A Business Acceleration Program Supporting Cross-Border Enterprises: A Comparative Study

Abstract

1. Introduction

2. Literature Review in Entrepreneurship Support Mechanisms and Entrepreneurship Traits

2.1. Entrepreneurship Support Mechanisms: Accelerator vs. Incubator Services and University Level Support Mechanisms

2.2. Open Innovation in SMEs

2.3. Business Skills

2.4. The Greek Entrepreneurial Ecosystem

2.5. The Albanian Entrepreneurial Ecosystem

2.6. Transnational Trade Routes

3. The ACCEL Acceleration Program

4. Materials and Methods

4.1. Sample

4.2. Characteristics of SMEs

4.3. Measurement Variables

4.3.1. Acceleration Program Effectiveness

- Investment occurred towards developing a new strategy or idea after the business accelerator.

- New customers gained due to the new strategic approach the business applied or new product/service introduced in the market.

- Intention to operate in the second country i.e., Greece/Albania after the implementation of the project.

- Intention to work with the other members of the team with which the business participated during the ACCEL program.

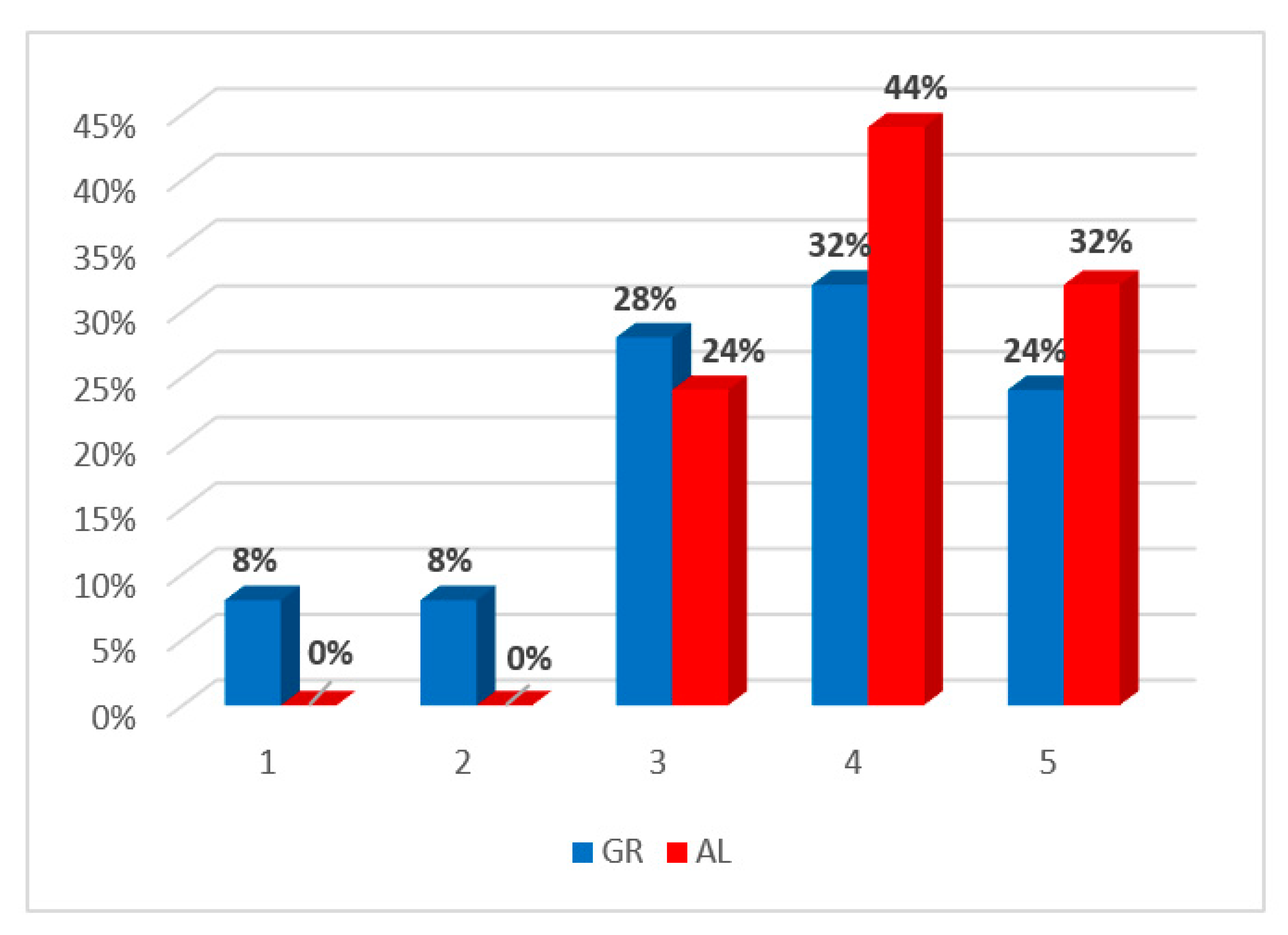

4.3.2. Participants Satisfaction on the Contribution of Experience Gained

- The experience from the program has helped participants develop their business idea.

