Abstract

The field of real estate valuations is multivariate in nature. Each property has different intrinsic attributes that have a bearing on its final value: location, use, purpose, access, the services available to it, etc. The appraiser analyzes all these factors and the current status of other similar properties on the market (comparable assets or units of comparison) subjectively, with no applicable rules or metrics, to obtain the value of the property in question. To model this context of subjectivity, this paper proposes the use of a fuzzy system. The inputs to the fuzzy system designed are the variables considered by the appraiser, and the output is the adjustment coefficient to be applied to the price of each comparable asset to obtain the price of the property to be appraised. To design this model, data have been extracted from actual appraisals conducted by three professional appraisers in the urban center of Santa Cruz de Tenerife (Canary Islands, Spain). The fuzzy system is a decision-helping tool in the real estate sector: appraisers can use it to select the most suitable comparables and to automatically obtain the adjustment coefficients, freeing them from the arduous task of calculating them manually based on the multiple parameters to consider. Finally, an evaluation is presented that demonstrates its applicability.

1. Introduction

The real estate market is subject to many factors of a multidisciplinary nature. These factors are changing and are not homogeneous in their behavior. For this reason, determining the value of a property requires carrying out a detailed study of the factors that influence it, the surrounding market and its trends [1,2]. In Europe, real estate appraisals require the professionals in the sector to have proven experience that supports the application of the appraisal method. In Spain, real estate appraisals are conditioned by the purpose of the appraisal, and in general, this process depends on the criteria of the professional who does the valuation.

The real estate appraisal sector relies on calculation methods based on the relationships between sale prices and the intrinsic characteristics of the properties [3,4]. The real estate market must be analyzed to consider where the property to be appraised ranks in said market, the economic level of potential users, the legal status, etc. [5], and to be able to determine the characteristics and factors to take into account and do a common-sense appraisal [1]. Assigning the weights of each attribute to the value of the property results in a multi-attribute model [4,6]. Statistically, the variables that comprise the attributes are independent, but appraisal decisions take into account the influence existing between them. This effect is natural in the buyer’s perception and is transferred to the market as a demand value, influencing the supply values. The study of real estate valuations from the perspective of buyer preferences can create greater uncertainty when identifying parameters, due to the amount of information on the key concepts that affect the value of the property and the buyer’s preferences [2,7].

The method that professionals in the real estate appraisal sector use the most to value a property before a mortgage is issued is, without a doubt, the comparison method. According to the Ministry of Economy Order [8], the comparison method is applicable to all types of properties. This technique allows both the professional and the client to determine the final appraised value obtained as a result of comparing the property in question with similar properties.

The literature published on the comparison method in real estate valuations focuses on analyzing the subjectivity of its applicability, the proper definition of the comparison parameters, the range of the weights, and even the use of mathematical techniques to try to uniformly quantify the process. For example, the authors of [9] present an analysis of the comparison method that highlights the importance of the professional’s subjectivity when selecting comparable assets or units of comparison, and their influence on the final value. In that paper, the authors also analyze the usual practice of selecting comparable assets, noting that those chosen usually have values that are within 10–15% of one another. Moreover, to quantify the importance of the variables that define a potentially comparable property, they used information from experts, which rely on semantic scales such as “Equally important”, “One element is moderately more important than another”, etc. The authors assigned a numerical value to these expressions to determine that the surface area variable is the most important, more so than age, income level, commercial environment, etc. In the same vein as the above and continuing with the comparison method, in [10], both “Basic” and other “Complementary” attributes are assigned, such that the former are the essential factors that allow for the comparison, and the latter serve to complement the selected comparable asset in its uniqueness, meaning their weights are less influential. The work [11] highlights the difficulty of objectively analyzing five or six comparable sales with four or five value-influencing differences and proposes a preliminary qualitative analysis to facilitate the task of achieving quantitative adjustments. In [12], the coefficients of the price adjustment process are estimated from the formulation of a quadratic programming model, which gives rise to a sales comparison model. Another approach to the comparison method is presented in [6], where a combination of multi-objective optimization (MOO) and multi-criteria decision analysis (MCDA) is proposed to estimate the value of a property derived as a weighted sum of the composite scores.

As we can see, there are references in the literature that try to guide professional appraisers, but there is no fixed rule that can be followed in every circumstance. It is the subjective opinion of these professionals and the changing market situation that sets the final appraised value, weighted by a knowledge of surrounding properties. The objective of our work is to propose a tool to aid in decision-making in this field that relies on the application of fuzzy logic [13]. Fuzzy logic is an extension of classical logic that allows for the modeling of complex, imprecise problems that reflect uncertain situations, such as, for example, the decision-making that a human engages in subjectively [14,15]. The principles of fuzzy logic have been successfully applied to a wide range of problems in different domains where uncertainty and ambiguity are present in different ways [16]. Fuzzy modeling [17,18], fuzzy control [19,20], and fuzzy classification [21,22] are some of the most common applications, but this technique has also been used in the field of engineering and construction [23,24].

The field of real estate investments contains several references that study the applicability of fuzzy logic. For example, in [3], a fuzzy mathematical system based on the Rough Set Theory is proposed to estimate the most likely appraisal value based on inexact information. The authors of [5] apply fuzzy clustering to 101 metropolitan areas in Thailand in order to compare properties with similar characteristics. The fuzzy clustering reveals the socio-demographic structure of the city and classifies each property as ‘Very Good’, ‘Good’, ‘Fair’, or ‘Bad’. A complete mathematical description of fuzzy logic, adapted to the financial domain, is presented in [25], where a specific case study is discussed and results obtained using fuzzy logic and crisp number approaches are compared. The paper [26] uses several soft fuzzy sets representing the different variables that are representative of the properties. The authors argue that the use of fuzzy soft sets to quantify the qualitative attributes of properties allows a better fit to real situations. In the case study they present, their fuzzy method is more suitable than the multiple linear regression-based methods they tested. In [27], an expert-knowledge-based fuzzy logic system is proposed and compared with an Adaptative Neuro-Fuzzy Inference System (ANFIS) for residential real estate valuation. The same technique is used in [28] to estimate housing demand and in [29] to estimate the value of the property considering its location within the neighborhood.

In [30], fuzzy logic is applied to determine house buying decisions based on consumer interests in Solok city (Indonesia), considering factors such as “size”, “type”, “design”, “position”, and “material”. The authors of [31] propose a flat selection model based on fuzzy logic. With this model they have determined that the design and quality of the flat are the most important factors for buyers. In addition, the landscape environment, the safety and intellect of the people, and the selling price constitute the second group of important factors. The third group of important dimensions is the location of the flat, utilities, and transport convenience.

House selling price assessment with fuzzy logic is the aim of several research works. In the fuzzy model proposed by [32], several factors are chosen as inputs to the model, reflecting housing condition, environmental surroundings, the presence of transportation, and other regional socio-economic factors. The system is fitted with the information of 200 residences from 40 different urban regions of the city of Eskişehir in Turkey, and this information is acquired through questionnaires to local real estate agencies. The same objective is pursued by the work presented in [33] for the city of Hong Kong. In [34], two different Adaptative Neuro-Fuzzy Inference Systems (ANFIS) were used in forecasting house prices. Comparison of results suggested that the ANFIS with grid partition (ANFIS-GP) model performed better and can be successfully used in the estimation of house prices. In [35] different methods (fuzzy logic, Artificial Neural Network, and K-Nearest Neighbor) are used for determining the house price by the sellers in Indonesia. The variables used are mainly related to the land, the location, and the age of the property. In [36], another housing price prediction system is proposed, specifically a regression model based on fuzzy logic.

Another area in which fuzzy logic has been applied is in the calculation of risks associated with real estate investments. For example, in [37], a “Fuzzy Quantitative Risk Assessment Model” is presented. The authors demonstrate its effectiveness by analyzing a real case study in Egypt. In [38] fuzzy cognitive mapping is proposed for the same task. The proposed technique allows for a better identification and understanding of the cause-effect relationships between the factors, which in turn allows for better informed investment decisions. In [39], fuzzy cognitive mapping is also used for identifying the factors that influence home sales and time on the market.

Although in the related work presented in this article we have emphasized fuzzy logic-based solutions for the Real Estate valuation problem, there are other contributions that use different approaches: Genetic Algorithms (GA) [40], Extreme Gradient Boosting (XGBoost) [41], Artificial Neural Networks (ANN) [42,43], Deep Learning (DL) techniques [44,45], and other Machine Learning (ML) approaches [46].

The objective of our work is to design a computerized system to help appraise real estate that is based on fuzzy rules (Fuzzy Rule-Based System—FRBS), which seeks to facilitate the application of the comparison technique. Designing it requires analyzing the relevant parameters that define each property (location, age, surface area, etc.), as these are the inputs to the system. The system’s output is the final weighting coefficient to be applied to the price of each property that is compared to the property being appraised. The relationship between the input variables and the output variable is modeled by reflecting, in a set of fuzzy rules, the expert knowledge of several professionals in the real estate sector who collaborated in this work.

As discussed in the previous paragraphs, there are many works that have addressed the problem of real estate valuations. However, they do not focus specifically on real estate valuations using the comparison method, which is the main objective of our work. In Spain, appraisers are obliged to use this technique, and our interest is to provide them with a tool to help them in their daily practice. Moreover, the choice of a fuzzy rule-based system is not accidental. This system is simple and easy to tune if the right knowledge is available. For the application addressed in this article, it is the most viable option, since another type of more complex model (such as neural networks, or another machine learning technique) would require training with many samples, which in our case (real appraisals carried out with the comparison method) are not easy to obtain. Finally, it is important to note that another reason for choosing an FRBS is its explainability. Many of the systems in the literature discussed above are complex and opaque, offering the user a possible decision but not explaining the reasons for it. They are not commonly used in practice because appraisers do not understand them and do not trust them. In contrast, simple systems, such as the proposed fuzzy rule-based system, can be adjusted with less information and are more explainable: the users can understand the reason for the decision simply by analyzing the activation of the rules that compose the system.

Thus, in this paper, we are first going to describe in simple language the principles of fuzzy logic and Fuzzy Rule-Based Systems, since this is the technique used. We will then present the information available from actual appraisals. The process of extracting the knowledge of experts in the field and incorporating it into the fuzzy system will also be detailed. The sections that follow are devoted to the FRBS design and to evaluating its applicability with real cases. Finally, the conclusions and future lines of work will be presented.

2. Materials and Methods

2.1. Fuzzy Logic and Fuzzy Rule-Based Systems

The Theory of Fuzzy Sets, introduced by [47], is an extension of classical logic. In a classical set, the value 1 or 0 is assigned to each element to indicate whether or not it belongs to that set, but in the context of fuzzy logic, an element can belong to several sets at once, with varying degrees of membership. Mathematically, this is achieved by assigning a membership function to each fuzzy set that returns a value between 0 and 1, indicating the element’s degree of membership in a given fuzzy set. By considering an element’s membership in several sets at the same time, we can model the imprecision that exists in human reasoning. As a result, Fuzzy Set Theory is more suitable than classical logic to represent human knowledge, since it allows phenomena and observations to have more than two logical states.

