The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic

Abstract

1. Introduction

1.1. Features of SME Development Prior to the COVID-19 Pandemic

1.2. Development of SMEs during the COVID-19 Pandemic

2. Literature Review

3. Methods and Materials

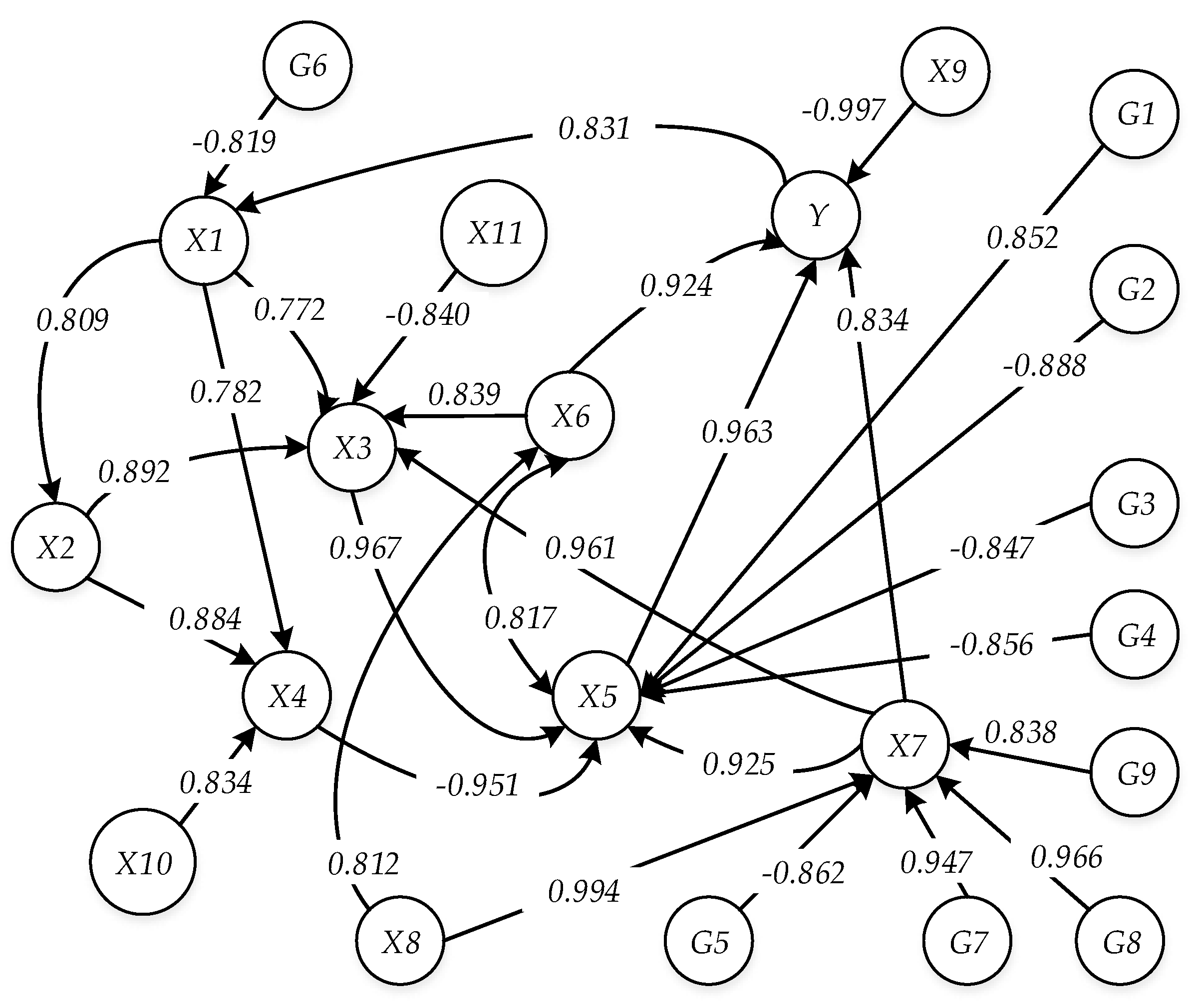

- (1)

- the number of SMEs, units (X1);

- (2)

- the number of employees of small and medium-sized enterprises, thousand people (X2);

- (3)

- the volume of SME turnover, billion RUB (X3);

- (4)

- the volume of production costs of small and medium-sized businesses, billion RUB (X4);

- (5)

- the amount of net profit of SMEs, billion RUB (X5);

- (6)

- the amount of equity capital of SMEs, billion RUB (X6);

- (7)

- the amount of borrowed and attracted capital of SMEs, billion RUB (X7);

- (8)

- the volumes of private investment in fixed assets of SMEs (foreign investment, funds of organizations and population), billion RUB (X8);

- (9)

- the intensity of COVID-19 propagation (X9);

- (10)

- producer price index, % (X10);

- (11)

- consumer price index, % (X11).

