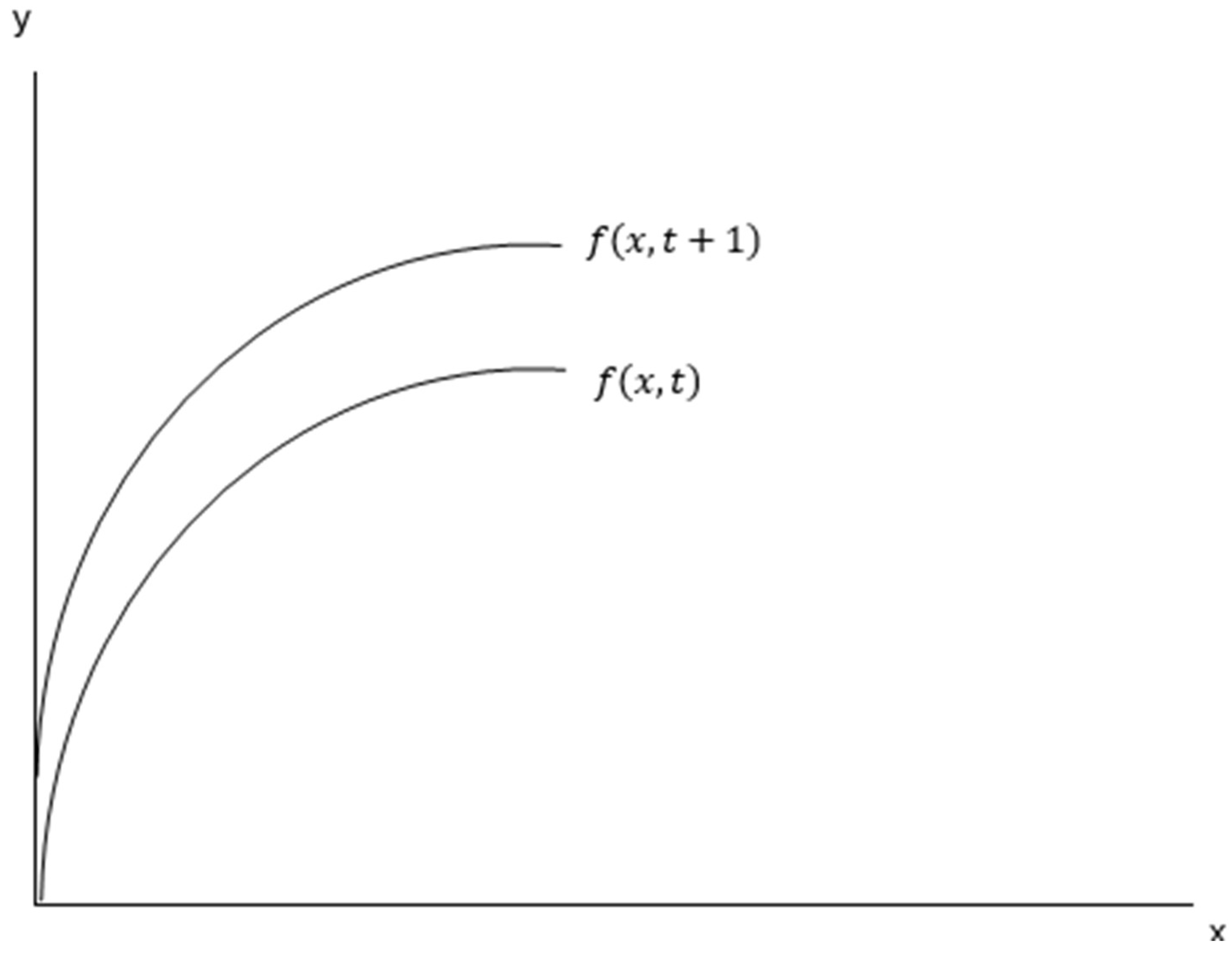

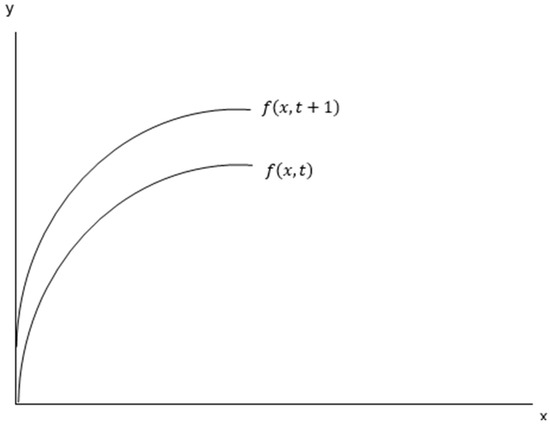

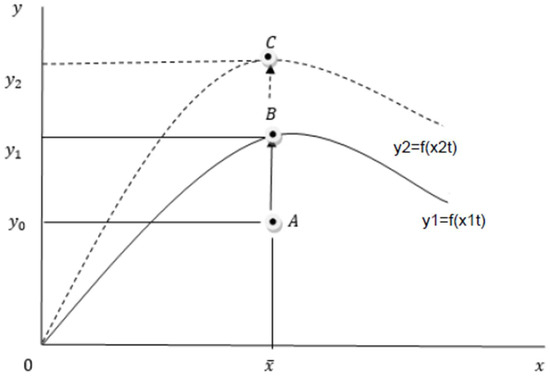

In theory, it is fair to narrow the rationale of government subsidies to imperfect credit markets, coordination failures, and underinvestment in R&D (Krugman, 1983; Schwartz & Clements, 1999). The theory mainly proposes two channels. The first avenue relates to the reduction in production costs, which allows industries to invest in R&D. Investing in research and development consequently leads to technological changes which, in the lens of endogenous growth theory, increase productivity in the long run. The second relates to the potential decrease in efficiency. It is argued that government subsidies can promote laxity in production practices that make industries operate inefficiently. To conceptualise these channels, it is necessary to begin with a familiarisation with basic productivity concepts. First, firms (whose aggregate output yields industrial output) combine factors of production such as labour, capital, and intermediates using some known technology to produce output. The existing technology defines the output frontier, which is essentially the maximum attainable output of the given inputs. Any output level below this frontier level of output represents inefficiencies. This typically occurs when firms are either underutilising existing technology or failing to get the best out of their input. A shift in the production frontier reflects technical changes that occur when there is technological progress. Figure 1 illustrates a technical change that shifts the frontier from f(x, t) to f(x, t + 1) where is a production function with an input vector , is output, is time period, and is the subsequent period. In this exposition, t + 1 being higher than t indicates a positive technical change from the current period to the next period (i.e., t + 1). Any point below would represent inefficiency in production in the current period.

Figure 1.

Technical Change. Source: Kumbhakar et al. (2015).

If we write the production function as , then the rate of technical change (TC) is algebraically defined as:

