The Influence of Local Economic Conditions on Start-Ups and Local Open Innovation System

Abstract

1. Introduction

2. Literature Studies

2.1. Innovativness As a Distinguishing Feature of Start-Ups

- (1)

- introducing a new product that customers have not yet used or giving new features to an existing product,

- (2)

- implementation of a new production method not previously used by the relevant industry,

- (3)

- opening up a new market where the industry has not previously operated,

- (4)

- acquiring new sources of production raw materials,

- (5)

- introduction of a new organizational structure in a given industry [21].

2.2. Determinants of Existence and Development of Start-Ups

- high capital intensity;

- unique product/service and business model;

- lack of history of the company operation;

- lack of collateral for the loan;

- high risk of bankruptcy.

2.3. The Role of City Authorities in the Development of Local Entrepreneurship

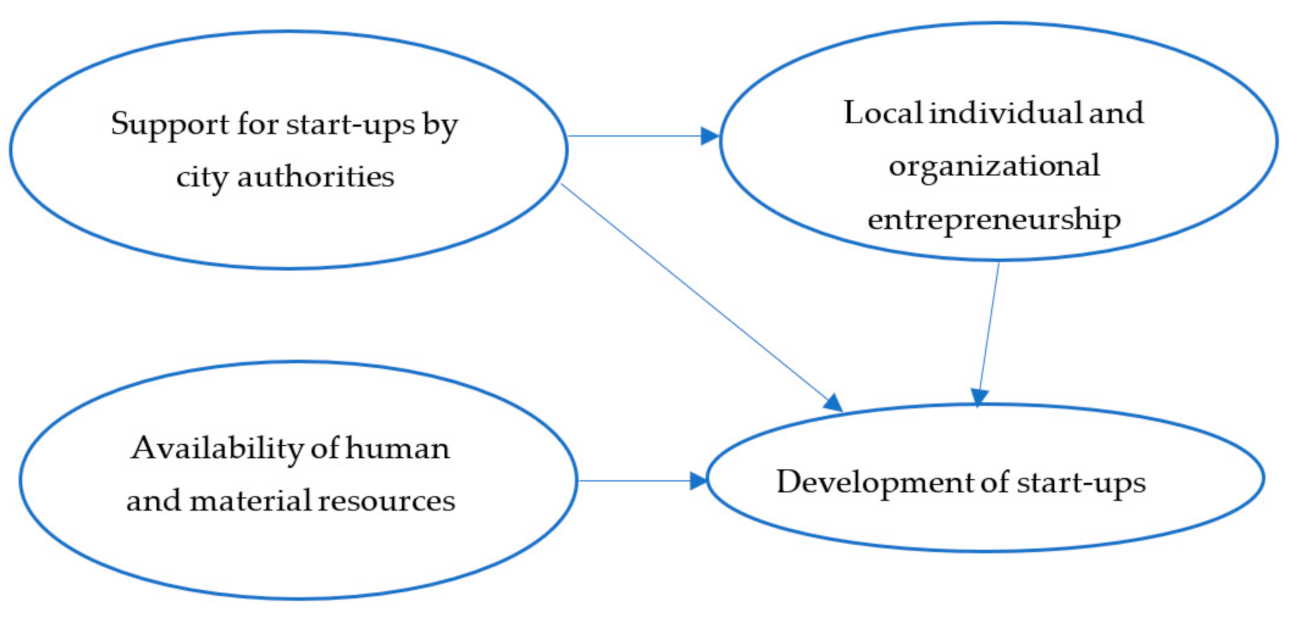

3. Materials and Methods

- What is the direction and strength of the influence of individual urban determinants (directly or indirectly created by the city) on the development of start-ups?

- What is the hierarchy of determinants of start-ups development in cities?

- Do municipal authorities in Poland, which is a developing economy, have a positive influence on local entrepreneurship implemented in the form of start-ups?

- How can cities use the experience and the identified interdependencies to develop start-ups in the future?

- availability of human and material resources;

- local individual and organizational entrepreneurship (technology parks and business incubators);

- support of the city authorities.

- Steiger-Lind’s RMSEA;

- GFI (goodness of fit index);

- AGFI (adjusted goodness of fit index).

- its construction included the existing and presented theory,

- sequential approach was used for estimation of measurement and structural model parameters,

- relationships between implicit variables were verified and tested to check the effectiveness and functionality of existing relationships.