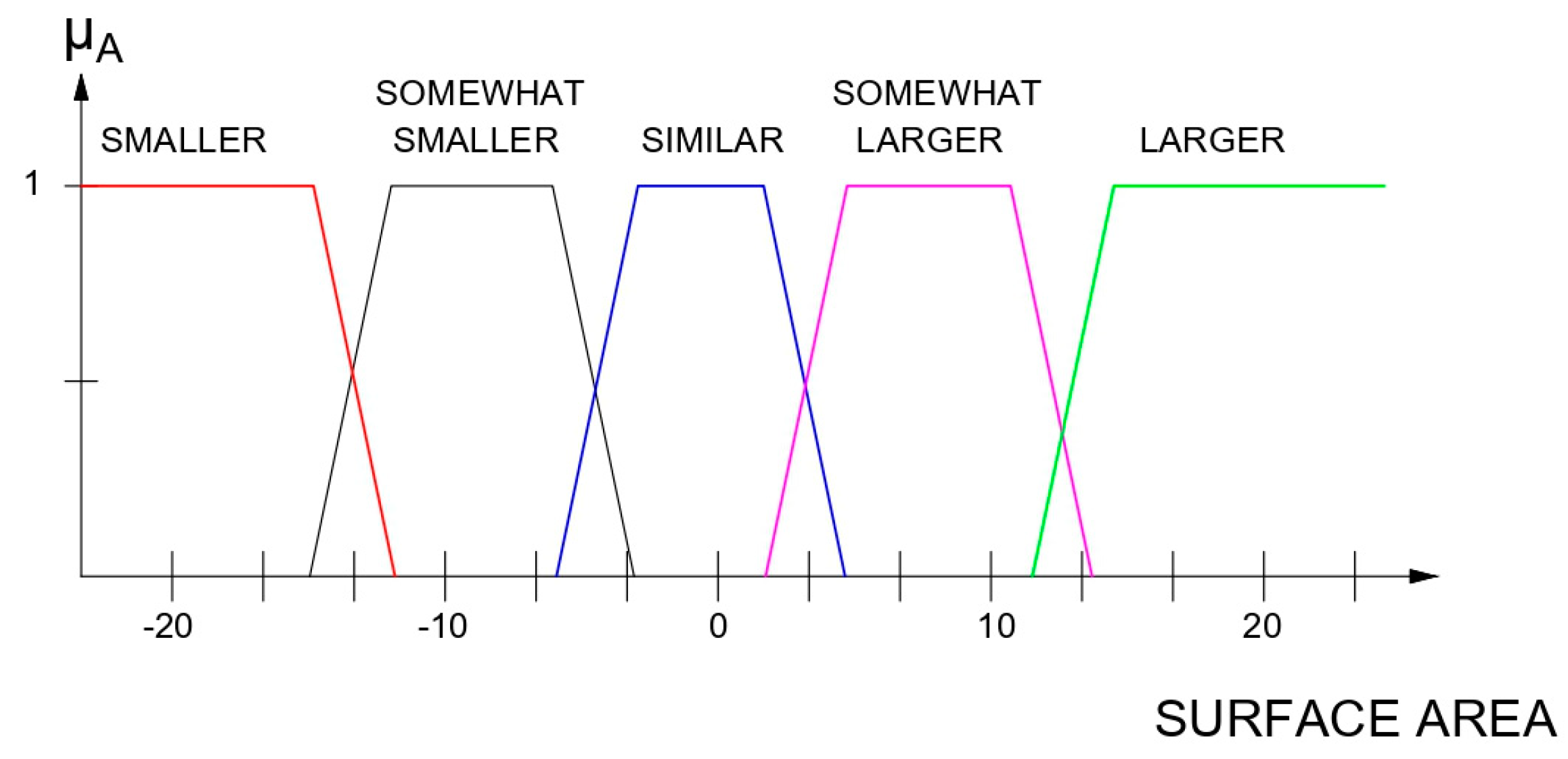

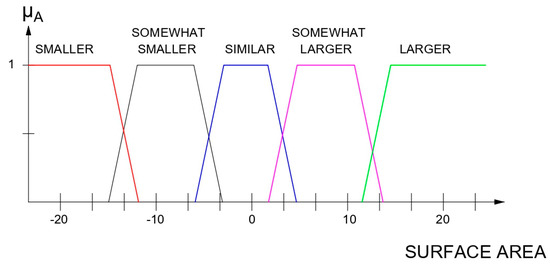

The first step in modeling a system with fuzzy logic is to define the system’s input and output variables as linguistic variables. Linguistic variables (for example, surface area) are variables whose possible values can be represented by linguistic terms (for example, Larger, Somewhat Larger, Similar, Somewhat Smaller, and Smaller), and each linguistic term has a fuzzy set associated with it. This step is very important, since it allows converting the semantic concept used in human reasoning (the linguistic label) to a mathematical function that is used to represent the fuzzy set. This process is shown graphically in Figure 1.

Figure 1.

Definition of the “surface area” linguistic variable and its linguistic labels (Smaller, Somewhat Smaller, Similar, Somewhat Larger, and Larger), expressed as fuzzy sets with a trapezoidal shape.

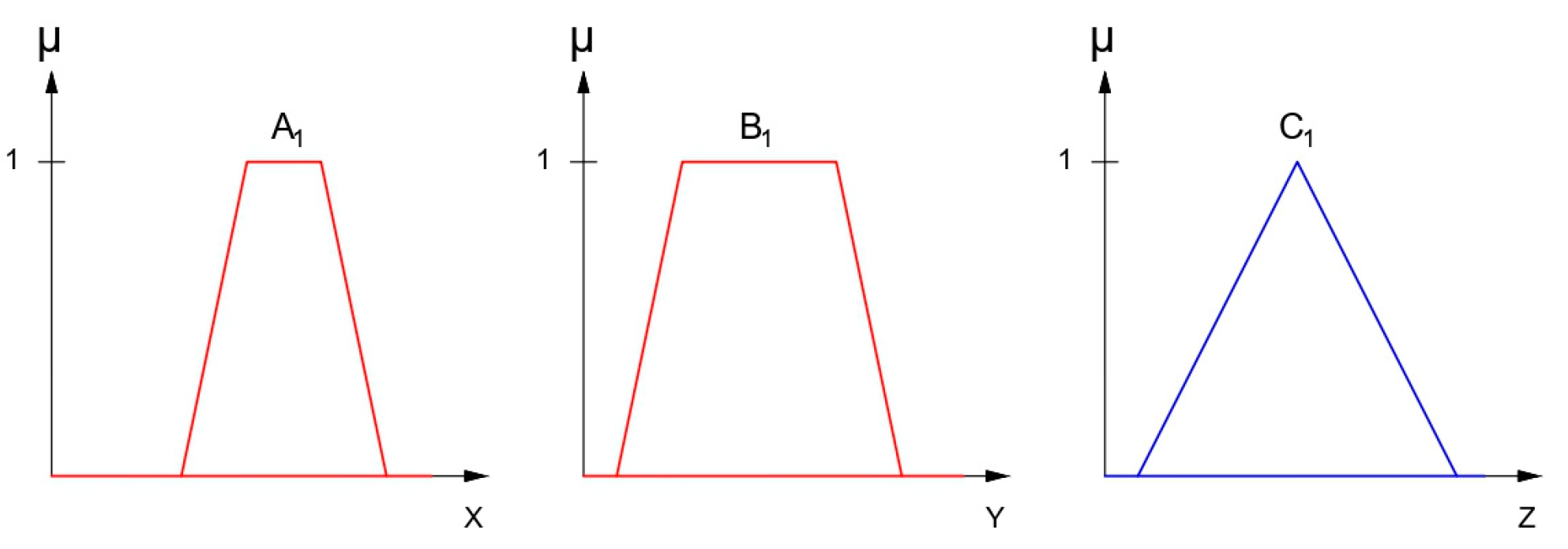

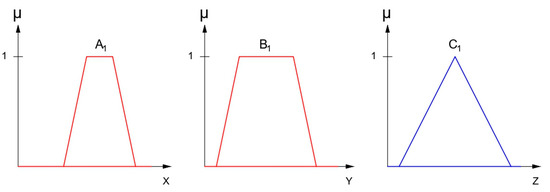

The second step consists of relating the system’s input and output variables to each other with fuzzy rules of the “if-then” type: If x is A then y is B, where A and B are linguistic labels for the respective linguistic variables. The term “x is A” is called the antecedent, while the term “y is B” is called the consequent [48]. Figure 2 shows a graphical example with an if-then rule. The rule relates the linguistic labels of two input variables (A and B) to a linguistic label for one output variable (C). The membership functions are shown graphically in red for the input variables and in blue for the output variable. Using fuzzy rules, we can model the knowledge of an expert in the field: the degree to which an output variable is modified depending on the input variables that affect it.

Figure 2.

Example of a fuzzy rule with two input variables and one output variable: if input X is A1 and input Y is B1, then output Z is C1.

