Export Trade, Absorptive Capacity, and High-Quality Economic Development in China

Abstract

:1. Introduction

1.1. Background

1.2. Study Motivation

1.3. Article Structure Arrangement

2. Literature Review

2.1. Relevant Research on High-Quality Economic Development and Its Measurement

2.2. Relevant Research on Trade and Economic Development

- (1)

- The impact of trade on the economic efficiency. In the endogenous economic growth theory, which emerged in the 1980s, endogenous technological progress is the decisive factor for sustainable economic growth. Based on this theory, the new trade theory further concludes that trade has an impact on economic growth and productivity through the expansion of the economies of scale and technological spillovers. The growth of exports can introduce technology innovation rewards to traders, and the end of the technology monopoly period will gradually narrow the technology gap between countries and stimulate a new demand for technology research and development in the countries with first-mover-innovation advantages [15]. Moreover, technology spillovers that are generated by trade exports through external economic effects and differential factor productivity effects can improve the productivity levels of the nonexport sectors [16], and the learning effect produced by trade via “learning by doing” can further enhance a country’s total factor productivity [17]. In China, there has been an R&D spillover effect since the opening-up of trade [18]. A large number of studies have emerged in the academic circle in which the researchers conduct in-depth discussions on the relationship between trade and technological progress, and they have concluded that the trade openness has remarkably improved the total factor productivity [19], and that exports encourage enterprises to participate in R&D. Comparatively speaking, enterprises that export and research and develop at the same time are more productive; however, the incentive effect of exports on innovation only occurs within foreign trade enterprises that have higher productivities [20]. On the contrary, some scholars believe that regions that are engaged in export processing have an inhibitory effect on the growth rate of the total factors in the region [21];

- (2)

- The impact of trade on the green efficiency. Foreign trade has a positive effect on energy efficiency, and primarily through the technology spillovers from imports and the learning from exports [22]. The service export trade of developing countries is conducive to the promotion of China’s green total factor productivity [23]. Moreover, the improvements in the trade export scale and export quality have substantially and positively promoted the green efficiency of regional industries [24]. Contrary to the above research conclusions, some scholars believe that the low-level expansion of export trade hinders the green transformation of China’s industry, thereby reducing the industrial energy efficiency [25]. The total trade volume at the industry level has not substantially affected China’s energy efficiency. However, the import of intermediate goods remarkably improves the energy efficiency, while the export of intermediate goods is not conducive to an improvement [26]. After crossing the threshold of human capital, trade liberalization has tremendously promoted green productivity; however, the impact is only partially relevant [27];

- (3)

- The impact of trade on the economic structure. The foreign trade structure has a vital impact on the upgrading of the national industrial structure [28]. In accordance with the theory of factor endowment and comparative advantage, a country will make full use of its factor resources with endowment advantages to participate in the international division of labor, which promotes industrial development. Based on the comparative advantage theory, developing countries can achieve industrial upgrading by following the development path of “assembly—manufacturing—R&D” [29]. At the same time, trade can accelerate the advanced development of the industrial structure through the accumulation of material capital and the stimulation of the consumption demand [30]. Some scholars also argue that foreign trade and the industrial structure have upgraded to a nonlinear U-shaped relationship. With the expansion of trade, the level of the industrial structure first declined and then increased [31]. Moreover, nothing but the optimization of the trade structure in goods can promote the upgrading of the industrial structure, while the role of trade in services is not substantial [32].

