Abstract

Among the hot research topics, Fintech is leading the trend in terms of the newest technology applications. The relatively new emerging paradigms in various sciences, such as geometry (fractals), physics (quantum), and database systems (distributed ledger—blockchain), seem to potentially contribute to a greater shift in the framework of the finance industry, bringing also some concerns (cyber-threats). Consistent and extensive investigation of the reasonable potential impact of these new models (and their underlying technologies) is performed, and then tested through a SWOT analysis, as the main objective of this research. Threats and opportunities are always intrinsically driven by the introduction of technological advancements (revolutions). This research confirms that information availability and the increasing interconnection of crosswise applications of each discovery to the different fields of science is determining the rapid succession of revolutions identified by evident large shifts in economic paradigms. The growing computing capacity and the development of increasingly powerful predictive software are leading to a competitive, extremely dynamic, and challenging system. In this context, as shown by history, there is a high possibility of market concentration in which, however, only a few corporations—digital giants—can afford to develop these technologies, consolidating their dominance.

Keywords:

fintech; blockchain; fractal geometry; quantum computing; financial markets; cybersecurity 1. Introduction

1.1. Research Objective

In this article, although limited to a general qualitative overview, the authors carried out an analysis aimed at highlighting not only the exposure of the financial sector to the technologies (FinTech) that are driving its exponential development, but also the inferences with different scientific fields, such as geometry (fractal), physics (quantum), and database systems (blockchain distributed ledger). The potential impact of each scientific progression on Fintech is then assessed through a SWOT analysis to verify and systematically confirm the assumptions.

The finance sector is certainly one of the most dynamic and regulated sectors of science [1,2], and technology has often been the main driver of social revolutions and paradigm shifts [3,4]. Fintech can, therefore, undoubtedly be considered a potential catalyst for innovative applications emerging from every field of science.

Considering that many sciences are witnessing exponential progress thanks to globalization and the easier dissemination of information, and given that social and technological revolutions have always been the result of a mix of innovations, it would be limiting to focus only on a single driving sector for the Fintech development. An analysis of the possible and potential interactions of different fields of science with the Fintech industry is, therefore, undoubtedly relevant and interesting.

1.2. Fintech Origins and Definition

Fintech is undoubtedly a very popular and trending topic, especially when it comes to considering its impact in the finance industry [5]. It is, therefore, considered useful to define its origins to better identify the period in which to contextualize its evolution, in parallel with the scientific and social revolutions that are shaping it.

It is possible to reasonably confirm that the digitization of finance has sharply accelerated in the last decade of the twentieth century, with the start-up of online banks, it is, therefore, not surprising that the term “FinTech” or “Fintech” [6,7] was used for the first time by the chairman of Citicorp, John Reed, in 1990, as documented [8], as the contraction of Finance (Fin) and Technology (Tech). The field of research relating to Fintech is, however, controversial [9], depending on (a) characteristics of the technologies to be included; (b) identification of technologies that can be considered “new”, therefore including only “the new breed of companies that specialize in providing financial services primarily through technologically-enabled mobile and online platform” [9]; (c) the willingness to include only technology-enabled business model innovations [8]. A broader meaning is referred to any use of new digital technologies applied in the financial sector to perform forecasts, analyses, or to facilitate financial transactions. As per the Oxford Dictionary, Fintech is identified as any “Computer programs and other technology used to support or enable banking and financial services” [10]. Given this broad definition, alternative payment systems are included in the analyses, therefore overcoming the academic controversy as to which “cryptocurrencies” or “virtual currencies” (based on the blockchain) may or may not be framed within the Fintech scope, although not backed by any government (since decentralized) and, therefore, lacking any intrinsic value [9].

1.3. Fintech and Interactions with Other Fields

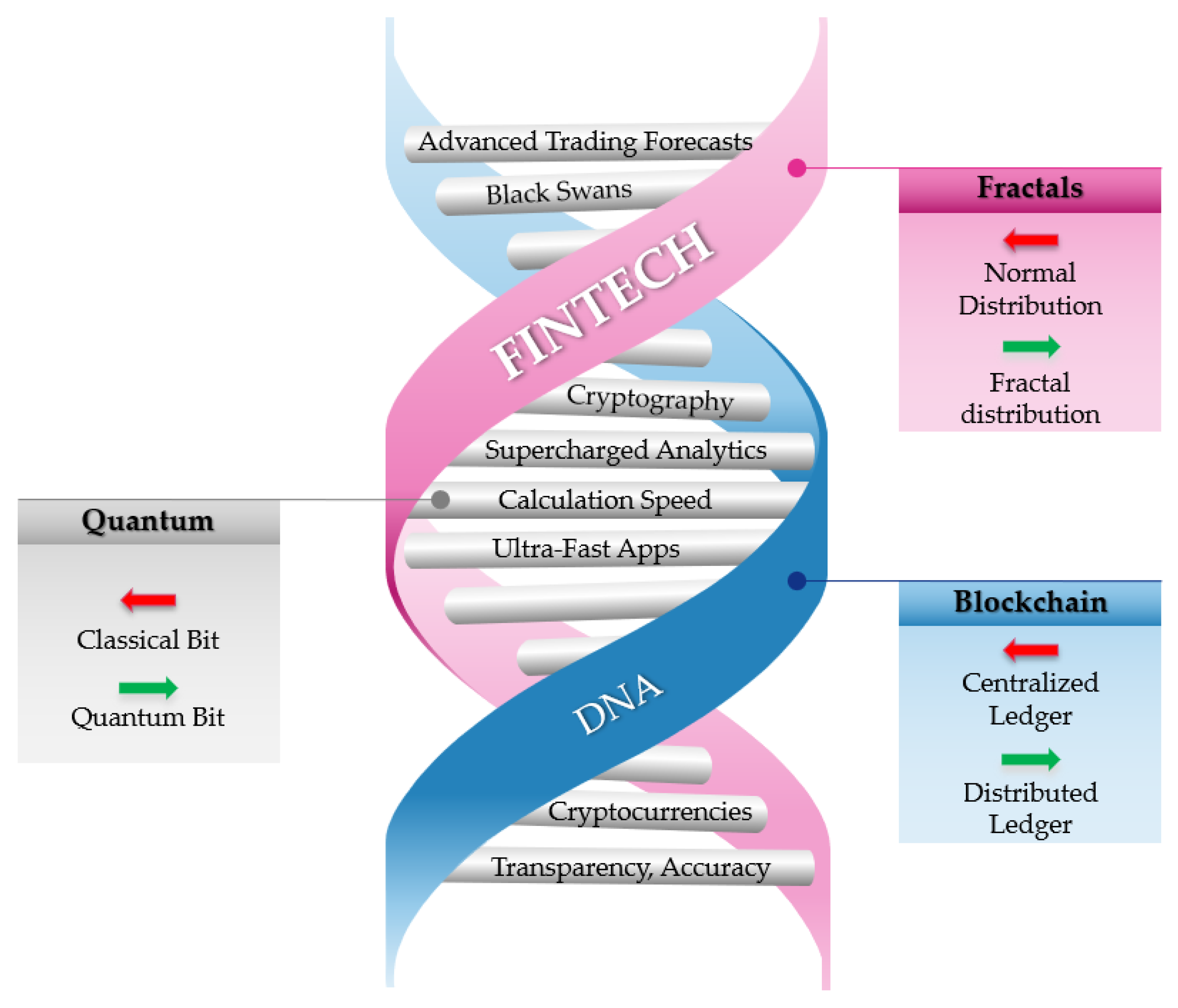

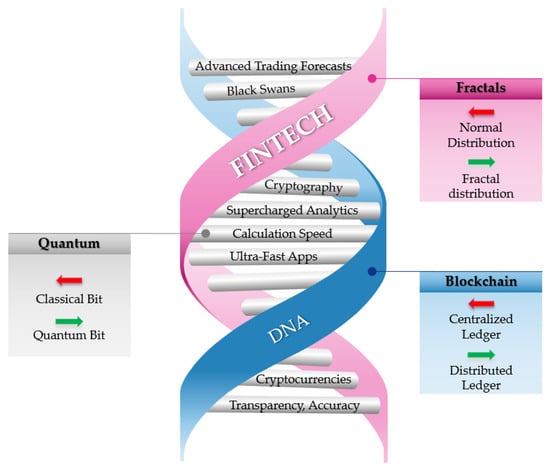

In general, Fintech companies aim to provide the most innovative financial services which, thanks to digital technologies, can be developed and evolve to bring new benefits to end-users, individual consumers, large companies, or SMEs. The future of finance has indeed a digital DNA (See Figure 1), and shifts in other sciences will have a great impact on the Fintech industry. As will be demonstrated below, three sciences, in particular, are identified as those that will have the greatest impact, given the specific applications and the main characteristics that make them particularly suitable for driving the development of the sector.

Figure 1.

Fintech Digital DNA and shifts in related sciences.

Banking, financial and insurance services have been witnessing profound change over the last two decades. The impact of digital technologies in finance is indisputable; FinTech is, therefore, the most challenging frontier. It is not limited to the banking sector, since it can be extended to open banking, API (Application Programming Interface), start-ups, robot-advisor, process automation, and crowdfunding online platforms [11].

In recent years, the interdependence among different areas of science has proven to be the best driver of the main advancements [12]. Fields that did not even exist a couple of centuries ago, such as data science (algorithms, data analytics), quantum computing, fractal geometry, distributed ledger, and cloud systems represent nowadays not only hot research topics but the driver of most strategic public and private projects. The need for ever-greater computing power, availability of big data and complex mathematical algorithms, decentralization of ledgers, seem to be the ideal context for the development and application of quantum computing. Financial and insurance innovations are relentless and driven by the customers’ satisfaction, increasingly convinced that digital services make every process more agile. Therefore, the willingness to use new technologies is becoming crucial. In this sense, great attention is focused on Blockchain, Big Data Analytics, Artificial Intelligence, Cloud Systems [13], and new 5G Communication Technologies [14,15].

Given that “Information” is the key driver that binds both technology (in the broader meaning of IT—Information Technology) and Finance, this research, therefore, identifies three main fields of science that may have the greatest potential impact (both in terms of opportunities and threats) on the Fintech industry, by enabling the availability of better information, namely: (a) quantum computing, through increased computing capacity; (b) fractal geometry, through a comprehensive approach that does not exclude the tails of the Gaussian bell; (c) blockchain distributed ledger, through decentralization of information. It is reasonable to argue that the possible further integration of these related sciences could lead to enormous advances, but it also needs great attention from the regulatory point of view to mitigating the systemic risk always linked to the financial system [16].

2. Materials and Methods

This is a piece of qualitative exploratory research, aimed at determining for the first time a complete framework on the frontiers of FinTech, represented by the most advanced scientific/technological paradigms. The understanding of this context, deriving from a systematic analysis of potential or already started applications is particularly relevant not only for pure scientific research but above all to understand current and potential risks, as well as to offer regulators an anticipated perspective of those that are the major regulatory challenges of the FinTech sector, which cannot be ignored, and which cannot be treated as a mere subspecies of finance.