4. Results

4.1. Statistical Analysis of Model Dimensions

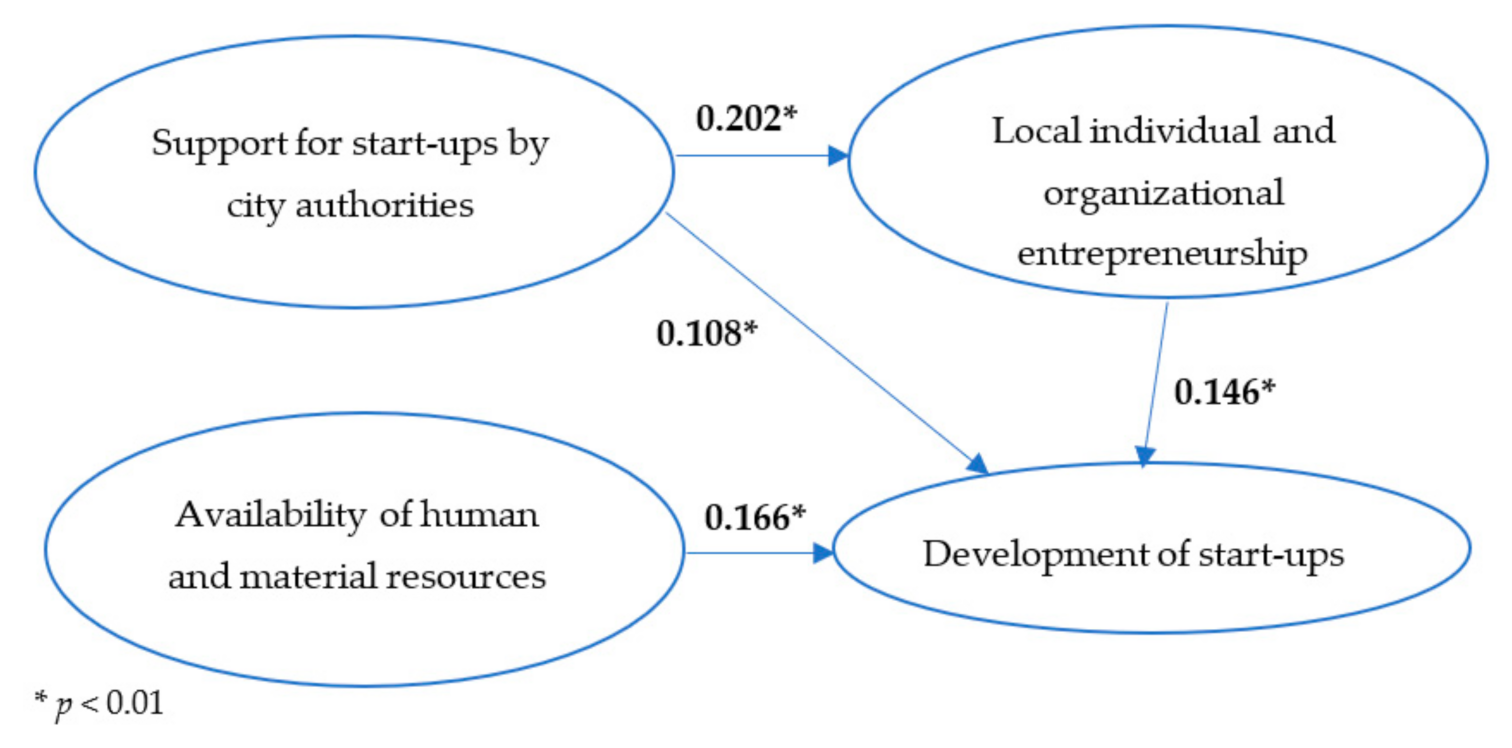

4.2. Estimation of Parameters and Goodness of Fit of The Structural Model

- Steiger-Lind’s RMSEA = 0.194

- GFI (goodness of fit index) = 0.697

- AGFI (adjusted goodness of fit index) = 0.433

5. Discussion

6. Conclusions

- cities should actively participate in the creation of local entrepreneurship, as this encourages the development of start-ups;

- city authorities interested in the creation of start-ups should first focus on providing them with access to intellectual and financial capital of high quality and sufficiency;

- the operations of business incubators and technology parks should be monitored and evaluated in terms of effectiveness and efficiency of support for start-ups.

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Ghezzi, A.; Cavallo, A. Agile Business Model Innovation in Digital Entrepreneurship: Lean Startup Approaches. J. Bus. Res. 2020, 110, 519–537. [Google Scholar] [CrossRef]

- de Faria, V.F.; Santos, V.P.; Zaidan, F.H. The Business Model Innovation and Lean Startup Process Supporting Startup Sustainability. Procedia Comput. Sci. 2021, 181, 93–101. [Google Scholar] [CrossRef]

- Barandiaran-Irastorza, X.; Peña-Fernández, S.; Unceta-Satrústegui, A. The Archipelago of Cultural and Creative Industries: A Case Study of the Basque Country. Economies 2020, 8, 21. [Google Scholar] [CrossRef]

- Jesemann, I. Support of startup innovation towards development of new industries. Procedia Cirp 2020, 88, 3–8. [Google Scholar] [CrossRef]

- Spender, J.-C.; Corvello, V.; Grimaldi, M.; Rippa, P. Startups and open innovation: A review of the literature. Eur. J. Innov. Manag. 2017, 20, 4–30. [Google Scholar] [CrossRef]