2.3. Objectives and Contributions

3. High-Quality Economic Development System

3.1. System Construction

3.2. Measurement Method

3.2.1. Standardization of Treatment

3.2.2. Calculation of Comprehensive Indicators

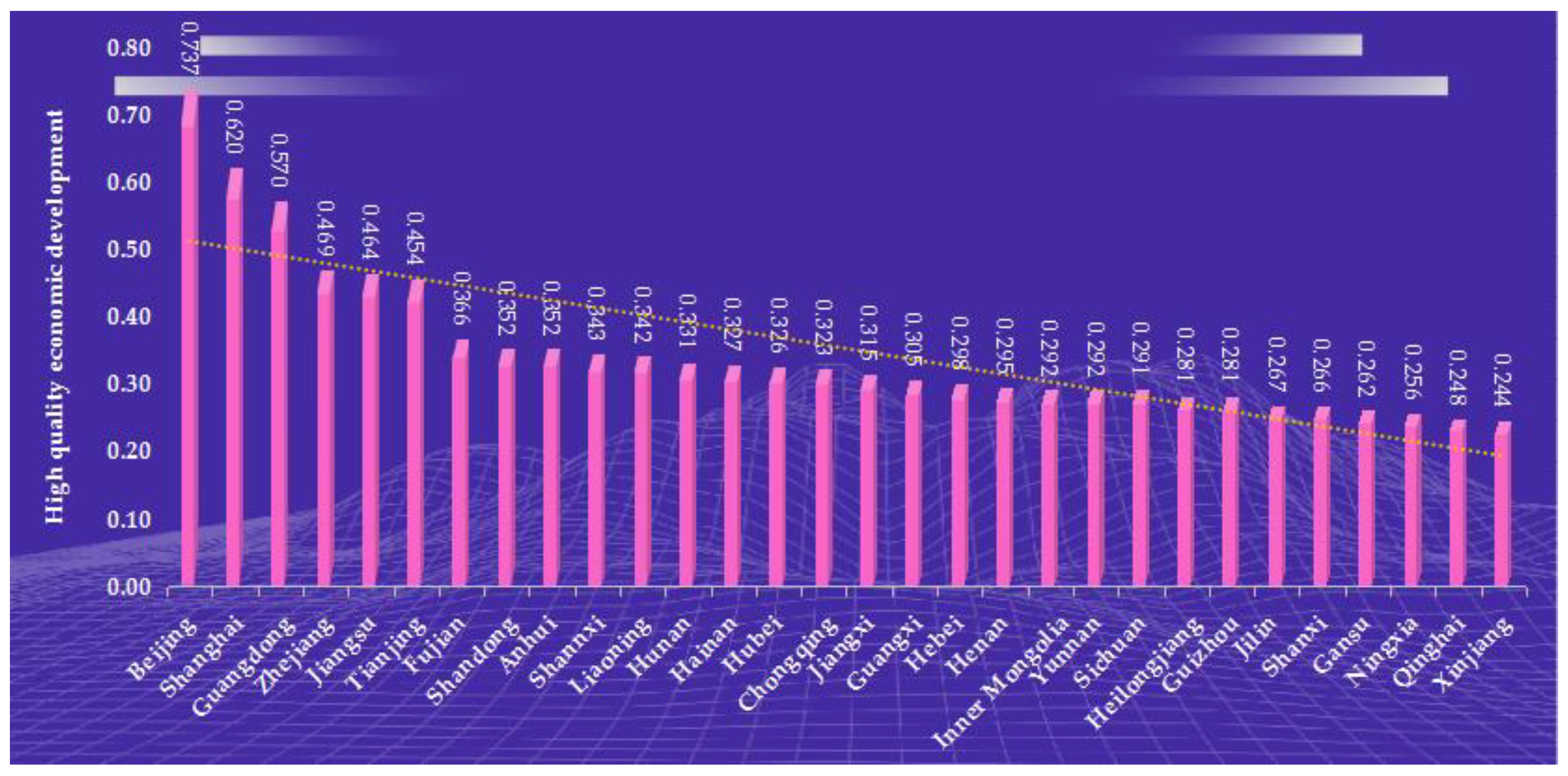

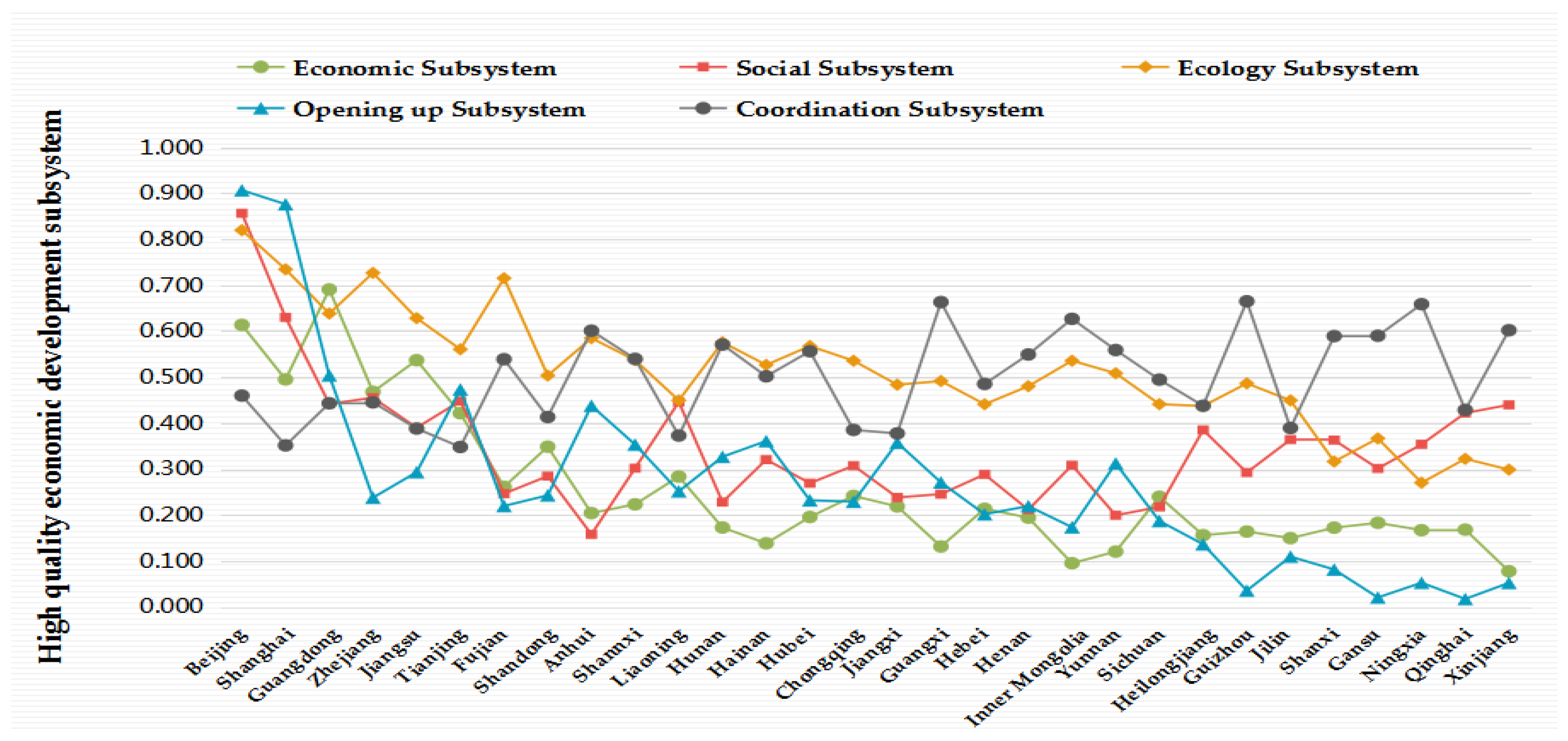

3.3. Analysis of System Results

4. Theoretical Mechanism, Hypotheses, and Research Design

4.1. Theoretical Mechanism and Hypotheses

4.1.1. Direct Impact of Export Trade on High-Quality Economic Development

4.1.2. Indirect Action Mechanism of Export Trade on High-Quality Economic Development

- (1)