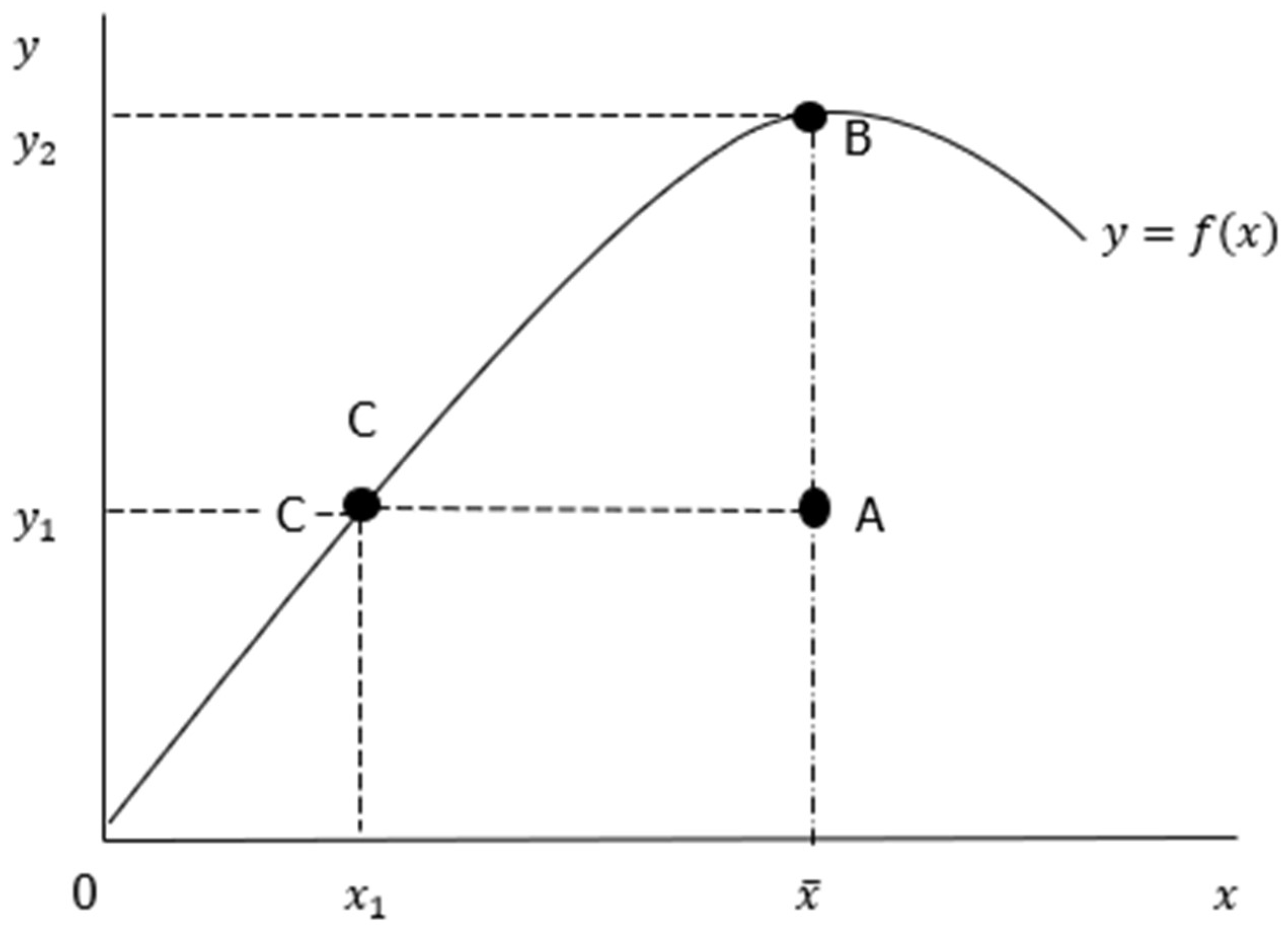

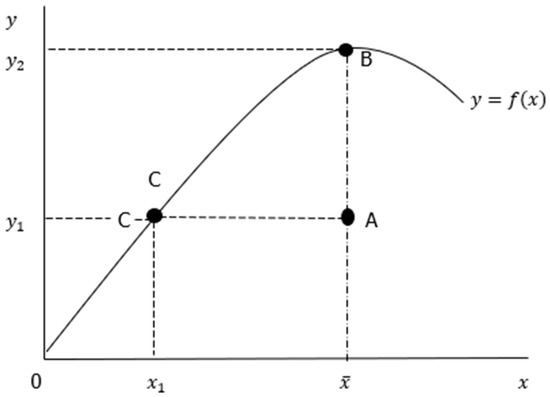

It is important at this stage to mention that efficiency can be input-orientated or output-orientated. The former occurs when industries are able to achieve the same level of output with fewer inputs. The latter occurs when industries are able to achieve higher output with the same level of input. Considering Figure 2, an industry is inefficient if its output is below the production frontier, such as point A. Moving vertically to point B defines output-oriented efficiency gains in that output industries attain a higher output, i.e., , with fixed inputs (). Moving leftwards horizontally to point C defines input-oriented efficiency gains in that industries can achieve the same level of output () with fewer inputs (). In this paper, the focus is on output-orientated efficiency given the regulatory constraints that make it hard for companies to fire workers in South Africa.

Figure 2.

Input- and output-orientated efficiency. Source: own illustration.

If technical inefficiency is output-oriented and it varies over time (i.e., where is the inefficiency term at time period ), then the rate of change in output while holding input quantities unchanged will be the sum of the rate of efficiency change and technical change. Here, this paper differs primarily from the existing literature. It considers an increase in industrial production as an outcome of technical inefficiency and technical changes, which are influenced by government subsidies. The treatment of a variable (subsidies in this instance) as a driver of both technical change and technical efficiency is possible, as indicated by Kumbhakar and Wang (2007). What most studies in the literature have carried out are proxy technical changes by R&D expenditure. With this practice, technical change is essentially embodied in R&D and, with this assumption, one can define technical change across units as

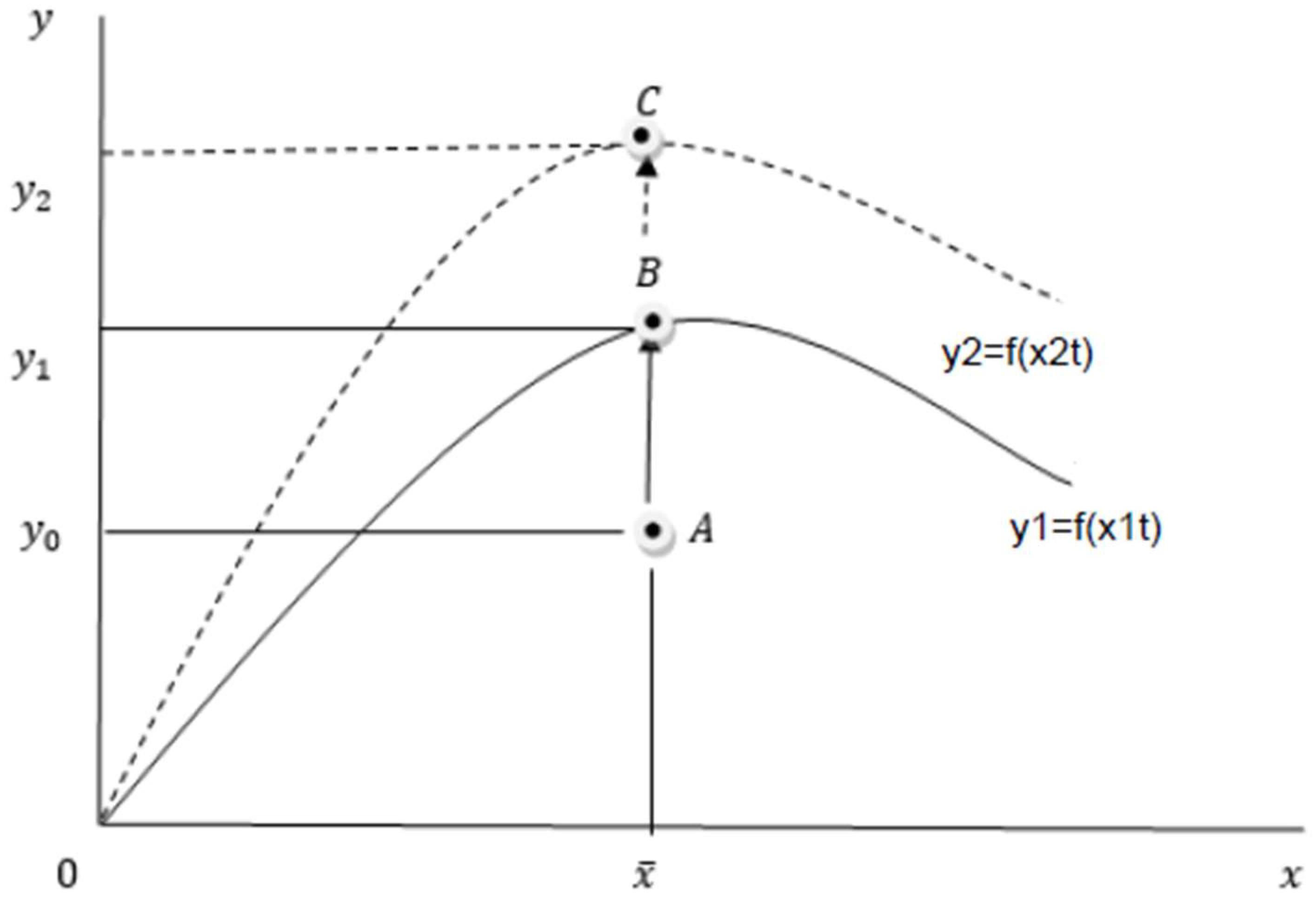

where R&D appears either neutrally or nonneutrally in the industrial production function (Kumbhakar, 2002). Figure 3 illustrates the two mechanisms through which subsidies can influence productivity. The initial production frontier is represented by . This is the maximum attainable level of output from the given input () and the existing technology. An industry operating at point A is considered inefficient and less productive as this level of output () is below the maximum possible output (). In theory, from a perspective of efficiency, government subsidies may may facilitate x-inefficiency which moves efficient industries from B to A. From an innovation perspective, government subsidies are argued to allow industries to invest in R&D. Conceptually, this would lead to innovation that facilitates a higher production frontier, also referred to as a technical change (Kumbhakar et al., 2023). In Figure 3, this mechanism culminates in a higher production frontier . In other words, a technical change that arises from subsidies may show up in a higher production frontier ().

Figure 3.

Subsidies and Productivity. Source: own illustration.

The empirical model described in the Section 3 is based on the stochastic frontier framework in which output (Y) is a function of inputs, a random term capturing stochastic factors affecting production, and an inefficiency term capturing inefficiency or production shortfalls.

where L is labour, K is capital stock, I is intermediate inputs, S are subsidies, M are intermediate imports and the exponents of the right-hand side variables are technology parameters, v is a random term while u is the inefficiency term which is also a function of subsidies and other factors. In Equation (2), captures the effect of subsidies (S) on efficiency while captures the effect of subsidies on technical changes. Empirically, Equation (1) will be log-transformed to make it estimable as it is nonlinear in parameters.

2.2. Empirical Literature

Several studies have shown that subsidies can have a positive impact on productivity. For example, building on the hypothesis that subsidies increase innovation and productivity, Li et al. (2022) use a semiparametric method to structurally identify the firm-level productivity in the presence of subsidies based on a panel dataset observed between 1998 and 2007. To mitigate the endogeneity of subsidies, they apply a switching regression on production function with endogenous variables in the Chinese machinery industry. Their results show strong empirical evidence that subsidies have a positive impact on productivity. Additionally, they find subsidies enabling firms to invest more in R&D and thus improve productivity. Similarly, Z. Jin et al. (2018) examine the impact of government subsidies on R&D expenditure and firm performance. Using a firm-level dataset on China’s manufacturing firms observed between 2011 and 2015, their results show that government subsidies improve private R&D expenditure and firm-level performance.

A critical aspect of the relationship between subsidies and productivity is that the impact operates in part through innovation. Studies testing this hypothesis have mainly regressed government subsidies on research and development. For example, D. Liu et al. (2019) use a dataset of the Chinese electronic manufacturing industry and confirm a positive impact of subsidies on enterprise technology innovation. In addition, they also find subsidies more effective for nonstate-owned enterprises compared to state-owned firms. Z. Liu and Zhou (2023) consider the impact of subsidies and tax incentives. Similarly to the current study, they applied an industry-level dataset comprising 31 manufacturing industries in China between 2009 and 2015 and the stochastic frontier analysis (SFA). Their results show that direct subsidies have no significant impact on the current R&D efficiency of the manufacturing industry and only begin to play a significantly positive role after two years.