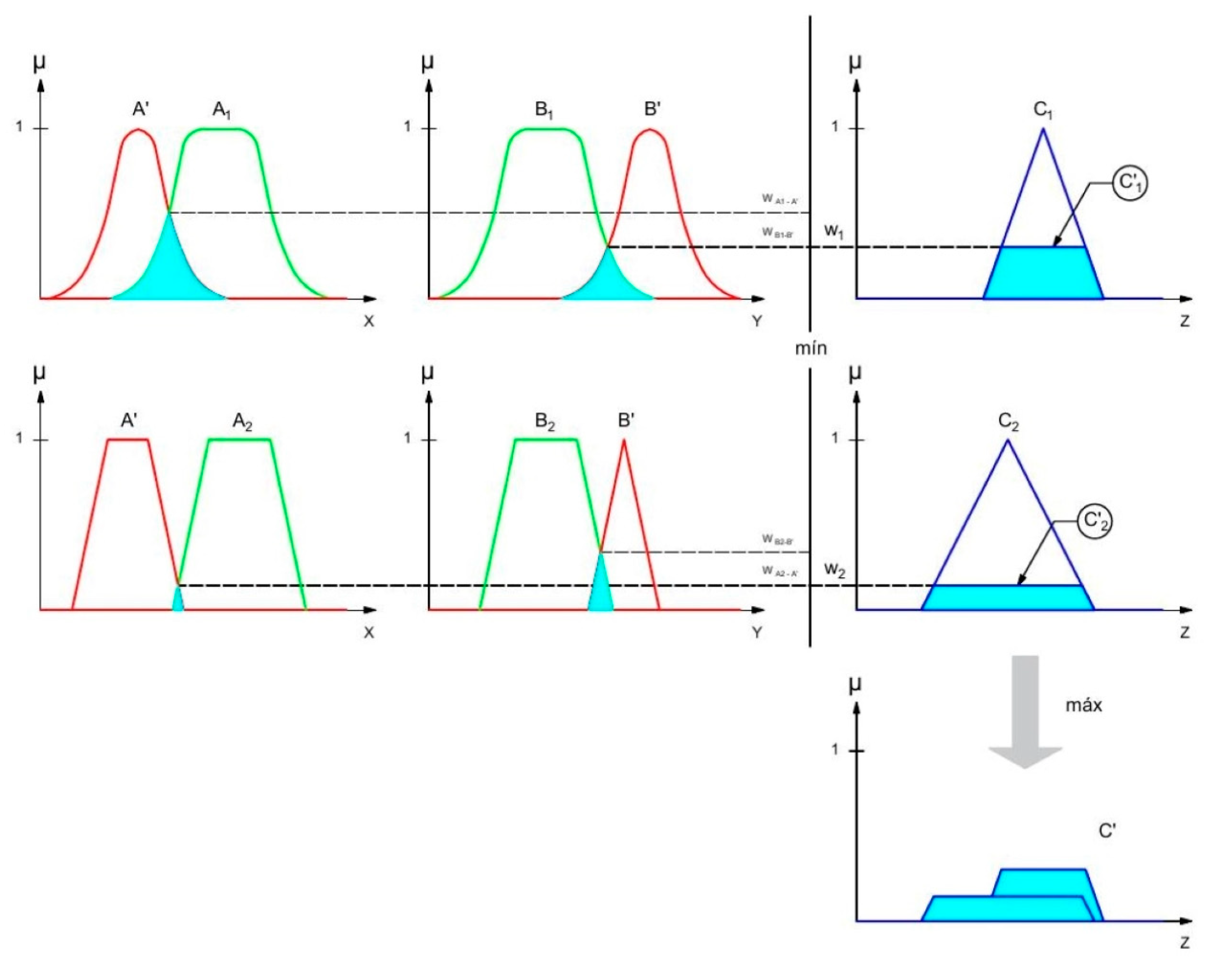

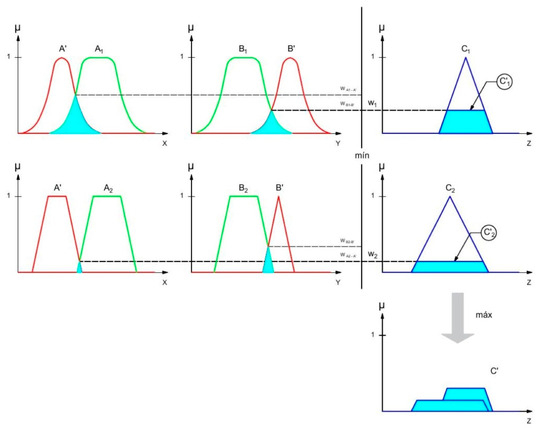

The third step involves fuzzy inference, which yields the conclusions from a set of fuzzy if-then rules and known real facts. This relies on fuzzy reasoning, also known as approximate reasoning. In this work, the fuzzy inference is carried out as explained graphically in Figure 3. For each rule of the fuzzy system, each antecedent is analyzed and the intersection between the fuzzy sets of the antecedent of the rule (in red) and the fact (in green) is calculated. The minimum value is chosen, and this value is used to activate the proportional part of the fuzzy set that represents the consequent. Once the activated parts of each rule’s consequents are obtained, the output of the system is calculated as the union of all these activated parts (final fuzzy set C’ in Figure 3). This type of inference, proposed by Mamdani [49], is widely used in the literature.

Figure 3.

Fuzzy system with two rules, each with two antecedents and one consequent. It shows the use of Mamdani’s fuzzy implicator (minimum) and the max-min compositional operator to carry out the inference.

The resulting set C’ is a fuzzy set. In the last step of the process, the numerical value that best represents the resulting fuzzy set (defuzzification process), which will be the system’s output, must be extracted. In this paper, we use the centroid of the area of the output fuzzy set.

In this paper, we want to design an FRBS to model the reasoning that professional appraisers employ when valuing a property using the comparison method. We have to extract the knowledge from the expert in the field so as to identify the input and output variables involved in making the decision (linguistic variables with their corresponding linguistic labels). But it is also very important to properly define the fuzzy sets and mathematical functions that represent them. The parameters involved in this process can be adjusted by analyzing the expert knowledge of the problem, as explained in the sections that follow.

2.2. Real Data Available

For the baseline data, ten actual appraisals required to issue a mortgage [8] were selected for properties located in two neighboring cities (in Tenerife, Spain), which have stable and consolidated real estate markets, to ensure a representative study analysis. The properties used in this paper are dwellings in block buildings under the horizontal property regime, as it is the most frequent appraisal required for this purpose.

All case studies are dwellings in a building located in the municipality of Santa Cruz de Tenerife, or in the municipality of La Laguna, both located in the province of Santa Cruz de Tenerife, Spain. For example, case study 1 corresponds to a dwelling in a building, located at 110 Obispo Ildefonso Infante Street, in the municipality of La Laguna.

The data for the selected comparables from the local market are available, as are the resulting coefficients obtained from the ten actual appraisals. The parameters considered in them are the location, the source of the data, the quality of the building, its condition, age, floor, the number of bedrooms and bathrooms, if it faces outward, and the surface area. Professionals in the sector regard these parameters as being representative of this type of property, and they use them in practice to issue appraisals for mortgage loans.

Table 1 shows the information on the property to be appraised and on the six comparables that were used in case study 1 (C1, C2, C3, C4, C5, and C6). Table 2 shows the adjustment coefficients that were used after comparing the characteristic parameters of each comparable with the property to be appraised. The same information is detailed in Appendix A for case studies 2–10.

Table 1.

Data for case study 1.

Table 2.

Coefficients for case study 1.

For example, in Table 2, corresponding to case 1, in the application of the method for comparable 1, in the comparison parameter “Location”, the coefficient assigned is “better” with a value of −7%. This means that the appraiser deemed the location of the comparable to be better than that of the property being appraised, assigning a coefficient of −7% to the price of the comparable property. The remaining weighting coefficients shown in Table 2 can be similarly interpreted.

The resulting total coefficient for each comparable is obtained by adding the coefficients assigned to each parameter considered when comparing that asset with the property being appraised. A negative final coefficient means that the characteristics of the comparable are better than those of the property to be valued, and therefore that the price of the latter corresponds to the price of the comparable minus the percentage indicated by the coefficient. A final coefficient of 0% indicates that the prices of the comparable and the property to be appraised are equivalent. Finally, a positive final coefficient indicates that the property to be appraised is better than the comparable, and thus its price is that of the latter increased by that percentage.

In this paper, the data from case 1 have been used to extract the knowledge of the experts and to adjust the rules of the proposed fuzzy system as shown in the subsection below. Case studies 2–10, on the other hand, are used later in the validation stage of the fuzzy system.

2.3. Extracting Expert Knowledge

The expert knowledge was collected in collaboration with three expert appraisers. Their profiles are as follows:

- Expert 1: professional appraiser in one of the most important appraisal companies in our country (company approved for mortgage credit appraisals by the Bank of Spain), with 5 years of professional experience in this field.

- Expert 2: university lecturer who has been teaching in the field of real estate valuations and appraisals for more than 10 years.

- Expert 3: university lecturer and professional appraiser in another of the most important appraisal companies in our country (company approved for mortgage credit appraisals by the Bank of Spain), with 10 years of professional experience.

All these experts are technical architects, a qualification that enables them to carry out real estate appraisals. In addition, they have received specific training in the field of appraisals and the real estate market. They are native to our geographical region (Canary Islands) and are well acquainted with the trends and changes in this local market.

Each expert analyzed the data for the property in case study 1, together with the data for the comparables, and the parameters used to appraise the property involved. The experts were not provided with the coefficients that are shown in the actual appraisal, so that each one could assign weights to each parameter based on their own criteria. This process yielded new weighting coefficients and their ranges based on each expert’s subjective opinion, values that will be used to design the fuzzy system.

Table 3, Table 4 and Table 5 show the weighting coefficients selected by experts 1, 2 and 3, respectively, for each comparable of the case study 1.

Table 3.

Weighting coefficients of “expert 1” for case study 1.

Table 4.

Weighting coefficients of “expert 2” for case study 1.

Table 5.

Weighting coefficients of “expert 3” for case study 1.

Analyzing the responses of the experts in Table 3, Table 4 and Table 5, the ranges of variation in the weighting coefficients can be estimated for each parameter studied and correlated with a significant semantic term. For example, the “location” parameter is assigned a coefficient that varies from −10% to 10%. The semantic levels considered for this variable can be proportionally distributed in this range: “Better Location” (from −10% to −5%), “Somewhat Better Location” (from −5% to −3%), “Similar Location” (from −3% to 3%), “Somewhat Worse Location” (from 3% to 5%), and “Worse Location” (from 5% to 10%). The same procedure was applied to the remaining parameters, yielding the ranges of variation in the coefficients shown in Table 6.

Table 6.

Range of variation in the weighting coefficients, for each parameter considered, that reflects the criteria of the experts in the field.

If we now analyze the values of the final weighting coefficients, obtained as the sum of all the coefficients of the parameters that define the comparable, we see that, in most of the comparables (four of the six), the final coefficients indicated by the experts have the same trend, although a different magnitude, as the final coefficients of the real appraisal for case 1. For example, the final weighting coefficients of comparables 2, 3, and 6 are negative, which reduces the price, although the three experts assign different magnitudes to each. The same thing happens with the final weighting coefficient of comparable 5, to which experts 1 and 2 assign positive coefficients, increasing the price, but of different magnitudes.

Therefore, it is necessary to define segments of variation in the output weighting coefficient such that it can be identified and classified according to its magnitude. We see that the most extreme coefficients are the positive coefficient of magnitude 14% and the negative one of magnitude −14%. Assigning an approximate range of values from −14% to +14%, proportionally, lets us divide the variation in the final coefficient into the segments shown in Table 7.

Table 7.

Variation ranges of the final weighting coefficients.

2.4. Design of the Fuzzy-Rule Based System

To design an FRBS, we need to start by identifying the relevant input and output variables of the problem to be modeled, defining them with semantic terms to convert them into linguistic variables, and assigning to each the necessary linguistic labels.

In this paper, the input variables are the parameters considered by expert appraisers when evaluating a property, which, as we saw in the previous section, are location, data source, construction quality, condition, age, floor, layout, and surface area. The system’s output variable will be the weighting coefficient to be applied to the price of each comparable.