- Cockayne, D. What is a startup firm? A methodological and epistemological investigation into research objects in economic geography. Geoforum 2019, 107, 77–87. [Google Scholar] [CrossRef]

- Bărbulescu, O.; Tecău, A.; Munteanu, D.; Constantin, C. Innovation of Startups, the Key to Unlocking Post-Crisis Sustainable Growth in Romanian Entrepreneurial Ecosystem. Sustainability 2021, 13, 671. [Google Scholar] [CrossRef]

- Skawińska, E.; Zalewski, R.I. Success Factors of Startups in the EU—A Comparative Study. Sustainability 2020, 12, 8200. [Google Scholar] [CrossRef]

- Aldianto, L.; Anggadwita, G.; Permatasari, A.; Mirzanti, I.; Williamson, I. Toward a Business Resilience Framework for Startups. Sustainability 2021, 13, 3132. [Google Scholar] [CrossRef]

- Romero-Rodríguez, J.-M.; Ramírez-Montoya, M.-S.; Aznar-Díaz, I.; Hinojo-Lucena, F.-J. Social Appropriation of Knowledge as a Key Factor for Local Development and Open Innovation: A Systematic Review. J. Open Innov. Technol. Mark. Complex. 2020, 6, 44. [Google Scholar] [CrossRef]

- Florida, R. Which Type of Place Is More Innovative, the City or the Suburbs?” CityLab. 2017. Available online: https://www.citylab.com/life/2017/08/the-geography-of-innovation/530349/ (accessed on 26 March 2021).

- Dvir, R.; Pasher, E. Innovation engines for knowledge cities: An innovation ecology perspective. J. Knowl. Manag. 2004, 8, 16–27. [Google Scholar] [CrossRef]

- Glaeser, E. Triumph of the City: How Our Greatest Invention Makes Us Richer, Smarter, Greener, Healthier, and Happier (an excerpt) (translated by Inna Kushnareva). J. Econ. Sociol. 2013, 14, 75–94. [Google Scholar] [CrossRef]

- Anttiroiko, A.-V.; Laine, M.; Lönnqvist, H. City as a Growth Platform: Responses of the Cities of Helsinki Metropolitan Area to Global Digital Economy. Urban Sci. 2020, 4, 67. [Google Scholar] [CrossRef]

- Yun, Y.; Lee, M. Smart City 4.0 from the Perspective of Open Innovation. J. Open Innov. Technol. Mark. Complex. 2019, 5, 92. [Google Scholar] [CrossRef]

- Yun, J.J.; Jeong, E.; Yang, J. Open innovation of knowledge cities. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1–20. [Google Scholar] [CrossRef]

- Lysenko, I.; Stepenko, S.; Dyvnych, H. Indicators of Regional Innovation Clusters’ Effectiveness in the Higher Education System. Educ. Sci. 2020, 10, 245. [Google Scholar] [CrossRef]

- Saleh, H.; Surya, B.; Ahmad, D.N.A.; Manda, D. The Role of Natural and Human Resources on Economic Growth and Regional Development: With Discussion of Open Innovation Dynamics. J. Open Innov. Technol. Mark. Complex. 2020, 6, 103. [Google Scholar] [CrossRef]

- Kim, C.; Seo, E.-H.; Booranabanyat, C.; Kim, K. Effects of Emerging-Economy Firms’ Knowledge Acquisition from an Advanced International Joint Venture Partner on Their Financial Performance Based on the Open Innovation Perspective. J. Open Innov. Technol. Mark. Complex. 2021, 7, 67. [Google Scholar] [CrossRef]

- Surya, B.; Menne, F.; Sabhan, H.; Suriani, S.; Abubakar, H.; Idris, M. Economic Growth, Increasing Productivity of SMEs, and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 20. [Google Scholar] [CrossRef]

- Schumpeter, J. Teoria Rozwoju Gospodarczego; Wydawnictwo Naukowe PWN: Warszawa, Poland, 1960. [Google Scholar]

- Oslo Manual. 2005. Available online: https://ec.europa.eu/eurostat/web/products-manuals-and-guidelines/-/OSLO (accessed on 26 March 2021).

- Radomska, E. Innowacyjność jako wyzwanie rozwojowe–Uwarunkowania działalności innowacyjnej przedsiębiorstw. KNUV 2015, 4, 63–85. [Google Scholar]

- Robbins, P.; O’Gorman, C.; Huff, A.; Moeslein, K. Multidexterity—A New Metaphor for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 99. [Google Scholar] [CrossRef]

- Bellantuono, N.; Pontrandolfo, P.; Scozzi, B. Measuring the Openness of Innovation. Sustainability 2021, 13, 2205. [Google Scholar] [CrossRef]

- Mathrani, S.; Edwards, B. Knowledge-Sharing Strategies in Distributed Collaborative Product Development. J. Open Innov. Technol. Mark. Complex. 2020, 6, 194. [Google Scholar] [CrossRef]

