Game Theoretical Analysis of a Multi-MNO MVNO Business Model in 5G Networks

Abstract

1. Introduction

- A business model proposal (multi-MNO MVNO) to provide service to end-users through an MVNO using the infrastructure support of two MNOs and analyze the interactions between the different actors (MVNO, MNOs and users).

- A viability analysis of an agreement between an MVNO and MNOs, wherein the MVNO will distribute the users’ traffic between to MNOs and will pay to each MNO for the traffic served through its infrastructure.

- A thorough mathematical analysis of the Nash Equilibria for the game played by the MVNO and both MNOs is carrying out.

Related Work

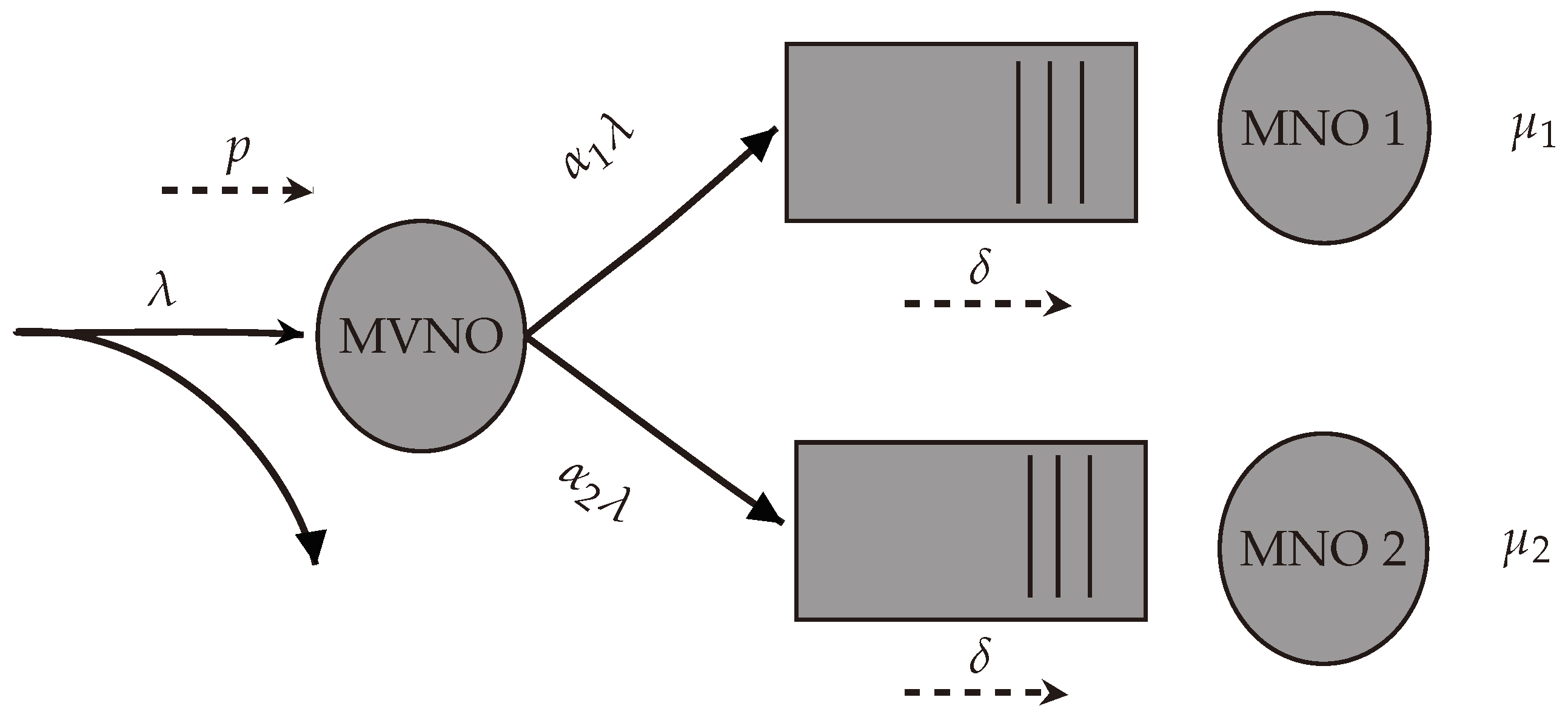

2. Model Description

- the MVNO provides service to final users;

- MNOs carry out that service for the MVNO;

- final users will determine if they subscribe or not with the MVNO. Moreover, operators profits (MVNO and MNOs) depend on the users’ subscription decisions to MVNO.

