1. Introduction

Understanding the factors that influence investment interest is a critical area of inquiry in both financial research and practice. Investment interest, or the degree to which individuals engage with and are motivated to participate in investment activities, is influenced by a range of behavioral, attitudinal, educational, and contextual factors. Grounded in the frameworks of behavioral finance theory [

1,

2] and prospect theory [

3,

4], this study examines the role of multiple predictors, including investment attitudes, financial education, speculative investment attitudes, resilience after financial losses, decision adaptability after losses, decision-making behaviors in investments, and trust in AI-based financial systems, in shaping investment interest.

Behavioral finance theory provides a foundation for understanding how psycho-logical factors, including cognitive biases and emotional responses, influence financial decisions. It challenges the traditional “homo economicus” assumption of rational decision making, emphasizing the systematic deviations from rationality observed in real-world investor behavior [

5,

6]. Prospect theory complements this by explaining how individuals perceive gains and losses asymmetrically, often exhibiting risk aversion for gains and risk-seeking behavior for losses [

7]. These theoretical frameworks are particularly relevant for analyzing the complex relationships among behavioral and attitudinal factors in investment decision making.

Investment attitudes—individuals’ perceptions of the benefits, risks, and im-portance of investing—are pivotal in shaping investment interest. Research has shown that positive attitudes towards investing correlate with higher engagement and better decision-making outcomes [

8,

9]. Similarly, financial education plays a crucial role in equipping individuals with the knowledge and skills needed to make informed investment decisions. Studies highlight the positive impact of financial literacy on both investment attitudes and performance [

10,

11]. Financially educated individuals are more likely to understand risks, assess opportunities, and optimize returns.

Speculative investment attitudes reflect a willingness to engage in high-risk, high-reward financial activities. These tendencies influence the degree of investment interest shown by individuals. Research suggests that attitudes towards speculative investments, such as cryptocurrencies or other volatile assets, are shaped by financial risk tolerance and personal values [

12,

13]. Additionally, resilience in the face of financial losses is essential for maintaining long-term investment engagement. Studies on resilience after financial losses demonstrate that individuals who view losses as opportunities for learning are better equipped to recover and adapt [

14,

15].

Adaptability in decision making following financial setbacks is another crucial factor. Decision adaptability after losses reflects an investor’s ability to revise strategies based on past experiences, which is essential for navigating volatile markets [

16,

17]. This adaptability is closely linked to overall decision-making behaviors in investments, which include systematic practices such as portfolio diversification and reliance on expert advice. Prior research underscores the importance of deliberate and informed decision making in achieving favorable investment outcomes [

18,

19].

In recent years, the integration of artificial intelligence (AI) into financial systems has introduced a new dimension to investment decision making. Trust in AI-based financial systems has become a significant determinant of investment interest, as individuals increasingly rely on AI-driven tools for financial analysis and recommendations. Studies indicate that trust in AI systems is influenced by perceptions of reliability, transparency, and performance [

20,

21]. As AI-enabled platforms become more prevalent, understanding the role of trust in shaping user engagement is critical [

22].

This study builds on the existing literature by integrating these diverse factors into a comprehensive model of investment interest. By employing decision tree regression, we aim to identify the hierarchical relationships among these predictors and provide actionable insights for financial educators, advisors, and policymakers. The findings contribute to the broader understanding of how behavioral, educational, and technological factors interact to shape investment behavior, offering practical implications for improving financial literacy and decision making in diverse populations.

The primary aim of this study is to investigate the behavioral, cognitive, demographic, and technological predictors of investment interest using a data-driven modeling approach. Specifically, this research applies decision tree regression to identify the most influential factors shaping individual investment behaviors. While grounded in behavioral finance theory and prospect theory, this is not a literature review but an empirical study based on a structured questionnaire administered to a sample of financial professionals. The research seeks to (1) model the hierarchy of influences affecting investment interest, (2) assess the predictive strength of these variables, and (3) offer practical implications for financial education, advisory services, and digital investment tools.

Unlike previous studies which primarily used linear models such as logistic or multiple regression, this research employs decision tree regression (DTR) to model non-linear relationships between behavioral predictors and investment interest. DTR offers a transparent and interpretable structure, which is critical in behavioral finance, where interactions among psychological and contextual variables can be complex. The novelty of this study lies in its integration of DTR within the behavioral finance framework, offering a hierarchical view of how attitudinal, educational, and technological factors collectively shape investment behavior.

Literature Review

Investment decisions have long been a central focus of financial research, with a variety of factors influencing both individual and corporate investment behaviors. The extant literature highlights the interplay of financial, demographic, behavioral, and contextual variables in shaping investment decisions, often framed within theoretical perspectives such as behavioral finance theory [

1,

6] and prospect theory [

3]. This section synthesizes findings across multiple domains to elucidate the determinants of investment interest and behavior.

Financial constraints, market conditions, and economic variables have consistently been found to influence corporate and individual investment decisions. Ref. [

23] compared investment behaviors across Belgium, France, Germany, and the United Kingdom, finding that financial constraints significantly limit corporate investment. Similarly, Ref. [

24] explored investment decisions in transitional China, revealing that financial factors, including liquidity and cost of capital, are critical determinants. This aligns with earlier findings by [

25], who demonstrated that financial constraints significantly impede firm-level investment. In individual contexts, Ref. [

26] identified liquidity as a key determinant of investment choices, while Ref. [

27] highlighted the relevance of macroeconomic conditions.

