Is Permissioned Blockchain the Key to Support the External Audit Shift to Entirely Open Innovation Paradigm?

Abstract

:1. Introduction

- -

- “The impact of new technologies on the auditor’s documentation;

- -

- the question about whether an automated audit procedure can be both a risk assessment procedure and a substantive procedure;

- -

- how the nature and number of sources of information affect planning and performing substantive analytical procedures, particularly with the use of data analytic tools.” [11]

- -

- The TWG interacts with similar groups set up by other national and international standard-setting boards and committees from an Open Innovation perspective.

- -

- “The International Ethics Standards Board for Accountants (IESBA) established their Technology Working Group in 2018. The IESBA TWG is completing its Phase 1 information gathering and analysis and will present its final report to the IESBA at its December 2019 meeting.

- -

- The Chair of the IAASB’s TWG and representatives of Staff have recently engaged with representatives of the PCAOB Office of the Chief Auditor to discuss possible coordination efforts and knowledge sharing about technology in the auditing landscape” [11].

- RQ1:

- Is the OI paradigm more suitable than the SOI that currently shapes the External Audit field?

- RQ1a:

- What are the main challenges and opportunities of both OI and SOI paradigms in the context of External Audit?

- RQ1b:

- Given the identified challenges and opportunities, what recommendations can be provided to policymakers, audit firms, and independent auditors?

- RQ2:

- Can a permissioned blockchain platform be suitable for an OI paradigm in External Audit?

2. Materials and Methods

- (a)

- research and development (R&D) require such a volume of investments that only big corporations can usually afford the cost [23],

- (b)

- (c)

- (d)

- ▪

- Analysis of the most relevant existing literature. It mainly refers to articles published by reliable and reputable sources such as journals listed in Scopus (detailed search criteria and outcomes are presented in Appendix A) and other articles published by the specialised press, such as Bloomberg, Financial Times, and the BBC. A combination of the following keywords was used to search the repositories “Open innovation; External audit; Blockchain; Big data analytics; Technology; Blockchain; Audit standards; Artificial intelligence; Audit regulations; Forensic accounting”. More than 200 articles were initially identified. After attempting different combinations, only the most relevant articles (28 in total) were selected and cited in this research, which are included in the references. The selection was made according to the following criteria: (1) Relevance to the studied topic (some articles were not consistent in terms of innovation as they focused on aspects irrelevant to the current aim); (2) When more papers shared the same or similar outcomes, only the most recent was considered; (3) Additional recent information was also considered from other reputable sources such as Fortune, The Times, Financial Times, BBC, EY, PwC, Deloitte, and KPMG.

- ▪

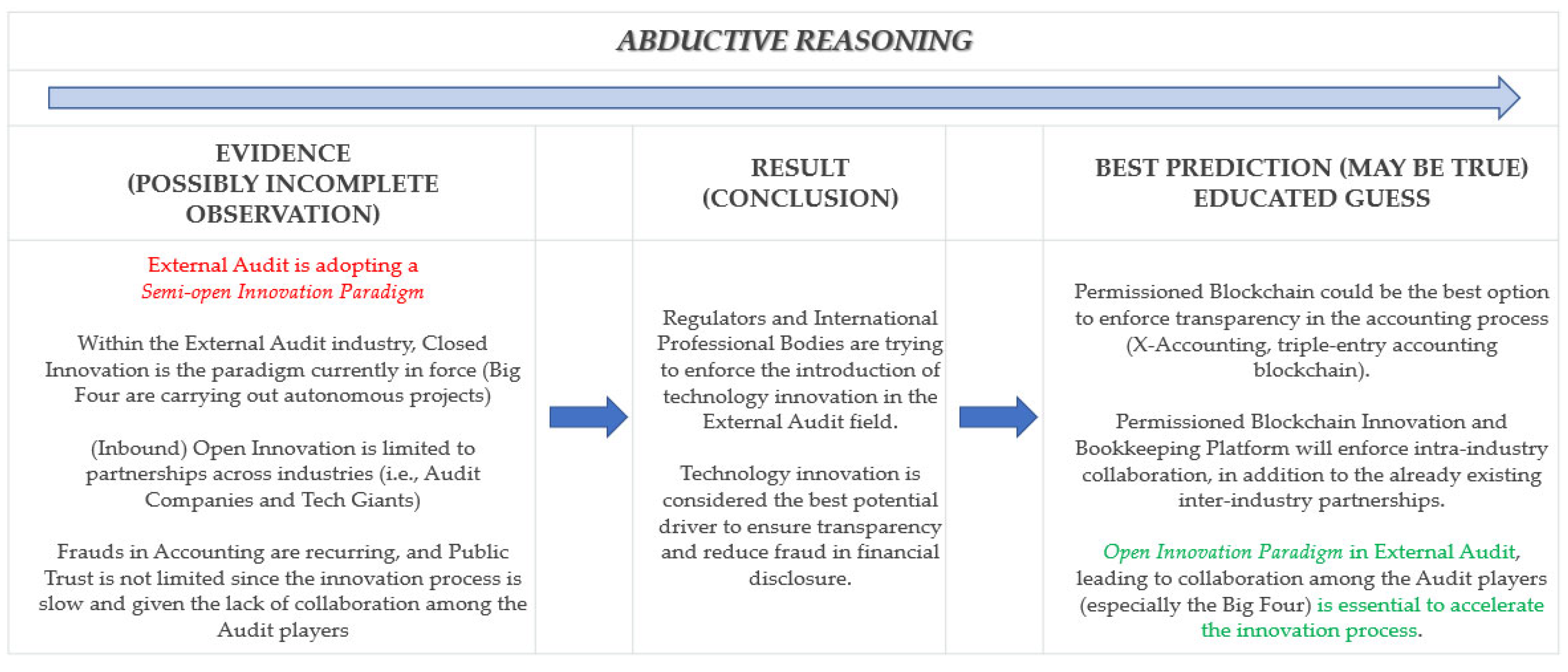

- The use of an abductive reasoning methodology to draft a subsequent, consistent, and reasoned strategic matrix that compares the Semi-Open Innovation and Open Innovation paradigms. The matrix follows a rigorous approach based on the classification of different criteria and factors that can potentially affect or support innovation in the external audit field. The inference process in abductive reasoning proves particularly suitable while assessing innovating paradigms (inference to best explanation or hypothesis for a set of observations). Abductive reasoning creates tentative explanations to make sense of observations for which there is no appropriate explanation or rule in the existing store of knowledge. It does not start with the explanation but instead links facts together to generate an order that fits the information available—the beginning of theory building. Successful examples based on this approach are machine learning, design thinking, grounded theory, constructive design research, prototyping, and cultural probes.

- ▪

- The presentation of a feasible model that includes permissioned blockchain platforms to enhance Open Innovation in the external audit field.

