Academic Assets, Life-Cycle, and Entrepreneurship: A Longitudinal Study of Estonian Academic Workers

Abstract

1. Introduction

2. Literature Review

2.1. Firm Creation by Academic Workers: A Resource-Based Theory

2.1.1. Financial Assets

2.1.2. Intellectual Property Assets

2.1.3. Knowledge Assets

2.1.4. Organizational Assets

2.1.5. Personal Assets

2.2. Life-Cycle Context in Academia

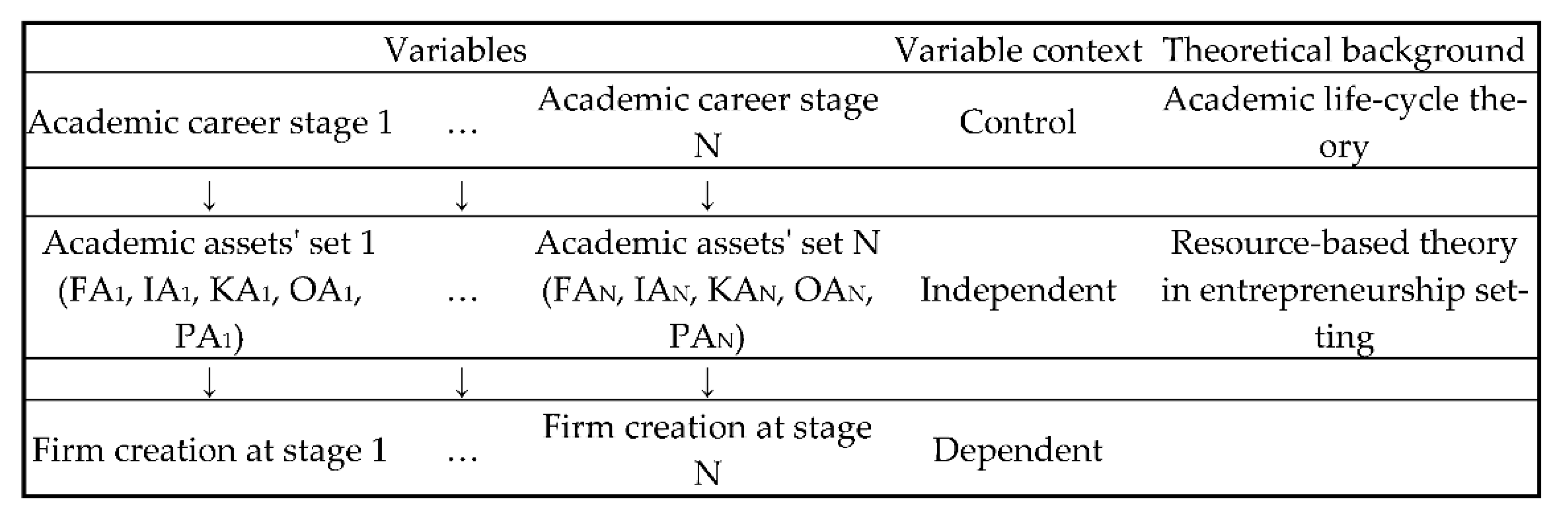

2.3. Conceptual Framework of the Study

3. Study Design

4. Empirical Analysis

4.1. Descriptive Statistics and Logistic Regression Models

4.2. Theoretical Conceptualization

5. Discussion of Findings

5.1. Comparison with Previous Empirical Research

5.2. Contribution to Innovation Literature

6. Practical Implications

7. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| STAGE_1 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 0.01 | 1.07 | 0.03 | 0.92 | 0.00 | |

| Founder | 0.17 | 1.90 | 0.05 | 2.73 | 0.07 | |

| Total | 0.03 * | 1.16 * | 0.03 | 1.12 ** | 0.01 *** | |

| STAGE_2 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 1.67 | 3.63 | 0.06 | 9.55 | 0.61 | |

| Founder | 2.88 | 4.22 | 0.14 | 11.19 | 0.56 | |

| Total | 1.87 * | 3.73 | 0.07 * | 9.82 | 0.60 | |

| STAGE_3 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 4.28 | 3.31 | 0.11 | 13.95 | 0.62 | |

| Founder | 6.48 | 3.59 | 0.15 | 16.11 | 0.61 | |

| Total | 4.64 | 3.35 | 0.11 | 14.30 | 0.62 | |

| STAGE_4 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 7.38 | 4.78 | 0.14 | 18.08 | 0.80 | |

