Energy-Efficient Products and Competitiveness in the Manufacturing Sector

Abstract

1. Introduction

2. Literature Review

3. Materials and Methods

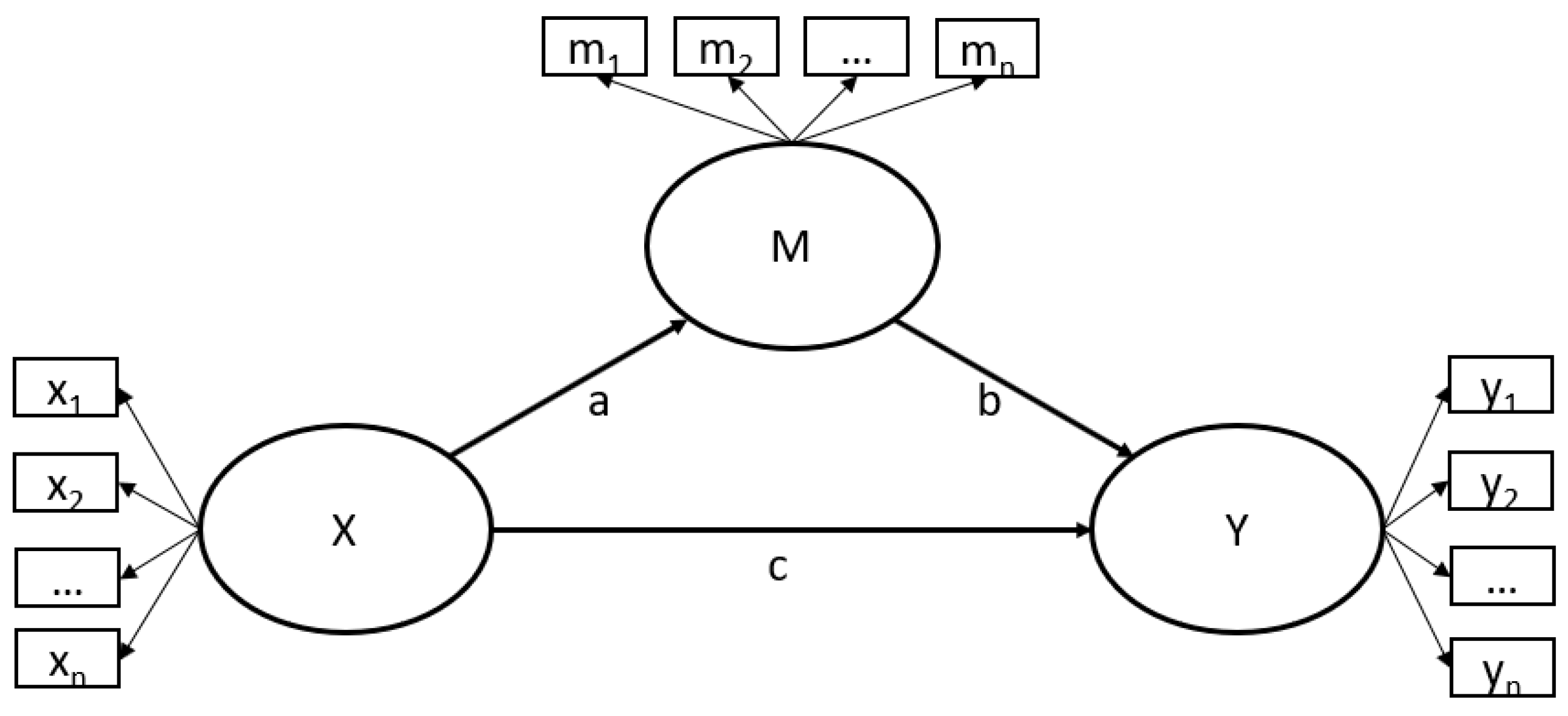

3.1. Design and Hypotheses

