Driving Sustainable Value. The Dynamic Interplay Between Artificial Intelligence Disclosure, Financial Reporting Quality, and ESG Scores

Abstract

1. Introduction

2. Theoretical Background and Research Hypotheses

3. Materials and Methods

4. Results and Discussion

4.1. Results

4.2. Discussion

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Gajevszky, A. Do Specific Corporate Governance Attributes Contribute to the Quality of Financial Reporting? Evidence from Romania. J. Econ. Bus. Manag. 2016, 4, 15–22. [Google Scholar] [CrossRef]

- Nguyen, T.H.; Vu, L.P.T.; Mai, A.N.; Tran, T.Q. Do Narrative-Related Disclosures in the Annual Report Enhance Firm Value? New Evidence from an Emerging Market. Int. Rev. Financ. Anal. 2025, 102, 104077. [Google Scholar] [CrossRef]

- Wedari, L.K.; Shafadila, G.A. Factors Affecting Corporate Social Responsibility Web Disclosure: Evidence from the Consumer Sector in Indonesia. Int. J. Sustain. Dev. Plan. 2022, 17, 2655–2667. [Google Scholar] [CrossRef]

- Ferguson, C.; Seow, P.-S. Accounting Information Systems Research over the Past Decade: Past and Future Trends: Accounting and Finance. Account. Financ. 2011, 51, 235–251. [Google Scholar] [CrossRef]

- Farcane, N.; Iordache, E.; Bogdan, V. Romanian Practitionners and the Use of Estimates in Romanian Business Environment. Ann. Univ. Apulensis-Ser. Oecon. 2010, 1, 134–151. [Google Scholar] [CrossRef]

- Bertomeu, J. Machine Learning Improves Accounting: Discussion, Implementation and Research Opportunities. Rev. Account. Stud. 2020, 25, 1135–1155. [Google Scholar] [CrossRef]

- Ding, K.; Lev, B.; Peng, X.; Sun, T.; Vasarhelyi, M.A. Machine Learning Improves Accounting Estimates: Evidence from Insurance Payments. Rev. Account. Stud. 2020, 25, 1098–1134. [Google Scholar] [CrossRef]

- Mohammed, M.M. Importance of Accounting Information in Management Decision-Making Process. J. Stud. Sci. Eng. 2022, 2, 42–56. [Google Scholar] [CrossRef]

- Zeng, Y. Neural Network Technology-Based Optimization Framework of Financial and Management Accounting Model. Comput. Intell. Neurosci. 2022, 2022, 4991244. [Google Scholar] [CrossRef]

- Salawu, M.K.; Moloi, T.S. Critical Factors for Accounting Estimation of Investment in Artificial Intelligence: An Imperative for Accounting Standards Setters in the Fourth Industrial Revolution Era. J. Account. Manag. 2020, 10, 39–48. [Google Scholar]

- Gao, Y.; Liu, Z.; Niu, G.; Huang, M. Automatic Measurement Method of Information Disclosure in Listed Enterprises’ Annual Reports under the Idea of Digital Twins. In Proceedings of the 2021 IEEE 1st International Conference on Digital Twins and Parallel Intelligence (DTPI), IEEE, Beijing, China, 15 July 2021; pp. 382–385. [Google Scholar]

- Baldwin, A.A.; Brown, C.E.; Trinkle, B.S. Opportunities for Artificial Intelligence Development in the Accounting Domain: The Case for Auditing. Intell. Syst. Acc. Fin. Mgmt. 2006, 14, 77–86. [Google Scholar] [CrossRef]

- Loukeris, N. Corporate Financial Analysis with Efficient Logistic Regressions and Hybrids of Neuro-Genetic Networks. In Proceedings of the 11th WSEAS International Conference on COMPUTERS, Agios Nikolaos, Crete Island, Greece, 26–28 July 2007; pp. 689–694. [Google Scholar]

- Cho, S.; Vasarhelyi, M.A.; Sun, T.; Zhang, C. Learning from Machine Learning in Accounting and Assurance. J. Emerg. Technol. Account. 2020, 17, 1–10. [Google Scholar] [CrossRef]

- Naveed, K.; Farooq, M.B.; Zahir-Ul-Hassan, M.K.; Rauf, F. AI Adoption, ESG Disclosure Quality and Sustainability Committee Heterogeneity: Evidence from Chinese Companies. Medit. Account. Res. 2025, 33, 708–732. [Google Scholar] [CrossRef]

- Shimamura, T.; Tanaka, Y.; Managi, S. Evaluating the Impact of Report Readability on ESG Scores: A Generative AI Approach. Int. Rev. Financ. Anal. 2025, 101, 104027. [Google Scholar] [CrossRef]

- Zhou, X.; Li, G.; Wang, Q.; Li, Y.; Zhou, D. Artificial Intelligence, Corporate Information Governance and ESG Performance: Quasi-Experimental Evidence from China. Int. Rev. Financ. Anal. 2025, 102, 104087. [Google Scholar] [CrossRef]

- Kaplan, A.; Haenlein, M. Siri, Siri, in My Hand: Who’s the Fairest in the Land? On the Interpretations, Illustrations, and Implications of Artificial Intelligence. Bus. Horiz. 2019, 62, 15–25. [Google Scholar] [CrossRef]

- Mbaidin, H.O.; Sbaee, N.Q.; AlMubydeen, I.O.; Chindo, U.M.; Alomari, K.M. The Role of AI Integration and Governance Standards: Enhancing Financial Reporting Quality in Islamic Banking. Grow. Sci. 2024, 13, 83–98. [Google Scholar] [CrossRef]

- Al Tarawneh, E.; Alqaraleh, M.H.; Ali, B.; Bani, A. A The Impact of the Efficiency and Effectiveness of Electronic Accounting Information Systems on the Quality of Accounting Information. Inf. Sci. Lett. 2023, 12, 1685–1692. [Google Scholar] [CrossRef]

- Ashraf, M. Does Automation Improve Financial Reporting? Evidence from Internal Controls. Rev. Account. Stud. 2025, 30, 436–479. [Google Scholar] [CrossRef]