The role of financial literacy and education in facilitating better investment decisions is also widely recognized. Ref. [

28] emphasized the critical need for financial education to enhance retirement preparedness and informed decision making. This is supported by [

10], who demonstrated the positive impact of financial literacy programs on high school students’ investment attitudes. Ref. [

29] further corroborated these findings, noting that financially literate investors in the UAE make more rational and informed decisions. Such insights are echoed by [

11], stressing the broader implications of financial education for economic stability and individual financial well-being.

Behavioral finance has shed a light on how cognitive biases and emotional factors influence investment decisions. Ref. [

30] identified key behavioral factors such as overconfidence, loss aversion, and herd behavior among institutional investors at the Nairobi Stock Exchange. These findings align with those of [

31], who examined the psychological underpinnings of individual investment decisions. Ref. [

32] employed the analytical hierarchy process (AHP) to quantify the impact of behavioral factors, noting that risk perception and emotional stability significantly shape investment behaviors.

Prospect theory has been particularly influential in understanding the asymmetrical attitudes toward gains and losses. Ref. [

7] highlighted how individuals exhibit risk aversion in the face of gains but are willing to take greater risks to recover losses. This dynamic was further supported by studies such as those by [

33,

34], which illustrated how past losses could trigger heightened risk-taking behaviors among investors.

Demographic variables such as age, income, education, and employment status also play a critical role in investment decisions. Ref. [

27] demonstrated that younger investors are more likely to engage in high-risk investments, whereas older individuals tend to prioritize safety and stability. Similarly, Ref. [

35] found that financial literacy levels and demographic characteristics jointly influence investment preferences, with higher-income individuals demonstrating a greater propensity for diversified portfolios. Studies by [

36,

37] further confirmed the importance of demographic factors in shaping financial behaviors, noting significant variations based on gender, income, and educational attainment.

Strategic decision-making processes in investment are often influenced by external and contextual factors. Ref. [

38] argued that aligning investments with broader strategic goals enhances their perceived value, particularly in energy efficiency initiatives. Ref. [

39] emphasized the role of contextual factors such as market competition and regulatory frameworks in shaping strategic investment decisions. Ref. [

40] extended this analysis to cross-border investments, highlighting the impact of finance-specific factors such as currency stability and financial integration.

Recent advancements in technology, particularly in artificial intelligence (AI), have transformed the landscape of investment decision making. Trust in AI-enabled financial systems is emerging as a critical factor in shaping investor behavior. Studies by [

20,

41] revealed that perceptions of reliability and transparency significantly influence the adoption of AI-based tools.

Financial literacy and behavioral biases remain pivotal in both individual and institutional contexts, while strategic and technological considerations increasingly influence modern investment landscapes.

Thus, the reviewed literature supports the relevance of integrating behavioral, demographic, and educational variables in understanding investment decisions. This literature review informed the construction of the survey instruments used in this study. Each behavioral dimension analyzed—such as investment attitudes, speculative behaviors, resilience after losses, and trust in AI—was derived from constructs identified as influential in prior studies. This connection between theoretical background and empirical instrumentation ensures the study’s conceptual coherence. Empirical studies have shown that financial education significantly shapes investment attitudes and long-term financial decision-making behavior. For example, Becchetti et al. [

10] demonstrated through a randomized controlled trial how educational interventions can positively influence students’ financial choices and attitudes toward investing. These findings reinforce the behavioral underpinnings of investment interest, supporting the integration of cognitive and attitudinal variables in predictive modeling.

Recent studies have demonstrated the utility of decision tree-based models in financial behavior prediction. For example, Sun and collaborators developed a decision tree ensemble method combining SMOTE and bagging to address class imbalance in enterprise credit evaluation, demonstrating improved predictive accuracy and robustness in complex financial contexts [

22]. This approach underscores the relevance and adaptability of tree-based algorithms in modeling investor behaviors where data imbalance and non-linear interactions are prevalent.

2. Materials and Methods

2.1. Participants

This study utilized a convenience sampling method, targeting networks of economists and financial professionals. Recruitment was conducted primarily through online platforms, with a Google Forms questionnaire distributed via email and professional social media channels. Participation was voluntary, and all respondents provided informed consent prior to completing the survey. Data collection was anonymous, ensuring confidentiality throughout the process.

Participants were recruited from professional networks and academic associations related to economics and finance. Eligibility required a basic level of investment experience and understanding, ensuring respondents could meaningfully answer questions about financial behaviors. Prior to survey distribution, an expert panel of three specialists in behavioral finance and psychometrics reviewed the item pool to ensure clarity, relevance, and content validity. Items were adapted from validated instruments and revised through cognitive interviews with five pilot participants. These steps enhanced the credibility and replicability of the research process.

A total of 548 participants completed the survey. Regarding gender distribution, 38% of respondents identified as male (n = 208), while 62% identified as female (n = 340). In terms of education level, 21.4% (n = 117) reported having completed high school or equivalent, 40.9% (n = 224) held a bachelor’s degree, 31.9% (n = 175) had a master’s degree, and 5.8% (n = 32) reported holding a doctoral degree.