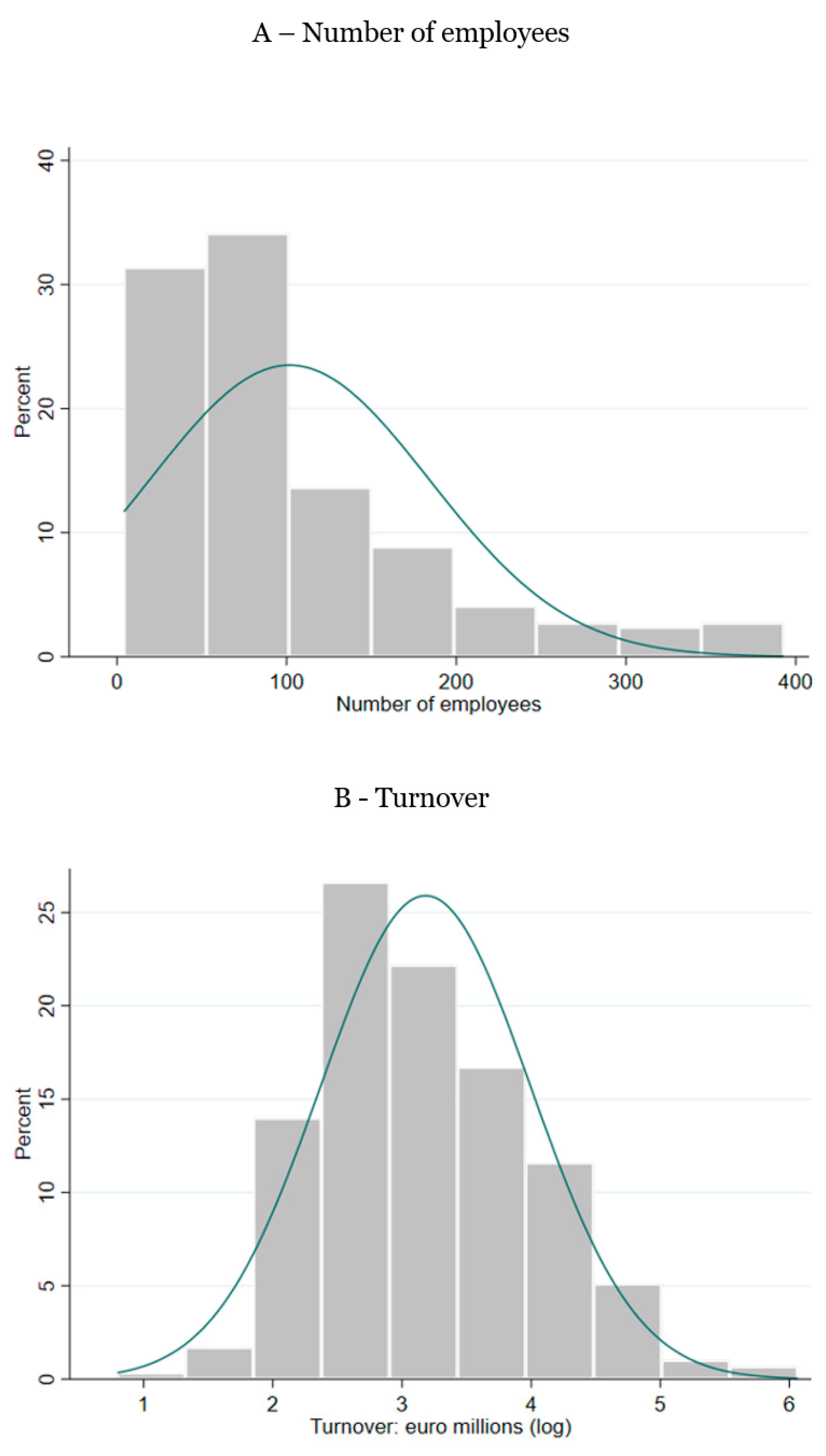

3.2. Data Collection and Sample

4. Results

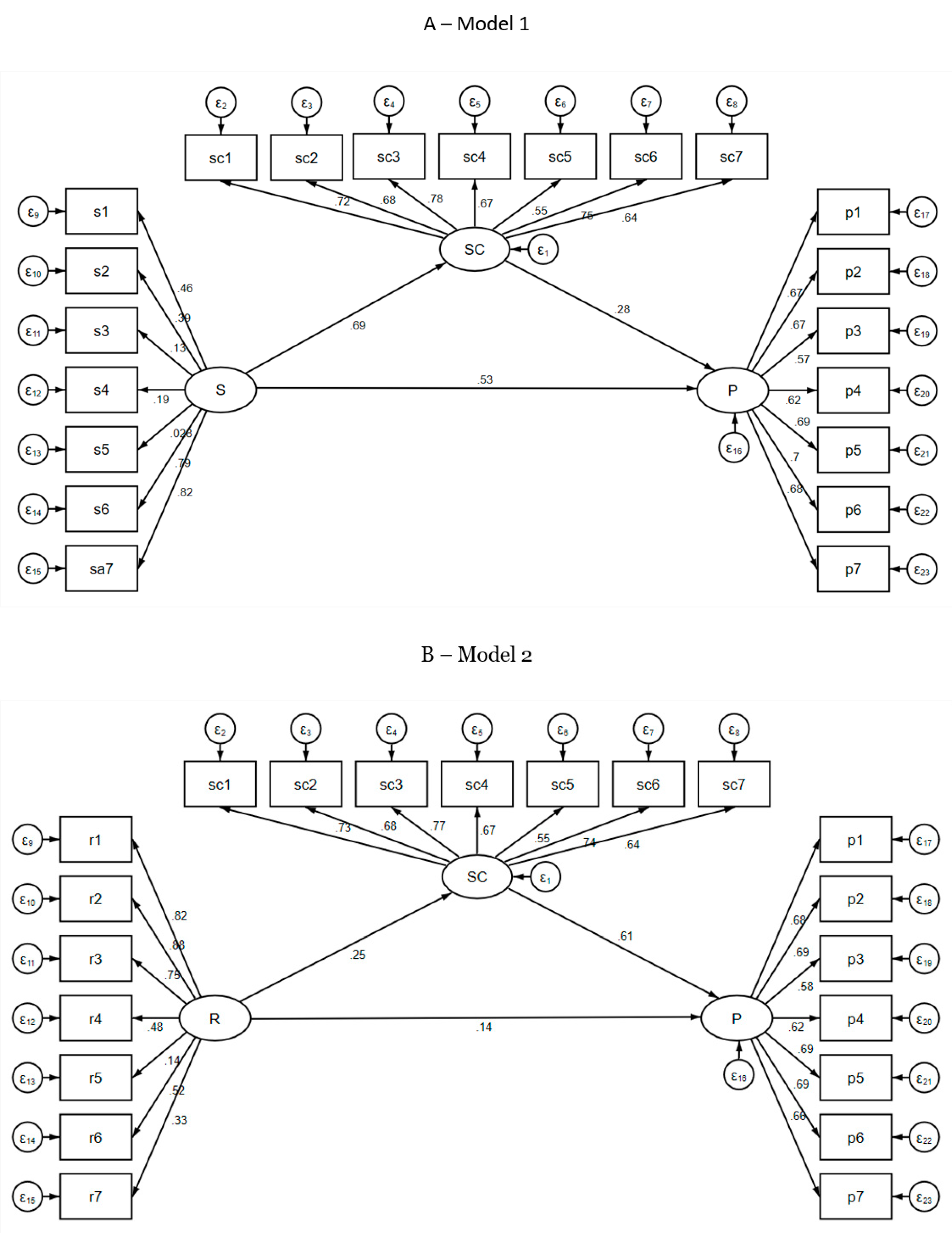

Analysis

5. Discussion

6. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

Appendix A

Appendix B

References

- Zhang, Y.; Xiao, C.; Zhou, G. Willingness to pay a price premium for energy-saving appliances: Role of perceived value and energy efficiency labeling. J. Clean. Prod. 2020, 242, 118555. [Google Scholar] [CrossRef]

