Expected Income of New Currency in Blockchain Based on Data-Mining Technology

Abstract

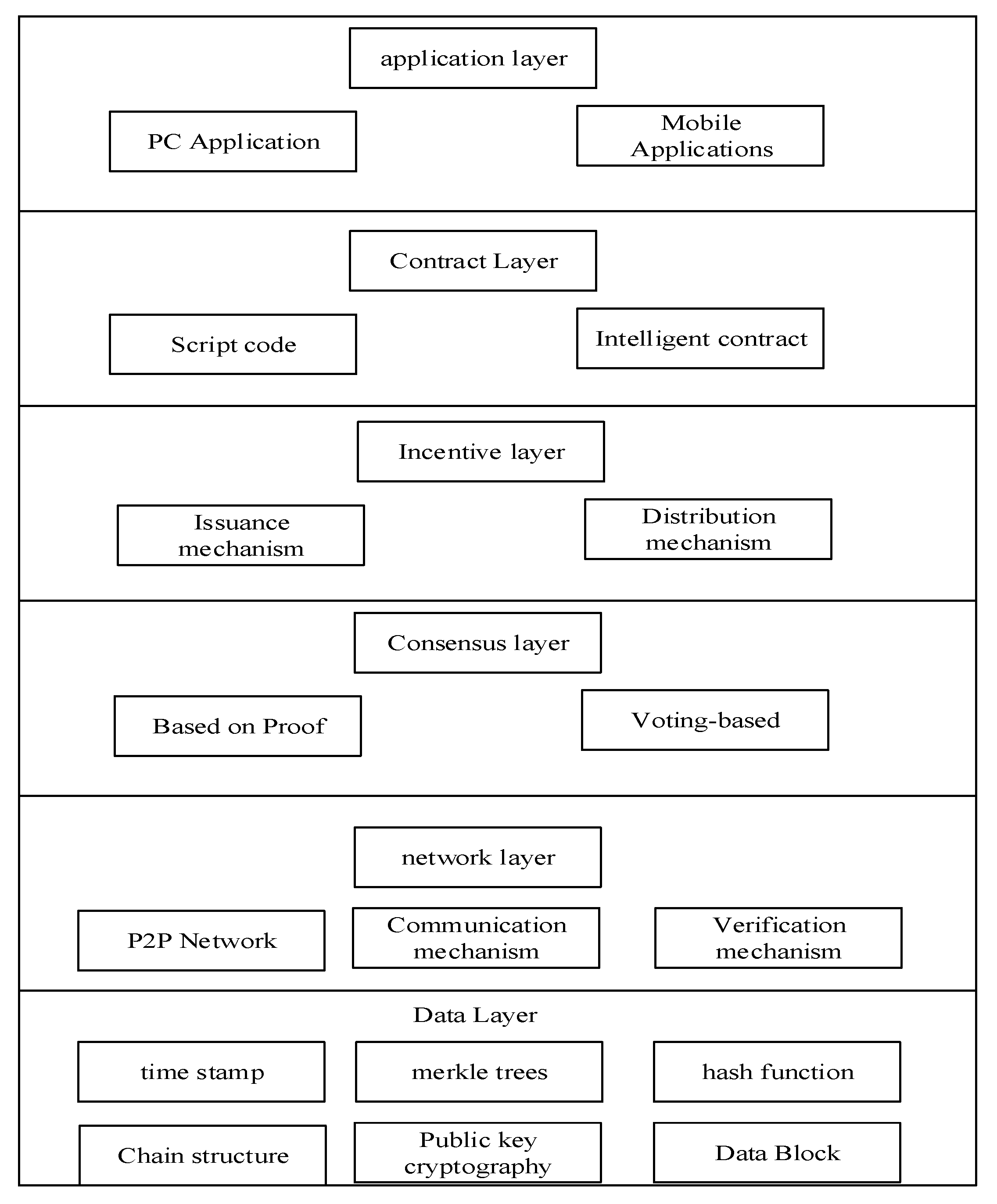

1. Introduction

2. Literature Review