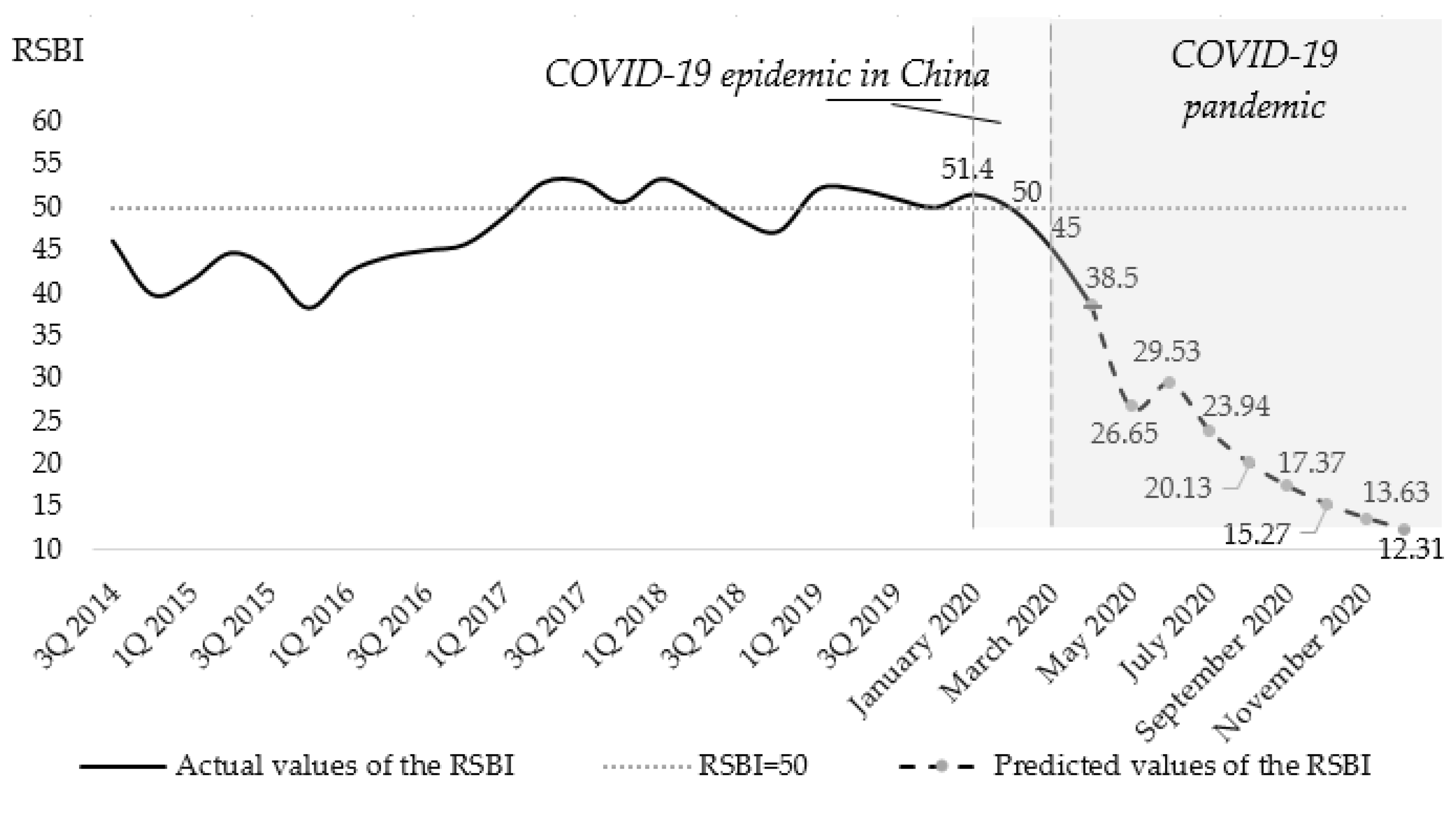

- (1)

- Duration of quarantine in the world (t1), days. The first country to introduce quarantine was China—since 23.01.2020, restrictions have been introduced that affect small and medium-sized businesses around the world. Therefore, 23 January 2020 is the “zero” point from which the duration of quarantine in the world is counted for the purposes of this study. The influence of this indicator on the level of business activities of small and medium-sized enterprises in Russia is conditioned by the mood of panic of the population, the limitation of passenger and transport traffic, the increase in the cost of transporting goods and a decrease in foreign trade. The value of the correlation coefficient between the quarantine duration in the world and the RSBI is −0.97;

- (2)

- The duration of quarantine in Russia (t2), expressed in days, is the duration of the non-working day regime. The impact of quarantine is expressed by a decrease in domestic demand for goods and services; decrease in labor productivity as a result of teleworking (according to [40], teleworking leads to a 5% decrease in labor productivity). The value of the correlation coefficient between the duration of non-working days in Russia and the RSBI is −0.96.

4. Results

- with an increase in the amount of deferred tax/duty payments by 1% relative to the level of 2018, the RSBI increases by 0.820%;

- with a decrease in the number of on-site tax audits by 1% it will increase by 0.855%;

- with a decrease in the number of cameral tax audits by 1% it will increase by 0.815%;

- with a decrease in the amount of insurance premium for compulsory social insurance by 1% it will increase by 0.824%;

- with a decrease in interest on loans by 1% it will increase by 0.753%;

- with a decrease in the number of enterprises that went bankrupt at the initiative of creditors by 1% it will increase by 0.004%;

- with an increase in the volume of subsidies allocated from the federal budget for government support of small and medium-sized businesses by 1% it will increase by 0.827%;

- with an increase in the volume of investments at the expense of budget funds in equity capital of small and medium-sized businesses by 1% it will increase by 0.844%;

- with an increase in investment in equity capital of small and medium-sized businesses at the expense of state non-budgetary funds by 1% it will increase by 0.767%.