- The export trade impact on the economic subsystem. Because the economic subsystem involves multiple indicator dimensions, such as economic growth, innovation efficiency, and financial development, at the level of economic growth, exports cause the rapid expansion of the domestic market scale and the doubling of the income levels. Under the effect of economies of scale, the marginal cost of enterprise production tends to decrease, and the profit returns tend to increase. The increase in profits provides the financial support for enterprises to carry out technological innovation. From the angle of innovation efficiency, Melitz points out that trade allows more productive firms to enter international markets, while those that are less productive maintain their home markets [40]. As a result, export enterprises usually face competitors with high technology level in the international market [41]. The learning effect of export enterprises through learning by doing can significantly promote the innovation of local enterprises [42], the technology spillover effect is more significant after the absorption capacity is added [43]. Serti and Tomasi also point out that whether exports can bring productivity gains depends on the absorptive capacity of exporting firms [44]. In addition, facing fierce international competition in the international market, trade enterprises will actively seek to innovate and upgrade their production technology [45], and the trade competition will also result in the withdrawal of enterprises with low productivities. Export earnings are concentrated among the enterprises with high productivities, which will improve the productivity of the entire industry in the long term;

- (2)

- The export trade impact on the social subsystem. The social subsystem covers different dimensions, such as social progress, social equity, and social security. Here, social progress refers to the livelihood level of the people rather than to economic development and productivity, and export trade is more likely to have an impact on the latter. Moreover, social security and social equity are dominated by government departments, while social security is only a part of the social responsibility that enterprises should bear; thus, export trade may not have a substantial impact on the social subsystem;

- (3)

- The export trade impact on the ecological subsystem. The ecological subsystem covers not only the undesired environmental pollution, energy consumption, and other indicators, but also the environmental protection level, which has a positive impact on the ecological environment. Most researchers have confirmed that the opening-up of export trade will aggravate and intensify the environmental pollution in China. Some energy- and resource-based trading enterprises increase their exports at the cost of higher energy consumption, which is also detrimental to the improvement in China’s environmental quality. However, some scholars have concluded that export trade can promote the progress of the green innovation efficiency [46], thereby improving the environmental protection levels of enterprises. Therefore, under the dual effects of negative pollution intensification and positive environmental protection enhancement, export trade may not have a substantial impact on the ecological subsystem;

- (4)

- The export trade impact on the open subsystem. Export trade is an important part of China’s opening-up, and the adherence to the opening-up is an important premise for China’s economy in its achievement of 40 years of high-speed growth. A higher level of openness in the new era was the original intention of the high-quality economic development. The opening up of China promotes reform, development, and innovation, which, in turn, promotes high-quality economic development. Second, on the level of investment openness, some studies have pointed out that export trade mainly affects the investment behavior of transnational corporations through the exchange rate, which is because exports are the main source of national foreign exchange reserves, which, in turn, have a direct impact on the national exchange rate [47]. Therefore, exports indirectly affect the exchange rate level through the surplus or gap in foreign exchange reserves. The exchange rate is an important factor that affects transnational investment because the fluctuation in the exchange rate may increase the expected income and profit levels of transnational investors, and export trade may improve China’s foreign investment level through the exchange rate transmission mechanism [48]. Third, export trade can also promote the development of cross-border tourism through the “publicity effect” of export commodities [49]. The expansion of inbound tourism will not only bring economic income to China, but will also contribute to transnational cultural exchange and cooperation;

- (5)

- The export trade impact on the coordinate subsystem. Because the coordination subsystem involves income coordination [50], consumption coordination, and production coordination, export trade mainly influences the coordination subsystem through these channels by improving the labor remuneration and optimizing the industrial structure to promote high-quality development. According to the above theoretical mechanism, we propose Hypothesis 2.

4.1.3. Extended Research Hypothesis

4.2. Research Design

4.2.1. Model Settings

Linear Regression Model

4.2.2. Dynamic Panel Model

4.2.3. Dynamic Panel Threshold Model

4.2.4. Variables and Data

5. Empirical Results Analysis

5.1. Regression Estimation Results of the Linear Model

5.2. Test of Action Mechanism

5.3. Regression Estimation Results of Dynamic Panel Threshold Model

5.3.1. Threshold Effect Test

5.3.2. Analysis of Threshold Regression Results

5.4. Robustness Test

6. Conclusions, Countermeasures, and Suggestions

6.1. Conclusions

6.2. Countermeasures and Suggestions

6.3. Research Deficiencies and Future Prospects

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

| 1 | Considering the availability of data, the Tibet, Hong Kong, Macao and Taiwan in China were excluded, and the interpolation method or analogy method is used to estimate the missing data. |

| 2 | Here, the rationalization index of industrial structure is constructed based on the Thiel index, and the calculation formula is: . where Yi is the output of industry i in a region, Y is the total output of all industries in a region, Li is the number of employees in industry i in a region, and L is the total number of employees in all industries in a region, TI is between [0, 1], the smaller the value is, the more reasonable the industrial structure is; otherwise, the more unreasonable it is. |

| 3 | “Pollution Haven Hypothesis” holds that the inflow of foreign capital may also bring “dirty technology” to the destination of investment, thus worsening the environmental pollution of the host country. Therefore, the impact of foreign capital inflow on a country’s environmental pollution needs to be further verified. |

| 4 | Here, the global super-efficiency EBM model defines the directional distance function and sets it as non-oriented and variable return to scale. Combined with the global Malmquist index, the green total factor productivity of each Chinese provincial level is measured. The input indicators include: human capital, which is measured by the number of employment in three industries in each province; capital stock, the data of fixed capital investment flow is adjusted by the fixed asset price index, the price factor is removed, the accumulated depreciation is subtracted, and the actual fixed capital stock is calculated by the perpetual inventory method; energy consumption, measured by the total energy consumption of each province. Output indicators include desired output, measured by actual provincial GDP, and undesired output, which includes sulfur dioxide emissions and wastewater emissions by provinces. |