Participants’ employment status was categorized into four groups: 11.7% (n = 64) reported being unemployed, 4% (n = 22) were employed part-time, 75% (n = 411) were employed full-time, and 9.3% (n = 51) identified as freelancers or self-employed. Income levels varied, with 19.3% (n = 106) reporting a monthly income below 3000 RON, 35.6% (n = 195) earning between 3000–5000 RON, 20.1% (n = 110) earning between 5000 and 7000 RON, 8.9% (n = 49) earning between 7000 and 9000 RON, and 16.1% (n = 88) earning above 9000 RON per month.

Participants’ professional experience was distributed as follows: 31.4% (n = 172) reported less than five years of experience, 33.4% (n = 183) had between five and ten years, 11.5% (n = 63) had ten to fifteen years, and 23.7% (n = 130) had over fifteen years of professional experience.

This diverse sample provided a robust foundation for exploring financial behaviors and attitudes across various demographic and professional contexts. While convenience sampling allowed rapid access to a specific professional population, it introduced potential selection bias and limited the generalizability of the findings. Future research should aim for stratified or random sampling to improve representativeness.

The recruitment process involved distributing the survey to over 1000 individuals via professional mailing lists, university alumni databases, and finance-related online communities. From these, 548 responses were received and retained for analysis. The exclusion criteria included incomplete responses.

2.2. Instruments

To analyze the factors influencing financial decision making, a set of rigorously developed scales was utilized, each comprising 7 to 14 items. These instruments were designed to measure behavioral, attitudinal, and cognitive dimensions critical to investment-related choices. The scales demonstrated strong reliability, with Cronbach’s alpha values ranging from 0.84 to 0.93.

The questionnaire consisted of 8 distinct scales covering behavioral, attitudinal, cognitive, technological, and demographic dimensions. Each scale used a 5-point Likert-type response format, ranging from 1 (strongly disagree) to 5 (strongly agree). Higher scores reflected stronger agreement with the construct being measured.

Investment interest captured the level of engagement individuals displayed toward financial investments, encompassing activities like seeking information and staying updated on market trends. For instance, participants responded to items such as the following: “How often do you seek information about financial investments?”, adapted from [

42]. The scale displayed a Cronbach’s alpha of 0.86, reflecting high internal consistency.

Investment attitudes measured beliefs about the benefits, risks, and overall significance of investing. This construct was vital for understanding how perceptions influence financial behavior. An example item read, “Investing is essential for long-term financial security.”, adapted from [

43]. This scale achieved a Cronbach’s alpha of 0.91, underscoring its reliability.

Financial education evaluated participants’ understanding of foundational financial principles, such as saving, budgeting, and investment strategies, and their ability to apply this knowledge effectively. A representative item was the following: “I understand the concept of compound interest and its impact on savings.” (adapted from [

28]). The scale recorded a Cronbach’s alpha of 0.89, indicating robust reliability.

Speculative investment attitudes examined individuals’ perceptions of and engagement with speculative investment options, including high-risk assets like crypto-currencies. This construct shed light on risk tolerance and preferences. An example item included the following: “Speculative investments are a viable way to achieve financial growth.” (adapted from [

4]). The scale demonstrated a Cronbach’s alpha of 0.87.

Resilience after financial losses assessed an individual’s emotional and behavioral recovery following financial setbacks, reflecting their ability to regain confidence in future investments. One item stated, “I view financial losses as an opportunity to learn and improve my strategies.” (adapted from [

3]). This scale had a Cronbach’s alpha of 0.84.

Decision adaptability after losses measured the flexibility in decision-making strategies post loss, capturing how individuals recalibrated their approach to investing. A sample item was the following: “After a financial loss, I reconsider my investment strategy to avoid repeating mistakes.” The scale yielded a Cronbach’s alpha of 0.88.

Decision-making behaviors in investments evaluated the systematic and deliberate approaches individuals used when making investment decisions, such as portfolio diversification and reliance on expert advice. An illustrative item was the following: “I diversify my in-vestment portfolio to manage risk effectively.”, adapted from [

44]. This scale had the highest Cronbach’s alpha at 0.93.

Trust in AI-based financial systems explored confidence in automated tools and systems using artificial intelligence for financial management. This construct focused on perceptions of technology’s reliability and utility. A representative item was the following: “I trust AI-based systems to provide accurate financial recommendations.”, adapted from [

45]. The scale achieved a Cronbach’s alpha of 0.92, confirming its reliability.

2.3. Procedure

The analysis aimed to investigate the factors influencing investment interest, which was designated as the dependent variable. The predictors included behavioral, attitudinal, and demographic factors: investment attitudes, financial education, speculative investment attitudes, resilience after financial losses, decision adaptability after losses, decision-making behaviors in investments, trust in AI-based financial systems, and demographic variables such as age, gender, education, income, and employment status.

The full list of factors included in the model is the following:

Behavioral/Attitudinal: Investment attitudes, speculative investment attitudes, resilience after financial losses, decision-making behaviors in investments, and decision adaptability after losses;

Cognitive: Financial education;

Technological: Trust in AI-based financial systems;

Demographic: Age, gender, education, income, employment status, and professional experience.