- Bril, A.; Kalinina, O.; Valebnikova, O.; Valebnikova, N.; Camastral, M.; Shustov, D.; Ostrovskaya, N. Improving Personnel Management by Organizational Projects: Implications for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 105. [Google Scholar] [CrossRef]

- Ryu, D.; Baek, K.; Yoon, J. Open Innovation with Relational Capital, Technological Innovation Capital, and International Performance in SMEs. Sustainability 2021, 13, 3418. [Google Scholar] [CrossRef]

- Kowalczyk, I. Start-up jako przejaw innowacyjnej przedsiębiorczości w Polsce. Studia Ekon. Prawne I Adm. 2020, 1, 12–21. [Google Scholar]

- Kollmann, T.; Stöckman, C.; Linstaed, J.; Kensbock, J. European Startup Monitor; German Startups Association: Berlin, Germany, 2015. [Google Scholar]

- Ries, E. Metoda Lean Startup. In Wykorzystaj Innowacyjne Narzędzia i Stwórz Firmę, Która Zdobędzie Rynek; Helion: Gliwice, Poland, 2012. [Google Scholar]

- Yun, J.; Zhao, X. Business Model Innovation through a Rectangular Compass: From the Perspective of Open Innovation with Mechanism Design. J. Open Innov. Technol. Mark. Complex. 2020, 6, 131. [Google Scholar] [CrossRef]

- Marzec, P.; Sliż, P. The specificity of Polish and Israeli start-ups utilizing modern ICT technologies. Scientific Quarterly. Organ. Manag. 2020, 2. [Google Scholar] [CrossRef]

- Chesbrough, H.W.; Garman, A.R. Otwarta innowacyjność: Recepta na trudne czasy. Harv. Bus. Rev. Pol. 2019, 11, 288–302. [Google Scholar]

- Chesbrough, H.W. Open Innovation: The New Imperative for Creating and Profiting from Technology; Harvard Business School Press: Boston, MA, USA, 2003. [Google Scholar]

- Buganza, T.; Verganti, R. Open Innovation Process to Inbound Knowledge. Collab. Univ. Four Lead. Firms Eur. J. Innov. Manag. 2009, 12, 306–325. [Google Scholar] [CrossRef]

- Mousa, M.; Nosratabadi, S.; Sagi, J.; Mosavi, A. The Effect of Marketing Investment on Firm Value and Systematic Risk. J. Open Innov. Technol. Mark. Complex. 2021, 7, 64. [Google Scholar] [CrossRef]

- Guede-Cid, R.; Rodas-Alfaya, L.; Leguey-Galán, S.; Cid-Cid, A. Innovation Efficiency in the Spanish Service Sectors, and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2021, 7, 62. [Google Scholar] [CrossRef]

- Eppinger, E. How Open Innovation Practices Deliver Societal Benefits. Sustainability 2021, 13, 1431. [Google Scholar] [CrossRef]

- Zarrouk, H.; El Ghak, T.; Bakhouche, A. Exploring Economic and Technological Determinants of FinTech Startups’ Success and Growth in the United Arab Emirates. J. Open Innov. Technol. Mark. Complex. 2021, 7, 50. [Google Scholar] [CrossRef]

- Zhou, Y.; Park, S. The Regional Determinants of the New Venture Formation in China’s Car-Sharing Economy. Sustainability 2020, 13, 74. [Google Scholar] [CrossRef]

- Kim, H.; Jo, Y.; Lee, D. R&D, Marketing, Strategic Planning, or Human Resources? Which CEO Career Is Most Helpful for the Economic Sustainability of ICT Startups in South Korea? Sustainability 2021, 13, 2729. [Google Scholar] [CrossRef]

- Tsolakidis, P.; Mylonas, N.; Petridou, E.; Mylonas, N. The Impact of Imitation Strategies, Managerial and Entrepreneurial Skills on Startups’ Entrepreneurial Innovation. Economies 2020, 8, 81. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.; Hanne, T. Fostering Continuous Value Proposition Innovation through Freelancer Involvement in Software Startups: Insights from Multiple Case Studies. Sustainability 2020, 12, 8922. [Google Scholar] [CrossRef]

- Gupta, V.; Fernandez-Crehuet, J.M.; Hanne, T.; Telesko, R. Fostering product innovations in software startups through freelancer supported requirement engineering. Results Eng. 2020, 8, 100175. [Google Scholar] [CrossRef]

- Baum, J.A.; Silverman, B.S. Picking winners or building them? Alliance, intellectual, and human capital as selection criteria in venture financing and performance of biotechnology startups. J. Bus. Ventur. 2004, 19, 411–436. [Google Scholar] [CrossRef]

- Marvel, M.R.; Wolfe, M.T.; Kuratko, D.F. Escaping the knowledge corridor: How founder human capital and founder coachability impacts product innovation in new ventures. J. Bus. Ventur. 2020, 35, 106060. [Google Scholar] [CrossRef]

- Riepe, J.; Uhl, K. Startups’ demand for non-financial resources: Descriptive evidence from an international corporate venture capitalist. Financ. Res. Lett. 2020, 36, 101321. [Google Scholar] [CrossRef]