2.1. System Model

2.2. Economic Model

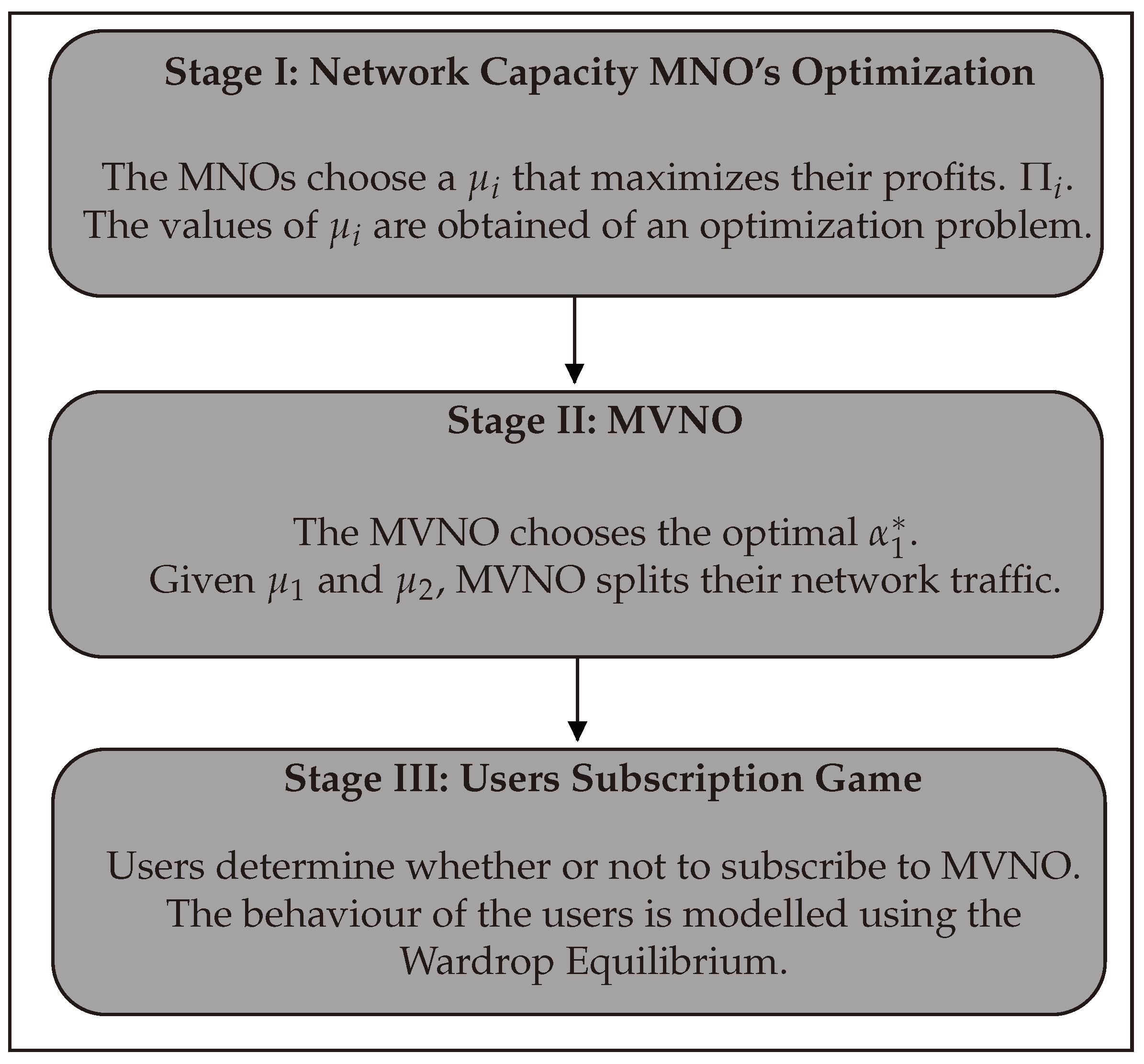

2.3. Strategic Game

3. Analysis

3.1. MVNO Service Provision

- If then .

- Otherwise, is the unique solution in of and equals

- either and the utility of entering the system is non-positive (so that nobody will join), i.e.,where we plugged in Equation (8),

- or the utility of entering the system is zero, i.e., is a solution of

- if the solution is trivial;

- otherwise, Equation (14) is equivalent to being the unique root in of , which we can rewrite asa degree-two polynomial equation in , with at least one positive root since an equilibrium exists, from the reasoning above. Equation (13) does not hold, . Additionally, notice that is strictly concave, therefore all its roots are strictly positive. However, there is only one root in , hence, we use the classical expression for the smallest root of a degree-two polynomial, and a bit of algebra, to get the expression in Equation (12).

3.2. MVNO Decision

- If , then for any so there is no maximizing λ (the MVNO always get a revenue 0);

- Otherwise, these is a unique maximizing the MVNO revenue, given by

- if for all then looking for an optimal makes no sense since user mean arrival rate is always null. That condition is equivalent to , or , or again .

- Otherwise, we know that there exists some eliciting a strictly positive user mean arrival rate ; our goal is now to find an maximizing . Note from Equations (12) that the network traffic is a continuously differentiable function of in the open interval (0,1).

3.3. MNO’s Simultaneous-Move Strategic Game

4. Results and Discussion

- q is the adjustment cost parameter [60] and values assigned to this parameter in analysis satisfy restrictions and .

- p is the price charged by MNO and value assigned is greater than MNOs fee for obtaining positive MVNO profits in Equation (9).

- is the fee paid by the MVNO and value assigned is .

- c is the conversion factor to monetary units, and the value assigned is 2. This parameter has not further relevance in the numerical computations.