3. Results

3.1. Analysis of the Relevant Existing Literature

3.1.1. Theoretical Framework

- -

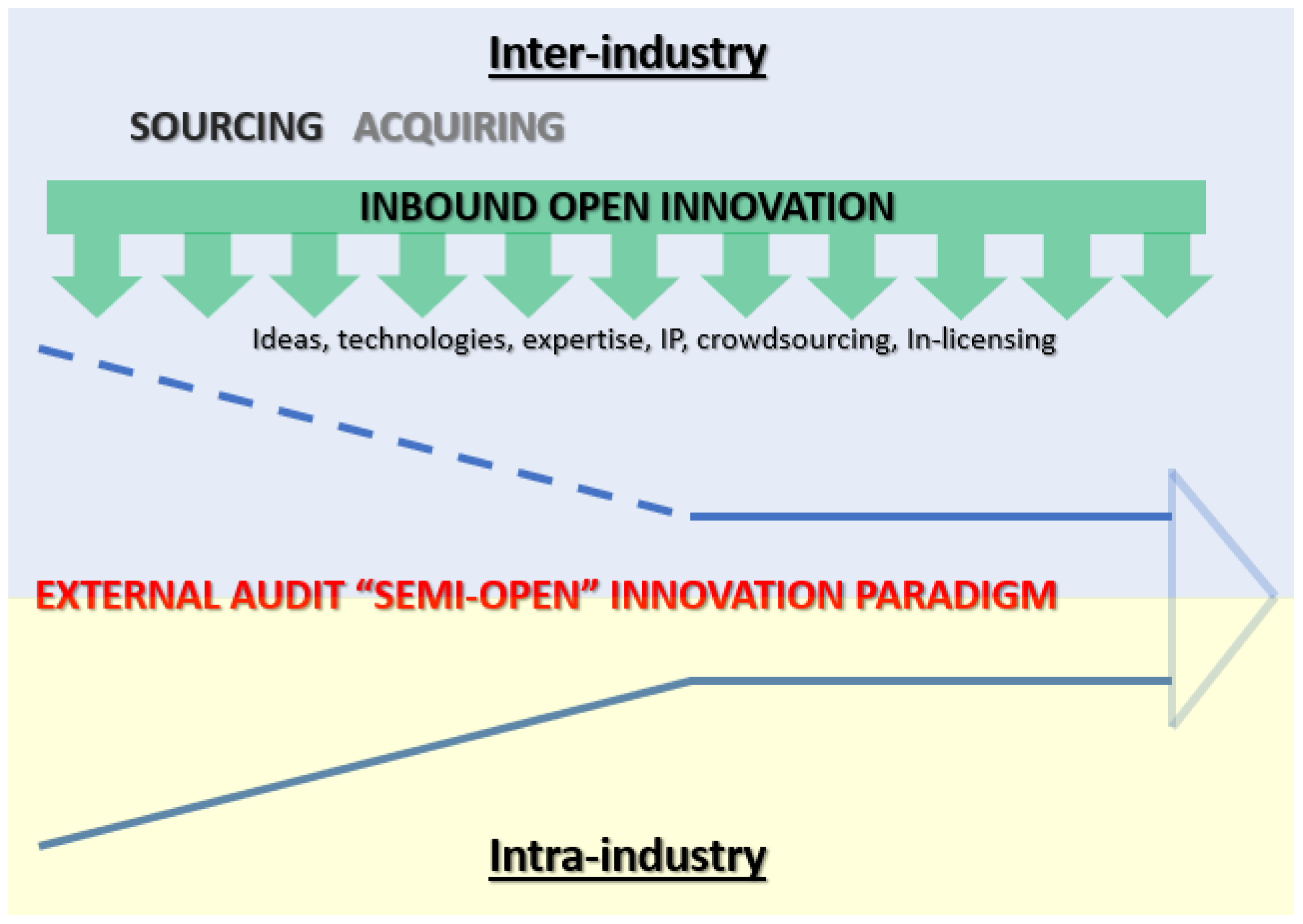

- Inbound Open Innovation is based on adopting external stimuli to innovate. The most common actions are collaborations with universities and established partners. These involve fewer investments and risks but also more modest results. Other less widespread actions, such as internal incubators and accelerators or the creation of corporate venture capital, have a greater impact on effort and results.

- -

- Outbound Open Innovation involves externalising internal stimuli to undertake innovation actions outside the company. This approach is much less common than the first, which is considered less risky. Furthermore, the most used outbound solutions (joint venture and platform business model) are also the safest in their category because they allow greater intellectual property protection.

3.1.2. R&D Investments and Company Size

3.1.3. Blockchain and Data Analytics Projects Developed by the Big Four

3.1.4. Blockchain, AI, and Big Data Analytics’ Potential Impact on the Audit Field

- -

- they are decentralised peer-to-peer networks in which all network participants keep a copy of the main ledger on their device;

- -

- they keep all the ledger copies constantly updated thanks to the consent protocol.