The adopted methodology is based on the following, sequential steps:

- (a)

- Interviews with fellow scholars specialized in various disciplines of science to identify, select, orient and focus analyses on trending topics in the specific areas with the greatest potential impact on Fintech.

- (b)

- Targeted search of numerous combinations of keywords (i.e., “quantum computing”, “fractal”, “finance”, “fintech”, “forecast”, “Machine learning”, “artificial intelligence”, “blockchain”, “distributed ledger”) in search engines such as Google Scholar, Locate, ACM Digital Library, and Scopus Search, and then filtering primarily research published in top tier journals (ABS 4 *, ABS 3 *, and Scopus Q1–Q2).

- (c)

- Systematic review of the sources and further selection of the most relevant and consistent ones, merging them with the most recent news found in international relevant scientific sources such as Bloomberg and Financial Times.

- (d)

- Identification of a useful framework of current and forthcoming Fintech applications classified according to the three main related sciences to perform a consistent SWOT analysis of the Fintech industry.

3. Literature Review: Frontiers’ Origins and Connections with Fintech

The term “paradigm” from the Late Latin “paradigma”, and the Ancient Greek παράδειγμα, derives from the verb παραδείκνυμι «show, present, compare», composed by παρα-«beyond» and δείκνυμι «show» [17,18]. Among its various meanings, a paradigm can be understood as a “model”; it has recently been introduced in the sociology and philosophy of science to identify a complex of methodological rules, explanatory models and problem-solving criteria that characterize a community of scientists in a given phase of the historical evolution of their discipline: the so-called “scientific revolutions” can be traced back to paradigm changes. Many scientific disciplines in recent decades have witnessed significant shifts, among which, however, three, in particular, have been more frequently brought to the world of finance. In the following paragraphs, three scientific sectors and their paradigm shifts are, therefore, briefly but exhaustively analyzed: geometry, physics, and database systems. All the possible known or potential applications that the new technologies introduced by these scientific revolutions can impact the Fintech sector will also be identified in the findings of this research, therefore expanding its frontiers [19,20,21].

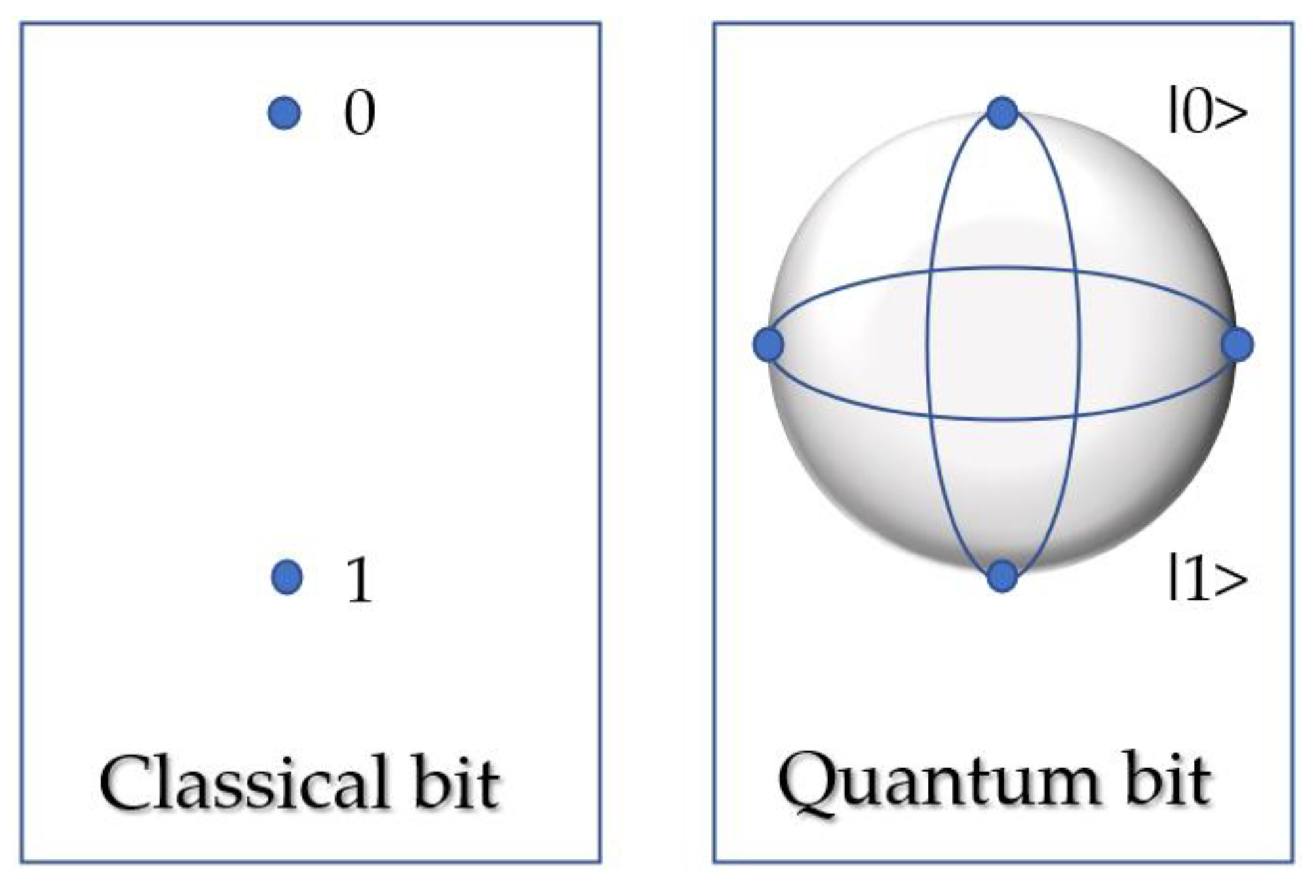

3.1. Quantum Computing

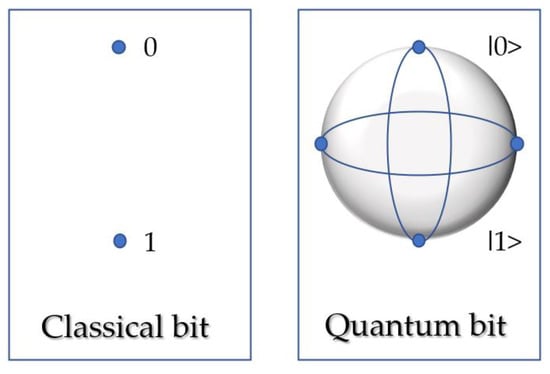

At the beginning of the twentieth century, scientists were convinced that they understood the basic principles of nature. Atoms were the “building blocks” [22] with which the natural world was built; Newton’s motion laws explained that most of the physics problems seemed to be solved. However, starting from Einstein’s theory of relativity, which replaced Newtonian mechanics, scientists have gradually understood that their knowledge was far from complete. Quantum physics, which completely altered the fundamental axioms of physics, is particularly relevant. The transition to this new approach involves fields of nanotechnology for the production of hardware with very strong computing power and, at the same time, it generates cybersecurity risks that cannot be ignored as current cryptography systems will soon become completely obsolete (since vulnerable). The Fintech industry will certainly be among the first to be affected both from the side of predictive calculation (performance of financial instruments), and from that of trust and security in financial systems [23,24]. Quantum mechanics, or quantum theory, or quantum physics [25] is a theory that its creators did not fully understand, but that has proved to be the only one capable of explaining the behavior of matter in the microscopic world. At the heart of the matter, there is an immense world, made up of billions and billions of particles, which escapes our senses and our intuition. Quantum computers are new types of devices that allow us to represent and manipulate information not through the classic bits, “0” and “1”, but through the quantum bits or qubits, more complex objects that take advantage of some properties that are peculiar to quantum physics such as the superposition of states, entanglement, and quantum interference. Just as in classical information it is encoded on two bits (0, 1); in quantum information, it is encoded on a two-level system (for example, the polarization of a photon), identified by “|0>” and “|1>” (see Figure 2).

Figure 2.

Classical bit vs. Quantum bit (Q-bit).

In the simplest possible way, the three main properties of quantum physics that are the basis of its extraordinary applications are explained below:

- ○

- Superposition of states. Under this principle, two or more quantum states can be added (“superimposed”), and the result will be another valid quantum state; conversely, each quantum state can be represented as the sum of two or more other distinct states. A single “particle” can, therefore, be prepared in a superposition of states, and for this reason, it is no longer localizable [26].

- ○

- Entanglement. It is a quantum phenomenon that describes an important feature of the non-classical world: if two states of different systems are entangled, there is no way to characterize one without referring to the other. When a measurement is made on one of the particles of the state, it also instantly determines the values of the observable quantities of all the other particles, however distant; this is also defined as the so-called quantum non-locality [27].

- ○

- Interference. In the analysis of particles in a quantum state, in the case of two waves, it is observed that in certain points these add up, and in others cancel at the same time. This effect cannot be anything other than a direct consequence of the first postulate of superposition (where the two states overlap) [28,29].

Quantum technologies aim to overcome the limits of current technologies by exploiting the properties of quantum systems. The first and most developed of these disciplines is quantum information, which deals with the study of the coding, transmission, and processing of information by exploiting these properties, in particular those of photons [30,31].

The main advantage of quantum computers is that this category of computers could potentially solve some complexity classes, which require excessive temporal, technical, and economic resources to be solved. This is a fascinating field, but one with considerable criticalities: both from a scientific perspective (there are still difficulties in demonstrating the effective superiority of quantum computing compared to classic approaches) and at the engineering level, given the fragility of quantum systems and the need to shield them from radiation, keep them in temperatures close to zero, and correct errors [32,33].

