1. Introduction

In recent decades, robots have significantly expanded in several industrial sectors with notable results in terms of productivity and quality. Nevertheless, their implementation is still limited and fragmented in small and medium-sized enterprises (SMEs) where investments in this type of technology have traditionally been expensive and inaccessible. However, this represents a significant opportunity for productivity growth and business innovation for the existing and new production systems.

In the past 15 years, the implementation of robotic systems has shown an annual global increment of 12%. The most active industrial sectors have been automotive, electronics, and mechanical processing. Traditionally, large companies have employed an extensive use of active robotic installations due to the required high capital costs and a high level of expertise. The operative cost of robots, the improvements in manipulability and gripping technologies, and the advances in vision and mobility, integrated with developments in artificial intelligence, are boosting elements to facilitate the implementation of industrial and collaborative robots. Production facilities are being transformed into extremely flexible factories, capable of rapidly changing assembly lines, allowing manufacturers to respond to customer demand for a greater variety of products, and maintaining high productivity indicators. This factory type can switch between different productions, thus managing multiple product lines.

Additionally, factory equipment is becoming increasingly digitalized. In this factory model, data are collected at every production stage from sensors embedded in machines and production systems. The data are then aggregated and processed to optimize the production process automatically. Automation and digital technologies, in general, impact not only types of machinery but also workers and job profiles. Repetitive or dangerous tasks are now primarily carried out by robotic solutions, while human labor focuses on managing production flows or handling unplanned exceptions.

Consequently, integration between technological skills and soft skills is needed. Robotics in the manufacturing context has been enhanced by technological transformation. Large organizations have directly recognized the economic and organizational benefits offered by robots [

1]. Indeed, developing production processes that integrate human skills with robotic capabilities is a synergistic approach to production [

2]. Meanwhile, the adoption of robots by small and medium-sized enterprises (SMEs) introduces specific challenges, particularly related to achieving new skills and developing new work expertise [

3]. Introducing robots into the workplace is a technical practice that significantly impacts the daily procedure of shopfloor workers [

4]. Robotics integration is a complex and multidimensional learning process that involves the company’s human capital ecosystem.

The literature presents a range of benefits of robotization or Automation Robotics Integration, ARI [

5,

6,

7,

8]. These benefits may be categorized into different topics, from economics to the flexibility, reliability, and consistency of the robotics application [

5]. Firstly, integrating robotic systems represents a cost-saving activity, offering an enhanced return on investment compared to traditional process optimization methods. These savings are obtained by reducing operational and personnel costs [

6]. Then, adopting automated robotic solutions is non-invasive, integrating with and complementing the existing infrastructure without the need to replace or reconfigure entire production systems. ARI systems represent an interface for integrating data from multiple sources. This integration capability facilitates the automation of interconnected processes across different technologies, promoting collaboration and data exchange both within individual organizational units and between external organizations [

9,

10]. The integration and standardization lead to another advantage of ARI: flexibility and scalability. Robotics can be implemented at various levels, allowing organizations to start with tests and experiments on specific processes or sub-processes [

11]. Once the system’s effectiveness is confirmed, it can be easily expanded and adapted to changing business needs [

12]. This aspect is significant for organizations that may address seasonal fluctuations or uncertain environments [

13]. The ability to rapidly reposition a robot contributes to organizational agility, providing flexibility to change the needs of the operational environment. This factor is recognized as a key element in increasing the efficiency and effectiveness of business operations [

14]. The reliability and consistency of ARI systems emerge from their ability to operate with defined accuracy and precision. This aspect reduces errors and rework, improving the quality of the parts produced [

15]. Robots have a processing capacity superior to that of humans, simultaneously managing multiple systems and processing large volumes of data in real time. These data can be automatically entered into corporate databases and reports, facilitating the smooth integration of information from different IT systems [

16]. Access to accurate and timely managerial information supports forecasting, planning, decision-making, and resource allocation, which are critical elements for organizational effectiveness [

17]. ARI significantly reduces risks related to compliance, such as human errors and data losses, and monitors human transactions for unusual activities. By offering precision in processes, ARI increases the ability of organizations to adhere to regulations and governance requirements while reducing the costs and time needed to manage non-compliance. ARI’s flexibility allows it to quickly adapt to regulatory changes, offering a competitive advantage in industries subject to frequent regulatory updates [

18,

19]. From the employee’s perspective, ARI represents a significant benefit. It provides abilities to reduce the burden of repetitive, low-value tasks, freeing workers to focus on activities that require specific human capabilities [

20]. Additionally, ARI stimulates innovation in talent, as it requires organizations to restructure job roles and offers employees opportunities for professional development. This evolution of roles enhances their value in the long-term job market [

21]. Finally, the benefits of ARI extend beyond the immediate scope, contributing to digital transformation. These processes support organizational growth, competitive advantage, and the development of new capabilities, allowing organizations to compete effectively with natively digital startups [

22]. A recognized industrial and research position provides elements confirming that the deployment of robots in the industrial context may catalyze economic growth [

23,

24,

25,

26]. Furthermore, it has been observed that industrial robotics at the corporate level facilitates the transfer of work between different industries and regions, encouraging the flow of talent to related sectors and integrating high-quality human capital into the production process [

27]. Organizations need to consider ARI as part of a holistic strategy, which integrates and aligns with their overall strategy, requiring detailed planning. [

28]. There is also a growing shortage of qualified ARI specialists to design and implement large-scale solutions, adding challenges for organizations in implementing ARI [

29,

30,

31]. These aspects highlight the need for a comprehensive and well-considered approach to introducing ARI within organizations. Implementing Automation Robotics Integration represents a significant challenge for organizations regarding the commitment and costs associated with internal development. The alternative, which involves employing external providers to assist organizations in selecting, implementing, and maintaining ARI, presents a different set of considerations.

Although various ARI case studies and reports are presented in the literature, there is a need for further investigation to examine the integration of robotics in terms of its applications, operational effects (as productivity, quality, and efficiency), and impacts on employees (as corporate technology management). Specifically, it is necessary to assess and evaluate the criticalities and barriers to the progress of robots’ maturity.

This paper examines the integration of robotics in manufacturing companies with discrete-batch production systems. A novel research focuses on the Province of Brescia in the North of Italy. This is an intensive industrial area with more than 90,000 companies and 26,000 workers. A survey and direct interviews describe some significant outcomes related to the proposed technology maturity model based on robotic deployment and context, impact, competences, and future. The main contributions of this work are summarized as follows:

Conducting a detailed study on adopting robotic solutions in companies of varying sizes using a survey and financial databases to explore the most used types of robots, their applications, and their impacts on the operational and personnel levels.

Examining the growth of companies in terms of expertise and employees.

Providing an analysis of the finding that the diffusion of robotics positively correlates with improved productivity and quality.

Presenting indications that robots are associated with increased corporate growth indicators, including staff expansion.

2. Materials and Methods

A data model has been developed to evaluate the effects of the industrial robotics integration, collecting information directly from the robotics end-users (large, medium-sized, and small companies) and financial database (e.g., AIDA). The analysis involved +2500 companies operating mainly in the mechanical sector, evaluating financial information from 2011 to 2023 and collecting specific and detailed data from a selected sample (+600 companies).

2.1. Local-Level Analysis

The Province of Brescia shows a notable position within the Italian economic context. The prominent companies demonstrate significant technical expertise, investing in product and process innovation. The presence of 169,698 Limited Liability Companies (LLCs) represents a significant aspect of the industrial model, followed by a robust contingent of 92,267 corporations. The significant number of corporations in Brescia’s industrial structure indicates a solid and varied local economy.

2.2. Operating Companies and Number of Employees

Different sectors contribute to the local economy through the number of companies and workers employed. The manufacturing sector is represented by a substantial group of 4890 enterprises, employing 109,979 people. Commercial activities, including wholesale and retail trade, as well as the repair of motor vehicles and motorcycles, are crucial to Brescia’s economy. With 4448 companies and a workforce of 29,924 people, it shows a lively market for goods and services and a strong demand in the consumer sector. Rental, travel agencies, and business support services are a segment that requires particular attention within the economic fabric of Brescia. The real estate and construction industries constitute a significant part of the regional economy, employing just over 26,000 workers. These numbers reflect a dynamic sector actively defining the province’s infrastructure and housing development, implying economic growth and urban expansion. The accommodation and food service industry numbers 1392 companies employing 16,423 people, while professional, scientific, and technical activities are represented by 2354 companies employing 8278 workers. The presence of these activities is indicative of an economy that values and invests in high-level competencies and knowledge-intensive services. It also reflects the region’s alignment with global economic trends that increasingly favor industries reliant on intellectual capital over traditional manufacturing and labor-intensive industries. Moreover, although smaller, the information and communication services sector, with 948 companies and 5022 employees, suggests an emerging digital economy, which is essential for supporting the landscape towards digitalization. The health and education sectors, with 425 and 188 companies, respectively, employing 7469 and 1733 individuals, represent the province’s commitment to social infrastructure. These sectors contribute to human capital development and, by extension, support long-term growth and stability. Finally, in the context of utilities, the energy supply and water waste management sectors, with 211 and 156 companies employing 4299 and 5290 people, may seem secondary in the current local context.

2.3. Value of Production

The data related to the production value generated by each sector of activity are shown in

Figure 1. The manufacturing sector has a production value of EUR 48,573 M. This indicator confirms the importance of the manufacturing industry for the economy of Brescia, highlighting its industrial tradition. The electricity, gas, steam, and air conditioning supply sector follows with a production value of EUR 22,407 M, reflecting the strong demand for energy from the province’s infrastructure. Wholesale and retail trade and the repair of motor vehicles and motorcycles are valued at EUR 24,967 M, highlighting the importance of these commercial activities that constitute a pillar for the local economy, stimulating consumption and employment. Construction represents another key sector, with a production value of EUR 6995 M, confirming a dynamic construction activity and infrastructure investments. Less extensive but no less important are the sectors of water supply, waste management, and remediation services, which together contribute EUR 2560 M, drawing attention to the quality of environmental services and sustainability. Transport and storage contribute EUR 2326 M, reflecting logistics’ strategic relevance in an industrialized and export-oriented province such as the Brescia area. Agriculture, forestry, and fishing, although in a more modest position than other sectors, are not to be underestimated, with a value of EUR 761 M, denoting the importance of these primary sectors for the economy and the territory. Other sectors that complete the provincial economic picture include accommodation and food service activities with EUR 1365 M, information and communication services with EUR 878 M, financial and insurance activities with EUR 927 M, and real estate with EUR 1237 M. These sectors reflect the diversity of Brescia’s economy.