References

- Zhang, J.; Li, Y.; Liu, Z. Does export promote the productivity of Chinese enterprises—Empirical evidence from Chinese local manufacturing enterprises: 1999~2003. Manag. World 2009, 12, 11–26. [Google Scholar]

- Gao, P.; Du, C.; Liu, X.; Yuan, F.; Tang, D. Construction of Modern Economic System Under the Background of High-quality Development: A logical framework. Econ. Res. J. 2019, 54, 4–17. [Google Scholar]

- Zhang, C.; Kong, J. Effect of Equity in Education on the Quality of Economic Growth: Evidence from China. Int. J. Hum. Sci. 2010, 7, 47–69. [Google Scholar]

- Mei, L.; Chen, Z. The Convergence Analysis of Regional Growth Differences in China: The Perspective of the Quality of Economic Growth. J. Serv. Sci. Manag. 2016, 9, 453–476. [Google Scholar] [CrossRef] [Green Version]

- Thomas, V.; Dailami, M.; Mansoor, D.; Dhareshear, A.; Kaufmann, D.; Kishor, N.; Lopez, R.; Wang, Y. The Quality of Growth; Oxford University Press: Oxford, UK, 2000. [Google Scholar]

- Barro, R.J. Quantity and Quality of Economic Growth. Chil. Econ. 2002, 5, 17–36. [Google Scholar]

- Li, M.; Ren, B. Comprehensive evaluation of China’s high-quality development in the new era and its path choice. Financ. Sci. 2019, 5, 21–32. [Google Scholar]

- Jin, B. Economic Research on “High Quality Development”. China’s Ind. Econ. 2018, 4, 5–18. [Google Scholar]

- Chen, S.Y.; Chen, D.K. Haze pollution, Government control and high-quality economic development. Econ. Res. 2018, 2, 22–34. [Google Scholar]

- Yu, Y.Z.; Yang, X.Z.; Zhang, S.H. Research on the time-space Transformation Characteristics of China’s Economy from high-speed growth to high-quality development. Res. Quant. Econ. Tech. Econ. 2019, 6, 3–21. [Google Scholar]

- Wang, G.J.; Zhang, H.; Jin, T.L. The driving force of China’s economic quality development: Structural adjustment or technological progress. Economist 2020, 6, 59–67. [Google Scholar]

- Wei, M.; Li, S. Research on the Measurement of the High Quality Development Level of China’s Economy in the New Era. Res. Quant. Econ. Tech. Econ. 2018, 35, 3–20. [Google Scholar]

- Jian, X.; Nie, C. Measurement of China’s high-quality development: 1978–2018. Economist 2020, 8, 49–58. [Google Scholar]

- Liu, Y.X.; Tian, C.S.; Cheng, L.Y. Measurement and Comparison of the High Quality Development Level of the World Economy. Economist 2020, 5, 69–78. [Google Scholar]

- Krugman, P. Increasing returns, monopolistic competition and international trade. J. Int. Econ. 1979, 9, 469–479. [Google Scholar] [CrossRef]

- Feder, G. On export and economic growth. J. Dev. Econ. 1983, 12, 59–73. [Google Scholar] [CrossRef]

- Grossman, G.; Krueger, A. Environmental Impacts of a North American Free Trade Agreement. NBER Work. Pap. 1991, No.3914. [Google Scholar]

- Coe, D.; Helpman, E. International R&D spillover. Eur. Econ. Rev. 1995, 39, 859–887. [Google Scholar]

- Li, J.; Tang, Y. Trade Opening, FDI and Total Factor Productivity. Macroecon. Res. 2019, 9, 67–79. [Google Scholar]

- Luo, C.; Zhang, Z. Complementarity of export and R&D activities and its impact on productivity—Evidence from Chinese listed enterprises. Res. Quant. Econ. Technol. Econ. 2020, 7, 134–154. [Google Scholar]

- Ye, X.; Chen, D.; Liu, R. The impact of bonded zones and export processing zones on regional total factor productivity: An empirical study based on the double difference method. J. Cent. Univ. Financ. Econ. 2021, 1, 119–128. [Google Scholar]

- Lin, B.; Liu, H. Whether foreign trade is conducive to improving energy and environmental efficiency—Taking China’s industrial sector as an example. Econ. Res. 2015, 50, 127–141. [Google Scholar]

- Wang, S.; Wang, X.; Hu, Z. Research on the green productivity effect of service export trade: Empirical analysis based on industry breakdown data of nine developing economies. World Econ. Res. 2019, 7, 29–42. [Google Scholar]

- Wang, L.; Song, J.; Yan, M. Export trade and industrial green efficiency improvement. Ind. Technol. Econ. 2020, 39, 144–151. [Google Scholar]

- Qi, S.; Xu, J. The impact of trade openness on green total factor productivity of countries along the “the Belt and Road”. China’s Popul. Resour. Environ. 2018, 28, 134–144. [Google Scholar]

- Liu, Y. Will International Trade Deteriorate Total Factor Energy Efficiency? -- An Empirical Analysis Based on China’s 33 Industrial Industries, China’s Population. Resour. Environ. 2018, 28, 20–29. [Google Scholar]