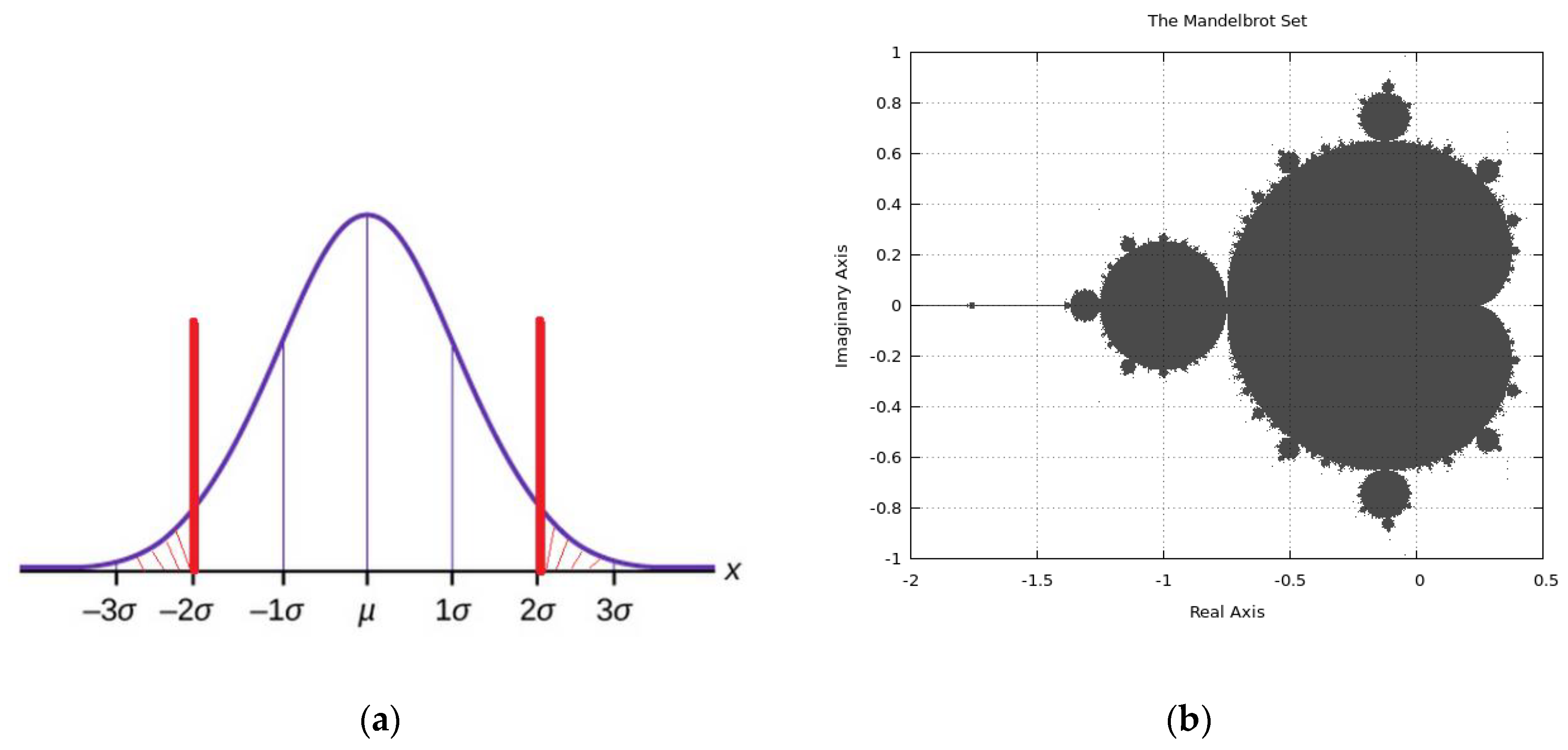

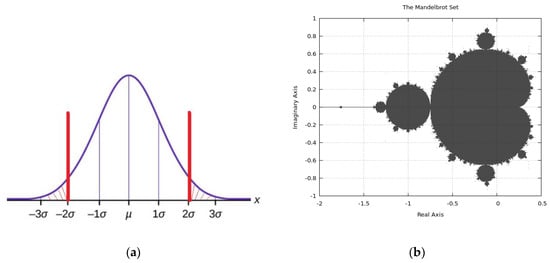

3.2. Fractal Geometry

Classical statistics generally require that price changes are normally distributed. One reason is that the Normal (or Gaussian) distribution can be described using only two parameters: the mean and the mean square deviation (understood as the square root of the arithmetic mean of the squares of the deviations of the observed values with respect to the mean, also called Deviation Standard). The latter is the usual tool for representing the dispersion around the mean of a random variable. Indeed, the probability of capturing an observation below or above the mean depends only on the standard deviation. In the real historical series in the economic and financial field—from ratios to equity returns and interest rates—but also in the physical field, however, the distributions of returns take different forms [34,35,36].

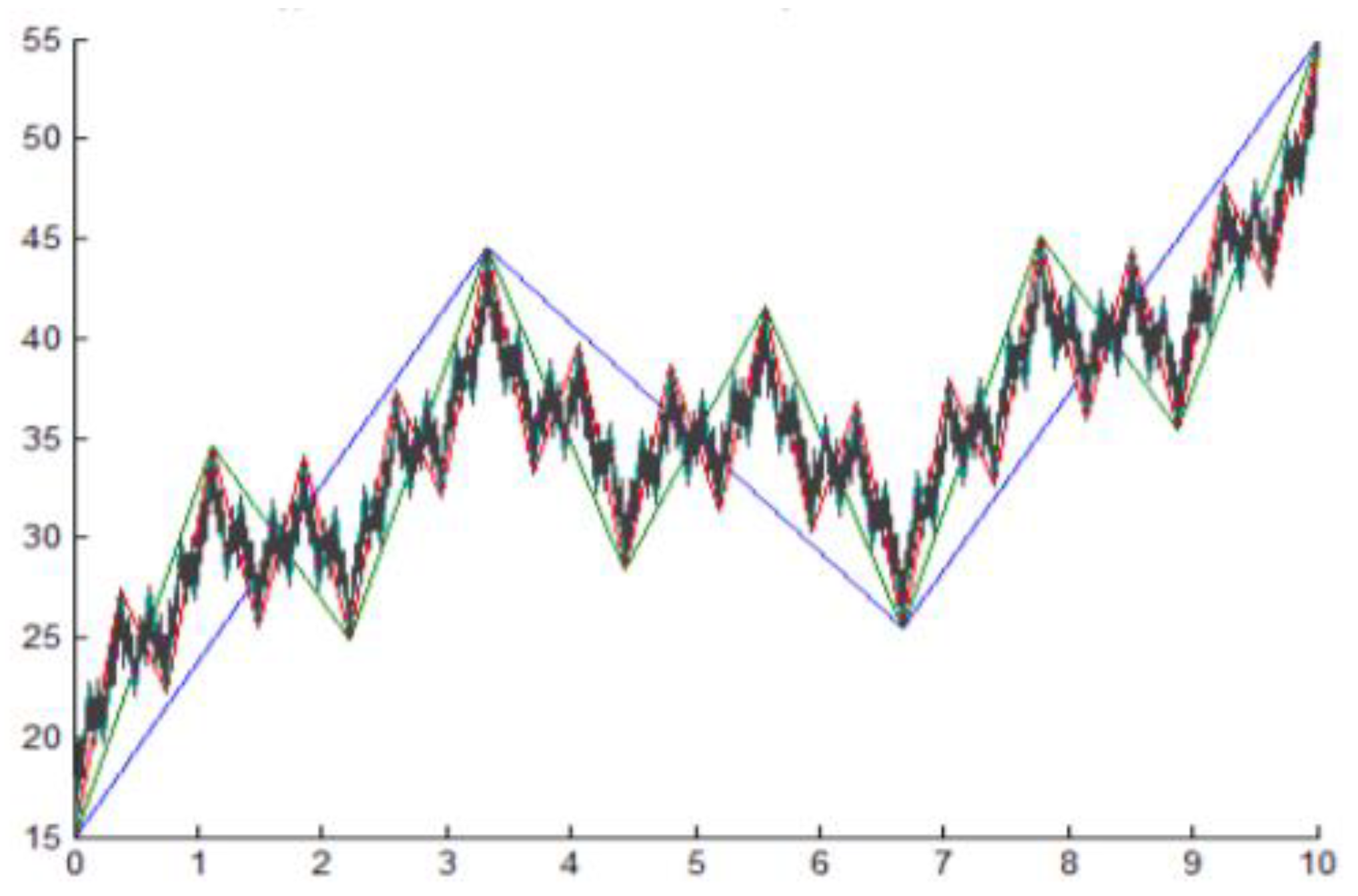

The study of fractals has influenced the finance industry since Mandelbrot [37], analyzing the daily fluctuations in the price of cotton sold in New York in the previous hundred years, found a recurrence of similar trends of the aforementioned price in different periods. A clear example of the presence of fractal geometry in finance can also be observed by analyzing the daily money transfer network between banks. The identification of patterns in price trends of financial instruments is certainly of great interest as it suggests the possibility of predicting price trends and changes in the long term. The need to identify the so-called black swans, unlikely events that can, however, produce devastating effects, is becoming increasingly widespread. This model contrasts with that of the Gaussian curve which instead theorizes the presumed “normality” of events, but which miserably fails to support decisions in uncertain and volatile contexts, as in the current time [38,39,40,41,42,43] (see Figure 3).

Figure 3.

Normal distribution vs. Fractal approach: (a) Gaussian Bell; (b) Mandelbrot set.

Fractals are geometric figures characterized by the repetition to infinity of the same shape on an increasingly smaller scale [38,39,40,41,42,43]. This is the most intuitive definition that can be given of figures that occur in nature with an impressive frequency but which do not yet have a precise mathematical definition: the current attitude is to consider fractal a set that has properties similar to the four listed below:

- ○

- Self-similarity: Fractal is the union of several parts which, enlarged by a certain factor, reproduce the whole Fractal; in other words, the Fractal is the union of copies of itself at different scales.

- ○

- Fine structure: Fractal reveals details with each enlargement.

- ○

- Irregularities: Fractal cannot be described as a place of points that satisfy simple geometric or analytical conditions.

- ○

- The self-similarity dimensions are greater than the topological dimension.

Fractal theory constitutes an interesting development of modern mathematics thanks to the impulse of Benoit Mandelbrot since the 1960s [38,39,40,41,42,43]. Fractal geometry allows us to fully describe the complexity and chaoticity present in real processes.