- Hudáková, M.; Urbancová, H.; Vnoučková, L. Key Criteria and Competences Defining the Sustainability of Start-Up Teams and Projects in the Incubation and Acceleration Phase. Sustainability 2019, 11, 6720. [Google Scholar] [CrossRef]

- Bergset, L. The Rationality and Irrationality of Financing Green Start-Ups. Adm. Sci. 2015, 5, 260–285. [Google Scholar] [CrossRef]

- Lee, M.; Park, S.; Lee, K.-S. What Are the Features of Successful Medical Device Start-Ups? Evidence from KOREA. Sustainability 2019, 11, 1948. [Google Scholar] [CrossRef]

- Chammassian, R.G.; Sabatier, V. The role of costs in business model design for early-stage technology startups. Technol. Forecast. Soc. Chang. 2020, 157, 120090. [Google Scholar] [CrossRef]

- Nigama, N.; Benetti, C.; Johan, S.A. Digital start-up access to venture capital financing: What signals quality? Emerg. Mark. Rev. 2020, 45, 100743. [Google Scholar] [CrossRef]

- Xu, J.; Yu, L.; Gupta, R. Evaluating the Performance of the Government Venture Capital Guiding Fund Using the Intuitionistic Fuzzy Analytic Hierarchy Process. Sustainability 2020, 12, 6908. [Google Scholar] [CrossRef]

- Kang, M. Sustainable Profit versus Unsustainable Growth: Are Venture Capital Investments and Governmental Support Medicines or Poisons? Sustainability 2020, 12, 7773. [Google Scholar] [CrossRef]

- Jeong, J.; Kim, J.; Son, H.; Nam, D.-I. The Role of Venture Capital Investment in Startups’ Sustainable Growth and Performance: Focusing on Absorptive Capacity and Venture Capitalists’ Reputation. Sustainability 2020, 12, 3447. [Google Scholar] [CrossRef]

- Cavallo, A.; Ghezzi, A.; Dell’Era, C.; Pellizzoni, E. Fostering digital entrepreneurship from startup to scaleup: The role of venture capital funds and angel groups. Technol. Forecast. Soc. Chang. 2019, 145, 24–35. [Google Scholar] [CrossRef]

- Antretter, T.; Sirén, C.; Grichnik, D.; Wincent, J. Should business angels diversify their investment portfolios to achieve higher performance? The role of knowledge access through co-investment networks. J. Bus. Ventur. 2020, 35, 106043. [Google Scholar] [CrossRef]

- Deleau, V.; Yu, J.Y. Risk and Return Management through Smart Contract Profit Redistribution. Multidiscip. Digit. Publ. Inst. Proc. 2019, 28, 3. [Google Scholar] [CrossRef]

- Wang, L.; Zhou, F.; An, Y. Determinants of control structure choice between entrepreneurs and investors in venture capital-backed startups. Econ. Model. 2017, 63, 215–225. [Google Scholar] [CrossRef]

- Li, J.-J.; Xu, C.; Fung, H.-G.; Chan, K.C. Do venture capital firms promote corporate social responsibility? Int. Rev. Econ. Financ. 2021, 71, 718–732. [Google Scholar] [CrossRef]

- Johansson, J.; Malmström, M.; Wincent, J. Sustainable Investments in Responsible SMEs: That’s What’s Distinguish Government VCs from Private VCs. J. Risk Financ. Manag. 2021, 14, 25. [Google Scholar] [CrossRef]

- Pinkow, F.; Iversen, J. Strategic Objectives of Corporate Venture Capital as a Tool for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 157. [Google Scholar] [CrossRef]

- Hommel, K.; Bican, P. Digital Entrepreneurship in Finance: Fintechs and Funding Decision Criteria. Sustainability 2020, 12, 8035. [Google Scholar] [CrossRef]

- Silvola, H. Do organizational life-cycle and venture capital investors affect the management control systems used by the firm? Adv. Account. 2008, 24, 128–138. [Google Scholar] [CrossRef]

- Kollmann, T.; Kuckertz, A.; Middelberg, N. Trust and controllability in venture capital fundraising. J. Bus. Res. 2014, 67, 2411–2418. [Google Scholar] [CrossRef]

- Nguyen, G.; Vu, L. Does venture capital syndication affect mergers and acquisitions? J. Corp. Financ. 2021, 67, 101851. [Google Scholar] [CrossRef]

- Santos, R.S.; Qin, L. Risk Capital and Emerging Technologies: Innovation and Investment Patterns Based on Artificial Intelligence Patent Data Analysis. J. Risk Financ. Manag. 2019, 12, 189. [Google Scholar] [CrossRef]

- Hong, Y.; Xu, D.; Xiang, K.; Qiao, H.; Cui, X.; Xian, H. Multi-Attribute Decision-Making Based on Preference Perspective with Interval Neutrosophic Sets in Venture Capital. Mathematics 2019, 7, 257. [Google Scholar] [CrossRef]

