1. Introduction

The growing need for transparency, accuracy, and adaptability in public budgeting highlights the limitations of traditional statistical models used for forecasting public expenditures [

1]. The current global economic context causes public institutions to face significant challenges in managing financial resources and developing budgets that respond to social and economic needs [

2]. The increasing complexity of modern economies, the volatility of financial markets and rapid changes in the macroeconomic environment bring the adoption of advanced and adaptable methods for forecasting and accounting planning into the news [

3,

4].

The digitalization process has led to an exponential growth in the volume of data available for economic and financial analysis in modern society [

5,

6,

7]. These data present vast opportunities for enhancing the accuracy of budget forecasts; however, traditional methods of analysis and forecasting often fail to capitalize on this potential fully. AI algorithms have demonstrated the ability to process and analyze large volumes of data, identify complex patterns, and provide more accurate predictions than conventional methods [

8]. Implementing AI in the budget process in public institutions can fundamentally transform the way forecasts are made in smart cities, contributing to a more efficient and transparent allocation of public resources [

9].

The general framework involves expanding the technological possibilities for digitizing financial and accounting activities and services, as well as the need to modernize forecasting methods in the public sector, to adequately respond to the complex challenges of the contemporary economy [

10]. Therefore, traditional budget forecasting methods have become inadequate, and the application of the latest information technologies is not only possible but also necessary.

Classical econometric approaches, including SARIMA, VAR, and ECM, have long been employed for forecasting public revenues and expenditures, yet their capacity to deliver accurate predictions at the monthly level remains limited. Expenditure series are shaped by strong seasonal patterns, institutional inertia, and sudden shocks, which create complexities that traditional models struggle to capture. These challenges have created an opportunity for artificial intelligence techniques, which can leverage non-linear relationships, long-term dependencies, and large-scale data sources to enhance the reliability of forecasts in the context of public budgeting.

The research context is closely tied to the need to improve upon traditional budget forecasting methods and capitalize on the opportunities presented by AI algorithms to enhance the accuracy, efficiency, and transparency of budgetary forecasting processes. Conventional forecasting techniques, which rely on historical data and basic econometric models, face notable limitations in their capacity to respond to rapid shifts in the economic landscape [

11]. These methods tend to be static and inflexible, struggling to process large volumes of data or recognize complex patterns in real time. Consequently, they can lead to inaccurate forecasts, resulting in suboptimal resource allocation and ineffective financial decisions [

12]. In contrast, AI algorithms provide promising solutions to these challenges, as they can swiftly and effectively analyze vast amounts of data from diverse sources, uncovering subtle patterns and producing more accurate and adaptive forecasts. Machine learning algorithms continually enhance forecast accuracy as they ingest new data, thereby adapting to changes in the economic environment [

13,

14].

The purpose of this research is to investigate and develop modern forecasting methods for public institutions, utilizing AI algorithms, which will lead to improved management of public expenditure. Specifically, the research aims to explore and validate the applicability of AI in public budgeting processes, to develop a robust methodological framework that will allow public administrations from smart cities to create the following directions:

Improving the accuracy of budget forecasts by using machine learning and predictive analytics techniques, and how AI can generate more accurate and relevant forecasts;

Optimizing resource allocation by identifying key areas where AI can contribute to a more efficient strategic allocation of public financial resources;

Simplifying and automating processes, by exploring how AI can automate and simplify complex analysis and forecasting processes, thus reducing the time and associated costs;

Increasing transparency and accountability by assessing the impact of the use of AI on transparency and accountability in the management of public funds, providing an objective and substantiated basis for financial decisions.

Two secondary objectives were developed for this research. The first concerns the identification and analysis of the current challenges facing the public budget forecasting process, to understand the context in which traditional forecasting methods are applied and to highlight specific limitations and difficulties. In the literature, frequently mentioned challenges include economic volatility, complexity of econometric models, incomplete or inaccurate data, and limited institutional capacity [

15,

16,

17]. Achieving this objective involves identifying and presenting the current state of knowledge regarding the budget process, developing budget forecasts within public institutions, and recognizing the need to model financial data specifically for this activity.

The secondary objective is to analyze classical budget forecasting methods, enabling the modeling of financial accounting data for budget forecasting applications. This analysis involves evaluating the performance of classical budget forecasting methods in various financial accounting contexts, identifying the limitations and weaknesses of traditional approaches, and exploring the potential of using AI technologies for budget forecasting and execution.

The relevance of this topic is supported by the urgent need to improve accounting forecasting methods in the context of an increasingly globalized, complex, and unpredictable economy. Exploring and developing modern forecasting methods using AI algorithms can bring substantial benefits in the development and implementation of public budgets, contributing to the economic and social well-being of communities [

18]. The possibility of simulating different models and comparing the results obtained can be beneficial for optimizing and balancing resources. The possibility of approaching this study was facilitated by the evolution of digitalization in the public institutions sector and the availability of publicly accessible data through specific digitalization platforms [

19,

20].

This investigation is guided by three operational hypotheses. H1 states that the methodological framework for budget forecasting in public accounting can be innovatively developed through the integration of AI algorithms. H2 posits that the implementation of such algorithms in the design of public budgets leads to a more efficient allocation of financial resources. H3 advances that the integration of AI-driven methods into budgetary processes is feasible without significant disruptions to existing institutional systems. These hypotheses establish the general framework for the study while also anchoring the more specific expectation that deep learning architectures, including LSTM and TCN, have the capacity to outperform classical econometric models in predicting monthly expenditure series.

The incremental contribution of the paper is to situate these hypotheses within both the state of the art and empirical practice by offering systematic benchmarking of AI-based approaches against SARIMA, VAR, and ECM models. By doing so, the paper enriches theoretical literature with evidence on how novel algorithms capture the distinctive features of public expenditure data, while also providing public administrations with a methodological pathway for testing and adopting these tools. The study thereby contributes to the modernization of forecasting practices in smart cities, enhancing the transparency and accountability of resource allocation, while clarifying the conditions under which AI models provide genuine improvements over traditional methods.

Therefore, this research contributes to the global effort to modernize public institutions and optimize public resource management for the benefit of communities. Theoretically, it contributes to enriching specialized literature by offering new perspectives and approaches in the field of forecasting within the budgetary process of public institutions and predictive analysis based on AI. Practically, it provides a tested and applicable methodological framework for utilizing AI algorithms in public budget forecasting and execution.

The paper is structured as follows:

Section 2 reviews the relevant literature and formulates research hypotheses.

Section 3 describes the research methodology, and

Section 4 outlines the study’s results.

Section 5 presents the research findings and highlights the key contributions of the study. Finally,

Section 6 addresses the study’s conclusions, limitations, and proposed directions for future research.

2. Materials and Methods

The use of AI algorithms and their specific application in public accounting and budget forecasting remains relatively unexplored. Numerous studies examine the application of AI algorithms in the economic domain from an institutional perspective [

21,

22,

23]. There is a consensus that AI can substantially improve forecast accuracy, but studies applied to the public sector are still limited [

24,

25]. Research on the use of AI algorithms in public budget forecasting is multidisciplinary, spanning several disciplines, including public accounting, public finance, econometrics, economic informatics, and data analysis [

26].

Based on the analysis of several existing studies, it is evident that opportunities exist for further research in the area of public expenditure. Thus, studies that explore the use of AI in the financial accounting domain are highlighted, demonstrating the efficiency of these technologies in various applications [

27]. Research has also shown that machine learning models can significantly improve forecast accuracy and optimize resource allocation [

28]. Therefore, the level of knowledge of the research area regarding the use of AI algorithms in budget forecasting in public institutions reflects both the significant potential of these technologies and the associated challenges and limitations.

