Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation

Abstract

1. Introduction

2. Literature Review and Methodology

2.1. Literature Review

2.2. Methodology

Measuring Information Flows Using Rényi Transfer Entropy

3. Data and Results

4. Discussion: The Implication for Open Innovation

5. Conclusions

5.1. The Summary of This Study

5.2. Implication

5.3. Limitation and Future Research Topic

Funding

Conflicts of Interest

Appendix A

References

- Forbes, K.J.; Chinn, M.D. A Decomposition of Global Linkages in Financial Markets over time. Rev. Econ. Stat. 2004, 86, 705–722. [Google Scholar] [CrossRef]

- Sum, V. The Reaction of Stock Markets in the BRIC Countries to Economic Policy Uncertainty in the United States. 2012. Available online: https://ssrn.com/abstract=2094697 (accessed on 26 August 2020).

- Dakhlaoui, I.; Aloui, C. The interactive relationship between the US economic policy uncertainty and BRIC stock markets. Int. Econ. 2016, 146, 141–157. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Uncertainty about government policy and stock prices. J. Financ. 2012, 67, 1219–1264. [Google Scholar] [CrossRef]

- Brogaard, J.; Detzel, A. The asset-pricing implications of government economic policy uncertainty. Manag. Sci. 2015, 61, 3–18. [Google Scholar] [CrossRef]

- Lam, S.S.; Zhang, H.; Zhang, W. Does policy instability matter for international equity markets. Int. Rev. Financ. 2020, 20, 155–196. [Google Scholar] [CrossRef]

- Dash, S.R.; Maitra, D.; Debata, B.; Mahakud, J. Economic policy uncertainty and stock market liquidity: Evidence from G7 countries. Int. Rev. Financ. 2019, 71, 1–16. [Google Scholar] [CrossRef]

- Carrière-Swallow, Y.; Céspedes, L.F. The impact of uncertainty shocks in emerging economies. J. Int. Econ. 2013, 90, 316–325. [Google Scholar] [CrossRef]

- Seck, D. (Ed.) The Performance of African Stock Markets Before and After the Global Financial Crisis. In Investment and Competitiveness in Africa. Advances in African Economic, Social and Political Development; Springer: Cham, Switzerland, 2017. [Google Scholar]

- OECD. COVID-19 and Africa: Socio-Economic Implications and Policy Responses; OECD: Paris, France, 2020; Available online: http://www.oecd.org/coronavirus/policy-responses/covid-19-and-africa-socio-economic-implications-and-policy-responses-96e1b282/ (accessed on 10 March 2020).

- Economic Commission for Africa. Economic Impact of the COVID-19 on Africa; UNCA: Addis Ababa, Ethiopia, 2020. [Google Scholar]

- Fama, E.F. Efficient capital markets: A review of theory and empirical work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- DeStefano, M. Stock Returns and the Business Cycle. Financ. Rev. 2004, 39, 527–547. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Antonakakis, N.; Chatziantoniou, I.; Filis, G. Dynamic co-movements of stock market returns, implied volatility and policy uncertainty. Econ. Lett. 2013, 120, 87–92. [Google Scholar] [CrossRef]

- Ko, J.H.; Lee, C.M. International economic policy uncertainty and stock prices: Wavelet approach. Econ. Lett. 2015, 134, 118–122. [Google Scholar] [CrossRef]

- Li, T.; Ma, F.; Zhang, X.; Zhang, Y. Economic policy uncertainty and the Chinese stock market volatility: Novel evidence. Econ. Model. 2020, 87, 24–33. [Google Scholar] [CrossRef]

- Christou, C.; Cunado, J.; Gupta, R.; Hassapis, C. Economic policy uncertainty and stock market returns in PacificRim countries: Evidence based on a Bayesian panel VAR model. J. Multinatl. Financ. Manag. 2017, 40, 92–102. [Google Scholar] [CrossRef]

- Adam, A.M.; Gyamfi, E.N. Time-varying world integration of the African stock markets: A Kalman filter approach. Invest. Manag. Financ. Innov. 2015, 12, 175–181. [Google Scholar]

- Bodomo, A.; Che, D. The Globalisation of Foreign Investment in Africa: In Comes the Dragon. In Reconfiguring Transregionalisation in the Global South (International Political Economy Series); Anthony, R., Ruppert, U., Eds.; Palgrave Macmillan: Cham, Switzerland, 2020. [Google Scholar]

- Kühnhausen, F. Financial Innovation and Financial Fragility (Munich Discussion Paper No. 2014-37). 2014. Available online: https://epub.ub.uni-muenchen.de/21173/ (accessed on 10 March 2020).