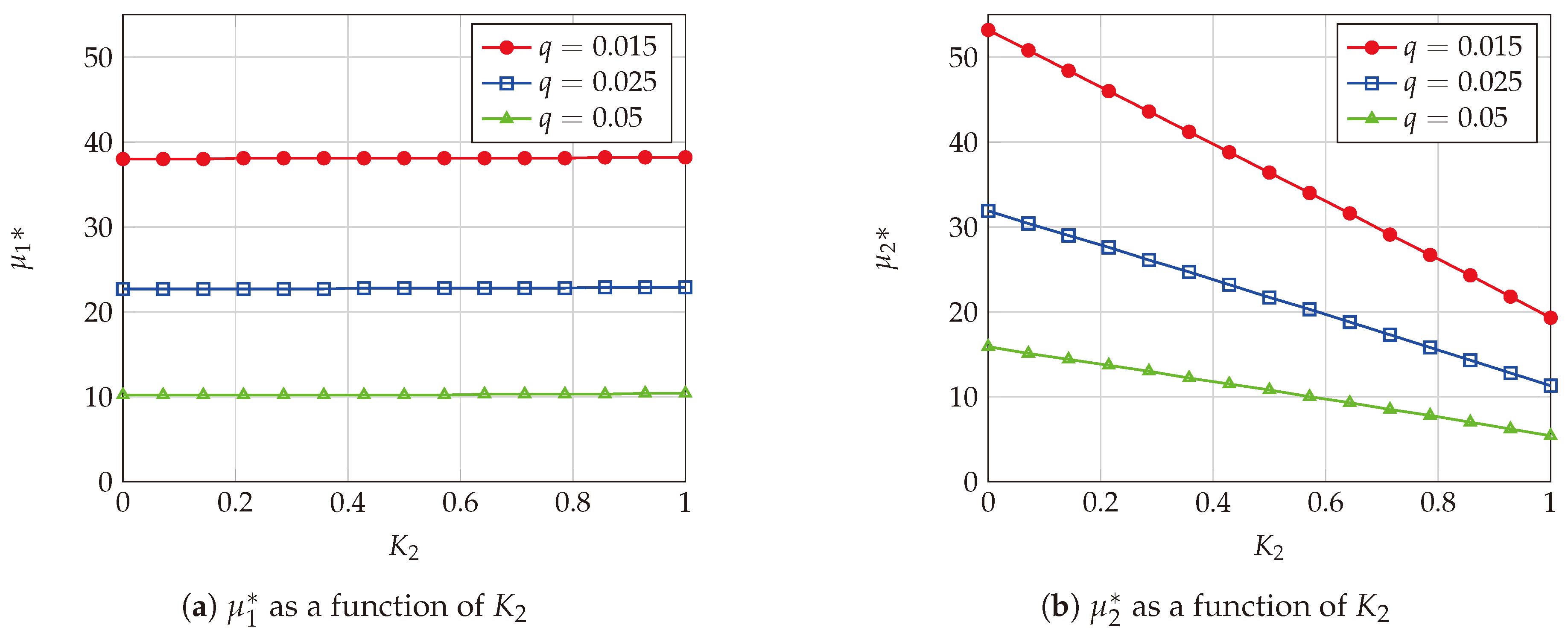

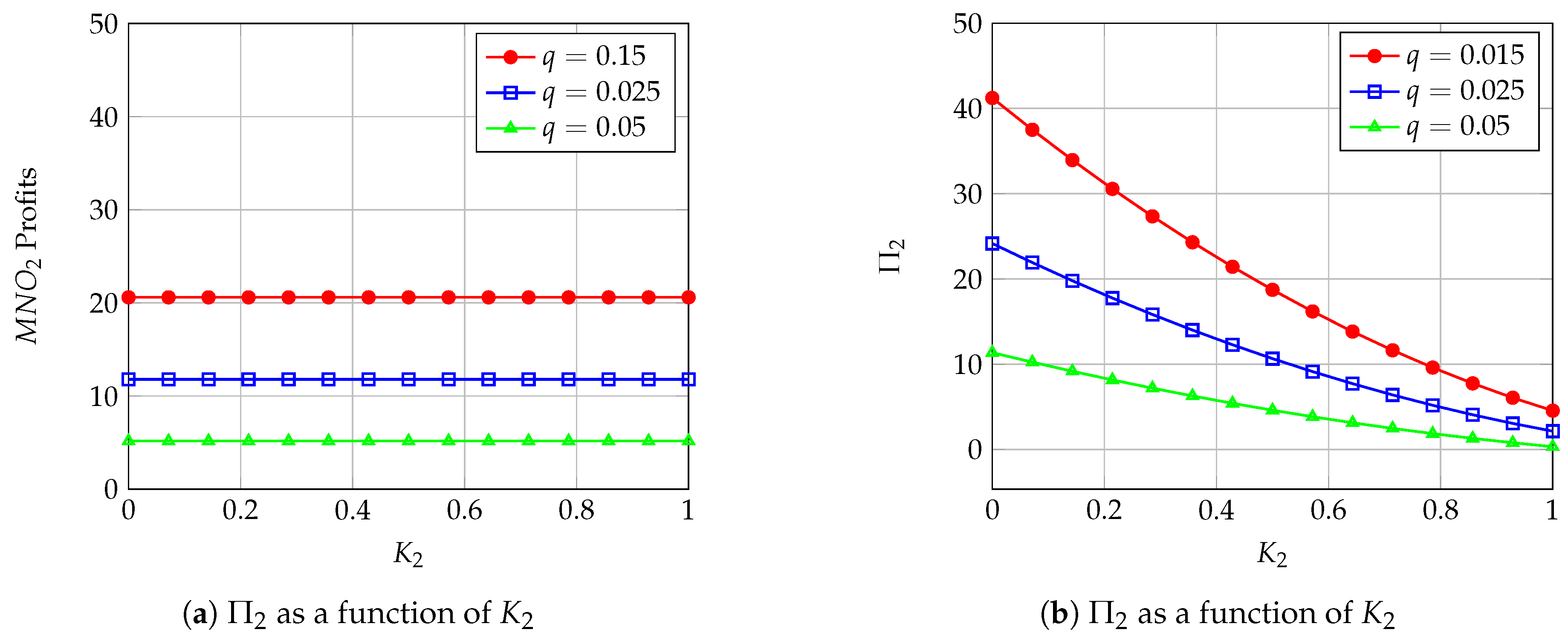

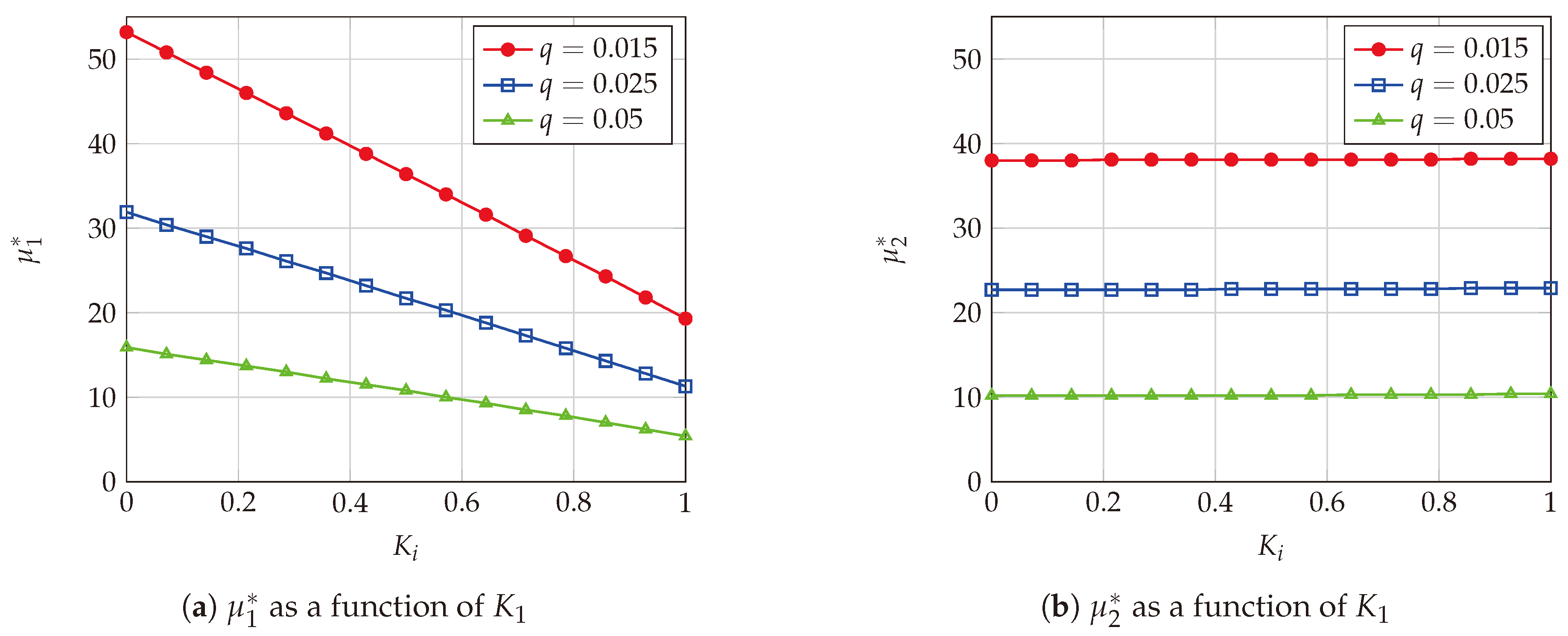

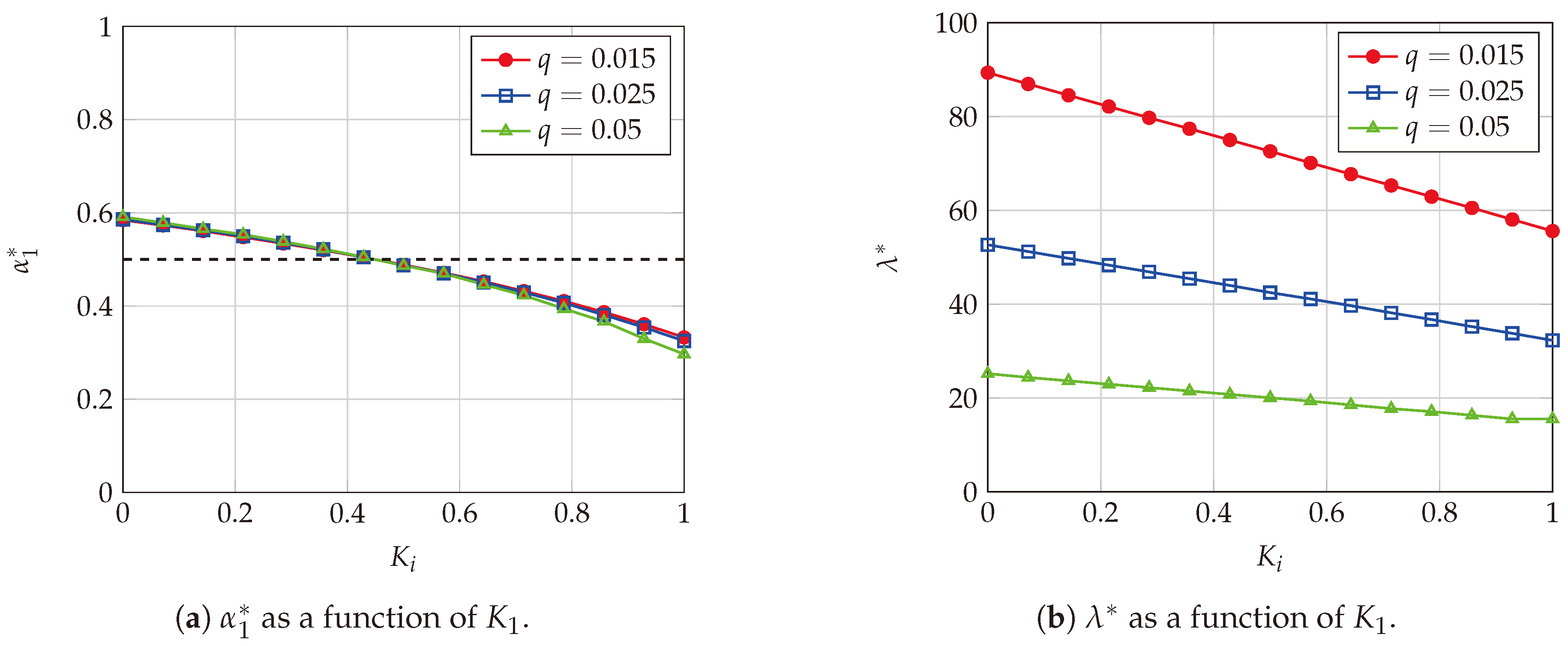

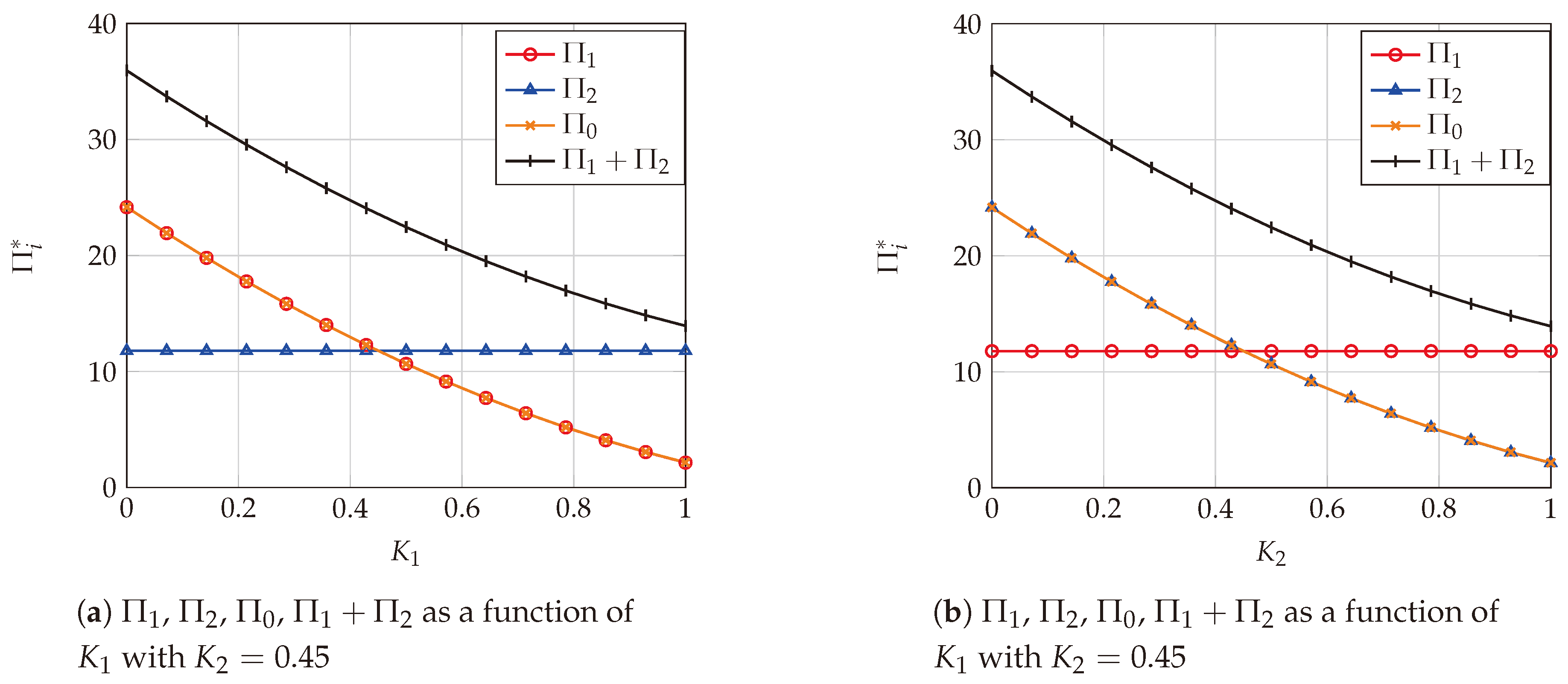

4.1. MNOs Investment Costs with

4.2. MNOs Investment Costs with

4.3. Comparison between Multi-MNO MVNO and Single-MNO Models

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A. Single-MNO

- MVNO Service ProvisionAnalyzing the users’ subscription decision, we observe that given a price p announced by the operator, the Wardrop equilibrium will be as follows.

- ‐

- Case I: The number of users subscribing increases until the utility is zero. Therefore, the condition for this case is

- ‐

- Case II: The price in Equation (A4) is so high that the utility is always negative. Therefore the condition for this case isUnder the Condition (A7), the users do not subscribe the service. Therefore, the number of users isAssuming equilibrium in Case I, we can obtain the MVNO profits substituting into Equation (9).