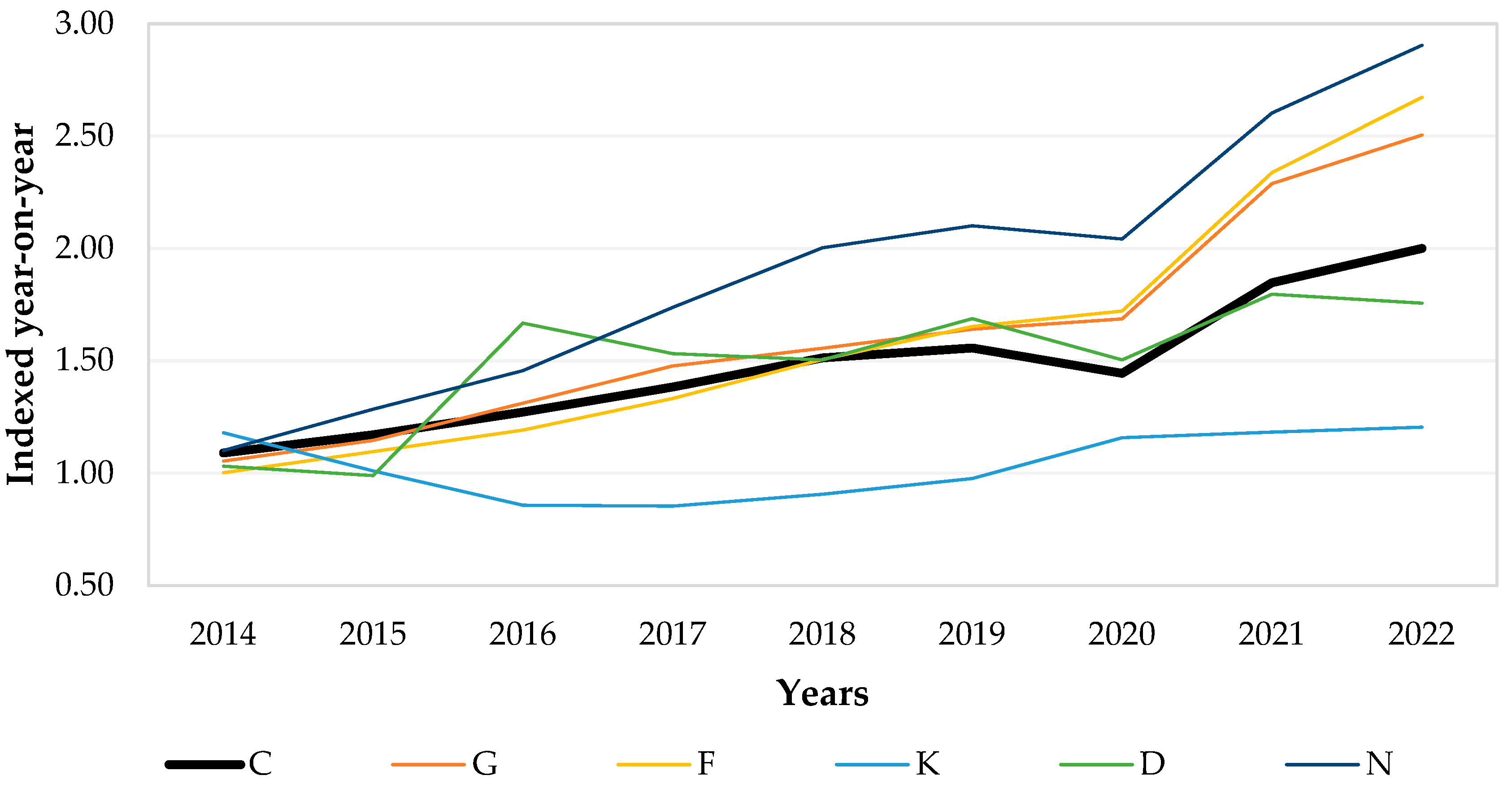

The manufacturing sector has shown consistent growth from 2013 to 2022. There was a gradual increase in 2013 with a 1.0 index, reaching 1.23 in 2017, and a further rise to 1.36 in 2018. The growth rate experienced a minor slope in 2019, decreasing to 1.37, before further declining to 1.25 in 2020 due to the impacts of the pandemic. However, the sector exhibited a strong recovery in the two subsequent years, with the index rising to 1.71 in 2021 and peaking at 2.03 in 2022. Similarly, the wholesale and retail trade sector has recorded consistent growth. Starting from a base value of 1.00 in 2013, it increased to 1.52 in 2017 and 1.67 in 2018. The index maintained a level of 1.70 in 2019, experienced a slight decrease to 1.67 in 2020, and then resumed growth in the following years, with a jump to 2.15 in 2021 and a further increase to 2.48 in 2022. The construction sector exhibited a consistent upward trend throughout the period under examination. Starting from a base index of 1.00 in 2013, it gradually increased, reaching 1.38 in 2017 and 1.53 in 2018. Subsequently, sustained growth led to 1.71 in 2019 and a slight increase to 1.74 in 2020. The growth was notably more robust in the two subsequent years, with the index reaching 2.39 in 2021 and 2.98 in 2022. The waste management and remediation activities sector (Sector E) followed a slightly different pattern. After a slight decline from 1.00 in 2013 to 0.97 in 2015, the sector grew, reaching 1.18 in 2017 and 1.30 in 2018. The growth continued, with the index reaching 1.34 in 2020 and further increasing to 1.75 in 2021 and 1.94 in 2022. One of the key drivers of growth in this sector has been the increasing awareness of environmental issues and the need for sustainable solutions. The professional, scientific, and technical activities sector (Sector M) exhibited a relatively stable trend.

2.4. Economic Value Added

The concept of value added constitutes a fundamental indicator in the economic analysis of a specific industrial sector or a particular enterprise, playing a relevant role in understanding income generation within an economic area. This parameter represents the difference between the total value of products or services generated by a company or an economic sector and the costs incurred for acquiring the necessary production factors, such as materials, labor, and services. Value added can be defined as the net contribution provided by a company or a sector to the economy, obtained by subtracting the costs associated with production factors from the total value of sales or revenues generated, as in

Figure 2.

Manufacturing itself is divided into various subcategories, including the automotive, electronics, textile, food, and mechanical industries, each of which plays a distinct role in the economic panorama. Furthermore, it should be emphasized that the manufacturing sector is closely interconnected with other components of the economy, such as transportation and warehousing, the supply of electricity and gas, and professional, scientific, and technical activities, thus significantly contributing to their development. Subsequently, the retail trade sector emerges with a value added of EUR 2532 M, ranking second in value creation. This sector plays a crucial role in the distribution of goods to end consumers, serving as an essential link between producers and consumers. The value added in retail trade stems from its ability to enhance the value of goods acquired from producers through selection and offering processes, thereby increasing their overall value. With technological advancement, e-commerce has further expanded the reach and effectiveness of this sector. The construction sector, with a value added of EUR 1866 M, encompasses many activities, including residential and commercial construction, public infrastructure such as roads, bridges, water systems, and large civil engineering projects. This diversification confers a central role in the sector in various aspects of the economy and society. The temporal analysis examines the evolution of the added values of the leading industrial sectors of the Province of Brescia between 2013 and 2022. Business support services are characterized by a significantly ascending evolution over the decade. The growth index increased to 1.12 in 2014 and reached 1.31 in 2015. The progression remained steady, with values of 1.49 in 2016, 1.83 in 2017, and 2.09 in 2018. In 2019, a peak of 2.16 was observed, followed by a slight contraction to 2.11 in 2020, presumably influenced by the global pandemic context. However, the sector showed a robust recovery, with an index of 2.73 in 2021 and 3.17 in 2022. The manufacturing sector shows sustained growth, with the index rising to 1.36 in 2017 and a maximum value of 2.09 in 2022.

3. Methodology of the Research

The classification of companies is based on the European Commission Recommendation 2003/361/EC, proposing a subdivision into four size categories: large, medium, small, and micro-enterprises, based on workforce parameters and financial indicators. To determine workforce size, the authors have applied a simplified methodology compared to EU directives, using annual work units (AWUs) as the measurement unit. The number of full-time employees is adjusted with the proportional inclusion of part-time staff. All active professional profiles within the company are considered, excluding non-operational owners. The data come from public accounting records, referencing the closing date of the 2022 financial year. From a financial perspective, annual turnover and total balance sheet are considered, following the European Commission 2003/361/EC guidelines. The classification of SMEs, including companies with fewer than 250 employees and an annual turnover or a total balance sheet below certain thresholds, is detailed in the relevant table. In this classification scheme, micro-enterprises are defined as entities with a maximum of 9 employees and specific financial limits, representing a fundamental pillar for local economies. Medium-sized enterprises are characterized by an intermediate workforce and financial parameters, distinguishing themselves for their managerial and organizational scale. Lastly, large enterprises exceed the established limits regarding staff, turnover, and total balance sheet, placing themselves in a distinct category. This research, conducted within the economic context of the Province of Brescia, focuses on exploring the discrete manufacturing industry, a distinctive sector that involves processing specific components. This area proves particularly relevant for the analysis due to its intensive adoption and spread of industrial automation, particularly articulated robotics. It is important to note that the survey excludes mechanical processing industries, such as steel mills, to focus on those operating in processing specific parts. The decision to focus on the mechanical industry is driven by its significant weight within the provincial economy, representing about 50% of Brescia’s manufacturing system in terms of the number of companies and employees. The selection leads to the identification of a homogeneous population of about 2500 companies, of which 655 were contacted between the last months of 2021 and 2022.