- Orlowski, L. Stages of the 2007/2008 Global Financail Crisis Is There a Wandering Asset-Price Bubble? (Economics Discussion Papers No. 2008-43). 2008. Available online: https://www.econstor.eu/handle/10419/27479 (accessed on 2 March 2020).

- Julio, B.; Yook, Y. Corporate financial policy under political uncertainty: International evidence from national elections. J. Financ. 2012, 67, 45–83. [Google Scholar] [CrossRef]

- Gulen, H.; Ion, M. Policy Uncertainty and Corporate Investment. Rev. Financ. Stud. 2016, 29, 523–564. [Google Scholar] [CrossRef]

- Arouri, M.; Estay, C.; Rault, C.; Roubaud, D. Economic policy uncertainty and stock markets: Long-run evidence from the US. Financ. Res. Lett. 2016, 18, 136–141. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Political Uncertainty and Risk Premia. J. Financ. Econ. 2013, 110, 520–545. [Google Scholar] [CrossRef]

- Kang, W.; Ratti, R.A. Oil shocks, policy uncertainty and stock marketreturn. J. Intent. Financ. Mark. Inst. Money 2013, 26, 305–318. [Google Scholar] [CrossRef]

- Backus, D.K.; Routledge, B.R.; Zin, S.E. Asset Prices in Business Cycle Analysis. Tepper School of Business. Paper 414. 2007. Available online: http://repository.cmu.edu/tepper/414 (accessed on 15 February 2020).

- Campa, J.M.; Fernandes, N. Sources of gains from international portfolio diversification. J. Empir. Financ. 2006, 13, 417–443. [Google Scholar] [CrossRef]

- Graham, M.; Peltomäki, J.; Piljak, V. Global economic activity as an explicator of emerging market equity returns. Res. Int. Bus. Financ. 2016, 36, 424–435. [Google Scholar] [CrossRef]

- Bartman, S.; Brown, G.; Stulz, R.M. Why do Foreign Firms have Less Idiosyncratic Risk than U.S. Firms? 2009. Available online: https://www.nber.org/papers/w14931 (accessed on 26 August 2020).

- Mehl, A. Large Global Volatility Shocks, Equity Markets and Globalization: 1885–2011. 2013. Available online: https://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1548.pdf (accessed on 26 August 2020).

- Das, D.; Kumar, S.B. International economic policy uncertainty and stock prices revisited: Multiple and Partial wavelet approach. Econ. Lett. 2018, 164, 100–108. [Google Scholar] [CrossRef]

- Sugimoto, K.; Matsuki, T.; Yoshida, Y. The global financial crisis: An analysis of the spillover effects on African stock markets. Emerg. Mark. Rev. 2014, 21, 201–233. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yilmaz, K. Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 2012, 28, 57–66. [Google Scholar] [CrossRef]

- Cakan, E.; Gupta, R.; Does, U.S. Macroeconomic News Make the South African Stock Market Riskier? Working Paper No. 201646; Department of Economics, University of Pretoria: Pretoria, South Africa, 2016. [Google Scholar]

- Belcaid, K.; El Ghini, A.U.S. European, Chinese economic policy uncertainty and Moroccan stock market volatility. J. Econ. Asymmetries 2019, 20, e00128. [Google Scholar] [CrossRef]

- Schreiber, T. Measuring information transfer. Phys. Rev. Lett. 2000, 85, 461. [Google Scholar] [CrossRef]

- Shannon, C.E. A mathematical theory of communication. Bell Labs Tech. J. 1948, 27, 379–423. [Google Scholar] [CrossRef]

- Marschinski, R.; Kantz, H. Analysing the Information Flow between Financial Time Series. Eur. Phys. J. B 2002, 30, 275–281. [Google Scholar] [CrossRef]

- Sensoy, A.; Sobaci, C.; Sensoy, S.; Alali, F. Effective transfer entropy approach to information flow between exchange rates and stock markets. Chaos Solitons Fractals 2020, 68, 180–185. [Google Scholar] [CrossRef]