Traditional budget forecasting methods have evolved considerably but remain limited in the face of modern economic complexity and volatility. AI algorithms, especially machine learning and deep learning, offer promising solutions for improving the accuracy and efficiency of budget forecasts [

29]. Realizing the potential of using AI technologies is conditional on overcoming challenges related to data quality, technological acceptance and ethical regulations [

30].

AI offers advanced solutions for data analysis and accurate forecasting, overcoming the limitations of traditional, classical methods. Previous studies [

31,

32] highlight the advantages of using AI in analyzing complex data and in making reliable forecasts.

To effectively apply AI algorithms, it is crucial to comprehend the accounting perspective involved in public expenditure forecasting and to adhere to the ethical standards upheld by the accounting profession. According to international governance standards established by relevant organizations (OECD [

33], INTOSAI [

34], and IFAC [

35]), principles such as transparency, accountability, and legality are fundamental values that an efficient financial accounting system must uphold. The existing literature offers a range of insights into the role of public accounting in managing public resources [

36,

37]. Additionally, studies conducted by other researchers highlight the significance of public accounting in promoting fiscal transparency and accountability [

38].

The rapid advancement of technology brings both opportunities and challenges to the public budget process, which also favors the integration of AI algorithms. Public institutions have begun to adopt and integrate new technologies, such as ERP systems and data analysis tools, to enhance the efficiency and accuracy of accounting processes [

39] or to manage dedicated digital platforms [

40]. Thus, the implementation of AI in accounting processes enhances transparency and accountability in the management of public funds, providing a more objective and well-founded basis for financial decisions [

41]. Additionally, the integration of AI in public accounting fosters innovation and modernization within public administrations, equipping them for future challenges and enhancing citizens’ trust in their ability to manage resources efficiently [

42].

Budget planning is the process by which public authorities establish priorities for spending resources, based on forecasted revenues and public policy objectives [

43]. Effective budget planning is the foundation of responsible governance and sustainable development, requiring adherence to sound principles in the allocation of funds. The consistent application of budget principles and the adoption of good international practices contribute to increasing the efficiency of resource allocation, enhancing transparency, and strengthening trust in public institutions [

44].

Recent studies have investigated budgeting practices at the local public administration level, highlighting variations in the approaches and methodologies employed [

45,

46]. These studies underscore the importance of standardizing and professionalizing budget processes at the local level to ensure efficient resource allocation and effective budget execution. The efficiency of public expenditure is assessed by relating the results obtained to the resources used. This indicator helps to identify areas where financial resources are used most efficiently and to optimize budget allocations to achieve public policy objectives. The socioeconomic impact of public expenditure is assessed by analyzing the effects of this expenditure on economic development and social well-being. Impact indicators include GDP growth, reduction in unemployment, improved access to public services, and poverty reduction [

47].

The dynamics of classical methods of forecasting public expenditures have been influenced by statistical modeling and technological development. Numerous studies use econometric models for forecasting public revenues and spending [

48,

49]. Autoregressive Integrated Moving Average (ARIMA) models and multiple regression models are frequently used to estimate expenditure and tax revenues based on economic and social variables [

50]. References to the use of budgeting software are increasingly common in the specialized literature, highlighting the growing adoption of these solutions for automating and optimizing budgeting processes [

51]. These tools offer advanced functionalities for collecting, analyzing, and visualizing financial data, thus facilitating the creation of accurate and up-to-date budget forecasts.

The transition to ERP systems marks a new step towards digital transformation, as they are used to integrate and manage all financial and administrative processes of public institutions. These systems provide a comprehensive view of finances and facilitate coordination between different departments and agencies, resulting in improved efficiency and accuracy in budget planning [

52,

53].

The introduction of the Box–Jenkins methodology revolutionized time series analysis through ARIMA models, allowing public institutions to develop more robust forecasts based on historical data of public expenditures [

54]. Subsequently, the emergence of vector autoregressive VAR models [

55], which allowed the simultaneous consideration of interdependencies between multiple economic and financial variables relevant to budgets, as well as the development of integration theory and error correction models ECM [

56], to combine long-term relationships with short-term dynamics. However, classical forecasting solutions have limitations in modern conditions characterized by large volumes of data and high complexity [

14]. Public institutions manage large volumes of financial transactions and significant annual budgets. Without modeling methods, identifying patterns, trends, or anomalies would be extremely difficult. Statistical models and algorithms can synthesize and analyze these large volumes of data, highlighting relevant relationships and reducing information to key parameters [

15]. Mathematical modeling enables the quantitative forecasting of these variables, providing a basis for substantiating fiscal policy decisions and resource allocation on a rational and objective basis. Without forecasting models, budgets would be built solely on intuitive judgments, susceptible to significant errors.

The necessity of employing AI algorithms in public financial forecasting is underscored by specialized studies [

26,

57], which highlight the critical issue of public expenditure. Recurrent expenditures, such as public salaries and social benefits, often exhibit inertia and seasonality that can be effectively modeled using time series techniques. Meanwhile, capital expenditures can be projected by considering investment plans and execution data from prior years. Forecasting algorithms facilitate the precise calibration of budget allocations, thereby preventing underestimation. By applying these algorithms under various assumptions, decision-makers can explore a range of potential variations in revenues and expenditures, allowing them to better prepare for uncertainty. Furthermore, these models support scenario and sensitivity analysis, enabling the simulation of different outcomes based on changes in macroeconomic indicators. Consequently, AI algorithms allow the early detection of budget deviations by routinely updating forecasts in line with current execution data, allowing for the identification of discrepancies from proposed targets and the implementation of timely corrective measures [

58].

To support the research hypotheses concerning AI-driven forecasting optimization for expense monitoring in public institutions, it is evident that the implementation of AI algorithms yields several noteworthy effects within these entities. Firstly, AI can integrate various internal data sources along with data from diverse external sources, such as unstructured data, economic news, and social media insights regarding taxpayer behavior. This integration enables enhanced forecast adjustments, offering a level of complexity that surpasses traditional models. Secondly, intelligent algorithms can propose optimized budget allocations, allowing the decision-makers to explore a significantly broader range of options than would be possible manually. Lastly, an AI algorithm designed for anomaly detection can meticulously examine accounting records to identify suspicious transactions, including potential errors or fraud, based on deviations from typical patterns-a task that is challenging to accomplish with static rules.

The hypotheses formulated in this research are intended to provide a theoretical foundation for exploring the applicability and efficiency of AI algorithms in public budget forecasting:

H1. The methodological framework for budget forecasting in public accounting can be approached innovatively, based on the use of AI algorithms.

H2. The implementation of AI algorithms in the development of public budgets leads to a more efficient use of financial resources.

H3 . The integration of AI algorithms into budget processes is feasible and can be achieved without significant disruptions to existing systems.

The methods for verifying these hypotheses are presented in the following sections, which employ both classical methods for integrating and forecasting public expenditure, as well as more specific AI algorithms. The expected result is to highlight the applicability and efficiency of AI algorithms in budget forecasting and monitoring public expenditure.

3. Research Methodology

The research approach adopted is exploratory and explanatory, aiming to investigate the potential of AI algorithms in enhancing the accuracy of budget forecasts by utilizing a series of classical methods. Exploratory research helps to identify the challenges and opportunities associated with the use of AI, while explanatory research evaluates the formulated hypotheses and explains the causal relationships. To assess the performance of classical research methods, historical data on public expenditures and revenues are used, which will be analyzed using statistical and econometric analysis software.