3.1.5. Recent Corporate Scandals and Audit Failures

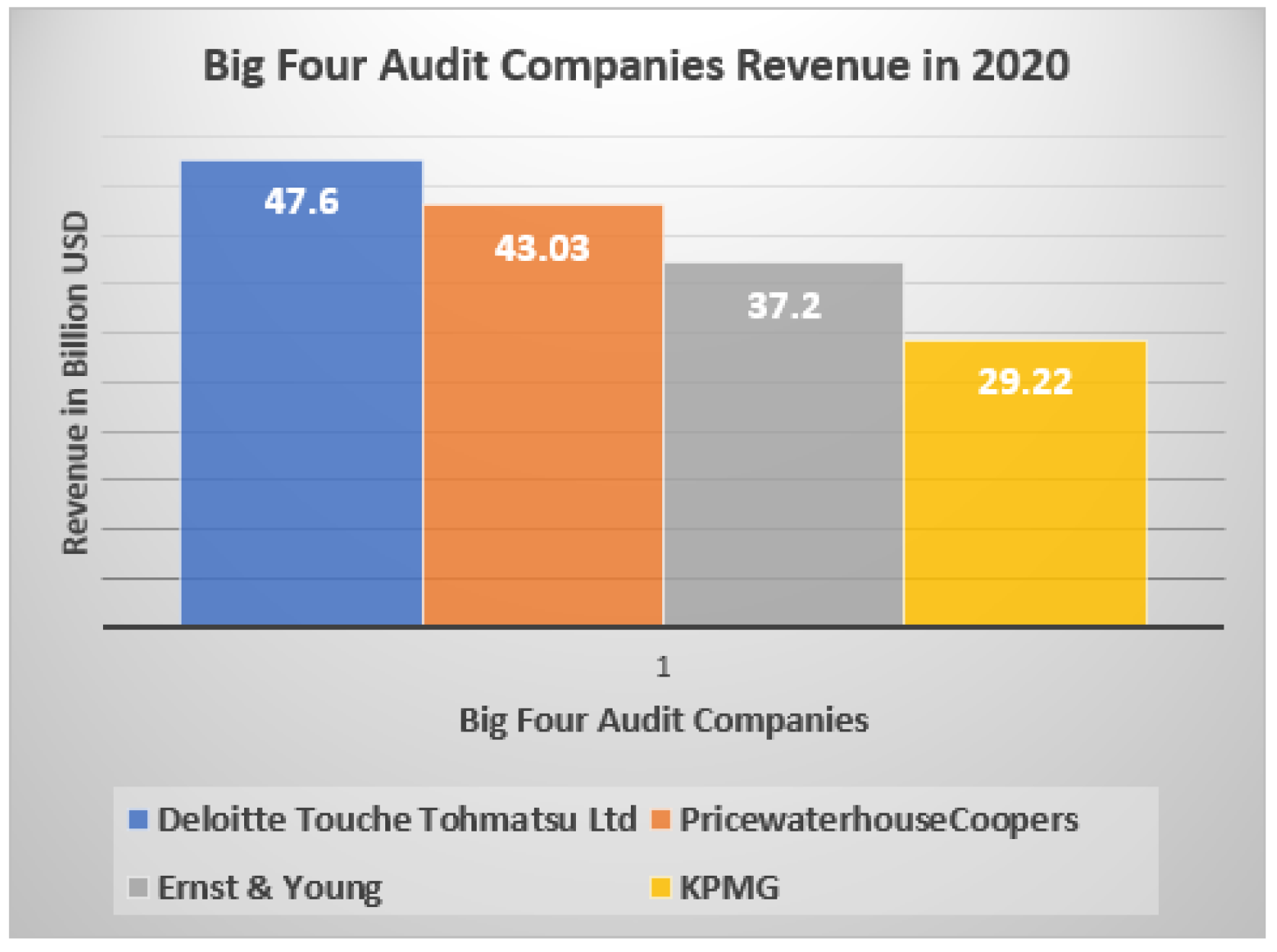

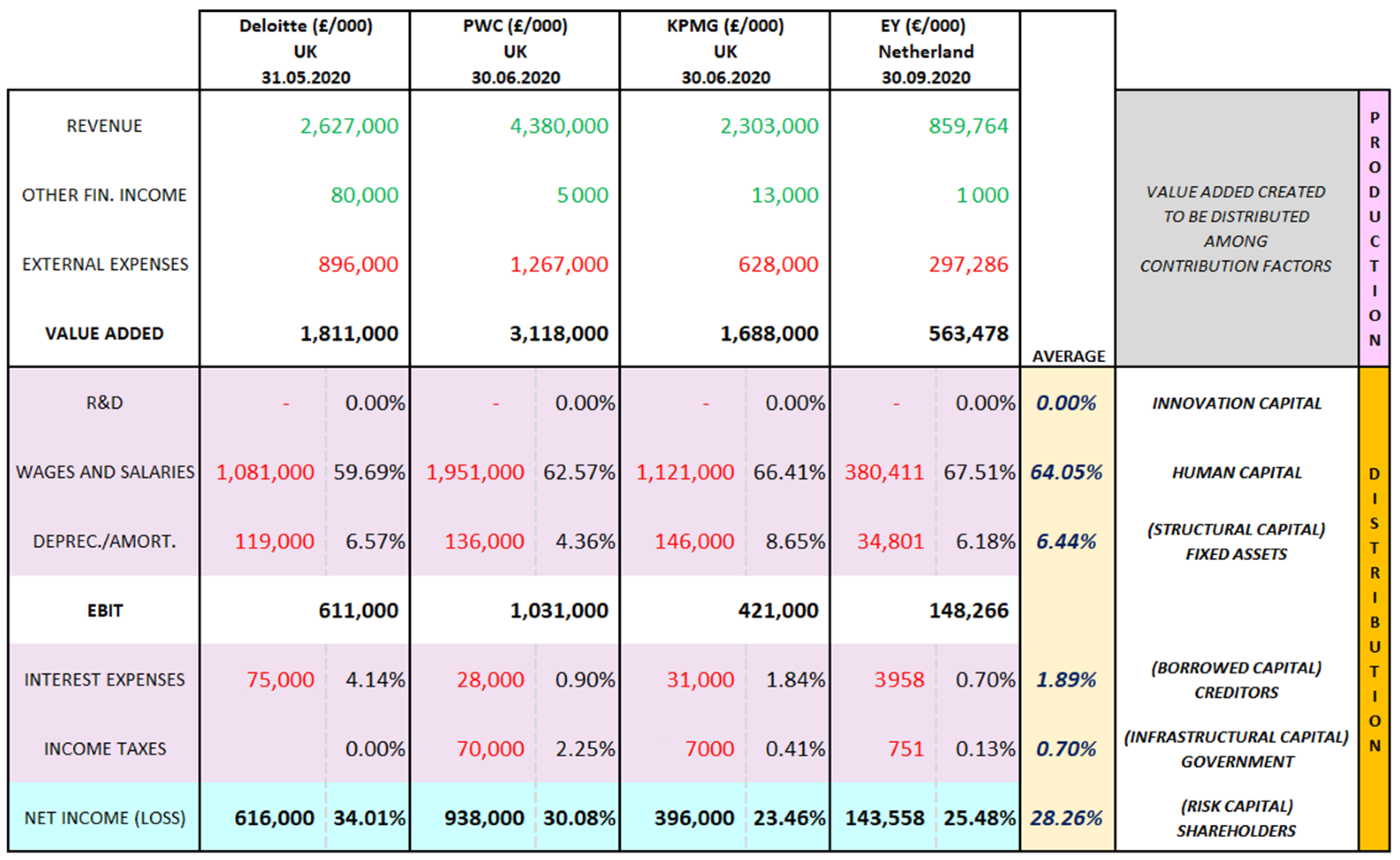

3.2. Comparison of Semi-Open and Open Innovation Paradigms in External Audits

4. Findings and Recommendations

4.1. Legal Framework Perspective

4.2. Team Expertise

- (a)

- Financial planning. Fundamental for the auditor is financial planning skill. It requires experience and a solid economic background, and the ability to think about medium and long-term objectives. This aspect involves budgeting and analysis, a process that considers many objective factors [107];

- (b)

- Project management skills. This includes organisation, achievement of objectives, and meeting deadlines. Project work is not easy, especially in the context of auditing. It could be argued that the auditor does not work on projects. However, the application of knowledge, aptitudes, tools and techniques to activities is essential to achieve their objectives. This skill refers to the variables that make up a task: times, costs, and objectives [108].

- (c)

- Analytical reasoning skills. An individual demonstrating this type of reasoning acts critically and knows how to fragment problems to solve them strategically. Auditors with analytical reasoning skills will be able to reduce a problem into steps to be overcome to solve it entirely [109].

- (d)

- Relational and communication skills. This ability is expressed in a particular way within this profession: an auditor’s ability to explain himself correctly within the team, and to any clients or superiors.

- (e)

- IT skills. Correct use of IT tools is essential for any professional in the accounting domain; this includes platforms, management systems, the Office package, ERP (and their subsets, AISs—Accounting Information Systems). MS Excel, for example, is a must for those who intend to pursue a career as an auditor: the level of competence required—and essential to carry out the tasks correctly—is very high [110].

- (f)

- Organization and time management. Planning, organisation and—if necessary—reorganisation are essential tasks for those who work with numbers in a team. Furthermore, the auditor must pay great attention to time management and meeting deadlines set by himself and others [111].

4.3. Investments

4.4. Theoretical Implications and Recommendations

4.5. Abductive Reasoning

5. Discussion

6. Limitations

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| (TITLE-ABS-KEY “(“Open Innovation””) AND TITLE-ABS-KEY “(“big data”” OR ““analytics”” OR ““blockchain”” OR ““Artificial Intelligence””) AND TITLE-ABS-KEY (accounting OR audit*)) |

| Kroon, N., Do Céu Alves, M., & Martins, I. (2021). The impacts of emerging technologies on accountants’ role and skills: Connecting to open innovation-a systematic literature review. Journal of Open Innovation: Technology, Market, and Complexity, 7(3) doi:10.3390/joitmc7030163 |

| (TITLE-ABS-KEY (“Innovation”) AND TITLE-ABS-KEY (“audit regulation*” OR “forensic accounting”)) |

| Edwards, J. R. (1992). Companies, corporations and accounting change, 1835–1933: A comparative study. Accounting and Business Research, 23(89), 59–73. doi:10.1080/00014788.1992.9729861 |

| Rehman, A., & Hashim, F. (2021). Can forensic accounting impact sustainable corporate governance? Corporate Governance (Bingley), 21(1), 212–227. doi:10.1108/CG-06-2020-0269 |

| (TITLE-ABS-KEY “(“external audit”” OR ““external auditing””) AND TITLE-ABS-KEY (innovation) OR TITLE-ABS-KEY (blockchain)) AND (LIMIT-TO (LANGUAGE, “English”)) AND (LIMIT-TO (SUBJAREA, “BUSI”) OR LIMIT-TO (SUBJAREA, “ECON”) OR LIMIT-TO (SUBJAREA, “SOCI”) OR LIMIT-TO (SUBJAREA, “DECI”)) |

| Appelbaum, D., & Nehmer, R. A. (2017). Using drones in internal and external audits: An exploratory framework. Journal of Emerging Technologies in Accounting, 14(1), 99–113. doi:10.2308/jeta-51704 |