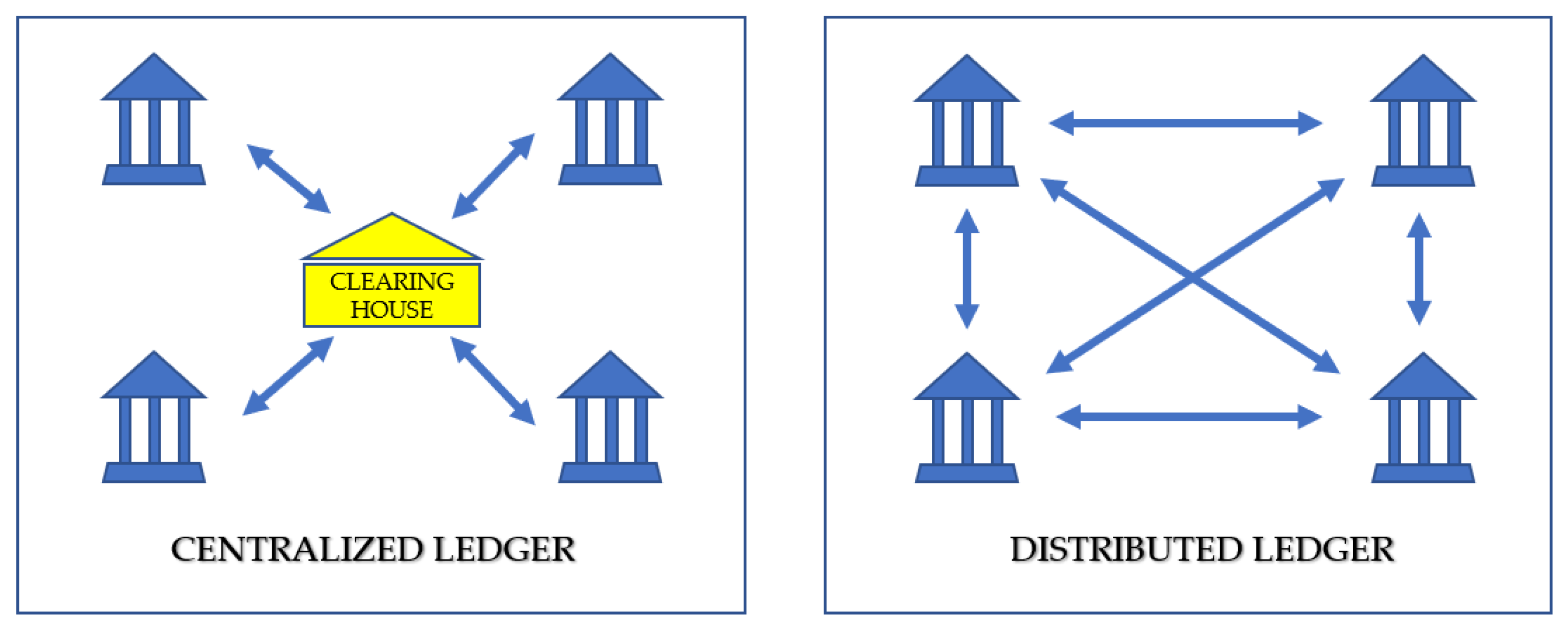

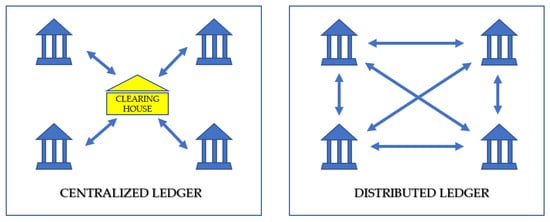

3.3. Database Systems: Blockchain Distributed Ledger

It is quite difficult to frame the blockchain in a single definition. It can be considered and presented from different perspectives as it is a sub-category of technologies in which the ledger is structured as a chain of blocks containing transactions and whose validation is entrusted to a consensus mechanism, distributed on all nodes of the network in the case of permission-less or public blockchains or on all nodes the nodes that are authorized to participate in the transaction validation process to be included in the register in the case of “permissioned” or private blockchains. The main characteristics of blockchain technologies are the immutability of the register, transparency, traceability of transactions, and security based on cryptographic techniques [44,45,46].

The blockchain is based on a network, and from the point of view of functionality, it allows us to manage a database in a distributed way. It is an alternative to centralized databases, and it allows us to manage the updating process of data with the collaboration of the network participants and with the possibility of having shared, accessible, distributed data among all participants. It, therefore, allows data management in terms of verification and authorization without the need for a central authority. It is understood as a communication protocol that identifies a technology based on the logic of the distributed database (a database in which data are not stored on a single computer but on multiple machines connected, called nodes). Blockchain is often confused or identified with Bitcoins, or one of the uses of the Blockchain and in particular to the one that underlies the digital currency or crypto-currency Bitcoin [47]. The Blockchain was, therefore, immediately associated with e-money, digital currency, and payment. The blockchain seems to have been conceived by Satoshi Nakamoto [48] (pseudonym of the inventor of the blockchain and its source code), and made famous by its best-known protocol, the virtual currency Bitcoin. Satoshi Nakamoto [49] revealed his project and his vision in October 2008 with the publication of a white paper that describes the possibility of developing a digital currency independent of any central body or institution in the form of Bitcoin. The white paper called Bitcoin is a Peer-to-Peer Electronic Cash System immediately met with great interest, in particular, because it opens a perspective for decentralized monetary and financial exchanges. Ledger technology distributed in finance is not limited to cryptocurrencies, but numerous studies are extending its application to accounting for auditing purposes, to take advantage of those intrinsic characteristics of transparency and reliability [50] (see Figure 4).

Figure 4.

Centralized ledger vs. Distributed ledger.

The blockchain can, therefore, be considered a technology that belongs to the category of Distributed Ledger Technologies (DLT), distributed archives. Distributed Ledger Technology can be defined as a set of systems characterized by the fact of referring to a distributed ledger, governed in such a way as to allow access and the ability to make changes by multiple nodes of a network [51].

Any transaction, or the data that represent it, is subjected to an asymmetric double key signature mechanism which, although not equipped with certificates issued by accredited certifiers (the blockchain precisely provides for the overcoming of centralized certification bodies), works with a similar mechanism to that of the digital signature. DLTs provide the use of cryptographic algorithms that enable the user to use the system by providing them with a public and private keys that are used to sign transactions or to activate smart contracts or other services connected to the blockchain [51,52,53].

4. Results

Security and engineering in finance (in terms of availability and development of both financial instruments and software–hardware) affect everyone—private individuals, the public sector, and businesses [54]. It is, therefore, absolutely impossible to overlook the cryptographic security of financial transactions and deposits, currently threatened by the evolution of quantum computers with previously unimaginable computing capabilities [55]. This great calculation power, however, combined with the use of fractal geometry that manages to identify patterns in the apparent chaos of nature, can at the same time offer highly efficient predictive tools to prevent and avoid financial crises that have cyclically (and increasingly frequently) affected the world economy due to globalization that generates almost instant domino effects. The application of technologies such as blockchain, which allows for greater transparency, transaction traceability, and information storage security is not negligible [56]. This research, demonstrating the most general and evident interrelationships between different sectors of science, was carried out by academics within FinTech and reaches out to engineers for greater collaboration. The fundamental (somewhat naive) goal of this research, through awareness of threats and opportunities, is to direct the application of scientific and technological research towards positive frontiers that can make the (financial) world safer and less exposed to volatility risks, reducing uncertainties and creating greater well-being and stability for people all over the world.

The main new applications made possible thanks to the main paradigmatic advances in the three different fields of science considered are, therefore, summarized below.

4.1. Quantum Computing Application in Fintech

Frontier of computational evolution, quantum computing is now taking its first concrete steps but is still far from meeting expectations. However, thanks also to important public and private investments, research is growing and in the short term, the first commercial applications will be available. The main advantage of quantum computers is that potentially this category of computers could solve some families of problems, in technical jargon, certain “complexity classes”, which today are very difficult and require excessive time and technical and economic resources to be able to deal with. This is a fascinating field, but with considerable criticalities: both from a scientific point of view (there are still difficulties in demonstrating the effective superiority of quantum computing over classical approaches) and at the engineering level, given the fragility of quantum systems and the need to shield them from radiation, it is necessary to keep them in temperatures close to freezing and correct errors.

In the first decade of the 2000s, many physical implementations of qubits were conducted, however, from a technology development perspective, the most recent advancements were determined by Google (Sycamore) in October 2019 [57], when its dedicated research team declared the achievement of the quantum supremacy. Subsequently, Honeywell Venture (System Model H1), in June 2020 [58], announced it had built the most powerful quantum computer in the world that reached supremacy, three months after disclosing (in March 2020), “investment in Cambridge Quantum Computing and Honeywell Quantum Systems confirms CQC as the first beta user of their powerful quantum computer” [59]. From the perspective of business opportunities and market domination, it is certainly desirable to obtain the possibility of making calculations in a few seconds that supercomputers based on traditional digital technology would be able to carry out in hundreds of years.

The evolution of research now addresses numerous areas, from systems scalability to error correction, from the exploration of early industrial applications to the creation of frameworks and languages to develop software able to exploit the potential of quantum technologies. In the short term, however, given that they require relatively few qubits, the most probable applications of quantum computing concern simulations, in particular as regards systems themselves based on quantum properties. Further applications related to simulations and big data can also be hypothesized, such as in finance or other scientific research fields. In the long term, quantum attacks could likely break some of the cryptographic algorithms regularly used today in financial transactions (including many cryptographic systems on which blockchains are based) and in securing military communications [60]. Very large quantities of qubits are needed to make these applications feasible; however, there are research lines related to postquantum cryptography (or “quantum encryption” or “quantum cyber-security”). A few days ago (30 November 2020), IBM announced the launch of quantum-safe cloud services (through IBM key protect encryption) [61,62], therefore starting a new market. From a cybersecurity perspective, if quantum physics-based technology is commercialized, all current cryptographic systems, including those that protect financial systems, would become extremely vulnerable and useless [63,64,65,66].

A further potential application of quantum computing is related to artificial intelligence and machine learning. Although it is still considered a hypothetical scenario to date, research on quantum machine learning can be soon made available on cloud quantum platforms that will create suitable testing environments, therefore massively accelerating learning in a neural network or improving statistical learning systems. It is also reasonable to consider that the first applications in the Fintech field will concern the detection of fraud (reducing the cases of false positives and false negatives) or supporting Monte Carlo simulations for a more accurate calculation of options. Moreover, the applications will be countless and would affect all sectors, not only Fintech, since artificial intelligence is already applied almost everywhere, and it will be boosted by extraordinary computing power.

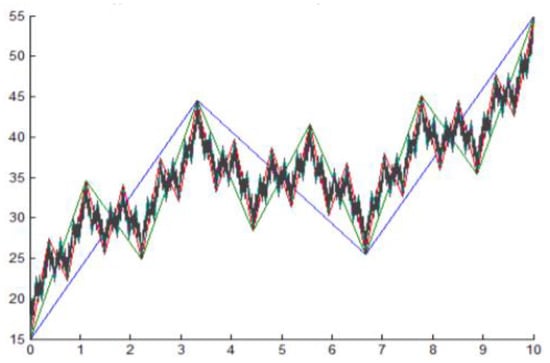

4.2. Fractal Geometry Application in Fintech

From a financial perspective, understanding the irregularities of market trends, using fractal theory through the implementation of adequate algorithms could provide a decisive tool in assessing the risks associated with devastating albeit improbable events (the so-called black swans) [67,68,69] (see Figure 5).

Figure 5.

Self-similarity at different scales. Source: [69].

According to Mandelbrot [37,38,39,40,41,42,43], the understanding of economics does not derive from some abstract theory or from what people want to happen, but from observation of the market. The prices of products do not depend only on the expenses incurred to make or transport them but on their intrinsic value. In any business textbook, that “value” is depicted, in the market trend, with a bell diagram [70,71]. So-called “turbulences”, unpredictable spikes in value in one direction (growth) or the other (decrease), may occur and therefore jeopardize previous forecasts. In general, turbulence is discarded (therefore, excluded by economic models) since it is considered by economists the result of highly improbable exogenous factors that fall into the extreme areas of the gaussian bell tails [38]. The key feature of fractal figures is “self-similarity”: if the details are observed at different scales, a certain similarity with the original fractal is always noted. Fractal geometry is a means to identify these configurations, to analyze and manipulate them, and can be used as a tool for analysis and synthesis. With fractals, the rules are precise and the result predictable, thus also explaining those events that traditional science considered as irregular aspects of nature, tracing them back to the theory of chaos [40]. Real events overcome chaos theory in the sense that the unpredictable takes place, such as the crash of the stock market in 1929 or the unfortunate financial events of August 1998, the 9/11 terroristic attack, or the global financial crisis in 2008. According to standard models studied by traditional economics, the sequence of these events was so unlikely that it was considered impossible. Technically, those events are called “outlier”, which is far from the “normal” expected value in the “gaussian world” [67]. Yet those “turbulent” events happened. This, according to fractals, means that the traditional economy is wrong. Financial markets are risky—everyone knows it—but a thorough study of risk, according to the supported of fractal theory, can offer a new understanding, therefore hoping to achieve “new” quantitative control. The goal is, therefore, to study the risk, even if Mandelbrot himself admits that nothing can be predicted with 100% accuracy [39,40,41,72,73,74,75,76].