These linguistic variables are assigned the necessary linguistic labels to represent the breadth of the problem to be modeled, as shown in Table 8. For example, the input linguistic variable Surface area has been assigned five linguistic labels: Larger, Somewhat Larger, Similar, Somewhat Smaller, and Smaller. In the same way, the output linguistic variable Weighting coefficient has been assigned six linguistic labels: Minimum, Decreased, Somewhat Decreased, Somewhat Increased, Increased, and Maximum.

Table 8.

Input and output linguistic variables, associated linguistic labels, and ranges of the universe of discourse covered by each label.

Once the linguistic variables and their labels are defined, the latter must be represented with fuzzy sets that specify their shape and location in the universe of discourse. In this work, we selected Gaussian membership functions for all the fuzzy sets, because the smooth shape of this function can better represent the gradual transition between labels. The range covered by each membership function is extracted from the appraisals made by the experts in case study 1, and it is subsequently normalized within the interval [0, 1]. The final membership functions will be Gaussian functions centered around the normalized ranges.

At this point, it is possible to define the rule base for the FRBS. To do this, we analyzed the decisions made by the three experts in their independent appraisals of case study 1, focusing on how the input parameters should be related to one another to obtain a certain value for the final weighting coefficient. In this paper, the knowledge of the experts was concentrated in 14 rules, which are shown in Table 9. Rule 1 is interpreted as follows:

Table 9.

Rule base.

“IF Location is Similar AND Data Source is Speculative AND Construction Quality is Similar AND Condition is Same AND Age is Similar AND Floor is Worse AND Layout is Functional AND Surface area is Larger THEN Weighting Coefficient is Increased”.

The remaining rules can be interpreted in the same way.

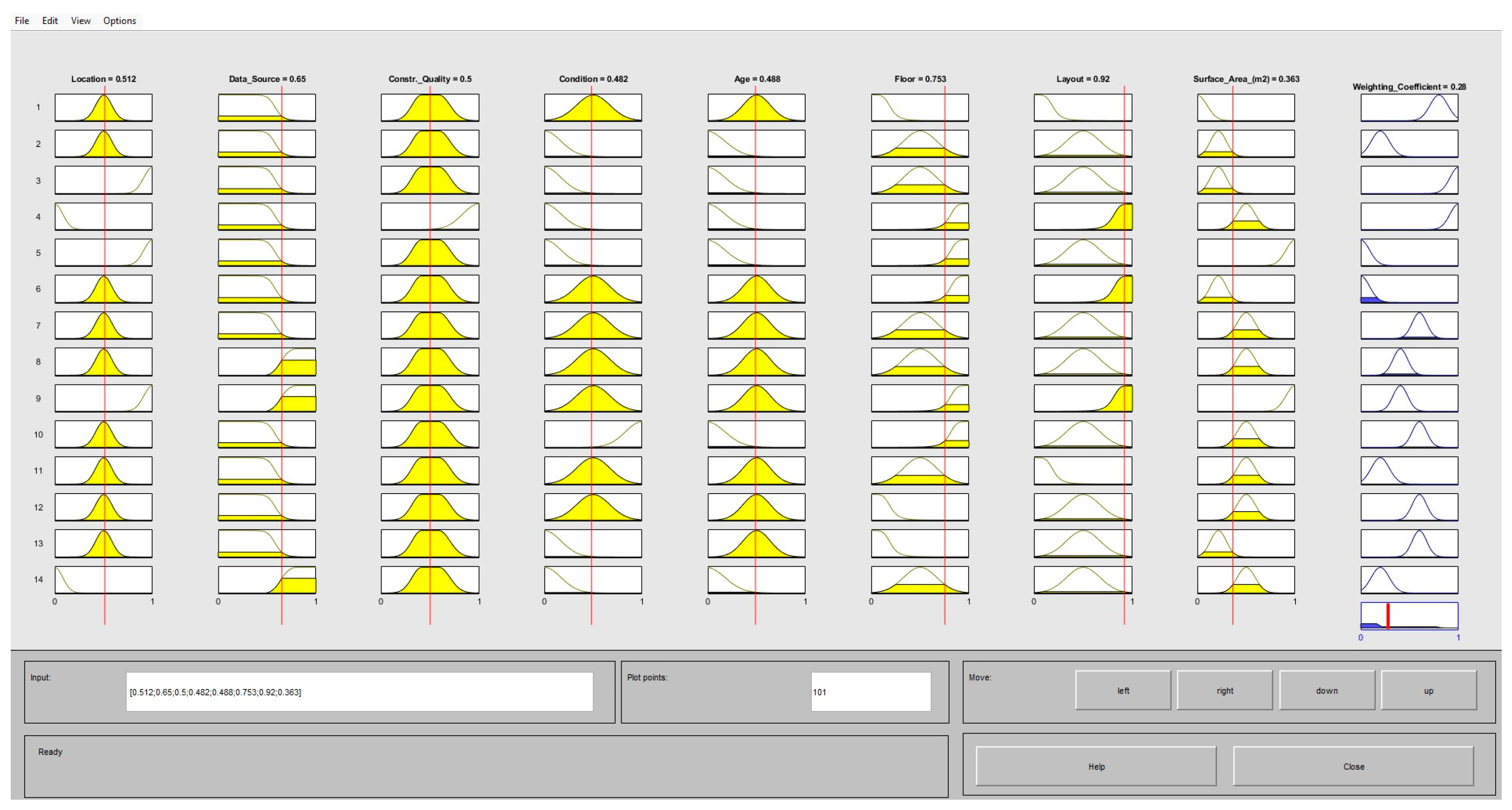

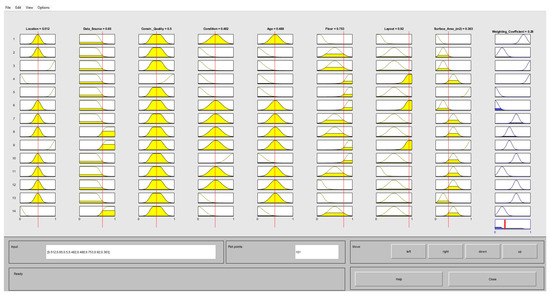

Finally, in order to infer the value of the output weighting coefficient from specific input values, we need to use an inference mechanism. In this paper, we use the fuzzy inference proposed by Mamdani [49], explained in Section 2.1. The Matlab Fuzzy Toolbox

(https://es.mathworks.com/, accessed on 10 November 2024) [50] was used to design and construct the entire FRBS. An example of the operation of the designed FRBS can be seen in Figure 4, where the data corresponding to the assessment of the comparable 1 developed by expert 3 have been entered.

Figure 4.

Operation of the FRBS corresponding to the appraisal of comparable 1 developed by expert 3.

3. Results and Discussion

The designed FRBS will be thoroughly evaluated in this section. This paper uses actual data from ten appraisals (ten case studies). As mentioned above, the first appraisal was used to adjust the rules and parameters of the FRBS, taking into account the opinions of three experts who re-evaluated case 1 according to their own criteria. In the evaluation stage, the data from case studies 1–10, the actual original appraisals, which were not taken into account when designing the proposed FRBS, are entered as inputs into the system. The purpose of this process is to evaluate how the FRBS responds to situations other than those considered during the design stage, and thus to assess its ability to generalize.

Table 10 shows the coefficients offered by the FRBS when entering the data from comparables 1–6 in case study 1. The values of the coefficients for the actual appraisal of this case can be consulted in Table 2. Analyzing the output provided by the FRBS with these input values reveals that the coefficients are consistent with those reflected in the real appraisals (see the last row in Table 10). Although their magnitudes do not match exactly, they are quite close, and, above all, in every case, the resulting fuzzy set at the output provides a range of variation that contains the coefficient proposed by the real appraisal.

Table 10.

FRBS output for case study 1.

The other case studies have been treated in the same way. For organizational reasons, the FRBS outputs for these cases are shown in Appendix B. For most of the comparables analyzed, the resulting fuzzy sets in the outputs provide a range of variation containing the coefficient proposed by the actual valuation, except in 6 cases:

- -

- Case study 6: comparables 2, 4, and 5.

- -

- Case study 7: comparable 5.

- -

- Case study 8: comparable 5.

- -

- Case study 1: comparable 1

These wrong cases are marked with an asterisk in the tables presented in Appendix B.

Considering that we have processed in the FRBS ten actual appraisals, composed of 6 comparables each, this makes a total of 60 comparables analyzed. As the system gives an erroneous approximation of the comparison for 6 of them (10% failures), the accuracy of the system is 90%. As a result, we may conclude that the proposed FRBS works correctly in situations other than those considered in its design.

4. Conclusions

This article proposes a tool to aid real estate valuation that is based on the comparison method. The tool relies on modeling the expert knowledge of various professionals in the area, which is not a simple process given the high degree of subjectivity in each expert’s opinions. Since there are no regulations or guidance for making decisions, the expert’s knowledge of the details of the aspect to be assessed is a potential factor in determining the criteria and parameters that define the comparables to be used.

The tool proposed is a Fuzzy Rule-Based System (FRBS). The system’s parameters were adjusted using data from real appraisals and the knowledge of three experts in the area. The application of this technique to the problem at hand is justified because the variables considered can be easily represented as linguistic variables. This makes it possible to use fuzzy sets, which makes the model mathematically flexible and allows different states for the decisions. The fuzzy nature of the system proposed accommodates each expert’s variability and subjectivity.

The parameters defined for applying coefficients to the comparables are highly dependent on human interpretations. The FRBS allows working with definitions and evaluations that approximate those used in human reasoning.

The available information, obtained through the knowledge of the experts in the area, made it possible to adjust the rules to make them more efficient. The most important knowledge was condensed into 14 rules, which simplifies the operation and interpretability of the system. The validation of the FRBS, carried out with ten real appraisals, was positive, with an estimated accuracy of 90%.

In the scientific literature, there are many proposed approaches to carry out real estate valuations, but few works aim at facilitating the application of the comparison method. The fuzzy system designed in our work, in addition to being one of the few to address this problem, has several important advantages:

- It allows appraisers to make much quicker and more objective comparisons.

- It is an easy-to-use decision support system for the target users: the appraisers. They do not need specific knowledge of mathematics or computer science to be able to use it, as is the case with more complicated techniques.

- One of the main difficulties in applying the comparison method is to select suitable comparables that are as similar as possible to the asset under evaluation. The tool we propose can help the user to decide whether a comparable is optimal or not, depending on the value of the coefficients offered by the system at its output (the most similar comparables give rise to coefficients around 0%).

- The proposed system is simple to understand and, therefore, to adjust to another situation if necessary.

- This simplicity is linked to its high interpretability: being a rule-based system, the decisions made by the model can be understood and explained by analyzing the activation of the different rules that compose it. The interpretability of the system is important for potential users of the system (professional real estate appraisers) to use it with confidence.

