1. Introduction

Stabilizing the supply of agricultural products is the cornerstone of rural economic development and an important guarantee for the implementation of the rural revitalization strategy. China is a traditionally agricultural country. Since the 21st century, “Central Document No. 1” has focused on the “Three Rural Issues” for 19 consecutive years. China’s food output increased from 490 million tons in 2000 to 682.85 million tons in 2021, and the gross agricultural output value also increased from USD 1675.88 billion to USD 12,143.40 billion, according to the National Bureau of Statistics of the People’s Republic of China. China is also a large consumer of grain. According to the General Administration of Customs, China imported 164.539 million tons of grain in 2021, accounting for 24% of China’s output, which reached a record high, indicating that China’s dependence on foreign food is also increasing. In addition, the transfer of young laborers, the aging of the population, the reduction in cultivated land area, and the foreign investors’ control of seed sources are constraining the development of agriculture [

1,

2,

3,

4]. It is of great practical significance to increase food output, stabilize the supply of agricultural products to consolidate the achievements of poverty alleviation, and realize the strategy of rural revitalization.

With the rise of a new round of information and technology revolutions, digital inclusive finance, characterized by the use of emerging technologies, has become a new driving force for China’s inclusive economic growth. In 2016, the Hangzhou G20 Summit officially put forward the concept of digital inclusive finance, referring to “all actions to promote inclusive finance through the use of digital financial services”. In 2021, the “Document No. 1”—“Central Committee of the Communist Party of China and the State Council’s Opinions on Promoting Rural Revitalization and Accelerating Agricultural and Rural Modernization” put forward the “Development of Rural Digital Inclusive Finance” for the first time. As a new model and industry formed by the integration of traditional finance with the new generation of information and communication technology and internet-related technology [

5], digital inclusive finance has created a new plan for the development of the rural economy and the service of rural revitalization. The birth of digital inclusive finance overcomes the difficulty of traditional inclusive finance in reconciling social and commercial benefits, helps to alleviate the spatial and geographical constraints, reduces the service threshold of finance in rural areas, reduces the high cost of financial services in rural areas, adjusts the allocation of urban and rural financial resources effectively, narrows the gap of financial services between urban and rural areas, and brings an opportunity to promote the development of agriculture and improve the level of agricultural output. According to the latest internet development report—“The 50th statistical report on China’s Internet Development”—as of June 2022, the internet penetration rate in China’s rural areas has been close to 60%, with 1.051 billion internet users, and the number of rural internet users has reached 293 million, accounting for 27.9% of the total number of netizens. Internet infrastructure construction in rural areas is being comprehensively strengthened, with “counties connected to 5G and villages connected to broadband”; digital technologies such as big data, artificial intelligence, and cloud computing have deepened the integration with planting, animal husbandry, and fisheries; rural e-commerce has developed rapidly, and the online retail of agricultural products has increased by 11.2%. The popularization of the internet in rural areas has laid a solid foundation for digital inclusive finance to help rural revitalization and serve farmers’ production.

With the rapid promotion of digital inclusive finance in rural areas, academia has begun to pay attention to the impact of digital inclusive finance on rural economic development. Existing research shows that digital inclusive finance has a driving effect on the development of the rural economy [

6]. From the macro level, the development of digital inclusive finance is conducive to optimizing the agricultural industrial structure [

7,

8], improving the level of agricultural mechanization [

9,

10], and promoting the integration of three rural industries [

11,

12], improving agricultural ecological efficiency [

13], and promoting high-quality agricultural development [

14,

15]. From the micro level, digital inclusive finance can improve farmers’ credit access, promote farmers’ entrepreneurship [

16,

17,

18], and narrow the income gap and consumption gap between urban and rural residents [

19,

20,

21,

22]. However, there are still relatively few studies on the impact of digital inclusive finance on agricultural output and its mechanism. Based on the digital inclusive finance index compiled by Peking University and the China Statistical Yearbook database, this paper empirically studies the impact of digital inclusive finance on agricultural output and its underlying mechanism using the double-fixed-effect and panel threshold model.