- Chunxia, Y.; Xueshuai, Z.; Luoluo, J.; Sen, H.; He, L. Study on the contagion among American industries. Phys. A Stat. Mech. Appl. 2016, 444, 601–612. [Google Scholar] [CrossRef]

- Lim, K.; Kim, S.; Kim, S.Y. Information transfer across intra/inter-structure of CDS and stock markets. Phys. A Stat. Mech. Appl. 2017, 486, 118–126. [Google Scholar] [CrossRef]

- Yue, P.; Cai, Q.; Yan, W.; Zhou, W.X. Information flow networks of Chinese stock market sectors. IEEE Access 2020, 8, 13066–13077. [Google Scholar] [CrossRef]

- Kim, S.; Ku, S.; Chang, W.; Song, J.W. Predicting the Direction of US Stock Prices Using Effective Transfer Entropy and Machine Learning Techniques. IEEE Access 2020, 8, 111660–111682. [Google Scholar] [CrossRef]

- Behrendt, S.; Dimpfl, T.; Peter, F.J.; Zimmermann, D.J. RTransferEntropy—Quantifying information flow between different time series using effective transfer entropy. SoftwareX 2019, 10, 100265. [Google Scholar] [CrossRef]

- Dimpfl, T.; Peter, F.J. The impact of the financial crisis on transatlantic information flows: An intraday analysis. J. Int. Financ. Mark. Inst. Money 2014, 31, 1–13. [Google Scholar] [CrossRef]

- Hartley, R.V. Transmission of information. Bell Labs Tech. J. 1928, 7, 535–563. [Google Scholar] [CrossRef]

- Jizba, P.; Kleinert, H.; Shefaat, M. Renyi’s information transfer between financial time series. Phys. A 2012, 391, 2971–2989. [Google Scholar] [CrossRef]

- Rényi, A. Probability Theory; Dover Publications: New York, NY, USA, 1970. [Google Scholar] [CrossRef]

- Beck, C.; Schögl, F. Thermodynamics of chaotic systems: An introduction. In Cambridge Nonlinear Science Series; Cambridge University Press: Cambridge, UK, 1993; Volume 4. [Google Scholar] [CrossRef]

- Alqahtani, A.; Martinez, M. US Economic Policy Uncertainty and GCC Stock Market. Asia-Pac. Financ. Mark. 2020. [Google Scholar] [CrossRef]

- Istiak, K.; Alam, M.R. US economic policy uncertainty spillover on the stock markets of the GCC countries. J. Econ. Stud. 2020, 47, 36–50. [Google Scholar] [CrossRef]

- Sum, V. How Do Stock Markets in China and Japan Respond to Economic Policy Uncertainty in the United States? 2012. Available online: https://ssrn.com/abstract=2092346 (accessed on 26 August 2020).

- Sum, V. The ASEAN stock market performance and economic policy uncertainty in the United States. Econ. Papers J. Appl. Econ. Policy 2013, 32, 512. [Google Scholar] [CrossRef]

- Yin, L.; Han, L. Spillovers of macroeconomic uncertainty among major economies. Appl. Econ. Lett. 2014, 21, 938–944. [Google Scholar] [CrossRef]

- Finger, M.; Stucki, A. Open Innovation as an Option for Reacting to Reform and Crisis: What Factors Influence the Adoption of Open Innovation. In Proceedings of the 2nd ISPIM Innovation Symposium, New York, NY, USA, 6–9 December 2009. [Google Scholar]

- Rauter, R.; Globocnik, D.; Perl-Vorbach, E.; Baumgartner, R.J. Open innovation and its effects on economic and sustainability innovation performance. J. Innov. Knowl. 2018, 4, 226–233. [Google Scholar] [CrossRef]

- Yun, J.J.; Xiaofei, Z.; KwangHo, J.; Tan, Y. The Culture for Open Innovation Dynamics. Sustainability 2020, 12, 5076. [Google Scholar] [CrossRef]

- Yun, J.J.; Won, D.; Park, K. Entrepreneurial cyclical dynamics of open innovation. J. Evol. Econ. 2018, 28, 1151–1174. [Google Scholar] [CrossRef]

- Yun, J.J.; Zhao, X.; Yigitcanlar, T.; Lee, D.; Ahn, H. Architectural Design and Open Innovation Symbiosis: Insights from Research Campuses, Manufacturing Systems, and Innovation Districts. Sustainability 2018, 10, 4495. [Google Scholar] [CrossRef]