ARIMA models are widely used in the domain of public accounting for forecasting budgetary indicators, particularly in relation to expenditures, revenues, and other financial series characterized by significant seasonality or internal dependencies. Empirical research supports the assertion that, across short- and medium-term forecasting horizons, ARIMA frequently yields predictions that are comparable in accuracy, if not superior, to those generated by more complex econometric models [

35,

39]. Furthermore, the modest data requirements inherent to SARIMA models enhance their applicability, particularly in scenarios where there is a lack of extensive historical data for potential predictors or when such predictors remain uncertain [

59].

VAR models extend the concept of autoregression from a single series to a set of intercorrelated variables, thus allowing the simultaneous modeling of the evolution of several economic indicators [

55]. VAR models are helpful for macro-fiscal forecasts and policy analysis, particularly when multiple financial and monetary variables interact. In this research on the budgetary context, a VAR includes variables that influence each other (tax revenues, public expenditures, GDP, inflation, unemployment rate, and interest rate). Applying a VAR model provides public institutions with the opportunity to obtain consistent forecasts for all these variables simultaneously, considering their interdependencies [

60].

AI techniques offer a promising alternative for forecasting, as they can automatically learn both temporal patterns and relationships between economic variables without imposing linear constraints. The research focuses on four types of AI models often used in time series forecasting that are suitable for the budgetary context, namely: MLP (Multilayer Perceptron), LSTM (Long Short-Term Memory), GRU (Gated Recurrent Unit), and TCN (Temporal Convolutional Network). The first three are recurrent or association neural network models [

61]. The last one is a model based on 1D convolutional networks applied to sequences, representing a recent alternative to RNNs in sequence modeling tasks [

62].

The inherent data structures and operational constraints guided model selection in this study. The analysis utilized a monthly budget series comprising 100 observations, which exhibited pronounced seasonality, inertia, and sporadic shocks. TCN was prioritized due to its dilated causal convolutions, which effectively capture long-range dependencies while maintaining stable training performance on short sequences. Additionally, LSTM networks and GRU were incorporated as sequence models capable of addressing regime shifts and persistence in the data.

While Transformer-based forecasting models are recognized as state-of-the-art in numerous long-sequence applications [

63,

64], the specific conditions of this study, characterized by short monthly sequences, a limited sample size, and the need for parsimonious and auditable models within public institutions, indicate potential risks related to overfitting and complexity. Consequently, a conceptual benchmark against the Transformer models was established, with a comprehensive empirical comparison reserved for future research when longer datasets, such as cross-entity or higher-frequency data, become accessible.

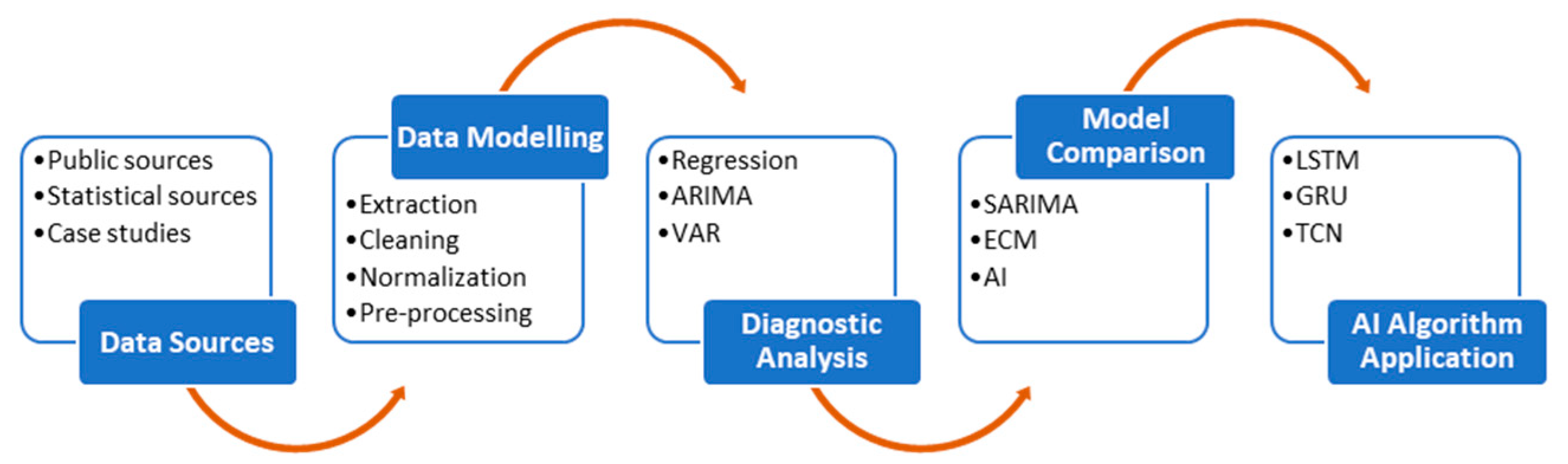

Data modeling encompasses key metrics, including R

2 (coefficient of determination), RMSE (Root Mean Squared Error), and MAPE (Mean Absolute Percentage Error), which provide a quantitative assessment of the accuracy and reliability of each model. The methodology employed consists of the following steps, along with associated activities and technologies, as illustrated in

Figure 1.

The data sources for this research include public and statistical sources, as well as case studies conducted in local public institutions. The data collection methods include documentary analysis, data preprocessing, and predictive analysis, and data extraction algorithms are developed.

The empirical analysis is grounded in a comprehensive dataset derived from Romania’s national budget reporting system (Forexebug), encompassing monthly observations from January 2016 to December 2024, resulting in a total of 108 data points. This dataset includes a range of financial indicators, such as total public expenditures, personnel costs, public investments, and social assistance payments, all denominated in the national currency (RON). Furthermore, macroeconomic variables included in the analysis are the GDP growth rate, the inflation rate as indicated by the Consumer Price Index (CPI), the unemployment rate, and the key policy interest rate established by the National Bank of Romania.

The data preprocessing adhered to a systematic protocol, in which outliers were identified using the Interquartile Range (IQR) method with a factor of 1.5, and subsequently replaced via linear interpolation. All monetary values were deflated to 2016 constant prices employing the CPI. To enhance robustness against outliers while maintaining the integrity of underlying patterns, RobustScaler normalization was implemented, utilizing the median and interquartile range instead of the mean and standard deviation. The dataset was chronologically partitioned into training (2016–2022), validation (2023), and test (2024) subsets. To mitigate the risk of look-ahead bias, all models were developed using blocked time-series splits, ensuring that future information was excluded from earlier forecasts. The collected data are preprocessed to ensure quality and consistency. Preprocessing involves several steps: data cleaning, eliminating outliers, filling in missing values, normalizing data, and transforming it into formats suitable for training AI algorithms.

The implementation of deep learning models followed a standardized configuration to ensure comparability. All recurrent and convolutional models utilized a lookback window of 12 months, capturing annual seasonality patterns. Training was conducted for 50 epochs with a batch size of 32, using the Adam optimizer with default learning rates (0.001). The LSTM and GRU architectures employed a single recurrent layer with 64 hidden units, followed by a dense output layer. The TCN architecture consisted of two dilated convolutional layers with 64 filters each, a kernel size of 2, and exponentially increasing dilation rates (1, 2), providing a receptive field of 7 time steps. To prevent overfitting, we implemented early stopping with a patience of 10 epochs based on validation loss. The train–test split followed a temporal blocking strategy: the first 84 months (approximately 78%) were allocated for training, while the final 24 months served as the hold-out test set, preventing any form of data leakage.