- Jovanovic, M.; Raja, J.Z.; Visnjic, I.; Wiengarten, F. Paths to service capability development for servitization: Examining an internal service ecosystem. J. Bus. Res. 2019, 104, 472–485. [Google Scholar] [CrossRef]

- Shah, S.A.A.; Jajja, M.S.S.; Chatha, K.A.; Farooq, S. Servitization and supply chain integration: An empirical analysis. Int. J. Prod. Econ. 2020, 229, 107765. [Google Scholar] [CrossRef]

- Thurner, T.W.; Roud, V. Greening strategies in Russia’s manufacturing—From compliance to opportunity. J. Clean. Prod. 2016, 112, 2851–2860. [Google Scholar] [CrossRef]

- Lightfoot, H.; Baines, T.; Smart, P. The servitization of manufacturing. Int. J. Oper. Prod. Manag. 2009, 20, 547–567. [Google Scholar] [CrossRef]

- Garcia Martin, P.C.; Schroeder, A.; Ziaee Bigdeli, A. The value architecture of servitization: Expanding the research scope. J. Bus. Res. 2019, 104, 438–449. [Google Scholar] [CrossRef]

- Kitching, J.; Hart, M.; Wilson, N. Burden or benefit? Regulation as a dynamic influence on small business performance. Int. Small Bus. J. Res. Entrep. 2015, 33, 130–147. [Google Scholar] [CrossRef]

- Cambini, C.; Meletiou, A.; Bompard, E.; Masera, M. Market and regulatory factors influencing smart-grid investment in Europe: Evidence from pilot projects and implications for reform. Util. Policy 2016, 40, 36–47. [Google Scholar] [CrossRef]

- Fliess, S.; Lexutt, E. How to be successful with servitization—Guidelines for research and management. Ind. Mark. Manag. 2019, 78, 58–75. [Google Scholar] [CrossRef]

- Annarelli, A.; Battistella, C.; Nonino, F. Competitive advantage implication of different Product Service System business models: Consequences of ‘not-replicable’ capabilities. J. Clean. Prod. 2020, 247, 119121. [Google Scholar] [CrossRef]

- Wang, W.; Lai, K.; Shou, Y. The impact of servitization on firm performance: A meta-analysis. Int. J. Oper. Prod. Manag. 2018, 38, 1562–1588. [Google Scholar] [CrossRef]

- Goldbach, K.; Rotaru, A.M.; Reichert, S.; Stiff, G.; Gölz, S. Which digital energy services improve energy efficiency? A multi-criteria investigation with European experts. Energy Policy 2018, 115, 239–248. [Google Scholar] [CrossRef]

- Wu, A.D.; Zumbo, B.D. Understanding and using mediators and moderators. Soc. Indic. Res. 2008, 87, 367–392. [Google Scholar] [CrossRef]

- Baines, T.; Ziaee Bigdeli, A.; Sousa, R.; Schroeder, A. Framing the servitization transformation process: A model to understand and facilitate the servitization journey. Int. J. Prod. Econ. 2020, 221, 107463. [Google Scholar] [CrossRef]

- Randhawa, K.; Scerri, M. Service Innovation: A Review of the Literature. In The Handbook of Service Innovation; Agarwal, R., Selen, W., Roos, G., Green, R., Eds.; Springer: London, UK, 2015; pp. 27–51. [Google Scholar]

- Jaakkola, E.; Meiren, T.; Witell, L.; Edvardsson, B.; Schäfer, A.; Reynoso, J.; Sebastiani, R.; Weitlaner, D. Does one size fit all? New service development across different types of services. J. Serv. Manag. 2017, 28, 329–347. [Google Scholar] [CrossRef]

- Biemans, W.G.; Griffin, A.; Moenaert, R.K. Perspective: New Service Development: How the Field Developed, Its Current Status and Recommendations for Moving the Field Forward. J. Prod. Innov. Manag. 2016, 33, 382–397. [Google Scholar] [CrossRef]