- The experience from the program has contributed to the development of a different business idea from the original one.

- The experience from the program has contributed to the development of more than one business ideas.

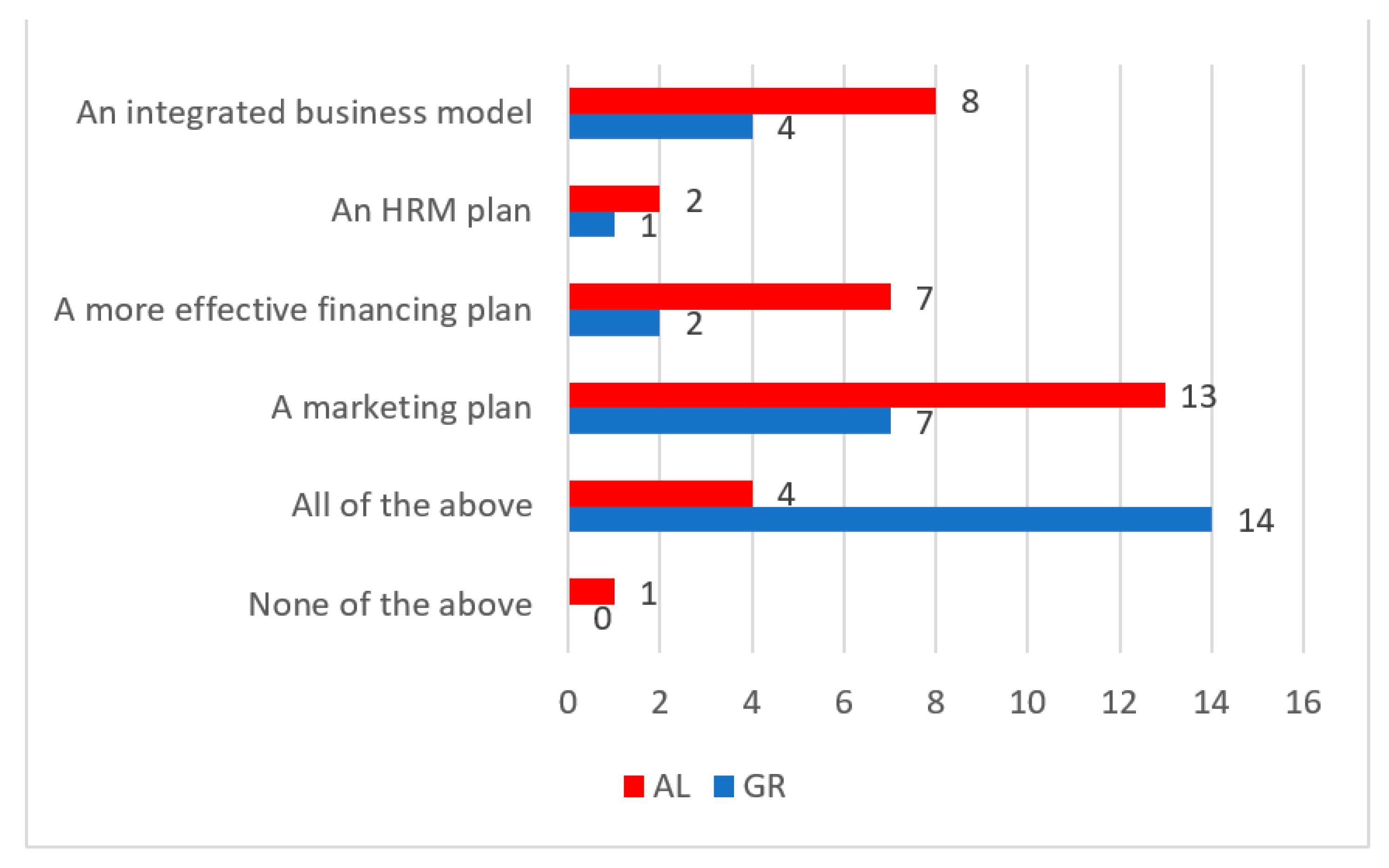

4.3.3. Business Skills

- Participation in the program helped in developing knowledge and skills to create/develop: a marketing plan, an integrated business model, a human recourse management plan, a financial plan.

- Improved strategy in addressing business weaknesses due to the consultation process such as: lack of organization, lack of trust, inability/fear of accepting changes and new ideas, centralized management/inability to delegate tasks on others, lack of vision and goal setting.