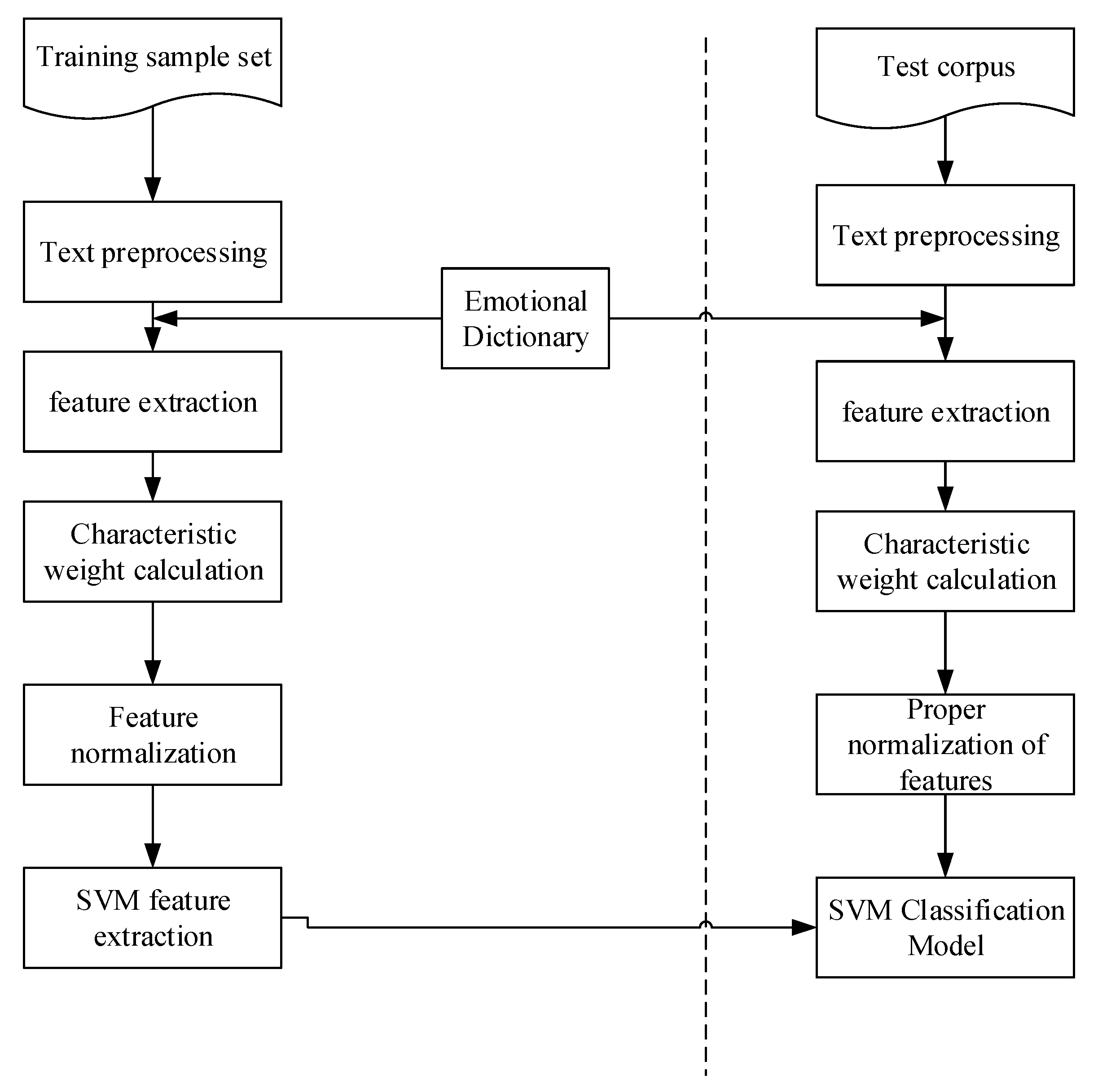

3. Semantic Orientation Pointwise Mutual Information (SO-PMI) Algorithm to Create a New Currency User Emotion Dictionary of Blockchain