- Snyder, H.; Witell, L.; Gustafsson, A.; Fombelle, P.; Kristensson, P. Identifying categories of service innovation: A review and synthesis of the literature. J. Bus. Res. 2016, 69, 2401–2408. [Google Scholar] [CrossRef]

- Thrane, S.; Blaabjerg, S.; Møller, R.H. Innovative path dependence: Making sense of product and service innovation in path dependent innovation processes. Res. Policy 2010, 39, 932–944. [Google Scholar] [CrossRef]

- Ferraz, I.N.; de Melo Santos, N. The relationship between service innovation and performance: A bibliometric analysis and research agenda proposal. RAI Rev. Adm. Inovação 2016, 13, 251–260. [Google Scholar] [CrossRef]

- Gambardella, A.; McGahan, A.M. Business-model innovation: General purpose technologies and their implications for industry structure. Long Range Plan. 2010, 43, 262–271. [Google Scholar] [CrossRef]

- Calabrese, A.; Castaldi, C.; Forte, G.; Ghiron, N. Sustainability-oriented service innovation: An emerging research field. J. Clean. Prod. 2018, 193, 533–548. [Google Scholar] [CrossRef]

- Anttonen, M.; Halme, M.; Houtbeckers, E.; Nurkka, J. The other side of sustainable innovation: Is there a demand for innovative services? J. Clean. Prod. 2013, 45, 89–103. [Google Scholar] [CrossRef]

- Bertoldi, P.; Boza-Kiss, B.; Panev, S.; Labanca, N. ESCO Market Report 2013; European Union: Ispra, Italy, 2014; Available online: https://ec.europa.eu/jrc/en/publication/eur-scientific-and-technical-research-reports/european-esco-market-report-2013 (accessed on 31 December 2020).

- Baines, T.; Bigdeli, A.Z.; Shi, V.G.; Baldwin, J.; Ridgway, K. Servitization: Revisiting the state-of-the-art and research priorities. Int. J. Oper. Prod. Manag. 2017, 37, 256–278. [Google Scholar] [CrossRef]

- Lütjen, H.; Tietze, F.; Schultz, C. Service transitions of product-centric firms: An explorative study of service transition stages and barriers in Germany’ s energy market. Int. J. Prod. Econ. 2017, 192, 106–119. [Google Scholar] [CrossRef]

- Björkdahl, J. Technology cross-fertilization and the business model: The case of integrating ICTs in mechanical engineering products. Res. Policy 2009, 38, 1468–1477. [Google Scholar] [CrossRef]

- Di Foggia, G.; Beccarello, M. Improving efficiency in the MSW collection and disposal service combining price cap and yardstick regulation: The Italian case. Waste Manag. 2018, 79, 223–231. [Google Scholar] [CrossRef]

- Demartini, M.C.; Trucco, S. Fad and fashion? The relevance of subjective performance measures. Manag. Decis. 2018, 56, 2391–2407. [Google Scholar] [CrossRef]

- Vij, S.; Bedi, H. Are subjective business performance measures justified? Int. J. Product. Perform. Manag. 2016, 65, 603–621. [Google Scholar] [CrossRef]

- Crescenzi, R.; Gagliardi, L. The innovative performance of firms in heterogeneous environments: The interplay between external knowledge and internal absorptive capacities. Res. Policy 2018, 47, 782–795. [Google Scholar] [CrossRef]

- Cagno, E.; Micheli, G.J.L.; Di Foggia, G. Smart metering projects: An interpretive framework for successful implementation. Int. J. Energy Sect. Manag. 2018, 12, 244–264. [Google Scholar] [CrossRef]

- Beneito, P.; Coscollá-Girona, P.; Rochina-Barrachina, M.E.; Sanchis, A. Competitive pressure and innovation at the firm level. J. Ind. Econ. 2015, 63, 422–457. [Google Scholar] [CrossRef]

- Salavou, H.; Baltas, G.; Lioukas, S. Organisational innovation in SMEs. Eur. J. Mark. 2004, 38, 1091–1112. [Google Scholar] [CrossRef]

