In this section, the empirical analysis is presented. The aim is to estimate different panel model specifications in order to detect the most critical factors that determine the real GDP growth of different Euro area countries and to assess the impact of these covariates (for the World Pandemic Index (WPI) in particular) on the economic activity of the analysed countries during the COVID-19 pandemic. Below, the panel data models used in this study are outlined in detail, the estimated panel model parameters are presented, and the main findings of the analysis are discussed.

6.1. Panel Model Specifications

The following panel model specifications are employed:

- :

A panel model with common covariates, without autoregressive dynamics:

,

,

,

where denotes the real GDP growth of country i at time t, , ; denotes the p-th exogenous common covariate/predictor at time t, ; is the error process; is the vector of real GDP growth for the analysed countries at time t; is the vector of common covariates at time t; of dimension is the Kronecker product of the identity matrix with the covariate vector ; S is an selection matrix with elements equal to 0 or 1; is an vector of the panel model parameters, i.e., ; is an matrix; is the vector of real GDP growth values; is the matrix of covariates; and is the vector of innovations.

- :

A panel model with common covariates, with autoregressive dynamics:

, ,

,

, ,

,

where denotes the real GDP growth of country i at time t, , , , denotes the p-th exogenous common covariate/predictor at time t, , follows an autoregressive model of order one, AR(1), is the error process, is an vector at time t, , is the vector with of common covariates at time t, of dimension is the Kronecker product of the identity matrix with the covariate vector , S is an selection matrix with elements equal to 0 or 1, is an vector of the panel model parameters, i.e., , is an matrix, is the vector, is the matrix of covariates, and is the vector of innovations.

- :

A panel model with common and country-specific covariates, without autoregressive dynamics:

,

,

,

where denotes the real GDP growth of country i at time t, , , denotes the p-th exogenous common covariate/predictor at time t, , with coefficients , denotes the q-th exogenous country-specific covariate, with coefficient , is the error process, is the vector of real GDP growth values for the analysed countries at time t, is the vector of covariates at time t, , of dimension is the Kronecker product of the identity matrix with the covariate vector , S is an selection matrix with elements equal to 0 or 1, is an vector of the panel model parameters, i.e., , is an matrix, is the vector of real GDP growth values, is the matrix of covariates, and is the vector of innovations.

6.2. Empirical Results

This section presents the empirical findings. As noted earlier, the panel data models use several predictor variables/factors to investigate the impact of the COVID-19 pandemic on real GDP growth. Furthermore, there is an interest in examining the drivers of economic activity during turbulent times using the proposed panel models and their associated SUR representation. The modeling framework is implemented on the real economic activity of six Eurozone economies of different scale, namely Germany, France, Italy, Spain, Greece, and Belgium, using quarterly data for the period 2001:Q2–2021:Q3. The models have been estimated under parameter heterogeneity across countries without and with cross-sectional dependence of the error processes.

First, the results obtained from the panel data model

or

(Model Specification M1), which uses three common covariates, i.e., the change in WTI oil price index (OIL), the World Uncertainty Index (WUI), and the World Pandemic Uncertainty Index (WPI), without employing autoregressive dynamics for the error process, are presented and discussed. Model parameter estimates are obtained by using OLS based on the SUR representation and by applying the Bayesian approach to inference, i.e., the MCMC sampling scheme described in

Section 4, which was implemented with over 5000 iterations to produce a sample from the posterior distribution of the model parameters.

Table 3 reports the corresponding OLS-based parameter estimates and standard errors (Panel A), as well as the posterior means and standard deviations (Panel B) of the common predictor factors of the panel data model. The findings reveal that all the estimated intercepts

,

, are positive, apart from Greece (−0.021), ranging from 0.093 for Italy to 0.455 for Belgium; however, only the population intercept parameter of Belgium (estimated at 0.455) is statistically significant. We observe that the World Pandemic Uncertainty Index, WPI, appears in all countries with a statistically significant negative coefficient, ranging from −0.274 for Germany to −0.616 for Spain, indicating that, as expected, the COVID-19 pandemic has negatively influenced each country’s real economic activity. However, the impact varies across the countries studied. The estimates suggest that the pandemic’s effect was more severe in Spain (−0.616), Greece (−0.502), France (−0.476), Italy (−0.469), and Belgium (−0.445) relative to Germany (−0.274). Almost identical findings arise from the estimates based on the MCMC posterior means.