3.1. SO-PMI Algorithm

3.2. Construction of User Emotional Dictionary Based on SO-PMI

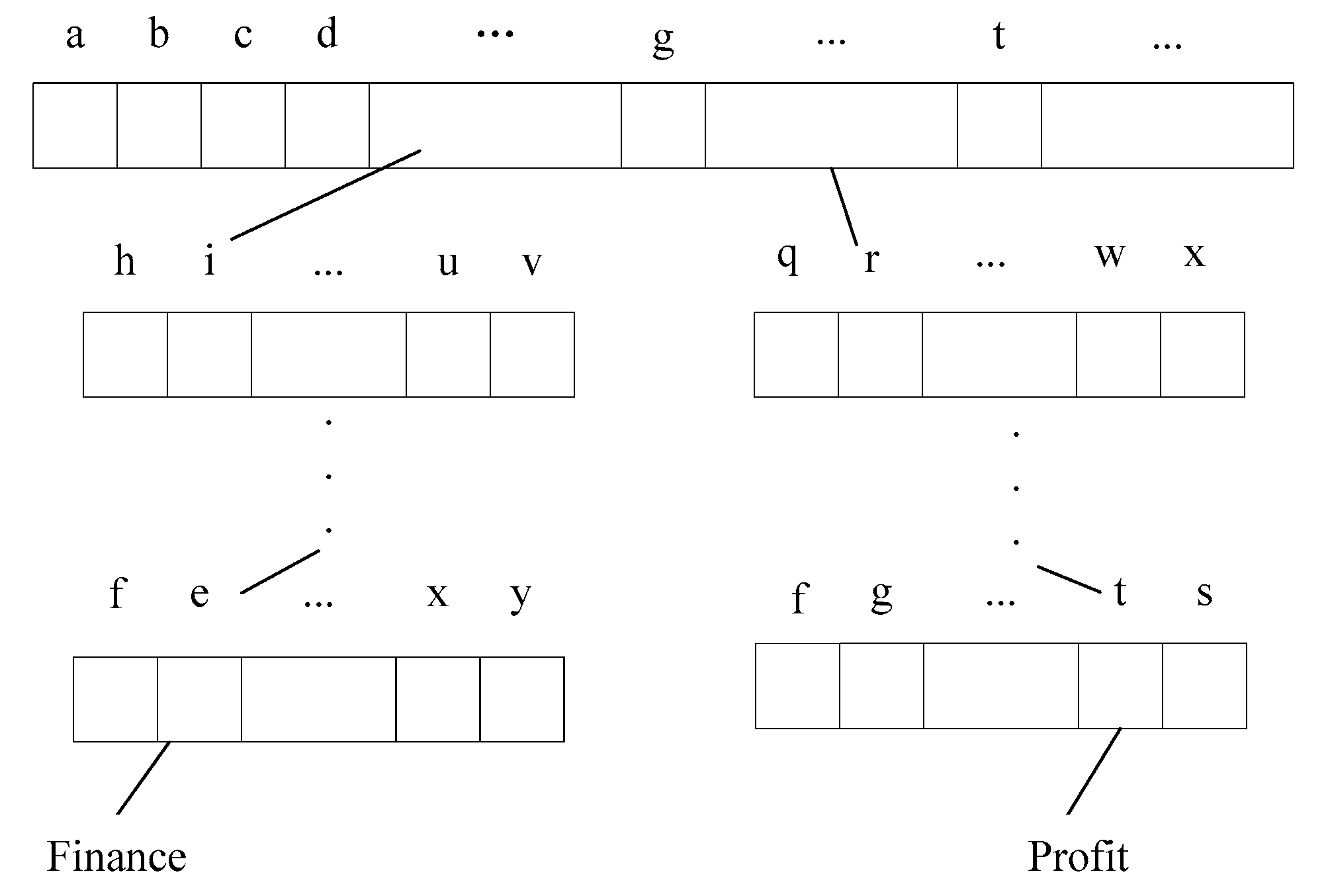

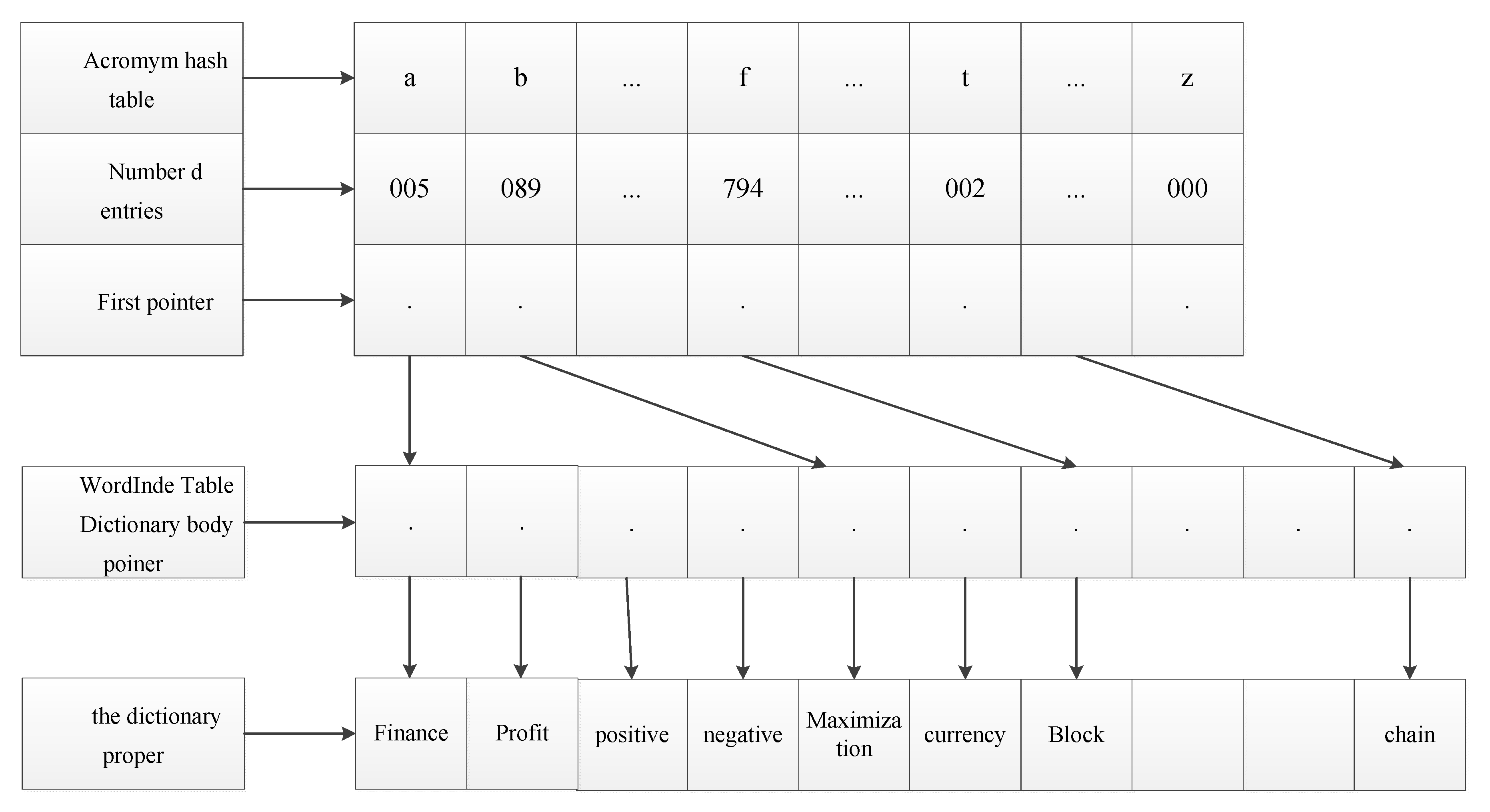

3.3. Storage Structure of Emotional Dictionary

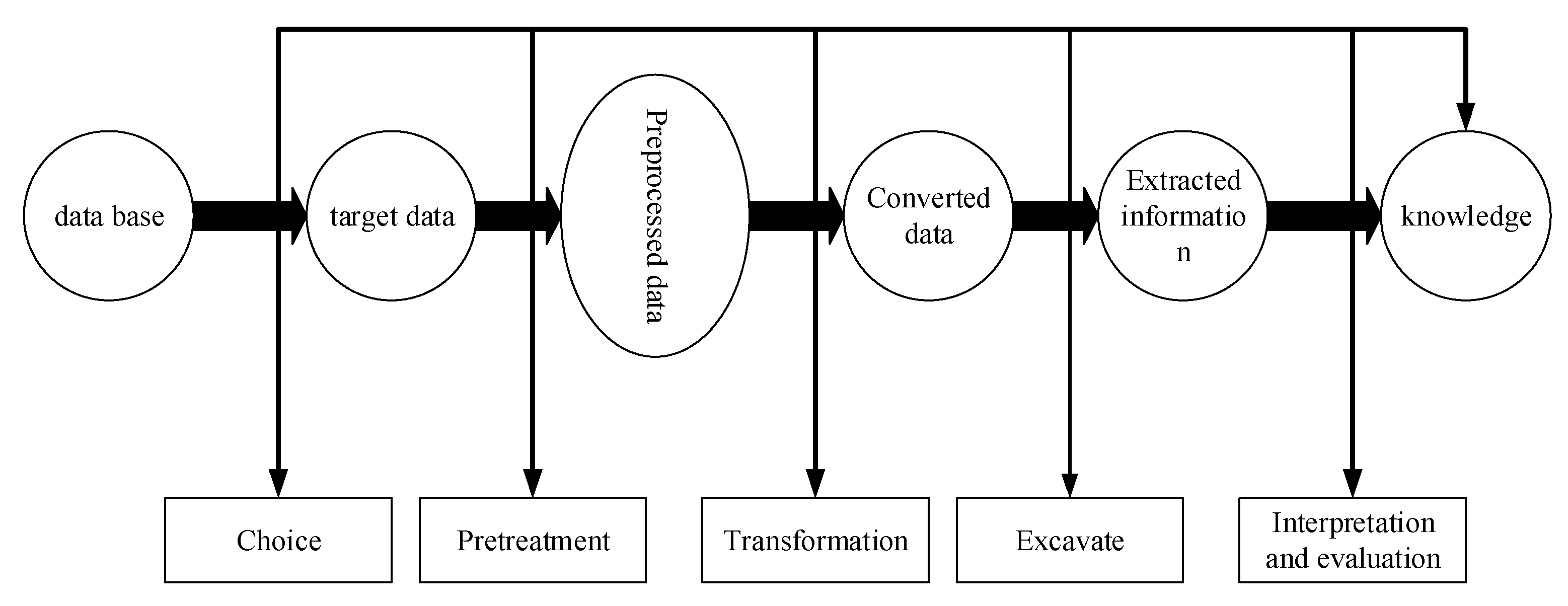

4. Data-Mining Support Vector Machine (SVM) Algorithms for Expected Income Analysis of New Currency in Blockchain

4.1. Data Mining

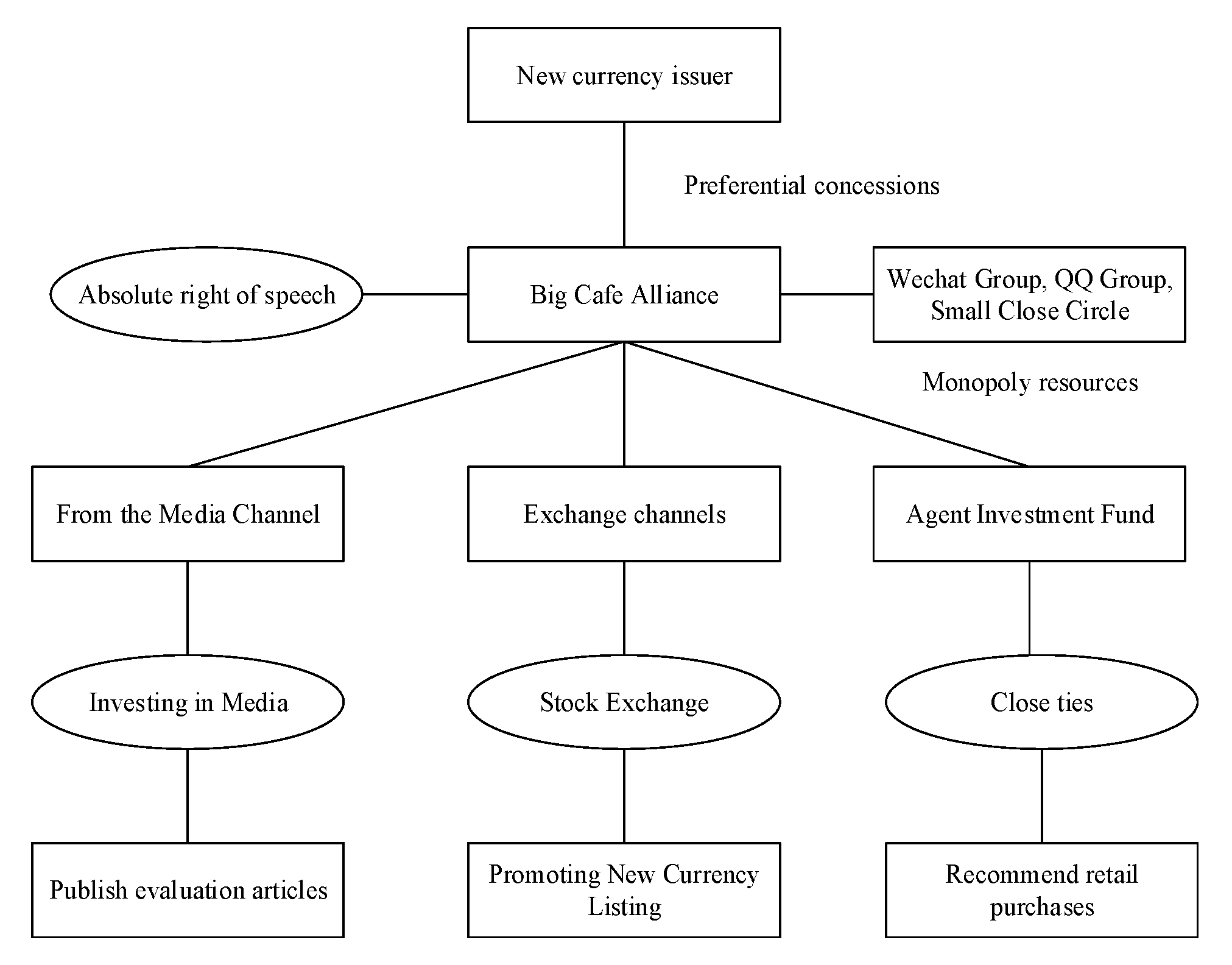

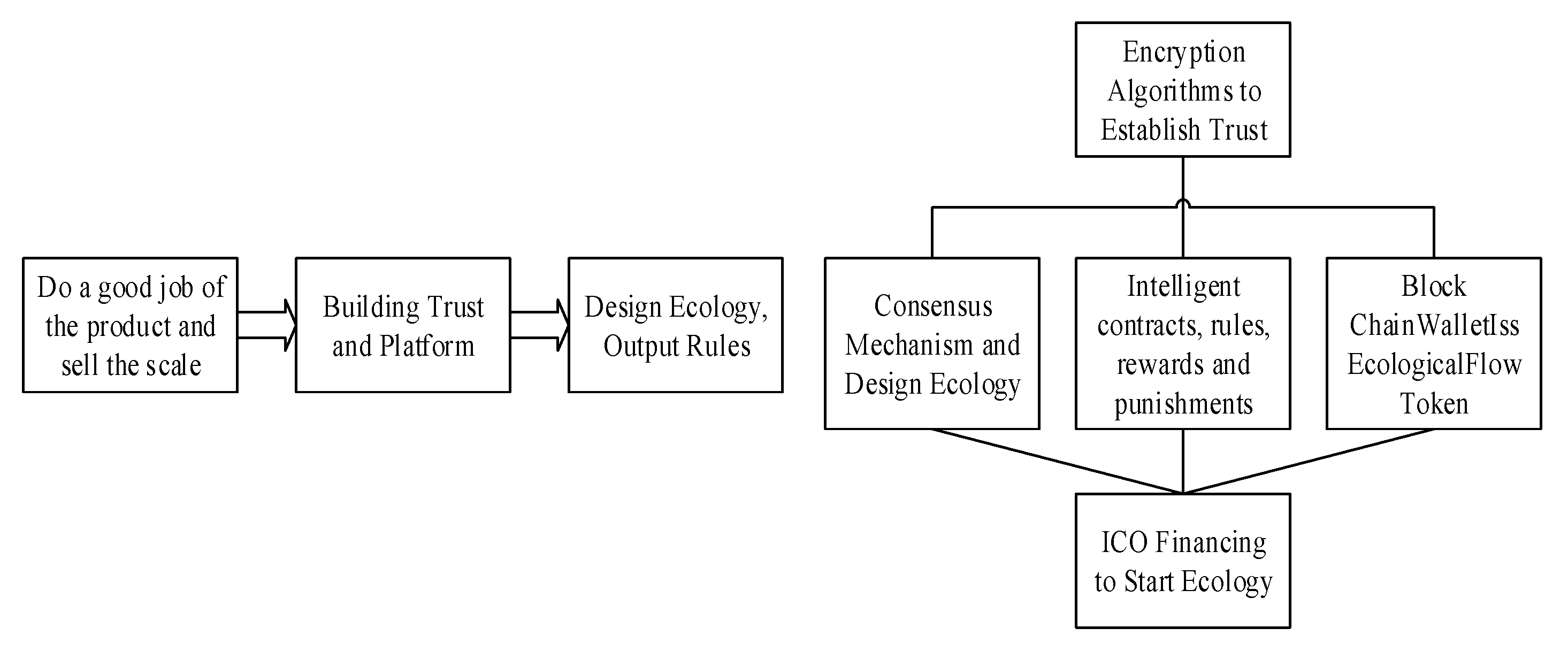

4.2. Initial Coin Offering (ICO) Issues New Currency