- Fülöp, M.T.; Topor, D.I.; Ionescu, C.A.; Căpușneanu, S.; Breaz, T.O.; Stanescu, S.G. Fintech Accounting and Industry 4.0: Future-Proofing or Threats to the Accounting Profession? J. Bus. Econ. Manag. 2022, 23, 997–1015. [Google Scholar] [CrossRef]

- Commerford, B.P.; Dennis, S.A.; Joe, J.R.; Ulla, J.W. Man Versus Machine: Complex Estimates and Auditor Reliance on Artificial Intelligence. J. Account. Res. 2022, 60, 171–201. [Google Scholar] [CrossRef]

- Gurmu, A.; Miri, M.P. Machine Learning Regression for Estimating the Cost Range of Building Projects. Constr. Innov. 2025, 25, 577–593. [Google Scholar] [CrossRef]

- Shiyyab, F.S.; Alzoubi, A.B.; Obidat, Q.M.; Alshurafat, H. The Impact of Artificial Intelligence Disclosure on Financial Performance. Int. J. Financ. Stud. 2023, 11, 115. [Google Scholar] [CrossRef]

- Bonsón, E.; Bednárová, M. Artificial Intelligence Disclosures in Sustainability Reports: Towards an Artificial Intelligence Reporting Framework. In Digital Transformation in Industry; Kumar, V., Leng, J., Akberdina, V., Kuzmin, E., Eds.; Lecture Notes in Information Systems and Organisation; Springer International Publishing: Cham, Switzerland, 2022; Volume 54, pp. 391–407. ISBN 978-3-030-94616-6. [Google Scholar]

- Bonsón, E.; Bednárová, M.; Perea, D. Disclosures about Algorithmic Decision Making in the Corporate Reports of Western European Companies. Int. J. Account. Inf. Syst. 2023, 48, 100596. [Google Scholar] [CrossRef]

- Dwivedi, Y.K.; Kshetri, N.; Hughes, L.; Slade, E.L.; Jeyaraj, A.; Kar, A.K.; Baabdullah, A.M.; Koohang, A.; Raghavan, V.; Ahuja, M.; et al. Opinion Paper: “So What If ChatGPT Wrote It?” Multidisciplinary Perspectives on Opportunities, Challenges and Implications of Generative Conversational AI for Research, Practice and Policy. Int. J. Inf. Manag. 2023, 71, 102642. [Google Scholar] [CrossRef]

- Buçinca, Z.; Swaroop, S.; Paluch, A.E.; Murphy, S.A.; Gajos, K.Z. Towards Optimizing Human-Centric Objectives in AI-Assisted Decision-Making with Offline Reinforcement Learning. arXiv 2024, arXiv:2403.05911. [Google Scholar]

- Przegalinska, A.; Triantoro, T. Converging Minds: The Creative Potential of Collaborative AI, 1st ed.; Human factors in design, engineering, and computing; CRC Press: Boca Raton, FL, USA, 2024; ISBN 978-1-032-62687-1. [Google Scholar]

- Li, Z.; Zheng, L. The Impact of Artificial Intelligence on Accounting. In Proceedings of the 2018 4th International Conference on Social Science and Higher Education (ICSSHE 2018); Atlantis Press: Sanya, China, 2018. [Google Scholar]

- Brabete, V.; Barbu, C.M.; Circiumaru, D.; Goagara, D.; Berceanu, D. Redesign of Accounting Education to Meet the Challenges of Artificial Intelligence—A Literature Review. Amfiteatru Econ. 2024, 26, 275. [Google Scholar] [CrossRef]

- Downen, T.; Kim, S.; Lee, L. Algorithm Aversion, Emotions, and Investor Reaction: Does Disclosing the Use of AI Influence Investment Decisions? Int. J. Account. Inf. Syst. 2024, 52, 100664. [Google Scholar] [CrossRef]

- Estep, C.; Griffith, E.E.; MacKenzie, N.L. How Do Financial Executives Respond to the Use of Artificial Intelligence in Financial Reporting and Auditing? Rev. Account. Stud. 2024, 29, 2798–2831. [Google Scholar] [CrossRef]

- Tiron-Tudor, A.; Hurghis, R.; Topor, D.I. A Holistic Review of Determinants and Effects of Integrated Reporting Adoption. Bus. Adm. Manag. 2022, 25, 100–117. [Google Scholar] [CrossRef]

- Babina, T.; Fedyk, A.; He, A.; Hodson, J. Artificial Intelligence, Firm Growth, and Product Innovation. J. Financ. Econ. 2024, 151, 103745. [Google Scholar] [CrossRef]

- Przegalinska, A.; Triantoro, T.; Kovbasiuk, A.; Ciechanowski, L.; Freeman, R.B.; Sowa, K. Collaborative AI in the Workplace: Enhancing Organizational Performance through Resource-Based and Task-Technology Fit Perspectives. Int. J. Inf. Manag. 2025, 81, 102853. [Google Scholar] [CrossRef]

- Liu, X.; Cifuentes-Faura, J.; Yang, X.; Pan, J. The Green Innovation Effect of Industrial Robot Applications: Evidence from Chinese Manufacturing Companies. Technol. Forecast. Soc. Change 2025, 210, 123904. [Google Scholar] [CrossRef]

- Andersson, D.; Berger, T.; Prawitz, E. Making a Market: Infrastructure, Integration, and the Rise of Innovation. Rev. Econ. Stat. 2023, 105, 258–274. [Google Scholar] [CrossRef]

- Ding, C.; Ke, J.; Levine, M.; Zhou, N. Potential of Artificial Intelligence in Reducing Energy and Carbon Emissions of Commercial Buildings at Scale. Nat. Commun. 2024, 15, 5916. [Google Scholar] [CrossRef] [PubMed]

- Martínez-Ros, E.; Kunapatarawong, R. Green Innovation and Knowledge: The Role of Size. Bus. Strat. Environ. 2019, 28, 1045–1059. [Google Scholar] [CrossRef]