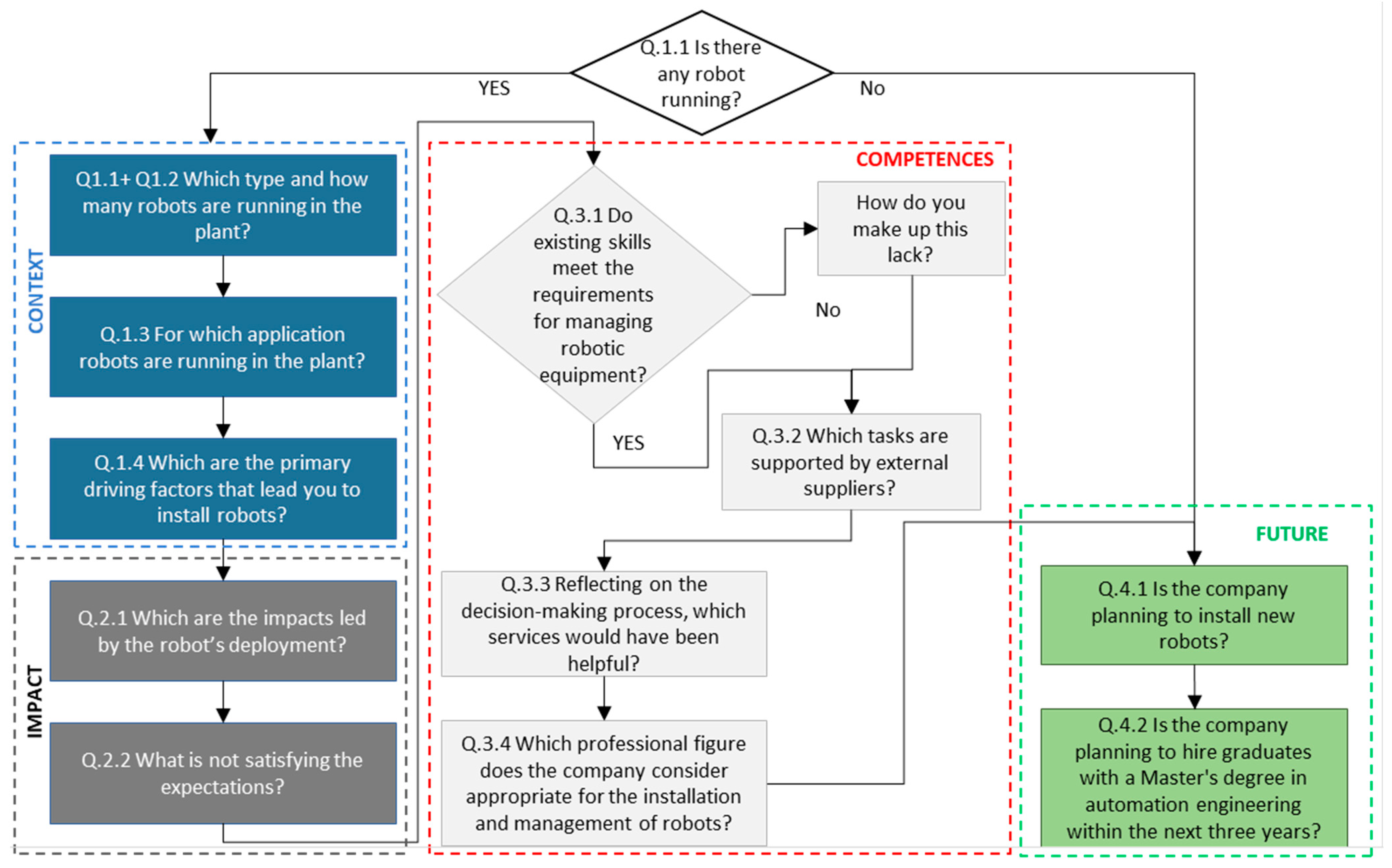

Regarding the stratification of the participating companies, they are divided into size categories according to previously defined criteria, resulting in a classification that includes large enterprises, medium enterprises, and small enterprises. This research focuses on the responses of these categories, as micro-enterprises provide less significant and often incomplete feedback. Participation is notable, with 80% of large companies, 34% of medium-sized companies, 26% of small companies, and only 21% of micro-enterprises participating. The technology maturity model is structured into four areas, as represented in

Figure 3:

Robotic development and context: This research aims to investigate the diffusion of robotics, focusing on which types of companies employ it most, specific applications, and the motivations behind adopting robotic solutions.

Impact: It explores the effects recorded in companies that have invested in robotics, analyzing operational aspects of human resources and identifying problems and benefits arising from implementing robotic systems.

Competences: This area investigates the diffusion of knowledge and skills related to robotics within companies, activities carried out internally and outsourced, analyzing the perception of companies regarding the operators’ training and the evolution of the production system.

Future vision: This area expresses the intention of the future, focusing on the development of ARI, the effectiveness of policy stimulus tools, and the relationship between universities and businesses.

4. Results

The survey and the direct interviews describe some significant outcomes for the proposed technology maturity model dimensions based on robotic deployment and context, impact, competencies, and future. Further analyses have been carried out for the most relevant dimensions.

4.1. Robotic Deployment and Context Q1.1 and Q1.2: Which Type and How Many Robots Are Running in the Plant?

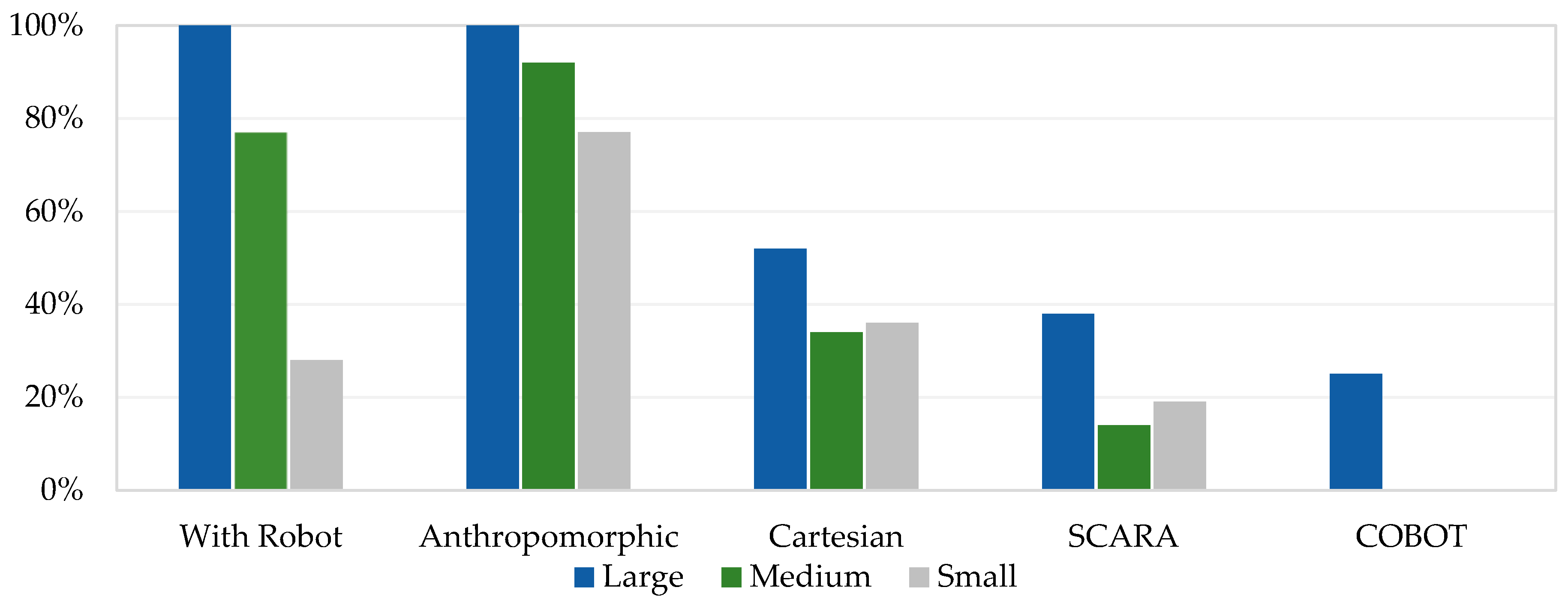

The initial dimension is the number and types of robots in the companies. Four main categories of robots are examined. The first is the anthropomorphic robot, equipped with mechanical arms with multiple joints, which offers high flexibility and precision in movements, making it particularly suitable for various industrial applications. Then, the Cartesian robot, which operates along three orthogonal axes, ensuring precise and repeatable movements, is ideal for palletizing, material handling, cutting, or dispensing applications. The SCARA, characterized by a rigid arm in vertical movements and flexible in horizontal ones, suitable for high-speed assembly operations, is then considered. Finally, COBOTS (collaborative robots), an emerging type in the industrial robotics landscape, are explored. The collected data are summarized in

Table 1 and

Figure 4.

Large companies have implemented robotic solutions, emphasizing their tendency towards advanced automation. In contrast, only 28% of small businesses have adopted this technology, highlighting a significant difference in adopting automation based on company size. Among the types of robots considered, the anthropomorphic robot is the most widespread one, with adoption rates of 100% in large companies, 92% in medium-sized companies, and 77% in small ones. This prevalence was widely anticipated and confirms the adaptability of this type of robot to a wide variety of activities and applications. Cartesian and Scara robots show limited diffusion.

The Cartesian type is present in 52% of large companies, 34% of medium-sized ones, and 36% of SMEs. In comparison, the SCARA type is present in 38% of large businesses, 14% of medium-sized businesses, and 19% of small businesses. These percentages reflect a relatively limited use attributable to specific applications and intrinsic limitations of their mechanical structure. COBOTS remain largely unknown, particularly in SMEs. COBOTs may represent an opportunity, given their ability to collaborate directly with humans in shared environments without physical barriers, and their easy reprogramming makes them highly versatile and suitable for the needs of numerous SMEs.

4.2. Robotic Deployment and Context Q1.3: For Which Application Are Robots Running in the Plant?

This research is conducted to explore the prospective applications of robotic cell technology, as summarized in

Table 2. Survey participants are presented with various options: handling and machine tending, welding, dispensing, processing, assembling, inspection, and transport. Each category reflects a distinct operation in the manufacturing process, showcasing the versatility and potential of robotic cells. Robotic cells in handling and machine tending are instrumental in automating the transfer and manipulation of materials and components. This technology simplifies loading and unloading production equipment, thus optimizing the throughput and reducing the cycle times of various manufacturing systems. In welding applications, robotic cells contribute to the precision and repeatability of joining parts. By employing automated welding solutions, companies benefit from enhanced joint quality, increased production rates, and significantly reduced exposure to hazardous conditions. The application of robotic cells in processing such as cutting, grinding, or polishing transforms raw materials into finished components with exact specifications. This automation allows for high-volume processing with very low variability and ensures consistent product quality. In assembly operations, robotic cells are essential for accurately and efficiently combining parts into a finished product.

ARI enables complex assembly tasks to be completed faster and more precisely than manual assembly, improving productivity and product quality. Robotic cells equipped with advanced vision systems and sensors are increasingly used to inspect parts. They provide non-invasive, high-speed quality control that can detect defects or irregularities more accurately than humans, ensuring that only parts meeting the highest quality standards proceed to the next production or market stage. Integrating robotic cells in transport involves the automated movement of parts or products between different stages of the manufacturing process. This application is critical for maintaining a smooth and timely flow of materials, which is essential for modern manufacturing processes. In large plants, it is evident that the majority of robot applications are concentrated in the realms of handling and machine tending (86%), assembling (35%), and processing (26%). The dominance of handling and machine tending can be attributed to the robots’ efficiency and reliability in large companies’ material transport and production processes.