- Weerawardena, J.; O’Cass, A.; Julian, C. Does industry matter? Examining the role of industry structure and organizational learning in innovation and brand performance. J. Bus. Res. 2006, 59, 37–45. [Google Scholar] [CrossRef]

- Jiménez-Jiménez, D.; Sanz-Valle, R. Innovation, organizational learning, and performance. J. Bus. Res. 2011, 64, 408–417. [Google Scholar] [CrossRef]

- Lambert, S.C.; Davidson, R.A. Applications of the business model in studies of enterprise success, innovation and classification: An analysis of empirical research from 1996 to 2010. Eur. Manag. J. 2013, 31, 668–681. [Google Scholar] [CrossRef]

- Dwyer, L.; Edwards, D. Tourism product and service innovation to avoid “strategic drift”. Int. J. Tour. Res. 2009, 11, 321–335. [Google Scholar] [CrossRef]

- Di Foggia, G. Effectiveness of Energy Efficiency Certificates as Drivers for Industrial Energy Efficiency Projects. Int. J. Energy Econ. Policy 2016, 6, 273–280. [Google Scholar]

- Bach, T.; Niklasson, B.; Painter, M. The role of agencies in policy-making. Policy Soc. 2012, 31, 183–193. [Google Scholar] [CrossRef]

- Sappington, D.E.M.; Weisman, D.L. Regulating regulators in transitionally competitive markets. J. Regul. Econ. 2012, 41, 19–40. [Google Scholar] [CrossRef][Green Version]

- Ruby, T.M. Innovation-enabling policy and regime transformation towards increased energy efficiency: The case of the circulator pump industry in Europe. J. Clean. Prod. 2015, 103, 574–585. [Google Scholar] [CrossRef]

- Zhang, Y.; Huang, T.; Yang, D. Impact of firms’ energy-saving effort and fixed asset characteristics on energy savings. J. Clean. Prod. 2020, 268, 122182. [Google Scholar] [CrossRef]

- Ahmed, R.; Stater, M. Is energy efficiency underprovided? An analysis of the provision of energy efficiency in multi-attribute products. Resour. Energy Econ. 2017, 49, 132–149. [Google Scholar] [CrossRef]

- Li, L.; Yu, S.; Tao, J. Design for energy efficiency in early stages: A top-down method for new product development. J. Clean. Prod. 2019, 224, 175–187. [Google Scholar] [CrossRef]

- Henseler, J.; Chin, W.W. A comparison of approaches for the analysis of interaction effects between latent variables using partial least squares path modeling. Struct. Equ. Model. 2010, 17, 82–109. [Google Scholar] [CrossRef]

- Little, T.D.; Card, N.A.; Bovaird, J.A.; Preacher, K.J.; Crandall, C.S. Structural Equation Modeling of Mediation and Moderation With Contextual Factors. In Modeling Contextual Effects in Longitudinal Studies; Little, T.D., Card, N.A., Bovaird, J.A., Eds.; Taylor & Francis: Abingdon, UK, 2007. [Google Scholar]

- Giones, F.; Brem, A.; Berger, A. Strategic decisions in turbulent times: Lessons from the energy industry. Bus. Horiz. 2019, 62, 215–225. [Google Scholar] [CrossRef]

- Teeratansirikool, L.; Siengthai, S.; Badir, Y.; Charoenngam, C. Competitive strategies and firm performance: The mediating role of performance measurement. Int. J. Product. Perform. Manag. 2013, 62, 168–184. [Google Scholar] [CrossRef]

- Brace, I. Questionnaire Design; Kogan Page: London, UK, 2004. [Google Scholar]

- Taber, K.S. The Use of Cronbach’s AlphaWhen Developing and Reporting Research Instruments in Science Education. Res. Sci. Educ. 2016, 48, 1273–1296. [Google Scholar] [CrossRef]

- Costa-Campi, M.T.; Duch-Brown, N.; García-Quevedo, J. R&D drivers and obstacles to innovation in the energy industry. Energy Econ. 2014, 46, 20–30. [Google Scholar] [CrossRef]