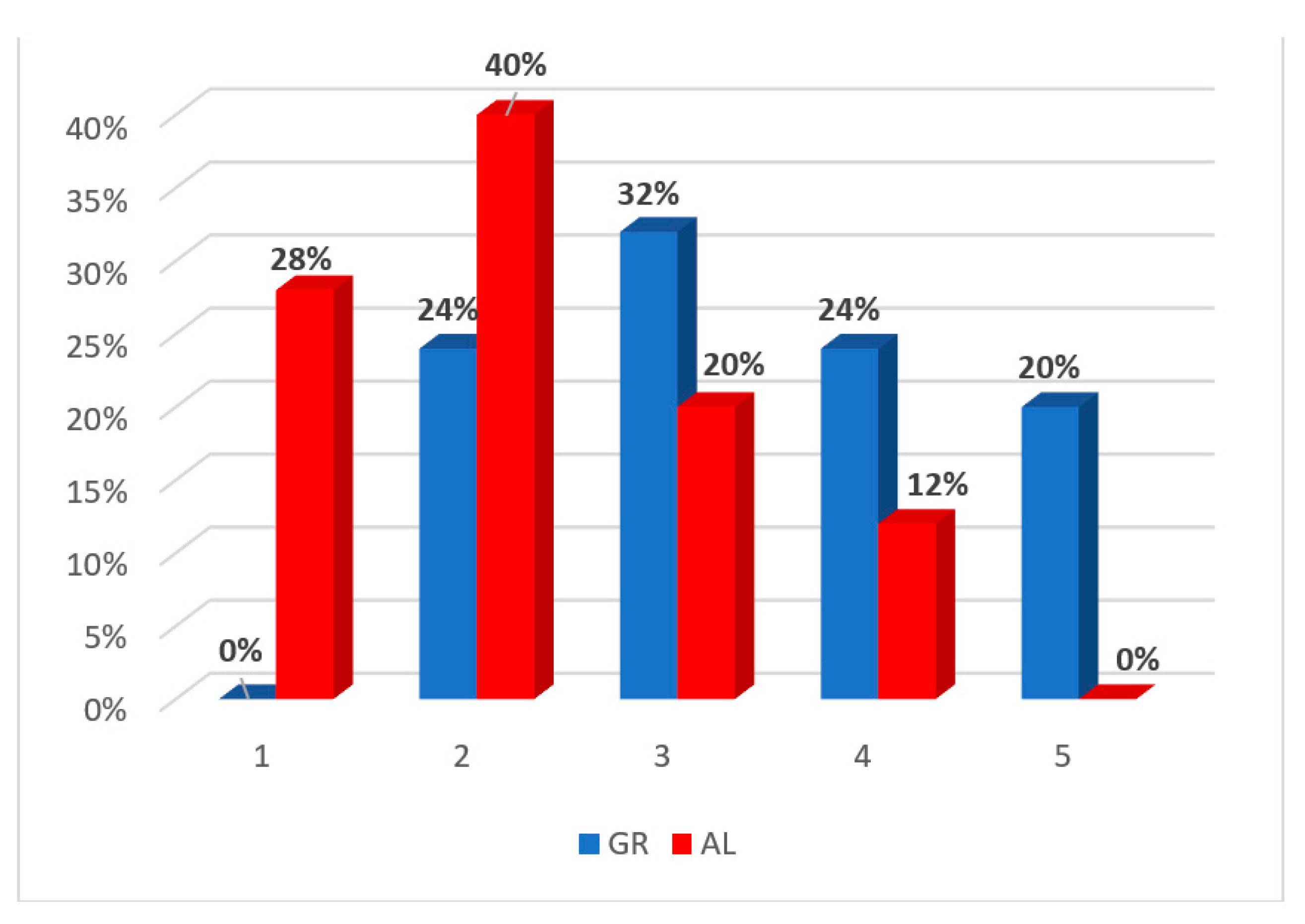

4.3.4. Business Development Key Criteria

- Availability of the necessary financial resources for the implementation of a business idea.

- Holding the necessary technical and technological knowledge related to the implementation of the idea.

- Existence of a working group with executives who have specific professional skills regarding the implementation of the business idea.

- Existence of an existing customer network in the implementation of the business idea.

- Existence of a complete and detailed business model for the implementation of the business idea.

4.4. Methods of Analysis

5. Results

5.1. Frequencies and Derscriptive Statistics

5.2. Non-Parametric Analysis

6. Discussion

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

- □

- Trade

- □

- Agri-food

- □

- Processing

- □

- Information and Communication Technologies (Software & Hardware)