- Yang, S.; Han, X.; Song, W. Does foreign direct investment affect China’s green total factor productivity? J. Shanxi Univ. Financ. Econ. 2017, 39, 14–26. [Google Scholar]

- Mzaumdar, J. Do static gains from trade lead to medium-run growth. J. Political Econ. 1996, 104, 1328–1337. [Google Scholar] [CrossRef]

- Memedovic, O. Inserting Local Industries into Global Value Chains and Global Production Networks; UNIDO Working Paper: Vienna, Austria, 2004. [Google Scholar]

- Cai, H.Y.; Xu, Y.Z. Does the trade opening affect the upgrading of China’s industrial structure? Research on Quantitative Economy. Tech. Econ. 2017, 34, 3–22. [Google Scholar]

- Yang, D.; Yang, L. Foreign Trade, Technological Progress and Industrial Structure Upgrading: Experience. Mechanism and Demonstration. Manag. World 2016, 11, 172–173. [Google Scholar]

- Bu, W.; Yang, Y.; Chi, S. Research on the Impact of China’s Foreign Trade Commodity Structure on the Upgrading of Industrial Structure. Macroecon. Res. 2019, 8, 55–70. [Google Scholar]

- Luo, N.; Jiang, Y. The Impact of Local government competition and opening to the Outside World on environmental pollution: A case study of 270 cities in China. Urban Probl. 2017, 12, 46–55. [Google Scholar]

- Wang, A.; Fang, Y. Reorientation of the development of China Pilot Free Trade Zone from the perspective of double-cycle new development pattern: And on the reform path of China’s free trade Zone with high-quality economic development. Mod. Econ. Res. 2021, 11, 37–48. [Google Scholar]

- Sun, L.J.; Xing, X.J.; Zhou, D.Q. Improvement of Entropy Weighting Method. Stat. Decis. Mak. 2010, 21, 153–154. [Google Scholar]

- Hu, X.P.; Xu, P. Research on the impact of FDI quality characteristics on China’s high-quality economic development. Int. Trade Issues 2020, 10, 31–50. [Google Scholar]

- Guo, Y.; Fan, B.; Long, J. Research on the practical Measurement of high-quality Regional Development and its Spatio-temporal evolution. J. Quant. Tech. Econ. 2020, 37, 118–132. [Google Scholar]

- Zou, Y.; Tang, L. Statistical Measurement of China’s High Quality Industrial Development Level. Stat. Decis. Mak. 2021, 37, 95–98. [Google Scholar]

- Keller, W. International Trade, Foreign Direct Investment, and Technology Spillovers. NBER Work. Pap. 2009, No. w15442. [Google Scholar]

- Melitz, M.J. The impact of trade on intra-industry re-allocations and aggregate industry productivity. Econometrica 2003, 71, 1695–1725. [Google Scholar] [CrossRef] [Green Version]

- Wang, Q.; Zhu, Y.; Wang, Y. Can export trade increase innovation output?—Based on the empirical analysis of China’s micro enterprises. J. Beijing Technol. Bus. Univ. 2016, 31, 41–52. [Google Scholar]

- Zhang, H.; Zhang, M. Learning effect of Chinese enterprises’ export trade -- based on the perspective of capacity utilization. J. Shanxi Univ. Financ. Econ. 2019, 41, 77–92. [Google Scholar]

- Liu, X.H.; Buck, T. Innovation performance and channels for international technology spillovers: Evidence from Chinese high-tech industries. Res. Policy 2007, 36, 355–366. [Google Scholar] [CrossRef]

- Serti, F.; Tomasi, C. Self-selection and post-entry effects of exports: Evidence from Italian manufacturing firms. Rev. World Econ. 2008, 144, 660–694. [Google Scholar] [CrossRef]

- Salomon, R.M.; Shaver, J.M. Learning by exporting:new insights from examining firm innovation. J. Econ. Manag. Strategy 2005, 14, 431–460. [Google Scholar] [CrossRef]

- Wang, H.; Bian, Y.-J.; Wang, S.-Q.; Li, X.-C. Geographical endowment, foreign trade and industrial technological innovation efficiency—Empirical analysis based on panel quantiles. Manag. Rev. 2017, 3, 40–48. [Google Scholar]

- Nie, F.; Liu, H. Interactive Mechanism of China’s IFDI, OFDI and Export Trade—An Empirical Test Based on Transnational Panel Data. Int. Econ. Trade Explor. 2018, 34, 68–84. [Google Scholar]

- Chakrabrti, R.; Scholnick, B. Exchange Rate Expectations and Foreign Direct Investment Flow. Weltwirtschaftliches Archiv. 2002, 1, 1–21. [Google Scholar] [CrossRef]

- Sun, G. Advantages of a Big Country and the High Speed and Sustainable Growth of China’s Tourism Industry. Tour. J. 2008, 4, 29–34. [Google Scholar]

- Wang, Y.; Wu, G. Trade liberalization and China’s urban-rural income gap: An empirical study based on prefecture level urban panel data. Int. Trade Issues 2019, 4, 64–75. [Google Scholar]

- Cohen, W.; Levinthai, D. Absorptive capacity: A new perspective on learning and innovation. Adm. Sci. Q. 1990, 35, 128–152. [Google Scholar] [CrossRef]

- Bai, Y.; Qian, Q.; Jiao, J.; Li, L.; Li, F.; Yang, R. Can environmental innovation benefit from outward foreign direct investment to developed countries? Evidence from Chinese manufacturing enterprises. Environ. Sci. Pollut. Res. 2020, 27, 13790–13808. [Google Scholar] [CrossRef]

- Chen, Y.; Yang, Z. Foreign Investment in Manufacturing Industry and Fluctuation of Market Power: Competition or Monopoly. China Ind. Econ. 2012, 10, 52–64. [Google Scholar]