- Odugbesan, J.A.; Aghazadeh, S.; Al Qaralleh, R.E.; Sogeke, O.S. Green Talent Management and Employees’ Innovative Work Behavior: The Roles of Artificial Intelligence and Transformational Leadership. J. Knowl. Manag. 2023, 27, 696–716. [Google Scholar] [CrossRef]

- Wen, X.; Sun, Y.; Ma, H.-L.; Chung, S.-H. Green Smart Manufacturing: Energy-Efficient Robotic Job Shop Scheduling Models. Int. J. Prod. Res. 2023, 61, 5791–5805. [Google Scholar] [CrossRef]

- Raza, H.; Khan, M.A.; Mazliham, M.S.; Alam, M.M.; Aman, N.; Abbas, K. Applying Artificial Intelligence Techniques for Predicting the Environment, Social, and Governance (ESG) Pillar Score Based on Balance Sheet and Income Statement Data: A Case of Non-Financial Companies of USA, UK, and Germany. Front. Environ. Sci. 2022, 10, 975487. [Google Scholar] [CrossRef]

- Lei, X.; Xu, Q.; Jin, C. Nature of Property Right and the Motives for Holding Cash: Empirical Evidence from Chinese Listed Companies. Manag. Decis. Econ. 2022, 43, 1482–1500. [Google Scholar] [CrossRef]

- He, L.; Mu, L.; Jean, J.A.; Zhang, L.; Wu, H.; Zhou, T.; Bu, H. Contributions and Challenges of Public Health Social Work Practice during the Initial 2020 COVID-19 Outbreak in China. Br. J. Soc. Work. 2022, 52, 4606–4621. [Google Scholar] [CrossRef]

- Yao, L.; Li, X.; Zheng, R.; Zhang, Y. The Impact of Air Pollution Perception on Urban Settlement Intentions of Young Talent in China. Int. J. Environ. Res. Public Health 2022, 19, 1080. [Google Scholar] [CrossRef]

- Fluharty-Jaidee, J.; Neidermeyer, P. Artificial Intelligence and Environmental, Social and Governmental Issues: A Current Perspective. In Handbook of Big Data and Analytics in Accounting and Auditing; Rana, T., Svanberg, J., Öhman, P., Lowe, A., Eds.; Springer Nature: Singapore, 2023; pp. 89–103. ISBN 978-981-19-4459-8. [Google Scholar]

- Zhang, D. The Pathway to Curb Greenwashing in Sustainable Growth: The Role of Artificial Intelligence. Energy Econ. 2024, 133, 107562. [Google Scholar] [CrossRef]

- Tian, X.; Shi, D. Facilitating or Inhibiting: A Study on the Impact of Artificial Intelligence on Corporate Greenwashing. Sustainability 2025, 17, 2154. [Google Scholar] [CrossRef]

- Sustainalytics—A Morningstar Company. ESG Risk Ratings-Methodology Abstract Version 2.1. 2021. Available online: https://www.scribd.com/document/552226139/Sustainalytics-ESG-Ratings-Methodology-Abstract (accessed on 15 March 2024).

- Beck, R.; Avital, M.; Rossi, M.; Thatcher, J.B. Blockchain Technology in Business and Information Systems Research. Bus. Inf. Syst. Eng. 2017, 59, 381–384. [Google Scholar] [CrossRef]

- Patricia Silva, A.; Azevedo, G.; Pedro Marques, R. Artificial Intelligence in Accounting: Literature Review. In Proceedings of the 2022 17th Iberian Conference on Information Systems and Technologies (CISTI), IEEE, Madrid, Spain, 22 June 2022; pp. 1–6. [Google Scholar]

- Chang, V.; Baudier, P.; Zhang, H.; Xu, Q.; Zhang, J.; Arami, M. How Blockchain Can Impact Financial Services—The Overview, Challenges and Recommendations from Expert Interviewees. Technol. Forecast. Soc. Change 2020, 158, 120166. [Google Scholar] [CrossRef]

- Grosu, V.; Cosmulese, C.G.; Socoliuc, M.; Ciubotariu, M.-S.; Mihaila, S. Testing Accountants’ Perceptions of the Digitization of the Profession and Profiling the Future Professional. Technol. Forecast. Soc. Change 2023, 193, 122630. [Google Scholar] [CrossRef]

- Armstrong, C.S.; Barth, M.E.; Jagolinzer, A.D.; Riedl, E.J. Market Reaction to the Adoption of IFRS in Europe. Account. Rev. 2010, 85, 31–61. [Google Scholar] [CrossRef]

- Dechow, P.M.; Sloan, R.G.; Sweeney, A.P. Causes and Consequences of Earnings Manipulation: An Analysis of Firms Subject to Enforcement Actions by the SEC*. Contemp. Accting Res. 1996, 13, 1–36. [Google Scholar] [CrossRef]

- Hosmer, D.W.; Lemeshow, S. Applied Logistic Regression, 1st ed.; Wiley: Hoboken, NJ, USA, 2000; ISBN 978-0-471-35632-5. [Google Scholar]

- Breiman, L. Random Forests. Mach. Learn. 2001, 45, 5–32. [Google Scholar] [CrossRef]

- Hastie, T.; Tibshirani, R.; Friedman, J.H. The Elements of Statistical Learning: Data Mining, Inference, and Prediction, 2nd ed.; Springer Series in Statistics; Springer: New York, NY, USA, 2017; ISBN 978-0-387-84857-0. [Google Scholar]

- Liaw, A.; Wiener, M. Classification and Regression by randomForest. R News 2002, 2, 18–22. [Google Scholar]

- Syah, L.Y.; Nafsiah, S.N.; Saddhono, K. Linear Regression Statistic from Accounting Information System Application for Employee Integrity. J. Phys. Conf. Ser. 2019, 1339, 012131. [Google Scholar] [CrossRef]

- Ajibade, A.T.; Okutu, N.; Akande, F.; Kwarbai, J.D.; Olayinka, I.M.; Olotu, A. IFRS Adoption, Corporate Governance and Faithful Representation of Financial Reporting Quality in Nigeria’s Development Banks. Cogent Bus. Manag. 2022, 9, 2139213. [Google Scholar] [CrossRef]