| Barr-Pulliam, D., Brown-Liburd, H. L., & Munoko, I. (2022). The effects of person-specific, task, and environmental factors on digital transformation and innovation in auditing: A review of the literature. Journal of International Financial Management and Accounting, doi:10.1111/jifm.12148 |

| Christensen, M., & Skærbæk, P. (2007). Framing and overflowing of public sector accountability innovations: A comparative study of reporting practices. Accounting, Auditing and Accountability Journal, 20(1), 101–132. doi:10.1108/09513570710731227 |

| De Andrés, J., & Lorca, P. (2021). On the impact of smart contracts on auditing. International Journal of Digital Accounting Research, 21, 155–181. doi:10.4192/1577-8517-v21_6 |

| Dyball, M. C., & Seethamraju, R. (2021). The impact of client use of blockchain technology on audit risk and audit approach—An exploratory study. International Journal of Auditing, 25(2), 602–615. doi:10.1111/ijau.12238 |

| Hamdan, S. L., Jaffar, N., & Razak, R. A. (2017). The effect of competency on internal ’auditors’ contribution to detect fraud in Malaysia. Paper presented at the Proceedings of the 29th International Business Information Management Association Conference - Education Excellence and Innovation Management through Vision 2020: From Regional Development Sustainability to Global Economic Growth, 1544–1559. Retrieved from www.scopus.com |

| Hnydiuk, I. V., Datsenko, G. V., Krupelnytska, I. H., Kudyrko, O. M., & Prutska, O. O. (2021). Audit of budget programs in european union countries. Universal Journal of Accounting and Finance, 9(4), 841–851. doi:10.13189/ujaf.2021.090430 |

| Ibáñez, E. M. (2021). Accounting and non-financial firm data tokens in permissioned DLT networks. International Journal of Intellectual Property Management, 11(1), 54–62. doi:10.1504/ijipm.2021.113358 |

| Ji, H. (2020). A periodic auditor designation and the role of audit committee. Global Business and Finance Review, 25(2), 11–18. doi:10.17549/gbfr.2020.25.2.11 |

| Krieger, F., Drews, P., & Velte, P. (2021). Explaining the (non-) adoption of advanced data analytics in auditing: A process theory. International Journal of Accounting Information Systems, 41 doi:10.1016/j.accinf.2021.100511 |

| Manita, R., Elommal, N., Baudier, P., & Hikkerova, L. (2020). The digital transformation of external audit and its impact on corporate governance. Technological Forecasting and Social Change, 150. doi:10.1016/j.techfore.2019.119751 |

| Rozario, A. M., & Thomas, C. (2019). Reengineering the audit with blockchain and smart contracts. Journal of Emerging Technologies in Accounting, 16(1), 21–35. doi:10.2308/jeta-52432 |

References

- Suzianti, A.; Paramadini, S.A. Continuance Intention of E-Learning: The Condition and Its Connection with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 97. [Google Scholar] [CrossRef]

- Mengual-Recuerda, A.; Tur-Viñes, V.; Juárez-Varón, D.; Alarcón-Valero, F. Emotional Impact of Dishes versus Wines on Restaurant Diners: From Haute Cuisine Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 96. [Google Scholar] [CrossRef]

- Lopes, J.; Oliveira, M.; Silveira, P.; Farinha, L.; Oliveira, J. Business Dynamism and Innovation Capacity, an Entrepreneurship Worldwide Perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 94. [Google Scholar] [CrossRef]

- Manetti, A.; Ferrer-Sapena, A.; Sánchez-Pérez, E.A.; Lara-Navarra, P. Design Trend Forecasting by Combining Conceptual Analysis and Semantic Projections: New Tools for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 92. [Google Scholar] [CrossRef]

- Huong, P.T.; Cherian, J.; Hien, N.T.; Sial, M.S.; Samad, S.; Tuan, B.A. Environmental Management, Green Innovation, and Social–Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 89. [Google Scholar] [CrossRef]

- Najib, M.; Ermawati, W.J.; Fahma, F.; Endri, E.; Suhartanto, D. FinTech in the Small Food Business and Its Relation with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 88. [Google Scholar] [CrossRef]

- Pereira, L.; Santos, R.; Sempiterno, M.; Costa, R.L.D.; Dias, Á.; António, N. Pereira Problem Solving: Business Research Methodology to Explore Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 84. [Google Scholar] [CrossRef]

- Blázquez Puerta, C.D.; Bermúdez González, G.; Soler García, I.P. Executives’ Knowledge Management and Emotional Intelligence Role: Dynamizing Factor towards Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 83. [Google Scholar] [CrossRef]

- Peñarroya-Farell, M.; Miralles, F. Business Model Dynamics from Interaction with Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 81. [Google Scholar] [CrossRef]

- Teodorescu, M.; Korchagina, E. Applying Blockchain in the Modern Supply Chain Management: Its Implication on Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 80. [Google Scholar] [CrossRef]

- IAASB. Technology and the Future-Ready Auditor. 2019. Available online: https://www.ifac.org/system/files/publications/files/IAASB-Tech-Talk-November-2019.pdf (accessed on 10 February 2022).

- Kroon, N.; Alves, M.D.C.; Martins, I. The Impacts of Emerging Technologies on Accountants’ Role and Skills: Connecting to Open Innovation—A Systematic Literature Review. J. Open Innov. Technol. Mark. Complex. 2021, 7, 163. [Google Scholar] [CrossRef]

- Edwards, J.R. Companies, corporations and accounting change, 1835–1933: A comparative study. Account. Bus. Res. 1992, 23, 59–73. [Google Scholar] [CrossRef]

- Van Raak, J.; Peek, E.; Meuwissen, R.; Schelleman, C. The effect of audit market structure on audit quality and audit pricing in the private-client market. J. Bus. Financ. Account. 2020, 47, 456–488. [Google Scholar] [CrossRef]

- Duh, R.R.; Ye, C.; Yu, L.H. Corruption and audit market concentration: An international investigation. Asia-Pac. J. Account. Econ. 2020, 27, 261–279. [Google Scholar] [CrossRef]

- Kallapur, S.; Sankaraguruswamy, S.; Zang, Y. Audit Market Concentration and Audit Quality. 2010. Available online: https://ssrn.com/abstract=1546356 (accessed on 10 February 2022).

- Francis, J.R.; Michas, P.N.; Seavey, S.E. Does audit market concentration harm the quality of audited earnings? Evidence from audit markets in 42 countries. Contemp. Account. Res. 2013, 30, 325–355. [Google Scholar] [CrossRef]

- Li, L. Book Review of Disruption in the Audit Market: The Future of the Big Four, Financial Failures & Scandals: From Enron to Carillion, and the Future of Auditing. Int. J. Audit. 2020, 24, 431–435. [Google Scholar]

- Shore, C. Audit failure and corporate corruption: Why Mediterranean patron-client relations are relevant for understanding the work of international accountancy firms. Focaal 2021, 90, 91–105. [Google Scholar] [CrossRef]

- Fortune Editors. The Biggest Business Scandals of 2020. Fortune. 2020. Available online: https://fortune.com/2020/12/27/biggest-business-scandals-of-2020-nikola-wirecard-luckin-coffee-twitter-security-hack-tesla-spx-mcdonalds-ceo-ppp-fraud-wells-fargo-ebay-carlos-ghosn/ (accessed on 10 February 2022).

- Big Four Losing Public Trust, Says KPMG. The Times. 2018. Available online: https://www.thetimes.co.uk/article/big-four-risk-losing-public-trust-says-kpmg-svd85q3hx (accessed on 10 February 2022).

- Accountants: Government to Break up Dominance of Big Four firms. BBC News. 2021. Available online: https://www.bbc.co.uk/news/business-56435732 (accessed on 10 February 2022).