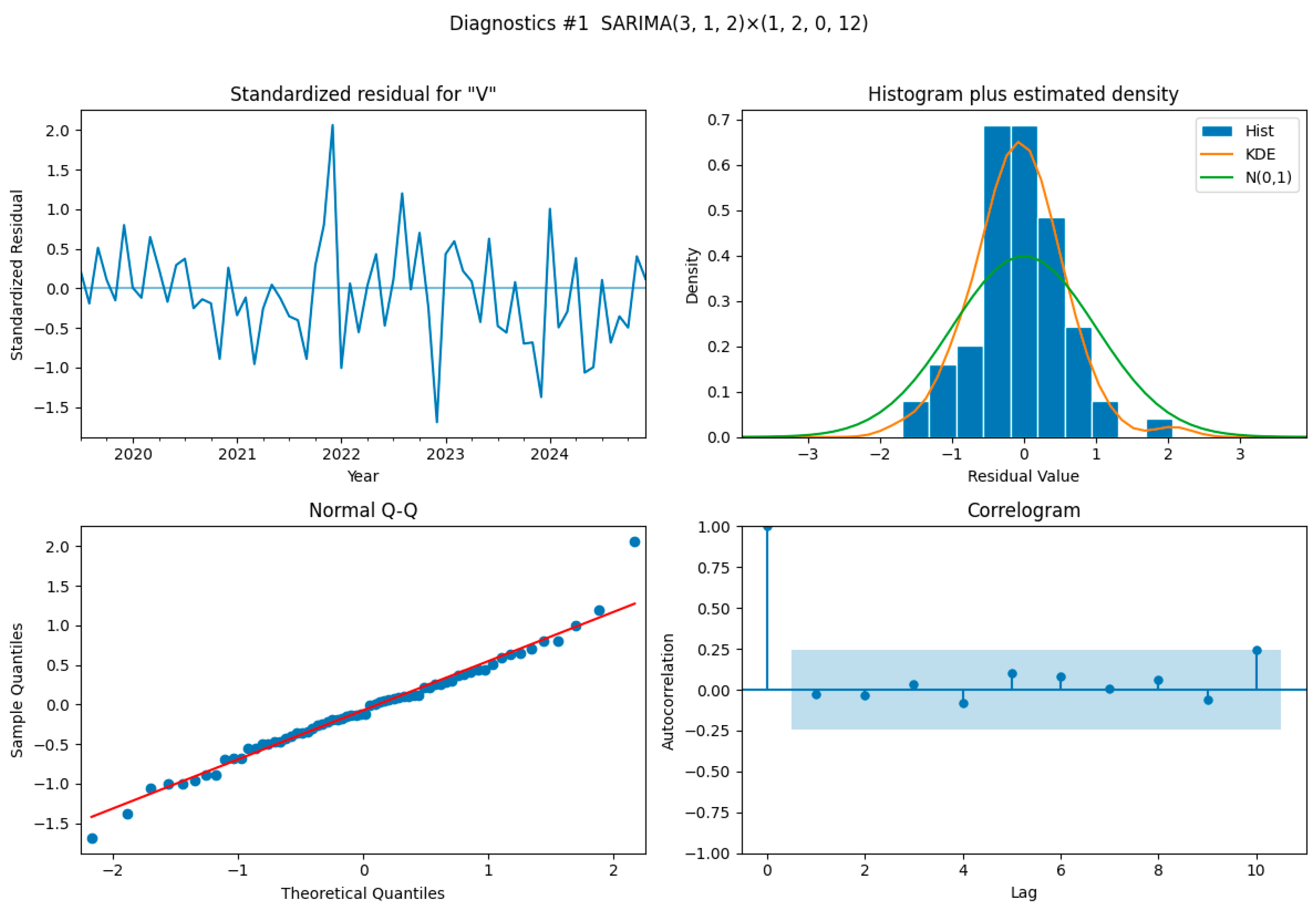

The SARIMA model selection employed a systematic grid search approach over the parameter space, where p, d, q ∈ [0, 3] were considered for the non-seasonal components and P, D, Q ∈ [0, 2] for the seasonal components, with s = 12 (monthly seasonality). The optimal configuration SARIMA (3,1,2) × (1,2,0)12 was selected based on the Akaike Information Criterion (AIC = 2661.062). Model diagnostics confirmed the adequacy of this specification: the Ljung–Box test indicated no significant autocorrelation in residuals (p-value > 0.05 for lags up to 24), the Jarque–Bera test confirmed approximate normality of residuals, and the ARCH test showed no evidence of heteroskedasticity.

This research utilizes a range of AI algorithms to develop a budget forecasting model. All implementations were carried out in Python using TensorFlow, Keras, and Scikit-learn; Python is already the dominant language for applied machine learning and deep learning, and these libraries support widely used ML/DL methods, although they do not encompass the full breadth of AI approaches (e.g., knowledge-based systems, agent architectures) [

65,

66] The Python integration with these widely used frameworks allows for efficient implementation of machine learning and deep learning models. At the same time, its readability and modularity make it suitable for interdisciplinary teams in both academic and policy-oriented environments. These features explain its selection in this study, ensuring both reproducibility of results and alignment with best practices in the field of applied AI.

4. Results

The results obtained were structured in two sections. The first refers to data modeling using the SARIMA forecasting model. The second reflects the training and application of the AI model for public expenditure forecasting in the smart society.