- □

- Energy

- □

- Transportation

- □

- Constructions

- □

- Tourism

- □

- Services

- □

- Other (please specify):……………………………………

| 1: Yes, 2: No | Authors | ||

| Acceleration program effectiveness | Yes | No | [17,18] |

| Investment occurred towards developing a new strategy or idea after the business accelerator. | |||

| New customers gained due to the new strategic approach you apply or the introduction of a new product/service in the market. | |||

| The business strategy was improved in addressing business weaknesses due to the consultation process such as: lack of organization, lack of trust, inability/fear of accepting changes and new ideas, centralized management/inability to delegate tasks on others, lack of vision and goal setting. | |||

| Acceleration program cross-border aspect | Yes | No | [19] |

| Intention to operate in the second country i.e., Greece/Albania after the implementation of the project. | |||

| Acceleration program collaboration aspect | Yes | No | [17] |

| Intention to work with the other members of the business team with which you participated in the ACCEL program | |||

| 1: Not Important, 5: Very Important | Authors | |||||

| Experience from the program | 1 | 2 | 3 | 4 | 5 | [17] |

| has helped develop your idea | ||||||

| has contributed to the development of a different business idea from your original one | ||||||

| has contributed to the development of more than one business idea | ||||||

| Importance of the existence of | 1 | 2 | 3 | 4 | 5 | [17,18,20,57] |

| the necessary financial resources in the implementation of the business idea | ||||||

| the necessary technical and technological knowledge about your idea, regarding its implementation | ||||||

| a working group with executives who have specific professional skills regarding the implementation of your idea | ||||||

| an existing customer network in the implementation of your idea? | ||||||

| a complete and detailed business model in the implementation of your idea | ||||||

- □

- a marketing plan

- □

- an integrated business model

- □

- a human resource management plan

- □

- a plan to better manage your finances

- □

- all of the above

- □

- none of the above

- □

- Lack of organization

- □

- Lack of trust

- □

- Inability/fear of accepting changes and new ideas

- □

- Centralised management/inability to delegate tasks on others

- □

- Lack of vision and goal setting

References

- Castellacci, F.; Grodal, S.; Mendonca, S.; Wibe, M. Advances and Challenges in Innovation Studies. J. Econ. Issues 2005, 39, 91–121. [Google Scholar] [CrossRef]

- Shearmur, R.; Doloreux, D. How Open Innovation Processes Vary between Urban and Remote Environments: Slow Innovators, Market-Sourced Information and Frequency of Interaction. Entrep. Reg. Dev. 2016, 28, 337–357. [Google Scholar] [CrossRef]

- Lopes, J.M.; Gomes, S.; Oliveira, J.; Oliveira, M. The Role of Open Innovation, and the Performance of European Union Regions. J. Open Innov. Technol. Mark. Complex. 2021, 7, 120. [Google Scholar] [CrossRef]

- Valdez-Juárez, L.E.; Castillo-Vergara, M. Technological Capabilities, Open Innovation, and Eco-Innovation: Dynamic Capabilities to Increase Corporate Performance of SMEs. J. Open Innov. Technol. Mark. Complex. 2021, 7, 8. [Google Scholar] [CrossRef]

- Surya, B.; Menne, F.; Sabhan, H.; Suriani, S.; Abubakar, H.; Idris, M. Economic Growth, Increasing Productivity of SMEs, and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 20. [Google Scholar] [CrossRef]

- Partanen, J.; Möller, K.; Westerlund, M.; Rajala, R.; Rajala, A. Social Capital in the Growth of Science-and-Technology-Based SMEs. Ind. Mark. Manag. 2008, 37, 513–522. [Google Scholar] [CrossRef]

- Fini, R.; Grimaldi, R.; Santoni, S.; Sobrero, M. Complements or Substitutes? The Role of Universities and Local Context in Supporting the Creation of Academic Spin-Offs. Res. Policy 2011, 40, 1113–1127. [Google Scholar] [CrossRef]

- Hochberg, Y.V. Accelerating Entrepreneurs and Ecosystems: The Seed Accelerator Model. Innov. Policy Econ. 2016, 16, 25–51. [Google Scholar] [CrossRef]

- Basu, S.; Phelps, C.; Kotha, S. Towards Understanding Who Makes Corporate Venture Capital Investments and Why. J. Bus. Ventur. 2011, 26, 153–171. [Google Scholar] [CrossRef]

- Ismail, A. A Framework for Designing Business-Acceleration Programs: A Case Study from Egypt. Entrep. Res. J. 2020, 10. [Google Scholar] [CrossRef]

- Cohen, S.; Hochberg, Y. Accelerating Startups: The Seed Accelerator Phenomenon. SSRN Electron. J. 2014. [Google Scholar] [CrossRef]

- Del Sarto, N.; Isabelle, D.A.; Di Minin, A. The Role of Accelerators in Firm Survival: An FsQCA Analysis of Italian Startups. Technovation 2020, 90–91, 102102. [Google Scholar] [CrossRef]

- Shankar, R.K.; Shepherd, D.A. Accelerating Strategic Fit or Venture Emergence: Different Paths Adopted by Corporate Accelerators. J. Bus. Ventur. 2019, 34, 105886. [Google Scholar] [CrossRef]