However, some limitations must be considered:

- Three experts have collaborated in the design of the fuzzy system, which may seem a small number. In Spain, it is difficult to convince a purely professional valuer to collaborate in research work. These valuers are usually self-employed and are very reluctant to share private information about their working method and reasoning in applying the comparison method in their valuations. Still, we believe that the opinions of these three experts are sufficiently informative to construct the fuzzy rule system proposed in our paper.

- Few real case studies are available (real appraisals carried out by experts following the comparison method). This limitation is due to the fact that these data are not public. Most of the works in the literature use public data, which are collected from real estate portals (with the questionable quality that this entails), or from other sources with geographic data. However, actual appraisals carried out by the comparison method, signed by a professional appraiser, and submitted to banks, are usually not in the public domain.

- The proposed fuzzy system is specifically designed to apply the comparison method on residential buildings in the largest urban cities in our region. This has been achieved because these types of appraisals are the most frequent in the daily activity of our local appraisers. The system should be readjusted for being used in another region, or for comparison of another type of property. However, as the system is simple to understand and highly interpretable, we think that this adjustment would not be too complicated to perform.

Finally, it is important to point out that the tool designed is a decision support system, never a replacement system for the appraiser. The aim of the fuzzy system is to help them to apply the comparison method in the valuation more quickly and objectively. The system proposed in this article can be useful in this task because it collects the opinions of several experts and thus maps the opinions of a typical participant in the local real estate market. In this way, the user can compare his or her personal criteria with the system’s response and reduce his or her subjectivity. The system provides the user with an answer that gathers the knowledge of several appraisers, so that they can get a more consensual idea in their assessment.

In future research, we plan to continue testing our FRBS with data from other real appraisals to verify its correct operation, and to evaluate if it needs to be adjusted—by including new rules, for example—to improve its efficiency. Once the system is finalized, we plan to integrate it into an easy-to-use web tool to make it available to professionals in the area. At this point, we will conduct a usability study of the tool. Finally, we may consider adapting the FRBS to other types of appraisals, if experts in the field express that interest.

Author Contributions

Conceptualization, F.-J.G.-G.; methodology, F.-J.G.-G. and S.A.-M.; software, F.-J.G.-G. and S.A.-M.; validation, F.-J.G.-G., S.A.-M. and P.P.-D.; data curation, F.-J.G.-G. and P.P.-D.; writing—original draft preparation, F.-J.G.-G. and S.A.-M. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Data are unavailable due to privacy restrictions.

Acknowledgments

This work relied on data from real estate appraisals carried out by professionals in the field. We are grateful to three expert appraisers for their cooperation: José Daniel Alonso Hernández (expert 1), Basilio Gómez Pescoso (expert 2), and José Antonio Valbuena Alonso (expert 3). All of them have been, for many years, renowned professionals in the sector and official appraisers for certified valuation companies.

Conflicts of Interest

The authors declare no conflicts of interest.

Appendix A

Data and coefficients for case studies 2–10 (real appraisals).

Table A1.

Data for case study 2.

Table A1.

Data for case study 2.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Ernesto Anastasio, 11 | Sauces (Los), 6 | Simón Bolivar, 32 | Rosario (Del), 90 | Rodrigo de Triana, 12 | Principes de España, 3 | Poeta Gutierrez Albelo, 13 |

| Municipality | Santa Cruz de Tenerife | Santa Cruz de Tenerife | Santa Cruz de Tenerife | Santa Cruz de Tenerife | Santa Cruz de Tenerife | Santa Cruz de Tenerife | Santa Cruz de Tenerife | |

| Postal code | 38009 | 38009 | 38007 | 38010 | 38010 | 38010 | 38009 | |

| 2 | Data Source | INDIVIDUAL | INDIVIDUAL | API | API | API | API | |

| 3 | Construction Quality | Average | Average | Average-low | Average | Average | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 45 | 39 | 54 | 50 | 50 | 44 | 62 |

| 6 | Floor | 13 | 3 | 2 | 3 | 3 | 6 | 4 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 3 | 3 | 2 | 2 | 3 | 2 | 3 | |

| Bathrooms | 1 | 1 | 1 | 1 | 1 | 1 | 1 | |

| 8 | Surface area (m2) | 107.00 | 113.00 | 97.00 | 66.00 | 61.00 | 74.00 | 92.19 |

Table A2.

Coefficients for case study 2.

Table A2.

Coefficients for case study 2.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Similar: 0% | Similar: 1% | Some. Better: −4% | Worse: 12% | Worse: 11% | Worse: 16% |

| 2 | Data Source | Direct: −1% | Direct: −1% | Speculative: −3% | Speculative: −3% | Speculative: −3% | Speculative: −3% |

| 3 | Construction Quality | Similar: 0% | Similar: 0% | Worse: 3% | Similar: 0% | Similar: 0% | Similar: 0% |

| 4 | Condition | Less det.: −2% | Less det.: −4% | Less det.: −1% | Less det.: −1% | Less det.: −1% | Less det.: −2% |

| 5 | Age | Newer: −3% | Newer: −3% | Similar: 0% | Newer: −2% | Similar: −1% | Newer: −3% |

| 6 | Floor | Better: −4% | Same: 0% | Worse: 1% | Same: 0% | Same: 0% | Better: −2% |

| 7 | Layout | Matching: 0% | Matching: 0% | Matching: 0% | Matching: −1% | Matching: 0% | Matching: 0% |

| 8 | Surface area (m2) | Some. Larger: 9% | Some. Larger: 9% | Similar: 1% | Some. smaller: −9% | Smaller: −10% | Some. smaller: −9% |

| WEIGHTING COEFFICIENTS | −1% | 2% | −3% | −4% | −4% | −3% | |

Table A3.

Data for case study 3.

Table A3.

Data for case study 3.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Sor Reyes,13 | Amatista, 5 | Doctor Marañon, 17 | Eduardo De Roo,49 | La Majadas, 3 | El Paso, 53 | Volcan Nevado de Ruiz. 28 |

| Municipality | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | |

| Postal code | 38108 | 38108 | 38207 | 38320 | 38108 | 38108 | 38108 | |

| 2 | Data Source | Individual | API | Individual | API | API | API | |

| 3 | Construction Quality | Average | Average | Average-low | Low | Average | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 9 | 25 | 42 | 43 | 20 | 8 | 28 |

| 6 | Floor | 1 | 2 | 6 | 3 | 3 | 5 | 2 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 3 | 2 | 2 | 3 | 3 | 2 | 3 | |

| Bathrooms | 2 | 1 | 1 | 2 | 2 | 2 | 1 | |

| 8 | Surface area (m2) | 80 | 85.00 | 85.00 | 65.10 | 71.00 | 65.00 | 79.42 |

Table A4.

Coefficients for case study 3.

Table A4.

Coefficients for case study 3.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Better: −5.10% | Similar: −1.19% | Better: −6.69% | Similar: 2.99% | Worse: 9.99% | Worse: 10.00% |

| 2 | Data Source | Direct: 0.32% | Speculative: −3.00% | Direct: −1.00% | Speculative: −2.00% | Speculative: −3.00% | Speculative: −2.50% |

| 3 | Construction Quality | Similar: 0.00% | Similar: 0.00% | Similar: 1.80% | Similar: 1.90% | Similar: 0.72% | Similar: 0.00% |

| 4 | Condition | More det.: 6.10% | Same: 0.00% | Same: −1.00% | More Det.: 9.00% | Same: 0.50% | Same: −1.00% |

| 5 | Age | Newer: −1.90% | Similar: −0.30% | Older: 1.40% | Older: 1.50% | Similar: −0.80% | Newer: −2.00% |

| 6 | Floor | Same: −0.50% | Same: 0.00% | Better: 2.00% | Worse: −1.50% | Better: 1.50% | Better: 2.50% |

| 7 | Layout | Matching: −0.50% | Matching: 0.00% | Matching: −1.00% | Functional: −1.50% | Matching: −0.50% | Functional: −2.00% |

| 8 | Surface area (m2) | Similar: 0.58% | Similar: 4.50% | Similar: 4.50% | Smaller: −10.40% | Some. Smaller: −8.42% | Some. Smaller: −9.00% |

| WEIGHTING COEFFICIENTS | −1.00% | 0.01% | 0.01% | −0.01% | −0.01% | −4.00% | |

Table A5.

Data for case study 4.

Table A5.

Data for case study 4.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Progreso, 6 | San Miguel de Chimisay, 8 | Santa Elena San Matias, 1 | Atacaite, 5 | La Libertad, 48 | La Libertad, 48 | Volcan de Fujiyama |

| Municipality | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | |

| Postal code | 38205 | 38108 | 38108 | 38296 | 38205 | 38108 | 38108 | |

| 2 | Data Source | API | Individual | Individual | Individual | Individual | Individual | |

| 3 | Construction Quality | Average | Average | Average | Average | Average | Average | Average-Low |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 25 | 35 | 15 | 3 | 10 | 9 | 49 |

| 6 | Floor | 2 | 1 | 4 | 2 | 2 | 2 | 2 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Bathrooms | 1 | 1 | 1 | 2 | 2 | 2 | 1 | |

| 8 | Surface area (m2) | 85.00 | 70.00 | 74.00 | 109.00 | 88.00 | 88.00 | 80.00 |

Table A6.

Coefficients for case study 4.

Table A6.

Coefficients for case study 4.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Better: −10.00% | Better: −6.60% | Better: −10.00% | Similar: −2.40% | Better: −7.50% | Better: −7.40% |

| 2 | Data Source | Speculative: −3.00% | Direct: −1.00% | Direct: −1.00% | Direct: −1.00% | Direct: −1.00% | Direct: −1.00% |

| 3 | Construction Quality | Similar: −2.00% | Similar: 0.00% | Similar: −1.10% | Similar: 1.90% | Similar: −2.00% | Similar: −2.00% |

| 4 | Condition | Less det.: −3.00% | Same: 0.00% | Same: −1.00% | More det.: 9.00% | Less det.: −3.00% | Less det.: −3.00% |

| 5 | Age | Newer: −5.00% | Newer: −1.40% | Newer: −3.40% | Newer: −4.60% | Newer: −3.90% | Newer: −4.00% |

| 6 | Floor | Same: 0.00% | Same: −0.50% | Better: 2.00% | Same: 0.00% | Same: 0.00% | Same: 0.00% |

| 7 | Layout | Functional: −3.00% | Matching | Matching: −1.00% | Functional: −1.50% | Matching: −0.50% | Matching: −0.50% |

| 8 | Surface area (m2) | Similar: 4.00% | Similar: 4.50% | Similar: 4.50% | Smaller: −10.40% | Similar: 4.90% | Similar: 4.90% |

| WEIGHTING COEFFICIENTS | −22.00% | −5.00% | −11.00% | −9.00% | −13.00% | −13.00% | |

Table A7.

Data for case study 5.

Table A7.