4.3. Establishment of the Revenue Prediction Model for SVM Algorithms

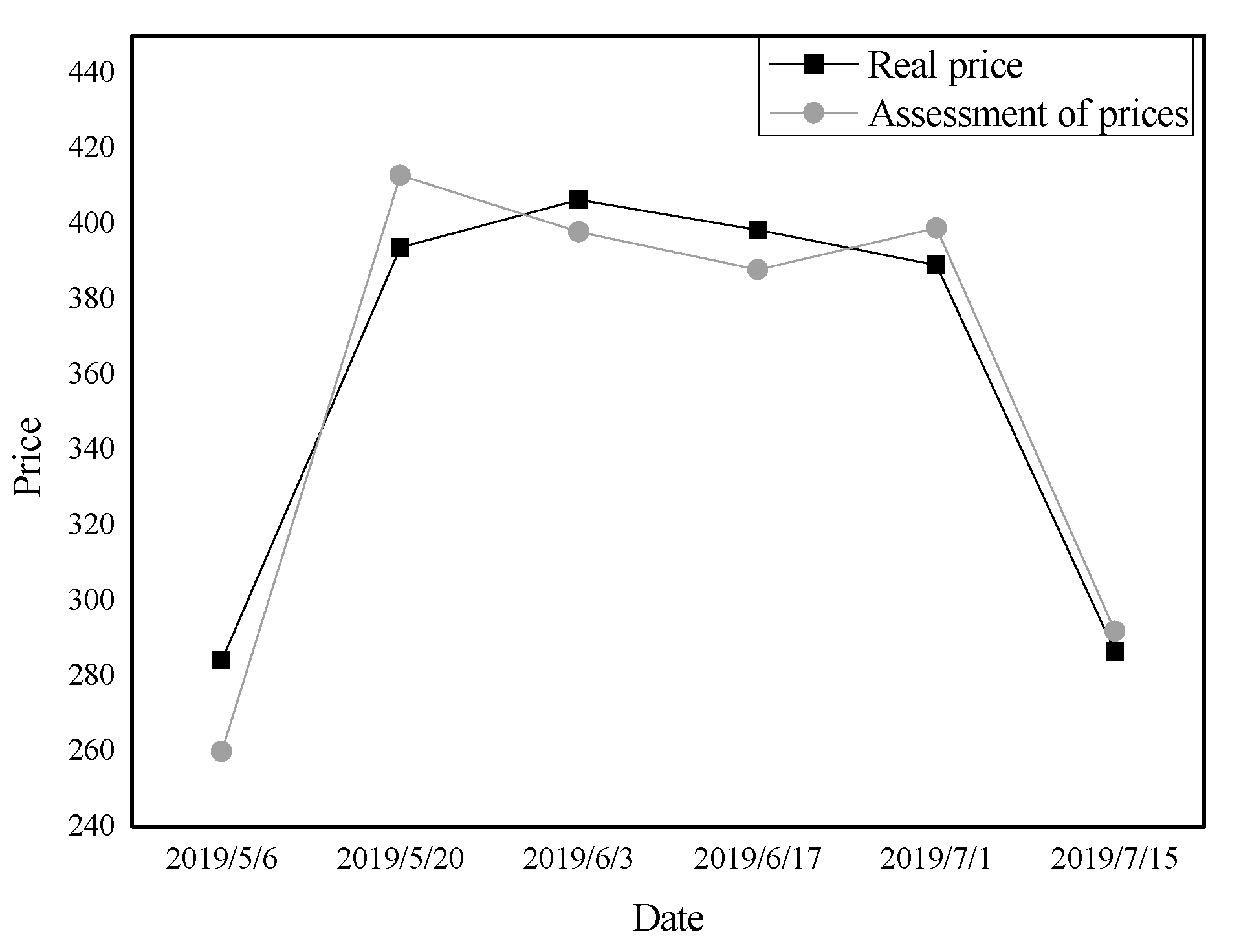

5. Analysis of New Currency Income in Blockchain

6. Conclusions

Author Contributions

Funding

Conflicts of Interest

References

- Yli-Huumo, J.; Ko, D.; Choi, S.; Park, S.; Smolander, K. Where is current research on blockchain technology?—A systematic review. PLoS ONE 2016, 11, e0163477. [Google Scholar] [CrossRef]

- Zheng, Z.; Xie, S.; Dai, H.N.; Chen, X.; Wang, H. Blockchain challenges and opportunities: A survey. Int. J. Web Grid Serv. 2018, 14, 352–375. [Google Scholar] [CrossRef]