5. Discussion

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Obi, J.; Ibidunni, A.S.; Tolulope, A.; Olokundun, M.A.; Amaihian, A.B.; Borishade, T.T.; Fred, P. Contribution of small and medium enterprises to economic development: Evidence from a transiting economy. Data Brief 2018, 18, 835–839. [Google Scholar] [CrossRef]

- Ndiaye, N.; Razak, L.A.; Nagayev, R.; Ng, A. Demystifying small and medium enterprises’ (SMEs) performance in emerging and developing economies. Borsa Istanb. Rev. 2018, 18, 269–281. [Google Scholar] [CrossRef]

- Prasetyo, P.E.; Kistanti, N.R. Human capital, institutional economics and entrepreneurship as a driver for quality & sustainable economic growth. Entrep. Sustain. Issues 2020, 7, 2575–2589. [Google Scholar]

- Gamidullaeva, L.A.; Vasin, S.M.; Wise, N. Increasing small- and medium-enterprise contribution to local and regional economic growth by assessing the institutional environment. J. Small Bus. Enterp. Dev. 2020, 27, 259–280. [Google Scholar] [CrossRef]

- Ronda, L.; Valor, C.; Abril, C. How small traditional businesses can become attractive employers: A means-end analysis. J. Small Bus. Manag. 2020, 58, 362–389. [Google Scholar] [CrossRef]

- Breitzman, A.; Hicks, D. An Analysis of Small Business Patents by Industry and Firm Size. Fac. Sch. Coll. Sci. Math. 2008, 12. Available online: https://pdfs.semanticscholar.org/6273/feb95407897f374761687cc5596b43b2c878.pdf?_ga=2.22497467.1806168906.1591278231-667158733.1588269937 (accessed on 21 May 2020).

- Herr, H.; Nettekoven, Z.M. The Role of Small and Medium-sized Enterprises in Development. What Can Be Learned from the German Experience? Friedrich Ebert Stiftung. 2017. Available online: https://library.fes.de/pdf-files/iez/14056.pdf (accessed on 25 May 2020).

- EC. Country Report Finland 2019. 2019 European Semester: Assessment of progress on structural reforms, Prevention and Correction of Macroeconomic Imbalances, and Results of In-Depth Reviews under Regulation (EU) No 1176/2011. 2019. Available online: https://ec.europa.eu/info/sites/info/files/file_import/2019-european-semester-country-report-finland_en.pdf (accessed on 22 May 2020).

- Stolypin, P.A.; Institute for the Economy of Growth. Small and Medium-Sized Business Sector: Russia and the World. 2018. Available online: http://stolypin.institute/novosti/sektor-malogo-i-srednego-predprinimatelstva-rossiya-i-mir/ (accessed on 28 May 2020).

- RBC. Rosstat Recorded a Decrease in the Share of Small Business in the Economy. 2020. Available online: https://www.rbc.ru/economics/28/01/2020/5e2eda219a79473c798d3692 (accessed on 22 May 2020).

- Government of Russia. National Project “Small and Medium-Sized Entrepreneurship and Support for Individual Entrepreneurial Initiatives”. 2018. Available online: http://government.ru/rugovclassifier/864/events/ (accessed on 25 May 2020).

- Government of Russia. On the Approval of the Strategy for the Development of Small and Medium-Sized Enterprises until 2030. 2016. Available online: http://government.ru/docs/23354/ (accessed on 25 May 2020).

- Expert, RA. Forecast for Lending to Small and Medium-Sized Businesses in Russia for 2020: Records behind. 2020. Available online: https://www.raexpert.ru/researches/banks/msb_2019 (accessed on 28 May 2020).

- Kraemer-Eis, H.; Botsari, A.; Gvetadze, S.; Lang, F.; Torfs, W. European Small Business Finance Outlook: June 2019; EIF Working Paper, No. 2019/57; European Investment Fund (EIF): Luxembourg; Available online: https://www.econstor.eu/bitstream/10419/201544/1/1670468127.pdf (accessed on 21 May 2020).

- SME Corporation. Concessional Lending Programs for Small and Medium-Sized Businesses, Stimulating Lending to SMEs. Available online: https://corpmsp.ru/bankam/programma_stimulir/ (accessed on 21 May 2020).

- Government of Russia. The Passport of the National Project “Small and Medium-Sized Entrepreneurship and Support for Individual Entrepreneurial Initiatives” Has Been Published. 2019. Available online: http://government.ru/info/35563/ (accessed on 23 May 2020).

- PwC. Paying Taxes 2020: Overall Ranking and Data Tables. Available online: https://www.pwc.com/gx/en/services/tax/publications/paying-taxes-2020/overall-ranking-and-data-tables.html (accessed on 28 May 2020).

- Arenina, K. The Number of Small and Medium-Sized Companies in Russia Decreases by 6–10% per Year. The Bell. 2020. Available online: https://thebell.io/chislo-malyh-i-srednih-kompanij-v-rossii-sokrashhaetsya-na-6-10-v-god (accessed on 30 May 2020).