Table 4 presents the posterior means and standard deviations for the elements of the covariance matrix

of the residuals of the panel model. All the covariances take statistically significant positive values, with a minimum value of 1.96 between Germany and Greece and a maximum of 6.18 between France and Spain, indicating strong evidence for cross-sectional dependence/correlation among the error terms of the analysed countries.

Next, the focus is shifted to the results obtained from the dynamic panel model

, where

or

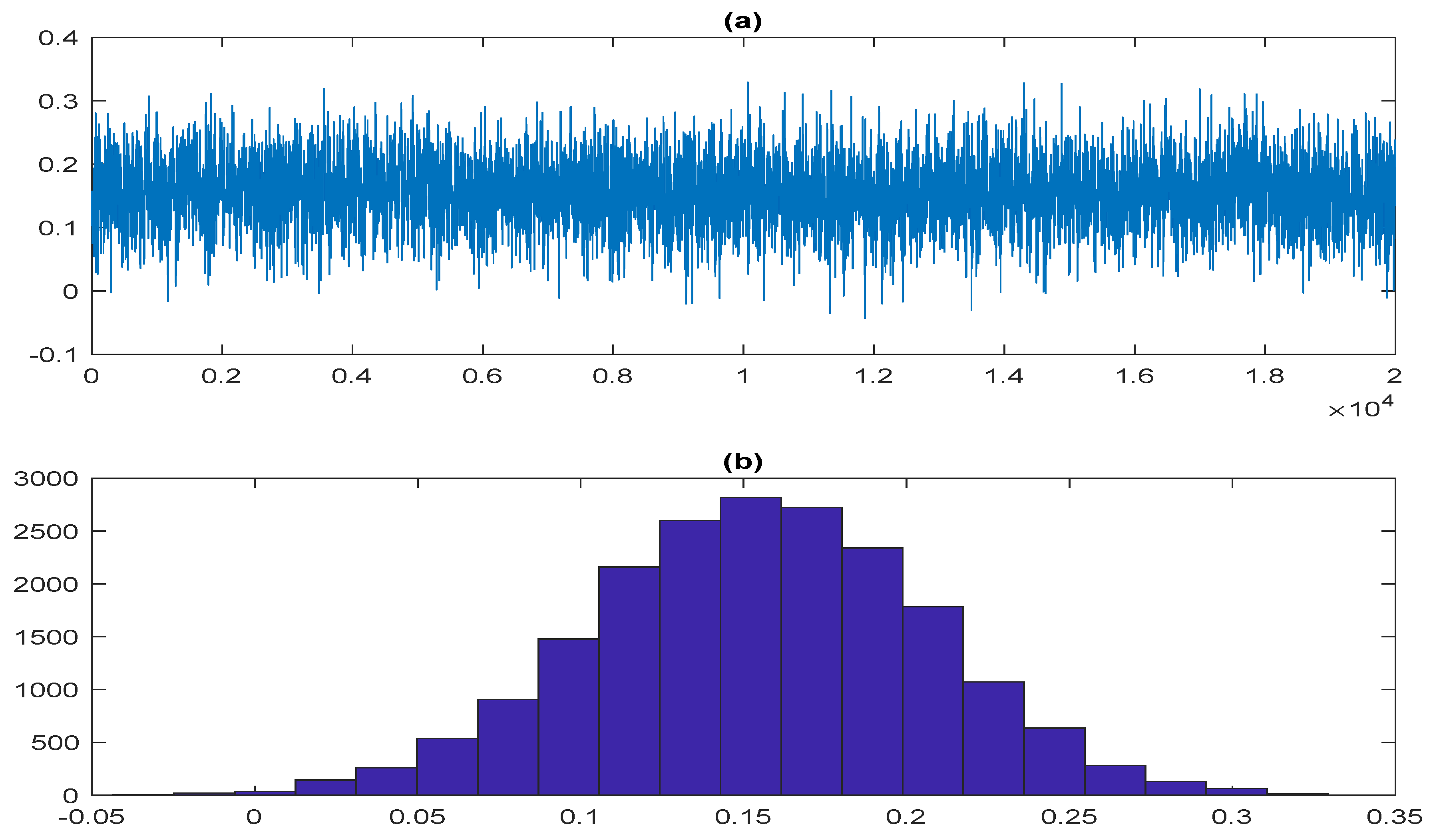

(Model Specification M2), that uses the three common covariates and allows for autoregressive dynamics for the error process. Model parameter estimates are obtained by implementing the MCMC sampling algorithm of

Section 4 for 20,000 iterations to generate a sample from the posterior distribution of the model parameters. The algorithm converges to the posterior distribution of model parameters very fast, i.e., in a small fraction of iterations. This is clearly depicted in the convergence plots and the histograms of the posterior sample of parameters of the panel model presented in

Figure 1,

Figure 2,

Figure 3 and

Figure 4. The shapes of the posterior distribution of all

and

,

(

Figure 2), as well as of the common

autoregressive parameter (

Figure 3), indicate a symmetric normal-like distribution, while the posterior distribution of the variances

and covariances

(

Figure 4) exhibits positive skewness, indicating deviation from normality.

In

Table 5, the posterior means and standard deviations of the parameters of the common predictor variables, as well as of the common autoregressive coefficient

in the dynamic panel data model, are presented. The results are similar in spirit with those of the model specification

and show that all the estimated intercepts

,

, are positive, apart from Greece (−0.033), ranging from 0.127 for Italy to 0.485 for Belgium. Again, only the population intercept parameter of Belgium (estimated at 0.485) is statistically significant. The World Pandemic Uncertainty Index, WPI, has significant negative exposure for all the analysed countries, ranging from −0.316 for Germany to −0.681 for Spain, which indicates considerable variability in the impact of the World Pandemic Uncertainty Index on the economic activity of the analysed countries. Based on the