| Founder | 11.20 | 6.65 | 0.40 | 21.05 | 0.75 | |

| Total | 7.92 | 5.04 | 0.18 ** | 18.51 | 0.79 |

| STAGE_1 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 0.01 | 0.26 | 0.01 | 0.18 | 0.00 | |

| Founder | 0.21 | 0.85 | 0.00 | 1.06 | 0.06 | |

| Total | 0.04 | 0.33 | 0.01 | 0.29 | 0.01 ** | |

| STAGE_2 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 1.29 | 1.20 | 0.00 | 3.58 | 0.34 | |

| Founder | 3.14 | 1.74 | 0.00 | 2.51 | 0.33 | |

| Total | 1.55 | 1.28 | 0.00 | 3.43 | 0.33 | |

| STAGE_3 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 3.62 | 1.67 | 0.01 | 5.25 | 0.38 | |

| Founder | 9.56 | 1.50 | 0.06 | 2.88 | 0.44 | |

| Total | 4.07 | 1.65 | 0.01 * | 5.07 | 0.38 | |

| STAGE_4 | Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 9.90 | 1.77 | 0.00 | 8.83 | 0.53 | |

| Founder | 5.14 | 2.00 | 0.14 | 6.71 | 0.29 | |

| Total | 9.40 | 1.79 | 0.01 ** | 8.61 | 0.51 |

References

- Abreu, M.; Grinevich, V. The nature of academic entrepreneurship in the UK: Widening the focus on entrepreneurial activities. Res. Policy 2013, 42, 408–422. [Google Scholar] [CrossRef]

- Perkmann, M.; Salandra, R.; Tartari, V.; McKelvey, M.; Hughes, A. Academic engagement: A review of the literature 2011. Res. Policy 2021, 50, 104114. [Google Scholar] [CrossRef]

- Heras-Rosas, C.D.L.; Herrera, J. Research Trends in Open Innovation and the Role of the University. J. Open Innov. Technol. Mark. Complex. 2021, 7, 29. [Google Scholar] [CrossRef]

- Mowery, D.C.; Nelson, R.R.; Sampat, B.N.; A Ziedonis, A. The growth of patenting and licensing by U.S. universities: An assessment of the effects of the Bayh–Dole act of 1980. Res. Policy 2001, 30, 99–119. [Google Scholar] [CrossRef]

- Fini, R.; Fu, K.; Mathisen, M.T.; Rasmussen, E.; Wright, M. Institutional determinants of university spin-off quantity and quality: A longitudinal, multilevel, cross-country study. Small Bus. Econ. 2017, 48, 361–391. [Google Scholar] [CrossRef]

- Bicknell, A.; Francis-Smythe, J.; Arthur, J. Knowledge transfer: Deconstructing the entrepreneurial academic. Int. J. Entrep. Behav. Res. 2010, 16, 485–501. [Google Scholar] [CrossRef]

- O’Shea, R.P.; Allen, T.J.; Chevalier, A.; Roche, F. Entrepreneurial orientation, technology transfer and spinoff performance of U.S. universities. Res. Policy 2005, 34, 994–1009. [Google Scholar] [CrossRef]

- Shane, S.A. Academic Entrepreneurship: University Spinoffs and Wealth Creation; Edward Elgar Publishing: Cheltenham, UK, 2004. [Google Scholar]

- Roberts, E. Entrepreneurs in High Technology: Lessons from MIT and Beyond; Oxford University Press: Oxford, UK, 1991. [Google Scholar]

- Miranda, F.J.; Chamorro-Mera, A.; Rubio, S. Academic entrepreneurship in Spanish universities: An analysis of the determinants of entrepreneurial intention. Eur. Res. Manag. Bus. Econ. 2017, 23, 113–122. [Google Scholar] [CrossRef]

- Hossinger, S.M.; Chen, X.; Werner, A. Drivers, barriers and success factors of academic spin-offs: A systematic literature review. Manag. Rev. Q. 2020, 70, 97–134. [Google Scholar] [CrossRef]

- Landry, R.; Amara, N.; Rherrad, I. Why are some university researchers more likely to create spin-offs than others? Evidence from Canadian universities. Res. Policy 2006, 35, 1599–1615. [Google Scholar] [CrossRef]