- PSB. The Russia Small Business Index (RSBI). Available online: https://www.psbank.ru/-/media/PSB-1_2/OnlineServices/RSBI-_2020_aprel_presentation.pdf (accessed on 21 May 2020).

- RuBezh. Russia Small Business Index Fell to Lowest Since 2014. Available online: https://ru-bezh.ru/kompanii-i-ryinki/news/20/05/19/indeks-delovoj-aktivnosti-malogo-i-srednego-biznesa-upal-do-mini (accessed on 21 May 2020).

- Interfax. Kudrin Predicted a Jump in Unemployment in Russia Amid the Crisis to 10% in the Worst Case. Available online: https://www.interfax.ru/russia/706027 (accessed on 29 May 2020).

- Zemtsov, S.; Tsareva, Y. Trends in the Development of the Sector of Small and Medium-Sized Enterprises in the Context of a Pandemic and Crisis. Monit. Econ. Situat. Russ. Trends Chall. Socio Econ. Dev. 2020, 10, 155–166. Available online: https://www.iep.ru/upload/iblock/543/16.pdf (accessed on 26 May 2020).

- Barinova, V. A hole in the GDP: What Does the Death of Small Business in Russia Threatens the Economy with. Forbes. 2020. Available online: https://www.forbes.ru/biznes/399389-dyra-v-vvp-chem-grozit-ekonomike-gibel-malogo-biznesa-v-rossii (accessed on 26 May 2020).

- Dimson, J.; Mladenov, Z.; Sharma, R.; Tadjeddine, K. COVID-19 and European Small and Medium-Size Enterprises: How They are Weathering the Storm. McKinsey & Company. 2020. Available online: https://www.mckinsey.com/industries/public-and-social-sector/our-insights/covid-19-and-european-small-and-medium-size-enterprises-how-they-are-weathering-the-storm (accessed on 4 November 2020).

- Deliu, D. The Intertwining between Corporate Governance and Knowledge Management in the Time of Covid-19–A Framework. Emerg. Trends Mkt. Manag. 2020, 1, 93–110. [Google Scholar]

- Eggers, F. Masters of disasters? Challenges and opportunities for SMEs in times of crisis. J. Bus. Res. 2020, 116, 199–208. [Google Scholar] [CrossRef]

- Bouey, J. Assessment of COVID-19′s Impact on Small and Medium-Sized Enterprises. Implications from China. RAND Corporation. 2020. Available online: https://www.rand.org/pubs/testimonies/CT524.html (accessed on 23 May 2020).

- Lesser, R.; Reeves, M. 5 Priorities for Leaders in the New Reality of COVID-19. World Economic Forum. 2020. Available online: https://www.weforum.org/agenda/2020/05/5-things-leaders-succeed-new-reality-coronavirus/ (accessed on 4 November 2020).

- CSR. Business Outlined the Problems to be Faced after the Crisis. Available online: https://www.csr.ru/ru/news/biznes-oboznachil-problemy-s-kotorymi-stolknetsya-posle-krizisa/ (accessed on 27 May 2020).

- Government of Russia. Resolution No. 434 dated 3 April 2020. On the Approval of the List of the Russian Economy Sectors Most Affected by the Worsening Situation as a Result of the Spread of the New Coronavirus Infection. Available online: https://ppt.ru/docs/postanovlenie/pravitelstvo/n-434-231476 (accessed on 27 May 2020).

- The State Duma. Federal Law Dated 03.04.2020 No. 106-FZ. On Amendments to the Federal Law “On the Central Bank of the Russian Federation (Bank of Russia)” and Certain Legislative Acts of the Russian Federation as Regards the Specifics of Amending the Terms of the Credit Agreement and Loan Agreement. Available online: http://publication.pravo.gov.ru/Document/View/0001202004030061?index=0&rangeSize=1 (accessed on 21 May 2020).

- The State Duma. Federal Law Dated 01.04.2020 No. 102-FZ. On Amendments to Parts One and Two of the Tax Code of the Russian Federation and Certain Legislative Acts of the Russian Federation. Available online: https://ppt.ru/docs/fz/102-fz-231279 (accessed on 21 May 2020).

- Tinkoff. Tinkoff CoronaIndex: In May, Small and Medium-Sized Businesses Began to Come Back to Life. 2020. Available online: https://www.tinkoff.ru/about/news/01062020-tinkoff-coronaindex-business-is-coming-back-to-life/ (accessed on 30 May 2020).

- Republic. Analysts Announced the Threat of Closure of Every Fifth Small and Medium-Sized Enterprise in Russia. Available online: http://rk.karelia.ru/ekonomika/analitiki-zayavili-ob-ugroze-zakrytiya-kazhdogo-pyatogo-malogo-i-srednego-predpriyatiya-v-rossii/ (accessed on 30 May 2020).

- National Action Plans on Business and Human Rights. Small & Medium-Sized Enterprises. Available online: https://globalnaps.org/issue/small-medium-enterprises-smes/ (accessed on 21 May 2020).

- Lemes, A.; Machado, T. SMEs and Their Space in the Latin American Economy. 2007. Available online: http://www.eumed.net/eve/resum/07-enero/alb.htm (accessed on 21 May 2020).