Other studies have found the productivity effect of subsidies to be negative. Branstetter et al. (2023), for instance, examine how subsidies affect productivity in China. They find ex ante productivity negatively affected by government subsidies received by firms. Additionally, neither subsidies targeting R&D and innovation promotion nor equipment upgrading positively affect the growth of the productivity of firms. Similarly, Lin and Xie (2024) examine the impact of government subsidies on total factor productivity in China between 2011 and 2022. Their results show that government subsidies are detrimental to the productivity of Chinese renewable energy firms, with a more negative impact among low-productivity firms. Furthermore, subsidies are found to negatively influence total factor productivity by reducing capacity utilisation and facilitating rent-seeking activities. Karhunen and Huovari (2015) examine the impact of R&D subsidies on labour productivity. Using as a firm-level dataset Finnish firms observed between 2000 and 2012, they find no significant effect of subsidies on labour productivity within the first five years of implementation. In addition, the results show a negative effect of subsidies in the first two years of receiving a government subsidy.

Some studies have focussed on technical efficiency using either data envelope analysis (DEA) or SFA. For example, Salustiano et al. (2020) examine how subsidies influence the technical efficiency of Portuguese firms between 2007 and 2015 using stochastic frontier models and a fixed effects estimator. Their analysis finds that subsidies are positively associated with the technical efficiency of firms in animal production, food production, and paper production. In contrast, Moulay Ali et al. (2024) find a negative impact of subsidies on technical efficiency of Algerian farms. In de Jorge and Suárez (2011), results from a stochastic frontier model show similar results. The results particularly show that the beneficiaries of subsidies are less efficient compared to nonbeneficiaries. In other studies, technical efficiency is computed using productivity decomposition methods. Bernini et al. (2017), for example, evaluate the effect of subsidies on the different components of TFP. The components of TFP particularly include technical change and technical efficiency change where the former captures technical progress while the latter represents improvements in efficiency. Using a quasi-experimental method to mitigate endogeneity, their results find that capital subsidies negatively affect TFP growth in the short term. The positive impact of subsidies only shows up after 3–4 years of implementation, reflecting technological change rather than scale efficiency.

In the literature, the relationship between subsidies and productivity has received little or no empirical attention in the context of South Africa. This is despite the fact that South Africa’s industrial policy is mostly characterised by subsidies that have been in place for decades. The few existing studies have largely focussed on the effects of subsidies on outcomes such as employment, inequality, and poverty. Examples include Go et al. (2010); Köhler et al. (2023); Levinsohn et al. (2014); Lin and Okyere (2023); Burns et al. (2013). Although these studies have focussed on equally important economic outcomes, a study on productivity is necessary, as industrial policies and subsidies, in particular, are primarily designed to enhance competitiveness and productivity of industries. In view of this empirical gap, this study links industrial subsidies with productivity, focussing on two specific channels, namely technical changes and technical inefficiency. While others have projected technical changes by the stock of R&D, this study uses a stochastic frontier model in which the elasticities of the frontier equation are considered technology shifters. The use of R&D expenditure as a proxy for technical changes is problematic, as spending on R&D does not always culminate in new techniques and technological progress. Treating subsidies as a technology shifter circumvents this problem as it provides a more direct approach to testing the hypothesis that subsidies facilitate technological change. In addition, this study applies the control function procedure within the stochastic frontier framework in a bid to address both heterogeneity endogeneity and idiosyncratic endogeneity.

3. Materials and Methods

This section discusses the methodology. It specifically describes the dataset and variables, specifies the empirical model, and outlines the estimation strategy.

3.1. Data Description

This analysis uses a panel dataset comprising 64 3-digit industries observed annually from 1993 to 2023. A panel dataset is desirable compared to time series and cross-sectional datasets due to its ability to bring more variation, which is key to efficient estimation. In addition, by pooling industries over time, panel data yield a relatively large sample size and more degrees of freedom. Of the 64 industries, 42 are from the goods sector and 22 are from the service sector. Selection of both the sampling period and the 64 industries is guided by data availability, particularly on government subsidies and some of the key control variables. Guided by empirical literature, the variables used in this analysis are industrial output in constant prices, total employment proxying labour, fixed capital stock, the monetary value of intermediate inputs, the monetary value of intermediate imports, and the monetary value of government subsidies. Control variables include the stock of information and communication technologies (ICTs), export intensity, unit labour costs, and the number of informal workers as a ratio of total employment proxying the size of the informal sector. All variables vary across industries and over time. The primary data sources are the National Treasury and Statistics South Africa.

3.2. Model Specification

To estimate the impact of subsidies, a stochastic frontier analysis is used. Compared to data envelope analysis (DEA), this method has the ability to account for statistical noise and measurement error that is mostly associated with government subsidies. Within a stochastic frontier framework, a variable can affect technical changes, technical inefficiency, or both. A variable that only affects technical changes is placed in the frontier specification where it has the capability to shift the production frontier. On the other hand, a variable that only influences the distance to the frontier is placed in the inefficiency specification. The decision to place variables as frontier or inefficiency determinants is, in the main, guided by economic theory and the specific aim of the study. In the present case, guided by theory and the objective of the study, government subsidies are treated as both a technology and an inefficiency variable. Within the literature on stochastic frontier models, functional form matters. Studies have mostly used either the restrictive Cobb–Douglas specification or the flexible Translog specification. In the present case, the Translog specification did not converge, reflecting the main criticism of the specification of being susceptible to curvature problems (Fox, 1996). Therefore, the Cobb–Douglas specification was used. The empirical models take the following form.

where log denotes logarithm (i.e., base 10), subscripts and denote industry and year, respectively, captures random noise while is the productivity gap, i.e., the gap between A and B in Figure 2. Equation (3) is the technology or frontier specification, hence a positive and significant would support the hypothesis that subsidies facilitate technical changes. From Figure 2 displayed earlier, this would be represented by a move from B to C . Equation (4) is the inefficiency specification. Since captures the productivity gap, a positive and significant would support the x-inefficiency argument in which subsidies distort the incentive for industries to operate efficiently.

Intermediate imports () are also included both in the frontier and inefficiency specification. Inclusion in the former is justified by the open economy endogenous growth theory of Grossman and Helpman (1991), in which intermediate imports are considered a vehicle through which domestic industries can import foreign technologies. Inclusion in the latter is in line with literature in which intermediate imports increase competitiveness, which compels domestic industries to operate efficiently. The year variable is included to capture Hicks neutral technological progress. Standard factors of production, labour (), capital (), and intermediate inputs () are expected have a positive impact on frontier output. Exports are included in the inefficiency specification to capture the potential efficiency gains arising from economies of scale. The share of ICTs in total capital stock is included to capture efficiency gains that likely arise from better communication and better coordination. Unit labour costs primarily capture the motivation effect of labour rewards. Informality is likely to improve efficiency by increasing competition for formal industries.

3.3. Estimation Strategy

The problem with Equations (1) and (2) is that subsidies are mostly endogenous. In addition, they are commonly measured with error as argued in Schwartz and Clements (1999), raising concerns of attenuation bias (Baltagi, 2010). Within the panel stochastic frontier literature, several models exist from the normal–truncated normal model with time-invariant technical inefficiency (Battese & Coelli, 1988), the time decay model (Battese & Coelli, 1992), the time-varying inefficiency specifications of Cornwell et al. (1990), Lee and Schmidt (1993), Kumbhakar (1990), and Battese and Coelli (1995), the true random and fixed stochastic frontier models of Greene (2005) and improved by Wang and Ho (2010), the random effects models with time-invariant inefficiency of Pitt and Lee (1981), the fixed effects specification of Schmidt and Sickles (1984), and the recent model of Karakaplan and Kutlu (2017) and Karakaplan (2022) which addresses idiosyncratic endogeneity. This study uses the Karakaplan and Kutlu (2017) and Karakaplan (2022) model as a baseline approach. Compared to other specifications, this specification accounts for the endogeneity of subsidies in both the frontier and inefficiency specifications via an instrumental variable approach. The approach builds on the following specifications.

where would be the logarithm of output for industry in year , is a vector of technology variables; is specifically government subsidies and is also a technology variable, where is a vector of exogenous variables, and are two-sided error terms, is a one-sided error term capturing the productivity gap, , is a vector of factors that affect the productivity gap, and is an industry-specific random component independent from and . Parameter Ω is the variance–covariance matrix of , is the variance of and is the vector representing correlation between and . By assumption,

where the last expression links the productivity gap with government subsidies and a set of controls. Since is the productivity gap, a negative would imply a positive impact of government subsidies on productivity. Estimation of stochastic frontier models can be performed through the one-step or the two-step procedure. The literature has long recommended the one-step procedure, as the two-step approach is biased (Battese & Coelli, 1995; Wang, 2002). Therefore, this analysis estimates the frontier equation and the inefficiency specification simultaneously in a one-step approach. The logarithmic likelihood function of panel i is given by

where denotes the standard normal cumulative distribution function. To exogenise the variation in subsidies, this study uses lagged subsidies as an instrument, in line with the previous literature. Lagged subsidies are an appealing instrument for two reasons. First, they are predetermined and exogenous in the current period since they are based on past policy decisions and not influenced by the current period’s productivity outcomes. This is important as a good instrument should not be correlated with the error term in the structural equation. Second, lagged subsidies are likely to be correlated with current subsidies, given the persistent nature of subsidy programmes.

Although the baseline method addresses idiosyncratic endogeneity, it lumps unobserved heterogeneity with inefficiency, making it susceptible to exaggerating industrial inefficiencies. As a robustness check, therefore, we propose a novel approach which integrates the true fixed effects method of Greene (2005), and Wang and Ho (2010) particularly propose a methodological approach in which the within and first-difference transformations yield a closed-form likelihood function that is free from the incidental parameters problem. As a starting point, consider the following structural frontier equation.