The data were collected via an online questionnaire and processed in JASP (version 0.19.3), an open-source statistical software. JASP was chosen for its ease of use, accessibility, and visual interpretability of tree structures, which aligns with the study’s applied focus. However, future studies could replicate the analysis in Python (scikit-learn version 1.4.1) or R (rpart, version 4.1.23) to allow greater control over model tuning and ensemble methods. Preliminary analyses included descriptive statistics and frequency tables to summarize participant characteristics. To model the relationships between the dependent variable and predictors, decision tree regression was employed. This method was selected for its ability to handle complex, non-linear relationships and provide interpretable hierarchical structures in the form of decision trees.

Decision tree regression was trained and tested on the dataset, using a default 80/20 split for training and validation purposes. Model evaluation metrics, including mean absolute error (MAE), mean absolute percentage error (MAPE), and R2, were calculated to assess predictive performance. Given the 5-point Likert scale used for the dependent variable, MAPE and R2 were prioritized as the most interpretable performance metrics. Feature importance values were computed to determine the relative contribution of each predictor to the model. Hyperparameters such as the tree’s maximum depth and minimum samples per split were set to default in JASP. While this was a simplified interpretation, it might have increased the risk of overfitting or underfitting. A grid search or cross-validation approach could further optimize performance in future studies.

3. Results

Decision tree regression is a non-parametric supervised learning method that splits data based on input variable values to predict continuous outcomes. The algorithm recursively partitions the dataset by selecting splits that minimize the mean squared error at each node. This structure reveals the hierarchical importance and interactions among predictors, offering interpretable insights into complex behavioral patterns.

The results of the decision tree regression model provide insights into the predictors of investment interest. The model was trained on 439 cases and tested on 109 cases, achieving a test mean squared error (MSE) of 1.065, a root mean squared error (RMSE) of 1.032, a mean absolute error (MAE) of 0.8, and a mean absolute percentage error (MAPE) of 172.96%. The R2 value of 0.185 indicated a modest proportion of variance in the investment interest explained by the predictors. The dependent variable (investment interest) was measured on a 5-point Likert scale. Given this limited scale range, the relatively low R2 (0.185) and high MAPE reflected the complex, subjective nature of investment interest and the influence of unmeasured latent variables. The goal of this model was, therefore, not precision forecasting but exploratory pattern recognition and predictor ranking. Thus, the relatively low R2 value suggested that, while the model captured meaningful predictors, other latent or contextual factors likely contributed to investment interest. This reflects the inherent complexity of financial behavior, which is often influenced by non-observable psychological or situational variables.

The relative importance of predictors (

Table 1) revealed that investment attitudes were the most influential factor, contributing 25.88% to the model. This was followed by decision-making behaviors in investments (19.53%) and financial education (16.69%), highlighting the significant role of behavioral and educational dimensions in shaping investment interest. Other important predictors included speculative investment attitudes (11.20%), decision adaptability after losses (8.27%), and trust in AI-based financial systems (6.78%).

Demographic variables such as age (1.94%), experience (1.50%), income (1.09%), education (0.39%), and employment status (0.28%) exhibited comparatively lower im-portance, suggesting a lesser direct impact on investment interest compared to behavioral and attitudinal factors.

The prominence of investment attitudes as the top predictor suggests a strong psychological basis for financial engagement. Individuals with positive attitudes are more proactive in seeking financial opportunities and show greater openness to using AI-based investment tools, especially when trust in technology is present.

Decision tree regression revealed a hierarchical structure of predictors, with the most significant splits occurring at various levels of the tree (

Table 2).

Table 2 presents the most relevant decision tree splits, where “Obs. in Split” indicates the number of observations at the node being split, “Split Point” represents the value of the predictor at which the split occurs, and “Improvement” reflects the reduction in model deviance (a proxy for prediction error); higher improvement values indicate stronger predictive contribution at that specific level of the tree.

The first split was based on investment attitudes, which emerged as the most influential variable. At a split point of −0.411, this factor provided an improvement of 0.160 in the model, emphasizing its foundational role in predicting investment interest. A subsequent split within the same variable, at −2.020, yielded an even greater improvement of 0.191, further highlighting its central importance.

The next critical split involved speculative investment attitudes, occurring at −0.249 and contributing an improvement of 0.165. This indicates that individuals’ perceptions and engagement with speculative investments are also key drivers of their interest in financial investments. Another significant split was observed with experience, at a point of 1.072, which provided an improvement of 0.122, suggesting that professional experience plays a supportive but secondary role in shaping investment behavior.

Decision-making behaviors in investments also appeared prominently in the tree structure, with splits at −0.240 and −0.392, providing improvements of 0.231 and 0.314, respectively. These findings underscore the importance of systematic and deliberate investment practices. Similarly, financial education splits at points such as 1.858 and 0.373 contributed improvements of 0.136 and 0.062, indicating that financial knowledge significantly complements other behavioral factors.

Other predictors, such as resilience after financial losses and trust in AI-based financial systems, showed influence in lower-level splits, with respective improvements of 0.112 and 0.124. Their roles, though less prominent, suggested nuanced contributions to the overall model. Notably, a split in trust in AI-based financial systems at −0.568 led to the highest improvement at this level, with a value of 0.337, highlighting the emerging significance of technological trust in financial contexts.