- Buchner, A.; Mohamed, A.; Schwienbacher, A. Diversification, risk, and returns in venture capital. J. Bus. Ventur. 2017, 32, 519–535. [Google Scholar] [CrossRef]

- Geronikolaou, G.; Papachristou, G. Investor competition and project risk in Venture Capital investments. Econ. Lett. 2016, 141, 67–69. [Google Scholar] [CrossRef]

- Zhang, X. Study on Venture Capital Investment Risk Avoiding Base on Option Pricing in Agricultural Production and Processing Enterprises. Phys. Procedia 2012, 33, 1580–1587. [Google Scholar] [CrossRef]

- Liu, J.; Tang, J.; Zhou, B.; Liang, Z. The Effect of Governance Quality on Economic Growth: Based on China’s Provincial Panel Data. Economies 2018, 6, 56. [Google Scholar] [CrossRef]

- Yigitcanlar, T.; Corchado, J.; Mehmood, R.; Li, R.; Mossberger, K.; Desouza, K. Responsible Urban Innovation with Local Government Artificial Intelligence (AI): A Conceptual Framework and Research Agenda. J. Open Innov. Technol. Mark. Complex. 2021, 7, 71. [Google Scholar] [CrossRef]

- Ilyas, A.; Khan, A.H.; Zaid, F.; Ali, M.; Razzaq, A.; Khan, W.A. Turnover Intention of Employees, Supervisor Support, and Open Innovation: The Role of Illegitimate Tasks. J. Open Innov. Technol. Mark. Complex. 2020, 6, 128. [Google Scholar] [CrossRef]

- Grigore, A.-M.; Dragan, I.-M. Towards Sustainable Entrepreneurial Ecosystems in a Transitional Economy: An Analysis of Two Romanian City-Regions through the Lens of Entrepreneurs. Sustainability 2020, 12, 6061. [Google Scholar] [CrossRef]

- Bărbulescu, O.; Constantin, C.P. Sustainable Growth Approaches: Quadruple Helix Approach for Turning Brașov into a Startup City. Sustainability 2019, 11, 6154. [Google Scholar] [CrossRef]

- Pierce, P.; Ricciardi, F.; Zardini, A. Smart Cities as Organizational Fields: A Framework for Mapping Sustainability-Enabling Configurations. Sustainability 2017, 9, 1506. [Google Scholar] [CrossRef]

- Van Winden, W.; Carvalho, L. Intermediation in public procurement of innovation: How Amsterdam’s startup-in-residence programme connects startups to urban challenges. Res. Policy 2019, 48, 103789. [Google Scholar] [CrossRef]

- Kim, H.M.; Soheil, K.; Sabri, S.; Kent, A. Smart cities as a platform for technological and social innovation in productivity, sustainability, and livability: A conceptual framework. Smart Cities for Technological and Social Innovation. Case Stud. Curr. Trends Future Steps 2021, 9–28. [Google Scholar] [CrossRef]

- Neumann, O.; Matt, C.; Hitz-Gamper, B.S.; Schmidthuber, L.; Stürmer, M. Joining forces for public value creation? Exploring collaborative innovation in smart city initiatives. Gov. Inf. Q. 2019, 36, 101411. [Google Scholar] [CrossRef]

- Doblinger, C.; Surana, K.; Anadon, L.D. Governments as partners: The role of alliances in U.S. cleantech startup innovation. Res. Policy 2019, 48, 1458–1475. [Google Scholar] [CrossRef]

- Noelia, F.-L.; Rosalia, D.-C. A dynamic analysis of the role of entrepreneurial ecosystems in reducing innovation obstacles for startups. J. Bus. Ventur. Insights 2020, 14, e00192. [Google Scholar] [CrossRef]

- Tse, C.H.; Yim, C.K.B.; Yin, E.; Wan, F.; Jiao, H. R&D activities and innovation performance of MNE subsidiaries: The moderating effects of government support and entry mode. Technol. Forecast. Soc. Chang. 2021, 166, 120603. [Google Scholar] [CrossRef]

- Gao, Y.; Hu, Y.; Liu, X.; Zhang, H. Can public R&D subsidy facilitate firms’ exploratory innovation? The heterogeneous effects between central and local subsidy programs. Res. Policy 2021, 50, 104221. [Google Scholar] [CrossRef]

- Steruska, J.; Simkova, N.; Pitner, T. Do science and technology parks improve technology transfer? Technol. Soc. 2019, 59, 101127. [Google Scholar] [CrossRef]

- Al-Kfairy, M.; Khaddaj, S.; Mellor, R.B. Evaluating the effect of organizational architecture in developing science and technology parks under differing innovation environments. Simul. Model. Pract. Theory 2020, 100, 102036. [Google Scholar] [CrossRef]

- Henriques, I.C.; Sobreiro, V.A.; Kimura, H. Science and technology park: Future challenges. Technol. Soc. 2018, 53, 144–160. [Google Scholar] [CrossRef]