It, therefore, seems obvious to hope and predict, the use of fractal models (more complete than the traditional ones based on the normal trend) to determine the study of risk, without neglecting (or completely excluding) potentially devastating events, only because they are not very probable. Practical applications have already been suggested or implemented as part of the calculation of options [68,69] and for the calculation of complex and more accurate forecasting algorithms of future scenarios in trading and “black swans” identification [67].

4.3. Database Systems, Blockchain Distributed Ledger Applications in Fintech

The blockchain, Distributed Ledger, is known above all for being the algorithm behind cryptocurrencies and is often used as a synonym for Bitcoin. However, it represents a paradigm shift ready to revolutionize the world of finance in terms of efficiency, costs, and intermediation. Indeed, blockchain is considered among the most interesting technologies that are impacting the world of Fintech and insurance [77,78]. Banks and industry players have now understood the importance of Blockchain and Distributed Ledger, and there is an increasing number of services based on these technologies promoted by financial and insurance institutions around the world. The leaders of the developed countries seem to have finally identified the potential and the innovative scope of the Blockchain [79,80].

Each time a new transaction occurs, all members of the community are informed and must validate the exchange of information by updating their register, and at the same time checking that everything is consistent with the history of previous transactions and with the rules of the market. The blockchain immediately appeared (since it became mainstream in 2009 for Bitcoin) technology expected to transform entire professional sectors, thanks to its essentially instant operation and the anti-tampering model it offers. Indeed, to tamper systems based on the blockchain, it would be necessary to simultaneously alter the various copies of the register, owned by the different users, not only by one centralized entity [81]. The decentralized information structure—in which the data in the registers are in the hands of everyone and, therefore, no one in particular—if, on the one hand, it promises disintermediation and evolution towards international peer-to-peer systems, on the other, it risks reducing the possibilities of control and the guarantees of legality offered by traditional systems, based instead on centralized management. In some cases, this is why blockchain was spoken of, at least at the beginning of its history, as an “anarchist” technology [82].

By focusing on the finance industry, not only money, but also stocks, bonds, and securities could be managed and traded using blockchain technology. The benefits of dematerialization would be added to the benefits already mentioned, with the definitive overcoming of the model based on a printed paper to move to a completely digital ecosystem. All this would then translate into savings, both for those who offer the intermediation service and for the citizen who acts as the sender or recipient of the transaction. Although the banking system is already enjoying cost-saving advantages, it is also demonstrated that dematerialization will bring many other efficiencies through the improvement of business models [83].

The blockchain will make it possible to make international payments faster and easier, which have always been slower and more expensive than national transactions. Contracts will also benefit from the same technology, becoming “smart” since they will eliminate the need (and cost) of a broker, also achieving immediate and automatic enforcement of the underlying economic transactions [84]. Remarkable advantages in terms of transparency and traceability of transactions are also pledged not only to banks but also to insurance companies, with services available at any time [85,86]. Trading is also expected to become even more efficient and accurate.

P2P lending (peer-to-peer lending, social lending), an innovative financial tool that offers the possibility of financing private consumers and businesses through the internet and blockchain, seems to be the best technology to host decentralized ledger systems [87]. These systems work as brokerage platforms to link potential borrowers and lenders looking for investments without the need for intermediaries (therefore, avoiding brokerage fees). In the past, deposits and payments were entirely carried out by the banking system. Recently, however, all over the world, the so-called P2P Lending platforms offer private citizens the opportunity to perform the same function [88].

The term Crowdfunding derives from the merger of two words, “crowd” and “funding”, therefore identifying the practice of “finding funds through the crowd”, that is, a type of micro-financing based on fostering investments in specific businesses freely inspired by the project and the proposed idea [89]. Currently, real estate crowdfunding, the fundraising to finance real estate transactions, is starting to use the blockchain, the set of technologies that allows maximum security and transparency in data storage [90]. It is possible to identify different levels in the use of blockchain architecture in the field of crowdfunding and P2P lending.

- ○

- Distribution of “tokens” (virtual coins) to donors/lenders in proportion to the amount given, to be used for events or as a medium of exchange with other users: in practice, a more flexible version of the rewards [90].

- ○

- Use of existing digital currencies such as Bitcoin to obtain the project funded or to obtain a loan, especially if linked to these technologies; the advantage is that donors/lenders are often supporters of cryptocurrencies and automatically become “investors” who want to expand the portfolio hoping that their virtual investments will increase in value [91].

- ○

- Apps or online services: dedicated App Coin can be created, “coins” (provided to donors/lenders) that can be used by them within the app or an ecosystem of apps and services [92].

- ○

- Self-financing: the creators of a technology project can create their cryptocurrency in a certain amount; they keep a part of the new cryptocurrency for themselves and the rest is sold in exchange for donations/loans from users: they automatically become investors, betting on the success of the project and the consequent increase in the value of their digital currencies [93].

The blockchain is, therefore, not connected in the financial field to crypto-currencies, but also and above all from the perspective of decentralized systems in general. The blockchain has features that can prove crucial for administrative and accounting consultancy companies. Not surprisingly, the four main companies in the sector—Deloitte, Ernst and Young (EY), KPMG, and PriceWaterhouseCooper (PWC)—are already implementing the technology in their offer [80]. The underlying reason why today’s accountants should be concerned about expanding their knowledge of the Blockchain is that it has two characteristics, which can prove crucial for their profession: transparency and immutability. It is of enormous benefit to the integrity of an accounting or finance company that the records are easily accessible to authorized persons. The rules that govern how authorized entities can access financial records, and the blockchain, use so-called smart contracts. Blockchain-based accounting and finance, therefore, inevitably represents the next step for the FinTech industry [94]; it should be noted, however, that the problems that have hitherto slowed down the effective diffusion of this technology are mainly linked to the high development costs and the need to train company personnel for its use.

4.4. Miscellaneous Further Fintech Applications

In addition to the possible applications determined by the paradigmatic shifts listed above, some further miscellaneous drivers constitute forthcoming applications. It is worth listing the major applications that, through the use of new technologies, are already impacting the Fintech sector, shaping the future of the industry, although unrelated to any of the three previous drivers.

- ○

- Payment gateways—software that facilitates a transaction by communicating information about transactions. A payment gateway authorizes credit card payment for online retailers, traditional stores, and e-commerce ventures. The payment gateway protects the details on a credit card by encrypting the sensitive information it holds. This process ensures that personal private details are passed securely between the customer and the merchant. A payment gateway is part of the process that occurs in the background when a credit or debit card transaction occurs. By sending information securely between the website and the credit card network for processing and then returning the transaction details from the payment network to the website, this is a core component that enables e-commerce [95].

- ○

- Digital wallets (E-wallets)—a virtual wallet that allows users to make payments, online or in physical stores, using electronic devices. In other words, an e-wallet is a secure tool that can store credit, debit, prepaid, or bank account numbers to make payments quickly and easily. The virtual wallet is the safest solution for digital payments: it allows users to make payments simply by creating a free account and entering an email address. After creating the account, the user can enable payments without sharing their personal data. Indeed, to authenticate the transaction, the consumer will only have to enter the email connected to his wallet and the relative password. In this way, there will be no need to share sensitive data or information, avoiding the risks of fraud or theft. All the user’s personal information is stored in dedicated protected environments outside the online pages, making the payment particularly secure. In the current context, increasingly oriented towards payments by phone and on the move, the most used version of e-wallets is undoubtedly the mobile one [95].

- ○

- Digital banking/digital insurance—represents the use of technology to provide banking/insurance products. However, the concept of digital banking/digital insurance (or “InsurTech”) cannot be understood only using an online or mobile platform. Going digital means embracing the latest technologies at all functional levels and across all service delivery platforms. A digital bank would behave in the same way at the branch, at the head office, on an online service delivery platform, at ATMs, and vending machines. Many other banking/insurances functions can be managed online, such as (a) risk management, (b) treasury, (c) product development, (d) marketing, and (e) relationship-based sales teams [96,97].

4.5. Fintech Frontiers Overview and SWOT Analysis

As demonstrated, the frontiers of Fintech are numerous, as well as the applications that are currently and soon ready to revolutionize the financial and banking sector. Some of these frontiers, however, are expected to have a greater impact, as they are linked to structural paradigm shifts.

Given the above discussion and the underlying systematic review of the literature, it is possible to summarize in Table 1 the main current and forthcoming applications in the Fintech field, classified according to the paradigm shifts relating to the three main identified scientific fields.

Table 1.

Drivers; new paradigms; current and forthcoming applications.