Overall, the tree structure highlights the dominant role of behavioral and attitudinal factors, with demographic variables contributing more subtly to the prediction of investment interest. These results offer a comprehensive view of how different predictors interact and contribute hierarchically to financial decision making (

Figure 1).

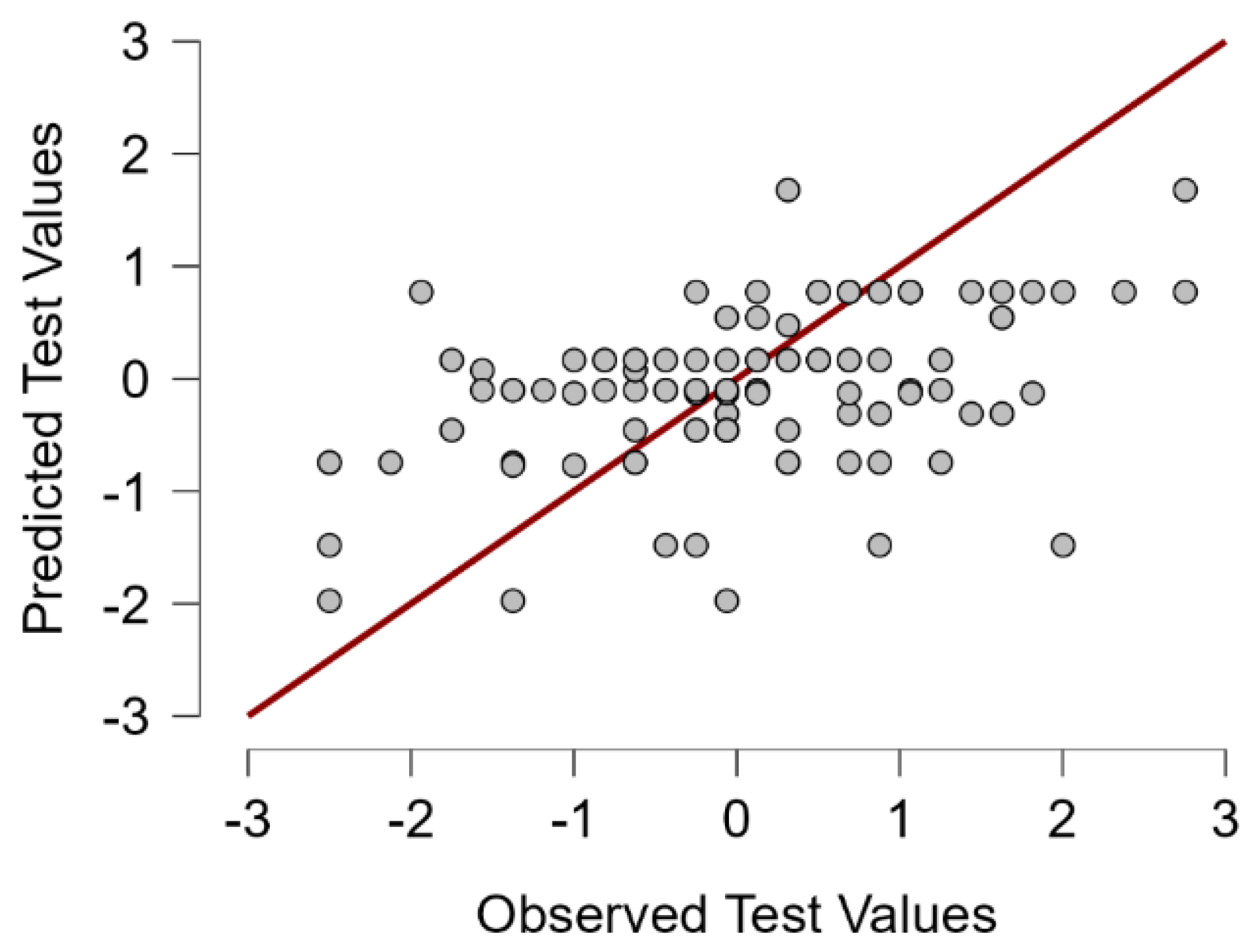

Figure 1 illustrates the predictive performance of the decision tree regression model, visualizing the relationship between observed and predicted values of the dependent variable, investment interest. The plot provides an assessment of the model’s ability to accurately predict the levels of investment interest based on the identified predictors.

The scatterplot reveals a clustering of points around the diagonal line, which represents perfect prediction. While there is some dispersion, particularly at extreme values, the general alignment of data points with the diagonal indicates that the model captures the overall trend effectively. This is consistent with the model’s performance metrics, including a test mean squared error (MSE) of 1.065 and a root mean squared error (RMSE) of 1.032, which reflect a reasonable level of predictive accuracy. However, the modest R2 value of 0.185 suggests that, while the model identifies key predictors, additional unmeasured factors may contribute to unexplained variance.