- Eyal, I.; Sirer, E.G. Majority is not enough: Bitcoin mining is vulnerable. Commun. ACM 2018, 61, 95–102. [Google Scholar] [CrossRef]

- Ozercan, H.I.; Ileri, A.M.; Ayday, E.; Alkan, C. Realizing the potential of blockchain technologies in genomics. Genome Res. 2018, 28, 1255–1263. [Google Scholar] [CrossRef] [PubMed]

- Wang, R.; Lin, Z.; Luo, H. Blockchain, bank credit and SME financing. Qual. Quant. 2019, 53, 1127–1140. [Google Scholar] [CrossRef]

- Kano, Y.; Nakajima, T. A novel approach to solve a mining work centralization problem in blockchain technologies. Int. J. Pervasive Comput. Commun. 2018, 14, 15–32. [Google Scholar] [CrossRef]

- Crosby, M.; Pattanayak, P.; Verma, S.; Kalyanaraman, V. Blockchain technology: Beyond bitcoin. Appl. Innov. 2016, 2, 71. [Google Scholar]

- Chuen, D.L.K.; Guo, L.; Wang, Y. Cryptocurrency: A new investment opportunity? J. Altern. Investig. 2017, 20, 16–40. [Google Scholar] [CrossRef]

- Yeoh, P. Regulatory issues in blockchain technology. J. Financ. Regul. Compliance 2017, 25, 196–208. [Google Scholar] [CrossRef]

- Hayes, A.S. Cryptocurrency value formation: An empirical study leading to a cost of production model for valuing bitcoin. Telemat. Inform. 2017, 34, 1308–1321. [Google Scholar] [CrossRef]

- Giungato, P.; Rana, R.; Tarabella, A.; Tricase, C. Current trends in sustainability of bitcoins and related blockchain technology. Sustainability 2017, 9, 2214. [Google Scholar] [CrossRef]

- Risius, M.; Spohrer, K. A blockchain research framework. Bus. Inf. Syst. Eng. 2017, 59, 385–409. [Google Scholar] [CrossRef]