The possible marginal contributions of this paper are: First, based on the panel data of 31 provinces from 2011 to 2020, the panel threshold model confirmed that the impact of digital inclusive finance on agricultural output level shows an increase in marginal utility, which provides evidence for digital inclusive finance to promote agricultural production. Second, the paper analyses the structural heterogeneity of the impact of digital inclusive finance on agricultural output levels at the national level, and further divides the total sample into eastern and midwest regions, agricultural provinces and industrial provinces to demonstrate the regional heterogeneity and scale heterogeneity of the impact of digital inclusive finance on agricultural output levels, and to provide support for the formulation of digital inclusive finance differentiated development policies. Finally, this paper argues the specific path of digital inclusive finance’s effect on agricultural output level from agricultural mechanization and farmers’ participation in insurance, which expands the research on the paths of digital inclusive finance’s effect on agricultural output and makes up for the shortcomings of the existing literature.

The rest of this article is arranged as follows.

Section 2 is the theoretical analysis and research hypothesis.

Section 3 introduces the research model and describes the data.

Section 4 analyzes the empirical results.

Section 5 introduces the research conclusions, policy recommendations and limitations of the research.

3. Research Methods and Data Sources

3.1. Methods

In order to test the impact of digital inclusive finance on the level of agricultural output and test Hypothesis 1, the following model is constructed in this paper:

where

represents the province,

represents the year,

represents the level of agricultural output,

represents the digital inclusive financial index,

are control variables, including crop-planting area, irrigation area, fertilizer use, natural disaster rate, human capital, and financial support for agriculture,

is the individual fixed effect,

is the time fixed effect,

is a random error term.