- Wang, Z.; He, Q.; Xia, S.; Sarpong, D.; Xiong, A.; Maas, G. Capacities of business incubator and regional innovation performance. Technol. Forecast. Soc. Chang. 2020, 158, 120125. [Google Scholar] [CrossRef]

- Millette, S.; Hull, C.E.; Williams, E. Business incubators as effective tools for driving circular economy. J. Clean. Prod. 2020, 266, 121999. [Google Scholar] [CrossRef]

- Kim, H.J.; Kim, T.S.; Sohn, S.Y. Recommendation of startups as technology cooperation candidates from the perspectives of similarity and potential: A deep learning approach. Decis. Support Syst. 2020, 130, 113229. [Google Scholar] [CrossRef]

- de Fabrício, R.S., Jr.; Da Silva, F.R.; Simões, E.; Galegale, N.V.; Akabane, G.K. Strengthening of Open Innovation Model: Using startups and technology parks. Ifac Pap. 2015, 48, 14–20. [Google Scholar] [CrossRef]

- Bergmann, T.; Utikal, H. How to Support Start-Ups in Developing a Sustainable Business Model: The Case of an European Social Impact Accelerator. Sustainability 2021, 13, 3337. [Google Scholar] [CrossRef]

- García, I. Adaptive Leadership and Social Innovation: Overcoming Critical Theory, Positivism, and Postmodernism in Planning Education. E-journal of Public Affairs. August 2018. Available online: http://www.ejournalofpublicaffairs.org/adaptive-leadership-and-social-innovation-overcoming-critical-theory-positivism-and-postmodernism-in-planning-education/ (accessed on 26 March 2021).

- Roman, M.; Varga, H.; Cvijanovic, V.; Reid, A. Quadruple Helix Models for Sustainable Regional Innovation: Engaging and Facilitating Civil Society Participation. Economies 2020, 8, 48. [Google Scholar] [CrossRef]

- Ierapetritis, D.G. Discussing the Role of Universities in Fostering Regional Entrepreneurial Ecosystems. Economies 2019, 7, 119. [Google Scholar] [CrossRef]

- Temiz, S. Open Innovation via Crowdsourcing: A Digital Only Hackathon Case Study from Sweden. J. Open Innov. Technol. Mark. Complex. 2021, 7, 39. [Google Scholar] [CrossRef]

- Yan, M.-R.; Chi, H.-L.; Yang, J.-Y.; Chien, K.-M. Towards a City-Based Cultural Ecosystem Service Innovation Framework as Improved Public-Private-Partnership Model—A Case Study of Kaohsiung Dome. J. Open Innov. Technol. Mark. Complex. 2019, 5, 85. [Google Scholar] [CrossRef]

- Szczukiewicz, K.; Makowiec, M. Characteristics and Specificities of Local Innovation Accelerators: A Case of Poland. Sustainability 2021, 13, 1689. [Google Scholar] [CrossRef]

- Yin, R.K. Case Study Research: Design and Methods (4th Ed.). Thousand Oaks, CA: Sage, 2009. Can. J. Action Res. 2009, 14, 69–71. [Google Scholar] [CrossRef]

- Feagin, J. A Case for the Case Study. University of North Carolina Press. 1991. Available online: https://uncpress.org/book/9780807843215/a-case-for-the-case-study/ (accessed on 26 March 2021).

- Jung, K.; Lee, S.-H.; E Workman, J. Exploring a relationship between creativity and public service motivation. Knowl. Manag. Res. Pract. 2018, 16, 292–304. [Google Scholar] [CrossRef]

- Cohen, B.; Almirall, E.; Chesbrough, H. The City as a Lab. Calif. Manag. Rev. 2016, 59, 5–13. [Google Scholar] [CrossRef]

- He, J.; Wan, Y.; Tang, Z.; Zhu, X.; Wen, C. A Developed Framework for the Multi-District Ecological Compensation Standards Integrating Ecosystem Service Zoning in an Urban Area in China. Sustainability 2019, 11, 4876. [Google Scholar] [CrossRef]

- Hernández-López, J.; Cervantes, O.; Olivos-Ortiz, A.; Ricardo, R. DSPIR Framework as Planning and Management Tools for the La Boquita Coastal System, Manzanillo, Mexico. J. Mar. Sci. Eng. 2020, 8, 615. [Google Scholar] [CrossRef]

- Derek, M. Nature on a Plate: Linking Food and Tourism within the Ecosystem Services Framework. Sustainability 2021, 13, 1687. [Google Scholar] [CrossRef]

- Yun, J.J.; Park, K.; Gaudio, G.D.; Corte, V.D. Open innovation ecosystems of restaurants: Geo-graphical economics of successful restaurants from three cities. Eur. Plan. Stud. 2020, 28, 2348–2367. [Google Scholar] [CrossRef]