- Mõttus, M.; Lukason, O.; Varblane, U. Which Individual Characteristics are Associated with Academic Entrepreneurship? Evidence from Estonia. Int. J. Innov. Technol. Manag. 2019, 16, 1950018. [Google Scholar] [CrossRef]

- Iorio, R.; Labory, S.; Rentocchini, F. The importance of pro-social behaviour for the breadth and depth of knowledge transfer activities: An analysis of Italian academic scientists. Res. Policy 2017, 46, 497–509. [Google Scholar] [CrossRef]

- Jones-Evans, D. A typology of technology-based entrepreneurs. Int. J. Entrep. Behav. Res. 1995, 1, 26–47. [Google Scholar] [CrossRef]

- Renault, C.S. Academic Capitalism and University Incentives for Faculty Entrepreneurship. J. Technol. Transf. 2006, 31, 227–239. [Google Scholar] [CrossRef]

- Diamond, A.M. An economic model of the life-cycle research productivity of scientists. Science 1984, 6, 189–196. [Google Scholar] [CrossRef]

- Levin, S.G.; Stephan, P.E. Research productivity over the life cycle: Evidence for academic scientists. Am. Econ. Rev. 1991, 81, 114–132. Available online: https://www.jstor.org/stable/2006790 (accessed on 10 February 2021).

- Thursby, M.; Thursby, J.; Gupta-Mukherjee, S. Are there real effects of licensing on academic research? A life cycle view. J. Econ. Behav. Organ. 2007, 63, 577–598. [Google Scholar] [CrossRef]

- Bogers, M.; Chesbrough, H.; Moedas, C. Open Innovation: Research, Practices, and Policies. Calif. Manag. Rev. 2018, 60, 5–16. [Google Scholar] [CrossRef]

- Perkmann, M.; West, J.; Link, A.N.; Siegel, D.S.; Wright, M. Chapter Open Science and Open Innovation. In The Chicago Handbook of University Technology Transfer and Academic Entrepreneurship; University of Chicago Press: Chicago, IL, USA, 2015; pp. 41–74. [Google Scholar]

- Spender, J.-C.; Corvello, V.; Grimaldi, M.; Rippa, P. Startups and open innovation: A review of the literature. Eur. J. Innov. Manag. 2017, 20, 4–30. [Google Scholar] [CrossRef]

- Avalos-Quispe, G.A.; Hernández-Simón, L.M. Open Innovation in SMEs: Potential and Realized Absorptive Capacity for Interorganizational Learning in Dyad Collaborations with Academia. J. Open Innov. Technol. Mark. Complex. 2019, 5, 72. [Google Scholar] [CrossRef]

- Perkmann, M.; Walsh, K. University–industry relationships and open innovation: Towards a research agenda. Int. J. Manag. Rev. 2007, 9, 259–280. [Google Scholar] [CrossRef]

- Enkel, E.; Gassmann, O.; Chesbrough, H. Open R&D and open innovation: Exploring the phenomenon. R&D Manag. 2009, 39, 311–316. [Google Scholar] [CrossRef]

- Wynarczyk, P. Open innovation in SMEs. J. Small Bus. Enterp. Dev. 2013, 20, 258–278. [Google Scholar] [CrossRef]

- Gulbrandsen, M.; Smeby, J.-C. Industry funding and university professors’ research performance. Res. Policy 2005, 34, 932–950. [Google Scholar] [CrossRef]

- Louis, K.S.; Blumenthal, D.; Gluck, M.E.; Stoto, M.A. Entrepreneurs in Academe: An Exploration of Behaviors among Life Scientists. Adm. Sci. Q. 1989, 34, 110. [Google Scholar] [CrossRef]

- Perkmann, M.; Tartari, V.; McKelvey, M.; Autio, E.; Broström, A.; D’Este, P.; Fini, R.; Geuna, A.; Grimaldi, R.; Hughes, A.; et al. Academic engagement and commercialisation: A review of the literature on university–industry relations. Res. Policy 2013, 42, 423–442. [Google Scholar] [CrossRef]

- Aldridge, T.T.; Audretsch, D.; Desai, S.; Nadella, V. Scientist entrepreneurship across scientific fields. J. Technol. Transf. 2014, 39, 819–835. [Google Scholar] [CrossRef]

- Aldridge, T.T.; Audretsch, D. The Bayh-Dole Act and scientist entrepreneurship. Res. Policy 2011, 40, 1058–1067. [Google Scholar] [CrossRef]