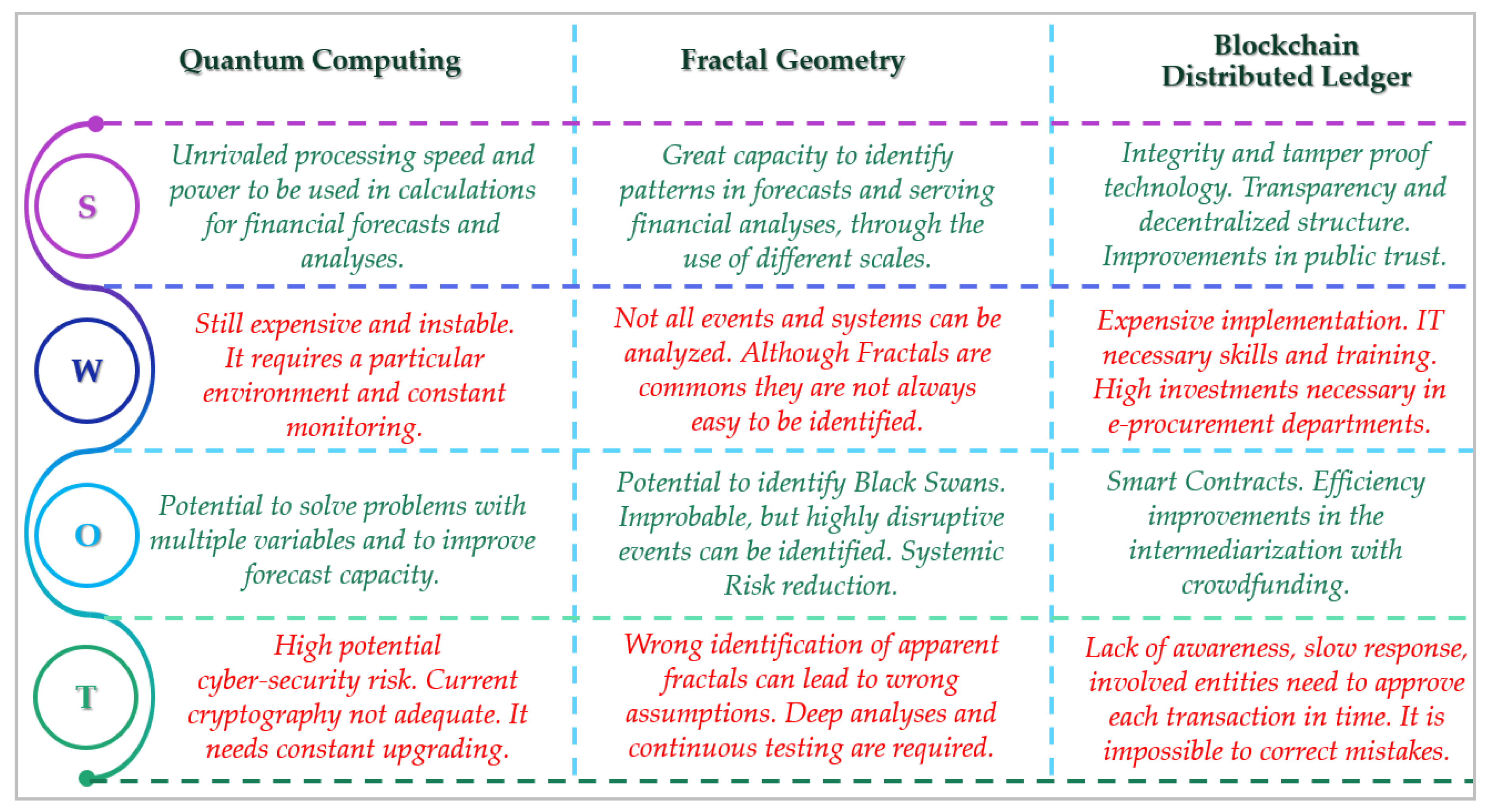

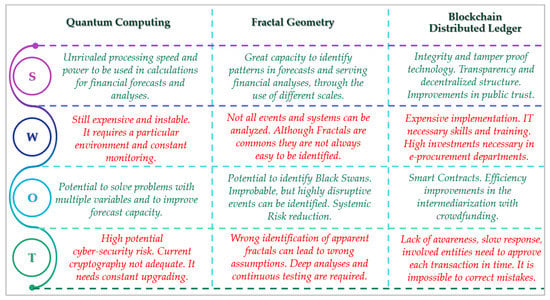

Based on the outlined results in the table above, important outcomes are further examined by defining a SWOT analysis, to identify Strengths, Weaknesses, Opportunities, and Threats (See Figure 6).

Figure 6.

SWOT Analysis. Quantum Computing, Fractal Geometry, and Blockchain Distributed Ledger impacts on Fintech Industry.

The identified framework, thanks to the SWOT analysis, is undoubtedly relevant for the orientation of regulation development in the Fintech field. It is well known that financial regulations are usually only updated after huge scandals and frauds. Indeed, the slow response of the regulators and the rigidity of the legal system, based on feedback mechanisms, are notorious [98].

Thus, this framework aims to offer: (a) an opportunity for regulators to adopt a feed-forward approach in defining regulations in the Fintech field; (b) an overview of the technologies that can reasonably and potentially have a greater impact on the sector to the other interested players.

5. Discussion: Fintech Frontiers and Open Innovation

The above-identified possible interconnections among the different fields of science, indeed, must be supported by a review of the business models adopted by Fintech companies operating in the Fintech sector. The open innovation business management model [99,100,101,102,103,104,105,106] is undoubtedly the most suitable to face the changes that Fintech companies are already facing and that they must be ready to face. As broadly confirmed by previous research, the firm performance is significantly and positively affected by the level of open innovation, especially in emerging and growing sectors [99,107,108,109,110,111,112,113]. Hiring highly qualified personnel or establishing collaborations with external companies specializing in quantum computing, fractal geometry, and blockchain will, therefore, be essential to contribute to a cultural shift [103] needed to ride innovation and to obtain the typical first movers’ greatest benefits [111].

While blockchain technology is undoubtedly considered as a “mainstream technology for OI ecosystems” [104,105], internal factors such as “the extent of knowledge amount, the degree of technological knowledge, and the different open innovation strategy” [99] can have a great impact on the level of open innovation that can lead to success in the Fintech sector. However, this success can be also generated by many external drivers, such as regional or national innovation systems [99]. It will, therefore, be crucial for Fintech companies to base their headquarters in the most innovation-oriented countries, which are, according to the Bloomberg Innovation Index: 1. Germany; 2. South Korea; 3. Singapore; 4. Switzerland; 5. Sweden; 6. Israel; 7. Finland; 8. Denmark; 9. United States of America; and 10. France [101,112].

According to Chandler, Amatori, and Hikino [114], big businesses are the only ones that can afford the necessary triple investment necessary to catch the opportunities of technology: (a) plants and equipment that allow economies of scale and diversification; (b) merger of production and distribution within the same company to obtain a fluid connection between factory and market that transforms high fixed costs into low unit costs, and (c) creation of an extensive managerial network capable of supervising the entire business process for coordination. However, given that the investment in R&D in the Fintech industry is not only made by the spin-off of big banking companies but also by many new competitors [113], it is demonstrated that the investment in Open Innovation made by new start-ups and SMEs allows the development of a “new combination of entrepreneurial technology and markets” [101].

Investigating in future research the number of applicants for total patents could be useful to calculate the Intensity of Open Innovation (IOI) and the related Total Level of Open Innovation (TOI) [100]. According to Minesoft, the most recent patents in the Fintech industry are those related to the following main clusters: (a) Trading, for example, in stocks, commodities, derivatives, or currencies; (b) Crypto-Currencies; (c) Financial Security, e.g., Blockchain; (d) Electronic or mobile payments; (e) Banking, e.g., interest calculation, credit approval, and mortgages; (f) Investments, e.g., financial instruments or portfolio and fund management; (g) Insurance, e.g., risk analysis or pensions [115]. Considering these clusters, and weighting the number of patents with their market value (when available), could undoubtedly be a good starting point to test the level of innovation of each country and to eventually confirm the findings of the Bloomberg Innovation Index from an Open Innovation perspective.

The focus on patents, however, cannot be the only one to be considered. It is known that many open-source projects are currently developed in the quantum computing field [102]. Indeed, this trend can even increase the opportunities for open innovation in Fintech, decreasing the cost of the introduction of new technologies and, therefore, creating opportunities for new start-ups. It must be said, however, that in the case of quantum computing, despite the open-source software and applications, the cost of hardware is still unaffordable to most companies. The introduction of cloud-based quantum platforms, however, could overcome this limitation [116]. The one offered by the first-mover IBM is a leading example [117].

6. Conclusions

Given that the financial sector is undoubtedly the most regulated, as a pillar of the functioning of the economy, based on public trust, the development of all technologies with application in this industry appears to be of considerable interest to policymakers and regulators [1,2,44]. The incredible ability to speed up transactions, to connect users (potential lenders and borrowers) without adequate reliability checks, along with the decentralization of systems, represent essential challenges and as many concerns for the future of Fintech. The need to reduce (or at least mitigate) systemic risk certainly contrasts with an increasingly easily interconnected system, where “concentrated markets are not necessarily more susceptible to systemic risk than dispersed or disaggregated ones” [9].

The economy, in general, and finance, in particular, have always been impacted by technological advances. Although some attempts have been already carried out [118,119,120,121], the identification of the drivers that can most lead (and at the same time threaten) the development of the Fintech industry appears to be a very controversial topic, being to date the object of unsystematic research, only focused on specific features, rather than providing a comprehensive framework that could help to:

- (a)

- Improve the regulations, therefore ensuring public trust and reducing systemic risks;

- (b)

- Gather relevant information on the opportunities that technologies can bring through a re-intermediarization.

Given the need for new Open Innovation business models, this article intends to highlight the impact that paradigmatic shifts in three interdependent sciences are generating on the Fintech industry: geometry (from normal to fractal distribution), physics (from classical bit to quantum bit), and database systems (from centralized to the distributed ledger—blockchain). After briefly, but rather comprehensively, analyzing the shifts in those paradigms, it was possible to demonstrate (see Table 1 and Figure 6) that most of the forthcoming Fintech applications are based and attributable to at least one of them or to a combination of them (i.e., forecasting algorithms to be run on a cloud quantum environment). The process of introducing these applications has also been accelerated by the current outbreak of the COVID-19 pandemic, which has substantially changed consumer expectations, focusing in particular on the need to ensure consumer trust and ease of use [121].

While the main limitation of this research is related to the impossibility of predicting which of these technologies will generate the greatest impact on the Fintech industry, its main usefulness is due to the ability to shed light on the Fintech sector. The systematic survey, through a classification that can be traced back to major paradigms, allows readers (scholars, regulators, entrepreneurs, and Fintech stakeholders in general) to understand and foresee most of the future technological trends.

Author Contributions

Conceptualization, A.F. and N.R.M.; methodology, A.F.; validation, A.F.; formal analysis, A.F.; investigation, A.F.; resources, A.F.; data curation, N.R.M.; writing—original draft preparation, A.F.; writing—review and editing, N.R.M.; visualization, A.F.; supervision, N.R.M.; project administration, A.F.; funding acquisition, N.R.M. All authors have read and agreed to the published version of the manuscript.

Funding

The APC was funded by the American University of Malta.

Data Availability Statement

No new data were created or analyzed in this study. Data sharing is not applicable to this article.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Mishra, P.; Reshef, A. How do central bank governors’ matter? Regulation and the financial sector. J. Money Credit Bank. 2019, 51, 369–402. [Google Scholar] [CrossRef]

- Jones, E.; Knaack, P. Global financial regulation: Shortcomings and reform options. Glob. Policy 2019, 10, 193–206. [Google Scholar] [CrossRef]

- Corrado, C.A.; Hulten, C.R. How do you measure a “technological revolution”? Am. Econ. Rev. 2010, 100, 99–104. [Google Scholar]

- Grinin, L.; Grinin, A. The Cybernetic Revolution and the Future of Technologies. In The 21st Century Singularity and Global Futures; Springer: Cham, Switzerland, 2020; pp. 377–396. [Google Scholar]

- Philippon, T. The fintech opportunity (No. w22476). Natl. Bur. Econ. Res. 2016, 1–25. [Google Scholar] [CrossRef]

- Arner, D.W.; Barberis, J.; Buckley, R.P. The evolution of Fintech: A new post-crisis paradigm. Georget. J. Int. Law 2015, 47, 1271–1285. [Google Scholar] [CrossRef]

- Kutler, J. Citibank is Shedding Individualistic Image. American Banker. 1993. Available online: https://www.americanbanker.com/opinion/friday-flashback-didciti-coin-the-term-fintech (accessed on 5 January 2021).

- Magnuson, W.J. Regulating Fintech. Vanderbilt Law Rev. 2018, 71, 1167. [Google Scholar]

- Oxford Learner’s Dictionaries. Fintech. Available online: https://www.oxfordlearnersdictionaries.com/definition/english/fintech (accessed on 21 December 2020).

- Vasiljeva, T.; Lukanova, K. Commercial banks and FINTECH companies in the digital transformation: Challenges for the future. J. Bus. Manag. 2016. Available online: https://www.riseba.lv/sites/default/files/inline-files/jbm_09.02_2016_11_2.pdf#page=25 (accessed on 5 January 2021).

- Utzerath, C.; Fernández, G. Shaping science for increasing interdependence and specialization. Trends Neurosci. 2017, 40, 121–124. [Google Scholar] [CrossRef]

- Puschmann, T. Fintech. Bus. Inf. Syst. Eng. 2017, 59, 69–76. [Google Scholar] [CrossRef]

- Available online: https://www.computerweekly.com/opinion/How-5G-is-going-to-transform-digital-banking-in-2021 (accessed on 21 December 2020).