Data for case study 5.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | San Pedro, 3 | Los Andenes Viejo, 7 | El Siroco, 102 | Sor Elena, 9 | La Libertad, 45 | Sor Reyes, 13 | Garajonay taco, 18 |

| Municipality | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | |

| Postal code | 38108 | 38108 | 38111 | 38108 | 38108 | 38108 | 38108 | |

| 2 | Data Source | API | Individual | Individual | Individual | API | Individual | |

| 3 | Construction Quality | Average | Average | Average | Average | Average | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 15 | 8 | 13 | 9 | 13 | 9 | 12 |

| 6 | Floor | 2 | 2 | 1 | 2 | 3 | 1 | 3 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Bathrooms | 1 | 2 | 2 | 2 | 2 | 2 | 2 | |

| 8 | Surface area (m2) | 71.50 | 90.00 | 110.00 | 76.00 | 75.00 | 80.00 | 105.55 |

Table A8.

Coefficients for case study 5.

Table A8.

Coefficients for case study 5.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Some. Worse: 4.00% | Similar: 2.89% | Similar: 2.90% | Some. Worse: 4.90% | Some. Worse: 4.90% | Some. Worse: 4.90% |

| 2 | Data Source | Speculative: −2.00% | Direct: −1.00% | Direct: −1.00% | Direct: −1.00% | Speculative: −2.00% | Direct: −1.00% |

| 3 | Construction Quality | Similar: 1.90% | Similar: 1.90% | Similar: −1.10% | Similar: 1.90% | Similar: 1.15% | Similar: 1.90% |

| 4 | Condition | Same: 0.90% | Same: 0.90% | Same: −1.00% | Same: 0.90% | Same: 0.90% | Same: 0.90% |

| 5 | Age | Similar: 0.30% | Similar: −0.40% | Similar: 0.10% | Similar: −0.30% | Similar: 0.10% | Similar: −0.30% |

| 6 | Floor | Same: −0.50% | Same: −0.50% | Same: −0.91% | Same: −0.50% | Same: 0.00% | Same: −1.00% |

| 7 | Layout | Matching: 0.90% | Matching: −0.90% | Matching: 0.90% | Matching: 0.95% | Matching: 0.95% | Matching: 0.90% |

| 8 | Surface area (m2) | Some. Smaller: −8.51% | Similar: −3.89% | Similar: 1.11% | Some. Smaller: −9.85% | Some. Smaller: −9.00% | Some. Smaller: −7.30% |

| WEIGHTING COEFFICIENTS | −3.01% | −1.00% | 1.00% | −3.00% | −3.00% | −1.00% | |

Table A9.

Data for case study 6.

Table A9.

Data for case study 6.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Lucas Vega, 36 | Cruz de Candelaria, 32 | Teobaldo Power, 1 | La Trinidad, 62 | La Trinidad, 62 | Rosendo Díaz Mendez, 19 | Vergara, 11 |

| Municipality | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | La Laguna | |

| Postal code | 38208 | 38203 | 38201 | 38204 | 38204 | 38205 | 32208 | |

| 2 | Data Source | Individual | Individual | API | API | API | Individual | |

| 3 | Construction Quality | Average | Average | Average | Average-Higgh | Average-High | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 16 | 11 | 35 | 1 | 1 | 15 | 18 |

| 6 | Floor | 3 | 1 | 1 | 4 | 4 | 3 | 1 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 2 | 2 | 3 | 3 | 3 | 3 | |

| Bathrooms | 1 | 1 | 1 | 2 | 3 | 1 | 2 | |

| 8 | Surface area (m2) | 93.00 | 110.00 | 99.00 | 97.00 | 100.50 | 85.00 | 142.26 |

Table A10.

Coefficients for case study 6.

Table A10.

Coefficients for case study 6.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Similar: 2.90% | Similar: 2.90% | Similar: 2.90% | Some. Better: −3.01% | Some. Better: −3.01% | Worse: 5.10% |

| 2 | Data Source | Direct: −2.00% | Direct: −0.50% | Speculative: −1.10% | Speculative: −1.01% | Speculative: −1.01% | Direct: −1.00% |

| 3 | Construction Quality | Similar: 1.90% | Similar: 1.97% | Similar: 1.97% | Better: −2.01% | Similar_ −1.00% | Similar: 1.90% |

| 4 | Condition | Same: 0.90% | Same: 0.90% | More det.: 1.85% | More det.: 4.00% | Same: 0.90% | Same: 0.90% |

| 5 | Age | Similar: −0.20% | Similar: −0.70% | Older: 1.70% | Newer: −1.70% | Newer: −1.70% | Similar: −0.30% |

| 6 | Floor | Better: 1.00% | Same: 0.00% | Same: 0.00% | Better: 1.50% | Better: 1.50% | Better: 1.00% |

| 7 | Layout | Matching: 0.90% | Matching: 0.50% | Matching: 0.50% | Matching: 0.12% | Matching: 0.95% | Dysfunctional: 1.50% |

| 8 | Surface area (m2) | Some. Smaller: −10.00% | Some. Smaller: −8.07% | Smaller: −10.82% | Some. Smaller: −9.89% | Some. Smaller: −9.11% | Smaller: −15.10% |

| WEIGHTING COEFFICIENTS | −4.60% | −3.00% | −3.00% | −12.00% | −12.48% | −6.00% | |

Table A11.

Data for case study 7.

Table A11.

Data for case study 7.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Diego de Almagro, 8 | Principes de España, 3 | Legazpi, 2 | Bencheque, 16 | Hurtado de Mendoza, 36 | Francisco de Aguilar y Aguilar | Caupolican, 7 |

| Municipality | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | |

| Postal code | 38010 | 38010 | 38005 | 38010 | 38010 | 38008 | 38010 | |

| 2 | Data Source | API | API | API | Individual | API | API | |

| 3 | Construction Quality | Average-Low | Average | Average-Low | Average | Low | Average | Average-Low |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 41 | 35 | 50 | 31 | 7 | 28 | 66 |

| 6 | Floor | 4 | 4 | 4 | 5 | 0 | 3 | 2 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 3 | 3 | 2 | 3 | 3 | 3 | |

| Bathrooms | 1 | 1 | 1 | 1 | 2 | 1 | 1 | |

| 8 | Surface area (m2) | 75.00 | 88.00 | 86.00 | 96.00 | 93.10 | 107.00 | 75.29 |

Table A12.

Coefficients for case study 7.

Table A12.

Coefficients for case study 7.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Some. Better: −3.01% | Some. Worse: 3.00% | Similar: −1.79% | Some. Better: −3.01% | Similar: 2.66% | Similar: −3.00% |

| 2 | Data Source | Speculative: −0.40% | Speculative: −5.00% | Speculative: −3.00% | Direct: −1.00% | Speculative: −3.00% | Speculative: −3.00% |

| 3 | Construction Quality | Similar: 1.99% | Similar: −1.99% | Similar: 1.97% | Similar: −1.90% | Similar: −1.00% | Similar: −1.17% |

| 4 | Condition | Same: 0.99% | Same: −0.99% | More det.: 1.85% | Same: 0.00% | Same: 0.90% | Same: 0.90% |

| 5 | Age | Newer: −2.50% | Newer: −4.10% | Newer: −1.60% | Newer: −3.50% | Older: 5.00% | Newer: −3.80% |

| 6 | Floor | Better: 1.00% | Better: 1.00% | Better: 1.00% | Better: 1.50% | Same: −1.00% | Same: 0.50% |

| 7 | Layout | Matching: 0.99% | Matching: −1.00% | Matching: 0.00% | Functional: −2.00% | Functional: −1.50% | Matching: −1.00% |

| 8 | Surface area (m2) | Similar: −0.10% | Similar: 4.08% | Similar: 3.57% | Some. Larger: 6.90% | Some. Larger: 5.94% | Larger: 10.57% |

| WEIGHTING COEFFICIENTS | −1.04% | −5.00% | 2.00% | −3.01% | 8.00% | 0.00% | |

Table A13.

Data for case study 8.

Table A13.

Data for case study 8.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Ponce de León, 13 | Maestro Estany, 5 | Dacil Vilar Borges, 2 | Tagore, 7 | Dacil Vilar Borges, 2 | Abenhama, 6 | La Vica, 3 |

| Municipality | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | |

| Postal code | 38010 | 38010 | 38010 | 38010 | 38010 | 38010 | 38010 | |

| 2 | Data Source | API | Individual | API | API | API | API | |

| 3 | Construction Quality | Average | Average-Low | Average | Average | Average | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 47 | 40 | 40 | 40 | 31 | 47 | 48 |

| 6 | Floor | 1 | 1 | 7 | 8 | 9 | 7 | 7 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 3 | 3 | 3 | 3 | 3 | 3 | |

| Bathrooms | 2 | 1 | 2 | 2 | 2 | 2 | 1 | |

| 8 | Surface area (m2) | 58.00 | 94.00 | 98.00 | 117.00 | 102.00 | 98.00 | 99.70 |

Table A14.

Coefficients for case study 8.

Table A14.

Coefficients for case study 8.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Similar: 2.99% | Some. Worse: 3.00% | Some. Better: −3.01% | Better: −5.08% | Better: −10.00% | Similar: −2.00% |

| 2 | Data Source | Speculative: −1.33% | Direct: −1.00% | Speculative: −2.26% | Speculative: −3.00% | Speculative: −3.00% | Speculative: −3.00% |

| 3 | Construction Quality | Similar: 1.90% | Similar: 0.50% | Similar: 0.00% | Similar: −1.90% | Similar: −1.90% | Similar: −1.00% |

| 4 | Condition | Same: 0.99% | Less det.: −3.00% | Same: 0.00% | Same: −0.99% | Less det.: −2.90% | Same: 0.90% |

| 5 | Age | Similar: −0.10% | Similar: −0.80% | Similar: −0.80% | Similar: −0.80% | Older: 5.00% | Similar: −0.10% |

| 6 | Floor | Worse: −2.00% | Worse: −2.00% | Same: 0.00% | Same: 0.50% | Better: 1.00% | Same: 0.00% |

| 7 | Layout | Functional: −2.00% | Matching: −1.00% | Functional: −1.50% | Functional: −1.50% | Functional: −1.50% | Functional: −1.50% |

| 8 | Surface area (m2) | Smaller: −10.43% | Similar: −3.70% | Similar: −0.43% | Some. Larger: 5.77% | Similar: 0.77% | Similar: −0.57% |

| WEIGHTING COEFIiCIENTS | −9.98% | −8.00% | −8.00% | −7.00% | −12.53% | −7.27% | |

Table A15.

Data for case study 9.

Table A15.