- Amankwah-Amoah, J.; Khan, Z.; Wood, G. COVID-19 and business failures: The Paradoxes of Experience, Scale, and Scope for Theory and Practice. Eur. Manag. J. 2020. [Google Scholar] [CrossRef]

- Jenson, H.B. How did “flatten the curve” become “flatten the economy?”. Perspect. USA Asian J. Psychiatry 2020, 51, 102165. [Google Scholar] [CrossRef] [PubMed]

- Shafi, M.; Liu, J.; Ren, W. Impact of COVID-19 pandemic on micro, small, and medium-sized Enterprises operating in Pakistan. Res. Glob. 2020, 2, 100018. [Google Scholar] [CrossRef]

- Vasiljeva, M.; Neskorodieva, I.; Ponkratov, V.; Kuznetsov, N.; Ivlev, V.; Ivleva, M.; Maramygin, M.; Zekiy, A. A Predictive Model for Assessing the Impact of the COVID-19 Pandemic on the Economies of Some Eastern European Countries. J. Open Innov. Technol. Mark. Complex. 2020, 6, 92. [Google Scholar] [CrossRef]

- Sharma, P.; Leung, T.Y.; Kingshott, R.P.J.; Davcik, N.S.; Cardinali, S. Managing uncertainty during a global pandemic: An international business perspective. J. Bus. Res. 2020, 116, 188–192. [Google Scholar] [CrossRef] [PubMed]

- Kulachinskaya, A.; Akhmetova, I.G.; Kulkova, V.Y.; Ilyashenko, S.B. The Challenge of the Energy Sector of Russia during the 2020 COVID-19 Pandemic through the Example of the Republic of Tatarstan: Discussion on the Change of Open Innovation in the Energy Sector. Open Innov. Technol. Mark. Complex. 2020, 6, 60. [Google Scholar] [CrossRef]

- Ponkratov, V.; Kuznetsov, N.; Bashkirova, N.; Volkova, M.; Alimova, M.; Ivleva, M.; Vatutina, L.; Elyakova, I. Predictive Scenarios of the Russian Oil Industry; with a Discussion on Macro and Micro Dynamics of Open Innovation in the COVID 19 Pandemic. Open Innov. Technol. Mark. Complex. 2020, 6, 85. [Google Scholar] [CrossRef]

- Eichenbaum, M.S.; Rebelo, S.; Trabandt, M. The Macroeconomics of Epidemics. NBER Working Paper No. 26882. 2020. Available online: https://www.nber.org/papers/w26882.pdf (accessed on 25 May 2020).

- Guan, D.; Wang, D.; Hallegatte, S.; Davis, S.J.; Huo, J.; Li, S.; Bai, Y.; Lei, T.; Xue, Q.; Coffman, D.; et al. Global supply-chain effects of COVID-19 control measures. Nat. Hum. Behav. 2020, 4, 577–587. [Google Scholar] [CrossRef]

- McKibbin, W.; Fernando, R. The Global Macroeconomic Impacts of COVID-19: Seven Scenarios. 2020. Available online: https://www.brookings.edu/wp-content/uploads/2020/03/20200302_COVID19.pdf (accessed on 23 May 2020).

- Caracciolo, G.; Cingano, F.; Ercolani, V.; Ferrero, G.; Hassan, F.; Papetti, A.; Tommasino, P. Covid-19 and Economic Analysis: A Review of the Debate. Banca D’italia. Lit. Rev. 2020, 2. Available online: https://www.bancaditalia.it/media/notizie/2020/Covid-literature-newsletter-n2.pdf (accessed on 26 May 2020).

- Li, T. A SWOT analysis of China’s air cargo sector in the context of COVID-19 pandemic. J. Air Transp. Manag. 2020, 88, 101875. [Google Scholar] [CrossRef]

- Akande-Sholabi, W.; Adebisi, Y.A.; Bello, A.; Ilesanmi, O.S. COVID-19 in Nigeria: Is the pharmaceutical sector spared? Public Health Pract. 2020, 1, 100044. [Google Scholar] [CrossRef]

- Rowan, N.J.; Galanakis, C.M. Unlocking challenges and opportunities presented by COVID-19 pandemic for cross-cutting disruption in agri-food and green deal innovations: Quo Vadis? Sci. Total Environ. 2020, 748, 141362. [Google Scholar] [CrossRef] [PubMed]

- Kennelly, B.; O’Callaghan, M.; Coughlan, D.; Cullinan, J.; Doherty, E.; Glynn, L.; Moloney, E.; Queally, M. The COVID-19 pandemic in Ireland: An overview of the health service and economic policy response. Health Policy Technol. 2020. [Google Scholar] [CrossRef] [PubMed]

- Lee, J.-W.; McKibbin, W. Globalization and Disease: The Case of SARS. Asian Econ. Pap. 2004, 3, 113–131. [Google Scholar] [CrossRef]

- Evans, D.K.; Goldstein, M.; Popova, A. The Next Wave of Deaths from Ebola? In The Impact of Health Care Worker Mortality; Policy Research Working Paper, no. WPS 7344; World Bank Group: Washington, DC, USA, 2015. [Google Scholar]