- Chandler, A.D.; Amatori, F.; Hikino, T. Big Business and the Wealth of Nations; Cambridge University Press: Cambridge, UK, 1999. [Google Scholar]

- Bonsón, E.; Bednárová, M. Blockchain and its implications for accounting and auditing. Meditari Account. Res. 2019, 27, 725–740. [Google Scholar] [CrossRef]

- Moşteanu, N.R.; Faccia, A. Fintech Frontiers in Quantum Computing, Fractals, and Blockchain Distributed Ledger: Paradigm Shifts and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 19. [Google Scholar] [CrossRef]

- Kapoor, M. Big Four Invest Billions in Tech, Reshaping Their Identities. Bloomberg Tax. 2020. Available online: https://news.bloombergtax.com/financial-accounting/big-four-invest-billions-in-tech-reshaping-their-identities (accessed on 10 February 2022).

- Rozario, A.M.; Thomas, C. Reengineering the Audit with blockchain and smart contracts. J. Emerg. Technol. Account. 2019, 16, 21–35. [Google Scholar] [CrossRef]

- CGMA; CFE. Blockchain Augmented Audit—Benefits and challenges for accounting professionals. J. Theor. Account. Res. 2018, 14, 117–137. [Google Scholar]

- Brender, N.; Gauthier, M.; Morin, J.H.; Salihi, A. The Potential Impact of Blockchain Technology on Audit Practice; The University of Hawai’i at Manoa: Honolulu, HI, USA, 2018. [Google Scholar]

- Earley, C.E. Data analytics in auditing: Opportunities and challenges. Bus. Horiz. 2015, 58, 493–500. [Google Scholar] [CrossRef]

- Hooda, N.; Bawa, S.; Rana, P.S. Fraudulent firm classification: A case study of an external audit. Appl. Artif. Intell. 2018, 32, 48–64. [Google Scholar] [CrossRef]

- Appelbaum, D.A.; Kogan, A.; Vasarhelyi, M.A. Analytical procedures in external auditing: A comprehensive literature survey and framework for external audit analytics. J. Account. Lit. 2018, 40, 83–101. [Google Scholar] [CrossRef]

- Toms, S. Financial scandals: A historical overview. Account. Bus. Res. 2019, 49, 477–499. [Google Scholar] [CrossRef] [Green Version]

- Hail, L.; Tahoun, A.; Wang, C. Corporate scandals and regulation. J. Account. Res. 2018, 56, 617–671. [Google Scholar] [CrossRef] [Green Version]

- Van Driel, H. Financial fraud, scandals, and regulation: A conceptual framework and literature review. Bus. Hist. 2018, 61, 1259–1299. [Google Scholar] [CrossRef] [Green Version]

- Admati, A. Financial Crises, Corporate Scandals, and Blind Spots: Who Is Responsible? LSE Bus. Rev. 2018. Available online: https://blogs.lse.ac.uk/businessreview/2018/01/25/financial-crises-corporate-scandals-and-blind-spots-who-is-responsible/ (accessed on 10 February 2022).

- McKenna, F. The KPMG Cheating Scandal Was Much More Widespread Than Originally Thought. MarketWatch 2019. Available online: https://www.marketwatch.com/story/the-kpmg-cheating-scandal-was-much-more-widespread-than-originally-thought-2019-06-18 (accessed on 10 February 2022).

- Kinder, T. Bill Michael Fights to Restore KPMG’s Image and Profits. Financial Times. 2020. Available online: https://www.ft.com/content/9002e2ac-20b3-11ea-b8a1-584213ee7b2b (accessed on 10 February 2022).

- Iacone, A. KPMG, PwC Work to Repair Reputations Following Scandals, Fines. Bloomberg Tax. 2020. Available online: https://news.bloombergtax.com/financial-accounting/kpmg-pwc-work-to-repair-reputations-following-scandals-fines (accessed on 10 February 2022).

- Smith, A. The Wealth of Nations; CreateSpace Independent Publishing Platform: Scotts Valley, CA, USA, 2018. [Google Scholar]

- Marx, K. Das Kapital; Verlag von Otto Meisner: Berlin, Gemany, 1867. [Google Scholar]

- Usher, A.P. An Introduction to the Industrial History of England; Houghton Mifflin: Boston, MA, USA, 1920. [Google Scholar]

- Usher, A.P. A History of Mechanical Innovation; McGraw-Hill: New York, NY, USA, 1929. [Google Scholar]

- Ruttan, V.W. Usher and Schumpeter on invention, innovation, and technological change. Q. J. Econ. 1959, 73, 596–606. [Google Scholar] [CrossRef]

- Schumpeter, J.A. Theory of Economic Development; Springer: Boston, MA, USA, 2003. [Google Scholar]

- Nelson, R.R.; Winter, S.G. Neoclassical vs. evolutionary theories of economic growth: Critique and prospectus. Econ. J. 1974, 84, 886–905. [Google Scholar] [CrossRef]

- Rahmeyer, F. Schumpeter, Marshall, and Neo-Schumpeterian Evolutionary Economics. Jahrbücher Natl. Und Stat. 2013, 233, 39–64. [Google Scholar] [CrossRef]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business Press: Boston, MA, USA, 2003. [Google Scholar]

- Michelino, F.; Caputo, M.; Cammarano, A.; Lamberti, E. Inbound and outbound open innovation: Organisation and performances. J. Technol. Manag. Innov. 2014, 9, 65–82. [Google Scholar] [CrossRef]

- Chandler, A.D., Jr. The Visible Hand; Harvard University Press: Cambridge, MA, USA, 1993. [Google Scholar]

- Rothschild, E. Adam Smith and the invisible hand. Am. Econ. Rev. 1994, 84, 319–322. [Google Scholar]

- Tubbs, M. The relationship between R&D and company performance. Res.-Technol. Manag. 2007, 50, 23–30. [Google Scholar]

- Coad, A.; Rao, R. Firm growth and R&D expenditure. Econ. Innov. New Technol. 2010, 19, 127–145. [Google Scholar]

- Falk, M. Quantile estimates of the impact of R&D intensity on firm performance. Small Bus. Econ. 2012, 39, 19–37. [Google Scholar]

- Audretsch, D.B.; Coad, A.; Segarra, A. Firm growth and Innovation. Small Bus. Econ. 2014, 43, 743–749. [Google Scholar] [CrossRef]

- Parast, M.M. The impact of R&D investment on mitigating supply chain disruptions: Empirical evidence from US firms. Int. J. Prod. Econ. 2020, 227, 107671. [Google Scholar]

- Kim, J.; Yang, I.; Yang, T.; Koveos, P. The impact of R&D intensity, financial constraints, and dividend payout policy on firm value. Financ. Res. Lett. 2020, 48, 101802. [Google Scholar]

- Kim, J. Innovation failure and firm growth: Dependence on firm size and age. Technol. Anal. Strateg. Manag. 2021, 34, 166–179. [Google Scholar] [CrossRef]

- Turner, S.; Endres, A. Strategies for enhancing small business owners’ success rates. Int. J. Appl. Manag. Technol. 2017, 16, 3. [Google Scholar] [CrossRef]

- Ali, M.M.; Haron, N.H.; Abdullah, N.A.I.N.; Hamid, N.A. Loan applications amongst small medium enterprises: Challenges, risk and sustainability. Commun. Stoch. Anal. 2019, 13, 211. [Google Scholar]

- Chowdhury, T.Y.; Yeasmin, A.; Ahmed, Z. Perception of women entrepreneurs to accessing bank credit. J. Glob. Entrep. Res. 2018, 8, 32. [Google Scholar] [CrossRef]