Data for case study 9.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Felipe Pedrell, 4 | Agustin Espinosa García, 20 | Felipe Pedrell, 6 | Fermin Morín, 2 | José Calzadilla Delahanty, 3 | Fernando Pri, o de Rivera, 68 | Felipe Pedrell, 4 |

| Municipality | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | |

| Postal code | 38007 | 38007 | 38007 | 38007 | 38007 | 38007 | 38007 | |

| 2 | Data Source | API | API | API | API | API | Individual | |

| 3 | Construction Quality | Average | Average | Average | Average | Average | Average | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 53 | 55 | 53 | 39 | 39 | 53 | 53 |

| 6 | Floor | 2 | 3 | 2 | 4 | 1 | 1 | 6 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 2 | 2 | 3 | 3 | 3 | 3 | 3 | |

| Bathrooms | 1 | 1 | 1 | 2 | 1 | 2 | 1 | |

| 8 | Surface area (m2) | 83.60 | 121.00 | 84.00 | 100.00 | 84.00 | 78.00 | 83.75 |

Table A16.

Coefficients for case study 9.

Table A16.

Coefficients for case study 9.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Similar: 2.99% | Similar: 2.00% | Similar: 2.90% | Similar: −1.65% | Some. Worse: 3.00% | Some. Worse: 4.99% |

| 2 | Data Source | Speculative: −1.84% | Speculative: −3.00% | Speculative: −2.70% | Speculative: −3.00% | Speculative: −3.20% | Direct: −0.01% |

| 3 | Construction Quality | Similar: 1.90% | Similar: −1.90% | Similar: 1.90% | Similar: −1.90% | Similar: −1.90% | Similar: 1.99% |

| 4 | Condition | Same: 0.99% | Less det.: −2.00% | Same: 0.90% | Same: −0.99% | Less det.: −2.90% | More det.: 2.70% |

| 5 | Age | Similar: 0.00% | Similar: 0.20% | Similar: 0.00% | Newer: −1.40% | Older: 5.00% | Similar: 0.00% |

| 6 | Floor | Worse: −2.00% | Worse: −1.50% | Worse: −2.00% | Same: −1.00% | Worse: −2.00% | Worse: −1.01% |

| 7 | Layout | Matching: −1.00% | Matching: −1.00% | Matching: 0.00% | Functional: −1.50% | Matching: 0.00% | Matching: 0.99% |

| 8 | Surface area (m2) | Similar: −0.04% | Some. Larger: 9.31% | Similar: 0.06% | Some. Larger: 5.42% | Similar: 0.08% | Some. Smaller: −5.01% |

| WEIGHTING COEFFICIENTS | 1.00% | 2.11% | 1.06% | −6.02% | −1.92% | 4.64% | |

Table A17.

Data for case study 10.

Table A17.

Data for case study 10.

| Comparable 1 (C1) | Comparable 2 (C2) | Comparable 3 (C3) | Comparable 4 (C4) | Comparable 5 (C5) | Comparable 6 (C6) | Property to Appraise | ||

| Data | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | Dwelling in building | |

| 1 | Address | Tagore, 7 | Ponce de León, 13 | Nicolás Parquet, 2 | Dacil Vilar Borges, 2 | Abenhama, 6 | Maestro Estany, 5 | Tajaraste, 1 |

| Municipality | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | S/C de Tenerife | |

| Postal code | 38010 | 38010 | 38009 | 38010 | 38010 | 38010 | 38010 | |

| 2 | Data Source | Individual | API | API | API | API | API | |

| 3 | Construction Quality | Average | Average | Average | Average | Average | Average-Low | Average |

| 4 | Condition | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age | Consistent w/age |

| 5 | Age | 40 | 47 | 39 | 31 | 47 | 40 | 44 |

| 6 | Floor | 8 | 1 | 9 | 9 | 7 | 1 | 1 |

| 7 | Faces In/Out | Out | Out | Out | Out | Out | Out | Out |

| Bedrooms | 3 | 2 | 3 | 3 | 3 | 3 | 3 | |

| Bathrooms | 2 | 2 | 2 | 2 | 2 | 1 | 2 | |

| 8 | Surface area (m2) | 117.00 | 58.00 | 105.00 | 102.00 | 98.00 | 94.00 | 99.50 |

Table A18.

Coefficients for case study 10.

Table A18.

Coefficients for case study 10.

| Parameters | Comparison with C1 | Comparison with C2 | Comparison with C3 | Comparison with C4 | Comparison with C5 | Comparison with C6 | |

| 1 | Location | Some. Better: −3.90% | Worse: 9.00% | Similar: −2.90% | Similar: −1.42% | Similar: 1.20% | Similar: 2.90% |

| 2 | Data Source | Direct: −1.00% | Speculative: −3.00% | Speculative: −2.70% | Speculative: −3.00% | Speculative: −3.00% | Speculative: −3.00% |

| 3 | Construction Quality | Similar: 1.99% | Similar: 1.99% | Similar: 1.90% | Similar: 1.90% | Similar: 0.00% | Worse: 2.45% |

| 4 | Condition | Same: 0.99% | Same: 0.99% | Same: 0.90% | Same: 0.99% | Same: 0.00% | Same: 0.90% |

| 5 | Age | Similar: −0.40% | Similar: 0.30% | Similar: −0.50% | Newer: −1.30% | Similar: 0.30% | Similar: −0.40% |

| 6 | Floor | Better: 3.50% | Same: 0.00% | Better: 4.00% | Better: 4.00% | Better: 3.00% | Same: 0.00% |

| 7 | Layout | Matching: 0.00% | Matching: −0.50% | Matching: 0.00% | Matching: 0.00% | Matching: 0.00% | Matching: 0.98% |

| 8 | Surface area (m2) | Some. Larger: 5.83% | Some. Smaller: −9.80% | Similar: 1.38% | Similar: 0.83% | Similar: −0.50% | Similar: −1.83% |

| WEIGHTING COEFFICIENTS | 7.01% | −1.02% | 2.08% | 2.00% | 1.00% | 2.00% | |

Appendix B

FRBS output for case studies 2–10. Wrong cases are marked with an asterisk.

Table A19.

FRBS output for case study 2.

Table A19.

FRBS output for case study 2.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Similar | 0.500 | Similar | 0.470 | Some. Better | 0.370 | Worse | 0.840 | Worse | 0.840 | Worse | 0.850 |

| Data Source | Direct | 0.750 | Direct | 0.900 | Speculative | 0.650 | Speculative | 0.650 | Speculative | 0.650 | Speculative | 0.500 |

| Const. Quality | Similar | 0.500 | Similar | 0.510 | Worse | 0.700 | Similar | 0.420 | Similar | 0.500 | Similar | 0.500 |

| Condition | Less det. | 0.250 | Less det. | 0.270 | Less det. | 0.320 | Less det. | 0.300 | Less det. | 0.340 | Less det. | 0.320 |

| Age | Newer | 0.200 | Newer | 0.010 | Similar | 0.490 | Newer | 0.340 | Similar | 0.490 | Newer | 0.200 |

| Floor | Better | 0.700 | Same | 0.370 | Worse | 0.240 | Same | 0.550 | Same | 0.630 | Better | 0.670 |

| Layout | Matching | 0.450 | Matching | 0.500 | Matching | 0.560 | Matching | 0.450 | Matching | 0.450 | Matching | 0.420 |

| Surface area | Some. larger | 0.450 | Some. larger | 0.350 | Some. smaller | 0.610 | Some. smaller | 0.560 | Some. smaller | 0.575 | Some. smaller | 0.580 |

| OUTPUT | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Weighting Coefficient range [0, 1] | Somewhat Decreased [0.45, 0.50] | 0.45 | Somewhat Increased [0.50, 0.55] | 0.499 | Somewhat Decreased [0.45, 0.50] | 0.478 | Somewhat Decreased [0.45, 0.50] | 0.46 | Somewhat Decreased [0.45, 0.50] | 0.466 | Somewhat Decreased [0.45, 0.50] | 0.471 |

| Weighting Coefficient actual range | Somewhat Decreased [−6%, 0%] | −6% | Somewhat Increased [0%, 6%] | 0% | Somewhat Decreased [−6%, 0%] | −2.64% | Somewhat Decreased [−6%, 0%] | −4.80% | Somewhat Decreased [−6%, 0%] | −4.08% | Somewhat Decreased [−6%, 0%] | −3.48% |

Table A20.

FRBS output for case study 3.

Table A20.

FRBS output for case study 3.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Better | 0.140 | Similar | 0.510 | Better | 0.120 | Similar | 0.500 | Worse | 0.850 | Worse | 0.850 |

| Data Source | Direct | 0.850 | Speculative | 0.600 | Direct | 0.870 | Speculative | 0.500 | Speculative | 0.500 | Speculative | 0.500 |

| Const. Quality | Similar | 0.500 | Similar | 0.510 | Similar | 0.550 | Similar | 0.500 | Similar | 0.510 | Similar | 0.600 |

| Condition | More Det. | 0.750 | Same | 0.610 | Same | 0.550 | More Det. | 0.850 | Same | 0.450 | Same | 0.500 |

| Age | Newer | 0.250 | Similar | 0.420 | Older | 0.850 | Older | 0.660 | Similar | 0.450 | Newer | 0.150 |

| Floor | Same | 0.400 | Same | 0.370 | Better | 0.750 | Worse | 0.100 | Better | 0.800 | Better | 0.750 |

| Layout | Matching | 0.550 | Matching | 0.500 | Matching | 0.500 | Functional | 0.250 | Matching | 0.500 | Functional | 0.300 |

| Surface area | Similar | 0.550 | Similar | 0.500 | Similar | 0.520 | Smaller | 0.960 | Some. Smaller | 0.560 | Some. Smaller | 0.580 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Somewhat Decreased [0.45, 0.50] | 0.496 | Somewhat Increased [0.50, 0.55] | 0.512 | Somewhat Increased [0.50, 0.55] | 0.5 | Somewhat Decreased [0.45, 0.50] | 0.488 | Somewhat Decreased [0.45, 0.50] | 0.496 | Somewhat Decreased [0.45, 0.50] | 0.471 |

| Weighting Coefficient actual range | Somewhat Decreased [−6%, 0%] | −0.48% | Somewhat Increased [0%, 6%] | 1.44% | Somewhat Increased [0%, 6%] | 0.00% | Somewhat Decreased [−6%, 0%] | −1.44% | Somewhat Decreased [−6%, 0%] | −0.08% | Somewhat Decreased [−6%, 0%] | −3.48% |

Table A21.

FRBS output for case study 4.

Table A21.