- Brown, R.; Rocha, A. Entrepreneurial uncertainty during the Covid-19 crisis: Mapping the temporal dynamics of entrepreneurial finance. J. Bus. Ventur. Insights 2020, 14, e00174. [Google Scholar] [CrossRef]

- Smith, R.D.; Keogh-Brown, M.R.; Barnett, T. Estimating the economic impact of pandemic influenza: An application of the computable general equilibrium model to the UK. Soc. Sci. Med. 2011, 73, 235–244. [Google Scholar] [CrossRef]

- Choi, S.-Y. Industry volatility and economic uncertainty due to the COVID-19 pandemic: Evidence from wavelet coherence analysis. Finance Res. Lett. 2020, 101783. [Google Scholar] [CrossRef]

- Grida, M.; Mohamed, R.; Zaied, A.N.H. Evaluate the impact of COVID-19 prevention policies on supply chain aspects under uncertainty. Transp. Res. Interdiscip. Perspect. 2020, 8, 100240. [Google Scholar] [CrossRef]

- Fernandes, N. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. 2020. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3557504 (accessed on 4 November 2020).

- OECD. Coronavirus (COVID-19): SME Policy Responses. 2020. Available online: https://www.oecd.org/coronavirus/policy-responses/coronavirus-covid-19-sme-policy-responses-04440101/ (accessed on 4 November 2020).

- Turner, J.; Akinremi, T. The business effects of pandemics—A rapid literature review. In ERC Insight Paper; Available online: https://www.enterpriseresearch.ac.uk/publications/the-business-effects-of-pandemics-a-rapid-literature-review/ (accessed on 4 November 2020).

- Cheng, C. COVID-19 in Malaysia: Economic Impacts & Fiscal Responses. Institute of Strategic and International Studies (ISIS) Malaysia. Policy Brief 2020, 1–20. Available online: https://www.isis.org.my/wp-content/uploads/2020/06/POLICY-BRIEF_COVID-19-in-Malaysia.pdf (accessed on 4 November 2020).

- Zheng, C.; Zhang, J. The impact of COVID-19 on the efficiency of microfinance institutions. Int. Rev. Econ. Financ. 2020, 71, 407–423. [Google Scholar] [CrossRef]

- Alonso, A.D.; Kok, S.K.; Bressan, A.; O’Shea, M.; Sakellarios, N.; Koresis, A.; Solis, M.A.B.; Santoni, L.J. COVID-19, aftermath, impacts, and hospitality firms: An international perspective. Int. J. Hosp. Manag. 2020, 91, 102654. [Google Scholar] [CrossRef]

- Ibarra, D.; Bigdeli, A.Z.; Igartua, J.I.; Ganzarain, J. Business Model Innovation in Established SMEs: A Configurational Approach. Open Innov. Technol. Mark. Complex. 2020, 6, 76. [Google Scholar] [CrossRef]

- Jagongo, A. Strategic Resource Mobilization for Entrepreneurial Financing (A Review of Impediments for Growth of Women Owned Msmes in Kenya). In Proceedings of the 5th Business & Management Conference, Rome, Italy, 5–8 April 2017; pp. 75–98. [Google Scholar] [CrossRef]

- Papadopoulos, T.; Baltas, K.N.; Balta, M.E. The use of digital technologies by small and medium enterprises during COVID-19: Implications for theory and practice. Int. J. Inf. Manag. 2020, 55, 102192. [Google Scholar] [CrossRef] [PubMed]

- Temitope, A.E. Change Management in Small and Medium Enterprises: Leveraging Information Technology. Int. J. Adv. Res. Comput. Sci. Technol. 2015, 3, 10–16. [Google Scholar]

- Grama-Vigouroux, S.; Saidi, S.; Berthinier-Poncet, A.; Vanhaverbeke, W.; Madanamoothoo, A. From closed to open: A comparative stakeholder approach for developing open innovation activities in SMEs. J. Bus. Res. 2019. [Google Scholar] [CrossRef]

- Mei, L.; Zhang, T.; Chen, J. Exploring the effects of inter-firm linkages on SMEs’ open innovation from an ecosystem perspective: An empirical study of Chinese manufacturing SMEs. Technol. Forecast. Soc. Chang. 2019, 144, 118–128. [Google Scholar] [CrossRef]

- Albats, E.; Alexander, A.; Mahdad, M.; Miller, K.; Post, G. Stakeholder management in SME open innovation: Interdependences and strategic actions. J. Bus. Res. 2019. [Google Scholar] [CrossRef]

- De Marco, C.E.; Martelli, I.; Di Minin, A. European SMEs’ engagement in open innovation When the important thing is to win and not just to participate, what should innovation policy do? Technol. Soc. Chang. 2020, 152, 119843. [Google Scholar] [CrossRef]

- Government of Russia. On the Measures to Support Small and Medium-Sized Businesses and on the Organization of Lending to SMEs in the Context of the Coronavirus Infection Proliferation. 2020. Available online: http://government.ru/news/39291/ (accessed on 21 May 2020).

- RBC. The Authorities came up with a Scheme to Help Small Businesses during a Pandemic. Available online: https://www.rbc.ru/economics/25/03/2020/5e7b0b6c9a7947bf1ac40ded (accessed on 24 May 2020).

- Federal Tax Service. Available online: https://analytic.nalog.ru/portal/index.ru-RU.htm (accessed on 21 May 2020).