- Prasad, K.K.; Aithal, P.S. Massive Growth of Banking Technology with the Aid of 5G Technologies. Int. J. Manag. IT Eng. (IJMIE) 2015, 5, 616–627. [Google Scholar]

- Treleaven, P. Financial regulation of FinTech. J. Financ. Perspect. 2015, 3, 1–17. [Google Scholar]

- Available online: https://www.oxfordreference.com/view/10.1093/acref/9780192830982.001.0001/acref-9780192830982-e-10830?rskey=5FhuqV&result=1 (accessed on 21 December 2020).

- Bagozzi, R.P. The legacy of the technology Acceptance model and a proposal for a paradigm shift. J. Assoc. Inf. Syst. 2007, 8, 3. [Google Scholar] [CrossRef]

- Sultana, F. Paradigm shift and diversity in finance. J. Financ. Account. Res. 2020, 2, 94–113. [Google Scholar] [CrossRef]

- Omarini, A. FinTech: A New Hedge for a Financial Re-intermediation. Strategy and Risk Perspectives. Front. Artif. Intell. 2020, 3, 63. [Google Scholar] [CrossRef]

- Knewtson, H.S.; Rosenbaum, Z.A. Toward understanding FinTech and its industry. Manag. Financ. 2020. [Google Scholar] [CrossRef]

- Remacle, F.; Levine, R.D. Quantum dots as chemical building blocks: Elementary theoretical considerations. ChemPhysChem 2001, 2, 20–36. [Google Scholar] [CrossRef]

- Carney, M. The promise of Fintech–something new under the sun. In Speech at Deutsche Bundesbank G20 Conference, by Bank of England Governor Mark Carney; Bank of England: London, UK, 25 January 2017. [Google Scholar]

- Jiao, J.; Long, G.J.; Grandjean, F.; Beatty, A.M.; Fehlner, T.P. Building blocks for the molecular expression of quantum cellular automata. Isolation and characterization of a covalently bonded square array of two ferrocenium and two ferrocene complexes. J. Am. Chem. Soc. 2003, 125, 7522–7523. [Google Scholar] [CrossRef]

- Giamarchi, T. Quantum Physics in One Dimension; Clarendon Press: Oxford, UK, 2003; Volume 121. [Google Scholar]

- Wodkiewicz, K.; Knight, P.L.; Buckle, S.J.; Barnett, S.M. Squeezing and superposition states. Phys. Rev. A 1987, 35, 2567. [Google Scholar] [CrossRef]

- Plenio, M.B.; Virmani, S.S. An introduction to entanglement theory. In Quantum Information and Coherence; Springer: Cham, Switzerland, 2014; pp. 173–209. [Google Scholar]

- De Barros, J.A.; Suppes, P. Quantum mechanics, interference, and the brain. J. Math. Psychol. 2009, 53, 306–313. [Google Scholar] [CrossRef]

- Bhattacharyya, R.; Banerjee, M.; Heiblum, M.; Mahalu, D.; Umansky, V. Melting of interference in the fractional quantum Hall effect: Appearance of neutral modes. Phys. Rev. Lett. 2019, 122, 246801. [Google Scholar] [CrossRef]

- Zeng, B.; Chen, X.; Zhou, D.L.; Wen, X.G. Quantum Information Meets Quantum Matter; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Slussarenko, S.; Pryde, G.J. Photonic quantum information processing: A concise review. Appl. Phys. Rev. 2019, 6, 41303. [Google Scholar] [CrossRef]

- Raychev, N. Interactive Quantum Development Environment (IQDE). J. Quantum Inform. Sci. 2016, 6, 105. [Google Scholar] [CrossRef]

- Egger, D.J.; Gambella, C.; Marecek, J.; McFaddin, S.; Mevissen, M.; Raymond, R.; Yndurain, E. Quantum computing for Finance: State of the art and future prospects. IEEE Trans. Quantum Eng. 2020. [Google Scholar] [CrossRef]

- Selvam, A.M. Fractal fluctuations and statistical normal distribution. Fractals 2009, 17, 333–349. [Google Scholar] [CrossRef]

- Fernández-Martínez, M.; Guirao, J.L.G.; Sánchez-Granero, M.Á.; Segovia, J.E.T. Fractal Dimension for Fractal Structures: With Applications to Finance; Springer: Berlin/Heidelberg, Germany, 2019; Volume 19. [Google Scholar]

- Makletsov, S.V.; Opokina, N.A.; Shafigullin, I.K. Application of fractal analysis method for studying stock market. Int. Trans. J. Eng. Manag. Appl. Sci. Technol. 2019, 11. [Google Scholar] [CrossRef]

- Mandelbrot, B.B. Fractals and Chaos: The Mandelbrot Set and Beyond; Springer Science & Business Media: Berlin, Germany, 2013. [Google Scholar]

- Mandelbrot, B.B.; Hudson, R.L. The (mis) Behavior of Markets: A Fractal View of Risk, Ruin and Reward; Profile Books: London, UK, 2010. [Google Scholar]

- Mandelbrot, B.B. Les Objets Fractals. Forme, Hasard et Dimension; Champs Flammarion: Paris, France, 1975. [Google Scholar]

- Campbell, P.; Abhyankar, S. Fractals, Form, Chance and Dimension; Springer: Berlin/Heidelberg, Germany, 1978. [Google Scholar]

- Mori, H. Fractal dimensions of chaotic flows of autonomous dissipative systems. Prog. Theor. Phys. 1980, 63, 1044–1047. [Google Scholar] [CrossRef]

- Mandelbrot, B.B. The Fractal Geometry of Nature; W.H. Freeman and Co.: New York, NY, USA, 1982. [Google Scholar]

- Mandelbrot, B.B. Fractals and Scaling in Finance: Discontinuity, Concentration, Risk. Selecta Volume E; Springer Science & Business Media: Berlin, Germany, 2013. [Google Scholar]

- Jun, M. Blockchain government—A next form of infrastructure for the twenty-first century. J. Open Innov. Technol. Mark. Complex. 2018, 4, 7. [Google Scholar] [CrossRef]

- Choi, B.-G.; Jeong, E.; Kim, S.-W. Multiple Security Certification System between Blockchain Based Terminal and Internet of Things Device: Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2019, 5, 87. [Google Scholar] [CrossRef]

- Setyowati, M.S.; Utami, N.D.; Saragih, A.H.; Hendrawan, A. Blockchain Technology Application for Value-Added Tax Systems. J. Open Innov. Technol. Mark. Complex. 2020, 6, 156. [Google Scholar]

- Kher, R.; Terjesen, S.; Liu, C. Blockchain, Bitcoin, and ICOs: A review and research agenda. Small Bus. Econ. 2020, 1–22. [Google Scholar] [CrossRef]

- Nakamoto, S. Bitcoin: A Peer-to-Peer Electronic Cash System; Manubot; Satoshi Nakamoto Institute: Tokyo, Japan, 2019. [Google Scholar]

- Lemieux, P. Who Is Satoshi Nakamoto? Regulation 2013, 36, 14. [Google Scholar]

- Berentsen, A. Aleksander Berentsen Recommends “Bitcoin: A Peer-to-Peer Electronic Cash System” by Satoshi Nakamoto. In 21st Century Economics; Springer: Cham, Switzerland, 2019; pp. 7–8. [Google Scholar]

- Sunyaev, A. Distributed ledger technology. In Internet Computing; Springer: Cham, Switzerland, 2020; pp. 265–299. [Google Scholar]

- Kannengießer, N.; Lins, S.; Dehling, T.; Sunyaev, A. Trade-offs between distributed ledger technology characteristics. ACM Comput. Surv. Csur. 2020, 53, 1–37. [Google Scholar] [CrossRef]

- Hamilton, M. Blockchain distributed ledger technology: An introduction and focus on smart contracts. J. Corp. Account. Financ. 2020, 31, 7–12. [Google Scholar] [CrossRef]

- Shiau, W.L.; Yuan, Y.; Pu, X.; Ray, S.; Chen, C.C. Understanding fintech continuance: Perspectives from self-efficacy and ECT-IS theories. Ind. Manag. Data Syst. 2020. [Google Scholar] [CrossRef]

- Lee, R.S. Future Trends in Quantum Finance. In Quantum Finance; Springer: Singapore, 2020; pp. 399–405. [Google Scholar]

- Hayes, J. Quantum on the money quantum computing in financial services sector. Eng. Technol. 2019, 14, 34–37. [Google Scholar]

- Arute, F.; Arya, K.; Babbush, R.; Bacon, D.; Bardin, J.C.; Barends, R.; Burkett, B. Quantum supremacy using a programmable superconducting processor. Nature 2019, 574, 505–510. [Google Scholar]

- Crane, L. Honeywell claims quantum record. In New Scientists; Elsevier: Amsterdam, The Netherlands, 2020. [Google Scholar]

- Available online: https://cambridgequantum.com/cambridge-quantum-computing-and-honeywell-announce-new-investment-and-strengthened-partnership/ (accessed on 21 December 2020).

- Claessens, S.; Frost, J.; Turner, G.; Zhu, F. Fintech credit markets around the world: Size, drivers and policy issues. BIS Q. Rev. September 2018. Available online: https://www.bis.org/publ/qtrpdf/r_qt1809e.htm (accessed on 5 January 2021).

- Alcazar, J.; Leyton-Ortega, V.; Perdomo-Ortiz, A. Classical versus quantum models in machine learning: Insights from a finance application. Mach. Learn. Sci. Technol. 2020. [Google Scholar] [CrossRef]

- Available online: https://newsroom.ibm.com/2020-11-30-IBM-Cloud-Delivers-Quantum-Safe-Cryptography-and-Hyper-Protect-Crypto-Services-to-Help-Protect-Data-in-the-Hybrid-Era#:~:text=IBM%20Key%20Protect%2C%20a%20cloud,protect%20data%20during%20the%20key (accessed on 21 December 2020).