- Wang, J.; Blomstrom, M. Foreign Investment and Technology Transfer:A Simple Mode. Eur. Econ. Rev. 1992, 36, 137–155. [Google Scholar] [CrossRef]

- Glass, A.; Saggi, K. International Technology Transfer and the Technology Gap. J. Dev. Econ. 1998, 55, 369–398. [Google Scholar] [CrossRef]

- Xu, G.; Song, D. Empirical Study on the Relationship between China’s Export Trade, Economic Growth and Carbon Emission. Int. Trade Issues 2010, 1, 74–79. [Google Scholar]

- Hausman, J.A. Specification tests in econometrics. Econometrica 1978, 46, 1251–1271. [Google Scholar] [CrossRef] [Green Version]

- Arellano, M.; Bond, S. Some Tests of Specification for Panel Data: Monte Carlo Evidence and an Application to Empolyment Equations. Rev. Econ. Stud. 1991, 58, 277–297. [Google Scholar] [CrossRef] [Green Version]

- Chen, C.F. Industrial green total factor productivity and its influencing factors in China: An empirical study based on ML productivity index and dynamic panel model. Stat. Res. 2016, 33, 53–62. [Google Scholar]

- Hansen, B. Sample Splitting and Threshold Estimation. Econometrica 2000, 68, 575–603. [Google Scholar] [CrossRef] [Green Version]

- Caner, M.; Hansen, B.E. Instrumental variable estimation of a threshold model. Econom. Theory 2004, 20, 813–843. [Google Scholar] [CrossRef]

- Kremer, S.; Bick, A.; Nautz, D. Inflation and growth: New evidence from a dynamic panel threshold analysis. Empir. Econ. 2013, 44, 861–878. [Google Scholar] [CrossRef] [Green Version]

- Li, M.; Liu, S. Regional differences and threshold effects of reverse technology spillovers of foreign direct investment -- threshold regression analysis based on China’s inter-provincial panel data. Manag. World 2012, 1, 21–32. [Google Scholar]

- Amiti, M.; Konings, J. Trade Liberalization, Intermediate Inputs and Productivity: Evidence from Indonesia. Am. Econ. Rev. 2007, 97, 1611–1638. [Google Scholar] [CrossRef]

- Kneller, R.; Pisu, M. Industrial Linkages and Export Spillovers from FDI. World Econ. 2007, 30, 105–134. [Google Scholar] [CrossRef]

- Wang, Y.; Liu, S. Empirical Study on International Technology Spillover Channels. Res. Quant. Econ. Technol. Econ. 2008, 4, 153–161. [Google Scholar]

- Han, F.; Zhuang, Z. Domestic Big Market, Artificial Intelligence Application and Manufacturing Export Domestic Added Value. World Econ. Res. 2022, 33–47. [Google Scholar]

- Foster, B.P.; Balassa, T.; Benen, T.D. Extracellular vesicles in blood, milk and body fluids of the female and male urogenital tract and with special regard to reproduction. Crit. Rev. Clin. Lab. Sci. 2017, 6, 53–59. [Google Scholar] [CrossRef]

- Wen, D. FDI, Export Opening and provincial Industrial Growth in China. J. Financ. Res. 2003, 6, 104–114. [Google Scholar]

- Xie, T.; Li, Y.; Pan, Y. Foreign Direct Investment, technological progress and Industrial structure upgrading: Based on the spatial econometric analysis of China’s provinces. Ind. Technol. Econ. 2018, 37, 35–43. [Google Scholar]

- He, X.; Ou, Y.; Shi, W. FDI technology spillover and the threshold of China’s absorptive capacity. World Econ. 2014, 10, 52–76. [Google Scholar]

- Qian, X.; Wang, J.; Huang, Y.; Wang, S. Exports and the productivity of Chinese industrial enterprises – self selection effect or export learning effect? Quant. Econ. Tech. Econ. Res. 2011, 28, 37–51. [Google Scholar]

- Ge, X.; Chen, L. The technological progress effect of international R&D spillovers: An empirical study based on absorptive capacity. Quant. Econ. Tech. Econ. Res. 2009, 26, 86–98. [Google Scholar]

| Subsystem | Subindicator | Basic Indicator | Measurement Method | Sign |

|---|---|---|---|---|

| Economics | Economic growth | GDP growth rate per capita | Real GDP growth rate per capita | + |

| Innovation efficiency | Number of authorized invention patent applications | Number of authorized invention patent applications/total population of region (piece) | + | |

| Proportion of output value of high-tech enterprises | Output value of high-tech enterprises/total regional output value (%) | + | ||

| Total factor productivity | Annual average growth rate of total factor productivity | + | ||

| Financial efficiency | Deposit balance per unit GDP | Balance of financial institution deposits at end of year/regional GDP (%) | + | |

| Loan balance per unit GDP | Balance of financial institution loans at end of year/regional GDP (%) | + | ||

| Market development | Marketization degree | Marketization index | + | |

| Society | Social progress | Internet penetration | Number of Internet users/total resident population (%) | + |

| Educational expenditure | Total expenditure on education/regional GDP (%) | + | ||

| Registered urban unemployment rate | Unemployed/sum of employees and unemployed (%) | − | ||

| Social equity | Engel coefficient of urban households | Food, tobacco, and alcohol expenditure/total consumption expenditure of urban residents | − | |

| Engel coefficient of rural households | Food, tobacco, and alcohol expenditure/total consumption expenditure of rural residents | − | ||

| Social security | Participation rate for medical insurance | Number of medical insurance participants/total number of employees (%) | + | |

| Participation rate for endowment insurance | Number of pension insurance participants/total number of employees (%) | + | ||