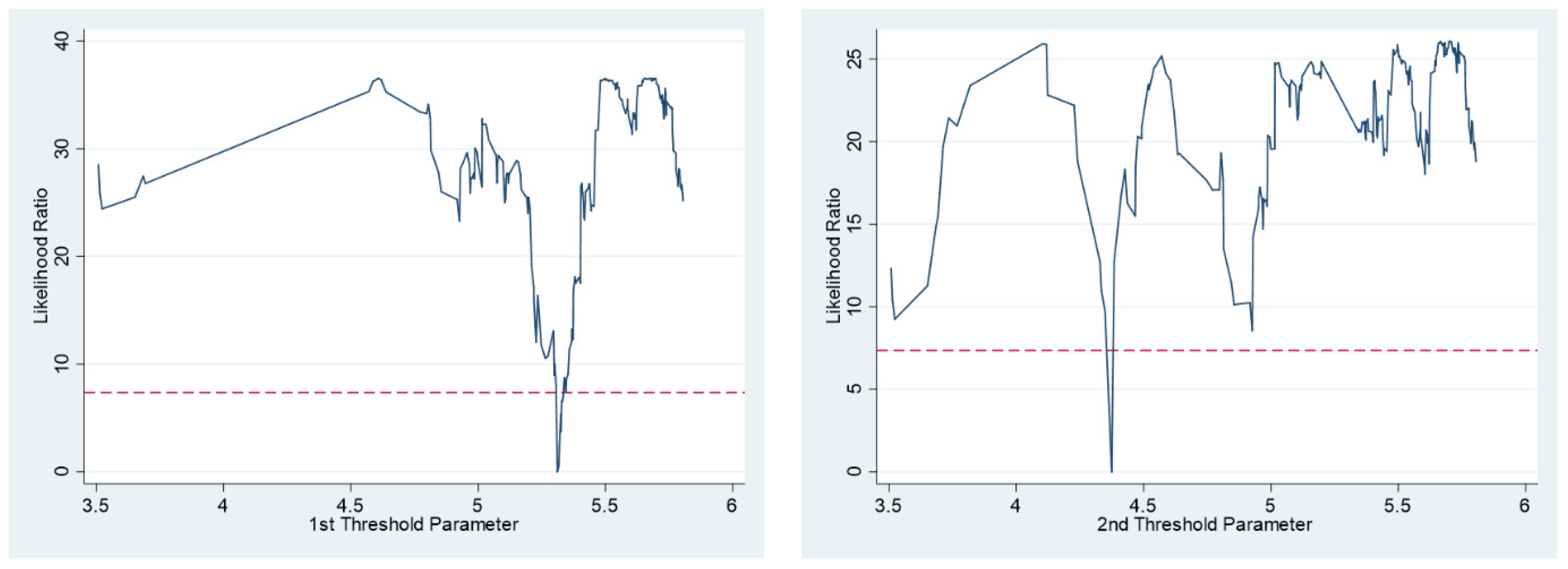

Digital inclusive finance inherently has non-equilibrium in its development and may have a non-linear impact on the level of agricultural output. This paper constructs a threshold model with digital inclusive finance as the threshold variable:

where

d is the threshold value of digital inclusive finance, and I(·) is an indicator function. The value depends on whether the level of digital inclusive finance development meets the threshold conditions in parentheses. If it does, it is assigned a value of 1; otherwise, it is 0.

3.2. Variables

Dependent Variables: Agricultural output level (

). In this paper, the gross output value of agriculture, forestry, animal husbandry, and fishery production is chosen to represent the level of agricultural output. Some scholars use the gross output value per capita of agriculture, forestry, animal husbandry, and fishery to represent the level of agricultural output, but Zhang et al. [

48] pointed out that the migration of migrant workers to urban areas affects the accuracy of the measurement of agricultural workers, and the application of modern technology in the agricultural production process replaces the labor force. The measurement error is larger when using the per capita output value.

Independent Variables: The development level of digital inclusive finance (). This paper adopts the digital inclusive finance index (2011–2020), which has been measured by the research team of the Digital Finance Research Center of Peking University and Ant Group Research Institute since 2016. The index of digital inclusive financial includes three dimensions and 33 specific indicators. For further study, this paper also selects the breadth of coverage () and depth of use () of the digital inclusive financial index to study its effects on the level of agricultural output. Among them, the breadth of coverage () is measured by the proportion of bank cards tied to third-party accounts, such as WeChat and Alipay, and their coverage. The more bank cards bound to third-party accounts, the wider the coverage. The depth of usage () measures the actual use of digital inclusive financial services in daily life.

Control variables: To control the influence of relevant factors on the level of agricultural output as much as possible, the following control variables are set in this paper concerning the relevant literature. Crop-sown area (): Unlike arable land, which may be abandoned or semi-abandoned, crop-sown area truly reflects the actual area of crops planted and should have a positive correlation with the level of agricultural output. Irrigation area (): Proper irrigation of crops will help crops grow and increase crop yields. Fertilizer usage (): In the process of agricultural production, chemical fertilizers can eliminate the damage of pests to crops and improve the level of agricultural output, which is expressed in this paper using the discounted fertilizer application amount. The natural disaster rate level (): The occurrence of natural disasters will affect the growth of crops, resulting in crop yield reduction. In this paper, the ratio of damage area (the sown area of crops with more than 10% reduction in production due to disasters) and disaster-caused area (the sown area of crops with more than 30% re-duction in production due to disasters) to the total planting area of crops is weighted by 0.1 and 0.3 to characterize the level of natural disaster rate. Financial support to agriculture (). In this paper, the expenditure on agriculture, forestry, and water in the public expenditure of each province is selected to represent the government’s support for agricultural production. Human capital (): Farmers with a high level of education tend to be more receptive and operate high-tech products, which, in turn, increases labor productivity and output level. Therefore, this paper uses the weighted years of education in rural areas to measure human capital.