- Mian, S.; Lamine, W.; Fayolle, A. Technology Business Incubation: An Overview of the State of Knowledge. Technovation 2016, 50–51, 1–12. [Google Scholar] [CrossRef]

- Hallen, B.; Bingham, C.; Cohen, S. Do Accelerators Accelerate? A Study of Venture Accelerators as a Path to Success? Acad. Manag. Proc. 2014, 2014, 12955. [Google Scholar] [CrossRef]

- Smith, S.W.; Hannigan, T.J.; Gasiorowski, L. Accelerators and Crowdfunding: Complementarity, Competition, or Convergence in the Earliest Stages of Financing New Ventures? In Proceedings of the University of Colorado-Kauffman Foundation Crowd-Funding Conference, Boulder, CO, USA, 12–13 July 2013. [Google Scholar]

- Bone, J.; Gonzalez-Uribe, J.; Haley, C.; Lahr, H. The Impact of Business Accelerators and Incubators in the UK. p. 125. Available online: http://oro.open.ac.uk/67380/ (accessed on 23 May 2021).

- Roberts, P.; Lall, S.; Baird, R.; Eastman, E.; Davidson, A.; Jacobson, A. What’s Working in Startup Acceleration: Insigths from Fifteen Village Capital Programs. Available online: https://www.galidata.org/publications/whats-working-in-startup-acceleration/ (accessed on 23 May 2016).

- Accathon Capital|New York|Cross-Border Accelerator VC. Available online: https://www.accathon.com/accelerator (accessed on 23 May 2021).

- Kerr, W.R.; Lerner, J.; Schoar, A. The Consequences of Entrepreneurial Finance: Evidence from Angel Financings. Rev. Financ. Stud. 2014, 27, 20–55. [Google Scholar] [CrossRef]

- Hach, K.; Trenkmann, E. Entrepreneurial Ecosystem in Albania with Focus on Tirana. EU for Innovation, Instrument for Pre-Aceessiobn Assistance (IPAII) 2014–2020 for the Competitiveness and Innovation Sector. Project Number 2018/400-907. 2019. Available online: http://euforinnovation.al/wp-content/uploads/2019/12/Gap-Analysis_E-Publication.pdf (accessed on 23 May 2019).

- Antoniades, V.; Kavounides, C.; Giakoumelos, M.; Petkakis, T.; Zacharias, Z. Greece Startup Ecosystem; Boston Consulting Group: Athens, Greece, 2018. [Google Scholar]

- Tolstykh, T.; Gamidullaeva, L.; Shmeleva, N.; Woźniak, M.; Vasin, S. An Assessment of Regional Sustainability via the Maturity Level of Entrepreneurial Ecosystems. J. Open Innov. Technol. Mark. Complex. 2021, 7, 5. [Google Scholar] [CrossRef]

- Huggins, R.; Johnston, A. Knowledge Flow and Inter-Firm Networks: The Influence of Network Resources, Spatial Proximity and Firm Size. Entrep. Reg. Dev. 2010, 22, 457–484. [Google Scholar] [CrossRef]

- Leckel, A.; Veilleux, S.; Dana, L.P. Local Open Innovation: A Means for Public Policy to Increase Collaboration for Innovation in SMEs. Technol. Forecast. Soc. Chang. 2020, 153, 119891. [Google Scholar] [CrossRef]

- Dempwolf, C.; Auer, J.; Fabiani, M. Innovation Accelerators: Defining Characteristics among Startup Assistance Organizations. Available online: https://advocacy.sba.gov/2014/10/01/innovation-accelerators-defining-characteristics-among-startup-assistance-organization/ (accessed on 23 May 2021).

- Hausberg, J.P.; Korreck, S. Business Incubators and Accelerators: A Co-Citation Analysis-Based, Systematic Literature Review. J. Technol. Transf. 2020, 45, 151–176. [Google Scholar] [CrossRef]

- Ries, E. The Lean Startup: How Today’s Entrepreneurs Use Continuous Innovation to Create Radically Successful Businesses; Crown, 2011; Available online: https://www.amazon.com/Lean-Startup-Entrepreneurs-Continuous-Innovation/dp/0307887898 (accessed on 23 May 2011).

- Ratinho, T.; Henriques, E. The Role of Science Parks and Business Incubators in Converging Countries: Evidence from Portugal. Technovation 2010, 30, 278–290. [Google Scholar] [CrossRef]

- Hathaway, I. What Startup Accelerators Really Do. Harvard Business Review. Available online: https://hbr.org/2016/03/what-startup-accelerators-really-do (accessed on 23 May 2016).