- D’Este, P.; Perkmann, M. Why do academics engage with industry? The entrepreneurial university and individual motivations. J. Technol. Transf. 2011, 36, 316–339. [Google Scholar] [CrossRef]

- Goel, R.K.; Grimpe, C. Are all academic entrepreneurs created alike? Evidence from Germany. Econ. Innov. New Technol. 2012, 21, 247–266. [Google Scholar] [CrossRef]

- D’Este, P.; Mahdi, S.; Neely, A. Academic Entrepreneurship: What Are the Factors Shaping the Capacity of Academic Researchers to Identify and Exploit Entrepreneurial Opportunities? DRUID Working Paper No. 10–05. Available online: https://wp.druid.dk/wp/20100005.pdf (accessed on 10 February 2021).

- D’Este, P.; Mahdi, S.; Neely, A.; Rentocchini, F. Inventors and entrepreneurs in academia: What types of skills and experience matter? Technovation 2012, 32, 293–303. [Google Scholar] [CrossRef]

- Krabel, S.; Mueller, P. What drives scientists to start their own company? Res. Policy 2009, 38, 947–956. [Google Scholar] [CrossRef]

- Stuart, T.E.; Ding, W.W. When Do Scientists Become Entrepreneurs? The Social Structural Antecedents of Commercial Activity in the Academic Life Sciences. Am. J. Sociol. 2006, 112, 97–144. [Google Scholar] [CrossRef]

- Marion, T.J.; Dunlap, D.R.; Friar, J.H. The university entrepreneur: A census and survey of attributes and outcomes. R&D Manag. 2012, 42, 401–419. [Google Scholar] [CrossRef]

- Karlsson, T.; Wigren, C. Start-ups among university employees: The influence of legitimacy, human capital and social capital. J. Technol. Transf. 2010, 37, 297–312. [Google Scholar] [CrossRef]

- Haeussler, C.; Colyvas, J.A. Breaking the Ivory Tower: Academic Entrepreneurship in the Life Sciences in UK and Germany. Res. Policy 2011, 40, 41–54. [Google Scholar] [CrossRef]

- Clarysse, B.; Tartari, V.; Salter, A. The impact of entrepreneurial capacity, experience and organizational support on academic entrepreneurship. Res. Policy 2011, 40, 1084–1093. [Google Scholar] [CrossRef]

- Blake, D. Motivations and Paths to Becoming Faculty at Minority Serving Institutions. Educ. Sci. 2018, 8, 30. [Google Scholar] [CrossRef]

- Becker, G.S. Human Capital: A Theoretical and Empirical Analysis, with Special Reference to Education. National Bureau of Economic Research: New York, NY, USA, 1965; 187p, distributed by Columbia University Press. [Google Scholar]

- Goodwin, T.H.; Sauer, R.D. Life Cycle Productivity in Academic Research: Evidence from Cumulative Publication Histories of Academic Economists. South. Econ. J. 1995, 61, 728. [Google Scholar] [CrossRef]

- Rauber, M.; Ursprung, H.W. Evaluation of Researchers: A Life Cycle Analysis of German Academic Economists. Conf. New Politi-Econ. 2008, 25, 101–122. [Google Scholar] [CrossRef]

- Bercovitz, J.; Feldman, M. Academic Entrepreneurs: Organizational Change at the Individual Level. Organ. Sci. 2008, 19, 69–89. [Google Scholar] [CrossRef]

- Carayol, N. Academic Incentives, Research Organization and Patenting at a Large French University. Econ. Innov. New Technol. 2007, 16, 119–138. [Google Scholar] [CrossRef]

- Link, A.N.; Siegel, D.S.; Bozeman, B. An empirical analysis of the propensity of academics to engage in informal university technology transfer. Ind. Corp. Chang. 2007, 16, 641–655. [Google Scholar] [CrossRef]

- Stephan, P.E.; Gurmu, S.; Sumell, A.J.; Black, G. Who’s Patenting in the University? Evidence from the Survey of Doctorate Recipients. Econ. Innov. New Technol. 2007, 16, 71–99. [Google Scholar] [CrossRef]

- QS Top Universities. Rankings. Available online: https://www.topuniversities.com (accessed on 8 March 2021).