4.1. Testing the SARIMA Forecasting Model in Public Expenditure Monitoring

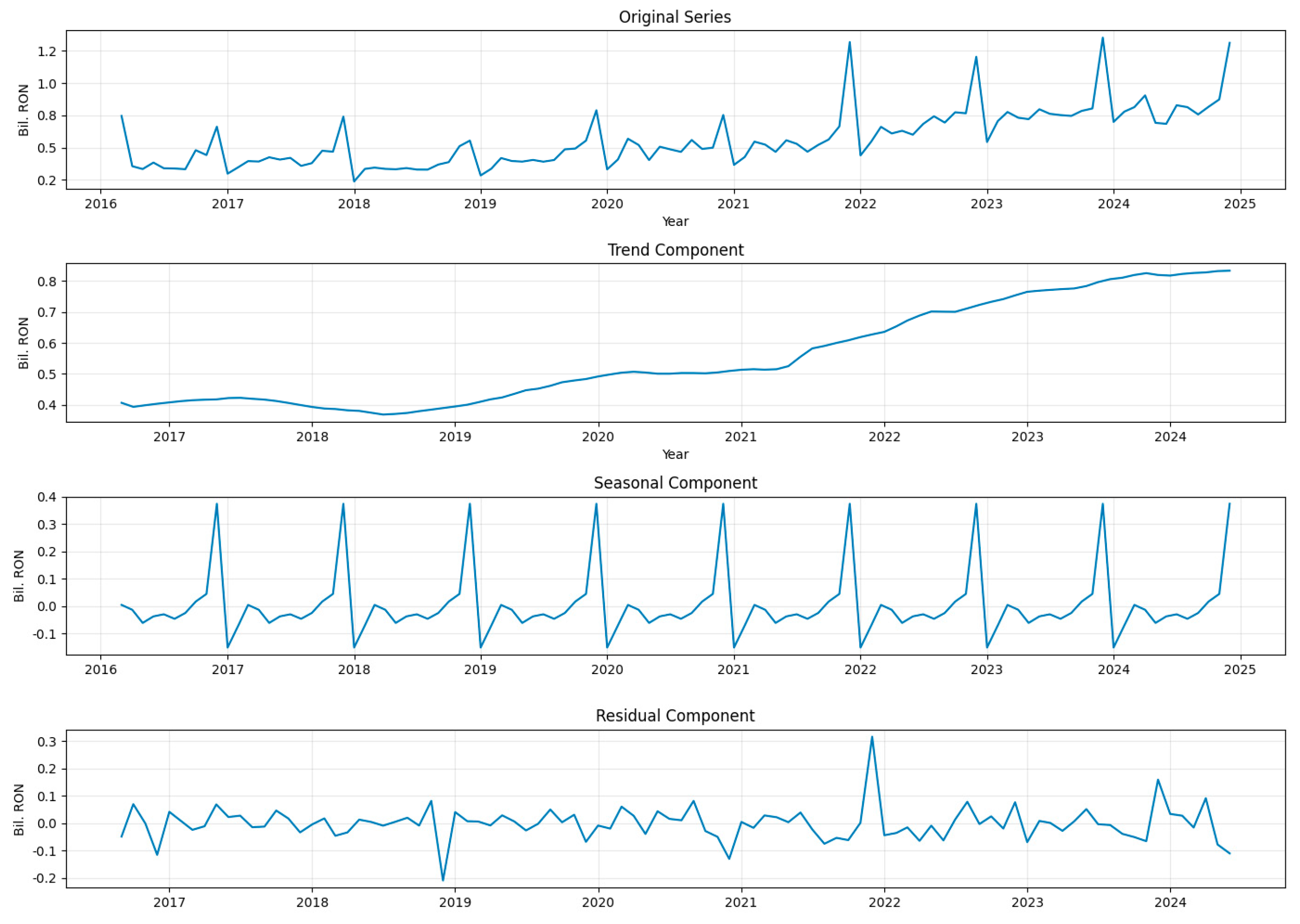

To demonstrate the performance of a SARIMA model utilizing empirical data from local public administration, an analysis was conducted on the monthly budget expenditure of a national region spanning from January 2016 to December 2024, encompassing a total of 108 observations. The analyzed series exhibits distinct upward trends along with pronounced annual seasonality with a coefficient of approximately 0.90.

Figure 2 presents a comprehensive component analysis for the SARIMA model, depicting the decomposition of the time series into its trend, seasonal, and residual components.

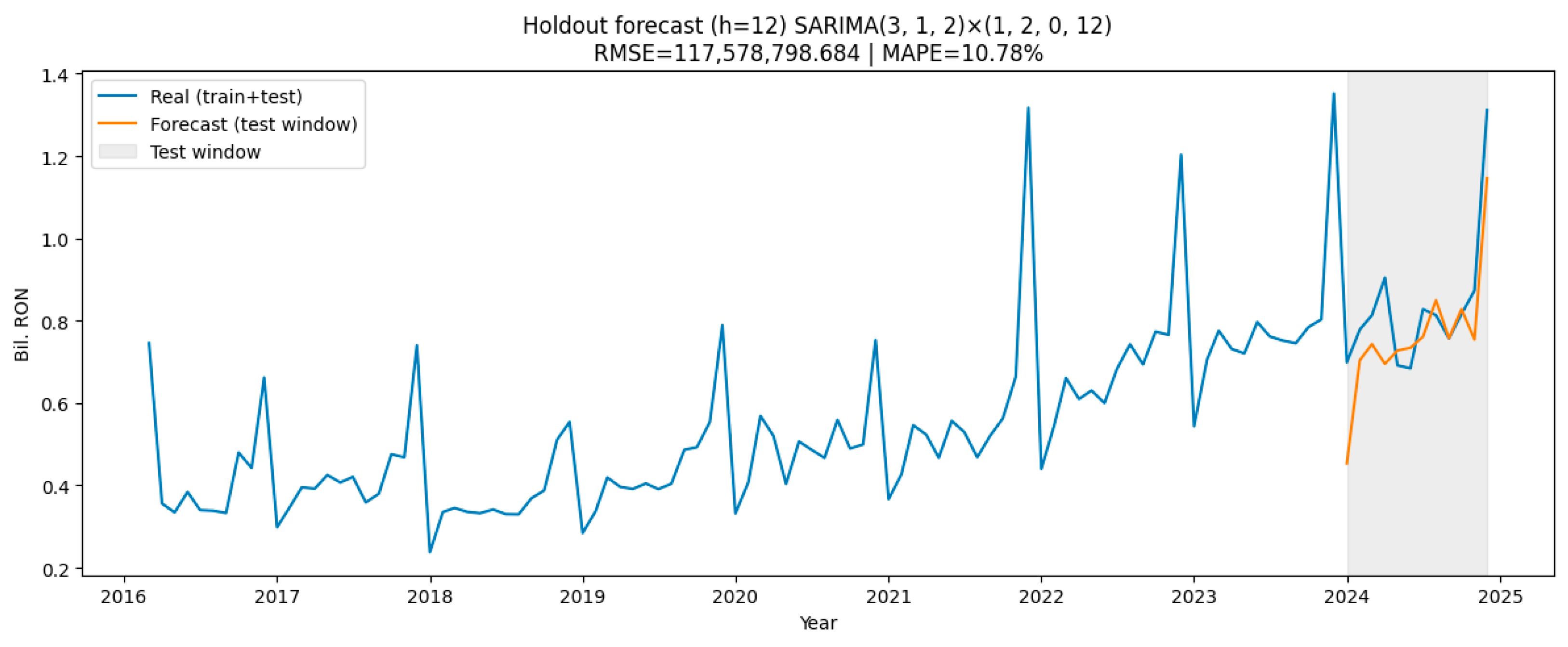

The model was applied using data from the period 2016–2023, with the first seven years allocated for training and the last year, for which official data were available, reserved for evaluation. The development of the model involved a grid search of the form SARIMA(p, d, q) × (P, D, Q)12, which revealed the optimal configuration as SARIMA(3, 1, 2) × (1, 2, 0)12, where 12 signifies the seasonal period. The AIC criterion was calculated to be 2661.062.

Figure 3 analyzes the performance of the SARIMA model, with the graph illustrating the model indicators.

The analysis of the results on the test provided a mean absolute percentage error MAPE = of 11.22% and a root mean squared error RMSE ≈ 1.19 × 108 RON. This indicates that, on average, the forecasts deviate by about 11% from the actual monthly values, a reasonable performance considering the volatility of the series. The seasonal specification (1,2,0,12) confirms the presence of strong annual seasonality. The double seasonal difference (D) was required to stabilize the seasonal component, while the autoregressive terms AR (3) capture short-term persistence up to three months. The moving average part, MA (2), accounts for short-lived shocks, and the seasonal autoregressive component, P = 1, highlights the dependency on the same period of the previous year. The diagnostics indicate that residuals are generally well-behaved, although some peaks in volatility remain unexplained, especially in the last few years, which partly explains the error rate. Compared to alternative configurations tested, this specification minimized the AIC and provided the most adequate balance between accuracy and parsimony.

Figure 4 shows the forecast for monthly budget expenditure with a SARIMA model.

The model predicts monthly values in the range of 450 million to 1.16 billion RON, with an average of approximately 7.7 × 108 RON and a dispersion of about ±1.7 × 108 RON, for the next 12 months (out-of-sample forecast). The forecasts suggest continued growth with pronounced seasonal fluctuations, peaking in the last quarter of the year.

Comparatively, SARIMA provides transparent decomposition and competitive short-horizon accuracy on regular seasonal patterns; however, it remains linear and struggles when shocks or non-linear interactions dominate. The univariate TCN outperformed SARIMA on total expenditures (higher R2 and lower MAPE) by modeling non-linearities and longer-range effects without manual feature engineering. In practice, SARIMA remains a strong baseline for monitoring and explainability, while AI models add flexibility and robustness to regime shifts; a combined baseline and AI residual or ensemble can deliver the best of both worlds for public budgeting workflows.