Additionally, the substantial presence of robots in assembling and processing activities highlights the role of automation in streamlining complex manufacturing operations, ultimately enhancing productivity. In contrast, medium-sized plants exhibit a somewhat different distribution of robot applications. While handling and machine tending still maintain a significant presence at 71%, the percentage allocation to dispensing, processing, and assembling is remarkably lower. Robots in manufacturing vary based on the plant’s size and the specific tasks being performed. Larger plants use robots for a broader range of tasks, while smaller plants rely heavily on robots for handling and assembling. However, there may still be some tasks that require manual labor for precision or lower production volumes. On the other hand, small plants have a distinct pattern of relying heavily on robots for handling and machine tending (83%) and assembling (25%). Welding and dispensing applications are absent in these plants. This trend may reflect the smaller scale of operations in smaller plants, where automated welding or dispensing solutions may not be as cost-effective. The focus on assembling in small plants may also indicate specialization or customization in production processes, where robots can provide the necessary flexibility and precision. The absence of welding applications in small plants and the limited presence in medium-sized plants raises questions about the feasibility and cost-effectiveness of deploying welding robots in such contexts. With their unique and diverse production needs, smaller and medium-sized plants rely on human welders for greater adaptability or cost savings.

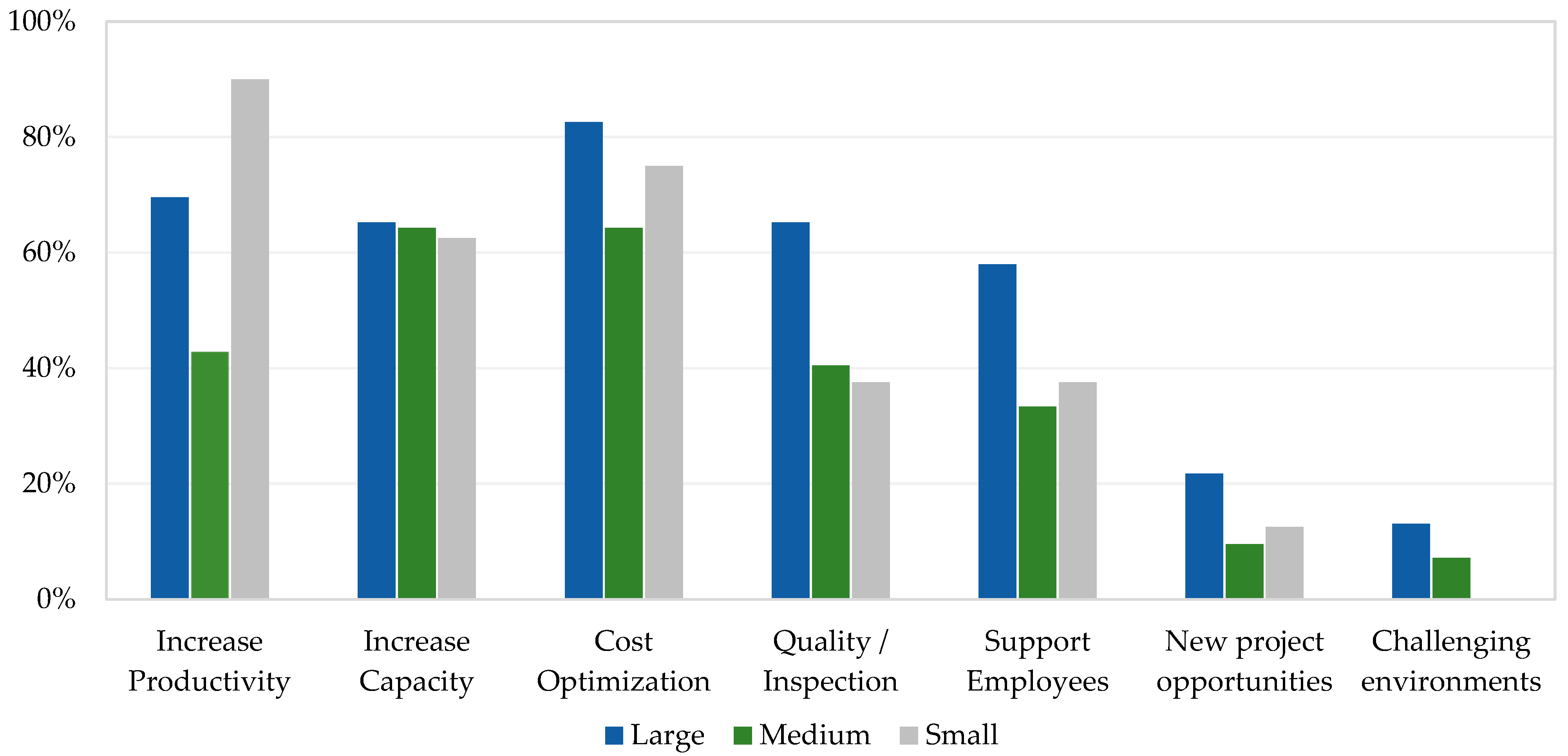

4.3. Robotic Deployment and Context Q1.4: Which Are the Primary Driving Factors That Led You to Install Robots?

This dimension aims to identify the key drivers behind the implementation of robots in industrial operations, as seen in

Figure 5. It reveals that businesses currently rely on automation to achieve their strategic goals. The findings demonstrate a diverse range of factors motivating the deployment of robotic solutions, including the desire to enhance productivity and support employees in their operations. These drivers often overlap and interact with each other, particularly in the context of cost optimization, which is closely linked to productivity improvements and capacity expansion. Companies are installing robots to achieve more efficient production processes, where the goal is to maintain or increase output with less input. Since market demand is not within the business’s direct control, the focus is on maximizing efficiency within the existing parameters. This means producing the same quantity and quality of goods without proportional labor or material cost increases, often achieved through robots’ velocity, consistency, and operational capabilities. When market trends indicate a rise in product demand, companies must scale up their production capabilities to capitalize on these opportunities. In this case, robots provide a scalable solution to increase capacity, enabling companies to meet higher production demands. Although increasing productivity and capacity are distinct objectives, both contribute substantially to cost optimization. Robots can operate continuously, reducing the need for multiple shifts and minimizing waste by improving task precision, resulting in material savings. Large organizations emphasize this aspect, with 70% indicating it as a primary driver. However, medium-sized and small enterprises also recognize the potential of robots to enhance productivity, with 43% and 90%, respectively. This highlights the widespread recognition of robots as powerful tools for improving operational efficiency. Another important observation is the desire to augment production capacity, which resonates strongly across all organization sizes. This is a fundamental incentive in both large (65%) and medium-sized (64%) enterprises. This highlights the importance of robots in addressing capacity constraints and improving the ability of organizations to meet increasing demand.

The utilization of robotic systems is significant for organizations of all sizes since robots are instrumental in enhancing operational efficiency and achieving organizational objectives by improving productivity and augmenting capacity. Cost optimization has emerged as a primary driver for many organizations, regardless of size. A significant factor for 83% of large enterprises, 64% of medium-sized companies, and 75% of small organizations, the strategic use of robots aims to reduce labor and operational costs in the long run. Investing in automation aligns with the economic rationale, where long-term savings offset the initial capital outlay. Large organizations consider quality control and inspection an essential driver, with 65% emphasizing this aspect. This highlights the importance of quality assurance, particularly in sectors where precision and reliability are critical, such as manufacturing. Incorporating robotic technology in the workplace is no longer a mere novelty but a necessity for companies striving to maintain their competitiveness in the market. An emerging paradigm gaining traction is human–robot collaboration, whereby robots are designed to assist employees in their work environment. Larger organizations tend to emphasize this aspect more, with 58% recognizing the strategic deployment of robots to complement human labor and create a safer and more comfortable work environment. It is critical to highlight that even smaller organizations are still mindful of automation’s ethical and social implications. This is evidenced by 38% of small organizations and 33% of medium-sized organizations taking these dimensions into account to some extent. However, it is essential to note that “New project opportunities” and “Challenging environments” are not high on the list of priorities for organizations of any size. The current focus of companies implementing robotics is more on cost savings rather than exploring new opportunities or operating in challenging environments. This is evidenced by the fact that most companies prioritize cost reduction when considering the implementation of robotics while placing little emphasis on the latter. This indicates that most companies do not currently perceive new opportunities or the ability to operate in challenging environments as significant drivers for adopting robotics.

Table 3 shows the visions for using robots across organizations focusing on supporting or substituting operators. Multiple factors drive robotic implementations in various industries. Safety concerns, industry context, and the physical demands of tasks are just some of the reasons why organizations are adopting these technologies. These findings offer insights into the diverse motivations behind such implementations. Supporting or substituting operators on repetitive tasks is the primary driving force behind the installation of robotic systems across all organization sizes, as robots are ideally suited to performing monotonous and repetitive tasks. Large organizations, in particular, seem to place much emphasis on this aspect, with 48% stating that it is a crucial factor. Meanwhile, medium-sized and small organizations also recognize the potential benefits of robots in tackling repetitive tasks, though to a somewhat lesser extent (23% and 30%, respectively). It is interesting to note that automation is universally appealing in relieving workers from routine, repetitive assignments, boosting productivity, and minimizing the risk of errors.

Another significant incentive for implementing robotic systems is the ability to handle hazardous tasks. However, the importance of this factor varies across different organization sizes. Large organizations (43%) prioritize this aspect, reflecting their commitment to worker safety and compliance with occupational health regulations. Implementing robots in industries involving hazardous tasks has become increasingly popular. This is particularly evident in large organizations, where 43% recognize the potential of robots in reducing physical risks associated with dangerous operations. However, it is worth noting that medium-sized and small organizations, while showing slightly lower percentages (26% and 31%, respectively), also acknowledge the benefits of using robots in mitigating the risks of hazardous work.

Moreover, using robots to handle strenuous tasks has become a primary driver for large organizations, with 67% recognizing the importance of introducing these machines to reduce the physical strain on workers. This aligns with improving occupational health and safety, which is essential in any industry. However, medium-sized and small organizations show relatively lower percentages (22% and 11%, respectively) in this regard, suggesting that the urgency of relieving employees from physically demanding work may be less pronounced in smaller enterprises due to their nature of operations and available resources. Overall, repetitive tasks emerge as a prominent driver across all organization sizes, underscoring the appeal of automation in streamlining routine work and improving efficiency.

4.4. Impact Q2.1: Which Are the Impacts of the Robot’s Implementation?

Table 4 shows the level of satisfaction with robotic integration stratified by company size (large, medium, and small). It is noted that three out of four companies are fully satisfied or satisfied with the robot installation, while small enterprises include the most significant group of unsatisfied (9%) companies.