FRBS output for case study 4.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Better | 0.210 | Better | 0.250 | Better | 0.200 | Similar | 0.500 | Better | 0.230 | Better | 0.240 |

| Data Source | Speculative | 0.720 | Direct | 0.800 | Direct | 0.840 | Direct | 0.950 | Direct | 0.850 | Direct | 0.900 |

| Const. Quality | Similar | 0.360 | Similar | 0.600 | Similar | 0.550 | Similar | 0.600 | Similar | 0.400 | Similar | 0.350 |

| Condition | Less det. | 0.250 | Same | 0.450 | Same | 0.390 | More det. | 0.850 | Less det. | 0.300 | Less det. | 0.150 |

| Age | Newer | 0.120 | Newer | 0.330 | Newer | 0.250 | Newer | 0.200 | Newer | 0.300 | Newer | 0.150 |

| Floor | Same | 0.500 | Same | 0.400 | Better | 0.800 | Same | 0.450 | Same | 0.450 | Same | 0.600 |

| Layout | Functional | 0.260 | Matching | 0.640 | Matching | 0.550 | Functional | 0.200 | Matching | 0.450 | Matching | 0.400 |

| Surface area | Similar | 0.500 | Similar | 0.500 | Similar | 0.460 | Smaller | 0.660 | Similar | 0.460 | Similar | 0.500 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Minimum [0.00, 0.35] | 0.252 | Somewhat Decreased [0.45, 0.50] | 0.455 | Minimum [0.00, 0.35] | 0.275 | Decreased [0.35, 0.45] | 0.406 | Minimum [0.00, 0.35] | 0.315 | Minimum [0.00, 0.35] | 0.333 |

| Weighting Coefficient actual range | Minimum [−14%, −10%] | −11.12% | Somewhat Decreased [−6%, 0%] | −5.40% | Minimum [−14%, −10%] | −10.86% | Decreased [−10%, −6%] | −7.76% | Minimum [−14%, −10%] | −10.40% | Minimum [−14%, −10%] | −10.19% |

Table A22.

FRBS output for case study 5.

Table A22.

FRBS output for case study 5.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Some. Worse | 0.560 | Similar | 0.532 | Similar | 0.500 | Some. Worse | 0.750 | Some. Worse | 0.560 | Some. Worse | 0.740 |

| Data Source | Speculative | 0.650 | Speculative | 0.619 | Speculative | 0.590 | Direct | 0.760 | Speculative | 0.660 | Direct | 0.780 |

| Const. Quality | Similar | 0.400 | Similar | 0.591 | Similar | 0.600 | Similar | 0.450 | Similar | 0.450 | Similar | 0.450 |

| Condition | Same | 0.550 | Same | 0.644 | Same | 0.450 | Same | 0.600 | Same | 0.600 | Same | 0.600 |

| Age | Similar | 0.600 | Similar | 0.644 | Similar | 0.600 | Similar | 0.550 | Similar | 0.550 | Similar | 0.550 |

| Floor | Same | 0.500 | Same | 0.412 | Same | 0.500 | Same | 0.600 | Same | 0.600 | Same | 0.600 |

| Layout | Matching | 0.400 | Matching | 0.639 | Matching | 0.550 | Matching | 0.580 | Matching | 0.450 | Matching | 0.550 |

| Surface area | Some. Smaller | 0.640 | Similar | 0.468 | Similar | 0.500 | Some. Smaller | 0.560 | Some. Smaller | 0.620 | Some. Smaller | 0.560 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Somewhat Decreased [0.45, 0.50] | 0.460 | Somewhat Decreased [0.45, 0.50] | 0.490 | Somewhat Increased [0.50, 0.55] | 0.526 | Somewhat Decreased [0.45, 0.50] | 0.464 | Somewhat Decreased [0.45, 0.50] | 0.454 | Somewhat Decreased [0.45, 0.50] | 0.464 |

| Weighting Coefficient actual range | Somewhat Decreased [−6%, 0%] | −4.80% | Somewhat Decreased [−6%, 0%] | −1.20% | Somewhat Increased [0%, 6%] | 3.12% | Somewhat Decreased [−6%, 0%] | −4.32% | Somewhat Decreased [−6%, 0%] | −5.52% | Somewhat Decreased [−6%, 0%] | −4.32% |

Table A23.

FRBS output for case study 6. Wrong cases are marked with an asterisk.

Table A23.

FRBS output for case study 6. Wrong cases are marked with an asterisk.

| Comparable 1 | Comparable 2 (*) | Comparable 3 | Comparable 4 (*) | Comparable 5 (*) | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Similar | 0.540 | Similar | 0.540 | Similar | 0.480 | Somewhat Better | 0.430 | Somewhat Better | 0.400 | Worse | 0.790 |

| Data Source | Direct | 0.760 | Direct | 0.750 | Speculative | 0.600 | Speculative | 0.550 | Speculative | 0.740 | Direct | 0.760 |

| Const. Quality | Similar | 0.400 | Similar | 0.550 | Similar | 0.470 | Better | 0.130 | Similar | 0.550 | Similar | 0.600 |

| Condition | Same | 0.550 | Same | 0.470 | More det. | 0.850 | More det. | 0.850 | Same | 0.450 | Same | 0.620 |

| Age | Similar | 0.450 | Similar | 0.530 | Older | 0.800 | Newer | 0.200 | Newer | 0.340 | Similar | 0.480 |

| Floor | Better | 0.920 | Same | 0.480 | Same | 0.550 | Better | 0.850 | Better | 0.670 | Better | 0.740 |

| Layout | Matching | 0.600 | Matching | 0.540 | Matching | 0.350 | Matching | 0.470 | Matching | 0.550 | Dysfunctional | 0.800 |

| Surface area | Some. Smaller | 0.640 | Some. Smaller | 0.640 | Smaller | 0.950 | Some. Smaller | 0.610 | Some. Smaller | 0.560 | Smaller | 0.680 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Somewhat Decreased [0.45, 0.50] | 0.452 | Decreased [0.35, 0.40] | 0.418 | Somewhat Decreased [0.45, 0.50] | 0.485 | Decreased [0.35, 0.40] | 0.417 | Decreased [0.35, 0.40] | 0.417 | Somewhat Decreased [0.45, 0.50] | 0.465 |

| Weighting Coefficient actual range | Somewhat Decreased [−6%, 0%] | −5.76% | Decreased [−10%, −6%] | −9.84% | Somewhat Decreased [−6%, 0%] | −1.80% | Decreased [−10%, −6%] | −9.23% | Decreased [−10%, −6%] | −9.23% | Somewhat Decreased [−6%, 0%] | −4.20% |

Table A24.

FRBS output for case study 7. Wrong cases are marked with an asterisk.

Table A24.

FRBS output for case study 7. Wrong cases are marked with an asterisk.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 (*) | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Somewhat Better | 0.260 | Some. Worse | 0.700 | Similar | 0.540 | Somewhat Better | 0.250 | Similar | 0.520 | Similar | 0.540 |

| Data Source | Speculative | 0.470 | Speculative | 0.750 | Speculative | 0.550 | Direct | 0.820 | Speculative | 0.700 | Speculative | 0.560 |

| Const. Quality | Similar | 0.380 | Similar | 0.490 | Similar | 0.450 | Similar | 0.550 | Similar | 0.450 | Similar | 0.480 |

| Condition | Same | 0.580 | Same | 0.590 | More det. | 0.740 | Same | 0.610 | Same | 0.380 | Same | 0.640 |

| Age | Newer | 0.270 | Newer | 0.330 | Newer | 0.280 | Newer | 0.051 | Older | 0.990 | Newer | 0.240 |

| Floor | Better | 0.780 | Better | 0.800 | Better | 0.830 | Better | 0.780 | Same | 0.620 | Same | 0.380 |

| Layout | Matching | 0.550 | Matching | 0.560 | Matching | 0.390 | Functional | 0.320 | Functional | 0.150 | Matching | 0.530 |

| Surface area | Similar | 0.520 | Similar | 0.550 | Similar | 0.510 | Some. Larger | 0.366 | Some. Larger | 0.350 | Larger | 0.330 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Somewhat Decreased [0.45, 0.50] | 0.496 | Somewhat Decreased [0.45, 0.50] | 0.456 | Somewhat Increased [0.50, 0.55] | 0.523 | Somewhat Decreased [0.45, 0.50] | 0.471 | Somewhat Decreased [0.45, 0.50] | 0.485 | Somewhat Increased [0.50, 0.55] | 0.513 |

| Weighting Coefficient actual range | Somewhat Decreased [−6%, 0%] | −0.48% | Somewhat Decreased [−6%, 0%] | −5.28% | Somewhat Increased [0%, 6%] | 2.76% | Somewhat Decreased [−6%, 0%] | −3.48% | Somewhat Decreased [−6%, 0%] | −3.60% | Somewhat Increased [0%, 6%] | 1.56% |

Table A25.

FRBS output for case study 8. Wrong cases are marked with an asterisk.

Table A25.

FRBS output for case study 8. Wrong cases are marked with an asterisk.

| Comparable 1 | Comparable 2 | Comparable 3 | Comparable 4 | Comparable 5 (*) | Comparable 6 | |||||||

| INPUTS | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value | Label | Value |

| Location | Similar | 0.470 | Some. Worse | 0.650 | Some. Better | 0.350 | Better | 0.240 | Better | 0.250 | Similar | 0.520 |

| Data Source | Speculative | 0.150 | Direct | 0.800 | Speculative | 0.150 | Speculative | 0.150 | Speculative | 0.220 | Speculative | 0.260 |

| Const. Quality | Similar | 0.470 | Similar | 0.480 | Similar | 0.450 | Similar | 0.580 | Similar | 0.490 | Similar | 0.590 |

| Condition | Same | 0.550 | Less det. | 0.220 | Same | 0.450 | Same | 0.590 | Less det. | 0.250 | Same | 0.420 |

| Age | Similar | 0.620 | Similar | 0.600 | Similar | 0.600 | Similar | 0.610 | Older | 0.800 | Similar | 0.390 |

| Floor | Worse | 0.200 | Worse | 0.300 | Same | 0.620 | Same | 0.380 | Better | 0.780 | Same | 0.630 |

| Layout | Functional | 0.250 | Matching | 0.450 | Functional | 0.300 | Functional | 0.280 | Functional | 0.200 | Functional | 0.250 |

| Surface area | Smaller | 0.670 | Similar | 0.520 | Similar | 0.540 | Some. Larger | 0.390 | Similar | 0.470 | Similar | 0.470 |

| OUTPUT | ||||||||||||

| Weighting Coefficient range [0, 1] | Decreased [0.35, 0.45] | 0.386 | Decreased [0.35, 0.45] | 0.407 | Decreased [0.35, 0.45] | 0.428 | Decreased [0.35, 0.45] | 0.443 | Decreased [0.35, 0.45] | 0.422 | Decreased [0.35, 0.45] | 0.407 |

| Weighting Coefficient actual range | Decreased [−10%, −6%] | −8.56% | Decreased [−10%, −6%] | −7.72% | Decreased [−10%, −6%] | −6.88% | Decreased [−10%, −6%] | −6.28% | Decreased [−10%, −6%] | −7.12% | Decreased [−10%, −6%] | −7.72% |

Table A26.

FRBS output for case study 9.

Table A26.

FRBS output for case study 9.