Table 1 shows the coefficients used in the model.

The estimated parameters confirm the presence of significant short-term and seasonal dynamics. The autoregressive terms AR(1) = −0.60 and AR(2) = +0.64 indicate an oscillatory adjustment mechanism, with deviations in one month being corrected and partially reversed over the following two months. The third autoregressive term (AR(3) = +0.37) is weaker and statistically less relevant. On the moving average side, the effect of the first lag is negligible (MA(1) ≈ 0). In contrast, the second lag is highly significant (MA(2) = −0.97), showing that shocks are rapidly compensated after two periods.

The seasonal autoregressive coefficient AR.S(12) = −0.59 highlights a strong negative dependence on the value of the same month in the previous year, reflecting a cyclical alternation of peaks and troughs between corresponding months across years. This confirms the presence of robust annual seasonality, consistent with the double seasonal differencing applied in the model.

The parameter structure suggests that the series is characterized by a combination of short-term oscillations and intense yearly cycles, where shocks are quickly corrected and seasonal influences exert significant negative feedback from one year to the next. Such SARIMA models are commonly used by public institutions and government agencies for short-term forecasting of revenues and expenditures, offering decision-makers a statistical framework that balances historical patterns with expected cyclical behavior.

By developing the VAR model, public institutions can simultaneously forecast Y and X for the following years. In the model based on two variables (public expenditure and GDP), the impulse response functions extracted from the VAR model can accurately analyze the impact of such a shock on the variables. For the relationship between public expenditure (Y) and GDP (X), the resulting equations are:

Figure 5 graphically presents this analysis, showing the

Y curve slightly deviated upwards from the baseline scenario, reaching a peak at

t + 1 and gradually returning to its initial trend. The figure also illustrates the accuracy of the VAR forecasts compared to the univariate ARIMA ones for

Y, highlighting potential improvements resulting from the inclusion of GDP information.

The results obtained from the ECM model confirm the presence of a stable cointegration relationship between expenditures (E) and income (I). The estimated long-run equilibrium relation is:

The data suggests that, on average, expenditure surpasses revenues by approximately 5%. The ECM delineates the relationship between expenditure and income through the following equation:

The short-term dynamics show moderate persistence of shocks, while the adjustment coefficient for the expenditure equation (α ≈ −0.75) is significant. This implies that about 75% of any deviation from the long-run equilibrium is corrected within one year, ensuring convergence of expenditures toward the equilibrium path determined by revenues. For the income equation, the adjustment coefficient (α ≈ 0.25) was not statistically significant, suggesting that income dynamics are less responsive to disequilibria.

Figure 6 illustrates the historical evolution of income and expenditure between 2016 and 2023, along with the evolution and forecast up to 2025, including the equilibrium error, defined in Equation (3). The two series remain closely aligned, with expenditures consistently above revenues, reflecting structural fiscal imbalance. The error oscillated around zero, capturing cyclical deviations from the long-run relationship. During the forecast period (2023–2025), the model predicts a gradual stabilization of the disequilibria, with the error converging toward a constant band near zero. This confirms the corrective power of the ECM mechanism.

The results suggest that the ECM model provides a coherent framework for matching expenditure and revenue, capturing both long-run proportionality and short-run deviations. However, even if fiscal policy tends to be overly expenditure-oriented, adjustments occur relatively quickly, thereby limiting the long-run imbalance.

4.2. Experimental Forecasting Model Based on AI Algorithms for Public Expenditure

Budgetary expenditures are more predictable than revenues, often subject to rigorous planning and have significant inertial components, especially for specific categories, such as salaries, pensions, multi-year commitments, and contracted expenses. The application of AI algorithms was carried out in a series of successive actions, leading to the development of a model. The preliminary analysis of the monthly series of public expenditures is illustrated in

Figure 7 with the representation of three dimensions:

The long-term upward trend in public expenditure reflects economic growth in conditions of inflation and the expansion of the role of the state. Possible periods of austerity or fiscal stimulus may be reflected in changes in the slope of the trend;

The seasonality of public expenditure peaks at the end of the year due to the commitment of expenditure and the closure of the budget year. This dimension may vary over time depending on scheduled one-off events;

Residual refers to unforeseen expenditure resulting from shocks or government decisions.

Figure 8 reflects the analysis of the autocorrelation functions (ACF) and partial autocorrelation functions (PACF) for the expenditure series and measures the degree of correlation of the time series with its own lagged values (lags). The results define clear patterns, which facilitate the identification of ARIMA/SARIMA models.

The presence of significant autocorrelation up to approximately lag 25 suggests that the series exhibits strong temporal dependence and potential seasonality or trend components. The PACF plot reveals significant partial autocorrelations at the first few lags, particularly at lag 1 and lag 5, indicating potential AR terms suitable for autoregressive modeling. The shaded confidence intervals allow visual identification of statistically significant lags. Values falling outside these bands denote non-random correlation and are candidates for inclusion in ARIMA or other time series models.

The performance of the univariate models for the public expenditure series is presented in

Table 2. The results for the public expenditure series are significantly different and much more encouraging, especially for one of the models. The univariate TCN model stands out clearly, obtaining an R

2 of 0.713132. This is a good result, indicating that the model explains over 71% of the variance in the total expenditure series. The RMSE (0.275900) and MAPE (26.439529%) errors are also the lowest recorded to date in the entire analysis, indicating a significantly better fit of the model to the data and superior predictive potential. A MAPE of around 26% is still notable, but considerably better than what was observed for income, and starts to approach an acceptable level for some planning applications.

In contrast to the income series, the univariate SARIMA model successfully achieves a commendable positive R2 (0.324851) for total expenditure, accompanied by a MAPE of 39.59%. This suggests that the expenditure series possesses a temporal structure that SARIMA can partially capture. This stands in stark contrast to the income series, where SARIMA consistently underperformed, implying that the patterns in total expenditure align more closely with the assumptions of the SARIMA model.

The univariate LSTM performs similarly to SARIMA in terms of R2 (0.280283), but with a slightly better MAPE (31.26%). The univariate GRU model, however, fails (R2 = −0.212887), as does the univariate linear regression (R2 = −7.331381), which continues to be the weakest model in all univariate scenarios. The superior performance of the univariate TCN for the public expenditure series suggests that the temporal convolutional network architecture, with its ability to model long-term dependencies over a large receptive field and to process sequences in parallel, is particularly well-suited to capturing the complex and inertial patterns in this specific series.

Figure 9 illustrates the comparison of the results obtained by applying the univariate models to total expenditure.

The performance of the multivariate models for the public expenditure series is presented in

Table 3. Regrettably, the shift to multivariate models for the Public Expenditure Series results in a significant decline in performance compared to the top univariate model (TCN Univariate). The TCN Multivariate model, which performed exceptionally well in its univariate form, now sees its

R2 drop to only 0.094000. However, it maintains a relatively controlled MAPE of 30.22%, which is only marginally higher than that of the univariate version. This substantial reduction in

R2 indicates that the inclusion of exogenous variables did not effectively contribute to explaining the long-term variance.

Figure 10 illustrates the progression of the training loss for the total expenditure model.