model estimates, the effect of the pandemic seems to be significant for Spain (−0.681), France (−0.556), Italy (−0.536), Greece (−0.524), and Belgium (−0.495) relative to the effect on Germany (−0.316). Therefore, both panel model specifications,

and

, identify the World Pandemic Uncertainty Index as an important covariate that influences the economic activity in the analysed countries. Another important finding is that the common autoregressive coefficient

is statistically significant and positive, estimated at 0.155, indicating positive autocorrelation dynamics in real GDP.

The posterior means and standard deviations of the elements of the covariance matrix

of the residuals of the dynamic panel model specification

with common covariates and autoregressive dynamics for the six European countries’ real GDP growth are reported in

Table 6. The estimated covariance structure is similar in spirit with those of the panel model specification

, indicating some level of robustness in the estimated covariance matrix

. Specifically, all the estimated covariances are positive and statistically significant, with a minimum value of 2.18 between Germany and Greece and a maximum of 6.58 between France and Spain, indicating cross-sectional dependence/correlation among the error terms of the analysed countries and pointing out the need for allowing for cross-sectional dependence in the corresponding panel data models.

Next, the panel data model is considered, i.e., the equivalent Seemingly Unrelated Regression (SUR) representation (Model Specification M3), which allows for common covariates, , , and specific cross-sectional unit explanatory variables, , , to impact the panel model’s dependent variable series. The covariance structure of allows for cross-sectional dependence of the innovation process if is not diagonal, and in this way, it may capture unobserved random (pandemic, war, geopolitical, etc.) effects and provide a natural link/connection to the system of dependent variables. Note also that in this model specification, the set of country-specific covariates is augmented by the lagged values of the individual country’s real GDP series. More specifically, the model includes four autoregressive terms for each country/economy (, , , ) in the model to manage autocorrelation issues and to utilize their informational content for the projected estimates. In this sense, the proposed panel model specification, , has a dynamic structure that allows for lagged dependent variables to affect current and/or future GDP series.