- Bunget, O.C.; Lungu, C. Impactul Indicatorilor de Dimensiune a Companiilor Asupra Onorariului de Audit. Audit. Financ. 2023, 21, 477–482. [Google Scholar] [CrossRef]

- Cristea, L.M. Emerging IT Technologies for Accounting and Auditing Practice. Audit. Financ. 2020, 18, 731–751. [Google Scholar] [CrossRef]

- Hategan, C.-D.; Pitorac, R.-I.; Hategan, V.-P.; Imbrescu, C.M. Opportunities and Challenges of Companies from the Romanian E-Commerce Market for Sustainable Competitiveness. Sustainability 2021, 13, 13358. [Google Scholar] [CrossRef]

- Harraf, A.; Ghura, H. Potentials of Artificial Intelligence for Business Performance. In The Fourth Industrial Revolution: Implementation of Artificial Intelligence for Growing Business Success; Hamdan, A., Hassanien, A.E., Razzaque, A., Alareeni, B., Eds.; Studies in Computational Intelligence; Springer International Publishing: Cham, Switzerland, 2021; Volume 935, pp. 99–109. ISBN 978-3-030-62795-9. [Google Scholar]

- Lei, G.; Su, S.; Liao, W. Classification of Credit Card Holders Based on Random Forest Algorithm. In Proceedings of the 2021 the 5th International Conference on Machine Learning and Soft Computing, ACM, Sanya, China, 29–31 January 2021; pp. 29–32. [Google Scholar]

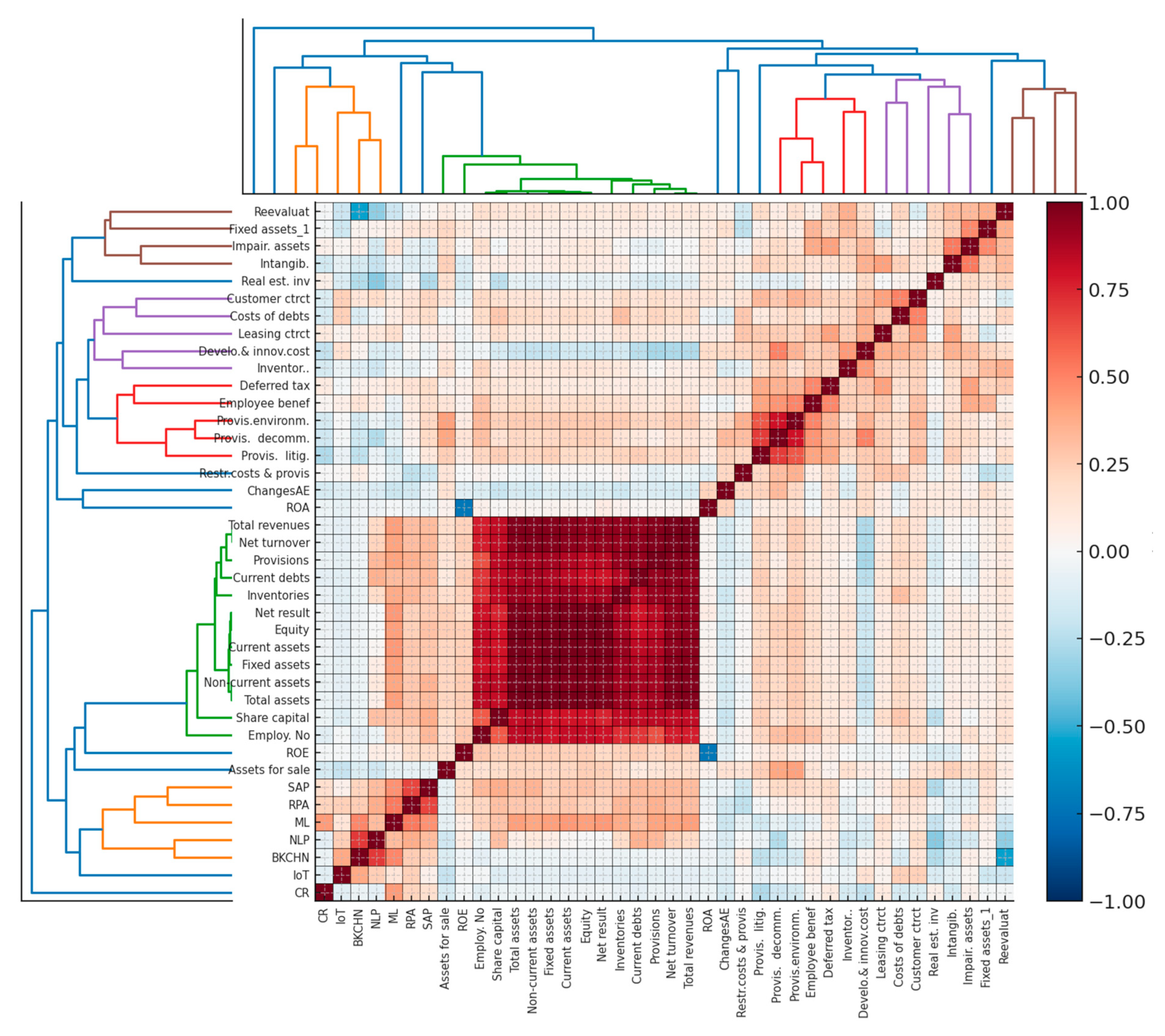

| Variables | Abbreviation | Measuring | Type of Variable |

|---|---|---|---|

| Financial performance | Fin_perform (FP) | Classical/traditional financial indicators | Dependent variable |