- Pirard, R.; Lapeyre, R. Classifying market-based instruments for ecosystem services: A guide to the literature jungle. Ecosyst. Serv. 2014, 9, 106–114. [Google Scholar] [CrossRef]

- Backlund, S.; Eidenskog, M. Energy service collaborations-it is a question of trust. Energy Effic. 2013, 6, 511–521. [Google Scholar] [CrossRef]

- Yan, S. The economic and environmental impacts of tax incentives for battery electric vehicles in Europe. Energy Policy 2018, 123, 53–63. [Google Scholar] [CrossRef]

| Variable | Label | Min. | Mean | Max | SD | Kurtosis |

|---|---|---|---|---|---|---|

| sc1 | Idea management and collection | 1 | 4.478 | 7 | 1.853 | 1.921 |

| sc2 | Differentiation from competitors | 1 | 5.512 | 7 | 1.604 | 3.489 |

| sc3 | Trade-off analysis of energy-efficiency projects | 1 | 4.782 | 7 | 1.769 | 2.257 |

| sc4 | Energy-efficiency servitization financial analysis | 1 | 4.744 | 7 | 1.832 | 2.074 |

| sc5 | Pricing, placing, and value analysis | 1 | 4.945 | 7 | 1.735 | 2.311 |

| sc6 | Energy-efficiency service characteristics | 1 | 4.901 | 7 | 1.637 | 2.325 |

| sc7 | Client integration (feedback) into service design | 1 | 5.253 | 7 | 1.589 | 2.511 |

| s1 | Implementation of SWOT analysis | 1 | 4.263 | 7 | 1.760 | 2.065 |

| s2 | Industry analysis and research | 1 | 2.345 | 7 | 1.706 | 3.517 |

| s3 | Implementation of PEST analysis | 1 | 5.406 | 7 | 1.622 | 2.771 |

| s4 | Assessment of possible strategic alternatives | 1 | 3.713 | 7 | 1.752 | 2.133 |

| s5 | Analysis of substitute products | 1 | 4.253 | 7 | 1.729 | 2.016 |

| s6 | Competitive strategy and advantage | 1 | 4.034 | 7 | 1.759 | 2.082 |

| s7 | Market trends analysis | 1 | 4.372 | 7 | 1.703 | 2.145 |

| r1 | Regulation simple to understand and practical | 1 | 2.877 | 7 | 1.665 | 2.447 |

| r2 | Analysis of possible market distortions | 1 | 2.532 | 7 | 1.602 | 3.120 |

| r3 | Consistency with complementary rules or policies | 1 | 3.147 | 7 | 1.687 | 2.352 |

| r4 | Forecasting of regulation goals and output | 1 | 2.700 | 7 | 1.503 | 3.475 |

| r5 | Regulation fairly implemented | 1 | 3.932 | 7 | 1.610 | 2.145 |

| r6 | Regulation compatible with competition | 1 | 2.106 | 7 | 1.332 | 3.320 |

| r7 | Cost-efficiency analysis of regulation | 1 | 3.956 | 7 | 1.904 | 1.919 |

| p1 | Positioning of products | 1 | 4.584 | 7 | 1.874 | 2.157 |

| p2 | Quality of offered products | 1 | 5.003 | 7 | 1.525 | 2.350 |

| p3 | Product delivery operations | 1 | 4.532 | 7 | 1.635 | 2.336 |

| p4 | Strengthened market share | 1 | 4.553 | 7 | 1.569 | 2.429 |

| p5 | Client feedback | 1 | 5.150 | 7 | 1.576 | 2.624 |

| p6 | Product attractiveness | 1 | 4.717 | 7 | 1.604 | 2.520 |

| p7 | Industry knowledge | 1 | 4.512 | 7 | 1.772 | 2.290 |

| NACE | Freq. | % | NACE Rev. 2 Code |

|---|---|---|---|

| 26 | 21 | 7.17 | Manufacture of computer, electronic, and optical products |

| 27 | 91 | 31.06 | Manufacture of electrical equipment |

| 28 | 154 | 52.57 | Manufacture of machinery and equipment n.e.c. |

| 35 | 22 | 7.51 | Manufacture and supply: electricity, gas, steam, and air conditioning |