Since Wang and Ho (2010) demonstrate that the within-transformed model and the first-differenced specification models are algebraically identical, this analysis only focusses on the first differenced model. Defining , and the stacked vector of for a given and denoted as , the log-likelihood function for the i-th cross-sectional unit is

where

The variance–covariance matrix of is given by

The matrix comprises on the diagonal and on the off diagonals. To obtain the marginal log-likelihood function, we sum the above function over the cross-sectional units. The model’s parameters are numerically estimated by maximising the marginal log-likelihood function. Post-estimation, the observation-specific inefficiency scores are calculated as

evaluated at . This approach avoids the contamination of inefficiency with unobserved heterogeneity. But it ignores idiosyncratic endogeneity if subsidies are correlated with the error term in both the frontier and inefficiency specifications. As indicated earlier, we propose an integration of the true fixed effects stochastic frontier model with the control function procedure. The control function approach addresses potential endogeneity or omitted variable bias by using instruments in the first stage (similar to two-stage least squares). It differs from the two-stage least squares procedure in that the residuals (rather than the predicted variables of the endogenous variable) computed in the first stage are added in the structural equation with bootstrapped or robust standard errors to improve efficiency. Consider the following structural equation, which in this case can be the frontier equation. The idea is applicable to the inefficiency specification without loss of generality.

where

is frontier output, are technology variables which include subsidies () suspected to be endogenous and other variables embedded in vector such as labour, capital, intermediate imports, and a time trend variable, is a vector of technology parameters, captures unobserved heterogeneity specific to each industry, and is the idiosyncratic term which is potentially correlated with subsidies. For simplicity, we take to be exogenous, i.e., for . Recall that Equation (11) is identical to Equation (7) estimated via the Wang and Ho (2010) fixed effects approach. In the first step, we estimate the reduced-form equation

where is the lagged term of subsidies used as an instrument and captures its strength. The problem with fixed effects estimation on Equation (12) is that the presence of a lagged dependent variable invites the famous Nickell (1981) bias. To avoid this bias, we propose estimating Equation (12) with the bias-adjusted least squares dummy variable (LSDV) approach. The bias-adjusted LSDV estimators are designed to correct Nickell bias in an autoregressive panel data model using the bias approximations in Bruno (2005). In our estimation, we use the Arellano and Bond (1991) approach to initialize the bias correction. We then compute the residuals.

Lastly, we include the residuals as an additional variable in the structural equation.

where a robust Walt test for serves as an endogeneity test. In other words, the significance of the residual in the structural equation will be a test for idiosyncratic endogeneity. In summary, the actual models estimated in this analysis are as follows.

where Equations (15)–(17) are associated with the Karakaplan and Kutlu (2017) and Karakaplan (2022) procedure, while Equations (18)–(20) are associated with the true fixed effects of Greene (2005) and Wang and Ho (2010) modified to accommodate residuals from a control function of Papke and Wooldridge (2008) and Wooldridge (2014). The change in the starting period (that is, from 1993 to 1994) is due to the use of lagged subsidies. All models are estimated in Stata version 17, Stata Corp LLC, TX 77845, USA. The dataset and the Stata do-file supporting the baseline results are available upon request. The next section presents and discusses the empirical results of the study.

4. Results and Discussion

Table 1 presents side-by-side results from the model that assumes exogeneity (Model EX) and a model that treats subsidies as endogenous (Model EN). Both models show a positive and statistically significant impact of labour on output, which is consistent with economic theory that suggests that labour is a key factor of production. This result indicates that increasing labour input results in higher output. Specifically, in both models, a 1% increase in employment increases the frontier output by 0.127–0.128% on impact, holding other factors constant. The positive impact of labour on industrial output empirically agrees with Mohsen et al. (2015). However, the impact is small relative to the 0.952–1.746% reported in Masunda (2011) in the context of Zimbabwe and the 0.3% reported in Camino-Mogro and Carrillo-Maldonado (2023) for Turkey. The smaller elasticity in our case could reflect the skill mismatch that generally characterises the South African labour market. This explanation is plausible given the results observed in Gilles et al. (2023) where a positive impact is observed specifically in the case of skilled labour. The abundance of relatively low-skilled workers and the scarcity of skilled workers in South Africa is well documented. With respect to capital stock, an insignificant effect is observed in both models, suggesting that capital stock has no direct effect on output. This result has two possible explanations. It could suggest that most industries in South Africa are labour intensive such that increases in capital stock barely raise frontier output. It could also reflect the low-capacity utilisation of capital investments in South Africa. The positive and highly significant coefficient for intermediate inputs in both models suggests that South Africa’s industrial output is mainly driven by intermediate goods. Intermediate imports enter similarly with a positive and significant effect, corroborating the notion that South African industries benefit from imported goods. Since this coefficient is in the frontier specification, this result supports Grossman and Helpman’s (1991) theory that intermediate imports facilitate the uptake of foreign technologies. Empirically, the positive impact of intermediate imports on frontier output is in line with Gilles et al. (2023) and Camino-Mogro and Carrillo-Maldonado (2023). Compared to Camino-Mogro and Carrillo-Maldonado (2023), however, our elasticity is slightly larger, 0.54%, compared to their 0.33%. The higher elasticity could indicate South Africa’s relatively higher dependence on imported inputs.

Table 1.

Baseline results—Government subsidies and industrial productivity.

The variable of interest, subsidies, has a negative and statistically significant coefficient in both models, indicating that subsidies have a negative impact on frontier output. This result is consistent with Krueger and Tuncer (1982); Beason and Weinstein (1996); Branstetter et al. (2023); Karhunen and Huovari (2015); and X. Jin (2018), who similarly report a detrimental effect of government subsidies on productivity. This result does not support the hypothesis that subsidies encourage positive technical changes. Rather, it lends empirical support to the notion that subsidies facilitate an over-reliance on government support, which destroys the incentive for industries to innovate. Interestingly, subsidies are positive and statistically significant in the inefficiency specification. The results essentially show that, in addition to destroying the incentive to innovate as confirmed in the frontier specification, subsidies are also associated with higher inefficiency. This result agrees with Martin and Page (1983), who found that government subsidies facilitate inefficiencies. Martin and Page (1983) proposed two possible explanations that are relevant in the present case. One is that government subsidies allow managers to relax and enjoy a quiet life. Two is that subsidies facilitate rent-seeking activities in which beneficiaries spend time lobbying for loans rather than focussing on operating productively. Therefore, in general, the results support the proposition that industries that receive government subsidies may be less efficient in their use of resources. They validate the argument that industries shielded from market pressures through subsidies might not optimise their operations.

The negative and significant coefficient for intermediate imports in the inefficiency specification suggests that industries with higher imports of intermediate goods are more technically efficient. This aligns with the idea that access to better quality or cheaper intermediate goods from abroad can help local industries improve their productivity and competitiveness. The negative coefficient of ICT also shows that industries with a higher share of ICTs in their capital stock are more technically efficient. This is consistent with modern economic theory that emphasises the role of information and communication technologies in improving production processes, eliminating coordination failures, and enhancing efficiency. Further, evidence shows that higher labour costs are associated with lower technical inefficiency, suggesting that financial labour rewards encourage efficiency. In line with expectations, informality enters negatively, validating the hypothesis that the informal sector creates competition for formal and organised industries, which promotes efficiency. The mean technical efficiency indicates that, on average, industries in South Africa operate at only about 28–29% of their potential output efficiency. The eta term is statistically significant at 5%, while the eta endogeneity test result rejects the null hypothesis at the 0.1% level. This indicates that subsidies are endogenous and that addressing endogeneity in the model is justified.

Table 2 presents the results of the first stage. These results are important for two reasons. First, they allow us to assess the relevance of the instrument. Second, they provide information on other drivers of industrial subsidies in South Africa. We observe a strong positive coefficient on lagged subsidies, indicating that current subsidies are strongly influenced by the previous level of subsidies. This result particularly suggests that historical government decisions and budgetary allocations shape the current landscape of industrial subsidies, making past levels of subsidies a relevant instrument. Interestingly, the labour coefficient is significantly negative. This suggests that subsidies target industries with a low capacity to create jobs. Capital stock enters positively and significantly, suggesting that government subsidies are more likely to flow to capital-intensive sectors.

Table 2.

First-Stage Results.

The coefficient for intermediate inputs is positive and statistically significant, indicating that subsidies increase with the use of intermediate inputs. A possible explanation is that the government subsidises sectors that rely heavily on intermediate inputs in a bid to make them globally competitive. Intermediate imports are similarly positively and significantly correlated with government subsidies, possibly reflecting the government’s efforts to support industries that rely on imported inputs. Most of the South African industries depend on imported intermediate goods. The government could be providing subsidies to ease the cost burden of these imports, helping local industries remain competitive.

Evidence also shows a small but positive impact of unit labour cost rises. This result suggests that rising labour costs, particularly in unionised sectors, might push the government to provide subsidies to help industries cope with the higher cost of doing business. Similarly, informal employment has a positive and statistically significant impact on industrial subsidies. This is not surprising since the South African government has an expansive social support programme that mostly reacts to social dynamics, including informality.

The chi2 statistic is above 10 with a very low probability value. This diagnostic downplays concerns of lagged subsidies being a potentially weak instrument. Table 3 presents the first-stage results from the bias-adjusted LSDV approach applied in the control function. Both Table 2 and Table 3 report a positive and statistically significant coefficient for the lagged subsidies variable. The coefficients are 0.877 and 0.762 in Table 2 and Table 3, respectively, affirming the strength of lagged subsidies as an instrument. Several control variables exhibit similar patterns in significance in both tables. For example, the coefficients for the logarithmic of intermediate imports are statistically significant in both tables, with a much larger magnitude in Table 3 (0.181 compared to 0.069 in Table 2). The log of informal employment is also significant in both tables, showing a similar magnitude (0.197 in Table 2 and 0.177 in Table 3). Furthermore, year is statistically significant in both models, although the coefficients are different (−0.003 in Table 2 and −0.00885 in Table 3).

Table 3.

LSDV First-stage regression.