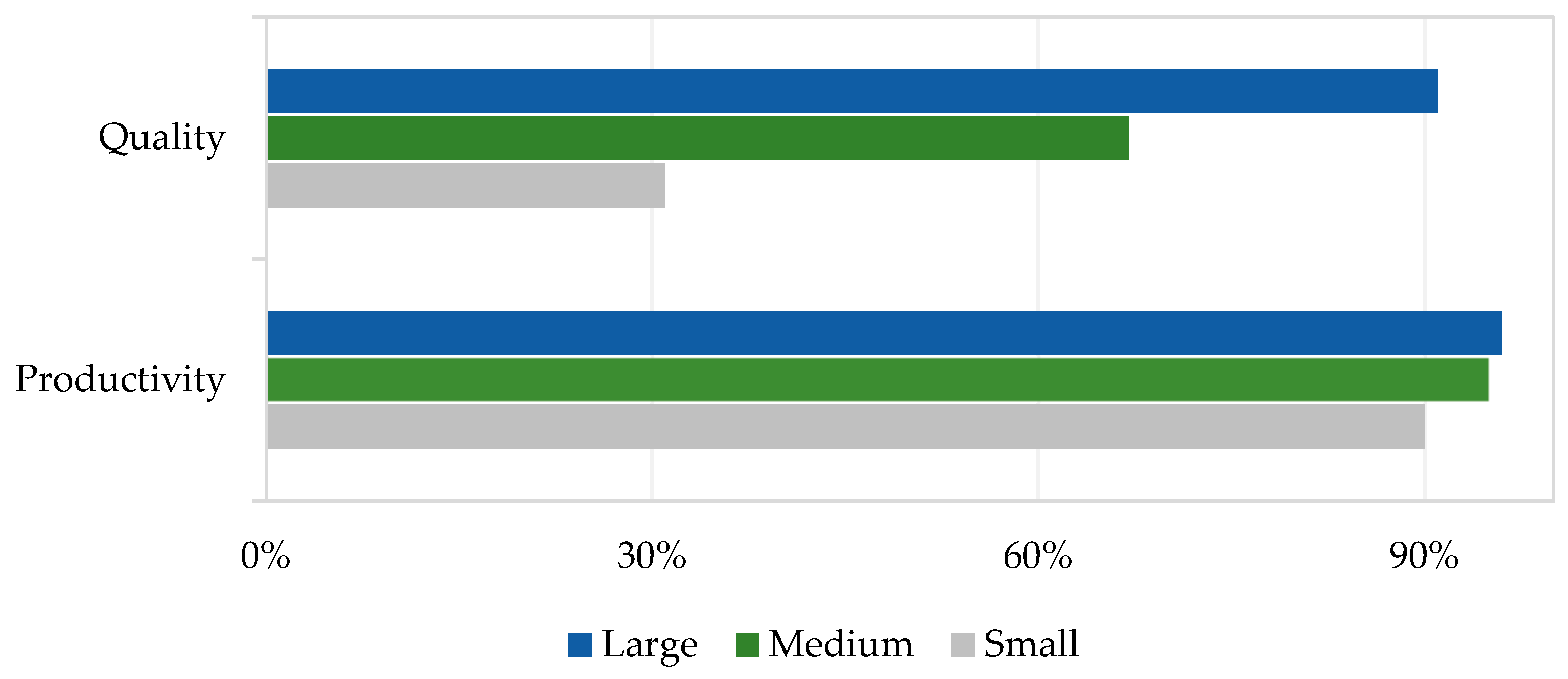

Figure 6 states the operational impact and the results obtained from industrial robotics. Large companies, with an overall satisfaction rate of 23%, show that the quality of manufacturing processes and products has increased in 91% of cases, confirming that high technology and automation also contribute to continuous improvement. These data contrast with the results of medium-sized companies, which, while expressing a higher overall satisfaction rate of 31%, recognize an increase in quality in a lower percentage of 67%, suggesting that the benefits of robotics can be perceived differently depending on the available infrastructures and resources.

Regarding productivity, the numbers are positive for all three types of companies. The high percentage of small businesses that have recorded an increase in productivity reveals that robotics can be a great leveler, confirming the upcoming democratization process of robotics. Medium-sized companies report an increase in productivity in 65% of cases, indicating that for companies of this size, the production systems are in a middle ground where there are challenges in robotic integration that do not allow these systems to exploit their potential.

Large companies continue to derive obvious benefits from high technology, while small businesses demonstrate surprising resilience and adaptability, finding robotics a key to growth and efficiency. Medium-sized companies located in an intermediate position can be the link to a better understanding of how to optimize the implementation of robotics to maximize both quality and productivity. The following analysis examines the possible correlation between the implementation of robots and employment changes in companies adopting such technologies. For this purpose, data on personnel and economic performance of the sample of companies involved in the research are analyzed, specifically in terms of total production and added value. Due to the lack of detailed information on robot installations in the Province of Brescia during this period, the local trend is assumed to reflect the national Italian trend. Hence, these data are compared with the number of new robotic installations in Italy. The companies in the sample are classified into two categories: those without robots in their facilities and those using robots in their production lines.

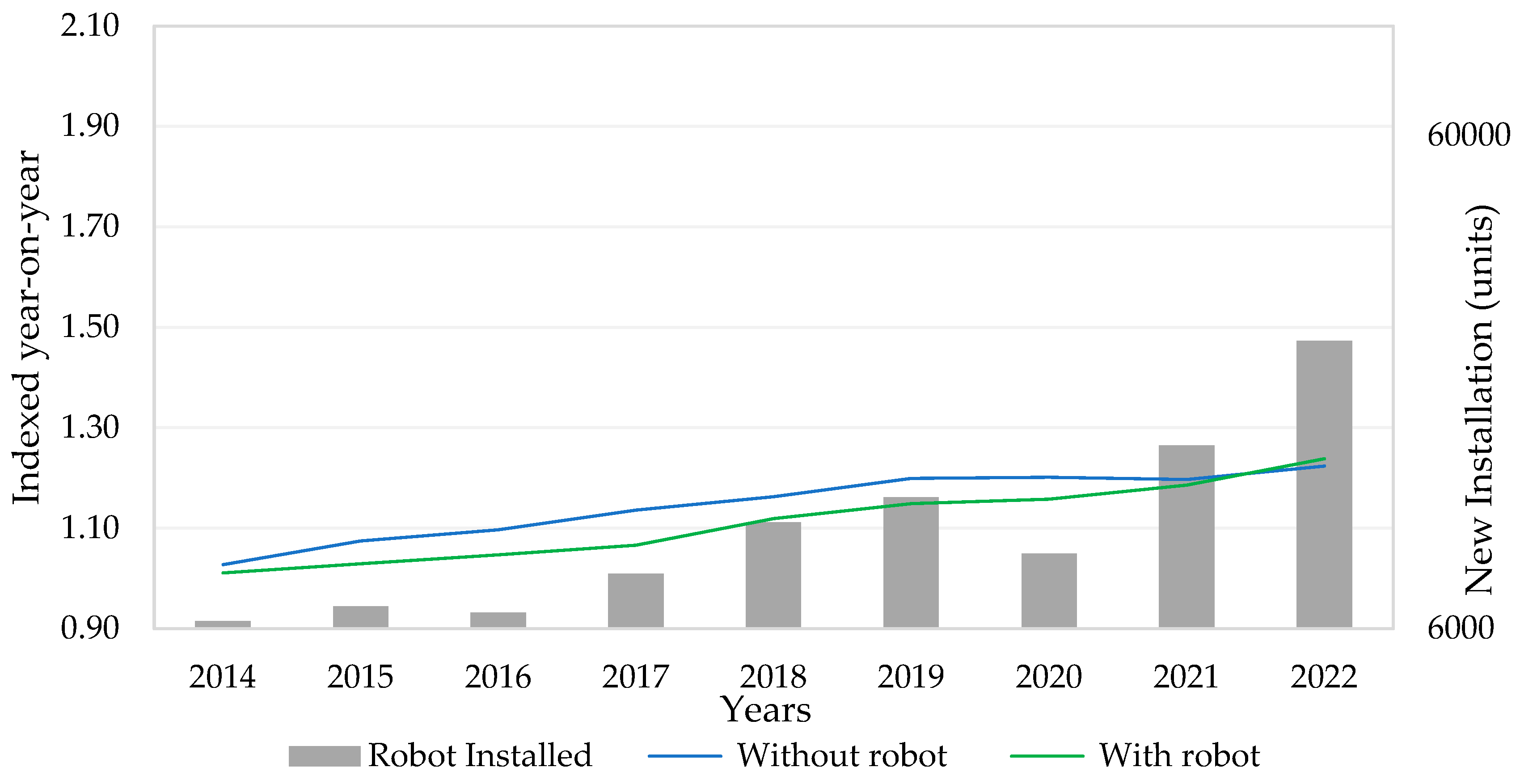

Figure 7 compares the employment evolution of the sample companies with the number of annual robot installations in Italy. There was a constant increase in personnel for companies without robots from 2013 to 2022, with gradual and relatively stable growth peaking in 2019. However, in 2021, there was a slight slowdown, presumably due to the COVID-19 pandemic, followed by a recovery in 2022.