The GRU Multivariate model achieves the second-best R2 (0.053612) and, notably, records the lowest MAPE among all models tested for the Public Expenditure Series, with a value of 22.67%. In contrast, the Multivariate LSTM presents a zero R2 (−0.001412). Yet, it boasts an even lower MAPE of 21.04%, making it the top performer in terms of average absolute percentage error for this category. This paradox, where the GRU and Multivariate LSTM exhibit poor R2 values but promising MAPE results, suggests that while these models may struggle to explain the overall variance of the series and capture major trends, they excel in making point predictions that are, on average, more accurate in percentage terms. This phenomenon might be attributed to their capability to detect certain short-term fluctuations or local relationships with exogenous variables, despite their inability to fully grasp and model the long-term dynamics or the magnitude of changes.

All other models (Multivariate SARIMA, Multivariate Linear Regression, Multivariate ECM, Multivariate VAR) have negative R2, indicating that the addition of exogenous variables, in the current configuration, introduced more “noise” than useful information for the forecast of total expenditures. The failure of VAR and ECM is again pronounced, highlighting the difficulty of their application without a thorough analysis of the preconditions (stationarity, cointegration).

Figure 11 illustrates the Comparison of results for the application of multivariate models to total expenditure.

Figure 12 illustrates the forecast of the best models for Total Expenditure.

These empirical results reveal a nuanced landscape of model performance that varies significantly across forecasting contexts. The TCN demonstrates exceptional capability in the univariate setting, achieving an R2 of 0.71 for total expenditure forecasting, which represents a 30–40% reduction in MAPE compared to the classical linear regression baseline. However, this superior performance is context-dependent and does not universally translate to multivariate settings, where the R2 drops to 0.094. This deterioration suggests that the inclusion of exogenous macroeconomic variables introduces noise that overwhelms the signal, potentially due to asynchronous relationships between economic indicators and budget execution cycles. The MAPE values, ranging from 21% to 26% across various configurations, while seemingly high, are consistent with the inherent volatility of monthly budget data and comparable to results reported in similar public finance forecasting studies.

The heterogeneous performance across model classes can be attributed to several factors. Budget inertia, stemming from multi-year contractual commitments and rigid personnel costs (representing approximately 60% of total expenditures), creates strong autoregressive patterns that univariate models exploit effectively. Conversely, the failure of multivariate VAR and ECM models (negative R2 values) indicates violations of their fundamental assumptions—stationarity and stable cointegration relationships—which are frequently disrupted by policy changes and external economic shocks. The multicollinearity among exogenous variables (correlation coefficients greater than 0.7 between GDP growth and unemployment) further degrades the performance of the multivariate model.

Forecasting total expenditure appears to be more feasible than revenue forecasts, particularly through univariate approaches. The Univariate TCN model demonstrated commendable predictive capacity (R2 ≈ 0.713, MAPE ≈ 26.44), establishing it as a viable candidate for practical short-term monitoring and planning applications. Additionally, the Univariate SARIMA model exhibited greater potential than for revenue forecasts, indicating a more regular temporal structure. The general underperformance of multivariate models of R2 suggests that the relationship between aggregate expenditures and general macroeconomic indicators may be weak at the monthly level or may require more sophisticated modeling techniques that account for potential non-linearities, threshold effects, or variable lags. Despite their lower R2 values, the relatively good MAPEs recorded by GRU and multivariate LSTM (around 21–23%) warrant further exploration, perhaps through residual analysis or sub-period testing, to determine whether they capture specific dynamics that R2 does not adequately reflect.

5. Discussion

A fundamental finding is that the accuracy of the forecasts, assessed primarily by the coefficient of determination (R2), varied considerably, being generally modest to poor for most of the scenarios tested. The only case in which a performance considered reasonable in the context of economic time series (R2 > 0.7) was obtained was for the Total Expenditures aggregate, and this exclusively through the Univariate TCN model (R2 = 0.713). This result suggests that the internal dynamics of total expenditure, likely due to the inertia of major components such as personnel costs, social assistance, or multi-year contractual commitments, exhibit a higher degree of regularity and predictability based on their own history. Budgetary planning, although flexible, tends to anchor current expenditure to previous ones, creating an intrinsic predictability that TCN has been able to exploit effectively.

Although the reported experiments demonstrate relative improvements of AI-based models compared to classical econometric approaches, the generally low R2 values across several specifications highlight essential limitations. From a statistical perspective, these values indicate that a substantial share of expenditure volatility remains unexplained, reflecting the strong influence of policy shocks, discretionary spending, and structural rigidities that time-series models struggle to capture. For public institutions, this implies that forecast outputs should be treated as decision-support tools rather than precise predictors, informing budget monitoring and scenario analysis rather than directly determining allocations. The modest explanatory power thus highlights the need to combine AI forecasts with expert judgment and institutional knowledge in operational practice.

The experiments clearly showed that there is no single universal “winner” model, successfully applicable to all budget series and in all configurations. However, certain trends regarding the suitability of specific model classes can be identified. The TNC architecture demonstrated remarkable potential in the univariate regime, ranking as the best-performing model for the Public Expenditure Series, explaining over 71% of the variance. Its efficiency stems from the use of dilated causal convolutions, which enable a large receptive field (the ability to “see” far into the past) without requiring an excessive number of parameters or layers. Additionally, its non-recurrent nature facilitates parallelization and potentially more stable training compared to RNNs. TCN seems to be particularly well-suited for series with long-term dependencies and complex patterns, but without a rigid seasonal structure.

A simplified version of LSTM, GRU was generally inferior to both TCN and LSTM in univariate mode for most series in terms of R2. However, it presented interesting results in multivariate mode for Total Expenditure, where together with LSTM, it obtained the best MAPE values, despite weak R2, suggesting some ability to fit the values pointwise, even if not the general trend.

On the other hand, the SARIMA model records a decent and interpretable performance for the univariate Public Expenditure Series (R2 ≈ 0.325). Its significant contribution was in multivariate mode (SARIMAX) for Own Expenditure. From a comparative standpoint, SARIMA offers reasonable accuracy and the advantage of transparency, as its parameters directly capture seasonal and autoregressive components that practitioners in public institutions can easily understand. Its rigorous residual diagnostics further enhance interpretability and trust. However, SARIMA’s reliance on linear structures limits its ability to cope with structural breaks, intense volatility, and complex non-linear relationships that often characterize public expenditure data. In contrast, AI-based models such as LSTM, GRU, and TCN demonstrated greater flexibility in learning hidden patterns, robustness to irregular shocks, and adaptability to heterogeneous expenditure categories. These findings suggest that SARIMA remains a valuable benchmark due to its interpretability and diagnostic clarity. The strengths of SARIMA include the explicit modeling of trend, seasonality, and autocorrelation components, which also offer some interpretability. Its limitations are related to the assumption of linearity and the sometimes-laborious process of correctly identifying orders.

Classical models (linear and econometric) have primarily proven inadequate for capturing the complexity and potential non-linearity of monthly budget data, often resulting in a strongly negative R-squared value. Their strict assumptions (linearity, stationarity for VAR, stable cointegration for ECM) appear to be frequently violated by these time series, which are subject to external shocks, policy changes, and complex endogenous dynamics.

The research results indicate that AI can significantly enhance the accuracy of budget forecasts compared to traditional methods, including linear regression and econometric models. The use of AI contributes to increasing transparency and accountability in the management of public funds, providing more detailed and well-founded forecasts. The case study of the local public institution demonstrates the practical benefits of implementing AI and provides recommendations for other public institutions.

AI models reduced the average forecast error compared to traditional models by up to 30–40%; for Total Expenditures, the univariate TCN reached R2 ≈ 0.71, the highest in the study.

For Own Expenditures—a volatile and challenging series—the only notable improvement came from multivariate SARIMA (R2 ≈ 0.23).