- MNO ProfitsAt this point, we proceed to analyze the network capacity given by the value of from the previous section. We can compute the profit for MNO in the monopoly scenario substituting Equation (A6) into Equation (A1)We can maximize the profit by setting its derivative with respect to the price () equal to zero, the result of () is

Appendix B. MNOs Profits with K1 = 0.45 and 0 < K2 < 1

| Parameter | Value |

|---|---|

| q | |

| p | 1.8 |

| 1.6 | |

| c | 2 |

References

- Gruber, H. Competition and innovation: The diffusion of mobile telecommunications in Central and Eastern Europe. Inf. Econ. Policy 2001, 13, 19–34. [Google Scholar] [CrossRef]

- Berne, M.; Vialle, P.; Whalley, J. An analysis of the disruptive impact of the entry of Free Mobile into the French mobile telecommunications market. Telecommun. Policy 2019, 43, 262–277. [Google Scholar] [CrossRef]

- Kostopoulos, A.; Chochliouros, I.P.; Spada, M.R. Business Challenges for Service Provisioning in 5G Networks. In Proceedings of the International Conference on Business Information Systems, Seville, Spain, 26–28 June 2019; pp. 423–434. [Google Scholar]

- Copeland, R.; Crespi, N. Modelling multi-MNO business for MVNOs in their evolution to LTE, VoLTE and advanced policy. In Proceedings of the BMMP’11: Third International Workshop on Business Models for Mobile Platforms: Access and Competitiveness in Multi-Sided Markets, Berlin, Germany, 4–7 October 2011; pp. 295–300. [Google Scholar]

- Nakao, A.; Du, P.; Kiriha, Y.; Granelli, F.; Gebremariam, A.A.; Taleb, T.; Bagaa, M. End-to-end network slicing for 5G mobile networks. J. Inf. Process. 2017, 25, 153–163. [Google Scholar] [CrossRef]

- Son, P.H.; Jha, S.; Kumar, R.; Chatterjee, J.M. Governing mobile Virtual Network Operators in developing countries. Util. Policy 2019, 56, 169–180. [Google Scholar] [CrossRef]

- Khalifa, N.B.; Benhamiche, A.; Simonian, A.; Bouillon, M. Profit and Strategic Analysis for MNO-MVNO Partnership. arXiv 2018, arXiv:1812.05413. [Google Scholar]

- Statista. Archivo Situacionista Hispano. Available online: Http://Www.Statista.Com/Statistics/671623/Global-Mvno-Market-Size/ (accessed on 3 March 2020).