- Boschini, C.; Camenisch, J.; Ovsiankin, M.; Spooner, N. Efficient Post-quantum SNARKs for RSIS and RLWE and Their Applications to Privacy. In International Conference on Post-Quantum Cryptography; Springer: Cham, Switzerland, 2020; pp. 247–267. [Google Scholar]

- Baaquie, B.E. Quantum finance: Path integrals and Hamiltonians for Options and Interest Rates; Cambridge University Press: Cambridge, UK, 2007. [Google Scholar]

- Focardi, S.; Fabozzi, F.J.; Mazza, D. Quantum Option Pricing and Quantum Finance. J. Deriv. 2020. [Google Scholar] [CrossRef]

- Orrell, D. Quantum-tative Finance. Wilmott 2020, 16–23. [Google Scholar] [CrossRef]

- Taleb, N.N. Ten principles for a Black Swan-proof world. Financial Times, 7 April 2009. [Google Scholar]

- Mosteanu, N.R.; Faccia, A.; Torrebruno, G.; Torrebruno, F. Fractals–A Smart Financial Tool to Assess Business Management Decisions. J. Inf. Syst. Operat. Manag. 2019, 1, 45–56. [Google Scholar]

- Mosteanu, N.R.; Faccia, A.; Torrebruno, G.; Torrebruno, F. The newest intelligent financial decisions tool: Fractals. A smart approach to assess the risk. Bus. Manag. Rev. 2019, 10, 89–97. [Google Scholar]

- Koller, T.; Goedhart, M.; Wessels, D. Valuation: Measuring and Managing the Value of Companies; John Wiley Sons: Hoboken, NJ, USA, 2010; Volume 499. [Google Scholar]

- Copeland Thomas, E.; Koller, T.; Murrin, J. Valuation: Measuring and Managing the Value of Companies; Wiley Frontiers in Finance; McKinsey & Company: New York, NY, USA, 1994. [Google Scholar]

- Mandelbrot, B.B. The inescapable need for fractal tools in finance. Ann. Financ. 2005, 1, 193–195. [Google Scholar]

- Mandelbrot, B.B. Parallel cartoons of fractal models of finance. Ann. Financ. 2005, 1, 179–192. [Google Scholar] [CrossRef]

- Jensen, M.H.; Johansen, A.; Simonsen, I. Inverse Fractal Statistics in Turbulence and Finance. Int. J. Mod. Phys. B 2003, 17, 4003–4012. [Google Scholar] [CrossRef]

- Calvet, L.E.; Fisher, A.J. Extreme Risk and Fractal Regularity in Finance. SSRN Electron. J. 2012, 601, 65–94. [Google Scholar] [CrossRef]

- Celeste, V.; Corbet, S.; Gurdgiev, C. Fractal dynamics and wavelet analysis: Deep volatility and return properties of Bitcoin, Ethereum and Ripple. Q. Rev. Econ. Financ. 2020, 76, 310–324. [Google Scholar] [CrossRef]

- Faccia, A.; Mosteanu, N.R. Accounting and blockchain technology: From double-entry to triple-entry. Bus. Manag. Rev. 2019, 10, 108–116. [Google Scholar]

- Mosteanu, N.R.; Faccia, A. Digital Systems and New Challenges of Financial Management-FinTech, XBRL, Blockchain and Cryptocurrencies. Qual. Access Success 2020, 21, 159–166. [Google Scholar]

- Simoyama, F.D.O.; Grigg, I.; Bueno, R.L.P.; Oliveira, L.C.D. Triple entry ledgers with blockchain for auditing. Int. J. Audit. Technol. 2017, 3, 163–183. [Google Scholar] [CrossRef]

- Kokina, J.; Mancha, R.; Pachamanova, D. Blockchain: Emergent Industry Adoption and Implications for Accounting. J. Emerg. Technol. Account. 2017, 14, 91–100. [Google Scholar] [CrossRef]

- Treleaven, P.; Brown, R.G.; Yang, D. Blockchain technology in finance. Computer 2017, 50, 14–17. [Google Scholar]

- Schrepel, T. Anarchy, State, and Blockchain Utopia: Rule of Law Versus Lex Cryptographia. General Principles and Digitalization; Hart Publishing: Oxford, UK, 2020. [Google Scholar]

- Hadad, S.; Bratianu, C. Dematerialization of banking products and services in the digital era. Manag. Mark. Chall. Knowl. Soc. 2019, 14, 318–337. [Google Scholar] [CrossRef]

- Cong, L.W.; He, Z. Blockchain disruption and smart contracts. Rev. Financ. Stud. 2019, 32, 1754–1797. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; DeMartini, C.; Pranteda, C.; Santamaría, V. Blockchain and Smart Contracts for Insurance: Is the Technology Mature Enough? Future Internet 2018, 10, 20. [Google Scholar] [CrossRef]

- Tapscott, A.; Tapscott, D. How blockchain is changing finance. Harv. Bus. Rev. 2017, 1, 2–5. [Google Scholar]

- Gonzalez, L. Blockchain, herding and trust in peer-to-peer lending. Manag. Financ. 2019, 46, 815–831. [Google Scholar]

- Coakley, J.; Huang, W. P2P lending and outside entrepreneurial finance. Eur. J. Financ. 2020, 1–18. [Google Scholar] [CrossRef]

- Harris, W.L.; Wonglimpiyarat, J. Dynamics of crowdfunding and FinTech challenges. Int. J. Bus. Innov. Res. 2020, 23, 501. [Google Scholar] [CrossRef]

- Shanbhag, S.; Bhalerao, T. Tokenization of Real Estate Using Blockchain Technology. In Proceedings of the Applied Cryptography and Network Security Workshops: ACNS 2020 Satellite Workshops, AIBlock, AIHWS, AIoTS, Cloud S&P, SCI, SecMT, and SiMLA, Rome, Italy, 19–22 October 2020; Springer Nature: Berlin/Heidelberg, Germany, 2020; Volume 12418, p. 77. [Google Scholar]

- Baber, H. Blockchain-Based Crowdfunding. In Blockchain Technology for Industry 4.0; Springer Science and Business Media LLC: Berlin, Germany, 2020; pp. 117–130. [Google Scholar]

- Zook, M.; Grote, M.H. Initial coin offerings: Linking technology and financialization. Environ. Plan. A Econ. Space 2020, 52, 1560–1582. [Google Scholar] [CrossRef]

- Adhami, S.; Giudici, G.; Martinazzi, S. Why do businesses go crypto? An empirical analysis of initial coin offerings. J. Econom. Bus. 2018, 100, 64–75. [Google Scholar] [CrossRef]

- Ibañez, J.I.; Bayer, C.N.; Tasca, P.; Xu, J. REA, Triple-Entry Accounting and Blockchain: Converging Paths to Shared Ledger Systems. SSRN Electron. J. 2020. [Google Scholar] [CrossRef]

- Koesworo, Y.; Muljani, N.; Ellitan, L. Fintech in the industrial revolution era 4.0. Int. J. Res. Cult. Soc. 2019, 3, 53–56. [Google Scholar]

- Sridharan, U.V.; Sridharan, V.; Huning, T.M. Fintech: Digital Tokens. J. Strat. Innov. Sustain. 2019, 14, 14. [Google Scholar] [CrossRef]

- Faccia, A.; Moşteanu, N.R.; Cavaliere, L.P.L.; De Santis, G. The rise of online banks in Italy “WIDIBA Bank” Case Study. Finac. Markets Inst. Risk. 2020. [Google Scholar] [CrossRef]

- Hail, L.; Tahoun, A.; Wang, C. Corporate scandals and regulation. J. Account. Res. 2018, 56, 617–671. [Google Scholar] [CrossRef]

- Lee, R.S.T. Chaos and Fractals in Quantum Finance. In Quantum Finance; Springer Science and Business Media LLC: Berlin, Germany, 2019; pp. 209–233. [Google Scholar]

- Yun, J.J.; Won, D.; Jeong, E.; Park, K.; Lee, D.; Yigitcanlar, T. Dismantling of the Inverted U-Curve of Open Innovation. Sustainability 2017, 9, 1423. [Google Scholar] [CrossRef]

- Yun, J.J.; Avvari, M.; Jeong, E.S.; Lim, N.W. Introduction of an objective model to measure open innovation and its application to the information technology convergence sector. Int. J. Technol. Policy Manag. 2014, 14, 383. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Fingerhuth, M.; Babej, T.; Wittek, P. Open source software in quantum computing. PLoS ONE 2018, 13, e0208561. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Jung, K.; Yigitcanlar, T. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Chen, Y. Blockchain tokens and the potential democratization of entrepreneurship and innovation. Bus. Horiz. 2018, 61, 567–575. [Google Scholar] [CrossRef]

- De La Rosa, J.L.; Torres-Padrosa, V.; El-Fakdi, A.; Gibovic, D.; Hornyák, O.; Maicher, L.; Miralles, F. A survey of block-chain technologies for open innovation. In Proceedings of the 4th Annual World Open Innovation Conference, San Francisco, CA, USA, 20 November 2017; pp. 14–15. [Google Scholar]

- Yun, J.J.; Kim, D.-C.; Yan, M.-R. Open Innovation Engineering—Preliminary Study on New Entrance of Technology to Market. Electronics 2020, 9, 791. [Google Scholar] [CrossRef]

- Jeon, J.-H.; Kim, S.-K.; Koh, J.-H. Historical review on the patterns of open innovation at the national level: The case of the roman period. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1–17. [Google Scholar] [CrossRef]

- Patra, S.K.; Krishna, V.V. Globalization of R&D and open innovation: Linkages of foreign R&D centers in India. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1–24. [Google Scholar] [CrossRef]

- Kodama, F.; Shibata, T. Demand articulation in the open-innovation paradigm. J. Open Innov. Technol. Mark. Complex. 2015, 1, 1–21. [Google Scholar] [CrossRef]

- Barge-Gil, A. Open, Semi-Open and Closed Innovators: Towards an Explanation of Degree of Openness. Ind. Innov. 2010, 17, 577–607. [Google Scholar] [CrossRef]

- Chandler, A.D., Jr. The Visible Hand; Harvard University Press: Cambridge, MA, USA, 1993. [Google Scholar]

- Available online: https://www.bloomberg.com/news/articles/2020-01-18/germany-breaks-korea-s-six-year-streak-as-most-innovative-nation (accessed on 5 January 2021).

- Gabor, D.; Brooks, S. The digital revolution in financial inclusion: International development in the fintech era. New Polit.-Econ. 2017, 22, 423–436. [Google Scholar] [CrossRef]

- Zunz, O.; Chandler, A.D.; Amatori, F.; Hikino, T. Big Business and the Wealth of Nations. Am. Hist. Rev. 2000, 105, 892. [Google Scholar] [CrossRef]

- Available online: https://minesoft.com/2020/03/11/understanding-the-fintech-landscape/ (accessed on 5 January 2021).

- Sim, S.; Cao, Y.; Romero, J.; Johnson, P.D.; Aspuru-Guzik, A. A framework for algorithm deployment on cloud-based quantum computers. arXiv 2018, arXiv:1810.10576. [Google Scholar]

- Available online: https://quantum-computing.ibm.com/ (accessed on 5 January 2021).

- Méndez-Suárez, M.; García-Fernández, F.; Gallardo, F. Artificial Intelligence Modelling Framework for Financial Automat-ed Advising in the Copper Market. J. Open Innov. Technol. Mark. Complex. 2019, 5, 81. [Google Scholar]

- Zulfikar, R.; Lukviarman, N.; Suhardjanto, D.; Ismail, T.; Astuti, K.D.; Meutia, M. Corporate Governance Compliance in Banking Industry: The Role of the Board. J. Open Innov. Technol. Mark. Complex. 2020, 6, 137. [Google Scholar] [CrossRef]

- Goo, J.J.; Heo, J.-Y. The Impact of the Regulatory Sandbox on the Fintech Industry, with a Discussion on the Relation be-tween Regulatory Sandboxes and Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 43. [Google Scholar]

- Al Nawayseh, M.K. FinTech in COVID-19 and Beyond: What Factors Are Affecting Customers’ Choice of FinTech Applica-tions? J. Open Innov. Technol. Mark. Complex. 2020, 6, 153. [Google Scholar]

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).