- van Rijnsoever, F.J. Meeting, Mating, and Intermediating: How Incubators Can Overcome Weak Network Problems in Entrepreneurial Ecosystems. Res. Policy 2020, 49, 103884. [Google Scholar] [CrossRef]

- Lopes, J.; Farinha, L.; Ferreira, J.J.; Ferreira, F. Peeking beyond the Wall: Analysing University Technology Transfer and Commercialisation Processes. Int. J. Technol. Manag. 2018, 78, 107. [Google Scholar] [CrossRef]

- Tucci, C.L.; Chesbrough, H.; Piller, F.; West, J. When Do Firms Undertake Open, Collaborative Activities? Introduction to the Special Section on Open Innovation and Open Business Models. Ind. Corp. Chang. 2016, 25, 283–288. [Google Scholar] [CrossRef]

- Chesbrough, H.; Vanhaverbeke, W.; West, J. New Frontiers in Open Innovation; Oxford University Press: Oxford, UK, 2014. [Google Scholar]

- Alexander, A.T.; Martin, D.P. Intermediaries for Open Innovation: A Competence-Based Comparison of Knowledge Transfer Offices Practices. Technol. Forecast. Soc. Chang. 2013, 80, 38–49. [Google Scholar] [CrossRef]

- Dismantling Knowledge Boundaries at NASA: The Critical Role of Professional Identity in Open Innovation-Hila Lifshitz-Assaf. 2018. Available online: https://journals.sagepub.com/doi/full/10.1177/0001839217747876 (accessed on 15 May 2021).

- Freel, M.; Robson, P.J. Appropriation Strategies and Open Innovation in SMEs. Int. Small Bus. J. 2017, 35, 578–596. [Google Scholar] [CrossRef]

- Green, L. The Entrepreneur’s Playbook: More Than 100 Proven Strategies, Tips, and Techniques to Build. a Radically Successful Business; American Management Association: New York, NY, USA, 2017. [Google Scholar]

- Hatthakijphong, P.; Ting, H.-I. Prioritizing Successful Entrepreneurial Skills: An Emphasis on the Perspectives of Entrepreneurs versus Aspiring Entrepreneurs. Think. Ski. Creat. 2019, 34, 100603. [Google Scholar] [CrossRef]

- Galanakis, K.; Giourka, P. Entrepreneurial Path: Decoupling the Complexity of Entrepreneurial Process. Int. J. Entrep. Behav. Res. 2017, 23, 317–335. [Google Scholar] [CrossRef]

- Gerli, F.; Gubitta, P.; Tognazzo, A. Entrepreneurial Competencies and Firm Performance: An Empirical Study. 2011. Available online: https://www.researchgate.net/profile/Paolo-Gubitta/publication/228314296_Entrepreneurial_Competencies_and_Firm_Performance_An_Empirical_Study/links/00463526e019fdfeb9000000/Entrepreneurial-Competencies-and-Firm-Performance-An-Empirical-Study.pdf (accessed on 15 May 2021).

- Silveyra, G.; Herrero, Á.; Pérez, A. Model of Teachable Entrepreneurship Competencies (M-TEC): Scale Development. Int. J. Manag. Educ. 2021, 19, 100392. [Google Scholar] [CrossRef]

- Herrmann, A.M.; Storz, C.; Held, L. Whom Do Nascent Ventures Search for? Resource Scarcity and Linkage Formation Activities during New Product Development Processes. Small Bus. Econ. 2020. [Google Scholar] [CrossRef]

- Kuratko, D.F.; Morris, M.H. Corporate Entrepreneurship: A Critical Challenge for Educators and Researchers. Entrep. Educ. Pedagog. 2018, 1, 42–60. [Google Scholar] [CrossRef]

- La Rocca, A.; Perna, A.; Sabatini, A.; Baraldi, E. The Emergence of the Customer Relationship Portfolio of a New Venture: A Networking Process. J. Bus. Ind. Mark. 2019, 34, 1066–1078. [Google Scholar] [CrossRef]

- Theodoropoulos, D.; Kyridis, A.; Zagkos, C.; Konstantinidou, Z. “Brain Drain” Phenomenon in Greece: Young Greek Scientists on Their Way to Immigration, in an Era of “Crisis”. Attitudes, Opinions and Beliefs towards the Prospect of Migration. JEHD 2014, 3. [Google Scholar] [CrossRef]

- Bank of Greece Governor Report. Available online: https://www.bankofgreece.gr/ekdoseis-ereyna/ekdoseis/ekthesh-dioikhth (accessed on 2 April 2021).

- Stournaras, Y. Yannis Stournaras: The Greek Economy 10 Years after the Crisis and Lessons for the Future Both for Greece and the Eurozone. 2019. Available online: https://www.bis.org/review/r190816e.htm (accessed on 2 April 2021).

- Hellenic Statistical Authority. Available online: https://www.statistics.gr/en/home/ (accessed on 2 April 2021).

- Michalopoulos, T. Rebrain Greece. Available online: https://medium.com/the-crowdpolicy-collection/rebrain-greece-portal-crowdsourcing-platform-crowdpolicy-d893d2c25ba (accessed on 2 April 2021).