- Xiao, A.; Liu, Y.; Li, Y.; Qian, F.; Li, Z.; Bai, S.; Liu, Y.; Xu, T.; Xin, X. An In-depth Study of Commercial MVNO: Measurement and Optimization. In Proceedings of the 17th Annual International Conference on Mobile Systems, Applications, and Services, Seoul, Korea, 17–21 June 2019; pp. 457–468. [Google Scholar]

- Zheng, L.; Chen, J.; Joe-Wong, C.; Tan, C.W.; Chiang, M. An economic analysis of wireless network infrastructure sharing. In Proceedings of the 2017 15th International Symposium on Modeling and Optimization in Mobile, Ad Hoc, and Wireless Networks (WiOpt), Paris, France, 15–19 May 2017; pp. 1–8. [Google Scholar]

- Duan, L.; Gao, L.; Huang, J. Cooperative spectrum sharing: A contract-based approach. IEEE Trans. Mob. Comput. 2012, 13, 174–187. [Google Scholar] [CrossRef]

- Sacoto-Cabrera, E.J.; Sanchis-Cano, A.; Guijarro, L.; Vidal, J.R.; Pla, V. Strategic interaction between operators in the context of spectrum sharing for 5G networks. Wirel. Commun. Mob. Comput. 2018, 4308913, 1–10. [Google Scholar] [CrossRef]

- Marsch, P.; Bulakci, Ö.; Queseth, O.; Boldi, M. 5G System Design: Architectural and Functional Considerations and Long Term Research; John Wiley & Sons: Hoboken, NJ, USA, 2018. [Google Scholar]

- Alliance, N. 5G white paper. Next Gener. Mob. Netw. White Pap. 2015, 1, 1–125. [Google Scholar]

- Samdanis, K.; Costa-Perez, X.; Sciancalepore, V. From network sharing to multi-tenancy: The 5G network slice broker. IEEE Commun. Mag. 2016, 54, 32–39. [Google Scholar] [CrossRef]

- Rost, P.; Banchs, A.; Berberana, I.; Breitbach, M.; Doll, M.; Droste, H.; Mannweiler, C.; Puente, M.A.; Samdanis, K.; Sayadi, B. Mobile network architecture evolution toward 5G. IEEE Commun. Mag. 2016, 54, 84–91. [Google Scholar] [CrossRef]

- Afolabi, I.; Taleb, T.; Samdanis, K.; Ksentini, A.; Flinck, H. Network slicing and softwarization: A survey on principles, enabling technologies, and solutions. IEEE Commun. Surv. Tutor. 2018, 20, 2429–2453. [Google Scholar] [CrossRef]

- Kazmi, S.A.; Khan, L.U.; Tran, N.H.; Hong, C.S. 5G Networks. In Network Slicing for 5G and Beyond Networks; Springer: Berlin/Heidelberg, Germany, 2019; pp. 1–12. [Google Scholar]

- Barakabitze, A.A.; Ahmad, A.; Mijumbi, R.; Hines, A. 5G network slicing using SDN and NFV: A survey of taxonomy, architectures and future challenges. Comput. Netw. 2020, 167, 106984. [Google Scholar] [CrossRef]

- Khan, L.U.; Yaqoob, I.; Tran, N.H.; Han, Z.; Hong, C.S. Network Slicing: Recent Advances, Taxonomy, Requirements, and Open Research Challenges. IEEE Access 2020, 8, 36009–36028. [Google Scholar] [CrossRef]

- Kim, D.; Kim, S. Network slicing as enablers for 5G services: State of the art and challenges for mobile industry. Telecommun. Syst. 2019, 71, 517–527. [Google Scholar] [CrossRef]

- Foukas, X.; Patounas, G.; Elmokashfi, A.; Marina, M.K. Network slicing in 5G: Survey and challenges. IEEE Commun. Mag. 2017, 55, 94–100. [Google Scholar] [CrossRef]

- Tikhvinskiy, V.; Terentyev, S.; Aitmagambetov, A.; Nurgozhin, B. Engineering and Architecture Building of 5G Network for Business Model of High Level Mobile Virtual Network Operator. In Internet of Things, Smart Spaces, and Next Generation Networks and Systems; Galinina, O., Andreev, S., Balandin, S., Koucheryavy, Y., Eds.; Springer International Publishing: Cham, Switzerland, 2019; pp. 495–504. [Google Scholar]

- Higginbotham, S. What 5G hype gets wrong. In Technical Report 3, Proceedings of the IEEE Spectrum, 3 Park Ave., 17th Floor, New York, NY, USA, 2020; CrossTalk: New York, NY, USA, 2020; Available online: https://ieeexplore.ieee.org/document/9014454.