- Kindsiko, E.; Baruch, Y. Careers of PhD graduates: The role of chance events and how to manage them. J. Vocat. Behav. 2019, 112, 122–140. [Google Scholar] [CrossRef]

- Statistics Estonia. Statistical Database. Available online: https://andmed.stat.ee/en/stat (accessed on 8 March 2021).

- Estonian Business Register. Statistics. Available online: https://www.rik.ee/et/e-ariregister/statistika (accessed on 8 March 2021).

- The World Bank. Ease of Doing Business in Estonia. Available online: https://www.doingbusiness.org/en/data/exploreeconomies/estonia (accessed on 8 March 2021).

- Mohnen, P.; Rõigas, K.; Varblane, U. Which firms use universities as cooperation partners?—A comparative view in Europe. Int. J. Technol. Manag. 2018, 76, 32. [Google Scholar] [CrossRef]

- University of Tartu. UT Spin-Off Programme. Available online: https://en.eik.ut.ee (accessed on 8 March 2021).

- BiGGAR Economics. Economic Contribution of the Estonian Universities. A Report to Non-Profit Association Universities Estonia. Available online: http://ern.ee/files/Biggar/economicimpact.pdf (accessed on 8 March 2021).

- Commercial Code. 2021. Available online: https://www.riigiteataja.ee/en/eli/ee/Riigikogu/act/511012021004/consolide (accessed on 8 March 2021).

- Lukason, O.; Camacho-Miñano, M.-D.-M. Corporate Governance Characteristics of Private SMEs’ Annual Report Submission Violations. J. Risk Financ. Manag. 2020, 13, 230. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Jeong, E.; Park, K.; Lee, D.; Yigitcanlar, T. Dismantling of the Inverted U-Curve of Open Innovation. Sustainability 2017, 9, 1423. [Google Scholar] [CrossRef]

- Zhu, X.; Xiao, Z.; Dong, M.C.; Gu, J. The fit between firms’ open innovation and business model for new product development speed: A contingent perspective. Technovation 2019, 86–87, 75–85. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

| Variable (Coding) | Content |

|---|---|

| Firm foundation (FOUNDER) | 1 if a person founded a firm, 0 otherwise |

| Supervision experience (SUPEXP) | Number of supervisions of master’s and doctoral theses 1 |

| Involvement in (applied) scientific projects (PROJECT) | Number of projects where the person is/was either the project’s head or one of the main executors |

| Intellectual property authorship (IP) | 1 if there is at least one intellectual property object 2 the person has authored |

| Publications (PUBLIC) | Number of high-quality 3 publications the person has authored |

| Doctoral degree (PHD) | 1 if a person has a doctoral degree, 0 otherwise |

| Population | STAGE_1 | STAGE_2 | STAGE_3 | STAGE_4 | Total |

|---|---|---|---|---|---|

| All workers | |||||

| Non-founder | 713 | 641 | 474 | 180 | 2008 |

| Founder | 93 | 116 | 70 | 27 | 306 |

| Total | 806 | 757 | 544 | 207 | 2314 |

| Only science workers | |||||

| Non-founder | 491 | 369 | 277 | 120 | 1257 |

| Founder | 60 | 73 | 54 | 20 | 207 |

| Total | 551 | 442 | 331 | 140 | 1464 |

| Only non-science workers | |||||

| Non-founder | 222 | 272 | 197 | 60 | 751 |

| Founder | 33 | 43 | 16 | 7 | 99 |

| Total | 255 | 315 | 213 | 67 | 850 |

| STAGE_1 | |||||

| Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 0.01 | 0.82 | 0.02 | 0.69 | 0.00 |

| Founder | 0.18 | 1.53 | 0.03 | 2.14 | 0.06 |

| Total | 0.03 * | 0.90 * | 0.02 | 0.86 ** | 0.01 *** |

| STAGE_2 | |||||

| Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 1.51 | 2.60 | 0.04 | 7.02 | 0.50 |

| Founder | 2.97 | 3.30 | 0.09 | 7.97 | 0.47 |

| Total | 1.74 | 2.71 | 0.04 * | 7.17 | 0.49 * |

| STAGE_3 | |||||

| Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 4.01 | 2.63 | 0.07 | 10.33 | 0.52 |