However, there are some notable differences between the two tables. For example, in Table 2, the coefficient for the capital log is 0.022 (significant at 1%) and significantly negative in Table 3. In Table 2, the coefficient for ICT (share of total capital stock) is 0.100, although not statistically significant. On the contrary, in Table 3, the coefficient for ICTs is slightly larger, 0.156, and statistically insignificant. The difference in statistical significance emanates from the differences in standard errors, as the bias-adjusted LSDV calculates a bootstrap variance–covariance matrix.

The residual was calculated based on the results presented in Table 3 and plugged into the structural equation with the true fixed effects SFA. The results are presented in Table 4. The results similarly show that subsidies have a negative and statistically significant effect on frontier output. Although this result is true under both the true fixed effects (TFE) and the TFE control function (TFE-CFA), evidence suggests that the TFE slightly underestimates the negative effect of subsidies. A 1% increase in subsidies is associated with a decrease in frontier output of about 0.057% in the first model (TFE-CFA) and 0.022% in the second model (TFE). The relatively small elasticity reported by the TFE validates concerns of attenuation bias in which potential measurement error in subsidies could bias their productivity effect towards zero. However, a key takeaway point is that both models still show a detrimental effect of government subsidies on frontier output, substantiating the result observed earlier that subsidies distort the incentives of industries to innovate. When we compare the frontier elasticity reported by the TFE-CFA with that observed in the baseline approach, we find the effect of government subsidies on technical changes to be more negative when idiosyncratic endogeneity is considered.

Table 4.

Robustness check—Government subsidies and industrial productivity.

The coefficients for labour, capital, and intermediate goods are all positive and statistically significant, indicating their importance as drivers of frontier output. A 1% increase in labour and capital results in a 0.11% and 0.08% increase in production, respectively. Intermediate goods have an even higher elasticity with a 1% increase in these goods leading to about a 0.48% increase in output. This emphasises the importance of raw materials in determining the frontier product. In addition, imports of intermediate goods also contribute positively to output, with a 1% increase in imports leading to a 0.11% and 0.09% increase in output in the two models. These results suggest that domestic inputs (labour and capital) and external inputs (imports of intermediate goods) are crucial to increasing frontier output.

In the inefficiency model, the impact of subsidies is found to be statistically insignificant. When this result is combined with the negative and significant effect of subsidies on the frontier specification, the evidence points to an overall detrimental effect of subsidies on productivity. This result supports the notion that subsidies create distortions in market behaviour and make industries reliant on external support rather than focussing on improving productivity and innovation. Put differently, the results suggest that subsidies might lead to inefficiencies by reducing the need for industries to optimise their operations.

Other variables, such as the adoption of ICT, unit labour costs, and informal labour share, play a more significant role in determining inefficiency. The negative and significant coefficients for ICT share suggest that industries with a higher proportion of ICT adoption tend to have lower inefficiency. This is plausible as ICTs improve communication and reduce logistical costs. Interestingly, higher unit labour costs are now associated with increased inefficiency. This could be viewed as economically more intuitive than the baseline result, as higher labour costs may reduce the incentives of industries to use labour efficiently, leading to higher costs and less efficient production practices. The share of informal labour retains its significant and negative impact on inefficiency. Finally, industries with greater dependence on imported intermediate goods show less inefficiency, with both coefficients for intermediate imports being negative and statistically significant. This indicates that industries that use a higher proportion of imported inputs tend to be more efficient. This supports the hypothesis that imported intermediate goods are often of higher quality and more cost-effective, enabling industries to reduce inefficiency.

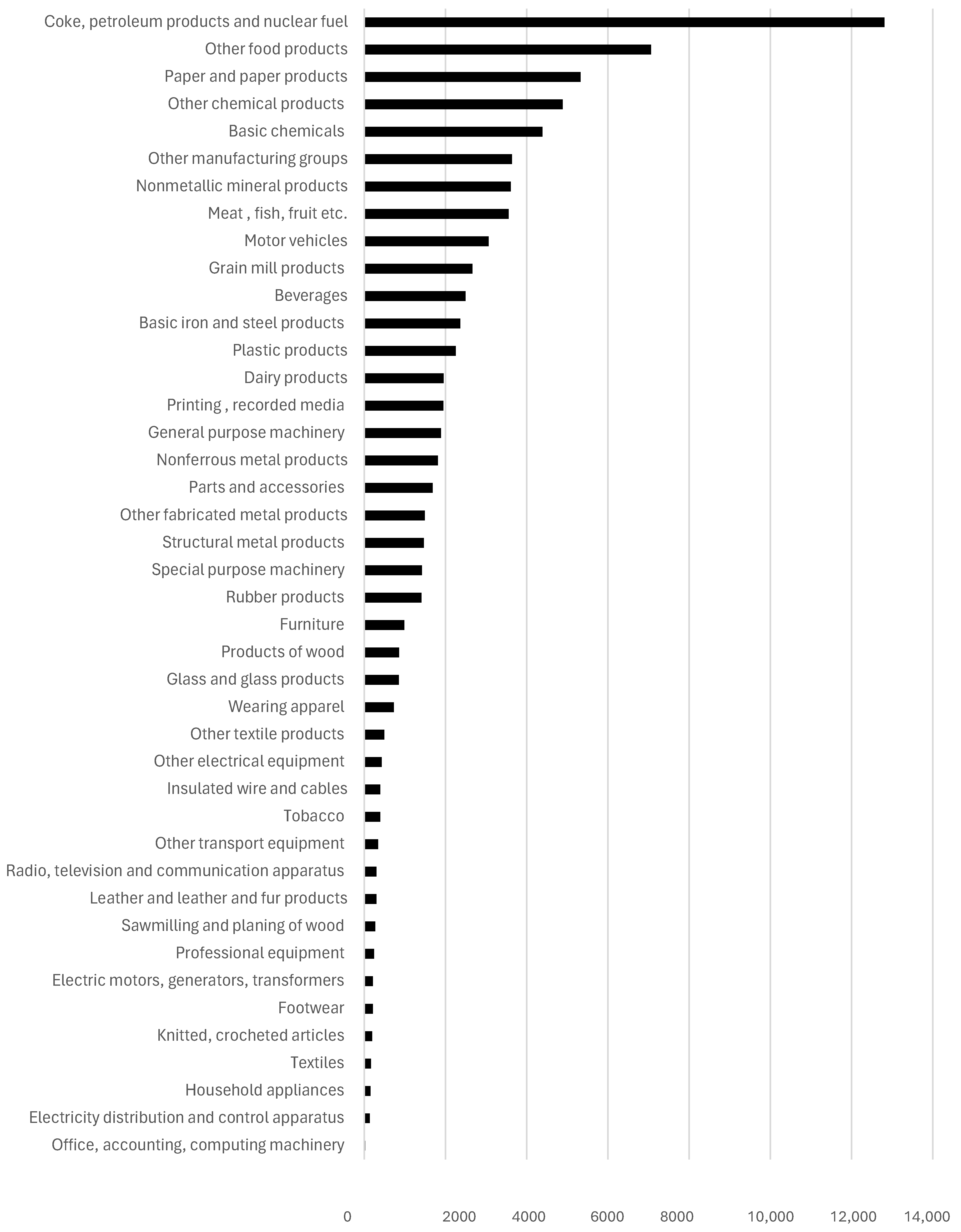

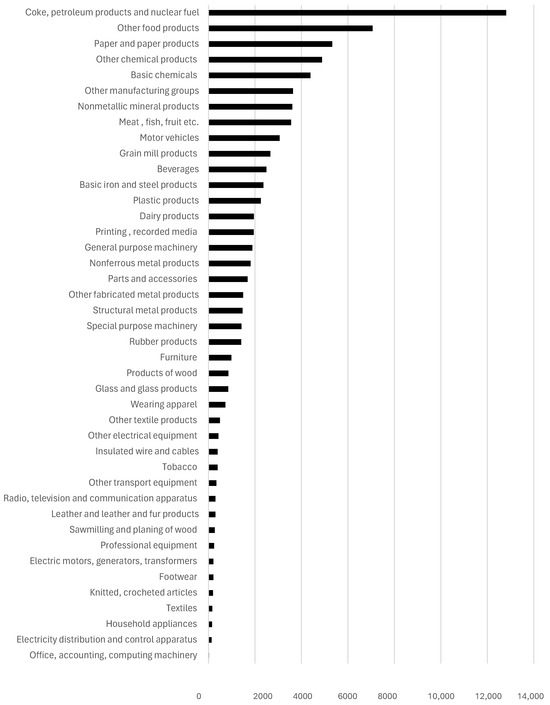

The average efficiency score has gone up from 0.29 in the baseline approach to 0.83–0.84 in the TFE-CFA and TFE approaches. This is not surprising since, unlike the baseline approach, the latter models separate inefficiency from unobserved heterogeneity. When unobserved heterogeneity is considered, the results show that an average industry operated about 16–17% below its production frontier. In the last exercise, the analysis ranks industries by their total subsidies received between 1993 and 2023. This is then accompanied by a comparison of efficiency between the recipients of the largest subsidies and the recipients receiving the least. As Figure 4 shows, the largest beneficiary in the goods sector was the coke, petroleum products, and nuclear fuel industry, followed by other food products and paper and paper products. These industries are key components of domestic and global supply chains, and the energy and food industries play an essential role in reducing poverty and food security. Additionally, a significant portion of government subsidies went to other chemical products and basic chemicals, reflecting the fact that these products are crucial for downstream industries. Motor vehicles, grain mill products, and beverages also received significant support, indicating their importance in contributing to job creation, exports, and industrial diversification.

Figure 4.

Total subsidies in the goods sector (1994–2023). Source: own computation.

The recipients of South Africa’s smallest industrial subsidies are primarily found in specialised sectors with smaller economic footprints. The office, accounting, and computing machinery received the smallest allocation. Electricity distribution and control apparatus, household appliances, and electric motors, generators, and transformers are also among the lower recipients, reflecting a limited focus on high-tech and consumer goods industries. In addition, sectors such as footwear, knitted and crocheted articles, and textiles received relatively modest subsidies, suggesting less emphasis on labour-intensive industries within the broader manufacturing sector.