| Current ratio | CR | Current assets/current liabilities | Dependent variable |

| Return on assets | ROA | Net profit/total assets | Dependent variable |

| Return on equity | ROE | Net profit/equity | Dependent variable |

| Net result | NR | Net income | Dependent variable |

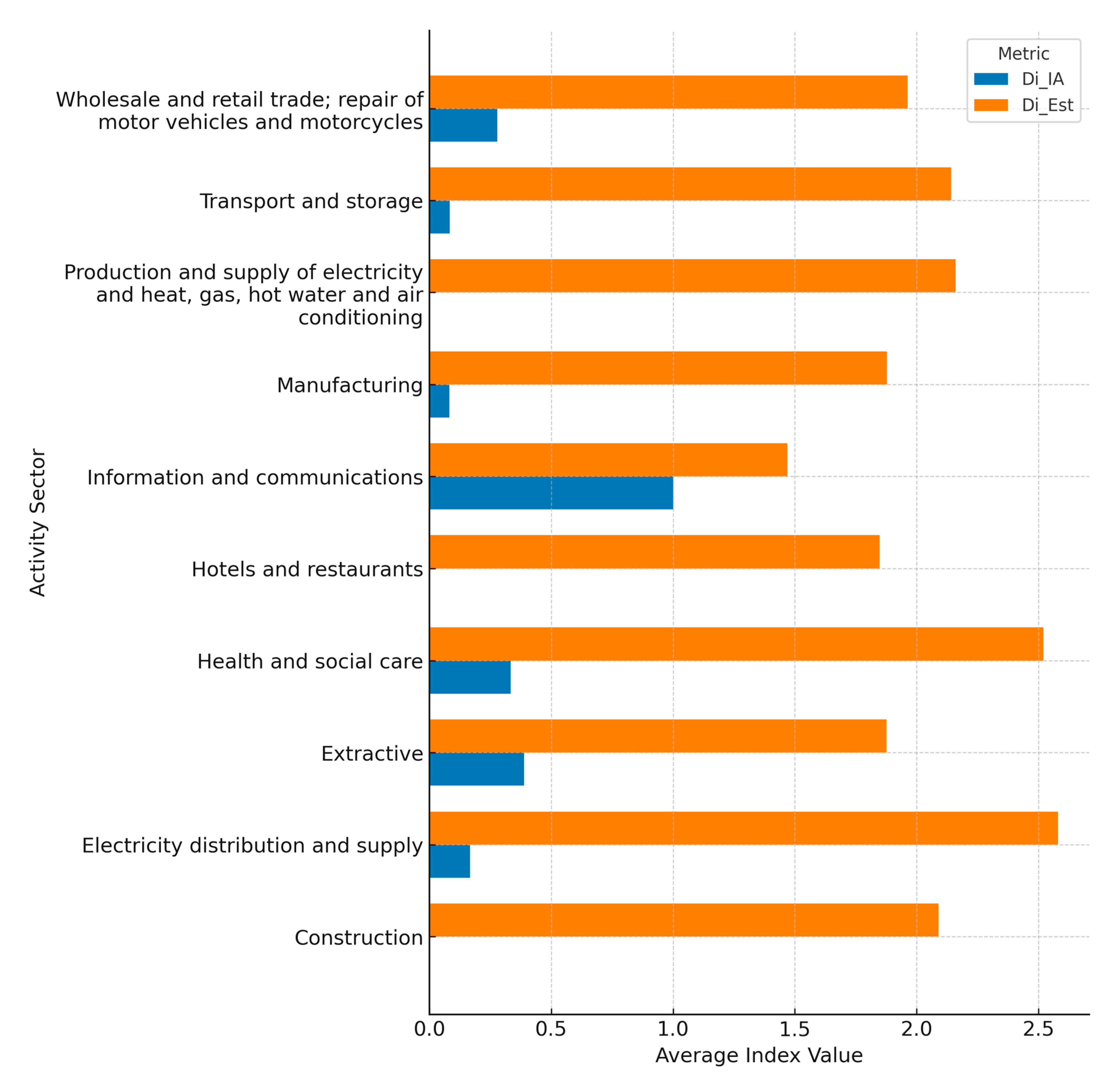

| The average disclosure degree of accounting estimates | Di_Est | x = information quantified according to the level of detail of the presentation in the financial reports n = number of quantified accounting estimates | Independent variable |

| The average disclosure score on changes in accounting estimates | Modif_Est | z = information quantified by 1 for the change in accounting estimate u = number of changes in accounting estimates | Independent variable |