| Ecology | Environmental pollution | Exhaust gas emissions per unit GDP | Sulfur dioxide emissions/regional GDP (ton/CNY 10,000) | − |

| Wastewater discharge per unit GDP | Wastewater discharge/regional GDP (ton/CNY 10,000) | − | ||

| Carbon emission intensity | Carbon emissions/regional GDP (ton/CNY 10000) | − | ||

| PM2.5 | Mean value of PM2.5 concentration in different regions (mg/m3) | − | ||

| Environmental protection level | Utilization rate of solid waste | Utilization amount of solid waste/generation amount of solid waste (%) | + | |

| Domestic garbage removal rate | Domestic waste clearing and transportation volume/domestic waste generation volume (%) | + | ||

| Urban sewage treatment rate | Urban sewage treatment capacity/total sewage discharge (%) | + | ||

| Number of public toilets per capita | Total number of public toilets/total population of region (seats/10,000 people) | + | ||

| Energy resources | Energy intensity per unit GDP | Total energy consumption/regional GDP (ton/CNY 10,000) | − | |

| Forest coverage | Forest coverage (%) | + | ||

| Opening up | Open trade | Total imports per unit GDP | Total imports/regional gross output value (%) | + |

| Investment openness | Actual utilized foreign capital per unit GDP | Actual utilized foreign capital/regional gross output value (%) | + | |

| Tourism openness | Proportion of overseas tourism income | Overseas tourism income/regional total output value (%) | + | |

| Coordi- nation | Revenue coordination | Urban–rural income gap | Urban residents’ disposable income/rural residents’ disposable income | − |

| Proportion of labor remuneration in GDP | Labor remuneration/regional gross output value (%) | + | ||

| Consumption coordination | Urban–rural consumption gap | Consumption of urban residents/consumption of rural residents | − | |

| CPI | Real consumer price index | − | ||

| Production coordination | Rational production structure | Calculation based on Thiel index2 | − | |

| Livelihood coordination | Urbanization rate | Urban population/total regional population (%) | + |

| Variable | Variable Name | Variable Symbol | Mean Value | Standard Deviation | Minimum Value | Maximum Value |

|---|---|---|---|---|---|---|

| Explained variables | High-quality economic development | hqd | 0.301 | 0.1409 | 0.0852 | 0.812 |

| Explanatory variables | Export trade | exp | 15.689 | 18.268 | 0.680 | 98.90 |

| Control variables | Environmental regulation | er | 1.288 | 0.660 | 0.289 | 4.230 |

| Government R&D investment | lngov | 3.956 | 1.615 | 0.904 | 7.589 | |

| Education level | lnh | 2.137 | 0.127 | 1.693 | 2.548 | |

| Domestic national capital investment | kr | 5.989 | 2.590 | 1.799 | 14.70 | |

| Population density | lnpd | 5.427 | 1.263 | 1.946 | 8.251 | |

| Threshold variables | Economic development level | lnpgdp | 9.850 | 0.771 | 7.887 | 11.815 |

| R&D intensity | rd | 1.388 | 1.136 | 0.140 | 7.410 | |

| Technical gap | tgap | 0.102 | 0.073 | 0.013 | 0.407 |

| Variable | (1) | (2) | (3) | (4) |

|---|---|---|---|---|

| OLS | FE | FE | SYS-GMM | |

| exp | 0.340 *** (7.392) | 0.223 *** (5.031) | 0.224 *** (4.676) | 0.115 *** (11.512) |

| er | 0.308 (0.241) | −0.359 (−1.220) | 0.177 (0.579) | −0.699 *** (−2.581) |

| lngov | 46.016 *** (3.209) | 1.037 *** (4.202) | 2.823 *** (3.564) | 0.055 * (1.943) |

| lnh | 2.561 *** (6.672) | 27.252 *** (8.783) | 12.912 ** (2.230) | 15.109 *** (18.222) |

| kr | 0.796 (1.034) | 0.301 ** (2.064) | 0.133 (0.796) | 0.323 *** (9.040) |

| lnpd | 39.563 *** (3.291) | 1.018 (0.249) | −2.405 (−0.586) | 3.052 *** (4.767) |

| hqdt-1 | 0.408 *** (22.068) | |||

| Constant | −68.678 *** (−2.773) | −42.587 * (−1.937) | −2.715 (−0.092) | −33.504 *** (−9.984) |

| Hausman | 110.20 *** | 73.46 *** | ||

| Sargan | 0.766 (0.910) | 28.179 (1.000) | ||

| AR(1) | −3.373 *** (0.001) | |||

| AR(2) | 0.011 (0.991) | |||

| Adj-R2 | 0.849 | 0.747 | 0.826 | |

| Observed value | 600 | 600 | 600 | 570 |

| Variable | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| Economic | Social | Ecological | Opening-Up | Coordination | |

| exp | 0.025 *** (3.005) | 0.010 (1.100) | 0.005 (0.737) | 0.027 ** (2.742) | 0.026 *** (4.607) |

| Constants | 7.111 * (1.650) | 3.222 (0.587) | 3.072 (0.401) | −4.444 (−0.691) | −14.969 *** (−2.891) |

| Control variable | Yes | Yes | Yes | Yes | Yes |

| Hausman test | 54.40 *** | 82.04 *** | 175.11 *** | 54.45 *** | 39.43 *** |

| Individual effect | Yes | Yes | Yes | Yes | Yes |

| Time effect | Yes | Yes | Yes | Yes | Yes |

| Adj-R2 | 0.424 | 0.573 | 0.421 | 0.421 | 0.743 |

| Observations | 600 | 600 | 600 | 600 | 600 |

| Threshold Variable | Threshold Number | F-Value | p-Value | Threshold Value | Confidence Interval | BS Time | |