- Belás, J.; Smrcka, L.; Gavurova, B.; Dvorsky, J. The impact of social and economic factors in the credit risk management of SME. Technol. Econ. Dev. Econ. 2018, 24, 1215–1230. [Google Scholar] [CrossRef] [Green Version]

- Lieberman, M.B.; Montgomery, D.B. First-mover advantages. Strateg. Manag. J. 1988, 9 (Suppl. S1), 41–58. [Google Scholar] [CrossRef]

- Makadok, R. Can first-mover and early-mover advantages be sustained in an industry with low barriers to entry/imitation? Strateg. Manag. J. 1998, 19, 683–696. [Google Scholar] [CrossRef]

- Karakaya, F. Barriers to entry in industrial markets. J. Bus. Ind. Mark. 2002, 17, 379–388. [Google Scholar] [CrossRef]

- Cullinan, C.P.; Du, H.; Zheng, X. Barriers to entry to the big firm audit market: Evidence from market reaction to switches to second Tier audit firms in the post-sox period. Res. Account. Regul. 2012, 24, 6–14. [Google Scholar] [CrossRef]

- Kelly, J. The power of an indictment and the demise of Arthur Andersen. S. Tex. L. Rev. 2006, 48, 509. [Google Scholar] [CrossRef]

- Feldman, E.R. A basic quantification of the competitive implications of the demise of Arthur Andersen. Rev. Ind. Organ. 2006, 29, 193–212. [Google Scholar] [CrossRef]

- Tang, J. Competition and innovation behaviour. Res. Policy 2006, 35, 68–82. [Google Scholar] [CrossRef]

- Aghion, P.; Bloom, N.; Blundell, R.; Griffith, R.; Howitt, P. Competition and Innovation: An inverted-U relationship. Q. J. Econ. 2005, 120, 701–728. [Google Scholar]

- Acemoglu, D.; Akcigit, U. Intellectual property rights policy, competition and Innovation. J. Eur. Econ. Assoc. 2012, 10, 1–42. [Google Scholar] [CrossRef] [Green Version]

- Gayle, P.G. Market Concentration and Innovation: New Empirical Evidence on the Schumpeterian Hypothesis; Center for Economic Analysis, Department of Economics, University of Colorado at Boulder: Boulder, CO, USA, 2001. [Google Scholar]

- Yanbing, W. Firm Size, Market Concentration, and Innovation: A Survey. Econ. Res. J. 2007, 5, 125–138. [Google Scholar]

- Bae, K.H.; Bailey, W.; Kang, J. Why is stock market concentration bad for the economy? J. Financ. Econ. 2021, 140, 436–459. [Google Scholar] [CrossRef]

- KPMG. Auditing Blockchain Solutions. 2018. Available online: https://assets.kpmg/content/dam/kpmg/in/pdf/2018/10/Auditing_Blockchain_Solutions.pdf (accessed on 10 February 2022).

- KPMG.; Gambhir, P. Audit Point of View the Blockchain Shift Will Be Seismic. 2018. Available online: https://assets.kpmg/content/dam/kpmg/be/pdf/2019/11/apov-blockchain-feb-2018.pdf (accessed on 10 February 2022).

- KPMG. Data and Analytics in the Audit Driving up Trust in the Capital Markets. 2017. Available online: https://assets.kpmg/content/dam/kpmg/xx/pdf/2017/01/data-and-analytics-in-audit.pdf (accessed on 10 February 2022).

- Deloitte. Blockchain—Perspectives, Insights, and Analysis. 2021. Available online: https://www2.deloitte.com/us/en/pages/consulting/topics/blockchain.html (accessed on 10 February 2022).

- Deloitte. Audit Analytics. 2015. Available online: https://www2.deloitte.com/content/dam/Deloitte/cz/Documents/audit/EN_Audit_Analytics.pdf (accessed on 10 February 2022).

- PwC. PwC’s Global Blockchain Survey. 2018. Available online: https://www.pwc.com/jg/en/publications/blockchain-is-here-next-move.pdf (accessed on 10 February 2022).

- PwC. Data Analytics Delivering Intelligence in the Moment. 2014. Available online: https://www.pwc.co.uk/assets/pdf/data-analytics-january-2014-without-inserts.pdf (accessed on 10 February 2022).

- EY. How Big Data and Analytics Are Transforming the Audit. 2018. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/assurance/assurance-pdfs/ey-reporting-big-data-transform-audit.pdf?download (accessed on 10 February 2022).

- EY. Blockchain Technology as a Platform for Digitisation. 2016. Available online: https://assets.ey.com/content/dam/ey-sites/ey-com/en_gl/topics/advisory/EY-blockchain-technology-as-a-platform-for-digitization.pdf?download (accessed on 10 February 2022).

- O’Neal, S. Big Four, and Blockchain: Are Audit Giants Adopting Yet? 2019. Available online: https://cointelegraph.com/news/big-four-and-blockchain-are-auditing-giants-adopting-yet (accessed on 10 February 2022).

- Bhaskar, K.; Flower, J. Disruption in the Audit Market: The Future of the Big Four; Routledge: London, UK, 2019. [Google Scholar]

- Peterson, J. Count Down: The Past, Present and Uncertain Future of the Big Four Accounting Firms; Emerald Group Publishing: Bradford, UK, 2017. [Google Scholar]

- Faccia, A.; Mataruna-Dos-Santos, L.J.; Munoz Helù, H.; Range, D. Measuring and Monitoring Sustainability in Listed European Football Clubs: A Value-Added Reporting Perspective. Sustainability 2020, 12, 9853. [Google Scholar] [CrossRef]

- Kokina, J.; Davenport, T.H. The emergence of artificial intelligence: How automation is changing auditing. J. Emerg. Technol. Account. 2017, 14, 115–122. [Google Scholar] [CrossRef]

- Zemankova, A. Artificial Intelligence in Audit and Accounting: Development, Current Trends, Opportunities and Threats-Literature Review. In Proceedings of the 2019 International Conference on Control, Artificial Intelligence, Robotics & Optimization (ICCAIRO), Majorca Island, Spain, 3–5 May 2019; pp. 148–154. [Google Scholar]

- Eilifsen, A.; Kinserdal, F.; Messier, W.F., Jr.; McKee, T.E. An exploratory study into the use of audit data analytics on audit engagements. Account. Horiz. 2020, 34, 75–103. [Google Scholar] [CrossRef]

- Varriale, V.; Cammarano, A.; Michelino, F.; Caputo, M. The Unknown Potential of Blockchain for Sustainable Supply Chains. Sustainability 2020, 12, 9400. [Google Scholar] [CrossRef]

- Wang, J.; Cheng, H. Application of Blockchain Technology in the Governance of Executive Corruption in Context of National Audit. Teh. Vjesn. 2020, 27, 1774–1780. [Google Scholar]

- Kend, M.; Nguyen, L.A. Big Data Analytics and Other Emerging Technologies: The Impact on the Australian Audit and Assurance Profession. Aust. Account. Rev. 2020, 30, 269–282. [Google Scholar] [CrossRef]

- Joshi, P.L.; Marthandan, G. Continuous internal auditing: Can big data analytics help? Int. J. Account. Audit. Perform. Eval. 2020, 16, 25–42. [Google Scholar] [CrossRef]

- Moşteanu, N.R.; Faccia, A. Digital Systems and New Challenges of Financial Management—FinTech, XBRL, Blockchain, and Cryptocurrencies. Qual.-Access Success J. 2020, 21, 159–166. [Google Scholar]

- Faccia, A. X-Accounting®—Towards a New Accounting System. Blockchain Applied Accounting. How Robots Will Overcome Humans in Accounting Recording. 2020. Available online: http://www.alexpander.it/01-XAccounting.pdf (accessed on 10 February 2022).