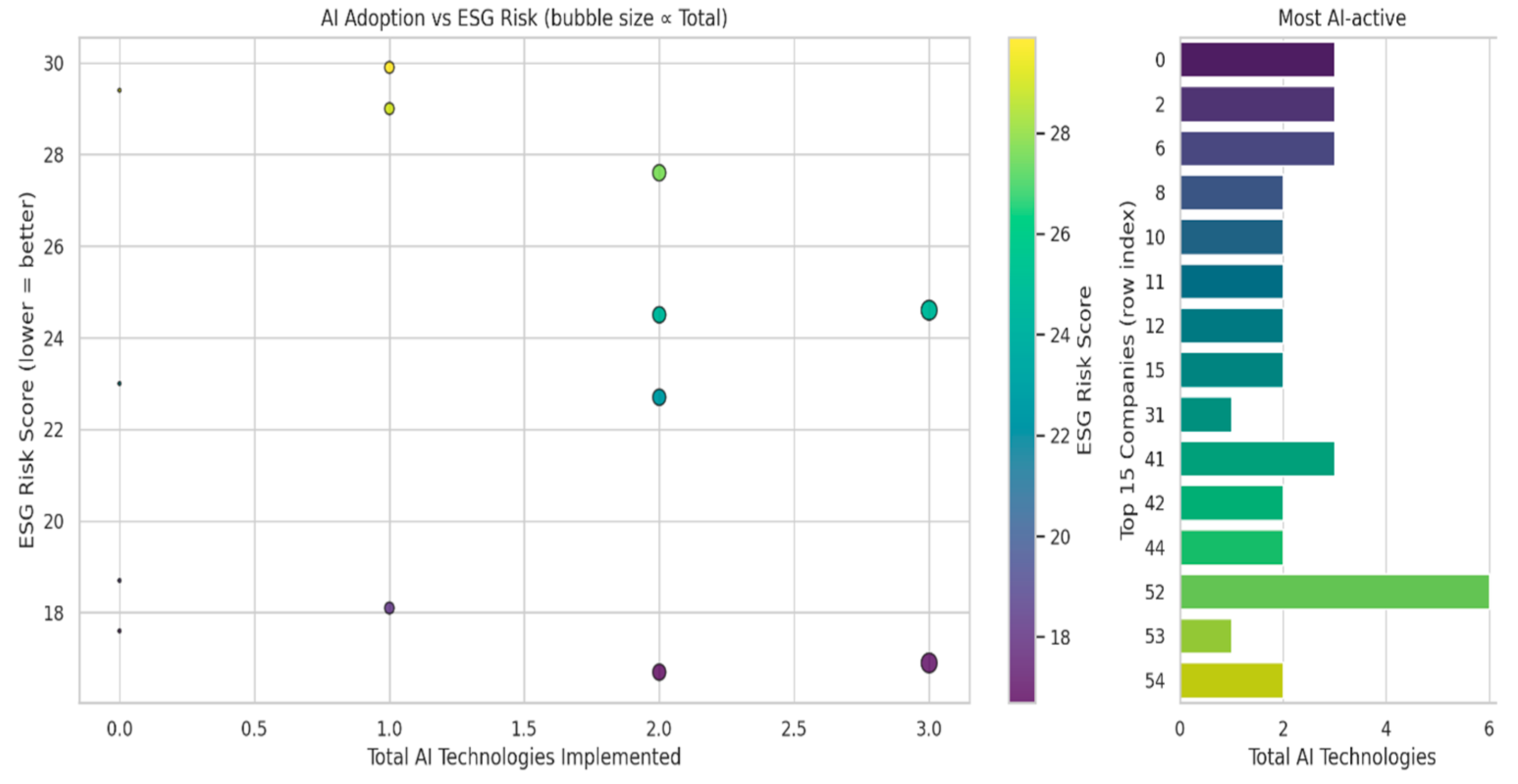

| The average disclosure score on information regarding the use of AI | Di_IA | y = information quantified by 1 for the AI technologies disclosed on the website t = number of AI technologies used | Dependent variable for testing H1/independent variable for testing H2 |

| The average number of employees | Sal | The average value of the number of employees for the analyzed period | Independent variable |

| Company size (total assets) | Size (TA) | The total value of assets for the investigated period | Independent variable |

| The industry in which the company operates | Ind | Industry type | Independent variable |

| Owner’s equity | Capital_pr. | Owner’s equity = Total assets—Liabilities | Independent variable |

| ESG performance scores | ESG risk score | Measures the magnitude of risks not managed by the company. Lower scores indicate that the company’s risks are not managed are lower [51]. | Independent variable |

| ESG exposure | The Sustainalytics Exposure Score measures a company’s exposure to various significant ESG issues, based on industry-specific factors. The higher the score, the higher the company’s exposure to relevant ESG issues [51]. | Independent variable | |

| ESG management | The Sustainalytics ESG management score measures the robustness of a company’s ESG programs, practices, and policies. A higher score indicates better performance in managing ESG risks [51]. | Independent variable | |

| ESG risk ranking Score | According to the Sustainalytics methodology [51], it shows how the company ranks among industry representatives. | Independent variable |

| Panel A | |||

|---|---|---|---|

| Financial performance indicators | |||

| Mean | Median | Std. Dev. | |

| ROA | 0.100021325 | 0.04513833 | 0.36161 |

| ROE | 0.051465779 | 0.060043015 | 0.191651 |

| CR | 225.336114 | 5.704113 | 962.5243 |

| Net result | 4.272653793 | 2.269164494 | 9.156484 |

| Aggregate score for disclosure of information on the use of artificial intelligence (AI) | 0.121 | 0 | 0.204 |

| ESG information | |||

| ESG risk score | 44.47692308 | 48 | 14.67834 |

| ESG exposure | 49.98461538 | 48.9 | 14.71569 |

| ESG management | 22.97692308 | 23 | 4.993188 |

| Company size | |||

| Large company | 1 | ||

| Medium company | 4 | ||

| Small company | 50 | ||

| Percentage of companies that recorded changes in accounting estimates | |||

| 1 (changes are present) | 43.64% | ||

| 0 (nonexistent changes) | 56.36% | ||

| Number of companies in each sector | |||

| The extractive industry | 3 | ||

| Manufacturing industry | 35 | ||

| Energy production and supply | 2 | ||

| Constructions | 1 | ||

| Wholesale and retail trade | 3 | ||

| Transportation and storage | 4 | ||

| Hotels and restaurants | 4 | ||

| Information and communications | 1 | ||

| Professional, scientific activities | 1 | ||

| Health and social care | 1 | ||

| Frequency of disclosure of information on the use of AI (%) | |||

| BKCHN | 1.82 | ||

| ML | 7.27 | ||

| NLP | 3.64 | ||

| RPA | 21.82 | ||

| IoT | 10.91 | ||

| SAP | 27.27 | ||

| INDUSTRY ID | Aggregate_Score AI | Company Size | Debts | Provisions | ESG MN | ESG EXPS | ESG RISK_SCORE | |

|---|---|---|---|---|---|---|---|---|

| INDUSTRY_ID | 1 | −0.30044 | 0.196039 | −0.11939 | −0.25583 | −0.51735 | −0.30131 | 0.102332 |

| Aggregate_Score_AI | −0.30044 | 1 | −0.1823 | −0.15942 | 0.091096 | 0.327376 | 0.065475 | −0.15088 |

| Company size | 0.196039 | −0.1823 | 1 | −0.7308 | −0.812 | −0.5684 | −0.6902 | −0.39247 |

| Debts | −0.11939 | −0.15942 | −0.7308 | 1 | 0.884615 | 0.510989 | 0.82967 | 0.813187 |

| Provisions | −0.25583 | 0.091096 | −0.812 | 0.884615 | 1 | 0.697802 | 0.917582 | 0.774725 |