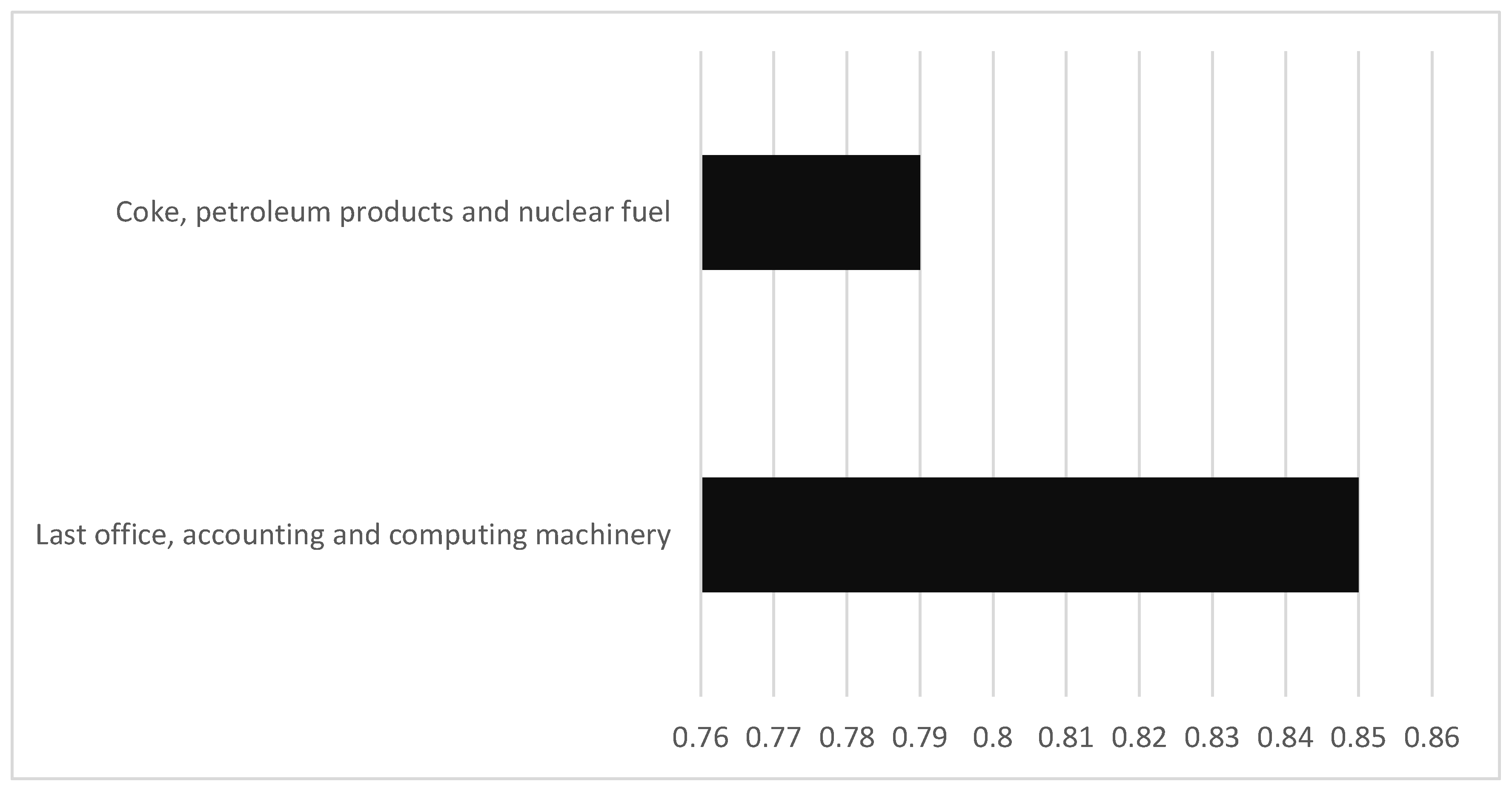

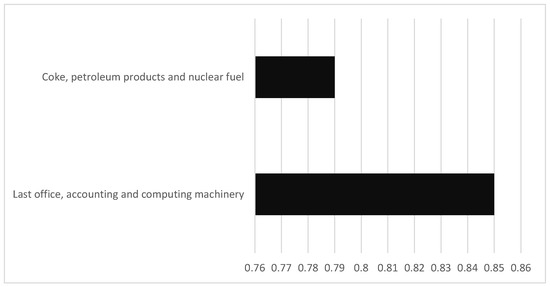

Figure 5 compares the average efficiency of the recipient industry receiving the most in the goods sector (coke, petroleum products, and nuclear fuel) and the recipient receiving the least (office, accounting and computing machinery). A cursory look at the graph is reassuring. The recipient of the largest government subsidies had an average efficiency score of 0.79 compared to the recipient receiving the least, 0.85. The beneficiary of the smallest government subsidies was therefore more efficient by 6 percentage points, validating the argument that industries that rely less on state support are forced to operate more efficiently.

Figure 5.

An efficiency comparison: largest vs. least recipient. Source: own computation.

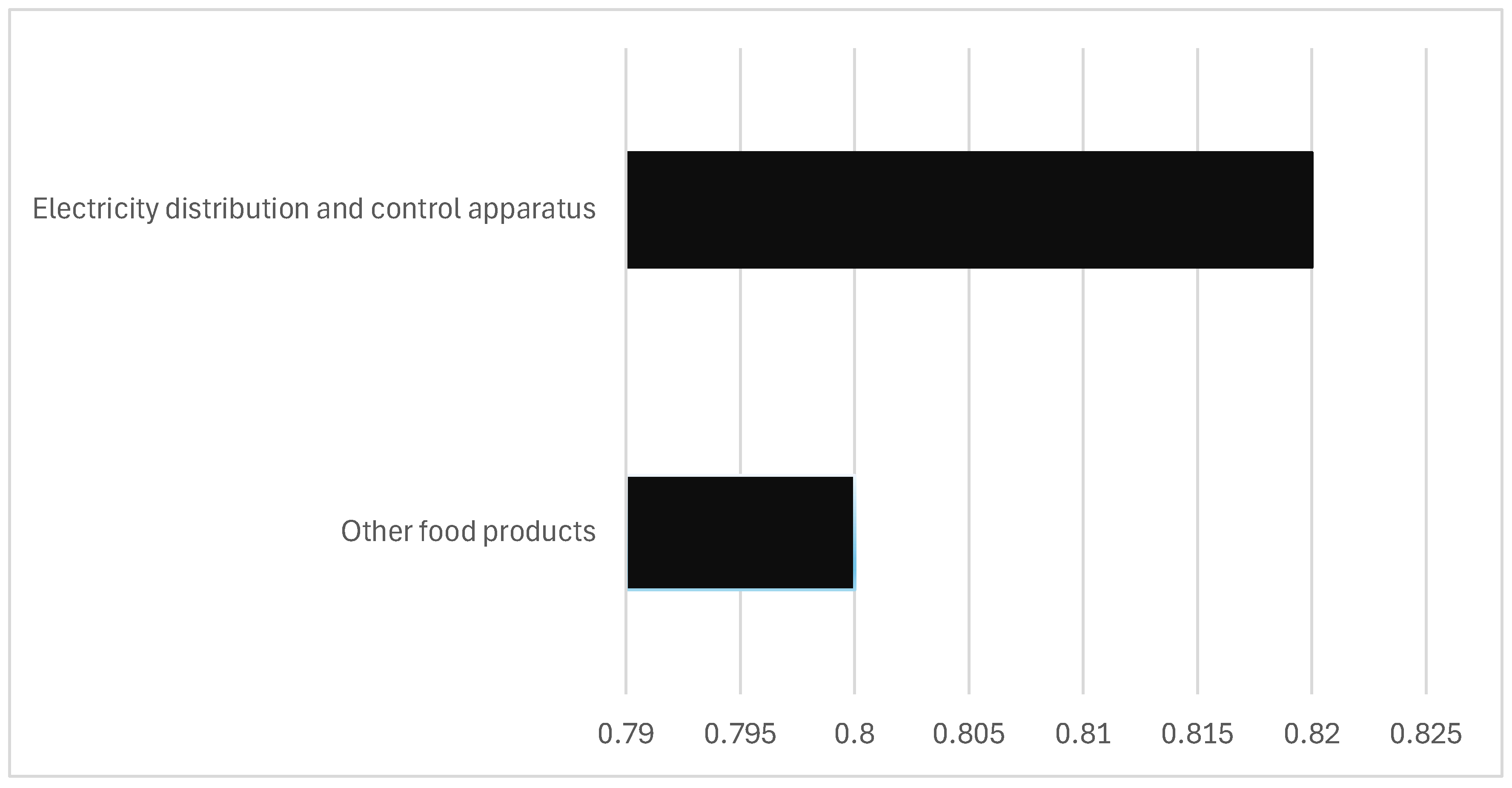

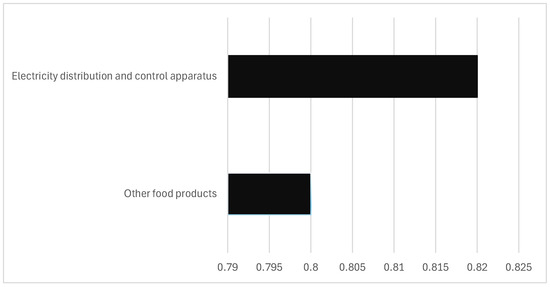

Similarly, in Figure 6, the beneficiary of the second largest government subsidies (other food products industry) was relatively more inefficient on average compared to the recipient with the second lowest subsidies (electricity distribution and control apparatus) by 2 percentage points.

Figure 6.