- Faccia, A.; Moşteanu, N.R.; Cavaliere, L.P.L. Blockchain Hash, the Missing Axis of the Accounts to Settle the Triple Entry Bookkeeping System. In Proceedings of the 2020 12th International Conference on Information Management and Engineering, New York, NY, USA, 16–18 September 2020. [Google Scholar]

- Faccia, A. Tackling Tax Evasion through Big Data Analytics. 2020. Available online: http://www.alexpander.it/05-BigDataAnalyticsTaxEvasion.htm (accessed on 10 February 2022).

- Faccia, A.; Moşteanu, N.R.; Cavaliere, L.P.L.; Mataruna-Dos-Santos, L.J. Electronic Money Laundering, The Dark Side of Fintech: An Overview of the Most Recent Cases. In Proceedings of the 2020 12th International Conference on Information Management and Engineering, Amsterdam, The Netherlands, 29–34 September 2020. [Google Scholar]

- Brummer, A. Audit Reforms Put on Hold as Failures Pile up: Big Four Beancounters in the Firing Line after Series of Botched Reports. 2020. Available online: https://www.thisismoney.co.uk/money/markets/article-8856393/Big-four-auditors-firing-line-failures-pile-up.html (accessed on 10 February 2022).

- FRC. Report and Financial Statements for the Year Ended 31 March 2020. 2020. Available online: https://www.frc.org.uk/getattachment/985d9c2a-8a6d-4c8b-8172-06858edfabab/FRC-Annual-Report-and-Accounts-2020-21.pdf (accessed on 10 February 2022).

- Nunes, M.; Abreu, A. Managing Open Innovation Project Risks Based on a Social Network Analysis Perspective. Sustainability 2020, 12, 3132. [Google Scholar] [CrossRef]

- Millar, C.; Lockett, M.; Ladd, T. Disruption: Technology, Innovation and Society. Technol. Forecast. Soc. Chang. 2018, 129, 254–260. [Google Scholar] [CrossRef]

- Josifidis, K.; Supic, N. Innovation and Income Inequality in the USA: Ceremonial versus Institutional Changes. J. Econ. Issues 2020, 54, 486–494. [Google Scholar] [CrossRef]

- Yoo, J.; Lee, S.; Park, S. The effect of firm life cycle on the relationship between R&D expenditures and future performance, earnings uncertainty, and sustainable growth. Sustainability 2019, 11, 2371. [Google Scholar]

- OECD. Business and Finance Outlook 2019: Strengthening Trust in Business. 2020. Available online: https://www.oecd-ilibrary.org/sites/4d7c9b81-en/index.html?itemId=/content/component/4d7c9b81-en (accessed on 10 February 2022).

- Austin, J.R. Transactive memory in sorganisational groups: The effects of content, consensus, specialisation, and accuracy on group performance. J. Appl. Psychol. 2003, 88, 866. [Google Scholar] [CrossRef]

- Siriwardane, H.P.; Kin Hoi Hu, B.; Low, K.Y. Skills, knowledge, and attitudes important for present-day auditors. Int. J. Audit. 2014, 18, 193–205. [Google Scholar] [CrossRef] [Green Version]

- Agustina, F.; Nurkholis, N.; Rusydi, M. Auditors’ professional skepticism and fraud detection. Int. J. Res. Bus. Soc. Sci. 2021, 10, 275–287. [Google Scholar] [CrossRef]

- Alsabahi, M.A.; Bahador, K.M.K.; Saat, R.M. Skills Development Factors of Information Technology Competency Among External Auditors. Int. J. Inf. Syst. Serv. Sect. 2021, 13, 13–28. [Google Scholar] [CrossRef]

- Alba, J. Vault Career Guide to Accounting. 2005. Available online: https://books.google.ae/books?hl=en&lr=&id=zthQTa5D29IC&oi=fnd&pg=PP2&dq=111.%09Alba,+J.+Vault+Career+Guide+to+Accounting&ots=DXOwMBwlJx&sig=0m-AQubDUgzIkdYhHadj91ISH3k&redir_esc=y#v=onepage&q&f=false (accessed on 10 February 2022).

- Thagard, P.; Shelley, C. Abductive reasoning: Logic, visual thinking, and coherence. In Logic and Scientific Methods; Springer: Dordrecht, The Netherlands, 1997; pp. 413–427. [Google Scholar]

- Krieger, F.; Drews, P.; Velte, P. Explaining the (non-) adoption of advanced data analytics in auditing: A process theory. Int. J. Account. Inf. Syst. 2021, 41, 100511. [Google Scholar] [CrossRef]

- De Andrés, J.; Lorca, P. On the impact of smart contracts on auditing. Int. J. Digit. Account. Res. 2021, 21, 155–181. [Google Scholar] [CrossRef]

- Dyball, M.C.; Seethamraju, R. The impact of client use of blockchain technology on audit risk and Rozario—An exploratory study. Int. J. Audit. 2021, 25, 602–615. [Google Scholar] [CrossRef]

- Ibáñez, E.M. Accounting and non-financial firm data tokens in permissioned DLT networks. Int. J. Intellect. Prop. Manag. 2021, 11, 54–62. [Google Scholar] [CrossRef]

- Manita, R.; Elommal, N.; Baudier, P.; Hikkerova, L. The digital transformation of external audit and its impact on corporate governance. Technol. Forecast. Soc. Chang. 2020, 150, 119751. [Google Scholar] [CrossRef]

- Appelbaum, D.; Nehmer, R.A. Using drones in internal and external audits: An exploratory framework. J. Emerg. Technol. Account. 2017, 14, 99–113. [Google Scholar] [CrossRef]

- Rehman, A.; Hashim, F. Can forensic accounting impact sustainable corporate governance? Corp. Gov. 2021, 21, 212–227. [Google Scholar] [CrossRef]

- Christensen, M.; Skærbæk, P. Framing and overflowing of public sector accountability innovations: A comparative study of reporting practices. Account. Audit. Account. J. 2007, 20, 101–132. [Google Scholar] [CrossRef]

- Hamdan, S.L.; Jaffar, N.; Razak, R.A. The Effect of Competency on Internal Auditors Contribution to Detect Fraud in Malaysia. Paper Presented at the Proceedings of the 29th International Business Information Management Association Conference—Education Excellence and Innovation Management through Vision 2020: Regional Development Sustainability to Global Economic Growth. 2017, pp. 1544–1559. Available online: www.scopus.com (accessed on 10 February 2022).

- Hnydiuk, I.V.; Datsenko, G.V.; Krupelnytska, I.H.; Kudyrko, O.M.; Prutska, O.O. Audit of budget programs in european union countries. Univers. J. Account. Financ. 2021, 9, 841–851. [Google Scholar] [CrossRef]

- Ji, H. A periodic auditor designation and the role of audit committee. Glob. Bus. Financ. Rev. 2020, 25, 11–18. [Google Scholar] [CrossRef]