| ESG_MANAGEMENT | −0.51735 | 0.327376 | −0.5684 | 0.510989 | 0.697802 | 1 | 0.851648 | 0.401099 |

| ESG_EXPOSURE | −0.30131 | 0.065475 | −0.6902 | 0.82967 | 0.917582 | 0.851648 | 1 | 0.763736 |

| ESG_RISK_SCORE | 0.102332 | −0.15088 | −0.39247 | 0.813187 | 0.774725 | 0.401099 | 0.763736 | 1 |

| Models | M1 ROA | M2 ROE | M3 CR | M4 NR (mil.lei) | M5 CR | M6 CR | M7 NR .(mil.lei) | M8 NR .(mil.lei) | M9 NR (mil.lei) | M10 NR mil.lei) |

|---|---|---|---|---|---|---|---|---|---|---|

| Medium company | −0.078 ** | −0.041 | 27.90 * | −5602.96 *** | 41.58 *** | 28.68 * | −5460.65 *** | −5530.44 *** | −5618.05 *** | −5857.26 *** |

| Small company | −0.147 *** | −0.136 ** | 42.11 ** | −6485.49 *** | 47.58 *** | 42.27 ** | −6455.42 *** | −6385.64 *** | −6475.43 *** | −6944.06 *** |

| Industry type (ref = health and social care) | ||||||||||

| Extractive industry | 0.06 *** | 0.079 | 40.28 ** | 393.34 | 23.43 | 36.32 ** | 337.22 | 407.01 | 494.50 * | |

| Manufacturing industry | 0.07 *** | 0.07 ** | 6.83 ** | −119.13 * | 1.79 *** | 0.758 | 24.79 ** | −83.53 | 42.505 *** | |

| Energy production and supply | 0.049 | 0.209 *** | 16.57 | 466.88 * | 6.127 | 9.91 | 583.13 ** | 533.30 * | 651.83 ** | |

| Constructions | −0.017 | 0.133 ** | 8.30 ** | −132.93 * | 1.958 *** | - | 39.44 *** | −80.17 | 39.44 *** | |

| Wholesale and retail trade | 0.046 | 0.067 *** | 1.59 | −27.48 | −7.96 | −4.32 | 1.249 | −78.49 | 119.51 | |

| Transportation and storage | −0.011 | 0.117 * | 9.59 * | −273.15 * | 2.778 | 2.84 | −171.93 | −226.75 | −93.23 | |

| Hotels and restaurants | −0.05 | 0.072 | 12.98 ** | −173.14 * | 6.637 * | 6.63 * | −0.768 | −120.38 * | −0.768 | |

| Information and communications | 0.125 | −0.139 | −13.13 * | 342.77 ** | −25.94 * | −7.73 * | 579.88* | −1.97 *** | 175.42 ** | |

| Professional, scientific activities | −0.028 | 0.029 | 4.54 ** | −72.51 * | 1.369 *** | 1.369 *** | - | 13.67 *** | - | |

| AI aggregated disclosure score | −0.185 | 0.209 | 19.05 * | −517.12 ** | 25.50 * | −428.87 ** | ||||

| AI aggregated disclosure score * information and communications | 363.87 * | |||||||||

| SAP | −119.61 * | |||||||||

| RPA | 7.29 * | −177.40 ** | ||||||||

| NLP | −581.86 * | |||||||||

| Constant | 0.212 | 0.078 | −47.22 ** | 6660.25 *** | −46.34 *** | −41.03 ** | 6457.80 *** | 6507.64 *** | 6477.81 *** | 7009.47 *** |

| Observations | 55 | 55 | 55 | 55 | 55 | 55 | 55 | 55 | 55 | 55 |

| S.E. of Reg. | 0.40 | 0.204 | 6.73 | 146.80 | 6.01 | 6.67 | 148.36 | 157.97 | 149.01 | 200.92 |

| F-test | 6.89 ** | 4.45 *** | 4.82 *** | 189.94 *** | 6.93 *** | 4.95 *** | 185.90 *** | 163.54 *** | 184.24 *** | 297.30 *** |

| R2 adj. | 19.3 | 14.05 | 0.459 | 0.976 | 0.568 | 0.467 | 0.976 | 0.973 | 0.976 | 0.956 |

| Jarque–Bera test | 5202.82 (0.00) | 1583.71 (0.00) | 63.48 (0.00) | 4.571 (0.101) | 27.47 (0.00) | 63.81 (0.00) | 135.79 (0.00) | 20.43 (0.00) | 5.06 (0.079) | 115.51 (0.00) |

| Breusch–Godfrey serial correlation LM Test: Null hypothesis: no serial correlation at up to 1 lag | 0.86 (0.356) | 3.52 (0.06) | 2.93 (0.09) | 1.162 (0.28) | 2.171 (0.14) | 2.67 (0.11) | 2.72 (0.106) | 3.25 (0.078) | 0.92 (0.34) | 1.95 (0.168) |

| White heteroskedasticity test | 0.057 (1.00) | 0.087 (1.00) | 84.13 (0.00) | 16.11 (0.00) | 37.40 (0.00) | 91.81 (0.00) | 7.81 (0.00) | 25.17 (0.00) | 23.77 (0.00) | 105.73 (0.00) |