- Yun, J.J.; Lee, M.; Park, K.; Zhao, X. Open innovation and serial entrepreneurs. Sustainability 2019, 11, 5055. [Google Scholar] [CrossRef]

| Countries | Mean | Std Dev. | Skewness | Kurtosis | Risk-Adjusted Mean | Jarque–Bera | ADF | PP |

|---|---|---|---|---|---|---|---|---|

| Botswana | −0.021 | 0.007 | −0.650 | 9.061 | −3.075 | 3618.274 *** | −48.886 *** | −48.915 *** |

| Egypt | −0.004 | 0.016 | −2.889 | 106.553 | −0.221 | 973,471.000 *** | −52.020 *** | −51.725 *** |

| Ghana | −0.029 | 0.009 | −0.396 | 142.383 | −3.178 | 186,511.000 *** | −11.999 *** | −54.455 *** |

| Kenya | −0.014 | 0.012 | −8.895 | 274.502 | −1.129 | 71,346.000 *** | −37.434 *** | −38.009 *** |

| Morocco | −0.019 | 0.008 | −1.018 | 15.544 | −2.367 | 15,295.590 *** | −42.238 *** | −42.238 *** |

| Namibia | −0.023 | 0.017 | −0.693 | 7.939 | −1.385 | 2421.507 *** | −44.861 *** | −44.861 *** |

| Nigeria | −0.034 | 0.014 | −9.860 | 250.552 | −2.507 | 5,858,732 *** | −40.348 *** | −40.404 *** |

| South Africa | −0.022 | 0.016 | −0.671 | 7.735 | −1.353 | 2362.746 *** | −49.001 *** | −49.050 *** |

| Zambia | −0.038 | 0.011 | 0.499 | 18.280 | −3.361 | 22,088.790 *** | −42.054 *** | −42.013 *** |