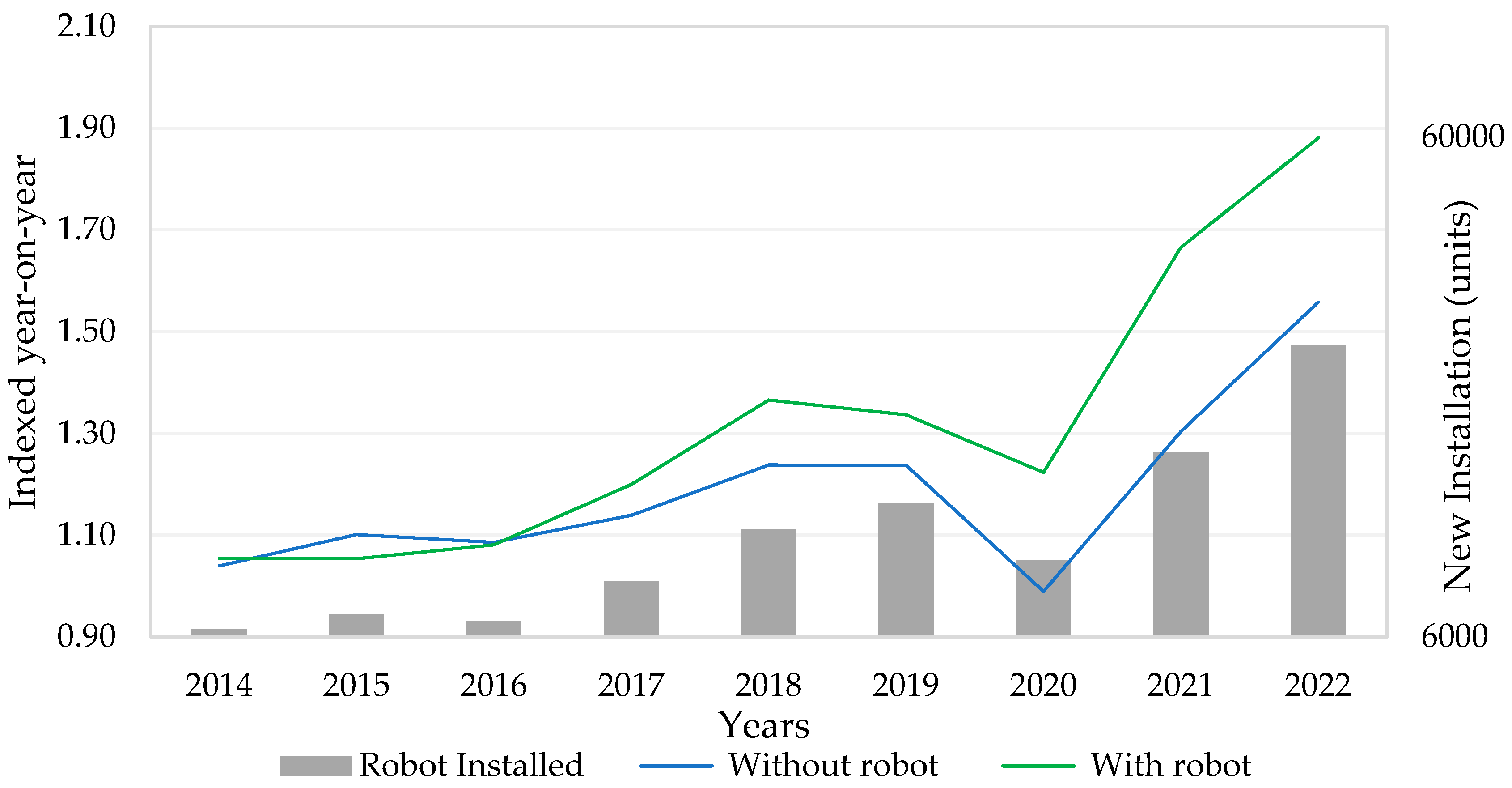

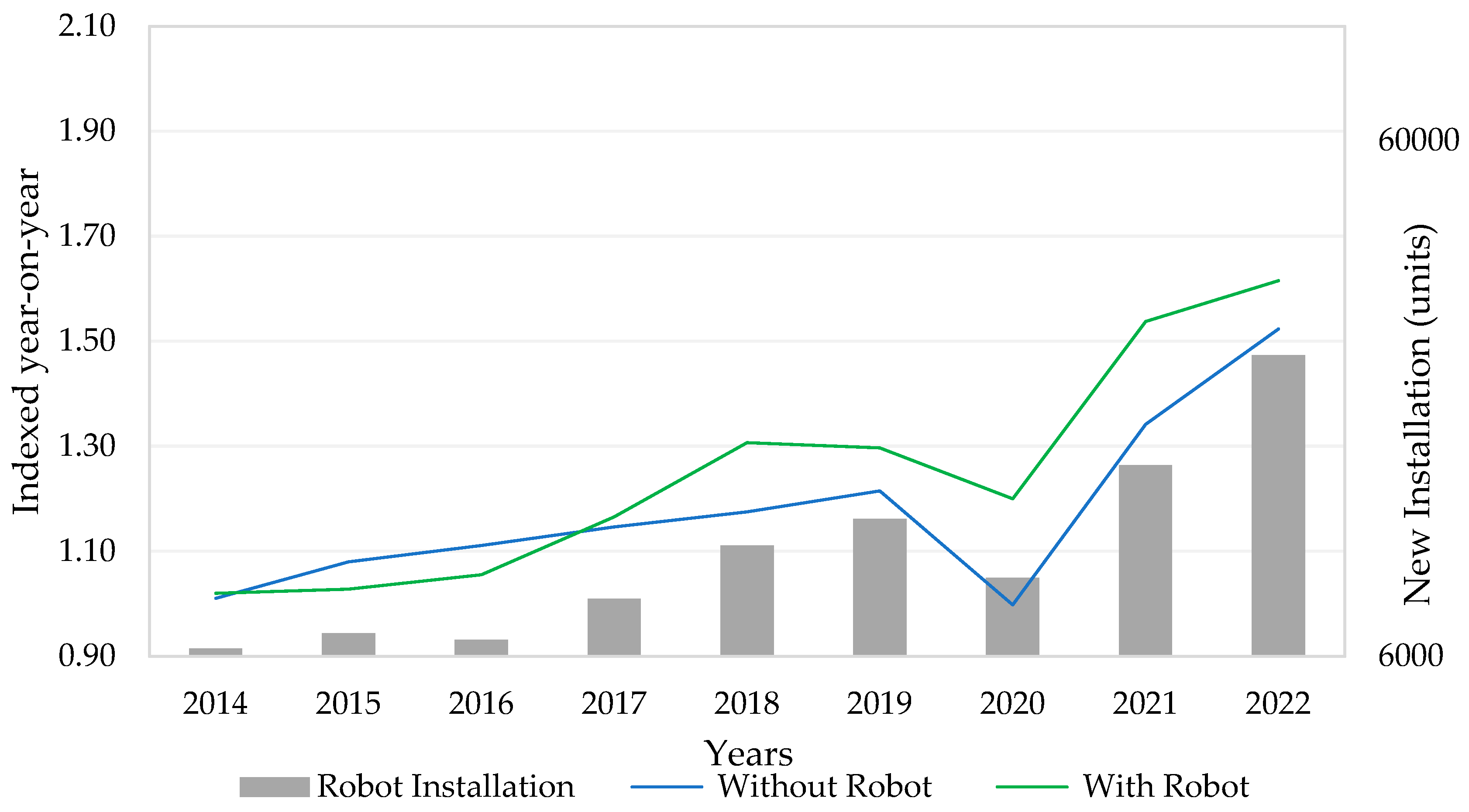

A constant upward trend in employee numbers was observed for companies with robots, with a slightly higher growth rate than companies without robots. The most significant growth occurred between 2018 and 2022, suggesting a positive impact of robotics on employment in these companies. Extending the previous analysis to economic indicators as the value of production and added value, the graph in

Figure 8 and

Figure 9 illustrates the comparison between the number of robots installed in Italy and the evolution of the production value of companies, both with and without robots. During the period under review, both the value of production and added value showed similar trends. For companies without robots, there was a variation in the value of production and added value, characterized by annual fluctuations. In particular, there was a marked increase in 2018 and 2022, except for the decline in 2020, which was affected by the economic impacts of external factors.

In contrast, data indicate a more substantial and sustained growth of these economic indicators in companies equipped with robots than those without robots. The acceleration starting from 2017 and the peak in 2022 are significant, coinciding with increased robotic installations. With the increase in personnel, there is also more significant company growth in terms of production value and added value.

4.5. Impact Q2.2: What Is Not Meeting Expectations?

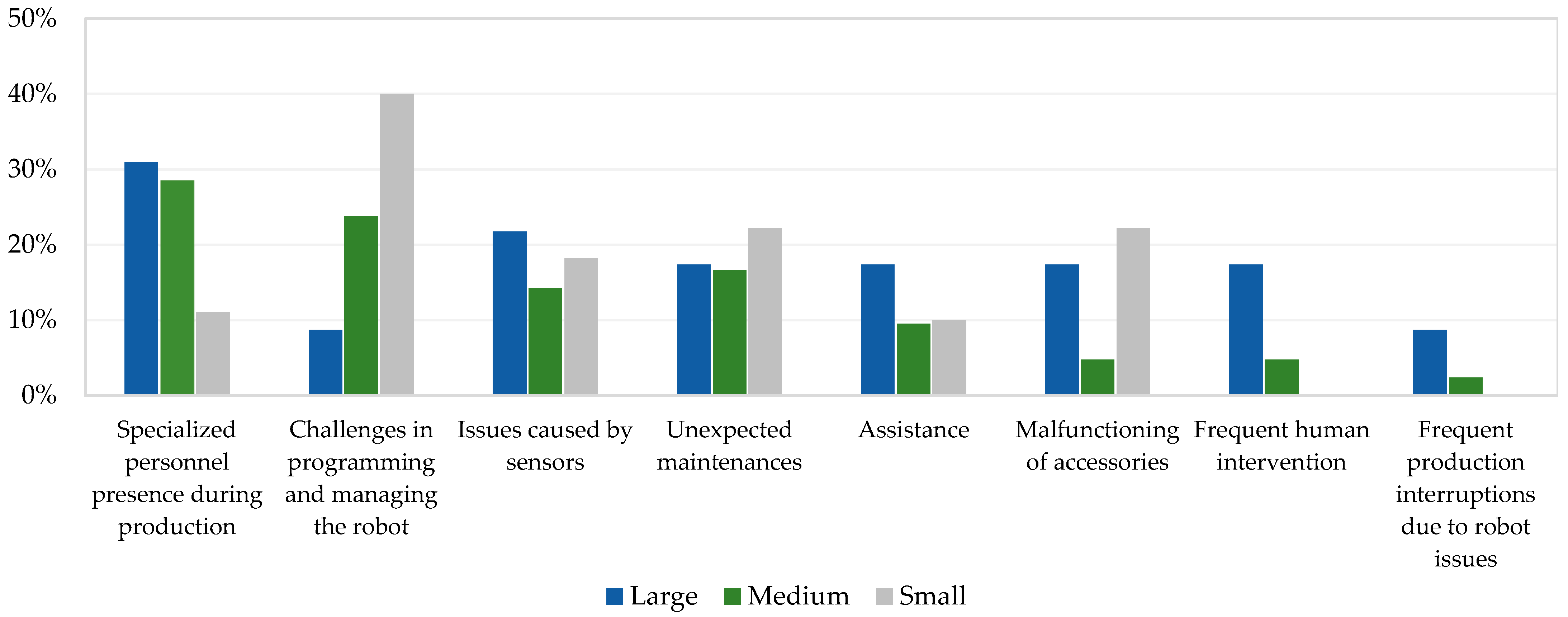

The data presented in

Figure 10 describes the challenges faced by companies of various sizes after integrating robotics into their operations. Large organizations report a requirement of specialized personnel at 31%. This profile, though substantial, is interestingly close to that of medium-sized companies, which report this need at 29%. In contrast, small enterprises indicate a markedly lower requirement, with only 11%. The marginal difference between large and medium-sized companies highlights a potential convergence in the complexities of robotic systems deployed.

Conversely, the significantly lower value reported by small companies offers a different point of view. One could surmise that smaller enterprises might be deploying less sophisticated robotic systems, diminishing the necessity for specialized oversight. Alternatively, it is reasonable that smaller companies, with their leaner operational structures, might have a more integrated approach where specialized roles are merged with broader operational ones. On the other hand, smaller companies are more concerned about the programming and management of robots. Small businesses show the highest percentage of difficulties, at 40%, highlighting the intrinsic challenges these economic entities face in keeping up with the technical requirements imposed by automation. Medium-sized companies are in an intermediate range, at 24%, demonstrating a higher capacity than small ones but not yet up to the self-sufficiency typical of large companies, which only report 9% of problems in this area.