| Founder | 7.19 | 3.11 | 0.13 | 13.09 | 0.57 |

| Total | 4.42 * | 2.69 | 0.07 | 10.69 | 0.53 |

| STAGE_4 | |||||

| Status | SUPEXP | PROJECT | IP | PUBLIC | PHD |

| Non-founder | 8.22 | 3.77 | 0.09 | 15.00 | 0.71 |

| Founder | 9.63 | 5.44 | 0.33 | 17.33 | 0.63 |

| Total | 8.40 | 3.99 | 0.13 *** | 15.30 | 0.70 |

| All Workers 1 | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | STAGE_1 | STAGE_2 | STAGE_3 | STAGE_4 | ||||

| B | p-value | B | p-value | B | p-value | B | p-value | |

| SUPEXP | 1.064 | 0.014 | 0.048 | 0.011 | 0.031 | 0.031 | −0.005 | 0.813 |

| PROJECT | 0.032 | 0.642 | 0.030 | 0.226 | −0.009 | 0.750 | 0.050 | 0.199 |

| IP | −0.174 | 0.810 | 0.881 | 0.043 | 0.690 | 0.123 | 1.909 | 0.001 |

| PUBLIC | 0.159 | 0.005 | −0.009 | 0.418 | −0.004 | 0.681 | 0.010 | 0.407 |

| PHD | 1.158 | 0.191 | −0.276 | 0.253 | 0.037 | 0.905 | −1.427 | 0.022 |

| Constant | −2.333 | 0.000 | −1.748 | 0.000 | −2.081 | 0.000 | −1.679 | 0.000 |

| Only Science Workers | ||||||||

| Variable | STAGE_1 | STAGE_2 | STAGE_3 | STAGE_4 | ||||

| B | p-value | B | p-value | B | p-value | B | p-value | |

| SUPEXP | 1.457 | 0.015 | 0.059 | 0.068 | 0.030 | 0.128 | 0.014 | 0.615 |

| PROJECT | 0.017 | 0.829 | 0.011 | 0.699 | −0.011 | 0.733 | 0.040 | 0.334 |

| IP | 0.008 | 0.991 | 0.834 | 0.059 | 0.342 | 0.459 | 1.508 | 0.017 |

| PUBLIC | 0.162 | 0.009 | −0.005 | 0.693 | 0.001 | 0.919 | 0.006 | 0.606 |

| PHD | 0.859 | 0.430 | −0.416 | 0.169 | −0.275 | 0.460 | −1.379 | 0.070 |

| Constant | −2.468 | 0.000 | −1.577 | 0.000 | −1.649 | 0.000 | −1.598 | 0.001 |

| Only Non-Science Workers | ||||||||

| Variable | STAGE_1 | STAGE_2 | STAGE_3 | STAGE_4 | ||||

| B | p-value | B | p-value | B | p-value | B | p-value | |

| SUPEXP | 0.550 | 0.305 | 0.052 | 0.026 | 0.077 | 0.010 | −0.164 | 0.240 |

| PROJECT | 0.275 | 0.166 | 0.099 | 0.102 | 0.018 | 0.799 | 0.827 | 0.045 |

| IP | −19.015 | 0.999 | N/A 2 | N/A 2 | 7.146 | 0.430 | 38.894 | 0.999 |

| PUBLIC | 0.279 | 0.128 | −0.107 | 0.070 | −0.131 | 0.071 | −0.303 | 0.264 |

| PHD | 0.857 | 0.636 | 0.216 | 0.639 | 0.495 | 0.446 | −1.892 | 0.364 |

| Constant | −2.188 | 0.000 | −1.850 | 0.000 | −2.725 | 0.000 | −1.928 | 0.001 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mõttus, M.; Lukason, O. Academic Assets, Life-Cycle, and Entrepreneurship: A Longitudinal Study of Estonian Academic Workers. J. Open Innov. Technol. Mark. Complex. 2021, 7, 113. https://doi.org/10.3390/joitmc7020113

Mõttus M, Lukason O. Academic Assets, Life-Cycle, and Entrepreneurship: A Longitudinal Study of Estonian Academic Workers. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(2):113. https://doi.org/10.3390/joitmc7020113

Chicago/Turabian StyleMõttus, Maksim, and Oliver Lukason. 2021. "Academic Assets, Life-Cycle, and Entrepreneurship: A Longitudinal Study of Estonian Academic Workers" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 2: 113. https://doi.org/10.3390/joitmc7020113

APA StyleMõttus, M., & Lukason, O. (2021). Academic Assets, Life-Cycle, and Entrepreneurship: A Longitudinal Study of Estonian Academic Workers. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 113. https://doi.org/10.3390/joitmc7020113