| Variables | Coefficient | Std. Error | t-Statistic | Prob. |

|---|---|---|---|---|

| C | −330.80 | 563.97 | −0.60 | 0.56 |

| ESG_EXPOSURE * AGGREGATE SCORE_AI | 116.50 | 67.84 | 1.72 | 0.10 |

| R-squared | 0.39 | Mean dependent var | 839.60 | |

| Adjusted R-squared | 0.33 | S. D. dependent var | 1898.47 | |

| S.E. of regression | 1554.14 | Akaike info criterion | 17.68 | |

| Sum squared resid | 26,568,929.75 | Schwarz criterion | 17.76 | |

| Log likelihood | −112.89 | Hannan–Quinn criter. | 17.66 | |

| F-statistic | 6.91 | Durbin–Watson stat | 1.65 | |

| Prob (F-statistic) | 0.02 | Wald F-statistic | 2.95 | |

| Prob (Wald F-statistic) | 0.10 | |||

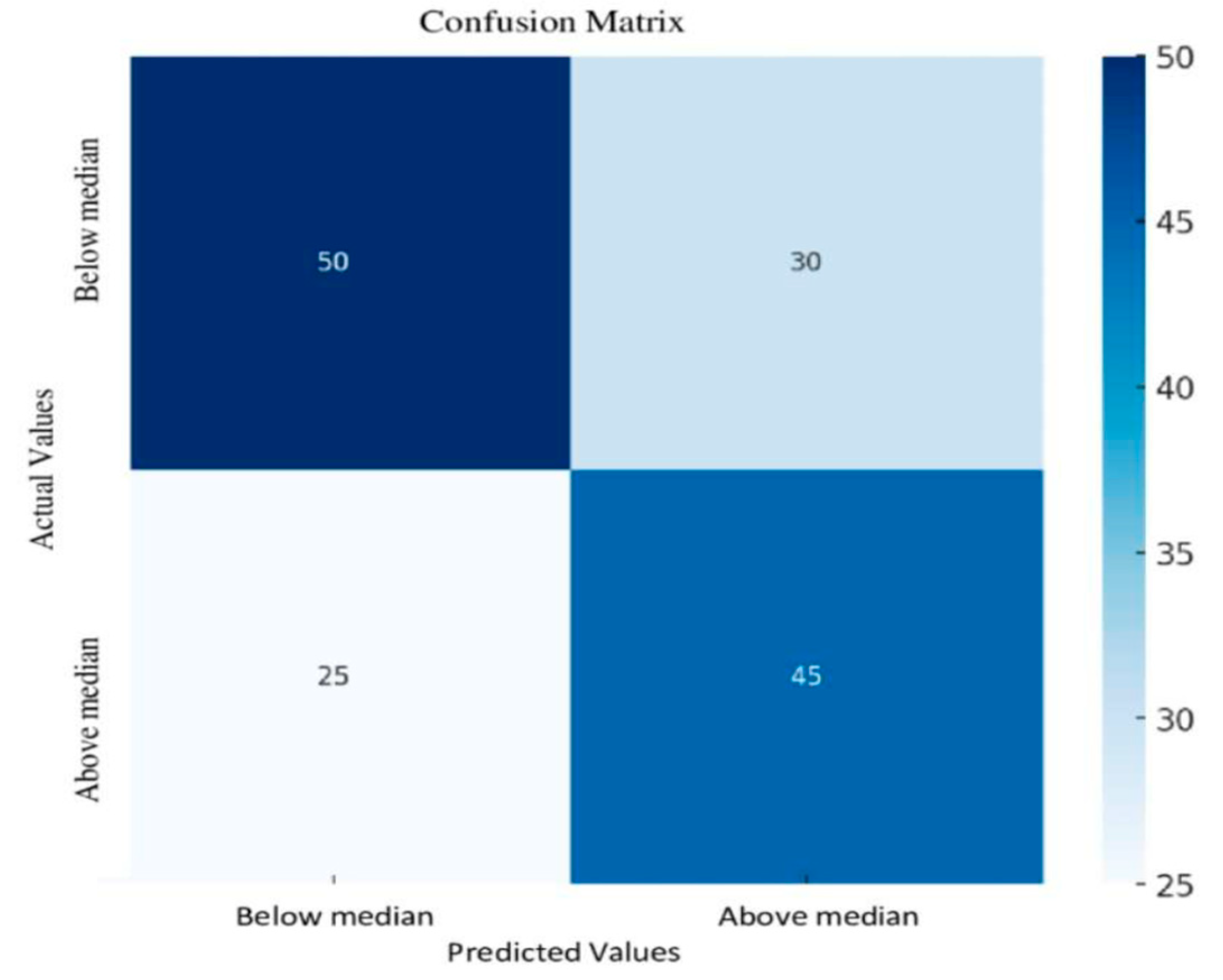

| Hypotheses | Statistical Outcomes |

|---|---|

| H1(a). There is a significant positive correlation between the average disclosure score of AI technologies and company size | Validated |

| H1(b). There is a significant positive correlation between the average AI technology disclosure score and industry typology | Not validated |

| H1(c). There is a significant positive correlation between the average disclosure score of AI technologies and the average number of employees | Not validated |

| H2(a). There is a significant positive correlation between the current liquidity (CR) indicator and AI disclosure | Validated |

| H2(b). There is a significant positive correlation between the return on assets (ROA) indicator and AI disclosure | Not validated |

| H2(c). There is a significant positive correlation between the return on equity (ROE) indicator and AI disclosure | Not validated |

| H3. There is an interaction between ESG performance scores and AI disclosure in terms of the impact on companies’ financial performance | Partially validated |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bogdan, V.; Hațegan, C.-D.; Török, R.M.; Blidișel, R.-G.; Popa, D.-N.; Pitorac, R.-I. Driving Sustainable Value. The Dynamic Interplay Between Artificial Intelligence Disclosure, Financial Reporting Quality, and ESG Scores. Electronics 2025, 14, 3247. https://doi.org/10.3390/electronics14163247

Bogdan V, Hațegan C-D, Török RM, Blidișel R-G, Popa D-N, Pitorac R-I. Driving Sustainable Value. The Dynamic Interplay Between Artificial Intelligence Disclosure, Financial Reporting Quality, and ESG Scores. Electronics. 2025; 14(16):3247. https://doi.org/10.3390/electronics14163247

Chicago/Turabian StyleBogdan, Victoria, Camelia-Daniela Hațegan, Réka Melinda Török, Rodica-Gabriela Blidișel, Dorina-Nicoleta Popa, and Ruxandra-Ioana Pitorac. 2025. "Driving Sustainable Value. The Dynamic Interplay Between Artificial Intelligence Disclosure, Financial Reporting Quality, and ESG Scores" Electronics 14, no. 16: 3247. https://doi.org/10.3390/electronics14163247

APA StyleBogdan, V., Hațegan, C.-D., Török, R. M., Blidișel, R.-G., Popa, D.-N., & Pitorac, R.-I. (2025). Driving Sustainable Value. The Dynamic Interplay Between Artificial Intelligence Disclosure, Financial Reporting Quality, and ESG Scores. Electronics, 14(16), 3247. https://doi.org/10.3390/electronics14163247