|---|---|---|---|---|---|---|---|

| Economic level | Single threshold | 56.01 *** | 0.000 | 9.957 | 9.955 | 9.959 | 500 |

| Double threshold | 20.12 | 0.213 | 10.329 | 10.318 | 10.330 | 500 | |

| Triple threshold | 13.34 | 0.587 | 10.904 | 10.844 | 10.905 | 500 | |

| R&D intensity | Single threshold | 139.75 *** | 0.000 | 1.160 | 1.120 | 1.170 | 500 |

| Double threshold | 16.40 | 0.177 | 2.030 | 1.815 | 2.040 | 500 | |

| Triple threshold | 14.62 | 0.550 | 2.830 | 2.750 | 2.890 | 500 | |

| Technical gap | Single threshold | 68.45 *** | 0.000 | 0.084 | 0.080 | 0.084 | 500 |

| Double threshold | 29.29 | 0.107 | 0.052 | 0.051 | 0.056 | 500 | |

| Triple threshold | 30.76 | 0.113 | 0.175 | 0.172 | 0.177 | 500 | |

| Variable | Economic Level | R&D Density | Technical Gap | |||

|---|---|---|---|---|---|---|

| lnpgdp ≤ γ1 | lnpgdp > γ1 | rd ≤ γ2 | rd > γ2 | tgap ≤ γ3 | tgap > γ3 | |

| hqdt−1 | 0.164 *** (5.984) | 0.337 *** (17.209) | 0.188 *** (6.902) | 0.304 *** (5.738) | 0.152 *** (7.030) | 0.335 *** (19.790) |

| exp | −0.006 (−0.710) | 0.017 *** (4.262) | −0.068 ** (−2.281) | 0.018 ** (2.425) | 0.008 (0.031) | 0.024 *** (3.435) |

| Constant | −0.738 ** (−2.393) | −0.710 *** (−13.616) | −0.253 (−0.699) | −0.648 *** (−3.786) | −1.772 *** (−3.815) | −0.636 *** (−4.096) |

| Control variable | Yes | Yes | Yes | Yes | Yes | Yes |

| Sargan test | 25.774 (1.000) | 21.357 (1.000) | 23.616 (1.000) | 17.355 (1.000) | 25.889 (1.000) | 22.004 (1.000) |

| AR(1) | −2.822 *** (0.005) | −2.343 ** (0.019) | −2.857 *** (0.004) | −2.399 ** (0.016) | −3.322 *** (0.001) | −2.668 *** 0.008 |

| AR(2) | −0.959 (0.338) | 0.072 (0.942) | −0.973 (0.331) | −0.243 (0.808) | −0.137 (0.891) | 0.127 (0.899) |

| Observations | 290 | 250 | 289 | 251 | 234 | 306 |

| Variable | Linear Regression | Economic Level | R&D Intensity | Technical Gap | ||||

|---|---|---|---|---|---|---|---|---|

| Fe | SYS-GMM | lnpgdp ≤ γ1 | lnpgdp > γ1 | rd ≤ γ2 | rd > γ2 | tgap ≤ γ3 | tgap > γ3 | |

| hqdt−1 | 0.862 *** (37.264) | |||||||

| hqdt−2 | 0.023 (0.910) | 0.478 *** (17.340) | 0.237 *** (7.508) | 0.333 *** (3.688) | 0.176 *** (7.773) | 0.390 *** (28.435) | ||

| exp | 0.040 *** (2.792) | 0.049 *** (43.712) | 0.156 *** (6.129) | 0.260 ** (2.278) | 0.015 (1.036) | 0.036 * (1.716) | 0.016 (1.463) | 0.025 *** (3.033) |

| Constant | −12.173 (−1.148) | −20.561 *** (−17.120) | −6.363 *** (−8.774) | −0.540 *** (−3.278) | −0.887 *** (−4.581) | −0.459 (−1.309) | −0.998 *** (−2.773) | −0.557 *** (−5.025) |

| Control variables | Yes | Yes | Yes | Yes | Yes | Yes | Yes | Yes |

| Sargan | 28.294 (1.000) | 18.629 (0.9474) | 21.055 (1.000) | 19.641 (1.000) | 12.499 (1.000) | 24.310 (1.000) | 21.764 (1.000) | |

| AR(1) | −2.356 ** (0.019) | −2.505 ** (0.013) | −3.056 *** (0.002) | −3.394 *** (0.000) | −2.592 ** (0.011) | −3.412 *** (0.001) | −2.327 (0.020) | |

| AR(2) | −0.673 (0.501) | −0.840 (0.400) | 0.802 (0.423) | −0.114 (0.909) | −0.317 (0.751) | −0.947 (0.344) | 0.398 (0.697) | |

| 0.103 | ||||||||

| Observations | 600 | 570 | 125 | 415 | 356 | 190 | 238 | 302 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Luo, H.; Qu, X. Export Trade, Absorptive Capacity, and High-Quality Economic Development in China. Systems 2023, 11, 54. https://doi.org/10.3390/systems11020054

Luo H, Qu X. Export Trade, Absorptive Capacity, and High-Quality Economic Development in China. Systems. 2023; 11(2):54. https://doi.org/10.3390/systems11020054

Chicago/Turabian StyleLuo, Haiyan, and Xiaoe Qu. 2023. "Export Trade, Absorptive Capacity, and High-Quality Economic Development in China" Systems 11, no. 2: 54. https://doi.org/10.3390/systems11020054

APA StyleLuo, H., & Qu, X. (2023). Export Trade, Absorptive Capacity, and High-Quality Economic Development in China. Systems, 11(2), 54. https://doi.org/10.3390/systems11020054