- OECD Education at a Glance. 2017. Available online: https://www.oecd.org/education/education-at-a-glance/ (accessed on 2 April 2017).

- European Commision the Economy. Available online: https://europa.eu/european-union/about-eu/figures/economy_en (accessed on 3 April 2021).

- Share of Member States in EU GDP. Available online: https://ec.europa.eu/eurostat/web/products-eurostat-news/-/DDN-20170410-1 (accessed on 2 April 2021).

- Kobicheva, A.; Baranova, T.; Tokareva, E. The Development of an Interaction Mechanism between Universities and Other Innovation System Actors: Its Influence on University Innovation Activity Effectiveness. J. Open Innov. Technol. Mark. Complex. 2020, 6, 109. [Google Scholar] [CrossRef]

- Seland, E.H. Writ in Water, Lines in Sand: Ancient Trade Routes, Models and Comparative Evidence. Cogent Arts Humanit. 2015, 2, 1110272. [Google Scholar] [CrossRef]

- Priyono, A.; Idris, F.; Lim, S.B.A.H. Achieving Ambidexterity in Internationalization: Analysis of How SMEs Cope with Tensions between Organizational Agility–Efficiency. J. Open Innov. Technol. Mark. Complex. 2020, 6, 188. [Google Scholar] [CrossRef]

- Lahr, H.; Mina, A. Venture Capital Investments and the Technological Performance of Portfolio Firms. Res. Policy 2016, 45, 303–318. [Google Scholar] [CrossRef]

- Chaparro, X.A.F.; de Vasconcelos Gomes, L.A. Pivot Decisions in Startups: A Systematic Literature Review. Int. J. Entrep. Behav. Res. 2021. [Google Scholar] [CrossRef]

- Vajjhala, N.R.; Strang, K.D. Collaboration Strategies for a Transition Economy: Measuring Culture in Albania. Cross Cult. Manag. 2014, 21, 78–103. [Google Scholar] [CrossRef]

- Habili, M. Understanding Level of CSR and Marketing in Albania in 2020. IJMHRR 2021, 2, 35–42. [Google Scholar]

- Tomprou, M.; Nikolaou, I.; Vakola, M. Experiencing Organizational Change in Greece: The Framework of Psychological Contract. Int. J. Hum. Resour. Manag. 2012, 23, 385–405. [Google Scholar] [CrossRef]

- Shkurti, L. The Albanian Organization and Organizational Structure—The Challenges of the Adaptation to the Dynamic Reality. J. Educ. Cult. Soc. 2014, 2014. [Google Scholar] [CrossRef]

- Kolliopoulos, A. Reforming the Greek Financial System: A Decade of Failure; Hellenic Observatory Discussion Papers on Greece ans Southeast Europe; Hellenic Observatory, European Institute, LSE: London, UK, 2021. [Google Scholar]

- Gerdoçi, B.; Bortoluzzi, G.; Dibra, S. Business Model Design and Firm Performance: Evidence of Interactive Effects from a Developing Economy. Eur. J. Innov. Manag. 2017, 21, 315–333. [Google Scholar] [CrossRef]

- Kilintzis, P.; Samara, E.; Carayannis, E.G.; Bakouros, Y. Business Model Innovation in Greece: Its Effect on Organizational Sustainability. J. Knowl. Econ. 2020, 11, 949–967. [Google Scholar] [CrossRef]

| Country | Sector | Gender |

|---|---|---|

| Greece | 24% Agrifood 16% Trade 16% Processing | 56%, Male 44% Female |

| Albania | 20% Trade 16% ICT 16% Agrifood | 24% Female 76%, Male |

| Acceleration Program Effectiveness | Greece | Albania | ||

|---|---|---|---|---|

| Yes | No | Yes | No | |

| Investments occurred towards developing a new strategy or idea after the business accelerator | 68% | 32% | 60% | 40% |

| New customers gained due to the new strategic approach that the business applied, or new product/service introduced in the market | 64% | 36% | 68% | 32% |

| The business strategy was improved in addressing business weaknesses due to the consultation process such as: lack of organization, lack of trust, inability/fear of accepting changes and new ideas, centralized management/inability to delegate tasks on others, lack of vision and goal setting. | 92% | 8% | 96% | 4% |

| Acceleration program | ||||

| Intention to operate in the second country i.e., Greece/Albania after the implementation of the project. (cross-border aspect) | 68% | 32% | 72% | 28% |

| Intention to work with the other members of the team with which the business participated during the ACCEL program (collaboration aspect) | 88% | 12% | 68% | 32% |

| Variables | ||||||

| Acceleration Program Effectiveness | ||||||

| Investments occurred towards developing a new strategy or idea after the business accelerator | New customers gained due to the new strategic approach that the business applied, or new product/service introduced in the market | The business strategy was improved in addressing business weaknesses due to the consultation process such as: lack of organization, lack of trust, inability/ fear of accepting changes and new ideas, centralized management/inability to delegate tasks on others, lack of vision and goal setting. | Intention to operate in the second country i.e., Greece/Albania after the implementation of the project. (cross-border aspect) | Intention to work with the other members of the team with which the business participated during the ACCEL program (collaboration aspect) | ||