First, the panel model specification

with common and country-specific covariates with cross-sectional independent errors (i.e., identical to estimating univariate regression models) is estimated for the analysed countries.

Table 7 presents the OLS estimates and standard errors (in parentheses) of the panel model parameters. The results show that the estimated constants

are positive and range from 0.110 for Greece to 0.931 for Belgium, see, for example, the estimated

parameters of Germany (0.532), Spain (0.892), and Belgium (0.931), which appear to be statistically significant. Turning to the autoregressive terms, there are important lagged real GDP predictors for all the analysed countries, something that was expected based on the nature of real GDP growth series. In particular, for Germany, Spain, and Belgium, the first two autoregressive terms are significant, while for Italy, the third lagged variable is also significant; for France, only the second autoregressive term is significant, and for Greece, only the third one is significant. The World Pandemic Uncertainty Index (WPI) appears to be statistically significant with a negative exposure in all analysed countries, varying from −0.505 for Germany to −1.193 for Spain. Therefore, each country’s real economic activity was negatively influenced by the COVID-19 pandemic. However, the magnitude of impact varies significantly across the countries, with a larger effect on Spain (−1.193), Italy (−0.971), Belgium (−0.936), and France (−0.876) relative to Greece, and especially to Germany. The rate of unemployment (UNEM) also had a significant negative effect on German (−1.938), Spanish (−1.486), and Belgian (−0.699) real GDP growth. In contrast, the OECD leading indicator (LEAD) has a significant positive effect on the real GDP of Germany (0.405), Italy (0.630), and Belgium (0.156). Other important predictors appear to be the real productivity growth (RPROD), which has a positive impact on French (1.607) and Belgian (1.030) real GDP growth; car registrations, CREG (0.048); the change in the consumer price index for Greece (−0.797); and the stock market return for Germany (0.044).

Next, the results of the panel model specification

with common and country-specific covariates and cross-sectional dependence for the error processes of real GDP growth are presented.

Table 8 reports the feasible GLS estimates and corresponding standard errors (in parentheses) of the panel model parameters. The results indicate that the estimated intercepts

are positive and, in most of the cases, statistically significant, apart from for Italy and Greece, ranging from 0.132 for Italy to 0.742 for Belgium. With respect to the autoregressive dynamics of the analysed series, it is observable that the autoregressive terms, mainly at lags one and two, are significant for the real GDP of Germany, France, Italy, and Belgium, while for Spain, the lagged third term is also significant. In contrast, for Greece, none of the autoregressive terms appear to be critical. Regarding the important common and country-specific macroeconomic and financial covariates, the analysis reveals that the World Pandemic Uncertainty Index (WPI) is universally significant. As was expected, it has a negative effect on all countries’ GDPs, with a higher impact mainly on Spain (−1.013), Italy (−0.883), France (−0.877), Belgium (−0.770), and Greece (−0.637). In Germany, the impact is relatively lower (−0.443). The critical predictors seem to be the OECD leading indicator, with a positive impact on the real GDP of Germany (0.276), Italy (0.416), and Belgium (0.131), and the rate of unemployment, which has a significant negative effect on Spanish (−0.486) and Belgian (−0.405) real GDP growth. Other important predictors appear to be the real productivity growth index, with a positive impact on French (0.544) and Belgian (0.502) real GDP growth; the change in the consumer price index for Greece (−0.668); and the equity market return for Germany (0.044). Therefore, based on this model and the respective GLS estimates, there are differences with respect to the findings about the intercepts, the autoregressive terms, and, in some cases, the magnitude of the effect of several predictors on the GDP growth of the analysed countries compared to previews modeling approaches.

Table 9 presents the estimates of the correlation coefficients (Panel A) and of the variances/covariances (Panel B) of the residuals of the panel model. All the estimated correlations/covariances are positive, indicating strong evidence of cross-sectional dependence among the error terms of the analysed countries. Evidence of cross-sectional correlation seems reasonable, since the underlying effect of the COVID-19 pandemic can be considered as a latent unobserved factor that influences the economic activity of the analysed Eurozone countries in such a highly connected and integrated world.