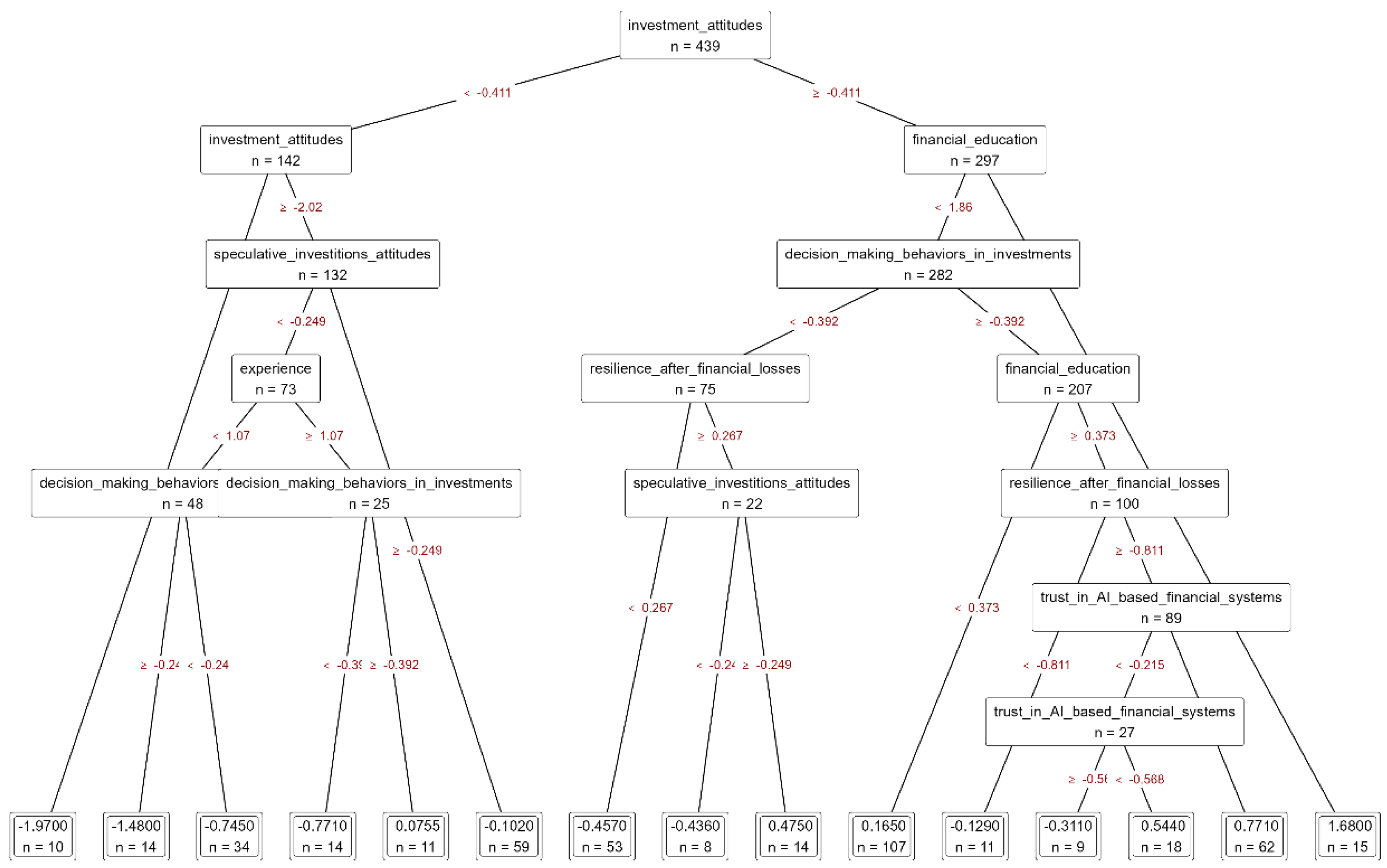

The decision tree plot (

Figure 2) illustrates the hierarchical structure of the regression model used to predict investment interest, highlighting the sequential importance of the predictors. The root node identifies investment attitudes as the most significant variable, splitting the dataset at a value of −0.411. This confirms that investment attitudes are the strongest driver of investment interest, as indicated in the feature importance analysis. For individuals with lower investment attitudes (<−0.411), further splits occur at −2.02 within the same variable, underscoring its critical role. Subsequent splits in this branch are determined by speculative investment attitudes (<−0.249), followed by experience (<1.07) and decision-making behaviors in investments, which refine the prediction for individuals with negative or low attitudes toward investments.

For individuals with higher investment attitudes (≥−0.411), the next significant split is based on financial education (<1.86), demonstrating the role of financial knowledge in distinguishing levels of investment interest among this group. The tree further branches on variables such as decision-making behaviors in investments (<−0.392), resilience after financial losses (<0.267), and speculative investment attitudes (<−0.249). Deeper splits in the right subtree also include trust in AI-based financial systems, reflecting the emerging relevance of technological trust in financial decision-making contexts.

The terminal nodes represent predicted levels of investment interest, with each node displaying the predicted score and the number of observations (n) in that subset. These terminal nodes provide insights into the segmentation of participants based on their characteristics and predictors. The tree demonstrates that investment attitudes play a foundational role, with variables such as financial education, speculative investment attitudes, and decision-making behaviors acting as critical secondary influences. Other factors, like resilience after financial losses and trust in AI-based financial systems, contribute more nuanced effects at deeper levels of the tree.

Although the full decision tree includes multiple levels of splits, this depth reflects the complexity of interactions among behavioral and demographic predictors. The deeper branches capture complex decision pathways that may apply to specific investor profiles, while the upper levels highlight the most influential variables overall. This structure allows for both general and detailed interpretation of investment interest segmentation.