| Absolute Frequencies | ||||||

| Yes | Greece | 17 | 16 | 23 | 17 | 22 |

| Albania | 15 | 17 | 24 | 18 | 17 | |

| No | Greece | 8 | 9 | 2 | 8 | 3 |

| Albania | 10 | 8 | 1 | 7 | 8 | |

| Relative Frequencies | ||||||

| Yes | Greece | 0.68 | 0.64 | 0.92 | 0.68 | 0.88 |

| Albania | 0.60 | 0.68 | 0.96 | 0.72 | 0.68 | |

| No | Greece | 0.32 | 0.36 | 0.08 | 0.32 | 0.12 |

| Albania | 0.4 | 0.32 | 0.04 | 0.28 | 0.32 | |

| Key Criteria | Nationality | Mean | Std. Error of Mean | Std. Deviations |

|---|---|---|---|---|

| Financial Resources | Albanian | 4.0400 | 0.14697 | 0.73485 |

| Greek | 4.6000 | 0.12910 | 0.64550 | |

| Technological/Scientific Knowledge | Albanian | 4.2000 | 0.18257 | 0.91287 |

| Greek | 4.3600 | 0.12754 | 0.63770 | |

| Professional Skills | Albanian | 4.0800 | 0.19933 | 0.99666 |

| Greek | 4.4400 | 0.13013 | 0.65064 | |

| Customer Network | Albanian | 3.4000 | 0.14142 | 0.70711 |

| Greek | 3.9200 | 0.21541 | 1.07703 | |

| Business Model | Albanian | 2.7200 | 0.21229 | 1.06145 |

| Greek | 4.4800 | 0.16452 | 0.82260 |

| Key Criteria | Nationality | N | Mean Rank | Sum of Ranks |

|---|---|---|---|---|

| Financial Resources | Albanian | 25 | 20.26 | 506.50 |

| Greek | 25 | 30.74 | 768.50 | |

| Total | 50 | |||

| Technological/Scientific Knowledge | Albanian | 25 | 24.80 | 620.00 |

| Greek | 25 | 26.20 | 655.00 | |

| Total | 50 | |||

| Professional Skills | Albanian | 25 | 23.30 | 582.50 |

| Greek | 25 | 27.70 | 692.50 | |

| Total | 50 | |||

| Customer Network | Albanian | 25 | 21.52 | 538.00 |

| Greek | 25 | 29.48 | 737.00 | |

| Total | 50 | |||

| Business Model | Albanian | 25 | 15.68 | 392.00 |

| Greek | 25 | 35.32 | 883.00 | |

| Total | 50 |

| Financial Resources | Technological/Scientific Knowledge | Professional Skills | Customer Network | Business Model | |

|---|---|---|---|---|---|

| Mann-Whitney U | 181.5 | 295 | 257.5 | 213 | 67 |

| Wilcoxon W | 506.5 | 620 | 582.5 | 538 | 392 |

| Z | −2.775 | −0.369 | −1.159 | −2.048 | −4.923 |

| Asymp. Sig. (2-tailed) | 0.006 | 0.712 | 0.246 | 0.041 | 0.000 |

| a. Grouping Variable: Nationality | |||||

| Test | Value | df | Asymptotic Significance (2-Sided) |

|---|---|---|---|

| Pearson Chi-Square | 6.650 a | 1 | 0.01 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Giourka, P.; Kilintzis, P.; Samara, E.; Avlogiaris, G.; Farmaki, P.; Bakouros, Y. A Business Acceleration Program Supporting Cross-Border Enterprises: A Comparative Study. J. Open Innov. Technol. Mark. Complex. 2021, 7, 152. https://doi.org/10.3390/joitmc7020152

Giourka P, Kilintzis P, Samara E, Avlogiaris G, Farmaki P, Bakouros Y. A Business Acceleration Program Supporting Cross-Border Enterprises: A Comparative Study. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(2):152. https://doi.org/10.3390/joitmc7020152

Chicago/Turabian StyleGiourka, Paraskevi, Pavlos Kilintzis, Elpida Samara, Giorgos Avlogiaris, Polytimi Farmaki, and Yiannis Bakouros. 2021. "A Business Acceleration Program Supporting Cross-Border Enterprises: A Comparative Study" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 2: 152. https://doi.org/10.3390/joitmc7020152

APA StyleGiourka, P., Kilintzis, P., Samara, E., Avlogiaris, G., Farmaki, P., & Bakouros, Y. (2021). A Business Acceleration Program Supporting Cross-Border Enterprises: A Comparative Study. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 152. https://doi.org/10.3390/joitmc7020152