Sensory-related barriers are a significant obstacle, with a relatively balanced prevalence among companies of various sizes. Large companies are affected by them in 22% of cases, medium-sized ones in 14%, and small ones in 18%, indicating that sensors, as fundamental elements of robotic systems, can generate operational problems regardless of the level of resources or personnel experience. Unplanned maintenance presents another critical issue, touching all three business dimensions equally: 22% for both large and small companies and slightly lower for medium-sized ones, at 17%. This indicates that the incidence of unexpected interventions is a constant in the use of industrial robots, influencing the programming and regularity of production processes. Significant records can be observed by focusing on the concrete consequences of the frequent need for human intervention and recurring production interruptions due to robotic problems. In large structures, such problems are found in 17% and 9% of cases, confirming that, despite the advanced degree of automation, there is still a need for human interaction and problem resolution. In smaller entrepreneurial contexts, surprisingly, such problems are not detected, which could be interpreted as the internalization of a basic assumption: with limited resources, there is a greater need for direct involvement, and anomalies tend to be considered inherent elements of the process. In other words, while these incidents occur, they are not labeled as unexpected but rather as aspects intrinsic to adopting robotic technologies in an environment with more limited resources.

4.6. Competences Q3.1: Do Existing Skills Meet the Requirements for Managing Robotic Equipment? If Not, How Do You Make up For This Lack?

In robotics, aligning professional skills to take advantage of technological changes is significant. Academic institutions and corporate initiatives are fundamental in achieving this goal through advanced training courses and targeted up-skilling and re-skilling programs. The training courses may focus on the creation of qualified professional profiles. These should include roles specialized in the collaborative design of automated machines, with particular emphasis on developing robot control logic and managing electronic components related to modern automation systems. In addition, it is essential to prepare professionals capable of maintaining industrial robotics, combining mechanical, electronic, information technology, and problem-solving skills, as well as thoroughly understanding the potential and safety implications of human–machine interactions. The architecture of the training courses should be bifocal: on the one hand, focused on a theoretical approach that provides conceptual and methodological foundations, and on the other hand, on a practical approach implemented through laboratory experiences. Technological laboratories represent a critical element of these programs due to specific solutions designed to reproduce actual industry conditions safely. This approach ensures that students are adequately prepared to operate effectively in industrial contexts characterized by automation and digitization, ranging from small and medium enterprises to large corporations. The data analysis in

Table 5 shows the trend regarding companies’ aptitude for managing robotic equipment.

Large enterprises, often equipped with extensive resources and robust training infrastructures, manifest a commendable proficiency in this domain. Most companies (82%) have successfully developed a workforce expert at handling robotic equipment. This highlights large corporations’ intrinsic advantages, allowing them to adapt to technological advancements swiftly. On the contrary, 18% of large enterprises find themselves in difficulty, facing a skill deficit. This contrast presents an interesting problem. Despite high resources, intrinsic challenges, such as resistance to technological paradigm shifts, might impede the unified integration of new technological skills. Medium-sized companies, operating within a more constrained resource environment than their larger counterparts, exhibit a similar trend. Approximately 75% of these enterprises have successfully upskilled their workforce, while 25% have to cover the skill gap, as shown in

Table 6.

The immediacy of these profiles to those of large enterprises suggests that the total scale of a company determines its adaptability to technological advancements. Instead, other factors, perhaps organizational agility or leadership vision, might play a pivotal role. Smaller businesses are in a slightly more complicated situation. While 62% of them can handle robotic equipment, they fall behind larger and medium-sized enterprises. These businesses often operate with limited resources and might face difficulties in improving their skills. Several findings are evident when examining the data table detailing how different companies of various sizes respond to technological changes. Firstly, the predominant approach used by companies, particularly in larger and medium-sized ones, is providing training to their employees, with a notable adoption rate of 90% in both categories. This highlights the importance of investing in the current workforce’s skills to address immediate technological skill gaps and promote a culture of continual learning and adaptability. As technology advances rapidly, focusing on training is a wise strategic move that can strengthen a company’s resilience against future disruptions. Another interesting finding is related to hiring practices. Larger companies hire new employees with the necessary skills at a higher rate of 26%, compared to medium-sized ones at 20%. This could be due to the more significant resources and broader access to talent networks that large corporations typically have.

On the other hand, small companies have a significantly lower rate of 5% in hiring, which can be attributed to their limited resources and financial constraints, making large-scale hiring efforts impractical. However, the most striking data point is the column representing “No Action.” While larger and medium-sized companies show proactive behavior by not resorting to inaction, 42% of small companies have refrained from taking action through hiring or training. This poses important questions about the obstacles that small companies face. It could be due to various reasons, such as financial limitations or a lack of awareness about upcoming technological change.

4.7. Competences Q3.2: Which Tasks Are Supported by External Suppliers?

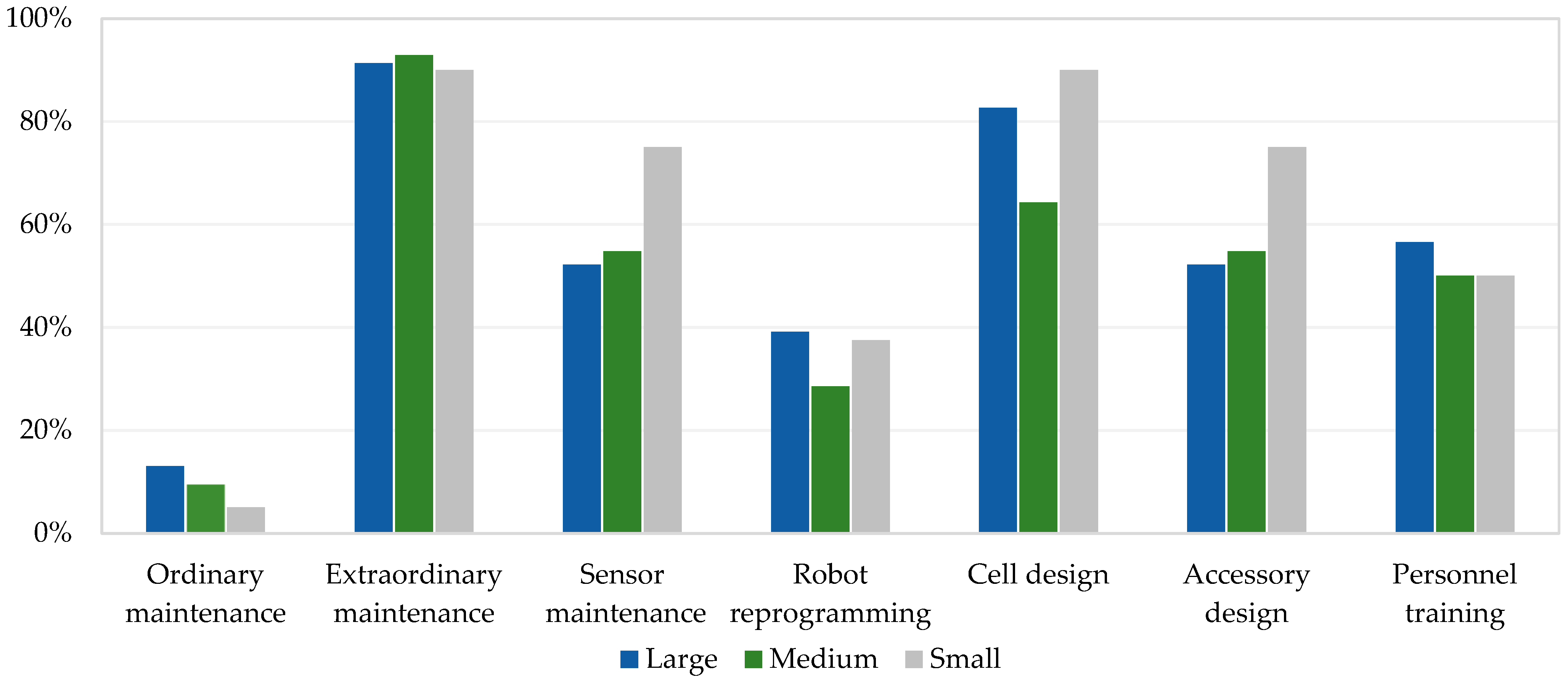

The data presented in

Figure 11 offer insights into how companies of varying sizes tend to approach outsourcing solutions for different aspects of their robotics operations. The data trend reveals that companies of all sizes keep ordinary maintenance tasks in-house, with relatively low outsourcing rates. This is likely due to several factors, including the fact that these tasks do not require a high level of specialized skills. As such, they can be efficiently handled by the internal workforce, which reduces the need for external support.

Additionally, there is the cost-effectiveness of managing ordinary maintenance internally and the ability to respond quickly to everyday maintenance needs. Companies can ensure a faster turnaround time when addressing issues by relying on their skilled personnel. However, the data also show that regardless of company size, there is a high reliance on external suppliers for extraordinary maintenance. This trend is particularly striking, with 91% of large companies, 93% of medium-sized companies, and 90% of small companies seeking external support for these tasks. This suggests that these tasks require more specialized skills and expertise that may not be readily available in-house.

Small companies appear to be leading in sensor maintenance, with a high outsourcing rate of 75%. This likely reflects their resource constraints, making engaging external expertise more efficient. On the other hand, larger companies can handle sensor maintenance in-house or have established partnerships with sensor technology providers. Medium-sized companies seem to be the most confident in robot reprogramming with their in-house expertise, with only 29% outsourcing this task. In contrast, small and large companies exhibit a more comparable reliance on external suppliers, driven by the need for specialized skills or flexibility in adapting their robotic systems. Different companies have varying approaches to designing and training personnel for robotic systems. Large and small companies exhibit a relatively high level of outsourcing regarding cell design, suggesting a strategic approach to this critical aspect of their robotics operations, accessing specialized external expertise, and enabling them to tackle complex design challenges.

On the other hand, only 64% of medium-sized companies tend to outsource this task. Similarly, small companies outsource accessory design the most, with 75% outsourcing this task. Medium-sized and large companies follow closely behind, with 55% and 52% outsourcing the task, respectively. This pattern suggests that large and medium-sized companies have established internal technical departments capable of accessory design and appear to benefit from greater efficiency and cost savings by utilizing their in-house expertise and resources. Finally, large companies outsource personnel training slightly more, with 57% outsourcing compared to 50% for medium and small companies. This indicates that larger companies prioritize specialized training services, perhaps due to their larger workforce or the diversity of applications for their robotic systems.

4.8. Competences Q3.3: Reflecting on the Decision-Making Process, Which Services Would Have Been Helpful?

Table 7 presents the results on critical factors that influence the decision-making process of companies during the evaluation phase grouped by size factor: large, medium, and small businesses.