- Bank of Russia. Available online: http://www.cbr.ru/hd_base/ProcStav/IR_SRM/?UniDbQuery.Posted=True&UniDbQuery.From=01.05.2014&UniDbQuery.To=25.05.2020 (accessed on 21 May 2020).

- Federal Resource. Available online: https://fedresurs.ru/?attempt=1 (accessed on 21 May 2020).

- Federal State Statistics Service. Statistics. Available online: https://gks.ru/statistic (accessed on 21 May 2020).

- Parshutina, I. Formation of Entrepreneurial Climate in Russia for Sustainable Development of Small Business. In Proceedings of the International Scientific and Practical Conference “Contemporary Issues of Economic Development of Russia: Challenges and Opportunities” (CIEDR 2018), Veliky Novgorod, Russia, 12–13 December 2018; pp. 142–152. [Google Scholar] [CrossRef]

- Egorova, N.E.; Koroleva, E.A. Measurement of Mutual Trust Level between Small Enterprises and Banks. Adv. Soc. Sci. Educ. Hum. Res. 2019, 298, 565–567. [Google Scholar]

- Chemodanova, O.; Grib, G. Problems of Development of Small and Medium Enterprise (SME) in Russia and Methods of Solving Them. Adv. Econ. Bus. Manag. Res. 2017, 32, 45–48. [Google Scholar]

- Makarenko, E.N.; Chernysheva, Y.G.; Polyakova, I.A.; Makarenko, T.V. The Success Factors of Small Business. Int. J. Econ. Bus. Adm. 2019, VII, 280–288. [Google Scholar]

- Kotane, I.; Kuzmina-Merlino, I. Analysis of Small and Medium Sized Enterprises’ Business Performance Evaluation Practice at Transportation and Storage Services Sector in Latvia. Procedia Eng. 2017, 178, 182–191. [Google Scholar] [CrossRef]

- Massaro, M.; Rubens, A.; Bardy, R.; Bagnoli, C. Antecedents to Export Performance and How Italian and Slovanian SME’s Innovate during Times of Crisis. J. East. Eur. Cent. Asian Res. 2017, 4, 22. [Google Scholar] [CrossRef]

- Šebestová, J.; Sroka, W. Sustainable development goals and SMEs decisions: Czech Republic vs. Poland. J. East. Eur. Cent. Asian Res. 2020, 7, 39–50. [Google Scholar] [CrossRef]

- Zylla, E.; Hartman, L. State COVID-19 Data Dashboards. State Health and Value Strategies. 2020. Available online: https://www.shvs.org/state-covid-19-data-dashboards/ (accessed on 27 May 2020).

- Chen, Z.-L.; Zhang, Q.; Lu, Y.; Guo, Z.-M. Distribution of the COVID-19 Epidemic and Correlation with Population Emigration from Wuhan, China. Chin. Med. J. 2020, 133. Available online: https://www.researchgate.net/publication/339626443_Distribution_of_the_COVID-19_epidemic_and_correlation_with_population_emigration_from_Wuhan_China (accessed on 24 May 2020). [CrossRef]

- Saba, A.I.; Elsheikh, A.H. Forecasting the prevalence of COVID-19 outbreak in Egypt using nonlinear autoregressive artificial neural networks. Process Saf. Environ. Prot. 2020, 141, 1–8. [Google Scholar] [CrossRef]

- Support of Russia. Support Index RSBI. Available online: https://opora.ru/projects/indeks-opory-rsbi/ (accessed on 21 May 2020).

- LB.ua. Russia to Start Exit from Quarantine from May 12. Available online: https://lb.ua/world/2020/05/11/457255_rossiya_nachnet_vihod_karantina_12.html (accessed on 29 May 2020).

- OECD. Tackling Coronavirus (COVID-19). Contributing to a Global Effort. Available online: http://www.oecd.org/coronavirus/en/ (accessed on 27 May 2020).

- Ferra.ru. Experts Calculated When the Coronavirus Pandemic May End in the World. Available online: https://www.ferra.ru/news/techlife/eksperty-podschitali-kogda-v-mire-mozhet-zakonchitsya-pandemiya-koronavirusa-24-05-2020.htm (accessed on 28 May 2020).

- Glavcom. The European Union Gave a Forecast When the Vaccine Against Coronavirus Was Ready. Available online: https://glavcom.ua/ru/news/v-evrosoyuze-dali-prognoz-kogda-budet-gotova-vakcina-ot-koronavirusa-679963.html (accessed on 28 May 2020).