4. Discussion

The findings of this study highlight the complex nature of investment decisions, underscoring the interplay between behavioral, financial, demographic, and technological factors. These results align with and expand upon the existing literature, offering significant implications for investors, policymakers, and financial institutions.

The dominance of behavioral factors, such as investment attitudes, decision-making behaviors, and speculative investment attitudes, reflects the critical role of psychology in financial decision making. Behavioral biases, such as overconfidence and loss aversion, influence how individuals perceive and respond to investment opportunities, as supported by [

46]. These findings are consistent with behavioral finance theory [

1,

6], which posits that psychological influences often override rational financial analysis. The results also highlight generational differences, as younger investors, particularly from Generation Y, exhibit higher engagement in speculative investments [

46]. This has implications for financial education programs tailored to specific demographic groups, as emphasized by [

35,

47].

The observed influence of demographic factors, such as income, education, and employment status, corroborates earlier studies that emphasize their importance in shaping investment preferences. For instance, Refs. [

48,

49] highlight how macroeconomic and socio-economic factors influence individual investment behavior in developing economies. Furthermore, the interplay between financial literacy and demographic variables, as demonstrated by [

10,

11], underscores the need for targeted financial literacy initiatives to bridge gaps in investment knowledge and participation.

The findings demonstrate the importance of financial education in fostering informed investment decisions, aligning with studies by [

28,

50]. Financially educated individuals are better equipped to evaluate risks and returns, enhancing their decision-making processes. These results hold strategic implications for policymakers and educational institutions, particularly in designing programs to enhance financial literacy. Ref. [

47] emphasizes that financial literacy in developing economies is critical to improving investment outcomes, which is especially pertinent for emerging markets like Pakistan and other developing regions.

The role of strategic investment decision making, as highlighted in this study, aligns with findings from [

51,

52], underscoring the importance of non-financial drivers in strategic contexts, such as renewable energy and nuclear sectors. These insights extend to individual investors, where alignment with long-term strategic goals can improve decision outcomes. Additionally, this study confirms the relevance of contextual factors in shaping investment behavior, consistent with findings by [

53] on real estate investments and [

54] on foreign direct investment. Advanced analytical methods, such as fuzzy clustering and decision tree modeling, have been shown to provide valuable insights into complex decision-making processes, highlighting their potential application in understanding financial behaviors [

55,

56]. Recent advancements in machine learning and decision tree methodologies, such as split difference weighting and self-aware prediction models, offer promising solutions for addressing imbalances and improving investment recommendations [

57,

58]. Also, techniques such as fuzzy-payoff methods and multi-period decision trees have demonstrated significant utility in evaluating sustainable investment opportunities, bridging behavioral and strategic considerations [

56,

59].

The growing significance of trust in AI-based financial systems observed in this study reflects the increasing reliance on technology for investment decision making. These findings are consistent with the recent literature, such as [

20], highlighting the role of transparency and reliability in fostering trust in AI systems. As financial technologies continue to evolve, financial institutions must prioritize user trust through transparent and user-friendly AI solutions. This is particularly important in the post-pandemic era, where digital solutions are reshaping traditional investment processes [

53]. The adoption of advanced clustering analyses in management and accounting practices further illustrates the potential for enhancing investor profiling and service customization [

60].

These insights are valuable for financial advisors seeking to personalize investment recommendations. Behavioral segmentation models can help financial service providers adapt their approaches to risk-tolerant versus risk-averse clients. Moreover, education programs should prioritize not only general financial literacy but also psychological preparedness for speculative environments, helping individuals develop resilience and adaptability. For researchers, the hierarchical modeling provided by decision trees offers an alternative to linear approaches, capturing non-linear and interactive effects often missed in traditional econometric analyses.

Compared to traditional linear models, decision tree regression offers interpretability and non-linearity but may lack robustness in high-dimensional data. Future research should explore ensemble models like random forests or XGBoost, which offer better generalization. Additionally, Bayesian or deep learning methods could provide more nuanced modeling of investor uncertainty.

The integration of AI and other digital tools in financial decision making presents both opportunities and challenges. While AI-based systems can provide accurate and data-driven insights, they must also address concerns about data security and ethical decision making, as suggested by [

41]. These findings underscore the need for regulatory frameworks to govern the use of AI in finance, ensuring both trust and accountability. Additionally, the integration of emotional and behavioral insights into AI-based systems, such as those examining the role of trust and friendship in information-sharing behaviors [

61], highlights the importance of user-centric approaches in fostering engagement and trust in financial technologies. Trust in AI is not only about system performance but also ethical and emotional considerations. As Pelau and collaborators note, perceptions of “friendship” and emotional trust in AI systems significantly affect information-sharing and engagement [

61]. Financial AI tools must therefore address emotional UX design alongside accuracy.

The role of technological advancements, including cloud computing services [

62] and risk management systems for sustainable development [

63], further illustrates the transformative potential of AI in addressing investment complexities. Similarly, considerations of cryptocurrency’s impact on accounting practices [

64] and sustainability-focused business models [

65] underscore the need for aligning technological innovations with evolving market demands.