An efficiency comparison—second largest vs. second bottom. Source: own computation.

The same pattern appears in the case of the service industries. The results are not reported for the purpose of brevity, but they are available on request. The next section discusses the empirical results in line with the existing literature and South Africa’s experiences with government subsidies.

Discussion

From an economic theory perspective, subsidies are generally intended to correct market failures, support industries in difficulty, or encourage certain behaviours. However, in practice, subsidies can distort market incentives, leading to inefficiencies and over-reliance on government support. The negative impact of subsidies on frontier output and technical efficiency observed in this study aligns with the “moral hazard” argument in economics, where industries receiving subsidies might not strive to improve their productivity as much as industries that are exposed to market competition. Within the literature, the negative effect of government subsidies on technical changes and efficiency observed in this study is in line with Krueger and Tuncer (1982); Beason and Weinstein (1996); Branstetter et al. (2023); Karhunen and Huovari (2015); and X. Jin (2018), who similarly found subsidies detrimental to productivity.

In the South African context, this result is not surprising as subsidy programmes have been particularly criticised for misallocation, corruption, and inefficiencies in their implementation. There are notable cases where government subsidies have led to negative productivity outcomes, often through inefficient allocation of resources and fostering dependence on state support rather than encouraging long-term growth and competitiveness. In the manufacturing sector, for example, the Automotive Production and Development Programme (APDP), which has provided subsidies to domestic vehicle manufacturers for decades, is a prime example. While the programme was designed to support local production and promote export-orientated growth, it has not always driven the expected productivity improvements. Many of the firms benefiting from these subsidies have relied heavily on government support to remain competitive, rather than focussing on improving their efficiency and technological advancement. This has created a situation where manufacturers are less motivated to invest in process innovation, reducing the sector’s ability to compete in the global market. In addition, the benefits of the subsidies have been uneven, with larger players in the industry gaining more, leaving smaller firms or new entrants with fewer opportunities for growth and development. The result is a sector that has seen limited progress in terms of improving productivity and competitiveness, which are crucial for long-term economic sustainability.

Another relevant case from the South African industrial sector is the steel industry which has, over the years, received substantial government support, particularly in terms of energy subsidies and import protection. Although these subsidies have been designed to help South African steel producers remain competitive, they have led to inefficiencies in the sector. There has been concern that energy subsidies targeting the steel industry have contributed to a lack of incentive to adopt more energy-efficient practices. Today, South Africa’s steel industry, reliant on state subsidies, continues to face inefficiencies and stagnation, and production often lags behind global standards. The reliance on subsidies has also undermined the competitiveness of the industry on the international stage, as most firms in this industry do not face the same pressure to improve efficiency as unsubsidized firms in more competitive markets.

5. Conclusions

In conclusion, this study contributes to the ongoing debate on the impact of government subsidies on productivity, specifically in the context of South Africa. By focussing on two primary channels, efficiency and technical changes, the analysis reveals that government subsidies are detrimental to productivity growth. Contrary to the expectation that subsidies would stimulate innovation and improve efficiency through facilitating technical progress, the findings suggest that subsidies in South Africa primarily hinder these outcomes. The negative impact on innovation is particularly noteworthy, as subsidies appear to stifle technological progress, which is crucial for long-term economic growth and global competitiveness.

The results align with previous studies that argue that government subsidies may undermine industries’ incentives to innovate and operate efficiently. In addition to supporting the hypothesis of inefficiency, the study highlights the role of subsidies in fostering dependency, where industries may fail to optimise resource use, knowing that government support absorbs their inefficiencies. The study also sheds light on the persistent nature of subsidy programmes, revealing that past allocations influence current decisions. This suggests a long-term commitment to subsidising industries, many of which are capital intensive, face high labour costs, or rely on imported inputs.

In light of these findings, the broader implications of the study for policy are clear. While subsidies have been used to support industrial development in South Africa, their negative impact on productivity calls for a reevaluation of their design and implementation. To mitigate these adverse effects, policymakers may need to consider implementing more rigorous monitoring mechanisms, setting clear timelines, and ensuring that subsidies encourage innovation and efficient use of resources rather than foster dependency. If not carefully managed, industrial policies driven by subsidies could inadvertently undermine the very goals they are meant to achieve, namely, improving productivity, innovation, and global competitiveness.

In terms of areas for further study, this study has shown a general negative effect of subsidies on productivity, but the impact may vary between different industries. Future research could conduct a more granular analysis, focussing on specific industries or subsectors, particularly those that rely heavily on technological innovation or those that are most vulnerable to inefficiency due to subsidy dependence. For example, examining high-tech industries, such as information technology or green energy, can provide information on how subsidies might have varying effects on industries with different innovation needs. Furthermore, future studies may consider the role of subsidy design and governance. Examining how different designs of subsidy programmes (e.g., targeted vs. blanket subsidies, performance-based vs. unconditional subsidies) influence their effectiveness could provide more insight. It may also be useful to specifically consider the role of governance in shaping the outcomes of subsidy programmes, focussing on how accountability mechanisms, transparency, and enforcement influence the productivity effects of subsidies.

Funding

This research received no external funding.

Data Availability Statement

The datasets used and/or analysed during the current study are available from the author on reasonable request.

Conflicts of Interest

The author declares no conflict of interest.

References

- Agostino, M., Comert, E. E., Demaria, F., & Ruberto, S. (2024). What kinds of subsidies affect technical efficiency? The case of Italian dairy farms. Agribusiness, 40(1), 116–138. [Google Scholar] [CrossRef]

- Aiginger, K., & Rodrik, D. (2020). Rebirth of industrial policy and an agenda for the twenty-first century. Journal of Industry, Competition and Trade, 20, 189–207. [Google Scholar] [CrossRef]

- Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. The Review of Economic Studies, 58(2), 277–297. [Google Scholar] [CrossRef]

- Baltagi, B. H. (2010). Fixed effects and random effects. In Microeconometrics (pp. 59–64). Palgrave Macmillan. [Google Scholar]

- Battese, G. E., & Coelli, T. J. (1988). Prediction of firm-level technical efficiencies with a generalized frontier production function and panel data. Journal of Econometrics, 38(3), 387–399. [Google Scholar] [CrossRef]

- Battese, G. E., & Coelli, T. J. (1992). Frontier production functions, technical efficiency and panel data: With application to paddy farmers in India. Journal of Productivity Analysis, 3, 153–169. [Google Scholar] [CrossRef]

- Battese, G. E., & Coelli, T. J. (1995). A model for technical inefficiency effects in a stochastic frontier production function for panel data. Empirical Economics, 20, 325–332. [Google Scholar] [CrossRef]

- Beason, R., & Weinstein, D. E. (1996). Growth, economies of scale, and targeting in Japan (1955–1990). The Review of Economics and Statistics, 78, 286–295. [Google Scholar] [CrossRef]

- Bernini, C., Cerqua, A., & Pellegrini, G. (2017). Public subsidies, TFP and efficiency: A tale of complex relationships. Research Policy, 46(4), 751–767. [Google Scholar] [CrossRef]

- Branstetter, L. G., Li, G., & Ren, M. (2023). Picking winners? Government subsidies and firm productivity in China. Journal of Comparative Economics, 51(4), 1186–1199. [Google Scholar] [CrossRef]

- Bruno, G. S. (2005). Approximating the bias of the LSDV estimator for dynamic unbalanced panel data models. Economics Letters, 87(3), 361–366. [Google Scholar] [CrossRef]

- Burns, J., Edwards, L., & Pauw, K. (2013). Revisiting wage subsidies: How pro-poor is a South African wage subsidy likely to be? Development Southern Africa, 30(2), 186–210. [Google Scholar] [CrossRef]

- Camino-Mogro, S., & Carrillo-Maldonado, P. (2023). Do imports of intermediate inputs generate higher productivity? Evidence from Ecuadorian manufacturing firms. The World Economy, 46(5), 1471–1521. [Google Scholar] [CrossRef]

- Cin, B. C., Kim, Y. J., & Vonortas, N. S. (2017). The impact of public R&D subsidy on small firm productivity: Evidence from Korean SMEs. Small Business Economics, 48, 345–360. [Google Scholar]

- Cornwell, C., Schmidt, P., & Sickles, R. C. (1990). Production frontiers with cross-sectional and time-series variation in efficiency levels. Journal of Econometrics, 46(1–2), 185–200. [Google Scholar] [CrossRef]

- de Jorge, J., & Suárez, C. (2011). Influence of R&D subsidies on efficiency: The case of Spanish manufacturing firms. Cuadernos de Economía y Dirección de la Empresa, 14(3), 185–193. [Google Scholar]

- Devlin, R., & Moguillansky, G. (2013). What’s new in the new industrial policy in Latin America? In The industrial policy revolution I: The role of government beyond ideology (pp. 276–317). Palgrave Macmillan. [Google Scholar]

- Fox, K. J. (1996). Specification of functional form and the estimation of technical progress. Applied Economics, 28(8), 947–956. [Google Scholar] [CrossRef]

- Gilles, E., Deaza, J., & Vivas, A. (2023). The role of imported intermediates in productivity change. Economic Systems Research, 35(2), 211–227. [Google Scholar] [CrossRef]

- Go, D. S., Kearney, M., Korman, V., Robinson, S., & Thierfelder, K. (2010). Wage subsidy and labour market flexibility in South Africa. The Journal of Development Studies, 46(9), 1481–1502. [Google Scholar] [CrossRef]

- Greene, W. (2005). Reconsidering heterogeneity in panel data estimators of the stochastic frontier model. Journal of Econometrics, 126(2), 269–303. [Google Scholar] [CrossRef]

- Greenwald, B., & Stiglitz, J. E. (2006). Helping infant economies grow: Foundations of trade policies for developing countries. American Economic Review, 96(2), 141–146. [Google Scholar] [CrossRef]

- Grossman, G. M., & Helpman, E. (1991). Trade, knowledge spillovers, and growth. European Economic Review, 35(2–3), 517–526. [Google Scholar] [CrossRef]