The 3D simulation of a cell allows for a complete and detailed evaluation of the integration of robotic cells in the design phase, ensuring effectiveness, particularly in large-scale operations. This includes features such as “digital twin” technology and “virtual commissioning” that enable the construction of a model capable of replicating the functioning of the cell. Large companies often prefer it because they have highly skilled technicians and advanced methodologies for planning new work layouts. The participants’ responses confirmed that large companies attribute the most importance to the 3D simulation of the cell, with 43% indicating its significance. In contrast, medium-sized and small companies, with 29% and 13%, respectively, consider it less significant due to their resource limitations. Plug-and-play solutions offer an all-inclusive package for companies seeking an automation solution. This implies complete reliance on external providers for the design and implementation of the robotic cell. Companies usually adopt the approach that may lack internal skills and has limited staff who dedicate themselves to realizing and managing a robotic cell. Therefore, small businesses attach great importance to plug-and-play solutions, with a significant 75%. Growing with the size factor is considered secondary, as stated by 40% of medium-sized and 30% of large businesses. Technical insights have a relatively uniform importance, indicating that companies of all sizes recognize limited value in this activity. This result suggests that robotic cells are increasingly considered consumer goods that can be implemented and adapted flexibly to their needs without resorting to complex technical interventions. Large companies (52%) assign great importance to time and motion analysis, suggesting a solid awareness of the potential impact on production systems. This activity ensures fast and reliable integration into existing workflows and avoids potential disruptions and inefficiencies. Medium-sized companies (43%) recognize its significance, while 25% of small businesses underestimate this aspect.

In many cases, the impact of time analysis is not considered in the project’s initial planning phase. Consequently, companies may adapt their production systems after installing a robotic cell to ensure the planned productivity. Small and medium-sized businesses, with 38% and 45% of responses, respectively, rate the business plan as a service that would be highly useful. This emphasizes that these companies often do not draw up economic plans because they lack the necessary skills to predict the financial implications of investments in robotic cells accurately. All three types of companies highlight a relatively minor importance assigned to analyzing tax incentive measures. This suggests that companies often consider investments in robotic cells to be self-sufficient and that specialized consultants already carry out this activity in many cases.

4.9. Competences Q3.4: Which Professional Profile Does the Company Consider Appropriate for the Installation and Management of Robots?

The evolution of industrial automation has generated an increasing need for qualified professionals capable of managing and supervising robot operations in various business contexts.

Table 8 reveals which professional profile companies of different sizes consider most suitable for the installation and management of robots. The professional profiles presented are Industrial Technician, Automation Engineer, and Master’s in Automation Engineering.

The Master’s in Automation Engineering plays a decisive role in industrial automation, contributing in various ways to the efficiency, reliability, and safety of industrial processes. This process involves defining specifications, selecting necessary hardware and software components, and creating diagrams and algorithms that enable the automation of production and control operations. Advanced knowledge of process optimization, as well as artificial intelligence concepts, is required for these activities. They define operating and maintenance manuals and system user guides, ensuring company personnel can understand and use the system effectively and safely. The Automation Engineer has less in-depth and transversal technical training than the Master’s in Automation Engineering. They have a foundation in electronics, computer science, and control systems. Typically, their knowledge base includes programming PLCs (Programmable Logic Controllers) and SCADA (Supervisory Control and Data Acquisition). They work in the technical office, performing design roles and testing activities to ensure everything works correctly and the automation systems are realized. The Industrial Technician has more direct and practical professional training, such as maintaining and repairing automated equipment, ensuring proper functioning, and resolving technical problems.

Additionally, they install new automation equipment and support engineers in PLC programming. Therefore, it is possible to conclude the current panorama of automation and the training needs of the job market. Large companies tend to prefer profiles with “higher” education, as evidenced by the fact that 54% of large companies consider Master’s degree holders, specifically Automation Engineers with five years of training, more suitable. This preference is attributed to the increasing complexity of automation operations in large environments, where process management and optimization require deep technical knowledge and advanced transversal training. On the other hand, the percentage of large companies that prefer an Industrial Technician stands at 32%, suggesting that, although advanced training is valued, there is still ample room for professional profiles with basic technical training but with practical field experience. Medium-sized companies have a more heterogeneous distribution of their preferences. While 49% lean towards an Industrial Technician, only 11% consider an Automation Engineer with three years of training more suitable. It is also interesting to note that the percentage rises to 34% when considering an Automation Engineer with five years of training. This indicates that medium-sized companies have different needs regarding the complexity of their production systems compared to large companies, as complexity is manageable by professional profiles with less in-depth training. Medium-sized companies turn to external providers when high expertise is required. Finally, small companies are inclined towards professional profiles with practical training, as evidenced by the 46% that prefer an Industrial Technician. Small companies (28%) recognize the value of an Automation Engineer with five years of training, considering the competence of an Industrial Technician sufficient and stressing that the limited company size places a budget limit on resource acquisition.

4.10. Future Vision Q4.1 and Q4.2: Is the Company Planning to Install Robots? Is the Company Planning to Hire Graduates with a Master’s Degree in Automation Engineering within the Next Three Years?

The transition towards a highly automated economy is a global phenomenon, and the forecast for 2023–2026 highlights several trends related to adopting new robots and hiring specialized personnel in industrial automation.

All large companies involved intend to install robots in the next three years. This result confirms their growing dependence on automation to maximize market efficiency, productivity, and competitiveness. Moreover, it is interesting to note that 61% of large companies intend to hire an Industrial Automation Engineer in the same period. This value reflects the demand for qualified personnel generated by the increasing automation of production processes. Medium-sized companies show that the adoption of robotics is expected from 57% of the companies, while only 21% plan to hire an industrial automation engineer. This disparity suggests that medium-sized companies are more cautious in dealing with this period of economic uncertainty, especially when it is required to increase the support staff. On the other hand, the forecast for expanding their robot fleet is positive and encouraging, a testament to the general positive effect resulting from the installation of robotic solutions. Small businesses show a surprising and encouraging trend, representing a significant share of the production fabric. SMEs (78%) plan to adopt robotic solutions, confirming that the democratization of robotics is in progress. Moreover, this demonstrates that confidence in robotics is growing and is about to spread convincingly, even in the most minor realities. However, their inability to reach other skilled profiles is confirmed, as only 11% plan to hire a specialized Engineer. Small businesses demonstrate a lack of financial resources or the infrastructure necessary to support an internal team of specialists, recognizing the importance of having skilled profiles within their organization. Considering that 75% of small businesses have not yet adopted robotics but are considering the option, it highlights the enormous growth potential in this segment.

5. Discussion and Conclusions

In this paper, a study was conducted on the impact of robotics in manufacturing companies with discrete production in the Brescia area, involving +600 companies. The study examined and evaluated the level of knowledge and skills of the human capital involved, highlighting the success factors of current applications and future deployment intentions. The study observed that robots have increased productivity, quality, and operational efficiency. Industrial robotics has already established a robust presence, with significant applications in sectors such as automotive and electronics, where the efficiency and reliability of robots have enabled high-quality mass production. These markets are expected to continue offering growth opportunities through ongoing innovation and the optimization of existing production processes. However, a subgroup of small enterprises highlighted several critical issues in adopting automation. In the following years, it is predicted that large companies will continue to consolidate their leadership position in adopting advanced technologies, while medium-sized and small enterprises will evaluate strategic decisions regarding the tradeoff between investments in automation and human resource management. Anthropomorphic robots were considered the most prevalent category within companies. Their high flexibility and precision make them particularly suitable for a wide range of applications in the industrial sector. The use of Cartesian and SCARA robots is more limited and characterized by variable distribution to the specific needs of the business and the applications for which they are intended. The study shows that robots are primarily employed for handling operations and machine tending, demonstrating their effectiveness in automating the transfer and manipulation of materials and components. Smaller robots can be easily transported and adapted to various tasks, proving particularly suitable in industrial sectors characterized by high variability in production needs. The key factors driving companies towards implementing industrial robotics include the target to increase productivity, expand production capacities, and sustain cost optimization. These elements are closely interrelated: automation allows for the maintenance or increase of production levels while reducing resource use. Concurrently, integrating robots into business dynamics is often aimed at enhancing production quality and supporting employees, thereby mitigating workload and increasing workplace safety. It is noted that companies tend to rely on external suppliers for a wide range of robotics-related services. This includes the reprogramming of robots, the design of robotic cells, and the design of accessories. A marked dependence on external suppliers is particularly evident in extraordinary maintenance due to the requirement for specialized skills and knowledge often unavailable internally within the organization. Integrating robotics into the work environment introduces a series of complexities and challenges that companies need to evaluate, such as issues related to sensors and the need for unexpected maintenance, despite the company’s size. Other issues, particularly for small businesses, involve difficulties in programming and operating the robots, raising concerns regarding the ease of use and accessibility of robotic technology for SMEs. The study indicates that the ability of companies to manage robotic equipment effectively varies according to their size. Large enterprises, often beneficiaries of resources and established training infrastructures, demonstrate significant competence in this area, highlighting the link between available resources and effectiveness in managing industrial robotics. Collaborative robots (COBOTs), despite their potential for adaptability and application in various fields, are under-utilized, specifically in SMEs. Nevertheless, the evolution towards greater collaboration between humans and robots emerges as a critical perspective outlined by robot manufacturers and the scientific community. To facilitate this integration, the development of intuitive user interfaces is necessary, aiming to make robots accessible to a broader audience, including those without experience in robotic programming. Modern interfaces focus on usability, often incorporating touchscreen control, visually guided programming, or gesture-based control. In this expansion process, technological innovation plays a fundamental role. Emerging technologies, such as artificial intelligence (AI), advanced sensors, and artificial vision systems, are revolutionizing the field, making robots progressively capable of operating autonomously in complex environments. This translates into a significant increase in their operational autonomy and the ability to adapt to variations in the production environment dynamically. As industrial automation continues to evolve, the training needs of the labor market follow a parallel trajectory. Large-scale business entities with complex systems and extensive operations require highly qualified professional profiles. The progressive adoption of robotics in businesses has triggered a change in work structure. On the one hand, there is a trend towards reducing direct labor activities, while on the other, there is a notable increase in indirect work. This shift highlights a transformation in the role of workers, who move from manual tasks to supervision, maintenance, and programming roles, implying the need for more advanced skills and greater flexibility. Thus, implementing industrial robotics induces substantial changes in every enterprise area, leading to a global need for training involving the entire workforce and all organizational functions. It becomes essential for companies to proceed with an accurate identification of the specific training needs of each professional profile. This process aims to provide staff with adequate tools to effectively face technical and organizational challenges by developing customized and targeted training programs. The installation of robots in the workplace is perceived as a complex learning process that involves the entire work structure. The optimization of the layout and the connectivity of the workstation to permit the reconfiguration of the system, using algorithms based on machine learning (artificial neural networks, clustering, and others) and reinforcement learning [

32,

33,

34], are recognized as enabling success factors. The outcome highlights the importance of an integrated, holistic, and multidimensional approach to ARI.