The results of this study hold broader implications for policymakers and practitioners. For developing economies, such as those discussed by [

48,

66], improving financial literacy and access to financial services can significantly enhance investment participation and outcomes. Policymakers should consider implementing targeted interventions, such as tax incentives for investment in financial education programs, to address gaps in literacy and participation.

For financial institutions, understanding the behavioral and demographic nuances of investors can inform the design of personalized investment products and advisory services. By leveraging AI and big data analytics, institutions can tailor solutions to meet the needs of diverse investor profiles, as highlighted by [

20]. Furthermore, the integration of behavioral insights into financial advisory services can improve engagement and decision making, as emphasized by [

52,

67].

Policymakers can apply these findings by integrating behavioral segmentation into public financial literacy campaigns, tailoring messages to match investor profiles (e.g., speculative vs. risk-averse). Financial institutions can use DTR-based profiles to customize robo-advisory systems and align product offerings with behavioral predictors.

5. Conclusions

Future research should explore complementary modeling approaches to deepen the insights obtained from behavioral predictors. In particular, the analytic hierarchy process (AHP) and fuzzy logic represent valuable methods for multi-criteria decision making under uncertainty. AHP facilitates pairwise comparisons and priority rankings of investment-related criteria, enabling researchers to assess trade-offs between risk, return, and psychological comfort [

68]. Similarly, fuzzy logic models the imprecision inherent in human judgment, capturing the degrees of investor preferences and beliefs in a flexible manner [

69]. These techniques would allow for a more systematic evaluation of investor decision patterns and could be used in combination with machine learning models for enhanced hybrid approaches. Exploring these methods may also provide a stronger foundation for personalized financial advisory tools.

This study provides exploratory insights into the factors associated with investment interest, emphasizing the potential of integrating behavioral, educational, and technological variables into predictive modeling frameworks. The results tentatively suggest that behavioral factors, particularly investment attitudes and decision-making behaviors, may play a more pronounced role compared to traditional demographics, though further validation is needed. Additionally, this study highlights the growing significance of financial literacy and AI-driven technologies in shaping investment strategies, reinforcing the need for adaptive financial education and personalized advisory services.

Although this study contributed valuable insights, it had several limitations. First, the reliance on self-reported data might have introduce response biases, namely social desirability or recall bias, as individuals’ stated investment behaviors may not fully align with their actual financial decisions. Future studies should consider integrating objective financial data or experimental methodologies to mitigate this limitation. Second, the study’s sample was non-random and, thus, limited in scope, potentially restricting the generalizability of the findings to other regions or investor groups. The use of a single predictive algorithm might have also constrained the study’s broader applicability. Expanding the dataset to include a more diverse population across different economic backgrounds and investment environments would enhance the robustness of the conclusions. Finally, while decision tree regression provided valuable insights into predictive relationships, this study does not account for potential interactions between variables. Future research could employ ensemble models or deep learning techniques to capture more complex decision-making patterns.

The results have significant implications for policymakers, financial institutions, and investors. For policymakers, the findings emphasize the need for targeted financial literacy programs, particularly for younger investors and individuals with limited financial education. Governments could implement incentive-driven initiatives to promote financial awareness and responsible investment behaviors. Financial institutions, on the other hand, should leverage behavioral insights to design personalized investment products and AI-driven advisory services that account for cognitive biases and risk perceptions. The increasing role of technology in investment decisions suggests that institutions must prioritize transparency, trust, and ethical considerations in AI-powered financial tools. Additionally, this study reinforces the importance of integrating behavioral finance principles into traditional investment strategies, offering a more comprehensive approach to understanding market behavior.

Additional work could test ensemble learning methods or apply the current methodology in cross-cultural settings to examine how investment predictors vary across economic systems. A hybrid approach that integrates behavioral scoring with machine learning could also enhance real-time financial advising systems. Future research should explore the dynamic interplay between behavioral, technological, and financial factors in different economic and cultural contexts. Specifically, longitudinal studies could provide a deeper understanding of how investor behaviors evolve over time in response to market fluctuations and financial education initiatives. Additionally, examining sector-specific investment behaviors—such as in sustainable finance, cryptocurrency, or real estate—could offer more tailored insights into decision-making processes. Further research should also investigate the ethical and regulatory challenges associated with AI-driven investment platforms, particularly in ensuring fairness, privacy, and data security. Lastly, interdisciplinary approaches combining behavioral finance, machine learning, and neuroscience could provide groundbreaking perspectives on how emotions and cognitive biases shape financial decision making.

Building on these exploratory results, future research should adopt longitudinal designs to track changes in investment behavior over time and across economic cycles. Applying more advanced algorithms—such as random forests, gradient boosting, and deep learning networks—could improve prediction accuracy. Cross-national comparisons would also be valuable in examining how cultural and institutional contexts shape investment attitudes. Lastly, integrating behavioral data with real financial behavior (e.g., transaction records) could enhance the ecological validity of predictive models.

In conclusion, this study advances the field of investment decision making by integrating multiple dimensions of financial behavior. The findings call for a more holistic approach to investment strategies, combining behavioral insights with technological advancements to enhance decision-making efficiency and financial well-being. Ongoing research and innovation in financial literacy, AI-driven advisory systems, and regulatory frameworks will be crucial in shaping the future of investment practices in an increasingly digital and complex financial landscape.