- Cricelli, L.; Grimaldi, M.; Ghiron, N.L. The impact of regulating mobile termination rates and MNO-MVNO relationships on retail prices. Telecommun. Policy 2012, 36, 1–12. [Google Scholar] [CrossRef]

- Osborne, M.J. An Introduction to Game Theory; Oxford University Press: New York, NY, USA, 2004; Volume 3. [Google Scholar]

- Maillé, P.; Tuffin, B. Telecommunication Network Economics: From Theory to Applications; Cambridge University Press: Cambridge, UK, 2014. [Google Scholar]

- Shakkottai, S.; Srikant, R. Network optimization and control. Found. Trends® Netw. 2008, 2, 271–379. [Google Scholar] [CrossRef]

- Habib, M.A.; Moh, S. Game theory-based Routing for Wireless Sensor Networks: A Comparative Survey. Appl. Sci. 2019, 9, 2896. [Google Scholar] [CrossRef]

- Su, R.; Zhang, D.; Venkatesan, R.; Gong, Z.; Li, C.; Ding, F.; Jiang, F.; Zhu, Z. Resource Allocation for Network Slicing in 5G Telecommunication Networks: A Survey of Principles and Models. IEEE Netw. 2019, 33, 172–179. [Google Scholar] [CrossRef]

- Antoniou, J. Game Theory, the Internet of Things and 5G Networks; Springer: Berlin/Heidelberg, Germany, 2019. [Google Scholar]

- Guijarro, L.; Pla, V.; Vidal, J.R.; Naldi, M. Competition in data-based service provision: Nash equilibrium characterization. Future Gener. Comput. Syst. 2019, 96, 35–50. [Google Scholar] [CrossRef]

- Banerjee, A.; Dippon, C.M. Voluntary relationships among mobile network operators and mobile virtual network operators: An economic explanation. Inf. Econ. Policy 2009, 21, 72–84. [Google Scholar] [CrossRef]

- Lotfi, M.H.; Sarkar, S. The economics of competition and cooperation between MNOs and MVNOs. In Proceedings of the 2017 51st Annual Conference on Information Sciences and Systems (CISS), Baltimore, MD, USA, 22–24 March 2017; pp. 1–6. [Google Scholar]

- Li, C.; Li, J.; Li, Y.; Han, Z. Price and Spectrum Inventory Game for MVNOs in Wireless Virtualization Communication Markets. In Proceedings of the 2018 IEEE Global Communications Conference (GLOBECOM), Abu Dhabi, UAE, 9–13 December 2018; pp. 1–7. [Google Scholar]

- Zheng, L.; Joe-Wong, C.; Chen, J.; Brinton, C.G.; Tan, C.W.; Chiang, M. Economic viability of a virtual ISP. In Proceedings of the IEEE INFOCOM 2017-IEEE Conference on Computer Communications, Atlanta, GA, USA, 1–4 May 2017; pp. 1–9. [Google Scholar]

- Caballero, P.; Banchs, A.; De Veciana, G.; Costa-Pérez, X. Network slicing games: Enabling customization in multi-tenant mobile networks. IEEE/ACM Trans. Netw. 2019, 27, 662–675. [Google Scholar] [CrossRef]

- Bega, D.; Gramaglia, M.; Banchs, A.; Sciancalepore, V.; Samdanis, K.; Costa-Perez, X. Optimising 5G infrastructure markets: The business of network slicing. In Proceedings of the IEEE INFOCOM 2017-IEEE Conference on Computer Communications, Atlanta, GA, USA, 1–4 May 2017; pp. 1–9. [Google Scholar]

- Habibi, M.A.; Han, B.; Schotten, H.D. Network slicing in 5G mobile communication architecture, profit modeling, and challenges. arXiv 2017, arXiv:1707.00852. [Google Scholar]

- Myllymäki, M. A Dynamic Allocation Mechanism for Network Slicing as-a-Service. Master’s Thesis, Aalto University School of Business, Espoo, Finland, March 2019. [Google Scholar]

- Fantacci, R.; Picano, B. When Network Slicing Meets Prospect Theory: A Service Provider Revenue Maximization Framework. IEEE Trans. Veh. Technol. 2020, 69, 3179–3189. [Google Scholar] [CrossRef]

- Fossati, F.; Moretti, S.; Perny, P.; Secci, S. Multi-resource allocation for network slicing. IEEE/ACM Trans. Netw. 2020. [Google Scholar] [CrossRef]

- Maier-Rigaud, F.P.; Ivaldi, M.; Heller, C. Cooperation among Competitors: Network sharing can increase Consumer Welfare. 2020. Available online: http://dx.doi.org/10.2139/ssrn.3571354 (accessed on 3 March 2020).

- Mendelson, H. Pricing computer services: Queueing effects. Commun. ACM 1985, 28, 312–321. [Google Scholar] [CrossRef]

- Hayel, Y.; Ros, D.; Tuffin, B. Less-than-best-effort services: Pricing and scheduling. In Proceedings of the IEEE INFOCOM 2004, Hong Kong, China, 7–11 March 2004; Volume 1. [Google Scholar]

- Markendahl, J. Mobile Network Operators and Cooperation: A Tele-Economic Study of Infrastructure Sharing and Mobile Payment Services. Ph.D. Thesis, KTH, Stockholm, Sweden, 2011. [Google Scholar]

- Hayel, Y.; Tuffin, B. Pricing for heterogeneous services at a discriminatory processor sharing queue. In Proceedings of the International Conference on Research in Networking, Innsbruck, Austria, March 14–17 2005; pp. 816–827. [Google Scholar]

- Sanchis-Cano, A.; Guijarro, L.; Pla, V.; Vidal, J.R. Economic viability of HTC and MTC service provision on a common network infrastructure. In Proceedings of the 2017 14th IEEE Annual Consumer Communications & Networking Conference (CCNC), Las Vegas, NV, USA, 8–11 January 2017; pp. 1044–1050. [Google Scholar]

- Liu, C.; Li, K.; Xu, C.; Li, K. Strategy configurations of multiple users competition for cloud service reservation. IEEE Trans. Parallel Distrib. Syst. 2015, 27, 508–520. [Google Scholar] [CrossRef]

- Liu, C.; Li, K.; Li, K.; Buyya, R. A new cloud service mechanism for profit optimizations of a cloud provider and its users. IEEE Trans. Cloud Comput. 2017, 6, 276–286. [Google Scholar] [CrossRef]