- Barr-Pulliam, D.; Brown-Liburd, H.L.; Munoko, I. The effects of person-specific, task, and environmental factors on digital transformation and innovation in auditing: A review of the literature. J. Int. Financ. Manag. Account. 2022. [Google Scholar] [CrossRef]

| Company | Bloomberg | In Millions of USD | FY 2015 | FY 2016 | FY 2017 | FY 2018 | FY 2019 | FY 2020 | Average Growth | R&D |

|---|---|---|---|---|---|---|---|---|---|---|

| Name | Ticker | 12 Months Ending | 30 June 2015 | 30 June 2016 | 30 June 2017 | 30 June 2018 | 30 June 2019 | 30 June 2020 | Total | |

| APPLE | AAPL US | Market Capitalization | 639,938.76 | 601,439.27 | 790,050.10 | 1,073,390.54 | 972,268.90 | 1,906,150.95 | ||

| MC Growth | −6% | 31% | 36% | −9% | 96% | 30% | ||||

| R&D Expenditure | 8067.00 | 10,045.00 | 11,581.00 | 14,236.00 | 16,217.00 | 18,752.00 | 78,898.00 | |||

| R&D Growth | 25% | 15% | 23% | 14% | 16% | 18% | ||||

| AMAZON | AMZN US | Market Capitalization | 318,344.19 | 357,687.99 | 566,023.48 | 737,467.27 | 920,224.32 | 1,638,235.79 | ||

| MC Growth | 12% | 58% | 30% | 25% | 78% | 41% | ||||

| R&D Expenditure | 12,540.00 | 16,085.00 | 22,620.00 | 28,837.00 | 35,931.00 | 42,740.00 | 158,753.00 | |||

| R&D Growth | 28% | 41% | 27% | 25% | 19% | 28% | ||||

| MICROSOFT | MSFT US | Market Capitalization | 354,392.05 | 399,535.36 | 531,312.44 | 757,028.97 | 1,023,856.28 | 1,540,774.21 | ||

| MC Growth | 13% | 33% | 42% | 35% | 50% | 35% | ||||

| R&D Expenditure | 12,046.00 | 11,988.00 | 13,037.00 | 14,726.00 | 16,876.00 | 19,269.00 | 87,942.00 | |||

| R&D Growth | 0% | 9% | 13% | 15% | 14% | 10% | ||||

| Alphabet | GOOGL US | Market Capitalization | 527,687.37 | 540,170.04 | 729,274.63 | 723,340.70 | 921,949.02 | 1,183,421.09 | ||

| MC Growth | 2% | 35% | −1% | 27% | 28% | 18% | ||||

| R&D Expenditure | 12,282.00 | 13,948.00 | 16,625.00 | 21,419.00 | 26,018.00 | 27,573.00 | 117,865.00 | |||

| R&D Growth | 14% | 19% | 29% | 21% | 6% | 18% | ||||

| FB US | Market Capitalization | 297,757.70 | 332,724.60 | 512,792.76 | 374,130.86 | 585,373.00 | 778,232.84 | |||

| MC Growth | 12% | 54% | −27% | 56% | 33% | 26% | ||||

| R&D Expenditure | 4816.00 | 5919.00 | 7754.00 | 10,273.00 | 13,600.00 | 18,447.00 | 60,809.00 | |||

| R&D Growth | 23% | 31% | 32% | 32% | 36% | 31% | ||||

| TESLA | TSLA US | Market Capitalization | 31,543.31 | 34,523.97 | 52,554.95 | 57,442.28 | 75,717.73 | 677,443.20 | ||

| MC Growth | 9% | 52% | 9% | 32% | 795% | 179% | ||||

| R&D Expenditure | 717.90 | 834.41 | 1378.07 | 1460.37 | 1343.00 | 1491.00 | 7224.75 | |||

| R&D Growth | 16% | 65% | 6% | −8% | 11% | 18% | ||||

| ALIBABA | BABA US | Market Capitalization | 193,230.00 | 189,240.00 | 281,370.00 | 446,340.00 | 472,440.00 | 555,045.00 | ||

| MC Growth | −2% | 49% | 59% | 6% | 17% | 26% | ||||

| R&D Expenditure | 1598.70 | 2068.20 | 2559.00 | 3413.10 | 5615.25 | 6462.00 | 21,716.25 | |||

| R&D Growth | 29% | 24% | 33% | 65% | 15% | 33% | ||||

| TOT R&D Expenditure | 52,067.60 | 60,887.61 | 75,554.07 | 94,364.47 | 115,600.25 | 134,734.00 | 533,208.00 |

| Year of Fraud | Company | Country | Industry | Audit Company |

|---|---|---|---|---|

| 2020 | Wirecard | Germany | Fintech | EY |

| 2020 | NMC Health | UAE/UK | Private hospitals | EY |

| 2018 | Carillon | UK | Construction | KPMG |

| 2010–2013 | Rolls-Royce | UK | Aerospace | KPMG |

| 2014 | Tesco | UK | Retail | PwC |

| 2015–2016 | Redcentric | UK | IT Services | PwC |

| 2010–2011 | Autonomy | UK | IT Services | Deloitte |

| 2018 | Johnston Press | UK | Multimedia | Deloitte |

| Perspectives | Requirements |   Challenges Challenges Opportunities Opportunities |   Challenges Challenges  Opportunities Opportunities |

|---|---|---|---|

| Legal Framework |

|  Oligopolistic equilibrium Oligopolistic equilibrium Antitrust concerns due to lack of transparences and standardisation in the audit processes Antitrust concerns due to lack of transparences and standardisation in the audit processes Difficult standardisation as the progress in innovation is not shared Difficult standardisation as the progress in innovation is not shared Progress in innovation slowed by a lack of sharing Progress in innovation slowed by a lack of sharing Permissioned or permissionless BC are both available Permissioned or permissionless BC are both available |  Nash equilibrium Nash equilibrium Increased complexity of controlling innovation and regulating how contributors affect a project Increased complexity of controlling innovation and regulating how contributors affect a project Increased transparency Increased transparency Increased standardisation and cooperation among audit companies Increased standardisation and cooperation among audit companies Accelerated innovation progress thanks to advancements in sharing Accelerated innovation progress thanks to advancements in sharing Permissioned or permissionless BC are both available Permissioned or permissionless BC are both available |

| Team Expertise |

|  IT audit not fully integrated with external audit IT audit not fully integrated with external audit Non-collaborative environment Non-collaborative environment Different goals among departments Different goals among departments High risk of conflicting interests and corruption High risk of conflicting interests and corruption Low risk of confidential information leaks Low risk of confidential information leaks |  Risk of confidential information leaks Risk of confidential information leaks  Clear and common goals Clear and common goals Collaboration Collaboration Transparency and equal opportunities Transparency and equal opportunities Low risk of conflicting interests and corruption Low risk of conflicting interests and corruption |

| Investments |

|  High entry barriers High entry barriers Full affordability is limited to big companies only Full affordability is limited to big companies only Limited integration and diversification Limited integration and diversification High stimulus to investments in R&D to benefit from intellectual property rights High stimulus to investments in R&D to benefit from intellectual property rights |  Few stimuli to invest in R&D because results should be shared (no intellectual property rights) Few stimuli to invest in R&D because results should be shared (no intellectual property rights) Low entry barriers Low entry barriers Affordability Affordability Integration and diversification Integration and diversification |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Faccia, A.; Pandey, V.; Banga, C. Is Permissioned Blockchain the Key to Support the External Audit Shift to Entirely Open Innovation Paradigm? J. Open Innov. Technol. Mark. Complex. 2022, 8, 85. https://doi.org/10.3390/joitmc8020085

Faccia A, Pandey V, Banga C. Is Permissioned Blockchain the Key to Support the External Audit Shift to Entirely Open Innovation Paradigm? Journal of Open Innovation: Technology, Market, and Complexity. 2022; 8(2):85. https://doi.org/10.3390/joitmc8020085

Chicago/Turabian StyleFaccia, Alessio, Vishal Pandey, and Charu Banga. 2022. "Is Permissioned Blockchain the Key to Support the External Audit Shift to Entirely Open Innovation Paradigm?" Journal of Open Innovation: Technology, Market, and Complexity 8, no. 2: 85. https://doi.org/10.3390/joitmc8020085

APA StyleFaccia, A., Pandey, V., & Banga, C. (2022). Is Permissioned Blockchain the Key to Support the External Audit Shift to Entirely Open Innovation Paradigm? Journal of Open Innovation: Technology, Market, and Complexity, 8(2), 85. https://doi.org/10.3390/joitmc8020085