| Type of Government Support | Indicator | Symbolic Notation of the Indicator |

|---|---|---|

| Tax support [74] | The amount of deferred payments (installment liabilities) and restructured debt, million RUB, which includes taxes and fees payable, as well as fines and tax sanctions payable | G1 |

| Number of on-site tax audits, units | G2 | |

| Number of office tax audits, units | G3 | |

| The amount of premium income from compulsory social insurance, million RUB | G4 | |

| Credit support [75] | Interest on loans to support small and medium-sized businesses, % per annum | G5 |

| Administrative support [76] | The number of enterprises that went bankrupt on the creditors’ initiative, units | G6 |

| Public funding [77] | The volume of subsidies allocated from the federal budget for government support for small and medium-sized businesses, billion RUB | G7 |

| The volume of investment in fixed assets of small and medium-sized businesses at the expense of budget funds, billion RUB | G8 | |

| The volume of investment in fixed assets of small and medium-sized businesses at the expense of state non-budgetary funds, billion RUB. | G9 |

| Null Hypothesis | Prob. | Causal Direction | Paired Correlation Coefficients |

|---|---|---|---|

| G1 does not Granger cause X5 | 0.003 | G1→X5 | 0.852 |

| G2 does not Granger cause X5 | 0.002 | G2→X5 | −0.888 |

| G3 does not Granger cause X5 | 0.004 | G3→X5 | −0.847 |

| G4 does not Granger cause X5 | 0.003 | G4→X5 | −0.856 |

| G5 does not Granger cause X7 | 0.003 | G5→X7 | −0.862 |

| G6 does not Granger cause X1 | 0.006 | G6→X1 | −0.819 |

| G7 does not Granger cause X7 | 0.000 | G7→X7 | 0.947 |

| G8 does not Granger cause X7 | 0.000 | G8→X7 | 0.966 |

| G9 does not Granger cause X7 | 0.005 | G9→X7 | 0.838 |

| X1 does not Granger cause X2 | 0.006 | X1→X2 | 0.809 |

| X1 does not Granger cause X3 | 0.010 | X1→X3 | 0.772 |

| X1 does not Granger cause X4 | 0.009 | X1→X4 | 0.782 |

| X2 does not Granger cause X3 | 0.002 | X2→X3 | 0.892 |

| X2 does not Granger cause X4 | 0.002 | X2→X4 | 0.884 |

| X3 does not Granger cause X5 | 0.000 | X3→X5 | 0.967 |

| X4 does not Granger cause X5 | 0.000 | X4→X5 | −0.951 |

| X5 does not Granger cause X6 | 0.006 | X5→X6 | 0.817 |

| X5 does not Granger cause Y | 0.000 | X5→Y | 0.963 |

| X6 does not Granger cause X3 | 0.004 | X6→X3 | 0.839 |

| X6 does not Granger cause X5 | 0.006 | X6→X5 | 0.817 |

| X6 does not Granger cause Y | 0.001 | X6→Y | 0.924 |

| X7 does not Granger cause X3 | 0.000 | X7→X3 | 0.961 |

| X7 does not Granger cause X5 | 0.001 | X7→X5 | 0.925 |

| X7 does not Granger cause Y | 0.005 | X7→Y | 0.834 |

| X8 does not Granger cause X6 | 0.006 | X8→X6 | 0.812 |

| X8 does not Granger cause X7 | 0.000 | X8→X7 | 0.994 |

| X9 does not Granger cause Y | 0.000 | X9→Y | −0.997 |

| X10 does not Granger cause X4 | 0.005 | X10→X4 | 0.834 |

| X11 does not Granger cause X3 | 0.004 | X11→X3 | −0.840 |

| Y does not Granger cause X1 | 0.005 | Y→X1 | 0.831 |

| Government Support Indicators | Chain of Intermittent Actions | Changes in Indicator Y under the Intermittent Influence, % |

|---|---|---|

| G1, million RUB | G1→X5→Y | 0.820 |

| G2, units | G2→X5→Y | −0.855 |

| G3, units | G3→X5→Y | −0.815 |

| G4, million RUB | G4→X5→Y | −0.824 |

| G5, % per annum | G5→X7→X5→Y | −0.753 |

| G5→X7→Y | ||

| G5→X7→X3→X5→Y | ||

| G6, units | G6→X1→X2→X3→X5→Y | −0.004 |

| G6→X1→X2→X→X5→Y | ||

| G6→X1→X3→X5→Y | ||

| G6→X1→X4→X5→Y | ||

| G7, billion RUB | G7→X7→X5→Y | 0.827 |

| G7→X7→Y | ||

| G7→X7→X3→X5→Y | ||

| G8, billion RUB | G8→X7→X5→Y | 0.844 |

| G8→X7→Y | ||

| G8→X7→X3→X5→Y | ||

| G9, billion RUB | G9→X7→X5→Y | 0.767 |

| G9→X7→Y | ||

| G9→7→X3→X5→Y |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Razumovskaia, E.; Yuzvovich, L.; Kniazeva, E.; Klimenko, M.; Shelyakin, V. The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic. J. Open Innov. Technol. Mark. Complex. 2020, 6, 160. https://doi.org/10.3390/joitmc6040160

Razumovskaia E, Yuzvovich L, Kniazeva E, Klimenko M, Shelyakin V. The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(4):160. https://doi.org/10.3390/joitmc6040160

Chicago/Turabian StyleRazumovskaia, Elena, Larisa Yuzvovich, Elena Kniazeva, Mikhail Klimenko, and Valeriy Shelyakin. 2020. "The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 4: 160. https://doi.org/10.3390/joitmc6040160

APA StyleRazumovskaia, E., Yuzvovich, L., Kniazeva, E., Klimenko, M., & Shelyakin, V. (2020). The Effectiveness of Russian Government Policy to Support SMEs in the COVID-19 Pandemic. Journal of Open Innovation: Technology, Market, and Complexity, 6(4), 160. https://doi.org/10.3390/joitmc6040160