- Chesbrough, H.; Sohyeong, K.; Agodino, A. Chez Panisse: Building an Open Innovation Ecosystem. Calif. Manag. Rev. 2014, 56, 144–171. [Google Scholar] [CrossRef]

| Implicit Variables (Model Dimensions) | Explicit Variables (Survey Questions) |

|---|---|

| Development of start-ups | Number of start-ups emerging in the city |

| Availability of human and financial resources | Availability of qualified personnel in the city Support of entrepreneurs in raising funds for innovation Availability of venture capitals funds |

| Local individual and organizational entrepreneurship | Level of entrepreneurship of the city’s residents Level of functioning of entrepreneurship incubators in the city Level of functioning of technological parks in the city |

| Support for start-ups by city authorities | Involvement of city authorities in the development of start-ups Promotion of start-up initiatives by the city authorities |

| Question | Average | Median | Deviation | Variation coefficient | Skewness | Kurtosis |

|---|---|---|---|---|---|---|

| Development of start-ups | ||||||

| Number of start-ups emerging in the city | 2.662 | 3.000 | 0.986 | 37.05% | 0.059 | –0.336 |

| Availability of human and material resources | ||||||

| Availability of qualified personnel in the city | 2.955 | 3.000 | 0.983 | 33.27% | –0.265 | –0.476 |

| Support of entrepreneurs in raising funds for innovation | 2.902 | 3.000 | 0.937 | 32.29% | –0.035 | –0.106 |

| Availability of venture capitals funds | 2.328 | 2.000 | 0.977 | 41.99% | 0.3675 | –0.460 |

| Local individual and organizational entrepreneurship | ||||||

| Level of entrepreneurship of the city’s residents | 3.446 | 3.000 | 0.795 | 23.08% | 0.031 | –0.223 |

| Level of functioning of entrepreneurship incubators in the city | 2.697 | 3.000 | 1.244 | 46.12% | 0.142 | –0.975 |

| Level of functioning of technological parks in the city | 2.459 | 2.000 | 1.228 | 49.92% | 0.481 | –0.780 |

| Support for start-ups by city authorities | ||||||

| Involvement of city authorities in the development of start-ups | 3.160 | 3.000 | 0.991 | 31.34% | –0.174 | –0.186 |

| Promotion of start-up initiatives by the city authorities | 2.993 | 3.000 | 1.068 | 35.67% | –0.090 | –0.489 |

| Question | 1-Very Poor | 2-Poor | 3-Average | 4-Good | 5-Very Good |

|---|---|---|---|---|---|

| Number of start-ups emerging in the city | 13.58 | 27.18 | 41.81 | 14.29 | 3.14 |

| Availability of qualified personnel in the city | 8.71 | 21.25 | 39.03 | 27.87 | 3.14 |

| Support of entrepreneurs in raising funds for innovation | 7.32 | 23.01 | 45.99 | 19.51 | 4.18 |

| Availability of venture capitals funds | 21.61 | 37.63 | 28.56 | 10.80 | 1.39 |

| Level of entrepreneurship of the city’s residents | 0.35 | 9.41 | 44.25 | 37.28 | 8.71 |

| Level of functioning of entrepreneurship incubators in the city | 21.60 | 24.75 | 23.34 | 23.00 | 7.31 |

| Level of functioning of technological parks in the city | 26.48 | 30.31 | 20.91 | 15.33 | 6.97 |

| Involvement of city authorities in the development of start-ups | 5.92 | 16.03 | 42.51 | 27.18 | 8.36 |

| Promotion of start-up initiatives by the city authorities | 9.76 | 20.21 | 38.68 | 23.69 | 7.66 |

| Parameter | Parameter Assessment | Standard Error | T Statistics | Probability Level |

|---|---|---|---|---|

| Availability of human and material resources | 0.166 | 0.036 | 4.653 | 0.000 |

| Local individual and organizational entrepreneurship | 0.146 | 0.037 | 3.973 | 0.000 |

| Support for start-ups by city authorities | 0.108 | 0.042 | 2.576 | 0.009 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jonek-Kowalska, I.; Wolniak, R. The Influence of Local Economic Conditions on Start-Ups and Local Open Innovation System. J. Open Innov. Technol. Mark. Complex. 2021, 7, 110. https://doi.org/10.3390/joitmc7020110

Jonek-Kowalska I, Wolniak R. The Influence of Local Economic Conditions on Start-Ups and Local Open Innovation System. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(2):110. https://doi.org/10.3390/joitmc7020110

Chicago/Turabian StyleJonek-Kowalska, Izabela, and Radosław Wolniak. 2021. "The Influence of Local Economic Conditions on Start-Ups and Local Open Innovation System" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 2: 110. https://doi.org/10.3390/joitmc7020110

APA StyleJonek-Kowalska, I., & Wolniak, R. (2021). The Influence of Local Economic Conditions on Start-Ups and Local Open Innovation System. Journal of Open Innovation: Technology, Market, and Complexity, 7(2), 110. https://doi.org/10.3390/joitmc7020110