- Niyato, D.; Hossain, E. Competitive pricing for spectrum sharing in cognitive radio networks: Dynamic game, inefficiency of nash equilibrium, and collusion. IEEE J. Sel. Areas Commun. 2008, 26, 192–202. [Google Scholar] [CrossRef]

- Guijarro, L.; Vidal, J.R.; Pla, V. Competition in Service Provision between Slice Operators in 5G Networks. Electronics 2018, 7, 315. [Google Scholar] [CrossRef]

- Han, B.; Tayade, S.; Schotten, H.D. Modeling profit of sliced 5G networks for advanced network resource management and slice implementation. In Proceedings of the 2017 IEEE Symposium on Computers and Communications (ISCC), Heraklion, Greece, 3–6 July 2017; pp. 576–581. [Google Scholar]

- Han, B.; Feng, D.; Ji, L.; Schotten, H.D. A profit-Maximizing strategy of network resource management for 5G tenant slices. arXiv 2017, arXiv:1709.09229. [Google Scholar]

- Sacoto-Cabrera, E.J.; Guijarro, L.; Vidal, J.R.; Pla, V. Economic feasibility of virtual operators in 5G via network slicing. Future Gener. Comput. Syst. 2020, 109, 172–187. [Google Scholar] [CrossRef]

- Zhu, Y.; Yu, H.; Berry, R.A.; Liu, C. Cross-Network Prioritized Sharing: An Added Value MVNO’s Perspective. In Proceedings of the IEEE INFOCOM 2019-IEEE Conference on Computer Communications, Paris, France, 29 April–2 May 2019; pp. 1549–1557. [Google Scholar]

- Ng, C.H.; Boon-Hee, S. Queueing Modelling Fundamentals: With Applications In Communication Networks; John Wiley & Sons: Hoboken, NJ, USA, 2008. [Google Scholar]

- Mandjes, M. Pricing strategies under heterogeneous service requirements. Comput. Netw. 2003, 42, 231–249. [Google Scholar] [CrossRef]

- Guijarro, L.; Pla, V.; Tuffin, B. Entry game under opportunistic access in cognitive radio networks: A priority queue model. In Proceedings of the Wireless Days (WD), 2013 IFIP, Valencia, Spain, 13–15 November 2013; pp. 1–6. [Google Scholar]

- Reynolds, S.S. Capacity investment, preemption and commitment in an infinite horizon model. Int. Econ. Rev. 1987, 28, 69–88. [Google Scholar] [CrossRef]

- Wardrop, J.G. Some theoretical aspects of road traffic research. In Proceedings of the Institution of Civil Engineers; Thomas Telford-ICE Virtual Library: London, UK, 1952; pp. 325–362. [Google Scholar]

- Dixit, A.K.; Skeath, S. Games of Strategy: Fourth International Student Edition; WW Norton & Company: New York, NY, USA, 2015. [Google Scholar]

| Equation | ||

|---|---|---|

| General Model | ||

| MNO i’s mean packet system time | (1) | |

| MNO i’s network capacity | (1) | |

| MNO i’s packets mean arrival rate | (1) | |

| MVNO packets mean arrival rate | (2) | |

| MVNO traffic split factor | (2) | |

| MVNO mean packet system time | T | (1) |

| Quality perceived by the users | Q | (6) |

| Conversion factor from to monetary units | c | (6) |

| Users utility | (7) | |

| Economic Model | ||

| Price charged by MNO | p | (7) |

| Fee paid by the MVNO | (7) | |

| MVNO profits | (9) | |

| MNO profits | (10) | |

| Constant of the unit cost of acquisition | (10) | |

| Cost adjustment parameter | q | (10) |

| Analysis | ||

| MVNO optimal packets mean arrival | (12) | |

| MVNO optimal profits | (15) | |

| MVNO optimal traffic split factor | (2) | |

| MNO 1’s best response | (21) | |

| MNO 2’s best response | (22) | |

| MNO 1’s equilibrium capacity | (23) | |

| MNO 2’s equilibrium capacity | (24) | |

| Appendix A | ||

| MNO 0’s profits—single-MNO model | (A1) | |

| Constant of the unit cost of acquisition—single-MNO model | (A1) | |

| Cost adjustment parameter—single-MNO model | (A1) | |

| Users Utility | (A4) | |

| MVNO profits—single-MNO model | (A4) |

| Parameter | Value |

|---|---|

| q | |

| p | 1.8 |

| 1.6 | |

| c | 2 |

| Parameter | Value |

|---|---|

| 0.45 | |

| q | |

| p | 1.8 |

| 1.6 | |

| c | 2 |

| Parameter | Value |

|---|---|

| 0.45 | |

| q | 0.025 |

| p | 1.8 |

| 1.6 | |

| c | 2 |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Sacoto Cabrera, E.J.; Guijarro, L.; Maillé, P. Game Theoretical Analysis of a Multi-MNO MVNO Business Model in 5G Networks. Electronics 2020, 9, 933. https://doi.org/10.3390/electronics9060933

Sacoto Cabrera EJ, Guijarro L, Maillé P. Game Theoretical Analysis of a Multi-MNO MVNO Business Model in 5G Networks. Electronics. 2020; 9(6):933. https://doi.org/10.3390/electronics9060933

Chicago/Turabian StyleSacoto Cabrera, Erwin Jairo, Luis Guijarro, and Patrick Maillé. 2020. "Game Theoretical Analysis of a Multi-MNO MVNO Business Model in 5G Networks" Electronics 9, no. 6: 933. https://doi.org/10.3390/electronics9060933

APA StyleSacoto Cabrera, E. J., Guijarro, L., & Maillé, P. (2020). Game Theoretical Analysis of a Multi-MNO MVNO Business Model in 5G Networks. Electronics, 9(6), 933. https://doi.org/10.3390/electronics9060933