| EPU | 0.034 | 0.509 | 0.019 | 5.513 | 0.066 | 594.653 *** | −26.559 *** | −298.297 *** |

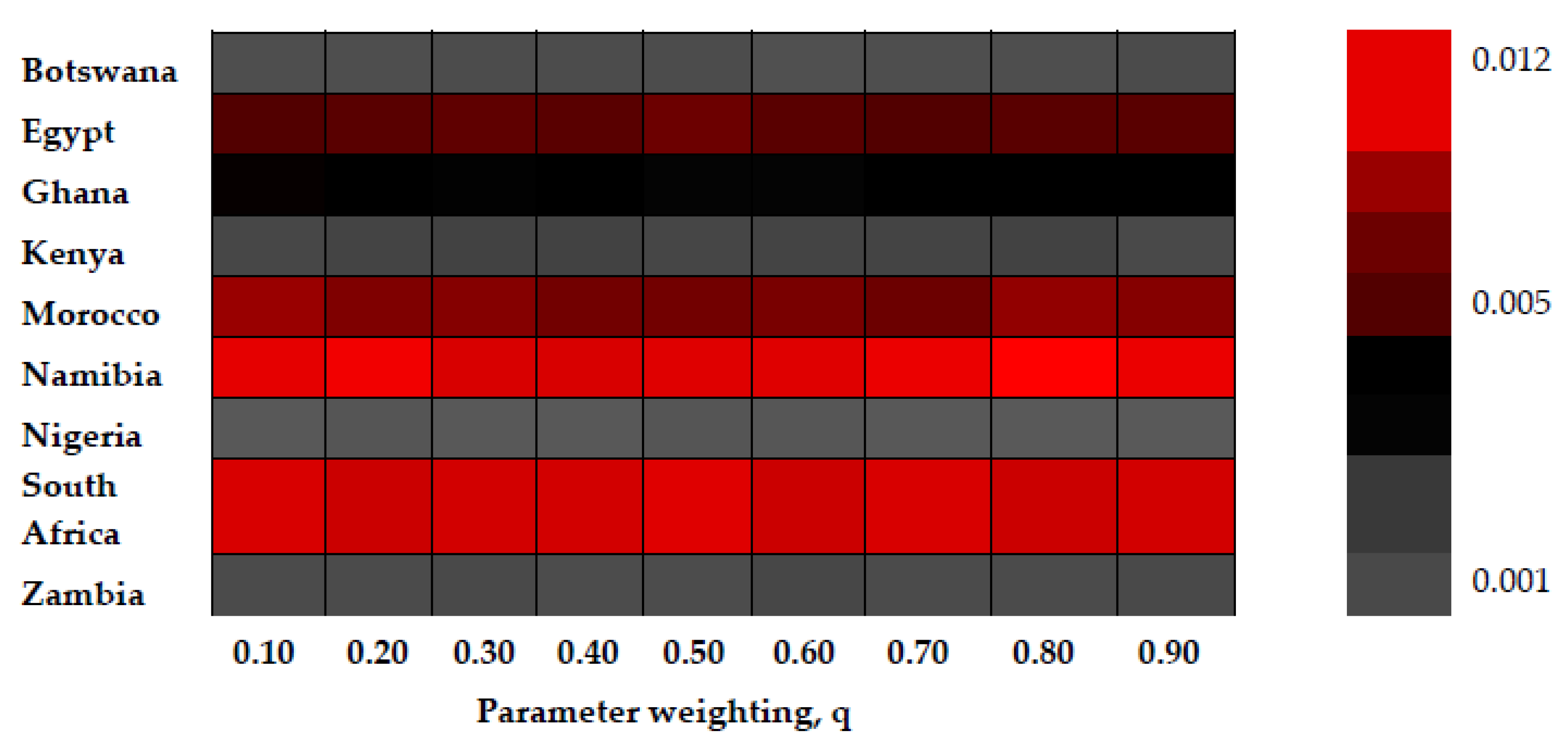

| Parameter Weighting, q | |||||||||

|---|---|---|---|---|---|---|---|---|---|

| 0.1 | 0.2 | 0.3 | 0.4 | 0.5 | 0.6 | 0.7 | 0.8 | 0.9 | |

| Botswana | 0.0017 | 0.0017 | 0.0018 | 0.0018 | 0.0018 | 0.0016 | 0.0017 | 0.0017 | 0.0019 |

| Egypt | 0.0077 *** | 0.0078 *** | 0.0079 *** | 0.0078 *** | 0.0081 *** | 0.0078 *** | 0.0077 *** | 0.0078 *** | 0.0078 *** |

| Ghana | 0.0065 *** | 0.0064 *** | 0.0063 *** | 0.0064 *** | 0.0062 *** | 0.0062 *** | 0.0064 *** | 0.0064 ** | 0.0064 ** |

| Kenya | 0.0021 * | 0.0023 | 0.0024 | 0.0024 * | 0.0022 | 0.0023 * | 0.0023 * | 0.0024 * | 0.002 |

| Morocco | 0.0088 *** | 0.0084 *** | 0.0085 *** | 0.0082 *** | 0.0082 *** | 0.0083 *** | 0.0081 *** | 0.0087 *** | 0.0085 *** |

| Namibia | 0.0100 *** | 0.0102 *** | 0.0098 *** | 0.0098 *** | 0.0099 *** | 0.0099 *** | 0.0101 *** | 0.0104 *** | 0.0101 *** |

| Nigeria | 0.0011 | 0.0013 | 0.0011 | 0.0011 | 0.0013 | 0.0012 | 0.0011 | 0.001 | 0.001 |

| South Africa | 0.0098 *** | 0.0096 *** | 0.0097 *** | 0.0097 *** | 0.0099 *** | 0.0096 *** | 0.0098 *** | 0.0096 *** | 0.0097 *** |

| Zambia | 0.0019 | 0.0019 | 0.002 | 0.0018 | 0.0018 | 0.0021 | 0.0019 | 0.0019 | 0.002 |

© 2020 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Adam, A.M. Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation. J. Open Innov. Technol. Mark. Complex. 2020, 6, 71. https://doi.org/10.3390/joitmc6030071

Adam AM. Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity. 2020; 6(3):71. https://doi.org/10.3390/joitmc6030071

Chicago/Turabian StyleAdam, Anokye M. 2020. "Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation" Journal of Open Innovation: Technology, Market, and Complexity 6, no. 3: 71. https://doi.org/10.3390/joitmc6030071

APA StyleAdam, A. M. (2020). Susceptibility of Stock Market Returns to International Economic Policy: Evidence from Effective Transfer Entropy of Africa with the Implication for Open Innovation. Journal of Open Innovation: Technology, Market, and Complexity, 6(3), 71. https://doi.org/10.3390/joitmc6030071