- Mengelkamp, E.; Notheisen, B.; Beer, C.; Dauer, D.; Weinhardt, C. A blockchain-based smart grid: Towards sustainable local energy markets. Comput. Sci. Res. Dev. 2018, 33, 207–214. [Google Scholar] [CrossRef]

- Kuo, T.T.; Kim, H.E.; Ohno-Machado, L. Blockchain distributed ledger technologies for biomedical and health care applications. J. Am. Med. Inform. Assoc. 2017, 24, 1211–1220. [Google Scholar] [CrossRef] [PubMed]

- Mamoshina, P.; Ojomoko, L.; Yanovich, Y.; Ostrovski, A.; Botezatu, A.; Prikhodko, P.; Izumchenko, E.; Aliper, A.; Romantsov, K.; Zhebrak, A.; et al. Converging blockchain and next-generation artificial intelligence technologies to decentralize and accelerate biomedical research and healthcare. Oncotarget 2018, 9, 5665. [Google Scholar] [CrossRef] [PubMed]

- Yoo, S. Blockchain based financial case analysis and its implications. Asia Pac. J. Innov. Entrep. 2017, 11, 312–321. [Google Scholar] [CrossRef]

- Puthal, D.; Malik, N.; Mohanty, S.P.; Kougianos, E.; Das, G. Everything you wanted to know about the blockchain: Its promise, components, processes, and problems. IEEE Consum. Electron. Mag. 2018, 7, 6–14. [Google Scholar] [CrossRef]

- Truby, J. Decarbonizing Bitcoin: Law and policy choices for reducing the energy consumption of Blockchain technologies and digital currencies. Energy Res. Soc. Sci. 2018, 44, 399–410. [Google Scholar] [CrossRef]

- Yang, R.; Yu, F.R.; Si, P.; Yang, Z.; Zhang, Y. Integrated blockchain and edge computing systems: A survey, some research issues and challenges. IEEE Commun. Surv. Tutor. 2019, 21, 1508–1532. [Google Scholar] [CrossRef]

- Eyal, I. Blockchain technology: Transforming libertarian cryptocurrency dreams to finance and banking realities. Computer 2017, 50, 38–49. [Google Scholar] [CrossRef]

- Aste, T.; Tasca, P.; Di Matteo, T. Blockchain technologies: The foreseeable impact on society and industry. Computer 2017, 50, 18–28. [Google Scholar] [CrossRef]

- Yuan, Y.; Wang, F.Y. Blockchain and cryptocurrencies: Model, techniques, and applications. IEEE Trans. Syst. ManCybern. Syst. 2018, 48, 1421–1428. [Google Scholar] [CrossRef]

- Gatteschi, V.; Lamberti, F.; DeMartini, C.; Pranteda, C.; Santamaria, V. Blockchain and smart contracts for insurance: Is the technology mature enough? Future Internet 2018, 10, 20. [Google Scholar] [CrossRef]

- Park, J.; Park, J. Blockchain security in cloud computing: Use cases, challenges, and solutions. Symmetry 2017, 9, 164. [Google Scholar] [CrossRef]

- Seshia, S.A.; Hu, S.; Li, W.; Zhu, Q. Design Automation of Cyber-Physical Systems: Challenges, Advances, and Opportunities. IEEE Trans. Comput. Aided Des. Integr. Circuits Syst. 2017, 36, 1421–1434. [Google Scholar] [CrossRef]

- Huang, Z.; Soljak, M.; Boehm, B.O.; Car, J. Clinical relevance of smartphone apps for diabetes management: A global overview. Diabetes Metab. Res. Rev. 2018, 34, e2990. [Google Scholar] [CrossRef]

| Investment Preference | Demand Group | Ways of Return |

|---|---|---|

| Short-term | Short-term speculators | Trading Spread |

| Metaphase | Value Investors | ICO token Trading Spread + ICO special token Selling Revenue |

| Long-term | Strategic investors, brokerage companies, industry veterans, ticketing companies, etc. | ICO token Trading Spread+, Selling Income + Dividend Income+, Non-expendable equity income |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Li, X.; Zeng, X. Expected Income of New Currency in Blockchain Based on Data-Mining Technology. Electronics 2020, 9, 160. https://doi.org/10.3390/electronics9010160

Li X, Zeng X. Expected Income of New Currency in Blockchain Based on Data-Mining Technology. Electronics. 2020; 9(1):160. https://doi.org/10.3390/electronics9010160

Chicago/Turabian StyleLi, Xingzhou, and Xin Zeng. 2020. "Expected Income of New Currency in Blockchain Based on Data-Mining Technology" Electronics 9, no. 1: 160. https://doi.org/10.3390/electronics9010160

APA StyleLi, X., & Zeng, X. (2020). Expected Income of New Currency in Blockchain Based on Data-Mining Technology. Electronics, 9(1), 160. https://doi.org/10.3390/electronics9010160