- Jin, X. (2018). Government subsidies, resource misallocation and manufacturing productivity. China Finance and Economic Review, 7(3), 74–95. [Google Scholar]

- Jin, Z., Shang, Y., & Xu, J. (2018). The impact of government subsidies on private R&D and firm performance: Does ownership matter in China’s manufacturing industry? Sustainability, 10(7), 2205. [Google Scholar] [CrossRef]

- Jongwanich, J., & Kohpaiboon, A. (2020). Effectiveness of industrial policy on firm productivity: Evidence from Thai manufacturing. Asian-Pacific Economic Literature, 34(2), 39–63. [Google Scholar] [CrossRef]

- Juhász, R., Lane, N., & Rodrik, D. (2023). The new economics of industrial policy. Annual Review of Economics, 16, 213–242. [Google Scholar] [CrossRef]

- Karakaplan, M. U. (2022). Panel stochastic frontier models with endogeneity. The Stata Journal, 22(3), 643–663. [Google Scholar] [CrossRef]

- Karakaplan, M. U., & Kutlu, L. (2017). Endogeneity in panel stochastic frontier models: An application to the Japanese cotton spinning industry. Applied Economics, 49(59), 5935–5939. [Google Scholar] [CrossRef]

- Karhunen, H., & Huovari, J. (2015). R&D subsidies and productivity in SMEs. Small Business Economics, 45, 805–823. [Google Scholar]

- Köhler, T., Bhorat, H., & Hill, R. (2023). The effect of wage subsidies on job retention in a developing country: Evidence from South Africa (No. 2023/114) (WIDER Working Paper). UNU-WIDER. [Google Scholar]

- Krueger, A. O., & Tuncer, B. (1982). An empirical test of the infant industry argument. The American Economic Review, 72(5), 1142–1152. [Google Scholar]

- Krugman, P. R. (1983). Targeted industrial policies: Theory and evidence. Industrial Change and Public Policy, 123–155. Available online: https://www.kansascityfed.org/documents/7641/1983-S83-full-publication.pdf#page=139 (accessed on 2 April 2025).

- Kumbhakar, S. C. (1990). Production frontiers, panel data, and time-varying technical inefficiency. Journal of Econometrics, 46, 201–211. [Google Scholar] [CrossRef]

- Kumbhakar, S. C. (2002). Specification and estimation of production risk, risk preferences and technical efficiency. American Journal of Agricultural Economics, 84(1), 8–22. [Google Scholar] [CrossRef]

- Kumbhakar, S. C., Li, M., & Lien, G. (2023). Do subsidies matter in productivity and profitability changes? Economic Modelling, 123, 106264. [Google Scholar] [CrossRef]

- Kumbhakar, S. C., & Wang, D. (2007). Economic reforms, efficiency and productivity in Chinese banking. Journal of Regulatory Economics, 32, 105–129. [Google Scholar] [CrossRef]

- Kumbhakar, S. C., Wang, H. J., & Horncastle, A. P. (2015). A practitioner’s guide to stochastic frontier analysis using Stata. Cambridge University Press. [Google Scholar]

- Latruffe, L., Bravo-Ureta, B. E., Carpentier, A., Desjeux, Y., & Moreira, V. H. (2017). Subsidies and technical efficiency in agriculture: Evidence from European dairy farms. American Journal of Agricultural Economics, 99(3), 783–799. [Google Scholar] [CrossRef]

- Lee, Y. H., & Schmidt, P. (1993). A production frontier model with flexible temporal variation in technical efficiency. The Measurement of Productive Efficiency: Techniques and Applications, 237, 255. [Google Scholar]

- Levinsohn, J., & Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. The Review of Economic Studies, 70(2), 317–341. [Google Scholar] [CrossRef]

- Levinsohn, J., Rankin, N., Roberts, G., & Schöer, V. (2014). Wage subsidies and youth employment in South Africa: Evidence from a randomised control trial. Stellenbosch Economic Working Papers, 2, 14. [Google Scholar]

- Li, M., Jin, M., & Kumbhakar, S. C. (2022). Do subsidies increase firm productivity? Evidence from Chinese manufacturing enterprises. European Journal of Operational Research, 303(1), 388–400. [Google Scholar] [CrossRef]

- Lin, B., & Okyere, M. A. (2023). Race and energy poverty: The moderating role of subsidies in South Africa. Energy Economics, 117, 106464. [Google Scholar] [CrossRef]

- Lin, B., & Xie, Y. (2024). Effect of renewable energy subsidy policy on firms’ total factor productivity: The threshold effect. Energy Policy, 192, 114241. [Google Scholar] [CrossRef]

- Liu, D., Chen, T., Liu, X., & Yu, Y. (2019). Do more subsidies promote greater innovation? Evidence from the Chinese electronic manufacturing industry. Economic Modelling, 80, 441–452. [Google Scholar] [CrossRef]

- Liu, Z., & Zhou, X. (2023). Can direct subsidies or tax incentives improve the R&D efficiency of the manufacturing industry in China? Processes, 11(1), 181. [Google Scholar] [CrossRef]

- Martin, J. P., & Page, J. M. (1983). The impact of subsidies on X-efficiency in LDC industry: Theory and an empirical test. The Review of Economics and Statistics, 65, 608–617. [Google Scholar] [CrossRef]

- Masunda, S. (2011). Real exchange rate misalignment and sectoral output in Zimbabwe. International Journal of Economic Research, 2(4), 59–74. [Google Scholar]

- Mattsson, P. (2019). The impact of labour subsidies on total factor productivity and profit per employee. Economic Analysis and Policy, 62, 325–341. [Google Scholar] [CrossRef]

- Minviel, J. J., Sipiläinen, T., Latruffe, L., & Bravo-Ureta, B. E. (2024). Impact of public subsidies on persistent and transient technical efficiency: Evidence from French mixed crop-livestock farms. Applied Economics, 56(55), 7286–7301. [Google Scholar] [CrossRef]

- Mohsen, A. S., Chua, S. Y., & Sab, C. N. C. (2015). Determinants of industrial output in Syria. Journal of Economic Structures, 4, 1–12. [Google Scholar] [CrossRef]

- Moulay Ali, H., Guellil, M. S., Mokhtari, F., & Tsabet, A. (2024). The effect of subsidies on tecnical efficiency of Algerian agricultural sector: Using stochastic frontier model (SFA). Discover Sustainability, 5(1), 98. [Google Scholar] [CrossRef]

- Nickell, S. (1981). Biases in dynamic models with fixed effects. Econometrica: Journal of the Econometric Society, 49, 1417–1426. [Google Scholar] [CrossRef]

- Obeng, K., & Sakano, R. (2008). Public transit subsidies, output effect and total factor productivity. Research in Transportation Economics, 23(1), 85–98. [Google Scholar] [CrossRef]

- Papke, L. E., & Wooldridge, J. M. (2008). Panel data methods for fractional response variables with an application to test pass rates. Journal of Econometrics, 145(1–2), 121–133. [Google Scholar] [CrossRef]

- Pitt, M. M., & Lee, L. F. (1981). The measurement and sources of technical inefficiency in the Indonesian weaving industry. Journal of Development Economics, 9(1), 43–64. [Google Scholar] [CrossRef]

- Rizov, M., Pokrivcak, J., & Ciaian, P. (2013). CAP subsidies and productivity of the EU farms. Journal of Agricultural Economics, 64(3), 537–557. [Google Scholar] [CrossRef]

- Rodrik, D. (1995). Getting interventions right: How South Korea and Taiwan grew rich. Economic Policy, 10(20), 53–107. [Google Scholar] [CrossRef]

- Rodrik, D. (2019). Where are we in the economics of industrial policies? 1. Frontiers of Economics in China, 14(3), 329–335. [Google Scholar]

- Rodrik, D. (2022). An industrial policy for good jobs. In Hamilton project—Policy proposal. Brookings Institution. [Google Scholar]

- Salustiano, S. F. M., Barbosa, N., & Moreira, T. B. S. (2020). Do subsidies drive technical efficiency? The case of Portuguese firms in the agribusiness sector. Revista de Economia e Sociologia Rural, 58(3), e216150. [Google Scholar] [CrossRef]

- Schmidt, P., & Sickles, R. C. (1984). Production frontiers and panel data. Journal of Business & Economic Statistics, 2(4), 367–374. [Google Scholar]

- Schwartz, G., & Clements, B. (1999). Government subsidies. Journal of Economic Surveys, 13(2), 119–148. [Google Scholar] [CrossRef]

- Wang, H. J. (2002). Heteroscedasticity and non-monotonic efficiency effects of a stochastic frontier model. Journal of Productivity Analysis, 18, 241–253. [Google Scholar] [CrossRef]

- Wang, H. J., & Ho, C. W. (2010). Estimating fixed-effect panel stochastic frontier models by model transformation. Journal of Econometrics, 157(2), 286–296. [Google Scholar] [CrossRef]

- Wooldridge, J. M. (2014). Quasi-maximum likelihood estimation and testing for nonlinear models with endogenous explanatory variables. Journal of Econometrics, 182(1), 226–234. [Google Scholar] [CrossRef]

- Zhang, X., Gong, D., Huang, Y., & Li, Y. (2024). The government’s fiscal and taxation policy effect on enterprise productivity: Policy choice and optimal allocation. International Review of Economics & Finance, 93, 28–41. [Google Scholar]

- Zhu, M., Zheng, K., Liu, B., & Jin, F. (2024). Can agricultural support and protection subsidy policies promote high-quality development of grain industry? A case study of China. Agriculture, 14(10), 1664. [Google Scholar] [CrossRef]

- Zhu, X., Zuo, F., Wang, S., Yang, Q., & Shi, X. (2024). Can government subsidies facilitate TFP growth? From the perspective of dynamic capability. International Journal of Innovation and Technology Management (IJITM), 21(5), 2450035. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).