3.3. Data

This paper selects panel data of 31 provinces, municipalities, and autonomous regions (excluding Hong Kong, Macao, and Taiwan) in China from 2011 to 2020, with a total of 310 samples to study and analyze the impact of digital inclusive finance on the level of agricultural output. The data include two parts: agricultural production-related data, and digital inclusive financial data. Among them, agricultural production-related statistics are from China Statistical Yearbook (2011–2020), China Rural Statistical Yearbook (2011–2020), China Population and Employment Statistical Yearbook (2011–2020) and China Agricultural Machinery Industry Yearbook (2011–2020). Digital inclusive finance-related indicators are from the Digital Finance Research Center of Peking University. This paper mainly selects the digital inclusive finance index, coverage breadth and usage depth. To eliminate the influence of price factors, this paper uses the GDP deflator to deflate price-related variables in 2010 as the base period since logarithms will not only not change the nature and related relationships of the data, but also prevent the impact of extreme outliers and alleviate heterogeneity. Therefore, referring to the relevant literature [

11,

49,

50], some variables (except

Dis) are logarithmically processed to keep the data smooth. The descriptive statistics of each variable are shown in

Table 1.

To better show the relationship of agricultural output and digital financial inclusion, we compared and ranked them at the same time. According to

Table 2, we can see that the growth rate of agricultural output and digital financial inclusion rank similarly in individual regions.

5. Conclusions and Suggestions

Farmers often encounter both difficulties in financing and expensive financing in the production process. Digital inclusive finance relies on the internet and other technologies to provide ideas to solve the financial problem in the agricultural production process. Based on the panel data of 31 provinces and cities in China from 2011 to 2020, this paper uses a double-fixed-effect model and a threshold model to carry out a regression analysis of the impact of digital inclusive finance on the level of agricultural output. It is found that: (1) the development of digital inclusive finance can significantly increase the level of agricultural output, and the promotion effect remains significant in robustness and endogeneity tests. In addition, the effect shows a state of increasing marginal utility; (2) There is structural, regional, and production scale heterogeneity in the impact of digital inclusive finance on the level of agricultural output. Structurally, the breadth of coverage and the depth of usage can significantly improve the level of agricultural output, among which the depth of usage can be more significant; regionally, digital inclusive finance can significantly improve the level of agricultural output in the midwest regions; in terms of scale, the promotion effect of digital inclusive finance on the level of agricultural output in large agricultural provinces is more significant. (3) Digital inclusive finance improves the level of agricultural output mainly through two paths: promoting agricultural mechanization and enhancing farmers’ willingness to participate in insurance.

The research of this paper confirms that digital inclusive finance can significantly promote the level of agricultural output. This conclusion is enlightening for the current development policy of digital inclusive finance. First, the government should continue to strengthen the construction of rural digital infrastructure, expand the coverage of rural networks, and promote the development of digital inclusive finance in rural areas. At the same time, the government should also pay attention to the training of farmers’ digital skills to improve the digital literacy and application ability of farmers. Second, governments should implement the regionally differentiated development strategy of digital inclusive finance. In particular, the midwest regions and major agricultural provinces should formulate corresponding policies to deepen the digital construction of traditional financial institutions, help rural development, and open up the “last kilometer” of agricultural production. Third, financial institutions, especially township banks, should accelerate the digitization of traditional financial services, innovate the types of financial products, and meet the diversified needs of farmers by increasing the supply categories of financial products. For example, by providing special agricultural loan products, increasing subsidies for agricultural machinery and equipment, etc. Insurance institutions should also: improve the agricultural insurance system, actively expand the coverage of rural insurance, improve the compensable capacity of agricultural insurance, consolidate and deepen the role of agricultural insurance as a “stabilizer” in agricultural production, and guide farmers to participate in agricultural insurance. Fourth, accelerate the process of agricultural mechanization and promote the modernization of agricultural production. It is necessary to increase investment in agricultural scientific research, promote the application and popularization of agricultural production technology, improve the level of agricultural technology, and promote the efficient development of agricultural production.

There are also some limitations in this study. On the one hand, the sample size is relatively small. Considering the availability of some data, the paper selects the provincial panel data from 2011–2020 for analysis, which is easily affected by uncertain factors, such as emergencies in a certain year, and affects the accuracy of empirical results. In the future, the city-level panel data can be used to increase the research sample to make up for the possible impact of the relatively small number of samples in the study. On the other hand, digital inclusive finance has obvious spatial agglomeration in the development process. Whether it will have a spatial spillover effect on agricultural output level can be further discussed in future research.