| other | 5 | 1.71 | Construction of utility projects |

| Construct | Items | Cronbach’s Alpha | RMSEA | CFI | SRMR |

|---|---|---|---|---|---|

| SC | sc1, sc2, sc3, sc4, sc5, sc6, sc7 | 0.858 | 0.102 | 0.945 | 0.044 |

| R | r1, r2, r3, r4, r5, r6, r7 | 0.756 | 0.061 | 0.974 | 0.046 |

| S | s1, s2, s3, s4, s5, s6, s7 | 0.610 | 0.125 | 0.807 | 0.090 |

| P | p1, p2, p3, p4, p5, p6, p7 | 0.840 | 0.064 | 0.974 | 0.034 |

| Coefficients | Std. Err. | Z | ||

|---|---|---|---|---|

| Model 1 | SC | |||

| S | 0.693 *** | 0.045 | 15.250 | |

| P | ||||

| SC | 0.277 *** | 0.086 | 3.210 | |

| S | 0.528 *** | 0.084 | 6.260 | |

| Model 2 | SC | |||

| R | 0.250 *** | 0.063 | 3.950 | |

| P | ||||

| SC | 0.607 *** | 0.049 | 12.420 | |

| R | 0.135 ** | 0.058 | 2.310 |

| RMSEA | AIC | BIC | CFI | TLI | SRMR | |

|---|---|---|---|---|---|---|

| Model 1 | 0.069 | 22,130.24 | 22,373.13 | 0.879 | 0.864 | 0.067 |

| Model 2 | 0.048 | 21,695.47 | 21,938.36 | 0.942 | 0.935 | 0.076 |

| Effects | Coef. | Std. Err. | Z | ||

|---|---|---|---|---|---|

| Model 1 | Direct | SC | |||

| S | 1.125 *** | 0.169 | 6.64 | ||

| P | |||||

| SC | 0.261 *** | 0.085 | 3.07 | ||

| S | 0.807 *** | 0.169 | 4.77 | ||

| Indirect | P | ||||

| S | 0.293 *** | 0.102 | 2.86 | ||

| Total | SC | ||||

| S | 1.125 *** | 0.169 | 6.64 | ||

| P | |||||

| SC | 0.260 *** | 0.085 | 3.07 | ||

| S | 1.100 *** | 0.174 | 6.33 | ||

| Model 2 | Direct | SC | |||

| R | 0.246 *** | 0.067 | 3.69 | ||

| P | |||||

| SC | 0.571 *** | 0.073 | 7.76 | ||

| R | 0.125 ** | 0.055 | 2.27 | ||

| Indirect | P | ||||

| R | 0.140 *** | 0.040 | 3.47 | ||

| Total | SC | ||||

| R | 0.246 *** | 0.067 | 3.69 | ||

| P | |||||

| SC | 0.571 *** | 0.073 | 7.76 | ||

| R | 0.266 *** | 0.064 | 4.13 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Foggia, G. Energy-Efficient Products and Competitiveness in the Manufacturing Sector. J. Open Innov. Technol. Mark. Complex. 2021, 7, 33. https://doi.org/10.3390/joitmc7010033

Di Foggia G. Energy-Efficient Products and Competitiveness in the Manufacturing Sector. Journal of Open Innovation: Technology, Market, and Complexity. 2021; 7(1):33. https://doi.org/10.3390/joitmc7010033

Chicago/Turabian StyleDi Foggia, Giacomo. 2021. "Energy-Efficient Products and Competitiveness in the Manufacturing Sector" Journal of Open Innovation: Technology, Market, and Complexity 7, no. 1: 33. https://doi.org/10.3390/joitmc7010033

APA StyleDi Foggia, G. (2021). Energy-Efficient Products and Competitiveness in the Manufacturing Sector. Journal of Open Innovation: Technology, Market, and Complexity, 7(1), 33. https://doi.org/10.3390/joitmc7010033