The hypotheses formulated in this research aimed to provide a theoretical foundation for exploring the applicability and efficiency of AI algorithms in public budget forecasting. Descriptive analysis and qualitative methods identified the main technical and organizational challenges faced by the public budget forecasting process, as well as the specific opportunities and difficulties associated with it. This explored the possibility of monitoring public expenditure through the implementation of AI algorithms.

The applied study highlighted the complex nature of the budget forecasting process, revealing the need for rigorous modeling of financial accounting data through advanced methods that can be applied today due to the existence of digital platforms. It successfully proposed an innovative methodological framework for budget forecasting in public accounting, which partially supports H1.

By utilizing budget data provided by public institutions and analyzing case studies to document and assess the necessary changes and the impact of AI implementation on existing systems, it was found that the implementation of AI algorithms in the development of public budgets leads to a more efficient use of financial resources, thereby validating H2.

The implementation and testing of the proposed forecasting model in a real context enabled the analysis of AI’s impact on existing systems, leading to the conclusion that integrating AI algorithms into budget processes is feasible without major disruptions, thereby validating H3.

On a practical level, the effective implementation of AI in budget processes enables public institutions to utilize powerful tools for enhancing the management of financial resources, thereby contributing to long-term economic stability and sustainability. The application of AI in this area improves the accuracy of forecasts and contributes to a more accountable and transparent management of public funds. The potential impact of this research is significant, as it can positively influence public policies and accounting practices at the macroeconomic level.

A tiered forecasting system is proposed for public administration, strategically leveraging the strengths of various predictive models to enhance decision-making. The operational framework consists of three key components: (i) a primary forecasting layer that TCN for total expenditure projections, updated every month; (ii) a monitoring dashboard that provides real-time forecast accuracy metrics, including automated alerts triggered when the MAPE exceeds 20%, thereby indicating the necessity for expert review; and (iii) a fallback mechanism that employs SARIMA models during periods of extreme volatility or when indicators suggest that the performance of deep learning models may be deteriorating. This tiered approach not only enhances decision-making but also strengthens transparency and governance by making forecast reliability explicit and ensuring institutional accountability.

The computational demands of this system are relatively modest; model training is completed within a timeframe of 10 min on standard GPU infrastructure, such as the NVIDIA RTX 3060 or an equivalent model, while monthly forecast inference requires less than one second. The system’s deployment necessitates the involvement of one to two data scientists for initial setup and quarterly model retraining, with operational costs projected to be between €50,000 and €70,000 annually for a medium-sized municipality.

The deployment of artificial intelligence models in public financial management underscores the need for robust governance frameworks that enhance transparency, accountability, and mitigate bias. It is advisable to implement Shapley Additive Explanations (SHAP) to deliver interpretable justifications for each forecast, thereby facilitating public administrators’ comprehension of the primary factors influencing predictions. Furthermore, model decisions should be subject to auditability through comprehensive logging of inputs, outputs, and model versions. Quarterly bias monitoring is also recommended to assess whether forecasts yield systematic under- or over-predictions for specific expenditure categories or temporal frames. Additionally, human oversight is essential, as AI-generated forecasts should serve to inform, rather than replace, expert judgment, particularly in contexts related to strategic budget allocations that significantly impact public services.

The limitations of the research arise from the extent to which certain factors can be managed, including the quality of public data, the varying degrees of digitalization, the acceptance of technology, and the level of training among the professionals involved. These elements could hinder the widespread implementation of the solution. To address this, it is advisable to invest in infrastructure, standardize data, provide professional training, and conduct algorithm testing across multiple institutions and with real-time data sources.

Regarding the limitations of the proposed architectures, the MLP issues of weak scalability and overfitting were addressed by constraining model complexity and applying dropout and early stopping. In the case of the LSTM, the tendency to overfit small datasets and its weaker performance on long sequences were mitigated by the relatively short 12-month input window and by validation-based early stopping. The GRU was recognized as requiring larger datasets to unlock its full potential; in this study, its performance was limited by data scarcity, highlighting the need for future remedies such as transfer learning or data augmentation. Finally, TCN was noted to entail higher memory usage. However, in practice, this requirement remained manageable on standard GPU infrastructure. Design adjustments, such as smaller kernels or optimized causal convolutions, were identified as possible enhancements. Overall, the discussion emphasized that while each architecture exhibited inherent limitations, these could be partially overcome through methodological safeguards, and that such constraints contextualized rather than undermined the validity of the empirical findings.

Although the present study provides a systematic comparison between deep learning and econometric models, further extensions are necessary to strengthen the robustness of the conclusions. Future work should incorporate additional classical baselines, such as Seasonal Naïve, ETS, Prophet, and a controlled Transformer benchmark once data length permits, to situate AI performance within a broader forecasting tradition. The exploration of transfer learning techniques is warranted to utilize data from municipalities exhibiting analogous demographic and economic profiles, thereby addressing challenges related to data scarcity in smaller administrative units. Moreover, the application of formal statistical significance tests, including the Diebold–Mariano procedure, along with effect size measures, will enable a more rigorous assessment of comparative accuracy. Expanding the scope of evaluation in this way will consolidate the methodological framework and provide greater confidence for policy applications in public finance forecasting. Another future direction is to expand the results obtained through the possibility of replication and integration into an integrated implementation model on a national scale.

6. Conclusions

The research explores how AI technologies can be integrated into existing public accounting systems to optimize the budgeting process. Moreover, in the current economic and financial environment, characterized by increasing volatility and complexity, public institutions must have advanced tools that allow them to better anticipate and manage budget revenues and expenditures. AI algorithms offer superior analysis and prediction capabilities, which can fundamentally transform the way accounting forecasts are made.

The study analyzed both the potential benefits and challenges associated with implementing AI in public expenditure, to provide practical and theoretical recommendations for the effective use of these technologies. This analysis encompassed several stages, including the integration of AI into public budgeting processes, the identification and validation of the most effective AI algorithms, and the development of a specific forecasting model tailored for the public sector. This process ultimately led to the optimization and streamlining of budgeting processes in smart cities.

The conclusions are directly supported by the empirical evidence obtained. The superior performance of TCN in univariate forecasting demonstrates the ability of AI to capture strong autoregressive and seasonal patterns in expenditure data. In contrast, the weaker results in multivariate contexts reveal the challenges posed by noisy exogenous indicators. Traditional econometric models confirmed their limitations under these conditions, further emphasizing that AI methods can provide added value primarily when aligned with the structural properties of the data. These findings justify the recommendation that AI should be integrated selectively, in settings where its comparative advantages are most evident.

At the same time, the conclusions of this study must be interpreted with consideration for the inherent limitations of the proposed approaches. Each of the analyzed architectures demonstrated context-dependent strengths and weaknesses, which highlights the importance of aligning methodological choices with the specific conditions of public finance data. Rather than presenting AI models as universally superior, the findings underline that their value lies in complementing, rather than replacing, traditional econometric approaches. By recognizing these constraints and adopting appropriate safeguards, such as regularization, human oversight, and transparent governance frameworks, public administrations can integrate AI responsibly, ensuring that technological innovation serves the principles of accountability, transparency, and fiscal sustainability.

The research results are of great importance both theoretically and practically. Theoretically, the research contributes to expanding the existing knowledge on the application of AI in public accounting, proposes a methodological framework for integrating this technology into budgeting processes, and opens new research directions. The recommendations formulated support the adoption of AI by public institutions, promoting investments in technology and professional training, and emphasizing the need for an appropriate technological and regulatory framework.